Colorado Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Residents of the mile-high city prefer to drive alone. According to DataUSA, 74.9 percent of drivers in Denver commute alone, followed by 8.56 percent who work from home, and 8.55 percent who carpool.

While rates are regulated by “open competition,” auto insurance rate increases and decreases will generally need to be approved by the State’s Insurance Commissioner.

Don’t be anxious. We will provide you with the most meaningful data you’ll need when deciding on the best car insurance company for you. The public reputation and perception of any company from which you’re considering purchasing car insurance should be a major factor in your deliberations.

The Insurance Commissioner must ensure that the individual will be able to pay the minimum coverages required by the state. For more information on self‑insurance, contact the state’s Division of Insurance within the Department of Regulatory Agencies (DORA).

- $25,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

The state of Colorado requires all motorists to carry the minimum liability limits of 25/50/15 to satisfy “basic coverage.” This means that car owners must carry the following Colorado car insurance requirements, with minimum levels of liability insurance:

Uninsured Motorists 13.3

Knowing the basics of Colorado car insurance laws is important when you’re ready to get out on the road. We’ll look at minimum requirements, rates, ways to lower your rates, factors that affect the price of car insurance, and more. If you’re looking to lower your rates, one option is taking an AARP.org driving 101 course. This is especially important considering the steeply rising cost of auto insurance in Colorado.

Another great way to keep your rates as low as possible, even in the midst of rising costs statewide, is to look at car insurance in Colorado and conduct a comparison of car insurance quotes from multiple companies. Then you can choose the one with the best rates for you.

Looking for affordable Colorado car insurance? Enter your ZIP code to start your Colorado car insurance quotes comparison with our FREE tool.

What Are The Average Rates and Coverage on Colorado Car Insurance?

Car insurance is a necessity, but knowing how and where to begin to choose the proper coverage from the best car insurance companies can be burdensome.

The good news is we have made it our business to ease your burden when it comes to the need-to-knows about car insurance in your state. We will provide you with statistical and anecdotal medicine to alleviate any anxiety you may be feeling over the rising costs of auto insurance premiums.

Take a look at this chart to see the average cost of auto insurance in Colorado, as well as car insurance rates by state across the country.

We’ll help you discover what the law requires, what you may want or need, and where you can get it at the best rates possible for your circumstance, as well as average car insurance per month in Colorado and other useful information.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Much Car Insurance Coverage Is Required in Colorado?

Colorado is a “fault” state. If you are found at-fault in an accident, you are responsible to pay for all the resulting damages. Minimum coverage is meant to cover your liability if you’re at fault. So it covers the other party’s property damage and bodily injury liability.

The state of Colorado requires all motorists to carry the minimum liability limits of 25/50/15 to satisfy “basic coverage.” This means that car owners must carry the following Colorado car insurance requirements, with minimum levels of liability insurance:

- $25,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

- $50,000 for total bodily injury or death in an accident caused by the owner of the insured vehicle

- $15,000 for property damage per accident caused by the owner of the insured vehicle

Take a look at this table for specific minimum coverage requirements in Colorado.

| Colorado Minimum Coverage Requirements | Minimum Policy Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $15,000 per accident |

| Uninsured/Underinsured Motorist Coverage* | $25,000 per person $50,000 per accident |

| Medical Payments (MedPay)* | $5000 |

*May be waived if rejected. UUM must be rejected in writing. MedPay may be rejected in writing or in the same way you buy insurance.If uninsured/underinsured motorist coverage is not rejected, it will automatically be applied to a basic policy. Take a look at this video to learn a little more about uninsured/underinsured motorist coverage.

Take a look at this chart to see mandatory minimum coverage requirements for every state in the country.

Any motorist or business with 25 or more vehicles registered in the state has the option of self-insurance.

Any individual who has over 25 vehicles registered to his or her name may qualify as a self‑insurer by applying for a certificate of self‑insurance from the state Insurance Commissioner.

The Insurance Commissioner must ensure that the individual will be able to pay the minimum coverages required by the state. For more information on self‑insurance, contact the state’s Division of Insurance within the Department of Regulatory Agencies (DORA).

How Much Coverage Is Enough with Insurance Providers in Colorado?

Will opting for just the basic Colorado car insurance minimums meet all your insurance needs? That all depends on whether you have substantial assets (present or future) to protect. Are you willing to open yourself up to potential litigation in the event of an accident?

If not, consider increasing your liability limits. The experts at the Wall Street Journal advise limits of 100/300/50, offering the following recommendation:

Make sure you’re covered for an amount equal to the total value of your assets (add up the dollar values of your house, your car, savings, and investments).

Next, we will glance at what the average driver in Colorado pays for car insurance. The exact amount you will pay will probably be slightly higher or lower than these figures, but this data will give you a healthy frame of reference. With telematics programs and other discounts available that weren’t before, even the initial rate you get may not be completely accurate.

What Percentage of Income Are Car Insurance Rates in Colorado?

Arthur Godfrey, the late, great radio and television broadcaster and entertainer once quipped, “I am proud to be paying taxes in the United States. The only thing is I could be just as proud for half of the money.”

This humorous quote underlies the principle of Disposable Personal Income (DPI), which is the amount of money you retain after paying the government its cut by way of taxes. Take a look at this table, where we compare average monthly Colorado car insurance rates to average DPI in the state.

| Annual Full Coverage Average Rate | Monthly Full Coverage Average Rate | Annual Per Capita Disposable Personal Income in CO | Monthly Per Capita Disposable Personal Income in CO | Percentage of Income Spent on Insurance |

|---|---|---|---|---|

| $939.52 | $78.29 | $43,609.00 | $3,634.08 | 2.15% |

Basic liability coverage is what is required by law. What is considered full coverage auto insurance in Colorado? It includes liability, comprehensive, and collision insurance. We’ll break down the average cost of each.

| Type of Core Coverage | Average Annual Rate for Each Coverage Type |

|---|---|

| Liability | $520.04 |

| Collision | $287 |

| Comprehensive | $174.61 |

| Full Coverage | $981.64 |

So what are average monthly car insurance rates in Colorado for these coverage types? Take a look.

- Average monthly liability rate: $43.34

- Average monthly collision rate: $24

- Average monthly comprehensive rate: $14.55

- Average monthly full coverage rate: $81.80

We’ve perused some stats about what Colorado car insurance costs the individual Coloradan. Next, we will delve into some pertinent statistics about the insurance companies within the state.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Loss Ratio?

The insurance loss ratio is the dollar amount of losses compared to the dollar amount of earned premiums expressed as a percentage. A high loss ratio means that an insurance company has too many customers filing claims, which will subsequently lead to an increase in future premiums for all consumers.

For example, an auto insurer collects $100,000 of premiums in a given year and pays out $42,000 in claims, the company’s loss ratio is 42 percent ($42,000 incurred losses/$100,000 earned premiums).

Small insurers often offset this risk by avoiding high-risk drivers. They offer exceptionally low rates, but only if you have a clean driving record and high credit score. Larger insurance companies typically have a higher tolerance due to economies of scale. It actually costs them less per customer to provide coverage. This is why companies like Geico and Progressive can cover higher risk drivers while keeping rates relatively affordable.

What car insurance add-ons, endorsements, and riders are available in Colorado?

There are several additional coverage options that you can learn more about to decide if they’re a good choice for your situation. We’ll look at those right here:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

The Colorado Department of Insurance released the Consumer’s Guide to Auto Insurance for a quick and helpful summary of all the enhancements available to you in the Centennial State.

Just over 13 percent of drivers in Colorado (13.3 percent to be precise) don’t have insurance, which ranks the state as the 19th highest percentage in the nation, which is why it’s a good idea to purchase uninsured/underinsured motorist coverage.

Medical Payments is another coverage that is included in a basic Colorado policy but can be rejected in writing or in the form in which the policy was purchased (e.g. internet or phone).

Despite the increasing popularity of pay-by-the-mile auto insurance plans offered by companies like Metromile, presently they are unavailable in Colorado.

Other Usage-Based Insurance programs (UBI) are active and available to drivers in Colorado. Programs like SmartRide from Nationwide, or Drive Safe & Save from State Farm, or Drivewise from Allstate offer discounts to drivers based on their driving proficiency.

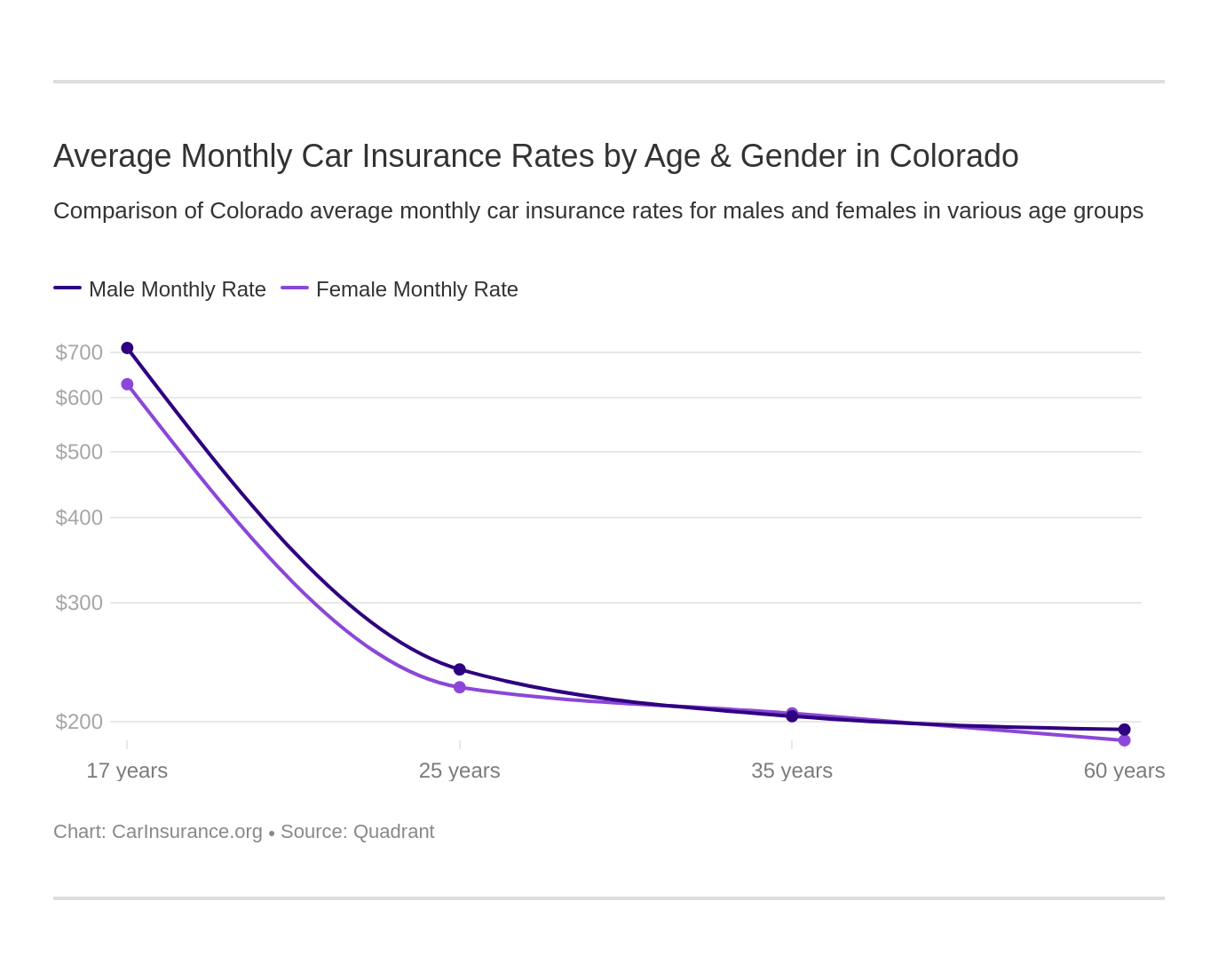

Do gender and age affect my car insurance in Colorado?

