Hawaii Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 10.60

Who doesn’t want to enjoy the surf and turf along a stunning sunny beach? It sounds like paradise doesn’t it? Well, those that live in Hawaii are well acquainted with such an amazing landscape, and the beauty that it holds.

Hawaii is the 50th, and most recent, state and joined the United States on August 21st, 1959.

Well known for the beaches, as well as the monstrous volcanoes, the terrain can be challenging to those not used to it.

Those who are well acquainted with it though are complete pros at navigating the roads with ease.

For those lucky enough to live in Hawaii, the last thing you want to do is to spend your hard-earned time having to research car insurance. You could be spending that time hitting up the beach.

So how do you know what car insurance is best for you? There are so many choices that it can seem intimidating, but that’s what we’re here for. We’ve come up with this comprehensive guide to help make choosing the best car insurance at affordable rates an absolute breeze.

We will look at everything from car insurance coverage and rates, insurance providers in Hawaii, state laws particular to only Hawaii, and much more. Want to start comparing rates now? Use our FREE online tool to get started.

What are Hawaii insurance coverage and rates?

What sense does it make paying thousands of dollars each year for a car insurance plan you don’t even fully understand? Hawaii, like all states across the nation, requires drivers to have insurance. The choices can be overwhelming to pick out but making sure you get the best coverage plan for yourself is key.

We want you to know what you’re paying for, it’s your money after all. In this section, we’ve gone through and explained some of the most important coverage and rate information for Hawaii that you’ll need to know. From the minimum coverage you’ll need, all the way rates by zip code and city.

Buckle up and let’s get started.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Hawaii minimum coverage requirements?

Hawaii requires all drivers to have a minimum level of insurance coverage in order to drive. This ensures that all drivers have the ability to pay off the cost of an accident, should it occur.

Hawaii requires the following minimum coverage to legally drive in the state:

- $20,000 for the payment of bodily injury liability, per person

- $40,000 for the payment of total bodily injury liability if multiple people are injured

- $10,000 for the payment of property damage liability

- $10,000 for the payment of personal injury (a.k.a for you!)

These amounts are fairly standard and show a heavier emphasis on the protection of individuals than for property. Something you would hope would be more important.

These amounts, however, are the absolute MINIMUM insurance requirements in Hawaii. It’s always wise to consider getting above the minimum coverage, as while these amounts may seem like a lot, they can run out quickly if you are in a serious enough accident. Better to be safe than sorry.

What are acceptable forms of financial responsibility?

So, you’ve got the required insurance for your vehicle, now what? You carry it with you, that’s what. Hawaii law requires that you need to have some form of financial responsibility (also known as proof of insurance) with you at all times while operating a vehicle.

Any of the below are considered acceptable forms of financial responsibility:

- A valid Insurance ID card (both a physical copy and electronic copy are accepted)

- Copy of your current insurance policy

- Valid insurance binder (serves as a temporary form of car insurance)

Just how serious does the state of Hawaii take it if you DON’T have your insurance on you? First-time offenders can see up to $500 in fines and up to $5,000 for multiple offenses. That’s a lot of your hard-earned cash flushed down the toilet.

What’s one lesson we hope to impart to you as you read this guide? Make sure to keep your proof of insurance on you at all times while you’re operating your vehicle.

How much are premiums as a percentage of income?

Have you ever heard of the term per capita disposable income? Well if you haven’t, it basically is the amount of money a person has to spend after taxes have been paid.

| Year | Average Amount for Full Coverage | Average Disposable Income | Insurance as a Percentage of Income |

|---|---|---|---|

| 2012 | $844.12 | $40,339 | 2.09% |

| 2013 | $844.16 | $40,094 | 2.11% |

| 2014 | $858.16 | $41,801 | 2.05% |

As you can see from the data above, the average disposable income has trended upward during this three-year period. This is a very good thing, as it means that the income for the average Hawaii citizen has increased. Way to go Hawaii!

If you were to compare states such as California or New York, whose disposable incomes are larger and where the cost of living is much more expensive than that in Hawaii, the cost of a full coverage insurance plan increases by over a hundred dollars.

More recently, as of 2017 Hawaii had an average per capita disposable income of $52,787. Well above the 2012 to 2014 ranges.

When the average cost of car insurance in Hawaii is approximately $860, this means that over 1.6 percent of that $52,787 is going just to your auto insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are average monthly car insurance rates in HI (liability, collision, comprehensive)?

We’ve gone through the data from the National Association of Insurance Commissioners for the core coverage of Hawaii.

| COVERAGE TYPE | ANNUAL COSTS IN 2015: |

|---|---|

| Liability | $458.54 |

| Collision | $313.17 |

| Comprehensive | $101.56 |

| Combined | $873.28 |

Keep in mind that these rates are likely to change in 2019 and moving forward.

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

What are additional coverage options?

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection | 60.91% | 62.05% | 62.76% |

| Medical Payments (MedPay) | 78.70% | 231.68% | 126.12% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 40.49% | 42.57% | 42.91% |

Medical Payments (MedPay), Personal Injury Protection, and Uninsured/Underinsured Motorist coverage are additional forms for liability coverage that are available. In Hawaii, Personal Injury Protection coverage is required to legally drive, meanwhile, MedPay and Uninsured/Underinsured Motorist coverage are optional.

These are some of the most important auto insurance coverages that you can have in the case of an accident. If you’re hit by a driver without insurance, for instance, it’s likely that they will go completely bankrupt with all of the costs of the accident before they can finish paying everything off.

That means that anything left will fall into your lap. Even though you weren’t the at-fault driver, you’ll then have to pay for your medical bills and property damage.

In Hawaii, it’s estimated that approximately 10.6 percent of drivers in Hawaii are uninsured. This means that Hawaii is ranked as 30th in the nation for uninsured/underinsured drivers. (For more information, read our “How the States Rank on Uninsured Drivers“).

All of that said, let’s dig deeper into the data listed above. What in the world does all of that mean and how does it apply to you?

Essentially it tells you exactly where an insurance provider stands financially. A company that has a loss ratio that is too high (over 100 percent) may not have priced their policies appropriately and is losing money.

This is due to the fact that they are likely paying out too many claims. A company that has a loss ratio that is too low probably overpriced their policies or did not see the expected claim frequency.

Think back to that old-school tale of Goldilocks. You want something that’s not too hot, not too cold, but just right.

So you can then see that the above data that the loss ratios for Personal Injury Protection are relatively healthy. Premiums for uninsured/underinsured motorist coverage, on the one hand, are in the low 40s range, meaning the premiums might be slightly overpriced.

Then, on the other hand, MedPay coverage is paying WAY more than they’re taking in. How does this affect you? Premiums for this coverage type will likely begin to increase in order to break-even.

While the initial costs of adding on these additional coverage options may seem a little higher, but consider how they will help you in the long run. They’ll give you a much better protection plan in the case of an emergency or an accident, so they’re definitely something to consider.

Watch the video below if you need a little more information about why uninsured motorist coverage is beneficial.

What add-ons, endorsements, and riders are available?

We’ve discussed previously how the minimum coverage just may not be enough to fully cover you. Life happens, and so does unforeseen circumstances just beyond your control. You may need to add additional types of coverage to your plan. But what?

We’ve collected a list of some of the best, most affordable coverages that you can add on to your plan.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

