Minnesota Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 11.5

From the Minnesota Marine Art Museum to Minnesota’s North Shore Scenic Drive, there is a lot to see and do in the North Star State.

This explains why there are approximately 5 million registered vehicles on the road in Minnesota. That is almost one car for every resident.

With so many cars on the road, there are bound to be some accidents. This could leave you with a huge headache if you are forced to navigate the claims process and car insurance premium laws on your own.

Having the right car insurance provider on your side can help you cut through all the red tape and get things back to normal quickly though.

How do you know that you have chosen the right provider? Keep reading to find out about some simple tips that can help you chose your car insurance provider with confidence.

How to Get Minnesota Car Insurance Coverage and Rates

Minnesota really is a great place to live. The North Star State also cares about the safety and security of its residents which is why it has passed legislation to ensure that all drivers in the Land of 10,000 Lakes are protected.

Knowing what these requirements are and who really is offering you the best price for them can be tricky though. That is where we come in.

We are here to help you sort through the confusion by providing you insight into all of the data you need in order to make an educated investment in your car insurance provider and policy.

Keep scrolling to find out just what your minimum insurance requirements, rights, and responsibilities are as a driver on Minnesota roadways.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s Minnesota car culture like?

In the North Star State, the “Minnesota Nice” extends beyond the office or supermarket. This is why many tourists and newcomers to the Minnesota car culture often remark about the lack of aggression displayed on Minnesota roadways.

That is of course unless you live in Minneapolis-St. Paul which Infoplease ranks as 14th on its list of the top 25 U.S. Cities with the worst road rage.

Just because most Minnesotans aren’t as vocal as drivers in other states doesn’t mean that they aren’t silently judging your lack of driving ability though.

All jokes aside, residents of the North Star State really are great people who truly do have a desire to share the road with each other and get from point A to point B with as little conflict or incident as possible.

Harsh Minnesota winters can sometimes make this a near-impossible endeavor, but the Minnesota spirit is hardier than anything that Mother Nature can throw at it.

This hardy spirit has crafted residents of the North Star State into savvy shoppers who want to make sure that they are getting the most out of every dollar they spend.

This is why we have collected all of the information you need in one place so that you can make the best decision for you and your loved ones when it comes time to purchase your car insurance policy.

What are the Minnesota minimum coverage requirements?

Because driving conditions on the roads in Minnesota can sometimes be more hazardous than the roads in other places across the United States the Minnesota Department of Public Safety (DPS), Minnesota Driver and Vehicle Servis (DVS), and the state legislature have worked together to create the minimum car insurance requirements for drivers in the North Star State.

These minimum mandatory requirements for liability coverage are as follows:

- $30,000 in bodily injury liability coverage for one person injured in an accident.

- $60,000 in bodily injury liability coverage for two or more people injured in an accident.

- $10,000 for property damages occurring as a result of an accident.

Minnesota also requires that you carry the following Personal Injury Protection coverage:

- $40,000 per person per accident

- $20,000 for medical expenses

- $20,000 to cover any other expenses such as lost wages that were incurred due to a car accident

The North Star State requirements don’t stop there.

As a driver in Minnesota you are also required to carry the following amounts in Uninsured and Underinsured Motorist Coverage:

- $25,000 to cover injuries to one person for both UM and UMI

- $50,000 to cover injuries to two or more people for UM and UMI

With so much coverage required by the North Star State, you will definitely want to be sure that you are getting the most for your money when you purchase your car insurance policy.

You will also want to make sure that you have the proper forms of financial responsibility should you get pulled over or be involved in an accident.

What’s the form of financial responsibility?

The Minnesota Legislature has mandated that:

No motor carrier and no interstate carrier shall operate a vehicle until it has obtained and has in effect the minimum amount of financial responsibility required.

This is part of the statutes that define Minnesota’s financial responsibility laws.

Simply put, the financial responsibility laws in the North Star State mandate that all drivers carry the minimum amount of coverage required by law, and that they have proof of insurance to demonstrate their compliance with the law.

This is why forms of financial responsibility are often called proof of insurance since they are the way that drivers prove that they have a valid car insurance policy or surety bond.

A surety bond is also referred to as an SR-22 insurance form and it may be required if you have an accident or other driving offenses on your record.