Country music living legend Reba McEntire once sang a ballad lamenting not knowing what to get the girl who has everything. Our response to that query is to raise a suspicious eyebrow and question or not the girl truly did have everything. Namely, did she have more favorable car insurance premiums than her male counterparts?

The only way to find out is to consult the data. Take a look.

| Insurance Company | Average Annual Insurance Rate for a Single 17-year-old Female | Average Annual Insurance Rate for a Single 17-year-old Male | Average Annual Insurance Rate for a Single 25-year-old Female | Average Annual Insurance Rate for a Single 25-year-old Male | Average Annual Insurance Rate for a Married 35-year-old Female | Average Annual Insurance Rate for a Married 35-year-old Male | Average Annual Insurance Rate for a Married 60-year-old Female | Average Annual Insurance Rate for a Married 60-year-old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $11,732.84 | $12,322.40 | $3,748.22 | $3,771.84 | $3,397.34 | $3,180.33 | $3,056.13 | $3,088.23 |

| American Family Mutual | $6,182.18 | $8,292.20 | $2,552.17 | $3,128.70 | $2,552.17 | $2,552.17 | $2,302.28 | $2,302.28 |

| Farmers Ins Exchange 2.0 | $11,703.79 | $11,788.62 | $3,401.12 | $3,436.88 | $3,095.55 | $3,068.12 | $2,804.12 | $3,023.70 |

| Geico Cas | $6,116.54 | $6,472.19 | $1,797.35 | $1,830.71 | $1,962.23 | $2,140.86 | $2,069.94 | $2,343.70 |

| Safeco Ins Co of America | $5,559.53 | $6,061.99 | $1,877.93 | $1,897.98 | $1,859.15 | $1,810.08 | $1,578.98 | $1,736.25 |

| AMCO Insurance | $6,292.06 | $8,057.66 | $2,863.59 | $3,094.73 | $2,490.00 | $2,536.58 | $2,226.47 | $2,354.68 |

| Progressive Direct | $8,765.26 | $9,802.10 | $2,926.11 | $2,846.92 | $2,593.20 | $2,426.75 | $2,250.01 | $2,245.05 |

| State Farm Mutual Auto | $5,901.90 | $7,471.21 | $2,293.13 | $2,717.20 | $2,048.74 | $2,048.74 | $1,842.60 | $1,842.60 |

| USAA | $5,582.30 | $6,398.91 | $2,873.09 | $3,130.10 | $2,232.85 | $2,232.55 | $2,126.52 | $2,134.62 |

Take a look at average premium rates for the Most Expensive Demographics in the Rocky Mountain State.

| Insurance Company | Demographic (Age, Gender, and Marital Status) | Average Annual Insurance Rate | Rank |

|---|---|---|---|

| Allstate F&C | Single 17-year-old male | $12,322.40 | 1 |

| Farmers Ins Exchange 2.0 | Single 17-year-old male | $11,788.62 | 2 |

| Allstate F&C | Single 17-year-old female | $11,732.84 | 3 |

| Farmers Ins Exchange 2.0 | Single 17-year-old female | $11,703.79 | 4 |

| Progressive Direct | Single 17-year-old male | $9,802.10 | 5 |

| Progressive Direct | Single 17-year-old female | $8,765.26 | 6 |

| American Family Mutual | Single 17-year-old male | $8,292.20 | 7 |

| AMCO Insurance | Single 17-year-old male | $8,057.66 | 8 |

| State Farm Mutual Auto | Single 17-year-old male | $7,471.21 | 9 |

| Geico Cas | Single 17-year-old male | $6,472.19 | 10 |

| USAA CIC | Single 17-year-old male | $6,398.91 | 11 |

| AMCO Insurance | Single 17-year-old female | $6,292.06 | 12 |

| American Family Mutual | Single 17-year-old female | $6,182.18 | 13 |

| Geico Cas | Single 17-year-old female | $6,116.54 | 14 |

| Safeco Ins Co of America | Single 17-year-old male | $6,061.99 | 15 |

| State Farm Mutual Auto | Single 17-year-old female | $5,901.90 | 16 |

| USAA CIC | Single 17-year-old female | $5,582.30 | 17 |

| Safeco Ins Co of America | Single 17-year-old female | $5,559.53 | 18 |

| Allstate F&C | Single 25-year-old male | $3,771.84 | 19 |

| Allstate F&C | Single 25-year-old female | $3,748.22 | 20 |

| Farmers Ins Exchange 2.0 | Single 25-year-old male | $3,436.88 | 21 |

| Farmers Ins Exchange 2.0 | Single 25-year-old female | $3,401.12 | 22 |

| Allstate F&C | Married 35-year-old female | $3,397.34 | 23 |

| Allstate F&C | Married 35-year-old male | $3,180.33 | 24 |

| USAA CIC | Single 25-year-old male | $3,130.10 | 25 |

| American Family Mutual | Single 25-year-old male | $3,128.70 | 26 |

| Farmers Ins Exchange 2.0 | Married 35-year-old female | $3,095.55 | 27 |

| AMCO Insurance | Single 25-year-old male | $3,094.73 | 28 |

| Allstate F&C | Married 60-year-old male | $3,088.23 | 29 |

| Farmers Ins Exchange 2.0 | Married 35-year-old male | $3,068.12 | 30 |

| Allstate F&C | Married 60-year-old female | $3,056.13 | 31 |

| Farmers Ins Exchange 2.0 | Married 60-year-old male | $3,023.70 | 32 |

| Progressive Direct | Single 25-year-old female | $2,926.11 | 33 |

| USAA CIC | Single 25-year-old female | $2,873.09 | 34 |

| AMCO Insurance | Single 25-year-old female | $2,863.59 | 35 |

| Progressive Direct | Single 25-year-old male | $2,846.92 | 36 |

| Farmers Ins Exchange 2.0 | Married 60-year-old female | $2,804.12 | 37 |

| State Farm Mutual Auto | Single 25-year-old male | $2,717.20 | 38 |

| Progressive Direct | Married 35-year-old female | $2,593.20 | 39 |

| American Family Mutual | Married 35-year-old female | $2,552.17 | 40 |

| American Family Mutual | Married 35-year-old male | $2,552.17 | 40 |

| American Family Mutual | Single 25-year-old female | $2,552.17 | 40 |

| AMCO Insurance | Married 35-year-old male | $2,536.58 | 43 |

| AMCO Insurance | Married 35-year-old female | $2,490.00 | 44 |

| Progressive Direct | Married 35-year-old male | $2,426.75 | 45 |

| AMCO Insurance | Married 60-year-old male | $2,354.68 | 46 |

| Geico Cas | Married 60-year-old male | $2,343.70 | 47 |

| American Family Mutual | Married 60-year-old female | $2,302.28 | 48 |

| American Family Mutual | Married 60-year-old male | $2,302.28 | 48 |

| State Farm Mutual Auto | Single 25-year-old female | $2,293.13 | 50 |

| Progressive Direct | Married 60-year-old female | $2,250.01 | 51 |

| Progressive Direct | Married 60-year-old male | $2,245.05 | 52 |

| USAA CIC | Married 35-year-old female | $2,232.85 | 53 |

| USAA CIC | Married 35-year-old male | $2,232.55 | 54 |

| AMCO Insurance | Married 60-year-old female | $2,226.47 | 55 |

| Geico Cas | Married 35-year-old male | $2,140.86 | 56 |

| USAA CIC | Married 60-year-old male | $2,134.62 | 57 |

| USAA CIC | Married 60-year-old female | $2,126.52 | 58 |

| Geico Cas | Married 60-year-old female | $2,069.94 | 59 |

You may be in goods hands with Allstate, but as a 17-year-old single male, you’ll pay on average three and a half times more to be secured by those good hands than his 25-year-old single brother.

Choose the insurance company that best meets your needs. Focus on yourself. There’s no need to apologize.

This chart compares the average differences in rates between males and females in Colorado.

A married 60-year-old female will pay $2,069.94 on average with Geico, compared to $3,056.13 she would pay with Allstate. That is a difference of a whopping $986.19. Clearly, it pays to shop around.

In another example, if you’re looking for car insurance for a 35-year-old male, your best bet may be Geico, with average rates of $2,140.86.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

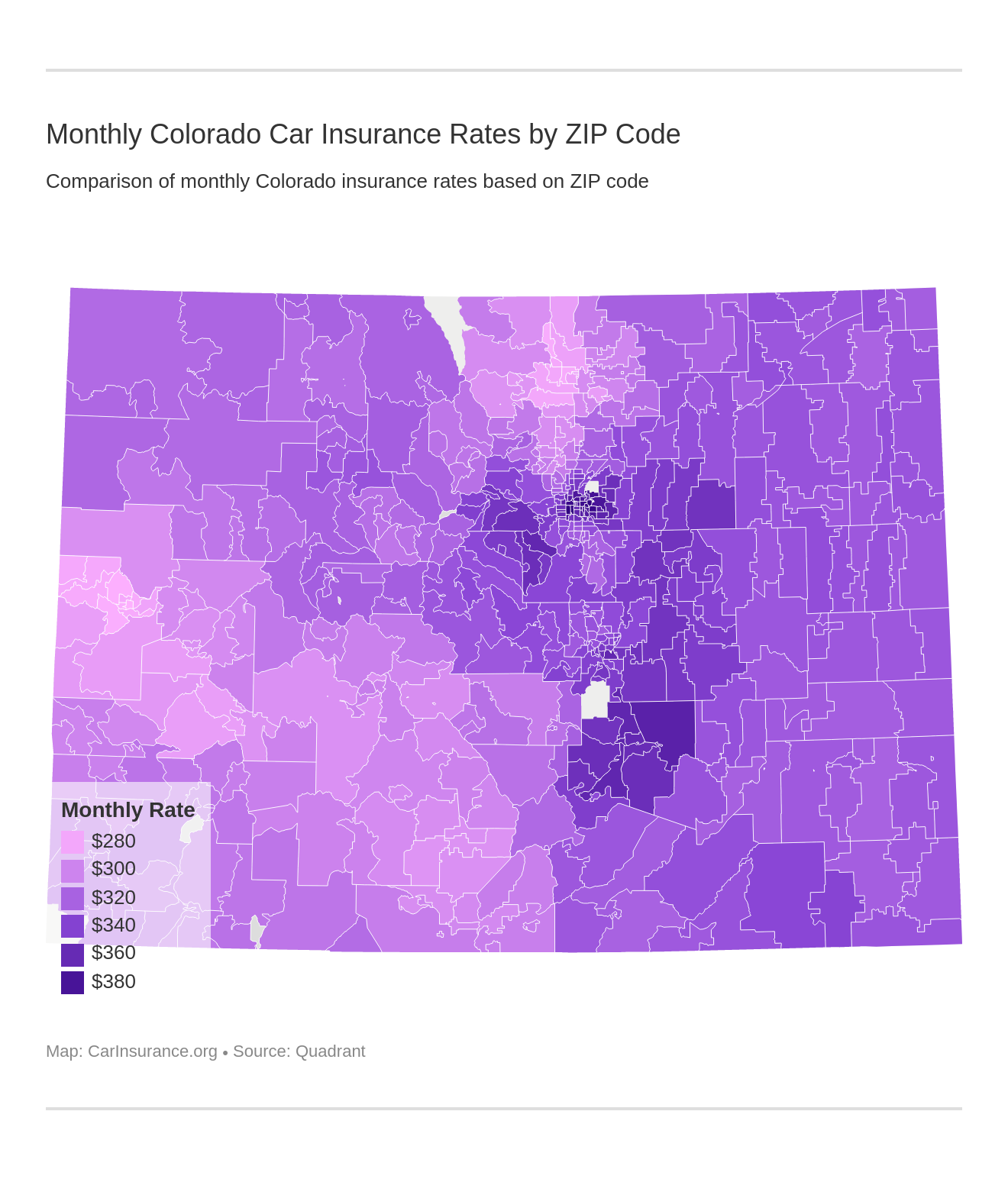

What are the cheapest car insurance rates by ZIP code in Colorado?

