Idaho Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 8.20

Are you looking to settle in the northwest? Maybe settle somewhere in the mountains in a little cabin? Well if you are, Idaho may be just where you’re looking for.

What you may not be looking forward to, is searching for the right car insurance for your new Idaho life. What kind of coverage do you need to live in the Gem State?

That’s what we’re here to help you with. We’ve made up this comprehensive guide to help you navigate the terrain of the car insurance world.

In this guide, we will explore all of the topics you’ll want to know for picking out the perfect car insurance policy for yourself. We’ll talk about everything from car insurance coverage and rates, insurance providers, the state laws prevalent in Idaho, and much more.

Ready to start comparing rates today? Use our FREE online tool to get started, all you need is your zip code.

What Are Idaho Insurance Coverage and Rates?

It’s hard enough trying to find car insurance coverage, let alone the best coverage that’ll fit your needs. Idaho mandates that ALL drivers are to have insurance coverage, but the choices can feel extremely overwhelming.

It’s important to us that you know exactly what you’re paying for. In this section, we’ve explained the major coverage types and rates you’ll find in Idaho.

Keep reading to find out more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Idaho Minimum Coverage?

Each state requires something known as minimum liability coverage. This coverage ensures that should you be in an accident, you are able to pay for the costs of that accident (both the cost of repair costs for vehicles and any medical bills that may be accrued) for either yourself or for another driver should you be the driver at fault. Idaho follows a minimum liability coverage of 25/50/15.

What exactly does this mean? Well, we’ve explained this coverage for you below.

- 25 = $25,000 for the payment of any bodily injuries of ONE person [Bodily Injury Liability Coverage]

- 50 = $50,000 for the payment of any bodily injuries of MULTIPLE people [Bodily Injury Liability Coverage]

- 15 = $15,000 for the payment of any property damage [Property Damage Liability Coverage]

In addition to this, Idaho requires that all drivers must also have uninsured motorist coverage to protect themselves from uninsured drivers that is equal to the insured’s selected bodily liability coverage (for medical expenses) amount.

Meaning that if you select a policy with a bodily liability coverage amount of $75,000, you will need to have uninsured motorist coverage that is equal to that amount.

Under Idaho’s Statute Section 41-2502, however, you may opt to waive this requirement in writing in the form of a bond.

“Drivers may opt to post an indemnity bond to meet Idaho’s financial responsibility requirements in lieu of taking out liability insurance. However, the risks of driving without auto insurance coverage for your vehicle make this an ill-advised maneuver in most scenarios.”

Keep in mind that the amounts listed above are the MINIMUM requirements for coverage you are allowed to have to legally drive in Idaho. This may not be enough coverage for you, however, if you are in a severe enough accident. Forcing you to shell out your hard-earned cash to cover the costs.

It is wise to consider carrying more than the minimum insurance requirements, as there are many optional coverages beyond the insurance requirements that come in handy in a variety of situations. Common types of additional coverage include collision insurance, comprehensive insurance (for weather and natural disaster damage as well as vehicle theft), underinsured motorist insurance, and GAP coverage. You can find affordable auto insurance that gives you the protection you need.

What About Forms of Financial Responsibility?

Forms of financial responsibility, more commonly known as proof of insurance, allow you to legally prove that you are in fact insured. You’ll be asked to provide this anytime you are in an accident, are pulled over by law enforcement, and more.

Making sure you have your proof of insurance on you at all times while driving is vital.

So what exactly can you use as a form of responsibility?

- Valid (as well as current) insurance ID card (most states will allow both a physical copy and an electronic copy on your mobile device)

- Copy of your insurance policy

- SR-22 (a certificate of insurance that you can carry instead)

If you are caught driving without your proof of insurance, you could be facing some serious fines and penalties. So make sure you keep it with you at all times.

What About Premiums as a Percentage of Income?

Premiums in a state can often be affected by something known as per capita disposable income. What does this mean? Well, think of it this way.

If you make an annual salary of $50,000 per year, whatever you have left after taxes are taken out is your disposable income. This then in turn, with the average disposable income of all of the other people in that particular state, turns into the per capita disposable income.

So what is Idaho’s?

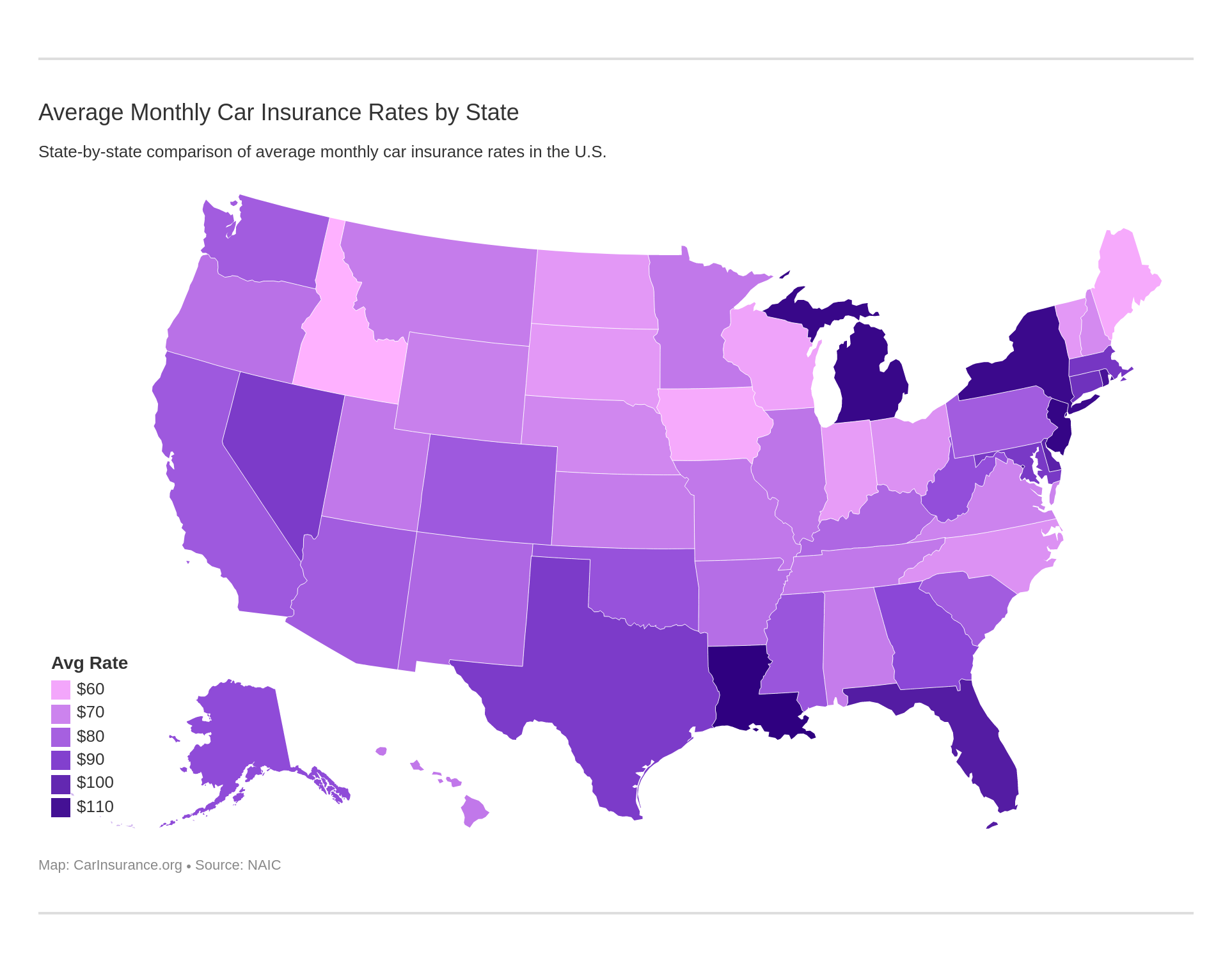

The average per capita disposable income for Idaho citizens is about $41,826.

If you divide this up by month, this means that on average residents of Idaho have about $3,500 to spend. This is in addition to all of the other expenses you would normally have in a given month, such as living expenses, health insurance, etc.

The average yearly cost of Idaho car insurance is approximately $700, which means you’ll have to take about $58 per month out of your monthly disposable income for your car insurance.

So making sure you keep your insurance rate as low as you can by driving safe, you’ll drive down your costs even further.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Average Monthly Car Insurance Rates in ID (Liability, Collision, Comprehensive)?

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

| Coverage Type | Annual Cost as of 2015 |

|---|---|

| Liability | $344.29 |

| Collision | $219.05 |

| Comprehensive | $116.55 |

| Combined | $679.89 |

What About Additional Coverage?

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 69.52 | 73.00 | 79.94 |

| Uninsured/ Underinsured Motorist Coverage | 54.69 | 57.40 | 59.20 |

If you take a look at the table above, you’ll see the average loss ratio’s for car insurance providers in the state of Idaho.

Loss ratios are the percentage of loss that a car insurance company has in comparison with the amount they receive from premiums. What does this mean for you exactly?

You want your insurance provider to have a loss ratio that’s right in the middle. Not too high, and not too low.

If a provider has a loss ratio that is too high (over 100 percent), it means that they are paying out more claims than they anticipated and are probably losing money. A high loss ratio is a good indicator of future rate increases.

If a company has a loss ratio that is too low, it means that the provider isn’t paying as many claims as expected and that they might have overpriced their policies.

Uninsured/Underinsured Motorist Coverage, as you’ll recall from a previous section, is required by the state of Idaho (unless waived in writing). Well, from the information above, you can see that the loss ratio is a little on the low side.

Insurance providers will likely want to think about lowering their premiums because they are paying only around 50 percent for their claims.

Medical Payments (MedPay), on the other hand, has loss ratios that are much more than what you would want from your insurance providers. They are paying out a fair amount to their clients, earning them a higher loss ratio.

Coverage such as MedPay is optional, but it doesn’t mean that it is something you should shirk off. It is extremely valuable coverage that could mean the world of a difference if you were to ever be in an accident.

What About Add-Ons, Endorsements, and Riders?

What other kinds of coverage options should you consider? There are so many choices that it can be a little overwhelming.

