Oklahoma Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 10.50

Welcome to Oklahoma, often referred to as the “Sooner State.” When you hear Oklahoma, you often think of wide-open spaces, oil, and tornados, which is accurate, as all of these have a place in the Sooner State.

Oil is a major way of life and can even be found under the state capital building. Oklahoma City Oil Field has 13,770 productive acres. Oklahoma averages 52 tornados a year. It is not surprising it was the setting for the movie Twister (see below).

Just another reason you should ensure you have the right auto insurance coverage. Start comparing with our free quote box above.

Where Should You Find Oklahoma Car Insurance Coverage & Rates?

Car insurance can be a confusing topic. How much do you need? Where can you find the best rates? Which company is most reliable?

If you google car insurance, you get a plethora of options to chose from, and that can be very confusing. We are going to answer those questions and more as you read.

We make it so easy you can enter your zip code here and use our free comparison quote tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s Oklahoma’s Car Culture like?

Ouachitas, Arbuckles, Wichitas, and the Kiamichis are the four mountain ranges located in the Sooner State. It is no surprise Oklahoma is a state filled with pickup trucks and 4×4 off-roading vehicles.

Oklahoma prides itself on the famous roadway called Route 66, and they even have a museum honoring this monumental road.

What’s Oklahoma’s Minimum Coverage for Auto Insurance?

How much coverage do you need on your vehicle? Oklahoma has a minimum required amount, but remember this is the minimum amount.

| Insurance Required | Minimum Limits: 25/50/25 |

|---|---|

| Body Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

These are the limits that will be paid out by your insurance company to the other party if you are found at fault in an accident. If you are in a serious accident with a luxury car or if the other party is seriously injured, these limits may not be enough to cover the loss. You could be responsible for the remaining balance.

These limits do not cover your own damages in an accident where you are at fault. You can add other coverages to your policy to cover you and your vehicle. We will take a more in-depth look at those coverages in another section.

It is always wise to talk to your insurance agent and see how much full coverage would cost. An agent can help you decide what you need, and then they can get quotes from different companies for that coverage. You can also get quotes by entering your zip code and answering a few questions in our free comparison quote tool. We will be looking further into rates, and the rates for more coverage might be surprising.

We will also take a look at the penalties for driving without the minimum insurance coverage. You must be able to show proof of insurance, which you can do with a copy of your policy or ID card. In Oklahoma, you can also show electronic proof via your smartphone or other devices.

What are the Forms of Financial Responsibility?

All drivers must have an active insurance policy covering their registered vehicles. This prevents drivers from being on the road with no insurance, being unable to pay for an accident they caused. If you drive uninsured and get caught, you would be responsible for any damages you cause. You could also be fined and otherwise penalized even if you don’t get in an accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Much Do Oklahoma Residents Spend on Auto Insurance?

Since you know you need insurance, the next question is usually how much will I be paying for it?

| Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|

| $985.58 | $40,879.00 | 2.41% | $931.41 | $38,623.00 | 2.41% | $902.90 | $37,298.00 | 2.42% |

We took the average income and average rates for three years and found about 2.4 percent of your income should be allocated for insurance premiums.

You can use our free percentage tool to input your exact numbers.

What are the Core Coverages?

We took a look at the average premiums for the below core coverages.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $461.01 |

| Collision | $318.47 |

| Comprehensive | $225.84 |

| Combined | $1,005.32 |

As we mentioned earlier, liability insurance will cover the other person if you are at fault. Comprehensive and collision work a little differently. They cover your vehicle whether you are at fault or not.

Full coverage, or combined coverage, is when you opt to have all three above coverages.

Are There Additional Auto Insurance Coverages?

There are also other liability coverages you can add to your policy.

Medical payments can be added to your policy to cover medical expenses for anyone in your vehicle at the time of the accident. This coverage will be paid out regardless of who is at fault.

Underinsured/Uninsured motorist coverage is for accidents involving someone at fault with no or little insurance, to make sure you’re covered even if it’s not by them.

It is good to know you have coverage that your company will payout on in the event of a loss. We can look at a company’s loss ratio to determine how they payout and also how well they are doing financially.

The loss ratio is the ratio between earned premiums and paid claims. For instance, if a company writes $100,000 of premium and pays out $50,000 in claims, its loss ratio is 50 percent.

- A High Loss Ratio (over 75 percent) indicates that the companies underestimated the frequency and severity of losses and how much premium would be needed to cover them. A high loss ratio is a good indicator of future rate increases.

- A Low Loss Ratio (under 35 percent) could indicate that companies overestimated the frequency and severity of claims or overpriced their policies.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 63% | 66% | 66% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 65% | 63% | 63% |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are There any Add-Ons, Endorsements, & Riders?

Many other optional coverages can be endorsed on your policy. We have taken some of the most common added coverages and listed them below.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

What are the Demographic Rates?

So, who pays more? Well from the table below we see young males pay the highest in insurance premiums, followed closely by young females.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,328.59 | $2,340.04 | $2,141.58 | $2,249.20 | $7,139.27 | $8,374.22 | $2,516.93 | $2,659.13 |

| Farmers Ins Co | $2,388.47 | $2,371.89 | $2,146.04 | $2,266.74 | $9,093.76 | $9,327.58 | $2,709.31 | $2,835.43 |

| Geico Cas | $2,253.30 | $2,465.41 | $2,404.73 | $2,704.77 | $6,619.94 | $7,073.30 | $1,975.53 | $2,001.68 |

| SAFECO Ins Co of America | $4,632.47 | $4,896.08 | $4,069.22 | $4,435.89 | $12,935.67 | $14,212.79 | $4,819.54 | $4,995.32 |

| Progressive Northern | $2,671.48 | $2,540.84 | $2,198.84 | $2,327.53 | $10,613.86 | $11,900.02 | $3,126.90 | $3,279.31 |

| State Farm Mutual Auto | $1,920.57 | $1,920.57 | $1,690.71 | $1,690.71 | $4,875.91 | $6,153.78 | $2,017.34 | $2,264.81 |

| USAA | $1,883.69 | $1,887.12 | $1,807.32 | $1,826.96 | $6,095.05 | $6,803.79 | $2,425.69 | $2,663.55 |

Females, in all age brackets, tend to pay slightly less than males.

How Can You Find the Cheapest Car Insurance Rates by ZIP Code?

Where you live can also play a part in how much you pay. Below are charts showing the most expensive and cheapest ZIP codes in Oklahoma.

| Most Expensive ZIP Codes in Oklahoma | City | Average by ZIP Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 74110 | TULSA | $5,150.50 | Liberty Mutual | $8,036.87 | Progressive | $6,463.20 | USAA | $3,803.59 | State Farm | $3,821.57 |

| 74115 | TULSA | $5,130.85 | Liberty Mutual | $8,170.58 | Progressive | $6,486.61 | State Farm | $3,613.95 | USAA | $3,798.77 |

| 74106 | TULSA | $5,113.35 | Liberty Mutual | $8,036.87 | Progressive | $6,415.81 | State Farm | $3,612.06 | USAA | $3,803.59 |

| 74103 | TULSA | $5,031.82 | Liberty Mutual | $7,967.96 | Progressive | $7,174.36 | State Farm | $3,491.00 | USAA | $3,601.75 |

| 74146 | TULSA | $4,996.54 | Liberty Mutual | $8,064.64 | Progressive | $6,253.73 | State Farm | $3,482.71 | USAA | $3,720.71 |

| 74120 | TULSA | $4,955.86 | Liberty Mutual | $8,133.55 | Progressive | $6,436.54 | State Farm | $3,416.00 | USAA | $3,467.63 |

| 74128 | TULSA | $4,946.22 | Liberty Mutual | $8,033.79 | Progressive | $6,046.90 | State Farm | $3,286.17 | USAA | $3,720.71 |

| 74119 | TULSA | $4,938.25 | Liberty Mutual | $8,138.50 | Progressive | $6,332.46 | State Farm | $3,333.26 | USAA | $3,601.75 |

| 74129 | TULSA | $4,932.56 | Liberty Mutual | $8,064.64 | Progressive | $5,904.00 | State Farm | $3,425.78 | USAA | $3,720.71 |

| 74126 | TULSA | $4,924.71 | Liberty Mutual | $8,036.87 | Progressive | $5,752.62 | State Farm | $3,524.07 | USAA | $3,803.59 |

| 74134 | TULSA | $4,923.31 | Liberty Mutual | $8,064.64 | Progressive | $5,740.74 | State Farm | $3,493.32 | USAA | $3,718.14 |

| 74116 | TULSA | $4,912.91 | Liberty Mutual | $7,777.09 | Progressive | $6,252.36 | State Farm | $3,399.50 | USAA | $3,718.14 |

| 74104 | TULSA | $4,906.22 | Liberty Mutual | $8,124.78 | Progressive | $6,026.21 | USAA | $3,467.63 | State Farm | $3,475.89 |

| 74112 | TULSA | $4,905.35 | Liberty Mutual | $8,033.79 | Progressive | $5,767.37 | State Farm | $3,443.96 | USAA | $3,798.77 |

| 73119 | OKLAHOMA CITY | $4,901.45 | Liberty Mutual | $8,234.24 | Progressive | $6,328.07 | State Farm | $3,524.17 | USAA | $3,548.39 |

| 74172 | TULSA | $4,895.93 | Liberty Mutual | $7,967.96 | Progressive | $7,267.59 | State Farm | $2,739.02 | USAA | $3,495.20 |

| 73106 | OKLAHOMA CITY | $4,893.95 | Liberty Mutual | $8,278.13 | Progressive | $6,024.45 | State Farm | $3,243.59 | USAA | $3,548.39 |

