New Hampshire Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 9.9

With its White Mountains and expansive wilderness, The Granite State offers many recreational opportunities. Whether you want to hike, ski, kayak, or simply take a road trip, your options for exploration and free-living are seemingly limitless.

Like when you choose car insurance, you may feel you have too many alternatives. You may not know where to go, or what to do. If you’re lost and don’t know which car insurance you should buy for your needs, you’ve found the right site.

We’ll go over the state minimum coverage requirements, the average cost of premiums, the coverage you should buy, state laws, and everything else related to car insurance. We’ll give you the information you need to get affordable coverage whether you have a clean driving record or a few dings.

So, let’s get ready for an adventure along the lines of car insurance.

But, first, to find out how much you can save, enter your zip code to start comparing rates.

What Insurance Coverage and Rates Do You Need in New Hampshire?

What kind of car insurance should you buy in New Hampshire? Do you really need it? The many options and the volumes of data available on the topic can make you feel confused and leave you wondering what to do.

But, you’re in good hands. We’re going to answer your questions soon. We’ll cover New Hampshire’s minimum insurance requirements, the average annual cost of premiums, company reviews, state laws, and so much more.

So, let’s get started on the path to learning more about car insurance.

New Hampshire Car Culture

The Hartford states that Sport Utility Vehicles (SUVs) and trucks are popular in the Granite State because of the winter weather. The vehicle New Hampshire drivers love most is the Chevrolet Silverado 1500.

The tough conditions make snow tires and four-wheel drive a necessity. Roads filled with ice and snow can be dangerous to drive on, and rugged vehicles make these hazards more bearable. They also help locals reach their destinations faster.

New Hampshire also has a thriving classic car community. One club, the Newport-based Car Nutz, lets enthusiasts share their passion for these vintage vehicles regularly.

New Hampshire Minimum Coverage

New Hampshire is an “at-fault” state. Whoever causes a car accident there is legally and financially responsible for any damages. Generally, fault is determined by police officers at the scene who issue citations. Insurance companies may do further investigations if needed before issuing payment.

Despite this requirement, Granite State drivers don’t have to buy car insurance. It’s part of the state’s “live free or die” philosophy. But, if they don’t want potentially costly medical and property damage bills from an accident, they should purchase a premium.

To get liability coverage in New Hampshire, you must already have uninsured/underinsured motorist insurance coverage of $25,000.

If you decide to buy a car insurance policy, per legal advice site Nolo, these are the minimum limits required:

- $25,000 – Bodily injury liability for one person

- $50,000 – Bodily injury liability total for multiple persons

- $25,000 – Property damage

- $1,000 – MedPay or medical payments

Drivers with lots of violations on their records, known as “high-risk” drivers, must also carry insurance. The state may require an SR-22 form, which could lead to higher insurance premiums. Especially in a state like New Hampshire, that requirement indicates serious records like drunk driving or accidents you couldn’t afford.

Just how much coverage should you buy? If you can afford to, we suggest you purchase more than the state-required minimums. The experts at the Wall Street Journal advises insurance buyers to get liability coverage with limits of 100/300/50.

Nearly ten percent of New Hampshire drivers — 9.9 percent to be exact — are uninsured. Interestingly, that rate matches that of the only other state that doesn’t require car insurance, Virginia.

The percentage of uninsured drivers ranks New Hampshire 35th in the United States, which is higher than the national average, while Virginia ranks just below at 34th.

With the risks involved in not having coverage, even buying the liability coverage can protect yourself and your loved ones on the road. Of course, unless you can afford to replace your car and pay your own medical bills after an auto accident, collision, comprehensive, and PIP are also worth buying. Cheap car insurance companies make this type of coverage accessible to just about everyone.

Forms of Financial Responsibility

Though car insurance isn’t required in New Hampshire, you must show proof of your financial responsibility or ability to pay for bodily injury and property damages. You have two options:

- You can buy insurance coverage and keep an ID card or copy of the policy in your vehicle. You can also show your proof of insurance electronically on any mobile device.

- You may deposit money or securities with the state treasury office.

Next, we’ll explore how much the average New Hampshirite spends on car insurance.

Premiums as a Percentage of Income

The table below shows how much Granite State residents pay for car insurance yearly.

| Annual Full Coverage Average Premiums | Monthly Full Coverage Average Premiums | Annual Per Capita Disposable Personal Income | Monthly Per Capita Disposable Personal Income | Percentage of Income |

|---|---|---|---|---|

| $795.50 | $66.29 | $48,280.00 | $4,023.33 | 1.65% |

Drivers there with an average annual income of $48,280 spend a little less than two percent of their disposable earnings on car insurance. New Hampshire residents don’t pay sales tax or income tax, but they pay higher property taxes than other Americans.

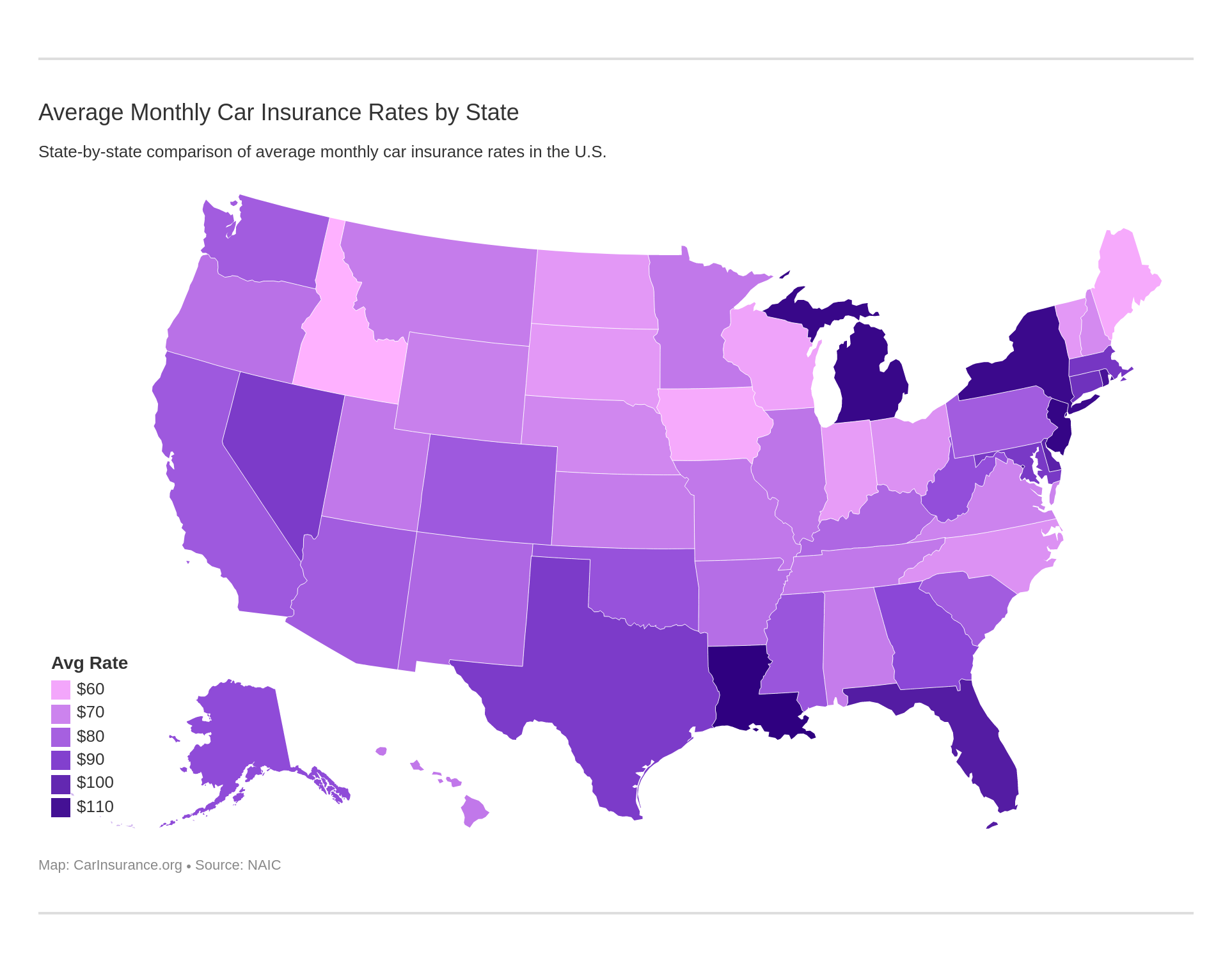

With the cost of annual premiums at just under $800.00, New Hampshirites pay more than $500.00 less than the average American ($1,311 yearly).

From 2012 to 2014, the annual average cost of premiums in New Hampshire increased by $40, yet the percentage of income residents paid for it remained the same.

Of its border states, Maine residents paid less than those in New Hampshire, but a slightly higher percentage of their incomes went to insurance. Vermont’s annual car insurance premiums cost somewhat less than New Hampshire’s, while Massachusetts residents averaged over $1,100 for their premiums. (For more information, read our Massachusetts“).

Use the tool below to calculate how much you spend on car insurance.

Average Monthly Car Insurance Rates in NH (Liability, Collision, Comprehensive)

The data below from the National Association of Insurance Commissioners (NAIC) compares the average yearly costs of core coverages nationwide with those in New Hampshire.

| Coverage Type | National Average | New Hampshire Average |

|---|---|---|

| Full Coverage | $1009.38 | $818.75 |

| Liability | $538.73 | $400.56 |

| Collision | $322.61 | $307.42 |

| Comprehensive | $148.04 | $110.77 |

Liability will cover you and the other party if you cause an accident. Comprehensive and collision coverage will pay for damage to your vehicle. All three coverages get rolled into a package that is commonly called ‘full coverage’. If you need medical coverage for your injuries, you should also buy PIP coverage. While this sounds like a lot, the combination is often more affordable than you might think, especially with insurance discounts.

As shown, the average New Hampshirite pays almost $2,000 less for full coverage than the national average. Only the cost of collision coverage came close to the nationwide average.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Other Coverages Should New Hampshire Residents Buy?

As we mentioned earlier, if you have car insurance in New Hampshire, you must buy $1,000 of MedPay or medical payments coverage. It will pay for the bodily injuries or burial expenses of those involved, no matter who’s at fault.

Uninsured/underinsured motorist coverage will pay if you are in an accident that you’re not responsible for, and if the other driver lacks insurance or doesn’t have enough to cover your expenses. Generally, these limits match your chosen liability limits. You can also get them stacked or unstacked. If stacked, you pay more. But you also get coverage from both in the event of a claim. So you double your coverage.

The below table goes over loss ratios for the above coverages.

| Coverage | Loss Ratio |

|---|---|

| Medical Payments | 68.50% |

| Uninsured/Underinsured Motorist Coverage | 59.51% |

A Loss ratio compares how much an insurance company pays for a claim to the amount of money it earns on premiums. For example, with a loss ratio of 60 percent, the company paid $60 for every $100 it earned in premiums.

A ratio of over 100 percent shows that the company isn’t earning enough to cover the cost it pays for claims and will probably have to raise rates. On the other hand, if the number is too low, the company probably overpriced its policies or didn’t get as many claims as it anticipated.

What Add-ons, Endorsements, Riders Are Available to New Hampshire Citizens?

Below are some more coverage options you can add to a basic car insurance policy.

You can add many different types of coverage to a car insurance policy. This list is not exhaustive, but it can help you decide which ones to add.

Talk to your insurance carrier about your needs to make sure you have no coverage gaps.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Pay-as-You Drive or Usage-Based Insurance

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Usage-based or pay-as-you-drive coverage such as Metromile isn’t currently available in New Hampshire. But, the companies below are among those that offer discounts based on safe driving habits. A telematics device installed in the car’s diagnostic port or a smartphone app will track your driving.

- Progressive Snapshot – telematics device

- Allstate Drivewise – App-based

- Nationwide SmartRide – telematics device

Also, regarding non-owner coverage, all auto liability policies in New Hampshire cover a “nonowner” operator if they drive the car with the permission of the “named insured.”

