New Mexico Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 20.80

New Mexico is known as the Land of Enchantment, a place with a little bit of everything, like captivating desert lands, hot springs, beautiful mountains, and stunning Spanish colonial architecture. The state’s motto comes from a 1935 New Mexico Tourist Bureau brochure that promoted it as “the Land of Enchantment.”

By 1941, the nickname appeared on state license plates, and the state officially adopted it in 1999. The video below features the official state ballad named — you guessed it — “The Land of Enchantment”:

When it comes to researching car insurance, do you feel like you’re in a Land of Enchantment, or are you on the road to nowhere? If you’ve lost your direction, don’t worry. You’ve found the right place.

This is your guide to car insurance. We’ll go over the state’s minimum car insurance coverage requirements, average rates, state car insurance, and driving laws, and everything else connected to auto insurance. You’ll learn all you need to make an informed decision.

So, strap yourself in and let’s get ready to roll.

And, if you want to start comparison shopping right now, enter your zip code in the box above.

What Should You Expect from New Mexico Insurance Coverage and Rates?

Just the thought of looking up car insurance companies’ prices can seem nerve-wracking. Where should you go? What should you do?

Fortunately, information is available at our fingertips. But the problem often comes down to the many results you receive, and you might not always get what you need. In this guide, we cut to the chase and give you the facts (without the fluff).

In the section below, we’ll cover New Mexico’s minimum insurance coverage requirements, the average cost of premiums, and more interesting details to help you find the right insurance. Read on for some insightful information.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s New Mexico’s Car Culture like?

The different economic climates throughout New Mexico affect the types of cars you’ll see on its roads, whether they’re Acuras or Lexus or pickup trucks like the Fords that ranchers prefer.

The Hartford’s “State of Driving” describes New Mexico as “a land of contrasts.” Besides the variety of vehicles along its highways, you’ll notice smooth blacktop in some areas and other roads marked with mudholes.

TRIP, a national transportation research group, recently ranked New Mexico sixth in the nation for the state of its roads. The organization found that 25 percent of rural New Mexico roads are in poor condition, and 21 percent of its back roads are in mediocre condition.

They described 7 percent of the state’s bridges as “structurally deficient.” So, you may need to fasten your seatbelt to prepare for a bumpy ride as you move from city blocks to rural stretches of desert lands. It’s all part of the charm that comes with the territory of the Land of Enchantment.

What’s New Mexico’s Minimum Coverage Policy?

New Mexico requires drivers to carry bodily injury liability and property damage liability insurance in the following minimum amounts:

- $10,000 for property damages from an accident

- $25,000 for injuries to one person in an accident

- $50,000 for injuries to all people in an accident

The state also requires drivers to carry uninsured/underinsured motorist coverage, but you can opt-out. To refuse it, you will need to sign a form and give it to your insurance provider.

Forgoing uninsured motorist coverage may not be the wisest decision, however. According to the Insurance Information Institute, New Mexico ranks third in the U.S. for the number of uninsured drivers, at 20.3 percent, so you assume the risk of paying lots of damages later if you don’t carry that coverage.

Besides uninsured motorist coverage, we suggest you buy more than the required minimum coverage to pay for all damages from a potential accident. Otherwise, if the costs exceed your coverage limits, you may have to pay them yourself.

Read More: How the States Rank on Uninsured Drivers

Should You Buy Additional Auto Coverage in New Mexico?

Cheap car insurance that only meets state minimums covers the other party’s liability when you’re at fault in an accident. If you want coverage for your own property damage and bodily injury on an auto policy, you’ll need to consider PIP and collision coverage. Many drivers also buy comprehensive insurance to cover damage not associated with an accident. This could include heavy hail, a falling tree, a loose animal, and much more.

Of course, this will raise your premium on insurance quotes. If you cannot afford to pay for your own repairs and injuries on your own, though, it could save you thousands after an accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

When do you Need to Show a Form of Financial Responsibility?

In New Mexico, you must show proof of insurance or financial responsibility in the following situations:

- If you’re in an accident

- When you apply for a title

- When you register a car

- If an officer pulls you over

The Mandatory Financial Responsibility Act (MFRA) requires motorists to have the ability to settle damages from accidents or buy motor vehicle insurance. Unless the motor vehicle is exempt per MFRA guidelines, drivers must carry the below proof of financial responsibility:

- A current insurance card meeting the state minimum liability coverage requirements

- If a motorist has met the criteria for the insurance set for workmen’s compensation liability — a self-insurance certificate from the Superintendent of Insurance

The New Mexico Motor Vehicle Department (MVD) also accepts the following forms of financial responsibility for vehicle registrations:

- A copy of your current auto insurance policy

- A letter from your car insurance company verifying that you have auto insurance coverage

The state doesn’t currently accept electronic forms of proof of insurance.

Note New Mexico police officers are not required to accept e-insurance cards. Even if you sign into your account to get the card, they can still request a paper version or issue a ticket. Vehicle registration generally requires proof of insurance, and the state will upload it to their database at that time. In New Mexico, at a traffic stop, officers can also check the state’s electronic verification system to see if you’re insured.

How Much of Your Income Goes to Insurance Premiums in New Mexico?

The amount of money you earn after taxes is your per capita disposable income (DPI). Below is data on how much the average New Mexican spends on car insurance every year, including the percentage of their incomes that go toward it.

| Particulars | 2012 | 2013 | 2014 |

|---|---|---|---|

| Income | $32,526 | $31,573 | $33,358 |

| Full Coverage Average Premiums | $866 | $889 | $920 |

| Percentage of Income | 2.66% | 2.82% | 2.76% |

New Mexico’s average DPI as of 2014 is $33,358. Residents have $2,779 to spend monthly on living expenses, from food to rent to a mortgage, and yes, even car insurance.

Out of that, they pay an average of $920 annually for car insurance or $76 monthly. That’s still less than the nationwide average of $981.77 yearly.

From 2012 – 2014, the average cost of annual car insurance premiums in New Mexico rose by nearly $60. Residents of neighboring states Colorado and Utah paid about the same as New Mexicans for their car insurance, though Utahn residents paid annual premiums under $900.

What are the Average Monthly Car Insurance Rates in NM (Liability, Collision, Comprehensive)?

Below are the average costs of liability, collision, and comprehensive car insurance coverage in New Mexico as part of a full coverage premium. This data comes from the National Association of Insurance Commissioners (NAIC). Expect rates in 2019 and beyond to continue to rise.

| Core Car Insurance Coverage in New Mexico | |

|---|---|

| Liability | $488.03 |

| Collision | $276.98 |

| Comprehensive | $172.57 |

| Full Coverage | $937.59 |

As shown, collision and comprehensive insurance cost less than liability coverage. So getting more coverage for greater peace of mind and protection is affordable.

Though you must buy liability coverage in New Mexico, collision and comprehensive will cover other property damages. Collision pays for damages if you hit something, and comprehensive covers damage from “acts of God” such as theft, fire, and hail damage. (For more information, read our What are ‘Acts of God’ and when are they covered?“).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There an Additional Coverage?

The below NAIC data, based on the state minimum coverage, spans 2012 – 2014.

| Additional Liability Coverage in New Mexico - Loss Ratios | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Pay (Med Pay) | 72% | 77% | 73% |

| Uninsured/Underinsured Motorist Coverage | 79% | 71% | 67% |

A loss ratio shows how much money a company pays in claims. Figures over 100 percent indicate a company is losing money. If they’re far below 100 percent, the company isn’t paying much in claims. As the above numbers show, New Mexico insurers pay a fair amount of claims.

Other options for additional liability coverage in the Land of Enchantment include medical payments (or MedPay), Personal Injury Protection (PIP), and uninsured and underinsured motorist coverage.

MedPay covers medical expenses, and PIP will pay for medical expenses, burial costs, childcare expenses, and lost wages.

As we mentioned earlier, a high percentage of New Mexico drivers are uninsured, so consider buying more than the mandatory minimum coverage required in case of an accident.

Are There any Add-Ons, Endorsements, Riders?

You can add more coverage to a basic car insurance policy. Below are some of the most popular options available in New Mexico:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Pay-as-You Drive or Usage-Based Insurance

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Pay-as-you-drive or usage-based insurance will reward you for following safe driving habits regularly. Insurers who offer the coverage will track your driving using a telematics device attached to your car’s diagnostic port or through a mobile device app.

One such program available in New Mexico is Travelers’ IntelliDrive® program. It uses a smartphone app to record and score the driving behavior of drivers covered under your policy. If you enroll, you may be eligible for insurance discounts on your policy’s first term.

Travelers Insurance states that safe driving habits can lead to savings of up to 20 percent for those renewing policies; those who sign up immediately receive a 10 percent discount. Policyholders who drive 13,000 miles or less yearly can receive up to a 30 percent discount.

IntelliDrive allows you to set safe driving rules for your teen and receive email or text alerts to let you know if the vehicle is being driven outside the safe driving guidelines. GPS also lets you know where your car is being driven.

Information tracked includes mileage, time of day, speed, braking, and acceleration measured through an installed telematics device plugged into your vehicle’s diagnostic port.

The app also offers coaching tips to teenage drivers.

Read more: How to Find a Safe, Budget-Friendly Car for your Teen

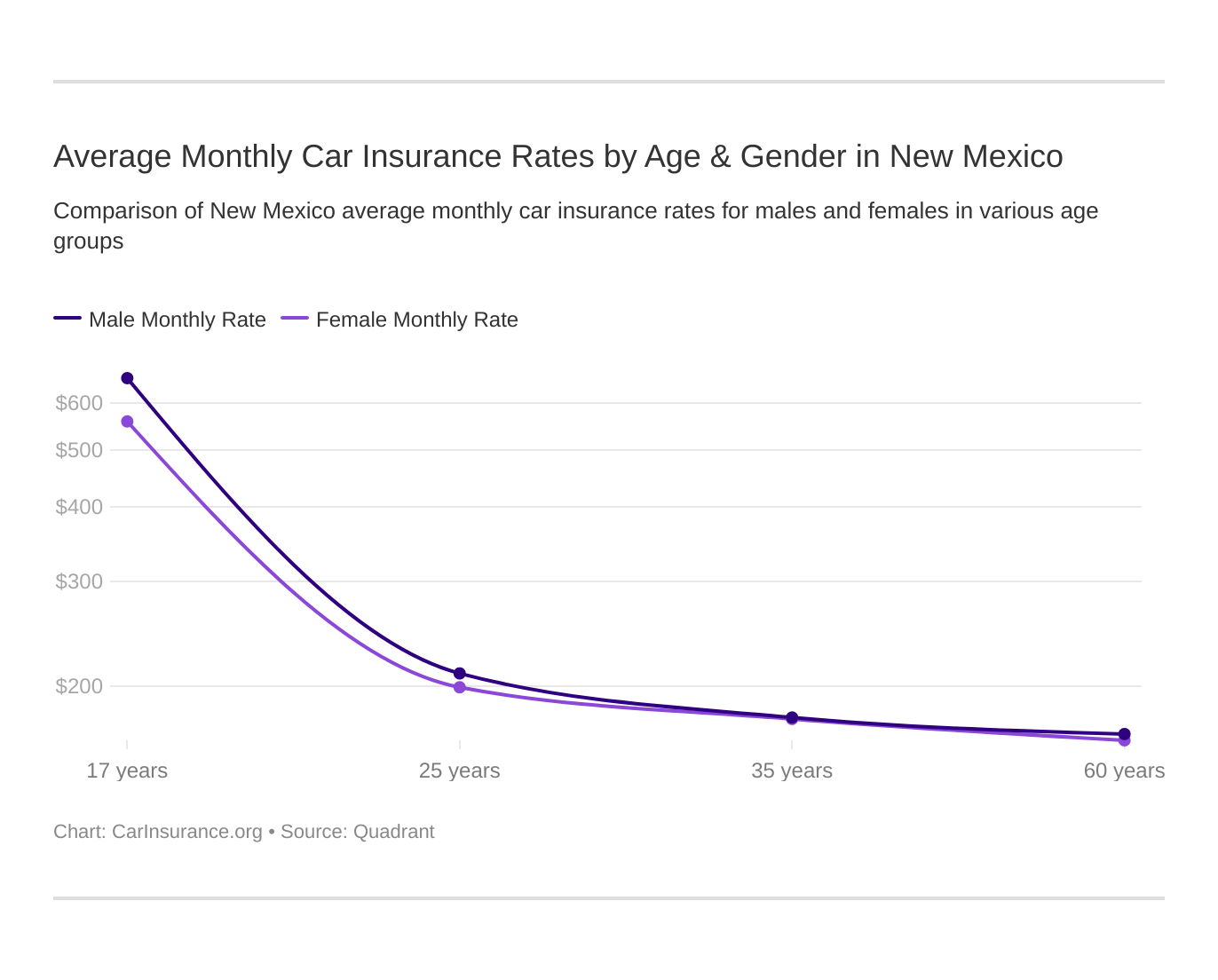

What are the Average Monthly Car Insurance Rates by Age & Gender in New Mexico?

In this section, we’ll explore the major factors that go into setting car insurance rates. We’ve partnered with Quadrant Information Services to bring you the data below. It’s based on coverage the state population has purchased and includes rates for high-risk drivers and drivers who choose to buy more than the state minimum, as well as other types of coverage the state doesn’t require.