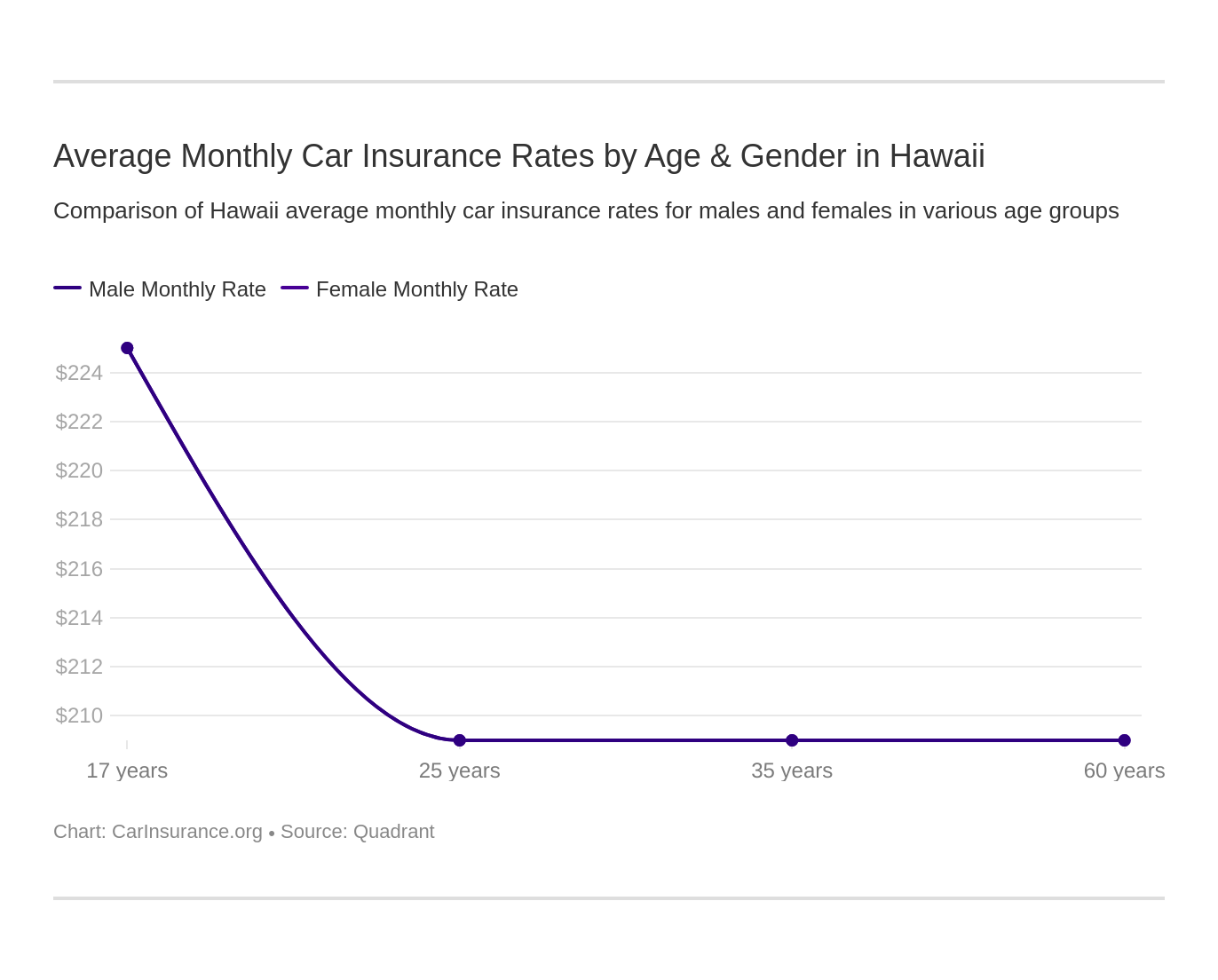

How much are average monthly car insurance rates by age & gender in HI?

Did you know that your demographics will affect what your insurance rate is going to be? It isn’t something that should affect it, but when it comes to age and gender in particular, it can definitely affect the price tag on your policy. Take a look at the average rates below.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Insurance | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 | $2,173.49 |

| Farmers Ins HI Standard | $4,659.38 | $4,659.38 | $4,659.38 | $4,659.38 | $5,077.15 | $5,077.15 | $4,659.38 | $4,659.38 |

| Geico Govt Employees | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 | $3,358.86 |

| Liberty Mutual Fire | $3,179.89 | $3,179.89 | $3,179.89 | $3,179.89 | $3,218.54 | $3,218.54 | $3,179.89 | $3,179.89 |

| Progressive Direct | $1,976.86 | $1,976.86 | $1,976.86 | $1,976.86 | $2,781.14 | $2,781.14 | $1,976.86 | $1,976.86 |

| State Farm Mutual Auto | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 | $1,040.28 |

| USAA | $1,176.35 | $1,176.35 | $1,176.35 | $1,176.35 | $1,228.38 | $1,228.38 | $1,176.35 | $1,176.35 |

Hawaii is one of the few states in the nation that has extremely comparable rates across the board. As you can see from the data above, all of the insurance providers listed charge the same rate for both married genders. So both married males and married females (35 and 60 years old) pay the exact same rate.

Some providers increase their rates slightly for single drivers (17 and 25-year-olds), such as Farmers Ins HI Standard. Others charge the exact same rate across the board, such as Allstate, Geico Govt Employees, and State Farm Mutual Auto.

Keep in mind that you can save significantly by asking about auto insurance discounts. This can be especially helpful if you have a teenage driver on your policy. Most of the major insurers offer bundling discounts if you choose to buy an auto policy along with a life insurance policy or homeowners insurance policy.

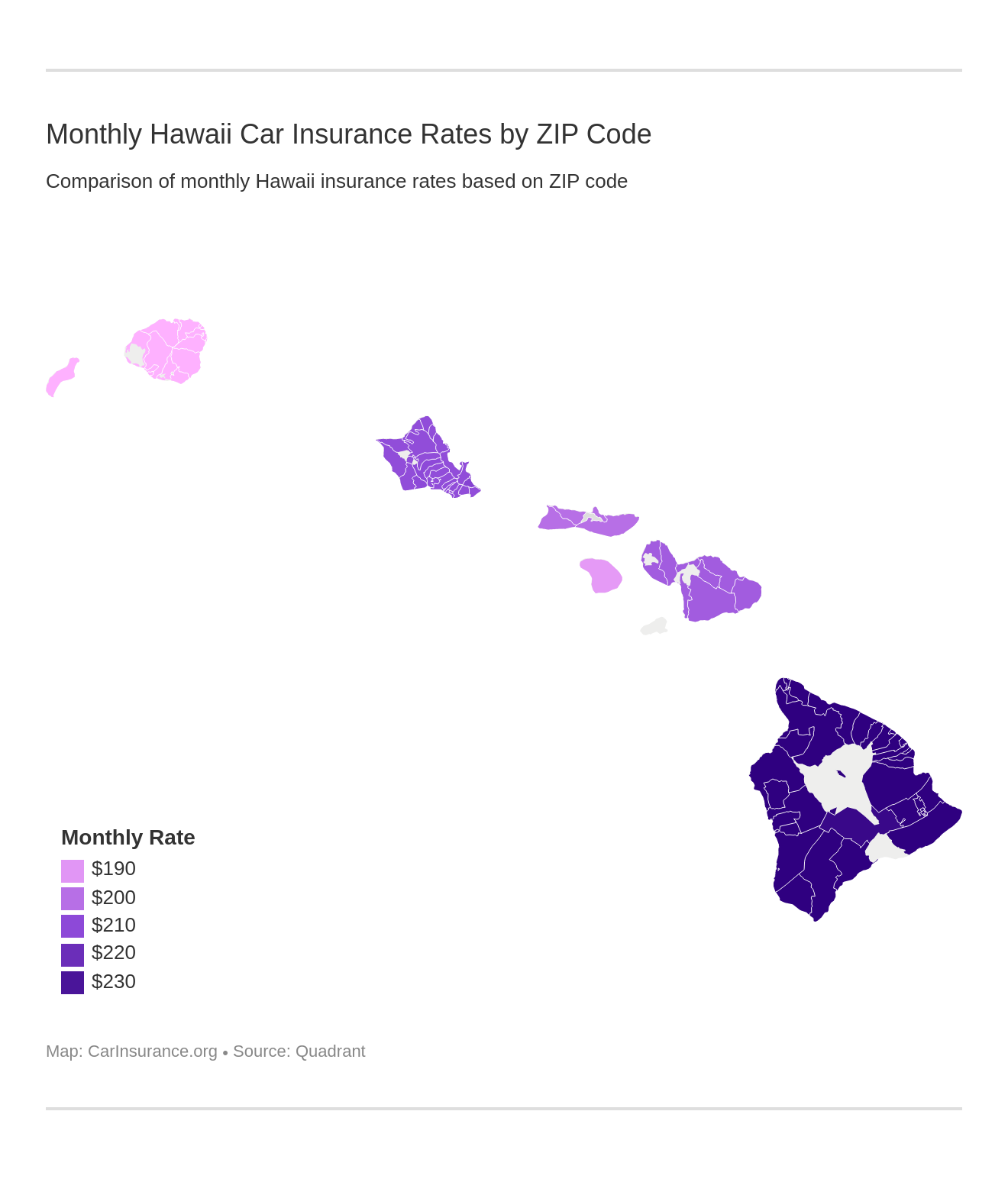

How much are rates by ZIP code and city?

We’ve gone through and collected the insurance rates in Hawaii based on zip code and city.