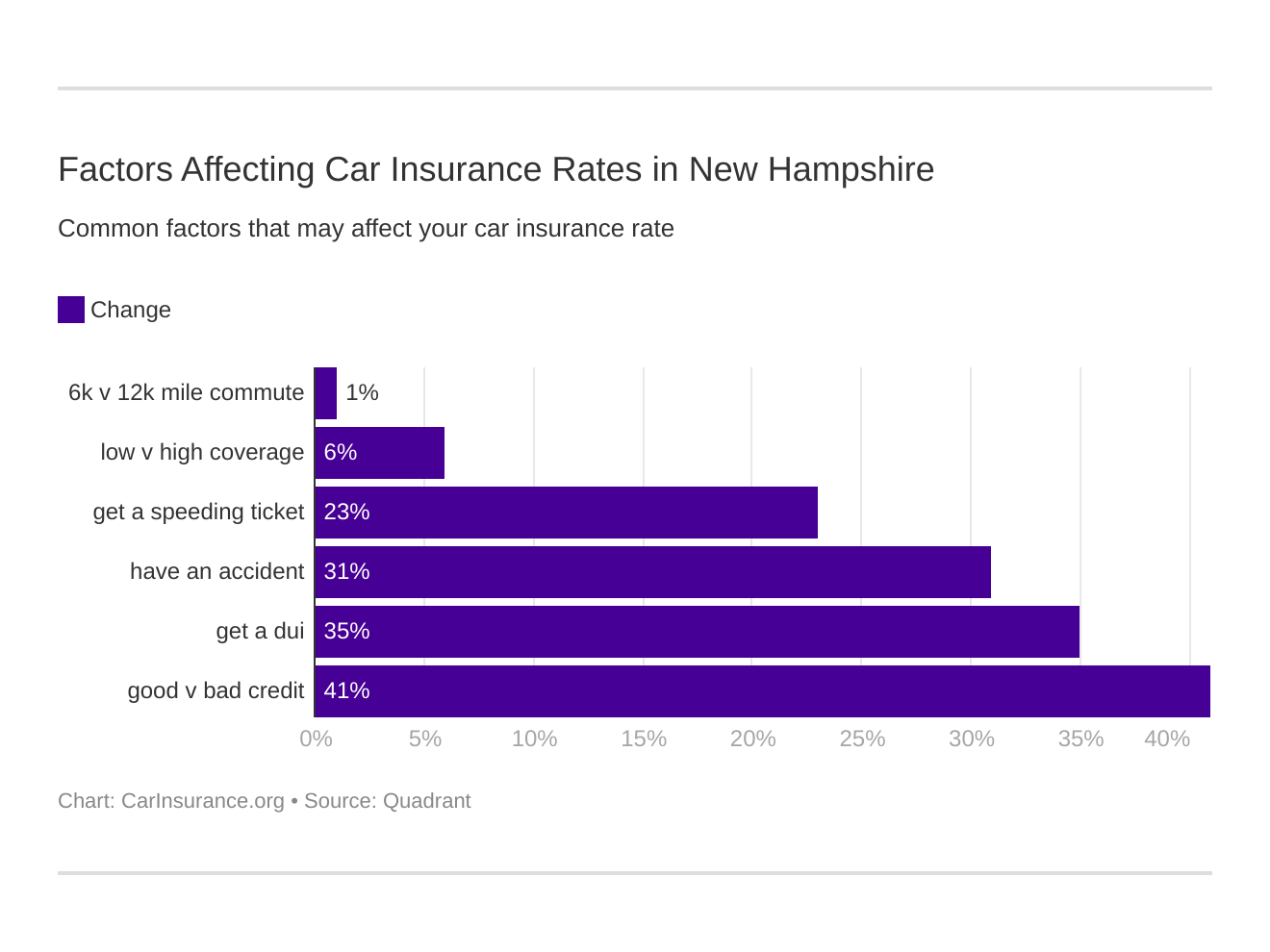

In the section below, we partnered with Quadrant Data to cover the biggest factors that go into setting car insurance rates in New Hampshire.

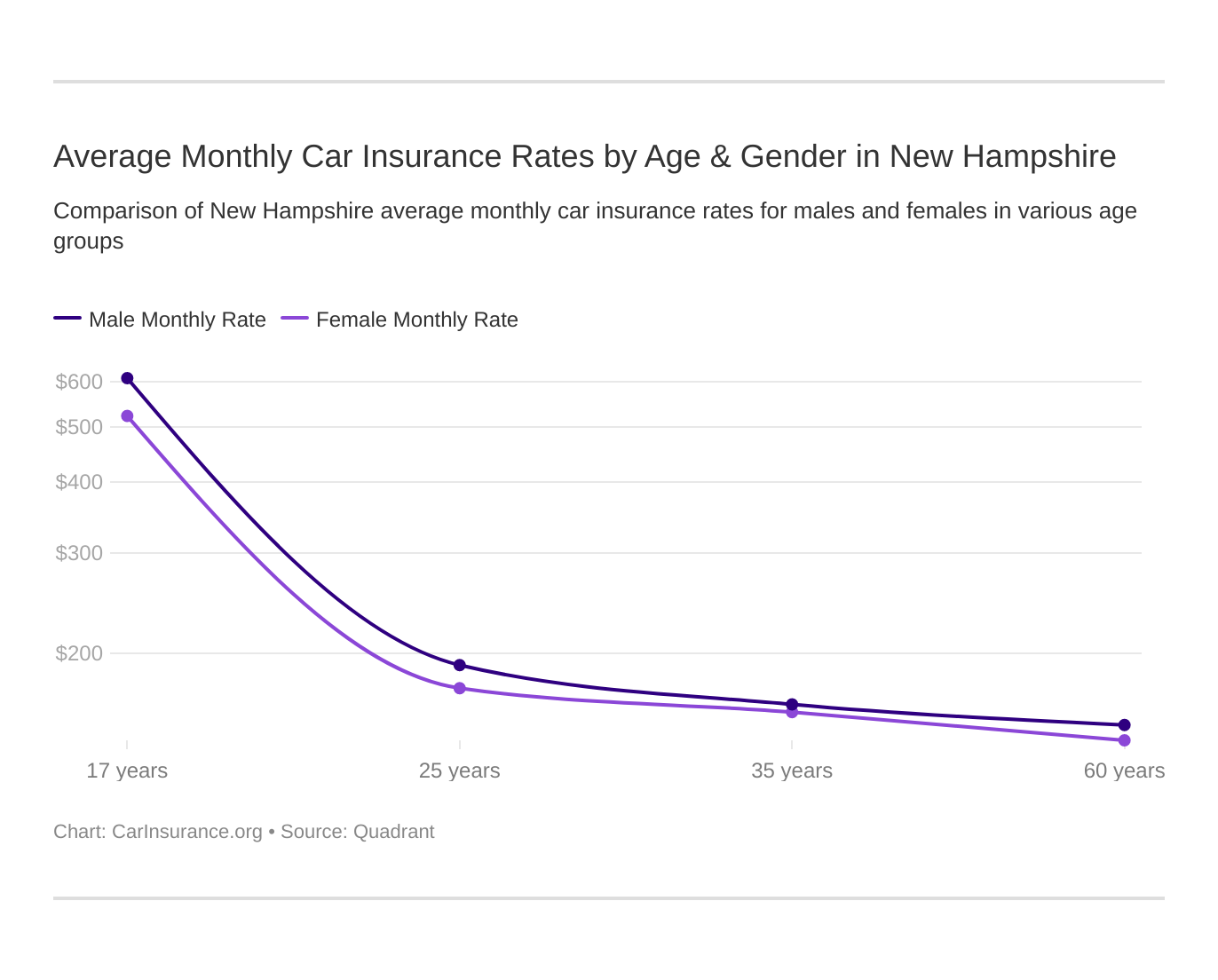

Average Monthly Car Insurance Rates by Age & Gender in NH

New Hampshire is among the states that still allow insurers to use age and gender to calculate insurance risks. Let’s see how the rates in the Granite State compare.

| Company | Married 35-year-old female annual average | Married 35-year-old male annual average | Married 60-year-old female annual average | Married 60-year-old male annual average | Single 17-year-old female annual average | Single 17-year-old male annual average | Single 25-year-old female annual average | Single 25-year-old male annual average |

|---|---|---|---|---|---|---|---|---|

| Allstate | $1,971.11 | $2,091.82 | $2,108.93 | $2,311.91 | $4,044.64 | $5,099.29 | $2,074.05 | $2,199.82 |

| Geico | $1,057.44 | $1,046.60 | $946.66 | $946.66 | $2,567.96 | $3,560.95 | $1,102.51 | $1,664.55 |

| Safeco | $4,942.38 | $5,338.33 | $4,025.54 | $4,521.69 | $18,139.34 | $20,118.55 | $5,209.68 | $5,519.33 |

| Nationwide | $1,585.61 | $1,608.07 | $1,429.82 | $1,499.99 | $4,405.75 | $5,590.99 | $1,823.61 | $1,956.81 |

| Progressive | $1,366.59 | $1,244.66 | $1,188.47 | $1,199.26 | $6,320.20 | $6,980.91 | $1,610.65 | $1,618.31 |

| State Farm | $1,352.09 | $1,352.09 | $1,231.58 | $1,231.58 | $4,066.25 | $5,031.12 | $1,508.29 | $1,721.50 |

| USAA | $992.31 | $973.40 | $926.28 | $927.55 | $4,269.45 | $4,673.07 | $1,246.20 | $1,361.16 |

As the table shows, some companies base their rates on gender, but it’s not as significant of a factor as a driver’s age. Generally speaking, younger, less experienced drivers will pay more for car insurance than older drivers.

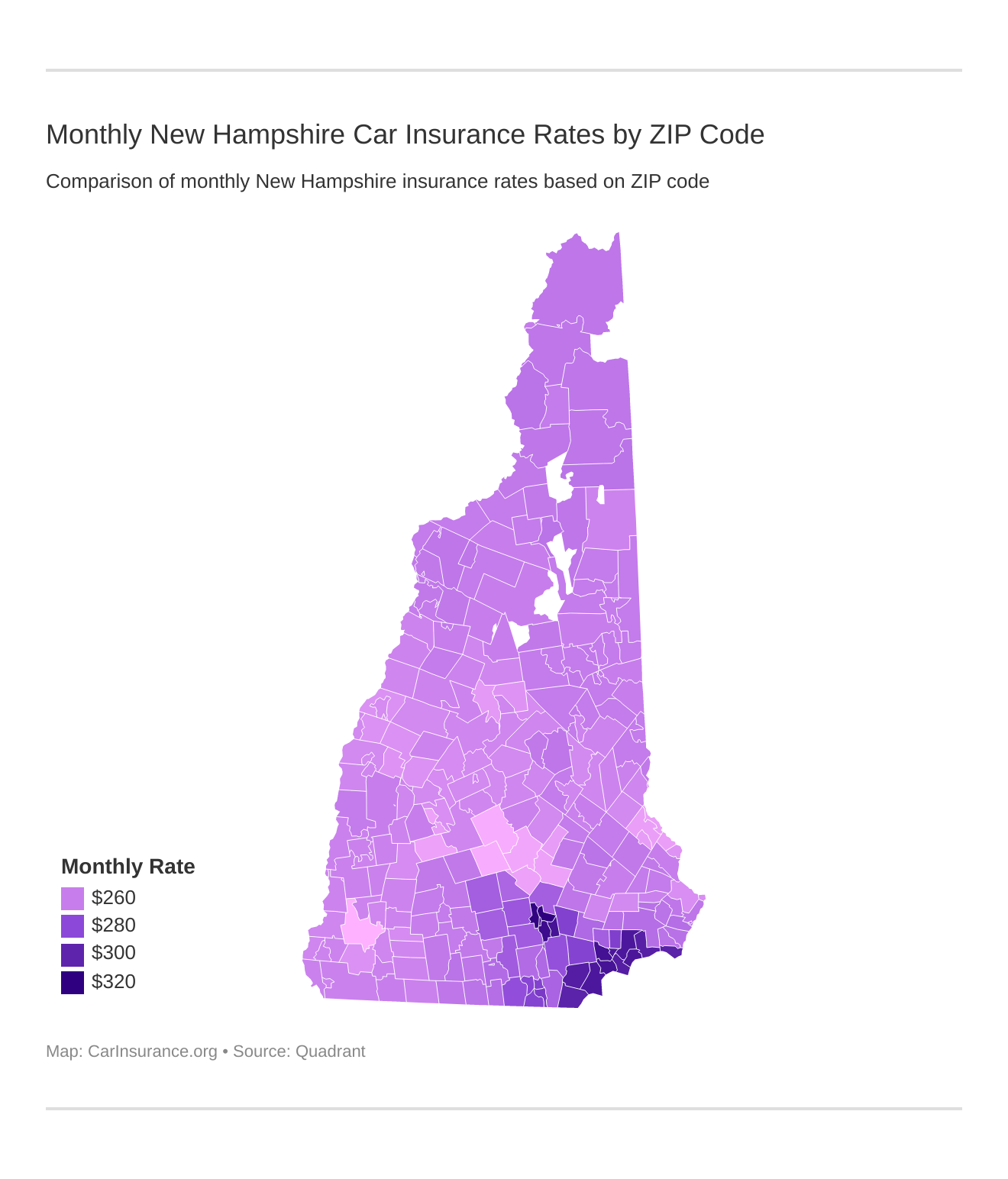

Rates in New Hampshire’s Ten Largest Cities

Let’s look at some of the most expensive and least expensive rates by population in the Granite State.