We’ve helped you out by listing some of the most valuable coverage options that you can add to your policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

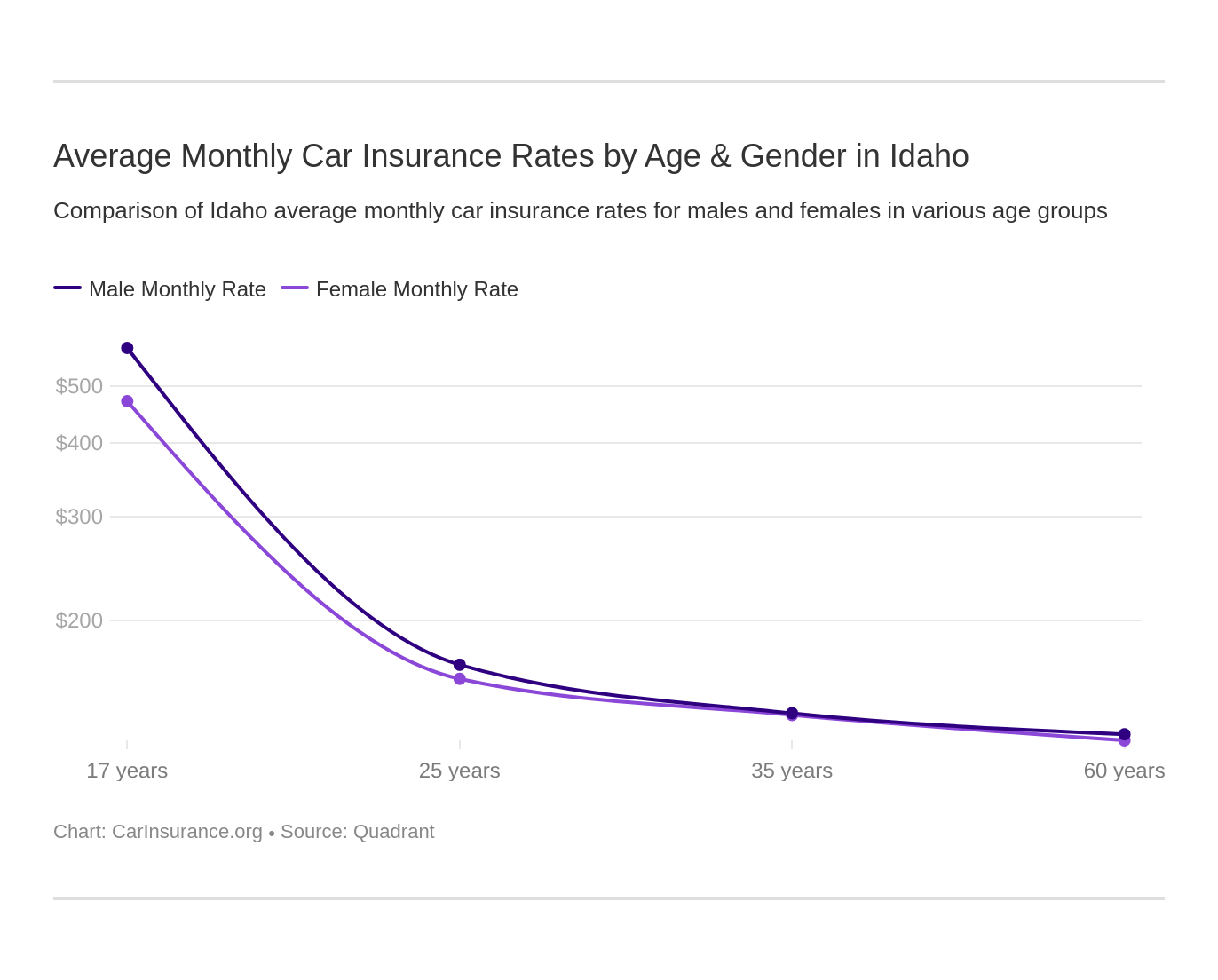

What Are the Average Monthly Car Insurance Rates by Age & Gender in ID?

What particular demographic you fall into, as well as marital status, can heavily influence your insurance rate in some states. On average, men tend to pay more for their rates than women do, as they are typically seen as higher-risk drivers.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,345.01 | $2,332.52 | $2,040.06 | $2,114.91 | $8,575.44 | $9,910.14 | $2,620.54 | $2,771.46 |

| American Family Mutual | $2,098.66 | $2,098.66 | $1,865.53 | $1,865.53 | $7,458.86 | $9,709.85 | $2,098.66 | $2,634.55 |

| Farmers Ins Co Of ID | $1,579.86 | $1,568.87 | $1,394.21 | $1,475.19 | $7,662.21 | $7,928.27 | $1,819.86 | $1,917.77 |

| Geico General | $2,003.54 | $1,977.85 | $1,905.97 | $1,851.21 | $4,285.41 | $5,332.81 | $2,715.75 | $2,092.87 |

| Safeco Ins Co of IL | $1,441.66 | $1,555.14 | $1,167.08 | $1,303.18 | $4,638.27 | $5,157.45 | $1,530.65 | $1,618.67 |

| Depositors Insurance | $1,856.77 | $1,901.41 | $1,674.47 | $1,778.32 | $4,550.02 | $5,610.65 | $2,171.95 | $2,339.94 |

| State Farm Mutual Auto | $1,150.90 | $1,150.90 | $1,037.46 | $1,037.46 | $3,436.89 | $4,333.19 | $1,298.56 | $1,498.32 |

| Travelers Home & Marine Ins Co | $1,355.74 | $1,376.87 | $1,363.72 | $1,357.36 | $6,688.71 | $10,577.29 | $1,440.61 | $1,650.04 |

| USAA | $1,099.98 | $1,098.36 | $1,073.73 | $1,059.32 | $3,611.65 | $4,046.57 | $1,458.58 | $1,572.68 |

This trend seems to be relatively true in Idaho as well, as single males pay a good bit more for their insurance rates than their counterparts. Married couples, however, have the opposite effect. Married men seem to pay less for their insurance coverage than their spouses do.

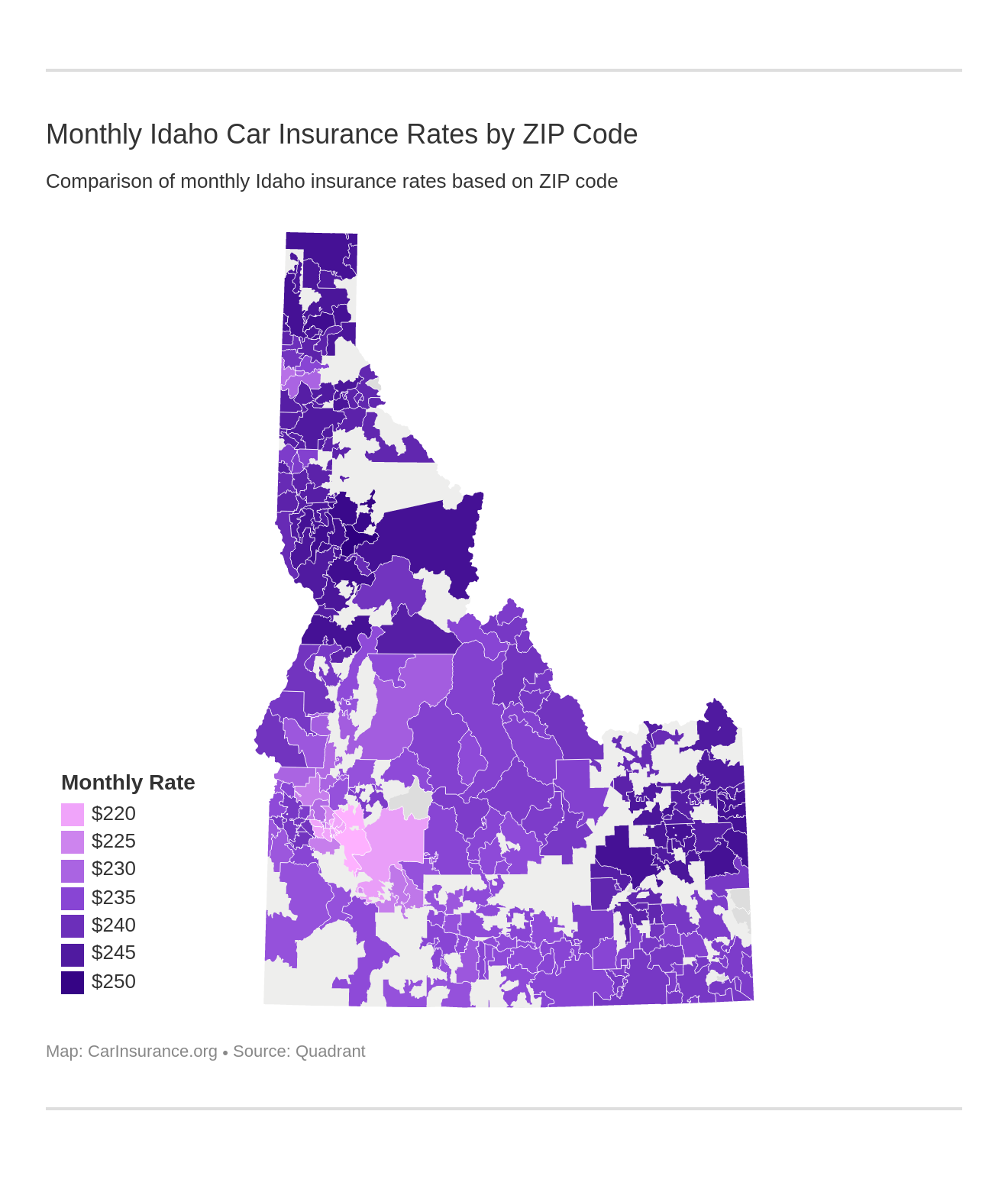

What About Rates by Zip Code and City?

What does your zip code and city tend to pay for their insurance rates? Let’s find out.

| Zipcode | Average Annual Rate | Allstate F&C | American Family Mutual | Farmers Ins Co Of ID | Geico General | Safeco Ins Co of IL | Depositors Insurance | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| 83536 | $3,008.28 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,989.82 | $3,344.06 | $1,998.09 |

| 83546 | $2,999.62 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,000.81 | $3,281.24 | $1,998.09 |

| 83531 | $2,994.12 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,338.96 | $2,872.16 | $1,921.71 | $3,435.94 | $1,998.09 |

| 83544 | $2,991.37 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,017.88 | $3,281.24 | $1,998.09 |

| 83520 | $2,988.00 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,872.16 | $1,921.71 | $3,161.57 | $1,998.09 |

| 83553 | $2,987.99 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,003.38 | $3,265.37 | $1,998.09 |

| 83523 | $2,980.70 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,924.06 | $3,161.57 | $1,998.09 |

| 83543 | $2,975.21 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,965.99 | $3,161.57 | $1,998.09 |

| 83860 | $2,974.33 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,949.95 | $3,566.74 | $2,028.83 |

| 83530 | $2,973.80 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,825.55 | $3,435.94 | $1,998.09 |

| 83526 | $2,973.54 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,246.18 | $1,998.09 |

| 83449 | $2,968.69 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,023.09 | $3,349.33 | $1,944.86 |

| 83434 | $2,968.23 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,916.45 | $3,457.46 | $1,944.86 |

| 83826 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83853 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83404 | $2,967.30 | $4,279.29 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,803.64 | $1,939.56 | $3,236.84 | $1,944.86 |

| 83524 | $2,965.83 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,863.47 | $3,374.98 | $1,854.19 |

| 83809 | $2,964.55 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,974.64 | $3,453.94 | $2,028.83 |

| 83548 | $2,964.45 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,921.71 | $3,161.57 | $1,854.19 |

| 83865 | $2,964.42 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,479.87 | $2,028.83 |

| 83805 | $2,964.11 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,889.90 | $3,455.88 | $2,028.83 |

| 83455 | $2,963.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,102.03 | $3,262.32 | $1,890.34 |

| 83428 | $2,963.46 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,016.77 | $3,382.90 | $1,870.51 |

| 83539 | $2,963.26 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.75 | $1,998.09 |

| 83856 | $2,961.57 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,422.54 | $2,028.83 |