Check the data below to see where your zip code and city are!

| City | Zipcode | Average Annual Rate |

|---|---|---|

| CAPTAIN COOK | 96701 | $2,508.57 |

| HAKALAU | 96703 | $2,198.62 |

| HAWAII NATIONAL PARK | 96704 | $2,859.11 |

| HAWI | 96705 | $2,198.62 |

| HILO | 96706 | $2,520.31 |

| HOLUALOA | 96707 | $2,508.57 |

| HONAUNAU | 96708 | $2,459.60 |

| HONOKAA | 96710 | $2,859.11 |

| HONOMU | 96712 | $2,508.57 |

| OCEAN VIEW | 96713 | $2,459.60 |

| WAIKOLOA | 96714 | $2,198.62 |

| KEAUHOU | 96716 | $2,198.62 |

| KAILUA KONA | 96717 | $2,508.57 |

| KAMUELA | 96718 | $2,859.11 |

| KEAAU | 96719 | $2,859.11 |

| KEALAKEKUA | 96720 | $2,859.11 |

| KAPAAU | 96722 | $2,198.62 |

| KURTISTOWN | 96725 | $2,859.11 |

| LAUPAHOEHOE | 96726 | $2,859.11 |

| MOUNTAIN VIEW | 96727 | $2,859.11 |

| NAALEHU | 96728 | $2,859.11 |

| NINOLE | 96729 | $2,397.78 |

| OOKALA | 96730 | $2,508.57 |

| PAAUILO | 96731 | $2,508.57 |

| PAHALA | 96732 | $2,459.60 |

| PAHOA | 96734 | $2,508.57 |

| PAPAALOA | 96737 | $2,859.11 |

| PAPAIKOU | 96738 | $2,859.11 |

| PEPEEKEO | 96739 | $2,859.11 |

| VOLCANO | 96740 | $2,859.11 |

| WAIMANALO | 96741 | $2,198.62 |

| EWA BEACH | 96742 | $2,397.78 |

| WAIPAHU | 96743 | $2,859.11 |

| HONOLULU | 96744 | $2,508.57 |

| HONOLULU | 96746 | $2,198.62 |

| HONOLULU | 96747 | $2,198.62 |

| HONOLULU | 96748 | $2,397.78 |

| HONOLULU | 96749 | $2,859.11 |

| HONOLULU | 96750 | $2,859.11 |

| HONOLULU | 96751 | $2,198.62 |

| HONOLULU | 96752 | $2,198.62 |

| HONOLULU | 96753 | $2,459.60 |

| HONOLULU | 96754 | $2,198.62 |

| HONOLULU | 96755 | $2,859.11 |

| HONOLULU | 96756 | $2,198.62 |

| HONOLULU | 96759 | $2,508.57 |

| HICKAM AFB | 96760 | $2,859.11 |

| WHEELER ARMY AIRFIELD | 96761 | $2,459.60 |

| SCHOFIELD BARRACKS | 96762 | $2,508.57 |

| FORT SHAFTER | 96763 | $2,263.39 |

| TRIPLER ARMY MEDICAL CENTER | 96764 | $2,859.11 |

| PEARL HARBOR | 96766 | $2,198.62 |

| CAMP H M SMITH | 96768 | $2,459.60 |

| M C B H KANEOHE BAY | 96769 | $2,198.62 |

| WAKE ISLAND | 96770 | $2,397.78 |

| AIEA | 96771 | $2,859.11 |

| KAPOLEI | 96772 | $2,859.11 |

| HALEIWA | 96773 | $2,859.11 |

| HAUULA | 96774 | $2,859.11 |

| KAAAWA | 96776 | $2,859.11 |

| KAHUKU | 96777 | $2,859.11 |

| KAILUA | 96778 | $2,859.11 |

| KANEOHE | 96779 | $2,459.60 |

| KUNIA | 96780 | $2,859.11 |

| LAIE | 96781 | $2,859.11 |

| PEARL CITY | 96782 | $2,508.57 |

| WAHIAWA | 96783 | $2,859.11 |

| MILILANI | 96784 | $2,459.60 |

| WAIALUA | 96785 | $2,814.68 |

| WAIANAE | 96786 | $2,508.57 |

| HAIKU | 96789 | $2,508.57 |

| HANA | 96790 | $2,459.60 |

| KAHULUI | 96791 | $2,508.57 |

| KIHEI | 96792 | $2,508.57 |

| LAHAINA | 96793 | $2,459.60 |

| MAKAWAO | 96795 | $2,544.50 |

| PAIA | 96796 | $2,198.62 |

| PUUNENE | 96797 | $2,520.31 |

| KULA | 96813 | $2,511.19 |

| WAILUKU | 96814 | $2,511.19 |

| HOOLEHUA | 96815 | $2,511.19 |

| KALAUPAPA | 96816 | $2,511.19 |

| KAUNAKAKAI | 96817 | $2,511.19 |

| MAUNALOA | 96818 | $2,511.19 |

| LANAI CITY | 96819 | $2,511.19 |

| ANAHOLA | 96821 | $2,511.19 |

| ELEELE | 96822 | $2,511.19 |

| HANALEI | 96825 | $2,511.19 |

| HANAPEPE | 96826 | $2,511.19 |

| PRINCEVILLE | 96844 | $2,511.19 |

| KALAHEO | 96850 | $2,511.19 |

| KAPAA | 96853 | $2,511.19 |

| KAUMAKANI | 96854 | $2,511.19 |

| KEALIA | 96857 | $2,511.19 |

| KEKAHA | 96858 | $2,511.19 |

| KILAUEA | 96859 | $2,511.19 |

| KOLOA | 96860 | $2,511.19 |

| LIHUE | 96861 | $2,511.19 |

| MAKAWELI | 96863 | $2,511.19 |

| WAIMEA | 96898 | $2,511.19 |

What are the best car insurance companies in Hawaii?

Raise your hand if you’ve seen at least one car insurance commercial in the past week. Okay, so everyone basically. There are so many car insurance providers out there that it’s hard to know which one to pick. Every single one of them is vying for your business, so which one should you go with?

We’ve got you covered on that one! Continue reading to find out more about car insurance companies in Hawaii.

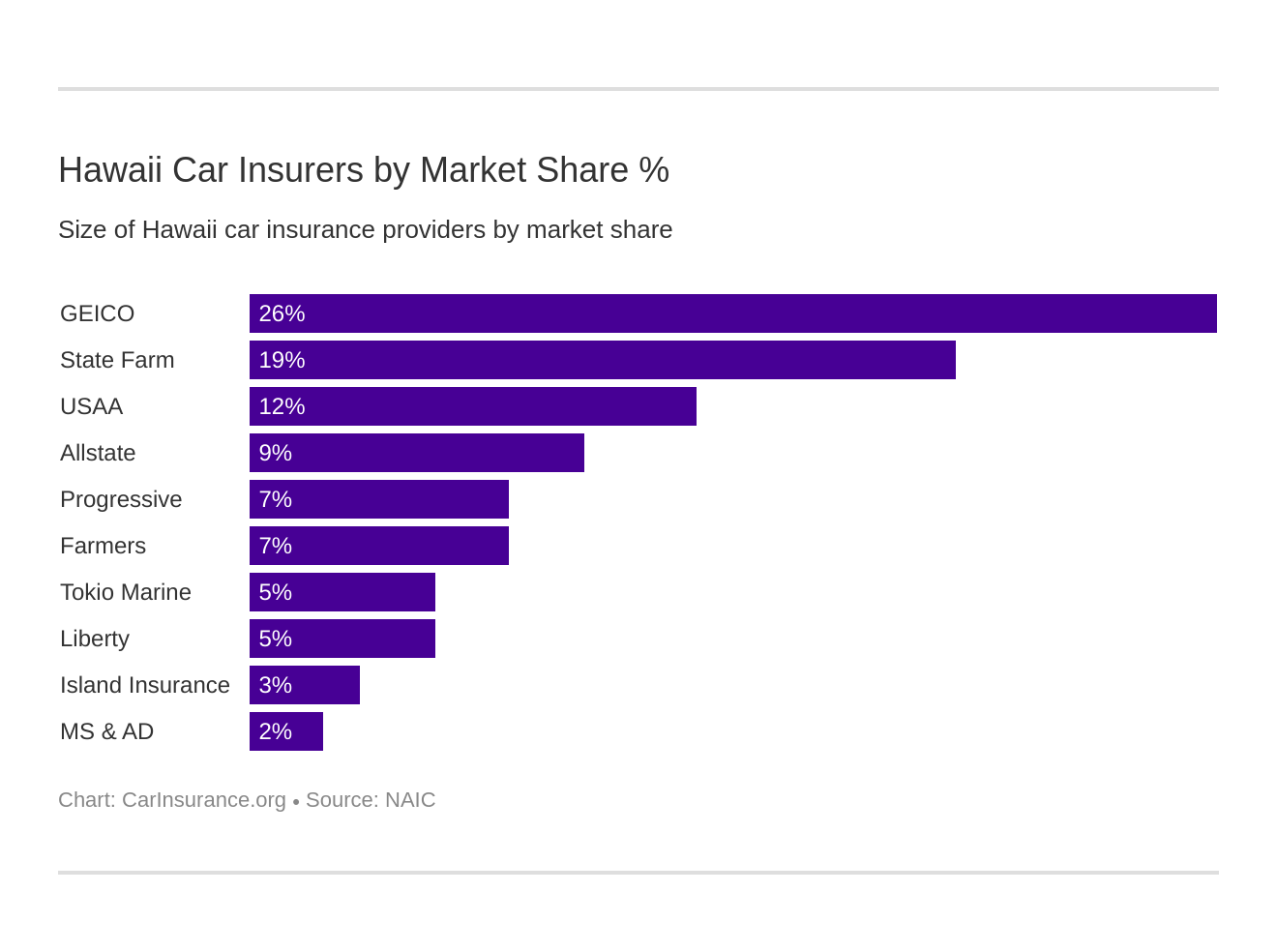

Largest Companies Financial Rating

Just who are the big dogs in Hawaii? The insurance providers listed in the table below have been listed as the top 10 providers in the state.