First up, we’ll cover male versus female rates and how they affect different age groups.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,516.34 | $2,528.61 | $2,298.09 | $2,418.45 | $8,382.58 | $9,698.44 | $2,795.93 | $2,965.82 |

| Farmers Ins Co Of AZ | $2,404.81 | $2,396.01 | $2,152.83 | $2,295.21 | $9,750.62 | $10,025.51 | $2,703.37 | $2,790.84 |

| Geico General | $2,776.17 | $2,853.11 | $2,612.63 | $2,612.63 | $7,978.18 | $10,952.99 | $2,924.53 | $2,950.75 |

| AMCO Insurance | $2,405.85 | $2,446.69 | $2,185.49 | $2,293.80 | $5,818.94 | $7,338.72 | $2,714.96 | $2,908.12 |

| Progressive Direct | $1,666.84 | $1,613.98 | $1,510.13 | $1,515.71 | $6,833.07 | $7,700.89 | $2,017.17 | $2,087.52 |

| State Farm Mutual Auto | $1,523.13 | $1,523.13 | $1,383.93 | $1,383.93 | $4,131.10 | $5,189.28 | $1,704.41 | $1,881.32 |

| USAA | $1,530.57 | $1,520.66 | $1,459.73 | $1,455.56 | $3,987.84 | $4,506.45 | $1,891.06 | $2,025.18 |

As the table above shows, there’s not much of a difference in cost for male versus female drivers. Generally, men have been found to get into more accidents than women.

There’s a major price difference for 17- and 25-year-olds compared to those aged 35 and older. This reflects the amount of risk insurers feel they need to bear because of a driver’s inexperience.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Rates in New Mexico’s 10 Largest Cities?

Now, let’s go over the rates for the 10 most and least expensive cities in New Mexico.

| Ten Most Expensive Cities | Ten Least Expensive Cities | ||||

|---|---|---|---|---|---|

| City | Zip Code | Average Rate | City | Zip Code | Average Rates |

| Albuquerque | 87121 | $4,364.29 | Animas | 88422 | $3,489.24 |

| Isleta | 87006 | $4,154.37 | Bent | 88424 | $3,515.52 |

| Tijeras | 87013 | $3,520.12 | Las Cruces | 88426 | $3,419.96 |

| Cedar Crest | 87021 | $3,355.45 | La Luz | 88427 | $3,436.72 |

| Belen | 87025 | $3,601.04 | Garfield | 88430 | $3,464.99 |

| Bosque Farms | 87027 | $3,564.28 | Lordsburg | 88431 | $3,436.99 |

| Peralta | 87028 | $3,411.15 | Salem | 88433 | $3,455.36 |

| Los Lunas | 87029 | $3,627.66 | Deming | 88434 | $3,404.02 |

| Sandia Park | 87031 | $3,893.50 | Tularosa | 88435 | $3,431.92 |

| Corrales | 87035 | $3,580.84 | Alamogordo | 88439 | $3,499.53 |

From the most expensive city, Albuquerque, to the leave expensive, Alamogordo, the price difference is just under $1,000. This shows that where you live can affect your rates.

What are the Cheapest Auto Insurance Rates by Zip Code?

Here are the average costs for premiums in New Mexico cities and towns by zip code.