| 83422 | $2,960.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,075.08 | $3,262.32 | $1,890.34 |

| 83836 | $2,960.60 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,948.96 | $3,365.22 | $2,028.83 |

| 83822 | $2,959.92 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,407.67 | $2,028.83 |

| 83549 | $2,959.83 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,959.63 | $3,236.40 | $1,998.09 |

| 83401 | $2,959.48 | $4,181.57 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,023.03 | $3,272.09 | $1,944.86 |

| 83452 | $2,959.41 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,063.11 | $3,262.32 | $1,890.34 |

| 83533 | $2,959.06 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,115.83 | $1,998.09 |

| 83221 | $2,958.18 | $4,201.19 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,105.49 | $3,148.31 | $1,944.86 |

| 83845 | $2,957.53 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,895.95 | $3,390.67 | $2,028.83 |

| 83554 | $2,956.33 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83821 | $2,956.28 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,898.85 | $3,376.45 | $2,028.83 |

| 83444 | $2,955.14 | $4,153.76 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,962.74 | $3,404.85 | $1,944.86 |

| 83848 | $2,953.98 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,332.93 | $2,028.83 |

| 83811 | $2,953.78 | $4,076.47 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,776.38 | $1,959.78 | $3,300.64 | $2,028.83 |

| 83864 | $2,953.66 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,323.02 | $2,802.25 | $1,929.51 | $3,479.87 | $2,028.83 |

| 83218 | $2,953.40 | $4,224.74 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83402 | $2,952.67 | $4,213.93 | $3,935.85 | $3,319.49 | $2,841.52 | $2,395.81 | $2,803.64 | $1,937.78 | $3,181.16 | $1,944.86 |

| 83450 | $2,951.80 | $4,185.79 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,937.02 | $3,368.48 | $1,944.86 |

| 83840 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83841 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83541 | $2,950.11 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,935.36 | $3,161.57 | $1,854.19 |

| 83555 | $2,949.99 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,900.98 | $3,149.76 | $1,998.09 |

| 83850 | $2,949.04 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $2,012.25 | $3,342.64 | $2,028.83 |

| 83813 | $2,948.73 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,983.50 | $3,302.74 | $2,028.83 |

| 83406 | $2,948.71 | $4,234.50 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,004.26 | $3,141.01 | $1,944.86 |

| 83852 | $2,947.82 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,919.29 | $3,332.93 | $2,028.83 |

| 83236 | $2,946.32 | $4,192.99 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,008.19 | $3,211.14 | $1,944.86 |

| 83839 | $2,946.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,985.71 | $3,342.64 | $2,028.83 |

| 83522 | $2,945.39 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,889.98 | $3,115.83 | $1,998.09 |

| 83427 | $2,945.31 | $4,279.29 | $3,935.85 | $3,231.61 | $2,841.52 | $2,404.62 | $2,712.31 | $2,016.77 | $3,141.01 | $1,944.86 |

| 83847 | $2,945.23 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,895.95 | $3,332.93 | $2,028.83 |

| 83425 | $2,944.13 | $4,305.88 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83274 | $2,942.05 | $4,192.99 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $1,937.52 | $3,179.32 | $1,944.86 |

| 83424 | $2,941.37 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,900.69 | $3,262.32 | $1,890.34 |

| 83540 | $2,940.84 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,859.37 | $3,395.55 | $1,854.19 |

| 83861 | $2,940.69 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,965.80 | $3,359.32 | $2,028.83 |

| 83545 | $2,938.99 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,832.79 | $3,164.06 | $1,854.19 |

| 83431 | $2,938.11 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,947.35 | $3,150.27 | $1,944.86 |

| 83420 | $2,937.21 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,915.05 | $3,234.18 | $1,890.34 |

| 83866 | $2,937.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,933.37 | $3,359.32 | $2,028.83 |

| 83810 | $2,936.68 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,964.36 | $3,279.25 | $2,028.83 |

| 83429 | $2,936.38 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,932.41 | $3,209.35 | $1,890.34 |

| 83451 | $2,936.22 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,838.44 | $3,301.86 | $1,890.34 |

| 83442 | $2,935.59 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,956.08 | $3,118.91 | $1,944.86 |

| 83436 | $2,934.77 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83542 | $2,933.61 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,038.34 | $1,998.09 |

| 83833 | $2,932.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,931.25 | $3,271.08 | $2,028.83 |

| 83842 | $2,931.94 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,921.71 | $3,279.25 | $2,028.83 |

| 83824 | $2,931.84 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,368.17 | $2,028.83 |

| 83262 | $2,931.35 | $4,050.30 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,098.97 | $3,128.26 | $1,944.86 |

| 83537 | $2,929.55 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,804.12 | $1,896.98 | $3,267.47 | $1,854.19 |

| 83445 | $2,929.41 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,832.34 | $3,246.69 | $1,890.34 |

| 83421 | $2,928.50 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,234.18 | $1,890.34 |

| 83215 | $2,928.21 | $4,201.19 | $3,935.85 | $3,028.45 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83446 | $2,927.88 | $4,305.88 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,211.60 | $1,866.71 |

| 83851 | $2,927.88 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,938.71 | $3,271.08 | $2,028.83 |

| 83440 | $2,926.93 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,830.10 | $3,226.58 | $1,890.34 |

| 83671 | $2,926.88 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83870 | $2,926.80 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,885.23 | $3,359.32 | $2,028.83 |

| 83433 | $2,925.74 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,209.35 | $1,890.34 |

| 83872 | $2,925.52 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,849.83 | $3,406.89 | $1,947.30 |

| 83876 | $2,923.27 | $3,941.82 | $3,668.25 | $3,306.96 | $2,892.45 | $2,478.28 | $2,776.38 | $1,945.43 | $3,271.08 | $2,028.83 |

| 83535 | $2,922.35 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,884.61 | $3,345.44 | $1,854.19 |

| 83443 | $2,922.33 | $4,270.46 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,118.91 | $1,944.86 |

| 83832 | $2,921.33 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,860.24 | $3,267.47 | $1,947.30 |

| 83812 | $2,919.68 | $3,988.75 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,167.40 | $2,028.83 |

| 83803 | $2,919.27 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,966.22 | $3,329.59 | $2,028.83 |

| 83871 | $2,918.98 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,842.99 | $3,354.93 | $1,947.30 |

| 83460 | $2,918.87 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,876.70 | $1,817.18 | $3,226.58 | $1,944.86 |

| 83448 | $2,918.32 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,802.78 | $3,226.58 | $1,890.34 |

| 83868 | $2,918.02 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,992.56 | $3,342.64 | $2,028.83 |

| 83806 | $2,917.85 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,354.93 | $1,947.30 |

| 83827 | $2,917.63 | $3,988.75 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $1,921.71 | $3,265.37 | $1,998.09 |

| 83830 | $2,917.14 | $4,033.13 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,269.84 | $2,028.83 |

| 83438 | $2,917.01 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83837 | $2,916.87 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,973.04 | $3,351.76 | $2,028.83 |

| 83204 | $2,916.73 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,783.09 | $2,094.87 | $3,115.76 | $1,870.51 |

| 83547 | $2,916.57 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,150.00 | $1,998.09 |

| 83808 | $2,914.35 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,950.38 | $3,351.76 | $2,028.83 |

| 83801 | $2,911.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,776.38 | $1,971.85 | $3,184.02 | $2,028.83 |

| 83823 | $2,911.17 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,865.74 | $3,354.93 | $1,854.19 |

| 83804 | $2,911.12 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,954.48 | $3,102.03 | $2,028.83 |

| 83867 | $2,910.15 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,342.64 | $2,028.83 |

| 83435 | $2,910.08 | $3,999.42 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83849 | $2,909.77 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,918.28 | $3,342.64 | $2,028.83 |

| 83844 | $2,909.41 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,278.99 | $1,947.30 |

| 83201 | $2,908.65 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,072.13 | $3,113.54 | $1,870.51 |

| 83802 | $2,907.88 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,322.24 | $2,028.83 |

| 83202 | $2,902.87 | $4,008.90 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,034.83 | $3,040.47 | $1,870.51 |

| 83873 | $2,902.47 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,854.26 | $3,340.98 | $2,028.83 |

| 83210 | $2,902.40 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $1,995.38 | $3,187.48 | $1,944.86 |

| 83846 | $2,901.21 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,861.68 | $3,322.24 | $2,028.83 |

| 83245 | $2,900.20 | $3,992.53 | $3,935.85 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $2,033.19 | $3,127.33 | $1,870.51 |

| 83209 | $2,897.71 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,631.16 | $2,075.63 | $3,115.76 | $1,870.51 |

| 83423 | $2,897.09 | $3,999.42 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,941.79 | $3,199.88 | $1,866.71 |

| 83277 | $2,895.19 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $2,016.77 | $3,179.32 | $1,866.71 |

| 83843 | $2,891.59 | $4,600.50 | $3,552.57 | $3,306.96 | $2,596.54 | $2,214.33 | $2,673.74 | $1,853.42 | $3,278.99 | $1,947.30 |

| 83501 | $2,890.80 | $4,691.81 | $3,552.57 | $3,208.69 | $2,596.54 | $2,225.41 | $2,804.12 | $1,846.78 | $3,237.05 | $1,854.19 |

| 83552 | $2,888.02 | $3,954.45 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.78 | $1,998.09 |

| 83869 | $2,875.40 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,933.66 | $3,102.03 | $2,028.83 |

| 83687 | $2,871.66 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,267.71 | $2,801.06 | $1,909.39 | $3,297.43 | $1,726.98 |

| 83626 | $2,871.31 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,859.31 | $3,382.91 | $1,726.98 |

| 83686 | $2,871.09 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,381.57 | $2,717.98 | $1,908.45 | $3,262.45 | $1,726.98 |

| 83858 | $2,869.16 | $3,819.53 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,926.26 | $3,157.25 | $2,028.83 |

| 83612 | $2,868.51 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,808.07 | $3,088.31 | $1,866.71 |

| 83525 | $2,867.22 | $3,863.12 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,894.73 | $3,144.95 | $1,998.09 |

| 83250 | $2,865.42 | $3,992.53 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,964.55 | $3,127.33 | $1,866.71 |

| 83651 | $2,864.29 | $3,973.77 | $4,166.07 | $3,185.49 | $2,499.48 | $2,269.58 | $2,801.06 | $1,991.41 | $3,164.82 | $1,726.98 |

| 83672 | $2,864.12 | $4,637.51 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,705.50 | $3,054.16 | $1,866.71 |

| 83464 | $2,863.70 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,961.37 | $3,160.69 | $1,866.71 |

| 83605 | $2,863.42 | $3,937.96 | $4,166.07 | $3,014.28 | $2,499.48 | $2,345.70 | $2,838.90 | $1,965.27 | $3,276.10 | $1,726.98 |

| 83467 | $2,862.84 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,940.19 | $3,174.07 | $1,866.71 |

| 83286 | $2,859.35 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,788.99 | $3,364.85 | $1,866.71 |

| 83610 | $2,859.27 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,814.28 | $2,998.91 | $1,866.71 |

| 83462 | $2,859.10 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,919.91 | $3,160.69 | $1,866.71 |