| Rank | Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|---|

| 1 | Geico | A++ | $198,986 | 69.37% | 26.45% |

| 2 | State Farm Group | A | $139,679 | 56.60% | 18.56% |

| 3 | USAA Group | A++ | $90,542 | 64.08% | 12.03% |

| 4 | Allstate Insurance Group | A+ | $67,866 | 51.00% | 9.02% |

| 5 | Progressive Group | A+ | $53,397 | 50.11% | 7.10% |

| 6 | Farmers Insurance Group | A | $51,498 | 52.22% | 6.84% |

| 7 | Tokio Marine Holdings Inc Group | A++ | $38,833 | 64.55% | 5.16% |

| 8 | Liberty Mutual Group | A | $34,387 | 60.68% | 4.57% |

| 9 | Island Insurance Co Group | A | $24,127 | 64.89% | 3.21% |

| 10 | MS & AD Insurance Group | A | $17,932 | 53.46% | 2.38% |

You might be wondering what exactly an AM Best Rating is at this point. Well, an AM Best Rating essentially determines a company’s financial strength. The higher the grade, the higher the rating.

The companies above all have relatively high AM Best Ratings, as well as loss ratios in a safe range.

Companies with Most Complaints in Hawaii

The following companies have the most complaints listed in the state of Hawaii.

| Company | Number of Vehicles Insured | Number of Complaints Received | Ratio of Complaints per 1,000 Vehicles |

|---|---|---|---|

| Allstate Ins. Co.'s | 83,479 | 5 | 0.060 |

| DTRIC Ins. Co. | 26,234 | 5 | 0.191 |

| Farmers Ins. Hawaii | 67,473 | 43 | 0.637 |

| First Ins. Co.'s | 59,085 | 8 | 0.135 |

| Geico Ins. Co.'s | 232,142 | 79 | 0.340 |

| Hartford Underwriters Ins. Co. | 17,979 | 3 | 0.167 |

| Island Ins. Co.'s | 26,450 | 3 | 0.113 |

| Liberty Mutual Ins. Co.'s | 36,017 | 5 | 0.139 |

| Progressive Ins. Co.'s | 40,623 | 12 | 0.295 |

| State Farm Ins. Co.'s | 176,321 | 12 | 0.068 |

| USAA Ins. Co.'s | 104,745 | 15 | 0.143 |

Keep in mind, however, that the amount of complaints isn’t necessarily indicative of whether a company is good or not. It more or less tells you how a provider is going to handle customer satisfaction as well as complaints.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

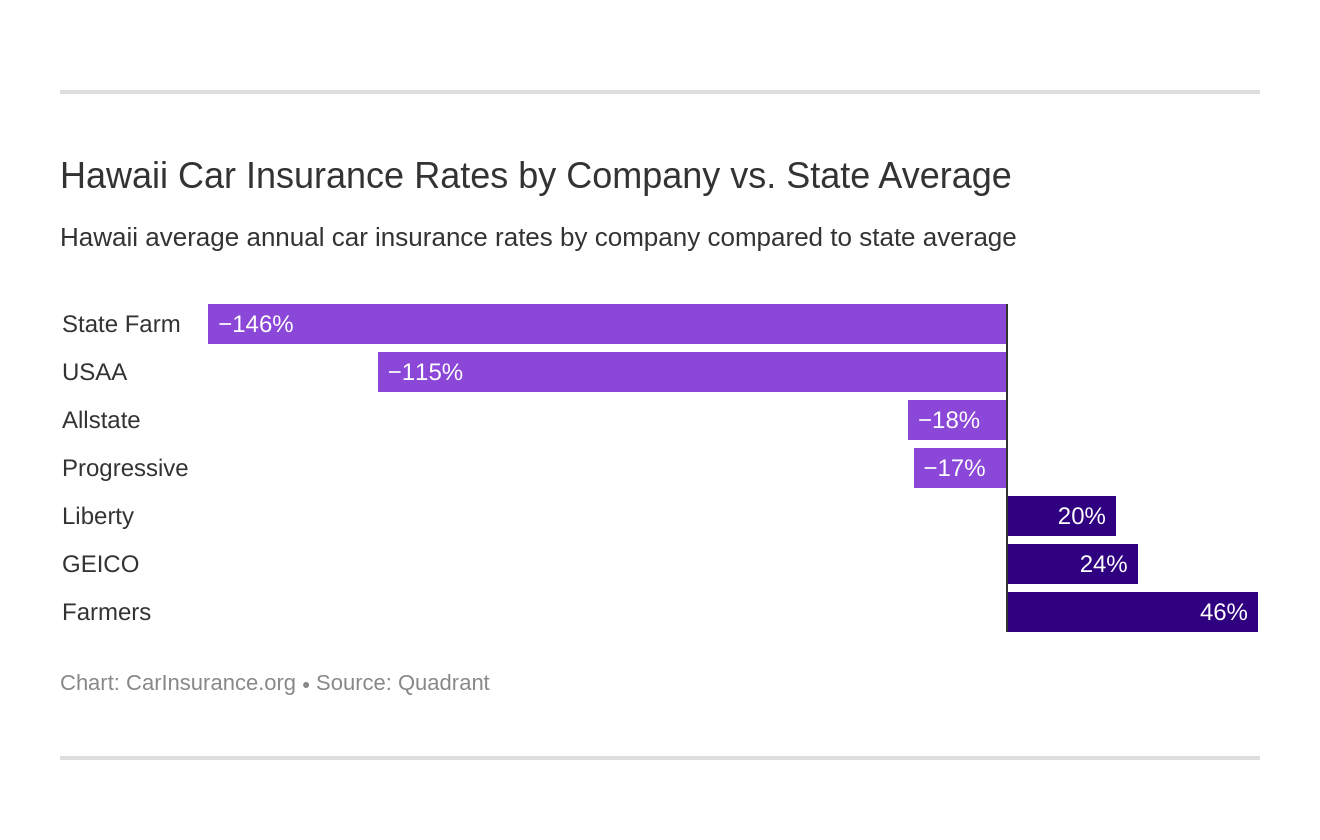

What are Hawaii car insurance rates by company?

| Company | Average Annual Rate | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Allstate Insurance | $2,173.49 | -$382.70 | -17.61% |

| Farmers Ins HI Standard | $4,763.82 | $2,207.64 | 46.34% |

| Geico Govt Employees | $3,358.86 | $802.68 | 23.90% |

| Liberty Mutual Fire | $3,189.55 | $633.37 | 19.86% |

| Progressive Direct | $2,177.93 | -$378.25 | -17.37% |

| State Farm Mutual Auto | $1,040.28 | -$1,515.90 | -145.72% |

| USAA | $1,189.35 | -$1,366.83 | -114.92% |

What are commute rates by companies?

How far you commute on a normal basis can affect what insurance rate you receive.

| GROUP | COMMUTE & ANNUAL MILEAGE | ANNUAL AVERAGE |

|---|---|---|

| Farmers | 10 miles commute. 6000 annual mileage. | $4,763.82 |

| Farmers | 25 miles commute. 12000 annual mileage. | $4,763.82 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,358.86 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,358.86 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $3,189.55 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $3,189.55 |

| Allstate | 10 miles commute. 6000 annual mileage. | $2,035.52 |

| Allstate | 25 miles commute. 12000 annual mileage. | $2,311.46 |

| Progressive | 10 miles commute. 6000 annual mileage. | $2,177.93 |

| Progressive | 25 miles commute. 12000 annual mileage. | $2,177.93 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,189.35 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,189.35 |

| State Farm | 10 miles commute. 6000 annual mileage. | $1,040.28 |

| State Farm | 25 miles commute. 12000 annual mileage. | $1,040.28 |

As you can see, most providers in Hawaii offer comparable rates no matter what your commute is. The only exception to this would be Allstate, which charges approximately $200 MORE for a longer commute distance.

What are coverage level rates by companies?

