North Dakota Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 6.80

North Dakota is a wide-open state of ranches and roadways. Known for its wild animals and open farms, North Dakota is ranked seventeenth out of all the states.

From Lake Sakakawea and Devils Lake to The International Peace Garden, there are so many sites to see in the great state of North Dakota. The roads are wide open with gorgeous sites but with those wide-open roads is the need for insurance. That is why we are here.

Finding insurance is tough. There are so many different companies, not to mention all the coverages available. We are going to make this task more bearable. We have compiled rates from different car insurance companies to help you find the cheapest and best North Dakota insurance rate for your needs.

Want to go ahead and start with your auto insurance coverage rates? You can enter your zip code and use our free online tool to start comparing today.

What Are the North Dakota Car Insurance Coverage Requirements and Rates?

First up, let’s talk about what it’s like to drive in North Dakota. If you want to drive in North Dakota, you are going to need car insurance.

But how much do you need? What coverages are available? We will keep you up to date with how much you need, what coverages are available, and what demographic factors can affect your rates.

What is North Dakota’s Car Culture Like?

It is no surprise Ford F150 is the truck of choice in North Dakota. Cars are not conducive to farm life and heavy winters.

North Dakota may be in the top twenty for land size, but she ranks low in population. So those wide open roads are also mostly uninhabited by shelter or someone that can help you if needed. With heavy winters and no place to stop in a storm, a larger truck is your best bet to getting home safely.

Depending on the area, you might see tractors or other non-traditional vehicles driving down the road as well. Insurance has to cover potential collisions or accidents associated with all these things.

What Are the North Dakota Insurance Minimum Coverage Requirements?

In order to drive on North Dakota roadways, you must at least have the required minimum limits set by the state.

The North Dakota Insurance Department has the following information listed on their site:

The coverages and minimum limits mandated by law are:

- Bodily injury liability – $25,000 per person (the maximum amount payable to one person)/$50,000 per accident (the maximum amount payable to all people injured in one accident). Bodily injury liability provides coverage for claims brought against you for bodily injury caused to another person through the operation of your vehicle.

- Property damage liability – $25,000 per accident. Property damage liability provides coverage for claims brought against you for damage caused to someone else’s property through the operation of your vehicle. Also covers damage to a car you rent for personal use on a short-term basis.

- Uninsured motorist coverage – $25,000 per person/$50,000 per accident. Uninsured motorist provides you coverage for a bodily injury claim you would have against another driver who does not have insurance. This coverage does not pay for physical damage to your vehicle.

- Underinsured motorist coverage – underinsured motorist coverage must be equal to the uninsured motorist coverage. Underinsured motorist provides you coverage for a bodily injury claim you would have against another driver whose liability coverage is less than your underinsured coverage.

- Basic no-fault – $30,000 per person. Basic no-fault provides you coverage for economic loss (such as medical expenses and work loss) as a result of an accidental injury without regard to fault. No-fault is also known as Personal Injury Protection (PIP).

North Dakota is a no-fault state. We will explain this more as we go into state laws, but this means no matter who is at fault your North Dakota insurance will pay out for certain coverages. Then insurance companies settle reimbursements with the other insurer.

Keep in mind, this is the minimum required amount according to the North Dakota Insurance Department. If you get into an accident and damages are more than your coverage limits, your insurance company only pays out your limits and you could be held liable for the remaining amount.

Auto insurance quotes can quote state minimums. You can get quotes for comparison that show comprehensive and collision, higher liability limits, and much more.

What Are the Different Forms of Financial Responsibility?

You have at least the required minimum amount of insurance, but how do you prove it? That is called forms of financial responsibility.

The following can be used for proof of insurance in North Dakota:

- Valid insurance cards showing liability coverage

- Copy of insurance policy

- Electronic proof on your smartphone or electronic device

Failure to carry insurance can lead to some hefty fines and consequences. It could be a ticket requiring you to submit proof of coverage to your local court house. The state can also suspend your license or charge you fees.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Heavy Is The Financial Burden for Insurance in North Dakota?

You work hard. You want to be able to relax on your downtime and enjoy the scenic views and great sites of your state. But how much of your income is going towards keeping you legal in the road? Here is some data around North Dakota insurance rates.

| North Dakota Disposable Income (2012-2014) | |||

|---|---|---|---|

| 2012 | 2013 | 2014 | |

| Disposable Income | $50,227 | $49,309 | $51,311 |

| Full Coverage Auto Insurance (annual cost) | $714.75 | $743.27 | $768.09 |

| Insurance as Percentage of Income | 1.42% | 1.51% | 1.50% |

So how does North Dakota compare to the rest of the country? Pretty good as they are the lowest percentages in the country. Neighboring state, South Dakota, ranks sixth in lowest percentages of income.

Want to get a little more specific? Use our free percentage of income tool below to plug in your information. While the average cost could be a low dollar amount, that amount has to be balanced against your total disposable income to determine how affordable it is.

What Are the Average Monthly Car Insurance Rates in ND (Liability, Collision, Comprehensive)?

The following rates were taken from the National Associations of Insurance Commissioners. North Dakota rates lower in three out of the four categories than national averages for insurance rates.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $298.18 |

| Collision | $244.09 |

| Comprehensive | $231.04 |

| Combined | $773.30 |

What Are Additional Liability Coverage Options in North Dakota?

Loss Ratio is a good indicator of how well a company is doing financially. Loss ratio is the amount of money a company pays in claims to how much they earn in premium. If the percentage is too high, they are not making money and could be under financial stress.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 70.40% | 63.81% | 65.87% |

| Uninsured/Underinsured Motorist Coverage | 49.57% | 50.58% | 58.03% |

Medical payment is a coverage used for medical payments only. This is an additional coverage used for anyone in the vehicle regardless of fault.

Additional liability coverages do increase the premium, but if a loss occurs it could be less stress when paying for the claim.

Are There Add-ons, Endorsements, and Riders?

While minimum coverage is required, there are many other coverage options available. As we mentioned earlier, the minimum coverage is cheaper in premium but could be a problem if you file a claim. Sometimes it is not enough to cover the loss and leave you with enough to get you back behind the wheel.

We have compiled a list of affordable coverages you can opt to add to your policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

As always, you can sit down with an agent and go over your needs to make sure there is no gap in your coverage with your needs.

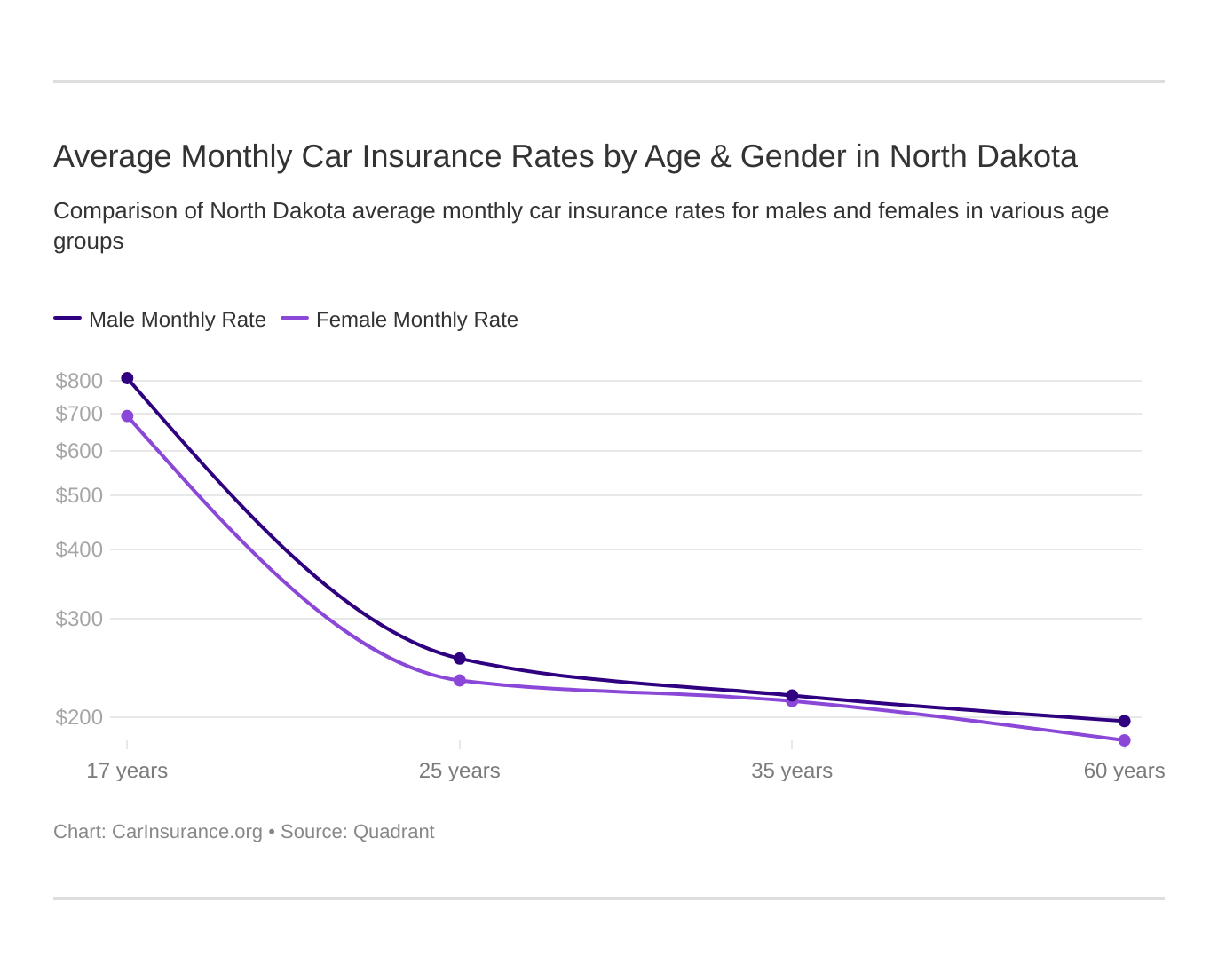

What Are the Average Monthly Car Insurance Rates by Age & Gender in ND?

Most know that having a teen driver is going to drive up your premium. They have the obvious problem of inexperience on the road, which decreases over time leading to significant drops in insurance rates. Does being male or female make a difference? What about marital status?

We took some of the largest insurance carriers in North Dakota and compiled their rates for different age groups, marital status, and gender.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Insurance | $2,590.48 | $2,605.94 | $2,288.23 | $2,428.15 | $9,875.97 | $11,607.96 | $2,861.48 | $3,096.28 |

| American Family Mutual | $2,737.18 | $2,737.18 | $2,470.01 | $2,470.01 | $5,790.24 | $8,352.79 | $2,737.18 | $3,204.61 |

| Mid-Century Ins Co | $1,849.52 | $1,817.12 | $1,652.82 | $1,719.45 | $6,604.22 | $6,774.20 | $2,101.08 | $2,221.48 |

| Geico General | $2,140.76 | $2,124.33 | $1,843.20 | $1,864.30 | $4,118.08 | $5,176.02 | $1,932.65 | $2,146.59 |

| SAFECO Ins Co of America | $7,111.32 | $7,686.04 | $5,710.32 | $6,918.97 | $28,261.47 | $31,519.57 | $7,447.31 | $8,167.61 |

| Allied P&C | $1,826.79 | $1,873.86 | $1,636.45 | $1,748.60 | $4,070.66 | $5,037.47 | $2,078.84 | $2,210.12 |

| Progressive Northwestern | $2,097.81 | $2,000.91 | $1,698.60 | $1,760.43 | $7,671.25 | $8,577.02 | $2,574.11 | $2,604.38 |

| State Farm Mutual Auto | $1,653.32 | $1,653.32 | $1,456.43 | $1,456.43 | $4,560.32 | $5,771.61 | $1,846.44 | $2,086.33 |

| USAA GIC | $1,126.55 | $1,118.67 | $917.93 | $920.50 | $3,888.40 | $4,696.71 | $1,622.27 | $1,763.41 |

Teen drivers can cost thousands more than older drivers and females tend to pay slightly less than males.