| 83468 | $2,858.98 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83654 | $2,858.61 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,828.16 | $2,979.06 | $1,866.71 |

| 83233 | $2,858.15 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83213 | $2,857.29 | $4,201.19 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,916.84 | $3,206.17 | $1,866.71 |

| 83465 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83466 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83607 | $2,856.56 | $4,054.78 | $4,166.07 | $3,041.94 | $2,515.57 | $2,375.37 | $2,805.89 | $1,921.26 | $3,101.23 | $1,726.98 |

| 83676 | $2,855.64 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,826.41 | $3,274.70 | $1,726.98 |

| 83263 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83272 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83223 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83283 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83252 | $2,854.44 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,780.84 | $3,138.23 | $1,866.71 |

| 83285 | $2,854.44 | $4,192.99 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,283.25 | $1,870.51 |

| 83234 | $2,853.72 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,776.88 | $3,135.65 | $1,866.71 |

| 83217 | $2,852.05 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,769.34 | $3,166.74 | $1,870.51 |

| 83214 | $2,851.19 | $4,034.89 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,803.19 | $3,167.89 | $1,866.71 |

| 83220 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83238 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83281 | $2,849.34 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,127.33 | $1,866.71 |

| 83463 | $2,849.34 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83855 | $2,848.45 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,852.90 | $3,413.29 | $1,947.30 |

| 83243 | $2,847.29 | $4,116.21 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,745.81 | $3,059.27 | $1,866.71 |

| 83251 | $2,846.67 | $3,999.42 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,973.22 | $3,255.95 | $1,866.71 |

| 83340 | $2,846.21 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,392.53 | $1,823.77 |

| 83230 | $2,845.61 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,206.20 | $1,870.51 |

| 83228 | $2,845.31 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,776.88 | $3,250.62 | $1,866.71 |

| 83237 | $2,844.28 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,767.61 | $3,250.62 | $1,866.71 |

| 83254 | $2,844.20 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,697.43 | $3,364.85 | $1,866.71 |

| 83211 | $2,843.72 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,806.31 | $3,248.63 | $1,866.71 |

| 83239 | $2,843.53 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,691.38 | $3,364.85 | $1,866.71 |

| 83276 | $2,843.08 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,723.03 | $3,206.20 | $1,870.51 |

| 83255 | $2,842.92 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,921.71 | $3,238.75 | $1,866.71 |

| 83631 | $2,841.87 | $3,916.80 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,863.50 | $3,391.58 | $1,866.71 |

| 83232 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83287 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83644 | $2,839.20 | $3,892.56 | $4,166.07 | $3,041.94 | $2,543.13 | $2,230.07 | $2,805.89 | $1,928.74 | $3,217.41 | $1,726.98 |

| 83857 | $2,838.56 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,831.70 | $3,345.44 | $1,947.30 |

| 83244 | $2,834.89 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,187.51 | $1,866.71 |

| 83241 | $2,833.28 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,739.83 | $3,217.91 | $1,870.51 |

| 83246 | $2,831.92 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,751.93 | $3,088.06 | $1,866.71 |

| 83253 | $2,831.54 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83212 | $2,829.43 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,071.82 | $1,866.71 |

| 83834 | $2,828.33 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,345.44 | $1,854.19 |

| 83278 | $2,826.86 | $4,012.05 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,971.75 | $3,053.03 | $1,866.71 |

| 83235 | $2,826.72 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83226 | $2,826.16 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,895.71 | $3,160.69 | $1,866.71 |

| 83641 | $2,824.89 | $3,878.18 | $4,166.07 | $3,041.94 | $2,515.57 | $2,252.15 | $2,717.98 | $1,824.03 | $3,161.37 | $1,866.71 |

| 83271 | $2,824.30 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,820.94 | $3,059.27 | $1,866.71 |

| 83327 | $2,824.05 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,896.19 | $3,277.85 | $1,744.94 |

| 83229 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83469 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83347 | $2,823.71 | $4,034.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,719.58 | $3,317.43 | $1,744.94 |

| 83353 | $2,823.59 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,188.93 | $1,823.77 |

| 83341 | $2,823.22 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,814.30 | $3,312.51 | $1,744.94 |

| 83342 | $2,821.81 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,787.86 | $3,231.96 | $1,744.94 |

| 83655 | $2,820.93 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,765.46 | $3,386.32 | $1,866.71 |

| 83311 | $2,820.70 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,777.86 | $3,231.96 | $1,744.94 |

| 83312 | $2,820.50 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,776.05 | $3,231.96 | $1,744.94 |

| 83666 | $2,820.16 | $3,990.50 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,259.27 | $1,866.71 |

| 83333 | $2,819.20 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,157.63 | $2,706.72 | $1,903.09 | $3,243.00 | $1,823.77 |

| 83635 | $2,816.93 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83323 | $2,816.45 | $4,004.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,770.01 | $3,231.96 | $1,744.94 |

| 83316 | $2,816.20 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,703.17 | $3,360.47 | $1,744.94 |

| 83321 | $2,816.17 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,702.88 | $3,360.47 | $1,744.94 |

| 83835 | $2,814.62 | $3,378.15 | $3,668.25 | $3,306.96 | $2,892.45 | $2,224.25 | $2,705.06 | $1,913.57 | $3,214.11 | $2,028.83 |

| 83350 | $2,812.32 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,733.43 | $3,312.05 | $1,744.94 |

| 83325 | $2,811.29 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,810.88 | $3,312.51 | $1,744.94 |

| 83336 | $2,810.54 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,317.43 | $1,744.94 |

| 83318 | $2,809.93 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,311.97 | $1,744.94 |

| 83328 | $2,809.58 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,761.33 | $3,242.70 | $1,744.94 |

| 83344 | $2,809.18 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,812.35 | $3,276.17 | $1,744.94 |

| 83335 | $2,807.89 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,816.63 | $3,276.17 | $1,744.94 |

| 83324 | $2,807.80 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,837.80 | $3,189.15 | $1,744.94 |

| 83320 | $2,807.71 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,932.41 | $3,188.93 | $1,823.77 |

| 83677 | $2,807.29 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83338 | $2,807.01 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,807.70 | $3,189.15 | $1,744.94 |

| 83638 | $2,806.24 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,781.75 | $3,282.34 | $1,866.71 |

| 83227 | $2,806.14 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $2,975.52 | $1,866.71 |

| 83334 | $2,805.37 | $3,951.78 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,806.74 | $3,189.15 | $1,744.94 |

| 83346 | $2,805.21 | $3,923.89 | $3,989.27 | $3,028.45 | $2,640.14 | $2,078.91 | $2,722.48 | $1,806.80 | $3,312.05 | $1,744.94 |

| 83352 | $2,804.68 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,809.70 | $3,189.15 | $1,744.94 |

| 83313 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.71 | $3,188.93 | $1,823.77 |

| 83348 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.69 | $3,188.93 | $1,823.77 |

| 83604 | $2,803.70 | $3,957.83 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,716.71 | $3,153.84 | $1,866.71 |

| 83660 | $2,803.64 | $4,004.21 | $3,695.28 | $3,041.94 | $2,515.57 | $2,338.96 | $2,746.31 | $1,784.72 | $3,378.79 | $1,726.98 |

| 83332 | $2,803.35 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,745.80 | $3,303.66 | $1,744.94 |

| 83349 | $2,802.61 | $4,065.22 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,848.81 | $3,189.15 | $1,744.94 |

| 83637 | $2,802.41 | $4,035.84 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,040.72 | $1,866.71 |

| 83302 | $2,801.88 | $3,957.83 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,776.05 | $3,182.42 | $1,744.94 |

| 83622 | $2,801.87 | $3,851.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,961.84 | $2,998.91 | $1,866.71 |

| 83650 | $2,801.63 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,148.92 | $1,866.71 |

| 83615 | $2,801.62 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83355 | $2,801.00 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,737.29 | $3,205.41 | $1,744.94 |

| 83629 | $2,800.10 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,850.06 | $3,052.86 | $1,866.71 |

| 83314 | $2,793.41 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,252.15 | $2,501.20 | $1,745.80 | $3,205.41 | $1,744.94 |

| 83337 | $2,791.00 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,277.85 | $1,744.94 |

| 83624 | $2,790.70 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,695.73 | $3,094.98 | $1,866.71 |

| 83330 | $2,789.58 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,786.32 | $3,303.66 | $1,744.94 |

| 83645 | $2,786.61 | $3,928.48 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,767.19 | $3,003.84 | $1,866.71 |

| 83639 | $2,785.64 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,828.33 | $3,178.81 | $1,866.71 |

| 83619 | $2,784.05 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,721.94 | $3,097.92 | $1,866.71 |

| 83301 | $2,782.56 | $3,767.16 | $3,989.27 | $3,136.73 | $2,640.14 | $2,243.36 | $2,517.12 | $1,821.89 | $3,182.42 | $1,744.94 |

| 83628 | $2,780.47 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,781.81 | $3,178.81 | $1,866.71 |

| 83611 | $2,777.71 | $3,850.00 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,770.53 | $2,998.91 | $1,866.71 |

| 83643 | $2,776.34 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83602 | $2,775.91 | $3,776.31 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,061.71 | $1,866.71 |

| 83632 | $2,771.35 | $3,818.17 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83322 | $2,770.68 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,094.98 | $1,744.94 |

| 83815 | $2,769.93 | $3,287.39 | $3,668.25 | $3,069.45 | $2,892.45 | $2,188.37 | $2,616.57 | $1,925.45 | $3,252.68 | $2,028.83 |

| 83661 | $2,763.83 | $3,917.84 | $3,695.28 | $3,041.94 | $2,543.13 | $2,252.15 | $2,746.31 | $1,721.94 | $3,089.14 | $1,866.71 |

| 83814 | $2,761.06 | $3,287.39 | $3,668.25 | $3,106.56 | $2,892.45 | $2,137.80 | $2,616.57 | $1,925.45 | $3,186.27 | $2,028.83 |

| 83670 | $2,756.15 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,836.16 | $3,051.43 | $1,707.67 |

| 83657 | $2,747.13 | $3,960.33 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,740.19 | $2,998.91 | $1,707.67 |

| 83616 | $2,743.03 | $3,798.47 | $3,533.88 | $3,203.06 | $2,515.57 | $2,156.72 | $2,622.63 | $2,000.78 | $3,167.23 | $1,688.94 |

| 83854 | $2,732.36 | $3,359.90 | $3,668.25 | $2,736.09 | $2,892.45 | $2,152.23 | $2,681.54 | $1,908.48 | $3,163.44 | $2,028.83 |

| 83633 | $2,728.15 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $3,205.41 | $1,866.71 |

| 83623 | $2,725.76 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,718.69 | $3,205.41 | $1,866.71 |

| 83669 | $2,725.33 | $3,970.99 | $3,438.58 | $3,203.06 | $2,499.48 | $2,158.46 | $2,550.15 | $1,790.11 | $3,228.23 | $1,688.94 |

| 83713 | $2,719.52 | $3,912.68 | $3,533.88 | $3,107.12 | $2,451.67 | $2,258.52 | $2,626.54 | $1,871.30 | $3,077.54 | $1,636.40 |