Did you know that you could be paying more for a low coverage plan when you could be paying less for a plan that’ll give you better protection?

| GROUP | COVERAGE TYPE | ANNUAL AVERAGE |

|---|---|---|

| Farmers | High | $4,918.73 |

| Farmers | Medium | $4,799.09 |

| Farmers | Low | $4,573.64 |

| Geico | High | $3,493.66 |

| Geico | Medium | $3,383.08 |

| Geico | Low | $3,199.86 |

| Liberty Mutual | High | $3,365.61 |

| Liberty Mutual | Medium | $3,193.05 |

| Liberty Mutual | Low | $3,009.99 |

| Allstate | High | $2,320.93 |

| Allstate | Medium | $2,178.85 |

| Allstate | Low | $2,020.68 |

| Progressive | High | $2,369.14 |

| Progressive | Medium | $2,176.37 |

| Progressive | Low | $1,988.28 |

| USAA | High | $1,255.96 |

| USAA | Medium | $1,188.96 |

| USAA | Low | $1,123.14 |

| State Farm | High | $1,108.19 |

| State Farm | Medium | $1,042.97 |

| State Farm | Low | $969.68 |

You can see from the above information that a high coverage plan with State Farm is $1,108.19, while a LOW coverage plan with Progressive is $1,988.28. That’s approximately $800 MORE than you’d be paying to have less protection for yourself.

Making sure that you compare rates is going to be key to keep the lowest rates you can while still getting the optimal coverage plan.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are credit history rates by companies?

Want some good news? If your credit isn’t the greatest, you don’t have to worry in the state of Hawaii.

According to Experian, the average Vantage Score for Hawaii is 693, almost 20 points higher than the national average at 675!

Due to this, insurers in the state of Hawaii have been prohibited from using credit card history as a factor of insurance rates. So keep up the good work Hawaii citizens.

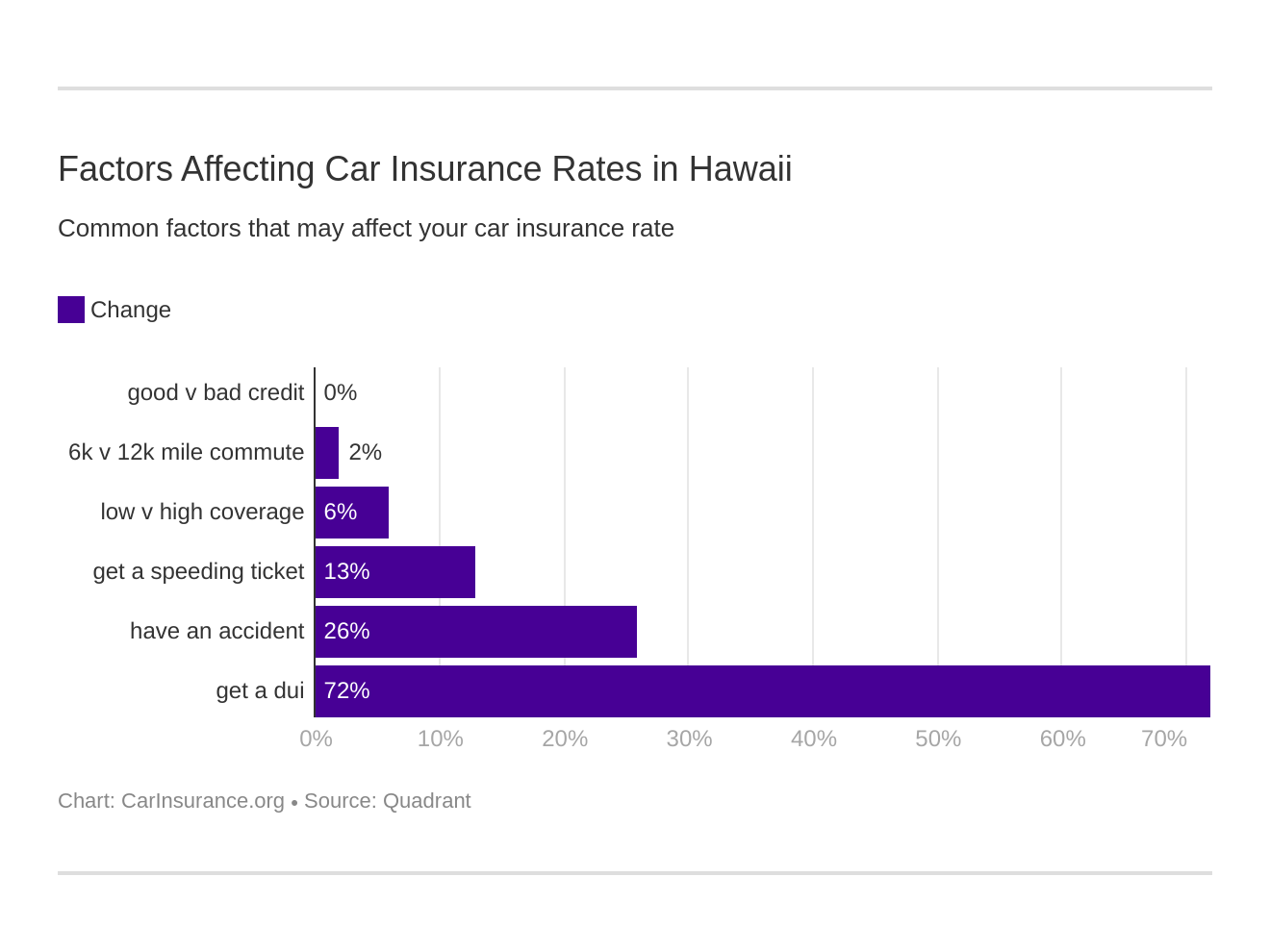

What are driving record rates by companies?

Yes, how you drive factors into what kind of rate you’ll be offered. Shocking, right? Having a clean driving record is one of the top ways you can save money on your insurance rate, guaranteed.

Don’t believe us? Just check out how different driving violations and accidents can affect Hawaii rates below.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | Clean record | $1,293.11 |

| Allstate | With 1 speeding violation | $1,774.29 |

| Allstate | With 1 accident | $1,904.18 |

| Allstate | With 1 DUI | $3,722.37 |

| Farmers | Clean record | $2,290.51 |

| Farmers | With 1 speeding violation | $2,290.51 |

| Farmers | With 1 accident | $3,419.86 |

| Farmers | With 1 DUI | $11,054.40 |

| Geico | Clean record | $1,414.01 |

| Geico | With 1 speeding violation | $1,414.01 |

| Geico | With 1 accident | $1,834.57 |

| Geico | With 1 DUI | $8,772.86 |

| Liberty Mutual | Clean record | $1,697.57 |

| Liberty Mutual | With 1 speeding violation | $2,124.22 |

| Liberty Mutual | With 1 accident | $2,124.22 |

| Liberty Mutual | With 1 DUI | $6,812.19 |

| Progressive | Clean record | $1,649.25 |

| Progressive | With 1 speeding violation | $2,137.29 |

| Progressive | With 1 accident | $2,322.92 |

| Progressive | With 1 DUI | $2,602.26 |

| State Farm | Clean record | $950.44 |

| State Farm | With 1 speeding violation | $1,040.29 |

| State Farm | With 1 accident | $1,130.10 |

| State Farm | With 1 DUI | $1,040.29 |

| USAA | Clean record | $901.19 |

| USAA | With 1 speeding violation | $942.77 |

| USAA | With 1 accident | $1,109.67 |

| USAA | With 1 DUI | $1,803.79 |

The more severe the offense, the more dollar signs go behind your insurance rate, particularly if you get even one DUI. A DUI offense, in particular, will tack on the most.

You can see thousands of dollars in extra costs if you were to have a DUI on your record. State Farm, for example, charges an addition $8,763.89 MORE if you have a DUI on your record.

So make sure you buckle up and follow the rules of the road Hawaii.

Number of Insurers in Hawaii

| PROPERTY & CASUALTY INSURANCE | AMOUNT |

|---|---|

| Domestic | 17 |

| Foreign | 608 |

| Total | 625 |

You may see the above information and wonder what it all means.

- Domestic Insurer – an insurance company admitted by and formed under the laws under the state in which insurance is written

- Foreign Insurer – an insurance provider which was formed under the laws of another state, but is still doing business in Hawaii

What does this mean for you? Nothing necessarily, it only means that if you do choose a foreign provider that you’ll want to make sure that the insurance policy you have with them has at LEAST all of the minimum liability coverages you are required to have in Hawaii.

What Hawaii state laws should you know?

Hawaii is a beautiful and unique state. As it is very unique, it comes with its own unique state laws. Each state has its own state laws because, after all, each state is different.

In this section, we’ll dive deeper into the laws unique to Hawaii, from high-risk drivers, to vehicle licensing laws, and more. Keep reading to find out more!

