South Carolina

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 9.4 %

The Palmetto State is full of economic and population growth. Between tourism and increasing employment percentages, South Carolina has become one of the most rapidly growing states in the U.S. With that growth comes busier roadways and car insurance premiums.

South Carolina has approximately 4,046,410 registered motor vehicles. Traffic can get quite busy along everyday roadways, Interstate-85 and Interstate-26. Car insurance companies are aware of the numbers and prepare premiums based on the risk, age, gender and marital status of their policyholders.

How much will you pay? We explain all those costs in this guide. We’ve compiled thorough research data to help you find the most cost-efficient annual premium. Also, you’ll get an idea of what car insurance company is right for you.

You can compare some rates by using our free comparison tool at the top of this webpage.

For more information, continue reading for a thorough review of South Carolina car insurance rates and the car insurance companies that provide them.

How Do You Get Affordable South Carolina Car Insurance Coverage & Rates?

Car insurance is essential if you’re a licensed driver in the United States. Many states require motorists to have car insurance before their vehicle is registered. You don’t need a clean driving record, but it could cost a lot more to insure yourself if you don’t have one. While some people do drive uninsured, getting caught could result in fines, jail time, and more depending on how you get caught and if it’s a previously known issue.

South Carolina ranks 34th in uninsured/underinsured percentage. The state is strict on uninsured drivers. Especially if your vehicle is in an accident and not insured, you could face a hefty fine, driver’s license suspension, or jail time. This is true whether or not you were aware of your uninsured status.

This article will explore car insurance options, allowing you to choose from the coverage you need at the rate you can afford.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is South Carolina Car Culture like?

The automotive industry runs deep within South Carolina’s history. In 1916, the Rock Hill Buggy Company began manufacturing their handmade, five-passenger touring cars called The Anderson. It sold 7,000 units and was considered the most successful vehicle ever manufactured in the southern states.

South Carolina is home to one of NASCAR’s events, as well. The Darlington Raceway, which was established in 1950, hosts world-class drivers and a fanbase that can’t get enough of the speed racers on the 2.27-mile course.

In recent years, BMW has made a strong presence in Upstate, South Carolina. More than 8,000 workers construct vehicles on BMW’s Spartanburg campus. Volvo is currently constructing a 2.3-million-square-foot facility in Ridgeville, South Carolina. This facility plans to produce 60,000 cars per year.

While there are many luxury cars around South Carolina, the state also has a large number of older or classic cars. Some of these cars may not yield a high payout in an accident. So it doesn’t make sense to buy collision coverage, but drivers still need to carry liability insurance. Experts also recommend medical coverage to protect you and your passengers.

What are South Carolina Minimum Coverage Requirements?

South Carolina requires its motorists to have minimum coverage, which includes liability coverage and uninsured motorist coverage.

Liability is car insurance coverage that pays for legal responsibilities to other driver’s bodily injury or property damage. But isn’t uninsured motorist coverage within liability coverage? Yes.

Uninsured motorist coverage automatically comes with your liability coverage in South Carolina. Its limits match those of your liability coverage, and it’s designed to protect you in an accident with an uninsured driver.

All motorist must carry car insurance with required minimums on their liability coverage:

- $25,000 per accident for property damage

- $25,000 per person and $50,000 per accident for bodily injury liability

- $25,000 per person and $50,000 per accident for uninsured motorist bodily injury liability

- $25,000 per accident with a $200 deductible for uninsured motorist property damage

- $25,000 per person and $50,000 per accident for underinsured motorist bodily injury*

- $25,000 per accident for underinsured motorist property damage*

*This indicates there’s a chance that underinsured motorist coverage could be rejected.In the video below, the Joye Law Firm explains how auto insurance coverage works in South Carolina, and he explains the different types of coverage.

South Carolina is known as a tort liability state, meaning the person not-at-fault can file a claim against the at-fault person(s).

Also, South Carolina follows comparative negligence law. This bars a person(s) from collecting for the percentage that you may contribute to the accident.

Let’s say you hit a driver at an intersection. You have the right of way, but they’re at a stop sign. Because they failed to yield to oncoming traffic, they’d be at fault. Regardless of the speed, you would be able to file a claim against the other driver. Due to comparative negligence, you’re unable to collect for the percentage you contributed to the accident.

If you do get into an accident, have your car insurance information handy. Don’t have a physical copy of your insurance card?

South Carolina allows electronic proof of insurance. So you can pull it up on your phone or other mobile device.

What does the Form of Financial Responsibility mean?

Speaking of proof, all South Carolina drivers need some form of financial responsibility. This any digital or physical information that shows you have car insurance. So a form of financial responsibility could be:

- an electronic insurance card (proof of insurance on a smartphone or other device)

- a valid car insurance ID card

- a copy of your auto insurance policy

- a car insurance binder (usually given to you when you first sign-up)

South Carolina Code of Law has a section on financial responsibility requirements regarding vehicles.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Much Do South Carolinans Pay in Auto Insurance Rates?

Were you ever curious about the amount of money you spend on car insurance coverage?

Surprisingly enough, car insurance coverage doesn’t take much of your salary per year.

Let’s explore some income data to see the percentage that car insurance takes from your income; also, we’ll compare it to other states to give a general idea of what they pay.

| States | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 |

|---|---|---|---|---|---|---|---|---|---|

| South Carolina | $881 | $32,117 | 2.74% | $904 | $31,830 | 2.84% | $937 | $33,295 | 2.81% |

| North Carolina | $720 | $34,814 | 2.07% | $740 | $33,710 | 2.19% | $768 | $35,099 | 2.19% |

| Georgia | $922 | $33,167 | 2.78% | $949 | $33,100 | 2.87% | $991 | $34,558 | 2.87% |

| U.S. Average | $924 | $39,473 | 2.34% | $951 | $39,192 | 2.43% | $982 | $40,859 | 2.40% |

South Carolina motorists spent close to 3 percent of their yearly income on car insurance coverage.

That’s nearly a percent more than the national average, and it’s 1 percent more than North Carolina’s premium as a percentage of income. Therefore, South Carolina motorists who earned at least $33,295 in 2014 spent 2.81 percent of their income on car insurance coverage.

Are these salaries close to what you earn?

What are the Average Monthly Car Insurance Rates in SC (Liability, Collision, Comprehensive)?

Let’s review some coverage rates in South Carolina and compare them to the national average rates.

| Coverage Type | South Carolina Averages | National Average |

|---|---|---|

| Liability | $498 | $516 |

| Collision | $248 | $300 |

| Comprehensive | $165 | $139 |

| Full | $911 | $955 |

South Carolina car insurance coverage rates are close to the national average. Motorists in South Carolina save at least $40 on full coverage but will pay more for the comprehensive perk on car insurance.

Liability coverage is required by law, but the other coverages are optional. Collision and comprehensive are good perks to add to your liability policy, just so you can cover your bases in the event of a car accident.

Is There an Additional Liability?

We talked about how liability coverage may come with uninsured/underinsured motorist coverage. If it doesn’t, you’ll have to add it to your policy. South Carolina law dictates all motorists in its state must have liability coverage and uninsured/underinsured coverage.

South Carolina does not require Personal Injury Protection (PIP) or Medical Payment (MedPay) insurance coverage, but it’ll come in handy in the event you get injured. Here are two videos that explain how PIP and MedPay works.

Adding these perks to your policy may be considered double coverage, but it ultimately protects the vehicle owner and possible passengers.

Here are some statistical data describing the loss ratio of MedPay and uninsured/underinsured car insurance coverage (UM/UIM). This table shows the ratio of payments going out to policyholders and money coming into the company.

| Additional Liability Coverages | 2013 Loss Ratios | 2014 Loss Ratios | 2015 Loss Ratios |

|---|---|---|---|

| MedPay | 91.36 | 88.63 | 89.04 |

| UUM* | 76.28 | 85.99 | 90.71 |

Not sure what the table means?

Let’s examine the MedPay loss ratio. The 2013 MedPay loss ratio is 91.36. This means for every $100 a car insurance company earned in South Carolina, $91.36 was paid to a policyholder’s or other driver’s filed claim.

Ratios close to 100 show that the car insurance company is making a profit.

Companies that have loss ratios too close or over 100 are losing money. Low ratios may indicate that a car insurance company isn’t effectively paying out claims.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are There any Add-Ons, Endorsements, & Riders?

There are additional features and endorsements in South Carolina. Here are a few examples you can explore with your car insurance coverage. Click each link for an overview of what these items will do for your car insurance coverage.

- Guaranteed Auto Protection (GAP) – Car insurance that pays the difference between the value of a damaged or stolen vehicle and the amount owed on the car under a loan or lease.

- Personal Umbrella Policy (PUP) – This car insurance coverage provides a stack of high limits of liability to protect an insured motorist against a catastrophic liability loss such as bodily injury, property damage, personal injury, and even libel.

- Rental Reimbursement – A car insurance coverage with additional coverage in case a motorist has paid additional costs for a car rental.

- Emergency Roadside Assistance – This is a car insurance coverage perk that sends out locksmiths, towtrucks or any other roadside assistance personnel in case a motorist is stranded on a roadway. Most insurance companies don’t require a deductible.

- Mechanical Breakdown Insurance – This car insurance endorsement is for loss due to mechanical or electrical breakdown of a motor vehicle.

- Non-Owner Car Insurance – This coverage is for a motorist who has liability insurance but does not own a car.

- Modified Car Insurance Coverage- Modified car insurance coverage is coverage for vehicles with custom parts, paint, and other motor vehicle accessories. Alert your car insurance company that your car is custom-made.

- Classic Car Insurance – Rare vehicles and rare car parts are costly. It can be just as expensive they’re damaged and are in need of repair. Classic Car Insurance covers those costs.

- Pay-As-You-Drive or Usage-Based Insurance – Car insurance coverage where costs are based on how many miles you drive.

When you decide which car insurance provider best fits your needs, ask about these additional perks.

