Vermont

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 6.8%

Car insurance is a necessity if you’re going to operate a motor vehicle. Vermont is a small state in comparison to most, but the competition for car insurance companies is the same.

You can get started on your car insurance quote for Vermont today by simply entering your ZIP code above.

As you go through this section, you’ll see the culture of vehicles in Vermont and car insurance coverage rates you can expect from car insurance companies in Vermont.

How to get Vermont car insurance coverage & rates

You could spend a whole work week or more figuring out what kind of insurance you need and where to get it.

Or you could find everything you need to know right here and go do something fun with all your extra time. Like go skiining on one of Vermont’s many top-ranked mountains.

We’ll cover what’s required, optional car insurance coverage, and what you can expect for rates In the great state of Vermont.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s Vermont car culture like?

Rural roads and beautiful sceneries are the pride and joy of the “Green Mountain State.” Vehicles equipped for the harsh winter weather conditions are winners in Vermont. The state prides itself on being environmentally friendly. Vermont even encourages biodiesel and electric cars — so much so that they are investing time and money into the industry of car mechanics.

What’s Vermont minimum coverage?

In Vermont, the minimum requirement for car insurance is liability coverage. The liability coverage is as follows:

- $10,000 for property damage per car accident

- $25,000 for injury or death to one person per car accident

- $50,000 for injury or death to more than one person per accident

Vermont motorists are required to have uninsured/underinsured motorist insurance, also. This insurance covers a motorist who is in a car accident with another driver who is not insured or who is underinsured.

The minimum limits for uninsured/underinsured coverage are $50,000 for one person who’s sustained bodily injury in a car accident and $100,000 for two or more people who are sustained bodily injury in a car accident.

What’s the form of financial responsibility?

There are different ways a motorist can show proof of financial responsibility. Forms or proof of financial responsibility are items proving you have car insurance, a driver’s license, and vehicle registration. A law enforcement officer will ask for these sorts of items should you get pulled over.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What percentage of income are insurance premiums?

The amount of money that comes out of your income for the car insurance coverage per year may make you cringe. The national average premium as a percentage of income for car insurance coverage was 2.4 percent in 2014.

These percentages fluctuate from year to year, but not as much as you might think. The information below will provide an example of how percentages change in a three-year trend.

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Vermont | $747 | $42,267 | 1.77% | $735 | $40,990 | 1.79% | $727 | $40,735 | 1.78% |

| National Average | $982 | $40,859 | 2.40% | $951 | $39,192 | 2.43% | $924 | $39,473 | 2.34% |

The percentage of income values in Vermont is nearly one1 percent lower than the national average. In a three-year trend, Vermont’s full coverage has remained under $800, which is at least 1.8 percent of annual income in Vermont.

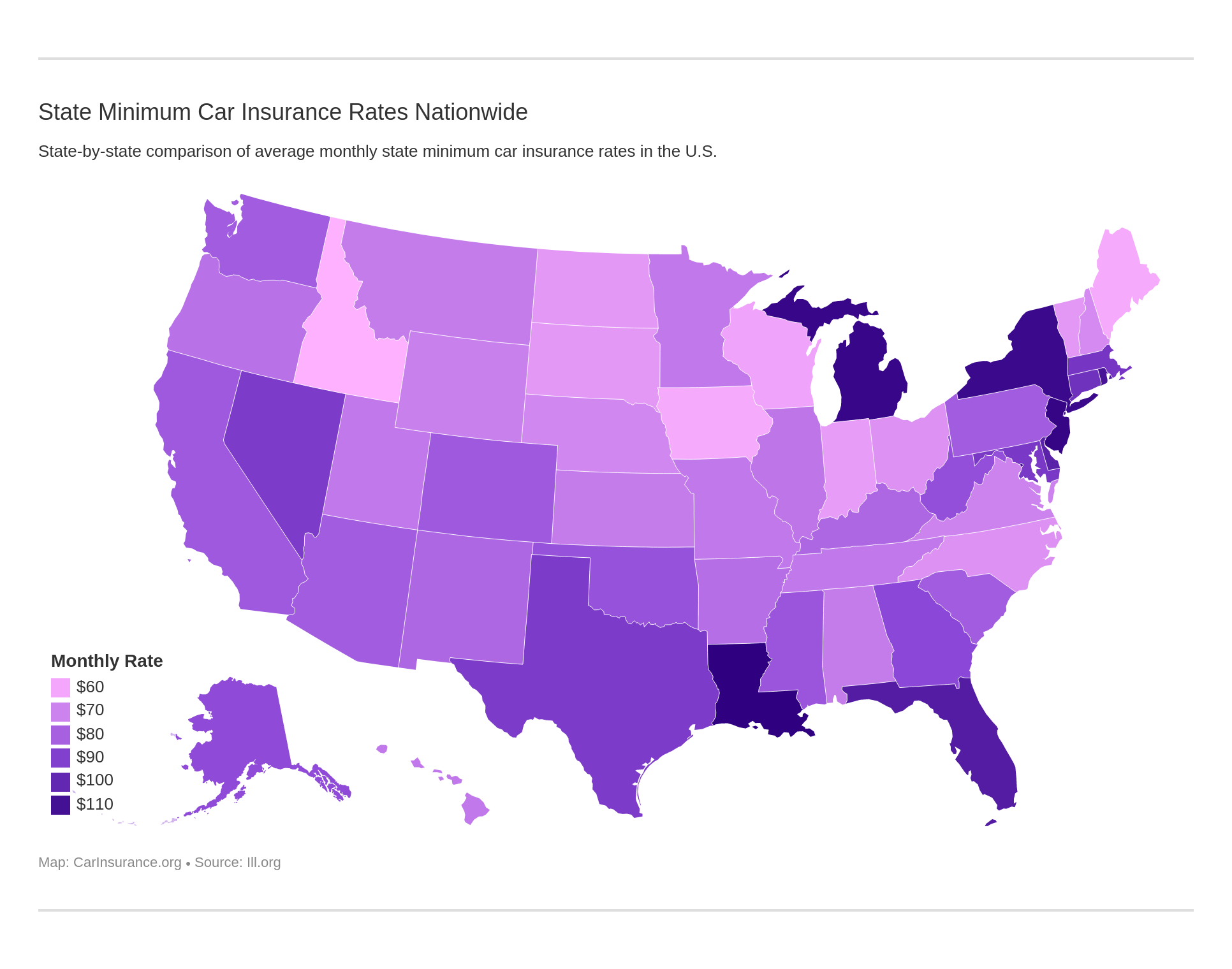

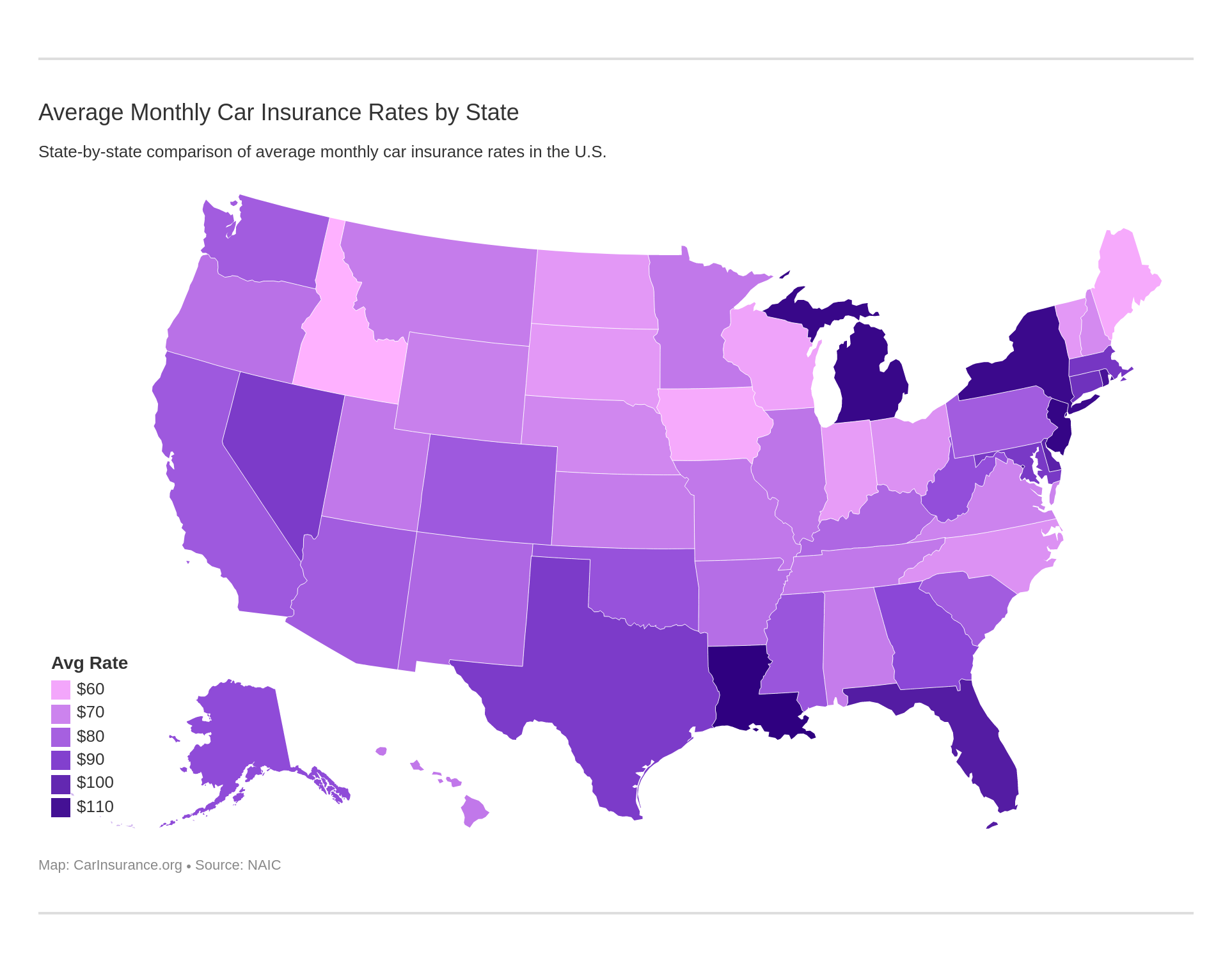

What are the average monthly car insurance rates in VT (liability, collision, comprehensive)?

We mentioned how liability coverage is the minimum requirement for Vermont, but what about other types of coverage? Collision and comprehensive coverage are often available to motorists seeking a policy for car insurance providers.

Collision coverage is additional coverage for property damage should a car accident happen with another driver, while comprehensive coverage insures a motorist if their vehicle is damaged due to theft, falling objects, weather conditions, or events.

How much do those coverages cost in Vermont?

| Coverage Type | Vermont's Annual Average Rate | National Annual Average Rate |

|---|---|---|

| Liability | $341 | $516 |

| Collision | $278 | $300 |

| Comprehensive | $118 | $139 |

| Combined (Full) | $738 | $955 |

Vermont motorists will have the option to add collision and comprehensive to their policy, but it would increase the monthly premium. Compared to the national average, Vermont’s annual car insurance rates are almost $100 cheaper.