| 74130 | TULSA | $4,887.69 | Liberty Mutual | $7,561.76 | Progressive | $5,897.39 | State Farm | $3,492.86 | USAA | $3,803.59 |

| 74135 | TULSA | $4,883.58 | Liberty Mutual | $8,129.71 | Progressive | $6,101.54 | State Farm | $3,348.99 | USAA | $3,425.64 |

| 73102 | OKLAHOMA CITY | $4,879.88 | Liberty Mutual | $8,056.71 | Progressive | $6,611.05 | USAA | $3,376.34 | State Farm | $3,427.03 |

| 73108 | OKLAHOMA CITY | $4,873.82 | Liberty Mutual | $8,278.13 | Progressive | $6,090.43 | State Farm | $3,320.26 | USAA | $3,548.39 |

| 73103 | OKLAHOMA CITY | $4,872.88 | Liberty Mutual | $7,986.52 | Progressive | $6,412.37 | State Farm | $3,332.42 | USAA | $3,376.34 |

| 74127 | TULSA | $4,870.80 | Liberty Mutual | $7,900.10 | Progressive | $5,994.04 | State Farm | $3,249.42 | USAA | $3,601.75 |

| 74105 | TULSA | $4,869.18 | Liberty Mutual | $8,129.71 | Progressive | $5,745.38 | State Farm | $3,378.65 | USAA | $3,409.32 |

| 73109 | OKLAHOMA CITY | $4,867.95 | Liberty Mutual | $8,234.24 | Progressive | $6,211.04 | State Farm | $3,379.66 | USAA | $3,544.14 |

Tulsa and Oklahoma City have the most expensive ZIP codes in the state.

| Cheapest ZIP Codes in Oklahoma | City | Average by ZIP Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 73555 | MANITOU | $3,646.98 | Liberty Mutual | $6,048.86 | Progressive | $4,036.19 | State Farm | $2,591.02 | Geico | $2,743.46 |

| 73542 | FREDERICK | $3,650.18 | Liberty Mutual | $6,134.72 | Progressive | $4,036.19 | State Farm | $2,369.85 | Geico | $2,743.46 |

| 73521 | ALTUS | $3,682.05 | Liberty Mutual | $6,059.14 | Progressive | $4,247.18 | State Farm | $2,536.43 | Geico | $2,743.46 |

| 73539 | ELMER | $3,692.21 | Liberty Mutual | $6,048.86 | Progressive | $4,038.41 | State Farm | $2,591.02 | Geico | $2,743.46 |

| 73570 | TIPTON | $3,692.55 | Liberty Mutual | $6,119.06 | Progressive | $4,162.66 | State Farm | $2,484.29 | Geico | $2,743.46 |

| 73537 | ELDORADO | $3,694.92 | Liberty Mutual | $6,119.06 | Progressive | $4,089.93 | State Farm | $2,591.02 | Geico | $2,743.46 |

| 73939 | GOODWELL | $3,704.39 | Liberty Mutual | $5,974.78 | Farmers | $3,871.33 | State Farm | $2,566.00 | USAA | $3,063.11 |

| 73946 | KENTON | $3,715.81 | Liberty Mutual | $5,930.51 | Farmers | $3,973.18 | State Farm | $2,591.02 | USAA | $3,063.11 |

| 73549 | HEADRICK | $3,722.42 | Liberty Mutual | $6,119.06 | Progressive | $4,071.71 | State Farm | $2,591.02 | Geico | $2,743.46 |

| 73523 | ALTUS AFB | $3,724.33 | Liberty Mutual | $6,059.14 | Progressive | $4,398.59 | State Farm | $2,591.02 | Geico | $2,743.46 |

| 73945 | HOOKER | $3,725.51 | Liberty Mutual | $6,107.55 | Progressive | $3,978.70 | State Farm | $2,413.73 | USAA | $3,063.11 |

| 73937 | FELT | $3,725.60 | Liberty Mutual | $5,930.51 | Farmers | $3,987.50 | State Farm | $2,591.02 | USAA | $3,063.11 |

| 73951 | TYRONE | $3,725.68 | Liberty Mutual | $5,930.51 | Progressive | $4,076.36 | State Farm | $2,427.10 | USAA | $3,063.11 |

| 73944 | HARDESTY | $3,726.17 | Liberty Mutual | $5,930.51 | Progressive | $3,963.30 | State Farm | $2,591.02 | USAA | $3,063.11 |

| 73552 | INDIAHOMA | $3,727.43 | Liberty Mutual | $6,170.47 | Progressive | $3,974.04 | State Farm | $2,650.11 | Geico | $2,929.45 |

| 73703 | ENID | $3,729.94 | Liberty Mutual | $6,062.18 | Progressive | $4,317.07 | State Farm | $2,605.49 | USAA | $2,775.83 |

| 73938 | FORGAN | $3,732.65 | Liberty Mutual | $5,930.51 | Farmers | $3,924.56 | State Farm | $2,644.59 | USAA | $3,063.11 |

| 73950 | TURPIN | $3,734.52 | Liberty Mutual | $5,930.51 | Farmers | $4,077.42 | State Farm | $2,530.49 | USAA | $3,063.11 |

| 73942 | GUYMON | $3,735.69 | Liberty Mutual | $6,107.55 | Progressive | $3,975.41 | State Farm | $2,539.69 | USAA | $3,063.11 |

| 73949 | TEXHOMA | $3,737.64 | Liberty Mutual | $5,930.51 | Progressive | $4,086.86 | State Farm | $2,602.61 | USAA | $3,063.11 |

| 73931 | BALKO | $3,743.28 | Liberty Mutual | $5,930.51 | Progressive | $3,991.29 | State Farm | $2,652.36 | USAA | $3,063.11 |

| 73526 | BLAIR | $3,745.24 | Liberty Mutual | $6,048.86 | Progressive | $4,149.82 | State Farm | $2,594.10 | Geico | $2,743.46 |

| 73932 | BEAVER | $3,746.46 | Liberty Mutual | $5,973.04 | Farmers | $3,992.83 | State Farm | $2,625.34 | USAA | $3,063.11 |

| 73538 | ELGIN | $3,753.25 | Liberty Mutual | $6,417.53 | Progressive | $3,935.21 | State Farm | $2,680.52 | Geico | $2,929.45 |

| 73933 | BOISE CITY | $3,754.57 | Liberty Mutual | $5,930.51 | Progressive | $3,920.57 | State Farm | $2,828.97 | USAA | $3,063.11 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Cities in Oklahoma Have The Cheapest Average Cost?

We have also taken this information and separated it by cities in Oklahoma.

| Most Expensive Cities in Oklahoma | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Tulsa | $4,903.84 | Liberty Mutual | $7,969.89 | Progressive | $6,156.47 | State Farm | $3,378.92 | USAA | $3,592.35 |

| Nichols Hills | $4,794.06 | Liberty Mutual | $7,672.10 | Progressive | $5,997.68 | State Farm | $3,290.75 | USAA | $3,414.20 |

| Oakhurst | $4,745.40 | Liberty Mutual | $7,718.08 | Progressive | $5,756.48 | State Farm | $3,222.50 | USAA | $3,601.75 |

| Forest Park | $4,715.69 | Liberty Mutual | $7,387.73 | Progressive | $5,906.39 | State Farm | $3,118.89 | USAA | $3,557.24 |

| Oklahoma City | $4,713.34 | Liberty Mutual | $7,827.17 | Progressive | $5,859.47 | State Farm | $3,212.84 | USAA | $3,454.53 |

| Del City | $4,680.38 | Liberty Mutual | $7,707.40 | Progressive | $5,958.85 | State Farm | $3,177.55 | USAA | $3,387.22 |

| Midwest City | $4,663.70 | Liberty Mutual | $7,591.38 | Progressive | $5,929.75 | State Farm | $3,159.62 | USAA | $3,425.67 |

| Glenpool | $4,659.69 | Liberty Mutual | $7,369.86 | Progressive | $6,301.87 | State Farm | $3,125.00 | Geico | $3,255.36 |

| Bixby | $4,644.01 | Liberty Mutual | $7,495.04 | Progressive | $5,758.16 | State Farm | $3,292.25 | USAA | $3,374.02 |

| Catoosa | $4,634.41 | Liberty Mutual | $7,524.38 | Progressive | $5,939.26 | State Farm | $3,091.73 | USAA | $3,491.27 |

| Broken Arrow | $4,615.49 | Liberty Mutual | $7,610.60 | Progressive | $5,711.59 | State Farm | $3,195.70 | USAA | $3,492.20 |

| Bethany | $4,603.06 | Liberty Mutual | $7,482.10 | Progressive | $5,617.79 | State Farm | $3,180.39 | USAA | $3,480.61 |

| Wheatland | $4,559.24 | Liberty Mutual | $7,721.70 | Progressive | $5,641.86 | State Farm | $2,955.50 | USAA | $3,480.61 |

| Sperry | $4,535.05 | Liberty Mutual | $7,492.84 | Progressive | $5,560.96 | Geico | $3,255.36 | State Farm | $3,456.65 |

| Jenks | $4,533.23 | Liberty Mutual | $7,532.72 | Progressive | $5,444.49 | State Farm | $3,118.62 | Geico | $3,255.36 |

| Moore | $4,532.19 | Liberty Mutual | $7,741.34 | Progressive | $5,535.16 | State Farm | $3,114.17 | USAA | $3,364.53 |

| Kiefer | $4,520.92 | Liberty Mutual | $7,067.04 | Progressive | $6,401.55 | State Farm | $2,955.11 | Geico | $3,255.36 |

| Jones | $4,511.62 | Liberty Mutual | $7,461.14 | Progressive | $5,372.22 | State Farm | $3,184.63 | USAA | $3,404.21 |

| Newalla | $4,500.55 | Liberty Mutual | $7,532.89 | Progressive | $5,423.01 | State Farm | $2,991.37 | USAA | $3,392.86 |

| Choctaw | $4,493.07 | Liberty Mutual | $7,532.89 | Progressive | $5,582.56 | State Farm | $2,726.56 | USAA | $3,236.09 |

| Macomb | $4,485.54 | Liberty Mutual | $6,808.25 | Progressive | $6,124.88 | State Farm | $2,904.89 | USAA | $3,326.43 |

| Sapulpa | $4,461.79 | Liberty Mutual | $7,103.45 | Progressive | $6,186.67 | State Farm | $2,692.50 | Geico | $3,255.36 |

| Arcadia | $4,434.77 | Liberty Mutual | $7,288.95 | Progressive | $5,351.58 | State Farm | $2,888.22 | USAA | $3,284.58 |

| Luther | $4,421.24 | Liberty Mutual | $7,234.87 | Progressive | $5,061.66 | State Farm | $2,977.73 | USAA | $3,404.21 |

| Harrah | $4,395.57 | Liberty Mutual | $7,585.54 | Progressive | $4,971.03 | State Farm | $2,938.60 | USAA | $3,377.30 |