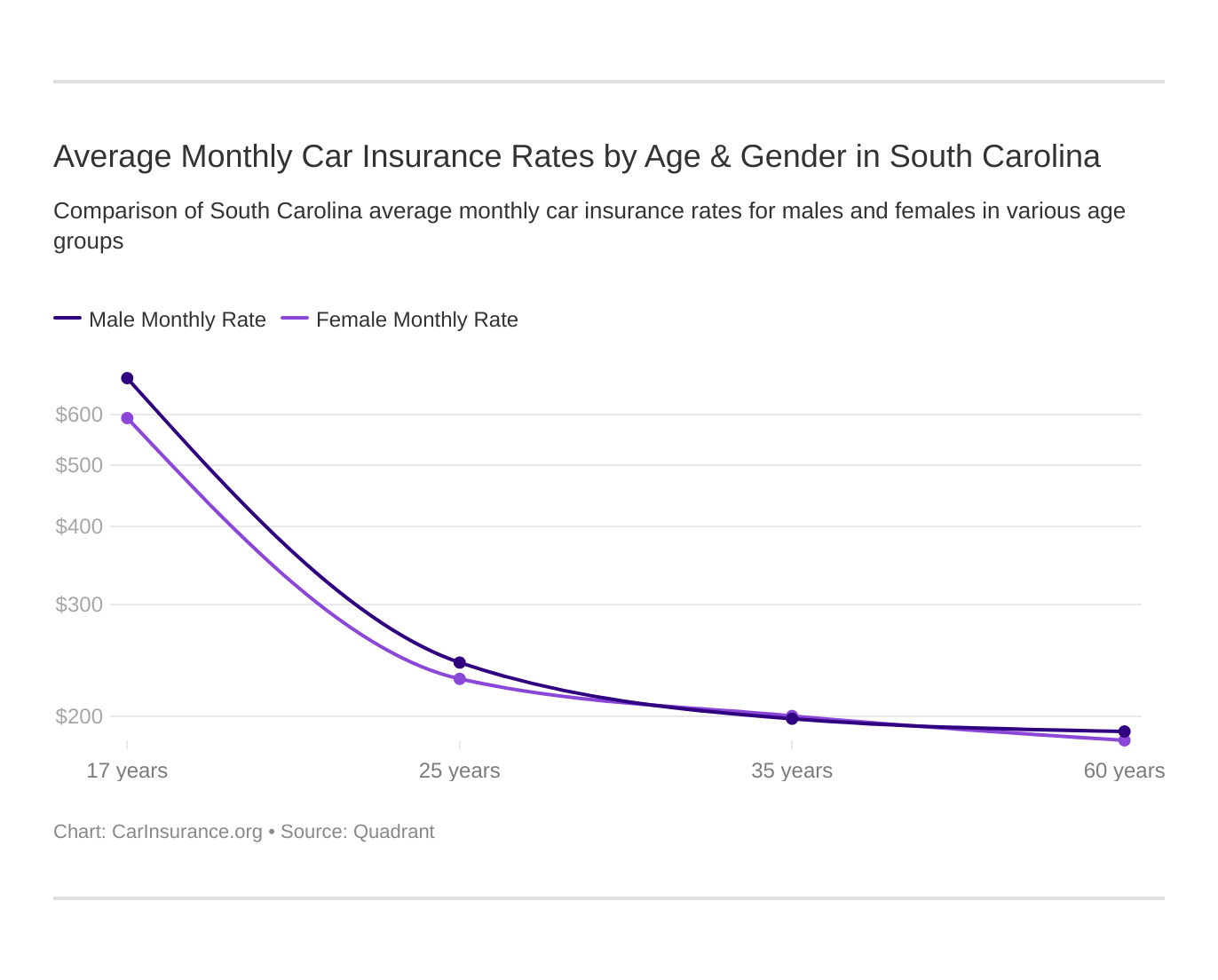

What are the Average Monthly Car Insurance Rates by Age & Gender in SC?

Believe it or not, age, gender, and marital status will determine the rate of car insurance coverage. South Carolina insurance companies, like all others in the U.S., consider statistical data and use it to assess the cost of annual car insurance coverage premiums.

Most car insurance companies offer higher rates for male drivers than female drivers. Only a few car insurance companies charge females more on their premiums than men.

Generally, teenaged male drivers have the highest car insurance premiums.

The same principle applies to single and married individuals. Married people pay less than those that identify as single. The proof is in the numbers. Let’s take a look at some demographic stats.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $6,662 | $8,518 | $2,859 | $3,111 | $2,575 | $2,575 | $2,463 | $2,463 |

| Bristol West | $8,424 | $9,324 | $3,487 | $3,515 | $3,199 | $3,213 | $3,054 | $3,319 |

| Geico | $5,553 | $5,685 | $2,675 | $2,741 | $2,293 | $2,293 | $2,092 | $2,092 |

| Nationwide | $5,970 | $7,693 | $2,793 | $3,046 | $2,469 | $2,502 | $2,224 | $2,308 |

| Progressive | $10,288 | $11,361 | $2,849 | $2,969 | $2,477 | $2,286 | $2,129 | $2,225 |

| State Farm | $5,564 | $6,994 | $2,176 | $2,447 | $1,939 | $1,939 | $1,756 | $1,756 |

| USAA* | $7,341 | $8,041 | $2,414 | $2,544 | $1,836 | $1,843 | $1,688 | $1,690 |

USAA is only available to military personnel, veterans, and active members of the Armed Forces and immediate family of military personnel.

From the table alone, you can see how much young, single policyholders pay for premiums per year. Also, premiums for male drivers pay $1,000 more than for female drivers.

Moderately and elderly aged married drivers usually have equal premium rates but pay significantly less than young and single drivers.

There’s a slight difference in Bristol West, Progressive, and Nationwide. For the most part, young and single males will pay more for car insurance coverage.

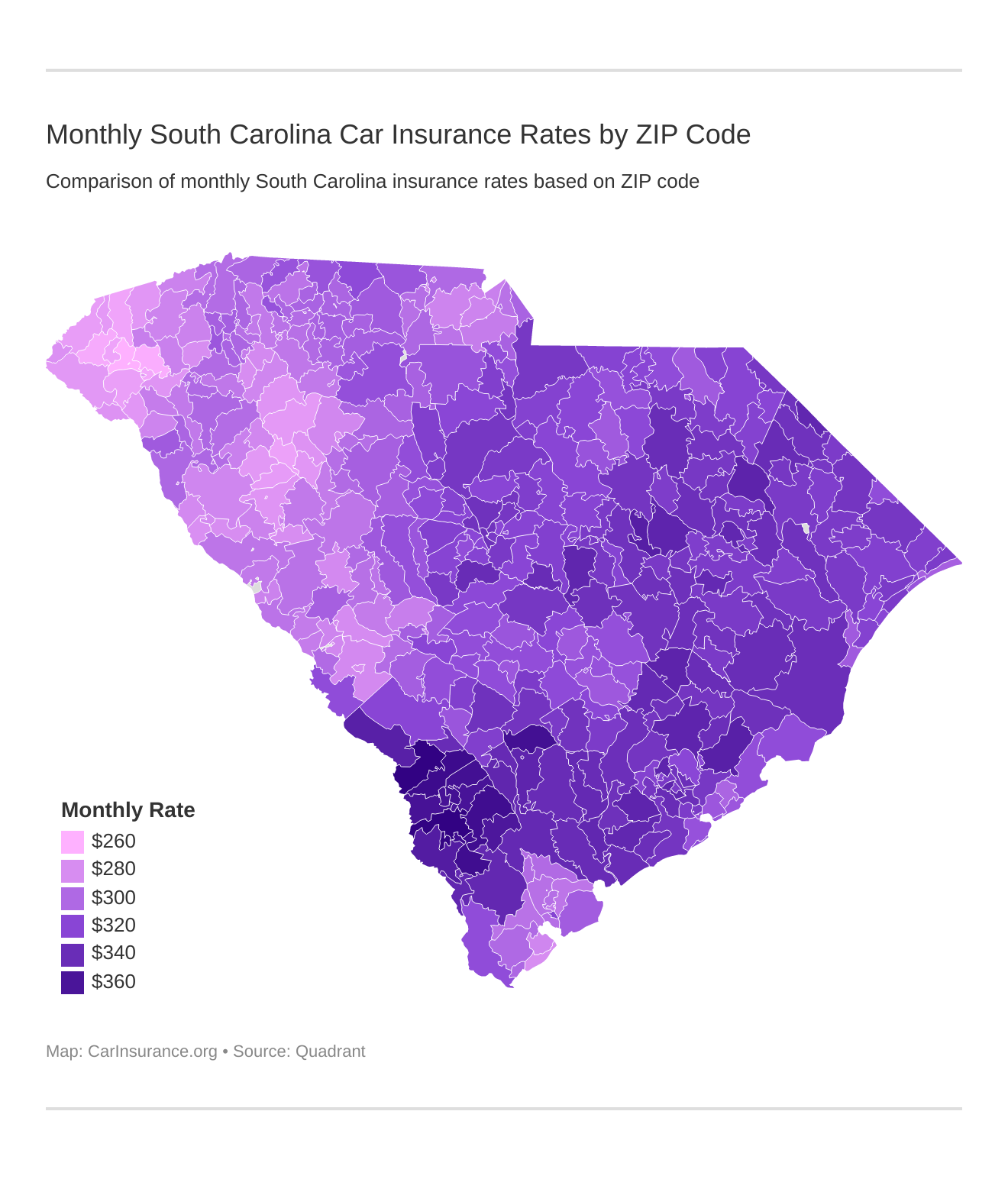

What are the Cheapest Car Insurance Rates by ZIP Code?

What you pay for car insurance also varies by location. To help you find the best rate in your area, we are going to look through prices by ZIP code to see which insurers offer the best and worst rates.

| Cheapest ZIP Codes in South Carolina | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 29672 | SENECA | $3,115.58 | Progressive | $3,579.43 | Allstate | $3,415.04 | Geico | $2,565.72 | State Farm | $2,833.51 |

| 29630 | CENTRAL | $3,145.58 | Progressive | $3,566.99 | Allstate | $3,516.93 | Geico | $2,565.72 | State Farm | $2,737.87 |

| 29665 | NEWRY | $3,149.62 | Progressive | $3,579.43 | Allstate | $3,415.04 | Geico | $2,565.72 | State Farm | $2,772.98 |

| 29675 | RICHLAND | $3,155.03 | Progressive | $3,579.43 | Allstate | $3,415.04 | Geico | $2,565.72 | State Farm | $2,772.98 |

| 29691 | WALHALLA | $3,166.58 | Progressive | $3,790.86 | Farmers | $3,508.45 | Geico | $2,565.72 | State Farm | $2,734.29 |

| 29631 | CLEMSON | $3,197.43 | Progressive | $3,861.76 | Farmers | $3,710.66 | Geico | $2,565.72 | State Farm | $2,699.23 |

| 29676 | SALEM | $3,206.09 | Progressive | $3,940.77 | Farmers | $3,623.51 | Geico | $2,565.72 | State Farm | $2,689.60 |

| 29696 | WEST UNION | $3,217.19 | Progressive | $3,969.16 | Farmers | $3,667.62 | Geico | $2,565.72 | State Farm | $2,751.09 |

| 29384 | WATERLOO | $3,225.08 | Progressive | $3,703.61 | Allstate | $3,577.44 | Geico | $2,694.51 | State Farm | $2,713.91 |

| 29678 | SENECA | $3,243.62 | Progressive | $3,919.60 | Farmers | $3,671.68 | Geico | $2,565.72 | State Farm | $2,787.44 |

| 29664 | MOUNTAIN REST | $3,249.79 | Progressive | $4,144.41 | Farmers | $3,766.09 | Geico | $2,565.72 | State Farm | $2,665.68 |

| 29649 | GREENWOOD | $3,265.18 | Allstate | $3,608.76 | Farmers | $3,540.15 | Geico | $2,694.51 | State Farm | $3,058.20 |

| 29360 | LAURENS | $3,274.83 | Progressive | $3,742.80 | Allstate | $3,577.44 | Geico | $2,694.51 | State Farm | $2,933.08 |

| 29686 | TAMASSEE | $3,281.99 | Progressive | $4,231.99 | Farmers | $3,820.09 | Geico | $2,565.72 | State Farm | $2,772.98 |

| 29693 | WESTMINSTER | $3,282.69 | Progressive | $4,249.81 | Farmers | $3,775.24 | Geico | $2,565.72 | State Farm | $2,710.30 |

| 29653 | HODGES | $3,282.69 | Progressive | $3,703.61 | Allstate | $3,577.44 | State Farm | $2,801.83 | Geico | $2,932.61 |

| 29634 | CLEMSON | $3,284.03 | Progressive | $4,245.12 | Farmers | $3,924.92 | Geico | $2,565.72 | State Farm | $2,605.92 |

| 29632 | CLEMSON | $3,293.34 | Progressive | $4,245.12 | Farmers | $3,924.92 | Geico | $2,565.72 | State Farm | $2,772.98 |

| 29685 | SUNSET | $3,297.56 | Progressive | $4,227.89 | Farmers | $3,930.35 | Geico | $2,565.72 | State Farm | $2,735.92 |

| 29689 | TOWNVILLE | $3,300.96 | Progressive | $4,137.45 | Farmers | $3,805.52 | Geico | $2,565.72 | State Farm | $2,803.61 |

| 29332 | CROSS HILL | $3,305.73 | Progressive | $3,807.26 | Allstate | $3,695.94 | State Farm | $2,745.30 | Geico | $2,761.75 |

| 29645 | GRAY COURT | $3,306.89 | Progressive | $3,824.81 | Allstate | $3,694.75 | Geico | $2,717.44 | State Farm | $2,949.06 |

| 29670 | PENDLETON | $3,307.03 | Progressive | $4,074.82 | Farmers | $3,925.33 | Geico | $2,565.72 | State Farm | $2,712.82 |

| 29646 | GREENWOOD | $3,307.52 | Progressive | $3,652.20 | Allstate | $3,608.76 | Geico | $2,694.51 | USAA | $3,091.57 |

| 29370 | MOUNTVILLE | $3,320.32 | Progressive | $3,903.48 | Farmers | $3,687.20 | Geico | $2,761.75 | State Farm | $2,773.66 |