Let’s take a look at the cheapest and most expensive ZIP codes in Colorado. Here are charts with the average annual premiums in Colorado by ZIP code:

| Cheapest ZIP Codes in Colorado | City | Average Annual Rate by ZIP Code | Most Expensive Car Insurance Company | Most Expensive Annual Car Insurance Rate | 2nd Most Expensive Car Insurance Company | 2nd Most Expensive Annual Car Insurance Rate | Cheapest Car Insurance Company | Cheapest Annual Car Insurance Rate | 2nd Cheapest Car Insurance Company | 2nd Cheapest Annual Car Insurance Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 81504 | Grand Junction | $3,291.13 | Allstate | $5,559.67 | Farmers | $4,321.67 | Geico | $2,158.40 | Liberty Mutual | $2,350.84 |

| 81505 | Grand Junction | $3,299.49 | Allstate | $5,559.67 | Farmers | $4,391.99 | Geico | $2,106.05 | Liberty Mutual | $2,360.44 |

| 81507 | Grand Junction | $3,312.39 | Allstate | $5,559.67 | Farmers | $4,300.31 | Geico | $2,236.13 | Liberty Mutual | $2,360.44 |

| 81501 | GGrand Junction | $3,314.33 | Allstate | $5,134.33 | Farmers | $4,336.53 | Geico | $2,236.13 | Liberty Mutual | $2,434.26 |

| 80535 | Laporte | $3,327.82 | Farmers | $4,375.65 | Allstate | $4,199.55 | Liberty Mutual | $2,280.34 | USAA | $2,837.72 |

| 81521 | Fruita | $3,330.77 | Allstate | $5,559.67 | Farmers | $4,352.53 | Geico | $2,106.05 | State Farm | $2,610.96 |

| 80525 | Fort Collins | $3,334.66 | Farmers | $4,695.19 | Allstate | $4,308.76 | Liberty Mutual | $2,448.71 | USAA | $2,707.04 |

| 81520 | Clifton | $3,336.43 | Allstate | $5,559.67 | Farmers | $4,381.59 | Geico | $2,106.05 | Liberty Mutual | $2,350.84 |

| 81503 | Grand Junction | $3,338.85 | Allstate | $5,559.67 | Farmers | $4,452.48 | Geico | $2,158.40 | Liberty Mutual | $2,360.44 |

| 81525 | Mack | $3,344.40 | Allstate | $5,431.16 | Farmers | $4,591.98 | Geico | $2,106.05 | Liberty Mutual | $2,551.75 |

| 81524 | Loma | $3,344.96 | Allstate | $5,431.16 | Farmers | $4,439.13 | Geico | $2,106.05 | Liberty Mutual | $2,375.76 |

| 81506 | Grand Junction | $3,346.16 | Allstate | $5,559.67 | Farmers | $4,308.80 | Geico | $2,158.40 | Liberty Mutual | $2,434.26 |

| 80521 | Fort Collins | $3,347.76 | Farmers | $4,523.55 | Allstate | $4,199.55 | Liberty Mutual | $2,415.11 | Geico | $2,799.30 |

| 80537 | Loveland | $3,361.47 | Farmers | $4,562.20 | Allstate | $4,377.44 | Liberty Mutual | $2,555.08 | Geico | $2,746.43 |

| 80526 | Fort Collins | $3,361.56 | Farmers | $4,637.80 | Allstate | $4,199.55 | Liberty Mutual | $2,361.92 | Geico | $2,799.30 |

| 80538 | Loveland | $3,366.63 | Farmers | $4,650.88 | Allstate | $4,319.84 | Liberty Mutual | $2,603.47 | Geico | $2,746.43 |

| 81526 | Palisade | $3,381.38 | Allstate | $5,431.16 | Farmers | $4,485.57 | Geico | $2,158.40 | Liberty Mutual | $2,603.97 |

| 80528 | Fort Collins | $3,393.99 | Farmers | $4,632.36 | Allstate | $4,319.84 | Liberty Mutual | $2,448.71 | USAA | $2,749.54 |

| 80524 | Fort Collins | $3,397.23 | Farmers | $4,678.84 | Allstate | $4,558.04 | Liberty Mutual | $2,415.11 | USAA | $2,707.04 |

| 81401 | Montrose | $3,417.08 | Allstate | $5,235.78 | Farmers | $4,581.77 | Geico | $2,159.83 | Liberty Mutual | $2,711.63 |

| 80549 | Wellington | $3,419.33 | Allstate | $4,571.00 | Farmers | $4,517.83 | Liberty Mutual | $2,574.62 | State Farm | $2,743.35 |

| 81523 | Glade Park | $3,420.49 | Allstate | $5,559.67 | Farmers | $4,510.33 | Geico | $2,236.13 | Liberty Mutual | $2,562.30 |

| 81403 | Montrose | $3,421.86 | Allstate | $5,235.78 | Farmers | $4,525.94 | Geico | $2,159.83 | Liberty Mutual | $2,711.63 |

| 80547 | Timnath | $3,423.02 | Farmers | $4,978.52 | Allstate | $4,308.76 | Liberty Mutual | $2,448.71 | Geico | $2,758.74 |

| 81527 | Whitewater | $3,432.47 | Allstate | $5,577.83 | Farmers | $5,055.56 | Geico | $2,158.40 | Liberty Mutual | $2,386.31 |

ZIP codes affect auto insurance because of factors like traffic and crime rates. Find out how your ZIP code stacks up in Colorado by checking out this state chart.

Six of the cheapest ZIP codes in Colorado can be found in Grand Junction.

| Most Expensive ZIP Codes in Colorado | City | Average Annual Rate by ZIP Code | Most Expensive Car Insurance Company | Most Expensive Annual Car Insurance Rate | 2nd Most Expensive Car Insurance Company | 2nd Most Expensive Annual Car Insurance Rate | Cheapest Car Insurance Company | Cheapest Annual Car Insurance Rate | 2nd Cheapest Car Insurance Company | 2nd Cheapest Annual Car Insurance Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 80219 | Denver | $4,762.40 | Allstate | $6,635.51 | Farmers | $6,600.49 | USAA | $3,345.01 | Liberty Mutual | $3,514.27 |

| 80223 | Denver | $4,757.54 | Farmers | $6,750.80 | Allstate | $6,481.50 | Liberty Mutual | $3,591.58 | Geico | $3,680.74 |

| 80010 | Aurora | $4,722.91 | Allstate | $6,709.57 | Farmers | $6,345.60 | Liberty Mutual | $3,454.53 | USAA | $3,525.81 |

| 80230 | Denver | $4,693.01 | Allstate | $6,939.29 | Farmers | $5,866.11 | Liberty Mutual | $3,477.44 | USAA | $3,530.73 |

| 80012 | Aurora | $4,677.64 | Allstate | $6,831.76 | Farmers | $5,996.27 | USAA | $3,530.73 | Liberty Mutual | $3,565.22 |

| 80246 | Denver | $4,673.75 | Allstate | $6,913.77 | Farmers | $6,273.18 | Liberty Mutual | $3,309.16 | USAA | $3,516.53 |

| 80204 | Denver | $4,672.66 | Allstate | $6,481.50 | Farmers | $6,153.74 | Liberty Mutual | $3,560.88 | USAA | $3,657.89 |

| 80220 | Denver | $4,642.72 | Allstate | $6,744.02 | Farmers | $6,276.00 | Liberty Mutual | $3,413.46 | USAA | $3,530.73 |

| 80247 | Denver | $4,642.34 | Allstate | $6,831.76 | Farmers | $5,763.39 | Liberty Mutual | $3,442.19 | USAA | $3,530.73 |

| 80045 | Aurora | $4,620.43 | Allstate | $6,709.57 | Farmers | $5,817.07 | Liberty Mutual | $3,454.53 | USAA | $3,530.73 |

| 80239 | Denver | $4,581.88 | Allstate | $6,523.66 | Farmers | $5,864.52 | Liberty Mutual | $3,441.92 | USAA | $3,525.81 |

| 80205 | Denver | $4,576.50 | Farmers | $6,325.44 | Allstate | $6,283.66 | Geico | $3,461.13 | USAA | $3,484.32 |

| 80203 | Denver | $4,567.76 | Allstate | $6,411.14 | Farmers | $6,104.04 | Liberty Mutual | $3,292.91 | Geico | $3,369.30 |

| 80011 | Aurora | $4,550.80 | Allstate | $6,523.66 | Farmers | $5,979.90 | USAA | $3,244.30 | Liberty Mutual | $3,442.19 |

| 80047 | Aurora | $4,547.13 | Allstate | $6,074.05 | Farmers | $5,683.22 | Liberty Mutual | $3,565.22 | State Farm | $3,687.16 |

| 80207 | Denver | $4,527.63 | Farmers | $6,369.66 | Allstate | $5,928.00 | Liberty Mutual | $3,406.04 | USAA | $3,530.73 |

| 80206 | Denver | $4,526.04 | Farmers | $6,145.16 | Allstate | $5,853.97 | Liberty Mutual | $3,368.61 | Geico | $3,369.30 |

| 80014 | Aurora | $4,525.03 | Allstate | $6,565.34 | Farmers | $6,007.98 | Liberty Mutual | $3,155.03 | USAA | $3,504.28 |

| 80218 | Denver | $4,521.67 | Allstate | $6,283.66 | Farmers | $6,002.72 | Liberty Mutual | $3,321.71 | Geico | $3,322.81 |

| 80216 | Denver | $4,519.40 | Farmers | $6,451.96 | Allstate | $6,074.49 | Liberty Mutual | $3,315.08 | Geico | $3,544.79 |

| 80224 | Denver | $4,505.94 | Allstate | $6,496.63 | Farmers | $6,063.86 | Liberty Mutual | $3,389.52 | USAA | $3,504.28 |

| 80017 | Aurora | $4,500.52 | Allstate | $6,671.40 | Farmers | $5,906.67 | Liberty Mutual | $3,402.15 | USAA | $3,405.74 |

| 80202 | Denver | $4,497.08 | Allstate | $6,296.06 | Farmers | $6,112.84 | Liberty Mutual | $3,352.37 | Geico | $3,414.64 |

| 80231 | Denver | $4,475.84 | Allstate | $6,496.63 | Farmers | $5,769.53 | Liberty Mutual | $3,429.51 | USAA | $3,530.73 |

| 80211 | Denver | $4,464.23 | Allstate | $6,086.89 | Farmers | $6,033.88 | Geico | $3,243.61 | Liberty Mutual | $3,369.71 |

By contrast, some of the most expensive ZIP codes in Colorado are in Denver and Aurora.