| 83627 | $2,717.41 | $4,004.78 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $2,999.83 | $1,866.71 |

| 83634 | $2,711.21 | $3,786.71 | $3,438.58 | $3,203.06 | $2,470.64 | $2,146.48 | $2,580.24 | $1,846.56 | $3,239.70 | $1,688.94 |

| 83617 | $2,706.75 | $3,882.38 | $3,695.28 | $3,041.94 | $2,543.13 | $2,080.69 | $2,550.15 | $1,806.66 | $3,052.86 | $1,707.67 |

| 83648 | $2,692.24 | $3,920.66 | $3,695.28 | $3,041.94 | $2,470.64 | $2,252.15 | $2,771.34 | $1,599.08 | $3,072.20 | $1,406.90 |

| 83636 | $2,691.56 | $3,951.90 | $3,695.28 | $3,041.94 | $2,403.40 | $2,080.69 | $2,550.15 | $1,740.19 | $3,052.86 | $1,707.67 |

| 83714 | $2,691.46 | $3,892.84 | $3,533.88 | $3,041.94 | $2,403.40 | $2,140.68 | $2,622.63 | $1,874.85 | $3,076.52 | $1,636.40 |

| 83704 | $2,671.21 | $3,645.33 | $3,533.88 | $3,107.12 | $2,451.67 | $2,177.55 | $2,590.59 | $1,805.21 | $3,093.17 | $1,636.40 |

| 83708 | $2,652.60 | $3,892.48 | $3,438.58 | $3,012.15 | $2,403.40 | $2,030.14 | $2,473.21 | $1,827.67 | $3,068.76 | $1,726.98 |

| 83647 | $2,647.03 | $3,810.09 | $3,695.28 | $3,041.94 | $2,097.93 | $2,252.15 | $2,771.34 | $1,836.28 | $2,911.33 | $1,406.90 |

| 83705 | $2,646.43 | $3,652.78 | $3,533.88 | $3,012.15 | $2,451.67 | $2,158.80 | $2,586.68 | $1,732.81 | $3,052.70 | $1,636.40 |

| 83712 | $2,644.60 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,153.26 | $2,473.21 | $1,741.39 | $3,123.46 | $1,636.40 |

| 83702 | $2,643.34 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,011.10 | $2,473.21 | $1,850.82 | $3,144.94 | $1,636.40 |

| 83642 | $2,642.29 | $3,677.17 | $3,438.58 | $2,785.84 | $2,408.93 | $2,216.06 | $2,580.24 | $1,841.47 | $3,143.40 | $1,688.94 |

| 83709 | $2,641.37 | $3,547.57 | $3,438.58 | $3,270.65 | $2,451.67 | $2,030.14 | $2,581.95 | $1,821.11 | $2,994.27 | $1,636.40 |

| 83646 | $2,636.84 | $3,708.80 | $3,438.58 | $2,763.07 | $2,408.93 | $2,146.48 | $2,622.63 | $1,772.67 | $3,143.40 | $1,726.98 |

| 83703 | $2,630.15 | $3,724.95 | $3,438.58 | $3,012.15 | $2,403.40 | $2,094.92 | $2,630.93 | $1,809.91 | $2,920.16 | $1,636.40 |

| 83725 | $2,625.99 | $3,680.86 | $3,438.58 | $2,945.06 | $2,403.40 | $2,116.06 | $2,511.51 | $1,827.67 | $3,074.37 | $1,636.40 |

| 83706 | $2,615.06 | $3,602.20 | $3,438.58 | $3,012.15 | $2,403.40 | $2,008.23 | $2,511.51 | $1,711.24 | $3,211.80 | $1,636.40 |

| 83716 | $2,612.88 | $3,669.45 | $3,438.58 | $2,975.76 | $2,470.64 | $2,036.00 | $2,473.21 | $1,741.54 | $3,074.37 | $1,636.40 |

]

But who pays the most? Who pays the least? Find out below.