A ZIP code in Seneca has the cheapest car insurance rates in South Carolina.

| Most Expensive ZIP Codes in South Carolina | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 29933 | MILEY | $4,519.05 | Farmers | $6,522.32 | Progressive | $5,092.35 | State Farm | $3,329.79 | USAA | $3,939.94 |

| 29810 | ALLENDALE | $4,504.34 | Progressive | $5,893.85 | Farmers | $5,603.79 | State Farm | $3,343.86 | USAA | $3,939.94 |

| 29918 | ESTILL | $4,499.47 | Farmers | $5,824.91 | Progressive | $5,611.39 | State Farm | $3,371.09 | USAA | $3,939.94 |

| 29939 | SCOTIA | $4,493.57 | Farmers | $5,824.91 | Progressive | $5,611.39 | State Farm | $3,329.79 | USAA | $3,939.94 |

| 29913 | CROCKETVILLE | $4,449.78 | Farmers | $6,522.32 | Progressive | $4,607.45 | State Farm | $3,329.79 | USAA | $3,939.94 |

| 29433 | CANADYS | $4,434.52 | Farmers | $6,522.32 | Progressive | $4,731.33 | State Farm | $3,329.79 | Geico | $3,780.89 |

| 29827 | FAIRFAX | $4,412.90 | Progressive | $5,607.56 | Farmers | $5,282.19 | State Farm | $3,311.69 | USAA | $3,939.94 |

| 29921 | FURMAN | $4,405.94 | Farmers | $6,522.32 | Geico | $4,320.69 | State Farm | $3,354.61 | USAA | $3,939.94 |

| 29934 | PINELAND | $4,396.05 | Farmers | $5,601.37 | Progressive | $5,227.88 | State Farm | $3,343.22 | USAA | $3,939.94 |

| 29944 | VARNVILLE | $4,386.30 | Progressive | $5,694.00 | Farmers | $5,669.24 | State Farm | $3,295.29 | Geico | $3,677.41 |

| 29481 | SMOAKS | $4,369.12 | Farmers | $5,486.93 | Progressive | $5,358.73 | State Farm | $3,358.76 | Geico | $3,707.18 |

| 29911 | BRUNSON | $4,363.46 | Farmers | $5,367.87 | Progressive | $5,223.76 | State Farm | $3,263.75 | USAA | $3,939.94 |

| 29923 | GIFFORD | $4,338.69 | Farmers | $5,259.85 | Progressive | $5,092.35 | State Farm | $3,329.79 | USAA | $3,939.94 |

| 29932 | LURAY | $4,338.69 | Farmers | $5,259.85 | Progressive | $5,092.35 | State Farm | $3,329.79 | USAA | $3,939.94 |

| 29924 | HAMPTON | $4,333.58 | Farmers | $5,178.39 | Progressive | $5,172.50 | State Farm | $3,295.29 | USAA | $3,939.94 |

| 29916 | EARLY BRANCH | $4,295.75 | Farmers | $5,139.84 | Progressive | $4,917.16 | State Farm | $3,324.36 | USAA | $3,939.94 |

| 29486 | SUMMERVILLE | $4,291.55 | Progressive | $6,330.20 | Farmers | $4,486.60 | State Farm | $3,335.97 | Geico | $3,363.86 |

| 29922 | GARNETT | $4,252.93 | Farmers | $4,952.29 | Progressive | $4,743.26 | State Farm | $3,386.08 | USAA | $3,939.94 |

| 29046 | ELLIOTT | $4,248.92 | Farmers | $5,797.64 | Progressive | $4,870.51 | State Farm | $3,320.82 | Geico | $3,779.59 |

| 29430 | BETHERA | $4,239.55 | Farmers | $6,542.72 | Nationwide | $4,364.41 | State Farm | $3,335.97 | Geico | $3,395.57 |

| 29104 | MAYESVILLE | $4,229.63 | Farmers | $5,718.85 | Progressive | $4,931.71 | State Farm | $3,203.35 | Geico | $3,779.59 |

| 29836 | MARTIN | $4,215.45 | Progressive | $5,303.60 | Farmers | $5,186.48 | State Farm | $3,329.79 | Geico | $3,707.18 |

| 29450 | HUGER | $4,214.87 | Farmers | $5,333.72 | Progressive | $5,068.38 | State Farm | $3,228.14 | Geico | $3,512.70 |

| 29476 | RUSSELLVILLE | $4,179.21 | Progressive | $5,051.12 | Farmers | $5,030.80 | State Farm | $3,335.97 | Geico | $3,512.70 |

| 29468 | PINEVILLE | $4,174.40 | Farmers | $5,236.46 | Progressive | $5,172.71 | State Farm | $3,091.77 | Geico | $3,395.57 |

As you can see, rates can change within a city as drivers move from one neighborhood to another.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Cheapest Car Insurance Rates by City?

Since the ZIP codes are clustered in just a few cities, we want to show you the cheapest and most expensive cities in South Carolina.

| Cheapest Cities in South Carolina | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Central | $3,145.58 | Progressive | $3,566.99 | Allstate | $3,516.93 | Geico | $2,565.72 | State Farm | $2,737.87 |

| Newry | $3,149.62 | Progressive | $3,579.43 | Allstate | $3,415.04 | Geico | $2,565.72 | State Farm | $2,772.98 |

| Richland | $3,155.03 | Progressive | $3,579.43 | Allstate | $3,415.04 | Geico | $2,565.72 | State Farm | $2,772.98 |

| Walhalla | $3,166.58 | Progressive | $3,790.86 | Farmers | $3,508.45 | Geico | $2,565.72 | State Farm | $2,734.29 |

| Seneca | $3,179.60 | Progressive | $3,749.52 | Farmers | $3,519.99 | Geico | $2,565.72 | State Farm | $2,810.48 |

| Salem | $3,206.09 | Progressive | $3,940.77 | Farmers | $3,623.51 | Geico | $2,565.72 | State Farm | $2,689.60 |

| West Union | $3,217.19 | Progressive | $3,969.16 | Farmers | $3,667.62 | Geico | $2,565.72 | State Farm | $2,751.09 |

| Waterloo | $3,225.08 | Progressive | $3,703.61 | Allstate | $3,577.44 | Geico | $2,694.51 | State Farm | $2,713.91 |

| Mountain Rest | $3,249.79 | Progressive | $4,144.41 | Farmers | $3,766.09 | Geico | $2,565.72 | State Farm | $2,665.68 |

| Clemson | $3,258.27 | Progressive | $4,117.33 | Farmers | $3,853.50 | Geico | $2,565.72 | State Farm | $2,692.71 |

| Laurens | $3,274.83 | Progressive | $3,742.80 | Allstate | $3,577.44 | Geico | $2,694.51 | State Farm | $2,933.08 |

| Tamassee | $3,281.99 | Progressive | $4,231.99 | Farmers | $3,820.09 | Geico | $2,565.72 | State Farm | $2,772.98 |

| Westminster | $3,282.69 | Progressive | $4,249.81 | Farmers | $3,775.24 | Geico | $2,565.72 | State Farm | $2,710.30 |

| Hodges | $3,282.69 | Progressive | $3,703.61 | Allstate | $3,577.44 | State Farm | $2,801.83 | Geico | $2,932.61 |

| Greenwood | $3,286.35 | Allstate | $3,608.76 | Progressive | $3,576.34 | Geico | $2,694.51 | USAA | $3,091.57 |

| Sunset | $3,297.56 | Progressive | $4,227.89 | Farmers | $3,930.35 | Geico | $2,565.72 | State Farm | $2,735.92 |

| Townville | $3,300.97 | Progressive | $4,137.45 | Farmers | $3,805.52 | Geico | $2,565.72 | State Farm | $2,803.61 |

| Cross Hill | $3,305.73 | Progressive | $3,807.26 | Allstate | $3,695.94 | State Farm | $2,745.30 | Geico | $2,761.75 |

| Gray Court | $3,306.89 | Progressive | $3,824.81 | Allstate | $3,694.75 | Geico | $2,717.44 | State Farm | $2,949.06 |

| Pendleton | $3,307.03 | Progressive | $4,074.82 | Farmers | $3,925.33 | Geico | $2,565.72 | State Farm | $2,712.82 |

| Mountville | $3,320.32 | Progressive | $3,903.48 | Farmers | $3,687.20 | Geico | $2,761.75 | State Farm | $2,773.66 |

| Fair Play | $3,323.71 | Progressive | $4,266.56 | Farmers | $3,859.49 | Geico | $2,565.72 | State Farm | $2,787.44 |

| Long Creek | $3,333.92 | Progressive | $4,274.73 | Farmers | $3,941.61 | Geico | $2,565.72 | State Farm | $2,772.98 |

| Mount Carmel | $3,352.98 | Progressive | $3,839.66 | Allstate | $3,735.83 | State Farm | $2,776.13 | Geico | $2,932.61 |

| Simpsonville | $3,354.24 | Farmers | $3,826.74 | Allstate | $3,759.62 | Geico | $2,717.44 | USAA | $2,969.43 |

Central is the cheapest city for car insurance, as it costs about $1,400 less than car insurance in Miley.