Tulsa is one of the largest cities in Oklahoma, and it also has the most expensive car insurance rates.

| Cheapest Cities in Oklahoma | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Manitou | $3,646.98 | Liberty Mutual | $6,048.86 | Progressive | $4,036.19 | State Farm | $2,591.02 | Geico | $2,743.46 |

| Frederick | $3,650.18 | Liberty Mutual | $6,134.72 | Progressive | $4,036.19 | State Farm | $2,369.85 | Geico | $2,743.46 |

| Altus | $3,682.05 | Liberty Mutual | $6,059.14 | Progressive | $4,247.18 | State Farm | $2,536.43 | Geico | $2,743.46 |

| Elmer | $3,692.21 | Liberty Mutual | $6,048.86 | Progressive | $4,038.41 | State Farm | $2,591.02 | Geico | $2,743.46 |

| Tipton | $3,692.55 | Liberty Mutual | $6,119.06 | Progressive | $4,162.66 | State Farm | $2,484.29 | Geico | $2,743.46 |

| Eldorado | $3,694.92 | Liberty Mutual | $6,119.06 | Progressive | $4,089.93 | State Farm | $2,591.02 | Geico | $2,743.46 |

| Goodwell | $3,704.39 | Liberty Mutual | $5,974.78 | Farmers | $3,871.33 | State Farm | $2,566.00 | USAA | $3,063.11 |

| Kenton | $3,715.81 | Liberty Mutual | $5,930.51 | Farmers | $3,973.18 | State Farm | $2,591.02 | USAA | $3,063.11 |

| Headrick | $3,722.42 | Liberty Mutual | $6,119.06 | Progressive | $4,071.71 | State Farm | $2,591.02 | Geico | $2,743.46 |

| Altus Afb | $3,724.33 | Liberty Mutual | $6,059.14 | Progressive | $4,398.59 | State Farm | $2,591.02 | Geico | $2,743.46 |

| Hooker | $3,725.51 | Liberty Mutual | $6,107.55 | Progressive | $3,978.70 | State Farm | $2,413.73 | USAA | $3,063.11 |

| Felt | $3,725.60 | Liberty Mutual | $5,930.51 | Farmers | $3,987.50 | State Farm | $2,591.02 | USAA | $3,063.11 |

| Tyrone | $3,725.68 | Liberty Mutual | $5,930.51 | Progressive | $4,076.36 | State Farm | $2,427.10 | USAA | $3,063.11 |

| Hardesty | $3,726.17 | Liberty Mutual | $5,930.51 | Progressive | $3,963.30 | State Farm | $2,591.02 | USAA | $3,063.11 |

| Indiahoma | $3,727.43 | Liberty Mutual | $6,170.47 | Progressive | $3,974.04 | State Farm | $2,650.11 | Geico | $2,929.45 |

| Forgan | $3,732.65 | Liberty Mutual | $5,930.51 | Farmers | $3,924.56 | State Farm | $2,644.59 | USAA | $3,063.11 |

| Turpin | $3,734.52 | Liberty Mutual | $5,930.51 | Farmers | $4,077.42 | State Farm | $2,530.49 | USAA | $3,063.11 |

| Guymon | $3,735.69 | Liberty Mutual | $6,107.55 | Progressive | $3,975.41 | State Farm | $2,539.69 | USAA | $3,063.11 |

| Texhoma | $3,737.64 | Liberty Mutual | $5,930.51 | Progressive | $4,086.86 | State Farm | $2,602.61 | USAA | $3,063.11 |

| Balko | $3,743.28 | Liberty Mutual | $5,930.51 | Progressive | $3,991.29 | State Farm | $2,652.36 | USAA | $3,063.11 |

| Blair | $3,745.24 | Liberty Mutual | $6,048.86 | Progressive | $4,149.82 | State Farm | $2,594.10 | Geico | $2,743.46 |

| Beaver | $3,746.46 | Liberty Mutual | $5,973.04 | Farmers | $3,992.83 | State Farm | $2,625.34 | USAA | $3,063.11 |

| Elgin | $3,753.25 | Liberty Mutual | $6,417.53 | Progressive | $3,935.21 | State Farm | $2,680.52 | Geico | $2,929.45 |

| Boise City | $3,754.57 | Liberty Mutual | $5,930.51 | Progressive | $3,920.57 | State Farm | $2,828.97 | USAA | $3,063.11 |

| Snyder | $3,765.73 | Liberty Mutual | $6,134.72 | Progressive | $4,100.83 | State Farm | $2,511.91 | USAA | $3,019.27 |

Who Are The Best Oklahoma Car Insurance Companies?

Since you need to buy insurance, it’s best to do so from a reputable company.

We are going to look at the biggest insurance companies in Oklahoma. We will break down their rates and what factors they use to give rates to customers. We will also look at their financial information and customer service satisfaction.

Every company will try to sell themselves to customers. It is their job. We are going to take the guessing out of which ones would be a good fit and which ones you should avoid.

If you’re just looking for cheap car insurance, the lowest rates aren’t always from the same company. Insurers use complex algorithms to determine rates, and some of it depends on the individual underwriter. While Allstate may provide the lowest prices for some customers, Geico will offer lower prices to others. The best way to find affordable pricing is by getting insurance quotes from multiple auto insurance companies.

What’s the Financial Rating of the Largest Companies?

AM Best is one of the largest financial rating companies available. They specialize in the insurance industry.

You can find the following information about the company on their website: “AM Best was founded in 1899 by Alfred M. Best with the mission to report on the financial stability of insurers and the insurance industry. It is the oldest and most widely recognized provider of ratings, financial data and news with an exclusive insurance industry focus.”

Ratings are issued on approximately 3,500 companies in more than 90 countries worldwide.

Best’s Credit Ratings are an essential tool to help the financial industry and consumers assess an insurer’s financial strength, creditworthiness, and ability to honor obligations to policyholders worldwide.

We have taken the top 10 largest insurance carriers in Oklahoma and listed their AM Best ratings below.

| Providers | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| State Farm Group | A | $677,192 | 25.41% | 57.03% |

| Farmer's Insurance Group | NR | $303,207 | 11.38% | 51.38% |

| Progressive Group | A+ | $238,951 | 8.96% | 55.51% |

| Allstate Insurance Group | A+ | $186,448 | 7.00% | 48.05% |

| Geico | A++ | $184,196 | 6.91% | 66.79% |

| Liberty Mutual Group | A | $174,654 | 6.55% | 57.68% |

| USAA Group | NR | $172,914 | 6.49% | 69.06% |

| Oklahoma Farm Bureau Group | B+ | $105,712 | 3.97% | 55.16% |

| CSAA Insurance Group | A | $103,378 | 3.88% | 50.54% |

| Shelter Insurance Group | A | $92,167 | 3.46% | 61.81% |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

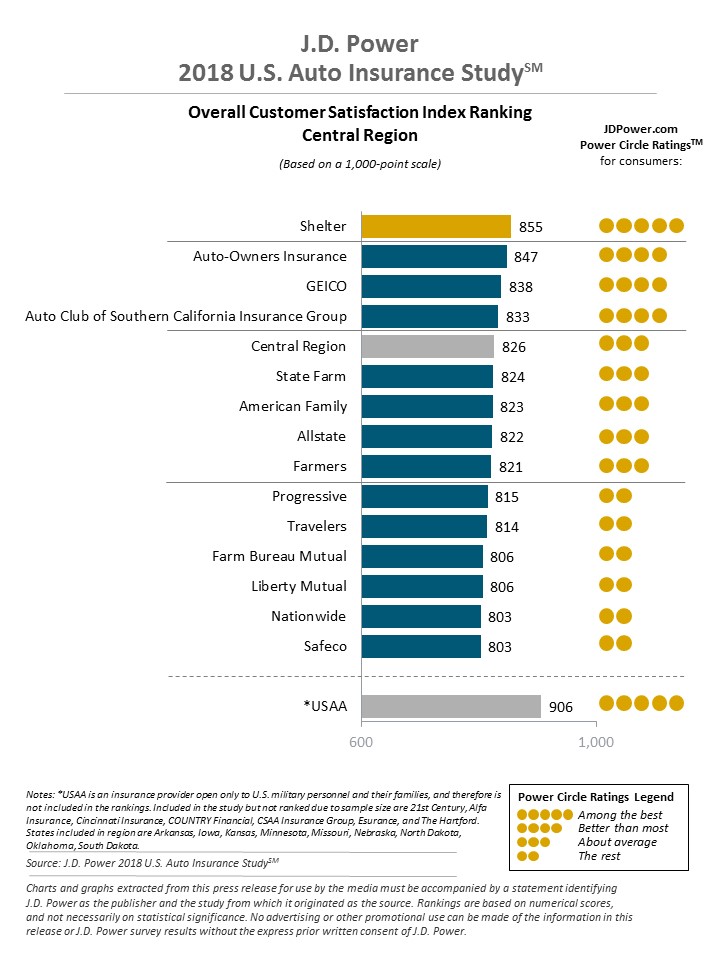

Which Companies Have the Best Ratings?