If you want to cover all your bases, enlist in combined or full coverage.

Is there an additional liability?

Some call it double coverage, but additional liability coverages ensure medical bills will get paid after a car accident. Additional liability coverages include Medical Payments (MedPay), Personal Injury Protection (PIP), and uninsured/underinsured motorist (UM/UIM).

Personal injury protection is not required in the state of Vermont, but uninsured/underinsured motorist coverage is. MedPay is an additional liability coverage that pays for medical bills of injured motorists. Many choose MedPay over PIP in Vermont. The data table below will reflect that.

| Loss Ratio Type | Loss Ratio in 2013 | Loss Ratio in 2014 | Loss Ratio in 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 80.01% | 78.56% | 83.44% |

| Personal Injury Protection (PIP) | - | - | - |

| Uninsured/Underinsured Motorist (UUM) | 71.48% | 51.66% | 76.72% |

A loss ratio is the number of claims being paid out compared to the money an insurance company makes. Percentages close to 100 show the majority of car insurance companies paid their claims and earned money along the way.

For example, the loss ratio for UM/UIM in 2015 was 76.72 percent. So for every $100 that a car insurance company earned, they paid out $77 to claims. Low loss ratios reflect insurance companies’ inability to pay out claims, and loss ratios exceeding 100 show a car insurance company isn’t earning money.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any add-ons, endorsements, & riders?

- Guaranteed Auto Protection (GAP) – Car insurance that pays the difference between the value or actual cash value (ACV) of a damaged or stolen vehicle and the amount owed on the car, usually under a loan or lease.

- Personal Umbrella Policy (PUP) – This car insurance option provides a stack of high limits of liability to protect an insured motorist against a catastrophic liability loss such as bodily injury, property damage, personal injury, and even libel.

- Rental Reimbursement – A car insurance coverage with additional coverage in case a motorist has paid additional costs for a car rental.

- Emergency Roadside Assistance – Most car insurance companies provide this. This is a car insurance coverage perk that sends out locksmiths and towtrucks in case a motorist is stranded on a roadway. Most insurance companies don’t require a deductible.

- Mechanical Breakdown Insurance – Often referred to as Equipment Breakdown Insurance, this car insurance endorsement is for loss due to mechanical or electrical breakdown of a motor vehicle.

- Non-Owner Car Insurance – Simply put, this is car insurance coverage for a motorist who has liability insurance but does not own a car.

- Modified Car Insurance Coverage – High-performance parts and custom paint jobs are covered by Modified Car insurance coverage. Alert your car insurance company that your car is custom-built.

- Classic Car Insurance – Classic cars can be treasures to gear-heads. The parts are just as rare and require costly repair if damaged. Classic Car Insurance covers those high costs.

- Pay-As-You-Drive or Usage-Based Insurance – Car insurance coverage that’s determined by how much you drive your car.

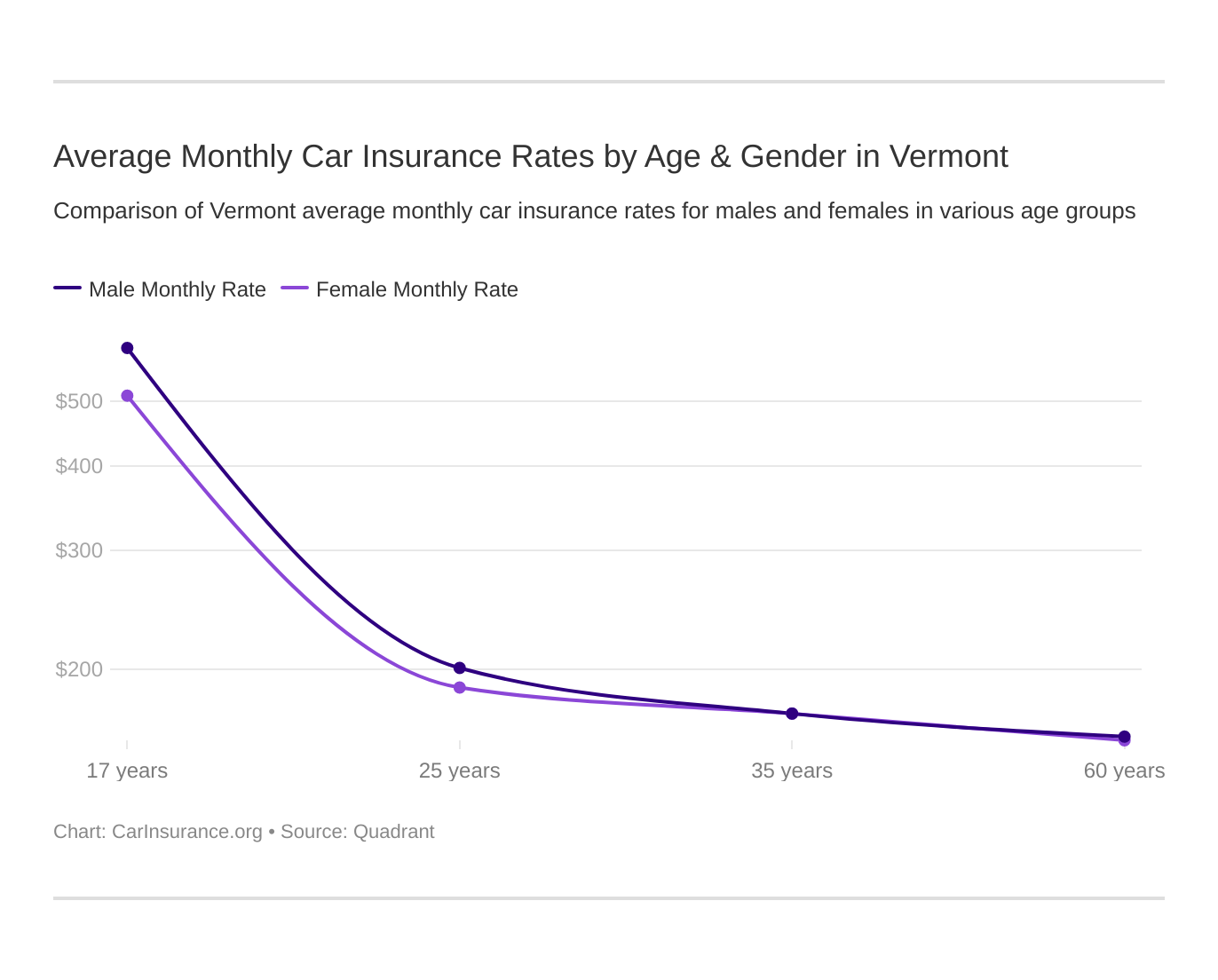

What are the average monthly car insurance rates by age & gender in VT?

Your age and gender can determine what you pay for car insurance coverage. We’ve collected some car insurance coverage data and compared them by age, gender, and marital status.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $5,154.27 | $6,803.81 | $2,449.28 | $2,688.80 | $2,156.27 | $2,156.27 | $2,057.16 | $2,057.16 |

| Geico | $3,848.67 | $4,488.09 | $1,420.67 | $1,390.28 | $1,684.84 | $1,566.30 | $1,657.04 | $1,509.79 |

| General Ins Co of America | $8,037.59 | $8,935.93 | $2,175.96 | $2,307.62 | $1,899.55 | $2,055.13 | $1,676.31 | $1,880.55 |

| Nationwide | $3,515.58 | $4,474.30 | $1,657.72 | $1,786.24 | $1,446.33 | $1,472.29 | $1,300.39 | $1,372.80 |

| Progressive | $10,429.81 | $11,415.82 | $3,448.68 | $3,670.58 | $3,373.74 | $3,347.85 | $3,018.68 | $3,031.96 |

| State Farm | $8,041.71 | $10,326.54 | $3,030.29 | $3,369.84 | $2,718.93 | $2,718.93 | $2,428.22 | $2,428.22 |

| USAA* | $3,710.69 | $3,881.09 | $1,568.30 | $1,637.38 | $1,145.98 | $1,150.47 | $1,070.48 | $1,064.01 |

Young, single males pay much more than males who are 35 years old and married. Females pay lower coverage rates. Married males and females pay the same rates at some companies.

What are the cheapest rates by Vermont cities?

Let’s narrow it down. What are car insurance rates for each city in Vermont? The table below will explain that. You can sort the table from highest to lowest or lowest to highest by clicking the “up” and “down” triangles at the top of the table.