As would be expected, there are specific car insurance laws that are applicable only to Hawaii citizens.

Keep reading to find out more about some of the specifics you’ll want to watch out for.

How State Laws for Insurance are Determined

Did you know that Hawaii requires a 30-day waiting period before you are allowed to legally use your car insurance? That’s right, according to the NAIC:

“Regarding rate filings, prior approval – 30-day waiting period – commissioner may require insurers to submit new filings for any type of coverage when the commissioner has actuarially sound information that the rates are excessive, inadequate or unfairly discriminatory.”

So if you’re filing for your insurance policy for the first time, make sure you wait the appropriate amount of time before you start driving. If you don’t, your insurance won’t be valid and you could be fined for not having your proper insurance.

Windshield Coverage

Having windshield coverage can be extremely beneficial, as it can help you with any damages and replacements you may have.

Currently, in Hawaii, there are no specific laws regarding windshield coverage. It is a completely optional coverage that you can add to your policy, should a provider offer it to you.

If you do wish to add windshield coverage to your policy, you will need to make sure you have comprehensive coverage.

High-Risk Laws

Are you known as a “high-risk driver”? If you are, chances you’ve had an extremely hard time finding insurance providers willing to offer you coverage. The more accidents and traffic violations on your record you have, the less likely a provider is going to want to cover you.

This places you in a strange conundrum, as you are required to have insurance to legally drive in Hawaii, but no one wants to willingly provide you with an insurance policy. What do you do?

Well, in Hawaii, there is something known as the Hawaii Joint Underwriting Plan. It’s essentially a program that helps to ensure that drivers who are unable to secure insurance from a provider have access to the insurance they need.

There are currently three authorized service insurers who participate actively in this program:

- First Insurance Company of Hawaii

- Island Insurance

- State Farm

So if you’re a high-risk driver, you’re in luck! It’s advised that if you ARE able to find some kind of insurance coverage from a willing insurance provider, to accept that plan.

Once you participate in this program, you are assigned to one of the above providers, who then are allowed to charge you at whatever rate they feel is appropriate for you. This likely is MUCH higher than what you’d normally be paying.

Use this plan as a last resort if you can.

Low-Cost Insurance

Do you need some financial assistance for getting car insurance? Well, some residents of Hawaii are in luck!

If you are a citizen receiving disability benefits through Hawaii’s Assistance to the Aged, Blind, and Disabled (AABD) Program, you are probably eligible for FREE car insurance.

In order to participate, you will need to meet at least one of the following criteria:

- 65 years or older

- Legally blind

- Permanently disabled

- Caring for and living with an individual receiving AABD financial aid

Automobile Insurance Fraud in Hawaii

Automobile Insurance Fraud is a criminal offense across the nation, including Hawaii.

Insurance fraud can be committed in any of the following ways:

- Faking an accident or making a claim that is false

- Assisting someone in faking an accident/making a false claim in order to receive benefits

- Adding on additional “costs” onto a legitimate claim

This crime is taken very seriously across the nation. According to the III, it’s estimated that over $30 BILLION is stolen by car insurance fraud. Per year! The penalty for such a crime could result in hefty fines and even prison time!

Rule of thumb, don’t commit insurance fraud. It’s simply not worth it.

Statute of Limitations

So, you’ve been in an accident and need to make a claim. How long do you have? Well, there’s something known as the statute of limitations that limits the amount of time you have to make and resolve such a claim, or to take your case to court.

In Hawaii, you have 2 years to make a claim for either a personal injury or for property damage.

This may seem like a decent amount of time, but keep in mind that time goes by quickly. Especially if you’re dealing with the repercussions of an accident! So make sure you make your claim as soon as you can.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the vehicle licensing laws?

On top of having proof of insurance with you when you’re driving, what else are you required to have with you? That’s right, your driver’s license! There are a few laws that are mandatory in the state of Hawaii for vehicle licensing.

We’ll discuss those in depth below.

Penalties for Driving without Insurance

As we’ve mentioned numerous times in previous sections, you have to have proof of insurance with you at all times while operating your vehicle. So what would happen if you were caught without having your insurance, or if you didn’t have insurance at all?

- First Offense: $500 fine (or community service if approved by a judge) and a three-month license suspension (or purchase of a six-month non-refundable insurance policy)

- Second Offense: minimum of a $1500 fine (if the offense has occurred within five years of the first offense), and a one-year license suspension (or purchase of a six-month non-refundable insurance policy)

Hawaii’s revised Statute Section 286-26 states that proof of insurance for registration is acceptable in the form of a hard copy or electronic copy (on your mobile device). So make sure you keep your proof of insurance with you, or you could be parting with a hefty chunk of change.

Teen Driver Laws

If you are aged 15 years or older, congratulations, you’re allowed to start driving with a learner’s permit in Hawaii! There are a few requirements that teen drivers must meet in order to receive a license or a restricted license, listed below.

| YOUNG DRIVER LICENSING LAWS | AGE RESTRICTIONS | PASSENGER RESTRICTIONS | TIME RESTRICTIONS |

|---|---|---|---|

| Learner's Permit: | 15 years, 6 months | Passenger must be licensed driver aged 21 or older supervising in front seat. | Between 11 p.m. and 5 a.m., young driver must be accompanied by a parent or guardian. Teens must have 50 hours of driving practice, including 10 hours at night, with a parent or legal guardian, before obtaining provisional license. |

| Provisional License | Must be 16 years old and have held learner's permit for at least 6 months. | Can drive alone but transport no more than one person under age 18 who is not a household member. | May not drive between 11 p.m. and 5 a.m. unless accompanied by a licensed parent or guardian or driving to/from employment or to/from a school-authorized activity at the driver’s school. Between 11 p.m. and 5 a.m., they may not transport more than one person under 18 unless accompanied by a parent or guardian. |

| Full License | Must be 17 years old and have held provisional license for at least 6 months. | None. | None. |

With the new excitement of getting out on the road for the first time, don’t forget that with great driving, comes great responsibility.

Older Driver License Renewal Procedures

| LICENSE RENEWAL PROCEDURES | GEN POPULATION | OLDER POPULATION |

|---|---|---|

| License renewal cycle | 8 years | 2 years for people 72 and older |

| Mail or online renewal permitted | by mail, limited to 2 consecutive renewals, but must appear in person at least every 16 years | by mail, limited to 2 consecutive renewals, but must appear in person at least every 16 years |

| Proof of adequate vision required at renewal | every renewal | every renewal |

New Residents

Want to make paradise your forever home? If so, there are a few things you’ll need to do as a new resident in regards to your vehicle.

New residents who are looking to get their Hawaii driver’s license will need to provide the following:

- Proof of name/date of birth

- Proof of Social Security Number

- Proof of Legal Presence

- Proof of Residence

The following documents are acceptable forms for the above requirements:

- Valid current state license (from the state you’re moving from)

- Certified copy of your birth certificate

- Certified copy of your marriage certificate

- Certification of a name change

- State of military ID card

- Immigration paperwork

- Social Security Card

Negligent Operator Treatment System

Have you ever heard of comparative negligence? It basically means that if an injured party was less than 51% at fault for an accident, they can still receive damages for that accident.

Hawaii is a No-Fault state, so all of these costs come directly from your own insurance company first.

If you are to exhaust your insurance due to your injury, then under comparative negligence, you are able to pursue a case against the driver who caused the accident for additional damages.

This comparative negligence errs on the side of 51 percent, meaning you will need to prove that this other driver is the direct cause of your injuries by at LEAST 51 percent.

This also means that you, as the injured person, must be found to have been LESS than 51 percent at fault for your injury in order to collect damages.

So if, for example, you were texting and driving when the accident occurred, you may be found to be 51 percent or more at fault, and you, therefore, would not be able to proceed with your claim against the other driver.

In addition to all of this, if you bear some form of fault for the accident (even if it is less than the 51 percent), the amount you are found to be at fault will be subtracted from any damages you do recover.

So if you were found to have only been responsible for 10 percent of the accident, you would be able to receive damages from the other driver, but 10 percent would be subtracted from the amount you would receive.

What are the rules of the road?

You’re gonna need to know some of the rules of the road in order to drive in Hawaii. After all, if you break a law you didn’t even know existed, you’re still going to be ticketed and have to face the penalties.

We don’t want you to have to experience that, so we’ve collected some of Hawaii’s most common rules of the road.

Fault Versus No-Fault

As mentioned in the previous section about negligence, Hawaii is a No-Fault state. It is one of the few states in the nation that follows this insurance system.

This means that your own insurance provider will have to cover the cost of your accident, no matter who caused the accident.

This system is the reason why Hawaii also requires drivers to have Personal Injury Protection coverage. All states that fall under the No-Fault insurance system are required to have this coverage added to their insurance policy.