| City | Average Grand Total |

|---|---|

| MERIDIAN | $2,639.57 |

| BOISE | $2,645.74 |

| MOUNTAIN HOME | $2,647.03 |

| GARDEN CITY | $2,691.46 |

| LETHA | $2,691.57 |

| MOUNTAIN HOME A F B | $2,692.24 |

| EMMETT | $2,706.75 |

| KUNA | $2,711.21 |

| HAMMETT | $2,717.41 |

| STAR | $2,725.33 |

| GLENNS FERRY | $2,725.77 |

| KING HILL | $2,728.15 |

| POST FALLS | $2,732.36 |

| EAGLE | $2,743.03 |

| OLA | $2,747.13 |

| SWEET | $2,756.15 |

| PAYETTE | $2,763.83 |

| COEUR D ALENE | $2,765.50 |

| CORRAL | $2,770.68 |

| INDIAN VALLEY | $2,771.35 |

| BANKS | $2,775.91 |

| MESA | $2,776.34 |

| CASCADE | $2,777.71 |

| HOMEDALE | $2,780.47 |

| TWIN FALLS | $2,782.56 |

| FRUITLAND | $2,784.04 |

| MARSING | $2,785.64 |

| MIDVALE | $2,786.60 |

| GOODING | $2,789.58 |

| GRAND VIEW | $2,790.70 |

| HILL CITY | $2,791.00 |

| BLISS | $2,793.41 |

| HORSESHOE BEND | $2,800.10 |

| WENDELL | $2,801.00 |

| DONNELLY | $2,801.62 |

| MURPHY | $2,801.63 |

| GARDEN VALLEY | $2,801.87 |

| ROGERSON | $2,801.88 |

| LOWMAN | $2,802.41 |

| RICHFIELD | $2,802.61 |

| HAGERMAN | $2,803.35 |

| PARMA | $2,803.64 |

| BRUNEAU | $2,803.70 |

| BELLEVUE | $2,804.18 |

| PICABO | $2,804.18 |

| SHOSHONE | $2,804.68 |

| OAKLEY | $2,805.21 |

| HANSEN | $2,805.37 |

| CLAYTON | $2,806.14 |

| MCCALL | $2,806.23 |

| JEROME | $2,807.02 |

| YELLOW PINE | $2,807.29 |

| CAREY | $2,807.71 |

| DIETRICH | $2,807.80 |

| HAZELTON | $2,807.89 |

| MURTAUGH | $2,809.18 |

| FILER | $2,809.58 |

| BURLEY | $2,809.93 |

| HEYBURN | $2,810.54 |

| EDEN | $2,811.29 |

| RUPERT | $2,812.32 |

| HAYDEN | $2,814.63 |

| CASTLEFORD | $2,816.17 |

| BUHL | $2,816.20 |

| DECLO | $2,816.44 |

| LAKE FORK | $2,816.93 |

| HAILEY | $2,819.20 |

| PLACERVILLE | $2,820.16 |

| ALMO | $2,820.50 |

| ALBION | $2,820.70 |

| NEW PLYMOUTH | $2,820.93 |

| MALTA | $2,821.81 |

| KIMBERLY | $2,823.22 |

| SUN VALLEY | $2,823.59 |

| PAUL | $2,823.71 |

| COBALT | $2,823.92 |

| SHOUP | $2,823.92 |

| FAIRFIELD | $2,824.05 |

| ROCKLAND | $2,824.31 |

| MELBA | $2,824.89 |

| CHALLIS | $2,826.16 |

| ELLIS | $2,826.72 |

| STANLEY | $2,826.86 |

| HARVARD | $2,828.33 |

| ARBON | $2,829.43 |

| MAY | $2,831.54 |

| LAVA HOT SPRINGS | $2,831.92 |

| GRACE | $2,833.28 |

| HOWE | $2,834.89 |

| PRINCETON | $2,838.55 |

| MIDDLETON | $2,839.20 |

| DAYTON | $2,841.86 |

| FISH HAVEN | $2,841.86 |

| IDAHO CITY | $2,841.87 |

| MOORE | $2,842.92 |

| SODA SPRINGS | $2,843.08 |

| GEORGETOWN | $2,843.53 |

| AMERICAN FALLS | $2,843.72 |

| MONTPELIER | $2,844.20 |

| FRANKLIN | $2,844.28 |

| CLIFTON | $2,845.31 |

| CONDA | $2,845.61 |

| KETCHUM | $2,846.21 |

| MACKAY | $2,846.67 |

| HOLBROOK | $2,847.29 |

| POTLATCH | $2,848.45 |

| GIBBONSVILLE | $2,849.34 |

| SWANLAKE | $2,849.34 |

| BERN | $2,849.58 |

| GENEVA | $2,849.58 |

| ARIMO | $2,851.19 |

| BANCROFT | $2,852.05 |

| DOWNEY | $2,853.72 |

| MALAD CITY | $2,854.44 |

| WAYAN | $2,854.44 |

| BLOOMINGTON | $2,854.55 |

| THATCHER | $2,854.55 |

| PRESTON | $2,854.56 |

| SAINT CHARLES | $2,854.56 |

| WILDER | $2,855.64 |

| LEMHI | $2,856.96 |

| NORTH FORK | $2,856.96 |

| ARCO | $2,857.30 |

| DINGLE | $2,858.15 |

| NEW MEADOWS | $2,858.60 |

| TENDOY | $2,858.99 |

| CARMEN | $2,859.10 |

| CAMBRIDGE | $2,859.27 |

| WESTON | $2,859.35 |

| CALDWELL | $2,859.99 |

| SALMON | $2,862.84 |

| LEADORE | $2,863.70 |

| WEISER | $2,864.12 |

| MCCAMMON | $2,865.42 |

| ELK CITY | $2,867.22 |

| COUNCIL | $2,868.51 |

| NAMPA | $2,869.02 |

| RATHDRUM | $2,869.15 |

| GREENLEAF | $2,871.31 |

| SPIRIT LAKE | $2,875.40 |

| STITES | $2,888.02 |

| LEWISTON | $2,890.80 |

| SPRINGFIELD | $2,895.19 |

| DUBOIS | $2,897.10 |

| INKOM | $2,900.20 |

| MOSCOW | $2,900.50 |

| MULLAN | $2,901.21 |

| ABERDEEN | $2,902.40 |

| WALLACE | $2,902.47 |

| POCATELLO | $2,906.49 |

| AVERY | $2,907.88 |

| OSBURN | $2,909.77 |

| MONTEVIEW | $2,910.08 |

| SILVERTON | $2,910.15 |

| BLANCHARD | $2,911.12 |

| DEARY | $2,911.17 |

| ATHOL | $2,911.64 |

| CALDER | $2,914.35 |

| POLLOCK | $2,916.57 |

| KELLOGG | $2,916.87 |

| PARKER | $2,917.01 |

| FERNWOOD | $2,917.14 |

| ELK RIVER | $2,917.63 |

| BOVILL | $2,917.85 |

| SMELTERVILLE | $2,918.02 |

| SUGAR CITY | $2,918.32 |

| TROY | $2,918.98 |

| BAYVIEW | $2,919.27 |

| CLARKIA | $2,919.68 |

| GENESEE | $2,921.33 |

| RIRIE | $2,922.33 |

| JULIAETTA | $2,922.35 |

| REXBURG | $2,922.90 |

| WORLEY | $2,923.28 |

| VIOLA | $2,925.52 |

| MACKS INN | $2,925.75 |

| TENSED | $2,926.80 |

| WARREN | $2,926.88 |

| PLUMMER | $2,927.88 |

| SPENCER | $2,927.88 |

| ATOMIC CITY | $2,928.21 |

| CHESTER | $2,928.51 |

| SAINT ANTHONY | $2,929.41 |

| KENDRICK | $2,929.55 |

| PINGREE | $2,931.35 |

| DESMET | $2,931.84 |

| MEDIMONT | $2,931.94 |

| HARRISON | $2,932.09 |

| LUCILE | $2,933.61 |

| NEWDALE | $2,934.77 |

| RIGBY | $2,935.59 |

| TETON | $2,936.22 |

| ISLAND PARK | $2,936.38 |

| CATALDO | $2,936.68 |

| SANTA | $2,937.09 |

| ASHTON | $2,937.21 |

| LEWISVILLE | $2,938.11 |

| PECK | $2,938.99 |

| SAINT MARIES | $2,940.69 |

| LAPWAI | $2,940.83 |

| FELT | $2,941.37 |

| SHELLEY | $2,942.05 |

| HAMER | $2,944.13 |

| NAPLES | $2,945.23 |

| IONA | $2,945.31 |

| COTTONWOOD | $2,945.39 |

| KINGSTON | $2,946.09 |

| FIRTH | $2,946.32 |

| PONDERAY | $2,947.82 |

| COCOLALLA | $2,948.73 |

| PINEHURST | $2,949.04 |

| WINCHESTER | $2,949.99 |

| LENORE | $2,950.11 |

| KOOTENAI | $2,951.68 |

| LACLEDE | $2,951.68 |

| TERRETON | $2,951.80 |

| BASALT | $2,953.40 |

| SANDPOINT | $2,953.66 |

| CLARK FORK | $2,953.78 |

| NORDMAN | $2,953.98 |

| ROBERTS | $2,955.14 |

| COOLIN | $2,956.28 |

| WHITE BIRD | $2,956.33 |

| IDAHO FALLS | $2,957.04 |

| MOYIE SPRINGS | $2,957.53 |

| BLACKFOOT | $2,958.18 |

| GREENCREEK | $2,959.06 |

| TETONIA | $2,959.41 |

| RIGGINS | $2,959.83 |

| OLDTOWN | $2,959.92 |

| HOPE | $2,960.60 |

| DRIGGS | $2,960.74 |

| PRIEST RIVER | $2,961.57 |

| KOOSKIA | $2,963.26 |

| IRWIN | $2,963.46 |

| VICTOR | $2,963.74 |

| BONNERS FERRY | $2,964.11 |

| COLBURN | $2,964.42 |

| REUBENS | $2,964.45 |

| CAREYWOOD | $2,964.55 |

| CULDESAC | $2,965.83 |

| EASTPORT | $2,967.64 |

| PORTHILL | $2,967.64 |

| MENAN | $2,968.23 |

| SWAN VALLEY | $2,968.69 |

| FERDINAND | $2,973.54 |

| GRANGEVILLE | $2,973.79 |

| SAGLE | $2,974.33 |

| NEZPERCE | $2,975.21 |

| CRAIGMONT | $2,980.70 |

| WEIPPE | $2,987.99 |

| AHSAHKA | $2,988.00 |

| OROFINO | $2,991.37 |

| FENN | $2,994.12 |

| PIERCE | $2,999.61 |

| KAMIAH | $3,008.28 |

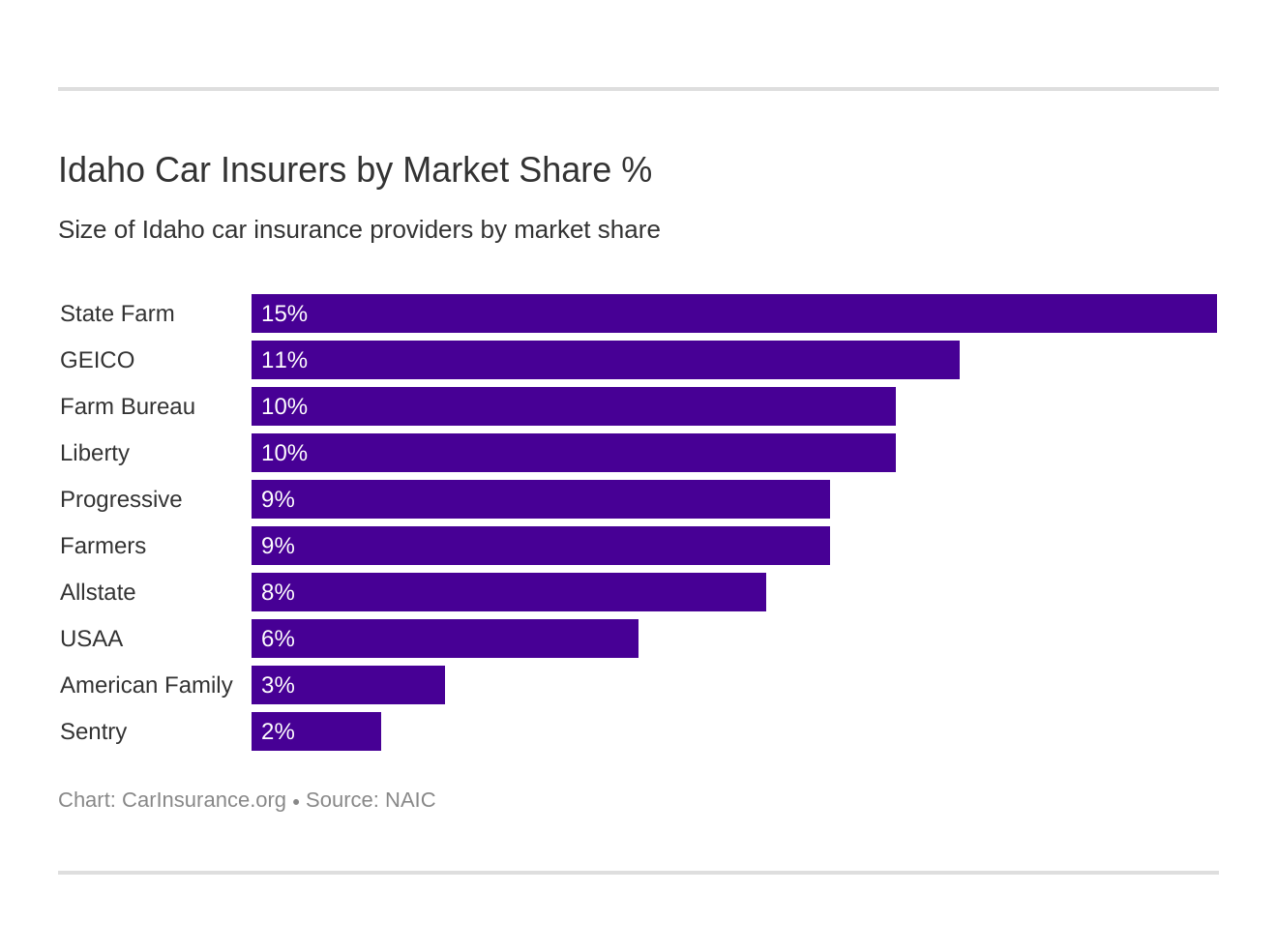

Are There Many Car Insurance Companies in Idaho?

You’ve likely seen all the thousands of commercials from popular car insurance providers out there these days. From Geico’s gecko mascot to Flo from Progressive and Jake from State Farm. Now imagine all of these companies being advertised trying to fight for your business. Intense, right?

That’s what we’re here to help you with. Which companies are worth your time and money?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Largest Companies Financial Rating?

Did you know that you can find out what kind of financial rating a car insurance provider has? It’s something known as an A.M. Best Rating, and it basically grades a provider based on their financial strength. Are they more financially healthy, or less so?

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Farm Bureau Group | A |

| Liberty Mutual Group | A |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| Allstate Insurance Group | A+ |

| USAA Group | A++ |

| American Family Insurance Group | A |

| Sentry Insurance Group | A+ |

You can see in the above table that a few providers have an A++ rating. This is a very good thing, as the more plus signs behind the grade, the higher the rating is.

What Are the Companies with the Best Customer Ratings?

According to a 2018 J.D. Power study, they found out the annual auto insurance customer satisfaction based off of region. Below is the northwest region’s customer satisfaction results.

What Are the Companies with Most Complaints in Idaho?

The other side of the coin for customer satisfaction is which company has the most complaints.

| Company Name | # of Complaints | Index | Market Share | Premium |

|---|---|---|---|---|

| State Farm | 3 | 2.24 | 13.38 % | $126,962,470 |

| Liberty Mutual | 2 | 9.99 | 2.00 % | $19,000,251 |

| Safeco | 1 | 1.32 | 7.58 % | $71,952,626 |

| Geico | 1 | 4.06 | 2.46 % | $23,355,526 |

Keep in mind with the data above that there is more to consider with car insurance companies than just their complaint ratio. Every company has complaints, not everyone is going to be happy with the plan they got.

Customer complaints are definitely something to consider, but take it with a grain of salt. You don’t make it onto the top 10 list of insurance providers unless it’s for a reason.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