J.D. Power uses customer feedback to get accurate customer service ratings. This information not only helps consumers when buying and receiving services but also helps the business learn how to do better and raise customer satisfaction levels.

Which Companies Have the Most Complaints in Oklahoma?

We have looked at the good financial scores and the excellent customer service, but now we have to also look at the bad. You can find complaints of Oklahoma insurers on the Oklahoma Insurance Commissioner website.

| Providers | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| State Farm Group | 0.44 | 1,482 |

| Farmers Insurance Group | 0 | 0 |

| Progressive Group | 0.75 | 120 |

| Allstate Insurance Group | 0.5 | 163 |

| Geico | .007 | 6 |

| Liberty Mutual Group | .007 | 6 |

| USSA Group | 0 | 2 |

| Oklahoma Farm Bureau Group | 0.21 | 2 |

| CSAA Insurance Group | 3.97 | 6 |

| Shelter Insurance Group | 0.61 | 47 |

Who are the Cheapest Companies in Oklahoma?

Where can you get the best rates? Well, we took some of the cheapest companies in Oklahoma and compared them against the state average.

| Company | Company Annual Average | Percentage Compared to State Annual Average |

|---|---|---|

| State Farm Mutual Auto | $2,816.80 | -47.06% |

| USAA | $3,174.15 | -30.50% |

| Geico | $3,437.33 | -20.51% |

| Allstate F&C | $3,718.62 | -11.39% |

| Farmers Insurance Co | $4,142.40 | 0.0% |

| Progressive Northern | $4,832.35 | 14.28% |

| SAFECO Insurance Co of America | $6,874.62 | 39.74% |

State Farm and USAA were by far the cheapest when comparing their rates to the state averages.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Commute Rates by Companies?

If you have a long commute to work, it could increase your insurance premium. The more miles you are on the road, the more likely an insurance carrier can view you as a high risk.

As you can tell from the chart below, Oklahoma insurers do not weigh heavily, if at all, on your commute or miles per year.

| Company | Commute and Annual Mileage | Average Annual Rate |

|---|---|---|

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $6,874.62 |

| Liberty Mutual | 25 miles commute. 6000 annual mileage. | $6,874.62 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,832.35 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,832.35 |

| Farmers | 10 miles commute. 6000 annual mileage. | $4,142.40 |

| Farmers | 25 miles commute. 12000 annual mileage. | $4,142.40 |

| Allstate | 10 miles commute. 6000 annual mileage. | $3,718.62 |

| Allstate | 25 miles commute. 12000 annual mileage. | $3,718.62 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,371.88 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,502.79 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,135.87 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,212.43 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,768.69 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,864.91 |

What’s the Coverage Level Rates by Companies?

Often when you are looking at your budget, you tend to cut things you do not readily need. Insurance tends to be one of those areas that do not take precedence since it is not something you use daily. It may seem like a necessity, but consumers will cut the cost by buying minimum limits.

All you are required to buy is the minimal coverage, but the more you buy, the more protected you are. We compared the rates for low, medium, and high coverage.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Liberty Mutual | High | $7,253.93 |

| Liberty Mutual | Medium | $6,849.85 |

| Liberty Mutual | Low | $6,520.08 |

| Progressive | High | $5,214.67 |

| Progressive | Medium | $4,801.19 |

| Progressive | Low | $4,481.18 |

| Farmers | High | $4,369.10 |

| Farmers | Medium | $4,095.52 |

| Farmers | Low | $3,962.59 |

| Allstate | High | $3,958.78 |

| Allstate | Medium | $3,703.87 |

| Geico | High | $3,670.99 |

| Allstate | Low | $3,493.21 |

| Geico | Medium | $3,442.87 |

| USAA | High | $3,308.89 |

| Geico | Low | $3,198.14 |

| USAA | Medium | $3,165.21 |

| USAA | Low | $3,048.34 |

| State Farm | High | $3,007.85 |

| State Farm | Medium | $2,796.58 |

| State Farm | Low | $2,645.97 |

As you can see from the rates, State Farm has the lowest rates for all three levels of coverage.

What are the Credit History Rates by Companies?

When you have a larger purchase to make, such as a car or home, your credit follows you. If you have better credit you can normally get a better interest rate. What else does your credit history affect? Your insurance rates.

| Group | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $3,073.21 | $3,484.29 | $4,598.37 |

| Farmers | $3,735.69 | $3,927.60 | $4,763.91 |

| Geico | $2,732.76 | $3,437.33 | $4,141.91 |

| Liberty Mutual | $4,724.45 | $6,024.91 | $9,874.49 |

| Progressive | $4,340.94 | $4,669.23 | $5,486.87 |

| State Farm | $2,020.90 | $2,510.32 | $3,919.18 |

| USAA | $2,139.63 | $2,681.79 | $4,701.02 |

Take a look at the Liberty Mutual rates above. A lower credit score can raise your rate by several thousand dollars. The average Oklahoma resident has a credit score of 656, which is a “near-prime” score.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Driving Record Rates by Companies?

Your driving record is the most obvious rating factor with your insurance premium.

| Company | Driving Record | Average Annual Rate |

|---|---|---|

| Liberty Mutual | With 1 DUI | $8,761.12 |

| Liberty Mutual | With 1 accident | $7,744.42 |

| Progressive | With 1 accident | $6,992.38 |

| Liberty Mutual | With 1 speeding violation | $6,369.71 |

| Liberty Mutual | Clean record | $4,623.23 |

| Farmers | With 1 accident | $4,490.66 |

| Progressive | With 1 speeding violation | $4,419.80 |

| Farmers | With 1 DUI | $4,381.87 |

| Allstate | With 1 DUI | $4,329.11 |

| Geico | With 1 DUI | $4,256.03 |

| Farmers | With 1 speeding violation | $4,199.60 |

| Progressive | With 1 DUI | $4,154.13 |

| USAA | With 1 DUI | $4,112.53 |

| Geico | With 1 accident | $3,835.75 |

| Progressive | Clean record | $3,763.08 |

| Allstate | With 1 accident | $3,749.51 |

| Allstate | With 1 speeding violation | $3,597.46 |

| Farmers | Clean record | $3,497.47 |

| USAA | With 1 accident | $3,362.41 |

| Allstate | Clean record | $3,198.39 |

| Geico | With 1 speeding violation | $3,153.48 |

| State Farm | With 1 accident | $3,017.59 |

| USAA | With 1 speeding violation | $2,880.43 |

| State Farm | With 1 DUI | $2,816.80 |

| State Farm | With 1 speeding violation | $2,816.80 |

| State Farm | Clean record | $2,616.01 |

| Geico | Clean record | $2,504.07 |

| USAA | Clean record | $2,341.22 |

Going from a clean record to a DUI conviction usually causes the biggest jump in premiums.

Who are the Largest Car Insurance Companies in Oklahoma?

Here is a list of the largest insurance companies in Oklahoma.

| Providers | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $677,192 | 25.41% |

| Farmer's Insurance Group | $303,207 | 11.38% |

| Progressive Group | $238,951 | 8.96% |

| Allstate Insurance Group | $186,448 | 7.00% |

| Geico | $184,196 | 6.91% |

| Liberty Mutual Group | $174,654 | 6.55% |

| USAA Group | $172,914 | 6.49% |

| Oklahoma Farm Bureau Group | $105,712 | 3.97% |

| CSAA Insurance Group | $103,378 | 3.88% |

| Shelter Insurance Group | $92,167 | 3.46% |

What’s the Number of Insurers in Oklahoma?

So how many insurers are available to Oklahoma drivers? The total number is 904. We divide insurers by foreign and domestic, “foreign” meaning the insurer was formed under out of state laws, “domestic” meaning insurers are formed under Oklahoma state law.

| Domestic Companies | Foreign Companies | Total Number of Licensed Insurers |

|---|---|---|

| 31 | 873 | 904 |

Think you are ready for a quote? You can enter your zip code below and use our comparison quote tool for free.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Oklahoma State Laws?

In this next section, we are going to focus on the state laws of Oklahoma. Laws keep drivers safe on the roadways.

We are going to look at car insurance laws, like windshield and fraud, and then move to license laws. This is a great section for a new resident or for parents with teens wanting to get their license.

The rules of the road will wrap up this section with speeding laws, seatbelts, and more.

What are the Car Insurance Laws?

Car insurance and laws are both difficult things to research and understand, and if you put them together you may want to avoid the topic altogether.

To help you through this, we are going to break down the laws and help you understand them.

How State Laws for Insurance are Determined

State laws shape insurance regulations. The National Association of Insurance Commissioners lists out laws and regulations for each state. You can visit their website here to take a look or keep reading as we will cover the laws below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Windshield Coverage

We all hate when we are following a truck and suddenly hear the crack of a rock hitting our windshield. Do you have coverage for a broken windshield?

Most companies have windshield coverage if you have comprehensive coverage added to your policy. If you do need to replace or repair your windshield, Oklahoma has no unique laws. Your insurer may want you to use only approved repair shops, and they can use aftermarket parts if stated in the estimate given.

How to Get High-Risk Insurance

You could be considered a high-risk driver if you have been convicted of driving under the influence or have numerous violations on your license.