| Zipcode | Average Annual Rate | Zipcode | Average Annual Rate |

|---|---|---|---|

| 87001 | $3,732.99 | 87121 | $4,364.29 |

| 87002 | $3,949.58 | 87105 | $4,275.84 |

| 87004 | $3,813.92 | 87102 | $4,184.38 |

| 87005 | $3,358.18 | 87108 | $4,166.27 |

| 87006 | $3,576.83 | 87022 | $4,154.37 |

| 87007 | $3,535.16 | 87101 | $4,134.80 |

| 87008 | $3,979.48 | 87115 | $4,078.29 |

| 87009 | $3,593.18 | 87123 | $4,048.65 |

| 87010 | $3,631.57 | 87112 | $4,021.69 |

| 87011 | $3,346.80 | 87117 | $4,013.99 |

| 87012 | $3,725.45 | 87104 | $4,013.24 |

| 87013 | $3,520.12 | 87059 | $4,002.49 |

| 87014 | $3,452.84 | 87107 | $3,999.83 |

| 87015 | $3,798.72 | 87116 | $3,997.82 |

| 87016 | $3,606.69 | 87106 | $3,997.74 |

| 87017 | $3,752.18 | 87110 | $3,991.63 |

| 87018 | $3,523.21 | 87122 | $3,988.31 |

| 87020 | $3,305.59 | 87111 | $3,987.13 |

| 87021 | $3,355.45 | 87008 | $3,979.48 |

| 87022 | $4,154.37 | 87109 | $3,972.16 |

| 87023 | $3,664.21 | 87131 | $3,964.89 |

| 87024 | $3,607.64 | 87113 | $3,958.74 |

| 87025 | $3,601.04 | 87002 | $3,949.58 |

| 87026 | $3,502.88 | 87120 | $3,927.06 |

| 87027 | $3,564.28 | 87068 | $3,922.38 |

| 87028 | $3,411.15 | 87042 | $3,919.14 |

| 87029 | $3,627.66 | 87031 | $3,893.50 |

| 87031 | $3,893.50 | 87047 | $3,888.99 |

| 87034 | $3,374.60 | 87114 | $3,865.66 |

| 87035 | $3,580.84 | 87048 | $3,852.73 |

| 87036 | $3,525.97 | 87004 | $3,813.92 |

| 87037 | $3,287.01 | 87144 | $3,799.75 |

| 87038 | $3,502.66 | 87015 | $3,798.72 |

| 87040 | $3,506.57 | 87017 | $3,752.18 |

| 87041 | $3,647.70 | 87043 | $3,751.22 |

| 87042 | $3,919.14 | 87551 | $3,750.61 |

| 87043 | $3,751.22 | 87124 | $3,742.33 |

| 87044 | $3,657.76 | 87001 | $3,732.99 |

| 87045 | $3,340.29 | 87012 | $3,725.45 |

| 87046 | $3,548.47 | 87510 | $3,724.57 |

| 87047 | $3,888.99 | 87508 | $3,716.45 |

| 87048 | $3,852.73 | 87520 | $3,711.69 |

| 87049 | $3,401.32 | 87506 | $3,711.43 |

| 87051 | $3,410.17 | 87530 | $3,710.81 |

| 87052 | $3,663.34 | 87531 | $3,710.66 |

| 87053 | $3,645.43 | 87514 | $3,710.61 |

| 87056 | $3,633.98 | 87072 | $3,709.52 |

| 87059 | $4,002.49 | 87582 | $3,706.27 |

| 87061 | $3,520.90 | 87527 | $3,705.56 |

| 87062 | $3,439.65 | 87539 | $3,705.41 |

| 87063 | $3,537.91 | 87581 | $3,702.24 |

| 87064 | $3,693.66 | 87575 | $3,702.21 |

| 87068 | $3,922.38 | 87548 | $3,701.31 |

| 87070 | $3,444.11 | 87579 | $3,697.76 |

| 87072 | $3,709.52 | 87511 | $3,696.89 |

| 87083 | $3,573.04 | 87522 | $3,696.42 |

| 87101 | $4,134.80 | 87537 | $3,694.94 |

| 87102 | $4,184.38 | 87517 | $3,693.92 |

| 87104 | $4,013.24 | 87064 | $3,693.66 |

| 87105 | $4,275.84 | 87515 | $3,693.66 |

| 87106 | $3,997.74 | 87516 | $3,693.66 |

| 87107 | $3,999.83 | 87518 | $3,693.66 |

| 87108 | $4,166.27 | 87529 | $3,692.25 |

| 87109 | $3,972.16 | 87557 | $3,691.42 |

| 87110 | $3,991.63 | 87571 | $3,688.03 |

| 87111 | $3,987.13 | 87554 | $3,687.74 |

| 87112 | $4,021.69 | 87576 | $3,687.14 |

| 87113 | $3,958.74 | 87577 | $3,687.14 |

| 87114 | $3,865.66 | 87525 | $3,681.62 |

| 87115 | $4,078.29 | 87556 | $3,674.41 |

| 87116 | $3,997.82 | 87549 | $3,672.76 |

| 87117 | $4,013.99 | 87543 | $3,672.19 |

| 87120 | $3,927.06 | 87521 | $3,670.38 |

| 87121 | $4,364.29 | 87528 | $3,670.23 |

| 87122 | $3,988.31 | 87535 | $3,669.52 |

| 87123 | $4,048.65 | 87566 | $3,667.66 |

| 87124 | $3,742.33 | 87507 | $3,666.97 |

| 87131 | $3,964.89 | 87532 | $3,666.58 |

| 87144 | $3,799.75 | 87567 | $3,666.53 |

| 87301 | $3,299.46 | 87023 | $3,664.21 |

| 87305 | $3,306.49 | 87578 | $3,663.47 |

| 87310 | $3,343.15 | 87052 | $3,663.34 |

| 87311 | $3,363.72 | 87044 | $3,657.76 |

| 87312 | $3,308.59 | 87553 | $3,657.08 |

| 87313 | $3,338.44 | 87501 | $3,656.08 |

| 87315 | $3,337.93 | 87574 | $3,650.42 |

| 87316 | $3,362.57 | 87041 | $3,647.70 |

| 87317 | $3,357.10 | 87053 | $3,645.43 |

| 87319 | $3,366.06 | 87580 | $3,645.09 |

| 87320 | $3,340.72 | 87524 | $3,638.73 |

| 87321 | $3,340.25 | 87564 | $3,637.87 |

| 87322 | $3,366.72 | 87056 | $3,633.98 |

| 87323 | $3,363.44 | 87558 | $3,633.30 |

| 87325 | $3,376.32 | 87519 | $3,632.43 |

| 87326 | $3,363.43 | 87505 | $3,631.62 |

| 87327 | $3,297.93 | 87010 | $3,631.57 |

| 87328 | $3,374.19 | 87512 | $3,629.09 |

| 87347 | $3,371.39 | 87029 | $3,627.66 |

| 87357 | $3,376.70 | 87024 | $3,607.64 |

| 87364 | $3,335.30 | 87016 | $3,606.69 |

| 87365 | $3,399.22 | 87540 | $3,605.26 |

| 87375 | $3,363.95 | 87025 | $3,601.04 |

| 87401 | $3,231.15 | 87009 | $3,593.18 |

| 87402 | $3,274.88 | 87035 | $3,580.84 |

| 87410 | $3,279.58 | 88240 | $3,577.38 |

| 87412 | $3,290.21 | 87006 | $3,576.83 |

| 87413 | $3,288.51 | 87083 | $3,573.04 |

| 87415 | $3,245.76 | 87027 | $3,564.28 |

| 87416 | $3,286.20 | 88230 | $3,554.80 |

| 87417 | $3,267.89 | 87046 | $3,548.47 |

| 87418 | $3,277.89 | 87063 | $3,537.91 |

| 87419 | $3,309.45 | 88232 | $3,536.09 |

| 87420 | $3,276.36 | 88256 | $3,535.19 |

| 87421 | $3,256.32 | 87007 | $3,535.16 |

| 87455 | $3,346.97 | 88264 | $3,533.93 |

| 87461 | $3,342.77 | 88220 | $3,532.36 |

| 87501 | $3,656.08 | 87573 | $3,532.07 |

| 87505 | $3,631.62 | 88242 | $3,531.05 |

| 87506 | $3,711.43 | 87538 | $3,529.15 |

| 87507 | $3,666.97 | 87036 | $3,525.97 |

| 87508 | $3,716.45 | 88253 | $3,524.49 |

| 87510 | $3,724.57 | 87018 | $3,523.21 |

| 87511 | $3,696.89 | 88260 | $3,521.66 |

| 87512 | $3,629.09 | 87061 | $3,520.90 |

| 87514 | $3,710.61 | 87013 | $3,520.12 |

| 87515 | $3,693.66 | 88201 | $3,519.88 |

| 87516 | $3,693.66 | 88262 | $3,517.08 |

| 87517 | $3,693.92 | 87715 | $3,515.84 |

| 87518 | $3,693.66 | 88265 | $3,515.75 |

| 87519 | $3,632.43 | 88424 | $3,515.52 |

| 87520 | $3,711.69 | 88254 | $3,508.61 |

| 87521 | $3,670.38 | 87713 | $3,507.60 |

| 87522 | $3,696.42 | 88255 | $3,507.60 |

| 87524 | $3,638.73 | 87710 | $3,506.61 |

| 87525 | $3,681.62 | 87040 | $3,506.57 |

| 87527 | $3,705.56 | 88203 | $3,506.26 |

| 87528 | $3,670.23 | 88231 | $3,504.75 |

| 87529 | $3,692.25 | 88263 | $3,504.43 |

| 87530 | $3,710.81 | 88268 | $3,504.43 |

| 87531 | $3,710.66 | 87026 | $3,502.88 |

| 87532 | $3,666.58 | 87038 | $3,502.66 |

| 87535 | $3,669.52 | 87714 | $3,501.22 |

| 87537 | $3,694.94 | 88439 | $3,499.53 |

| 87538 | $3,529.15 | 87732 | $3,497.38 |

| 87539 | $3,705.41 | 88418 | $3,496.57 |

| 87540 | $3,605.26 | 87552 | $3,496.36 |

| 87543 | $3,672.19 | 87562 | $3,494.87 |

| 87544 | $3,352.46 | 87569 | $3,494.87 |

| 87547 | $3,359.91 | 87749 | $3,494.53 |

| 87548 | $3,701.31 | 87729 | $3,493.43 |

| 87549 | $3,672.76 | 88422 | $3,489.24 |

| 87551 | $3,750.61 | 88213 | $3,486.50 |

| 87552 | $3,496.36 | 87711 | $3,486.21 |

| 87553 | $3,657.08 | 88419 | $3,478.48 |

| 87554 | $3,687.74 | 88252 | $3,478.11 |

| 87556 | $3,674.41 | 88267 | $3,475.02 |

| 87557 | $3,691.42 | 88436 | $3,474.93 |

| 87558 | $3,633.30 | 87723 | $3,470.06 |

| 87560 | $3,469.18 | 87560 | $3,469.18 |

| 87562 | $3,494.87 | 88415 | $3,469.12 |

| 87564 | $3,637.87 | 87736 | $3,466.92 |

| 87565 | $3,439.47 | 88430 | $3,464.99 |

| 87566 | $3,667.66 | 87712 | $3,462.47 |

| 87567 | $3,666.53 | 87728 | $3,462.20 |

| 87569 | $3,494.87 | 87724 | $3,457.51 |

| 87571 | $3,688.03 | 87742 | $3,456.82 |

| 87573 | $3,532.07 | 88410 | $3,456.70 |

| 87574 | $3,650.42 | 88433 | $3,455.36 |

| 87575 | $3,702.21 | 87731 | $3,454.92 |

| 87576 | $3,687.14 | 87730 | $3,454.78 |

| 87577 | $3,687.14 | 87747 | $3,453.90 |

| 87578 | $3,663.47 | 87014 | $3,452.84 |

| 87579 | $3,697.76 | 88114 | $3,452.13 |

| 87580 | $3,645.09 | 87746 | $3,450.19 |

| 87581 | $3,702.24 | 87701 | $3,450.08 |

| 87582 | $3,706.27 | 88134 | $3,448.70 |

| 87701 | $3,450.08 | 87735 | $3,448.47 |

| 87710 | $3,506.61 | 88421 | $3,447.45 |

| 87711 | $3,486.21 | 87743 | $3,445.89 |

| 87712 | $3,462.47 | 87733 | $3,445.46 |

| 87713 | $3,507.60 | 87070 | $3,444.11 |

| 87714 | $3,501.22 | 88123 | $3,442.86 |

| 87715 | $3,515.84 | 87722 | $3,440.41 |

| 87718 | $3,429.72 | 88210 | $3,440.01 |

| 87722 | $3,440.41 | 87062 | $3,439.65 |