If asked to provide proof of insurance in the North Star State you can always present your physical policy which will tell the demanding part that your policy is valid.

In the Land of 10,000 Lakes you also have two other ways that you can prove that you are within the letter of the law which are:

- An e-insurance card that can be accessed through your auto insurance provider’s app on your smartphone, laptop, tablet, or other electronic devices.

- A printed copy of your Insurance ID Card is usually mailed to you shortly after you purchase your policy or emailed to you so that you can print it out at your convenience.

Be aware that Minnesota does have penalties if you fail to present the proper proof of insurance.

Some of these penalties may include:

- A misdemeanor charge

- A $200 fine

- Community service

Why would you risk it though when modern-day conveniences have made proving your financial responsibility so easy?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What percentage of income are premiums?

Now that you know what is expected of you as a driver on Minnesota’s roadways it is time to start crunching numbers.

According to Business Insider, Minnesota ranks 19th in the nation when it comes to how much Americans are paying for car insurance premiums annually.

The Insurance Information Institute (III) also ranks the North Star State 39th nationally for average expenditures for auto insurance.

This is good news for residents of the North Star State because it means that, on the whole, the cost of car insurance in Minnesota is below the national average.

Car insurance rates have remained pretty consistent as a percentage of income over the last few years as well.

On average around 2.01 percent of every Minnesotans’ annual disposable income is spent on car insurance.

With a per capita disposable income of $42,516 per year earned by residents of the North Star State, and $875.49 of that being spent to maintain insurance on your vehicle, this means that the average cost for a Minnesotan is around $73 of their $3,543 monthly budget to drive in the Land of 10,00 Lakes.

The price of car insurance is also higher than it is in both Wisconsin and Iowa whose residents pay around $717 and $684 respectively for the car insurance coverage annually.

This is why it is so important to get the best price when shopping for your car insurance policy in the North Star State.

What are the average monthly car insurance fates in MN (liability, collision, comprehensive)?

Finding out how you can get the most for your money when shopping for your car insurance policy means understanding what is required of you as a vehicle owner in Minnesota.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $456.82 |

| Collision | $234.40 |

| Comprehensive | $184.27 |

| Combined total | $875.49 |

The rates reflected above are from the National Association of Insurance Commissioner’s (NAIC) 2014/2015 Auto Insurance Database Report which could mean that the rates in 2019 are slightly higher.

Because rates can sometimes fluctuate it pays to shop around for your car insurance policy. Taking the time to become a well-informed consumer is part of this process.

Is there additional coverage?

When making your decision about which car insurance provider is right for you, core coverage is not the only thing that should be on your mind.

In fact, sometimes it pays to have more auto insurance coverage than just what the state requires.

This is why insurers in the North Star State provide you with the following additional coverage options:

- Umbrella Insurance – This type of liability coverage protects you in the event that you find yourself being sued as a result of an accident and the underlying policy limits have been exhausted.

- Collision Coverage – With this addition to your policy you will be covered if you hit another vehicle, your vehicle is hit by someone else, you hit a stationary object, or your vehicle rolls over unintentionally.

- Comprehensive Coverage – This type of coverage protects you from damage due to vandalism, theft, natural disasters, or animal strikes.

Given that animal strikes are common at certain times of the year in the North Star State it could prove useful to invest in additional liability options.

When deciding on additional coverage options it is always a good idea to consider the loss ratio of the companies that you are thinking about doing business with.

Take a look at the table below to see the loss ratio trends for Minnesota.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection | 72% | 70% | 67% |

| Medical Payments (MedPay) | 421% | 72% | 48% |

| Uninsured/Underinsured Motorist | 56% | 54% | 56% |

As you can see, Minnesota made a major turnaround when it came to the loss ratio for MedPay. What does this mean to you? It means that Minnesota car insurance companies are constantly amending how they do business in order to improve the market’s overall health.

Looking at the loss ratio trends gives you an indication of how the car insurance market as a whole is performing in the North Star State.

- A High Loss Ratio (over 100 percent) means that the companies are losing money because they are paying out too many claims in comparison to the amount of premium they are collecting which might cause them financial trouble long-term.

- A Low Loss Ratio indicates that these companies might have over-priced their auto insurance policies or overestimated the number and severity of claims they expected to receive.