Oklahoma does not require SR-22 insurance filing, but if you currently have to file SR-22 you will still need to do so if you are a new resident to Oklahoma.

High-risk insurance may not cost you in regards to your filing, but if you have been convicted of a DUI or other violations, your insurance could be extremely high or you could have your license suspended — but more about that later.

How to Get Low-Cost Insurance

Oklahoma does not currently have a program for low-income families to obtain insurance. California, Hawaii, and New Jersey are the only states that have government programs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There an Automobile Insurance Fraud in Oklahoma?

The Insurance Information Institute says the following regarding fraud:

Insurance industry estimates generally put fraud at about 10 percent of the property/casualty insurance industry’s incurred losses and loss adjustment expenses each year, although the figure can fluctuate based on line of business, economic conditions and other factors.[1]. Using this measure, over the five-year period from 2013 to 2017, property/casualty fraud amounted to about $30 billion each year. Also, the Federal Bureau of Investigation said that healthcare fraud, both private and public, is an estimated 3 – 10 percent of total healthcare expenditures.[2]

That is a lot of money going to fraudulent claims every year.

There are two types of fraud: soft and hard. Soft fraud is the lies people may tell regarding mileage or making claims more than what they are. Hard fraud is when someone deliberately fabricates a story.

Fraud is illegal, and if you suspect it’s occurring, you should report it. Oklahoma takes fraud seriously and has an anti-fraud department dedicated to these crimes. You can find the Oklahoma Department of Insurance contact information here.

Is There a Statute of Limitations?

The statute of limitations is the time you have to file and resolve a claim. It is always better to file a claim as soon as it happens, but a consumer has two years, for both physical injury and property damage, to file a claim in the state of Oklahoma.

What are the Vehicle Licensing Laws?

You must maintain proper licensing, just like you must maintain insurance on your vehicle. We are going to break down the licensing laws of Oklahoma and find out what happens if you decide to drive without insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Real ID for?

The Real ID Act was passed by Congress in 2005 to set standards in the issuance of licenses in all states to maintain safety. If your state complies with these standards, you will be allowed to enter federal buildings and commercial aircraft carriers with your state driver’s license.

Oklahoma has filed an extension with the federal government to allow Oklahoma residents to use their current license rather than the new Real ID license.

What are the Penalties for Driving Without Insurance?

Oklahoma does not tolerate drivers operating a vehicle without insurance. The following can happen if you are found driving without insurance:

- A $250 fine

- Possible jail time up to 30 days

- Seizure of car and tags

- A reinstatement fee of $125 to obtain a license once insurance has been proved

You have 10 days to obtain valid insurance once you have been found without insurance.

What are the Teen Driver Laws?

The rite of passage for all teens is to get their driver’s license. Oklahoma has some laws to protect teens once they do.

To get your learner’s permit in Oklahoma, you must be 15 years and six months old. You must have your leaner’s permit for six months before being able to receive your license at 16 years of age.

At 16 years old you may take your driver’s test only after you have had 50 hours of supervised driving — 1o of those being at night. It does not stop there, though. Oklahoma also has the below restrictions for teen drivers.

| Restrictions | Limitations |

|---|---|

| Nighttime restrictions | 10 p.m. to 5 a.m. |

| Passenger restrictions (family members excluded unless noted otherwise) | no more than 1 passenger |

| Nighttime restrictions | -6 months with driver education -12 months without driver education or until age 18 (minimum age: 16 1/2) |

| Passenger restrictions | -6 months with driver education -12 months without driver education or until age 18 (minimum age: 16 1/2) |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Procedure for New Residents?

Welcome to the Sooner State! If you have moved to Oklahoma and have a valid out-of-state license, you can have your license changed to an Oklahoma license without taking the written or driving test.

Once you take your vision test and have shown the approved proof of resident and identification, you can get your Oklahoma driver’s license.

What are the License Renewal Procedures?

All license renewals in Oklahoma are the same, no matter your age. Every four years you must renew your driver’s license. You can not renew your license online or through mail at this time.

What are the Rules of the Road?

All states have rules to keep drivers safe. We are going to look at Oklahoma’s rules regarding seat belts, speed limits, and more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is Oklahoma a Fault or No-Fault State?

Oklahoma is an at-fault state when it comes to accidents. This means that if you are in an accident, the party at fault will be held responsible for damages and injury.

What are the Seat Belt & Car Seat Laws?

Most states have seat-belt and car-seat-safety laws. Oklahoma laws are listed below.

| Type of Car Seat Required | Age |

|---|---|

| Rear-Facing Child Safety Seat | Younger than 2 years (or until a child outgrows the manufacturer's top height or weight recommendations) |

| Child Restraint System | Younger than four years old |

| Child Restraint or Booster Seat | Four to seven years old (can't be taller than 4'9") |

| Adult Belt Permissible | Over eight years old (or taller than 4'9") |

Riding in the cargo area of a truck is allowed in Oklahoma.

Read more: What are the Oklahoma car seat laws?

What are the Keep Right & Move Over Laws?

Most drivers know the feeling of driving on the interstate behind a driver going below the speed limit. This is often a safety issue when drivers are trying to maneuver around slow drivers. All drivers going below the speed limit must stay to the right on Oklahoma roads.

Move over laws are also important for safety purposes. When approaching any emergency vehicle with flashing lights or maintenance vehicles, drivers are to vacate the closest lane to that vehicle.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Speed Limit?

Most speed limits are posted clearly on roads. Below is a chart listing most Oklahoma road speed limits.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 70 mph |

Remember, speed limits are subject to change, especially in construction zones.

Is Ridesharing Allowed?

Ridesharing has become a popular way to get a ride or make some extra cash on the side. Companies like Uber and Lyft have made ridesharing readily available to most drivers or riders.

If you want to become a driver for a ridesharing company, you must verify with your insurance company that you have coverage for ridesharing usage.

The following companies allow ridesharing use in Oklahoma:

- Allstate

- Farmers

- Geico

- Mercury

- State Farm

- USAA

What are the Safety Laws?

Oklahoma has laws in place to help keep dangerous drivers off the road. Driving under the influence of drugs or alcohol and distracted driving has become a danger on the road. We are going to take a look at the laws and penalties for this type of dangerous activity.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the DUI Laws?

| Type of Offense | Drinking Limits |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | 1st misdemeanor, 2nd+ in 10 years felony |

| Look Back Period | 10 years |

If you are convicted of driving under the influence in Oklahoma, you will be charged with a misdemeanor for your first offense. If you are convicted again, you will have a felony on your record.

If convicted, you could have possible jail time, license suspensions, and fines, not to mention you could harm or kill yourself or others. The use of marijuana is also considered driving under the influence. Oklahoma has not legalized the use of marijuana.

| DUI - 1st Offense | Consequences |

|---|---|

| License Revoked | 1 to 6 months |

| Jail Time | 5 days to 1 year |

| Fine | no minimum but up to $1,000 |

| Other | IID (ignition interlock) required for 18 months if BAC is 0.15+ |

| DUI - 2nd Offense | Consequences |

|---|---|

| License Revoked | 6 months minimum |

| Jail Time | 1-5 years |

| Fine | no minimum but up to $2,500 |

| Other | IID (ignition interlock) required for 5 years |

| DUI - 3rd Offense | Consequences |

|---|---|

| License Revoked | 1-3 years |

| Jail Time | 1-10 years |

| Fine | no minimum but up to $5,000 |

| Other | IID (ignition interlock) required for 5 years |

What are the Distracted Driving Laws?

You are unlikely to find an adult — or child — without a cell phone these days. Driving and cell phones are not a good mix. Texting while driving is banned in all of Oklahoma.

| Laws on Cellphones while Driving in Oklahoma | Who it Affects |

|---|---|

| Hand-held ban | Learner's permit and intermediate license holders |

| Text ban | All drivers |

| Enforcement | Primary |

What’s the Driving in Oklahoma like?

We have covered a lot about Oklahoma insurance and driving laws. Now, we are going to take a look at the things we all want to avoid, theft and roadway fatalities.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There a Vehicle Theft in Oklahoma?

It is no surprise that the top four most-stolen vehicles are pickup trucks.

| Car Model and Make | Most Popular Year of Vehicle Stolen | Total Number of Vehicles Stolen |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1994 | 1143 |

| Ford Pickup (Full Size) | 2004 | 780 |

| Dodge Pickup (Full Size) | 2001 | 419 |

| GMC Pickup (Full Size) | 1994 | 304 |

| Honda Civic | 1998 | 292 |

| Honda Accord | 1996 | 269 |

| Chevrolet Impala | 2005 | 181 |

| Chevrolet Pickup (Small Size) | 1998 | 127 |

| Ford Explorer | 2002 | 123 |

| Chevrolet Malibu | 2009 | 119 |

Read more: Honda Announces Massive Recall of 1.5 Million Cars

We gathered information from the Federal Bureau of Investigation to find which cities have the most stolen vehicles. Where does your city rank on the list?