| City | Average Grand Total |

|---|---|

| ORWELL | $3,117.06 |

| WINOOSKI | $3,120.61 |

| RUTLAND | $3,121.52 |

| PROCTOR | $3,122.86 |

| NEW HAVEN | $3,124.23 |

| GRAND ISLE | $3,129.69 |

| MIDDLEBURY | $3,131.51 |

| SOUTH BURLINGTON | $3,131.99 |

| ESSEX JUNCTION | $3,133.35 |

| RIPTON | $3,134.71 |

| BRIDPORT | $3,136.29 |

| SALISBURY | $3,136.29 |

| SHOREHAM | $3,136.29 |

| NORTH FERRISBURGH | $3,138.82 |

| ALBURGH | $3,140.08 |

| HANCOCK | $3,141.61 |

| WHITING | $3,141.61 |

| ISLE LA MOTTE | $3,142.08 |

| HUNTINGTON | $3,144.61 |

| COLCHESTER | $3,147.76 |

| NORTH HERO | $3,148.56 |

| JERICHO | $3,150.62 |

| SOUTH HERO | $3,151.83 |

| JONESVILLE | $3,152.92 |

| BURLINGTON | $3,158.55 |

| UNDERHILL CENTER | $3,168.55 |

| HIGHGATE SPRINGS | $3,170.34 |

| SHELBURNE | $3,172.92 |

| SHELDON SPRINGS | $3,176.26 |

| SAINT ALBANS BAY | $3,177.17 |

| CHESTER | $3,181.88 |

| LUDLOW | $3,184.67 |

| WESTON | $3,185.01 |

| CENTER RUTLAND | $3,186.44 |

| SPRINGFIELD | $3,186.54 |

| WINDSOR | $3,186.54 |

| STARKSBORO | $3,187.25 |

| WEST DUMMERSTON | $3,187.51 |

| BROWNSVILLE | $3,188.75 |

| PERKINSVILLE | $3,188.75 |

| WILLISTON | $3,190.14 |

| ASCUTNEY | $3,190.45 |

| FERRISBURGH | $3,190.53 |

| WELLS | $3,191.04 |

| VERGENNES | $3,191.52 |

| NORTH SPRINGFIELD | $3,191.55 |

| WEST RUTLAND | $3,191.69 |

| BRISTOL | $3,191.92 |

| SAINT ALBANS | $3,193.27 |

| CHARLOTTE | $3,193.77 |

| FAIR HAVEN | $3,193.90 |

| EAST FAIRFIELD | $3,195.51 |

| WEST PAWLET | $3,195.70 |

| CAVENDISH | $3,196.07 |

| POULTNEY | $3,196.14 |

| FAIRFIELD | $3,197.71 |

| PROCTORSVILLE | $3,198.86 |

| READING | $3,198.86 |

| GRANVILLE | $3,199.20 |

| HINESBURG | $3,199.68 |

| WESTFORD | $3,200.11 |

| FAIRFAX | $3,201.50 |

| CASTLETON | $3,203.02 |

| RICHMOND | $3,203.09 |

| HIGHGATE CENTER | $3,203.58 |

| SWANTON | $3,204.38 |

| SHELDON | $3,206.22 |

| PAWLET | $3,206.25 |

| BOMOSEEN | $3,207.67 |

| MILTON | $3,208.40 |

| BRANDON | $3,209.74 |

| MIDDLETOWN SPRINGS | $3,209.77 |

| PLYMOUTH | $3,209.97 |

| WESTMINSTER STATION | $3,210.12 |

| DORSET | $3,210.14 |

| BAKERSFIELD | $3,211.72 |

| FRANKLIN | $3,214.16 |

| WALLINGFORD | $3,214.43 |

| BRIDGEWATER CORNERS | $3,214.53 |

| EAST BERKSHIRE | $3,215.22 |

| MOUNT HOLLY | $3,215.93 |

| DANBY | $3,217.13 |

| UNDERHILL | $3,218.39 |

| MONTGOMERY CENTER | $3,218.67 |

| WHITE RIVER JUNCTION | $3,219.23 |

| EAST POULTNEY | $3,220.01 |

| PITTSFIELD | $3,220.16 |

| NORWICH | $3,220.86 |

| EAST WALLINGFORD | $3,221.06 |

| FLORENCE | $3,221.06 |

| ENOSBURG FALLS | $3,222.30 |

| MC INDOE FALLS | $3,222.81 |

| SHAFTSBURY | $3,223.74 |

| ARLINGTON | $3,224.09 |

| NORTH CLARENDON | $3,224.46 |

| BONDVILLE | $3,225.67 |

| EAST DORSET | $3,225.67 |

| MANCHESTER CENTER | $3,225.67 |

| WEST RUPERT | $3,225.67 |

| HYDEVILLE | $3,226.99 |

| POWNAL | $3,227.90 |

| NORTH BENNINGTON | $3,228.39 |

| WEBSTERVILLE | $3,228.76 |

| STAMFORD | $3,229.43 |

| TUNBRIDGE | $3,230.11 |

| PERU | $3,230.33 |

| RICHFORD | $3,230.46 |

| READSBORO | $3,230.47 |

| BENNINGTON | $3,230.61 |

| CHITTENDEN | $3,231.03 |

| PITTSFORD | $3,231.03 |

| EAST ARLINGTON | $3,231.24 |

| NORTH POWNAL | $3,231.24 |

| HARTLAND | $3,232.76 |

| SHARON | $3,233.30 |

| SOUTH POMFRET | $3,233.30 |

| SOUTH LONDONDERRY | $3,234.55 |

| SOUTH ROYALTON | $3,234.93 |

| ROCHESTER | $3,234.99 |

| BARRE | $3,236.57 |

| LONDONDERRY | $3,236.77 |

| CORINTH | $3,236.99 |

| CAMBRIDGEPORT | $3,237.68 |

| JACKSONVILLE | $3,237.68 |

| SAXTONS RIVER | $3,237.68 |

| SOUTH NEWFANE | $3,237.68 |

| WILLIAMSVILLE | $3,237.68 |

| CONCORD | $3,238.10 |

| GAYSVILLE | $3,238.64 |

| NORTH HARTLAND | $3,238.64 |

| NORTH POMFRET | $3,238.64 |

| SOUTH WOODSTOCK | $3,238.64 |

| TAFTSVILLE | $3,238.64 |

| BELMONT | $3,239.71 |

| BETHEL | $3,239.94 |

| MONTPELIER | $3,240.76 |

| BRIDGEWATER | $3,241.44 |

| WEST HARTFORD | $3,241.44 |

| EAST CORINTH | $3,241.50 |

| WOODSTOCK | $3,242.39 |

| CAMBRIDGE | $3,242.85 |

| STOCKBRIDGE | $3,242.88 |

| WEST NEWBURY | $3,242.96 |

| EAST MONTPELIER | $3,243.13 |

| WEST DOVER | $3,243.32 |

| NORTH THETFORD | $3,243.46 |

| HARTLAND FOUR CORNERS | $3,244.08 |

| ISLAND POND | $3,244.42 |

| CUTTINGSVILLE | $3,244.50 |

| KILLINGTON | $3,244.50 |

| LUNENBURG | $3,248.00 |

| TOPSHAM | $3,249.46 |

| BEECHER FALLS | $3,249.67 |

| GILMAN | $3,249.67 |

| DANVILLE | $3,249.71 |

| CHELSEA | $3,249.75 |

| GRAFTON | $3,249.76 |

| JAMAICA | $3,250.19 |

| NEWBURY | $3,251.30 |

| GREENSBORO | $3,251.40 |

| WEST WARDSBORO | $3,252.41 |

| EDEN | $3,252.67 |

| SAINT JOHNSBURY | $3,252.73 |

| WEST HALIFAX | $3,253.32 |

| WEST TOWNSHEND | $3,253.32 |

| ADAMANT | $3,253.47 |

| VERNON | $3,254.21 |

| WAITSFIELD | $3,255.31 |

| CRAFTSBURY | $3,255.77 |

| TOWNSHEND | $3,257.06 |

| LAKE ELMORE | $3,257.09 |

| BELVIDERE CENTER | $3,257.11 |

| GUILDHALL | $3,257.35 |

| WHITINGHAM | $3,257.42 |

| WILMINGTON | $3,257.42 |

| WORCESTER | $3,257.80 |

| SOUTH BARRE | $3,258.11 |

| BROOKFIELD | $3,258.52 |

| BRATTLEBORO | $3,258.78 |

| HYDE PARK | $3,258.89 |

| EAST DOVER | $3,258.96 |

| BELLOWS FALLS | $3,259.30 |

| WARDSBORO | $3,259.50 |

| WATERBURY CENTER | $3,260.01 |

| BRADFORD | $3,260.30 |

| NEWFANE | $3,260.93 |

| EAST BURKE | $3,261.38 |

| NORTH CONCORD | $3,261.42 |

| JOHNSON | $3,261.55 |

| EDEN MILLS | $3,262.69 |

| WATERVILLE | $3,262.69 |

| ROXBURY | $3,264.56 |

| EAST RYEGATE | $3,265.13 |

| AVERILL | $3,265.31 |

| EAST HAVEN | $3,265.31 |

| NORTON | $3,265.31 |

| WILLIAMSTOWN | $3,265.39 |

| MOSCOW | $3,265.75 |

| MORRISVILLE | $3,265.76 |

| PUTNEY | $3,266.27 |

| WEST BURKE | $3,266.92 |

| WELLS RIVER | $3,266.94 |

| STOWE | $3,268.09 |

| NORTHFIELD FALLS | $3,268.67 |

| BEEBE PLAIN | $3,269.09 |

| PEACHAM | $3,269.20 |

| SOUTH RYEGATE | $3,269.20 |

| CANAAN | $3,269.38 |

| LYNDONVILLE | $3,272.18 |

| QUECHEE | $3,272.33 |

| WARREN | $3,272.87 |

| EAST SAINT JOHNSBURY | $3,272.92 |

| SAINT JOHNSBURY CENTER | $3,272.92 |

| WESTFIELD | $3,273.28 |

| SHEFFIELD | $3,274.13 |

| WOLCOTT | $3,274.80 |

| CRAFTSBURY COMMON | $3,274.90 |

| NEWPORT | $3,275.13 |

| HARDWICK | $3,275.17 |

| GLOVER | $3,275.59 |

| IRASBURG | $3,275.59 |

| MARSHFIELD | $3,276.04 |

| DERBY | $3,277.14 |

| DERBY LINE | $3,277.14 |

| WEST TOPSHAM | $3,277.95 |

| WATERBURY | $3,278.05 |

| BARTON | $3,278.78 |

| JEFFERSONVILLE | $3,279.04 |

| EAST HARDWICK | $3,279.13 |

| NEWPORT CENTER | $3,279.79 |

| WOODBURY | $3,279.94 |

| CABOT | $3,280.12 |

| EAST CALAIS | $3,280.12 |

| WASHINGTON | $3,280.39 |

| MORETOWN | $3,281.11 |

| CALAIS | $3,281.86 |

| FOREST DALE | $3,281.97 |

| EAST THETFORD | $3,282.03 |

| LOWELL | $3,282.03 |

| MORGAN | $3,283.91 |

| SUTTON | $3,283.91 |

| TROY | $3,283.91 |

| GROTON | $3,285.37 |

| WESTMINSTER | $3,285.81 |

| ORLEANS | $3,286.92 |

| WEST CHARLESTON | $3,286.92 |

| ALBANY | $3,288.13 |

| EAST CHARLESTON | $3,288.13 |

| LYNDON CENTER | $3,288.13 |

| NORTH MONTPELIER | $3,288.91 |

| WEST DANVILLE | $3,288.91 |

| NORTHFIELD | $3,290.17 |

| GRANITEVILLE | $3,292.68 |

| BARNET | $3,292.97 |

| RANDOLPH | $3,297.50 |

| GREENSBORO BEND | $3,297.91 |

| WEST GLOVER | $3,297.91 |

| EAST BARRE | $3,299.21 |

| PLAINFIELD | $3,300.03 |

| LOWER WATERFORD | $3,300.29 |

| NORTH TROY | $3,301.97 |

| THETFORD CENTER | $3,302.10 |

| EAST RANDOLPH | $3,302.51 |

| PASSUMPSIC | $3,303.91 |

| FAIRLEE | $3,306.76 |

| STRAFFORD | $3,306.76 |

| RANDOLPH CENTER | $3,308.97 |

| POST MILLS | $3,310.47 |

| SOUTH STRAFFORD | $3,310.47 |

| WEST FAIRLEE | $3,310.47 |

| NORTH HYDE PARK | $3,313.69 |

| VERSHIRE | $3,314.44 |

The most expensive city for car insurance in Vermont is Vershire, and the least expensive city is Orwell.

Click the search box at the top right of this table and type in the city in which you live to see the average rate for car insurance coverage.