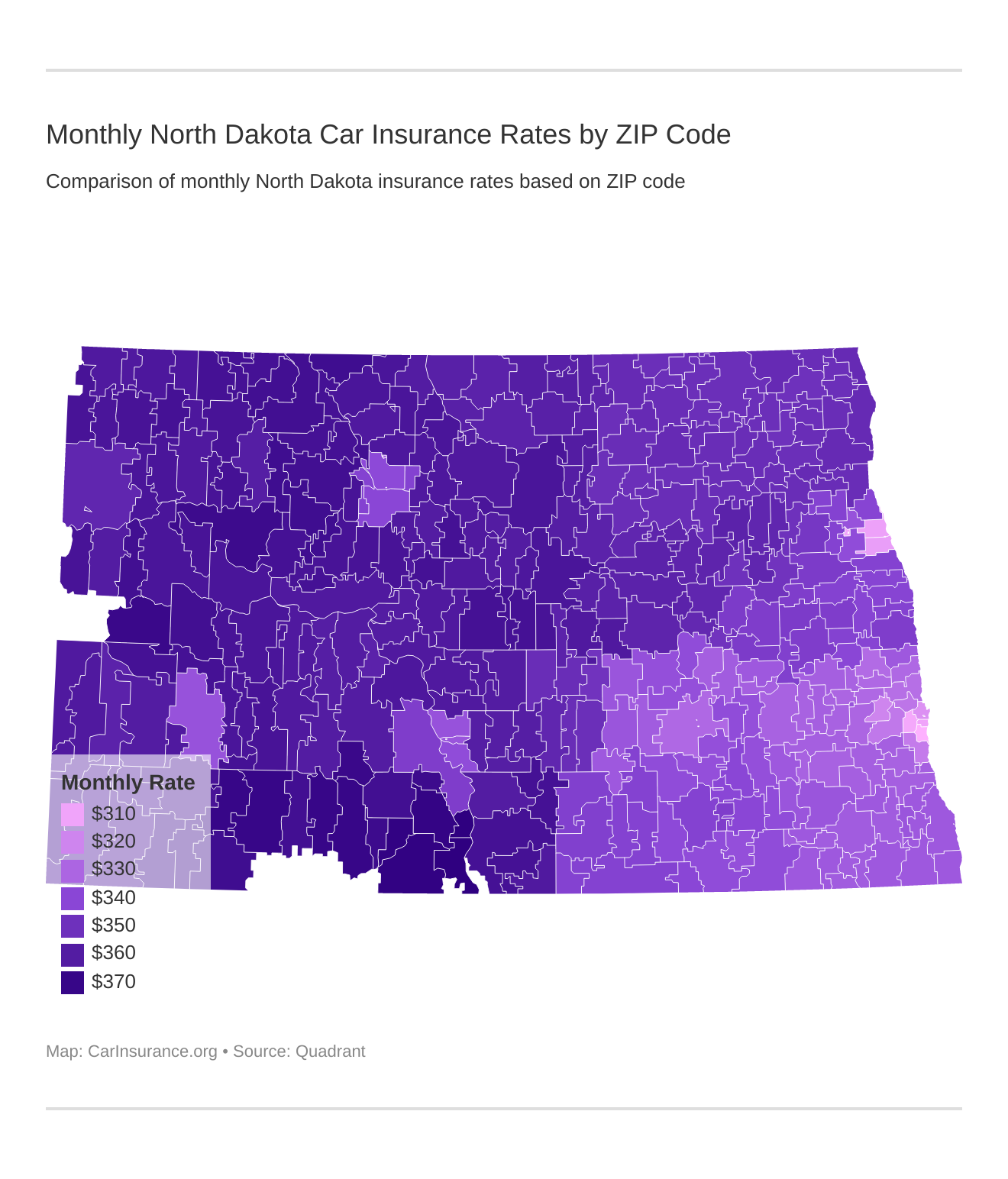

What Are the Cheapest Rates by Zip Code and City?

Another factor that can determine your rate is where you live and your zip code. For the average North Dakotan, rates are low, but they can vary widely based on the city. We took the same companies from above and rated them for North Dakota zip codes and cities.