| 87723 | $3,470.06 | 87565 | $3,439.47 |

| 87724 | $3,457.51 | 88122 | $3,437.11 |

| 87728 | $3,462.20 | 88431 | $3,436.99 |

| 87729 | $3,493.43 | 88427 | $3,436.72 |

| 87730 | $3,454.78 | 88136 | $3,434.49 |

| 87731 | $3,454.92 | 87750 | $3,433.71 |

| 87732 | $3,497.38 | 87753 | $3,433.01 |

| 87733 | $3,445.46 | 88435 | $3,431.92 |

| 87734 | $3,425.93 | 87718 | $3,429.72 |

| 87735 | $3,448.47 | 88321 | $3,427.42 |

| 87736 | $3,466.92 | 87745 | $3,426.37 |

| 87740 | $3,417.77 | 87734 | $3,425.93 |

| 87742 | $3,456.82 | 88414 | $3,425.42 |

| 87743 | $3,445.89 | 88426 | $3,419.96 |

| 87745 | $3,426.37 | 87752 | $3,419.45 |

| 87746 | $3,450.19 | 87740 | $3,417.77 |

| 87747 | $3,453.90 | 88126 | $3,417.29 |

| 87749 | $3,494.53 | 88417 | $3,414.14 |

| 87750 | $3,433.71 | 87028 | $3,411.15 |

| 87752 | $3,419.45 | 88125 | $3,410.51 |

| 87753 | $3,433.01 | 87051 | $3,410.17 |

| 87801 | $3,319.20 | 88121 | $3,406.79 |

| 87820 | $3,213.50 | 88434 | $3,404.02 |

| 87821 | $3,244.88 | 88401 | $3,402.41 |

| 87823 | $3,402.30 | 87823 | $3,402.30 |

| 87824 | $3,204.10 | 88119 | $3,401.83 |

| 87825 | $3,298.12 | 87049 | $3,401.32 |

| 87827 | $3,289.37 | 88416 | $3,401.14 |

| 87828 | $3,338.42 | 88343 | $3,400.16 |

| 87829 | $3,250.90 | 87365 | $3,399.22 |

| 87830 | $3,219.75 | 88411 | $3,395.42 |

| 87831 | $3,381.13 | 88133 | $3,393.89 |

| 87832 | $3,255.21 | 88124 | $3,393.52 |

| 87901 | $3,109.65 | 88113 | $3,388.51 |

| 87930 | $3,173.20 | 88135 | $3,385.34 |

| 87931 | $3,151.42 | 88318 | $3,381.31 |

| 87933 | $3,214.85 | 87831 | $3,381.13 |

| 87935 | $3,149.99 | 88118 | $3,379.69 |

| 87936 | $3,080.48 | 87357 | $3,376.70 |

| 87937 | $3,118.33 | 87325 | $3,376.32 |

| 87939 | $3,154.58 | 87034 | $3,374.60 |

| 87940 | $3,165.29 | 87328 | $3,374.19 |

| 87941 | $3,064.73 | 87347 | $3,371.39 |

| 87942 | $3,126.79 | 87322 | $3,366.72 |

| 87943 | $3,184.65 | 87319 | $3,366.06 |

| 88001 | $3,113.45 | 87375 | $3,363.95 |

| 88002 | $3,142.13 | 87311 | $3,363.72 |

| 88003 | $3,134.27 | 87323 | $3,363.44 |

| 88005 | $3,119.89 | 87326 | $3,363.43 |

| 88007 | $3,139.39 | 87316 | $3,362.57 |

| 88008 | $3,199.10 | 87547 | $3,359.91 |

| 88009 | $3,139.19 | 87005 | $3,358.18 |

| 88011 | $3,102.08 | 87317 | $3,357.10 |

| 88012 | $3,083.03 | 87021 | $3,355.45 |

| 88020 | $3,091.27 | 88120 | $3,354.00 |

| 88021 | $3,166.16 | 87544 | $3,352.46 |

| 88022 | $3,136.15 | 88112 | $3,352.14 |

| 88023 | $3,105.97 | 88132 | $3,349.46 |

| 88024 | $3,225.07 | 87455 | $3,346.97 |

| 88025 | $3,111.00 | 87011 | $3,346.80 |

| 88026 | $3,092.44 | 88116 | $3,343.47 |

| 88028 | $3,173.98 | 88250 | $3,343.26 |

| 88029 | $3,137.51 | 87310 | $3,343.15 |

| 88030 | $3,064.14 | 87461 | $3,342.77 |

| 88032 | $3,161.79 | 87320 | $3,340.72 |

| 88034 | $3,150.32 | 87045 | $3,340.29 |

| 88036 | $3,167.20 | 87321 | $3,340.25 |

| 88038 | $3,164.01 | 87313 | $3,338.44 |

| 88039 | $3,173.68 | 87828 | $3,338.42 |

| 88040 | $3,128.60 | 87315 | $3,337.93 |

| 88041 | $3,107.02 | 87364 | $3,335.30 |

| 88042 | $3,127.46 | 88101 | $3,328.33 |

| 88043 | $3,102.04 | 87801 | $3,319.20 |

| 88044 | $3,120.13 | 88350 | $3,312.94 |

| 88045 | $3,080.42 | 87419 | $3,309.45 |

| 88047 | $3,131.72 | 87312 | $3,308.59 |

| 88048 | $3,129.53 | 87305 | $3,306.49 |

| 88049 | $3,122.29 | 87020 | $3,305.59 |

| 88051 | $3,164.31 | 88130 | $3,305.22 |

| 88052 | $3,170.58 | 88351 | $3,300.97 |

| 88055 | $3,171.09 | 87301 | $3,299.46 |

| 88056 | $3,139.19 | 87825 | $3,298.12 |

| 88061 | $3,096.73 | 87327 | $3,297.93 |

| 88063 | $3,188.98 | 88324 | $3,292.85 |

| 88072 | $3,136.81 | 88338 | $3,290.95 |

| 88081 | $3,211.13 | 87412 | $3,290.21 |

| 88101 | $3,328.33 | 87827 | $3,289.37 |

| 88112 | $3,352.14 | 87413 | $3,288.51 |

| 88113 | $3,388.51 | 87037 | $3,287.01 |

| 88114 | $3,452.13 | 87416 | $3,286.20 |

| 88116 | $3,343.47 | 88346 | $3,284.31 |

| 88118 | $3,379.69 | 88336 | $3,280.77 |

| 88119 | $3,401.83 | 87410 | $3,279.58 |

| 88120 | $3,354.00 | 87418 | $3,277.89 |

| 88121 | $3,406.79 | 87420 | $3,276.36 |

| 88122 | $3,437.11 | 87402 | $3,274.88 |

| 88123 | $3,442.86 | 87417 | $3,267.89 |

| 88124 | $3,393.52 | 88342 | $3,263.06 |

| 88125 | $3,410.51 | 87421 | $3,256.32 |

| 88126 | $3,417.29 | 87832 | $3,255.21 |

| 88130 | $3,305.22 | 88349 | $3,252.14 |

| 88132 | $3,349.46 | 87829 | $3,250.90 |

| 88133 | $3,393.89 | 88325 | $3,250.56 |

| 88134 | $3,448.70 | 88348 | $3,250.17 |

| 88135 | $3,385.34 | 88345 | $3,249.71 |

| 88136 | $3,434.49 | 88323 | $3,249.33 |

| 88201 | $3,519.88 | 87415 | $3,245.76 |

| 88203 | $3,506.26 | 87821 | $3,244.88 |

| 88210 | $3,440.01 | 88312 | $3,244.31 |

| 88213 | $3,486.50 | 88341 | $3,240.99 |

| 88220 | $3,532.36 | 87401 | $3,231.15 |

| 88230 | $3,554.80 | 88316 | $3,228.63 |

| 88231 | $3,504.75 | 88024 | $3,225.07 |

| 88232 | $3,536.09 | 88301 | $3,220.80 |

| 88240 | $3,577.38 | 87830 | $3,219.75 |

| 88242 | $3,531.05 | 87933 | $3,214.85 |

| 88250 | $3,343.26 | 88339 | $3,214.75 |

| 88252 | $3,478.11 | 87820 | $3,213.50 |

| 88253 | $3,524.49 | 88081 | $3,211.13 |

| 88254 | $3,508.61 | 88340 | $3,207.96 |

| 88255 | $3,507.60 | 87824 | $3,204.10 |

| 88256 | $3,535.19 | 88008 | $3,199.10 |

| 88260 | $3,521.66 | 88063 | $3,188.98 |

| 88262 | $3,517.08 | 87943 | $3,184.65 |

| 88263 | $3,504.43 | 88344 | $3,177.56 |

| 88264 | $3,533.93 | 88347 | $3,175.44 |

| 88265 | $3,515.75 | 88028 | $3,173.98 |

| 88267 | $3,475.02 | 88039 | $3,173.68 |

| 88268 | $3,504.43 | 87930 | $3,173.20 |

| 88301 | $3,220.80 | 88055 | $3,171.09 |

| 88310 | $2,948.89 | 88052 | $3,170.58 |

| 88312 | $3,244.31 | 88036 | $3,167.20 |

| 88314 | $3,085.78 | 88021 | $3,166.16 |

| 88316 | $3,228.63 | 87940 | $3,165.29 |

| 88317 | $3,153.45 | 88051 | $3,164.31 |

| 88318 | $3,381.31 | 88038 | $3,164.01 |

| 88321 | $3,427.42 | 88354 | $3,162.74 |

| 88323 | $3,249.33 | 88032 | $3,161.79 |

| 88324 | $3,292.85 | 87939 | $3,154.58 |

| 88325 | $3,250.56 | 88317 | $3,153.45 |

| 88330 | $2,963.73 | 87931 | $3,151.42 |

| 88336 | $3,280.77 | 88034 | $3,150.32 |

| 88337 | $3,082.91 | 87935 | $3,149.99 |

| 88338 | $3,290.95 | 88002 | $3,142.13 |

| 88339 | $3,214.75 | 88007 | $3,139.39 |

| 88340 | $3,207.96 | 88009 | $3,139.19 |

| 88341 | $3,240.99 | 88056 | $3,139.19 |

| 88342 | $3,263.06 | 88029 | $3,137.51 |

| 88343 | $3,400.16 | 88072 | $3,136.81 |

| 88344 | $3,177.56 | 88022 | $3,136.15 |

| 88345 | $3,249.71 | 88003 | $3,134.27 |

| 88346 | $3,284.31 | 88047 | $3,131.72 |

| 88347 | $3,175.44 | 88048 | $3,129.53 |

| 88348 | $3,250.17 | 88040 | $3,128.60 |

| 88349 | $3,252.14 | 88042 | $3,127.46 |

| 88350 | $3,312.94 | 87942 | $3,126.79 |

| 88351 | $3,300.97 | 88049 | $3,122.29 |

| 88352 | $3,055.37 | 88044 | $3,120.13 |

| 88354 | $3,162.74 | 88005 | $3,119.89 |

| 88401 | $3,402.41 | 87937 | $3,118.33 |

| 88410 | $3,456.70 | 88001 | $3,113.45 |

| 88411 | $3,395.42 | 88025 | $3,111.00 |

| 88414 | $3,425.42 | 87901 | $3,109.65 |

| 88415 | $3,469.12 | 88041 | $3,107.02 |

| 88416 | $3,401.14 | 88023 | $3,105.97 |

| 88417 | $3,414.14 | 88011 | $3,102.08 |

| 88418 | $3,496.57 | 88043 | $3,102.04 |

| 88419 | $3,478.48 | 88061 | $3,096.73 |

| 88421 | $3,447.45 | 88026 | $3,092.44 |

| 88422 | $3,489.24 | 88020 | $3,091.27 |

| 88424 | $3,515.52 | 88314 | $3,085.78 |

| 88426 | $3,419.96 | 88012 | $3,083.03 |

| 88427 | $3,436.72 | 88337 | $3,082.91 |

| 88430 | $3,464.99 | 87936 | $3,080.48 |

| 88431 | $3,436.99 | 88045 | $3,080.42 |

| 88433 | $3,455.36 | 87941 | $3,064.73 |

| 88434 | $3,404.02 | 88030 | $3,064.14 |

| 88435 | $3,431.92 | 88352 | $3,055.37 |

| 88436 | $3,474.93 | 88330 | $2,963.73 |

| 88439 | $3,499.53 | 88310 | $2,948.89 |

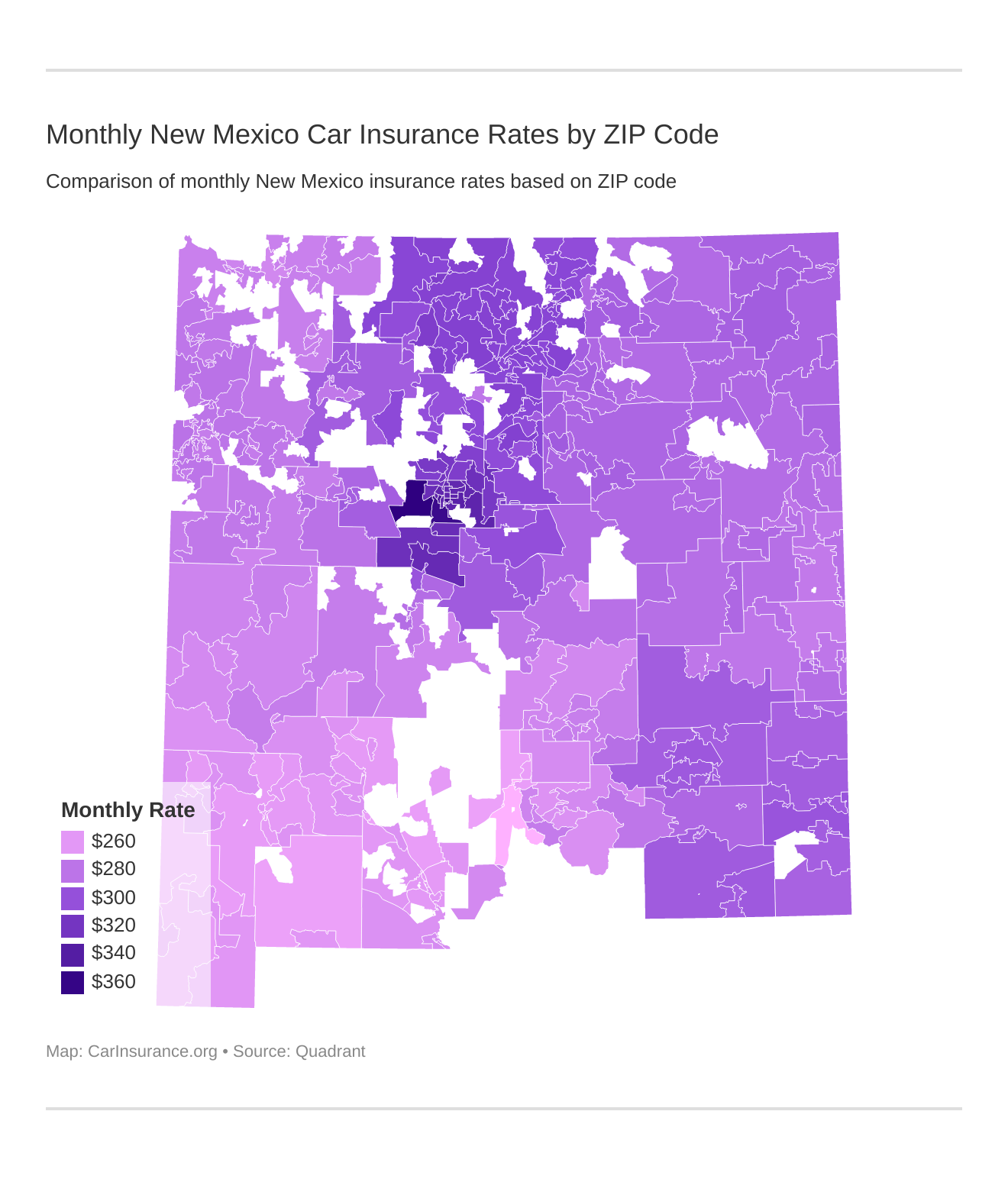

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in NM.

Generally speaking, the higher the population, the more average car insurance premiums will cost.

What are the Cheapest Insurance Rates by City?

Here’s the same information, this time organized by city or town name.