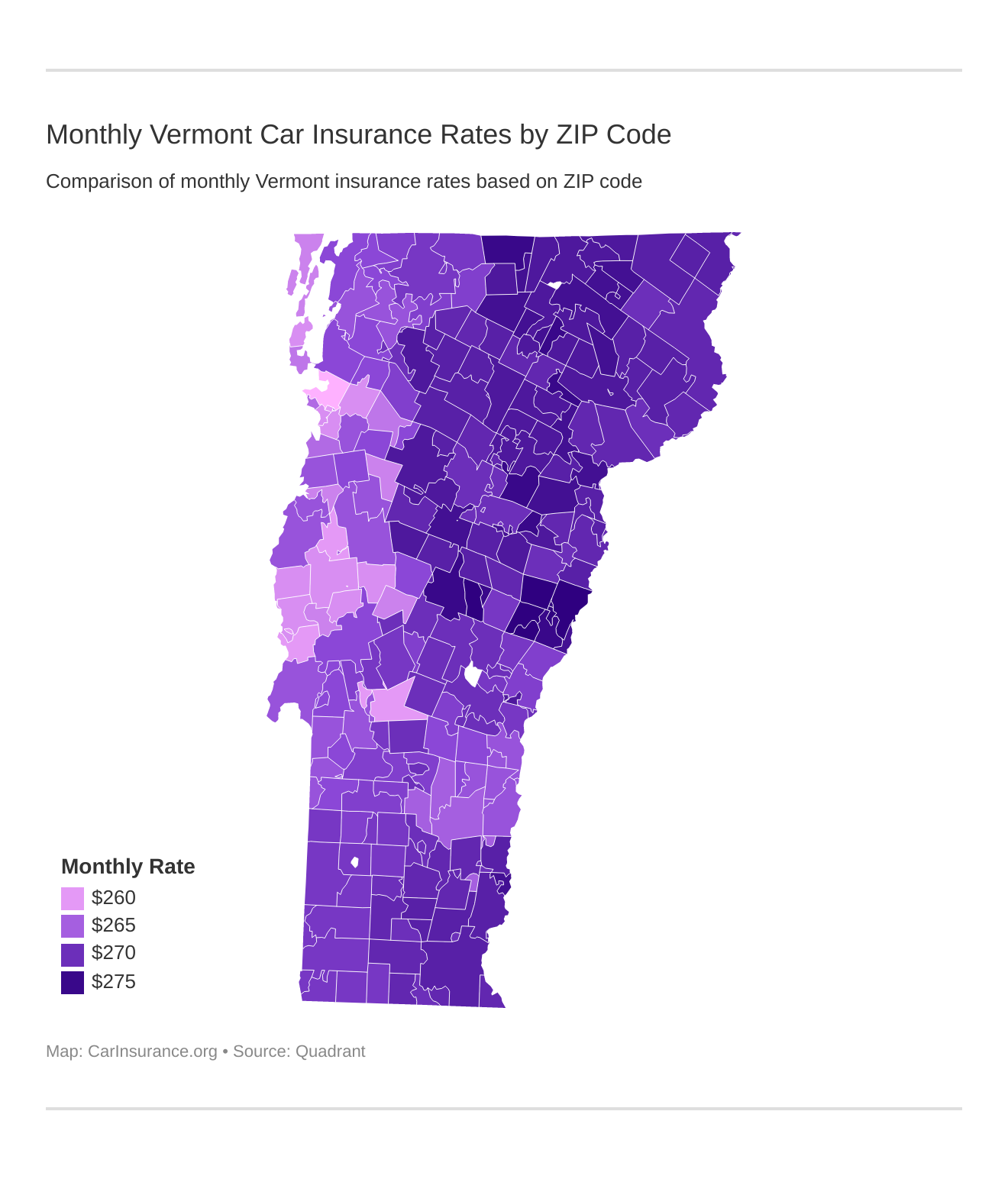

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in VT.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the best Vermont car insurance companies?

Now that you’ve seen car insurance coverage by percent of income, zip code, and city in Vermont, you’re might be wondering what the best car insurance company is.

Several data-collecting teams have provided us with information regarding the best car insurance company. One of them is called J.D. Power. Throughout this section, you’ll see financial ratings of car insurance companies, car insurance companies with the best ratings, and customer complaints. Also, we’ll elaborate on car insurance company rates by coverage level, credit history, and driving record.

What’s the financial rating of the largest companies?

The Insurance Information Institute (III) reported that several agencies judge insurance companies on fi. Each rating agency has its method, standard, and rating for each car insurance company. We’ve compiled some ratings for some popular car insurance companies you may find in your area.

| Company | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| Allstate | A+ | $998,919 | 11.42% | 55.64% |

| Erie Insurance | A+ | $1,153,856 | 13.19% | 64.93% |

| Farmers | NR | $192,162 | 2.20% | 74.14% |

| Geico | A++ | $706,897 | 8.08% | 74.24% |

| Liberty Mutual | A | $424,106 | 4.85% | 61.06% |

| Nationwide | A+ | $786,109 | 8.99% | 59.96% |

| Progressive | A+ | $875,579 | 10.01% | 58.55% |

| State Farm | A++ | $1,779,915 | 20.35% | 63.70% |

| Travelers | A++ | $335,963 | 3.84% | 62.41% |

| USAA* | A++ | $299,488 | 3.42% | 72.05% |

These are the top car insurance companies in the U.S. Vermont doubtlessly has one or more of these car insurance companies in the state.

According to Investopedia writer Adam Hayes, “Market share represents the percentage of an industry, or a market’s total sales, that is earned by a particular company over a specified time.”

Market share is calculated by taking a company’s sales over time and dividing them by the total sales of the industry as a whole over time.

A.M. Ratings are ratings from A.M. Best, an agency that grades companies on how they rank with consumers. A++, A+, A, and A- are grades used to identify the top insurance companies. A company with a grade A shows strong financial standing, and it represents a company that’s guaranteeing consumer policies and keeping them secure.

Most of the ratings in the table are grade A.

Which companies have the best rating?

Let’s look at some more ratings. These ratings are from J.D. Power’s Customer Overall Satisfaction Study. This table will project the rating of the New England Region.

| Company | Points (based on a 1,000-point scale) | Circle Ratings |

|---|---|---|

| Allstate | 834 | 4 |

| Amica Mutual | 879 | 5 |

| Arbella | 800 | 2 |

| Geico | 827 | 3 |

| Liberty Mutual | 809 | 3 |

| MAPFRE Insurance | 811 | 3 |

| MetLife | 803 | 2 |

| Nationwide | 817 | 3 |

| Plymouth Rock Assurance | 804 | 2 |

| Progressive | 826 | 3 |

| Safeco | 796 | 2 |

| Safety Insurance | 813 | 3 |

| State Farm | 838 | 4 |

| The Hanover | 795 | 2 |

| Travelers | 804 | 2 |

| USAA* | 893 | 5 |

| New England Region | 821 | 3 |

The ratings and scores are J.D. Power’s rating standards. These standards measure consumers’ or policyholders’ satisfaction with car insurance companies in their region.

Amica Mutual has the highest ratings in the state of Vermont with five circle ratings and 893 points. On average, however, the car insurance companies in Vermont have a rating of 821.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which companies have the most complaints in Vermont?

No car insurance company isn’t without complaint. It’s helpful for car insurance companies when consumers and financial agencies can find something wrong. If there were no complaints, there wouldn’t be any room for improvement. Too many complaints may cause issues for a company. Let’s look at the rate of complaints in Vermont car insurance companies.

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| Allstate | 1 | 0.5 | 163 |

| Erie Insurance | 1 | 0.7 | 22 |

| Farmers | 1 | 0.59 | 7 |

| Geico | NA | NA | NA |

| Liberty Mutual | 1 | 5.95 | 222 |

| Nationwide | 1 | 0.28 | 25 |

| Progressive | 1 | 0.75 | 120 |

| State Farm | 1 | 0.44 | 1482 |

| Travelers | 1 | 0.09 | 2 |

| USAA* | 1 | 0.74 | 296 |

It’s interesting to see that Liberty Mutual has the highest rate of complaints in 2017, while State Farm has the most total complaints in 2017.

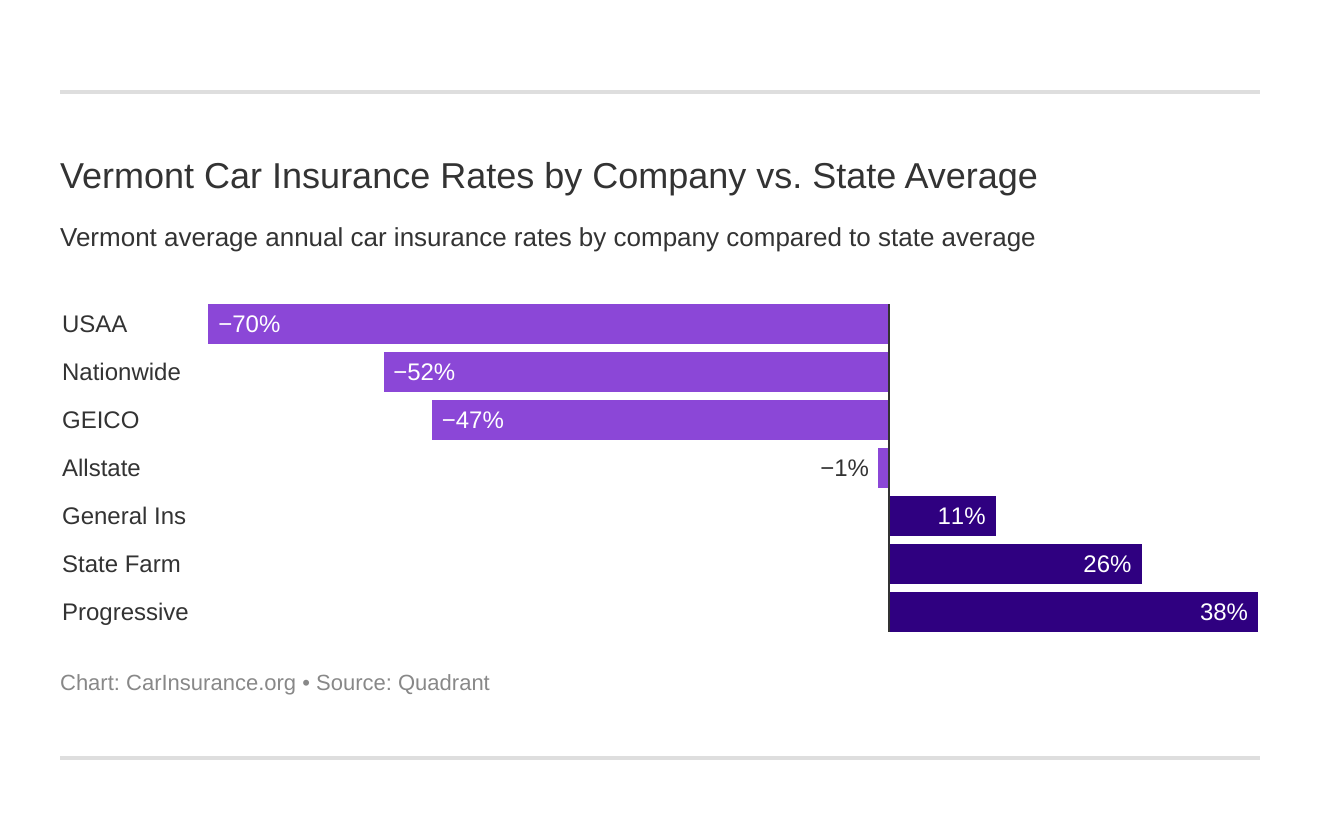

What are the cheapest companies in Vermont?