| Ten Most Expensive Cities | Ten Least Expensive Cities | ||||

|---|---|---|---|---|---|

| City | Zip Code | Average Rate | City | Zip Code | Average Rates |

| Manchester | 03104 | $3845.88 | South Sutton | 03273 | $2991.56 |

| Hampstead | 03060 | $3735.99 | Rochester | 03868 | $2980.81 |

| East Hampstead | 03826 | $3695.88 | Somersworth | 03878 | $2978.65 |

| Nashua | 03060 | $3451.59 | Stinson Lake | 03274 | $2977.73 |

| Dover | 03820 | $3124.15 | Bradford | 03221 | $2967.97 |

| Salem | 03079 | $3678.46 | Suncook | 03275 | $2962.53 |

| Merrimack | 03054 | $3201.58 | Bow | 03304 | $2960.07 |

| Exeter | 03833 | $3197.59 | Concord | 03303 | $2919.52 |

| Derry | 03038 | $3394.58 | Contoocook | 03229 | $2913.6 |

| Portsmouth | 03801 | $3046.47 | Keene | 03431 | $2887.77 |

For the most part, residents in cities and towns with higher populations, such as Manchester, pay more for their car insurance than in smaller ones like Keene. In this case, the difference is $1,000.

Cheapest Rates by Zip Code

As we showed above, and explore further below, where you live can influence your rates, too.

| ZIP Code | Average Annual Rate | Allstate | Geico | Safeco | Nationwide | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|---|

| 03104 | $3,845.88 | $3,137.78 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,949.61 | $2,265.12 |

| 03101 | $3,835.72 | $3,133.15 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,883.13 | $2,265.12 |

| 03102 | $3,825.66 | $3,002.18 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,994.46 | $2,265.12 |

| 03103 | $3,762.33 | $2,762.47 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,790.88 | $2,265.12 |

| 03841 | $3,735.99 | $3,212.02 | $1,731.34 | $9,804.60 | $2,827.31 | $3,434.34 | $2,863.76 | $2,278.55 |

| 03811 | $3,725.58 | $3,212.02 | $1,798.02 | $9,804.60 | $2,827.31 | $3,434.34 | $2,724.21 | $2,278.55 |

| 03109 | $3,720.88 | $2,787.74 | $1,747.47 | $10,234.44 | $3,322.91 | $3,081.80 | $2,606.71 | $2,265.12 |

| 03826 | $3,695.88 | $3,456.72 | $1,798.02 | $9,804.60 | $2,827.31 | $2,790.16 | $2,915.78 | $2,278.55 |

| 03858 | $3,694.35 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,747.63 | $2,278.55 |

| 03848 | $3,689.28 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,712.14 | $2,278.55 |

| 03079 | $3,678.46 | $3,132.62 | $1,762.82 | $9,646.10 | $3,153.58 | $3,289.60 | $2,363.39 | $2,401.14 |

| 03865 | $3,653.43 | $2,918.41 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,705.88 | $2,278.55 |

| 03087 | $3,648.72 | $3,132.62 | $1,747.47 | $9,646.10 | $3,153.58 | $2,946.89 | $2,513.28 | $2,401.14 |

| 03827 | $3,640.47 | $3,060.96 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,619.70 | $2,278.55 |

| 03076 | $3,611.18 | $3,103.08 | $1,747.47 | $9,646.10 | $2,528.63 | $3,289.60 | $2,562.23 | $2,401.14 |

| 03874 | $3,610.79 | $2,904.06 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,568.83 | $2,278.55 |

| 03859 | $3,512.48 | $3,163.14 | $1,798.02 | $9,804.60 | $2,421.57 | $2,790.16 | $2,689.18 | $1,920.69 |

| 03060 | $3,451.59 | $2,959.49 | $1,847.27 | $9,141.45 | $2,842.24 | $2,848.25 | $2,637.91 | $1,884.55 |

| 03819 | $3,424.28 | $2,918.41 | $1,650.93 | $9,804.60 | $2,421.57 | $2,790.16 | $2,463.63 | $1,920.69 |

| 03064 | $3,405.94 | $2,960.04 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,514.48 | $1,884.55 |

| 03032 | $3,404.93 | $3,132.62 | $1,747.47 | $8,513.56 | $3,153.58 | $2,923.20 | $2,403.01 | $1,961.04 |

| 03062 | $3,400.72 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,478.49 | $1,884.55 |

| 03038 | $3,394.58 | $2,863.36 | $1,886.80 | $8,483.24 | $3,153.58 | $2,749.60 | $2,664.42 | $1,961.04 |

| 03063 | $3,389.41 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,399.32 | $1,884.55 |

| 03049 | $3,331.53 | $2,936.83 | $1,689.50 | $9,141.45 | $2,469.60 | $2,785.35 | $2,336.95 | $1,961.04 |

| 03053 | $3,324.24 | $2,761.92 | $1,747.47 | $8,483.24 | $3,153.58 | $2,785.35 | $2,377.07 | $1,961.04 |

| 03073 | $3,314.36 | $3,132.62 | $1,762.82 | $8,382.59 | $2,421.57 | $3,289.60 | $2,290.65 | $1,920.69 |

| 03045 | $3,294.84 | $2,966.90 | $1,731.34 | $8,483.24 | $2,740.73 | $2,681.54 | $2,499.12 | $1,961.04 |

| 03031 | $3,277.35 | $2,959.49 | $1,689.50 | $8,483.24 | $2,740.73 | $2,785.35 | $2,322.10 | $1,961.04 |

| 03110 | $3,272.93 | $3,002.18 | $1,628.13 | $8,483.24 | $2,740.73 | $2,681.54 | $2,413.65 | $1,961.04 |

| 03873 | $3,269.18 | $3,212.02 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,500.32 | $1,920.69 |

| 03106 | $3,268.15 | $2,677.93 | $1,731.34 | $8,513.56 | $2,367.40 | $2,995.98 | $2,629.77 | $1,961.04 |

| 03070 | $3,263.40 | $2,886.16 | $1,731.34 | $8,476.40 | $2,740.73 | $2,736.25 | $2,352.22 | $1,920.69 |

| 03281 | $3,260.44 | $2,803.12 | $1,731.34 | $8,476.40 | $2,740.73 | $2,736.25 | $2,414.54 | $1,920.69 |

| 03051 | $3,242.99 | $2,732.39 | $1,747.47 | $8,483.24 | $2,528.63 | $2,785.35 | $2,462.81 | $1,961.04 |

| 03046 | $3,227.36 | $2,971.51 | $1,731.34 | $8,483.24 | $2,367.40 | $2,681.54 | $2,435.78 | $1,920.69 |

| 03052 | $3,214.50 | $2,761.92 | $1,747.47 | $8,483.24 | $2,528.63 | $2,785.35 | $2,233.82 | $1,961.04 |

| 03036 | $3,213.97 | $3,023.44 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,302.44 | $1,920.69 |

| 03054 | $3,201.58 | $2,690.79 | $1,628.13 | $8,483.24 | $2,740.73 | $2,785.35 | $2,121.76 | $1,961.04 |

| 03055 | $3,200.23 | $2,853.05 | $1,689.50 | $8,476.40 | $2,469.60 | $2,720.14 | $2,272.24 | $1,920.69 |

| 03833 | $3,197.59 | $2,897.03 | $1,650.93 | $8,433.03 | $2,583.08 | $2,834.52 | $2,196.82 | $1,787.68 |

| 03862 | $3,194.47 | $2,904.06 | $1,630.33 | $8,476.40 | $2,583.08 | $2,824.12 | $2,155.66 | $1,787.68 |

| 03033 | $3,187.78 | $2,853.05 | $1,689.50 | $8,382.59 | $2,469.60 | $2,720.14 | $2,278.87 | $1,920.69 |

| 03041 | $3,185.18 | $2,863.36 | $1,886.80 | $8,201.11 | $2,421.57 | $2,785.35 | $2,217.39 | $1,920.69 |

| 03856 | $3,180.82 | $2,904.06 | $1,650.93 | $8,288.13 | $2,583.08 | $3,007.19 | $2,044.64 | $1,787.68 |

| 03044 | $3,176.64 | $2,809.25 | $1,650.93 | $8,476.40 | $2,421.57 | $2,790.16 | $2,167.45 | $1,920.69 |

| 03842 | $3,174.72 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,174.70 | $1,787.68 |

| 03048 | $3,173.94 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,422.50 | $1,920.69 |

| 03885 | $3,173.12 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,163.51 | $1,787.68 |

| 03261 | $3,172.67 | $2,579.94 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,456.83 | $1,920.69 |

| 03570 | $3,170.23 | $2,776.57 | $1,619.58 | $8,382.59 | $2,398.41 | $2,878.16 | $2,199.02 | $1,937.28 |

| 03084 | $3,168.50 | $2,799.54 | $1,572.74 | $8,476.40 | $2,469.60 | $2,578.15 | $2,362.35 | $1,920.69 |

| 03590 | $3,164.31 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,310.72 | $1,918.91 |

| 03871 | $3,164.19 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,110.10 | $1,787.68 |

| 03844 | $3,163.02 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,092.76 | $1,787.68 |

| 03575 | $3,162.30 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,873.72 | $2,118.06 | $1,918.91 |

| 03586 | $3,161.98 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,871.51 | $2,118.06 | $1,918.91 |

| 03870 | $3,161.79 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,093.29 | $1,787.68 |

| 03034 | $3,161.67 | $2,653.66 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,306.11 | $1,920.69 |

| 03576 | $3,160.98 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,287.45 | $1,918.91 |

| 03071 | $3,160.05 | $2,792.98 | $1,572.74 | $8,382.59 | $2,469.60 | $2,578.15 | $2,403.60 | $1,920.69 |

| 03086 | $3,159.94 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,324.53 | $1,920.69 |

| 03579 | $3,159.78 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,279.04 | $1,918.91 |

| 03582 | $3,159.77 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,278.98 | $1,918.91 |

| 03593 | $3,156.04 | $2,776.57 | $1,619.58 | $8,382.59 | $2,398.41 | $2,878.16 | $2,118.06 | $1,918.91 |

| 03592 | $3,154.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,244.06 | $1,918.91 |

| 03840 | $3,153.42 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,034.67 | $1,787.68 |

| 03588 | $3,152.90 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,230.88 | $1,918.91 |