What are the cheapest car insurance rates by city in Colorado?

Will you get more affordable car insurance coverage living closer to the Colorado River, the Rocky Mountains, or Golden Gate Canyon State Park? Take a look at this table to find out.

| Cheapest Cities in Colorado | Average Annual Car Insurance Rate by City | Most Expensive Car Insurance Company | Most Expensive Annual Car Insurance Rate | 2nd Most Expensive Car Insurance Company | 2nd Most Expensive Annual Car Insurance Rate | Cheapest Car Insurance Company | Cheapest Annual Car Insurance Rate | 2nd Cheapest Car Insurance Company | 2nd Cheapest Annual Car Insurance Rate |

|---|---|---|---|---|---|---|---|---|---|

| Clifton | $3,313.78 | Allstate | $5,559.67 | Farmers | $4,351.63 | Geico | $2,132.23 | Liberty Mutual | $2,350.84 |

| Grand Junction | $3,322.24 | Allstate | $5,474.60 | Farmers | $4,358.02 | Geico | $2,179.02 | Liberty Mutual | $2,389.97 |

| Laporte | $3,327.82 | Farmers | $4,375.65 | Allstate | $4,199.55 | Liberty Mutual | $2,280.34 | USAA | $2,837.72 |

| Fruita | $3,330.77 | Allstate | $5,559.67 | Farmers | $4,352.53 | Geico | $2,106.05 | State Farm | $2,610.96 |

| Mack | $3,344.40 | Allstate | $5,431.16 | Farmers | $4,591.98 | Geico | $2,106.05 | Liberty Mutual | $2,551.75 |

| Loma | $3,344.96 | Allstate | $5,431.16 | Farmers | $4,439.13 | Geico | $2,106.05 | Liberty Mutual | $2,375.76 |

| Loveland | $3,366.63 | Farmers | $4,650.88 | Allstate | $4,319.84 | Liberty Mutual | $2,603.47 | Geico | $2,746.43 |

| Palisade | $3,381.38 | Allstate | $5,431.16 | Farmers | $4,485.57 | Geico | $2,158.40 | Liberty Mutual | $2,603.97 |

| Fort Collins | $3,388.15 | Farmers | $4,696.20 | Allstate | $4,352.61 | Liberty Mutual | $2,417.45 | USAA | $2,757.68 |

| Wellington | $3,419.32 | Allstate | $4,571.00 | Farmers | $4,517.83 | Liberty Mutual | $2,574.62 | State Farm | $2,743.35 |

| Montrose | $3,419.47 | Allstate | $5,235.78 | Farmers | $4,553.86 | Geico | $2,159.83 | Liberty Mutual | $2,711.63 |

| Glade Park | $3,420.49 | Allstate | $5,559.67 | Farmers | $4,510.33 | Geico | $2,236.13 | Liberty Mutual | $2,562.30 |

| Timnath | $3,423.02 | Farmers | $4,978.52 | Allstate | $4,308.76 | Liberty Mutual | $2,448.71 | Geico | $2,758.74 |

| Berthoud | $3,425.56 | Allstate | $4,665.40 | Farmers | $4,491.22 | Liberty Mutual | $2,618.43 | Geico | $2,705.72 |

| Whitewater | $3,432.47 | Allstate | $5,577.83 | Farmers | $5,055.56 | Geico | $2,158.40 | Liberty Mutual | $2,386.31 |

| Masonville | $3,433.77 | Farmers | $4,786.19 | Allstate | $4,291.74 | Liberty Mutual | $2,603.47 | Geico | $2,858.45 |

| Delta | $3,436.14 | Allstate | $5,752.64 | Farmers | $4,616.66 | Geico | $2,107.48 | Liberty Mutual | $2,494.42 |

| Gateway | $3,452.59 | Allstate | $5,449.29 | Farmers | $4,796.02 | Geico | $2,288.48 | Liberty Mutual | $2,562.30 |

| Evans | $3,468.17 | Allstate | $5,069.20 | Farmers | $4,680.78 | Liberty Mutual | $2,446.28 | Geico | $2,553.81 |

| Glen Haven | $3,468.96 | Farmers | $4,916.37 | Allstate | $4,291.74 | Liberty Mutual | $2,618.37 | Geico | $2,879.57 |

| Olathe | $3,473.78 | Allstate | $5,571.82 | Farmers | $4,793.37 | Geico | $2,159.83 | Liberty Mutual | $2,542.41 |

| Austin | $3,481.55 | Allstate | $5,449.29 | Farmers | $4,803.01 | Geico | $2,237.56 | State Farm | $2,581.05 |

| Monte Vista | $3,488.11 | Allstate | $5,021.13 | Farmers | $4,822.69 | Geico | $2,533.48 | Liberty Mutual | $2,599.59 |

| Drake | $3,488.53 | Farmers | $4,987.95 | Allstate | $4,291.74 | Liberty Mutual | $2,618.37 | Geico | $2,879.57 |

| Cimarron | $3,499.94 | Allstate | $5,235.78 | Farmers | $4,336.23 | State Farm | $2,717.05 | Liberty Mutual | $2,734.33 |

As you can see, if you’re looking for coverage from Geico in Grand Junction, CO, for example, you’ll find some of the most affordable rates, with an average of $2,179.02.

Where does your city of residence rank for car insurance rates? Search this table to learn more.

| Most Expensive Cities in Colorado | Average Annual Car Insurance Rates by City | Most Expensive Car Insurance Company | Most Expensive Annual Car Insurance Rate | 2nd Most Expensive Car Insurance Company | 2nd Most Expensive Annual Car Insurance Rate | Cheapest Car Insurance Company | Cheapest Annual Car Insurance Rate | 2nd Cheapest Car Insurance Company | 2nd Cheapest Annual Car Insurance Rate |

|---|---|---|---|---|---|---|---|---|---|

| Aurora | $4,485.52 | Allstate | $6,378.06 | Farmers | $5,847.54 | Liberty Mutual | $3,300.77 | USAA | $3,457.18 |

| Denver | $4,451.50 | Allstate | $6,122.07 | Farmers | $6,017.55 | Liberty Mutual | $3,345.16 | Geico | $3,449.52 |

| Boone | $4,416.55 | Allstate | $6,195.05 | Farmers | $5,955.20 | Liberty Mutual | $2,782.94 | Geico | $3,359.96 |

| Edgewater | $4,413.46 | Farmers | $6,279.67 | Allstate | $6,091.35 | Liberty Mutual | $3,136.43 | USAA | $3,400.44 |

| Conifer | $4,356.88 | Allstate | $6,303.70 | Farmers | $5,645.34 | Liberty Mutual | $2,816.90 | USAA | $3,577.09 |

| Pueblo | $4,351.79 | Allstate | $6,223.13 | Farmers | $5,783.22 | Liberty Mutual | $3,135.55 | Geico | $3,382.29 |

| Kittredge | $4,345.37 | Allstate | $6,303.70 | Farmers | $5,735.63 | Liberty Mutual | $3,023.84 | USAA | $3,281.91 |

| Blende | $4,307.21 | Allstate | $6,286.45 | Farmers | $5,462.17 | Liberty Mutual | $3,128.26 | Geico | $3,359.96 |

| Avondale | $4,286.82 | Allstate | $6,244.99 | Farmers | $5,848.93 | Liberty Mutual | $3,067.77 | Geico | $3,359.96 |

| Pine | $4,286.70 | Allstate | $6,227.20 | Farmers | $5,552.36 | Liberty Mutual | $2,775.42 | USAA | $3,350.30 |

| Evergreen | $4,275.74 | Allstate | $6,303.70 | Farmers | $5,490.26 | Liberty Mutual | $3,023.84 | Nationwide | $3,512.42 |

| Cherry Hills Village | $4,274.05 | Farmers | $6,150.27 | Allstate | $5,954.43 | Liberty Mutual | $3,261.13 | Geico | $3,375.68 |

| Berkley | $4,258.11 | Farmers | $5,906.16 | Allstate | $5,785.95 | Liberty Mutual | $3,185.40 | Geico | $3,219.53 |

| Beulah | $4,258.06 | Allstate | $6,153.61 | Farmers | $5,941.29 | Liberty Mutual | $3,078.33 | American Family | $3,353.48 |

| Dupont | $4,256.69 | Allstate | $6,074.49 | Farmers | $5,865.45 | Liberty Mutual | $3,047.65 | Geico | $3,160.61 |

| Kiowa | $4,237.52 | Farmers | $5,700.89 | Allstate | $5,428.33 | Liberty Mutual | $2,768.05 | Geico | $3,618.34 |

| Pueblo West | $4,237.11 | Allstate | $6,244.99 | Farmers | $5,447.51 | Liberty Mutual | $3,149.36 | Geico | $3,268.81 |

| Deer Trail | $4,231.16 | Farmers | $6,520.12 | Allstate | $5,470.96 | Liberty Mutual | $2,838.41 | State Farm | $3,395.95 |

| Calhan | $4,227.68 | Farmers | $5,999.58 | Allstate | $5,669.62 | Liberty Mutual | $2,646.84 | USAA | $3,494.59 |

| Fort Carson | $4,204.82 | Allstate | $6,083.85 | Farmers | $5,557.52 | Liberty Mutual | $2,867.51 | State Farm | $3,357.87 |

| Idaho Springs | $4,194.17 | Allstate | $6,032.22 | Farmers | $5,510.99 | Liberty Mutual | $3,168.00 | Geico | $3,170.65 |

| Yoder | $4,188.72 | Allstate | $5,685.45 | Farmers | $5,647.34 | Liberty Mutual | $2,646.84 | State Farm | $3,548.46 |

| Indian Hills | $4,187.74 | Farmers | $5,975.56 | Allstate | $5,645.56 | Liberty Mutual | $2,975.13 | USAA | $3,281.91 |

| Lakewood | $4,174.68 | Allstate | $6,070.40 | Farmers | $5,830.34 | Liberty Mutual | $3,093.81 | Geico | $3,205.94 |

| Buffalo Creek | $4,171.50 | Farmers | $5,663.46 | Allstate | $5,569.05 | Liberty Mutual | $2,929.81 | USAA | $3,350.30 |

You can compare the cheapest and most expensive rates in the cities listed in the above table to see where your policy rates rank.

What Are the Best Colorado Car Insurance Companies?

What are the best car insurance companies in Colorado?

Choosing the best car insurance company is an important decision that could potentially cost or save you hundreds of dollars annually. When you consider the hundreds of different companies from which to choose and all their various rates, discount programs, and ever-changing protocols, the task can become even more stressful.

How can you decide with any modicum of confidence? There isn’t enough time in the day to do substantial research on each insurer. Who’s going to give you the best rates? Who has the best customer service? Do you qualify for any discounts or upgrades?

Mulling over all these options without the proper guidance can lead to many sleepless nights in America.

Don’t be anxious. We will provide you with the most meaningful data you’ll need when deciding on the best car insurance company for you. The public reputation and perception of any company from which you’re considering purchasing car insurance should be a major factor in your deliberations.

Keep reading to learn more about Colorado insurance company ratings so you can find the best insurance companies in Colorado as a whole as well as the best auto insurance in Colorado Springs and other cities throughout the state.

What Are the Financial Ratings of the Largest Car Insurance Companies in Colorado?