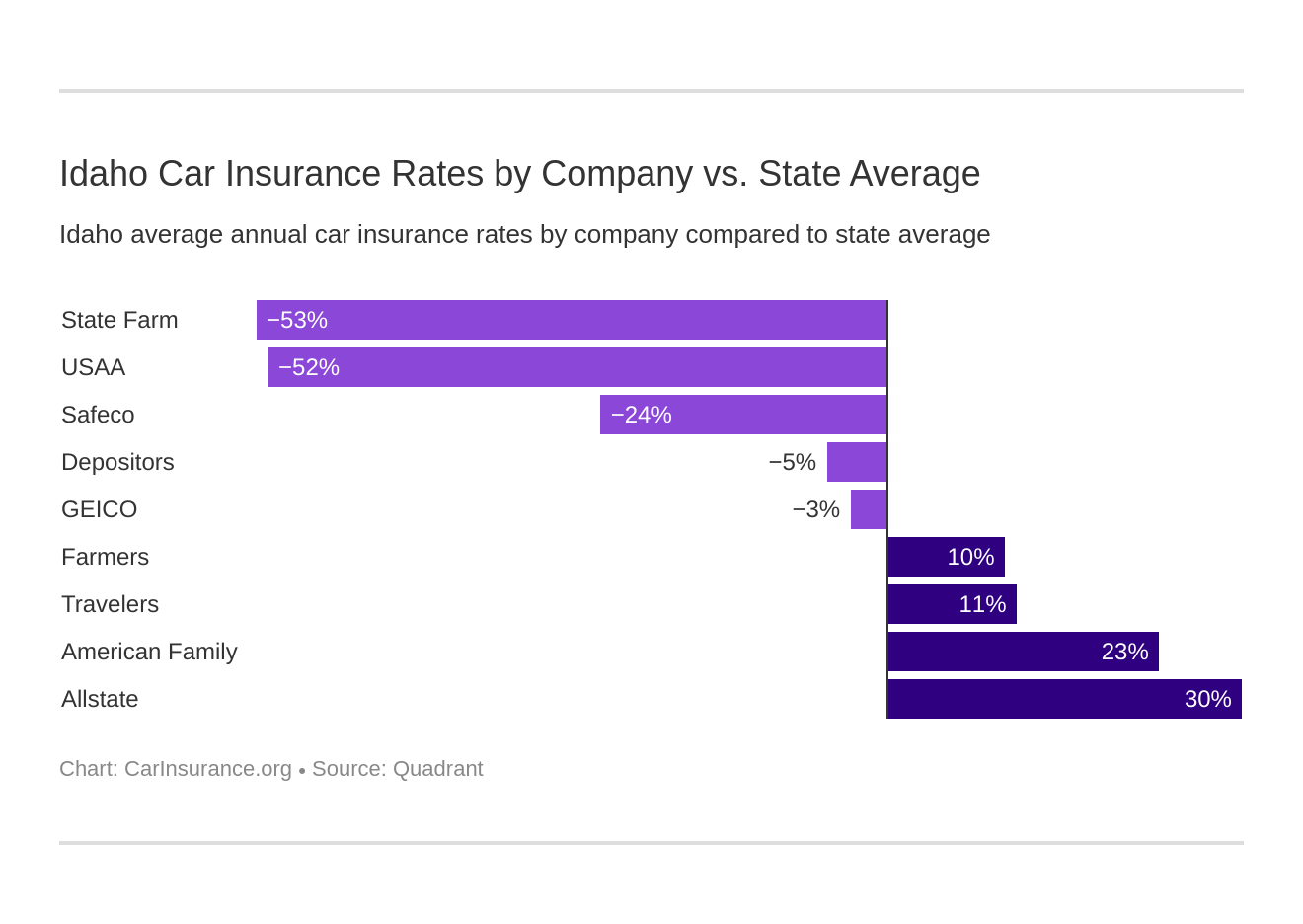

What Are Idaho Car Insurance Rates by Company?

Alright, so how much is all this gonna cost? Well, each company charges differently for their insurance coverage, so we’ve collected all of the data of their average rates for you to help you compare.

| Company | Average Annual Rate | Compared to State Average | Percentage |

|---|---|---|---|

| Allstate F&C | $4,088.76 | $1,225.95 | 29.98% |

| American Family Mutual | $3,728.79 | $865.97 | 23.22% |

| Farmers Ins Co Of ID | $3,168.28 | $305.47 | 9.64% |

| Geico General | $2,770.68 | -$92.14 | -3.33% |

| Safeco Ins Co of IL | $2,301.51 | -$561.30 | -24.39% |

| Depositors Insurance | $2,735.44 | -$127.37 | -4.66% |

| State Farm Mutual Auto | $1,867.96 | -$994.85 | -53.26% |

| Travelers Home & Marine Ins Co | $3,226.29 | $363.48 | 11.27% |

| USAA | $1,877.61 | -$985.20 | -52.47% |

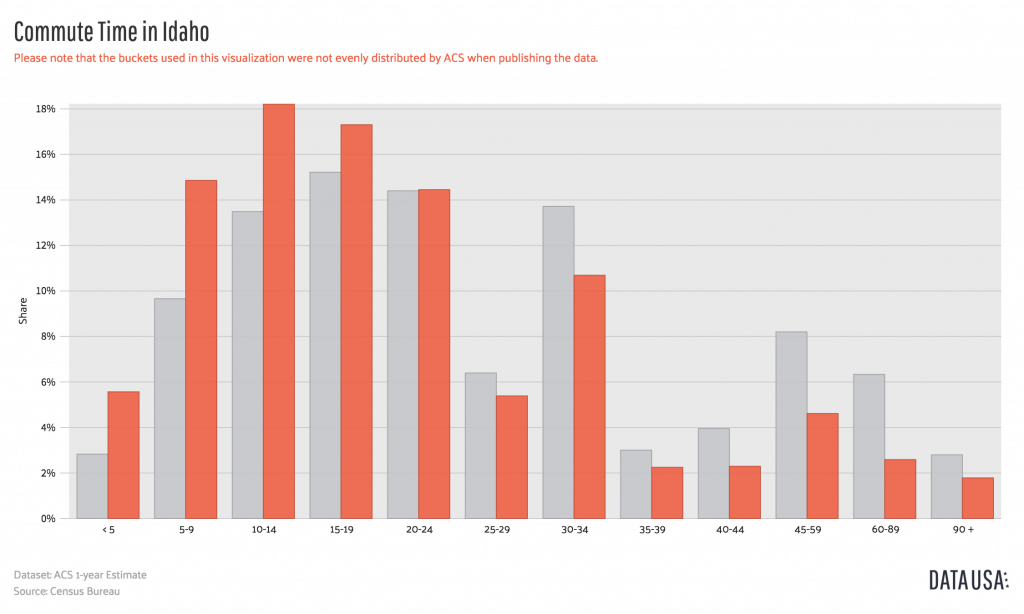

What Are the Commute Rates by Companies?

| Group | Commute & Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $4,088.76 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,088.76 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,651.77 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,805.81 |

| Travelers | 10 miles commute. 6000 annual mileage. | $3,226.29 |

| Travelers | 25 miles commute. 12000 annual mileage. | $3,226.29 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,168.28 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,168.28 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,723.05 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,818.30 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,735.44 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,735.44 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $2,301.51 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $2,301.51 |

| State Farm | 10 miles commute. 6000 annual mileage. | $1,823.01 |

| State Farm | 25 miles commute. 12000 annual mileage. | $1,912.91 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,855.16 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,900.06 |

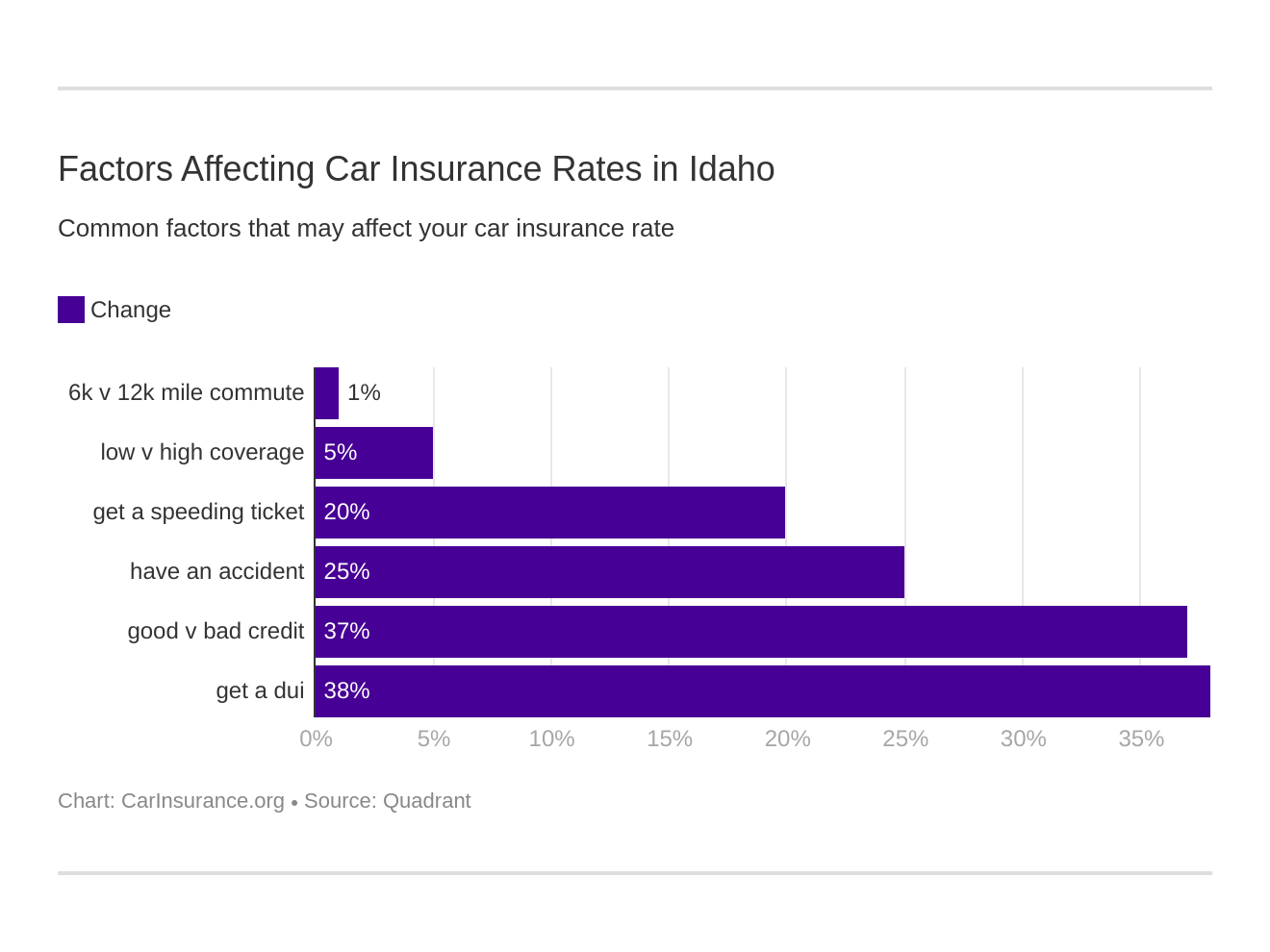

Take a look at these 6 major factors affecting auto insurance rates in Idaho.

What Are the Coverage Level Rates by Companies?

Did you know that you could be paying MORE for a lower coverage auto insurance policy? Depending on the company, you may actually be wasting money on a coverage plan that won’t protect you as well as a high coverage plan would.

Below you can find the average cost for several popular insurance carriers to help you find the cheapest insurance for the level of coverage you’re looking for.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $4,249.86 |

| Allstate | Medium | $4,080.92 |

| Allstate | Low | $3,935.49 |

| American Family | High | $3,542.83 |

| American Family | Medium | $3,914.07 |

| American Family | Low | $3,729.46 |

| Travelers | High | $3,232.47 |

| Travelers | Medium | $3,273.82 |

| Travelers | Low | $3,172.59 |

| Farmers | High | $3,359.73 |

| Farmers | Medium | $3,132.36 |

| Farmers | Low | $3,012.76 |

| Geico | High | $2,918.37 |

| Geico | Medium | $2,766.30 |

| Geico | Low | $2,627.36 |

| Nationwide | High | $2,635.33 |

| Nationwide | Medium | $2,874.15 |

| Nationwide | Low | $2,696.85 |

| Liberty Mutual | High | $2,429.56 |

| Liberty Mutual | Medium | $2,297.91 |

| Liberty Mutual | Low | $2,177.07 |

| State Farm | High | $1,969.68 |

| State Farm | Medium | $1,871.85 |

| State Farm | Low | $1,762.35 |

| USAA | High | $1,935.74 |

| USAA | Medium | $1,874.40 |

| USAA | Low | $1,822.69 |

So you can see from the table above that a low coverage plan for American Family is $3,729.46, while a high coverage plan with Travelers would only be $3,232,47. That’s a several hundred dollar difference.

