Virginia

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 9.90%

Virginia car insurance has liability requirements for drivers seeking car insurance. In Virginia, all vehicles must have what insurance is needed. The minimum requirement is 25/50/20. In 2015, Virginia residents paid $842.67 (average) for car insurance. Our goal is to assist you with finding cheap Virginia auto insurance.

From the warm, sandy beaches of Virginia Beach to the colonial home of Thomas Jefferson nestled near the magnificent grandeur of the Shenandoah Valley, the Commonwealth of Virginia has a lot to offer.

If you’re exploring this great state by car, there may be something you haven’t considered lately: “Am I paying too much for car insurance?”

Consumers in Virginia paid an average of $842.67 for car insurance in 2015.

Enter your ZIP code to get started and find the best auto insurance in Virginia.

How to get Virginia car insurance coverage and rates

The median household income in Virginia in 2017 was over $71,535, and drivers, on average, paid over $843 for car insurance. There’s certainly nothing to love about that. Were you one of them?

Next, we’re going to show you what coverage you have to have in Virginia, and other options, so you can choose the best car insurance in Virginia for your needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Virginia minimum coverage requirements?

Below, we have provided information and helpful advice so you can choose the best coverage options for your needs.

| Insurance Required | MINIMUM LIMITS: 25/50/20 |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Injury Liability | $25,000 per person $50,000 per accident |

We hope you never have to deal with, or end up in, one of these dire situations, but if you do, the basic coverage requirements in Virginia which all motorists must have for liability insurance are:

- $25,000 to cover the death or injury of one person

- $50,000 to cover the death or injury of more than one person

- $20,000 to cover property damage

Liability insurance pays all individuals — drivers, passengers, pedestrians, etc. — who are owed compensation for property damage and injuries resulting from a car accident that you or anyone under your policy causes. If you cause an accident, liability insurance pays everyone affected by the crash.

If you choose not to have these coverages, you will have to pay the $500 Uninsured Motor Vehicle (UMV) fee every year. You will still be held liable in auto accidents, and you drive at your own risk.

What’s Virginia’s car culture like?

Virginia has miles of roadways and depending on where you live, and you could spend a lot of time stuck in traffic. Virginians spend an average of 28 minutes in their car on an average commute, but drivers who live and commute into D.C. may spend an hour or more each way.

Commuters who do commute to the D.C. area have the option of taking alternate transportation via the Virginia Railway Express, which offers daily rail service to the downtown area.

What is considered a form of financial responsibility?

What is financial responsibility? Financial responsibility is proof that you have Virginia’s minimum liability coverage. State laws require every driver and owner of a vehicle to have evidence of financial stability at all times. Here are a few acceptable forms of proof of financial stability in Virginia:

- Valid Insurance Card

- Electronic evidence on a smartphone

- Proof that you paid the UMV fee

According to the Virginia DMV:

The $500 Uninsured Motor Vehicle (UMV) fee, which is paid to the Department of Motor Vehicles (DMV), does not provide any insurance; it only allows you to drive an uninsured vehicle at your own risk.

It expires with your registration and must be paid at renewal. If you are driving an uninsured vehicle and are involved in an accident, the other driver may notify DMV that your vehicle is uninsured as part of reporting the accident to DMV.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What percentage of income are insurance premiums?

In Virginia, the per capita disposable income is $43,904. Regarding the average car insurance cost in Virginia, residents spend $843 a year. To put this amount in perspective, the nationwide annual average for car insurance is $981. This means people in Virginia pay less than the countrywide average and less than neighboring states, New York and Pennsylvania, who pay yearly amounts of $1,328 and $953, respectively.

What are the average monthly car insurance rates in VA (liability, collision, comprehensive coverage)?

The main concern of almost every Virginian motorist is the rising cost of car insurance. The table below shows data based on the state’s minimum requirements provided by the National Association of Insurance Commissioners, which is an agency dedicated to keeping up with the changing costs of car insurance. As the data reflects, Virginians pay $150 less than the countrywide average of $1,009.

| Coverage Type | Annual Costs |

|---|---|

| Liability | $425.61 |

| Collision | $280.52 |

| Comprehensive | $136.54 |

| Combined | $842.67 |

If you’ve wondered about the best insurance group 14 for 17 year-old, up next, we take a look at loss ratios and what they mean to a company’s bottom line.

Is there an additional liability?

To assess the financial health of insurance companies, you should look at its loss ratios. Loss ratios are the money insurance companies pay out on claims compared to the money they take in on premiums.

For example, if an auto insurer collects $100,000 of premiums in a given year and pays out $55,000 in claims, the company’s loss ratio is 55 percent ($55,000 incurred losses/$100,000 earned premiums).

Check out the loss ratio for these two types of additional coverage in Virginia.

| Additional Liability Coverage in Virginia - Loss Ratios | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Pay (Med Pay) | 76.96% | 69.13% | 67.12% |

| Uninsured/Underinsured Motorist Coverage | 69.58% | 72.95% | 74.89% |

MedPay’s loss ratios have dipped over this timespan and are below the countrywide average of 75 percent. As for the uninsured/underinsured loss ratios, they have risen to match the countrywide average (which is about 74 percent).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any add-ons, endorsements, & riders?

No one wants to have an accident, but if you do, will you have enough protection for you and your family? Have you considered adding extra coverages to your policy? Choosing from a list of options can be daunting, and we know you want the best options for your family at affordable prices. To help you decide, we’ve made a list of affordable options to add to your policy. Check out the selections below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Usage-Based or Pay-As-You-Drive Insurance

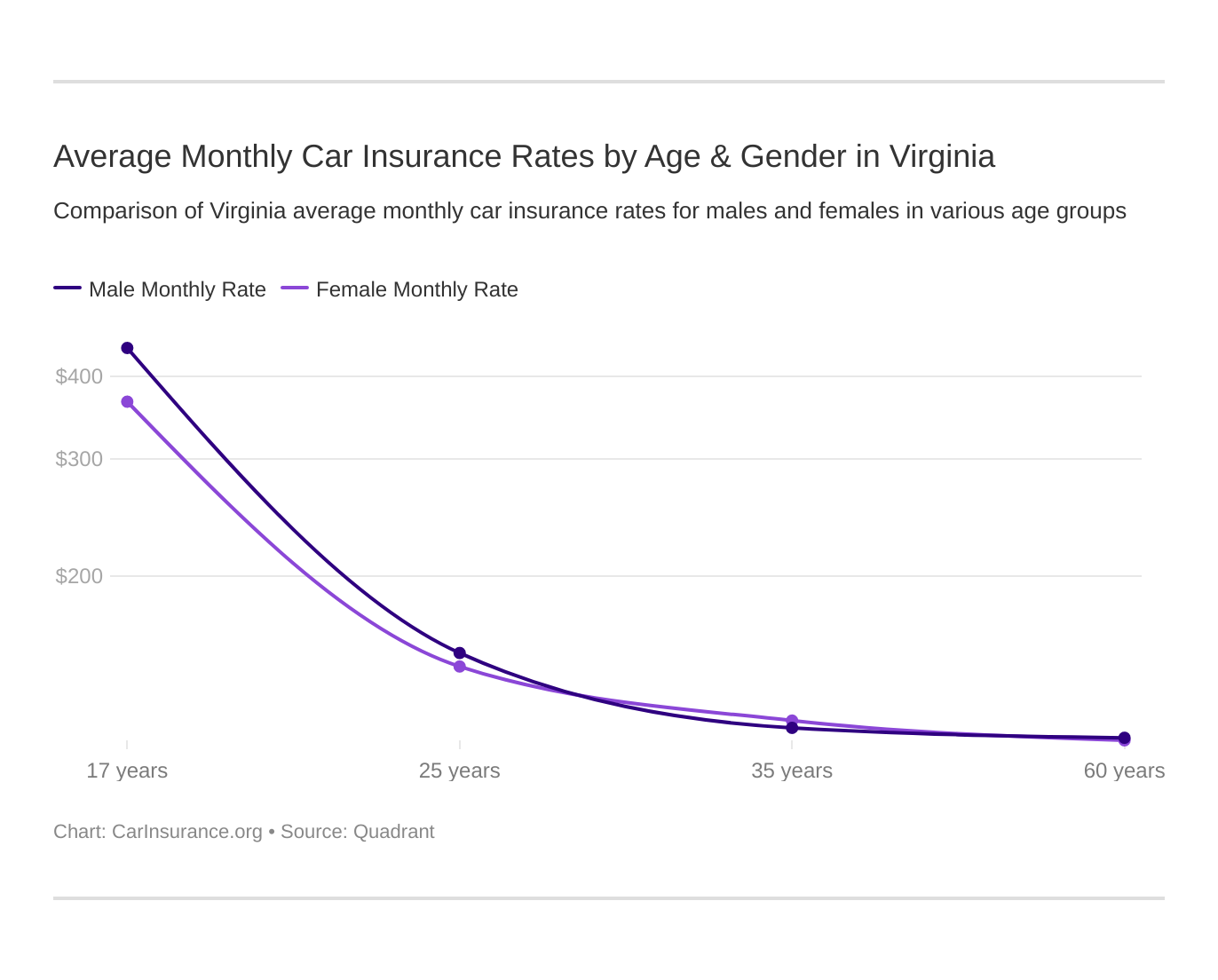

What are the average monthly car insurance rates by age & gender in VA?

Inc.com wrote an article that says women pay $100,000 more for the same products as men do. In fact, gender discrimination in car insurance rates is such a problem that California and other states banned gender discrimination and created gender-neutral insurance plans.

Up next, we partnered with Quadrant Information Services to show you rates that various folks in Virginia pay for car insurance.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $6,396.46 | $7,347.87 | $2,657.43 | $2,658.75 | $2,042.71 | $1,927.39 | $2,031.96 | $2,031.96 |

| Geico General | $3,138.15 | $4,204.21 | $1,714.05 | $1,694.63 | $1,474.02 | $1,470.60 | $1,398.20 | $1,398.20 |

| Nationwide P&C | $3,416.59 | $4,404.98 | $1,582.01 | $1,722.41 | $1,434.40 | $1,443.10 | $1,272.72 | $1,307.89 |

| Progressive Advanced | $5,745.36 | $6,458.02 | $1,518.75 | $1,551.92 | $1,253.97 | $1,191.17 | $1,132.78 | $1,136.43 |

| State Farm Mutual Auto | $4,201.32 | $5,274.60 | $1,572.89 | $1,810.26 | $1,391.16 | $1,391.16 | $1,254.98 | $1,254.98 |

| USAA | $3,443.74 | $4,098.09 | $1,436.42 | $1,578.62 | $1,116.18 | $1,099.39 | $1,043.95 | $1,050.74 |

As you see from the table, in some cases, teen drivers pay thousands more than older drivers do for car insurance. Unfortunately, for parents, those insurance rates are thousands higher than what they pay.