| Most Expensive Cities in South Carolina | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Miley | $4,519.05 | Farmers | $6,522.32 | Progressive | $5,092.35 | State Farm | $3,329.79 | USAA | $3,939.94 |

| Allendale | $4,504.34 | Progressive | $5,893.85 | Farmers | $5,603.79 | State Farm | $3,343.86 | USAA | $3,939.94 |

| Estill | $4,499.47 | Farmers | $5,824.91 | Progressive | $5,611.39 | State Farm | $3,371.09 | USAA | $3,939.94 |

| Scotia | $4,493.57 | Farmers | $5,824.91 | Progressive | $5,611.39 | State Farm | $3,329.79 | USAA | $3,939.94 |

| Crocketville | $4,449.78 | Farmers | $6,522.32 | Progressive | $4,607.45 | State Farm | $3,329.79 | USAA | $3,939.94 |

| Canadys | $4,434.52 | Farmers | $6,522.32 | Progressive | $4,731.33 | State Farm | $3,329.79 | Geico | $3,780.89 |

| Fairfax | $4,412.90 | Progressive | $5,607.56 | Farmers | $5,282.19 | State Farm | $3,311.69 | USAA | $3,939.94 |

| Furman | $4,405.94 | Farmers | $6,522.32 | Geico | $4,320.69 | State Farm | $3,354.61 | USAA | $3,939.94 |

| Pineland | $4,396.05 | Farmers | $5,601.37 | Progressive | $5,227.88 | State Farm | $3,343.22 | USAA | $3,939.94 |

| Varnville | $4,386.30 | Progressive | $5,694.00 | Farmers | $5,669.24 | State Farm | $3,295.29 | Geico | $3,677.41 |

| Smoaks | $4,369.12 | Farmers | $5,486.93 | Progressive | $5,358.73 | State Farm | $3,358.76 | Geico | $3,707.18 |

| Brunson | $4,363.46 | Farmers | $5,367.87 | Progressive | $5,223.76 | State Farm | $3,263.75 | USAA | $3,939.94 |

| Gifford | $4,338.69 | Farmers | $5,259.85 | Progressive | $5,092.35 | State Farm | $3,329.79 | USAA | $3,939.94 |

| Luray | $4,338.69 | Farmers | $5,259.85 | Progressive | $5,092.35 | State Farm | $3,329.79 | USAA | $3,939.94 |

| Hampton | $4,333.58 | Farmers | $5,178.39 | Progressive | $5,172.50 | State Farm | $3,295.29 | USAA | $3,939.94 |

| Early Branch | $4,295.75 | Farmers | $5,139.84 | Progressive | $4,917.16 | State Farm | $3,324.36 | USAA | $3,939.94 |

| Summerville | $4,291.55 | Progressive | $6,330.20 | Farmers | $4,486.60 | State Farm | $3,335.97 | Geico | $3,363.86 |

| Garnett | $4,252.93 | Farmers | $4,952.29 | Progressive | $4,743.26 | State Farm | $3,386.08 | USAA | $3,939.94 |

| Elliott | $4,248.92 | Farmers | $5,797.64 | Progressive | $4,870.51 | State Farm | $3,320.82 | Geico | $3,779.59 |

| Bethera | $4,239.55 | Farmers | $6,542.72 | Nationwide | $4,364.41 | State Farm | $3,335.97 | Geico | $3,395.57 |

| Mayesville | $4,229.62 | Farmers | $5,718.85 | Progressive | $4,931.71 | State Farm | $3,203.35 | Geico | $3,779.59 |

| Martin | $4,215.45 | Progressive | $5,303.60 | Farmers | $5,186.48 | State Farm | $3,329.79 | Geico | $3,707.18 |

| Huger | $4,214.87 | Farmers | $5,333.72 | Progressive | $5,068.38 | State Farm | $3,228.14 | Geico | $3,512.70 |

| Russellville | $4,179.20 | Progressive | $5,051.12 | Farmers | $5,030.80 | State Farm | $3,335.97 | Geico | $3,512.70 |

| Pineville | $4,174.40 | Farmers | $5,236.46 | Progressive | $5,172.71 | State Farm | $3,091.77 | Geico | $3,395.57 |

What are the Best South Carolina Car Insurance Companies?

There are hundreds of car insurance companies in the U.S.

All car insurance companies offer some form of liability coverage with additional perks unique to their company. What’s the best car insurance in South Carolina? We don’t have any favorites here we provide you with solid data to help you find the car insurance coverage that meets your budget. Ultimately, the choice is yours.

For now, let’s take a look at some car insurance company facts to further your journey along to finding the perfect premium and car insurance provider.

What is the Financial Rating of the Largest Companies?

The best method to measure the financial strength of a car insurance company is the A.M. Best method. Fortunately, those ratings have been provided for you in the data below.

| Company | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| Allstate | A+ | $998,919 | 11.42% | 55.64% |

| Erie Insurance | A+ | $1,153,856 | 13.19% | 64.93% |

| Farmers | NR | $192,162 | 2.20% | 74.14% |

| Geico | A++ | $706,897 | 8.08% | 74.24% |

| Liberty Mutual | A | $424,106 | 4.85% | 61.06% |

| Nationwide | A+ | $786,109 | 8.99% | 59.96% |

| Progressive | A+ | $875,579 | 10.01% | 58.55% |

| State Farm | A++ | $1,779,915 | 20.35% | 63.70% |

| Travelers | A++ | $335,963 | 3.84% | 62.41% |

| USAA* | A++ | $299,488 | 3.42% | 72.05% |

This prestigious list shows the top car insurance companies according to A.M. Best’s analysis. These car insurance providers are earning profit and paying out most of their filed claims.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Companies have the Best Rating?

J.D. Power compiled customer satisfaction data to determine the best car insurance companies by region. The data was submitted in a press release detailing their findings. They measured the scores of each company on a 1,000-point scale. South Carolina is included in the Southeast Region of its Overall Customer Satisfaction Region report. See it below.

| Company | Points (based on a 1,000-point scale) | Circle Ratings |

|---|---|---|

| Alfa Insurance | 829 | 3 |

| Allstate | 830 | 3 |

| Auto-Owners Insurance | 842 | 4 |

| Farm Bureau Insurance - Tennessee | 884 | 5 |

| Geico | 839 | 3 |

| KY Farm Bureau | 824 | 3 |

| Liberty Mutual | 814 | 2 |

| MetLife | 796 | 2 |

| National General | 810 | 2 |

| Nationwide | 823 | 3 |

| NC Farm Bureau | 839 | 3 |

| Progressive | 830 | 3 |

| Safeco | 820 | 3 |

| State Farm | 821 | 3 |

| Travelers | 822 | 3 |

| USAA* | 894 | 5 |

| Southeast Region | 832 | 3 |

For all other companies, Farmer Bureau Insurance of Tennessee has the highest score in the southeast region of the U.S. That company doesn’t appear to be in South Carolina.

Which Companies have the Most Complaints in South Carolina?

Every experience is different, so there will be complaints regarding car insurance companies. How the car insurance company handles the complaints is a great concern.

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| Allstate | 1 | 0.5 | 163 |

| Erie Insurance | 1 | 0.7 | 22 |

| Farmers | 1 | 0.59 | 7 |

| Geico | NA | NA | NA |

| Liberty Mutual | 1 | 5.95 | 222 |

| Nationwide | 1 | 0.28 | 25 |

| Progressive | 1 | 0.75 | 120 |

| State Farm | 1 | 0.44 | 1482 |

| Travelers | 1 | 0.09 | 2 |

| USAA* | 1 | 0.74 | 296 |

Geico does not appear to have any complaints. Perhaps this is because they don’t report complaints. Most companies have less than a 1 percent complaint ratio. It doesn’t mean no one complains, but it shows car insurance companies have more favorable reviews than complaints.

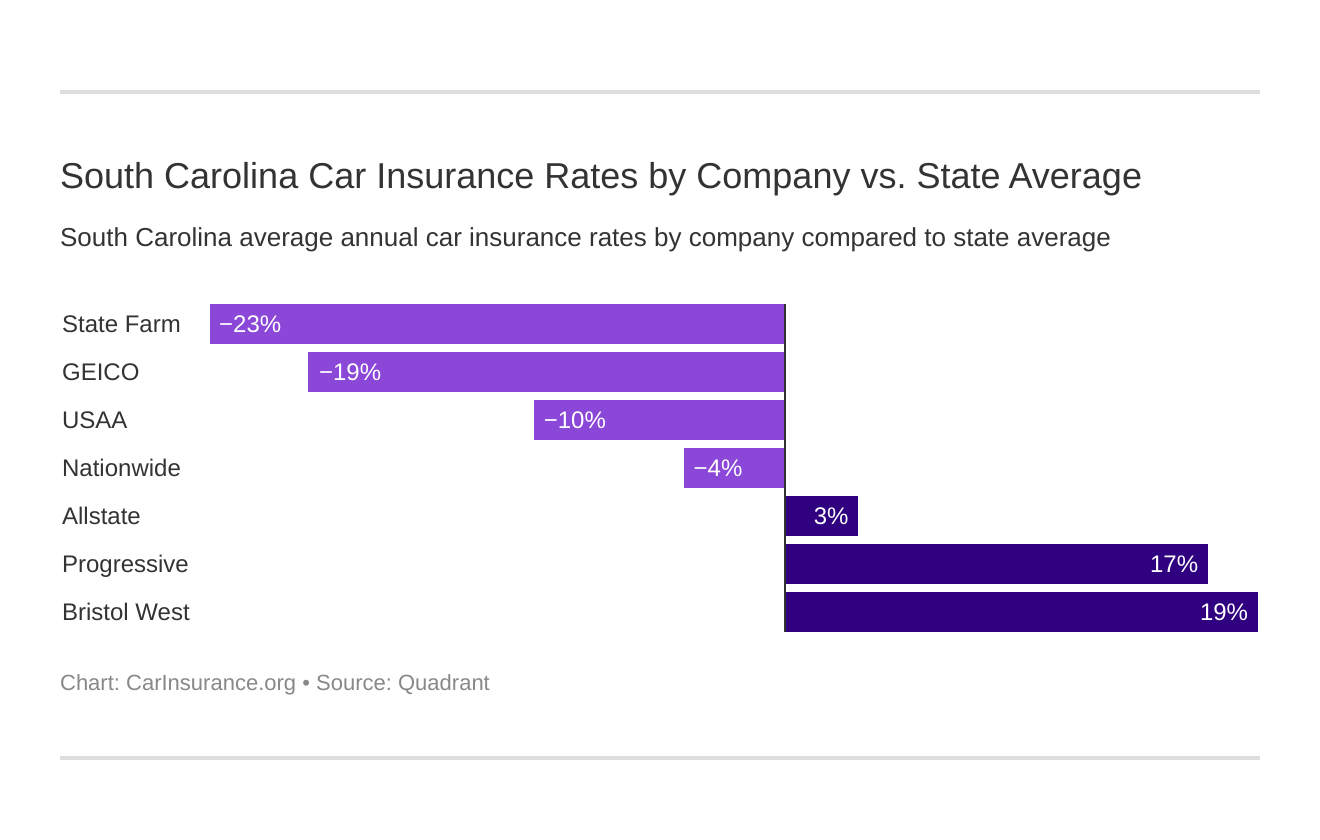

What are the Cheapest Car Insurance Companies in South Carolina?

There are several car insurance companies in South Carolina, but which company is the cheapest? The table lists car insurance premium data.

| Company | Average Annual Rate | Compared to State Average | % Compared to State Averge |

|---|---|---|---|

| Allstate | $3,903 | $122 | 3.13% |

| Bristol West | $4,692 | $910 | 19.41% |

| Geico | $3,178 | -$603 | -18.98% |

| Nationwide | $3,625 | -$155 | -4.29% |

| Progressive | $4,573 | $792 | 17.32% |

| State Farm | $3,071 | -$710 | -23.11% |

| USAA* | $3,425 | -$356 | -10.41% |

You’ll notice that the columns “Compared to State Average” and “% Compared to State Average” have negative signs next to them. The negative signs indicate the national average is less than the South Carolina average. The same applies to the percentage column.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