The gains in the area of MedPay really are good news then when it comes to the health of Minnesota’s overall insurance market.

The loss ratios for uninsured/underinsured motorists (UM/UIM) are also good news considering that 11.5 percent of all drivers in the North Star State are uninsured ranking Minnesota 27th in the nation.

Keep reading to find out about other ways to guard against unsee events.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any add-ons and endorsements?

Minnesotans do not just have insurance options when it comes to additional liability coverage. You also have a variety of add-on and endorsements to choose from when purchasing your car insurance policy in the North Star State.

The options can help you pay for things like a mechanical breakdown or renting a car, and they can help you protect yourself in the case of a total loss.

Some of the most popular add-on and endorsement options in the North Star State include:

- Guaranteed Auto Protection (GAP)-If your car is ever stolen or totaled in an accident this add-on can help you cover the loss by paying off the lease or loan.

- Rental Reimbursement-Should you ever find yourself in need of a rental car after an accident while your car is being repaired it will be nice to know that this nifty add-on has your back.

- Emergency Roadside Assistance – Getting caught on the side of the road is no fun. This type of add-on can take away some of the pain of getting a flat or needing a tow if your car ever breaks down while you are behind the wheel.

- Non-Owner Car Insurance – Don’t own a car but still enjoy driving once in a while? This add-on is perfect for you then because it offers you liability coverage even if the car you are driving isn’t registered to you.

- Mechanical Breakdown Insurance – This type of coverage can help you make up the difference in the cost of repair bills should you ever need help.

- Classic Car Insurance – Classic cars need special care and special coverage. This type of add-on is perfect for protecting your prized possession.

- Modified Car Insurance – If you like to soup up your wheels then this type of coverage can help cover the cost of repairing the modifications that you have made should they become damaged in a crash.

The type of car you drive or the possibility of a mechanical breakdown are not the only things that you should be considering as you construct a car insurance policy that suits all of your needs.

Sometimes just being who you are can impact how much you will pay which is why it is best to shop around. Keep reading to find out how you can help keep your rates down no matter who you are.