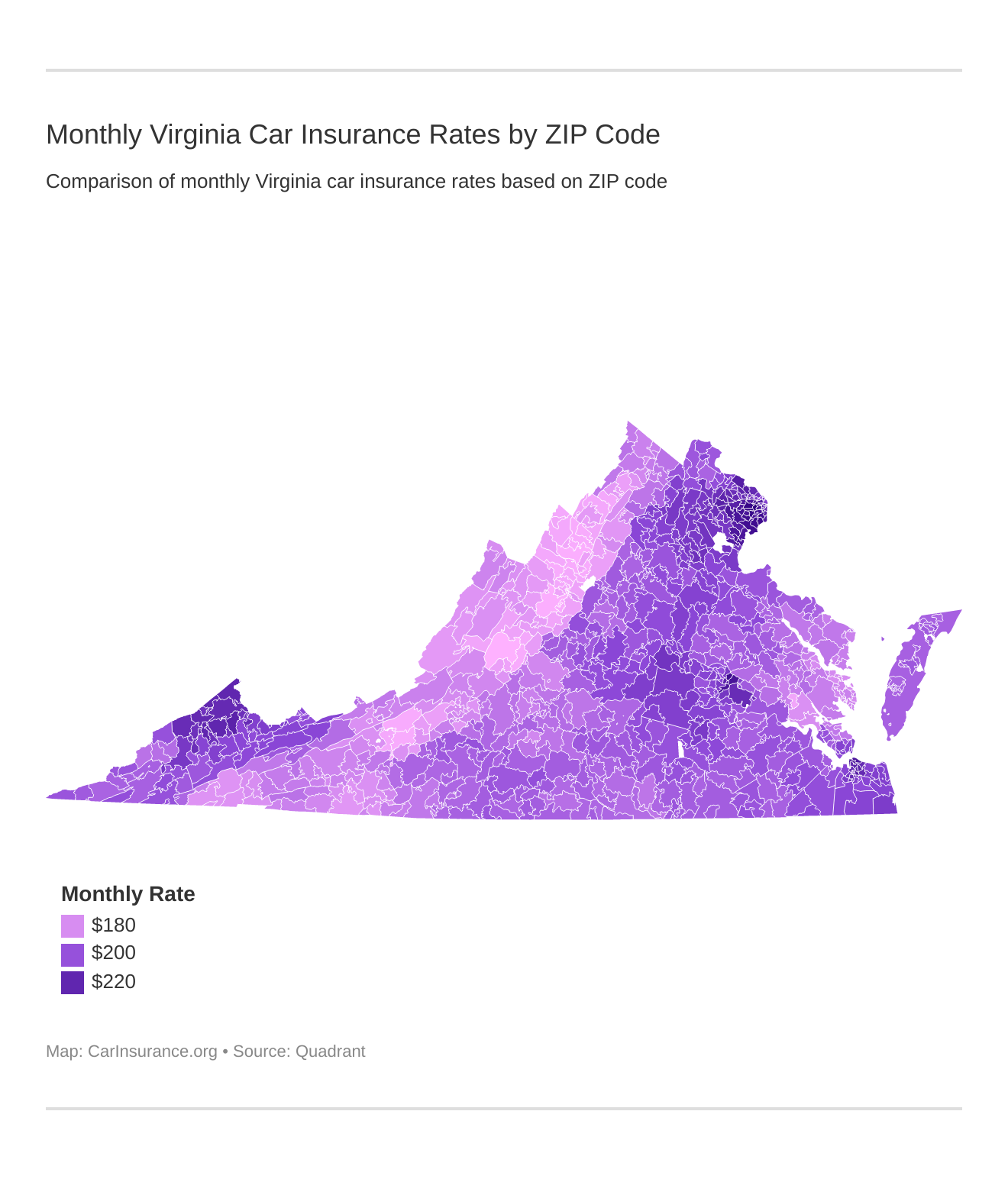

What are the cheapest car insurance rates by ZIP code?

In addition to gender and age, where you live can affect your Virginia auto insurance rates. We’ve collected data on the least and most expensive ZIP codes, so search to see where your ZIP code lands on the lists below.

| Cheapest ZIP Codes in Virginia | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 24450 | LEXINGTON | $2,018.13 | Allstate | $3,002.04 | Progressive | $2,054.03 | USAA | $1,638.89 | Nationwide | $1,646.95 |

| 22802 | HARRISONBURG | $2,031.22 | Allstate | $3,017.99 | Progressive | $1,930.39 | USAA | $1,624.96 | State Farm | $1,805.27 |

| 24401 | STAUNTON | $2,033.51 | Allstate | $3,046.63 | Geico | $1,921.33 | USAA | $1,639.53 | Nationwide | $1,845.67 |

| 22815 | BROADWAY | $2,034.01 | Allstate | $3,017.99 | Progressive | $2,048.27 | USAA | $1,624.96 | State Farm | $1,704.15 |

| 24060 | BLACKSBURG | $2,035.11 | Allstate | $3,021.92 | Progressive | $2,161.26 | USAA | $1,568.22 | Geico | $1,665.52 |

| 22840 | MC GAHEYSVILLE | $2,036.30 | Allstate | $2,998.27 | Progressive | $1,964.11 | USAA | $1,624.96 | State Farm | $1,821.75 |

| 22834 | LINVILLE | $2,037.09 | Allstate | $3,017.99 | Progressive | $2,103.54 | USAA | $1,624.96 | State Farm | $1,667.35 |

| 22853 | TIMBERVILLE | $2,038.95 | Allstate | $3,017.99 | Progressive | $2,131.25 | USAA | $1,624.96 | State Farm | $1,650.81 |

| 24416 | BUENA VISTA | $2,039.40 | Allstate | $3,002.04 | Progressive | $2,080.60 | USAA | $1,638.89 | Nationwide | $1,646.95 |

| 22833 | LACEY SPRING | $2,041.03 | Allstate | $2,998.27 | Progressive | $2,007.60 | USAA | $1,624.96 | State Farm | $1,806.66 |

| 24073 | CHRISTIANSBURG | $2,042.79 | Allstate | $3,021.92 | State Farm | $2,045.19 | Geico | $1,665.52 | USAA | $1,681.92 |

| 22812 | BRIDGEWATER | $2,043.31 | Allstate | $3,046.63 | Progressive | $1,993.75 | USAA | $1,624.96 | State Farm | $1,785.82 |

| 22801 | HARRISONBURG | $2,044.17 | Allstate | $3,046.63 | Progressive | $1,953.86 | USAA | $1,624.96 | State Farm | $1,830.88 |

| 22939 | FISHERSVILLE | $2,044.69 | Allstate | $3,046.63 | Progressive | $2,027.19 | USAA | $1,623.59 | State Farm | $1,803.71 |

| 24471 | PORT REPUBLIC | $2,046.56 | Allstate | $3,046.63 | Progressive | $1,992.42 | USAA | $1,624.96 | State Farm | $1,806.66 |

| 22821 | DAYTON | $2,046.69 | Allstate | $3,046.63 | Progressive | $1,993.64 | USAA | $1,624.96 | State Farm | $1,806.25 |

| 22841 | MOUNT CRAWFORD | $2,048.17 | Allstate | $3,046.63 | Progressive | $1,957.50 | USAA | $1,624.96 | State Farm | $1,851.24 |

| 22830 | FULKS RUN | $2,048.95 | Allstate | $3,017.99 | Progressive | $2,081.09 | USAA | $1,624.96 | State Farm | $1,760.97 |

| 22848 | PLEASANT VALLEY | $2,049.22 | Allstate | $3,017.99 | Progressive | $2,037.02 | USAA | $1,624.96 | State Farm | $1,806.66 |

| 22803 | HARRISONBURG | $2,050.19 | Allstate | $3,017.99 | Progressive | $2,029.09 | USAA | $1,638.73 | State Farm | $1,806.66 |

| 24141 | RADFORD | $2,050.57 | Allstate | $3,071.64 | Progressive | $2,108.49 | Geico | $1,665.52 | USAA | $1,681.92 |

| 22811 | BERGTON | $2,050.97 | Allstate | $3,017.99 | Progressive | $2,086.55 | USAA | $1,624.96 | State Farm | $1,767.64 |

| 24435 | FAIRFIELD | $2,053.78 | Allstate | $3,002.04 | Progressive | $2,250.94 | USAA | $1,638.89 | Nationwide | $1,646.95 |

| 24486 | WEYERS CAVE | $2,055.76 | Allstate | $3,046.63 | Progressive | $2,023.71 | USAA | $1,639.53 | Nationwide | $1,845.67 |

| 22824 | EDINBURG | $2,056.80 | Allstate | $3,017.99 | Progressive | $1,984.59 | USAA | $1,629.62 | State Farm | $1,826.20 |

The next table shows the most expensive ZIP codes.

| Most Expensive ZIP Codes in Virginia | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 22312 | ALEXANDRIA | $2,871.02 | Allstate | $4,305.77 | Progressive | $2,992.08 | USAA | $2,205.48 | Geico | $2,352.28 |

| 22041 | FALLS CHURCH | $2,857.11 | Allstate | $4,305.77 | State Farm | $3,156.56 | Geico | $2,141.17 | USAA | $2,206.52 |

| 22151 | SPRINGFIELD | $2,855.79 | Allstate | $4,388.84 | Progressive | $2,953.33 | USAA | $2,169.90 | Geico | $2,352.28 |

| 22311 | ALEXANDRIA | $2,838.20 | Allstate | $4,184.46 | State Farm | $3,141.18 | Geico | $2,141.17 | USAA | $2,206.52 |

| 22003 | ANNANDALE | $2,834.25 | Allstate | $4,397.33 | Progressive | $2,945.54 | Geico | $2,141.17 | USAA | $2,178.61 |

| 22150 | SPRINGFIELD | $2,816.60 | Allstate | $4,305.77 | Progressive | $2,910.33 | USAA | $2,055.48 | Geico | $2,351.37 |

| 22309 | ALEXANDRIA | $2,806.21 | Allstate | $4,184.46 | State Farm | $2,940.41 | USAA | $2,251.53 | Geico | $2,351.37 |

| 23222 | RICHMOND | $2,800.69 | Allstate | $3,544.83 | State Farm | $3,154.85 | USAA | $2,137.93 | Nationwide | $2,628.11 |

| 22153 | SPRINGFIELD | $2,797.16 | Allstate | $4,231.92 | State Farm | $2,879.87 | USAA | $2,060.19 | Geico | $2,351.37 |

| 22060 | FORT BELVOIR | $2,794.01 | Allstate | $4,184.46 | State Farm | $2,917.93 | USAA | $2,057.33 | Geico | $2,351.37 |

| 22306 | ALEXANDRIA | $2,788.85 | Allstate | $4,184.46 | Progressive | $2,840.81 | USAA | $2,131.22 | Geico | $2,351.37 |

| 22079 | LORTON | $2,786.19 | Allstate | $4,348.02 | State Farm | $2,857.77 | USAA | $2,121.40 | Geico | $2,351.37 |

| 22044 | FALLS CHURCH | $2,777.26 | Allstate | $4,077.51 | State Farm | $2,967.14 | Geico | $2,141.17 | USAA | $2,208.46 |

| 22081 | MERRIFIELD | $2,776.35 | Allstate | $4,348.02 | Progressive | $2,975.48 | Geico | $2,017.21 | USAA | $2,121.40 |

| 22015 | BURKE | $2,773.79 | Allstate | $4,220.49 | Progressive | $2,890.07 | Geico | $2,141.17 | USAA | $2,159.44 |

| 22103 | WEST MCLEAN | $2,771.74 | Allstate | $4,110.52 | Progressive | $2,848.04 | USAA | $2,170.66 | Geico | $2,403.36 |

| 22304 | ALEXANDRIA | $2,762.26 | Allstate | $4,184.46 | State Farm | $2,835.49 | USAA | $2,155.94 | Geico | $2,352.28 |

| 22152 | SPRINGFIELD | $2,751.29 | Allstate | $4,220.49 | Progressive | $2,867.72 | Geico | $2,141.17 | USAA | $2,145.81 |

| 22310 | ALEXANDRIA | $2,751.15 | Allstate | $4,184.46 | Progressive | $2,860.28 | USAA | $2,083.13 | Geico | $2,175.74 |

| 23223 | RICHMOND | $2,748.67 | Allstate | $3,590.82 | State Farm | $3,024.32 | USAA | $2,150.45 | Geico | $2,450.18 |

| 23224 | RICHMOND | $2,747.43 | Allstate | $3,411.84 | State Farm | $2,883.68 | USAA | $2,103.14 | Nationwide | $2,628.11 |

| 22039 | FAIRFAX STATION | $2,744.30 | Allstate | $4,023.95 | State Farm | $2,931.58 | Geico | $2,098.38 | USAA | $2,114.40 |

| 22191 | WOODBRIDGE | $2,741.58 | Allstate | $4,042.10 | State Farm | $2,784.49 | USAA | $2,135.48 | Nationwide | $2,235.10 |

| 22204 | ARLINGTON | $2,741.36 | Allstate | $4,184.46 | State Farm | $2,721.45 | USAA | $2,138.14 | Geico | $2,352.28 |

| 22026 | DUMFRIES | $2,739.74 | Allstate | $3,998.75 | Progressive | $2,915.52 | USAA | $2,098.46 | Nationwide | $2,235.10 |

Large cities like Alexandria and Richmond have the highest rates, although some ZIP codes in smaller cities have high rates, as well.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the cheapest car insurance rates by city?