Now it’s time for the big question — what is the cheapest car insurance company in Vermont? This table will show those numbers.

| Company | Average | Compared to State Average | Compared to State Average by % |

|---|---|---|---|

| Allstate | $3,190 | -$44 | -1.37% |

| Geico | $2,196 | -$1,038 | -47.29% |

| General Ins Co of America | $3,621 | $387 | 10.69% |

| Nationwide | $2,128 | -$1,106 | -51.96% |

| Progressive | $5,217 | $1,983 | 38.01% |

| State Farm | $4,383 | $1,149 | 26.21% |

| USAA* | $1,904 | -$1,331 | -69.90% |

Military veterans and their immediate families can receive the lowest annual cost the state of Vermont can offer.

Those who are not in the military can choose between the two lowest rates. The minus or negative sign indicates the average is less than the national average. For example, The Geico annual average is $2,196, which $1,038 less than the national average.

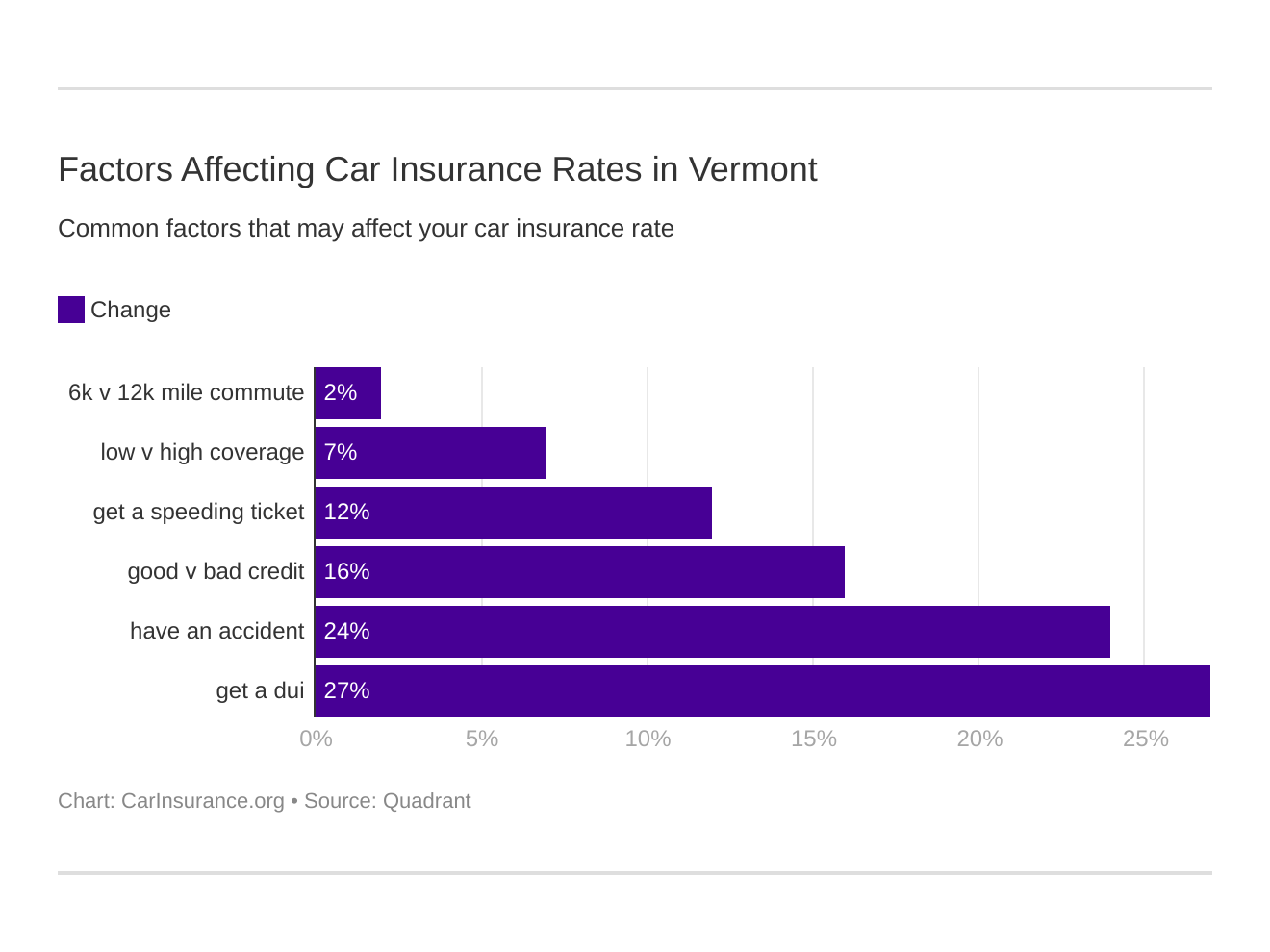

What are the commute rates by companies?

A car insurance company can determine your annual rate (i.e. premium) based on your annual commute.

| Company | 10 miles commute. 6,000 annual mileage. | 25 miles commute. 12,000 annual mileage. |

|---|---|---|

| Progressive | $5,217 | $5,217 |

| State Farm | $4,244 | $4,522 |

| Liberty Mutual | $3,621 | $3,621 |

| Allstate | $3,129 | $3,252 |

| Geico | $2,165 | $2,227 |

| Nationwide | $2,128 | $2,128 |

| USAA* | $1,881 | $1,926 |

Regardless of commute miles per year, Progressive, Nationwide, and Liberty Mutual will charge customers the same annual rate.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the coverage level rates by companies?

Expect car insurance company rates to come in levels. Liability coverage is the minimum and lowest coverage level you can receive. Medium coverage is at least two or three perks on your policy. High coverage is full car insurance coverage.

| Company | Low | Medium | High |

|---|---|---|---|

| Progressive | $4,963 | $5,150 | $5,539 |

| State Farm | $4,151 | $4,404 | $4,593 |

| Liberty Mutual | $3,419 | $3,610 | $3,834 |

| Allstate | $3,124 | $3,186 | $3,261 |

| Geico | $2,120 | $2,197 | $2,271 |

| Nationwide | $2,072 | $2,135 | $2,178 |

| USAA* | $1,842 | $1,901 | $1,967 |

Some of the amounts here aren’t too far from each other; take Allstate, for example. The rates are $40 – $80 apart. It may be more cost-efficient to get full coverage.

What are the credit history rates by companies?

Your credit score can affect car insurance rates, also. The table below will show what you can expect to pay depending on poor, fair, or good credit.

| Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $3,913 | $2,989 | $2,670 |

| Geico | $3,552 | $1,870 | $1,165 |

| Liberty Mutual | $5,426 | $3,097 | $2,340 |

| Nationwide | $2,455 | $2,038 | $1,891 |

| Progressive | $5,998 | $5,025 | $4,628 |

| State Farm | $7,711 | $3,287 | $2,150 |

| USAA* | $2,750 | $1,642 | $1,318 |

Car insurance companies consider your reputation with other car insurance companies, so be sure to pay any unpaid premiums before you move on to another company.

What are the driving record rates by companies?

How you drive will determine your car insurance coverage rate. The better your driving record, the less money you’ll pay for annual premium costs.

| Company | Clean Record | With 1 Accident | With 1 Speeding Violation | With 1 DUI |

|---|---|---|---|---|

| Allstate | $2,647 | $3,494 | $3,020 | $3,601 |

| Geico | $1,413 | $2,353 | $1,740 | $3,276 |

| Liberty Mutual | $3,185 | $3,812 | $3,443 | $4,045 |

| Nationwide | $1,704 | $2,187 | $1,872 | $2,749 |

| Progressive | $4,398 | $6,363 | $5,167 | $4,940 |

| State Farm | $3,987 | $4,778 | $4,383 | $4,383 |

| USAA* | $1,450 | $1,831 | $1,613 | $2,720 |

As you can see from the table, a clean driving record results in the cheapest rate for each car insurance company.

Some companies are lenient on drivers who’ve been in a car accident. Leniency in car insurance companies is called “accident forgiveness,” which is a policy that will not increase your rates after a car accident.

Most policyholders have one or two accident forgiveness uses in their policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

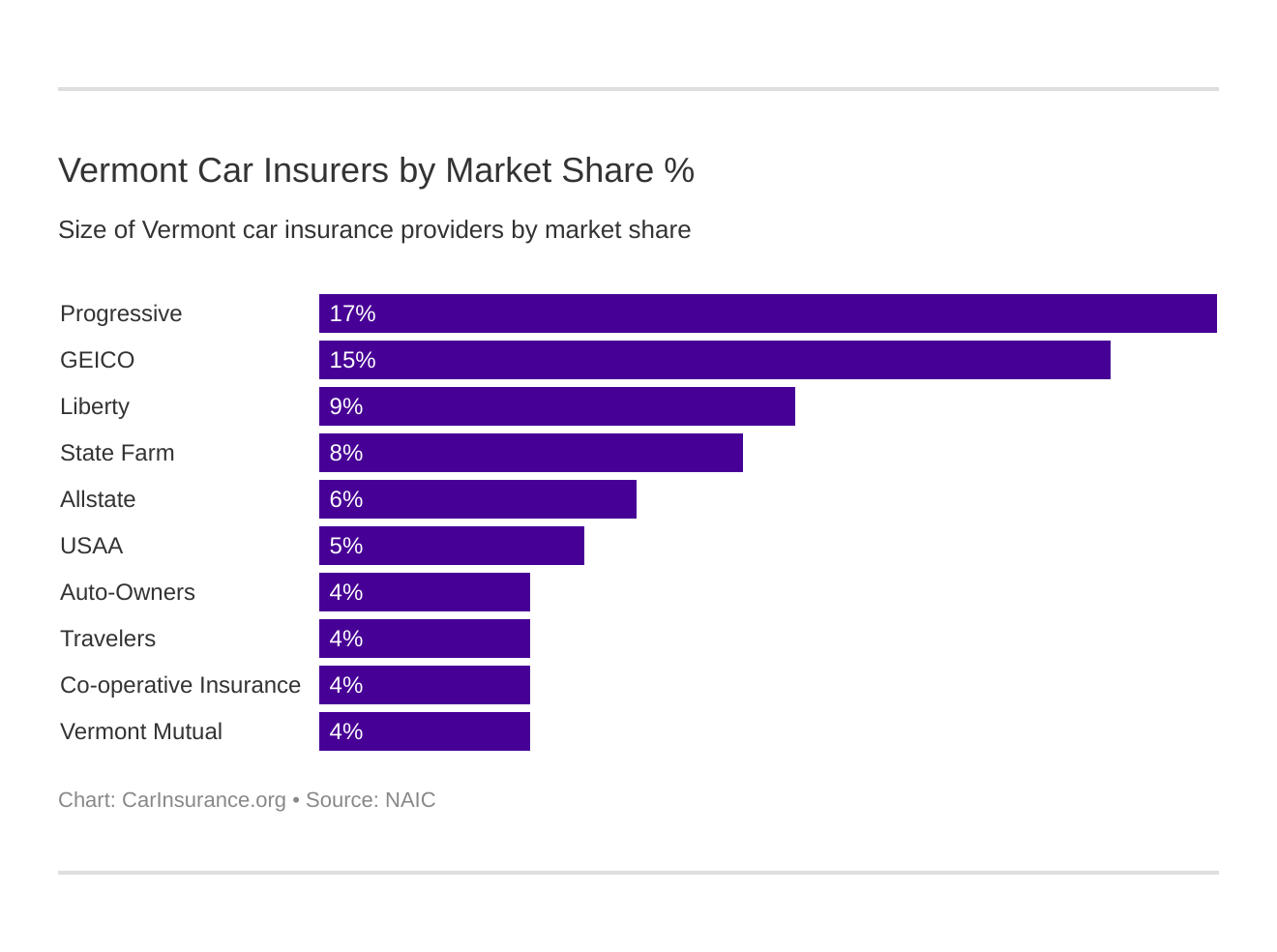

What are the largest car insurance companies in Vermont?