| 03249 | $3,151.96 | $2,516.00 | $1,677.77 | $8,697.05 | $2,497.26 | $2,597.59 | $2,157.41 | $1,920.69 |

| 03585 | $3,150.03 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,210.75 | $1,918.91 |

| 03584 | $3,149.75 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,208.83 | $1,918.91 |

| 03246 | $3,149.74 | $2,500.56 | $1,677.77 | $8,697.05 | $2,497.26 | $2,597.59 | $2,157.72 | $1,920.28 |

| 03740 | $3,149.45 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,206.70 | $1,918.91 |

| 03785 | $3,148.85 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,202.51 | $1,918.91 |

| 03244 | $3,147.66 | $2,803.12 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,288.50 | $1,920.69 |

| 03037 | $3,146.95 | $2,578.08 | $1,731.34 | $8,382.59 | $2,421.57 | $2,621.90 | $2,372.50 | $1,920.69 |

| 03468 | $3,146.12 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,287.82 | $1,920.69 |

| 03823 | $3,144.79 | $2,683.68 | $1,510.82 | $8,433.03 | $2,682.03 | $2,886.53 | $2,172.86 | $1,644.58 |

| 03082 | $3,144.30 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,215.03 | $1,920.69 |

| 03057 | $3,143.93 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,212.46 | $1,920.69 |

| 03215 | $3,143.86 | $2,732.30 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03238 | $3,143.86 | $2,732.30 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03234 | $3,143.33 | $2,550.40 | $1,731.34 | $8,476.40 | $2,469.60 | $2,578.15 | $2,276.70 | $1,920.69 |

| 03458 | $3,142.33 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,261.30 | $1,920.69 |

| 03852 | $3,140.95 | $2,789.42 | $1,667.83 | $8,476.40 | $2,421.57 | $2,642.42 | $2,068.33 | $1,920.69 |

| 03043 | $3,140.88 | $2,799.54 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,244.60 | $1,920.69 |

| 03242 | $3,139.93 | $2,809.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,228.19 | $1,920.69 |

| 03825 | $3,139.52 | $2,659.34 | $1,583.08 | $8,476.40 | $2,421.57 | $2,621.90 | $2,293.66 | $1,920.69 |

| 03583 | $3,138.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,132.10 | $1,918.91 |

| 03817 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03850 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03883 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03890 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03897 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03774 | $3,138.01 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,126.64 | $1,918.91 |

| 03561 | $3,137.67 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,124.23 | $1,918.91 |

| 03263 | $3,137.04 | $2,596.74 | $1,583.08 | $8,382.59 | $2,469.60 | $2,621.90 | $2,384.70 | $1,920.69 |

| 03589 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03597 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03765 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03771 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03780 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03832 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03838 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03847 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03580 | $3,136.50 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,116.04 | $1,918.91 |

| 03824 | $3,136.38 | $2,659.34 | $1,533.81 | $8,433.03 | $2,682.03 | $2,792.35 | $2,209.50 | $1,644.58 |

| 03884 | $3,136.05 | $2,604.28 | $1,583.08 | $8,382.59 | $2,421.57 | $2,621.90 | $2,418.21 | $1,920.69 |

| 03598 | $3,135.81 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,111.26 | $1,918.91 |

| 03845 | $3,133.95 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,098.20 | $1,918.91 |

| 03846 | $3,133.18 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,092.86 | $1,918.91 |

| 03237 | $3,132.54 | $2,596.74 | $1,677.77 | $8,476.40 | $2,357.73 | $2,578.15 | $2,320.34 | $1,920.69 |

| 03442 | $3,132.50 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,192.50 | $1,920.69 |

| 03813 | $3,132.06 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,084.96 | $1,918.91 |

| 03595 | $3,131.61 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,081.82 | $1,918.91 |

| 03440 | $3,131.41 | $2,799.54 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,178.28 | $1,920.69 |

| 03259 | $3,130.46 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03886 | $3,130.37 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,060.34 | $1,918.91 |

| 03812 | $3,130.25 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,072.29 | $1,918.91 |

| 03861 | $3,129.92 | $2,659.34 | $1,533.81 | $8,433.03 | $2,421.57 | $2,792.35 | $2,148.63 | $1,920.69 |

| 03816 | $3,129.85 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.66 | $1,918.91 |

| 03282 | $3,129.14 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,064.56 | $1,918.91 |

| 03875 | $3,129.12 | $2,776.95 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,063.99 | $1,918.91 |

| 03849 | $3,129.06 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,063.99 | $1,918.91 |

| 03860 | $3,127.97 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.33 | $1,918.91 |

| 03254 | $3,127.11 | $2,745.13 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,081.80 | $1,918.91 |

| 03830 | $3,127.00 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,036.71 | $1,918.91 |

| 03289 | $3,126.81 | $2,500.56 | $1,497.18 | $8,476.40 | $2,357.73 | $2,917.70 | $2,217.39 | $1,920.69 |

| 03047 | $3,126.80 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,152.63 | $1,920.69 |

| 03743 | $3,126.71 | $2,796.76 | $1,497.71 | $8,463.32 | $2,387.99 | $2,763.09 | $2,057.38 | $1,920.69 |

| 03864 | $3,126.70 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,034.60 | $1,918.91 |

| 03814 | $3,126.34 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,032.10 | $1,918.91 |

| 03872 | $3,126.15 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,030.78 | $1,918.91 |

| 03227 | $3,126.14 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,087.78 | $1,918.91 |

| 03882 | $3,125.99 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,029.63 | $1,918.91 |

| 03773 | $3,125.79 | $2,796.76 | $1,497.71 | $8,463.32 | $2,387.99 | $2,893.76 | $1,972.39 | $1,868.58 |

| 03836 | $3,125.50 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,026.25 | $1,918.91 |

| 03574 | $3,125.16 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,080.98 | $1,918.91 |

| 03279 | $3,124.58 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,076.87 | $1,918.91 |

| 03818 | $3,124.54 | $2,738.86 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,070.03 | $1,918.91 |

| 03820 | $3,124.15 | $2,649.28 | $1,533.81 | $8,433.03 | $2,682.03 | $2,792.35 | $2,134.00 | $1,644.58 |

| 03290 | $3,124.15 | $2,657.49 | $1,583.08 | $8,476.40 | $2,421.57 | $2,621.90 | $2,187.95 | $1,920.69 |

| 03262 | $3,123.89 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,072.05 | $1,918.91 |

| 03255 | $3,120.94 | $2,799.15 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,105.44 | $1,920.69 |

| 03449 | $3,120.67 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,109.67 | $1,920.69 |

| 03447 | $3,118.97 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,097.66 | $1,920.69 |

| 03285 | $3,118.72 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,035.90 | $1,918.91 |

| 03251 | $3,118.08 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,031.37 | $1,918.91 |

| 03225 | $3,117.31 | $2,579.94 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,411.05 | $1,920.69 |

| 03470 | $3,113.18 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,057.16 | $1,920.69 |

| 03857 | $3,112.71 | $2,659.34 | $1,533.81 | $8,433.03 | $2,583.08 | $2,792.35 | $1,999.69 | $1,787.68 |

| 03749 | $3,112.22 | $2,458.89 | $1,497.18 | $8,476.40 | $2,398.41 | $2,917.70 | $2,118.06 | $1,918.91 |

| 03887 | $3,111.28 | $2,540.34 | $1,667.83 | $8,476.40 | $2,421.57 | $2,642.42 | $2,109.74 | $1,920.69 |

| 03603 | $3,109.13 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,106.76 | $1,920.69 |

| 03602 | $3,108.89 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,102.66 | $1,920.69 |

| 03601 | $3,108.67 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,103.54 | $1,920.69 |

| 03451 | $3,108.29 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,022.88 | $1,920.69 |

| 03465 | $3,107.78 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,019.35 | $1,920.69 |

| 03461 | $3,107.24 | $2,792.98 | $1,572.74 | $8,382.59 | $2,387.99 | $2,578.15 | $2,115.56 | $1,920.69 |

| 03224 | $3,106.71 | $2,500.56 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,304.41 | $1,920.69 |

| 03456 | $3,105.83 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,081.28 | $1,920.69 |

| 03040 | $3,103.42 | $2,653.66 | $1,731.34 | $8,201.11 | $2,421.57 | $2,578.15 | $2,217.39 | $1,920.69 |

| 03218 | $3,103.25 | $2,545.54 | $1,583.08 | $8,476.40 | $2,357.73 | $2,621.90 | $2,217.39 | $1,920.69 |

| 03896 | $3,103.04 | $2,540.34 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03815 | $3,102.44 | $2,569.88 | $1,583.08 | $8,382.59 | $2,421.57 | $2,621.90 | $2,217.39 | $1,920.69 |

| 03605 | $3,102.34 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,059.25 | $1,920.69 |

| 03441 | $3,101.79 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03452 | $3,101.63 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,976.30 | $1,920.69 |

| 03609 | $3,101.57 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,053.80 | $1,920.69 |

| 03231 | $3,100.58 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03233 | $3,099.14 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03581 | $3,098.48 | $2,776.57 | $1,619.58 | $7,932.06 | $2,398.41 | $2,878.16 | $2,147.33 | $1,937.28 |

| 03462 | $3,098.02 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,951.03 | $1,920.69 |

| 03464 | $3,097.91 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,025.79 | $1,920.69 |

| 03769 | $3,097.73 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03779 | $3,097.73 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03855 | $3,097.12 | $2,540.34 | $1,497.18 | $8,476.40 | $2,421.57 | $2,578.15 | $2,245.51 | $1,920.69 |

| 03608 | $3,094.82 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,006.57 | $1,920.69 |

| 03777 | $3,094.76 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,097.27 | $1,918.91 |

| 03240 | $3,094.36 | $2,461.29 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,042.55 | $1,918.91 |

| 03894 | $3,094.29 | $2,540.34 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.80 | $1,918.91 |

| 03752 | $3,092.66 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,991.46 | $1,920.69 |

| 03266 | $3,091.88 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,077.16 | $1,918.91 |

| 03241 | $3,091.74 | $2,461.29 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03443 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03457 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03604 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03607 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03751 | $3,090.66 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03853 | $3,090.41 | $2,496.07 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,073.93 | $1,918.91 |

| 03448 | $3,090.10 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,971.16 | $1,920.69 |

| 03217 | $3,089.85 | $2,467.84 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,098.25 | $1,918.91 |

| 03220 | $3,089.09 | $2,500.56 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,153.42 | $1,920.69 |

| 03745 | $3,089.09 | $2,796.76 | $1,497.18 | $8,463.32 | $2,387.99 | $2,578.15 | $1,979.53 | $1,920.69 |

| 03746 | $3,088.79 | $2,796.76 | $1,497.18 | $8,463.32 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03768 | $3,087.85 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,048.92 | $1,918.91 |

| 03222 | $3,087.63 | $2,467.84 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,082.71 | $1,918.91 |

| 03467 | $3,087.03 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,952.01 | $1,920.69 |

| 03223 | $3,086.71 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,444.07 | $2,062.84 | $1,918.91 |

| 03455 | $3,085.99 | $2,792.98 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,948.52 | $1,920.69 |

| 03445 | $3,085.58 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,939.47 | $1,920.69 |

| 03256 | $3,085.51 | $2,461.67 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,167.23 | $1,920.69 |

| 03837 | $3,085.25 | $2,516.00 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,250.59 | $1,920.69 |

| 03809 | $3,084.47 | $2,516.00 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,245.12 | $1,920.69 |

| 03782 | $3,084.02 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,931.00 | $1,920.69 |

| 03077 | $3,083.74 | $2,657.49 | $1,583.08 | $8,201.11 | $2,421.57 | $2,602.73 | $2,199.49 | $1,920.69 |

| 03276 | $3,083.36 | $2,498.70 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,142.81 | $1,920.69 |

| 03253 | $3,082.56 | $2,471.73 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,136.54 | $1,920.69 |

| 03466 | $3,082.21 | $2,799.15 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $2,009.74 | $1,920.69 |