We’ve also collected data on car insurance rates by city. Below are lists of the least expensive and most expensive cities for car insurance.

| Cheapest Cities in Virginia | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| East Lexington | $2,018.13 | Allstate | $3,002.04 | Progressive | $2,054.03 | USAA | $1,638.89 | Nationwide | $1,646.95 |

| Broadway | $2,034.01 | Allstate | $3,017.99 | Progressive | $2,048.27 | USAA | $1,624.96 | State Farm | $1,704.15 |

| Blacksburg | $2,035.11 | Allstate | $3,021.92 | Progressive | $2,161.26 | USAA | $1,568.22 | Geico | $1,665.52 |

| Massanutten | $2,036.30 | Allstate | $2,998.27 | Progressive | $1,964.11 | USAA | $1,624.96 | State Farm | $1,821.75 |

| Linville | $2,037.09 | Allstate | $3,017.99 | Progressive | $2,103.54 | USAA | $1,624.96 | State Farm | $1,667.35 |

| Timberville | $2,038.95 | Allstate | $3,017.99 | Progressive | $2,131.25 | USAA | $1,624.96 | State Farm | $1,650.81 |

| Fishersville | $2,039.10 | Allstate | $3,046.63 | Progressive | $1,949.82 | USAA | $1,631.56 | State Farm | $1,839.59 |

| Buena Vista | $2,039.40 | Allstate | $3,002.04 | Progressive | $2,080.60 | USAA | $1,638.89 | Nationwide | $1,646.95 |

| Lacey Spring | $2,041.03 | Allstate | $2,998.27 | Progressive | $2,007.60 | USAA | $1,624.96 | State Farm | $1,806.66 |

| Christiansburg | $2,042.79 | Allstate | $3,021.92 | State Farm | $2,045.19 | Geico | $1,665.52 | USAA | $1,681.92 |

| Bridgewater | $2,043.31 | Allstate | $3,046.63 | Progressive | $1,993.75 | USAA | $1,624.96 | State Farm | $1,785.82 |

| Port Republic | $2,046.56 | Allstate | $3,046.63 | Progressive | $1,992.42 | USAA | $1,624.96 | State Farm | $1,806.66 |

| Dayton | $2,046.69 | Allstate | $3,046.63 | Progressive | $1,993.64 | USAA | $1,624.96 | State Farm | $1,806.25 |

| Mount Crawford | $2,048.17 | Allstate | $3,046.63 | Progressive | $1,957.50 | USAA | $1,624.96 | State Farm | $1,851.24 |

| Fulks Run | $2,048.95 | Allstate | $3,017.99 | Progressive | $2,081.09 | USAA | $1,624.96 | State Farm | $1,760.97 |

| Pleasant Valley | $2,049.22 | Allstate | $3,017.99 | Progressive | $2,037.02 | USAA | $1,624.96 | State Farm | $1,806.66 |

| Belview | $2,050.57 | Allstate | $3,071.64 | Progressive | $2,108.49 | Geico | $1,665.52 | USAA | $1,681.92 |

| Bergton | $2,050.97 | Allstate | $3,017.99 | Progressive | $2,086.55 | USAA | $1,624.96 | State Farm | $1,767.64 |

| Harrisonburg | $2,053.51 | Allstate | $3,078.46 | Progressive | $1,989.72 | USAA | $1,631.85 | State Farm | $1,812.37 |

| Fairfield | $2,053.78 | Allstate | $3,002.04 | Progressive | $2,250.94 | USAA | $1,638.89 | Nationwide | $1,646.95 |

| Weyers Cave | $2,055.76 | Allstate | $3,046.63 | Progressive | $2,023.71 | USAA | $1,639.53 | Nationwide | $1,845.67 |

| Edinburg | $2,056.80 | Allstate | $3,017.99 | Progressive | $1,984.59 | USAA | $1,629.62 | State Farm | $1,826.20 |

| Mount Sidney | $2,057.62 | Allstate | $3,046.63 | Progressive | $2,040.34 | USAA | $1,639.53 | Nationwide | $1,845.67 |

| Woodstock | $2,057.97 | Allstate | $3,017.99 | Progressive | $2,008.08 | USAA | $1,629.62 | State Farm | $1,809.79 |

| Stuarts Draft | $2,058.53 | Allstate | $2,998.27 | Progressive | $2,130.48 | USAA | $1,623.59 | State Farm | $1,831.82 |

As you see from the tables, where you live can impact your wallet when purchasing a Virginia automobile insurance plan. Folks in rural areas pay hundreds less than those in a major city like Alexandria.

| Most Expensive Cities in Virginia | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bailey's Crossroads | $2,857.10 | Allstate | $4,305.77 | State Farm | $3,156.56 | Geico | $2,141.17 | USAA | $2,206.52 |

| Kings Park | $2,855.78 | Allstate | $4,388.84 | Progressive | $2,953.33 | USAA | $2,169.90 | Geico | $2,352.28 |

| Springfield | $2,816.60 | Allstate | $4,305.77 | Progressive | $2,910.33 | USAA | $2,055.48 | Geico | $2,351.37 |

| Mount Vernon | $2,806.21 | Allstate | $4,184.46 | State Farm | $2,940.41 | USAA | $2,251.53 | Geico | $2,351.37 |

| Fort Belvoir | $2,794.01 | Allstate | $4,184.46 | State Farm | $2,917.93 | USAA | $2,057.33 | Geico | $2,351.37 |

| Annandale | $2,778.14 | Allstate | $4,274.61 | Progressive | $2,842.69 | Geico | $2,141.17 | USAA | $2,187.52 |

| Merrifield | $2,776.35 | Allstate | $4,348.02 | Progressive | $2,975.48 | Geico | $2,017.21 | USAA | $2,121.40 |

| East Highland Park | $2,774.68 | Allstate | $3,567.82 | State Farm | $3,089.59 | USAA | $2,144.19 | Geico | $2,550.75 |

| Burke | $2,774.08 | Allstate | $4,224.30 | Progressive | $2,867.75 | USAA | $2,121.81 | Geico | $2,211.23 |

| West Mclean | $2,771.74 | Allstate | $4,110.52 | Progressive | $2,848.04 | USAA | $2,170.66 | Geico | $2,403.36 |

| Crosspointe | $2,765.25 | Allstate | $4,185.98 | State Farm | $2,894.67 | USAA | $2,117.90 | Geico | $2,224.88 |

| Cherry Hill | $2,740.66 | Allstate | $4,020.42 | Progressive | $2,847.16 | USAA | $2,116.97 | Nationwide | $2,235.10 |

| Franconia | $2,739.44 | Allstate | $4,184.46 | Progressive | $2,824.75 | USAA | $2,079.92 | Geico | $2,175.74 |

| Fleet | $2,738.46 | Allstate | $3,615.05 | Progressive | $3,106.78 | Nationwide | $2,203.40 | USAA | $2,357.54 |

| Dumfries | $2,733.77 | Allstate | $3,998.75 | Progressive | $2,827.43 | USAA | $2,162.78 | Nationwide | $2,235.10 |

| Dale City | $2,730.84 | Allstate | $4,082.65 | State Farm | $2,867.49 | USAA | $2,121.54 | Nationwide | $2,235.10 |

| Huntington | $2,730.54 | Allstate | $4,184.46 | State Farm | $2,786.50 | USAA | $2,109.02 | Geico | $2,175.74 |

| Triangle | $2,705.49 | Allstate | $4,092.12 | State Farm | $2,704.39 | USAA | $2,137.00 | Nationwide | $2,235.10 |

| Alexandria | $2,696.83 | Allstate | $4,218.44 | State Farm | $2,683.58 | Geico | $2,097.78 | USAA | $2,132.32 |

| Fort Hunt | $2,695.93 | Allstate | $4,184.46 | State Farm | $2,731.27 | Geico | $2,005.71 | USAA | $2,243.43 |

| County Center | $2,689.81 | Allstate | $4,042.10 | State Farm | $2,635.19 | USAA | $2,162.77 | Nationwide | $2,235.10 |

| Fairfax | $2,689.31 | Allstate | $4,095.59 | Progressive | $2,883.13 | USAA | $2,061.59 | Geico | $2,141.54 |

| Great Falls | $2,686.17 | Allstate | $4,061.45 | Progressive | $2,571.77 | USAA | $2,188.17 | Nationwide | $2,327.14 |

| Fair Lakes | $2,680.83 | Allstate | $4,079.29 | Progressive | $2,709.26 | Geico | $2,098.38 | USAA | $2,107.08 |

| Greenway | $2,677.88 | Allstate | $4,061.45 | State Farm | $2,570.86 | Geico | $2,167.21 | USAA | $2,170.66 |

What are the best Virginia car insurance companies?

If you own a vehicle, there’s a good chance you are paying too much for your insurance. But it isn’t just cost that should be considered when shopping for car insurance.

Who wants to spend time looking for the lowest price? That’s why we’ve done all the work for you and researched the best insurance carriers in Virginia so you can make the best choice for your situation. We’ve looked at companies’ financial ratings, A.M.’s best ratings, and which Virginia auto insurance companies have the most complaints.

These companies can have multiple locations that you can contact. For example, Erie Insurance has quite a few (Erie Insurance Richlands, VA, Erie Insurance Weber City, VA, Erie Insurance Pennington Gap, VA, Erie Insurance Hillsville, VA, and Erie Insurance Big Stone Gap, Virginia).

Keep reading to learn about Virginia’s auto insurance providers.

What is the financial rating of the largest companies?

Loss ratios play a large part in how secure an auto insurance company is doing financially. That’s why we want to include A.M. Best ratings, which look at loss ratios to determine if a company has solid financial stability.

So to see how the 10 largest companies in Virginia are doing, we’ve included the A.M. Best ratings for each.

| Leading Insurance Providers | A.M. Best Ratings |

|---|---|

| Geico | A++ |

| State Farm Group | A++ |

| USAA Group | A++ |

| Allstate Insurance Group | A+ |

| Progressive Group | A+ |

| Nationwide Corp Group | A+ |

| Erie Insurance Group | A+ |

| Liberty Mutual Group | A |

| Travelers Group | A++ |

| Virginia Farm Bureau Group | A- |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which companies have the best ratings?

Virginia drivers who want greater insight into customer satisfaction can turn to J.D. Power. For years, the company has surveyed consumers and analyzed their feedback. J.D. Power delves into whether drivers are happy with their insurance company.

Through its 2019 U.S. Auto Insurance Study, auto insurance companies are ranked by region and measured in five areas (in order of importance):

- Interaction

- Policy offerings

- Price

- Billing process and policy information

- Claims

J.D. Power additionally assigns “Power Circle Ratings” to each insurer. They are:

- Five out of Five Circles, also known as “Among the Best”

- Four out of Five Circles/“Better than Most”

- Three out of Five Circles/“About Average”

- Two out of Five Circles/“The Rest”

Here’s a look at how insurers fared in the study’s Mid-Atlantic region. We placed them in order of their customer satisfaction index rating, from highest to lowest:

| Insurance Provider | Customer Satisfaction Index Rating (out of 1,000) | JDPower.com Power Circle Ratings |

|---|---|---|

| Erie Insurance | 854 | 5/5 |

| Geico | 848 | 4/5 |

| The Hartford | 839 | 3/5 |

| Mid-Atlantic Region | 838 | 3/5 |

| Allstate | 837 | 3/5 |

| Plymouth Rock Assurance | 835 | 3/5 |

| Progressive | 835 | 3/5 |

| State Farm | 826 | 2/5 |

| Nationwide | 823 | 2/5 |

| Travelers | 820 | 2/5 |

| CSAA Insurance Group | 816 | 2/5 |

| Farmers | 814 | 2/5 |

| Liberty Mutual | 801 | 2/5 |

| USAA | 896 | 5/5 |

| NJM Insurance Co. | 864 | 5/5 |

Of the larger providers, Geico leads the way with an overall satisfaction score of 848. However, Liberty Mutual is at the bottom of the list when it comes to customer satisfaction, with a score of 801. Additional top providers like Progressive, State Farm, and Nationwide are only separated by 12 points when it comes to customer satisfaction.

Lastly, it’s worth mentioning USAA’s status on this list. Though the insurer is part of the study, it is not ranked. This is because USAA is only open to U.S. military service personnel and their families, and therefore, is not included in J.D. Power’s overall rankings.

Next, let’s check out their record of official complaints.

Which companies have the most complaints in Virginia?

One thing to keep in mind is that a high complaint index doesn’t necessarily mean you should avoid a company. You should also look at a company’s customer satisfaction ratings, because how a company deals with complaints is also important.

| Leading Insurance Providers | Complaint Numbers |

|---|---|

| Geico | 333 |

| State Farm Group | 1482 |

| USAA Group | 296 |

| Allstate Insurance Group | 163 |

| Progressive Group | 120 |

| Nationwide Corp Group | 25 |

| Erie Insurance Group | 22 |

| Liberty Mutual Group | 222 |

| Travelers Group | 2 |

| Virginia Farm Bureau Group | 1 |

If you want more details of the complaints or to check out other insurers, the data is provided in the Consumer Insurance Search section on the website of the National Association of Insurance Commissioners.