| City | Zipcode | Average Annual Rate | Zipcode | Average Annual Rate |

|---|---|---|---|---|

| ALBUQUERQUE | 87001 | $3,732.99 | 87121 | $4,364.29 |

| ALBUQUERQUE | 87002 | $3,949.58 | 87105 | $4,275.84 |

| ALBUQUERQUE | 87004 | $3,813.92 | 87102 | $4,184.38 |

| ALBUQUERQUE | 87005 | $3,358.18 | 87108 | $4,166.27 |

| ISLETA | 87006 | $3,576.83 | 87022 | $4,154.37 |

| ALBUQUERQUE | 87007 | $3,535.16 | 87101 | $4,134.80 |

| ALBUQUERQUE | 87008 | $3,979.48 | 87115 | $4,078.29 |

| ALBUQUERQUE | 87009 | $3,593.18 | 87123 | $4,048.65 |

| ALBUQUERQUE | 87010 | $3,631.57 | 87112 | $4,021.69 |

| KIRTLAND AFB | 87011 | $3,346.80 | 87117 | $4,013.99 |

| ALBUQUERQUE | 87012 | $3,725.45 | 87104 | $4,013.24 |

| TIJERAS | 87013 | $3,520.12 | 87059 | $4,002.49 |

| ALBUQUERQUE | 87014 | $3,452.84 | 87107 | $3,999.83 |

| ALBUQUERQUE | 87015 | $3,798.72 | 87116 | $3,997.82 |

| ALBUQUERQUE | 87016 | $3,606.69 | 87106 | $3,997.74 |

| ALBUQUERQUE | 87017 | $3,752.18 | 87110 | $3,991.63 |

| ALBUQUERQUE | 87018 | $3,523.21 | 87122 | $3,988.31 |

| ALBUQUERQUE | 87020 | $3,305.59 | 87111 | $3,987.13 |

| CEDAR CREST | 87021 | $3,355.45 | 87008 | $3,979.48 |

| ALBUQUERQUE | 87022 | $4,154.37 | 87109 | $3,972.16 |

| ALBUQUERQUE | 87023 | $3,664.21 | 87131 | $3,964.89 |

| ALBUQUERQUE | 87024 | $3,607.64 | 87113 | $3,958.74 |

| BELEN | 87025 | $3,601.04 | 87002 | $3,949.58 |

| ALBUQUERQUE | 87026 | $3,502.88 | 87120 | $3,927.06 |

| BOSQUE FARMS | 87027 | $3,564.28 | 87068 | $3,922.38 |

| PERALTA | 87028 | $3,411.15 | 87042 | $3,919.14 |

| LOS LUNAS | 87029 | $3,627.66 | 87031 | $3,893.50 |

| SANDIA PARK | 87031 | $3,893.50 | 87047 | $3,888.99 |

| ALBUQUERQUE | 87034 | $3,374.60 | 87114 | $3,865.66 |

| CORRALES | 87035 | $3,580.84 | 87048 | $3,852.73 |

| BERNALILLO | 87036 | $3,525.97 | 87004 | $3,813.92 |

| RIO RANCHO | 87037 | $3,287.01 | 87144 | $3,799.75 |

| EDGEWOOD | 87038 | $3,502.66 | 87015 | $3,798.72 |

| GALLINA | 87040 | $3,506.57 | 87017 | $3,752.18 |

| PLACITAS | 87041 | $3,647.70 | 87043 | $3,751.22 |

| LOS OJOS | 87042 | $3,919.14 | 87551 | $3,750.61 |

| RIO RANCHO | 87043 | $3,751.22 | 87124 | $3,742.33 |

| ALGODONES | 87044 | $3,657.76 | 87001 | $3,732.99 |

| COYOTE | 87045 | $3,340.29 | 87012 | $3,725.45 |

| ABIQUIU | 87046 | $3,548.47 | 87510 | $3,724.57 |

| SANTA FE | 87047 | $3,888.99 | 87508 | $3,716.45 |

| CHAMA | 87048 | $3,852.73 | 87520 | $3,711.69 |

| SANTA FE | 87049 | $3,401.32 | 87506 | $3,711.43 |

| EL RITO | 87051 | $3,410.17 | 87530 | $3,710.81 |

| EMBUDO | 87052 | $3,663.34 | 87531 | $3,710.66 |

| ARROYO SECO | 87053 | $3,645.43 | 87514 | $3,710.61 |

| COCHITI PUEBLO | 87056 | $3,633.98 | 87072 | $3,709.52 |

| VELARDE | 87059 | $4,002.49 | 87582 | $3,706.27 |

| DIXON | 87061 | $3,520.90 | 87527 | $3,705.56 |

| LA MADERA | 87062 | $3,439.65 | 87539 | $3,705.41 |

| VALLECITOS | 87063 | $3,537.91 | 87581 | $3,702.24 |

| TIERRA AMARILLA | 87064 | $3,693.66 | 87575 | $3,702.21 |

| MEDANALES | 87068 | $3,922.38 | 87548 | $3,701.31 |

| VADITO | 87070 | $3,444.11 | 87579 | $3,697.76 |

| ALCALDE | 87072 | $3,709.52 | 87511 | $3,696.89 |

| CHIMAYO | 87083 | $3,573.04 | 87522 | $3,696.42 |

| HERNANDEZ | 87101 | $4,134.80 | 87537 | $3,694.94 |

| CARSON | 87102 | $4,184.38 | 87517 | $3,693.92 |

| YOUNGSVILLE | 87104 | $4,013.24 | 87064 | $3,693.66 |

| CANJILON | 87105 | $4,275.84 | 87515 | $3,693.66 |

| CANONES | 87106 | $3,997.74 | 87516 | $3,693.66 |

| CEBOLLA | 87107 | $3,999.83 | 87518 | $3,693.66 |

| EL PRADO | 87108 | $4,166.27 | 87529 | $3,692.25 |

| RANCHOS DE TAOS | 87109 | $3,972.16 | 87557 | $3,691.42 |

| TAOS | 87110 | $3,991.63 | 87571 | $3,688.03 |

| PETACA | 87111 | $3,987.13 | 87554 | $3,687.74 |

| TRAMPAS | 87112 | $4,021.69 | 87576 | $3,687.14 |

| TRES PIEDRAS | 87113 | $3,958.74 | 87577 | $3,687.14 |

| TAOS SKI VALLEY | 87114 | $3,865.66 | 87525 | $3,681.62 |

| QUESTA | 87115 | $4,078.29 | 87556 | $3,674.41 |

| OJO CALIENTE | 87116 | $3,997.82 | 87549 | $3,672.76 |

| LLANO | 87117 | $4,013.99 | 87543 | $3,672.19 |

| CHAMISAL | 87120 | $3,927.06 | 87521 | $3,670.38 |

| DULCE | 87121 | $4,364.29 | 87528 | $3,670.23 |

| GLORIETA | 87122 | $3,988.31 | 87535 | $3,669.52 |

| OHKAY OWINGEH | 87123 | $4,048.65 | 87566 | $3,667.66 |

| SANTA FE | 87124 | $3,742.33 | 87507 | $3,666.97 |

| ESPANOLA | 87131 | $3,964.89 | 87532 | $3,666.58 |

| SANTA CRUZ | 87144 | $3,799.75 | 87567 | $3,666.53 |

| JARALES | 87301 | $3,299.46 | 87023 | $3,664.21 |

| TRUCHAS | 87305 | $3,306.49 | 87578 | $3,663.47 |

| SANTO DOMINGO PUEBLO | 87310 | $3,343.15 | 87052 | $3,663.34 |

| PONDEROSA | 87311 | $3,363.72 | 87044 | $3,657.76 |

| PENASCO | 87312 | $3,308.59 | 87553 | $3,657.08 |

| SANTA FE | 87313 | $3,338.44 | 87501 | $3,656.08 |

| TESUQUE | 87315 | $3,337.93 | 87574 | $3,650.42 |

| PENA BLANCA | 87316 | $3,362.57 | 87041 | $3,647.70 |

| SAN YSIDRO | 87317 | $3,357.10 | 87053 | $3,645.43 |

| VALDEZ | 87319 | $3,366.06 | 87580 | $3,645.09 |

| COSTILLA | 87320 | $3,340.72 | 87524 | $3,638.73 |

| SAN CRISTOBAL | 87321 | $3,340.25 | 87564 | $3,637.87 |

| STANLEY | 87322 | $3,366.72 | 87056 | $3,633.98 |

| RED RIVER | 87323 | $3,363.44 | 87558 | $3,633.30 |

| CERRO | 87325 | $3,376.32 | 87519 | $3,632.43 |

| SANTA FE | 87326 | $3,363.43 | 87505 | $3,631.62 |

| CERRILLOS | 87327 | $3,297.93 | 87010 | $3,631.57 |

| AMALIA | 87328 | $3,374.19 | 87512 | $3,629.09 |

| LINDRITH | 87347 | $3,371.39 | 87029 | $3,627.66 |

| JEMEZ PUEBLO | 87357 | $3,376.70 | 87024 | $3,607.64 |

| ESTANCIA | 87364 | $3,335.30 | 87016 | $3,606.69 |

| LAMY | 87365 | $3,399.22 | 87540 | $3,605.26 |

| JEMEZ SPRINGS | 87375 | $3,363.95 | 87025 | $3,601.04 |

| CEDARVALE | 87401 | $3,231.15 | 87009 | $3,593.18 |

| MORIARTY | 87402 | $3,274.88 | 87035 | $3,580.84 |

| HOBBS | 87410 | $3,279.58 | 88240 | $3,577.38 |

| BOSQUE | 87412 | $3,290.21 | 87006 | $3,576.83 |

| COCHITI LAKE | 87413 | $3,288.51 | 87083 | $3,573.04 |

| LA JARA | 87415 | $3,245.76 | 87027 | $3,564.28 |

| DEXTER | 87416 | $3,286.20 | 88230 | $3,554.80 |

| REGINA | 87417 | $3,267.89 | 87046 | $3,548.47 |

| WILLARD | 87418 | $3,277.89 | 87063 | $3,537.91 |

| HAGERMAN | 87419 | $3,309.45 | 88232 | $3,536.09 |

| LOVING | 87420 | $3,276.36 | 88256 | $3,535.19 |

| CASA BLANCA | 87421 | $3,256.32 | 87007 | $3,535.16 |

| MALJAMAR | 87455 | $3,346.97 | 88264 | $3,533.93 |

| CARLSBAD | 87461 | $3,342.77 | 88220 | $3,532.36 |

| TERERRO | 87501 | $3,656.08 | 87573 | $3,532.07 |

| HOBBS | 87505 | $3,631.62 | 88242 | $3,531.05 |

| ILFELD | 87506 | $3,711.43 | 87538 | $3,529.15 |

| MOUNTAINAIR | 87507 | $3,666.97 | 87036 | $3,525.97 |

| LAKE ARTHUR | 87508 | $3,716.45 | 88253 | $3,524.49 |

| COUNSELOR | 87510 | $3,724.57 | 87018 | $3,523.21 |

| LOVINGTON | 87511 | $3,696.89 | 88260 | $3,521.66 |

| TORREON | 87512 | $3,629.09 | 87061 | $3,520.90 |

| CUBA | 87514 | $3,710.61 | 87013 | $3,520.12 |

| ROSWELL | 87515 | $3,693.66 | 88201 | $3,519.88 |

| MCDONALD | 87516 | $3,693.66 | 88262 | $3,517.08 |

| CLEVELAND | 87517 | $3,693.92 | 87715 | $3,515.84 |

| MONUMENT | 87518 | $3,693.66 | 88265 | $3,515.75 |

| GRENVILLE | 87519 | $3,632.43 | 88424 | $3,515.52 |

| LAKEWOOD | 87520 | $3,711.69 | 88254 | $3,508.61 |

| CHACON | 87521 | $3,670.38 | 87713 | $3,507.60 |

| LOCO HILLS | 87522 | $3,696.42 | 88255 | $3,507.60 |

| ANGEL FIRE | 87524 | $3,638.73 | 87710 | $3,506.61 |

| PAGUATE | 87525 | $3,681.62 | 87040 | $3,506.57 |

| ROSWELL | 87527 | $3,705.56 | 88203 | $3,506.26 |

| EUNICE | 87528 | $3,670.23 | 88231 | $3,504.75 |

| MALAGA | 87529 | $3,692.25 | 88263 | $3,504.43 |

| WHITES CITY | 87530 | $3,710.81 | 88268 | $3,504.43 |

| LAGUNA | 87531 | $3,710.66 | 87026 | $3,502.88 |

| NEW LAGUNA | 87532 | $3,666.58 | 87038 | $3,502.66 |

| CIMARRON | 87535 | $3,669.52 | 87714 | $3,501.22 |

| TREMENTINA | 87537 | $3,694.94 | 88439 | $3,499.53 |

| MORA | 87538 | $3,529.15 | 87732 | $3,497.38 |

| DES MOINES | 87539 | $3,705.41 | 88418 | $3,496.57 |

| PECOS | 87540 | $3,605.26 | 87552 | $3,496.36 |

| ROWE | 87543 | $3,672.19 | 87562 | $3,494.87 |

| SERAFINA | 87544 | $3,352.46 | 87569 | $3,494.87 |

| UTE PARK | 87547 | $3,359.91 | 87749 | $3,494.53 |

| MIAMI | 87548 | $3,701.31 | 87729 | $3,493.43 |

| GLADSTONE | 87549 | $3,672.76 | 88422 | $3,489.24 |

| CAPROCK | 87551 | $3,750.61 | 88213 | $3,486.50 |

| ANTON CHICO | 87552 | $3,496.36 | 87711 | $3,486.21 |

| FOLSOM | 87553 | $3,657.08 | 88419 | $3,478.48 |

| JAL | 87554 | $3,687.74 | 88252 | $3,478.11 |

| TATUM | 87556 | $3,674.41 | 88267 | $3,475.02 |

| SEDAN | 87557 | $3,691.42 | 88436 | $3,474.93 |

| HOLMAN | 87558 | $3,633.30 | 87723 | $3,470.06 |

| RIBERA | 87560 | $3,469.18 | 87560 | $3,469.18 |

| CLAYTON | 87562 | $3,494.87 | 88415 | $3,469.12 |

| RAINSVILLE | 87564 | $3,637.87 | 87736 | $3,466.92 |

| NARA VISA | 87565 | $3,439.47 | 88430 | $3,464.99 |

| BUENA VISTA | 87566 | $3,667.66 | 87712 | $3,462.47 |

| MAXWELL | 87567 | $3,666.53 | 87728 | $3,462.20 |

| LA LOMA | 87569 | $3,494.87 | 87724 | $3,457.51 |

| ROCIADA | 87571 | $3,688.03 | 87742 | $3,456.82 |

| AMISTAD | 87573 | $3,532.07 | 88410 | $3,456.70 |

| QUAY | 87574 | $3,650.42 | 88433 | $3,455.36 |

| MONTEZUMA | 87575 | $3,702.21 | 87731 | $3,454.92 |

| MILLS | 87576 | $3,687.14 | 87730 | $3,454.78 |

| SPRINGER | 87577 | $3,687.14 | 87747 | $3,453.90 |

| CUBERO | 87578 | $3,663.47 | 87014 | $3,452.84 |

| CROSSROADS | 87579 | $3,697.76 | 88114 | $3,452.13 |

| SOLANO | 87580 | $3,645.09 | 87746 | $3,450.19 |

| LAS VEGAS | 87581 | $3,702.24 | 87701 | $3,450.08 |

| TAIBAN | 87582 | $3,706.27 | 88134 | $3,448.70 |

| OJO FELIZ | 87701 | $3,450.08 | 87735 | $3,448.47 |

| GARITA | 87710 | $3,506.61 | 88421 | $3,447.45 |

| ROY | 87711 | $3,486.21 | 87743 | $3,445.89 |

| MOSQUERO | 87712 | $3,462.47 | 87733 | $3,445.46 |

| CLINES CORNERS | 87713 | $3,507.60 | 87070 | $3,444.11 |

| LINGO | 87714 | $3,501.22 | 88123 | $3,442.86 |

| GUADALUPITA | 87715 | $3,515.84 | 87722 | $3,440.41 |

| ARTESIA | 87718 | $3,429.72 | 88210 | $3,440.01 |

| VEGUITA | 87722 | $3,440.41 | 87062 | $3,439.65 |

| SAN JOSE | 87723 | $3,470.06 | 87565 | $3,439.47 |

| KENNA | 87724 | $3,457.51 | 88122 | $3,437.11 |

| NEWKIRK | 87728 | $3,462.20 | 88431 | $3,436.99 |

| MCALISTER | 87729 | $3,493.43 | 88427 | $3,436.72 |

| YESO | 87730 | $3,454.78 | 88136 | $3,434.49 |

| VALMORA | 87731 | $3,454.92 | 87750 | $3,433.71 |

| WATROUS | 87732 | $3,497.38 | 87753 | $3,433.01 |

| SANTA ROSA | 87733 | $3,445.46 | 88435 | $3,431.92 |

| EAGLE NEST | 87734 | $3,425.93 | 87718 | $3,429.72 |

| ENCINO | 87735 | $3,448.47 | 88321 | $3,427.42 |

| SAPELLO | 87736 | $3,466.92 | 87745 | $3,426.37 |

| OCATE | 87740 | $3,417.77 | 87734 | $3,425.93 |

| CAPULIN | 87742 | $3,456.82 | 88414 | $3,425.42 |

| LOGAN | 87743 | $3,445.89 | 88426 | $3,419.96 |

| WAGON MOUND | 87745 | $3,426.37 | 87752 | $3,419.45 |

| RATON | 87746 | $3,450.19 | 87740 | $3,417.77 |

| PEP | 87747 | $3,453.90 | 88126 | $3,417.29 |

| CUERVO | 87749 | $3,494.53 | 88417 | $3,414.14 |

| LA JOYA | 87750 | $3,433.71 | 87028 | $3,411.15 |

| MILNESAND | 87752 | $3,419.45 | 88125 | $3,410.51 |

| SAN RAFAEL | 87753 | $3,433.01 | 87051 | $3,410.17 |

| HOUSE | 87801 | $3,319.20 | 88121 | $3,406.79 |