| 03278 | $3,081.47 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,156.84 | $1,920.69 |

| 03851 | $3,081.10 | $2,540.34 | $1,497.18 | $8,476.40 | $2,421.57 | $2,578.15 | $2,133.37 | $1,920.69 |

| 03444 | $3,081.03 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,907.65 | $1,920.69 |

| 03268 | $3,079.41 | $2,476.03 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,137.85 | $1,920.69 |

| 03754 | $3,077.33 | $2,796.76 | $1,497.71 | $8,382.59 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03770 | $3,077.25 | $2,796.76 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03042 | $3,074.73 | $2,652.33 | $1,583.08 | $8,201.11 | $2,421.57 | $2,602.73 | $2,141.64 | $1,920.69 |

| 03269 | $3,073.67 | $2,461.67 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,084.32 | $1,920.69 |

| 03835 | $3,072.68 | $2,569.88 | $1,667.83 | $7,743.08 | $2,682.03 | $2,873.72 | $2,327.62 | $1,644.58 |

| 03741 | $3,071.72 | $2,461.29 | $1,667.83 | $8,382.59 | $2,398.41 | $2,642.42 | $2,030.57 | $1,918.91 |

| 03781 | $3,070.81 | $2,796.76 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,932.30 | $1,920.69 |

| 03243 | $3,070.38 | $2,461.67 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,088.96 | $1,920.69 |

| 03307 | $3,070.22 | $2,544.83 | $1,497.18 | $8,476.40 | $2,469.60 | $2,210.05 | $2,372.83 | $1,920.69 |

| 03216 | $3,070.06 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,076.98 | $1,920.69 |

| 03235 | $3,068.97 | $2,504.87 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,035.91 | $1,920.69 |

| 03784 | $3,068.10 | $2,458.89 | $1,497.18 | $8,382.59 | $2,398.41 | $2,917.70 | $1,903.04 | $1,918.91 |

| 03257 | $3,066.31 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,060.85 | $1,920.69 |

| 03810 | $3,066.17 | $2,516.00 | $1,497.18 | $8,382.59 | $2,357.73 | $2,578.15 | $2,210.87 | $1,920.69 |

| 03750 | $3,065.88 | $2,458.89 | $1,497.18 | $8,382.59 | $2,387.99 | $2,917.70 | $1,897.91 | $1,918.91 |

| 03450 | $3,064.85 | $2,799.15 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,888.17 | $1,920.69 |

| 03252 | $3,064.63 | $2,498.70 | $1,497.18 | $8,382.59 | $2,357.73 | $2,578.15 | $2,217.39 | $1,920.69 |

| 03230 | $3,063.98 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,044.53 | $1,920.69 |

| 03287 | $3,063.82 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,043.45 | $1,920.69 |

| 03226 | $3,057.79 | $2,461.67 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,112.73 | $1,920.69 |

| 03280 | $3,055.34 | $2,503.17 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,023.80 | $1,920.69 |

| 03260 | $3,052.95 | $2,471.42 | $1,497.18 | $8,382.59 | $2,469.60 | $2,578.15 | $2,051.05 | $1,920.69 |

| 03854 | $3,049.39 | $2,894.93 | $1,535.71 | $7,669.32 | $2,556.64 | $2,728.12 | $2,159.45 | $1,801.58 |

| 03801 | $3,046.47 | $2,894.93 | $1,535.71 | $7,669.32 | $2,556.64 | $2,728.12 | $2,138.99 | $1,801.58 |

| 03748 | $3,039.66 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,958.34 | $1,920.69 |

| 03272 | $3,038.38 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03446 | $3,037.08 | $2,799.15 | $1,533.97 | $8,476.40 | $2,340.52 | $2,587.81 | $1,909.36 | $1,612.39 |

| 03284 | $3,033.79 | $2,503.17 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,872.95 | $1,920.69 |

| 03755 | $3,032.36 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,907.21 | $1,920.69 |

| 03766 | $3,030.03 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,890.89 | $1,920.69 |

| 03245 | $3,029.02 | $2,467.84 | $1,667.83 | $7,986.70 | $2,398.41 | $2,695.12 | $2,068.34 | $1,918.91 |

| 03869 | $3,028.86 | $2,649.28 | $1,533.81 | $7,743.08 | $2,682.03 | $2,836.64 | $2,112.63 | $1,644.58 |

| 03753 | $3,023.42 | $2,503.17 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,894.16 | $1,920.69 |

| 03291 | $3,013.06 | $2,657.49 | $1,583.08 | $7,669.32 | $2,421.57 | $2,621.90 | $2,217.39 | $1,920.69 |

| 03264 | $2,994.72 | $2,461.29 | $1,667.83 | $7,986.70 | $2,398.41 | $2,444.07 | $2,085.85 | $1,918.91 |

| 03258 | $2,993.83 | $2,631.15 | $1,731.34 | $7,713.25 | $2,469.60 | $2,210.05 | $2,280.73 | $1,920.69 |

| 03273 | $2,991.56 | $2,471.42 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03839 | $2,986.51 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,215.18 | $1,644.58 |

| 03867 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 03868 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 03878 | $2,978.65 | $2,649.28 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,080.76 | $1,644.58 |

| 03274 | $2,977.73 | $2,503.17 | $1,497.18 | $7,713.25 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03221 | $2,967.97 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,210.05 | $2,165.89 | $1,920.69 |

| 03275 | $2,962.53 | $2,658.84 | $1,626.68 | $7,713.25 | $2,367.40 | $2,396.82 | $2,265.95 | $1,708.76 |

| 03304 | $2,960.07 | $2,572.77 | $1,731.34 | $7,713.25 | $2,367.40 | $2,324.36 | $2,302.61 | $1,708.76 |

| 03301 | $2,935.65 | $2,577.37 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,231.73 | $1,708.76 |

| 03303 | $2,919.52 | $2,469.86 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,226.33 | $1,708.76 |

| 03229 | $2,913.60 | $2,509.52 | $1,497.18 | $7,713.25 | $2,367.40 | $2,324.36 | $2,274.75 | $1,708.76 |

| 03435 | $2,901.99 | $2,799.15 | $1,533.97 | $7,369.92 | $2,340.52 | $2,722.03 | $1,935.95 | $1,612.39 |

| 03431 | $2,887.77 | $2,799.15 | $1,533.97 | $7,369.92 | $2,340.52 | $2,633.58 | $1,924.88 | $1,612.39 |

In some cases, depending on the location, the average rates among different carriers can vary by as much as about $2,000. How does your city or town compare?

Cheapest Rates by City

Now we present the same data — this time by city or town name.

| Least Expensive | Premiums | Most Expensive | Premiums |

|---|---|---|---|

| KEENE | $2,894.88 | MANCHESTER | $3,798.09 |

| CONTOOCOOK | $2,913.60 | HAMPSTEAD | $3,735.99 |

| CONCORD | $2,927.59 | ATKINSON | $3,725.58 |

| BOW | $2,960.07 | EAST HAMPSTEAD | $3,695.88 |

| SUNCOOK | $2,962.53 | NEWTON | $3,694.35 |

| BRADFORD | $2,967.97 | KINGSTON | $3,689.28 |

| STINSON LAKE | $2,977.73 | SALEM | $3,678.46 |

| SOMERSWORTH | $2,978.65 | PLAISTOW | $3,653.43 |

| ROCHESTER | $2,982.71 | WINDHAM | $3,648.72 |

| SOUTH SUTTON | $2,991.56 | EAST KINGSTON | $3,640.47 |

| CHICHESTER | $2,993.83 | PELHAM | $3,611.18 |

| PLYMOUTH | $2,994.72 | SEABROOK | $3,610.79 |

| WEST NOTTINGHAM | $3,013.06 | NEWTON JUNCTION | $3,512.48 |

| GRANTHAM | $3,023.42 | DANVILLE | $3,424.29 |

| ROLLINSFORD | $3,028.86 | NASHUA | $3,411.92 |

| HOLDERNESS | $3,029.02 | AUBURN | $3,404.93 |

| LEBANON | $3,030.03 | DERRY | $3,394.58 |

| HANOVER | $3,032.36 | HOLLIS | $3,331.53 |

| SPRINGFIELD | $3,033.79 | LONDONDERRY | $3,324.24 |

| SWANZEY | $3,037.08 | NORTH SALEM | $3,314.36 |

| SOUTH NEWBURY | $3,038.38 | GOFFSTOWN | $3,294.84 |

| ENFIELD | $3,039.66 | AMHERST | $3,277.35 |

| PORTSMOUTH | $3,046.47 | BEDFORD | $3,272.93 |

| NEW CASTLE | $3,049.39 | SANDOWN | $3,269.18 |

| NORTH SUTTON | $3,052.95 | HOOKSETT | $3,268.15 |

| WASHINGTON | $3,055.34 | NEW BOSTON | $3,263.40 |

| CENTER HARBOR | $3,057.79 | WEARE | $3,260.44 |

| WILMOT | $3,063.82 | HUDSON | $3,242.99 |

| DANBURY | $3,063.98 | DUNBARTON | $3,227.36 |

| LOCHMERE | $3,064.63 | LITCHFIELD | $3,214.50 |

| HARRISVILLE | $3,064.85 | CHESTER | $3,213.97 |

| ETNA | $3,065.88 | MERRIMACK | $3,201.58 |

| ALTON BAY | $3,066.17 | MILFORD | $3,200.23 |

| NEW LONDON | $3,066.31 | EXETER | $3,197.58 |

| WEST LEBANON | $3,068.10 | NORTH HAMPTON | $3,194.47 |

| FRANKLIN | $3,068.97 | BROOKLINE | $3,187.78 |

| ANDOVER | $3,070.06 | EAST DERRY | $3,185.18 |

| LOUDON | $3,070.22 | NEWFIELDS | $3,180.82 |

| HILL | $3,070.38 | FREMONT | $3,176.64 |

| PLAINFIELD | $3,070.81 | HAMPTON | $3,174.72 |

| CANAAN | $3,071.72 | GREENVILLE | $3,173.94 |

| FARMINGTON | $3,072.68 | STRATHAM | $3,173.12 |

| SANBORNTON | $3,073.67 | NORTHWOOD | $3,172.67 |

| EPPING | $3,074.74 | BERLIN | $3,170.23 |

| MERIDEN | $3,077.25 | TEMPLE | $3,168.50 |

| GUILD | $3,077.33 | NORTH STRATFORD | $3,164.31 |

| SALISBURY | $3,079.41 | RYE BEACH | $3,164.19 |

| DUBLIN | $3,081.03 | HAMPTON FALLS | $3,163.02 |

| MILTON | $3,081.10 | BRETTON WOODS | $3,162.30 |

| WARNER | $3,081.47 | SUGAR HILL | $3,161.99 |

As above, the more citizens, the more New Hampshire residents tend to pay for premiums in certain cities and towns.

Best New Hampshire Car Insurance Companies

Now that you’ve learned more about your coverage options and the major factors in setting rates, you may wonder which companies are the best. It can be tough to separate the wheat from the chaff.

You want excellent service and a fair amount of coverage at a decent price. Below, we’ll explore how some big-name reviewers rank the top insurers, and we’ll also consider how many complaints they receive.

Sound interesting? Read on to learn more.

The Largest Companies’ Financial Rating

A.M. Best‘s ratings act as a “scorecard” to measure the financial strength of insurance companies.

| Company | AM Best Rating |

|---|---|

| Geico | A++ |

| State Farm | A++ |

| Progressive | A+ |

| Liberty Mutual | A |

| Allstate | A+ |

| USAA | A++ |

| Amica | A+ |

| Auto-Owners | A++ |

| Metropolitan | A |

| Travelers | A++ |

The largest companies, such as State Farm and USAA, receive the highest ranking of “A++” for their financial stability and solid growth.