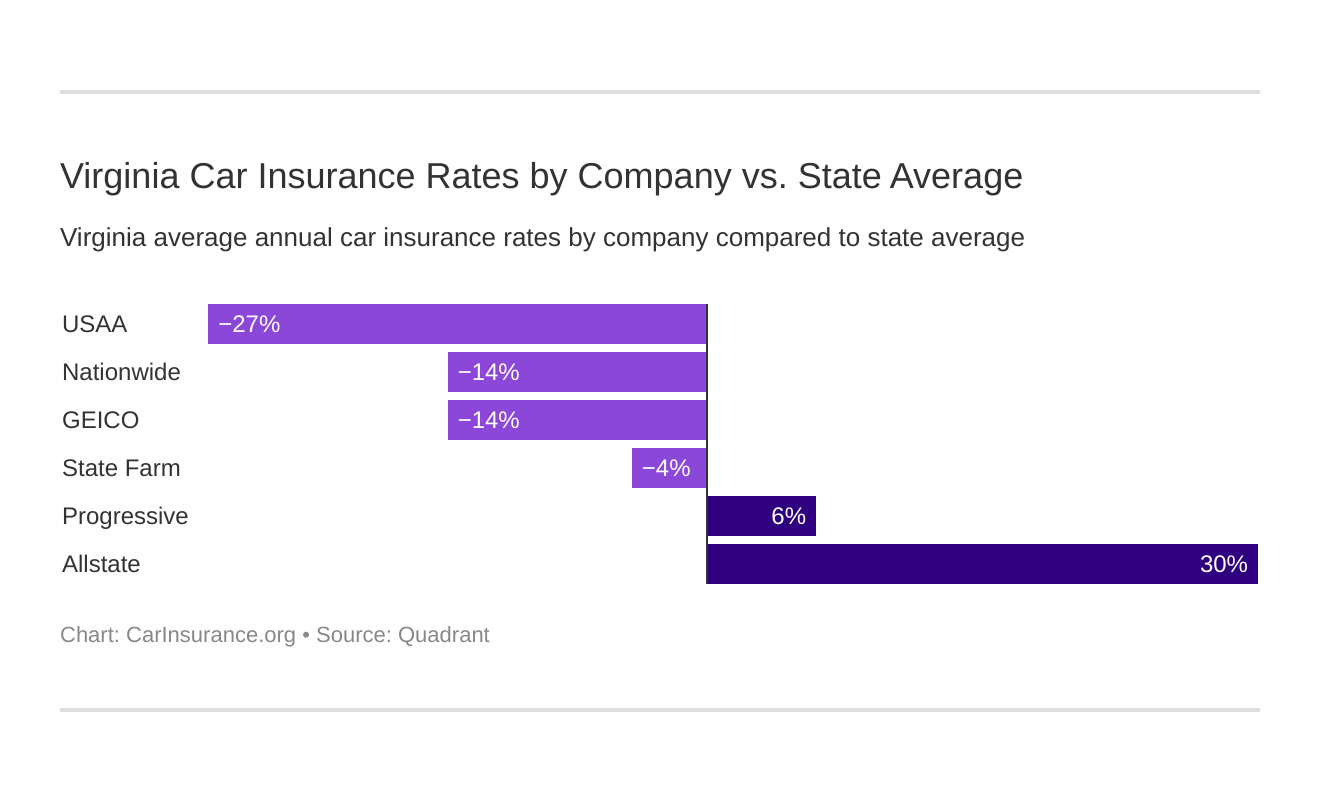

What are the cheapest car insurance companies in Virginia?

Nobody likes to be considered cheap, except when it comes to finding cheaper car insurance. To save money, you should shop around to see what’s available. The table below displays the top carriers in Virginia’s average rate for all drivers and compares it to the state average of all companies.

| Insurance Providers | Average Annual Premiums | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allstate P&C | $3,386.82 | $1,028.95 | 30.38% |

| Geico General | $2,061.51 | -$296.36 | -14.38% |

| Nationwide P&C | $2,073.01 | -$284.86 | -13.74% |

| Progressive Advanced | $2,498.55 | $140.68 | 5.63% |

| State Farm Mutual Auto | $2,268.92 | -$88.94 | -3.92% |

| USAA | $1,858.39 | -$499.47 | -26.88% |

Looking at different providers can save a lot of money. For example, Geico is $300 below the state average, which, over time, could add up to thousands of dollars saved.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

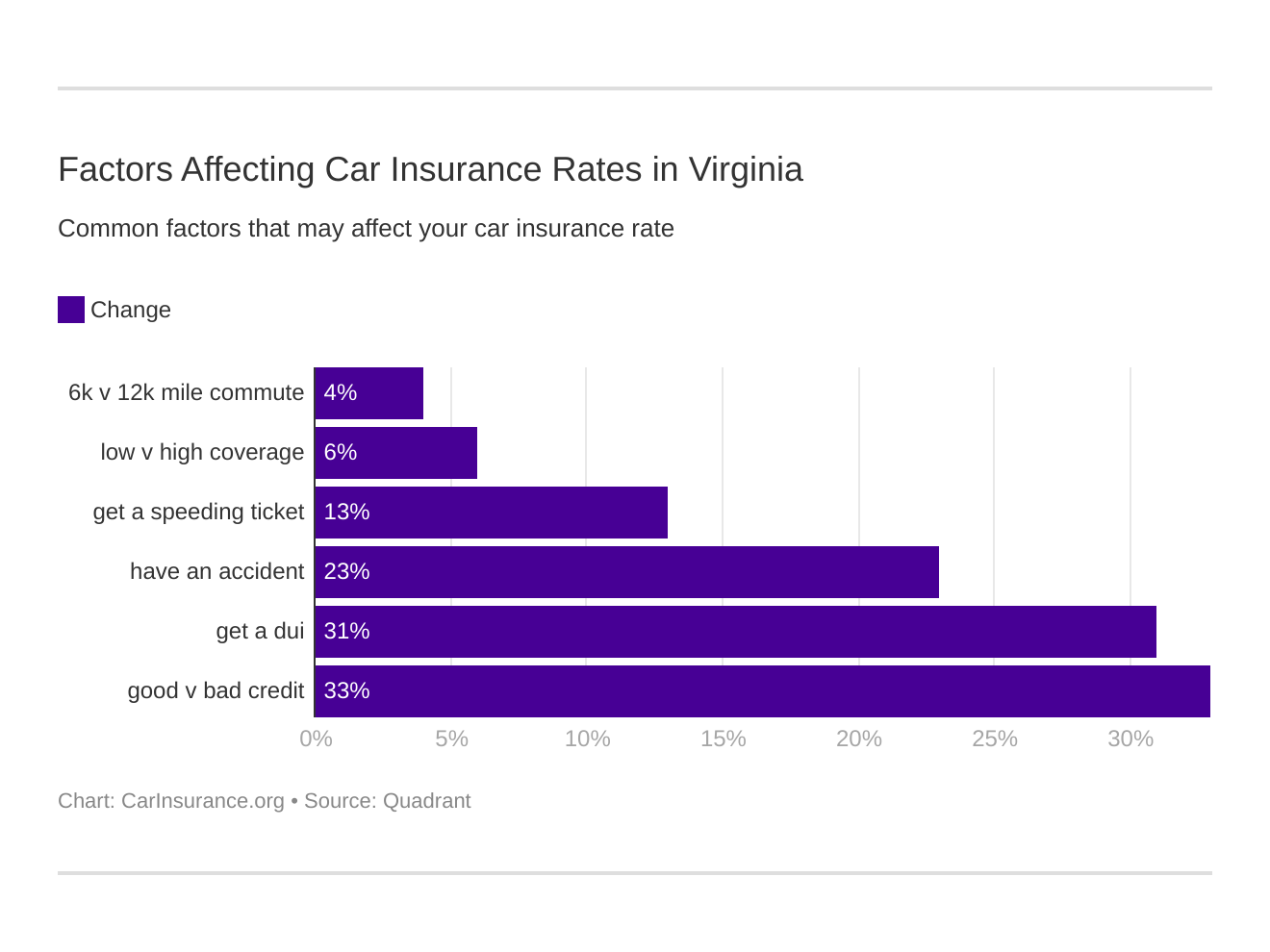

What are the commute rates by companies?

At some companies, how far you drive each day influences your insurance rates. Beyond age, gender, location, marital status, and carrier, other factors that affect your Virginia auto insurance quotes from each carrier are those specific to your situation, such as how much coverage you want, credit history, and driving record.

The tables below compare such factors based on each carrier.

| Insurance Providers | 10 miles commute/ 6,000 annual mileage | 25 miles commute/ 12,000 annual mileage |

|---|---|---|

| Allstate | $3,283.86 | $3,489.78 |

| Geico | $2,022.99 | $2,100.03 |

| Nationwide | $2,073.01 | $2,073.01 |

| Progressive | $2,498.55 | $2,498.55 |

| State Farm | $2,213.23 | $2,324.61 |

| USAA | $1,789.83 | $1,926.95 |

Most company rates don’t change when the drive shortens to a 10-mile commute, except for State Farm, who offers rate reductions of over $200.

What are the coverage level rates by companies?

Do you need better coverage, but don’t want to spend any more money? You might be surprised some companies offer more coverage with only small increases in auto insurance rates.

| Insurance Providers | Low | Medium | High |

|---|---|---|---|

| Allstate | $3,285.84 | $3,387.52 | $3,487.10 |

| Geico | $1,982.21 | $2,059.38 | $2,142.93 |

| Nationwide | $2,173.17 | $2,052.92 | $1,992.94 |

| Progressive | $2,389.08 | $2,470.69 | $2,635.87 |

| State Farm | $2,135.49 | $2,265.45 | $2,405.83 |

| USAA | $1,783.22 | $1,861.89 | $1,930.06 |

For example, the data above shows State Farm and Nationwide have less than $300 increases from low to high coverage.

What are the credit history rates by companies?

The quality of your credit score impacts your insurance rates. In Virginia, the average credit score is 680, which is slightly above the nationwide average of 675. This means motorists may have a better chance at getting great rates because of their above-average credit scores.

The table below shows what you can expect to pay yearly on car insurance based on your credit history.

| Insurance Providers | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $2,728.56 | $3,306.90 | $4,125.00 |

| Geico | $1,947.09 | $1,947.09 | $2,290.34 |

| Nationwide | $1,791.14 | $1,972.48 | $2,455.42 |

| Progressive | $2,274.08 | $2,435.06 | $2,786.51 |

| State Farm | $1,579.95 | $2,000.23 | $3,226.59 |

| USAA | $1,397.64 | $1,693.24 | $2,484.29 |

If you have coverage through Allstate and have poor credit, you can expect to pay nearly $1,400 more for car insurance than someone with good credit.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the driving record rates by companies?

A clean driving record is the easiest way to keep rates down. As you can see from the information below, at Nationwide, just one speeding violation can raise your rate by over $250.

| Insurance Providers | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $2,532.44 | $3,264.59 | $4,044.27 | $3,705.98 |

| Geico | $1,565.25 | $1,565.25 | $2,032.40 | $3,083.13 |

| Nationwide | $1,802.52 | $2,045.46 | $1,802.52 | $2,641.55 |

| Progressive | $2,134.65 | $2,484.88 | $2,827.50 | $2,547.17 |

| State Farm | $2,071.20 | $2,268.92 | $2,466.65 | $2,268.92 |

| USAA | $1,439.41 | $1,656.09 | $1,869.24 | $2,468.83 |

A better record equals better rates. We encourage you to obey posted speed limit signs and NOT drink and drive.