The more you shop and compare, the more you could be saving!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About Credit History Rates by Companies?

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $5,398.15 |

| Allstate | Fair | $3,666.01 |

| Allstate | Good | $3,202.11 |

| American Family | Poor | $4,816.08 |

| American Family | Fair | $3,436.47 |

| American Family | Good | $2,933.82 |

| Farmers | Poor | $3,573.21 |

| Farmers | Fair | $3,033.33 |

| Farmers | Good | $2,898.31 |

| Geico | Poor | $3,368.23 |

| Geico | Fair | $2,689.62 |

| Geico | Good | $2,254.17 |

| Liberty Mutual | Poor | $3,283.44 |

| Liberty Mutual | Fair | $2,020.02 |

| Liberty Mutual | Good | $1,601.08 |

| Nationwide | Poor | $3,266.83 |

| Nationwide | Fair | $2,632.86 |

| Nationwide | Good | $2,306.63 |

| State Farm | Poor | $2,624.03 |

| State Farm | Fair | $1,658.82 |

| State Farm | Good | $1,321.02 |

| Travelers | Poor | $3,694.26 |

| Travelers | Fair | $3,107.83 |

| Travelers | Good | $2,876.79 |

| USAA | Poor | $2,744.62 |

| USAA | Fair | $1,599.54 |

| USAA | Good | $1,288.67 |

What Are the Driving Record Rates by Companies?

If you have a clean driving record, you won’t have much to worry about for insurance rates. The more you add to your record, however, the more you could be paying for your monthly premium.

| Group | Driving Record | Annual Average |

|---|---|---|

| USAA | Clean record | $1,347.13 |

| USAA | With 1 accident | $1,921.59 |

| USAA | With 1 DUI | $2,609.61 |

| USAA | With 1 speeding violation | $1,632.10 |

| Travelers | Clean record | $1,990.40 |

| Travelers | With 1 accident | $2,832.53 |

| Travelers | With 1 DUI | $4,913.17 |

| Travelers | With 1 speeding violation | $3,169.07 |

| State Farm | Clean record | $1,703.63 |

| State Farm | With 1 accident | $2,032.29 |

| State Farm | With 1 DUI | $1,867.96 |

| State Farm | With 1 speeding violation | $1,867.96 |

| Nationwide | Clean record | $2,088.90 |

| Nationwide | With 1 accident | $2,712.70 |

| Nationwide | With 1 DUI | $3,792.39 |

| Nationwide | With 1 speeding violation | $2,347.77 |

| Liberty Mutual | Clean record | $1,912.27 |

| Liberty Mutual | With 1 accident | $2,394.45 |

| Liberty Mutual | With 1 DUI | $2,469.94 |

| Liberty Mutual | With 1 speeding violation | $2,429.40 |

| Geico | Clean record | $1,703.22 |

| Geico | With 1 accident | $2,715.10 |

| Geico | With 1 DUI | $3,793.66 |

| Geico | With 1 speeding violation | $2,870.72 |

| Farmers | Clean record | $2,765.42 |

| Farmers | With 1 accident | $3,502.85 |

| Farmers | With 1 DUI | $3,281.82 |

| Farmers | With 1 speeding violation | $3,123.03 |

| American Family | Clean record | $2,939.25 |

| American Family | With 1 accident | $4,158.40 |

| American Family | With 1 DUI | $4,488.53 |

| American Family | With 1 speeding violation | $3,328.97 |

| Allstate | Clean record | $3,374.66 |

| Allstate | With 1 accident | $4,240.80 |

| Allstate | With 1 DUI | $4,737.87 |

| Allstate | With 1 speeding violation | $4,001.71 |

What is the Number of Insurers in Idaho?

| Property & Casualty Insurance | Total |

|---|---|

| Domestic | 10 |

| Foreign | 822 |

| Total | 832 |

For the table above, keep in mind that there are two types of insurers – foreign and domestic.

- Domestic Insurer – an insurance company admitted by and formed under the laws under the state in which insurance policies are written

- Foreign Insurer – an insurance provider which was formed under the laws of another state, but is still doing business in other states

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About Idaho State Laws?

In order to drive in Idaho, you’ll want to know state laws specific to driving in Idaho. After all, if you try to drive in Idaho thinking that the same laws as driving in California, or in Washington, will be the same, you’ll be wrong.

Save yourself from tickets and fines from laws you didn’t even know existed. In this section, we’ll cover all of the specific state laws for Idaho and break them down for you.

What Are the Car Insurance Laws?

There are specific laws regarding car insurance unique to Idaho citizens. Each state has laws for car insurance such as this regarding items such as high-risk insurance, low-cost government-assisted insurance programs, the statute of limitations, and more.

We’ll go over some of these Idaho-specific car insurance laws in this section in more detail.

How Are State Laws for Insurance Determined?

According to the NAIC, Idaho follows a very specific way in which insurance can be filed:

” Regarding form filings, file, and use – filing shall be submitted with certification that each policy complies with Idaho law (Section 41-1812).”

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About Windshield Coverage?

Depending upon the state in which you live, windshield coverage may be required in addition to all of your other minimum liability coverage.

Idaho, luckily, is not one of these states. You get the option of choosing how/with what you repair or replace your windshield should it ever be damaged.

Windshield coverage is nonetheless an excellent option to have on your policy, as the windshield is kind of a big deal to have on your vehicle.

If you do decide you’d like to opt for windshield coverage in Idaho, you’ll need to make sure you’ve purchased comprehensive coverage. You can check out Idaho’s Department of Insurance Claims Page for more information.

What About High-Risk Laws?

How’s your driving record? Chances are that if you’ve had multiple driving offenses on your record, you’ve been labeled as a ‘high-risk driver’. What exactly does this mean for you?

Well, it makes it extremely difficult to find a car insurance provider who is willing to offer you coverage. This can put you in quite the pickle though, as you’re still required to have car insurance in order to legally drive in Idaho. So what do you do? How do you find High-Risk Policies?

Luckily, Idaho has a high-risk insurance plan known as the Idaho Automobile Insurance Plan, also known as IDAIP. How does this plan work for you?

Well, IDAIP works with all of the different insurance providers who provide insurance for Idaho citizens. In order for these companies to be able to serve their Idaho clients, they must agree to be part of this plan.

If they don’t, they are not permitted to operate within the state. IDAIP then assigns you to an insurance company.

How do you qualify for this program?

- Provide written proof that you have not been able to acquire coverage in the past 60 days

- Been offered carrier rates that are higher than IDAIP’s

If you do qualify, you’re going to need to do a few things before you can fill out an application:

- Possess a valid drivers license

- Your vehicle is registered in Idaho

- Make sure you have not skipped any payments to an auto insurance provider within the past 12 months

- Make sure your policy hasn’t been canceled due to you not fulfilling your car’s safety inspection

If you do not have the above items, your application will be rejected.

Once being accepted into the program, your coverage will last for three years. Take our advice, try to improve your driving record during that time! Otherwise, you could be paying massively high insurance rates.

Is There Low-Cost Insurance?

Some states are able to provide their citizens with a low-cost insurance program for those who are low-income. Idaho is unfortunately not one of these states, but that doesn’t mean you can’t save some cash.

Aside from having a clean driving record and a good credit history, many insurance providers offer discounts so that you may qualify for cheaper premiums.

Check out these common insurance discounts to see if you qualify:

- Good Student

- Home-Owner

- Multi-Car

- Bundled (if the provider also offers other types of insurance such as home-owners insurance)

- Paperless

- Auto-Pay

- Paid-in-Full

- Accident-Free

- Emergency Roadside Assistance

- Defensive Driver Training/Course

- Affiliation (through an employer, school, team, club, etc.)

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There Much Automobile Insurance Fraud in Idaho?

Insurance fraud is a crime all across the nation, with billions of dollars lost each year.

Idaho law under Statute 41-293 states that automobile insurance fraud can be committed by:

- Faking an accident

- Adding ‘costs’ to an otherwise legitimate claim – also called padding your claim

- Obtaining money or benefit from false claims/information

- Assisting with the falsification of claims/information

Under this, if you were to commit insurance fraud, you could be facing:

- Prison time of up to 15 years

- $15,000 in fines

So if you need to make a claim to your insurance provider, make sure everything is correct and accurate, otherwise, it could cost you your freedom.

What is the Statute of Limitations?

The statute of limitations is how long you have in order to file and resolve a claim if you are ever in an accident. Each state differs in this time frame and depends on whether it is a personal injury claim or a property damage claim.

In Idaho, the statute of limitations is as follows:

- Personal Injury Claim: two years

- Property Damage Claim: three years

Getting your insurance claim submitted within this time frame will ensure that you can get the money you need.

What About the Vehicle Licensing Laws?

The various types of licensing procedures and laws are what we’ll cover in this section.

Let’s get to it.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Penalties for Driving without Insurance?

It is required that in ordered to legally drive in Idaho, you have to carry at least one of the acceptable forms of financial responsibility with you. Driving without your insurance can lead you to some serious penalties.

A first-time offense can lead you to a $75 fine as well as your license being suspended. Once your license is suspended, you will then have to offer some proof of insurance in order to get it reinstated.

A second-time violation (within a five-year period of the first offense) will wind up costing you $5,000 as well as your license being suspended once again.

This time though, in order to get your license reinstated, you must show and maintain proof of insurance for at least three years. You may also possibly see a six-month prison sentence.

So remember, carrying your proof of insurance with you while operating your vehicle is crucial. Avoid all the fines and penalties by keeping it with you at all times.

Are There Any Teen Driver Laws?

Idaho teens are in luck! You only need to be 14 years of age and six months in order to get your learner’s permit.

In order to qualify for a restricted license, teens have to follow some pretty strict rules:

- Have a learner’s permit for a minimum of six months

- Have the supervised driving time of a minimum of 50 hours

- Be at least 15 years of age

During this time period of intermediate licensing, teens will also have to watch out for:

- Nighttime driving restrictions between sunset and sunrise

- Drivers 16 years old and younger can only drive if a family member is present, and can not have a passenger under the age of 17

These restrictions can then be lifted at 16 years old for nighttime driving and 17 or older for passenger restrictions.

What Are the Older Driver and General Population License Renewal Procedures?

After a certain period of time, your driver’s license needs to be renewed. That is standard across the nation, but what you are required to do upon renewal changes from state to state.

In Idaho, the following license renewal procedures are enacted for older drivers, as well as for the general population:

| Procedure | General Population | Older Population |

|---|---|---|

| Renewal Period | Every 4 or 8 years (personal option) | Every 4 years (for people 63 and older) |

| Proof of Vision | Required at each renewal | Required at each renewal |

| Online/Mail Renewal Permitted | By mail, every other renewal; must choose 4-year license | Not permitted 70 and older |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About New Residents?

New in town? If so, there’s a couple of things you’re going to want to make sure you do in order to cruise the Idaho roads.

You’ll need to apply for an Idaho driver’s license within the first 90 days of you establishing your residence by converting your older driver’s license over. There’s a couple of documents that you’ll need to apply:

- Documentation of Idaho residency (such as a rental agreement, utility bill, school enrollment records, mortgage payment documentation, etc.)

- ID proving age and identity (such as a passport, birth certificate, citizenship certificate, etc.)