| City | Zipcode | Average Annual Rate | Zipcode | Average Annual Rate | |

|---|---|---|---|---|---|

| FORT YATES | 58001 | $4,004.14 | 58538 | $4,477.64 | |

| CANNON BALL | 58002 | $4,027.31 | 58528 | $4,474.33 | |

| SELFRIDGE | 58004 | $3,948.28 | 58568 | $4,465.05 | |

| SHIELDS | 58005 | $3,926.08 | 58569 | $4,462.61 | |

| SOLEN | 58006 | $3,948.28 | 58570 | $4,448.27 | |

| CARSON | 58007 | $3,961.99 | 58529 | $4,441.63 | |

| ELGIN | 58008 | $4,018.79 | 58533 | $4,440.40 | |

| MOTT | 58009 | $4,086.79 | 58646 | $4,435.21 | |

| REGENT | 58011 | $3,974.84 | 58650 | $4,435.21 | |

| GRASSY BUTTE | 58012 | $3,838.00 | 58634 | $4,432.73 | |

| ALMONT | 58013 | $3,996.80 | 58520 | $4,426.62 | |

| RALEIGH | 58015 | $3,984.37 | 58564 | $4,421.20 | |

| SAINT ANTHONY | 58016 | $4,099.98 | 58566 | $4,419.94 | |

| NEW TOWN | 58017 | $4,004.02 | 58763 | $4,415.86 | |

| REEDER | 58018 | $4,007.57 | 58649 | $4,409.17 | |

| PALERMO | 58021 | $3,979.31 | 58769 | $4,407.67 | |

| PLAZA | 58027 | $3,972.41 | 58771 | $4,405.45 | |

| HETTINGER | 58029 | $3,969.20 | 58639 | $4,402.71 | |

| SHERWOOD | 58030 | $4,006.25 | 58782 | $4,400.72 | |

| MAKOTI | 58031 | $3,983.92 | 58756 | $4,398.33 | |

| KILLDEER | 58032 | $4,007.50 | 58640 | $4,395.24 | |

| KENMARE | 58033 | $4,015.64 | 58746 | $4,392.89 | |

| FLASHER | 58035 | $4,080.20 | 58535 | $4,392.86 | |

| BOWBELLS | 58036 | $3,949.60 | 58721 | $4,392.34 | |

| BERTHOLD | 58038 | $4,007.65 | 58718 | $4,390.95 | |

| SCRANTON | 58040 | $3,994.30 | 58653 | $4,390.28 | |

| NEW LEIPZIG | 58041 | $4,004.05 | 58562 | $4,389.06 | |

| ARNEGARD | 58042 | $3,905.99 | 58835 | $4,386.72 | |

| WILDROSE | 58043 | $3,996.80 | 58795 | $4,385.63 | |

| DONNYBROOK | 58045 | $4,122.50 | 58734 | $4,385.54 | |

| MANNING | 58046 | $4,124.99 | 58642 | $4,385.25 | |

| CARPIO | 58047 | $3,871.57 | 58725 | $4,383.60 | |

| LEFOR | 58048 | $3,940.10 | 58641 | $4,382.85 | |

| GOODRICH | 58049 | $4,002.73 | 58444 | $4,380.17 | |

| LINTON | 58051 | $3,976.06 | 58552 | $4,380.01 | |

| STRASBURG | 58052 | $3,981.57 | 58573 | $4,380.01 | |

| ROSS | 58053 | $4,002.20 | 58776 | $4,379.41 | |

| BRADDOCK | 58054 | $4,014.58 | 58524 | $4,379.34 | |

| FAIRFIELD | 58056 | $4,121.86 | 58627 | $4,378.97 | |

| PARSHALL | 58057 | $4,012.92 | 58770 | $4,378.62 | |

| MARMARTH | 58058 | $4,004.05 | 58643 | $4,378.35 | |

| VOLTAIRE | 58059 | $3,882.71 | 58792 | $4,376.39 | |

| COLUMBUS | 58060 | $3,997.45 | 58727 | $4,376.21 | |

| FLAXTON | 58061 | $4,007.57 | 58737 | $4,376.21 | |

| LIGNITE | 58062 | $3,970.69 | 58752 | $4,376.21 | |

| PORTAL | 58063 | $3,969.97 | 58772 | $4,376.21 | |

| RUSO | 58064 | $3,980.01 | 58778 | $4,376.08 | |

| KINTYRE | 58065 | $4,052.80 | 58549 | $4,375.70 | |

| ROSEGLEN | 58067 | $3,996.80 | 58775 | $4,375.67 | |

| TOLLEY | 58068 | $3,984.87 | 58787 | $4,375.63 | |

| DENHOFF | 58069 | $4,013.29 | 58430 | $4,375.61 | |

| MCCLUSKY | 58071 | $3,978.43 | 58463 | $4,375.61 | |

| DUNN CENTER | 58072 | $3,973.41 | 58626 | $4,373.55 | |

| ALAMO | 58075 | $4,004.14 | 58830 | $4,372.77 | |

| GRENORA | 58076 | $4,010.71 | 58845 | $4,372.77 | |

| DOUGLAS | 58077 | $3,985.76 | 58735 | $4,370.28 | |

| RYDER | 58078 | $3,709.87 | 58779 | $4,370.28 | |

| MAX | 58079 | $3,960.20 | 58759 | $4,369.62 | |

| HURDSFIELD | 58081 | $3,996.80 | 58451 | $4,368.61 | |

| WHITE EARTH | 58102 | $3,789.93 | 58794 | $4,366.39 | |

| POWERS LAKE | 58103 | $3,716.98 | 58773 | $4,364.74 | |

| CARTWRIGHT | 58104 | $3,677.18 | 58838 | $4,364.51 | |

| KEENE | 58105 | $3,806.23 | 58847 | $4,364.22 | |

| NEW ENGLAND | 58201 | $3,748.50 | 58647 | $4,363.97 | |

| RICHARDTON | 58202 | $3,736.36 | 58652 | $4,363.36 | |

| DES LACS | 58203 | $3,727.21 | 58733 | $4,363.23 | |

| MARSHALL | 58204 | $3,723.40 | 58644 | $4,362.68 | |

| ZAHL | 58205 | $3,723.40 | 58856 | $4,361.79 | |

| HARVEY | 58210 | $4,226.37 | 58341 | $4,360.64 | |

| MAXBASS | 58212 | $4,190.99 | 58760 | $4,359.44 | |

| WATFORD CITY | 58214 | $4,102.36 | 58854 | $4,358.39 | |

| DODGE | 58216 | $4,210.58 | 58625 | $4,357.46 | |

| NEWBURG | 58218 | $4,097.06 | 58762 | $4,356.93 | |

| RAY | 58219 | $4,108.65 | 58849 | $4,356.90 | |

| GLADSTONE | 58220 | $4,195.27 | 58630 | $4,356.70 | |

| UPHAM | 58222 | $4,209.35 | 58789 | $4,356.65 | |

| MANDAREE | 58223 | $4,105.83 | 58757 | $4,355.85 | |

| MOHALL | 58224 | $4,213.47 | 58761 | $4,355.73 | |

| EPPING | 58225 | $4,236.08 | 58843 | $4,355.55 | |

| TAYLOR | 58227 | $4,201.60 | 58656 | $4,354.69 | |

| HALLIDAY | 58228 | $4,059.54 | 58636 | $4,354.36 | |

| BALTA | 58229 | $4,222.78 | 58313 | $4,351.04 | |

| RUGBY | 58230 | $4,136.68 | 58368 | $4,351.04 | |

| ANTLER | 58231 | $4,220.67 | 58711 | $4,351.02 | |

| CROSBY | 58233 | $4,220.67 | 58730 | $4,349.17 | |

| MCGREGOR | 58235 | $4,101.02 | 58755 | $4,349.17 | |

| NOONAN | 58236 | $4,222.56 | 58765 | $4,349.17 | |

| RHAME | 58237 | $4,238.38 | 58651 | $4,348.27 | |

| AMIDON | 58238 | $4,210.58 | 58620 | $4,347.25 | |

| GLENBURN | 58239 | $4,208.62 | 58740 | $4,346.05 | |

| CENTER | 58240 | $4,101.20 | 58530 | $4,344.30 | |

| GRANVILLE | 58241 | $4,213.21 | 58741 | $4,342.64 | |

| DEERING | 58243 | $4,227.80 | 58731 | $4,340.72 | |

| BENEDICT | 58244 | $4,101.02 | 58716 | $4,338.28 | |

| MARTIN | 58249 | $4,209.93 | 58758 | $4,338.26 | |

| BALDWIN | 58250 | $4,225.10 | 58521 | $4,337.91 | |

| LANSFORD | 58251 | $4,160.48 | 58750 | $4,337.77 | |

| SYKESTON | 58254 | $4,255.37 | 58486 | $4,337.52 | |

| HAGUE | 58255 | $4,208.62 | 58542 | $4,337.48 | |

| AMBROSE | 58256 | $4,087.41 | 58833 | $4,336.98 | |

| FORTUNA | 58257 | $4,086.50 | 58844 | $4,336.98 | |

| TIOGA | 58258 | $4,029.08 | 58852 | $4,336.83 | |

| REGAN | 58259 | $4,254.06 | 58477 | $4,336.65 | |

| BOWDON | 58260 | $4,209.61 | 58418 | $4,336.13 | |

| BOWMAN | 58261 | $4,220.67 | 58623 | $4,336.00 | |

| GARRISON | 58262 | $4,201.35 | 58540 | $4,335.37 | |

| NORWICH | 58265 | $4,229.30 | 58768 | $4,334.73 | |

| SOUTH HEART | 58266 | $4,199.72 | 58655 | $4,333.65 | |

| GOLVA | 58267 | $4,145.67 | 58632 | $4,332.47 | |

| SENTINEL BUTTE | 58269 | $4,209.61 | 58654 | $4,332.47 | |

| BEACH | 58270 | $4,213.64 | 58621 | $4,331.79 | |

| BUTTE | 58271 | $4,236.08 | 58723 | $4,331.62 | |

| WILTON | 58272 | $4,255.37 | 58579 | $4,330.84 | |

| WASHBURN | 58273 | $4,230.93 | 58577 | $4,330.48 | |

| BALFOUR | 58274 | $4,123.81 | 58712 | $4,328.66 | |

| KARLSRUHE | 58275 | $4,086.18 | 58744 | $4,328.66 | |

| TOWNER | 58276 | $4,222.56 | 58788 | $4,328.66 | |

| GOLDEN VALLEY | 58277 | $4,131.34 | 58541 | $4,328.65 | |

| ZAP | 58278 | $4,100.56 | 58580 | $4,328.65 | |

| HEBRON | 58281 | $4,208.62 | 58638 | $4,327.98 | |

| MERCER | 58282 | $4,231.80 | 58559 | $4,326.79 | |

| TURTLE LAKE | 58301 | $4,220.00 | 58575 | $4,326.79 | |

| SAWYER | 58310 | $4,279.10 | 58781 | $4,326.62 | |

| HAZELTON | 58311 | $4,209.61 | 58544 | $4,325.73 | |

| ANAMOOSE | 58313 | $4,351.04 | 58710 | $4,325.40 | |

| DRAKE | 58316 | $4,303.00 | 58736 | $4,325.40 | |

| WING | 58317 | $4,211.65 | 58494 | $4,325.13 | |

| NEW SALEM | 58318 | $4,288.00 | 58563 | $4,324.42 | |

| WESTHOPE | 58321 | $4,228.39 | 58793 | $4,324.41 | |

| BANTRY | 58323 | $4,208.62 | 58713 | $4,324.25 | |

| GLEN ULLIN | 58324 | $4,219.20 | 58631 | $4,323.19 | |

| ALEXANDER | 58325 | $4,216.40 | 58831 | $4,322.78 | |

| VELVA | 58327 | $4,228.01 | 58790 | $4,321.49 | |

| COLEHARBOR | 58329 | $4,303.00 | 58531 | $4,320.73 | |

| RIVERDALE | 58330 | $4,223.59 | 58565 | $4,320.73 | |

| UNDERWOOD | 58331 | $4,237.97 | 58576 | $4,320.73 | |

| WOLFORD | 58332 | $4,304.77 | 58385 | $4,320.03 | |

| HAZEN | 58335 | $4,275.94 | 58545 | $4,314.51 | |

| BELFIELD | 58338 | $4,220.72 | 58622 | $4,314.10 | |

| STANLEY | 58339 | $4,245.24 | 58784 | $4,311.82 | |

| BEULAH | 58341 | $4,360.64 | 58523 | $4,311.14 | |

| DRISCOLL | 58343 | $4,303.07 | 58532 | $4,309.28 | |

| MOFFIT | 58344 | $4,282.35 | 58560 | $4,307.89 | |

| STERLING | 58345 | $4,226.05 | 58572 | $4,307.89 | |

| YORK | 58346 | $4,213.64 | 58386 | $4,306.79 | |

| ESMOND | 58348 | $4,280.93 | 58332 | $4,304.77 | |

| KNOX | 58351 | $4,220.14 | 58343 | $4,303.07 | |

| BELCOURT | 58352 | $4,225.73 | 58316 | $4,303.00 | |

| DUNSEITH | 58353 | $4,283.07 | 58329 | $4,303.00 | |

| MENOKEN | 58355 | $4,209.61 | 58558 | $4,302.50 | |

| ROLLA | 58356 | $4,278.15 | 58367 | $4,301.70 | |

| SAINT JOHN | 58357 | $4,259.04 | 58369 | $4,301.70 | |

| SOURIS | 58361 | $4,197.95 | 58783 | $4,301.50 | |

| KRAMER | 58362 | $4,219.99 | 58748 | $4,301.23 | |

| ROLETTE | 58363 | $4,269.20 | 58366 | $4,300.31 | |

| FESSENDEN | 58365 | $4,237.97 | 58438 | $4,294.88 | |

| TOKIO | 58366 | $4,300.31 | 58379 | $4,292.91 | |

| MEDORA | 58367 | $4,301.70 | 58645 | $4,289.13 | |

| BOTTINEAU | 58368 | $4,351.04 | 58318 | $4,288.00 | |

| WILLOW CITY | 58369 | $4,301.70 | 58384 | $4,288.00 | |

| STANTON | 58370 | $4,275.94 | 58571 | $4,286.75 | |

| CATHAY | 58372 | $4,208.62 | 58422 | $4,284.91 | |

| CHASELEY | 58374 | $4,281.62 | 58423 | $4,284.23 | |

| MYLO | 58377 | $4,234.82 | 58353 | $4,283.07 | |

| LAKOTA | 58379 | $4,292.91 | 58344 | $4,282.35 | |

| SHEYENNE | 58380 | $4,277.66 | 58374 | $4,281.62 | |

| MADDOCK | 58381 | $4,272.39 | 58348 | $4,280.93 | |

| GRACE CITY | 58382 | $4,216.40 | 58445 | $4,279.46 | |

| AGATE | 58384 | $4,288.00 | 58310 | $4,279.10 | |

| NEW ROCKFORD | 58385 | $4,320.03 | 58356 | $4,278.15 | |

| TOLNA | 58386 | $4,306.79 | 58380 | $4,277.66 | |

| CARRINGTON | 58401 | $3,947.84 | 58421 | $4,276.21 | |

| FORT TOTTEN | 58405 | $3,941.49 | 58335 | $4,275.94 | |

| SAINT MICHAEL | 58413 | $4,106.22 | 58370 | $4,275.94 | |

| TRENTON | 58415 | $4,122.06 | 58853 | $4,273.21 | |

| WARWICK | 58416 | $4,134.25 | 58381 | $4,272.39 | |

| PERTH | 58418 | $4,336.13 | 58363 | $4,269.20 | |

| OBERON | 58420 | $4,047.01 | 58357 | $4,259.04 | |

| WILLISTON | 58421 | $4,276.21 | 58801 | $4,256.31 | |

| STEELE | 58422 | $4,284.91 | 58482 | $4,255.44 | |

| MCVILLE | 58423 | $4,284.23 | 58254 | $4,255.37 | |

| PETERSBURG | 58424 | $4,001.33 | 58272 | $4,255.37 | |

| MCHENRY | 58425 | $4,130.29 | 58464 | $4,254.29 | |

| MICHIGAN | 58426 | $3,987.19 | 58259 | $4,254.06 | |

| GLENFIELD | 58428 | $4,220.16 | 58443 | $4,250.29 | |

| HANSBORO | 58429 | $4,013.08 | 58339 | $4,245.24 | |

| GRAFTON | 58430 | $4,375.61 | 58237 | $4,238.38 | |

| EGELAND | 58431 | $4,075.62 | 58331 | $4,237.97 | |

| ROCKLAKE | 58433 | $4,107.12 | 58365 | $4,237.97 | |

| DRAYTON | 58436 | $4,055.82 | 58225 | $4,236.08 | |

| PEMBINA | 58438 | $4,294.88 | 58271 | $4,236.08 | |

| STARKWEATHER | 58439 | $4,084.84 | 58377 | $4,234.82 | |

| WALHALLA | 58440 | $4,106.22 | 58282 | $4,231.80 | |

| PISEK | 58441 | $4,039.90 | 58273 | $4,230.93 | |

| NECHE | 58442 | $4,102.85 | 58265 | $4,229.30 | |

| BROCKET | 58443 | $4,250.29 | 58321 | $4,228.39 | |

| CRARY | 58444 | $4,380.17 | 58327 | $4,228.01 | |

| ROBINSON | 58445 | $4,279.46 | 58478 | $4,227.93 | |

| TUTTLE | 58448 | $4,141.42 | 58488 | $4,227.93 | |

| HOOPLE | 58451 | $4,368.61 | 58243 | $4,227.80 | |

| ADAMS | 58452 | $4,188.41 | 58210 | $4,226.37 | |

| LAWTON | 58454 | $4,051.76 | 58345 | $4,226.05 | |

| MUNICH | 58455 | $4,058.45 | 58352 | $4,225.73 | |

| LANKIN | 58456 | $4,065.62 | 58250 | $4,225.10 | |

| EDMORE | 58458 | $4,078.26 | 58330 | $4,223.59 | |

| FAIRDALE | 58460 | $4,102.31 | 58229 | $4,222.78 | |

| GLASSTON | 58461 | $4,048.15 | 58236 | $4,222.56 | |

| SAINT THOMAS | 58463 | $4,375.61 | 58276 | $4,222.56 | |

| HAMPDEN | 58464 | $4,254.29 | 58338 | $4,220.72 | |

| FORDVILLE | 58466 | $4,078.26 | 58231 | $4,220.67 | |

| FOREST RIVER | 58467 | $4,015.29 | 58233 | $4,220.67 | |