| State | Population | Stolen Vehicles |

|---|---|---|

| Achille | 521 | 0 |

| Ada | 17,455 | 41 |

| Allen | 935 | 2 |

| Altus | 19,054 | 41 |

| Alva | 5,149 | 6 |

| Amber | 460 | 1 |

| Anadarko | 6,756 | 15 |

| Antlers | 2,306 | 3 |

| Apache | 1,439 | 4 |

| Ardmore | 25,211 | 63 |

| Arkoma | 1,914 | 7 |

| Atoka | 3,056 | 8 |

| Barnsdall | 1,197 | 2 |

| Bartlesville | 36,788 | 101 |

| Beaver | 1,429 | 0 |

| Beggs | 1,244 | 0 |

| Bethany | 19,620 | 72 |

| Big Cabin | 257 | 1 |

| Bixby | 26,131 | 66 |

| Blackwell | 6,765 | 8 |

| Blanchard | 8,649 | 12 |

| Boise City | 1,074 | 0 |

| Bokoshe | 493 | 0 |

| Boley | 1,183 | 0 |

| Bristow | 4,251 | 18 |

| Broken Arrow | 108,823 | 229 |

| Broken Bow | 4,100 | 22 |

| Cache | 2,857 | 3 |

| Caddo | 1,070 | 4 |

| Calera | 2,295 | 4 |

| Caney | 197 | 1 |

| Carnegie | 1,711 | 2 |

| Carney | 664 | 2 |

| Cashion | 860 | 0 |

| Catoosa | 7,129 | 68 |

| Cement | 499 | 0 |

| Chandler | 3,194 | 3 |

| Chattanooga | 441 | 0 |

| Checotah | 3,207 | 15 |

| Chelsea | 1,972 | 1 |

| Cherokee | 1,553 | 1 |

| Chickasha | 16,489 | 33 |

| Choctaw | 12,556 | 12 |

| Chouteau | 2,088 | 2 |

| Claremore | 19,147 | 30 |

| Clayton | 780 | 6 |

| Cleveland | 3,217 | 3 |

| Clinton | 9,455 | 19 |

| Coalgate | 1,850 | 1 |

| Colbert | 1,207 | 1 |

| Colcord | 814 | 2 |

| Collinsville | 6,836 | 4 |

| Comanche | 1,595 | 3 |

| Cordell | 2,852 | 4 |

| Covington | 547 | 0 |

| Coweta | 9,718 | 37 |

| Crescent | 1,564 | 1 |

| Cushing | 7,790 | 15 |

| Cyril | 1,053 | 0 |

| Davenport | 826 | 1 |

| Davis | 2,822 | 5 |

| Del City | 22,046 | 105 |

| Depew | 482 | 0 |

| Dewar | 865 | 1 |

| Dewey | 3,513 | 6 |

| Dibble | 846 | 0 |

| Dickson | 1,253 | 0 |

| Drumright | 2,870 | 5 |

| Duncan | 22,909 | 47 |

| Durant | 17,871 | 52 |

| Earlsboro | 644 | 5 |

| Edmond | 92,876 | 66 |

| Elgin | 3,164 | 1 |

| Elk City | 12,057 | 17 |

| Elmore City | 708 | 0 |

| El Reno | 19,133 | 25 |

| Enid | 51,257 | 92 |

| Erick | 1,034 | 1 |

| Eufaula | 2,971 | 17 |

| Fairfax | 1,335 | 2 |

| Fairview | 2,672 | 4 |

| Fletcher | 1,138 | 0 |

| Forest Park | 1,082 | 1 |

| Fort Gibson | 4,045 | 5 |

| Frederick | 3,621 | 4 |

| Geary | 1,286 | 7 |

| Glenpool | 13,954 | 18 |

| Goodwell | 1,311 | 0 |

| Gore | 939 | 1 |

| Grandfield | 955 | 0 |

| Granite | 2,008 | 0 |

| Grove | 6,868 | 23 |

| Guthrie | 11,713 | 21 |

| Guymon | 11,733 | 10 |

| Haileyville | 762 | 0 |

| Harrah | 6,215 | 6 |

| Hartshorne | 1,966 | 6 |

| Haskell | 1,960 | 0 |

| Healdton | 2,757 | 2 |

| Heavener | 3,328 | 3 |

| Hennessey | 2,219 | 2 |

| Henryetta | 5,737 | 18 |

| Hinton | 3,273 | 6 |

| Hobart | 3,567 | 0 |

| Holdenville | 5,663 | 10 |

| Hollis | 1,886 | 2 |

| Hominy | 3,485 | 7 |

| Hooker | 1,959 | 1 |

| Howe | 789 | 0 |

| Hulbert | 607 | 0 |

| Hydro | 959 | 1 |

| Idabel | 6,940 | 14 |

| Jay | 2,520 | 4 |

| Jenks | 22,693 | 32 |

| Jennings | 359 | 2 |

| Jones | 3,067 | 7 |

| Kellyville | 1,147 | 2 |

| Kiefer | 1,968 | 4 |

| Kingfisher | 4,931 | 6 |

| Kingston | 1,634 | 1 |

| Konawa | 1,267 | 4 |

| Krebs | 1,928 | 9 |

| Lahoma | 645 | 0 |

| Lamont | 402 | 0 |

| Langley | 819 | 7 |

| Langston | 1,857 | 0 |

| Lawton | 94,134 | 314 |

| Lexington | 2,169 | 7 |

| Lindsay | 2,827 | 6 |

| Locust Grove | 1,401 | 3 |

| Lone Grove | 5,252 | 3 |

| Luther | 1,675 | 1 |

| Madill | 3,937 | 7 |

| Mangum | 2,848 | 6 |

| Mannford | 3,150 | 3 |

| Marietta | 2,782 | 6 |

| Marlow | 4,520 | 7 |

| Maud | 1,077 | 2 |

| Maysville | 1,233 | 0 |

| McAlester | 18,181 | 48 |

| McCurtain | 510 | 1 |

| McLoud | 4,656 | 10 |

| Medicine Park | 447 | 0 |

| Meeker | 1,179 | 0 |

| Miami | 13,470 | 13 |

| Midwest City | 57,772 | 143 |

| Minco | 1,649 | 0 |

| Moffett | 121 | 0 |

| Moore | 62,476 | 101 |

| Mooreland | 1,240 | 0 |

| Morris | 1,464 | 0 |

| Mounds | 1,200 | 0 |

| Mountain View | 759 | 1 |

| Muldrow | 3,250 | 7 |

| Muskogee | 38,199 | 110 |

| Mustang | 21,392 | 13 |

| Nash | 202 | 0 |

| Newcastle | 10,011 | 24 |

| Newkirk | 2,217 | 2 |

| Nichols Hills | 3,940 | 6 |

| Nicoma Park | 2,473 | 7 |

| Ninnekah | 1,033 | 0 |

| Noble | 6,799 | 10 |

| Norman | 124,074 | 277 |

| North Enid | 922 | 0 |

| Nowata | 3,709 | 2 |

| Oilton | 1,015 | 1 |

| Okemah | 3,239 | 10 |

| Oklahoma City | 648,260 | 2,800 |

| Okmulgee | 12,183 | 25 |

| Olustee | 576 | 0 |

| Owasso | 36,869 | 77 |

| Paoli | 616 | 0 |

| Pauls Valley | 6,225 | 16 |

| Pawhuska | 3,461 | 5 |

| Pawnee | 2,160 | 7 |

| Perkins | 2,841 | 6 |

| Perry | 5,000 | 6 |

| Piedmont | 7,738 | 1 |

| Pocola | 4,073 | 4 |

| Ponca City | 24,397 | 48 |

| Pond Creek | 854 | 0 |

| Porum | 707 | 0 |

| Poteau | 8,913 | 21 |

| Prague | 2,464 | 4 |

| Pryor Creek | 9,517 | 40 |

| Purcell | 6,483 | 22 |

| Quinton | 987 | 3 |

| Ringling | 989 | 1 |

| Roland | 3,720 | 6 |

| Rush Springs | 1,271 | 3 |

| Salina | 1,381 | 3 |

| Sallisaw | 8,548 | 8 |

| Sand Springs | 19,977 | 75 |

| Sapulpa | 21,062 | 83 |

| Savanna | 642 | 2 |

| Sawyer | 312 | 0 |

| Sayre | 4,644 | 6 |

| Seiling | 850 | 0 |

| Seminole | 7,415 | 18 |

| Shady Point | 995 | 1 |

| Shattuck | 1,333 | 1 |

| Shawnee | 31,725 | 155 |

| Skiatook | 8,018 | 21 |

| Snyder | 1,326 | 1 |

| South Coffeyville | 758 | 2 |

| Sparks | 174 | 0 |

| Spencer | 4,031 | 13 |

| Sperry | 1,292 | 10 |

| Spiro | 2,184 | 2 |

| Sportsmen Acres | 312 | 0 |

| Stigler | 2,760 | 5 |

| Stillwater | 50,159 | 60 |

| Stilwell | 4,062 | 20 |

| Stratford | 1,539 | 4 |

| Stringtown | 401 | 0 |

| Stroud | 2,792 | 9 |

| Sulphur | 5,105 | 6 |

| Tahlequah | 16,905 | 43 |

| Talala | 278 | 1 |

| Talihina | 1,094 | 1 |

| Tecumseh | 6,699 | 14 |

| Texhoma | 955 | 1 |

| Thackerville | 478 | 0 |

| The Village | 9,512 | 11 |

| Thomas | 1,235 | 1 |

| Tipton | 779 | 0 |

| Tishomingo | 3,119 | 6 |

| Tonkawa | 3,077 | 3 |

| Tryon | 505 | 1 |

| Tulsa | 404,868 | 3,460 |

| Tupelo | 313 | 1 |

| Tushka | 301 | 0 |

| Tuttle | 7,140 | 24 |

| Tyrone | 769 | 0 |

| Union City | 2,053 | 2 |

| Valley Brook | 779 | 9 |

| Valliant | 737 | 0 |

| Velma | 602 | 0 |

| Verden | 527 | 0 |

| Verdigris | 4,488 | 4 |

| Vian | 1,383 | 4 |

| Vici | 702 | 0 |

| Vinita | 5,532 | 9 |

| Wagoner | 8,931 | 10 |

| Wakita | 339 | 1 |

| Walters | 2,464 | 2 |

| Warner | 1,614 | 1 |

| Warr Acres | 10,480 | 46 |

| Washington | 655 | 0 |

| Watonga | 2,931 | 2 |

| Watts | 310 | 2 |

| Waukomis | 1,349 | 0 |

| Waynoka | 960 | 2 |

| Weatherford | 12,178 | 14 |

| Webbers Falls | 593 | 0 |

| Weleetka | 981 | 2 |

| West Siloam Springs | 839 | 14 |

| Westville | 1,561 | 8 |

| Wewoka | 3,390 | 3 |

| Wilburton | 2,633 | 4 |

| Wilson | 1,721 | 0 |

| Wister | 1,067 | 1 |

| Woodward | 12,655 | 18 |

| Wright City | 733 | 0 |

| Wyandotte | 330 | 0 |

| Wynnewood | 2,227 | 2 |

| Wynona | 440 | 0 |

| Yale | 1,207 | 5 |

| Yukon | 26,971 | 17 |

What is the Number of Road Fatalities in Oklahoma?