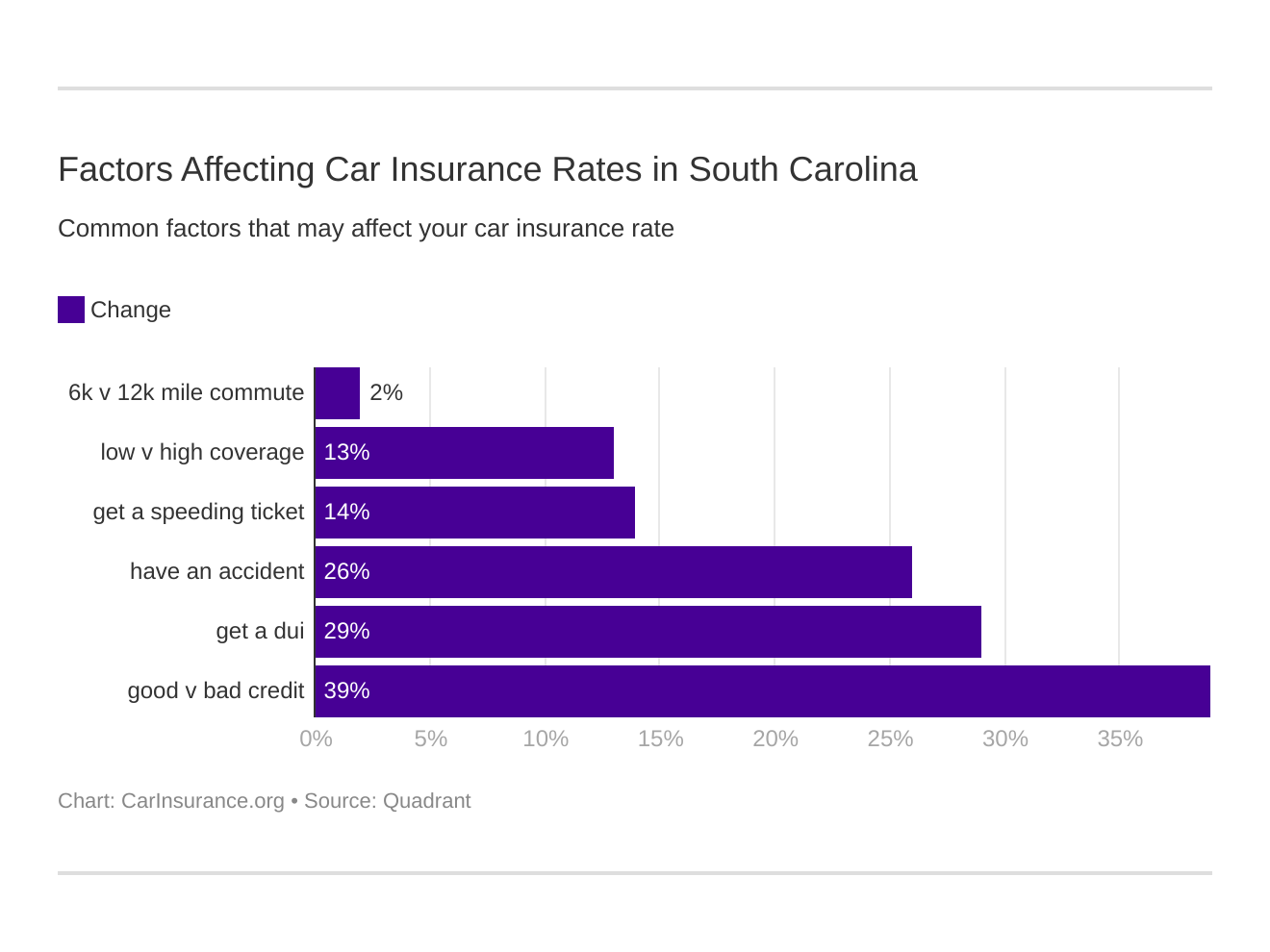

What are the Commute Rates by Companies?

The daily commute can affect car insurance coverage rates, also. In other words, car insurance companies will charge you based on how much you drive. Look at commute rate data below for details.

| Company | 10 Miles Commute, 6000 Annual Mileage | 25 Miles Commute, 12,000 Annual Mileage |

|---|---|---|

| Allstate | $3,822 | $3,985 |

| Farmers | $4,692 | $4,692 |

| Geico | $3160 | $3,195 |

| Nationwide | $3,625 | $3,625 |

| Progressive | $4,573 | $4,573 |

| State Farm | $2,995 | $3,148 |

| USAA* | $3,389 | $3,461 |

Car insurance companies will ask what your vehicle will be used for. You will likely see the above rates if you use your vehicle to commute to work and other commuting purposes. The frequency of car use increases the chances of a car accident.

What are the Coverage Level Rates by Companies?

Some car insurance companies will discount coverage perks on your policy depending on the level of coverage. Here are a few data points to consider when searching for a car insurance provider.

| Group | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,677 | $3,885 | $4,148 |

| Farmers | $4,186 | $4,689 | $5,201 |

| Geico | $2,961 | $3,147 | $3,426 |

| Nationwide | $3,579 | $3,627 | $3,671 |

| Progressive | $4,232 | $4,512 | $4,975 |

| State Farm | $2,845 | $3,070 | $3,298 |

| USAA | $3,232 | $3,420 | $3,622 |

Nationwide’s medium and high coverage level coverage rates are so close in price, it would be more cost-efficient to get high coverage.

What are the Credit History Rates by Companies?

Like most customer and company contracts, car insurance companies will review the credit history of each policyholder. The top car insurance companies in South Carolina have provided rates of those with poor, fair, and good credit.

| Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $4,904 | $3,693 | $3,113 |

| Farmers | $5,382 | $4,545 | $4,149 |

| Geico | $4,847 | $2,607 | $2,080 |

| Nationwide | $4,309 | $3,496 | $3,071 |

| Progressive | $5,091 | $4,464 | $4,164 |

| State Farm | $4,406 | $2,691 | $2,117 |

| USAA | $5,347 | $2,628 | $2,299 |

Policyholders are likely to pay less for car insurance coverage when their credit is fair or good. Take Geico, for example. Policyholders with poor credit pay over $2,000 more than those with fair or good credit.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Driving Record Rates by Companies?

Some car insurance companies are lenient and offer the same coverage rates if you’re in a car accident or get one speeding ticket.

Good driving not only looks good for the law, but it also does wonders for your car insurance coverage rates.

Review the table below for details on how much you could pay per driving record.

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $2,943 | $4,662 | $4,121 | $3,888 |

| Farmers | $3,921 | $5,418 | $4,509 | $4,919 |

| Geico | $2,429 | $3,135 | $4,719 | $2,429 |

| Nationwide | $2,892 | $3,728 | $4,701 | $3,181 |

| Progressive | $3,752 | $5,451 | $4,556 | $4,533 |

| State Farm | $2,789 | $3,416 | $3,040 | $3,040 |

| USAA | $2,707 | $3,341 | $4,619 | $3,032 |

From the data, we see that car insurance companies push higher rates for drivers with DUIs. The only company with some leniency is State Farm.

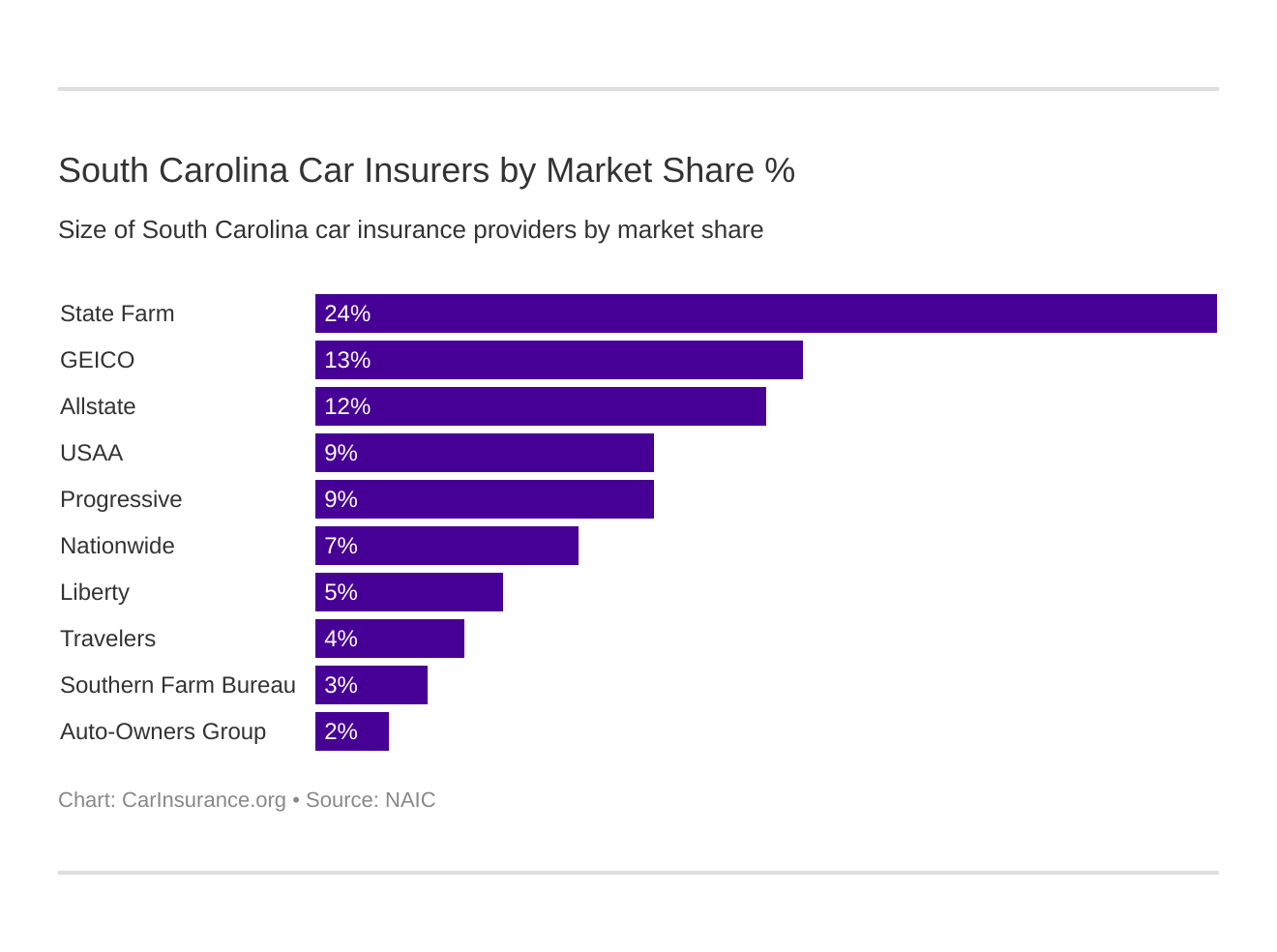

Who are the Largest Car Insurance Companies in South Carolina?

With so many car insurance companies out there, it’s hard to choose which is best. Some companies stick out more than others. Let’s explore the largest car insurance companies in South Carolina. The table details are listed below.

| Company | Rank | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| Allstate | 3 | $473,094 | 58.46% | 11.90% |

| Auto-Owners | 10 | $68,469 | 74.46% | 1.72% |

| Geico | 2 | $523,217 | 73.02% | 13.16% |

| Liberty Mutual | 7 | $206,434 | 69.57% | 5.19% |

| Nationwide | 6 | $283,086 | 62.32% | 7.12% |

| Progressive | 5 | $340,855 | 61.82% | 8.57% |

| Southern Farm Bureau Casualty | 9 | $134,639 | 81.21% | 3.39% |

| State Farm | 1 | $949,692 | 70.89% | 23.88% |

| Travelers | 8 | $176,219 | 70.63% | 4.43% |

| USAA* | 4 | $365,476 | 92.18% | 9.19% |

Pay close attention to the loss ratio. As we mentioned before, a ratio close to 100, but not exceeding it, is good for the car insurance company. The numbers show South Carolina car insurance companies are paying claims and earning as they go.

What’s the Number of Insurers in South Carolina?

There are many insurers in South Carolina. The state has split them into two categories, domestic and foreign. What’s the difference between domestic and foreign insurers?

Domestic insurers are insurers formed under the law of the state. In this case, it would be South Carolina. Foreign insurers are formed under the law of another state of the U.S.

Here are the number of insurers in South Carolina.

| Domestic | Foreign | Total # of Insurers |

|---|---|---|

| 19 | 993 | 1,012 |

The foreign insurers greatly outnumber domestic insurers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the South Carolina Laws?