| MINTO | 58472 | $4,045.16 | 58261 | $4,220.67 | |

| DAWSON | 58474 | $4,051.72 | 58428 | $4,220.16 | |

| MINNEWAUKAN | 58475 | $4,188.40 | 58351 | $4,220.14 | |

| DEVILS LAKE | 58476 | $4,047.70 | 58301 | $4,220.00 | |

| PENN | 58477 | $4,336.65 | 58362 | $4,219.99 | |

| CANDO | 58478 | $4,227.93 | 58324 | $4,219.20 | |

| TAPPEN | 58479 | $3,987.24 | 58487 | $4,216.57 | |

| CHURCHS FERRY | 58480 | $4,047.97 | 58325 | $4,216.40 | |

| WEBSTER | 58481 | $4,052.61 | 58382 | $4,216.40 | |

| LEEDS | 58482 | $4,255.44 | 58346 | $4,213.64 | |

| PARK RIVER | 58483 | $4,005.59 | 58270 | $4,213.64 | |

| DAHLEN | 58484 | $4,189.40 | 58224 | $4,213.47 | |

| HENSEL | 58486 | $4,337.52 | 58241 | $4,213.21 | |

| BISBEE | 58487 | $4,216.57 | 58317 | $4,211.65 | |

| BATHGATE | 58488 | $4,227.93 | 58216 | $4,210.58 | |

| HAMILTON | 58490 | $4,059.67 | 58238 | $4,210.58 | |

| LANGDON | 58492 | $3,991.20 | 58249 | $4,209.93 | |

| MILTON | 58494 | $4,325.13 | 58260 | $4,209.61 | |

| OSNABROCK | 58495 | $4,115.81 | 58269 | $4,209.61 | |

| ALSEN | 58496 | $4,025.55 | 58311 | $4,209.61 | |

| NEKOMA | 58497 | $4,045.44 | 58355 | $4,209.61 | |

| CRYSTAL | 58501 | $4,020.31 | 58222 | $4,209.35 | |

| HANNAH | 58503 | $4,029.26 | 58239 | $4,208.62 | |

| MAIDA | 58504 | $4,054.90 | 58255 | $4,208.62 | |

| WALES | 58505 | $4,039.32 | 58281 | $4,208.62 | |

| CALVIN | 58520 | $4,426.62 | 58323 | $4,208.62 | |

| SARLES | 58521 | $4,337.91 | 58372 | $4,208.62 | |

| EDINBURG | 58523 | $4,311.14 | 58227 | $4,201.60 | |

| MOUNTAIN | 58524 | $4,379.34 | 58262 | $4,201.35 | |

| NIAGARA | 58528 | $4,474.33 | 58266 | $4,199.72 | |

| PEKIN | 58529 | $4,441.63 | 58361 | $4,197.95 | |

| CAVALIER | 58530 | $4,344.30 | 58220 | $4,195.27 | |

| ANETA | 58531 | $4,320.73 | 58212 | $4,190.99 | |

| SUTTON | 58532 | $4,309.28 | 58484 | $4,189.40 | |

| JESSIE | 58533 | $4,440.40 | 58452 | $4,188.41 | |

| PETTIBONE | 58535 | $4,392.86 | 58475 | $4,188.40 | |

| LARIMORE | 58538 | $4,477.64 | 58251 | $4,160.48 | |

| NORTHWOOD | 58540 | $4,335.37 | 58267 | $4,145.67 | |

| HANNAFORD | 58541 | $4,328.65 | 58448 | $4,141.42 | |

| FINLEY | 58542 | $4,337.48 | 58230 | $4,136.68 | |

| BINFORD | 58544 | $4,325.73 | 58416 | $4,134.25 | |

| SHARON | 58545 | $4,314.51 | 58277 | $4,131.34 | |

| MANDAN | 58549 | $4,375.70 | 58554 | $4,131.14 | |

| COOPERSTOWN | 58552 | $4,380.01 | 58425 | $4,130.29 | |

| HOPE | 58554 | $4,131.14 | 58046 | $4,124.99 | |

| PORTLAND | 58558 | $4,302.50 | 58274 | $4,123.81 | |

| HILLSBORO | 58559 | $4,326.79 | 58045 | $4,122.50 | |

| BERLIN | 58560 | $4,307.89 | 58415 | $4,122.06 | |

| LUVERNE | 58561 | $4,112.39 | 58056 | $4,121.86 | |

| WISHEK | 58562 | $4,389.06 | 58495 | $4,115.81 | |

| NAPOLEON | 58563 | $4,324.42 | 58561 | $4,112.39 | |

| BURLINGTON | 58564 | $4,421.20 | 58722 | $4,109.61 | |

| CALEDONIA | 58565 | $4,320.73 | 58219 | $4,108.65 | |

| EDGELEY | 58566 | $4,419.94 | 58433 | $4,107.12 | |

| SURREY | 58568 | $4,465.05 | 58785 | $4,106.35 | |

| ASHLEY | 58569 | $4,462.61 | 58413 | $4,106.22 | |

| FREDONIA | 58570 | $4,448.27 | 58440 | $4,106.22 | |

| CUMMINGS | 58571 | $4,286.75 | 58223 | $4,105.83 | |

| GACKLE | 58572 | $4,307.89 | 58442 | $4,102.85 | |

| ARVILLA | 58573 | $4,380.01 | 58214 | $4,102.36 | |

| LEHR | 58575 | $4,326.79 | 58460 | $4,102.31 | |

| ZEELAND | 58576 | $4,320.73 | 58581 | $4,102.31 | |

| HATTON | 58577 | $4,330.48 | 58240 | $4,101.20 | |

| GILBY | 58579 | $4,330.84 | 58235 | $4,101.02 | |

| INKSTER | 58580 | $4,328.65 | 58244 | $4,101.02 | |

| THOMPSON | 58581 | $4,102.31 | 58278 | $4,100.56 | |

| CLIFFORD | 58601 | $4,028.33 | 58016 | $4,099.98 | |

| BUXTON | 58620 | $4,347.25 | 58218 | $4,097.06 | |

| MANVEL | 58621 | $4,331.79 | 58256 | $4,087.41 | |

| BLANCHARD | 58622 | $4,314.10 | 58009 | $4,086.79 | |

| MAYVILLE | 58623 | $4,336.00 | 58257 | $4,086.50 | |

| REYNOLDS | 58625 | $4,357.46 | 58275 | $4,086.18 | |

| FORBES | 58626 | $4,373.55 | 58439 | $4,084.84 | |

| GALESBURG | 58627 | $4,378.97 | 58035 | $4,080.20 | |

| LAMOURE | 58630 | $4,356.70 | 58458 | $4,078.26 | |

| MARION | 58631 | $4,323.19 | 58466 | $4,078.26 | |

| MINOT | 58632 | $4,332.47 | 58701 | $4,077.56 | |

| DICKEY | 58634 | $4,432.73 | 58431 | $4,075.62 | |

| KULM | 58636 | $4,354.36 | 58456 | $4,065.62 | |

| MINOT | 58638 | $4,327.98 | 58703 | $4,063.08 | |

| VERONA | 58639 | $4,402.71 | 58490 | $4,059.67 | |

| EMERADO | 58640 | $4,395.24 | 58228 | $4,059.54 | |

| KENSAL | 58641 | $4,382.85 | 58455 | $4,058.45 | |

| ELLENDALE | 58642 | $4,385.25 | 58436 | $4,055.82 | |

| MINOT | 58643 | $4,378.35 | 58707 | $4,055.48 | |

| BISMARCK | 58644 | $4,362.68 | 58504 | $4,054.90 | |

| PILLSBURY | 58645 | $4,289.13 | 58065 | $4,052.80 | |

| SPIRITWOOD | 58646 | $4,435.21 | 58481 | $4,052.61 | |

| JUD | 58647 | $4,363.97 | 58454 | $4,051.76 | |

| OAKES | 58649 | $4,409.17 | 58474 | $4,051.72 | |

| LITCHVILLE | 58650 | $4,435.21 | 58461 | $4,048.15 | |

| SANBORN | 58651 | $4,348.27 | 58480 | $4,047.97 | |

| PINGREE | 58652 | $4,363.36 | 58476 | $4,047.70 | |

| BUCHANAN | 58653 | $4,390.28 | 58420 | $4,047.01 | |

| YPSILANTI | 58654 | $4,332.47 | 58497 | $4,045.44 | |

| MONTPELIER | 58655 | $4,333.65 | 58472 | $4,045.16 | |

| FULLERTON | 58656 | $4,354.69 | 58441 | $4,039.90 | |

| BISMARCK | 58701 | $4,077.56 | 58505 | $4,039.32 | |

| BISMARCK | 58703 | $4,063.08 | 58503 | $4,029.26 | |

| MEKINOCK | 58704 | $3,986.79 | 58258 | $4,029.08 | |

| DICKINSON | 58705 | $4,025.54 | 58601 | $4,028.33 | |

| ABSARAKA | 58707 | $4,055.48 | 58002 | $4,027.31 | |

| WOODWORTH | 58710 | $4,325.40 | 58496 | $4,025.55 | |

| MINOT AFB | 58711 | $4,351.02 | 58705 | $4,025.54 | |

| BISMARCK | 58712 | $4,328.66 | 58501 | $4,020.31 | |

| BARNEY | 58713 | $4,324.25 | 58008 | $4,018.79 | |

| FORT RANSOM | 58716 | $4,338.28 | 58033 | $4,015.64 | |

| MEDINA | 58718 | $4,390.95 | 58467 | $4,015.29 | |

| LISBON | 58721 | $4,392.34 | 58054 | $4,014.58 | |

| STIRUM | 58722 | $4,109.61 | 58069 | $4,013.29 | |

| DAZEY | 58723 | $4,331.62 | 58429 | $4,013.08 | |

| MCLEOD | 58725 | $4,383.60 | 58057 | $4,012.92 | |

| WAHPETON | 58727 | $4,376.21 | 58076 | $4,010.71 | |

| GRANDIN | 58730 | $4,349.17 | 58038 | $4,007.65 | |

| COLFAX | 58731 | $4,340.72 | 58018 | $4,007.57 | |

| MOORETON | 58733 | $4,363.23 | 58061 | $4,007.57 | |

| FORMAN | 58734 | $4,385.54 | 58032 | $4,007.50 | |

| FAIRMOUNT | 58735 | $4,370.28 | 58030 | $4,006.25 | |

| STREETER | 58736 | $4,325.40 | 58483 | $4,005.59 | |

| ABERCROMBIE | 58737 | $4,376.21 | 58001 | $4,004.14 | |

| WAHPETON | 58740 | $4,346.05 | 58075 | $4,004.14 | |

| HANKINSON | 58741 | $4,342.64 | 58041 | $4,004.05 | |

| MANTADOR | 58744 | $4,328.66 | 58058 | $4,004.05 | |

| COGSWELL | 58746 | $4,392.89 | 58017 | $4,004.02 | |

| KATHRYN | 58748 | $4,301.23 | 58049 | $4,002.73 | |

| LIDGERWOOD | 58750 | $4,337.77 | 58053 | $4,002.20 | |

| CLEVELAND | 58752 | $4,376.21 | 58424 | $4,001.33 | |

| MILNOR | 58755 | $4,349.17 | 58060 | $3,997.45 | |

| CAYUGA | 58756 | $4,398.33 | 58013 | $3,996.80 | |

| HAVANA | 58757 | $4,355.85 | 58043 | $3,996.80 | |

| RUTLAND | 58758 | $4,338.26 | 58067 | $3,996.80 | |

| WYNDMERE | 58759 | $4,369.62 | 58081 | $3,996.80 | |

| GWINNER | 58760 | $4,359.44 | 58040 | $3,994.30 | |

| WIMBLEDON | 58761 | $4,355.73 | 58492 | $3,991.20 | |

| ROGERS | 58762 | $4,356.93 | 58479 | $3,987.24 | |

| COURTENAY | 58763 | $4,415.86 | 58426 | $3,987.19 | |

| MINOT AFB | 58765 | $4,349.17 | 58704 | $3,986.79 | |

| WALCOTT | 58768 | $4,334.73 | 58077 | $3,985.76 | |

| SHELDON | 58769 | $4,407.67 | 58068 | $3,984.87 | |

| CHRISTINE | 58770 | $4,378.62 | 58015 | $3,984.37 | |

| FINGAL | 58771 | $4,405.45 | 58031 | $3,983.92 | |

| LEONARD | 58772 | $4,376.21 | 58052 | $3,981.57 | |

| PAGE | 58773 | $4,364.74 | 58064 | $3,980.01 | |

| DAVENPORT | 58775 | $4,375.67 | 58021 | $3,979.31 | |

| TOWER CITY | 58776 | $4,379.41 | 58071 | $3,978.43 | |

| KINDRED | 58778 | $4,376.08 | 58051 | $3,976.06 | |

| BUFFALO | 58779 | $4,370.28 | 58011 | $3,974.84 | |

| VALLEY CITY | 58781 | $4,326.62 | 58072 | $3,973.41 | |

| ENDERLIN | 58782 | $4,400.72 | 58027 | $3,972.41 | |

| NOME | 58783 | $4,301.50 | 58062 | $3,970.69 | |

| ORISKA | 58784 | $4,311.82 | 58063 | $3,969.97 | |

| ERIE | 58785 | $4,106.35 | 58029 | $3,969.20 | |

| AYR | 58787 | $4,375.63 | 58007 | $3,961.99 | |

| WHEATLAND | 58788 | $4,328.66 | 58079 | $3,960.20 | |

| GARDNER | 58789 | $4,356.65 | 58036 | $3,949.60 | |

| AMENIA | 58790 | $4,321.49 | 58004 | $3,948.28 | |

| ARTHUR | 58792 | $4,376.39 | 58006 | $3,948.28 | |

| JAMESTOWN | 58793 | $4,324.41 | 58401 | $3,947.84 | |

| JAMESTOWN | 58794 | $4,366.39 | 58405 | $3,941.49 | |

| HUNTER | 58795 | $4,385.63 | 58048 | $3,940.10 | |

| ARGUSVILLE | 58801 | $4,256.31 | 58005 | $3,926.08 | |

| HARWOOD | 58830 | $4,372.77 | 58042 | $3,905.99 | |

| MAPLETON | 58831 | $4,322.78 | 58059 | $3,882.71 | |

| HORACE | 58833 | $4,336.98 | 58047 | $3,871.57 | |

| CASSELTON | 58835 | $4,386.72 | 58012 | $3,838.00 | |

| FARGO | 58838 | $4,364.51 | 58105 | $3,806.23 | |

| FARGO | 58843 | $4,355.55 | 58102 | $3,789.93 | |

| GRAND FORKS | 58844 | $4,336.98 | 58201 | $3,748.50 | |

| GRAND FORKS | 58845 | $4,372.77 | 58202 | $3,736.36 | |

| GRAND FORKS | 58847 | $4,364.22 | 58203 | $3,727.21 | |

| GRAND FORKS AFB | 58849 | $4,356.90 | 58204 | $3,723.40 | |

| GRAND FORKS AFB | 58852 | $4,336.83 | 58205 | $3,723.40 | |

| FARGO | 58853 | $4,273.21 | 58103 | $3,716.98 | |

| WEST FARGO | 58854 | $4,358.39 | 58078 | $3,709.87 | |

| FARGO | 58856 | $4,361.79 | 58104 | $3,677.18 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Best North Dakota Car Insurance Companies?

We know to be a legal driver in North Dakota you need insurance. So, which company is the best? Well, that depends on a lot of different factors.

This next section is going to be all about the companies. We will take a look at which ones are the biggest and more importantly, the cheapest.

Insurance companies take into consideration different factors when getting a quote. Some may rate heavier on driving record while others look more at your credit history. By comparing these different rates, you can get an idea of where you may find the best rate for your needs.

First up, which companies have the best financial rating and customer service.

What Are the Financial Ratings For the Largest Companies

AM Best is one of the top measuring sticks used to give insurance companies a grade as to how their companies are doing financially. Why does the financial rating of these companies matter to you?

If a company is not financially stable, you could have problems with them paying out for claims. Like we mentioned earlier, the loss ratio is an indicator of financial stability.

| Rank | Company Name | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|---|

| 1 | State Farm Group | A | $620,489 | 59.83% | 21.28% |

| 2 | Progressive Group | A+ | $370,678 | 62.08% | 12.71% |

| 3 | Farmers Insurance Group | A | $275,252 | 54.10% | 9.44% |

| 4 | Liberty Mutual Group | A | $261,291 | 67.77% | 8.96% |

| 5 | Geico | A++ | $260,828 | 70.56% | 8.95% |

| 6 | Allstate Insurance Group | A+ | $237,418 | 54.12% | 8.14% |

| 7 | USAA Group | A++ | $164,064 | 77.08% | 5.63% |

| 8 | Country Insurance & Financial Service Group | C | $104,849 | 58.75% | 3.60% |

| 9 | American Family Insurance Group | A | $91,870 | 66.64% | 3.15% |

| 10 | Nationwide Corp Group | A+ | $68,651 | 71.56% | 2.35% |

We took the top ten largest insurance companies in North Dakota and find that nine rated A or higher.

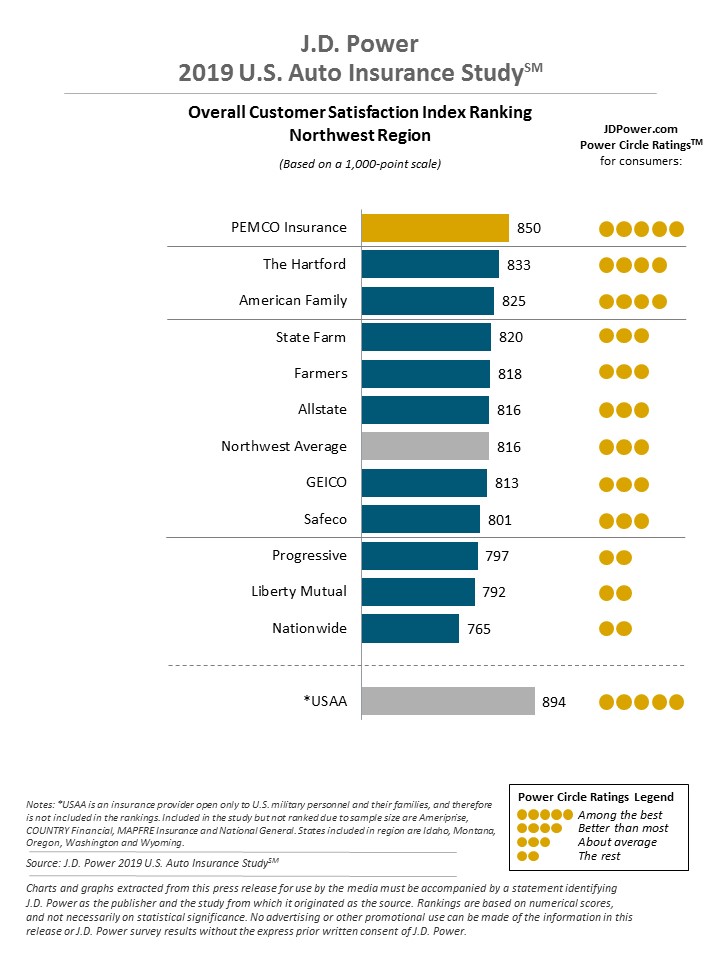

What Are the Companies with Best Ratings?