Companies with Best Ratings

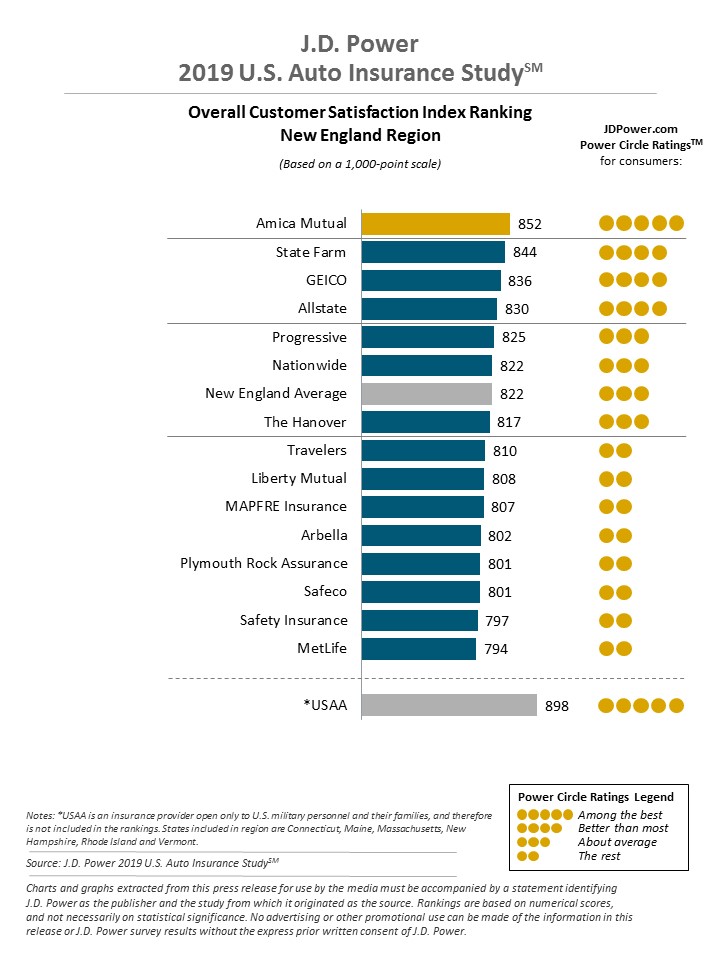

Here we’ll look at the results of J.D. Power’s U.S. Auto Insurance Study, which measures customer satisfaction among the top insurers.

Amica Mutual was the only company in the New England region to receive five of J.D. Power’s “power circle” ratings. That means that they consider it “among the best.” State Farm, ranked second, scored “better than most.”

Companies with the Most Complaints in New Hampshire

The NAIC tracks all complaints consumers make against insurance companies.

Below is data showing the complaint ratios for the largest New Hampshire insurers. Lower numbers are better than higher ones.

| Company | Complaint Ratio | Total Complaints |

|---|---|---|

| Geico | 0.68 | 333 |

| State Farm Group | 0.44 | 1482 |

| Progressive Group | 0.75 | 120 |

| Liberty Mutual Group | 5.95 | 222 |

| Allstate Insurance Group | 0.5 | 163 |

| USAA Group | 0.74 | 296 |

| Amica Mutual Group | 0.46 | 52 |

| Auto-Owners Group | 0.53 | 31 |

| Metropolitan Group | 1.3 | 70 |

| Travelers Group | 0.09 | 2 |

State Farm received the most complaints, but USAA had the highest complaint ratio.

The complaint ratio reveals how many complaints a company receives per $1 million of premiums written.

If you want to file a complaint against an auto insurer in the Granite State, use this online form.

Commute Rates by Company

Let’s see how the distance you commute regularly affects your car insurance rates in New Hampshire.

| Company | 10-mile-per-day commute (6000 miles annually) | 20-mile-per-day commute (1200 miles annually) |

|---|---|---|

| Liberty Mutual | $8,477 | $8,477 |

| Allstate | $2,700 | $2,775 |

| Progressive | $2,691 | $2,691 |

| Nationwide | $2,488 | $2,488 |

| State Farm | $2,137 | $2,236 |

| USAA | $1,902 | $1,940 |

| Geico | $1,598 | $1,625 |

Allstate, State Farm, and USAA are among the companies that still factor commute distances into their rates. For all of these insurers, the price differences between 10 and 25-mile commutes amounted to less than $50.

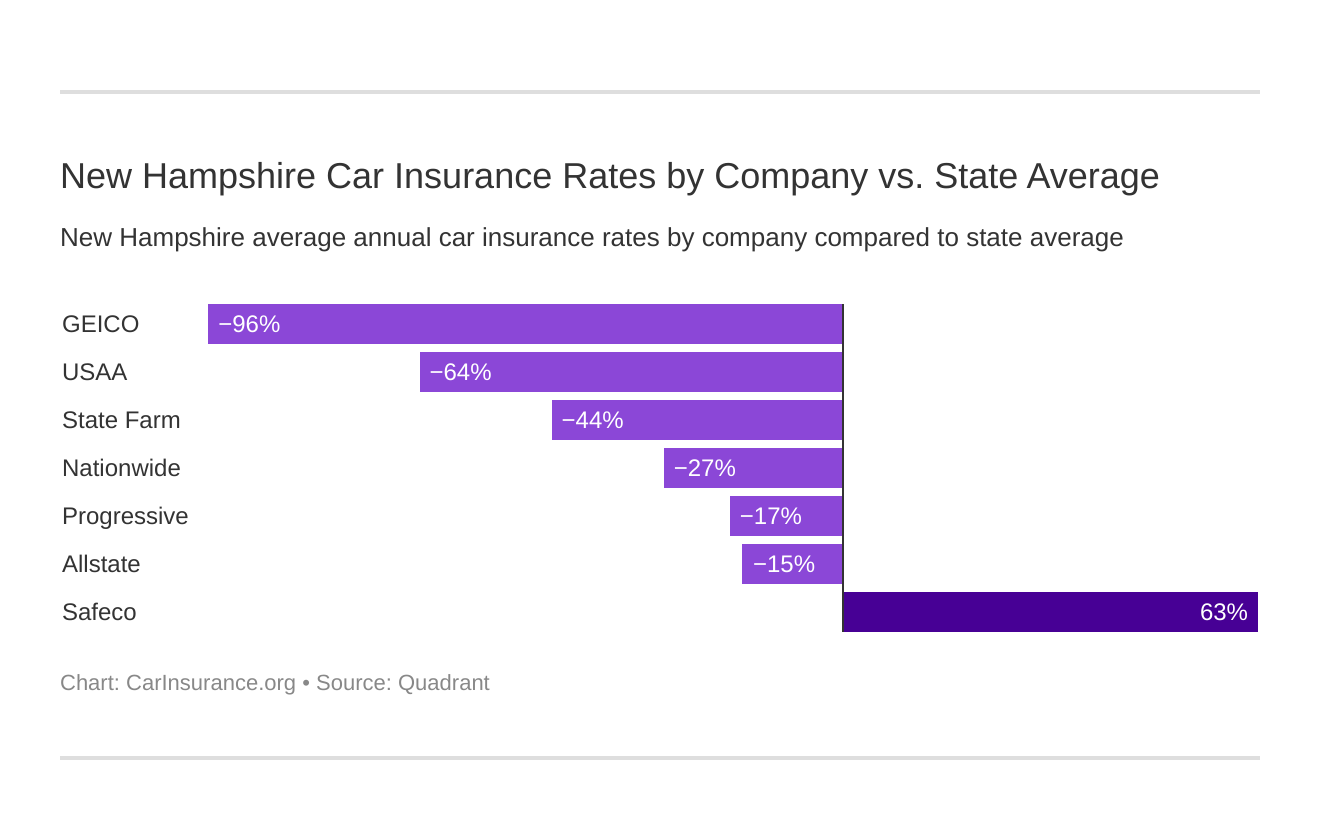

Cheapest Companies in New Hampshire

Here we show how the top insurance carriers’ premium costs compare to the state average.

| Company | Average Annual Rate | Compared to State Average | |

|---|---|---|---|

| Allstate F&C | $2,737.70 | -$421.29 | -15.39% |

| Geico General | $1,611.67 | -$1,547.32 | -96.01% |

| Safeco Ins Co of America | $8,476.85 | $5,317.87 | 62.73% |

| Nationwide Mutual | $2,487.58 | -$671.41 | -26.99% |

| Progressive Universal | $2,691.13 | -$467.86 | -17.39% |

| State Farm Mutual Auto | $2,186.81 | -$972.18 | -44.46% |

| USAA | $1,921.18 | -$1,237.81 | -64.43% |

Geico and USAA were among the insurances offering the cheapest rates, at more than 60 percent less than the state average premiums.

Coverage Level Rates by Company

To help you determine rates for different coverage by the carrier, below are their rates.

| Company | Coverage Level | Annual Average |

|---|---|---|

| Liberty Mutual | High | $8,836.00 |

| Liberty Mutual | Medium | $8,450.00 |

| Liberty Mutual | Low | $8,144.00 |

| Allstate | High | $2,817.35 |

| Allstate | Medium | $2,734.45 |

| Allstate | Low | $2,661.29 |

| Progressive | High | $2,797.82 |

| Progressive | Medium | $2,691.20 |

| Progressive | Low | $2,584.38 |

| Nationwide | High | $2,356.75 |

| Nationwide | Medium | $2,453.07 |

| Nationwide | Low | $2,652.92 |

| State Farm | High | $2,282.92 |

| State Farm | Medium | $2,189.03 |

| State Farm | Low | $2,088.49 |

| USAA | High | $1,997.66 |

| USAA | Medium | $1,917.96 |

| USAA | Low | $1,847.91 |

| Geico | High | $1,695.58 |

| Geico | Medium | $1,602.39 |

| Geico | Low | $1,537.03 |

In most cases, the cost difference between the lowest and the highest coverage amounts to only a few hundred dollars. If you can afford it, it may be worth buying more than the lowest coverage available for greater protection.

Credit History Rates by Company

Your credit score is another factor that can affect your car insurance rates.

| Company | Credit Rating | Annual Premium |

|---|---|---|

| Allstate | Poor | $3,368.00 |

| Allstate | Fair | $2,492.26 |

| Allstate | Good | $2,352.43 |

| Geico | Poor | $1,907.34 |

| Geico | Fair | $1,564.33 |

| Geico | Good | $1,363.32 |

| Liberty Mutual | Poor | $12,169.00 |

| Liberty Mutual | Fair | $7,441.00 |

| Liberty Mutual | Good | $5,821.00 |

| Nationwide | Poor | $2,896.14 |

| Nationwide | Fair | $2,374.92 |

| Nationwide | Good | $2,191.67 |

| Progressive | Poor | $2,986.88 |

| Progressive | Fair | $2,624.47 |

| Progressive | Good | $2,462.05 |

| State Farm | Poor | $3,096.59 |

| State Farm | Fair | $1,927.69 |

| State Farm | Good | $1,536.16 |

| USAA | Poor | $2,606.19 |

| USAA | Fair | $1,714.14 |

| USAA | Good | $1,443.21 |

As with USAA, the cost difference of insurance premiums for drivers with poor versus good credit can amount to over $1,000.

The average New Hampshire’s credit score is 701, which is higher than the national average of 675. Only Vermont had a higher average, at 702.

Driving Record Rates by Company

Another major factor in premium rates is your driving record. Let’s see how various penalties can affect them.

| Company | Annual Rate Clean Record | Annual Rate One Speeding Violation | Annual Rate One Accident | Annual Rate One DUI |

|---|---|---|---|---|

| Allstate | $2,276.40 | $2,655.21 | $3,095.98 | $2,923.20 |

| Geico | $1,437.50 | $1,437.50 | $1,590.83 | $1,980.83 |

| Liberty Mutual | $5,324.37 | $9,084.16 | $9,624.42 | $9,874.47 |

| Nationwide | $1,914.01 | $2,129.05 | $2,657.49 | $3,249.78 |

| Progressive | $2,312.48 | $2,711.71 | $3,190.12 | $2,550.23 |

| State Farm | $2,013.89 | $2,013.89 | $2,157.23 | $2,562.23 |

| USAA | $1,483.03 | $1,724.12 | $1,996.60 | $2,480.96 |

Interestingly, some insurers, like State Farm, don’t increase their rates for one speeding ticket. Others, such as Allstate, raise them by as much as $400.00.