A.M. Best is a credit rating agency. They evaluate insurance companies and then give them a grade based on their financial stability. The table below shows the 10 largest insurance companies in Colorado by market share with their A.M. Best rating.

| Insurance Company | A.M. Best Credit Rating |

|---|---|

| State Farm | A++ |

| USAA | A++ |

| Geico | A++ |

| Progressive | A+ |

| Allstate | A+ |

| American Family | A |

| Farmers | A |

| Liberty Mutual | A |

| Travelers | A++ |

| Nationwide | A+ |

Any company with a rating of A- or better has a stable financial outlook, which means you’re in good shape with any of these top rated auto insurance companies in Colorado.

J.D. Power insurance ratings is a trusted, third-party source for auto insurance ratings. These ratings are based on the opinions of a representative sample of customers who have used or purchased the product or service being rated and are therefore representative of a typical buying experience. We’ll start with the major insurance companies in Colorado and their average rates, as compared to the average insurance rates in the state.

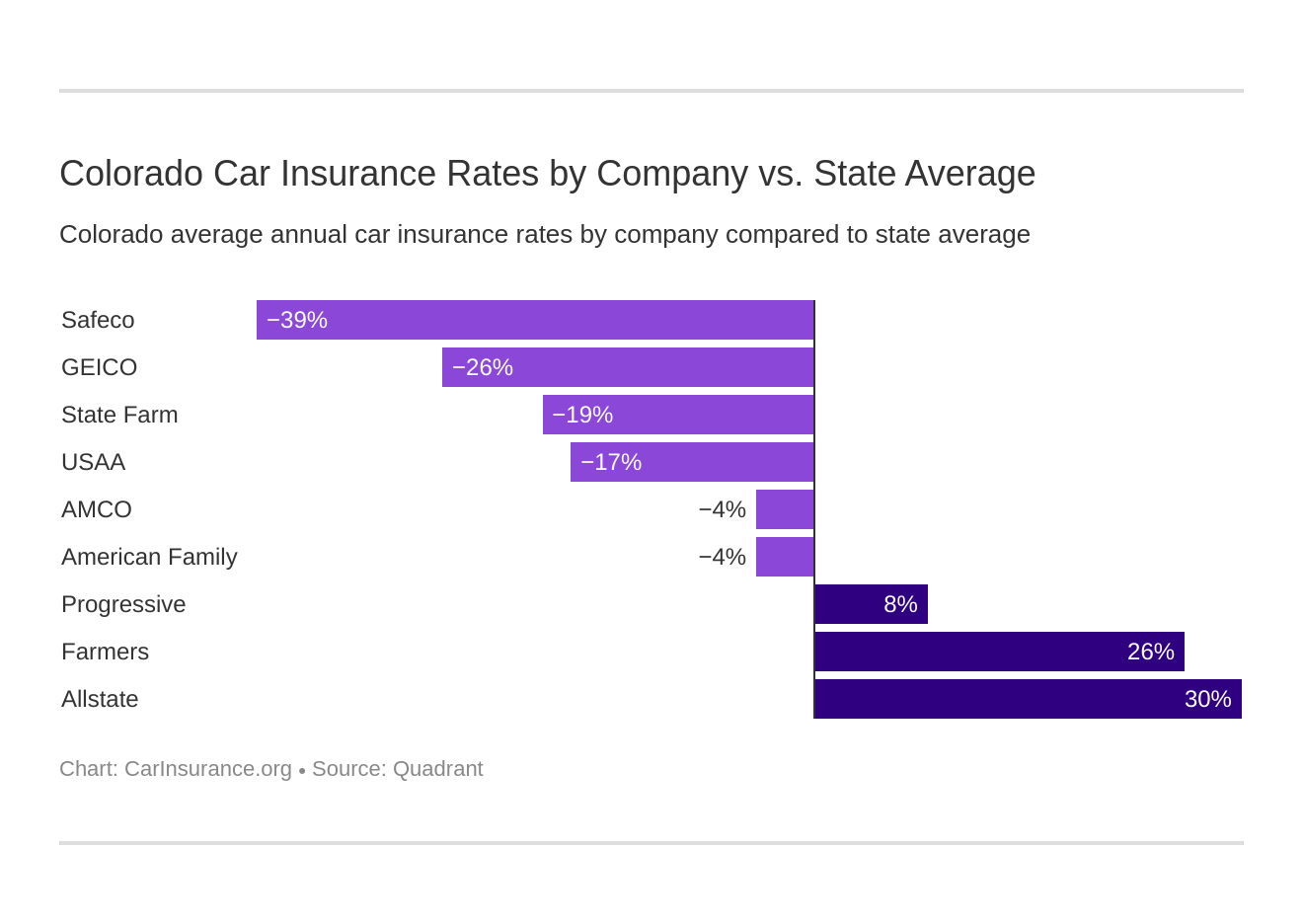

As you can see, State Farm Colorado car insurance rates, for example, are 19 percent lower than average rates for the state. Take a look at this table to see what J.D. Power’s auto insurance reviews for Colorado companies (along with other companies in the Southwest region) say about customer service ratings compared to other companies in the area.

| Insurance Company | Overall Customer Satisfaction Index Rating (1,000 point scale) |

|---|---|

| USAA | 876 |

| American Family | 834 |

| Geico | 834 |

| Allstate | 830 |

| The Hartford | 829 |

| State Farm | 826 |

| Farmers | 823 |

| Liberty Mutual | 816 |

| Safeco | 810 |

| CSAA Insurance Group | 809 |

| Travelers | 808 |

| Progressive | 803 |

| Nationwide | 786 |

J.D. Power often looks at companies based on region, rather than state, so for the purposes of this discussion, we’ve listed the insurance companies’ ratings for the Southwest region.

This information can help you decide on the best home and auto insurance companies in Colorado.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Car Insurance Companies Have the Most Complaints in Colorado?

Honesty, loyalty, trust, and open communication are all key elements for successful relationships that are characterized by long-term satisfaction. However, in some cases, longevity is impossible and dissatisfaction is inevitable. The relationship is on life support and there’s nothing anyone can do to save it.

In such cases where the customer is dissatisfied, he or she can file a complaint. Those complaints, justified or not, are factored into a company’s complaint ratios.

How many complaints does a company receive per one million dollars of business? The answer is the complaint ratio. If you wish to file a complaint against a car insurance company in the state of Colorado, use this online form.

Here’s how the largest companies by market share compare for complaint ratios.

| Insurance Company | Total Complaints | Confirmed Complaints | Complaint Ratio | Company Name | Total Complaints | Confirmed Complaints | Complaint Ratio |

|---|---|---|---|---|---|---|---|

| AIG | 0 | 0 | 0 | MetLife | 4 | 3 | 0.17 |

| Essentia | 0 | 0 | 0 | Nationwide Agribusiness | 6 | 3 | 0.18 |

| Farmers Alliance Mutual | 0 | 0 | 0 | 360 Insurance | 1 | 1 | 0.2 |

| Grange | 0 | 0 | 0 | Farmers | 53 | 18 | 0.2 |

| Great Northern | 1 | 0 | 0.08 | USAA | 32 | 11 | 0.2 |

| Country Preferred | 2 | 0 | 0.09 | Geico | 6 | 2 | 0.21 |

| Travelers Home and Marine | 2 | 0 | 0.12 | Liberty Mutual | 43 | 16 | 0.21 |

| Amica Mutual | 4 | 2 | 0.15 | State Farm | 174 | 62 | 0.21 |

| SECURA Supreme | 1 | 0 | 0.15 | Horace Mann | 1 | 0 | 0.22 |

As you can see, some of the best car insurance companies in Colorado have very low complaint ratio numbers (anything below one means below average), which is good news for you.

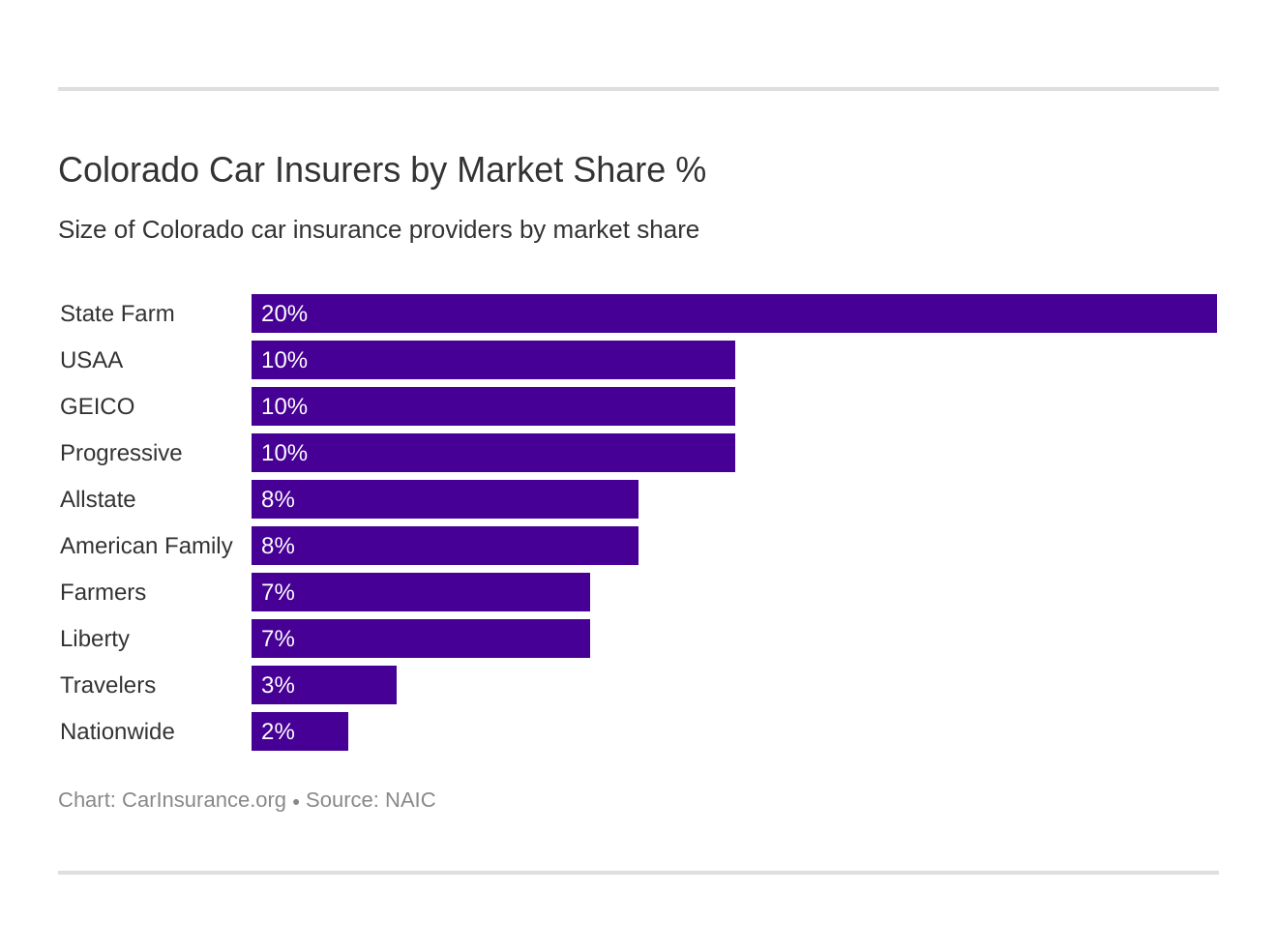

How Many Car Insurance Companies are Available in Colorado?

There are nearly 900 auto insurance companies registered in Colorado (858 to be exact). Ten of them are domestic (incorporated in the state) and 848 are foreign (incorporated outside of Colorado). Take a look at this chart to see the market share of the major companies in Colorado.