If a company is financially stable the next thing you want to look at is their customer service. No one wants to be dealing with loss and dealing with poor customer service. Long hold times and unhelpful customer service reps can make your insurance experience a bad one.

JD Power takes real customer experiences and charts companies with how well they do.

What Are the Companies with Most Complaints in North Dakota?

There is always some bad with the good. Even the best if companies may have complaints filed against them.

| Rank | Company | Written Premiums | Complaint Index |

|---|---|---|---|

| 1 | Oklahoma Farm Bureau | $54,794,000 | 0.20 |

| 2 | State Farm | $336,936,000 | 0.50 |

| 3 | Shelter | $48,116,000 | 0.70 |

| 4 | Allstate | $102,474,000 | 0.73 |

| 5 | Farmers | $172,523,000 | 0.74 |

| 5 | Progressive | $118,239,000 | 0.74 |

| 7 | Berkshire Hathaway (Geico) | $84,702,000 | 0.75 |

| 8 | USAA | $80,953,000 | 0.87 |

| 8 | CSAA | $57,151,000 | 0.87 |

| 10 | Liberty Mutual | $83,990,000 | 0.99 |

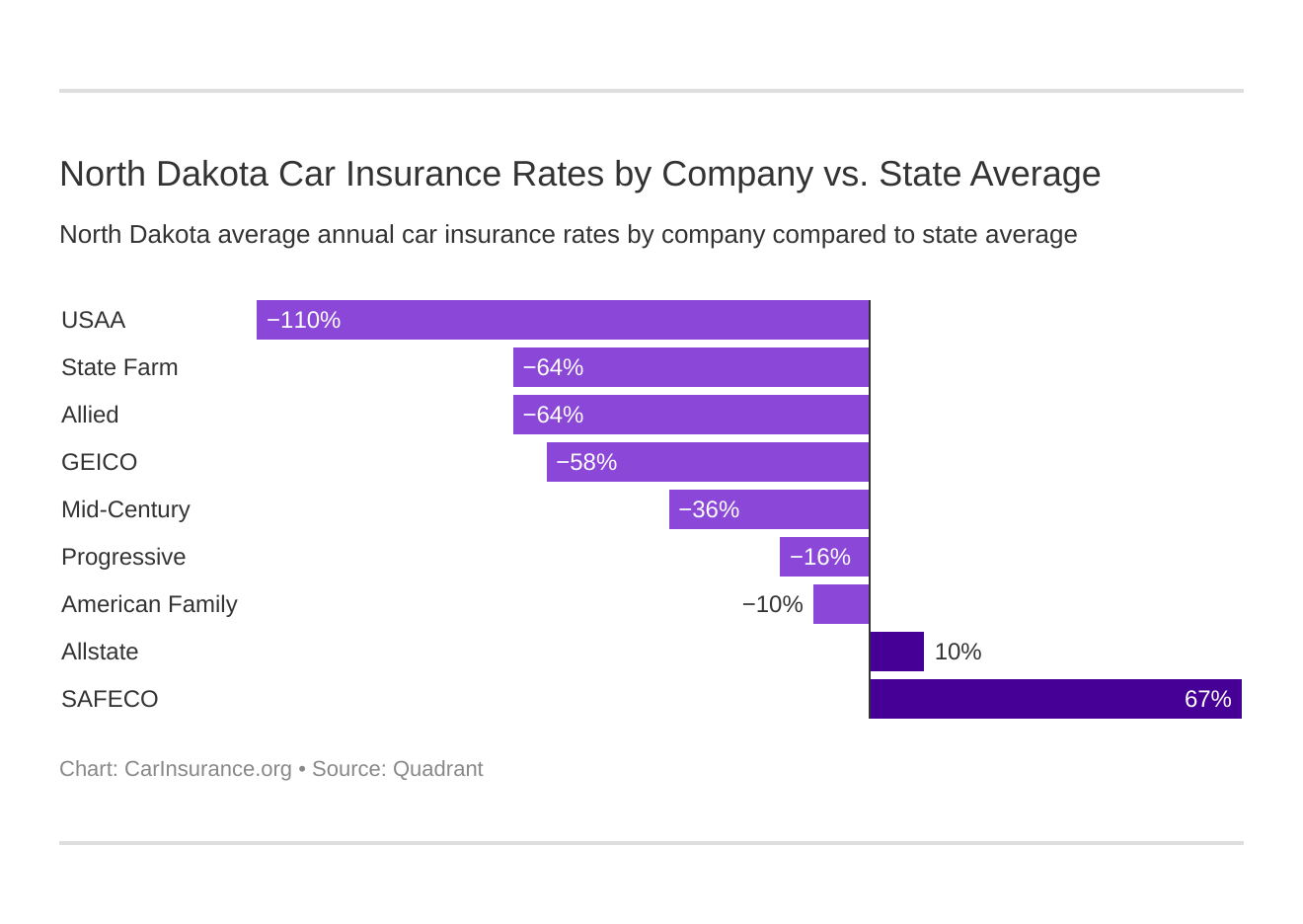

What Are the Cheapest Insurance Companies in North Dakota?

We all want to find the best coverage at the cheapest rates. In order to get the cheapest, you have to know the rates of other insurance companies. We took a sampling of rates from the largest companies and compared them to the state average.

| Company | Average Annual Rate | Compared to State Average | Percent Compared to State Average |

|---|---|---|---|

| Allstate Insurance | $4,669.31 | $464.20 | 9.94% |

| American Family Mutual | $3,812.40 | -$392.71 | -10.30% |

| Mid-Century Ins Co | $3,092.49 | -$1,112.63 | -35.98% |

| Geico General | $2,668.24 | -$1,536.87 | -57.60% |

| SAFECO Ins Co of America | $12,852.83 | $8,647.71 | 67.28% |

| Allied P&C | $2,560.35 | -$1,644.76 | -64.24% |

| Progressive Northwestern | $3,623.06 | -$582.05 | -16.07% |

| State Farm Mutual Auto | $2,560.53 | -$1,644.59 | -64.23% |

| USAA GIC | $2,006.80 | -$2,198.31 | -109.54% |

What Are Commute Rates by Companies?

North Dakota does not high commuter times, but often insurance companies will rate your premium by how far you drive every day.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 25 miles commute. 12000 annual mileage. | $4,783.75 |

| Allstate | 10 miles commute. 6000 annual mileage. | $4,554.87 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,859.56 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,765.24 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,092.49 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,092.49 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,698.69 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,637.80 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $12,852.83 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $12,852.83 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,560.35 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,560.35 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,623.06 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,623.06 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,628.93 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,492.12 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,027.09 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,986.52 |

Some companies, like Farmers and Progressive, do not rate based on commuting times. So, if you do commute to work you can choose a company that does not rate for a commute.

What Are Coverage Level Rates by Companies?

More coverage means more premium, right? Not necessarily.

Take a look at Liberty Mutual on the chart below.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $4,767.94 |

| Allstate | Medium | $4,667.42 |

| Allstate | Low | $4,572.58 |

| American Family | Medium | $4,001.36 |

| American Family | Low | $3,932.67 |

| American Family | High | $3,503.17 |

| Farmers | High | $3,175.02 |

| Farmers | Medium | $3,079.36 |

| Farmers | Low | $3,023.08 |

| Geico | High | $2,719.54 |

| Geico | Medium | $2,663.66 |

| Geico | Low | $2,621.52 |

| Liberty Mutual | High | $13,182.14 |

| Liberty Mutual | Medium | $12,799.69 |

| Liberty Mutual | Low | $12,576.65 |

| Nationwide | High | $2,636.28 |

| Nationwide | Medium | $2,547.13 |

| Nationwide | Low | $2,497.64 |

| Progressive | High | $3,738.69 |

| Progressive | Medium | $3,611.36 |

| Progressive | Low | $3,519.14 |

| State Farm | High | $2,618.19 |

| State Farm | Medium | $2,567.70 |

| State Farm | Low | $2,495.68 |

| USAA | High | $2,056.77 |

| USAA | Medium | $2,007.97 |

| USAA | Low | $1,955.67 |

A higher coverage actually costs less than a lower coverage. Also, you can see some higher coverage at one company is the same cost as a lower coverage at another. Shopping around and getting multiple quotes always pays off for the best coverage at the cheapest rates.

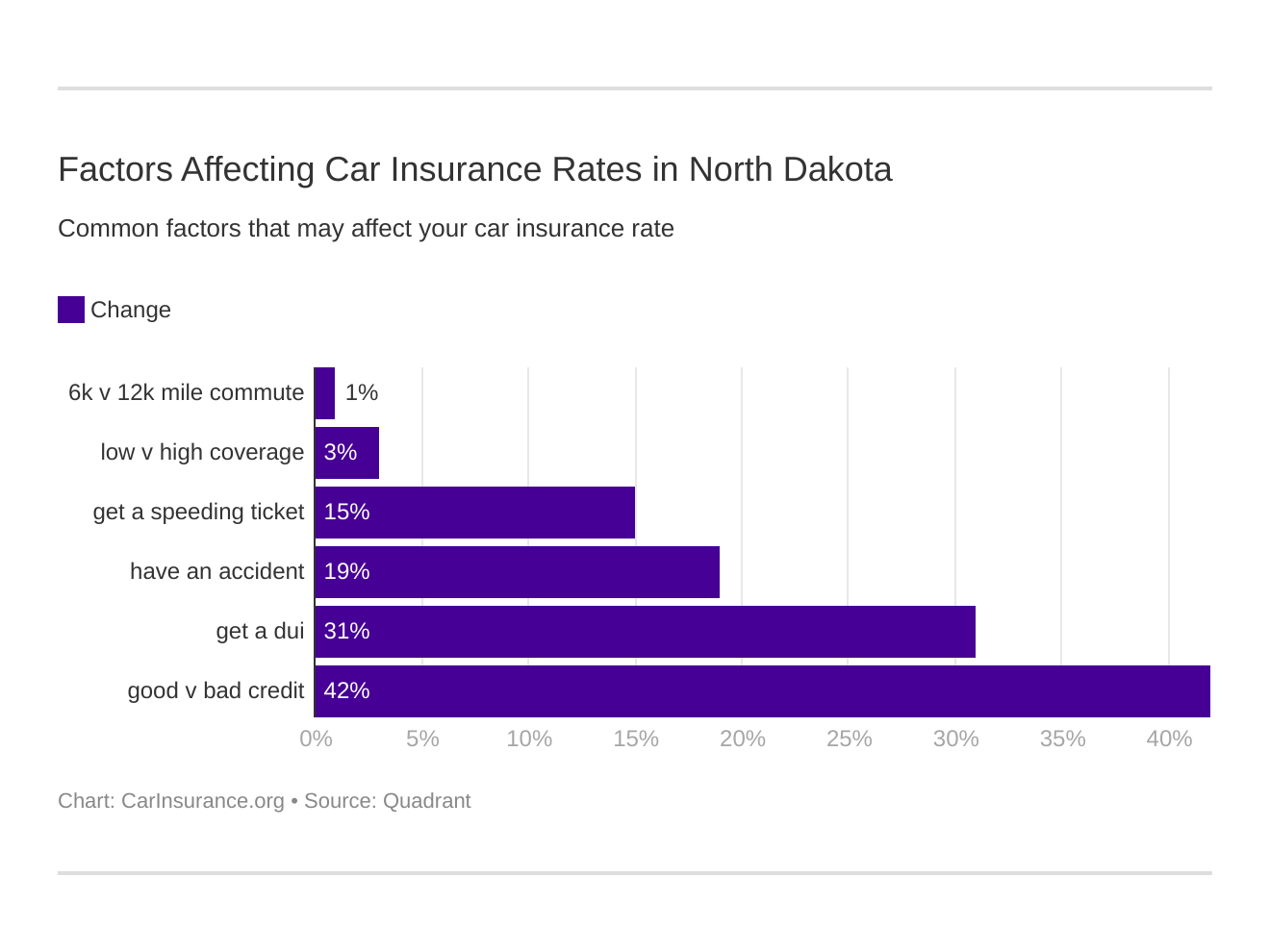

What Are Credit History Rates by Companies?

Credit history is not one of those factors a consumer thinks of when shopping for insurance. You usually think bigger purchases, like a home or car, would rate heavily on your credit.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $5,882.00 |

| Allstate | Fair | $4,478.77 |

| Allstate | Good | $3,647.16 |

| American Family | Poor | $5,012.38 |

| American Family | Fair | $3,481.08 |

| American Family | Good | $2,943.74 |

| Farmers | Poor | $3,579.67 |

| Farmers | Fair | $2,921.65 |

| Farmers | Good | $2,776.14 |

| Geico | Poor | $3,191.25 |

| Geico | Fair | $2,570.17 |

| Geico | Good | $2,243.30 |

| Liberty Mutual | Poor | $18,684.17 |

| Liberty Mutual | Fair | $11,151.13 |

| Liberty Mutual | Good | $8,723.18 |

| Nationwide | Poor | $3,119.84 |

| Nationwide | Fair | $2,427.42 |

| Nationwide | Good | $2,133.80 |

| Progressive | Poor | $4,187.48 |

| Progressive | Fair | $3,495.19 |

| Progressive | Good | $3,186.53 |

| State Farm | Poor | $3,582.34 |

| State Farm | Fair | $2,277.18 |

| State Farm | Good | $1,822.06 |

| USAA | Poor | $2,770.47 |

| USAA | Fair | $1,754.69 |

| USAA | Good | $1,495.25 |

The truth is your credit follows you even with your insurance premium. For instance, Liberty Mutual charges almost $10,000 more for poor credit versus a good credit.