No matter how cautious of a driver you are, road fatalities still occur. In this next section, we have gathered information about when and where most fatalities in Oklahoma happen. We give you this information to help spread awareness and hopefully help prevent fatalities in the future.

What’s the Most Fatal Highway in Oklahoma?

Route 69 runs north to south over 260 miles of Oklahoma roadway. This road is considered to be the most fatal highway with an average of 13 deaths a year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Fatal Crashes by Weather Condition & Light Condition?

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 281 | 50 | 195 | 27 | 3 | 556 |

| Rain | 13 | 3 | 17 | 1 | 1 | 35 |

| Snow/Sleet | 0 | 0 | 1 | 0 | 0 | 1 |

| Other | 7 | 1 | 7 | 0 | 0 | 15 |

| Unknown | 1 | 1 | 1 | 0 | 1 | 4 |

| TOTAL | 302 | 55 | 221 | 28 | 5 | 611 |

Many drivers think rain and dark bring accidents, but as you can see from the table above, that is not always the case. Most accidents in Oklahoma happen in lighted, normal conditions.

What’s the Number of Fatalities by County?

Here is a list of fatalities by county. Larger cities like Tulsa and Oklahoma see higher rates of fatalities due to population size.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adair | 4 | 3 | 3 | 2 | 8 |

| Alfalfa | 1 | 1 | 3 | 2 | 1 |

| Atoka | 8 | 9 | 3 | 5 | 7 |

| Beaver | 2 | 5 | 5 | 2 | 4 |

| Beckham | 4 | 6 | 9 | 8 | 5 |

| Blaine | 4 | 7 | 1 | 2 | 8 |

| Bryan | 10 | 17 | 11 | 20 | 11 |

| Caddo | 13 | 14 | 7 | 7 | 12 |

| Canadian | 12 | 14 | 12 | 17 | 24 |

| Carter | 14 | 16 | 11 | 11 | 11 |

| Cherokee | 6 | 9 | 7 | 10 | 11 |

| Choctaw | 1 | 5 | 5 | 8 | 7 |

| Cimarron | 0 | 1 | 2 | 1 | 2 |

| Cleveland | 21 | 16 | 28 | 14 | 25 |

| Coal | 2 | 1 | 0 | 1 | 0 |

| Comanche | 15 | 15 | 12 | 15 | 16 |

| Cotton | 5 | 2 | 4 | 3 | 2 |

| Craig | 8 | 7 | 0 | 6 | 2 |

| Creek | 23 | 12 | 14 | 14 | 8 |

| Custer | 5 | 5 | 6 | 5 | 7 |

| Delaware | 15 | 11 | 7 | 10 | 8 |

| Dewey | 3 | 6 | 3 | 5 | 2 |

| Ellis | 5 | 4 | 1 | 1 | 1 |

| Garfield | 10 | 7 | 4 | 10 | 5 |

| Garvin | 8 | 15 | 5 | 12 | 7 |

| Grady | 19 | 17 | 17 | 16 | 14 |

| Grant | 3 | 2 | 3 | 5 | 0 |

| Greer | 3 | 2 | 1 | 5 | 4 |

| Harmon | 0 | 0 | 1 | 0 | 1 |

| Harper | 0 | 1 | 3 | 6 | 2 |

| Haskell | 2 | 5 | 2 | 2 | 4 |

| Hughes | 2 | 2 | 2 | 2 | 3 |

| Jackson | 2 | 3 | 3 | 4 | 2 |

| Jefferson | 2 | 1 | 1 | 4 | 0 |

| Johnston | 6 | 3 | 2 | 3 | 5 |

| Kay | 12 | 2 | 15 | 6 | 4 |

| Kingfisher | 3 | 5 | 6 | 6 | 7 |

| Kiowa | 5 | 3 | 5 | 0 | 4 |

| Latimer | 3 | 1 | 4 | 3 | 4 |

| Le Flore | 7 | 10 | 14 | 18 | 16 |

| Lincoln | 14 | 11 | 9 | 11 | 11 |

| Logan | 5 | 10 | 7 | 7 | 2 |

| Love | 4 | 6 | 3 | 5 | 6 |

| Major | 7 | 2 | 7 | 5 | 3 |

| Marshall | 2 | 4 | 4 | 4 | 3 |

| Mayes | 12 | 15 | 7 | 21 | 14 |

| Mcclain | 9 | 7 | 7 | 16 | 14 |

| Mccurtain | 16 | 9 | 8 | 14 | 11 |

| Mcintosh | 6 | 3 | 5 | 7 | 3 |

| Murray | 4 | 9 | 4 | 4 | 5 |

| Muskogee | 20 | 11 | 14 | 5 | 5 |

| Noble | 9 | 3 | 1 | 4 | 7 |

| Nowata | 4 | 10 | 6 | 2 | 5 |

| Okfuskee | 4 | 4 | 1 | 4 | 5 |

| Oklahoma | 75 | 73 | 85 | 88 | 90 |

| Okmulgee | 10 | 12 | 7 | 13 | 3 |

| Osage | 7 | 5 | 8 | 8 | 11 |

| Ottawa | 8 | 4 | 11 | 7 | 14 |

| Pawnee | 3 | 2 | 3 | 6 | 4 |

| Payne | 22 | 20 | 16 | 10 | 9 |

| Pittsburg | 10 | 7 | 13 | 7 | 10 |

| Pontotoc | 7 | 9 | 8 | 14 | 9 |

| Pottawatomie | 6 | 9 | 20 | 21 | 12 |

| Pushmataha | 3 | 5 | 5 | 1 | 3 |

| Roger Mills | 3 | 3 | 0 | 3 | 0 |

| Rogers | 14 | 13 | 22 | 16 | 9 |

| Seminole | 6 | 13 | 5 | 10 | 12 |

| Sequoyah | 6 | 10 | 8 | 2 | 8 |

| Stephens | 5 | 11 | 6 | 4 | 3 |

| Texas | 0 | 3 | 8 | 3 | 7 |

| Tillman | 0 | 0 | 0 | 1 | 1 |

| Tulsa | 71 | 61 | 72 | 67 | 70 |

| Wagoner | 16 | 15 | 6 | 10 | 6 |

| Washington | 1 | 6 | 6 | 6 | 5 |

| Washita | 8 | 8 | 5 | 1 | 5 |

| Woods | 7 | 1 | 2 | 2 | 0 |

| Woodward | 6 | 10 | 4 | 7 | 6 |

What’s the Number of Traffic Fatalities?

More roadway deaths happen in rural areas than urban.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 523 | 498 | 465 | 497 | 468 | 499 | 468 | 391 | 426 | 417 |

| Urban | 226 | 239 | 203 | 199 | 241 | 229 | 201 | 254 | 260 | 238 |

| Total | 750 | 737 | 668 | 696 | 709 | 678 | 669 | 645 | 687 | 655 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Fatalities by Person Type?

Passenger car occupants have more fatalities than other vehicles or pedestrians.

| Traffic Deaths by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 230 | 226 | 222 | 207 | 198 |

| Light Pickup Truck Occupants | 130 | 174 | 121 | 144 | 123 |

| Light Utility Truck Occupants | 92 | 82 | 78 | 88 | 86 |

| Van Occupants | 22 | 18 | 21 | 31 | 27 |

| Large Truck Occupants | 29 | 41 | 27 | 27 | 28 |

| Other/Unknown Occupants | 9 | 11 | 9 | 6 | 11 |

| Bus Occupants | 0 | 4 | 0 | 0 | 0 |

| Motorcyclists | 92 | 57 | 89 | 88 | 93 |

| Pedestrians | 58 | 50 | 70 | 88 | 78 |

| Bicyclists and Other Cyclists | 13 | 4 | 6 | 5 | 6 |

| Other/Unknown Non-occupants | 3 | 2 | 2 | 3 | 5 |

| State Total | 678 | 669 | 645 | 687 | 655 |

What’s the Number of Fatalities by Crash Type

Below we have listed the different types of crashes, involving fatalities. Departure from roadways has the highest number of fatalities.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 678 | 669 | 645 | 687 | 655 |

| Single Vehicle | 351 | 335 | 351 | 376 | 357 |

| Involving a Large Truck | 112 | 134 | 106 | 126 | 133 |

| Involving Speeding | 174 | 152 | 171 | 185 | 143 |

| Involving a Rollover | 232 | 246 | 217 | 223 | 210 |

| Involving a Roadway Departure | 385 | 402 | 359 | 386 | 370 |

| Involving an Intersection (or Intersection Related) | 134 | 146 | 116 | 139 | 126 |