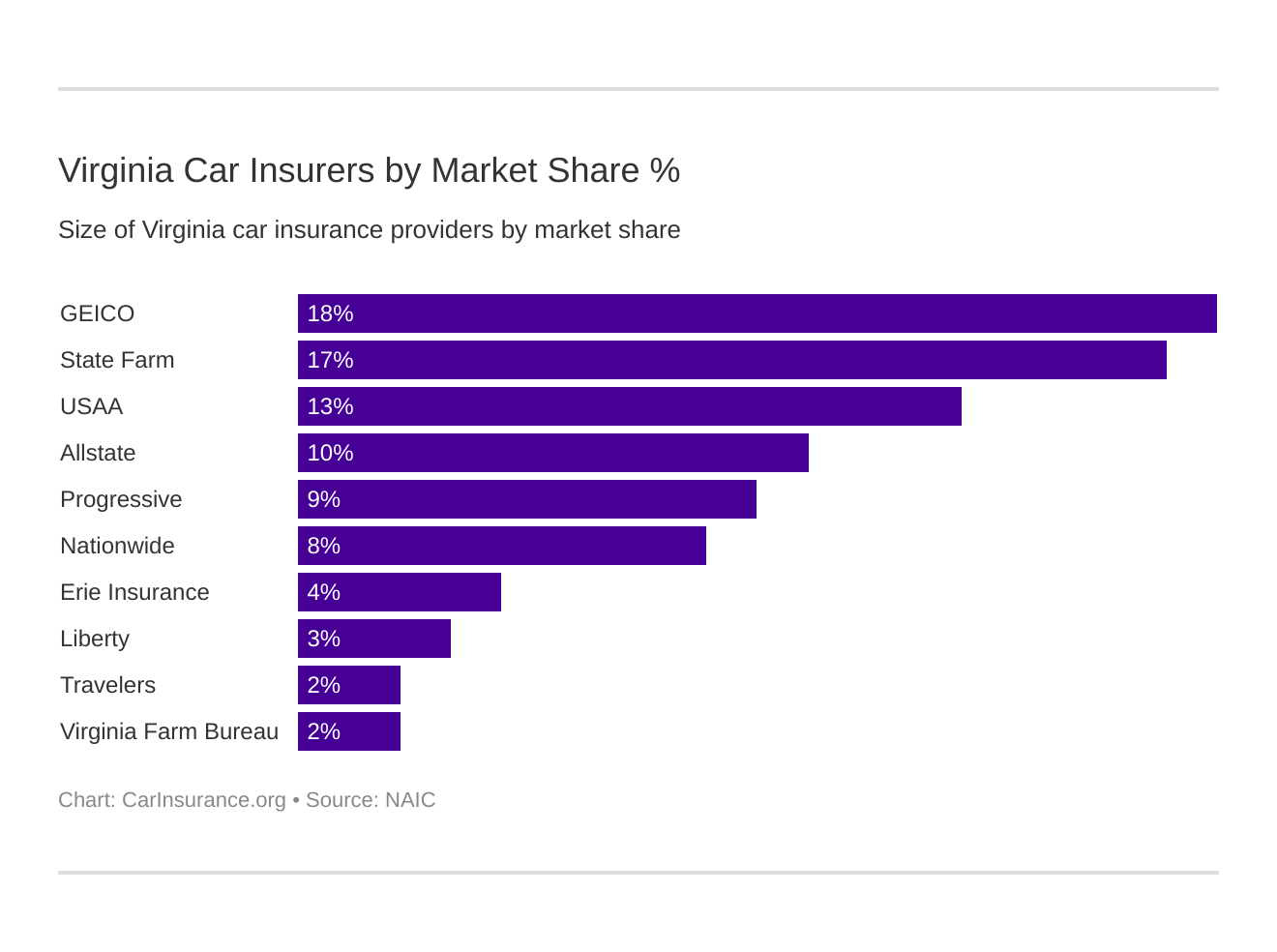

Who are the largest car insurance companies in Virginia?

Here’s a list of the largest car insurance companies in Virginia.

| Leading Car Insurance Providers | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| Geico | $979,950 | 71.20% | 18.04% |

| State Farm Group | $923,989 | 66.23% | 17.01% |

| USAA Group | $717,325 | 74.59% | 13.21% |

| Allstate Insurance Group | $523,325 | 54.37% | 9.64% |

| Progressive Group | $492,052 | 64.82% | 9.06% |

| Nationwide Corp Group | $426,052 | 59.34% | 7.85% |

| Erie Insurance Group | $205,964 | 69.19% | 3.79% |

| Liberty Mutual Group | $154,405 | 55.65% | 2.84% |

| Travelers Group | $120,565 | 60.00% | 2.22% |

| Virginia Farm Bureau Group | $115,612 | 59.08% | 2.13% |

Who are the largest auto insurance companies in VA?

What is the number of insurers by Virginia?

Domestic insurance means a company is formed under Virginia’s state laws, whereby a foreign provider is formed under the laws of any state in the country.

- Domestic Insurers: 19

- Foreign Insurers: 908

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Virginia Laws?

Insurance companies are subject to specific rules and regulations. Let’s look at some of the specific Virginia car insurance laws.

How Virginia Laws for insurance are determined

Every state is required to follow a regulation mechanism to implement new rates, and the options include determined by Commissioner, prior approval, modified prior approval, flex rating, file and use, use and file, and no file.

When it comes to tort laws, Virginia follows the at-fault system for determining liability in an accident. If you’re the at-fault driver in an accident, you would be required to pay the damages sustained by the third party.

Financial responsibility laws that require motorists to buy minimum liability coverage, such as the limit of 25/50/25 in Virginia, are also determined by the state laws.

How to get windshield coverage

Has something bounced off the road and fractured your windshield? In Virginia, if the crack meets any of the standards below, it must be repaired.

- A scratch greater than six inches by 1/4 inch in the area cleared by windshield wipers

- A crack above the bottom three inches of the windshield that is larger than 1 by 1/2 inches in diameter

- Multiple cracks in the same area if any crack is longer than one to 1/2 inches long

- Numerous cracks in the same area if above bottom three inches of the windshield

Compare car insurance rates now and see which company offers you the coverage you want at the best price.

Enter your ZIP code in our FREE online search tool to get started.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to get high-risk insurance

What happens with motorists who consistently accumulate points on their driving record? Initially, insurance providers raise their rates, but at times, it gets riskier to insure such motorists. When a motorist becomes high-risk, they can be denied coverage by insurance providers.

High-risk drivers in Virginia can knock on the doors of Virginia Automobile Insurance Plan to get coverage if they are denied insurance by more than two providers in a period of 60 days, albeit at a much higher rate.

The Virginia Automobile Insurance Plan (VAIP) was established by the State Corporation Commission in 1945 to provide coverage to those motorists unable to obtain insurance in the voluntary market.

In this plan, high-risk drivers are distributed equitably among insurers who are licensed to write insurance in the market of Virginia in proportion to their market share. This practice enables a fair risk-sharing between all insurance providers.

A motorist denied coverage is eligible to apply to VAIP, provided they have a valid Virginia driver’s license and a vehicle registered in the state.

If you want more information about the program, you can write to [email protected] or connect with a local insurance agent.

Is there an automobile insurance fraud in Virginia?

What is automobile insurance fraud? Creating a claim for damages or injuries that never occurred (such as faking an accident) or adding “extra” costs onto a legitimate claim are examples of fraud.

In 2018, the Virginia State Police Insurance Fraud Program created a report on insurance fraud in Virginia. A total of 82 arrests were made, and below you will see the number of notifications the police department received for automobile fraud.

- Property Fraud – 931

- Injury/Casualty Fraud – 188

Committing insurance fraud can result in fines and jail time.

How can you help? If you come across anything that you’re suspicious about, you can submit a confidential tip to the Virginia State Police. Any tips that help the police in making arrests against insurance fraud are eligible for cash rewards of up to $25,000.

You also have the option to report any complaints through the fraud reporting system of NAIC.

What’s the statute of limitations?

If you are in a car accident in Virginia, there is a statute of limitations if you want to file a claim.

Below, you will see Virginia’s statute of limitations.

| VIRGINIA STATUTE OF LIMITATIONS | YEARS |

|---|---|

| Personal Injury | 2 Years |

| Property Damage | 5 Years |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Virginia specific laws?

Unlike other states, in Virginia, it is against the law to have any device designed to prevent or evade detection by the police. Radar detectors must be completely inaccessible to drivers (such as stored in the trunk of a car), and police officers can fine you even if it’s turned off or broken.

Another law unique to Virginia is an unfair claim settlement law, which means insurers are legally required to disclose all information on auto insurance policies. This ensures that insurers don’t “forget” benefits when you file a claim. This law also prevents insurers from ignoring your claim or refusing to pay reasonable claims. While insurers are ethically required to follow these practices anyway, the law places extra emphasis on these guidelines.

What are the vehicle licensing laws?

Virginia, just like every other state, has mandatory licensing laws in addition to the statute of limitations and car insurance laws we previously covered.

What is considered a REAL ID?

Virginia is in full compliance with the REAL ID Act passed by Congress and enforced by Homeland Security. This means that a driver’s license or state ID issued by the Old Dominion State is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

As of October 1, 2020, anyone wishing to fly on a commercial flight or enter a federal facility must have a REAL ID-compliant form of identification.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the penalties for driving without insurance?

Drivers may drive while uninsured if they have paid the yearly UMV fee for driving uninsured. If you have not paid the UMV fee and do not have the minimum liability car insurance, you will receive an intent-to-suspend-car registration letter.

Proof of financial responsibility must be shown any time you are pulled over in a traffic stop, register a vehicle, or are in an accident. A valid insurance ID card or proof that you paid the UMV fee are acceptable forms of proof of financial responsibility.

The state of Virginia also has an electronic verification system that authorities use to check the status of vehicles.

When the DMV finds out a vehicle is uninsured, they will suspend any driver’s licenses, registration certification, and license plates associated with the uninsured vehicle. The suspension is revoked only when the auto owner complies with the following:

- Pays the statutory uninsured motorist fee of $500

- Files the form SR-22 which ensures financial responsibility for three years

- May need to pay the reinstatement fee

During these three years, insurance providers are required to notify the DMV if the vehicle owner cancels the insurance coverage.

What are the teen driver laws?

To begin driving in Virginia, teens must be 15 and a half to apply for a learner’s license. Before teens can apply for a regular license or a restricted license, the Insurance Institute for Highway Safety (IIHS) specifies that teens must meet the requirements below.

| License or Restricted License Requirements | Details |

|---|---|

| Mandatory Holding Period | 9 months |

| Minimum Supervised Driving Time | 45 hours (15 of which must be at night) |

| Minimum Age | 16 years and 3 months |

What are the license renewal procedures for older drivers?

Older drivers in Virginia have different license renewal procedures than the general population. Drivers 75 and older must follow the requirements listed below.

- License Renewal Cycle — Every five years

- Proof of Adequate Vision — Required at every renewal

- Mail or Online Renewal — Not permitted

Older drivers must visit in person every five years and provide proof of adequate vision at every license renewal.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the procedure for new residents?

Are you moving to Virginia? You need to make sure your insurance is updated to meet Virginia’s minimum liability insurance. To do so, new residents will need to contact their current insurance provider to provide updated address information.

Providers will make sure new residents have the proper coverage in the amounts below, as well as providing updated insurance ID cards.

- Bodily Injury: $25,000 per person and $50,000 per accident

- Property Damage Coverage: $20,000 per accident

- Uninsured Motorist Bodily Injury: $25,000 per person and $50,000 per accident

- Uninsured Motorist Property Damage: $20,000 per accident with a $200 deductible for hit-and-run accidents

New residents may choose to decline coverage but will need to pay the $500 UMV fee. This option is riskier because motorists will still be held liable for any accident costs and will have to cover all the bills themselves.

What are the license renewal procedures?

For the general population, license renewal procedures are fairly basic. Generally, the DMV will notify drivers well before their licenses expire, so that drivers have time to plan a trip to the DMV and prepare the necessary paperwork.

- License Renewal Cycle — Every eight years

- Proof of Adequate Vision — Required when renewing in person

- Mail or Online Renewal — Both permitted, every other renewal

Virginia’s licensing system means that drivers can go 16 years without an in-person trip to the DMV. This term is longer than most states. Just make sure to have proof of adequate vision ready when renewing in person.

What is considered a negligent operator treatment system (NOTS)?

Virginia is one of the few states that still observes contributory negligence laws. Contributory negligence only allows damages if one party wasn’t any way responsible for the accident. Comparative negligence allows both parties to be found at fault, and any compensation awarded is determined based on the degree of fault.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the rules of the road?

We all should obey the rules, but if you’re new to the state, there may be laws you’re unfamiliar with. That’s why we’ve assembled a list of several relevant laws to help keep you in good standing and on the road.

Is Virginia at fault or no-fault state?