Some companies are regional and some are state-only. You can bet that the largest car insurance companies are those that have chains all across the U.S.

| Rank | Company Group/group/code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 5 | Allstate Insurance | $22,761 | 35.62% | 6.05% |

| 7 | Auto-Owners | $16,863 | 52.25% | 4.48% |

| 9 | Co-operative Insurance | $14,844 | 63.50% | 3.95% |

| 2 | Geico | $55,737 | 64.15% | 14.82% |

| 3 | Liberty Mutual | $35,497 | 60.86% | 9.44% |

| 1 | Progressive | $63,901 | 58.62% | 16.99% |

| 4 | State Farm | $31,455 | 51.03% | 8.37% |

| 8 | Travelers | $15,600 | 64.59% | 4.15% |

| 6 | USAA* | $17,415 | 58.23% | 4.63% |

| 10 | Vermont Mutual | $14,575 | 47.94% | 3.88% |

| **state Total** | $376,023 | 56.53% | 100.00% |

*USAA is only available to military personnel, veterans, and active members of the Armed Forces, and immediate family of military personnel.

Travelers have the highest loss ratio, and Progressive has the highest direct premiums written.

What’s the number of insurers in Vermont?

An insurer, by definition, is a person or company that underwrites an insurance risk, or the party in an insurance contract undertaking to pay compensation. In the car insurance business, these companies and agents are separated into two categories: Domestic and Foreign

Domestic insurers are insurers who operate under in-state law, while foreign insurers operate under laws from another state.

Here are the number of insurers in Vermont.

| Insurers in Vermont | Number of Insurers |

|---|---|

| Domestic | 12 |

| Foreign | 671 |

| Total | 683 |

The total number of car insurance insurers is 683. Foreign insurers greatly outnumber domestic insurers.

What are Vermont state laws?

There are a few laws you should know about car insurance in Vermont, and this section will talk about them in detail. We’ll start with windshield coverage and move on to laws about high-risk insurance and low-cost insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Vermont car insurance laws?

Other laws will be included, such as Vermont’s definition of car insurance fraud, the statute of limitations, and Vermont laws specific to the state.

How Vermont laws for insurance are determined

Vermont is a use-and-file state. This means insurers can use new rates at their preference, but they have to file rates with a regulator in a designated time. According to the National Association of Insurance Commissioners, the lack of supporting information could get those new rates disapproved.

How to get windshield coverage

Vehicles with cracks and other damages on a windshield obstructing a motorist’s field of view are not permitted on Vermont roadways. Star cracks larger than two inches are also not allowed.

In Vermont, the zero deductible for a replacement windshield is not law, so a policyholder may have to pay a deductible. It depends on the car insurance company. Sometimes windshield coverage is bundled into comprehensive coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to get high-risk insurance

What can a Vermont motorist do when all options of voluntary insurance have been exhausted?

Motorists who have to enlist in SR22 for a DUI, too many car accidents, or too many roadway violations are subject to high-risk car insurance. States across the U.S. have car insurance programs designated for high-risk drivers.

The option for high-risk car insurance for high-risk motorists in Vermont will be the Vermont Automobile Insurance Plan (VTAIP). This was established in 1969 as Vermont’s “residual auto insurance market,” aiming to give high-risk Vermont motorists their last chance at purchasing insurance.

To be eligible for VTAIP risk pool, you must:

- Verify that you have attempted to find car insurance via normal, voluntary means in the past 60 days and have not been successful

- Have a driver’s license and proof of registration

- Complete a VTAIP application. Lying on the application means you will be subject to loss of eligibility

How to get low-cost insurance

At the moment, there isn’t a low-cost insurance program in Vermont. Search through the rates in the tables of this guide to find the lowest possible rate.

It’s a good idea to ask car insurance companies or agents for discounts when applying for a policy. If you have good credit or have decided to go with full coverage for your vehicle(s), the car insurance provider may give you a discount.

Is there an automobile insurance fraud in Vermont?

Anywhere you go, fraud is a serious crime. In the U.S., fraud can be a misdemeanor or a felony. It all depends on the severity of the fraud.

The code of law for insurance fraud in Vermont can be found here. Vermont law says no one shall defraud any person or company to gain or attempt to gain a claim from an insurance company.

Penalties for insurance fraud are as follows:

- Fraud committed that’s under $900 has a penalty of a $5,000 fine and/or six months in prison

- Fraud committed that’s over $900 has a penalty of $10,000 fine and/or 10 years in prison

If you believe you have been a victim of fraud or want to report fraud, contact Vermont Consumer Inquiries. Their contact information is listed below.

Consumer Inquiries

802-828-3302 or 800-964-1784

[email protected]

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the statute of limitations?

The statute of limitations is the amount of time in which a motorist or passenger can file a claim with a car insurance company or pursue legal actions against a person or company. The statute of limitations in Vermont is three years for personal injury and three years for property damage.

Remember, the statute of limitations begins when the event happens, and not when you file a claim.

What are the state-specific laws?

Vermont shares the same laws as many other states. Their most interesting is the Lemon Law. A vehicle with one or more serious issues is a “lemon.” In the state of Vermont, there are protections for vehicle owners who lease “lemons.” There’s one problem: the lemon law only applies to new vehicles such as snowmobiles, cars, trucks, or other motor vehicles.

What are Vermont vehicle licensing laws?

A lot is required to get a driver’s license. This section describes the procedure of how a current and new resident of Vermont can obtain a driver’s license and REAL ID. We’ll also talk about how teen drivers can obtain a Vermont driver’s license.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why do you need REAL ID?

REAL IDs are becoming the primary methods to verify your identity to airports, federal facilities, and security checkpoints. By October 2020, these standards will go into effect. Any license that’s not REAL ID–compliant will not be accepted by TSA.

New applicants who fulfill the requirements for a Vermont driver’s license or personal ID are eligible to receive a REAL ID.

Current driver’s license holders or ID holders should present proof of identity, date of birth, social security number, proof of residency in Vermont, and proof of U.S. citizenship — the same documentation as a new applicant.

What are the penalties for driving without insurance?

Driving without insurance carries stiff fines, a suspended driver’s license, car confiscation, and even prison time. If you’re pulled over by law enforcement and you don’t have car insurance, you will receive a traffic ticket and your car will be towed. A motorist without car insurance likely doesn’t have the registration on their vehicle or has been dropped by their car insurance company.

In Vermont, a driver without car insurance can face a $500 fine. Also, the driver will have their driver’s license suspended until they get car insurance.

Don’t take a chance on driving without car insurance.

What are the teen driver laws?

Teenagers that are 15 years old are allowed to apply for a learner’s permit. To apply for a junior driver’s license, a teen who is at least 15 years old has to hold the learner’s permit for six months without it being recalled, suspended, or revoked. After one year with a learner’s permit, the individual can apply for a junior driver’s license.

Parents are encouraged to bring proof of identity, date of birth, social security number, proof of insurance, and proof of Vermont residency.

Junior driver’s licenses are issued to 16- and 17-year olds who pass Vermont’s required driving examination. Parents and legal guardians must sign an application giving the DMV of Vermont permission to test the teen.

For teens to get a driver’s license, they must pass a state-approved driver course. These courses consist of 30 hours of study, six hours of wheeling training, and six hours of observation. The driver education courses are available in high schools across Vermont. Also, there are commercial driving training courses provided by the Vermont Department of Education.

To get a Vermont driver’s license as a teenager, you must:

- Must be 16- or 17-years old with your learner’s permit (it can’t be expired)

- Successful completion of a driver course. Out-of-state driving courses must be verified through documentation from the driving course instructor or DMV official

- A driving log sheet proving the teen has over 40 hours of daytime driving practice and 10 hours of nighttime driving practice

- A parent or legal guardian’s permission. Parents should provide proof of identity, date of birth, social security number, proof of car insurance and proof of residency

- Pass the road and vision tests and have a valid vehicle inspection

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the license renewal procedures for older drivers?

Vermont doesn’t have special requirements for elderly drivers. All drivers in Vermont have to renew their driver’s licenses every two to four years. No vision test is required to renew their license. Elderly drivers can renew their license online, by mail, or in person at the DMV.

What’s the procedure for new residents?

All new residents must obtain a Vermont driver’s license within 60 days after moving to Vermont. If your out-of-state driver’s license expires before the end of the 60 days, you need to obtain a Vermont driver’s license before it does so. For new residents to receive a Vermont driver’s license, they must provide documentation such as proof of identity, proof of age, proof of U.S. citizenship, proof of residency in Vermont, and a social security number.

If your out-of-state license is expired, Vermont DMV requires that you take a vision test.

What are the license renewal procedures?

Vermont DMV will notify motorists that their license is going to expire about 30 days beforehand. Motorists are encouraged to complete the renewal application and send it to the Vermont Department of Motor Vehicles. If you don’t want to mail in your renewal application, complete your driver’s license renewal online.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s considered a negligent operator treatment system (NOTS)?

Vermont defines a negligent operator as a person who operates a motor vehicle on a public highway in a manner that’s guilty of negligent operation. Negligent operation of a motor vehicle can carry fines up to $1,000, a prison sentence of no more than a year, or both.

A negligent operation can be reckless driving, speeding, driving slowly in the left lane, or any manner that’s inappropriate for the roadway.

What are the rules of the road?

To avoid tickets and decrease your chances of getting into a car accident, follow the rules of the road. The sub-sections will show you how fault versus no-fault work in Vermont. Also, we’ve summarized seat belt and child safety seat laws, keep right and mover over laws, speed limits, ridesharing, and automation on the road in small detail and data tables.

Is Vermont at fault or a no-fault state?

Vermont is not a no-fault state. Vermont is one of the states where personal injury protection isn’t required. A motorist who is injured in a car accident may seek compensation from the negligent motorist’s car insurance company. To file a claim against a negligent driver’s car insurance company, the injured driver must prove the negligent driver was the primary cause of the car accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the seat belt & car seat laws?

The seat belt law is a universal law among all drivers in the U.S. or any country where a lot of motor vehicles are on roadways. The Vermont seat belt law was established in January 1994. Drivers and passengers in the front seats of the motor vehicle require a belt. Even though the law doesn’t clarify if rear passengers need a seatbelt, it’s strongly encouraged.