Comparing quotes will help you know where to get started. Once you find the company that offers the best rates to you, do some more research into their financial rating, customer satisfaction rating, and complaint ratios. Then, you can confidently choose your insurer.

Another way to be certain you can maintain low insurance rates is to be a good driver. In order to be a good driver, you must know the rules of the road and obey them. We’ll review the laws of the Rocky Mountain State so that you can keep a rock-solid driving record.

What About Colorado Car Insurance Rates by Company?

Now, we’re going to compare and contrast the top car insurance companies to see which of them give the best rates on average in Colorado.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does my commute affect my car insurance rate in Colorado?

Commute distance can sometimes have an effect on your rates, because the more time you spend on the road, the higher the risk of you getting into an accident. Take a look at this table to see how insurance companies in Colorado handle commutes when adjusting insurance rates.

| Insurance Company | Average Annual Rates for a 10-mile Commute (6,000 Annual Mileage) | Average Annual Rates for a 25-Mile Commute (12,000 annual mileage) |

|---|---|---|

| Liberty Mutual | $2,797.74 | $2,797.74 |

| Allstate | $5,831.60 | $5,831.60 |

| State Farm | $3,190.31 | $3,351.22 |

| Nationwide | $3,739.47 | $3,739.47 |

| Progressive | $4,231.92 | $4,231.92 |

| Geico | $3,025.45 | $3,157.93 |

| USAA | $3,244.04 | $3,433.70 |

| American Family | $3,653.11 | $3,812.93 |

Not all companies use commute as a factor in Colorado. However, State Farm, Geico, USAA, and American Family do make minor adjustments to their rates based on commute.

Can coverage level change my car insurance rate with companies in Colorado?

The more coverage you purchase the higher the cost, right? Take a look at this table to see how much coverage level can affect your rates.

| Insurance Company | Average Annual Rates for a Low Coverage Level | Average Annual Rates for a Medium Coverage Level | Average Annual Rates for a High Coverage Level |

|---|---|---|---|

| Allstate | $5,236.91 | $5,518.14 | $5,856.45 |

| American Family | $3,546.22 | $3,809.91 | $3,842.92 |

| Farmers | $4,641.62 | $5,215.47 | $6,013.62 |

| Geico | $2,785.20 | $3,034.95 | $3,454.92 |

| Liberty Mutual | $2,637.04 | $2,787.15 | $2,969.02 |

| Nationwide | $3,748.13 | $3,740.53 | $3,729.76 |

| Progressive | $3,915.86 | $4,244.39 | $4,535.53 |

| State Farm | $3,052.89 | $3,272.35 | $3,487.06 |

| USAA | $3,191.66 | $3,338.66 | $3,486.28 |

Higher coverage levels do mean higher rates, but not by as much as you might think. For example, for American Family, the average low coverage rate is $3,546.22, with a 7 percent increase for medium coverage and a less than 1 percent increase from medium to higher coverage.

How does my credit history affect my car insurance rates with companies in Colorado?

Have you ever wondered how your credit history influences the quotes you receive from car insurance companies? Consumer Reports conducted a study for Colorado analyzing the effect of credit history on rates. Take a look at this table to see average car insurance rates based on credit score.

| Insurance Company | Average Annual Insurance Rates for Good Credit | Average Annual Insurance Rates for Fair Credit | Average Annual Insurance Rates for Poor Credit |

|---|---|---|---|

| Allstate | $4,105.68 | $5,439.82 | $7,066.00 |

| American Family | $2,895.90 | $3,452.49 | $4,850.67 |

| Farmers | $4,739.93 | $4,988.44 | $6,142.35 |

| Geico | $2,465.94 | $3,091.66 | $3,717.48 |

| Liberty Mutual | $1,947.80 | $2,446.38 | $3,999.04 |

| Nationwide | $3,118.09 | $3,578.13 | $4,522.20 |

| Progressive | $3,768.17 | $4,108.11 | $4,819.49 |

| State Farm | $2,352.76 | $2,918.53 | $4,541.00 |

| USAA | $2,256.64 | $2,816.63 | $4,943.34 |

Insurance companies often consider credit score a reflection of an individual’s overall responsibility. More responsible people are seen as lower risk drivers, who therefore qualify for lower insurance rates. A lower credit score can mean higher insurance rates, sometimes even as much as 100 percent higher.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does my driving record change my rates with car insurance companies in Colorado?

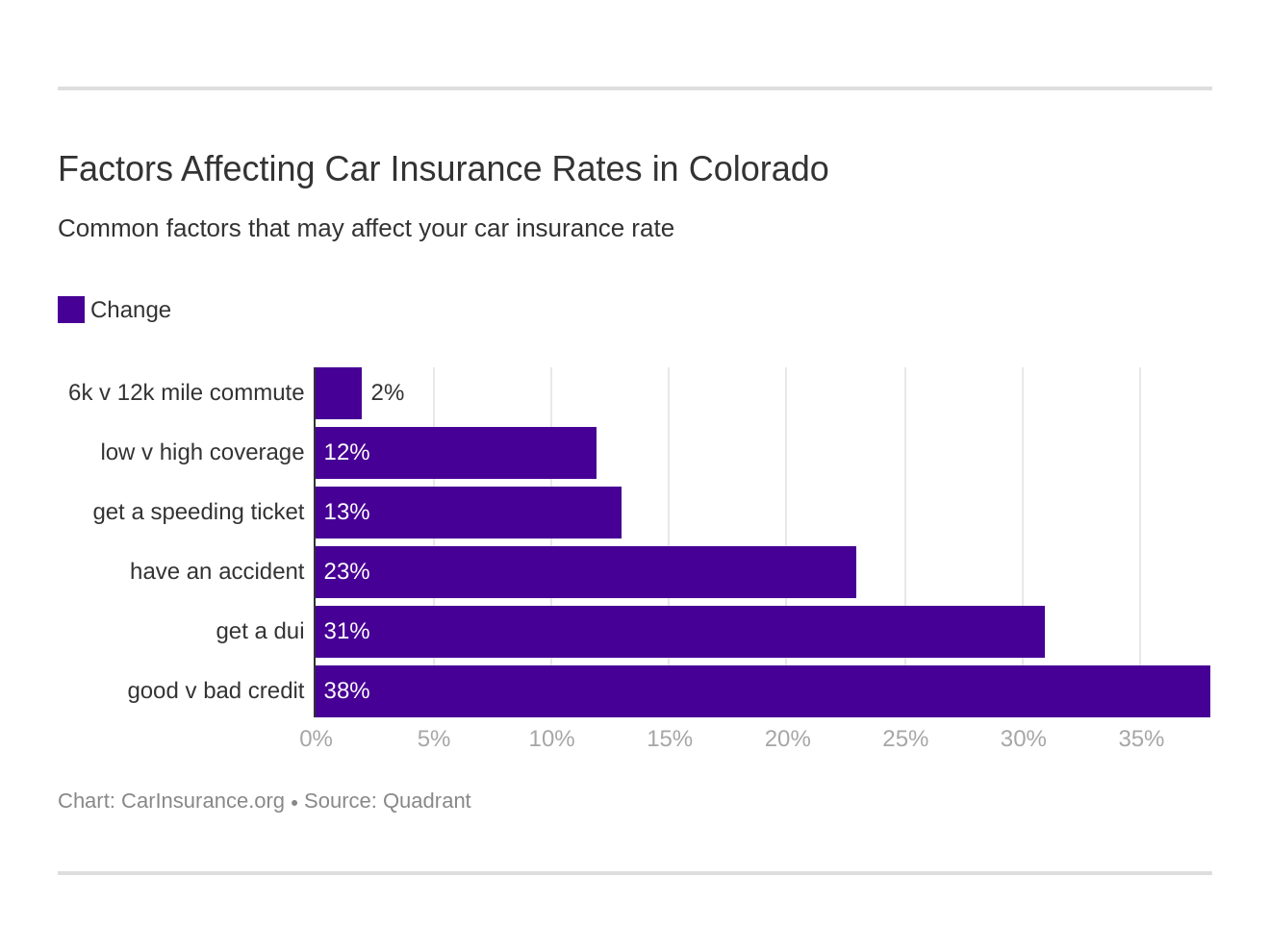

Traffic violations have the potential to cause your car insurance rates to rise a mile high. How adversely they will be affected will differ from company to company. Each insurance company has its own underwriting criteria and procedures. This chart provides averages for how heavily different factors can affect your insurance rates.

Here is a quick look at how top car insurance companies in the Mile High State price various driving infractions:

| Insurance Company | Average Annual Insurance Rates for a Clean Driving Record | Average Annual Insurance Rates for a Driving Record With 1 Speeding Violation | Average Annual Insurance Rates for a Driving Record With 1 Accident | Average Annual Insurance Rates for a Driving Record With 1 DUI |

|---|---|---|---|---|

| Allstate | $4,723.09 | $5,350.87 | $5,431.34 | $6,643.37 |

| American Family | $2,762.77 | $3,131.89 | $3,915.14 | $5,122.27 |

| Farmers | $4,468.57 | $5,283.78 | $5,743.39 | $5,665.21 |

| Geico | $2,184.55 | $2,858.30 | $3,395.15 | $3,928.75 |

| Liberty Mutual | $2,450.68 | $2,891.61 | $2,869.91 | $2,978.75 |

| Nationwide | $2,872.86 | $3,163.26 | $3,930.20 | $4,991.57 |

| Progressive | $3,665.41 | $4,278.14 | $5,115.10 | $3,869.05 |

| State Farm | $3,008.73 | $3,270.76 | $3,532.80 | $3,270.76 |

| USAA | $2,439.12 | $2,750.39 | $2,973.13 | $5,192.84 |

In general, the more severe your driving infraction, the higher your rates may be increased. In most cases, a DUI will mean higher rates than a speeding violation will, for example.

What Do I Need to Know About Colorado Laws?

It would take a long time to memorize every law in Colorado. It’s important to follow the laws, but the details can get a bit foggy. We’ll help clear the haze by listing some of the driving laws most important to know.

What Are the Car Insurance Laws in Colorado?

Insurance companies in Colorado don’t have free reign to set rates however they want. Although they have leeway, they are governed. Regardless, as we already noted, if you don’t follow the rules of the road, you may see an increase in your insurance rates. Keep reading to find out more about what you need to know before you get behind the wheel in Colorado.

Car Insurance Rate-Setting Regulations

While rates are regulated by “open competition,” rate increases and decreases will generally need to be approved by the State’s Insurance Commissioner.

Windshield Coverage

Some insurance companies may offer windshield replacement with comprehensive coverage, but there are no laws requiring insurers to cover windows.

High-Risk Insurance

If your license has been revoked or suspended, you may need to file an SR-22 to have your licenses reinstated. The SR-22 form is available from your insurance company but it is not an insurance policy.

The form is just assurance that you will have car insurance coverage. If your policy is canceled, the form ensures the insurer will notify the DMV of insurance cancellation, at which point, your license will be suspended.

Your license may be suspended for any of the following:

- A DUI conviction

- Driving without insurance

- Repeat traffic offenses

You can change insurance companies while you’re required to file an SR-22, but you must get a new SR-22 with the new company before the old one goes out of effect.

Automobile Insurance Fraud in Colorado

Insurance fraud is the second-largest economic crime in America. Rates are raised dramatically by insurance companies and passed on to consumers in attempts to combat fraud.

There are two classifications of fraud: hard and soft.