| SAN JON | 87820 | $3,213.50 | 88434 | $3,404.02 |

| TUCUMCARI | 87821 | $3,244.88 | 88401 | $3,402.41 |

| LEMITAR | 87823 | $3,402.30 | 87823 | $3,402.30 |

| FORT SUMNER | 87824 | $3,204.10 | 88119 | $3,401.83 |

| SAN FIDEL | 87825 | $3,298.12 | 87049 | $3,401.32 |

| CONCHAS DAM | 87827 | $3,289.37 | 88416 | $3,401.14 |

| PICACHO | 87828 | $3,338.42 | 88343 | $3,400.16 |

| SMITH LAKE | 87829 | $3,250.90 | 87365 | $3,399.22 |

| BARD | 87830 | $3,219.75 | 88411 | $3,395.42 |

| SAINT VRAIN | 87831 | $3,381.13 | 88133 | $3,393.89 |

| MELROSE | 87832 | $3,255.21 | 88124 | $3,393.52 |

| CAUSEY | 87901 | $3,109.65 | 88113 | $3,388.51 |

| TEXICO | 87930 | $3,173.20 | 88135 | $3,385.34 |

| CORONA | 87931 | $3,151.42 | 88318 | $3,381.31 |

| SAN ACACIA | 87933 | $3,214.85 | 87831 | $3,381.13 |

| FLOYD | 87935 | $3,149.99 | 88118 | $3,379.69 |

| PINEHILL | 87936 | $3,080.48 | 87357 | $3,376.70 |

| TOHATCHI | 87937 | $3,118.33 | 87325 | $3,376.32 |

| PUEBLO OF ACOMA | 87939 | $3,154.58 | 87034 | $3,374.60 |

| NAVAJO | 87940 | $3,165.29 | 87328 | $3,374.19 |

| JAMESTOWN | 87941 | $3,064.73 | 87347 | $3,371.39 |

| REHOBOTH | 87942 | $3,126.79 | 87322 | $3,366.72 |

| MENTMORE | 87943 | $3,184.65 | 87319 | $3,366.06 |

| YATAHEY | 88001 | $3,113.45 | 87375 | $3,363.95 |

| CHURCH ROCK | 88002 | $3,142.13 | 87311 | $3,363.72 |

| THOREAU | 88003 | $3,134.27 | 87323 | $3,363.44 |

| VANDERWAGEN | 88005 | $3,119.89 | 87326 | $3,363.43 |

| FORT WINGATE | 88007 | $3,139.39 | 87316 | $3,362.57 |

| #N/A | 88008 | $3,199.10 | 87547 | $3,359.91 |

| BLUEWATER | 88009 | $3,139.19 | 87005 | $3,358.18 |

| GAMERCO | 88011 | $3,102.08 | 87317 | $3,357.10 |

| MILAN | 88012 | $3,083.03 | 87021 | $3,355.45 |

| GRADY | 88020 | $3,091.27 | 88120 | $3,354.00 |

| LOS ALAMOS | 88021 | $3,166.16 | 87544 | $3,352.46 |

| BROADVIEW | 88022 | $3,136.15 | 88112 | $3,352.14 |

| ROGERS | 88023 | $3,105.97 | 88132 | $3,349.46 |

| NEWCOMB | 88024 | $3,225.07 | 87455 | $3,346.97 |

| CLAUNCH | 88025 | $3,111.00 | 87011 | $3,346.80 |

| ELIDA | 88026 | $3,092.44 | 88116 | $3,343.47 |

| HOPE | 88028 | $3,173.98 | 88250 | $3,343.26 |

| BRIMHALL | 88029 | $3,137.51 | 87310 | $3,343.15 |

| SANOSTEE | 88030 | $3,064.14 | 87461 | $3,342.77 |

| MEXICAN SPRINGS | 88032 | $3,161.79 | 87320 | $3,340.72 |

| PREWITT | 88034 | $3,150.32 | 87045 | $3,340.29 |

| RAMAH | 88036 | $3,167.20 | 87321 | $3,340.25 |

| CROWNPOINT | 88038 | $3,164.01 | 87313 | $3,338.44 |

| POLVADERA | 88039 | $3,173.68 | 87828 | $3,338.42 |

| FENCE LAKE | 88040 | $3,128.60 | 87315 | $3,337.93 |

| SHEEP SPRINGS | 88041 | $3,107.02 | 87364 | $3,335.30 |

| CLOVIS | 88042 | $3,127.46 | 88101 | $3,328.33 |

| SOCORRO | 88043 | $3,102.04 | 87801 | $3,319.20 |

| TIMBERON | 88044 | $3,120.13 | 88350 | $3,312.94 |

| NAVAJO DAM | 88045 | $3,080.42 | 87419 | $3,309.45 |

| CONTINENTAL DIVIDE | 88047 | $3,131.72 | 87312 | $3,308.59 |

| GALLUP | 88048 | $3,129.53 | 87305 | $3,306.49 |

| GRANTS | 88049 | $3,122.29 | 87020 | $3,305.59 |

| PORTALES | 88051 | $3,164.31 | 88130 | $3,305.22 |

| TINNIE | 88052 | $3,170.58 | 88351 | $3,300.97 |

| GALLUP | 88055 | $3,171.09 | 87301 | $3,299.46 |

| MAGDALENA | 88056 | $3,139.19 | 87825 | $3,298.12 |

| ZUNI | 88061 | $3,096.73 | 87327 | $3,297.93 |

| GLENCOE | 88063 | $3,188.98 | 88324 | $3,292.85 |

| LINCOLN | 88072 | $3,136.81 | 88338 | $3,290.95 |

| BLANCO | 88081 | $3,211.13 | 87412 | $3,290.21 |

| PIE TOWN | 88101 | $3,328.33 | 87827 | $3,289.37 |

| BLOOMFIELD | 88112 | $3,352.14 | 87413 | $3,288.51 |

| NAGEEZI | 88113 | $3,388.51 | 87037 | $3,287.01 |

| FRUITLAND | 88114 | $3,452.13 | 87416 | $3,286.20 |

| RUIDOSO DOWNS | 88116 | $3,343.47 | 88346 | $3,284.31 |

| HONDO | 88118 | $3,379.69 | 88336 | $3,280.77 |

| AZTEC | 88119 | $3,401.83 | 87410 | $3,279.58 |

| LA PLATA | 88120 | $3,354.00 | 87418 | $3,277.89 |

| SHIPROCK | 88121 | $3,406.79 | 87420 | $3,276.36 |

| FARMINGTON | 88122 | $3,437.11 | 87402 | $3,274.88 |

| KIRTLAND | 88123 | $3,442.86 | 87417 | $3,267.89 |

| OROGRANDE | 88124 | $3,393.52 | 88342 | $3,263.06 |

| WATERFLOW | 88125 | $3,410.51 | 87421 | $3,256.32 |

| SAN ANTONIO | 88126 | $3,417.29 | 87832 | $3,255.21 |

| SUNSPOT | 88130 | $3,305.22 | 88349 | $3,252.14 |

| QUEMADO | 88132 | $3,349.46 | 87829 | $3,250.90 |

| HIGH ROLLS MOUNTAIN PARK | 88133 | $3,393.89 | 88325 | $3,250.56 |

| SAN PATRICIO | 88134 | $3,448.70 | 88348 | $3,250.17 |

| RUIDOSO | 88135 | $3,385.34 | 88345 | $3,249.71 |

| FORT STANTON | 88136 | $3,434.49 | 88323 | $3,249.33 |

| FLORA VISTA | 88201 | $3,519.88 | 87415 | $3,245.76 |

| DATIL | 88203 | $3,506.26 | 87821 | $3,244.88 |

| ALTO | 88210 | $3,440.01 | 88312 | $3,244.31 |

| NOGAL | 88213 | $3,486.50 | 88341 | $3,240.99 |

| FARMINGTON | 88220 | $3,532.36 | 87401 | $3,231.15 |

| CAPITAN | 88230 | $3,554.80 | 88316 | $3,228.63 |

| BERINO | 88231 | $3,504.75 | 88024 | $3,225.07 |

| CARRIZOZO | 88232 | $3,536.09 | 88301 | $3,220.80 |

| RESERVE | 88240 | $3,577.38 | 87830 | $3,219.75 |

| DERRY | 88242 | $3,531.05 | 87933 | $3,214.85 |

| MAYHILL | 88250 | $3,343.26 | 88339 | $3,214.75 |

| ARAGON | 88252 | $3,478.11 | 87820 | $3,213.50 |

| CHAPARRAL | 88253 | $3,524.49 | 88081 | $3,211.13 |

| MESCALERO | 88254 | $3,508.61 | 88340 | $3,207.96 |

| LUNA | 88255 | $3,507.60 | 87824 | $3,204.10 |

| SANTA TERESA | 88256 | $3,535.19 | 88008 | $3,199.10 |

| SUNLAND PARK | 88260 | $3,521.66 | 88063 | $3,188.98 |

| WINSTON | 88262 | $3,517.08 | 87943 | $3,184.65 |

| PINON | 88263 | $3,504.43 | 88344 | $3,177.56 |

| SACRAMENTO | 88264 | $3,533.93 | 88347 | $3,175.44 |

| CLIFF | 88265 | $3,515.75 | 88028 | $3,173.98 |

| GLENWOOD | 88267 | $3,475.02 | 88039 | $3,173.68 |

| ARREY | 88268 | $3,504.43 | 87930 | $3,173.20 |

| REDROCK | 88301 | $3,220.80 | 88055 | $3,171.09 |

| ORGAN | 88310 | $2,948.89 | 88052 | $3,170.58 |

| FORT BAYARD | 88312 | $3,244.31 | 88036 | $3,167.20 |

| ANTHONY | 88314 | $3,085.78 | 88021 | $3,166.16 |

| RINCON | 88316 | $3,228.63 | 87940 | $3,165.29 |

| MULE CREEK | 88317 | $3,153.45 | 88051 | $3,164.31 |

| GILA | 88318 | $3,381.31 | 88038 | $3,164.01 |

| WEED | 88321 | $3,427.42 | 88354 | $3,162.74 |

| DONA ANA | 88323 | $3,249.33 | 88032 | $3,161.79 |

| MONTICELLO | 88324 | $3,292.85 | 87939 | $3,154.58 |

| CLOUDCROFT | 88325 | $3,250.56 | 88317 | $3,153.45 |

| CABALLO | 88330 | $2,963.73 | 87931 | $3,151.42 |

| FAYWOOD | 88336 | $3,280.77 | 88034 | $3,150.32 |

| ELEPHANT BUTTE | 88337 | $3,082.91 | 87935 | $3,149.99 |

| WHITE SANDS MISSILE RANGE | 88338 | $3,290.95 | 88002 | $3,142.13 |

| LAS CRUCES | 88339 | $3,214.75 | 88007 | $3,139.39 |

| PLAYAS | 88340 | $3,207.96 | 88009 | $3,139.19 |

| RODEO | 88341 | $3,240.99 | 88056 | $3,139.19 |

| COLUMBUS | 88342 | $3,263.06 | 88029 | $3,137.51 |

| VADO | 88343 | $3,400.16 | 88072 | $3,136.81 |

| ARENAS VALLEY | 88344 | $3,177.56 | 88022 | $3,136.15 |

| LAS CRUCES | 88345 | $3,249.71 | 88003 | $3,134.27 |

| MESILLA PARK | 88346 | $3,284.31 | 88047 | $3,131.72 |

| MESQUITE | 88347 | $3,175.44 | 88048 | $3,129.53 |

| HACHITA | 88348 | $3,250.17 | 88040 | $3,128.60 |

| HILLSBORO | 88349 | $3,252.14 | 88042 | $3,127.46 |

| WILLIAMSBURG | 88350 | $3,312.94 | 87942 | $3,126.79 |

| MIMBRES | 88351 | $3,300.97 | 88049 | $3,122.29 |

| LA MESA | 88352 | $3,055.37 | 88044 | $3,120.13 |

| LAS CRUCES | 88354 | $3,162.74 | 88005 | $3,119.89 |

| HATCH | 88401 | $3,402.41 | 87937 | $3,118.33 |

| LAS CRUCES | 88410 | $3,456.70 | 88001 | $3,113.45 |

| BUCKHORN | 88411 | $3,395.42 | 88025 | $3,111.00 |

| TRUTH OR CONSEQUENCES | 88414 | $3,425.42 | 87901 | $3,109.65 |

| HANOVER | 88415 | $3,469.12 | 88041 | $3,107.02 |

| BAYARD | 88416 | $3,401.14 | 88023 | $3,105.97 |

| LAS CRUCES | 88417 | $3,414.14 | 88011 | $3,102.08 |

| HURLEY | 88418 | $3,496.57 | 88043 | $3,102.04 |

| SILVER CITY | 88419 | $3,478.48 | 88061 | $3,096.73 |

| SANTA CLARA | 88421 | $3,447.45 | 88026 | $3,092.44 |

| ANIMAS | 88422 | $3,489.24 | 88020 | $3,091.27 |

| BENT | 88424 | $3,515.52 | 88314 | $3,085.78 |

| LAS CRUCES | 88426 | $3,419.96 | 88012 | $3,083.03 |

| LA LUZ | 88427 | $3,436.72 | 88337 | $3,082.91 |

| GARFIELD | 88430 | $3,464.99 | 87936 | $3,080.48 |

| LORDSBURG | 88431 | $3,436.99 | 88045 | $3,080.42 |

| SALEM | 88433 | $3,455.36 | 87941 | $3,064.73 |

| DEMING | 88434 | $3,404.02 | 88030 | $3,064.14 |

| TULAROSA | 88435 | $3,431.92 | 88352 | $3,055.37 |

| HOLLOMAN AIR FORCE BASE | 88436 | $3,474.93 | 88330 | $2,963.73 |

| ALAMOGORDO | 88439 | $3,499.53 | 88310 | $2,948.89 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Best New Mexico Car Insurance Companies?

Out of all of the car insurers in the Land of Enchantment, which ones are the best? It can be hard to get used to the thought of changing car insurance providers, and the many options available can leave you wondering what to do.

This section is here to help you. We’ll cover company financial rankings, complaints, reviews, and much more.

Let’s get ready to explore car insurance companies further.

What Is the Financial Rating of the Largest Companies?

A.M. Best rates insurance companies based on their overall financial strength. To arrive at their decisions, they look at a company’s operating costs, profitability, and other factors.

| Insurance Company | AM Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| USAA Group | A++ |

| Allstate Insurance Group | A+ |

| Liberty Mutual Group | A |

| Hartford Fire & Casualty Group | A+ |

| Sentry Insurance Group | A+ |

| Iowa Farm Bureau Group | A |

State Farm and USAA are among the leading contenders to receive A.M. Best’s highest score of “A++,” which shows that they’re financially solid and can afford to pay premiums.

Let’s find out more about insurers through reviews.

Which Companies Have the Best Ratings?

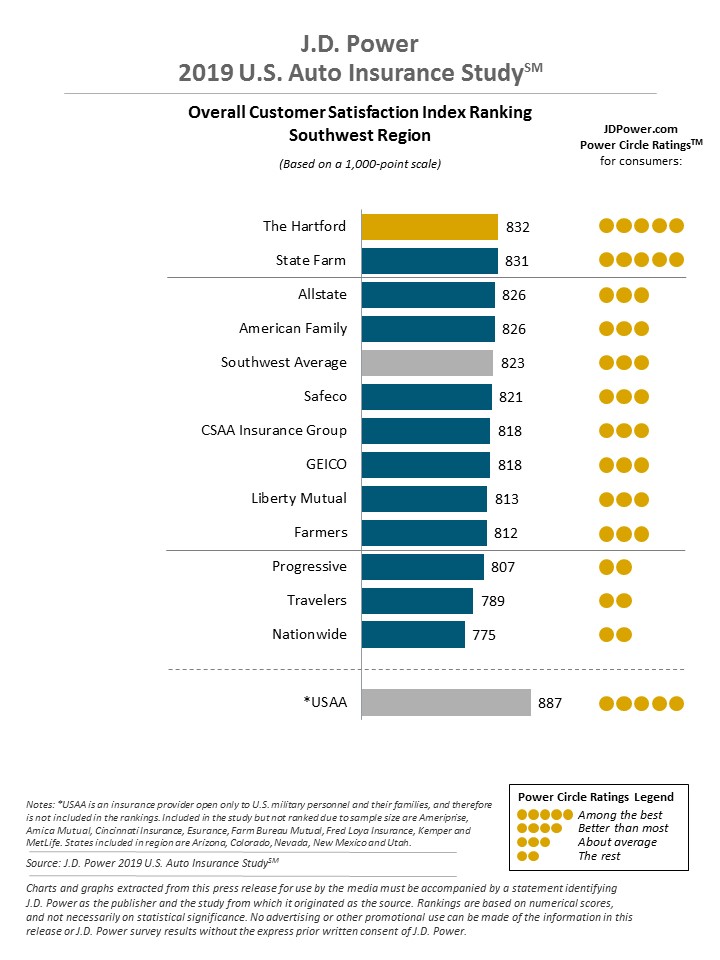

J.D. Power’s annual U.S. Auto Insurance Study reveals how well companies achieve customer satisfaction.

Who is the cheapest car insurance company in NM? Review the average auto insurance rates by company below:

Of the major companies who qualified in J.D. Power’s rankings, The Hartford and State Farm received five Power Circles, meaning they’re “among the best.”

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Companies Have the Most Complaints in New Mexico?

You can expect a few complaints now and then. No matter what you do, you can’t please everyone, and insurance companies are no different. But, if a company receives several, it’s time to pay closer attention.

These are the number of complaints and related ratios for the top 10 insurers in New Mexico.

| Company | Total Complaints 2017 | Complaint Ratio 2017 |

|---|---|---|

| State Farm Group | 1482 | 0.44 |

| Liberty Mutual Group | 222 | 5.95 |

| Progressive Group | 120 | 0.75 |

| Allstate Insurance Group | 163 | 0.5 |

| Iowa Farm Bureau Group | 32 | 0.77 |

| Hartford Fire & Casualty Group | 9 | 4.68 |

| Geico | 2 | 0 |

| USAA Group | 2 | 0 |

| Sentry Insurance Group | 1 | 6.53 |

| Farmers Insurance Group | 0 | 0 |

State Farm received the most complaints; however, compared to the overall number of customers, the complaint ratio of 44 percent out of 100 is fairly low.