Virginia is a fault-based state, which means if you are the cause of a car accident, you are responsible for any damage caused.

What are the seat belt & car seat laws?

Seat belts can considerably reduce the risk of serious injury in a crash, and the laws of Virginia require all front-seat passengers to wear a seat belt when the car is in motion. The driver of any vehicle must ensure that passengers below the age of 18 are secured by a seat belt or a child safety seat. Children under the age of 8 should be in a booster or child safety seat.

Laws in Virginia recommend motorists use a child restraint system that’s suitable for the age, height, and weight of your child. If your child isn’t safely restrained in a car seat, it is a $50 fine for the first violation. Any subsequent violations can lead to a fine of $500.

Currently, passengers 16 and under are not allowed to ride in the cargo areas of pickup trucks.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the keep right & move over laws?

Virginia traffic laws mandate that you must keep right when traveling slower than the average speed of traffic around you. Generally, the left lane is for faster traffic and passing.

What’s the speed limit?

Maximum posted speed limits are 70 mph on rural interstates, 70 mph on urban interstates, 65 mph on limited-access roads, and 55 mph on all other roads.

How does ridesharing work?

Virginia signed a ridesharing law quite early in 2015 that mandates background checks for drivers and minimum insurance requirements. The law specifically intended to make sure that drivers are vetted thoroughly before being allowed to drive.

Rideshare services like Uber and Lyft stress that all drivers carry personal car insurance that meets the minimum car insurance requirements. However, if drivers wish to purchase a commercial insurance policy, these are the companies that provide auto insurance coverage.

- Allstate

- Erie

- Geico

- Liberty Mutual

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is there an automation on the road?

According to the Insurance Institute for Highway Safety (IIHS), “Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera, and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

In 2015, the state announced the development of Virginia Automated Corridors that would offer the necessary infrastructure to test automated vehicles.

What are the safety laws?

Up next, we take a closer look at the safety laws in Virginia so that you can arrive alive. Please don’t drink and drive.

What are the DUI laws?

Driving while impaired has disastrous results for everyone involved, and that’s why strict laws are in place to prevent such tragedies. In Virginia alone, drunk driving caused 246 deaths in 2017. Each state differs in how they address drunk driving and therefore have different penalties.

The table below shows detail on what a driver will face if they are charged and convicted of DUI.

| BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back/Washout Period |

|---|---|---|---|---|

| 0.08 | 0.15; 0.2 | 1st-2nd class 1 misdemeanors 3rd+ in 10 years class 6 felony | Driving Under the Influence (DUI) | 10 years |

The penalties get worse with each subsequent offense.

| Offense | License Suspension | Fine | Jail Time | IID Lock | Other |

|---|---|---|---|---|---|

| 1st | 1 year (restricted permit possible) | $250 mandatory minimum | Up to 1 year Mandatory 5 days if BAC 0.15-0.19 Mandatory 20 days if BAC .20+ | Required if BAC 0.15+ | VA Alcohol Safety Action Program (VASAP) required |

| 2nd | 3 years (restricted permit possible) | $500 mandatory minimum | Up to 1 year Within 5 years 1st offense, mandatory 20 day minimum Within 10 years 1st offense, mandatory 10 additional days If BAC .20+ mandatory 20 additional days | Required | VASAP required |

| 3rd | Indefinite (but can petition court after 5 years) | $1,000 mandatory minimum | 1-5 years Within 5 years of 1st offense, 6 month mandatory minimum Within 10 years of 1st offense, 90 day mandatory minimum | Required | VASAP required. Possible vehicle seizure |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the distracted driving laws?

Distracted driving can be just as life-threatening as impaired driving. Virginia has regulated the use of cellphones in cars, so drivers pay more attention to the road. All it takes is a single second of distraction to cause a lifetime of complications.

The following table shows what restrictions Virginia lawmakers have implemented to combat distracted driving in the state.

| Hand-Held Ban | Young Drivers all Cellphone Ban | Texting Ban | Enforcement |

|---|---|---|---|

| Drivers in highway work zones | Drivers younger than 18 | All drivers | Primary; secondary for drivers younger than 18 |

What’s driving in Virginia like?

Now that you have a good understanding of Virginia state laws let’s dive into some facts that you might not know. While insurance is essential, it’s also crucial to know what to keep your eyes out for on the road.

Is there a vehicle theft in Virginia?

No one wants to have their car stolen. In 2016, over 4,428 cars were stolen in Virginia. When considering your next car purchase, one thing to consider is that certain vehicles are stolen more frequently, and thus, may have higher insurance rates.

The following shows a list of the top 10 stolen vehicles in Virginia.

| Vehicle Make and Model | Vehicle Year | Total Thefts |

|---|---|---|

| Honda Accord | 2002 | 266 |

| Ford Pickup (Full Size) | 2004 | 205 |

| Honda Civic | 2013 | 200 |

| Toyota Camry | 2014 | 181 |

| Nissan Altima | 2015 | 162 |

| Chevrolet Pickup (Full Size) | 2003 | 144 |

| Toyota Corolla | 2013 | 140 |

| Ford Explorer | 2002 | 119 |

| Jeep Cherokee/Grand Cherokee | 2001 | 107 |

| Chevrolet Impala | 2006 | 105 |

As is common in many states, the Honda Accord and Ford Pickup lead the way as the most stolen vehicles in the state.

Read more: Best Car Insurance for a Honda Accord

Where you live also plays a role in the number of vehicle thefts. The FBI created a report on Virginia’s vehicle thefts by cities, which are listed below.

| City | Motor Vehicle Theft |

|---|---|

| Richmond | 938 |

| Norfolk | 767 |

| Virginia Beach | 445 |

| Newport News | 344 |

| Alexandria | 291 |

| Chesapeake | 280 |

| Hampton | 226 |

| Portsmouth | 205 |

| Roanoke | 180 |

| Suffolk | 102 |

| Lynchburg | 87 |

| Petersburg | 87 |

| Danville | 84 |

| Charlottesville | 53 |

| Hopewell | 49 |

| Manassas | 49 |

| Harrisonburg | 35 |

| Waynesboro | 34 |

| Winchester | 33 |

| Fredericksburg | 32 |

| Martinsville | 27 |

| Salem | 27 |

| Front Royal | 25 |

| Fairfax City | 23 |

| Bristol | 20 |

| Culpeper | 20 |

| Colonial Heights | 18 |

| Staunton | 17 |

| Abingdon | 15 |

| Blacksburg | 15 |

| Christiansburg | 14 |

| Leesburg | 14 |

| Manassas Park | 14 |

| Bedford | 12 |

| Franklin | 12 |

| Ashland | 11 |

| Colonial Beach | 11 |

| Dumfries | 11 |

| Radford | 11 |

| South Boston | 10 |

| Smithfield | 9 |

| Herndon | 8 |

| Williamsburg | 8 |

| Falls Church | 7 |

| Hillsville | 7 |

| Marion | 7 |

| Pulaski | 7 |

| Big Stone Gap | 6 |

| Vinton | 6 |

| Wytheville | 6 |

| Dublin | 5 |

| Luray | 5 |

| Clifton Forge | 4 |

| Emporia | 4 |

| Galax | 4 |

| Lebanon | 4 |

| Norton | 4 |

| Poquoson | 4 |

| Richlands | 4 |

| Rocky Mount | 4 |

| Coeburn | 3 |

| Elkton | 3 |

| Farmville | 3 |

| Orange | 3 |

| Stephens City | 3 |

| Tazewell | 3 |

| Vienna | 3 |

| Wise | 3 |

| Amherst | 2 |

| Chilhowie | 2 |

| Clarksville | 2 |

| Covington | 2 |

| Crewe | 2 |

| Exmore | 2 |

| Gate City | 2 |

| Lawrenceville | 2 |

| Lexington | 2 |

| Pearisburg | 2 |

| Pound | 2 |

| South Hill | 2 |

| Stanley | 2 |

| Warrenton | 2 |

| West Point | 2 |

| Woodstock | 2 |

| Appalachia | 1 |

| Berryville | 1 |

| Blackstone | 1 |

| Boykins | 1 |

| Bridgewater | 1 |

| Buena Vista | 1 |

| Burkeville | 1 |

| Cape Charles | 1 |

| Chincoteague | 1 |

| Clintwood | 1 |

| Glen Lyn | 1 |

| Gordonsville | 1 |

| Gretna | 1 |

| Grundy | 1 |

| Louisa | 1 |

| Middletown | 1 |

| New Market | 1 |

| Onley | 1 |

| Quantico | 1 |

| St. Paul | 1 |

| Tappahannock | 1 |

| Warsaw | 1 |

| Waverly | 1 |

| Weber City | 1 |

| Windsor | 1 |

| Altavista | 0 |

| Bloxom | 0 |

| Bowling Green | 0 |

| Broadway | 0 |

| Brookneal | 0 |

| Chase City | 0 |

| Chatham | 0 |

| Damascus | 0 |

| Dayton | 0 |

| Edinburg | 0 |

| Glasgow | 0 |

| Grottoes | 0 |

| Halifax | 0 |

| Haymarket | 0 |

| Haysi | 0 |

| Honaker | 0 |

| Hurt | 0 |

| Independence | 0 |

| Jonesville | 0 |

| Kenbridge | 0 |

| Kilmarnock | 0 |

| La Crosse | 0 |

| Middleburg | 0 |

| Mount Jackson | 0 |

| Narrows | 0 |

| Occoquan | 0 |

| Onancock | 0 |

| Parksley | 0 |

| Pembroke | 0 |

| Pennington Gap | 0 |

| Pocahontas | 0 |

| Purcellville | 0 |

| Rich Creek | 0 |

| Rural Retreat | 0 |

| Saltville | 0 |

| Shenandoah | 0 |

| Strasburg | 0 |

| Timberville | 0 |

| Victoria | 0 |

| White Stone | 0 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the number of road fatalities in Virginia?

Accidents happen, and next, we’re going to show you statistics from the National Highway Traffic Safety Administration for different kinds of accidents in Virginia.

What is the number of most fatal highway in Virginia?

Route US-460 is the deadliest highway in Virginia, which registers around 19 crashes every year.

What is the number of fatal crashes by weather condition & light condition?

Since states have different weather conditions to watch out for, we want to take a look at Virginia’s fatalities during different types of weather conditions. The following table shows how many crashes occurred when weather and light conditions are a factor.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 0 | 0 | 0 | 0 | 0 | 0 |

| Rain | 27 | 15 | 25 | 4 | 1 | 72 |

| Snow/Sleet | 1 | 0 | 2 | 0 | 0 | 3 |

| Other | 2 | 1 | 2 | 2 | 0 | 7 |

| Unknown | 394 | 83 | 196 | 28 | 0 | 701 |

| TOTAL | 424 | 99 | 225 | 34 | 1 | 783 |

As you can see, most accidents occur during daylight hours.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatalities (all crashes) by county?