All drivers in South Carolina should know some of South Carolina’s laws. Of course, you won’t memorize them all, but get to know common laws of the road and state requirements to be privileged to drive. Some laws are the same across the U.S., but when it comes to driving laws and car insurance laws, it varies across the country.

We’ll explore those South Carolina specific laws in this section.

What are the Car Insurance Laws?

Let’s start by talking about South Carolina car insurance laws. Any car insurance company to do business in the state must be licensed to do business in South Carolina.

All South Carolina motorists must have minimum car insurance coverage to drive on South Carolina roadways.

South Carolina law is strict on uninsured drivers.

How South Carolina Laws for Insurance are Determined

The NAIC reported that South Carolina laws are determined by filings close to 7 percent. Filings in this range may qualify you for file-and-use.

File-and-use laws are approved by state car insurance managers who monitor and approve car insurance premiums.

Filings that don’t qualify for file-and-use need prior approval from state car insurance monitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Windshield Coverage

Some states require motorists to pay a deductible to their car insurance company to replace a windshield of a car.

South Carolina happens to be one of the states where policyholders with comprehensive coverage won’t have to pay a deductible to have your windshield fixed. If you only have liability coverage, take advantage of your coverage options by adding comprehensive coverage to your policy.

How to Get High-Risk Insurance

Whenever you’re involved in one or more car accidents, driving with a suspended license, or a DUI, the DMV will require a motorist to enroll in a high-risk policy.

High-risk policies are often known as SR-22 insurance.

All motorists under an SR-22 policy must submit car insurance documents to South Carolina DMV. Submission of these documents falls under the financial responsibility laws for motorists.

This video will give you an example of what to do if you need to enroll in a high-risk policy.

How to Get Low-Cost Insurance

Low-cost insurance all depends on your credit history, driving record, coverage level, and type of coverage. The lowest car insurance coverage rates a motorist will find in South Carolina is well over $2,500.

The lowest car insurance coverage type is liability insurance, which is the minimum car insurance coverage required by South Carolina law.

Manage your income effectively. Most motorists can afford car insurance. If South Carolina car insurance rates are 3 percent of the yearly salary, it won’t take much to maintain payments for liability cover.

But there’s nothing wrong with asking for discounts. Car insurance companies may offer discounts to motorists in the military or motorists with clean driving records. Car insurance companies will give you a break when more than one driver is on the policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There an Automobile Insurance Fraud in South Carolina?

Car insurance fraud is a serious crime with jail time and hefty fines. Insurance fraud costs U.S. taxpayers billions per year.

Car insurance fraud is misrepresenting facts, lying about repair or damage costs, and/or faking an injury to receive a claim from an insurance company.

The charge of insurance fraud depends on much a person has stolen from an insurance company or individual.

- A person who receives claim benefits of $10,000 or less is guilty of a misdemeanor

- A person who receives claim benefits of $10,000 or more is guilty of a felony

If a person is convicted of misdemeanor insurance fraud, they could be forced to pay a $1,000 fine and three years in jail. However, if a person is convicted of felony insurance fraud, they could face a prison sentence up to 10 years.

Check out the video below for additional information on how South Carolina identifies insurance fraud.

What’s the Statute of Limitations?

How is a statute of limitations relevant to car insurance? Whenever a motorist is in a car accident, the not-at-fault party will receive a claim from the at-fault party’s car insurance company for property damages and/or injuries (if any).

The statute of limitations is a time limit on the claim. In South Carolina, the statute of limitations of personal injury and property damage coverage is three years.

Where’s a statute of limitations for car insurance? Personal injury and property damage occur when a car accident happens. Also, the statute of limitations begins when the car accident occurs, not when it’s reported.

What are the Specific Laws in South Carolina?

South Carolina critics often condemn the state for its bad roadways and fatal crash statistics. There are some laws specific to South Carolina that you’d expect, while others are rather humorous.

It’s against the law for South Carolina motorists to display obscene or indecent bumper stickers. Motorists can be charged with a misdemeanor that comes with a $200 fine.

Slower traffic must be on the right side of the highway. Driving slowly on the left side (express lanes) can get you a $155 fine.

Motorists in South Carolina don’t have to pull over for funeral processions but must move over for emergency vehicles.

Cyclists, moped drivers, and motorcyclists can go through red lights at intersections, but only if the traffic signal has remained red for longer than two minutes. It sounds dangerous in heavy traffic, but for traffic that’s less hectic, maybe not so much.

The reason South Carolina allows this is because cyclists, moped drivers, and motorcyclists are on vehicles that don’t weigh enough to signal the light to change.

South Carolina discourages headphones or earbuds while driving. Also, if a motorist drives while their small pet is in their lap, a police officer may pull them over.

A motorist in South Carolina must have their headlights on during heavy rain.

If the windshield wipers are on, then the headlights should be on, also. Within the same law, South Carolina requires motorists to turn on their light 30 minutes after sunset. Violation of this law will get a motorist a $25 fine.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the South Carolina Vehicle Licensing Laws?

Now that you know what you can expect from car insurance company rates and laws regarding car insurance, you’re ready to explore what the licensing laws are like in South Carolina.

This video will briefly talk about South Carolina licensing laws and help you better understand what we’ll be covering in this section.

What is considered a REAL ID?

REAL ID will become the new standard for residents across South Carolina. You’ll need a REAL ID to verify your identity at airports.

Starting in 2019, South Carolina will require new, current, and out-of-state residents to have REAL IDs for domestic flights.

South Carolina motorists can purchase a REAL ID by mail if they have all the required documents on file at any South Carolina DMV. If the South Carolina DMV doesn’t have the necessary documents on file, you are only eligible to apply for a driver’s license by mail.

What are the Penalties for Driving Without Insurance?

Driving without insurance in South Carolina could result in a ticket or an arrest. Per South Carolina law, your license plate, vehicle registration, and driving privileges may be suspended for driving while not insured.

If your driving privileges are suspended in South Carolina, you will have to pay a $550 reinstatement fee. Also, you will have to pay $5 for each day your car was uninsured, but the amount cannot exceed $200.

Motorists who don’t get car insurance within 20 business days without contacting South Carolina DMV will have their license and vehicle registration suspended.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Teen Driver Laws?

Teenage drivers are permitted to drive in South Carolina under specific conditions.

Teenagers that are 15 years old are eligible to receive their beginner’s permit.

Teens must be accompanied by a parent or guardian to their local DMV office. Parents or guardians are required to provide their teen’s birth certificate, insurance information, social security card, and proof of residency.

Fifteen-year-old teens who receive their beginner’s permit are privileged to drive from 6 a.m. to midnight only if they are accompanied by a licensed driver who is at least 21 years old and has one year of driving experience. Teens may drive after midnight if they are accompanied by a licensed parent or guardian.

Licensed drivers accompanying a 15-year-old driver must be in the front passenger seat.

Teens who are at least 15 years old and have maintained a beginner’s permit for 180 days or more may apply for a conditional driver’s license. Also, the teen must have a minimum of 40 hours of driving practice in the day and 10 hours of driving practice at night.

Once these conditions are complete, a parent or guardian may bring their teen to the DMV to sign an application, show proof that the teen has completed a driver’s education course, and outstanding school attendance.

The conditions of a conditional driver’s license aren’t much different than a beginner’s permit. Someone 21 years old must accompany the teen driver, and a parent or guardian must accompany the teen after midnight.

The teen can have only two passengers under the age of 21 in the vehicle. The exception to the rule is if the teen driver is transporting family members or other students to school.

South Carolina teens who are 16 years old with a beginner’s permit for 180 days or more are eligible for a special restricted driver’s license. The conditions and restrictions for the special restricted driver’s license are the same as the conditional driver’s license except for one thing:

A teen can receive a disclaimer from the DMV allowing them to drive between home, school, work, and any vocational training.

They must submit two statements from parents or guardians, a statement from a school official, and a statement on letterhead from their employer.

At the age of 17, a South Carolina teen can acquire full driving privileges if they have a special restricted driver’s license for at least a year, have no driving offenses, and haven’t been involved in an at-fault car accident.

If a teen younger than 17 years old accumulates more than six points on their special restricted driver’s license, their license will be suspended for six months.

Seventeen-year-olds who have their beginner’s permit for at least 180 days are eligible for a full driver’s license. A parent or guardian must an application from the local DMV. The DMV encourages parents and guardians to enforce a parent-teen driving agreement.

Parents and guardians set rules and guidelines on driving and safety to establish that driving is an earned privilege, not a right.

With the conditions met, a 17-year-old must complete the vision and road skills tests. Drivers over the age of 18 don’t require parent or guardian consent to obtain a full driver’s license, but they must take the vision and road skills tests.

What are the License Renewal Procedures for Older Drivers?

The State of South Carolina has license renewal regulations on drivers who 65 years old and older. Those regulations include more frequent time limits, in-person vision tests, possible written tests, and possible road skills tests. Also, we’ll address the restrictions older drivers may face.

- Time Limit – Drivers who are 65 and older must renew their license in South Carolina every five years.

- Vision Test – When renewing a driver’s license, a senior must have satisfactory results on a vision test to have their driver’s license renewed.

- Written and Road Tests – This may be required of senior drivers if DMV employees find it necessary.

Restrictions on seniors are administered if the driving tests have inadequate results.

The common restrictions on seniors may include no driving at night, time of day restrictions, and no highway driving. Time of day driving may include rush hour morning and afternoon traffic.

What is the Procedure for New Residents?

Residents from another state who plan on having a permanent residency in South Carolina must apply for a South Carolina driver’s license. Once they have a license from South Carolina, they must submit their out-of-state driver’s license to DMV officials. New residents of South Carolina have 45 days to transfer their out-of-state vehicle registration to South Carolina.

New residents should be prepared to submit these documents as proof of identity and pay any applicable fees:

- Proof of Identity – passport, social security card, birth certificate

- Proof of residency – two or more documents proving residency in South Carolina

- Vision Test

- Applicable Fees – More than likely, a new resident will need to pay for an eight-year driver’s license, which is $25. More possible fees are listed on SCDMV.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the License Renewal Procedures?

The South Carolina DMV has three methods of renewing a driver’s license. Motorists can renew their license online, by mail, and in person.

The requirements to renewing your driving license online are as follows:

- Must be a U.S. citizen. Non-U.S. citizens cannot renew their driver’s licenses online.

- Hold a Class D, E, F, G, M or any approved DMV driver’s license

- Not in possession of a commercial driver’s license (CDL)

- A social security number that matches what’s on file with the Social Security Administration.

- You haven’t accumulated five points or more on your driver’s license in the past two years.

- You didn’t renew your driver’s license by mail or online during the last renewal.

- You’re not a convicted violent offender in the South Carolina DMV databases.

- You do not own a conditional or special restricted license.

- Your driver’s license isn’t expired or suspended in South Carolina

- Pay a $25 license fee for an eight-year license

Once these requirements have been met, the South Carolina DMV will send a renewed license by mail. The South Carolina DMV will use the same address, photo, and signature as the old license. It takes up to 10 business days to receive your renewed license.

To receive your renewed driver’s license by mail, you must be a U.S. citizen. The requirements are the same as the online requirements. If a South Carolina motorist meets the DMV conditions, they’ll need to download the SCDMV Form DL-63 by mail along with a check or money order for $25. Applicants should make the check or money order out to SCDMV and mail it to this address:

SCDMV

Alternative Media

P.O. Box 1498

Blythewood, SC 29016-0035

As a rule of thumb, if you’re eligible for online or mail renewal of your driver’s license, you can always go to any South Carolina DMV in person. The only thing you’ll require is the company name of your car insurance company and payment for the $25 license fee.