- Hard Fraud – A purposefully fabricated claim or accident

- Soft Fraud – A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to forty percent of consumers admitted to lying to their insurer about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime no matter how you slice it. Even the “little white lie” you tell to get a lower rate can lead to harmful consequences. That kind of willful misrepresentation of facts is known as “rate evasion” and is a $16 billion annual expense to auto insurers.

Misrepresentation to an insurance company is considered a misdemeanor and falsifying claims is a class 5 felony.

Colorado has employed an Insurance Fraud Unit to investigate fraudulent activity throughout the state. According to the Attorney General’s Office,

The Unit also works closely with other agencies including the National Insurance Crime Bureau (NICB), Colorado Division of Insurance, FBI, and local police departments.

They are working to eliminate insurance fraud in the state.

Committing insurance fraud is a crime, no matter your justification. If you suspect insurance fraud or have been a victim of insurance fraud, you can fill out and turn in a form provided on their website.

Statute of Limitations

Colorado’s statute of limitations for filing a claim is three years for both personal injury and property damage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Vehicle Licensing Laws in Colorado?

These are important laws to get familiar with. Your car has to be registered and insured to go on the road. If not, you’ll pay.

REAL ID

The Rocky Mountain State is compliant with the REAL ID Act passed by Congress and enforced by Homeland Security. Take a look at this news clip from when the REAL ID act requirements were announced in Colorado.

This means that a Colorado-issued driver’s license or state ID is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

Penalties for Driving Without Insurance

The Colorado car insurance database is called the Motorist Insurance Information Database (MIIDB) program to which the police and DMV have access. Registration information is updated in the MIIDB daily and insurance information is updated weekly or more. Take a look at this table to see what happens when you’re caught driving uninsured.

| Penalty Type | Driving Uninsured – First Offense | Driving Uninsured – Second Offense |

|---|---|---|

| Fine | $500 minimum | $1,000 minimum |

| Points | Four | Four |

| License Suspension | Until you show proof of insurance to the DMV | Four months |

| Community Service | Possible up to 40 hours | Possible up to 40 hours |

As you can see, driving without insurance can be expensive. There is no Colorado car insurance grace period and it’s not worth the risk.

Proof of Insurance

The following forms of proof of insurance are accepted in Colorado

- Electronic – picture of a current insurance card or pdf file of coverage on a phone, tablet, or another electronic device

- Insurance Card

- Declaration Page

- Letter/Binder – from the insurance company on their letterhead

Without at least one of these forms of proof of insurance, you may be penalized for driving without insurance, even if you do actually have insurance.

Affidavit of Non-Use

The Colorado Department of Revenue, Division of Motor Vehicles states the following: “Colorado residents who wish to register vehicles that will not be operated for a period of time or are temporarily residing out of state with valid out of state insurance, may complete the Affidavit of Non-Use and submit it to their county motor vehicle office.”

Teen Driver Laws

Adopted in 2002, the Graduated Driver Licensing laws have been a huge success. Teen motor vehicle fatalities have dropped an astounding 67 percent since the program’s inception.

| Teen Driver License Restrictions | Learner's Permit | Restricted License | Unrestricted License |

|---|---|---|---|

| Age | 15 - if enrolled, attending, and participating in driver's ed 15 1/2 - if completed a four-hour driver-awareness course 16 - if none of above | If under 18, one year after obtaining learner's permit | 17 - if held restricted license 12 months 18 - otherwise |

| Passengers | Must be supervised by a licensed parent/guardian or their licensed adult appointee | First six months - no passengers under 21 Second six months - limit of one passenger under 21 (exceptions: siblings, family emergencies) | No restrictions |

| Hours | No restrictions | First year - no driving between midnight and 5 a.m. (exceptions: presence of a parent/guardian, driving to and from school activities or work, family emergency, being an emancipated teen) | No restrictions |

| Cell phone use | Forbidden | Forbidden | Forbidden if under 18 |

| Pre-requisites | If under 18, parent or guardian must sign an affidavit of liability | Completion of 50 hours supervised driving, 10 of which at night | If under 18, holding a restricted license for one year |

As you can see, with this process, the youngest a driver can be in order to be fully licensed is 17.

Older Driver License Renewal

Some states maintain different license renewal rules for older drivers, and Colorado is no exception.

Older drivers must get their licenses renewed every five years, which is the same requirement for the general population. The only difference is how they can renew. The exceptions to getting a license renewed in person are as follows:

- General population – limited to two consecutive renewals online before having to go in person or every other renewal by mail

- Over 66 years old – every other renewal may be by mail

There are no other differences between general and older drivers in terms of license renewal.

New Resident Licensing

If you’ve recently moved to Colorado, you may be curious about when you’re required to get a Colorado license. The Colorado DMV website says you need a Colorado license within 30 days of residency. The residency requirements are as follows:

-

Own or operate a business in Colorado, OR

-

Are gainfully employed in Colorado, OR

-

Reside in Colorado for 90 consecutive days

Your valid driver’s license from your previous state of residence should be enough for you to not have to take a driving or written exam. When you go to the DMV to get a Colorado license, be prepared with the following documentation:

- A valid driver license from the previous state of residence

- Proof of your social security number

- Two proofs of current Colorado address

- Proof of lawful presence

- Money for fees

License Renewal

Driver licenses must be renewed every five years. You should not wait until your license expires.

Renewals may be completed online, in person, or by mail. There are restrictions on renewing online or by mail:

- May renew by mail only every other renewal

- Limited to two times in a row renewing online

- Those 66 years old and older are limited to renewing by mail every other renewal at most

Don’t miss your license renewal. Driving with an expired license can result in fines and other penalties.

What are the rules of the road in Colorado?

Colorado is a fault state, so the person at fault in an accident is responsible to pay for damages done to the other party. A fault state is also known as a tort state.

Seat Belt & Car Seat Laws

Colorado laws mandate that motorists and front-seat passengers 16 years old and older must wear a seat belt. A violation is a secondary offense. By itself, you cannot be pulled over for failure to wear a seat belt. However, if stopped for another offense while failing to wear your seat belt, you can receive a ticket for both the initial offense and for not having on a seat belt. The minimum fine is $65.

Passengers under 16 years old must wear seat belts at all times, and failure to do so is a primary offense for which you can be pulled over.

Riding in the cargo section of a pick-up truck is prohibited unless the cargo area is fully or partially enclosed on all four sides.

Colorado has specific car seat laws for children as well.

- Any child younger less than a year old and weighing less than 20 pounds is required to be buckled in a rear-facing child restraint.

- Any child between the ages of one and three and weighing between 20 and 40 pounds is required to be buckled in a child restraint

- Any child between the ages of four and seven must be in a booster seat

- Any child between the ages of eight and 15 is subject to adult seat belt requirements

Child safety seat laws are primary and you can be pulled over for violating them. The penalty is a $65 fine and a six dollar surcharge.

Keep Right and Move Over Laws

When driving, you must keep right when traveling slower than the average speed of traffic around you. On roads with a speed limit over 65 mph, the left lane is reserved for passing.

When stationary vehicles with emergency lights are present, drivers must vacate the lane nearest those vehicles if safe to do so, or they must slow down.

Colorado has increased penalties for motorists who fail to move over and recklessly endanger the lives of law enforcement, first responders, and safety road workers. Legislators hope that stiffer penalties for “move over” law violators will help prevent tragedies like that of fallen state trooper Cody Donahue.

Speed Limits

Take a look at this table to see speed limit maximums for different road types in Colorado.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 65 mph |

Speed limits on these kinds of roads cannot exceed the maximums in this table but can be set lower, depending on road safety, etc.

Ridesharing

The following insurance companies offer coverage for ridesharing services:

- Farmers

- USAA

- Geico

- Allstate

- SafeCo

- State Farm

- MetLife

- American Family

The level of coverage available for ridesharing varies. Some of these companies won’t provide coverage while a customer is in the car, others will with a surcharge, but none of these companies will drop you for offering ride-sharing services.

Colorado was the first to pass a regulatory bill for ridesharing companies in 2014.

Read More: Rideshare Insurance Coverage

Automation on the Road

Red Light Cameras

Colorado does have red-light cameras installed across the state. Take a look at this table for the details.

| Stats on Colorado Red Light Cameras | Details |

|---|---|

| Statewide or localized? | Statewide (requires local ordinance) |

| Violations? | Red light |

| Who receives citation? | Vehicle owner |

| Who is liable? | Driver |

| What image is captured? | Tag and driver |

| Penalty? | $75, no points |

Red light cameras are prevalent in Colorado. The monetary penalty for running a red light and getting caught on camera is $75 but no points are added to your license. However, if you are stopped by law enforcement in person for a red light offense, the fine is $110 and four points will be assessed to your record.

Speed Enforcement Cameras

Colorado also has speed enforcement cameras installed across the state. Take a look at this table for the details.

| Stats on Colorado Automated Speed Enforcement Cameras | Details |

|---|---|

| Statewide or localized? | Restricted to construction and school zones, residential areas, or adjacent to a municipal park; requires local ordinance and officer must be present |

| Violations? | Speed |

| Citations issued to whom? | Owner |

| Who is liable? | Driver |

| What image is captured? | Tag and Driver |

| Penalty? | $40 maximum fine ($80 in school zones), no points, warning only for first violation within 10 mph of speed limit |

Speed enforcement cameras are also used in Colorado. Again, if you are stopped in person by an officer, four points will be added to your license and there will be a heftier fine to pay to the tune of $151.

Puffing Laws

Puffing a joint in Colorado may be legal; however, puffing your vehicle is not. You may be asking, “What is exactly puffing your vehicle?”

When it’s cold outside and you start your vehicle to warm it up while you go back inside—that’s called “puffing” and in Colorado puffing is illegal. The law is in place to supposedly prevent auto theft.

Note: The exception is if you use a remote starter and your vehicle is locked without the keys inserted into the ignition.

What are the safety laws in Colorado?

Encouraging safety and eliminating catastrophes are the ultimate goals of all traffic laws. The Colorado Department of Transportation (CDOT) has created an online portal brimming with resources promoting useful safety tidbits and guides.

In accordance with the National Highway Traffic Saftey Administration (NHTSA), Colorado developed the “Moving Towards Zero Deaths” Highway Safety Plan in 2014 as an additional resource for drivers.

DUI Laws

The first three DUI offenses are classified as misdemeanors. The fourth and following offenses are class 4 felonies. There is no official look-back period, so any DUI, no matter how far in the past can be considered in your sentence.

Colorado has two levels of intoxicated driving offenses:

- Driving Under the Influence (DUI) – Blood alcohol content 0.08 percent or higher

- Driving While Ability Impaired (DWAI) – Blood alcohol content 0.05 percent to 0.07 percent

| Penalty Type | First Driving While Ability Impaired (DWAI) Violation | First Driving Under the Influence (DUI) Violation | Second DUI or DWAI Violation | Third and Subsequent DUI and DWAI Violations |

|---|---|---|---|---|

| Revoked License | Eight points on license | Nine months | One year | Two years |

| Imprisonment | Two days to 180 days | Five days to one year | 10 days to one year | 60 days to one year |

| Fine | $200-$500 | $600-$1000 | $600-$1500 | $600-$1500 |

| Community Service | 24 to 48 hours | 24 to 48 hours | 48 to 120 hours | 48 to 120 hours |

A law went into effect recently eliminating a loophole and mandating all persons with a felony DUI conviction to spend time behind bars.

Marijuana-Impaired Driving Laws

Driving under the influence of drugs is illegal and is subject to the same penalties as driving under the influence of alcohol.