What Are Driving Record Rates by Companies?

One of the most obvious factors in your rate is your driving record. Want to know how much that ticket is going to cost you?

Well, besides the cost of court fees and fines, it can cost you from a couple of hundred dollars to upwards of a thousand.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $6,316.36 |

| Allstate | With 1 speeding violation | $4,397.21 |

| Allstate | With 1 accident | $4,171.17 |

| Allstate | Clean record | $3,792.51 |

| American Family | With 1 DUI | $5,292.65 |

| American Family | With 1 accident | $3,977.01 |

| American Family | With 1 speeding violation | $3,191.73 |

| American Family | Clean record | $2,788.21 |

| Farmers | With 1 accident | $3,324.12 |

| Farmers | With 1 DUI | $3,281.75 |

| Farmers | With 1 speeding violation | $3,156.58 |

| Farmers | Clean record | $2,607.49 |

| Geico | With 1 DUI | $4,044.55 |

| Geico | With 1 accident | $2,581.12 |

| Geico | With 1 speeding violation | $2,504.84 |

| Geico | Clean record | $1,542.47 |

| Liberty Mutual | With 1 DUI | $13,981.02 |

| Liberty Mutual | With 1 speeding violation | $13,160.78 |

| Liberty Mutual | With 1 accident | $12,866.12 |

| Liberty Mutual | Clean record | $11,403.39 |

| Nationwide | With 1 DUI | $3,601.56 |

| Nationwide | With 1 accident | $2,606.56 |

| Nationwide | With 1 speeding violation | $2,146.95 |

| Nationwide | Clean record | $1,886.34 |

| Progressive | With 1 accident | $4,111.13 |

| Progressive | With 1 speeding violation | $3,650.62 |

| Progressive | With 1 DUI | $3,384.21 |

| Progressive | Clean record | $3,346.29 |

| State Farm | With 1 accident | $2,749.36 |

| State Farm | With 1 DUI | $2,560.51 |

| State Farm | With 1 speeding violation | $2,560.51 |

| State Farm | Clean record | $2,371.72 |

| USAA | With 1 DUI | $2,822.98 |

| USAA | With 1 accident | $2,018.24 |

| USAA | With 1 speeding violation | $1,760.03 |

| USAA | Clean record | $1,425.96 |

A DUI conviction is by far the most costly. Not only with your insurance, as we see above, but we will take a deeper look later to see how much that DUI conviction can impact your driver’s license and your wallet.

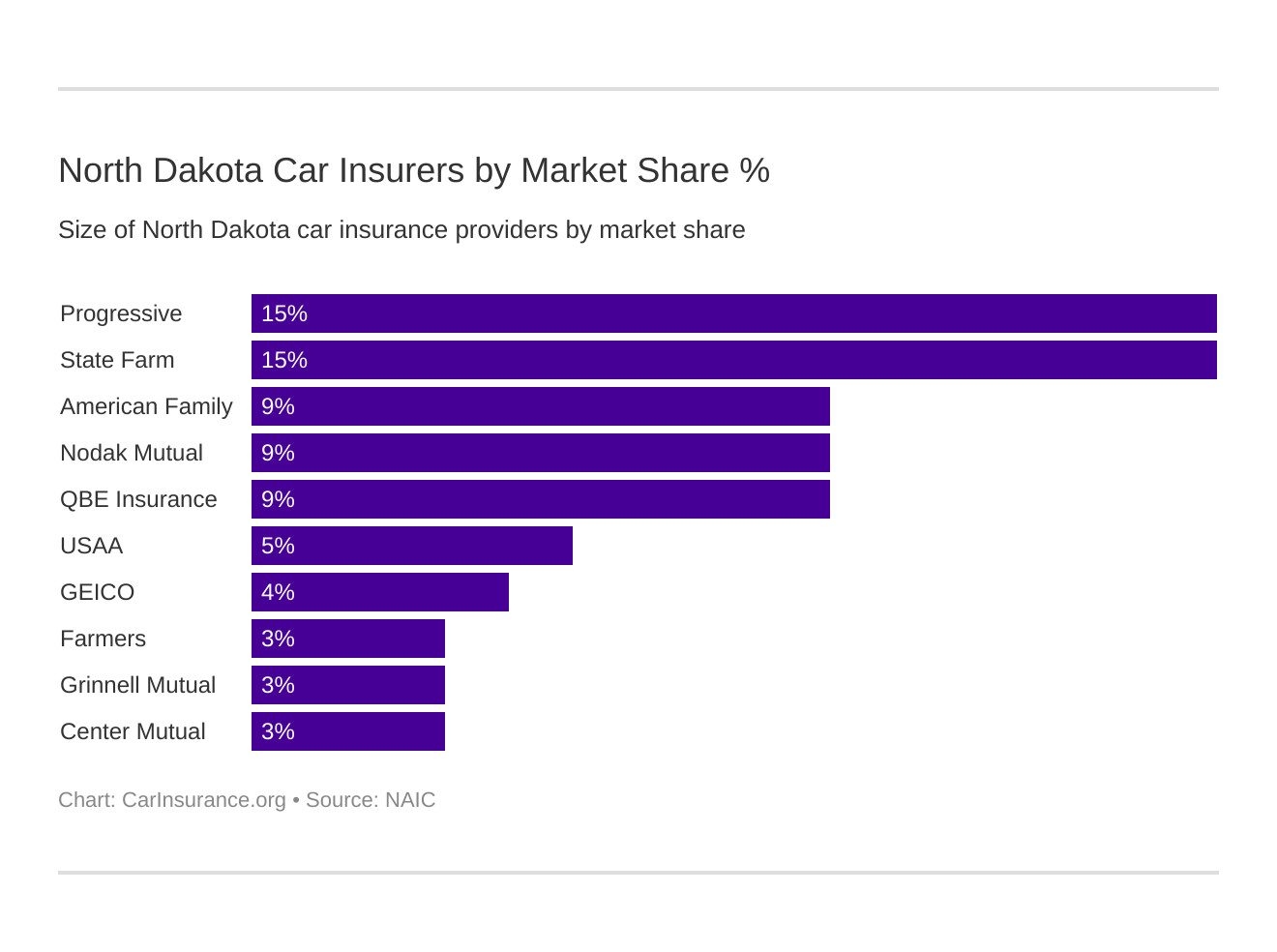

What Are the Largest Car Insurance Companies in North Dakota?

Let’s take a look at the largest companies available in North Dakota.

| Company | Direct Premium | Loss Ratio | Market Share | |

|---|---|---|---|---|

| Progressive Group | $72,179 | 58.06% | 15.32% | |

| State Farm Group | $68,853 | 55.76% | 14.61% | |

| American Family Insurance Group | $43,126 | 43.30% | 9.15% | |

| Nodak Mutual Group | $40,579 | 45.08% | 8.61% | |

| QBE Insurance Group | $40,186 | 66.96% | 8.53% | |

| USAA Group | $21,437 | 71.42% | 4.55% | |

| Geico | $16,554 | 67.03% | 3.51% | |

| Farmers Insurance Group | $16,221 | 59.19% | 3.44% | |

| Grinnell Mutual Group | $15,419 | 67.33% | 3.27% | |

| Center Mutual Insurance Co | $14,244 | 71.15% | 3.02% |

How Many Insurers Sell Policies in North Dakota?

There are almost 800 insurers in the state of North Dakota. We classify insurers as domestic and foreign. There are 12 domestic and 786 foreign insurers.

Domestic means the insurer was formed under the laws of North Dakota, while foreign means the company was formed under any state law.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the North Dakota Laws?

Each state has its own set of laws. It is hard when you are new to a state, and sometimes even when you have lived there your whole life, to keep up with the ever-changing state laws.

We have seen earlier you have to have insurance to drive legally, but there is more you should know. That is what we are here to do! We will help navigate state laws in regards to licensing and types of coverages.

What Are the Car Insurance Laws?

First up, let’s take a look at how laws are made followed by some specific types of insurance.

How Are North Dakota Laws for Insurance Determined?

All rates and regulations are state-specific and overseen by the National Association of Insurance Commissioners. On the NAIC website you can find the following regulation of North Dakota:

Regarding rate filing, a rate/rule filing of less than 5 percent for personal auto policy may be use-and-file once per calendar year per company. Otherwise, the filing must meet the prior approval standard.

How Can I Get Windshield Coverage?

When you hear the crack of the rock hit your windshield, you cringe because you know you may have a huge creeping crack start working its way across your windshield.

North Dakota has no state-specific laws regarding the repair or the use of aftermarket parts. Just because there is no law does not mean you do not have coverage, some companies have coverage under their comprehensive coverage.

How Can I Find High-Risk Insurance?

Are you having a hard time finding insurance due to speeding tickets and other moving violations? Just because you are having a harder time finding insurance to cover you doesn’t mean you do not have to have it.

If you are having a hard time finding insurance, the North Dakota Automobile Insurance Plan might be the next place to look for coverage.

Although this plan is higher than premiums in the normal market, it is available to drivers with a less than perfect record needing insurance.

SR-22 is also a type of filing some drivers may be required to have when looking for insurance. Reasons for having to obtain SR-22 insurance through your provider could be driving under the influence or driving with a suspended license. This filing will also cost drivers more than the average driver.

Is There Automobile Insurance Fraud in North Dakota?

Sadly, insurance fraud amounts to $30 billion over a five-year period of time. That is a lot of money that eventually is recovered by raising premiums across the board.

Insurance fraud can range from soft to hard fraud. Soft fraud refers to infractions like making a legitimate claim bigger to get more money. While hard fraud is a planned activity such as faking a car accident.

Both types of fraud are illegal and should be reported. If you ever suspect fraud please contact the North Dakota Insurance Department.

What Is Statute of Limitations?

Statute of limitations refers to the time frame you have to file a claim. Legally from the time of loss you only have a certain amount of time to file for losses. It is always best to file the claim immediately.

Insureds have six years for property damages and personal injuries to file a claim.

What Are the Vehicle Licensing Laws?

Your car must have insurance to stay legal, but what are your responsibilities as the driver to stay legal? We are going to be covering licensing and renewals in this next section.

What Are the Real ID Requirements in North Dakota?

In 2005, the Real ID Act was passed by Congress setting stricter standards for the issuance of driver’s licenses. North Dakota is compliant with this act and this means a North Dakota driver’s license can be used as a form of identification to enter a federal building and board commercial flights.

What Are the Penalties for Driving Without Insurance?

We know it is illegal to drive without insurance in North Dakota. What happens if you do?

| First Offense | Second Offense |

|---|---|

| Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; Proof of insurance must be provided for one year; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50, and the fee to remove this notation is $50. | Fine: up to $1500 and/or 30 days in prison; 14 points against license plus suspension; license plates impounded until proof of insurance (provided for one year) plus $20 reinstatement fee; license with a notation requiring that person keep proof of liability insurance on file with the department. The fee for this license is $50 and the fee to remove this notation is $50. |

The penalties for driving without insurance are pretty strict, as they should be. You are looking at fines, license suspension, and possible jail time for your first offense.

What Are the Teen Driver Laws?

Young drivers are always excited to get their license for the first time. Parents are not as excited. Did you see those rates for teen boys?

| Requirements Before Getting a License or Restricted License | Time Limits |

|---|---|

| Mandatory holding period | -at least 16 years old: 12 months -16 years old and older: 6 months or until age 18, whichever comes first |

| Minimum supervised driving time | -16 and younger: 50 hrs -16 and older: none |

| Minimum age | 16; 15 for a parent requested restricted license |

Along with the required holding times and driving courses, there are also restrictions for teen drivers.

| Restricted License Driving Requirements | Details | Minimum Time Restrictions May Be Lifted |

|---|---|---|

| Nighttime Restrictions | The holder of a restricted license may only drive a car belonging to a parent or guardian and may not drive between the later of sunset or 9 p.m. and 5 a.m. | until age 16 (min. age: 16) |

| Passenger Restrictions (excepting family members) | none | none |

What Are the Older Driver License Renewal Procedures?

Older drivers follow a slightly different protocol for license renewal.

| Older Driver Renewal Procedures | Details |

|---|---|

| License Renewal Cycle | 4 years for people 78 and older |

| Proof of Adequate Vision | Every Renewal |

| Mail or Online Renewal Permitted | Not Permitted 65 and older |

Drivers 65 years and old must renew their license at the DMV and have a vision test every renewal. Once you are 78 years or older, drivers must renew every four years.

What Is the Procedure for New Residents of North Dakota?

Once you have lived in North Dakota for a consecutive ninety days, you are not considered a North Dakota state resident. You now have sixty days to get a North Dakota driver’s license.

You must show proof of a North Dakota address when you visit your local licensing office.

What Are the License Renewal Procedures?

You must renew your North Dakota driver’s license every six years. You can choose to do so at your local licensing office or you can submit your renewal online or by mail.

You must provide an adequate vision screening at every renewal.

What Are the Rules of the Road?

In order to be a safe driver, you have to know the rules of the road. Each state may have regulations and guidelines for wearing seatbelts and speed limits.