Does South Carolina have a Negligent Operator Treatment System (NOTS)?

South Carolina doesn’t have NOTS. Negligent drivers are often dealt with through South Carolina’s judicial courts and South Carolina DMV. Negligent drivers are likely punished with traffic tickets, stiff fines, and points accumulated on their driver’s license or jail time.

What are the Rules of the Road?

The rules of roadways in South Carolina are embedded in law. The more a South Carolina motorist respects the rules of the road, the better your driving record will be.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is South Carolina at Fault or No-Fault State?

Any car accident can result in receiving a claim from a car insurance company and an increase in car insurance premiums per year. Also, determining fault will leave a South Carolina motorist with a ticket. The fault is given to a driver who fails to yield to a stop sign, is speeding, has an improper following distance between vehicles, and/or is not yielding to pedestrians.

When a car accident occurs, law enforcement will have to establish fault from the facts of the event. Fault and no-fault is established upon this report and a review from a car insurance company.

What are the Seat Belt & Car Seat Laws?

A condensed version of the seat belt law is listed in the table below.

| State | Initial Effective Date | Primary Enforcement | Who is cover in what seats? | Maximum base fine 1st offense, additional fees apply |

|---|---|---|---|---|

| South Carolina | 07/01/89 | yes; effective 12/09/05 | 8 years old and older in all seats. | $25 |

The South Carolina seat belt law has been around since July 1989. Drivers and passengers eight years old and older must wear a seat belt. Violating the seat belt law carries a $25 fine for the first offense.

Car seat laws are more detailed. We’ve placed the car seat laws in a table format below.

| State | Must be in child safety seat | Adult belt is permissible | Maximum base fine 1st offense, additional fees may apply | Preference for rear seat |

|---|---|---|---|---|

| South Carolina | younger than 2 years in rear-facing child restraint until exceeding manufacturer height/weight limit; children younger than 2 who outgrow rear-facing system and children 2 and older must be in forward-facing restraint with harness until exceeding manufacturer height/weight limit; children 4 and older who outgrow forward-facing child restraint must be in belt positioning booster using lap/shoulder belts until child is at least 8 years or at least 57 inches | 8 years or at least 57 inches tall if (1) lap belt fits across hips and thighs, not abdomen (2) shoulder belt crosses center of chest and not neck (3) knees bend over seat edge when sitting up straight with his/her back firmly against seat back | $150 | 7 years old and younger must be in the rear seat if available. |

The penalty for transporting a child improperly in a motor vehicle is more costly. Repeat offenders could see higher fines.

What are the Keep Right & Move Over Laws?

South Carolina law is very adamant about moving over on its roadways. Earlier, we talked about how vehicles on the highway need to move over from left lanes or express lanes. Traveling under the speed limit in those lanes can you get a ticket. Therefore, motorists are encouraged to stay in lanes on the right or center of the highway so vehicles may pass by.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Speed Limit?

Speed limits are designated for all roadways in South Carolina, like in many other U.S. states. Here the speed limits you can expect in South Carolina.

| Rural Interstates (mph) | Urban Interstates (mph) | Other Limited Access Roads (mph) | Other Roads (mph) |

|---|---|---|---|

| 70 mph | 70 mph | 60 mph | 55 mph |

Motorists can drive at least five miles over the speed limit.

How Does Ridesharing Work?

In mid-May 2019, the South Carolina Senate voted 40-0 to pass the law for ridesharers like Uber and Lyft to show their license plate on the front and back of their vehicles.

The law was enacted after Samantha Josephson was killed by a driver who pretended to be her rideshare transportation. Advocates for the law to be passed pushed for change in ridesharing laws, which ultimately, was passed unanimously by South Carolina.

Is There an Automation on the Road?

There isn’t much clarity on whether South Carolina allows automated vehicles to be on the road. However, the South Carolina law dictates car following distances don’t apply to non-leading vehicles. It’s safe to say this issue may be incoming to the South Carolina legislature very soon.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Safety Laws?

Penalties for violating safety laws can land you in prison in addition to costing you in fines. As one of the states with the highest fatality rates by motor vehicle, South Carolina is tough on motorists who break safety laws. In this law section, we’ll evaluate some of those safety laws and penalties for violating them.

What are the DUI Laws?

Driving with a blood alcohol limit of 0.08 – 0.17 or higher violate South Carolina’s law, and the motorist will be charged with DUI.

- The first offense is considered a misdemeanor.

- A second offense within 10 years is a Class C misdemeanor.

- A third offense within 10 years is a Class A misdemeanor.

- Four or more offenses in 10 years is a Class F felony.

The table below shows detail on what a driver will face if they are charged and convicted of DUI.

| 1st Offense - ALS or Revocation | 1st Offense - Imprisonment | 1st Offense - Fine | 2nd Offense - DL Revocation | 2nd Offense - Imprisonment | 2nd Offense - Fine | 3rd Offense - DL Revocation | 3rd Offense - Imprisonment | 3rd Offense - Fine | 3rd Offense - Other | 4th Offense - DL Revocation | 4th Offense - Imprisonment | Mandatory Interlock |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 6 months | 48 hours - 30 days | $400 minimum ($992 with assessments and surcharges) | 1 year | 5 days - 1 year | $2,100-$5,100 ($10,744.50 with assessments and surcharges) | minimum 2 years. 4 years if within 5 years of 1st offense | 60 days - 3 years | $3800 - $6300 ($13,234.50 with assessments and surcharges) | if within 10 years of first offense, vehicle must be confiscated if offender is owner or resident of owner's house | permanent | 1-5 years | High BAC and repeat offenders |

For each DUI, a motorist increases their chances of a suspended license, paying stiff fines and/or serving time in prison.

What are the Marijuana-Impaired Driving Laws?

The Foundation for Advancing Alcohol Responsibility reported that South Carolina doesn’t have a marijuana-impaired driving law.

A statute does exist penalizing drivers for driving under the influence of marijuana and other drugs.

This video will describe South Carolina’s approach in dealing with motorists who drive under the influence of drugs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Distracted Driving Laws?

South Carolina law is straightforward on distracted driving. AAA bluntly reported that South Carolina law of distracting driving says, “Texting while driving is prohibited.” More importantly, any distraction while driving on roadways is a quick way to a traffic ticket.

What’s Driving in Driving in South Carolina?

We’re almost there. This section will talk about the hard facts of South Carolina vehicles, driving in South Carolina, crime data, crash data and statistics, and emergency responder estimated time of arrival.

Is There a Vehicle Theft in South Carolina?

Having your vehicle stolen costs economically and mentally. Many car insurance companies offer coverage to compensate for that, but you should know the rate in which vehicle theft occurs in South Carolina. We’ve provided a table of that data to give you an idea.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 8 | Chevrolet Impala | 2008 | 166 |

| 3 | Chevrolet Pick-Up (full-size) | 2004 | 455 |

| 7 | Dodge Pick-Up (full-size) | 2001 | 172 |

| 4 | Ford Crown Victoria | 2003 | 210 |

| 10 | Ford Explorer | 2002 | 146 |

| 1 | Ford Pick-Up (full-size) | 2006 | 586 |

| 2 | Honda Accord | 1996 | 458 |

| 6 | Honda Civic | 2000 | 176 |

| 9 | Nissan Altima | 2015 | 155 |

| 5 | Toyota Camry | 2014 | 183 |

We’ve ranked stolen vehicles by the number of times that they’ve been stolen.

What city in South Carolina has the highest number of car thefts? The data in the table below give you that answer. Sort through the data using the up and down triangle on the number (#) of thefts to see what city has the lowest vehicle theft and which one has the highest.

| State | Motor vehicle theft |

|---|---|

| Abbeville2 | 7 |

| Aiken3 | 84 |

| Allendale | 5 |

| Anderson | 127 |

| Andrews | 5 |

| Aynor | 1 |

| Bamberg | 8 |

| Barnwell | 6 |

| Batesburg-Leesville | 17 |

| Beaufort | 33 |

| Belton | 25 |

| Bennettsville | 9 |

| Bishopville | 12 |

| Blacksburg | 12 |

| Blackville | 6 |

| Bluffton | 22 |

| Branchville | 2 |

| Burnettown | 3 |

| Camden | 20 |

| Cameron | 4 |

| Cayce | 94 |

| Central | 6 |

| Chapin | 1 |

| Charleston | 303 |

| Cheraw | 20 |

| Chesnee | 5 |

| Chester | 9 |

| Clemson | 36 |

| Clinton | 12 |

| Clover | 10 |

| Columbia | 791 |

| Conway | 67 |

| Coward | 1 |

| Cowpens | 6 |

| Darlington | 21 |

| Denmark | 5 |

| Dillon | 21 |

| Due West | 2 |

| Duncan | 3 |

| Easley | 64 |

| Edgefield | 4 |

| Edisto Beach | 3 |

| Elgin | 2 |

| Elloree | 0 |

| Estill | 3 |

| Eutawville | 0 |

| Florence | 133 |

| Forest Acres | 35 |

| Fort Lawn | 2 |

| Fort Mill | 9 |

| Fountain Inn | 23 |

| Gaffney | 25 |

| Gaston | 9 |

| Georgetown | 24 |

| Gifford | 0 |

| Goose Creek | 57 |

| Great Falls | 8 |

| Greeleyville | 0 |

| Greenville | 157 |

| Greenwood | 48 |

| Greer | 100 |

| Hampton | 17 |

| Hanahan | 42 |

| Hardeeville | 14 |

| Harleyville | 1 |

| Hartsville | 27 |

| Hemingway | 3 |

| Holly Hill | 4 |

| Honea Path | 20 |

| Irmo | 15 |

| Isle of Palms | 7 |

| Iva | 5 |

| Jackson | 1 |

| Johnsonville | 0 |

| Johnston | 5 |

| Jonesville | 0 |

| Kingstree | 11 |

| Lake City | 27 |

| Landrum | 4 |

| Lane | 0 |

| Latta | 6 |

| Laurens | 20 |

| Lexington | 34 |

| Liberty | 11 |

| Loris | 9 |

| Lyman | 7 |

| Manning | 17 |

| Marion | 37 |

| Mauldin | 32 |

| McColl | 0 |

| McCormick | 1 |

| Moncks Corner | 32 |

| Mount Pleasant | 87 |

| Mullins | 22 |

| Myrtle Beach | 345 |

| Newberry | 7 |

| New Ellenton | 1 |

| Ninety Six | 3 |

| North | 3 |

| North Augusta | 37 |

| North Charleston | 685 |

| North Myrtle Beach | 105 |

| Orangeburg | 49 |

| Pacolet | 5 |

| Pageland | 9 |

| Pendleton | 3 |

| Pickens | 10 |

| Port Royal | 22 |

| Prosperity | 1 |

| Quinby | 0 |

| Ridgeland | 7 |

| Ridge Spring | 1 |

| Rock Hill | 136 |

| Salem | 0 |

| Salley | 0 |

| Saluda | 4 |

| Santee | 6 |

| Scranton | 0 |

| Seneca | 13 |

| Simpsonville | 58 |

| Society Hill | 0 |

| South Congaree | 7 |

| Springdale | 15 |

| St. George | 7 |

| St. Matthews | 3 |

| St. Stephen | 5 |

| Sullivans Island | 4 |

| Summerton | 3 |

| Summerville | 115 |

| Sumter | 74 |

| Surfside Beach | 23 |

| Swansea | 6 |

| Tega Cay | 1 |

| Travelers Rest | 14 |

| Turbeville | 3 |

| Union | 8 |

| Walhalla | 9 |

| Walterboro | 11 |

| Ware Shoals | 5 |

| Wellford | 2 |

| West Columbia | 152 |

| Westminster | 5 |

| West Pelzer | 1 |

| Whitmire | 1 |

| Williamston | 7 |

| Williston | 6 |

| Winnsboro | 5 |

| Woodruff | 11 |

| Yemassee | 2 |

| York | 22 |

Several cities across South Carolina didn’t encounter any vehicle theft reports. However, the top three cities that saw a lot of vehicle theft were Columbia, Myrtle Beach, and North Charleston.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Number of Road Fatalities in South Carolina?