The National Highway Traffic Safety Administration (NHTSA) has collected extensive data on crashes in Virginia. One of the first statistics we want to look at is how fatalities vary from county to county. The following table shows how many crashes occurred by county in the state of Virginia

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Chesterfield County | 26 | 19 | 28 | 25 | 34 |

| Fairfax County | 40 | 33 | 31 | 34 | 34 |

| Virginia Beach City | 27 | 29 | 16 | 19 | 25 |

| Henrico County | 24 | 18 | 18 | 21 | 24 |

| Frederick County | 11 | 9 | 13 | 10 | 22 |

| Prince William County | 18 | 23 | 11 | 30 | 22 |

| Loudoun County | 13 | 12 | 11 | 12 | 21 |

| Richmond City | 12 | 9 | 13 | 16 | 21 |

| Norfolk City | 25 | 21 | 15 | 18 | 19 |

| Augusta County | 17 | 9 | 9 | 19 | 18 |

| Chesapeake City | 11 | 9 | 18 | 19 | 18 |

| Suffolk City | 14 | 12 | 15 | 7 | 18 |

| Bedford County | 9 | 7 | 6 | 14 | 17 |

| Newport News City | 10 | 11 | 15 | 17 | 16 |

| James City County | 8 | 5 | 8 | 4 | 15 |

| Pittsylvania County | 8 | 16 | 19 | 14 | 14 |

| Hanover County | 13 | 17 | 15 | 8 | 13 |

| Henry County | 10 | 13 | 16 | 13 | 13 |

| Montgomery County | 9 | 4 | 6 | 5 | 13 |

| Portsmouth City | 3 | 5 | 5 | 8 | 13 |

| Sussex County | 0 | 4 | 3 | 8 | 13 |

| Albemarle County | 11 | 16 | 15 | 9 | 12 |

| Franklin County | 8 | 7 | 7 | 16 | 12 |

| Roanoke City | 6 | 7 | 4 | 9 | 12 |

| Rockingham County | 12 | 18 | 10 | 12 | 12 |

| Spotsylvania County | 11 | 11 | 11 | 14 | 12 |

| Mecklenburg County | 11 | 9 | 6 | 8 | 10 |

| Wythe County | 4 | 4 | 14 | 6 | 10 |

| Dinwiddie County | 8 | 3 | 10 | 9 | 9 |

| Fauquier County | 6 | 9 | 19 | 15 | 9 |

| Halifax County | 3 | 8 | 9 | 12 | 9 |

| King George County | 8 | 11 | 5 | 6 | 9 |

| Pulaski County | 4 | 9 | 2 | 2 | 9 |

| Stafford County | 8 | 5 | 15 | 9 | 9 |

| Campbell County | 4 | 9 | 7 | 11 | 8 |

| Carroll County | 11 | 4 | 7 | 6 | 8 |

| Hampton City | 9 | 10 | 8 | 8 | 8 |

| Orange County | 8 | 6 | 6 | 6 | 8 |

| Roanoke County | 9 | 4 | 10 | 5 | 8 |

| Rockbridge County | 2 | 9 | 7 | 9 | 8 |

| Russell County | 4 | 1 | 9 | 6 | 8 |

| Washington County | 6 | 8 | 9 | 6 | 8 |

| Amelia County | 4 | 1 | 3 | 5 | 7 |

| Buckingham County | 1 | 11 | 2 | 8 | 7 |

| Caroline County | 14 | 1 | 10 | 12 | 7 |

| Gloucester County | 3 | 4 | 5 | 5 | 7 |

| Louisa County | 12 | 3 | 6 | 10 | 7 |

| Prince Edward County | 6 | 4 | 7 | 5 | 7 |

| Buchanan County | 7 | 3 | 6 | 3 | 6 |

| Fluvanna County | 6 | 3 | 7 | 0 | 6 |

| Patrick County | 6 | 4 | 4 | 1 | 6 |

| Prince George County | 10 | 6 | 13 | 3 | 6 |

| Warren County | 5 | 8 | 4 | 7 | 6 |

| Arlington County | 2 | 8 | 5 | 1 | 5 |

| Brunswick County | 11 | 9 | 6 | 7 | 5 |

| Culpeper County | 9 | 9 | 6 | 5 | 5 |

| Giles County | 5 | 9 | 4 | 1 | 5 |

| Goochland County | 5 | 3 | 9 | 2 | 5 |

| Lunenburg County | 3 | 3 | 1 | 3 | 5 |

| Tazewell County | 6 | 4 | 5 | 3 | 5 |

| York County | 4 | 5 | 5 | 9 | 5 |

| Alexandria City | 3 | 0 | 4 | 4 | 4 |

| Amherst County | 4 | 8 | 6 | 5 | 4 |

| Botetourt County | 4 | 5 | 8 | 4 | 4 |

| Cumberland County | 4 | 1 | 1 | 1 | 4 |

| Danville City | 6 | 2 | 3 | 4 | 4 |

| Isle Of Wight County | 7 | 9 | 2 | 4 | 4 |

| King And Queen County | 1 | 2 | 3 | 2 | 4 |

| Nelson County | 4 | 2 | 7 | 0 | 4 |

| Powhatan County | 7 | 5 | 4 | 1 | 4 |

| Scott County | 3 | 3 | 3 | 2 | 4 |

| Shenandoah County | 7 | 4 | 7 | 6 | 4 |

| Southampton County | 9 | 4 | 5 | 2 | 4 |

| Accomack County | 8 | 10 | 6 | 8 | 3 |

| Clarke County | 0 | 1 | 7 | 3 | 3 |

| Essex County | 1 | 5 | 3 | 3 | 3 |

| Greene County | 2 | 3 | 1 | 0 | 3 |

| King William County | 3 | 3 | 1 | 3 | 3 |

| Lancaster County | 4 | 1 | 2 | 4 | 3 |

| Lee County | 4 | 2 | 7 | 5 | 3 |

| Madison County | 1 | 1 | 3 | 1 | 3 |

| New Kent County | 4 | 8 | 8 | 5 | 3 |

| Northampton County | 1 | 3 | 3 | 9 | 3 |

| Nottoway County | 3 | 4 | 5 | 5 | 3 |

| Page County | 1 | 2 | 3 | 4 | 3 |

| Rappahannock County | 0 | 0 | 0 | 0 | 3 |

| Smyth County | 5 | 4 | 4 | 3 | 3 |

| Alleghany County | 4 | 5 | 3 | 4 | 2 |

| Appomattox County | 2 | 4 | 1 | 3 | 2 |

| Bland County | 1 | 1 | 1 | 1 | 2 |

| Fredericksburg City | 2 | 0 | 2 | 1 | 2 |

| Greensville County | 2 | 7 | 2 | 5 | 2 |

| Lynchburg City | 1 | 3 | 2 | 1 | 2 |

| Manassas City | 0 | 0 | 0 | 0 | 2 |

| Mathews County | 6 | 1 | 1 | 2 | 2 |

| Middlesex County | 1 | 2 | 2 | 1 | 2 |

| Petersburg City | 2 | 3 | 0 | 6 | 2 |

| Radford City | 0 | 1 | 1 | 0 | 2 |

| Salem City | 1 | 0 | 1 | 0 | 2 |

| Westmoreland County | 0 | 3 | 5 | 0 | 2 |

| Bath County | 1 | 1 | 0 | 1 | 1 |

| Colonial Heights City | 0 | 0 | 1 | 5 | 1 |

| Dickenson County | 2 | 2 | 3 | 1 | 1 |

| Floyd County | 4 | 3 | 3 | 1 | 1 |

| Harrisonburg City | 1 | 0 | 1 | 4 | 1 |

| Northumberland County | 2 | 2 | 1 | 2 | 1 |

| Richmond County | 0 | 1 | 1 | 4 | 1 |

| Surry County | 1 | 1 | 2 | 3 | 1 |

| Waynesboro City | 2 | 1 | 1 | 1 | 1 |

| Wise County | 8 | 5 | 4 | 6 | 1 |

| Bedford City | 0 | 0 | 0 | 0 | 0 |

| Bristol City | 2 | 1 | 0 | 0 | 0 |

| Buena Vista City | 0 | 0 | 0 | 0 | 0 |

| Charles City County | 0 | 3 | 3 | 4 | 0 |

| Charlotte County | 3 | 2 | 7 | 6 | 0 |

| Charlottesville City | 1 | 0 | 0 | 2 | 0 |

| Clifton Forge City | 0 | 0 | 0 | 0 | 0 |

| Covington City | 1 | 1 | 0 | 0 | 0 |

| Craig County | 4 | 0 | 2 | 0 | 0 |

| Emporia City | 1 | 1 | 0 | 0 | 0 |

| Fairfax City | 2 | 0 | 0 | 4 | 0 |

| Falls Church City | 0 | 0 | 0 | 0 | 0 |

| Franklin City | 0 | 0 | 0 | 2 | 0 |

| Galax City | 0 | 0 | 1 | 0 | 0 |

| Grayson County | 1 | 3 | 3 | 3 | 0 |

| Highland County | 0 | 1 | 0 | 1 | 0 |

| Hopewell City | 1 | 2 | 1 | 0 | 0 |

| Lexington City | 2 | 0 | 0 | 0 | 0 |

| Manassas Park City | 0 | 0 | 0 | 0 | 0 |

| Martinsville City | 1 | 0 | 0 | 0 | 0 |

| Norton City | 1 | 0 | 0 | 0 | 0 |

| Poquoson City | 0 | 0 | 2 | 0 | 0 |

| South Boston City (No Longer A County Equivalent) | 0 | 0 | 0 | 0 | 0 |

| Staunton City | 1 | 0 | 1 | 1 | 0 |

| Williamsburg City | 0 | 0 | 0 | 0 | 0 |

| Winchester City | 0 | 0 | 1 | 1 | 0 |

In evaluating fatalities by county, the following five have the highest totals for 2017:

- Fairfax County – 34

- Chesterfield County – 34

- Virginia Beach City County – 25

- Henrico County – 24

- Prince William County – 22

What is the number of traffic fatalities?

Car insurance companies, law enforcement, and the DMV consider all data collected over the years. To accurately report fatality data per year, these organizations separate the data by rural and urban categories.

In the table below, traffic fatality numbers for rural and urban areas are listed.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 479 | 421 | 308 | 405 | 500 | 473 | 448 | 484 | 477 | 519 |

| Urban | 343 | 334 | 234 | 279 | 259 | 260 | 247 | 269 | 281 | 319 |

| Unknown | 3 | 3 | 198 | 80 | 17 | 7 | 8 | 1 | 2 | 1 |

| Total | 825 | 758 | 740 | 764 | 776 | 740 | 703 | 754 | 760 | 839 |

In our 10 year lookback period, more fatal accidents occurred on rural roads than in urban areas.

What is the number of fatalities by person type?

The type of car driven can sometimes show trends in fatalities, and car occupants aren’t the only ones at risk in a crash. Pedestrians, cyclists, and motorcyclists die every year from vehicle accidents. In the table below, we examine fatalities by person type.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total | 740 | 703 | 754 | 760 | 839 |

| Passenger Car | 331 | 299 | 323 | 308 | 320 |

| Total Motorcyclists | 79 | 90 | 79 | 79 | 117 |

| Light Truck - Pickup | 87 | 86 | 103 | 82 | 111 |

| Light Truck - Utility | 99 | 68 | 103 | 88 | 111 |

| Pedestrian | 75 | 88 | 77 | 122 | 111 |

| Light Truck - Van | 32 | 23 | 24 | 30 | 32 |

| Large Truck | 24 | 22 | 19 | 25 | 18 |

| Bicyclist and Other Cyclist | 8 | 12 | 15 | 10 | 12 |

| Other/Unknown Occupants | 1 | 10 | 8 | 8 | 5 |

| Other/Unknown Nonoccupants | 3 | 4 | 2 | 2 | 2 |

| Light Truck - Other | 0 | 0 | 1 | 6 | 0 |

| Bus | 1 | 1 | 0 | 0 | 0 |

As the data reflects, most fatalities occurred in passenger cars, followed by light pickups.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the number of fatalities by crash type?

Between 2013 to 2017, the greatest number of fatalities occurred in single-vehicle crashes, followed by roadway departures. Fatalities involving speeding decreased from 2016 to 2017. In the table below, we examine fatalities by crash type.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| - (1) Single Vehicle | 461 | 436 | 474 | 476 | 493 |

| - (2) Involving a Large Truck | 89 | 90 | 71 | 91 | 98 |

| - (3) Involving Speeding | 132 | 99 | 105 | 257 | 219 |

| - (4) Involving a Rollover | 188 | 146 | 194 | 163 | 186 |

| - (5) Involving a Roadway Departure | 498 | 443 | 492 | 444 | 511 |

| - (6) Involving an Intersection (or Intersection Related) | 138 | 164 | 170 | 177 | 189 |

| Total Fatalities (All Crashes) | 740 | 703 | 754 | 760 | 839 |

Sadly, driving alone and single-vehicle crashes are the leading cause of fatalities in Virginia.

Five-year trend for the top 10 counties

When comparing the 10 largest counties in the state, Chesterfield and Fairfax Counties have the highest number of fatalities in 2017. In 2017, Prince William County saw a significant decline in fatalities, dropping from 30 to 22 from 2016 to 2017. In the table below, we show data for the rest of the counties.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| All Counties Total | 740 | 703 | 754 | 759 | 839 |

| All Other Counties | 522 | 493 | 559 | 541 | 599 |

| Chesterfield County | 26 | 19 | 28 | 25 | 34 |

| Fairfax County | 40 | 33 | 31 | 34 | 34 |

| Virginia Beach City | 27 | 29 | 16 | 19 | 25 |

| Henrico County | 24 | 18 | 18 | 21 | 24 |

| Frederick County | 11 | 9 | 13 | 10 | 22 |

| Prince William County | 18 | 23 | 11 | 30 | 22 |

| Loudoun County | 13 | 12 | 11 | 12 | 21 |

| Richmond City | 12 | 9 | 13 | 16 | 21 |

| Norfolk City | 25 | 21 | 15 | 18 | 19 |

| Augusta County | 17 | 9 | 9 | 19 | 18 |

What is the number of fatalities involving speeding by county?