The maximum fine for a seat belt violation is $25.

Children car seat laws are as follows:

- Children younger than one year or less than 20 pounds should be in rear-facing child restraints. Children also must be in a rear seat unless the front passenger air bag is deactivated

- Children ages one through seven and who also weigh more than 20 pounds should be in a child restraint or booster seat.

- Individuals who are eight through 17 and weigh more than 20 pounds should be in a seat belt.

What are the keep right & move over laws?

All states have moved over laws. Vermont keeps right and move law says slower traffic should keep right when driving slower than average speed. This will allow for faster traffic to pass. Violaters are often ticketed for improperly driving on Vermont roadways.

What’s the speed limit?

Vermont’s speed limits for rural interstates is 65 mph. For urban interstates, however, it’s 55 mph. All other roads and limited access roads have a speed limit of 50 mph. Like many other states, motorists are welcome to drive five mph over the speed limit. Vermont requires lower than average speed limits due to the hilly terrain and the increased chance of snowy weather.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does ridesharing work?

Uber operates in three cities in Vermont: Burlington, Cambridge, and Montpelier. Lyft became available in Vermont in Spring 2017. Ridesharers share the same laws as any other motorist in Vermont, but for special insurance coverage or laws regarding rideshare insurance, consult a car insurance company.

Is there automation on the road?

Vermont is currently testing automation on the road. This fits Vermont’s plan to be a more energy-efficient state. Anyone testing automation on the road must be licensed in Vermont, and the operator must be in the vehicle.

For example, a motorist who owns a self-driving electric car must be operating it as they would any other motor vehicle. Because these cars carry such a high price tag, their insurance coverage is beyond normal liability car insurance. The liability for automation vehicle carries a $5 million coverage level.

What are the safety laws?

Like many other states, Vermont firmly enforces its safety laws. Motorists who break safety laws in Vermont are hit with stiff fines, license suspension, and, possibly, prison time.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the DUI Laws?

The BAC Limit (blood alcohol limit) in Vermont is 0.08. A high BAC Limit is 0.16 or higher. Driving under the influence is a first- or second-class misdemeanor. Having more than three DUI offenses within a period can be considered a felony DUI.

- First Offense – Revoked license for 90 days or up to two years in prison at the discretion of the judge. Alcohol and driving education programs are required, along with a fine up to $700

- Second Offense – Revoked license for 18 months. Minimum 60 hours prison or 60 hours of community service, or up to two years in prison, and a fine up to $1,500

- Third Offense – Permanent revocation of driver’s license. A driver can apply for a license after three years of total abstinence of drugs and alcohol. Minimum 1,000 jail hours or 400 hours of community service. You’ll face possibly five years in prison and a fine of up to $2,500. Possible vehicle seizure

- Fourth Offense – Felony DUI

What are the marijuana-impaired driving laws?

There aren’t any marijuana-impaired driving laws in Vermont, but law enforcement and Vermont courts will consider a motorist driving under the influence of marijuana a crime.

What are the distracted driving laws?

Vermont law on distracted driving says all drivers are banned from using a handheld device to text, browse the net, or for any other reason while operating a motor vehicle.

Young drivers are also banned from using their cellphone while operating a motor vehicle.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s driving in Vermont like?

With laws and coverage rates covered, let’s review some information about Vermont’s theft, crash fatality numbers, teen arrest data, and EMS response time.

Is there a vehicle theft in Vermont?

Vermont’s vehicle theft rate is much lower than many other states’, but does it happen to motorists. Here’s a list of data showing what cars were stolen the most in Vermont.

| Make/Model | Year of Vehicle | Thefts | Rank |

|---|---|---|---|

| Chevrolet Pickup (Full Size) | 2001 | 15 | 1 |

| Ford Pickup (Full Size) | 2010 | 8 | 2 |

| Honda Accord | 2002 | 8 | 2 |

| Hyundai Elantra | 2015 | 7 | 3 |

| Honda Civic | 2005 | 6 | 4 |

| Subaru Legacy | 1999 | 6 | 4 |

| Ford Pickup (Small Size) | 2002 | 5 | 5 |

| GMC Pickup (Full Size) | 2007 | 5 | 5 |

| Nissan Sentra | 2012 | 5 | 5 |

| Subaru Impreza | 2002 | 5 | 5 |

Trucks and SUVs are good targets because of the rugged mountain terrain, long rural roads, and harsh winters. Fuel-efficient vehicles and powerful off-road vehicles are big targets for thieves.

What’s the number of vehicle thefts by city?

Let’s examine what cities are affected the most by vehicle theft.

| County | Motor Vehicle Theft |

|---|---|

| Barre | 0 |

| Barre Town | 0 |

| Bellows Falls | 0 |

| Bennington | 18 |

| Berlin | 1 |

| Bradford | 0 |

| Brandon | 0 |

| Brattleboro | 15 |

| Bristol | 0 |

| Burlington | 0 |

| Chester | 2 |

| Colchester | 0 |

| Dover | 1 |

| Essex | 12 |

| Hardwick | 0 |

| Hartford | 7 |

| Hinesburg | 1 |

| Ludlow | 0 |

| Lyndonville | 0 |

| Manchester | 0 |

| Middlebury | 0 |

| Milton | 0 |

| Montpelier | 0 |

| Morristown | 0 |

| Newport | 0 |

| Northfield | 2 |

| Randolph | 0 |

| Richmond | 0 |

| Rutland | 9 |

| Rutland Town | 1 |

| Shelburne | 2 |

| South Burlington | 0 |

| Springfield | 0 |

| St. Albans | 0 |

| St. Johnsbury | 0 |

| Stowe | 0 |

| Swanton | 0 |

| Thetford | 0 |

| Vergennes | 0 |

| Weathersfield | 1 |

| Williston | 0 |

| Wilmington | 1 |

| Windsor | 0 |

| Winooski | 0 |

| Woodstock | 0 |

It’s amazing to see that most cities in Vermont didn’t see any vehicle theft.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of road fatalities in Vermont?

One of the hardest things to grasp is the number of people that die from a car crash. It’s one of many reasons why law enforcement, state courts, and car insurance companies are tough on motorists who commit DUI.

What’s the most fatal highway in Vermont?

The most dangerous highway in Vermont is U.S. 7. This is an undivided two-to-four-lane highway that’s had 50 fatal crashes over the last 10 years.

What’s the number of fatal crashes by weather conditions & light conditions?

The Green Mountain State is known for the harsh winters. Let’s look at how weather and light conditions affect drivers in Vermont.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 32 | 4 | 13 | 3 | 0 | 52 |

| Rain | 3 | 0 | 2 | 0 | 0 | 5 |

| Snow/Sleet | 1 | 0 | 1 | 1 | 0 | 3 |

| Other | 0 | 0 | 1 | 1 | 0 | 2 |

| Unknown | 0 | 0 | 1 | 0 | 0 | 1 |

| TOTAL | 36 | 4 | 18 | 5 | 0 | 63 |

Based on the data, there are more fatal crashes when it’s daylight with normal conditions than any other time.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatalities (all crashes) by county?

What was the total number of fatal crashes by county? This table will reveal that information.

| County | Fatalities (2014) | Fatalities Per 100,000 (2014) | Fatalities (2015) | Fatalities Per 100,000 (2015) | Fatalities (2016) | Fatalities Per 100,000 (2016) | Fatalities (2017) | Fatalities Per 100,000 (2017) | Fatalities (2018) | Fatalities Per 100,000 (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Addison County | 1 | 2.71 | 3 | 8.12 | 6 | 16.25 | 8 | 21.66 | 6 | 16.23 |

| Bennington County | 4 | 11.06 | 3 | 8.30 | 5 | 13.92 | 2 | 5.60 | 5 | 14.03 |

| Caledonia County | 1 | 3.24 | 4 | 13.05 | 2 | 6.63 | 3 | 9.95 | 4 | 13.20 |

| Chittenden County | 9 | 5.63 | 9 | 5.58 | 6 | 3.71 | 8 | 4.91 | 6 | 3.65 |

| Essex County | 2 | 32.50 | 2 | 32.28 | 1 | 16.06 | 2 | 32.19 | 0 | 0.00 |

| Franklin County | 2 | 4.10 | 10 | 20.42 | 6 | 12.25 | 4 | 8.16 | 7 | 14.16 |

| Grand Isle County | 1 | 14.35 | 0 | 0.00 | 2 | 28.91 | 2 | 28.64 | 0 | 0.00 |

| Lamoille County | 2 | 7.96 | 2 | 7.92 | 3 | 11.85 | 2 | 7.89 | 4 | 15.81 |

| Orange County | 4 | 13.85 | 2 | 6.92 | 0 | 0.00 | 0 | 0.00 | 2 | 6.90 |

| Orleans County | 3 | 11.10 | 2 | 7.40 | 3 | 11.21 | 7 | 26.09 | 3 | 11.15 |

| Rutland County | 7 | 11.66 | 10 | 16.79 | 10 | 16.92 | 7 | 11.86 | 4 | 6.82 |

| Washington County | 4 | 6.78 | 2 | 3.41 | 5 | 8.57 | 8 | 13.73 | 6 | 10.32 |

| Windham County | 1 | 2.29 | 3 | 6.94 | 8 | 18.53 | 6 | 13.98 | 9 | 21.05 |

| Windsor County | 3 | 5.38 | 5 | 9.00 | 5 | 9.04 | 10 | 18.10 | 12 | 21.71 |

In 2014, Essex County saw the most fatal crashes with 33 fatal crashes per 100,000 crashes. Each county has fluctuating numbers in a five-year trend.

What’s the number of traffic fatalities?

Let’s see how traffic was affected by fatal crashes. Review the stats below.

| Traffic Fatalities | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total (C-1) | 44 | 57 | 62 | 69 | 68 |

| Rural | 37 | 48 | 52 | 56 | 60 |

| Urban | 7 | 9 | 10 | 13 | 7 |

| Unknown | 0 | 0 | 0 | 0 | 1 |

Urban traffic fatalities saw a steady increase until 2018; however, rural traffic fatalities have increased in a five-year trend.

What’s the number of fatalities by person type?