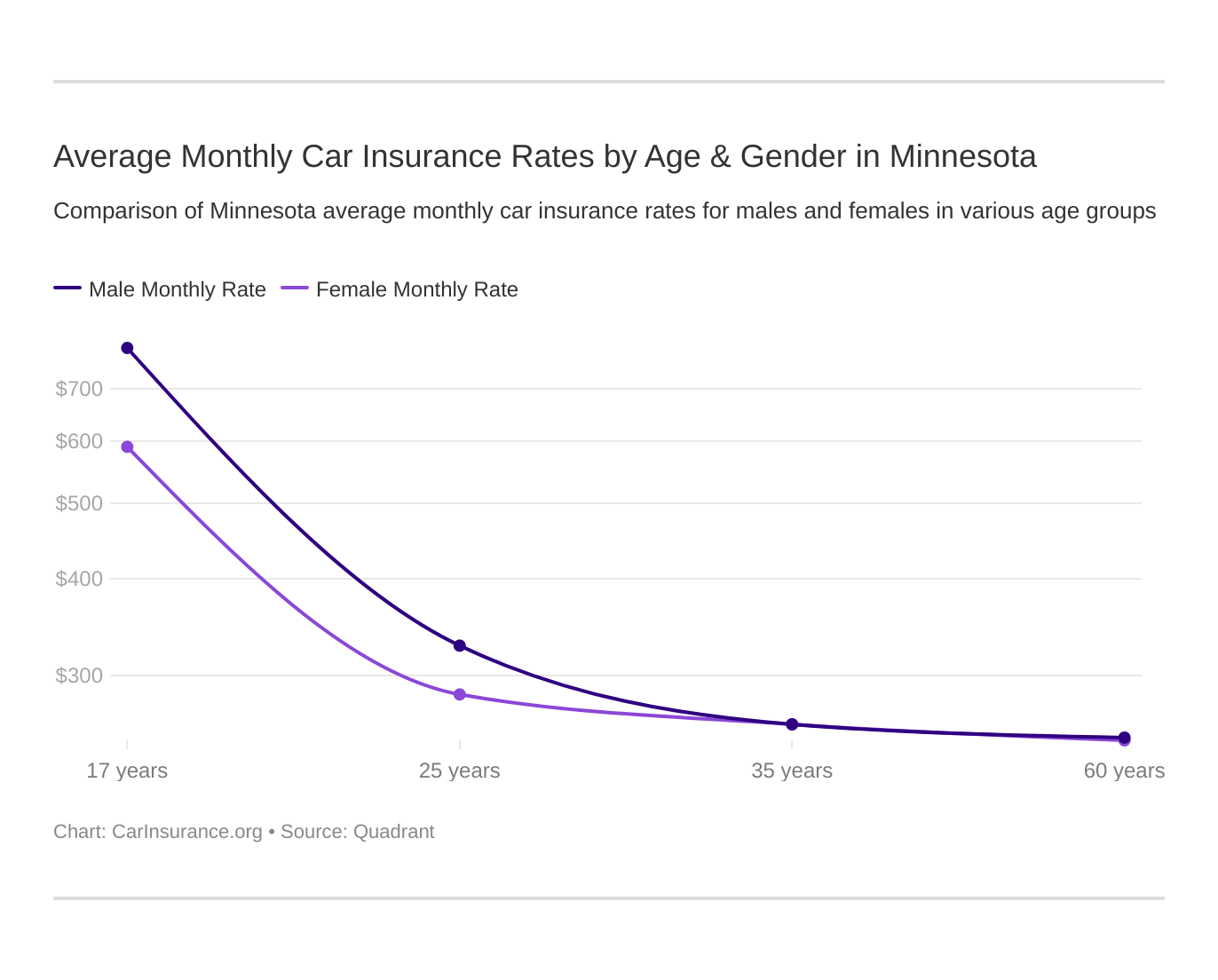

What are the average monthly car insurance rates by age & gender in MN?

No matter your age or gender, at some point most of us will end up needing to buy car insurance. When it comes time to make your purchase then you will want to know just how these things will impact you.

According to the Consumer Federation of America:

48 percent of Americans think auto insurers charge men more for coverage than women, while only 23 percent of mericans think that women are chargesd more.

The reality is that women are more likely to pay more according to their 2017 study.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Indemnity | $3,023.30 | $3,023.30 | $2,908.43 | $2,908.43 | $6,885.00 | $9,968.67 | $3,677.99 | $3,860.95 |

| American Family Mutual | $2,233.79 | $2,233.79 | $2,025.26 | $2,025.26 | $6,086.73 | $8,812.61 | $2,233.79 | $2,519.05 |

| Illinois Farmers Ins | $2,041.64 | $2,038.65 | $1,965.24 | $2,076.17 | $5,820.43 | $5,872.48 | $2,672.81 | $2,612.21 |

| Geico General | $2,661.52 | $2,641.10 | $2,544.82 | $2,473.72 | $5,545.67 | $7,047.50 | $2,494.27 | $2,579.67 |

| Liberty Mutual Fire | $9,604.65 | $9,604.65 | $9,510.34 | $9,510.34 | $18,911.44 | $28,385.86 | $9,604.65 | $13,376.94 |

| AMCO Insurance | $1,970.26 | $1,978.45 | $1,753.51 | $1,860.69 | $5,026.90 | $6,105.97 | $2,312.50 | $2,403.62 |

| State Farm Mutual Auto | $1,542.45 | $1,542.45 | $1,374.37 | $1,374.37 | $3,334.79 | $4,106.75 | $1,786.56 | $1,474.15 |

| USAA CIC | $1,895.96 | $1,879.44 | $1,726.56 | $1,724.94 | $5,042.84 | $5,519.17 | $2,473.98 | $2,629.95 |

As you can see from the table above, no matter what their gender is, teenaged drivers are still the most expensive people to insure.

The ability of car insurance companies to use gender as a factor for setting your rates is also a hotly debated issue among people such as University of Minnesota Law School professor Daniel Schwarcz who believes that:

If companies are not allowed to use “outdated stereotypes based on generalities” about men and women, the insurers will have to consider “more directly” such measures as the number if miles driven, the number of years customers have been driving, and where they live.

Many drivers agree with this as well.

For now, age and gender are still allowed to be considered in the North Star State. They are not the only things under consideration though.