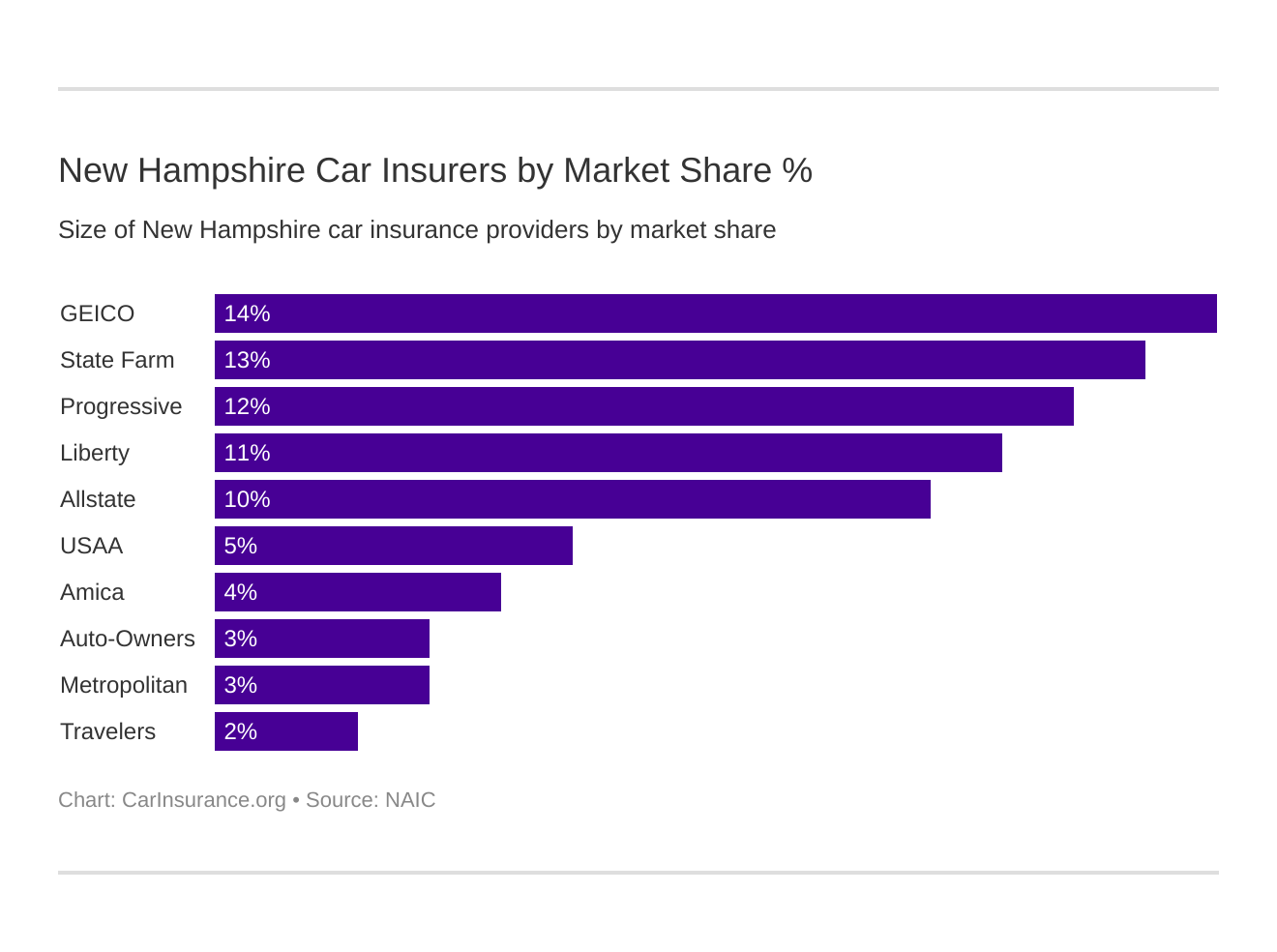

Largest Car Insurance Companies in New Hampshire

These companies have the greatest market share in the Granite State.

| Company | Direct Premium Written | Loss Ratio | Market Share |

|---|---|---|---|

| Geico | $114,977 | 72.49% | 13.59% |

| State Farm Group | $106,434 | 52.06% | 12.58% |

| Progressive Group | $103,823 | 61.53% | 12.28% |

| Liberty Mutual Group | $97,114 | 58.48% | 11.48% |

| Allstate Insurance Group | $84,945 | 54.95% | 10.04% |

| USAA Group | $44,555 | 72.58% | 5.27% |

| Amica Mutual Group | $29,976 | 65.49% | 3.54% |

| Auto-Owners Group | $27,987 | 60.58% | 3.31% |

| Metropolitan Group | $25,318 | 54.20% | 2.99% |

| Travelers Group | $20,099 | 59.55% | 2.38% |

Not surprisingly, big players like State Farm and Progressive top the list.

Number of Insurers by State

Like other states, several different insurance carriers operate in New Hampshire.

Domestic companies were formed in the Granite State, and “foreign” companies were founded out-of-state.

According to NAIC, almost seven hundred domestic (50) and foreign insurers (647) offer car insurance coverage in the Granite State.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Hampshire Laws

With the many laws on the books, it can be hard to keep track of them. You want to may sure you obey them and don’t rack up penalties. Below, we’ll cover the different car insurance laws in New Hampshire and the requirements to comply with them.

For a “crash course,” keep reading.

Car Insurance Laws

Insurance laws are a major determiner of how each state sets its car insurance rates.

Here, we’ll go over laws that decide car insurance rates, together with windshield coverage, high-risk, and auto insurance fraud regulations.

So, get ready to find out more.

How New Hampshire Car Insurance Rates Are Determined

Each state determines the type of tort law and threshold (if any) that applies, the type and amount of liability insurance required, and their system for approving insurer rates and coverage forms.

Insurance companies in New Hampshire are subject to the rules of the state insurance commissioner. Ultimately, all rates and regulations must meet the fair competition standards the National Association of Insurance Commissioners (NAIC) sets.

At times of market competition, New Hampshire car insurers must file rates with the state insurance department, but they don’t need to be approved. In a non-competitive market, companies need to submit their rates and get the state insurance department’s approval.

Windshield Coverage

No specific laws govern windshield repair in New Hampshire. If a repair shop disclosed to you in writing on an estimate that you can use aftermarket parts, you may do so if they’re of “like kind and quality.” You can use the original manufacturer’s parts if the vehicle is less than two years old and has fewer than 30,000 miles.

You may also choose your own repair shop.

Regarding insurance coverage, your carrier might have a zero deductible plan. Otherwise, windshield replacement can fall under comprehensive coverage.

High-Risk Insurance

Drivers who’ve been convicted for several offenses are riskier to insure. Though New Hampshire doesn’t require drivers to buy car insurance, “high-risk” drivers must file an SR-22 form as proof of insurance.

According to the New Hampshire Department of Public Safety, drivers who commit these violations must file an SR-22:

- DWI – 1st, 2nd, subsequent, and aggravated.

- Underage DWI – 1st, 2nd, subsequent, aggravated.

- Leaving the scene of an accident.

- Conduct after an accident.

- Subsequent (2nd) offense reckless operation.

Even if you haven’t committed the above offenses, and your driving record has other penalties, you may find it hard to get insurance coverage. The New Hampshire Automobile Insurance Plan offers an assigned risk pool where drivers can buy insurance if they don’t qualify for standard car insurance plans.

Low-Cost Insurance

Though New Hampshire has a program for high-risk drivers, it does not have one to help low-income drivers.

California, Hawaii, and New Jersey are the only three states that have government-funded programs to help low-income families pay for their car insurance.

Automobile Insurance Fraud in New Hampshire

There are two types of insurance fraud: “soft” and “hard.”

When someone intentionally provides false or deceptive information, that’s hard fraud. Soft fraud can occur when someone falsifies data under an existing claim to get more money or benefits.

The New Hampshire Insurance Department Fraud Unit at nh.gov investigates and prosecutes false claims. According to their annual report, in fiscal year 2018, the Unit received 267 referrals of suspected fraud or other insurance-related crimes.

“Of these referrals, the unit conducted 44 criminal investigations, of which 11 were presented for prosecution to either by the County Attorney’s office, the NH Attorney General’s office, or the United States Attorney’s office.”

As the Insurance Information Institute states, committing insurance fraud to get a lower rate can lead to harmful consequences. This intentional misrepresentation of facts is known as “rate evasion” and costs car insurers an average of $16 billion annually.

To file an insurance fraud claim, you may fill out an online form or call 1-800-852-3416.

Statute of Limitations

The statute of limitations is the time limit you have to file a claim. If you miss it, you might not be able to receive compensation.

New Hampshire’s statute of limitations is three years for both bodily injury and property damage.

Crucial evidence can wear away with time, and you can lose track of witnesses, so it makes sense to file your claim as soon as you can. Once you do so, the insurance company has ten working days to respond to you.

Vehicle Licensing Laws

The vehicle licensing process helps you comply with New Hampshire requirements for proper ID to drive on its roads.

In this section, we’ll cover Real ID, penalties for driving without insurance, licensing laws for all ages, and the state’s points system for violations.

Are you ready to read more?

Real ID

New Hampshire complies with the federal Real ID Act. As part of this law, Federal agencies, domestic air carriers, and nuclear power plants nationwide will start requiring Real ID cards for entry on October 1, 2020. These government-issued IDs help law enforcement prove a person’s identity.

The news report below goes into more detail about the cards and the documents required to get them:

Penalties for Driving Without Insurance

Unless you’re in a car accident and “at fault,” New Hampshire doesn’t require you to have insurance coverage. Earlier above, we covered the forms of financial responsibility the Granite State will accept as proof.

Otherwise, if you can’t show proof, the New Hampshire Department of Motor Vehicles may suspend your license. The same goes for drivers who have filed an SR-22 form.

Teen Driver Laws

Below are New Hampshire regulations and restrictions for teen drivers.

| Type of License | Minimum Age Requirement | Driving Requirement | Time Restriction | Passenger Restriction |

|---|---|---|---|---|

| Permit | 15 years 6 months | Must have a licensed adult over 25 years old supervising in the passenger seat | No restrictions | May not have more passengers than seat belts |

| Restricted License | 16 years | Must have completed 40 hours driving, 10 of which at night and passed an approved Driver Education Program | No driving between 1 a.m. and 4 a.m. | No more than one passenger younger than 25 (excluding family members) May not have more passengers than seat belts |

| Unrestricted License | Age after holding a restricted license six months (minimum 16 years 6 months) or 18 years, whichever occurs first | Must have held a restricted license six months or be 18 years old | No restrictions | No restrictions |

Older Driver License Renewal Procedures

New Hampshire has the same license requirements for older drivers as it does for the general population. We’ll go into more detail about them further below.

New Residents

New Granite State residents have 60 days to register their vehicles and get a new license. American citizens with valid out-of-state licenses may bring proof of residency and valid identification to the DMV to get a New Hampshire license. They also must surrender any licenses valid in other states.

License Renewal Procedures

The New Hampshire DMV requires drivers to renew their licenses every five years. They can do so by mail or online renewal at every other renewal cycle. They must provide proof of adequate vision every ten years.

Negligent Operator Treatment System (NOTS)

The state DMV has a demerit system for awarding drivers points for major violations. The number of demerit points they assess for each offense depends on the seriousness of the violation.

The number of demerit points they assign for a conviction will show up on a certified copy of the driver’s record for three years from the date of the violation.