When fatalities do occur in accidents, what type of car is the motorist driving?

| Person Type | # of Fatalities (2014) | % of Fatalities (2014) | # of Fatalities (2015) | % of Fatalities (2015) | # of Fatalities (2016) | % of Fatalities (2016) | # of Fatalities (2017) | % of Fatalities (2017) | # of Fatalities (2018) | % of Fatalities (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Car | 18 | 41 | 20 | 35 | 28 | 45 | 30 | 43 | 34 | 50 |

| Light Truck - Pickup | 3 | 7 | 2 | 4 | 2 | 3 | 7 | 10 | 10 | 15 |

| Light Truck - Utility | 4 | 9 | 10 | 18 | 15 | 24 | 8 | 12 | 8 | 12 |

| Light Truck - Van | 2 | 5 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Large Truck | 1 | 2 | 1 | 2 | 0 | 0 | 1 | 1 | 2 | 3 |

| Bus | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other/Unknown Occupants | 3 | 7 | 2 | 4 | 1 | 2 | 2 | 3 | 1 | 1 |

| Total Occupants | 32 | 73 | 37 | 65 | 46 | 74 | 48 | 70 | 55 | 81 |

| Light Truck - Other | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Motorcyclists | 7 | 16 | 11 | 19 | 11 | 18 | 13 | 19 | 7 | 10 |

| Pedestrian | 5 | 11 | 5 | 9 | 4 | 6 | 8 | 12 | 6 | 9 |

| Total Nonoccupants | 5 | 11 | 9 | 16 | 5 | 8 | 8 | 12 | 6 | 9 |

| Bicyclist and Other Cyclist | 0 | 0 | 4 | 7 | 1 | 2 | 0 | 0 | 0 | 0 |

| Total | 44 | 100 | 57 | 100 | 62 | 100 | 69 | 100 | 68 | 100 |

Although the fatalities are lower than most states, you can see numbers spiking and dropping within five years. More passenger cars were involved in fatal crashes than trucks and pedestrians.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatalities by crash type?

This table has a few more details than the others. It shows the total crashes, explains what kind of vehicle it was and how it was involved in the accident.

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 44 | 57 | 62 | 69 | 68 |

| - (1) Single Vehicle | 28 | 34 | 45 | 38 | 38 |

| - (2) Involving a Large Truck | 11 | 8 | 7 | 10 | 11 |

| - (3) Involving Speeding | 15 | 21 | 29 | 31 | 25 |

| - (4) Involving a Rollover | 12 | 7 | 19 | 14 | 17 |

| - (5) Involving a Roadway Departure | 33 | 44 | 49 | 49 | 52 |

| - (6) Involving an Intersection (or Intersection Related) | 5 | 6 | 6 | 14 | 12 |

*A fatality can be more than one category. Therefore, the sum of individual cells will not equal the total, due to double counting.

Crashes involving a roadway departure were the deadliest in 2018.

Five-year trend for the top 10 Vermont counties

Let’s focus on the top 10 counties in Vermont. Here’s a data table that shows the top 10 counties with the most fatalities and highest percentage of fatalities.

| County Rank | County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | % of Fatality Total (2014) | % of Fatality Total (2015) | % of Fatality Total (2016) | % of Fatality Total (2017) | % of Fatality Total (2018) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | Addison County | 1 | 3 | 6 | 8 | 6 | 2 | 5 | 10 | 12 | 9 |

| 7 | Bennington County | 4 | 3 | 5 | 2 | 5 | 9 | 5 | 8 | 3 | 7 |

| 8 | Caledonia County | 1 | 4 | 2 | 3 | 4 | 2 | 7 | 3 | 4 | 6 |

| 5 | Chittenden County | 9 | 9 | 6 | 8 | 6 | 20 | 16 | 10 | 12 | 9 |

| 3 | Franklin County | 2 | 10 | 6 | 4 | 7 | 5 | 18 | 10 | 6 | 10 |

| 9 | Lamoille County | 2 | 2 | 3 | 2 | 4 | 5 | 4 | 5 | 3 | 6 |

| 10 | Rutland County | 7 | 10 | 10 | 7 | 4 | 16 | 18 | 16 | 10 | 6 |

| 6 | Washington County | 4 | 2 | 5 | 8 | 6 | 9 | 4 | 8 | 12 | 9 |

| 2 | Windham County | 1 | 3 | 8 | 6 | 9 | 2 | 5 | 13 | 9 | 13 |

| 1 | Windsor County | 3 | 5 | 5 | 10 | 12 | 7 | 9 | 8 | 14 | 18 |

| Sub Total 1.* | Top Ten Counties | 40 | 51 | 57 | 63 | 63 | 91 | 89 | 92 | 91 | 93 |

| Sub Total 2.** | All Other Counties | 4 | 6 | 5 | 6 | 5 | 9 | 11 | 8 | 9 | 7 |

| Total | All Counties | 44 | 57 | 62 | 69 | 68 | 100 | 100 | 100 | 100 | 100 |

*This subtotal is the for the top 10 counties

**This subtotal is the for all counties outside the top 10

Windsor County crash fatalities increased every year in a five-year time span.

What’s the number of fatalities involving speeding by county?

Here’s some continued fatal crash data that describes how speeding affected the total of Vermont’s fatal crash numbers.

| County | Fatalities (2014) | Fatalities per 100,000 (2014) | Fatalities (2015) | Fatalities per 100,000 (2015) | Fatalities (2016) | Fatalities per 100,000 (2016) | Fatalities (2017) | Fatalities per 100,000 (2017) | Fatalities (2018) | Fatalities per 100,000 (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Addison County | 1 | 2.71 | 0 | 0.00 | 1 | 2.71 | 6 | 16.24 | 2 | 5.41 |

| Bennington County | 2 | 5.53 | 0 | 0.00 | 1 | 2.78 | 1 | 2.80 | 3 | 8.42 |

| Caledonia County | 1 | 3.24 | 2 | 6.53 | 0 | 0.00 | 0 | 0.00 | 1 | 3.30 |

| Chittenden County | 4 | 2.50 | 3 | 1.86 | 1 | 0.62 | 5 | 3.07 | 2 | 1.22 |

| Essex County | 1 | 16.25 | 1 | 16.14 | 1 | 16.06 | 1 | 16.10 | 0 | 0.00 |

| Franklin County | 0 | 0.00 | 6 | 12.25 | 2 | 4.08 | 2 | 4.08 | 5 | 10.12 |

| GrandIsle County | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 1 | 14.32 | 0 | 0.00 |

| Lamoille County | 0 | 0.00 | 0 | 0.00 | 3 | 11.85 | 0 | 0.00 | 1 | 3.95 |

| Orange County | 1 | 3.46 | 1 | 3.46 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 |

| Orleans County | 2 | 7.40 | 0 | 0.00 | 3 | 11.21 | 4 | 14.91 | 0 | 0.00 |

| Rutland County | 2 | 3.33 | 6 | 10.08 | 5 | 8.46 | 2 | 3.39 | 1 | 1.70 |

| Washington County | 0 | 0.00 | 1 | 1.71 | 4 | 6.85 | 3 | 5.15 | 1 | 1.72 |

| Windham County | 1 | 2.29 | 1 | 2.31 | 5 | 11.58 | 1 | 2.33 | 4 | 9.36 |

| Windsor County | 0 | 0.00 | 0 | 0.00 | 3 | 5.42 | 5 | 9.05 | 5 | 9.04 |

In the five-year trend, Grand Isle County wasn’t impacted by many fatal crashes due to speeding. Essex County had the most fatal crash activity in the same time period.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of fatalities in crashes involving an alcohol-impaired driver by county?

We talked about how DUI laws and penalties, but less look at how alcohol-impaired driving affected the fatal crash data of Vermont.

| County Name | Fatalities (2014) | Fatalities per 100,000 (2014) | Fatalities (2015) | Fatalities per 100,000 (2015) | Fatalities (2016) | Fatalities per 100,000 (2016) | Fatalities (2017) | Fatalities per 100,000 (2017) | Fatalities (2018) | Fatalities per 100,000 (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| AddisonCounty | 0 | 0.00 | 2 | 5.42 | 0 | 0.00 | 1 | 2.71 | 3 | 8.11 |

| BenningtonCounty | 2 | 5.53 | 1 | 2.77 | 3 | 8.35 | 1 | 2.80 | 1 | 2.81 |

| CaledoniaCounty | 0 | 0.00 | 2 | 6.53 | 2 | 6.63 | 0 | 0.00 | 1 | 3.30 |

| ChittendenCounty | 1 | 0.63 | 1 | 0.62 | 2 | 1.24 | 3 | 1.84 | 1 | 0.61 |

| EssexCounty | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 1 | 16.10 | 0 | 0.00 |

| FranklinCounty | 1 | 2.05 | 4 | 8.17 | 4 | 8.17 | 2 | 4.08 | 3 | 6.07 |

| GrandIsleCounty | 0 | 0.00 | 0 | 0.00 | 1 | 14.46 | 0 | 0.00 | 0 | 0.00 |

| LamoilleCounty | 0 | 0.00 | 0 | 0.00 | 3 | 11.85 | 1 | 3.95 | 0 | 0.00 |

| OrangeCounty | 0 | 0.00 | 1 | 3.46 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 |

| OrleansCounty | 2 | 7.40 | 0 | 0.00 | 0 | 0.00 | 3 | 11.18 | 0 | 0.00 |

| RutlandCounty | 2 | 3.33 | 2 | 3.36 | 5 | 8.46 | 2 | 3.39 | 1 | 1.70 |

| WashingtonCounty | 0 | 0.00 | 1 | 1.71 | 1 | 1.71 | 0 | 0.00 | 1 | 1.72 |

| WindhamCounty | 0 | 0.00 | 0 | 0.00 | 4 | 9.27 | 1 | 2.33 | 3 | 7.02 |

| WindsorCounty | 0 | 0.00 | 0 | 0.00 | 2 | 3.61 | 2 | 3.62 | 1 | 1.81 |

The counties that saw the most alcohol-impaired fatal crashes over five years were Rutland County, Franklin County, Lamoille County, and Caledonia County.

What are the laws for teen drinking & driving?

Law enforcement across the U.S. has a zero-tolerance policy for underage drinking.

Pairing drinking and driving with a teen is a recipe for disaster. The short table shows Vermont’s rank in teen DUI arrests and how many teens are arrested per million people.

| State | DUI Arrest (Under 18 years old) | DUI Arrests (Under 18 years old) Total Per Million People | Rank |

|---|---|---|---|

| Vermont | 8 | 67.49 | 30 |

Vermont ranks 30th, with 68 total arrests per one million people.

What’s the EMS response time?

Emergency vehicle response time is often determined by road conditions, traffic conditions, and mileage. EMS response time from the time of the crash to the arrival of the hospital is nearly 30 minutes for urban areas and nearly an hour for rural areas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s transportation like in Vermont?

What form of transportation do Vermont motorists use? This section talks about how most Vermont motorists get from point A to point B.

What’s the percentage of car ownership?

Forty-six percent of Vermont motorists own two cars, 22 percent own three cars, 21 percent own one car, and a small number of Vermont residents own four or more cars.

What’s the average commute time?

The average commute time in the U.S. is 26 minutes. In Vermont, however, the commute time is 22 minutes, which is four minutes less than the national average.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the preferred commuter transportation?

The most common method commuter transportation is driving. An estimated 75 percent of people drove alone in Vermont, while 9 percent carpooled. Seven percent of Vermont residents work from home.

Is there traffic congestion in Vermont?

Vermont has traffic congestion, like many other states, during the morning and afternoon rush hours, but congestion isn’t likely in normal weather conditions. Expect slower commute times during snowy weather and freezing rain.

What’s the bottom line?

Ultimately, the best choice for you as a motorist is a coverage rate that meets your budget and your motor vehicle needs. The most expensive auto insurance policy may not be in your best interest. However, policies like full coverage will help should you get into a car accident.

Need a second look at coverage rates? Enter your zip code in the FREE quote box below to get quick results.