It can be complicated to try to remember these rules, especially if you are newer to the area. Keep reading to see the rules North Dakota drivers follow.

Is North Dakota a No-Fault State?

North Dakota is a no-fault state. This means that when you get into a car accident you have personal injury protection to cover your medical and work leave regardless of fault.

Keep in mind, this is only for medical and economic losses. In North Dakota, you can claim property damage against the at-fault driver of the accident.

What Are the Seat Belt and Car Seat Laws?

Like most states, North Dakota has laws regarding seat belts and car seats for children.

| Seat Belt Law in Maine | Details |

|---|---|

| Effective Since | 07/14/94 |

| Primary Enforcement | No |

| Age/Seats Applicable | 18+ years old in front seat |

| 1st Offense Max Fine | $20 |

| Car Seat Laws | Details |

|---|---|

| Must be in child safety seat | 7 years and younger and less than 57 inches |

| Adult belt permissible | 8 through 17 years; 7 years and younger and at least 57 inches |

| Maximum base fine 1st offense | $25 (points on your license may also be applied) |

| Preference for rear seat | law states no preference for rear seat |

Currently, there are no laws regarding passengers in the cargo area of trucks.

What Are the Keep Right and Move Over Laws?

North Dakota has common laws like most states regarding keep right and move over laws.

Getting behind someone in the left lane can be annoying, it can also be dangerous when people are trying to weave in and out the right lane to get around. Therefore, North Dakota has a keep right law. You are always to keep right when you are the slowest moving vehicle.

Move over laws are also commonly known. Whenever a driver is approaching an accident or any emergency vehicle, you should always slow and try as soon as possible to vacate the lane closest to the emergency vehicle.

What Are the Speed Limit Laws?

Speed limits are another common law. Roads should have posted limit signs, but we have created a table below to help keep track of those limits.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 75 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 65 mph |

Please note, all speed limits are subject to change especially in construction zones.

– Ridesharing

Ridesharing has become a widely popular form of transportation. Anyone needing a little extra cash has been told to try driving for companies like Uber and Lyft.

Here is the thing, you need insurance for driving other people around for hire. It is always good to consult your insurance carrier and also see what coverages you may have with your hiring company.

What Do I Need to Know About Automation on the Road?

Cars driving themselves are no longer a thing of the future. The advanced technology of cars has surpassed what many thought they would be able to perform.

North Dakota allows the deployment of autonomous vehicles on North Dakota roadways.

What Are the Safety Laws in North Dakota?

Driving under the influence of any substance is very dangerous. It can destroy your life and the life of others. North Dakota has strict laws against any form of driving under the influence and distracted driving.

What are the North Dakota DUI Laws?

Below are the details for driving under the influence laws in North Dakota.

| BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back Period/Washout Period |

|---|---|---|---|---|

| 0.08 | 0.18 | 1st and 2nd offense within 7 years are class B misdemeanors. 3rd offense within 7 years is a Class A misdemeanor. 4th and subsequent offenses within 15 years are Class C felonies. | Driving Under the Influence (DUI) | 7 years |

What happens if you are convicted of driving under the influence?

| Number of Offense | License Revocation | Jail Time | Fine |

|---|---|---|---|

| 1st | 91 days minimum | no minimum | $500 minimum |

| 2nd | 1 year minimum | 10 days minimum | $600 minimum |

| 3rd | 2 years minimum | 120 days minimum | $2,000 minimum |

North Dakota has serious consequences for driving under the influence. Each subsequent offense means more jail time, fines, and license suspension.

It is not worth the above penalties and the lives that could be lost to drive while intoxicated.

What Are the Marijuana-Impaired Driving Laws?

North Dakota has no specific marijuana driving laws, but if you are driving while impaired from any substance you can be subject to the same DUI penalties.

What Are the Distracted Driving Laws?

Most adults, and kids, have handheld devices. Driving while texting is extremely dangerous. North Dakota has a complete ban on texting for all drivers.

| Hand-held ban | Young driver cell phone ban | Texting ban | Enforcement |

|---|---|---|---|

| no | drivers younger than 18 | all drivers | primary |

What Should I Know About Driving in North Dakota?

Driving can be dangerous. The above safety laws, if followed, can keep drivers safe while driving. Sometimes, accidents do happen and sadly there are fatalities.

In this last section, we are going to cover car theft, fatalities, and transportation of North Dakota drivers.

Is There Vehicle Theft in North Dakota?

Knowing what type of car is a popular target for theft can help drivers know what thieves are looking to steal.

| Rank | Make/Model | Year of Vehicle | Year | Thefts |

|---|---|---|---|---|

| 1 | Chevrolet Pickup (Full Size) | 2002 | 2002 | 127 |

| 2 | Ford Pickup (Full Size) | 1997 | 1997 | 101 |

| 3 | Dodge Pickup (Full Size) | 1998 | 1998 | 49 |

| 4 | GMC Pickup (Full Size) | 2006 | 2006 | 37 |

| 5 | Chevrolet Impala | 2015 | 2015 | 27 |

| 6 | Honda Accord | 1990 | 1990 | 23 |

| 7 | Jeep Cherokee/Grand Cherokee | 1999 | 1999 | 21 |

| 8 | Chevrolet Pickup (Small Size) | 1999 | 1999 | 18 |

| 9 | Pontiac Grand Am | 2000 | 2000 | 17 |

| 10 | Ford Taurus | 1998 | 1998 | 16 |

Pickup trucks top the list with Chevys being the number one stolen vehicle. Out of all the Chevy trucks stolen, the year 2002 was the most popular year.

Where you live is also a factor in auto thefts. Take a look at the below table with all the thefts by North Dakota city.

| City | Population | Motor vehicle theft |

|---|---|---|

| Belfield | 856 | 1 |

| Beulah | 3,149 | 3 |

| Bismarck | 65,850 | 107 |

| Bowman | 1,687 | 2 |

| Burlington | 1,054 | 1 |

| Carrington | 2,108 | 1 |

| Cavalier | 1,268 | 1 |

| Devils Lake | 7,260 | 16 |

| Dickinson | 20,347 | 47 |

| Ellendale | 1,388 | 0 |

| Fargo | 111,101 | 166 |

| Fessenden | 486 | 0 |

| Grafton | 4,326 | 4 |

| Grand Forks | 53,625 | 68 |

| Harvey | 1,827 | 5 |

| Jamestown | 15,286 | 20 |

| Kenmare | 1,050 | 1 |

| Killdeer | 841 | 1 |

| Lamoure | 895 | 0 |

| Lincoln | 2,898 | 1 |

| Lisbon | 2,149 | 0 |

| Mandan | 19,168 | 47 |

| Medora | 139 | 0 |

| Minot | 44,635 | 108 |

| Napoleon | 757 | 0 |

| New Town | 2,362 | 3 |

| Northwood | 918 | 1 |

| Oakes | 1,840 | 0 |

| Powers Lake | 314 | 1 |

| Rolla | 1,333 | 3 |

| Rugby | 2,972 | 0 |

| Sherwood | 254 | 0 |

| Stanley | 1,949 | 7 |

| Steele | 708 | 0 |

| Surrey | 1,042 | 0 |

| Thompson | 1,002 | 0 |

| Tioga | 1,247 | 6 |

| Valley City | 6,580 | 9 |

| Wahpeton | 7,812 | 8 |

| Watford City | 2,793 | 20 |

| West Fargo | 28,018 | 47 |

| Williston | 19,949 | 203 |

| Wishek | 974 | 0 |

How Many Road Fatalities Occur in North Dakota?

Knowing when and how fatalities happen can help others be more careful and aware while driving. We have compiled data and put in tables below showing where, when, and counties fatalities occur.

– Fatal Crashes by Weather and Light Condition

Drivers often think accidents happen in poor weather or maybe at night. Surprisingly, most accidents occur in normal, daylight hours.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 36 | 7 | 27 | 7 | 1 | 78 |

| Rain | 0 | 0 | 3 | 0 | 0 | 3 |

| Snow/Sleet | 5 | 0 | 1 | 1 | 0 | 7 |

| Other | 1 | 0 | 1 | 0 | 1 | 3 |

| Unknown | 1 | 1 | 5 | 1 | 6 | 14 |

| TOTAL | 43 | 8 | 37 | 9 | 8 | 105 |

Fatalities by County

Below is a breakdown of fatalities by North Dakota county.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 1 | 0 | 1 | 0 | 2 |

| Barnes | 6 | 3 | 3 | 2 | 3 |

| Benson | 0 | 4 | 2 | 3 | 1 |

| Billings | 2 | 0 | 0 | 1 | 0 |

| Bottineau | 1 | 1 | 1 | 2 | 4 |

| Bowman | 1 | 0 | 2 | 0 | 0 |

| Burke | 3 | 2 | 0 | 2 | 1 |

| Burleigh | 2 | 4 | 10 | 6 | 4 |

| Cass | 2 | 6 | 6 | 5 | 8 |

| Cavalier | 0 | 3 | 1 | 1 | 1 |

| Dickey | 1 | 0 | 0 | 3 | 0 |

| Divide | 3 | 0 | 0 | 3 | 0 |

| Dunn | 4 | 6 | 3 | 1 | 3 |

| Eddy | 0 | 1 | 0 | 0 | 0 |

| Emmons | 0 | 2 | 2 | 0 | 0 |

| Foster | 0 | 0 | 0 | 0 | 0 |

| Golden Valley | 1 | 0 | 0 | 2 | 0 |

| Grand Forks | 5 | 3 | 6 | 1 | 7 |

| Grant | 2 | 1 | 0 | 1 | 1 |

| Griggs | 0 | 0 | 0 | 3 | 0 |

| Hettinger | 1 | 0 | 0 | 0 | 0 |

| Kidder | 1 | 1 | 0 | 2 | 0 |

| Lamoure | 2 | 2 | 0 | 1 | 2 |

| Logan | 0 | 0 | 0 | 0 | 0 |

| Mchenry | 1 | 4 | 0 | 3 | 2 |

| Mcintosh | 0 | 0 | 0 | 0 | 0 |

| Mckenzie | 23 | 23 | 18 | 8 | 10 |

| Mclean | 1 | 2 | 6 | 6 | 4 |

| Mercer | 2 | 0 | 0 | 4 | 2 |

| Morton | 3 | 2 | 6 | 9 | 1 |

| Mountrail | 7 | 5 | 5 | 8 | 8 |

| Nelson | 2 | 5 | 0 | 1 | 1 |

| Oliver | 0 | 1 | 1 | 0 | 0 |

| Pembina | 4 | 2 | 1 | 0 | 0 |

| Pierce | 1 | 1 | 3 | 2 | 1 |

| Ramsey | 2 | 3 | 1 | 2 | 1 |

| Ransom | 2 | 1 | 0 | 2 | 1 |

| Renville | 0 | 0 | 0 | 1 | 0 |

| Richland | 2 | 3 | 2 | 4 | 4 |

| Rolette | 4 | 3 | 1 | 6 | 9 |

| Sargent | 0 | 2 | 1 | 0 | 2 |

| Sheridan | 0 | 0 | 1 | 0 | 0 |

| Sioux | 2 | 0 | 3 | 2 | 1 |

| Slope | 1 | 1 | 0 | 0 | 3 |

| Stark | 6 | 7 | 6 | 3 | 6 |

| Steele | 0 | 1 | 0 | 0 | 1 |

| Stutsman | 2 | 1 | 7 | 3 | 2 |

| Towner | 0 | 0 | 2 | 0 | 1 |

| Traill | 1 | 8 | 0 | 0 | 1 |

| Walsh | 1 | 0 | 4 | 3 | 4 |

| Ward | 18 | 9 | 8 | 6 | 6 |

| Wells | 0 | 0 | 0 | 0 | 1 |

| Williams | 25 | 12 | 18 | 1 | 6 |

Traffic Fatalities

Most accidents happen on rural roadways.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 92 | 135 | 93 | 132 | 146 | 138 | 116 | 122 | 106 | 103 | |||||||||||||||

| Urban | 12 | 5 | 12 | 16 | 24 | 10 | 19 | 9 | 7 | 9 |

Fatalities by Person Type

Person type shows what type of vehicle, bicyclist, or pedestrian was involved in the fatality.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 38 | 39 | 36 | 36 | 26 |

| Light Truck - Pickup | 43 | 33 | 45 | 25 | 33 |

| Light Truck - Utility | 26 | 27 | 18 | 13 | 18 |

| Light Truck - Van | 5 | 6 | 1 | 3 | 5 |

| Large Truck | 20 | 5 | 8 | 9 | 9 |

| Other/Unknown Occupants | 4 | 3 | 4 | 4 | 5 |

| Bus | 0 | 0 | 3 | 0 | 0 |

| Motorcyclists | 9 | 10 | 8 | 12 | 12 |

| Pedestrian | 1 | 9 | 7 | 7 | 5 |

| Bicyclist and Other Cyclist | 1 | 3 | 1 | 3 | 2 |

| Other/Unknown Nonoccupants | 1 | 0 | 0 | 1 | 0 |

Fatalities by Crash Type

How did the fatality happen? Most crashes occur involving roadway departure.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 69 | 77 | 72 | 67 | 69 |

| Involving a Large Truck | 63 | 49 | 47 | 13 | 26 |

| Involving Speeding | 59 | 50 | 43 | 25 | 28 |

| Involving a Rollover | 67 | 56 | 68 | 57 | 57 |

| Involving a Roadway Departure | 107 | 76 | 86 | 66 | 59 |

| Involving an Intersection (or Intersection Related) | 30 | 37 | 25 | 22 | 24 |

| Total Fatalities (All Crashes)* | 148 | 135 | 131 | 113 | 115 |

Five-Year Trend For The Top 10 Counties

Looking at the five-year trend in North Dakota, we have listed the top 10 counties for fatalities.