Below are some major violations that will earn you points on your license or even a suspension in New Hampshire:

- Aggravated DWI: six points

- Transporting drugs in a motor vehicle: six points

- Disobeying police officer: six points

- DWI: six points

- Road racing: six points

- False report of theft: six points

- School bus violation: six points

- Driving without proof of financial responsibility: four points

- Improper passing: four points

- Speeding at a rate of 25 mph or greater over the posted speed limit: four points

- Speeding at a rate of 1-24 mph over the posted speed limit: three points

- Failure to display or produce a license for an officer: two points

The amount of points drivers can accrue before the DMV suspends their licenses varies based on age and how long it took to earn the points:

Drivers under age 18:

- Six points in one calendar year = up to three months suspension

- 12 points in two calendar years = up to six months suspension

- 18 points in three calendar years = suspension up to one year

Drivers under age 21:

- Nine points in one calendar year = up to three months suspension

- 15 points in two calendar years = up to six months suspension

- 21 points in three calendar years = suspension up to one year

Drivers age 21 or older:

- 12 points in one calendar year = up to three months suspension

- 18 points in two calendar years = up to six months suspension

- 24 points in three calendar years = suspension up to one year

Speeding at over 100 miles per hour classifies as reckless driving in New Hampshire. Drivers caught for reckless driving face up to $500 in fines and a 60-day license revocation. A second speeding offense results in a $750 fine and a license revocation for between 60 days and one year.

Given the harsh penalties for even minor infractions, it makes sense to drive safely and obey the law whenever possible.

Rules of the Road

Rules, rules, and more rules — it can be hard to stay on top of what you should and shouldn’t do on the road.

To make it easier for you, below we’ll go over the ones you need to know most when you drive daily: negligence laws, seat belt laws, state speed limits, and much more.

So, let’s get ready to brush up on some facts, shall we?

Fault vs. No-Fault

New Hampshire is an at-fault state — whoever is “at fault” or responsible for an accident must file a claim.

Regarding negligence laws, things can get trickier. New Hampshire follows modified comparative negligence rules to assign fault:

- The injured party may recover compensation only if he or she is less than 50 percent at fault.

- If the injured party was also negligent, the original negligent party is only liable for the percentage of damages he or she caused.

For example, if you were in a car accident and the driver who hit you ran a red light while you were speeding, the jury can find the other driver was 60 percent negligent; your speeding could amount to 20 percent negligence. You would then receive only 60 percent of your total damages.

But, if the jury found you to be 51 percent negligent, you wouldn’t qualify for any compensation.

Seat Belt and Car Seat Laws

New Hampshire doesn’t currently have any seat belt laws for passengers or drivers over the age of eighteen.

A recent attempt to require them failed to pass the state legislature. This news report features more information:

Below are New Hampshire’s child seat laws:

| Child Restraint Law | Details |

|---|---|

| Must be in child restraint | 6 years and younger who are less than 57 inches |

| Adult safety belt permissible | 7 through 17 years; younger than 7 who are at least 57 inches tall |

| Maximum fine 1st offense | $50 |

State laws let passengers ride in the cargo area of a pickup truck.

Keep Right and Move Over Laws

In New Hampshire, in most cases, vehicles must travel in the right lane, except under the following situations:

- When passing another vehicle

- When there is an obstruction in the roadway

- When preparing for a left turn

The state also enacted two amendments effective in January 2019:

- “Motor vehicles shall not be operated continuously in the left lane of a multilane roadway whenever it impedes the flow of other traffic at or below the posted speed limit unless reasonable and prudent under the conditions having regard to the actual and potential hazards then existing.”

- “Any person who violates this section shall be guilty of a violation and shall be fined $50 plus penalty assessment.”

In other situations, including those involving emergency vehicles, drivers mustobey these rules:

- Maintain a reduced speed.

- Obey the directions of any authorized person directing traffic and of all applicable emergency signals and traffic control devices.

- Vacate as soon as possible any lane wholly or partially blocked.

- Give a wide berth, without endangering oncoming traffic, to public safety personnel, any persons in the roadway, and stationary vehicles displaying blue, red, or amber emergency or warning lights.

Speed Limits

Below are the speed limits on New Hampshire’s roads.

| Type of Roadway | Speed Limit |

|---|---|

| Rural interstates (mph) | 65; 70 on specified segments of road |

| Urban interstates (mph) | 65 |

| Other limited-access roads (mph) | 55 |

| Other roads (mph) | 55 |

Ridesharing

New Hampshire doesn’t currently have minimum insurance requirements for Uber, Lyft, and other ridesharing companies.

These companies offer ridesharing protection for Granite State drivers:

- Geico

- Liberty Mutual

- USAA

- State Farm

If you are interested in becoming a rideshare driver, you can check with your own insurance company to avoid any potential coverage gaps.

Automation on the Road

New Hampshire is among the states to have banned the testing of automated cars. In 2018, Governor Sununu issued a ban because of a fatal accident in Arizona.

Safety Laws

Driving laws, like those above, and those we’ll cover below, keep everyone safe on the road.

Among the biggest roadway hazards come from distracted drivers and those who are under the influence. Let’s look at the laws and how New Hampshire controls these dangers.

DUI Laws

In the chart below, the first three non-injury Driving While Intoxicated (DWI) convictions are misdemeanors while the fourth and later non-injury convictions are felonies.

If the intoxicated driver caused severe bodily injuries, the state will classify any DWI as a felony.

The legal New Hampshire blood alcohol content (BAC) limit is 0.08 percent, while the high BAC limit is 0.16 percent. The state has a ten-year lookback period for prior DWIs considered in later charges.

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| Driver's License Suspension | Nine months - six years. Six months of the sentence may be suspended for enrollment in 20 hour Impaired Driver Intervention Program | Three years minimum | Lifetime - may be reinstated after five years | Lifetime - may be reinstated after seven years |

| Imprisonment | No minimum | 30 days (mandatory minimum) - one year | 180 days - one year | 30 days - seven years, minimum six months deferred jail time |

| Fine | $500 minimum | $750 minimum | $750 minimum | $930 minimum |

| Other | N/A | IID required for one - two years after license reinstatement; Seven-day Multiple Offender Program (MOP) required | IID required one - two years after license reinstatement; 28 day MOP required | IID required one - two years after license reinstatement; 28 day MOP required |

Marijuana-Impaired Driving Laws

Though New Hampshire doesn’t have a specific marijuana-impaired driving law, anyone who drives while under the influence of alcohol or drugs may face a conviction.

Drivers arrested for driving under the influence of drugs must attend and complete a state-approved Impaired Driver Care Management Program.

Distracted Driving Laws

Cell phones have become a major distraction for drivers of all ages. Below are New Hampshire’s cell phone laws:

| Cell Phone and Texting Restrictions | Details |

|---|---|

| Hand-held ban | all drivers |

| Young drivers all cellphone ban | drivers younger than 18 |

| Texting ban | all drivers |

| Enforcement | primary |

Fines start at $100 and can reach $500 by the third offense.

Driving in New Hampshire

Anywhere you drive, you’re open to some risks, some of which you can’t control. You never know what will happen. It’s also harder to drive in harsh conditions.

The best you can do is to drive as safely as possible. To help you stay on top of the dangers, below, we’ll go over more hazards of driving and vehicle ownership: vehicle theft and fatal crashes.

So, buckle up and get ready for some eye-opening statistics from the National Traffic Highway Safety Administration (NHTSA) and other organizations.

Vehicle Theft in New Hampshire

The table below shows the most popular cars stolen in The Granite State, including the most popular vehicle years and the total number of thefts for each make and model.

| Vehicle | Year of Vehicle | Thefts |

|---|---|---|

| Honda Civic | 1997 | 34 |

| Honda Accord | 1996 | 20 |

| Chevrolet Pickup (Full Size) | 2002 | 19 |

| Ford Pickup (Full Size) | 2002 | 17 |

| Dodge Caravan | 2003 | 16 |

| Ford Focus | 2007 | 14 |

| Toyota Camry | 1999 | 13 |

| Jeep Cherokee/Grand Cherokee | 2000 | 11 |

| GMC Pickup (Full Size) | 2007 | 9 |

| Toyota Corolla | 1999 | 9 |

Two cars with the same make, Honda, top the list, with different models of a similar vintage, the 1996 Accord and the 1997 Civic.

Vehicle Theft by City

Now, per the Federal Bureau of Investigation (FBI) statistics, let’s see which cities have the most thefts. Is your city or town listed?

| City | Motor vehicle theft |

|---|---|

| Manchester | 159 |

| Nashua | 68 |

| Salem | 35 |

| Derry | 27 |

| Rochester | 24 |

| Claremont | 20 |

| Portsmouth | 20 |

| Laconia | 19 |

| Keene | 17 |

| Belmont | 15 |

| Hampton | 15 |

| Plaistow | 15 |

The biggest city in the state, Manchester, understandably, had the highest amount of thefts.

Road Fatalities in New Hampshire

Let’s look at the average number of road fatalities in The Granite State, including weather and light conditions, crash type, the types of vehicle involved, and the deaths through alcohol impairment.

Most Fatal Highway in New Hampshire

Interstate 93, which runs north to south and connects to I-495 in Massachusetts, has the most fatal traffic accidents in New Hampshire. An average of five to six traffic deaths have occurred over the past ten years along this roadway that spans over two-thirds of the state.

Fatal Crashes by Weather and Light Condition

Weather and lighting conditions may have a huge impact on certain crashes.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 50 | 6 | 20 | 5 | 0 | 81 |

| Rain | 5 | 0 | 1 | 0 | 0 | 6 |

| Snow/Sleet | 3 | 2 | 4 | 1 | 0 | 10 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 58 | 8 | 26 | 6 | 0 | 98 |

Most accidents in New Hampshire happened in normal daylight conditions when more drivers are on the road.

Fatalities (All Crashes) by County

When it comes to certain parts of the state, some areas had more crashes than others.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Belknap | 10 | 4 | 6 | 8 | 11 |

| Carroll | 7 | 6 | 6 | 10 | 6 |

| Cheshire | 17 | 7 | 2 | 11 | 10 |

| Coos | 5 | 3 | 7 | 6 | 7 |

| Grafton | 10 | 4 | 9 | 14 | 5 |

| Hillsborough | 28 | 27 | 24 | 27 | 20 |

| Merrimack | 7 | 13 | 16 | 13 | 12 |

| Rockingham | 30 | 18 | 29 | 28 | 16 |

| Strafford | 16 | 9 | 12 | 15 | 12 |

| Sullivan | 5 | 4 | 3 | 4 | 3 |

As you may expect, in counties with higher populations, such as Hillsborough and Rockingham, there tend to be more accidents.

Traffic Fatalities

Let’s see how the number of crashes breaks down for urban versus rural areas.

| Type of Roadway | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Rural | 60 | 87 | 48 | 66 | 75 | 51 |

| Urban | 48 | 48 | 47 | 48 | 61 | 51 |

Despite the differences in population between the areas, the amount of accidents was about the same for both.

Fatalities by Person Type

Here’s a breakdown by type of vehicle and incident involved in New Hampshire roadway crashes:

| Occupant/Nonoccupant | Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 58 | 42 | 49 | 57 | 46 |

| – | Light Truck - Pickup | 14 | 6 | 10 | 23 | 9 |

| – | Light Truck - Utility | 15 | 8 | 12 | 14 | 12 |

| – | Light Truck - Van | 4 | 2 | 3 | 1 | 3 |

| – | Light Truck - Other | 0 | 0 | 0 | 1 | 0 |

| – | Large Truck | 1 | 2 | 0 | 0 | 1 |

| – | Other/Unknown Occupants | 2 | 2 | 1 | 1 | 2 |

| – | Total Occupants | 94 | 62 | 75 | 97 | 73 |

| Motorcyclists | Total Motorcyclists | 24 | 17 | 26 | 19 | 15 |

| Nonoccupants | Pedestrian | 12 | 12 | 8 | 17 | 11 |

| – | Bicyclist and Other Cyclist | 4 | 3 | 3 | 2 | 2 |

| – | Other/Unknown Nonoccupants | 1 | 1 | 2 | 1 | 1 |

| – | Total Nonoccupants | 17 | 16 | 13 | 20 | 14 |

| Combined | Total Persons | 135 | 95 | 114 | 136 | 102 |