Seat Belt and Car Seat Laws

Seat belt and car seat laws are put into place in order to keep you and your passengers safe.

| Initial effective date | Primary enforcement? | Who is covered? In what seats? | Maximum base fine 1st offense, additional fees may apply |

|---|---|---|---|

| 12/16/85 | yes; effective 12/16/85 | 8+ years in all seats | $45 |

| Must be in child safety seat | Adult belt permissible | Maximum base fine 1st offense, additional fees may apply | Preference for rear seat |

|---|---|---|---|

| 3 years and younger in a child restraint; 4 years through 7 years must be in a child restraint or booster seat | 4 through 7 years who are taller than 4'9"; 4 through 7 years who are at least 40 pounds seated in a rear seat where if there are no available lap/shoulder belts, may be restrained by a lap belt | $100 | law states no preference for rear seat |

Keep in mind that primary enforcement just means that if law enforcement sees you without a safety belt, that they can pull you over immediately.

In addition to all of this, Hawaii drivers are also charged $50 for a mandatory child restraint education program and a $10 surcharge deposited into a neurotrauma fund. So make sure you have your seat belts buckled and that you have your child in the proper car seat!

Keep Right and Move Over Laws

Keep Right and Move Over Laws are pretty simple to understand.

Keep Right laws in Hawaii state you are to keep right on the road if you are driving slower than the average speed of the traffic around you. Easy enough, right?

Move Over laws are just as easy to remember. If you are approaching an emergency vehicle (basically any vehicle you see with flashing lights), then you must move over to the adjacent land to that vehicle.

If you’re unable to do this safely, you are then required to move over when it is safe to do so or slow down. If you don’t, you could be facing fines of up to $1,000.

Speed Limits

Hawaii has speed limits that are unique to the different road types that it has, listed below.

- Rural/Urban Interstates: 65 mph

- Limited Access Roads: 55 mph

- Other Roads: 45mph

Make sure you pay close attention to the posted speed limits as you’re driving.

Ridesharing

You’ve likely heard of the dozens of ridesharing services available these days. Services such as Uber and Lyft have grown massively in popularity in the past couple of years.

As such, many states require that if you are to work for one of these types of services that you are to carry (in addition to your existing car insurance policy) ridesharing insurance coverage.

As of now, Hawaii currently doesn’t have any providers in the state who provide this type of coverage.

Automation on the Road

What exactly does automation on the road? Are we talking about flying cars here?

According to the Insurance Institute for Highway Safety (IIHS), it is defined as:

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Hawaii currently only has authorized the testing of these types of vehicles rather than deployment. So while you may not see these types of vehicles on the road just yet, you might in the future!

What are the safety laws?

What other kinds of safety laws could be out there to help protect you? Keep reading to find out!

DUI Laws

Hawaii has some pretty strict laws in place about drunk driving. Why?

Hawaii is ranked as the 9th most dangerous state for drunk driving in the entire nation!

So what exactly are some of the laws regarding drunk driving in Hawaii?

| Hawaii DUI Laws | Details |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | N/A |

| Criminal Status by Offense | 1st-3rd petty misdemeanors, 4th+ class C felony |

| Formal Name for Offense | Driving Under the Influence (DUI) / Operating a Vehicle Under the Influence of an Intoxicant (OVUII) |

| Look Back Period/Washout Period | 5 years |

| Mandatory Interlock | All offenders |

The penalties for committing this crime are pretty severe, and only escalate the more offenses you get.

| Number of Offenses | ALS / Revocation | Prison Time | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 1 year | 48 hours-5 days | $150-$1000 +$25 to neurotrama special fund +$25 to trauma system special fund if court ordered | 14 hour min rehab program; may require 72 hours community service; IID for 1 year |

| 2nd Offense | 2nd offense in 5 years: 18 months-2 years | min 240 community service hours OR 5-30 with 48 consecutive hours | $500-$1500+$25 to neurotrama special fund+$50 to trauma system fund if court ordered; additional $500 if child in vehicle | abuse and education program required; IID during revocation period |

| 3rd Offense | in 5 years of prior two convictions, 2 year revocation | 10-30 days, 48 hours served consecutively | $500-$2500+$25 to neurotrama special fund+$50 to trauma system fund if court ordered; additional $500 if child in vehicle | 240 min community service; abuse and education program required, IID required during revocation period |

Moral of the story? Don’t drink and drive, it’s simply not worth it!

Marijuana-Impaired Driving Laws

Depending on the state you live in, if you drive under the influence of marijuana, you may face particular penalties. In Hawaii, there are not currently any marijuana-specific impaired driving laws.

That doesn’t mean you won’t get in trouble, however, if you decide to drive after using marijuana. It is currently only legal for medical use, but not in any other case. So you could still face penalties as if you were driving under the influence.

If we impart anything to you as you read this guide it is this: do not drive after consuming any type of substance. It is not worth your life, or the lives of others.

Distracted Driving Laws

Distracted driving is not only dangerous but can lead to some serious consequences. It only takes a second for an accident to occur, so making sure you keep your eyes on the road at all times is crucial.

| Hand-held ban | Young drivers all cellphone ban | Texting ban | Enforcement |

|---|---|---|---|

| all drivers | drivers younger than 18 | all drivers | primary |

Hawaii takes this distracted driving very seriously, banning the use of texting and hand-held devices for all drivers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How bad is vehicle theft in Hawaii?

Down to the final stretch. In this section, we’ll cover what driving around in the land of surf and turf is really like. Everything from common fatality statistics, to transportation, and more.

Let’s do this!

A surprising fact about vehicle theft is that it is not usually the sports cars that are most stolen. Instead, it is usually your everyday, run-of-the-mill vehicle that is common amongst a lot of drivers. Examples of this would be Honda, Toyota, Nissan, and more.

| MAKE/MODEL | YEAR | NUMBER OF THEFTS |

|---|---|---|

| Honda Civic | 2000 | 250 |

| Honda Accord | 1994 | 180 |

| Ford Pickup (Full Size) | 2006 | 154 |

| Toyota Tacoma | 2003 | 86 |

| Toyota Corolla | 2004 | 64 |

| Toyota Camry | 2000 | 55 |

| Toyota 4Runner | 1997 | 45 |

| Nissan Frontier | 2004 | 44 |

| Nissan Altima | 2004 | 42 |

| Dodge Pickup (Full Size) | 2001 | 37 |

Poor Honda and Toyota, they can’t catch a break.

Are there a lot of road fatalities in Hawaii?

There are infinite ways to cause an accident on the road, more so than even imaginable. We’ve collected the data from some of the most common causes of fatalities on the road for you, just so you can see what things to watch out for out there on the road.

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 37 | 26 | 14 | 2 | 0 | 79 |

| Rain | 5 | 6 | 1 | 0 | 0 | 12 |

| Snow/Sleet | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 1 | 1 | 0 | 0 | 2 | 4 |

| TOTAL | 43 | 33 | 16 | 2 | 2 | 96 |

All Fatalities by County

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hawaii | 26 | 13 | 21 | 32 | 35 |

| Honolulu | 53 | 53 | 48 | 59 | 49 |

| Kalawao | 0 | 0 | 0 | 0 | 0 |

| Kauai | 7 | 8 | 3 | 8 | 6 |

| Maui | 16 | 21 | 21 | 21 | 17 |

Road Type Fatalities

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 58 | 41 | 42 | 42 | 56 | 40 | 30 | 13 | 25 | 25 |

| Urban | 49 | 68 | 71 | 58 | 69 | 62 | 65 | 80 | 94 | 82 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| Total | 107 | 109 | 113 | 100 | 125 | 102 | 95 | 93 | 120 | 107 |