Speed limits are implemented to not only save on the cost of gasoline but to help keep you safe. The table below shows the fatalities involving speeding listed by county.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Fairfax County | 9 | 7 | 8 | 12 | 14 |

| Loudoun County | 3 | 2 | 2 | 5 | 10 |

| Prince William County | 4 | 6 | 2 | 14 | 9 |

| Chesterfield County | 2 | 3 | 8 | 14 | 8 |

| Sussex County | 0 | 1 | 1 | 5 | 7 |

| Bedford County | 2 | 0 | 0 | 8 | 6 |

| Chesapeake City | 2 | 0 | 2 | 5 | 6 |

| Henry County | 0 | 2 | 2 | 4 | 6 |

| Newport News City | 1 | 3 | 5 | 7 | 6 |

| Virginia Beach City | 7 | 6 | 2 | 8 | 6 |

| Amelia County | 1 | 1 | 0 | 3 | 5 |

| Augusta County | 3 | 3 | 3 | 5 | 5 |

| King George County | 0 | 2 | 0 | 3 | 5 |

| Montgomery County | 1 | 1 | 2 | 0 | 5 |

| Spotsylvania County | 4 | 0 | 3 | 4 | 5 |

| Campbell County | 0 | 3 | 1 | 5 | 4 |

| Frederick County | 2 | 0 | 2 | 1 | 4 |

| Hanover County | 2 | 0 | 1 | 5 | 4 |

| Pittsylvania County | 2 | 1 | 1 | 4 | 4 |

| Prince Edward County | 0 | 0 | 0 | 2 | 4 |

| Rockingham County | 5 | 5 | 2 | 5 | 4 |

| Carroll County | 2 | 1 | 0 | 0 | 3 |

| Cumberland County | 0 | 1 | 0 | 0 | 3 |

| Dinwiddie County | 2 | 0 | 1 | 2 | 3 |

| Franklin County | 0 | 0 | 0 | 4 | 3 |

| James City County | 1 | 0 | 0 | 1 | 3 |

| Louisa County | 3 | 1 | 0 | 7 | 3 |

| Mecklenburg County | 2 | 0 | 1 | 2 | 3 |

| Roanoke City | 2 | 0 | 4 | 2 | 3 |

| Stafford County | 1 | 1 | 2 | 2 | 3 |

| Accomack County | 1 | 0 | 1 | 3 | 2 |

| Albemarle County | 2 | 0 | 1 | 2 | 2 |

| Alexandria City | 0 | 0 | 1 | 1 | 2 |

| Brunswick County | 1 | 2 | 0 | 2 | 2 |

| Buchanan County | 3 | 1 | 4 | 1 | 2 |

| Caroline County | 1 | 0 | 0 | 7 | 2 |

| Fauquier County | 1 | 1 | 2 | 6 | 2 |

| Halifax County | 0 | 1 | 0 | 3 | 2 |

| Hampton City | 2 | 3 | 3 | 1 | 2 |

| King And Queen County | 0 | 1 | 0 | 0 | 2 |

| Lancaster County | 0 | 0 | 0 | 1 | 2 |

| Nottoway County | 0 | 0 | 0 | 3 | 2 |

| Page County | 0 | 0 | 0 | 3 | 2 |

| Richmond City | 2 | 0 | 1 | 5 | 2 |

| Roanoke County | 3 | 1 | 0 | 2 | 2 |

| Shenandoah County | 1 | 0 | 0 | 2 | 2 |

| Warren County | 0 | 0 | 0 | 1 | 2 |

| Wythe County | 0 | 2 | 1 | 2 | 2 |

| Amherst County | 1 | 1 | 1 | 2 | 1 |

| Buckingham County | 1 | 3 | 0 | 6 | 1 |

| Clarke County | 0 | 0 | 0 | 1 | 1 |

| Danville City | 1 | 0 | 0 | 0 | 1 |

| Dickenson County | 2 | 1 | 1 | 0 | 1 |

| Gloucester County | 0 | 0 | 2 | 1 | 1 |

| Greensville County | 0 | 0 | 0 | 2 | 1 |

| Harrisonburg City | 0 | 0 | 0 | 0 | 1 |

| Isle Of Wight County | 2 | 2 | 0 | 0 | 1 |

| King William County | 0 | 0 | 0 | 2 | 1 |

| Lunenburg County | 1 | 1 | 0 | 2 | 1 |

| Lynchburg City | 0 | 0 | 0 | 0 | 1 |

| Madison County | 0 | 0 | 0 | 0 | 1 |

| Nelson County | 0 | 0 | 2 | 0 | 1 |

| Northampton County | 0 | 0 | 1 | 0 | 1 |

| Portsmouth City | 0 | 2 | 0 | 4 | 1 |

| Powhatan County | 1 | 0 | 0 | 0 | 1 |

| Prince George County | 0 | 0 | 0 | 0 | 1 |

| Pulaski County | 1 | 0 | 0 | 0 | 1 |

| Rappahannock County | 0 | 0 | 0 | 0 | 1 |

| Richmond County | 0 | 0 | 0 | 1 | 1 |

| Rockbridge County | 0 | 2 | 0 | 3 | 1 |

| Russell County | 1 | 0 | 2 | 1 | 1 |

| Salem City | 0 | 0 | 0 | 0 | 1 |

| Suffolk City | 6 | 2 | 1 | 2 | 1 |

| Surry County | 0 | 0 | 0 | 1 | 1 |

| Tazewell County | 1 | 0 | 3 | 2 | 1 |

| Wise County | 0 | 2 | 0 | 3 | 1 |

| York County | 1 | 3 | 0 | 2 | 1 |

| Alleghany County | 0 | 1 | 2 | 1 | 0 |

| Appomattox County | 0 | 0 | 0 | 1 | 0 |

| Arlington County | 0 | 1 | 2 | 0 | 0 |

| Bath County | 0 | 0 | 0 | 0 | 0 |

| Bedford City | 0 | 0 | 0 | 0 | 0 |

| Bland County | 1 | 0 | 0 | 0 | 0 |

| Botetourt County | 0 | 0 | 0 | 2 | 0 |

| Bristol City | 1 | 0 | 0 | 0 | 0 |

| Buena Vista City | 0 | 0 | 0 | 0 | 0 |

| Charles City County | 0 | 0 | 1 | 2 | 0 |

| Charlotte County | 1 | 0 | 0 | 2 | 0 |

| Charlottesville City | 0 | 0 | 0 | 1 | 0 |

| Clifton Forge City | 0 | 0 | 0 | 0 | 0 |

| Colonial Heights City | 0 | 0 | 0 | 1 | 0 |

| Covington City | 0 | 0 | 0 | 0 | 0 |

| Craig County | 0 | 0 | 0 | 0 | 0 |

| Culpeper County | 1 | 0 | 0 | 1 | 0 |

| Emporia City | 1 | 0 | 0 | 0 | 0 |

| Essex County | 0 | 1 | 0 | 1 | 0 |

| Fairfax City | 0 | 0 | 0 | 1 | 0 |

| Falls Church City | 0 | 0 | 0 | 0 | 0 |

| Floyd County | 0 | 0 | 0 | 0 | 0 |

| Fluvanna County | 0 | 0 | 2 | 0 | 0 |

| Franklin City | 0 | 0 | 0 | 0 | 0 |

| Fredericksburg City | 0 | 0 | 0 | 1 | 0 |

| Galax City | 0 | 0 | 0 | 0 | 0 |

| Giles County | 1 | 1 | 1 | 0 | 0 |

| Goochland County | 0 | 0 | 5 | 0 | 0 |

| Grayson County | 0 | 0 | 0 | 1 | 0 |

| Greene County | 1 | 1 | 0 | 0 | 0 |

| Henrico County | 3 | 1 | 1 | 6 | 0 |

| Highland County | 0 | 0 | 0 | 0 | 0 |

| Hopewell City | 0 | 0 | 0 | 0 | 0 |

| Lee County | 1 | 2 | 1 | 2 | 0 |

| Lexington City | 0 | 0 | 0 | 0 | 0 |

| Manassas City | 0 | 0 | 0 | 0 | 0 |

| Manassas Park City | 0 | 0 | 0 | 0 | 0 |

| Martinsville City | 1 | 0 | 0 | 0 | 0 |

| Mathews County | 0 | 0 | 0 | 0 | 0 |

| Middlesex County | 0 | 1 | 0 | 0 | 0 |

| New Kent County | 4 | 0 | 1 | 3 | 0 |

| Norfolk City | 7 | 5 | 3 | 2 | 0 |

| Northumberland County | 0 | 0 | 0 | 1 | 0 |

| Norton City | 0 | 0 | 0 | 0 | 0 |

| Orange County | 1 | 1 | 0 | 2 | 0 |

| Patrick County | 0 | 0 | 1 | 0 | 0 |

| Petersburg City | 1 | 0 | 0 | 2 | 0 |

| Poquoson City | 0 | 0 | 0 | 0 | 0 |

| Radford City | 0 | 0 | 0 | 0 | 0 |

| Scott County | 0 | 1 | 0 | 0 | 0 |

| Smyth County | 0 | 0 | 0 | 0 | 0 |

| South Boston City (No Longer A County Equivalent) | 0 | 0 | 0 | 0 | 0 |

| Southampton County | 2 | 1 | 0 | 0 | 0 |

| Staunton City | 0 | 0 | 0 | 0 | 0 |

| Washington County | 5 | 1 | 1 | 4 | 0 |

| Waynesboro City | 1 | 0 | 0 | 0 | 0 |

| Westmoreland County | 0 | 0 | 2 | 0 | 0 |

| Williamsburg City | 0 | 0 | 0 | 0 | 0 |

| Winchester City | 0 | 0 | 0 | 0 | 0 |

Fairfax County leads the way with 14 reported speeding fatalities. We encourage you to obey posted speed limit signs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the number of fatalities in crashes involving an alcohol-impaired driver by county?

Check out the table below to see fatalities in crashes that involved an alcohol-impaired driver with a BAC over .08.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Fairfax County | 16 | 10 | 4 | 9 | 11 |

| Loudoun County | 4 | 4 | 4 | 2 | 11 |

| James City County | 3 | 2 | 2 | 1 | 9 |

| Spotsylvania County | 2 | 6 | 3 | 5 | 8 |

| Virginia Beach City | 11 | 13 | 7 | 4 | 8 |

| Chesterfield County | 11 | 8 | 8 | 11 | 7 |

| Frederick County | 4 | 1 | 3 | 1 | 7 |

| Albemarle County | 5 | 5 | 4 | 3 | 6 |

| Bedford County | 3 | 2 | 4 | 7 | 6 |

| Chesapeake City | 4 | 2 | 6 | 5 | 6 |

| Norfolk City | 9 | 10 | 5 | 3 | 6 |

| Pittsylvania County | 5 | 4 | 7 | 6 | 6 |

| Sussex County | 0 | 2 | 0 | 1 | 6 |

| Newport News City | 4 | 3 | 6 | 5 | 5 |

| Portsmouth City | 1 | 1 | 1 | 3 | 5 |

| Prince William County | 3 | 5 | 1 | 9 | 5 |

| Augusta County | 5 | 3 | 5 | 7 | 4 |

| Campbell County | 1 | 2 | 1 | 6 | 4 |

| Henrico County | 10 | 8 | 4 | 7 | 4 |

| Louisa County | 7 | 1 | 1 | 6 | 4 |

| Mecklenburg County | 3 | 0 | 0 | 4 | 4 |

| Montgomery County | 3 | 2 | 2 | 0 | 4 |

| Roanoke City | 1 | 4 | 4 | 4 | 4 |

| Rockingham County | 6 | 6 | 1 | 3 | 4 |

| Russell County | 1 | 0 | 3 | 1 | 4 |

| Stafford County | 4 | 1 | 3 | 1 | 4 |

| Amelia County | 1 | 0 | 1 | 2 | 3 |

| Franklin County | 1 | 4 | 2 | 1 | 3 |

| Gloucester County | 1 | 1 | 3 | 1 | 3 |

| Hanover County | 3 | 5 | 5 | 3 | 3 |

| Henry County | 5 | 2 | 4 | 3 | 3 |