Some of those direct measures that Daniel Schwarcz discussed are factors as well.

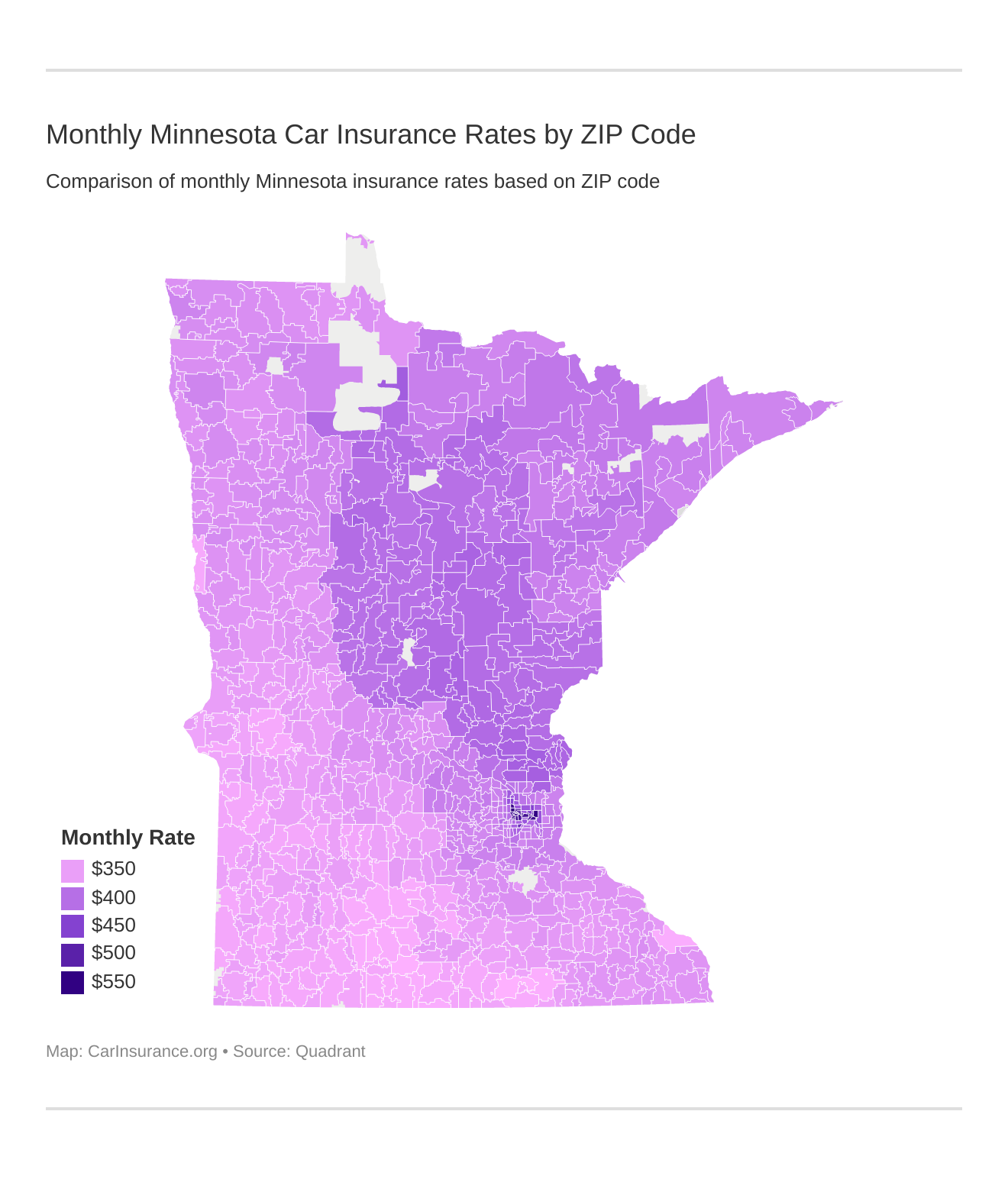

What are the cheapest car insurance rates by ZIP code?