Five-Year Trend For The Top 10 Counties

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Oklahoma County | 75 | 73 | 85 | 88 | 90 |

| Tulsa County | 71 | 61 | 72 | 67 | 70 |

| Cleveland County | 21 | 16 | 28 | 14 | 25 |

| Canadian County | 12 | 14 | 12 | 17 | 24 |

| Comanche County | 15 | 15 | 12 | 15 | 16 |

| Le Flore County | 7 | 10 | 14 | 18 | 16 |

| Grady County | 19 | 17 | 17 | 16 | 14 |

| McClain County | 9 | 7 | 7 | 16 | 14 |

| Mayes County | 12 | 15 | 7 | 21 | 14 |

| Ottawa County | 8 | 4 | 11 | 7 | 14 |

| Top 10 County Total | 298 | 265 | 303 | 300 | 297 |

| State Total (Includes All Counties) | 678 | 669 | 645 | 687 | 655 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Fatalities Involving Speeding by County

| County | 2015 | 2016 | 2017 | County | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|

| Atoka County | 0 | 1 | 4 | Garfield County | 3 | 0 | 1 |

| Dewey County | 0 | 1 | 1 | Wagoner County | 4 | 4 | 1 |

| Le Flore County | 6 | 5 | 8 | Alfalfa County | 0 | 0 | 0 |

| Texas County | 1 | 1 | 3 | Beaver County | 1 | 1 | 0 |

| Cherokee County | 1 | 3 | 7 | Beckham County | 3 | 2 | 0 |

| Woodward County | 3 | 4 | 3 | Carter County | 3 | 1 | 0 |

| Caddo County | 2 | 4 | 4 | Cimarron County | 0 | 1 | 0 |

| Adair County | 2 | 1 | 3 | Coal County | 0 | 1 | 0 |

| Choctaw County | 0 | 2 | 2 | Cotton County | 0 | 0 | 0 |

| Mccurtain County | 2 | 2 | 4 | Ellis County | 1 | 1 | 0 |

| Delaware County | 2 | 3 | 5 | Garvin County | 3 | 1 | 0 |

| Blaine County | 0 | 0 | 1 | Grady County | 4 | 2 | 0 |

| Love County | 0 | 1 | 1 | Grant County | 1 | 1 | 0 |

| Mayes County | 1 | 5 | 4 | Greer County | 0 | 4 | 0 |

| Johnston County | 2 | 0 | 1 | Harmon County | 0 | 0 | 0 |

| Hughes County | 0 | 1 | 1 | Harper County | 0 | 3 | 0 |

| Craig County | 0 | 0 | 1 | Haskell County | 0 | 1 | 0 |

| Custer County | 1 | 3 | 2 | Jackson County | 0 | 0 | 0 |

| Pittsburg County | 7 | 3 | 3 | Jefferson County | 0 | 4 | 0 |

| Pawnee County | 1 | 1 | 1 | Kingfisher County | 1 | 1 | 0 |

| Creek County | 0 | 3 | 4 | Kiowa County | 1 | 0 | 0 |

| Pontotoc County | 1 | 1 | 2 | Latimer County | 1 | 1 | 0 |

| Mcclain County | 2 | 3 | 2 | Lincoln County | 1 | 0 | 0 |

| Sequoyah County | 4 | 0 | 2 | Major County | 1 | 0 | 0 |

| Rogers County | 2 | 6 | 4 | Marshall County | 2 | 1 | 0 |

| Bryan County | 2 | 7 | 2 | Mcintosh County | 2 | 4 | 0 |

| Canadian County | 1 | 2 | 6 | Murray County | 0 | 1 | 0 |

| Seminole County | 3 | 3 | 1 | Noble County | 1 | 1 | 0 |

| Washington County | 0 | 2 | 2 | Nowata County | 1 | 1 | 0 |

| Ottawa County | 3 | 0 | 1 | Okfuskee County | 0 | 1 | 0 |

| Tulsa County | 22 | 24 | 20 | Okmulgee County | 3 | 4 | 0 |

| Muskogee County | 3 | 1 | 2 | Pottawatomie County | 5 | 3 | 0 |

| Oklahoma County | 36 | 30 | 21 | Pushmataha County | 0 | 0 | 0 |

| Payne County | 1 | 4 | 2 | Roger Mills County | 0 | 0 | 0 |

| Kay County | 3 | 1 | 1 | Stephens County | 0 | 0 | 0 |

| Cleveland County | 8 | 3 | 6 | Tillman County | 0 | 0 | 0 |

| Logan County | 1 | 0 | 1 | Washita County | 1 | 1 | 0 |

| Osage County | 3 | 4 | 1 | Woods County | 0 | 1 | 0 |

| Comanche County | 2 | 3 | 2 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Listed below are fatalities in the top 10 counties caused by drunk driving.

| County Name | 2015 | 2016 | 2017 |

|---|---|---|---|

| Carter County | 3 | 6 | 4 |

| Cimarron County | 7 | 3 | 5 |

| Comanche County | 7 | 5 | 5 |

| Dewey County | 5 | 5 | 3 |

| Grant County | 3 | 3 | 8 |

| Jackson County | 7 | 7 | 3 |

| Johnston County | 26 | 26 | 32 |

| Kay County | 18 | 25 | 25 |

| Logan County | 10 | 4 | 7 |

| Marshall County | 7 | 4 | 1 |

Teen Drinking & Driving

| Number of Under 18 DWI Arrests: | Total per One Million People (DWI Under 18 Arrests): | Rank: |

|---|---|---|

| 107 | 111.27 | 18 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the EMS Response Time?

In the unfortunate event of the need for emergency medical services, you want to know EMS can get you to a hospital quickly. Below is a chart showing times for both urban and rural areas.

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Rural | 9.44 min | 16.21 min | 49.34 min | 66.75 min | 383 |

| Urban | 4.18 min | 7.33 min | 30.04 min | 37.81 min | 244 |

What is Transportation like in California?

Lastly, we are going to look at car ownership and how much time the average Oklahoma driver spends in their cars.

The graphs below were gathered from Data USA. The national average is in gray and the average Oklahoma residents, orange.

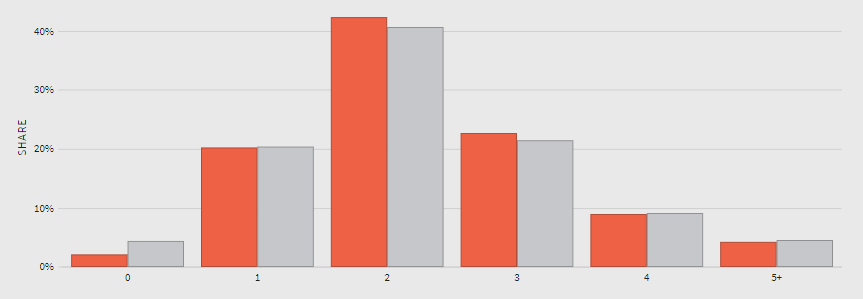

What’s the Average Car Ownership?

Like most Americans, most Oklahoma families have two cars.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

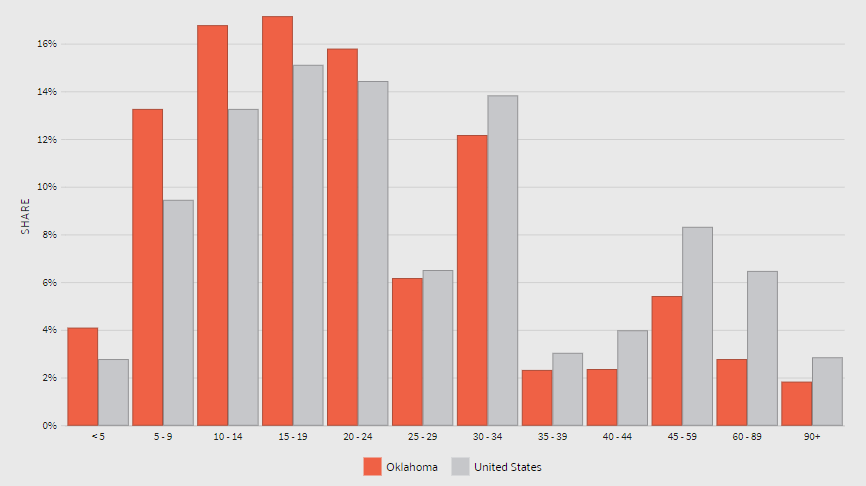

What’s the Average Commute Time?

The average worker commutes a little over 20 minutes to get to work, which is a little under the national average of 25 minutes.

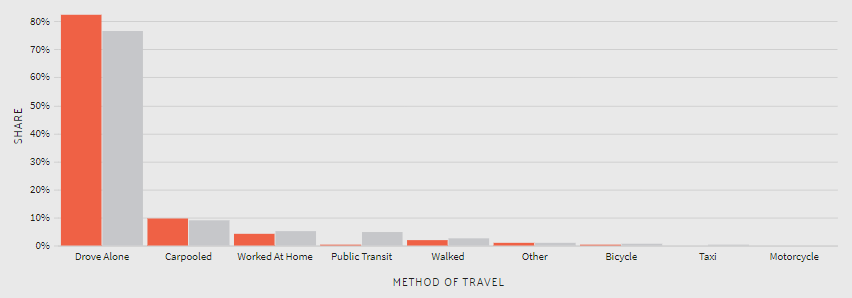

Commuter Transportation

Most Oklahoma drivers prefer to drive to work alone.

Is There a Traffic Congestion in Oklahoma?

We took a look at two of the biggest cities in Oklahoma — Tulsa and Oklahoma City.

Tulsa drivers lose 33 hours in congestion and $456 per driver a year. It doesn’t get better for Oklahoma City drivers. They lose 51 hours and $716 per driver a year.

Whew! That was a lot of information. We hope you have learned a lot about Oklahoma car insurance and feel ready to conquer the task of obtaining the best auto insurance. Don’t forget, you can enter your zip code here and use our free comparison tool to start your rate searching.