The unfortunate fact is that South Carolina ranks high in poor roadways and road fatalities. Part of the reason for high auto insurance premiums is because of the statistics you’re about to see below. We’ll summarize road fatalities in a combination of data tables and facts.

What is the Number of Fatalities by Weather Condition & Light Condition?

One of the causes of fatal crashes is weather and light conditions. This data will concentrate on fatal crash data caused by weather conditions and light conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 376 | 94 | 326 | 31 | 0 | 827 |

| Rain | 32 | 8 | 42 | 6 | 0 | 88 |

| Snow/Sleet | 1 | 0 | 0 | 0 | 0 | 1 |

| Other | 2 | 1 | 2 | 3 | 0 | 8 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 411 | 103 | 370 | 40 | 0 | 924 |

More fatal crashes occurred in normal, daylight conditions than any other weather or light condition listed in the table.

What is the Most Fatal Highway in South Carolina?

The most dangerous highway in South Carolina is Highway 95. Highway 95 is the main interstate on the East Coast. It runs from Miami, Florida, to the Houlton-Woodstock Border Crossing near New Brunswick, Canada.

GeoTab Management by Measurement reported 244 crashes and 301 fatal crashes.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Number of Fatalities (All Crashes) by County?

South Carolina has about 155 counties in the state. We collected fatality crash data by county. Review the details in the table below.

| County Name | Fatalities (2014) | Fatalities Per 100,000 Population (2014) | Fatalities (2015) | Fatalities Per 100,000 Population (2015) | Fatalities (2016) | Fatalities Per 100,000 Population (2016) | Fatalities (2017) | Fatalities Per 100,000 Population (2017) | Fatalities (2018) | Fatalities Per 100,000 Population (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Abbeville County | 6 | 24.22 | 6 | 24.22 | 4 | 16.24 | 8 | 32.57 | 3 | 12.22 |

| Aiken County | 23 | 14.01 | 26 | 15.70 | 37 | 22.14 | 39 | 23.18 | 25 | 14.76 |

| Allendale County | 3 | 30.93 | 4 | 42.46 | 2 | 22.10 | 4 | 44.44 | 4 | 44.93 |

| Anderson County | 45 | 23.46 | 32 | 16.52 | 57 | 29.13 | 44 | 22.19 | 44 | 21.95 |

| Bamberg County | 2 | 13.20 | 4 | 27.23 | 7 | 48.33 | 4 | 27.78 | 3 | 21.02 |

| Barnwell County | 6 | 27.24 | 5 | 22.95 | 5 | 23.14 | 8 | 37.46 | 1 | 4.74 |

| Beaufort County | 23 | 13.14 | 17 | 9.45 | 30 | 16.37 | 26 | 13.94 | 22 | 11.66 |

| Berkeley County | 40 | 20.18 | 36 | 17.73 | 34 | 16.31 | 34 | 15.85 | 34 | 15.38 |

| Calhoun County | 12 | 80.83 | 10 | 67.75 | 10 | 67.82 | 7 | 47.64 | 8 | 55.10 |

| Charleston County | 47 | 12.37 | 64 | 16.44 | 54 | 13.61 | 72 | 17.92 | 66 | 16.26 |

| Cherokee County | 15 | 26.62 | 17 | 30.08 | 5 | 8.82 | 20 | 35.13 | 18 | 31.54 |

| Chester County | 9 | 27.75 | 17 | 52.48 | 18 | 55.78 | 15 | 46.46 | 9 | 27.91 |

| Chesterfield County | 3 | 6.50 | 16 | 34.67 | 9 | 19.51 | 12 | 26.13 | 12 | 26.23 |

| Clarendon County | 10 | 29.26 | 17 | 50.03 | 21 | 61.36 | 19 | 55.88 | 15 | 44.51 |

| Colleton County | 17 | 45.29 | 21 | 56.07 | 24 | 63.84 | 18 | 47.88 | 22 | 58.42 |

| Darlington County | 13 | 19.22 | 25 | 37.03 | 24 | 35.68 | 15 | 22.38 | 20 | 29.94 |

| Dillon County | 14 | 44.73 | 7 | 22.46 | 11 | 35.78 | 9 | 29.46 | 11 | 35.95 |

| Dorchester County | 16 | 10.75 | 32 | 20.94 | 32 | 20.49 | 16 | 10.07 | 23 | 14.32 |

| Edgefield County | 3 | 11.26 | 2 | 7.47 | 3 | 11.27 | 4 | 14.94 | 9 | 33.27 |

| Fairfield County | 8 | 34.74 | 7 | 30.60 | 10 | 44.16 | 13 | 57.49 | 12 | 53.57 |

| Florence County | 23 | 16.57 | 38 | 27.39 | 29 | 20.92 | 32 | 23.10 | 43 | 31.12 |

| Georgetown County | 7 | 11.50 | 18 | 29.28 | 6 | 9.74 | 15 | 24.26 | 16 | 25.70 |

| Greenville County | 62 | 12.88 | 73 | 14.87 | 87 | 17.44 | 74 | 14.61 | 77 | 14.97 |

| Greenwood County | 7 | 10.04 | 11 | 15.71 | 12 | 17.07 | 10 | 14.17 | 20 | 28.27 |

| Hampton County | 5 | 24.48 | 7 | 35.06 | 1 | 5.05 | 4 | 20.51 | 2 | 10.34 |

| Horry County | 58 | 19.48 | 81 | 26.22 | 70 | 21.80 | 67 | 20.14 | 71 | 20.63 |

| Jasper County | 15 | 56.23 | 15 | 54.69 | 25 | 89.19 | 11 | 38.74 | 11 | 37.97 |

| Kershaw County | 13 | 20.57 | 18 | 28.28 | 18 | 28.00 | 19 | 29.19 | 17 | 25.92 |

| Lancaster County | 16 | 19.17 | 15 | 17.38 | 14 | 15.56 | 18 | 19.43 | 13 | 13.63 |

| Laurens County | 24 | 36.08 | 22 | 33.10 | 21 | 31.51 | 29 | 43.34 | 32 | 47.77 |

| Lee County | 6 | 32.74 | 8 | 44.95 | 5 | 28.58 | 5 | 28.96 | 9 | 52.50 |

| Lexington County | 35 | 12.62 | 46 | 16.32 | 43 | 15.01 | 47 | 16.16 | 68 | 23.05 |

| Marion County | 9 | 28.16 | 11 | 34.63 | 9 | 28.34 | 8 | 25.57 | 10 | 32.22 |

| Marlboro County | 13 | 46.40 | 9 | 32.64 | 9 | 33.38 | 8 | 29.96 | 8 | 30.31 |

| Mccormick County | 4 | 40.77 | 3 | 31.05 | 4 | 41.76 | 4 | 41.81 | 1 | 10.63 |

| Newberry County | 4 | 10.62 | 7 | 18.53 | 6 | 15.81 | 7 | 18.22 | 8 | 20.77 |

| Oconee County | 13 | 17.28 | 13 | 17.13 | 11 | 14.37 | 18 | 23.24 | 16 | 20.41 |

| Orangeburg County | 28 | 31.10 | 31 | 34.77 | 30 | 33.92 | 29 | 33.08 | 39 | 44.86 |

| Pickens County | 13 | 10.78 | 16 | 13.17 | 19 | 15.44 | 20 | 16.17 | 23 | 18.41 |

| Richland County | 41 | 10.24 | 45 | 11.08 | 69 | 16.87 | 52 | 12.64 | 50 | 12.06 |

| Saluda County | 6 | 29.87 | 0 | 0.00 | 1 | 4.94 | 7 | 34.27 | 3 | 14.60 |

| Spartanburg County | 39 | 13.31 | 75 | 25.29 | 54 | 17.95 | 51 | 16.63 | 72 | 22.94 |

| Sumter County | 26 | 24.15 | 20 | 18.66 | 20 | 18.67 | 18 | 16.90 | 15 | 14.08 |

| Union County | 5 | 17.91 | 6 | 21.63 | 7 | 25.31 | 6 | 21.82 | 5 | 18.24 |

| Williamsburg County | 11 | 33.59 | 8 | 24.60 | 17 | 53.27 | 15 | 48.10 | 12 | 39.21 |

| York County | 25 | 10.22 | 18 | 7.18 | 36 | 13.96 | 28 | 10.52 | 35 | 12.77 |

In a four-year trend, Greenville County had the most fatal crashes in South Carolina.

What is the Number of Traffic Fatalities?

Car insurance companies, law enforcement, and the DMV consider all data collected over the years. To accurately report fatality data per year, these organizations separate the data by rural and urban categories.

In the table below, you will see traffic fatality numbers in rural and urban areas. Let’s review a four-year trend of traffic fatalities.

| Core Outcome Measures | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Total (C-1) | 979 | 1,020 | 989 | 1,037 |

| Rural | 555 | 613 | 688 | 681 |

| Urban | 424 | 407 | 301 | 356 |

There appears to be a spike every two years in traffic fatalities.

What is the Number of Fatalities by Person Type?

It’s important to record how a person was involved in a fatal crash. The NHTSA reports data by person type. We’ve provided that for you in the details below.

| Person Type | 2014 Deaths | 2014 Death % | 2015 Deaths | 2015 Death % | 2016 Deaths | 2016 Death % | 2017 Deaths | 2017 Death % | 2018 Deaths | 2018 Death % |

|---|---|---|---|---|---|---|---|---|---|---|

| Bicyclists or Other Cyclists | 14 | 2 | 16 | 2 | 25 | 2 | 17 | 2 | 23 | 2 |

| Bus | 0 | 0 | 1 | 0 | 1 | 0 | 1 | 0 | 2 | 0 |

| Light Truck - Pickup | 118 | 14 | 105 | 11 | 115 | 11 | 114 | 12 | 129 | 12 |

| Light Truck - Utility | 106 | 13 | 121 | 12 | 118 | 12 | 133 | 13 | 138 | 13 |

| Light Truck - Van | 15 | 2 | 34 | 3 | 30 | 3 | 18 | 2 | 35 | 3 |

| Light Truck - Other | 1 | 0 | 0 | 0 | 3 | 0 | 2 | 0 | 3 | 0 |

| Large Truck | 10 | 1 | 24 | 2 | 20 | 2 | 19 | 2 | 21 | 2 |

| Other/Unknown Occupants | 2 | 0 | 10 | 1 | 7 | 1 | 6 | 1 | 4 | 0 |

| Other/Unknown Non-occupants | 2 | 0 | 2 | 0 | 4 | 0 | 3 | 0 | 3 | 0 |

| Passenger Car | 327 | 40 | 358 | 37 | 367 | 36 | 376 | 38 | 373 | 36 |

| Pedestrians | 107 | 13 | 123 | 13 | 144 | 14 | 155 | 16 | 165 | 16 |

| Total Motorcyclists | 121 | 15 | 185 | 19 | 186 | 18 | 145 | 15 | 141 | 14 |

| Total Non-occupants | 123 | 15 | 141 | 14 | 173 | 17 | 175 | 18 | 191 | 18 |

| Total Occupants | 579 | 70 | 653 | 67 | 661 | 65 | 669 | 68 | 705 | 68 |