Most people don’t realize that their car insurance rates can be impacted just by the neighborhood that they call home. Sometimes just crossing the street into a new ZIP code can make a world of difference. Take a look at the tables below to find out what we mean.

| Most Expensive ZIP Codes in Minnesota | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 55411 | MINNEAPOLIS | $6,620.56 | Liberty Mutual | $20,934.87 | Allstate | $6,404.25 | State Farm | $3,337.51 | USAA | $3,688.43 |

| 55106 | SAINT PAUL | $6,563.33 | Liberty Mutual | $20,971.66 | Allstate | $6,567.98 | State Farm | $3,568.79 | USAA | $3,711.58 |

| 55101 | SAINT PAUL | $6,547.31 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,460.84 | USAA | $3,504.15 |

| 55103 | SAINT PAUL | $6,520.89 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,315.39 | USAA | $3,504.15 |

| 55404 | MINNEAPOLIS | $6,491.18 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,895.66 | USAA | $3,328.08 |

| 55412 | MINNEAPOLIS | $6,434.63 | Liberty Mutual | $20,934.87 | Allstate | $6,465.92 | State Farm | $3,297.21 | USAA | $3,688.43 |

| 55107 | SAINT PAUL | $6,404.50 | Liberty Mutual | $20,971.66 | Allstate | $6,136.19 | State Farm | $3,003.66 | USAA | $3,261.85 |

| 55454 | MINNEAPOLIS | $6,394.17 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,770.93 | USAA | $3,328.08 |

| 55415 | MINNEAPOLIS | $6,385.64 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,861.81 | USAA | $3,328.08 |

| 55407 | MINNEAPOLIS | $6,382.20 | Liberty Mutual | $20,346.17 | Allstate | $6,595.26 | State Farm | $2,988.98 | USAA | $3,582.41 |

| 55408 | MINNEAPOLIS | $6,370.83 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,894.22 | USAA | $3,183.53 |

| 55402 | MINNEAPOLIS | $6,353.00 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,824.38 | USAA | $3,328.08 |

| 55455 | MINNEAPOLIS | $6,349.43 | Liberty Mutual | $20,934.87 | Allstate | $6,531.88 | State Farm | $2,935.21 | USAA | $3,328.08 |

| 55104 | SAINT PAUL | $6,339.29 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $3,032.21 | USAA | $3,328.08 |

| 55405 | MINNEAPOLIS | $6,320.72 | Liberty Mutual | $20,934.87 | Allstate | $6,601.34 | State Farm | $2,824.38 | USAA | $3,688.43 |

| 55406 | MINNEAPOLIS | $6,257.62 | Liberty Mutual | $20,346.17 | Allstate | $6,568.73 | State Farm | $2,777.97 | USAA | $3,222.20 |

| 55414 | MINNEAPOLIS | $6,254.15 | Liberty Mutual | $20,346.17 | Allstate | $6,531.88 | State Farm | $2,681.89 | USAA | $3,328.08 |

| 55403 | MINNEAPOLIS | $6,252.05 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,800.79 | USAA | $3,328.08 |

| 55413 | MINNEAPOLIS | $6,248.33 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,907.36 | USAA | $3,271.06 |

| 55401 | MINNEAPOLIS | $6,221.83 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,859.24 | USAA | $3,328.08 |

| 55114 | SAINT PAUL | $6,200.17 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $2,503.54 | USAA | $3,328.08 |

| 55102 | SAINT PAUL | $6,187.71 | Liberty Mutual | $20,346.17 | Allstate | $5,927.14 | State Farm | $2,977.73 | USAA | $3,261.85 |

| 55409 | MINNEAPOLIS | $6,109.20 | Liberty Mutual | $20,346.17 | Allstate | $6,509.73 | State Farm | $2,954.03 | USAA | $3,183.53 |

| 55130 | SAINT PAUL | $5,798.28 | Liberty Mutual | $14,314.34 | Allstate | $6,462.88 | State Farm | $3,582.91 | USAA | $3,711.58 |

| 55450 | MINNEAPOLIS | $5,758.23 | Liberty Mutual | $20,934.87 | Allstate | $5,069.73 | USAA | $2,531.82 | State Farm | $2,935.21 |

As the largest city in Minnesota, Minneapolis boasts no less than 68 ZIP codes. Not all people in these ZIP codes pay the same for car insurance though.

Looking at the data reveals that residents of Minneapolis who live near the U.S. Bank Stadium pay $6,385 on average while those who reside near North Commons Park pay almost $300 more.