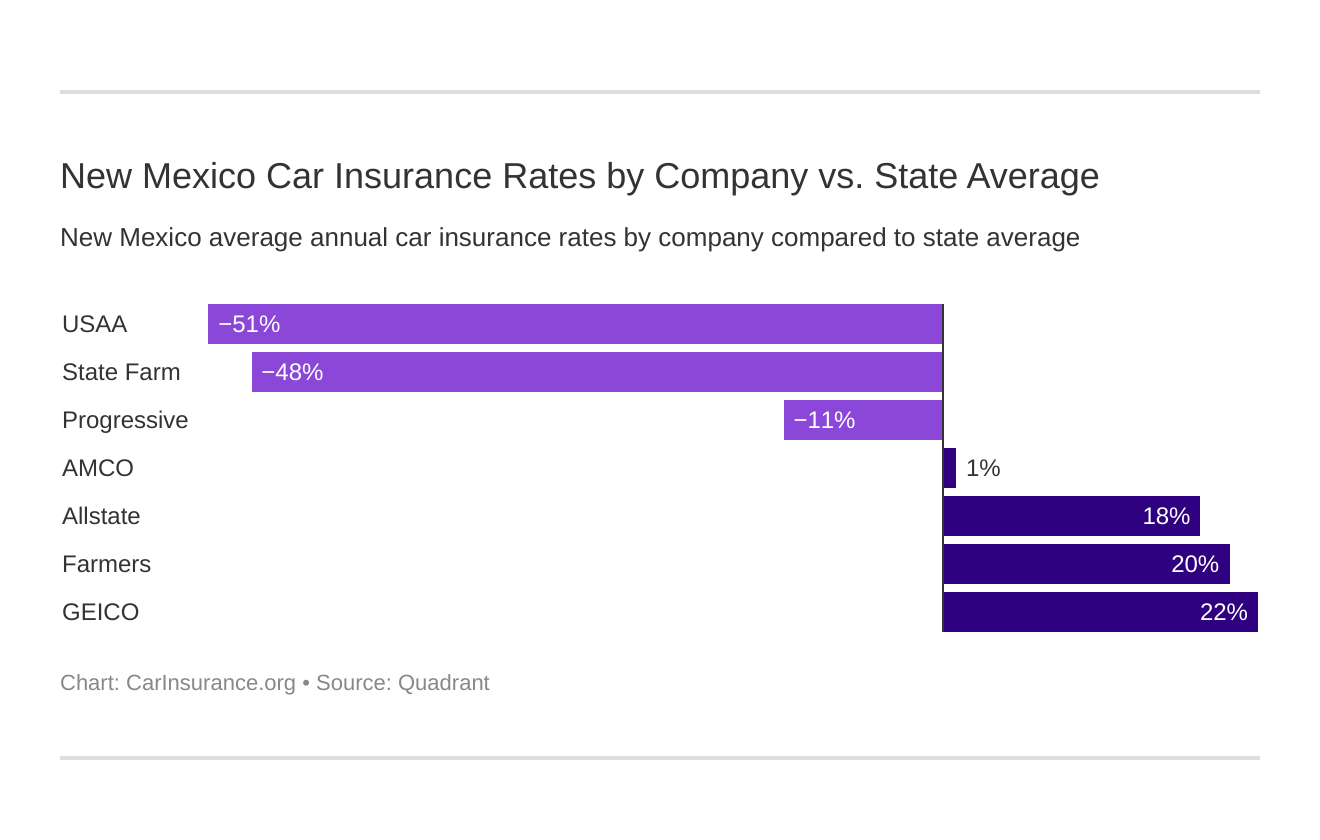

Who are the Cheapest Companies in New Mexico?

These are the cheapest and most expensive companies in New Mexico based on the average cost of premiums.

| Insurance Company | Average Annual Premiums | Deviation from State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| USAA | $2,297.13 | -$1,166.08 | -50.76% |

| State Farm Mutual Auto | $2,340.03 | -$1,123.18 | -48.00% |

| Progressive Direct | $3,118.17 | -$345.04 | -11.07% |

| AMCO Insurance | $3,514.07 | $50.86 | 1.45% |

| Allstate F&C | $4,200.53 | $737.32 | 17.55% |

| Farmers Ins Co Of AZ | $4,314.90 | $851.69 | 19.74% |

| Geico General | $4,457.62 | $994.42 | 22.31% |

State Farm and USAA beat the state average premium rates by roughly half. Allstate, however, was among those that nearly matched the average.

What are the Commute Rates by Company?

As the table below shows, how far you commute regularly can affect your rates.

| Insurance Company | 10 miles commute/ 6000 annual mileage | 25 miles commute/ 12000 annual mileage |

|---|---|---|

| Allstate | $4,200.53 | $4,200.53 |

| Farmers | $4,314.90 | $4,314.90 |

| Geico | $4,389.62 | $4,525.62 |

| Nationwide | $3,514.07 | $3,514.07 |

| Progressive | $3,118.17 | $3,118.17 |

| State Farm | $2,281.70 | $2,398.36 |

| USAA | $2,228.48 | $2,365.79 |

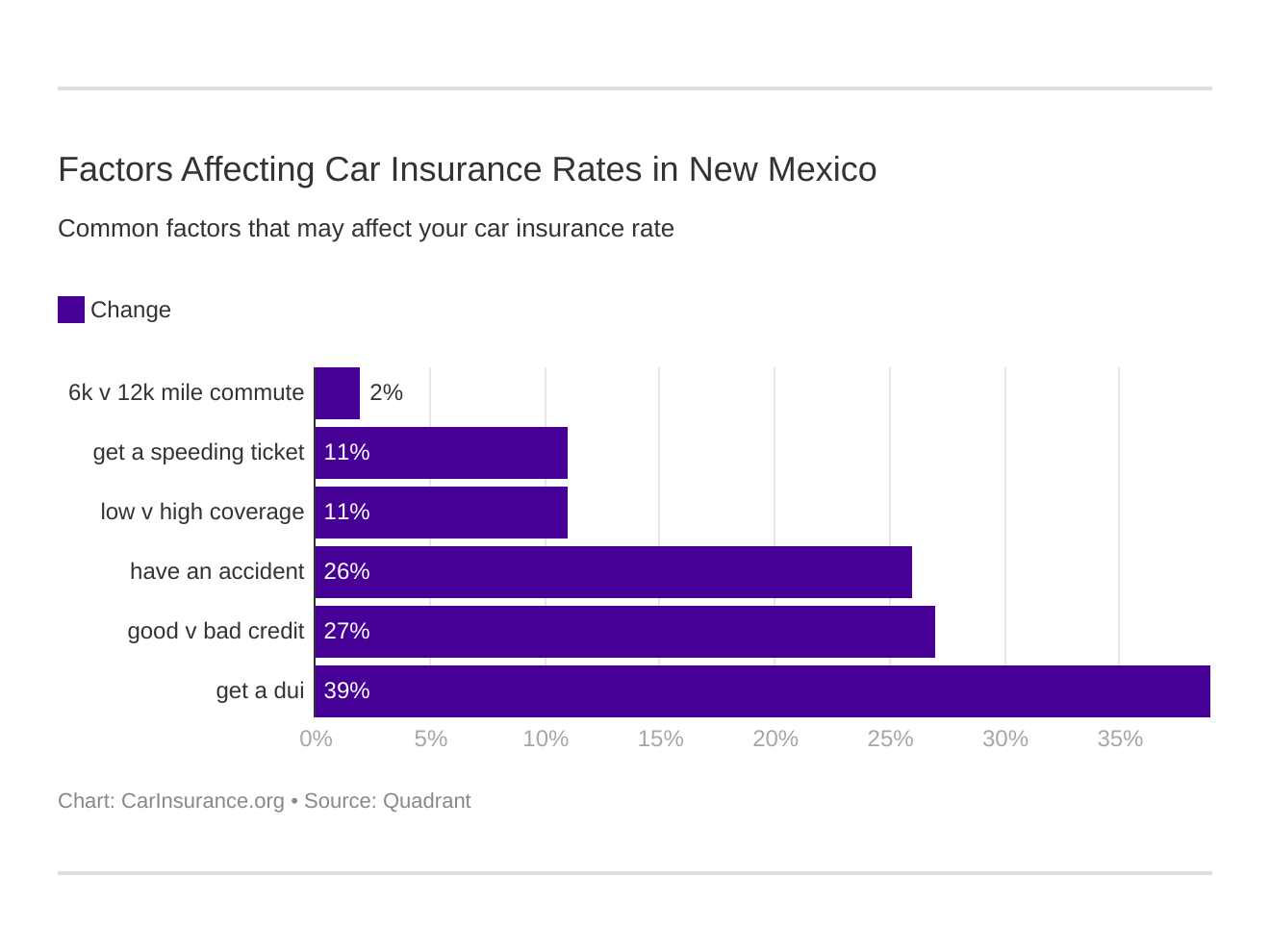

Take a look at these 6 major factors affecting auto insurance rates in New Mexico.

Farmers, Nationwide, Progressive, and Allstate didn’t change their rates for 10- versus 25-mile commutes. The companies that factored in the distances, such as State Farm, sometimes raised rates by more than $100.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Coverage Level Rates by Company?

Car insurance shoppers can compare companies based on their different coverage levels for a more price-based decision. These are rates for the top insurance providers in New Mexico.

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,018.38 | $4,192.35 | $4,390.87 |

| Farmers | $3,936.11 | $4,275.73 | $4,732.85 |

| Geico | $4,155.59 | $4,446.29 | $4,771.00 |

| Nationwide | $3,462.26 | $3,479.90 | $3,600.05 |

| Progressive | $2,975.51 | $3,117.04 | $3,261.94 |

| State Farm | $2,132.39 | $2,347.45 | $2,540.25 |

| USAA | $2,135.39 | $2,307.89 | $2,448.12 |

Progressive was among the companies with a big gap between their lowest and highest coverages more than $1,000. Others, such as State Farm, had a spread as low as $200.

It can pay to shop around you may be able to get the highest coverage for more protection at an affordable price.

What are the Credit History Rates by Company?

As you’ll see below, your credit score is among the bigger factors in your car insurance rates.

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $4,887.46 | $4,028.34 | $3,685.79 |

| Farmers | $4,950.09 | $4,097.94 | $3,896.67 |

| Geico | $4,999.10 | $4,349.78 | $4,023.99 |

| Nationwide | $4,300.68 | $3,341.72 | $2,899.82 |

| Progressive | $3,420.75 | $3,049.36 | $2,884.38 |

| State Farm | $3,337.18 | $2,056.00 | $1,626.91 |

| USAA | $2,874.97 | $2,151.55 | $1,864.88 |

The average American’s credit score is 675. New Mexico’s score ranks slightly below at 659, which is leaning more toward poor credit.

State Farm is among the companies that charge a true premium for imperfect credit scores — customers with good credit pay half the cost of those with poor credit.

What are the Driving Record Rates by Company?

Another major part of car insurance premiums is your driving record. One of the best ways to save is to keep it spotless.

| Insurance Company | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $3,463.66 | $4,561.80 | $4,877.87 | $3,898.80 |

| Farmers | $3,646.60 | $4,694.44 | $4,584.30 | $4,334.25 |

| Geico | $2,631.09 | $4,217.02 | $8,351.31 | $2,631.09 |

| Nationwide | $2,625.87 | $3,688.87 | $4,765.82 | $2,975.73 |

| Progressive | $2,696.21 | $3,686.49 | $2,904.96 | $3,184.99 |

| State Farm | $2,197.36 | $2,387.59 | $2,387.59 | $2,387.59 |

| USAA | $1,706.19 | $2,372.97 | $3,122.21 | $1,987.15 |

Rates tend to rise more for the bigger penalty of a DUI versus a speeding ticket. With Progressive, even one speeding ticket can lead to a $500-rate increase from a clean record.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

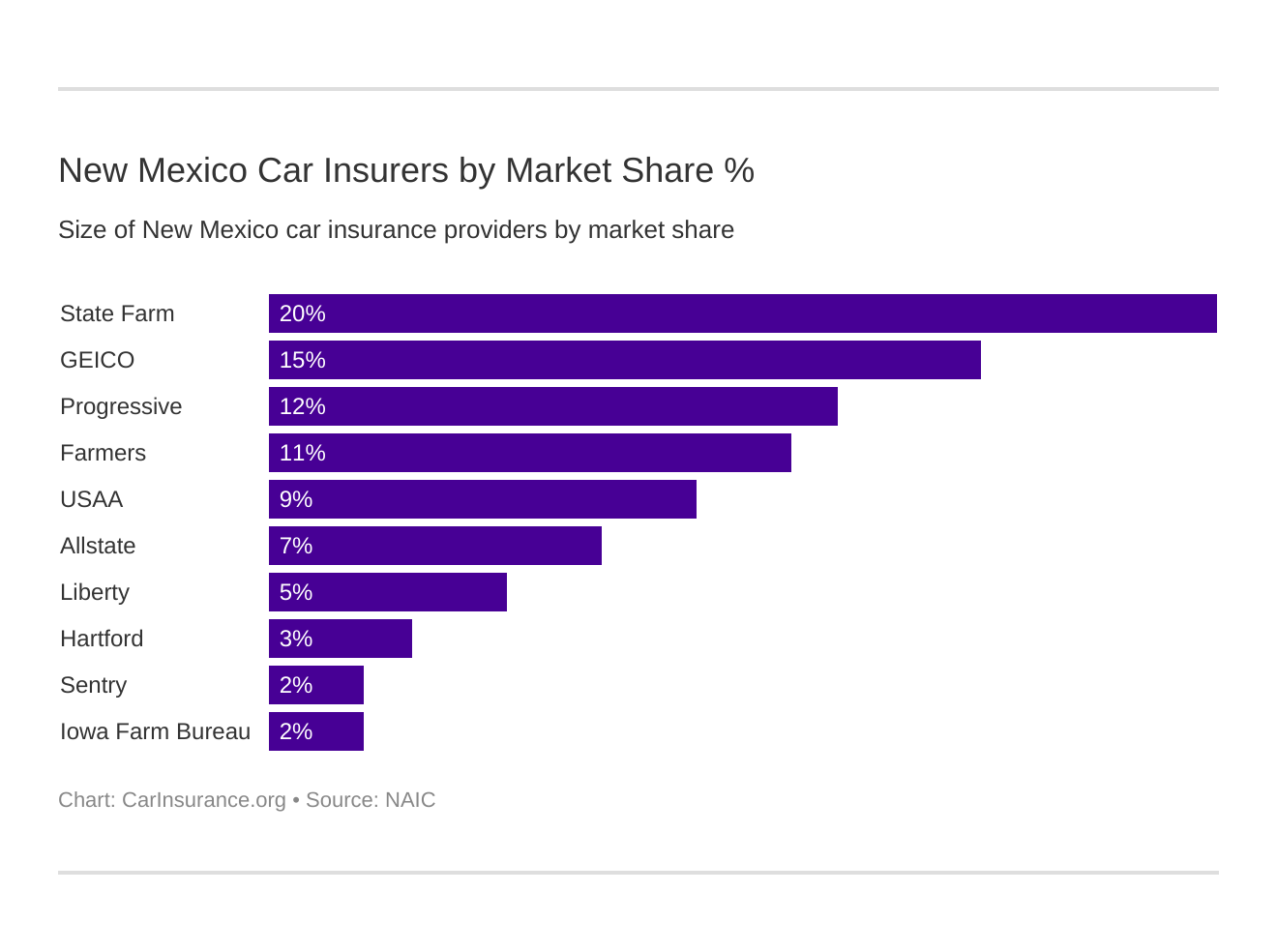

Who are the Largest Car Insurance Companies in New Mexico?