Person Type Fatalities

| Person Type | 2,013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 21 | 16 | 20 | 40 | 34 |

| Light Truck - Pickup | 12 | 15 | 9 | 8 | 10 |

| Light Truck - Utility | 9 | 7 | 7 | 7 | 12 |

| Large Truck | 3 | 0 | 0 | 1 | 0 |

| Other/Unknown Occupants | 1 | 0 | 1 | 0 | 2 |

| Light Truck - Van | 0 | 0 | 1 | 3 | 3 |

| Light Truck - Other | 0 | 0 | 0 | 5 | 0 |

| Motorcyclists | 29 | 25 | 26 | 24 | 25 |

| Pedestrian | 23 | 24 | 25 | 29 | 14 |

| Bicyclist and Other Cyclist | 2 | 4 | 2 | 0 | 6 |

| Other/Unknown Nonoccupants | 2 | 4 | 2 | 3 | 1 |

| Total Nonoccupants | 27 | 32 | 29 | 32 | 21 |

| Total | 102 | 95 | 93 | 120 | 107 |

Crash Type Fatalities

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 71 | 68 | 54 | 75 | 59 |

| Involving a Large Truck | 7 | 4 | 5 | 6 | 9 |

| Involving Speeding | 45 | 36 | 41 | 54 | 50 |

| Involving a Rollover | 19 | 10 | 14 | 16 | 26 |

| Involving a Roadway Departure | 54 | 44 | 42 | 65 | 60 |

| Involving an Intersection (or Intersection Related) | 20 | 30 | 26 | 31 | 30 |

| Total Fatalities (All Crashes)* | 102 | 95 | 93 | 120 | 107 |

5 Year Trend for the Top 10 Counties

| Ranking | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Honolulu County | 53 | 53 | 48 | 59 | 49 |

| 2 | Hawaii County | 26 | 13 | 21 | 32 | 35 |

| 3 | Maui County | 16 | 21 | 21 | 21 | 17 |

| 4 | Kauai County | 7 | 8 | 3 | 8 | 6 |

| 5 | Kalawao County | 0 | 0 | 0 | 0 | 0 |

| Total | All Counties | 102 | 95 | 93 | 120 | 107 |

Speeding Fatalities by County

Speeding is one of the most common causes of accidents, no matter what state you’re in.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hawaii | 11 | 4 | 9 | 12 | 19 |

| Honolulu | 27 | 19 | 21 | 30 | 25 |

| Kalawao | 0 | 0 | 0 | 0 | 0 |

| Kauai | 2 | 3 | 1 | 4 | 1 |

| Maui | 5 | 10 | 10 | 8 | 5 |

So instead of speeding, make sure you adhere to the road signs posted and drive safely.

Alcohol-Impaired Fatalities by County

Drunk driving is no joke, and the statistics below only show how deadly the decision to drink and drive can be.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hawaii | 5 | 3 | 7 | 8 | 11 |

| Honolulu | 19 | 17 | 17 | 19 | 17 |

| Kalawao | 0 | 0 | 0 | 0 | 0 |

| Kauai | 3 | 2 | 1 | 3 | 1 |

| Maui | 7 | 7 | 12 | 7 | 13 |

That’s quite a lot of people who won’t be able to return home to their families, all because one drunk driver decided to get behind the wheel.

So make sure that if you do decide to drink, that you have a safe way to get home. You can have a designated driver who won’t drink that can drive you home, or you can have a friend/family member pick you up, or you can even call one of the ridesharing services we mentioned in a previous section.

Teen Drinking and Driving

Another reason why the statistics above are so tragic is that this INCLUDES teen drivers who decided to drink and drive.

Hawaii is ranked as the 28th highest number of DUI arrests for individuals under 18 years old

The DUI laws in Hawaii are put into place for a reason, and this is just one of the many.

EMS Response Time

Should you find yourself in an accident, who are you gonna call? That’s right. No, not Ghostbusters, but the Emergency Medical Services (EMS). Knowing how long they typically take for rural and urban roads can help you know exactly how soon help will come to get you, and to take you to the hospital.

| Road Type | Time of Crash to EMS | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 3 minutes | 14.45 minutes | 34.86 minutes | 48.79 minutes | 23 |

| Urban | 3.13 minutes | 7.51 minutes | 27.54 minutes | 36.38 minutes | 85 |

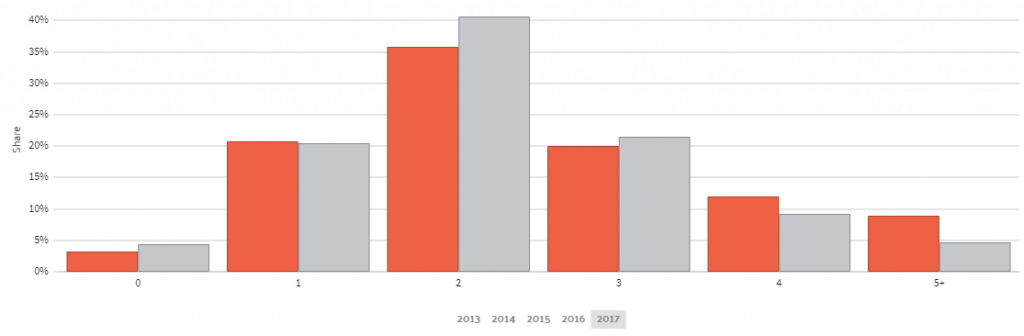

What is car ownership like?

The average number of vehicles owned is 2 cars per household. This is a very common average, as most households across the nation also have approximately 2 vehicles.

Commute Time

Just how long does it take you to get to your destination?

The average travel time in Hawaii is approximately 25.8 minutes. This is only slightly above the national average of 25.5 minutes!

In addition to this, approximately 2.65 percent of the workforce in Hawaii have something known as a super commute. This is a commute that is in excess of 90 minutes.

We don’t envy those of you with these super commutes, we salute you.

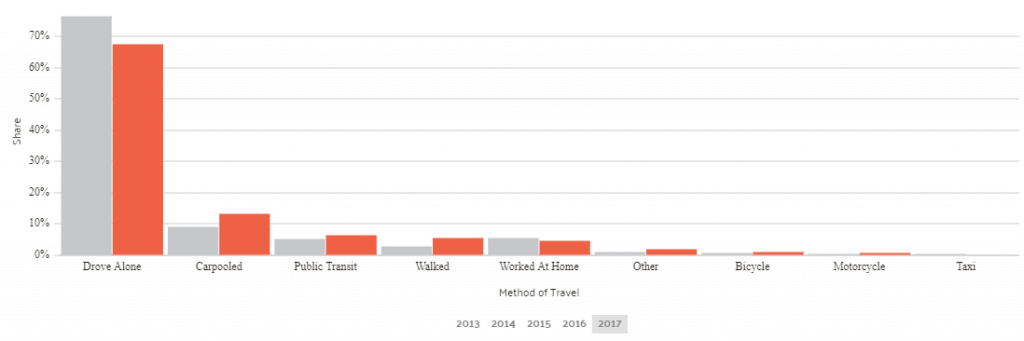

Commuter Transportation

Statistically, in Hawaii, drivers tend to prefer to drive alone as opposed to driving with others.

Traffic Congestion in Hawaii

Traffic is probably one of the most dreaded parts of driving on the roads today. For those living in Honolulu, HI, traffic can be pretty intense. It makes sense, given that it is the capital of Hawaii and the most populated city in the state

Honolulu made it onto INRIX’s scorecard for global traffic.

| Honolulu INRIX Scorecard | Details |

|---|---|

| 2018 Impact Rank (2017) | 111 (117) |

| Hours Lost in Congestion | 92 (132) |

| Year over Year Change | - 4% |

| Cost of Congestion (per driver) | $1,282 |

| Inner City Travel Time (minutes) | 5 |

| Inner City Last Mile Speed (mph) | 12 |

The good news of this, however, is that it appears that traffic has gotten better from 2017 to 2018, with an improvement in traffic of 4 percent.

According to TomTom though, Honolulu still ranks as the number 8 most congested city in the United States.

They report that there is 29 percent of extra travel time, with a zero percent change since the previous year.

| Honolulu TomTom Congestion | Details |

|---|---|

| Morning Peak | 56% |

| Evening Peak | 58% |

| Highways | 17% |

| Non-highways | 36% |

| Extra Travel Time | 34 minutes/day 132 hours/year |

Numbeo, on the other hand, states that Honolulu is the 5th most congested city in the nation.

| Traffic Index | Time Index (in minutes) | Time EXP. Index | Inefficiency Index | CO2 Emission Index |

|---|---|---|---|---|

| 209.52 | 42.52 | 2441.07 | 225.20 | 10525.33 |

That’s all folks! You’ve made it to the end of our comprehensive guide for Hawaii! We hope that this guide was able to help you navigate the different things you’ll need to consider when selecting the best insurance coverage for yourself.

Want to start comparing today? Use our FREE online tool, all you need is your zip code.

Resources

- https://content.naic.org/

- https://www.experian.com/blogs/ask-experian/consumer-credit-review/

- https://www.consumerreports.org/cro/car-insurance/credit-scores-affect-auto-insurance-rates/index.htm

- https://cca.hawaii.gov/ins/other_ins/hjup/

- https://humanservices.hawaii.gov/bessd/FNSRandR/

- https://www.iii.org/article/background-on-insurance-fraud

- https://www.capitol.hawaii.gov/sessions/session2015/bills/HB703_.HTM

- https://law.justia.com/codes/hawaii/2013/title-17/chapter-291c/section-291c-41/

- https://www.iihs.org/ https://inrix.com/scorecard/ https://www.tomtom.com/en_gb/trafficindex/city/honolulu

- https://www.numbeo.com/traffic/region_rankings.jsp?title=2019®ion=021