Distracted Driving Laws

Like most states, Colorado has distracted driving laws in place to keep drivers safe on the road by restricting cellphone usage.

| Cellphone and Texting Restrictions | Details |

|---|---|

| Hand-held ban | No |

| Young drivers all cellphone ban | Under 18 years old |

| Texting ban | All drivers |

| Enforcement | Primary |

If you’re caught violating the distracted driving laws in Colorado, the penalties are as follows:

| Driver Type | First Cellphone Use Offense | Second and Subsequent Cell Phone Use Offenses |

|---|---|---|

| Minor Drivers (all cellphone use) | Class A traffic infraction One point on license $50 fine | One point on license $100 fine |

| Adult Drivers (text messaging) | Class 2 misdemeanor traffic offense Four points on license $300 fine | Bodily injury or proximate cause of death to another, class 1 misdemeanor Four points on license $1000 fine and/or up to one year imprisonment |

Follow the cellphone and texting laws in Colorado. It’s not just about the penalties; it’s dangerous to drive while distracted.

Points System

Like many states, Colorado has a points system in place that tracks driving infractions. Too many points accrued in a specific time frame can mean suspension of your driver’s license. Colorado also has different thresholds for different driver types.

Take a look at this table for an overview of the points system structure for drivers under the age of 18.

| Time Frame for Points Accrual | Number of Points Required for License Suspension |

|---|---|

| Within 12 months | 6 |

| At any point before turning 18 | 7 |

This table summarizes the points system structure for drivers between the ages of 18 and 21.

| Time Frame for Points Accrual | Number of Points Required for License Suspension |

|---|---|

| Within 12 months | 9 |

| Within 24 months | 12 |

| At any point between ages 18 and 21 | 14 |

Take a look at this table to see the points system structure for drivers 21 and older.

| Time Frame for Points Accrual | Number of Points Required for License Suspension |

|---|---|

| Within 12 months | 12 |

| Within 24 months | 18 |

Regardless of your age, it’s important to follow the rules of the road to avoid a driver’s license suspension.

What Are Some Colorado Can’t-Miss Facts?

Next, we’ll take a look at some interesting nuggets of knowledge about Colorado. You won’t need the Colorado car insurance Reddit page when we’re done.

What does vehicle theft look like in Colorado?

Even in the safest cities and states, you need to be cautious of potential vehicle thefts.

Top Make and Model for Theft

Sedans manufactured by Honda and full-size pickup trucks are the top targets for thievery by burglars in Colorado.

Vehicle Theft by City

Now, we’ll look at the number of thefts in each of these cities.

| City | Number of Vehicle Thefts |

|---|---|

| Denver | 3,487 |

| Colorado Springs | 1,928 |

| Aurora | 1,000 |

| Lakewood | 623 |

| Pueblo | 528 |

| Thornton | 352 |

| Westminster | 322 |

| Arvada | 197 |

| Greeley | 186 |

| Commerce City | 183 |

As you might expect, cities like Denver that have a higher population density have higher vehicle theft rates.

What are Common Road Dangers in Colorado?

There are a number of factors that may affect your safety behind the wheel. Read through the following sections to learn more.

Fatality Rates by County

We’ve collected NHTSA accident fatality data on every county in Colorado across a five-year span. Take a look.

| County Name | Fatalities in 2013 | Fatalities in 2014 | Fatalities in 2015 | Fatalities in 2015 | Fatalities in 2016 |

|---|---|---|---|---|---|

| Adams County | 33 | 32 | 44 | 60 | 64 |

| Arapahoe County | 21 | 30 | 37 | 46 | 45 |

| Boulder County | 12 | 16 | 19 | 24 | 31 |

| Denver County | 40 | 42 | 52 | 54 | 49 |

| El Paso County | 63 | 53 | 48 | 48 | 77 |

| Garfield County | 7 | 8 | 8 | 10 | 21 |

| Jefferson County | 43 | 42 | 55 | 48 | 41 |

| Larimer County | 20 | 24 | 33 | 44 | 36 |

| Pueblo County | 14 | 19 | 12 | 20 | 34 |

| Weld County | 35 | 55 | 55 | 55 | 66 |

El Paso and Denver counties are in the top three most fatal counties for all five years.

Fatality Rates Rural Vs. Urban

We also looked at fatalities based on urban versus rural roads.

| Type of Roadway | Fatalities in 2008 | Fatalities in 2009 | Fatalities in 2010 | Fatalities in 2011 | Fatalities in 2012 | Fatalities in 2013 | Fatalities in 2014 | Fatalities in 2015 | Fatalities in 2016 | Fatalities in 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 296 | 252 | 247 | 227 | 233 | 244 | 228 | 260 | 266 | 277 |

| Urban | 252 | 213 | 203 | 220 | 241 | 238 | 260 | 285 | 342 | 369 |

Urban and rural fatalities vary from year-to-year, with some years having higher rates for urban roads, while other years the fatality rate is higher for rural roads.

Fatalities by Person Type

Take a look at this table to see fatalities by person type.

| Person Type | Vehicles Type | Fatalities In 2013 | Fatalities In 2014 | Fatalities In 2015 | Fatalities In 2016 | Fatalities In 2017 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 141 | 176 | 163 | 187 | 199 |

| – | Light Truck - Pickup | 77 | 56 | 77 | 66 | 78 |

| – | Light Truck - Utility | 85 | 70 | 85 | 85 | 104 |

| – | Light Truck - Van | 14 | 6 | 21 | 24 | 27 |

| – | Light Truck - Other | 0 | 0 | 1 | 0 | 2 |

| – | Large Truck | 11 | 10 | 13 | 18 | 26 |

| – | Bus | 0 | 0 | 0 | 1 | 1 |

| – | Total Occupants | 331 | 319 | 364 | 383 | 437 |

| Motorcyclists | Motorcycle | 87 | 94 | 106 | 125 | 103 |

| Nonoccupants | Pedestrian | 50 | 63 | 59 | 79 | 92 |

| – | Bicyclist and Other Cyclist | 12 | 10 | 13 | 16 | 16 |

| – | Other/Unknown Nonoccupants | 2 | 2 | 5 | 5 | 0 |

| – | Total Nonoccupants | 64 | 75 | 77 | 100 | 108 |

| Occupants, Motorcyclists, and Nonoccupants | Total Traffic-Related Fatalities | 482 | 488 | 547 | 608 | 648 |

Car passengers face the highest fatality rates in California.

Fatalities by Crash Type

Crash type is also an indicator of fatality type. This table summarizes data in Colorado for a five-year span.

| Crash Type | Fatalities in 2013 | Fatalities in 2014 | Fatalities in 2015 | Fatalities in 2016 | Fatalities in 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 482 | 488 | 547 | 608 | 648 |

| Single Vehicle | 284 | 273 | 305 | 344 | 335 |

| Involving a Large Truck | 56 | 63 | 64 | 86 | 87 |

| Involving Speeding | 151 | 168 | 217 | 211 | 230 |

| Involving a Rollover | 197 | 166 | 195 | 212 | 228 |

| Involving a Roadway Departure | 287 | 285 | 304 | 295 | 330 |

| Involving an Intersection (or Intersection Related) | 118 | 127 | 153 | 200 | 190 |

Single vehicles are by far the most fatal accidents in Colorado, with factors like rollovers and roadway departures being some of the biggest contributors.

Fatalities Involving Speeding by County

To see which counties face the most fatalities due to speeding, take a look at this table.

| County Name | Fatalities in 2015 | Fatalities in 2016 | Fatalities in 2017 | Three-Year Total |

|---|---|---|---|---|

| Douglas County | 4 | 8 | 8 | 20 |

| Garfield County | 5 | 6 | 10 | 21 |

| Denver County | 28 | 22 | 15 | 65 |

| Pueblo County | 4 | 4 | 16 | 24 |

| Larimer County | 9 | 15 | 16 | 40 |

| Arapahoe County | 17 | 19 | 17 | 53 |

| Jefferson County | 22 | 20 | 18 | 60 |

| Weld County | 25 | 11 | 20 | 56 |

| Adams County | 17 | 19 | 20 | 56 |

| El Paso County | 15 | 22 | 29 | 66 |

The top counties for fatalities are again El Paso and Denver counties.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

To see which counties face the most fatalities due to alcohol-impaired drivers, take a look at this table.

| County Name | Fatalities in 2015 | Fatalities in 2016 | Fatalities in 2017 | Three-Year Total |

|---|---|---|---|---|

| El Paso County | 17 | 20 | 24 | 61 |

| Denver County | 15 | 18 | 20 | 53 |

| Weld County | 19 | 13 | 13 | 45 |

| Adams County | 11 | 15 | 18 | 44 |

| Jefferson County | 19 | 9 | 13 | 41 |

| Arapahoe County | 12 | 13 | 13 | 38 |

| Larimer County | 8 | 12 | 11 | 31 |

| Pueblo County | 3 | 3 | 10 | 16 |

| Garfield County | 3 | 7 | 5 | 15 |

| Boulder County | 5 | 3 | 4 | 12 |

| Douglas County | 4 | 5 | 3 | 12 |

The three most fatal counties were Weld, El Paso, and Denver counties.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the EMS Response Time in Colorado?

Take a look at this table to see what EMS response times are like in Colorado.

| Location of Incident | Time of Crash to EMS Notification | Notification to Arrival | Arrival at Scene to Hospital Arrival | Time of Crash to Time of Hospital Arrival |

|---|---|---|---|---|

| Rural | 7.33 minutes | 12.01 minutes | 36.68 minutes | 48.96 minutes |

| Urban | 1.33 minutes | 5.09 minutes | 22.23 minutes | 28.16 minutes |

It’s no surprise that urban response times are significantly faster than rural ones. Rural emergency response often has significantly larger territory for which they are responsible. Additionally, road quality is not always consistent, which can also cause a slower response.

What is Transportation Like in Colorado?

How does the commute look for Colorado residents? How many own a car? How do they get to work? We’ll answer those questions next.

Car Ownership

We looked at DataUSA information to find out the average car ownership rates per householder in Colorado. Take a look.

- One vehicle: 18 percent in Colorado, versus 20.2 percent nationally

- Two vehicles: 40.9 percent in Colorado, versus 40.3 percent nationally

- Three vehicles: 23.7 percent in Colorado, versus 21.5 percent nationally

- Four vehicles: 10.1 percent in Colorado, versus 9.23 percent nationally

- Five or more vehicles:5.22 percent in Colorado, versus 4.56 percent nationally

Colorado’s vehicle ownership rates are higher for two, three, four, and five or more vehicles, while the national average is higher for households that own one vehicle.

Commute Time

Colorado drivers are fortunate that their average commute of 23.7 minutes is lower than the national average of 25.7 minutes by about 8 percent.

Commuter Transportation

Residents of the mile high city prefer to drive alone. According to DataUSA, 74.9 percent of drivers commute alone, followed by 8.56 percent that work at home, and 8.55 percent carpool.

Traffic Congestion in Colorado

Denver ranks 27th in North America and 136th in the world for traffic congestion in major cities.

In order to enjoy all the wonderful activities across the state, you will have to travel and traverse through a diversity of roads, landscapes, and terrains. And whether you choose to navigate the state in a pickup truck or in an RV or atop an ATV, you will want to make sure that you have the proper insurance for your vehicle and for your specific needs.

Ready to buy Colorado car insurance? Find the best Colorado car insurance company by entering your ZIP code below and comparing quotes from top-rated insurers in Colorado side-by-side for free. This will be especially helpful with the Colorado auto insurance rate increase that’s been occurring over the past few years.