These are the largest insurers in the Land of Enchantment, ranked by premiums written, loss ratio, and market share.

| Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $277,878 | 58.73% | 20.04% |

| Geico | $207,105 | 86.73% | 14.94% |

| Progressive Group | $160,619 | 61.50% | 11.58% |

| Farmers Insurance Group | $155,049 | 60.51% | 11.18% |

| USAA Group | $127,970 | 76.06% | 9.23% |

| Allstate Insurance Group | $97,610 | 51.94% | 7.04% |

| Liberty Mutual Group | $69,048 | 60.23% | 4.98% |

| Hartford Fire & Casualty Group | $41,760 | 77.10% | 3.01% |

| Sentry Insurance Group | $32,713 | 54.68% | 2.36% |

| Iowa Farm Bureau Group | $30,209 | 68.10% | 2.18% |

State Farm tops the list, and, as indicated earlier, is among the strongest companies financially.

What is the Number of Insurers by State?

As shown below, a small number of insurers (“domestic” companies) were formed in New Mexico. The rest, the “foreign” companies, started out of state.

| Type of Insurer | Number |

|---|---|

| Domestic | 15 |

| Foreign | 837 |

What are the New Mexico Laws?

State laws also affect car insurance rates, which makes obeying them crucial to both keeping your rate low and keeping yourself and others safe.

In this section, we’ll cover car insurance laws for windshield coverage and “high-risk” insurance, fraud, and other laws you should know.

So, let’s get started to learn more about how to stay legal on the road.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Car Insurance Laws?

Car insurance laws control how companies operate in New Mexico. These are some of the most vital laws to keep in mind.

How New Mexico Car Insurance Rates are Determined

New Mexico’s Office of the Superintendent of Insurance controls car insurers’ rates and form filings. In setting rates, it follows the National Association of Insurance Commissioners‘ guidelines.

How to Get Windshield Coverage

For windshield replacement, New Mexico law allows insurers to use aftermarket or generic parts if the quality is comparable to the manufacturer’s parts.

Depending on the insurer and what they offer, comprehensive coverage may cover the cost of repair or replacement.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get High-Risk Auto Insurance

Insurers consider drivers who have committed several violations as a “high risk” for coverage. Many times, insurance companies in the open marketplace deny them coverage or charge extremely high rates.

The New Mexico Motor Vehicle Insurance Plan (NMMVIP) offers a high-risk auto insurance pool to drivers who can’t qualify for coverage otherwise. The plan assigns drivers to certain insurers and the companies share the risk equally.

To be eligible to join, drivers must have New Mexico licenses and have registered their cars in the state.

They must also have been denied coverage within the past two months in the open marketplace. Premiums tend to cost more than those under traditional insurers.

How to Get Low-Cost Insurance

Though New Mexico has a program to help high-risk drivers, it does not have one for low-income drivers.

California, Hawaii, and New Jersey are the only states with government-funded programs to help low-income drivers pay for their car insurance.

Is There an Automobile Insurance Fraud in New Mexico?

Car insurance fraud occurs when people intentionally falsify or provide incomplete information to get insurance benefits.

According to the Insurance Information Institute, car insurance fraud costs insurers $16 billion annually. The insurers then transfer these losses onto consumers in the form of higher rates.

Car insurance fraud is a crime in New Mexico. Perpetrators can face fines and jail time.

The state considers the following actions as forms of insurance fraud:

- Falsifying information on an insurance application

- Filing a false claim

- Making a false document for support of a claim

- Making a false statement to obtain a policy or to obtain or maintain any kind of compensation

There are penalties:

- Victim loss of $250 or less: six months in prison and a $500 fine

- Victim loss of over $250: one year in prison and a $1,000 fine

- Victim loss between $500 – $2,500: 18 months in prison and a $5,000 fine

- Victim loss between $2,500 – $20,000: three years in prison and a $5,000 fine

- Victim loss over $20,000: nine years in prison and a $10,000 fine

The New Mexico Office of the Superintendent of Insurance investigates insurance and other fraud claims.

To report insurance fraud, you can fill out an online form or call the Office of the Superintendent of Insurance at (855) 857-0972.

According to their 2016 Annual Report, the Office investigated 747 insurance fraud cases that year and referred 18 for prosecution. They processed and recommended 81.26 percent of insurance fraud complaints for further administrative action or closure within 60 days.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Statute of Limitations?

The time limit, or statute of limitations, to file a personal injury claim in New Mexico is three years. For property damage claims, it’s four years.

What are the Vehicle Licensing Laws?

Keep reading to find out about the laws regulating the license you need to drive on New Mexico’s roads.

What is Considered a Real ID?

The federal Real ID Act requires a more secure form of identification for entry into federal buildings and for domestic air flights starting on October 1, 2020. In the meantime, existing New Mexico driver’s licenses and ID cards will continue to be accepted until that date or until their expiration. Real ID cards comply with the law and are valid proof of your identity.

In November 2016, the New Mexico MVD started issuing Real ID cards. You’re not required to get one. The MVD will continue to issue regular driver’s licenses and ID cards.

To get a Real ID license or ID card, you must present original or certified copies of your proof of identity, proof of Social Security number, and two proofs of address in person.

The MVD emphasizes that there’s no rush. You can wait until your next renewal or until you need to change your name or address.

This video offers more insights on how to get a Real ID card in New Mexico:

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Penalties for Driving Without Insurance?

As we mentioned earlier, you’ll need to show proof of insurance under the following scenarios in New Mexico:

- If you’re in an accident

- When you apply for a vehicle title

- When you register a car

- When an officer stops you

If you don’t have insurance, the New Mexico MVD will give you 30 days to provide proof. If you don’t, they will suspend your registration, and you’ll need to pay $30 to reinstate it. Driving without insurance in New Mexico will result in a $100 fine.

First offenders face the following penalties:

- Fine up to $300

- Imprisonment up to 90 days

- License suspension

So, make sure that you have proof of insurance with you at all times; otherwise, you face potential fines and jail time.

What are the Teen Driver Laws?

Young drivers in New Mexico must be at least 15 years old to get a learner’s permit. As part of the state’s graduated driver’s license program, teens must meet the following requirements to get a full or restricted license.

| Requirements to Receive License/Restricted License | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours (10 of which must be at night) |

| Minimum Age | 15 years, 6 months |

Teen drivers who get a restricted license must comply with the following rules.

| Restricted License Requirements | Details |

|---|---|

| Nighttime Restrictions | Midnight to 5 a.m. |

| Passenger Restrictions (family members excepted unless noted otherwise) | No more than 1 passenger younger than 21 |

| When Restrictions can be Lifted | Details |

| Nighttime Restrictions | 12 months or until age 18, whichever occurs first (minimum age: 16 years, 6 months) |

| Passenger Restrictions | 12 months or until age 18, whichever occurs first (minimum age: 16 years, 6 months) |

A crucial part of safe driving for drivers of all ages is to reduce or remove distractions. Drivers with learner’s permits or restricted licenses can’t text or use a hand-held device.

What are the License Renewal Procedures for Older Drivers?

According to the Insurance Institute for Highway Safety, older drivers must meet the following requirements for license renewal:

- Renewals: ages 67 -74 – every four years; age 75 and older – every year

- effective 10/01/19: ages 71 – 78 – every four years; ages 79 and older – every year

- Provide proof of vision at every renewal if age 75 years or older; otherwise, it’s required at every in-person renewal

- Mail or online renewal: You can do so at every other renewal unless you need a new photo. This isn’t allowed for drivers aged 75 and older.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Procedure for New Residents?

As the New Mexico MVD welcomes you to the Land of Enchantment, it will request the following from new residents when they apply for their licenses:

- Social Security card

- Birth certificate

- A current driver’s license

- Two proofs of the current physical address (bank statements, pay stubs, utility bills, etc.)

- Drivers aged 18 – 24 only: completion of the None for the Road program to curb accidents, citations, and deaths related to drunk driving

Best of all, 10 MVD Express locations throughout the state let you process your vehicle documentation without the large lines, so you can Get In, Get Done, and Get Going.

What are the License Renewal Procedures?

These are New Mexico’s license renewal requirements for the general population.

| Age | Renewal Cycle | Vision Test | Mail or Online Renewal Permitted |

|---|---|---|---|

| General Population | 4 or 8 years (personal choice) | Required at renewal if doing it in person | Online permitted for every other renewal. If new photo is required, then by mail |

Unless you need a new photo, you can go eight years without an in-person trip to the MVD if you choose to renew online or by mail.

What is Considered a Negligent Operator Treatment System (NOTS)?

Committing certain driving offenses in the Land of Enchantment can earn you points on your license. The points may ultimately lead to a driver’s license suspension or revocation.

Part of New Mexico law prohibits the assignment of points for speeding convictions on rural highways except in Bernalillo County. The law defines a “rural highway” as “part of a highway that is located at least two miles outside of the boundaries of an incorporated city, town or village.”

An exception is for vehicles that weigh 12,000 pounds or more and for speeding convictions if the motorist’s excessive speed was cited as a factor in an accident.

Below are some of the major violations that can generate points.

First up: careless driving, such as speeding or making sharp turns, is a misdemeanor crime. These are the penalties.

| Classification of Crime | Jail Time | Fines | Driving Record Points |

|---|---|---|---|

| Misdemeanor | Up to 90 days | Up to $300 | 3 points |

Reckless driving may harm yourself and others. Though it’s also classified as a misdemeanor offense, the penalties are worse than for careless driving.

| Offense | Classification of Crime | Jail Time | Fines | Driving Record Points | License Suspension |

|---|---|---|---|---|---|

| First Offense | Misdemeanor | 5 to 90 days | $25 to $100 | 6 points | Up to 90 days |

| Second and Subsequent Offenses | Misdemeanor | 10 days to 6 months | $50 to $1,000 | 6 points | Up to 90 days |

These are some more common offenses and the points that can result:

- Speeding 26 mph or more over the posted limit on any road way if the limit is 15, 30, or 75 mph: eight points

- Passing a school bus taking or discharging passengers or displaying a warning not to pass: six points

- Speeding 16-25 mph over the posted limit on any road way if the limit is 15, 30, or 75 mph: five points

- Failure to yield to the right of way to an authorized emergency vehicle: four points

It’s best to obey the rules to keep yourself and others safe than to engage in potentially criminal behavior.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Rules of the Road?

Now that we’ve covered some of the penalties you should avoid, we’ll go into more detail about the rules of the road.

Is New Mexico at Fault or No-Fault State?

In New Mexico, drivers who are at-fault for an accident must pay for any damages or injuries.

When it comes to filing a legal claim as a result of negligence or breaching the duty not to harm others, the state follows a doctrine of “pure” comparative negligence.

This means that a judge or a jury will assign each party part of the blame for an accident. For example, if your damages were $70,000, and you were found to be 40 percent responsible for the accident, you would recover $30,000 of the damages. You would be responsible for $40,000 of them.

You may also receive damages regardless of your degree of fault — whether it’s two percent, 51 percent, or even 99 percent.

What are the Seat Belt & Car Seat Laws?

Below are New Mexico’s seat belt and child safety seat laws.

| Initial Effective Date | Primary Enforcement | Seat Belt Use | Maximum Fine |

|---|---|---|---|

| January 1, 1986 | Yes. Effective since January 1, 1986 | 18+ years in all seats | $25 |

Violations of the seat belt law are a primary offense, which means an officer may pull over violators and ticket them for not wearing a seat belt.

Here are New Mexico’s child seat safety laws:

| Car Seat Type | Age/Weight |

|---|---|

| Rear-Facing Child Restraint | Younger than 1 year |

| Child Restraint | 1 to 4 years or less than 40 pounds |

| Booster Seat | 5 to 6 years or less than 60 pounds |