| Rank | North Dakota County | 2013 | $2,014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Mckenzie County | 23 | $23 | 18 | 8 | 10 |

| 2 | Rolette County | 4 | $3 | 1 | 6 | 9 |

| 3 | Cass County | 2 | $6 | 6 | 5 | 8 |

| 4 | Mountrail County | 7 | $5 | 5 | 8 | 8 |

| 5 | Grand Forks County | 5 | $3 | 6 | 1 | 7 |

| 6 | Stark County | 6 | $7 | 6 | 3 | 6 |

| 7 | Ward County | 18 | $9 | 8 | 6 | 6 |

| 8 | Williams County | 25 | $12 | 18 | 1 | 6 |

| 9 | Bottineau County | 1 | $1 | 1 | 2 | 4 |

| 10 | Burleigh County | 2 | 4 | 10 | 6 | 4 |

| Sub Total 1.* | Top Ten Counties | 102 | 85 | 91 | 62 | 68 |

| Sub Total 2.** | All Other Counties | 46 | 50 | 40 | 51 | 47 |

| Total | All Counties | 148 | 135 | 131 | 113 | 115 |

Fatalities Involving Speeding by County

Speeding is a common violation on most roadways. Below is the breakdown of speeding fatalities by county.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 0 | 0 | 0 | 0 | 0 |

| Barnes | 0 | 1 | 2 | 0 | 0 |

| Benson | 0 | 0 | 1 | 0 | 0 |

| Billings | 1 | 0 | 0 | 0 | 0 |

| Bottineau | 0 | 0 | 0 | 0 | 1 |

| Bowman | 1 | 0 | 0 | 0 | 0 |

| Burke | 1 | 1 | 0 | 0 | 0 |

| Burleigh | 0 | 2 | 4 | 1 | 1 |

| Cass | 1 | 3 | 1 | 0 | 2 |

| Cavalier | 0 | 0 | 0 | 0 | 1 |

| Dickey | 0 | 0 | 0 | 0 | 0 |

| Divide | 2 | 0 | 0 | 0 | 0 |

| Dunn | 0 | 2 | 1 | 1 | 0 |

| Eddy | 0 | 1 | 0 | 0 | 0 |

| Emmons | 0 | 1 | 0 | 0 | 0 |

| Foster | 0 | 0 | 0 | 0 | 0 |

| Golden Valley | 1 | 0 | 0 | 1 | 0 |

| Grand Forks | 3 | 2 | 0 | 1 | 1 |

| Grant | 1 | 0 | 0 | 1 | 1 |

| Griggs | 0 | 0 | 0 | 0 | 0 |

| Hettinger | 0 | 0 | 0 | 0 | 0 |

| Kidder | 0 | 1 | 0 | 0 | 0 |

| Lamoure | 2 | 0 | 0 | 1 | 0 |

| Logan | 0 | 0 | 0 | 0 | 0 |

| Mchenry | 0 | 1 | 0 | 1 | 0 |

| Mcintosh | 0 | 0 | 0 | 0 | 0 |

| Mckenzie | 6 | 8 | 6 | 6 | 4 |

| Mclean | 0 | 1 | 6 | 1 | 2 |

| Mercer | 1 | 0 | 0 | 1 | 1 |

| Morton | 1 | 0 | 2 | 3 | 0 |

| Mountrail | 4 | 3 | 4 | 1 | 2 |

| Nelson | 1 | 3 | 0 | 0 | 1 |

| Oliver | 0 | 0 | 1 | 0 | 0 |

| Pembina | 3 | 1 | 0 | 0 | 0 |

| Pierce | 0 | 0 | 1 | 0 | 0 |

| Ramsey | 1 | 2 | 0 | 0 | 0 |

| Ransom | 1 | 1 | 0 | 1 | 0 |

| Renville | 0 | 0 | 0 | 1 | 0 |

| Richland | 1 | 1 | 2 | 0 | 0 |

| Rolette | 2 | 0 | 0 | 0 | 1 |

| Sargent | 0 | 0 | 0 | 0 | 0 |

| Sheridan | 0 | 0 | 0 | 0 | 0 |

| Sioux | 0 | 0 | 2 | 0 | 1 |

| Slope | 0 | 1 | 0 | 0 | 2 |

| Stark | 4 | 2 | 3 | 0 | 1 |

| Steele | 0 | 0 | 0 | 0 | 1 |

| Stutsman | 1 | 0 | 0 | 2 | 1 |

| Towner | 0 | 0 | 0 | 0 | 0 |

| Traill | 1 | 5 | 0 | 0 | 0 |

| Walsh | 0 | 0 | 0 | 0 | 2 |

| Ward | 9 | 4 | 3 | 2 | 2 |

| Wells | 0 | 0 | 0 | 0 | 0 |

| Williams | 10 | 3 | 4 | 0 | 0 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Driving under the influence of any substance is very dangerous. You can lose your license, have jail time, and have hefty fines. The biggest thing you could lose is your life or taking the life of someone else.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 0 | 0 | 0 | 0 | 0 |

| Barnes | 2 | 1 | 1 | 1 | 2 |

| Benson | 0 | 1 | 1 | 3 | 0 |

| Billings | 0 | 0 | 0 | 0 | 0 |

| Bottineau | 0 | 1 | 1 | 2 | 1 |

| Bowman | 0 | 0 | 0 | 0 | 0 |

| Burke | 3 | 0 | 0 | 0 | 1 |

| Burleigh | 0 | 1 | 1 | 3 | 2 |

| Cass | 0 | 3 | 2 | 3 | 3 |

| Cavalier | 0 | 2 | 1 | 0 | 1 |

| Dickey | 0 | 0 | 0 | 2 | 0 |

| Divide | 2 | 0 | 0 | 0 | 0 |

| Dunn | 2 | 3 | 1 | 1 | 2 |

| Eddy | 0 | 1 | 0 | 0 | 0 |

| Emmons | 0 | 1 | 1 | 0 | 0 |

| Foster | 0 | 0 | 0 | 0 | 0 |

| Golden Valley | 0 | 0 | 0 | 1 | 0 |

| Grand Forks | 2 | 0 | 2 | 0 | 2 |

| Grant | 1 | 0 | 0 | 0 | 0 |

| Griggs | 0 | 0 | 0 | 2 | 0 |

| Hettinger | 0 | 0 | 0 | 0 | 0 |

| Mcintosh | 0 | 0 | 0 | 0 | 0 |

| Mckenzie | 8 | 9 | 7 | 2 | 4 |

| Mclean | 0 | 1 | 3 | 2 | 2 |

| Mercer | 1 | 0 | 0 | 1 | 2 |

| Morton | 0 | 1 | 4 | 5 | 0 |

| Mountrail | 2 | 2 | 4 | 6 | 3 |

| Nelson | 1 | 3 | 0 | 0 | 0 |

| Oliver | 0 | 0 | 1 | 0 | 0 |

| Pembina | 0 | 0 | 0 | 0 | 0 |

| Pierce | 0 | 0 | 2 | 0 | 1 |

| Ramsey | 2 | 2 | 0 | 1 | 0 |

| Ransom | 0 | 1 | 0 | 1 | 0 |

| Renville | 0 | 0 | 0 | 1 | 0 |

| Richland | 0 | 1 | 2 | 0 | 1 |

| Rolette | 1 | 1 | 1 | 5 | 4 |

| Sargent | 0 | 1 | 1 | 0 | 2 |

| Sheridan | 0 | 0 | 1 | 0 | 0 |

| Sioux | 2 | 0 | 2 | 0 | 1 |

| Slope | 0 | 0 | 0 | 0 | 0 |

| Stark | 1 | 2 | 2 | 1 | 4 |

| Steele | 0 | 0 | 0 | 0 | 0 |

| Stutsman | 2 | 1 | 1 | 0 | 2 |

| Towner | 0 | 0 | 2 | 0 | 0 |

| Traill | 0 | 3 | 0 | 0 | 1 |

| Walsh | 1 | 0 | 0 | 2 | 1 |

| Ward | 9 | 3 | 2 | 3 | 1 |

| Wells | 0 | 0 | 0 | 0 | 0 |

| Williams | 17 | 9 | 5 | 0 | 1 |

What Are the Consequenses of Teen Drinking and Driving?

The North Dakota underage drinking law found on the state website:

It is illegal to manufacture, purchase, consume or possess alcoholic beverages. Drinking underage can result in up to 30 days in jail and a $500 fine. Driving under the influence (.02 for minors) is punishable by up to five years in prison and a $10,000 fine.

Teen drinking can kill lives and North Dakota is serious about letting teens know it is against the law and dangerous. Sadly, the most common unruly crime to be taken to the North Dakota Juvenile Court system is underage consumption and possession of alcohol.

What Is the EMS Response Time?

If you are in a car accident, you will need an emergency medical team to get to you fast and transfer you to a local hospital.

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Rural | 7.33 min | 14.49 min | 41.05 min | 59.76 min | 95 |

| Urban | 13.50 min | 5.14 min | 25.43 min | 28.33 | 7 |

What Should I Know About Transportation in North Dakota?

How long do North Dakota drivers spend in the cars and how do they get back and forth to work? Let’s take a look.

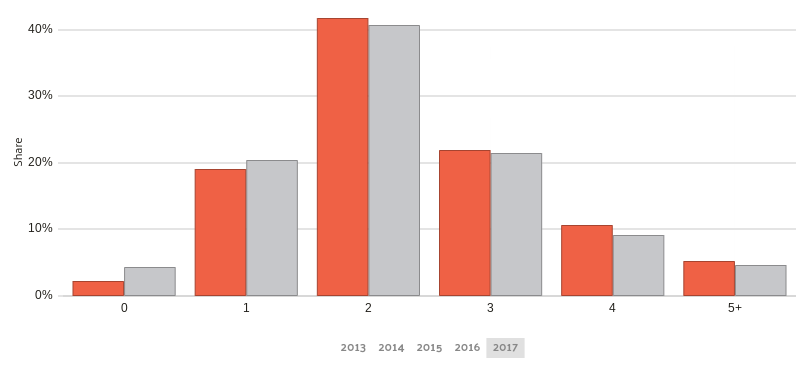

Car Ownership

Most North Dakota homes have two cars followed by three car households.

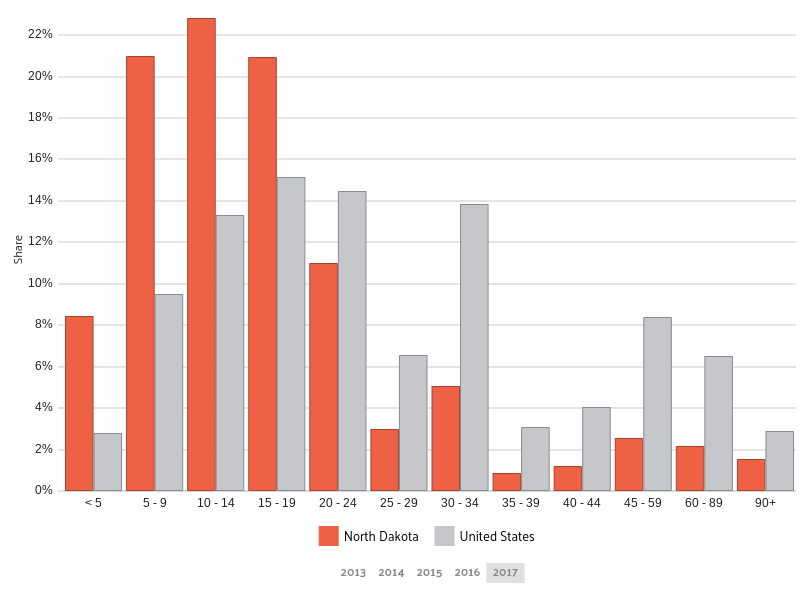

Commute Time

Most drivers have under a 15-minute commute to work. Most United States workers have 25 minutes or more commuting to work.

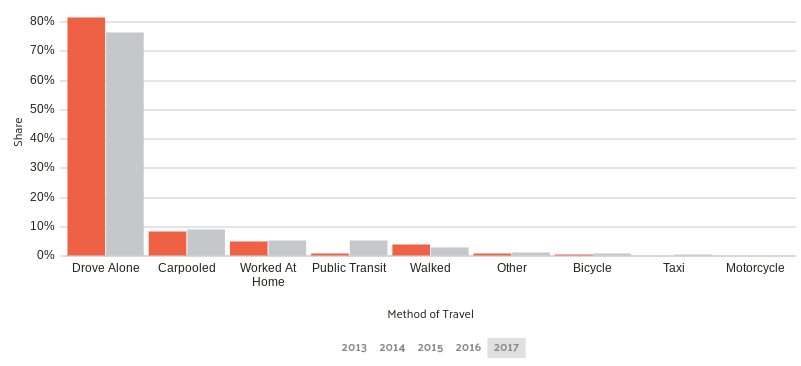

Commuter Transportation

It is common for most workers to drive alone to work, much like the rest of the United States.

You did it! You read through all the need-to-know information for driving in North Dakota. Now you are fully prepared to start comparing your rates and getting the best insurance.

Don’t forget to use our free comparison tool to get started.