Move into the neighborhood of Minneapolis near Lyndale Farmstead Park though and you will be paying about $200 less than those by U.S. Bank Stadium.

| Cheapest ZIP Codes in Minnesota | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 56007 | ALBERT LEA | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| 56088 | TRUMAN | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| 56120 | BUTTERFIELD | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| 55912 | AUSTIN | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| 56159 | MOUNTAIN LAKE | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| 55987 | WINONA | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| 56039 | GRANADA | $4,018.94 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| 56027 | ELMORE | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| 56073 | NEW ULM | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| 56181 | WELCOME | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| 56062 | MADELIA | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| 56031 | FAIRMONT | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| 56127 | DUNNELL | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| 56087 | SPRINGFIELD | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| 56054 | LAFAYETTE | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| 56081 | SAINT JAMES | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| 56075 | NORTHROP | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| 56098 | WINNEBAGO | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| 56019 | COMFREY | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| 56041 | HANSKA | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| 56001 | MANKATO | $4,043.78 | Liberty Mutual | $11,927.85 | Allstate | $4,376.76 | State Farm | $2,014.61 | Nationwide | $2,615.86 |

| 56085 | SLEEPY EYE | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| 56036 | GLENVILLE | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| 56171 | SHERBURN | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| 56162 | ORMSBY | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

Your neighborhood is not the only geographic factor that car insurance companies consider when determining how much you will pay for your policy. Sometimes the city that you love can cost you big bucks as well.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the cheapest car insurance rates by city?

From sights along the Mighty Mississippi as it meanders through Minneapolis-St. Paul to the tiny town of Funkley where Funkley Bar becomes City Hall when its time for the City Council to meet, the North Star State has some of the most beautiful and interesting cities in the nation.

The city that you call home could be working against you when it comes time to buy car insurance though.

This is why having the right information in your hands as you determine which car insurance provider is right for you could help you avoid a costly mistake when investing in your policy.

We have put the research together for you that could help you invest wisely. Take a look at the tables below to see just what residents of your hometown are paying for their car insurance policies.

| Cheapest Cities in Minnesota | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Albert Lea | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| Truman | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| Butterfield | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| Austin | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| Mountain Lake | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| Goodview | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| Granada | $4,018.95 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| Elmore | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| New Ulm | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| Welcome | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| Madelia | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| Fairmont | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| Dunnell | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| Springfield | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| Lafayette | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| St. James | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| Northrop | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Winnebago | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| Comfrey | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| Hanska | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| Sleepy Eye | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| Glenville | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| Sherburn | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| Ormsby | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Lewisville | $4,051.00 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,712.06 | USAA | $2,438.90 |

With a population of around 18,000, it is no wonder that car insurance rates in Albert Lea are so cheap compared to the sprawling city of Minneapolis where Minnesotans pay over $2,000 more on average.

| Most Expensive Cities in Minnesota | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Minneapolis | $6,106.69 | Liberty Mutual | $19,767.41 | Allstate | $6,275.74 | State Farm | $2,860.94 | USAA | $3,270.39 |

| St. Paul | $5,972.08 | Liberty Mutual | $18,511.98 | Allstate | $6,141.30 | State Farm | $3,006.99 | USAA | $3,309.17 |

| Little Canada | $5,397.29 | Liberty Mutual | $14,314.34 | Allstate | $5,939.60 | USAA | $3,246.25 | State Farm | $3,375.84 |

| Brooklyn Center | $5,250.46 | Liberty Mutual | $13,733.42 | Allstate | $5,517.75 | State Farm | $2,657.84 | USAA | $3,027.14 |

| Falcon Heights | $5,110.86 | Liberty Mutual | $14,384.20 | Allstate | $5,605.47 | State Farm | $2,445.02 | USAA | $3,000.34 |

| Columbia Heights | $5,103.52 | Liberty Mutual | $13,733.42 | Allstate | $5,453.46 | State Farm | $2,631.03 | USAA | $2,963.85 |

| Maplewood | $5,061.15 | Liberty Mutual | $14,314.34 | Allstate | $5,382.25 | State Farm | $2,720.57 | USAA | $2,960.39 |

| Waskish | $5,023.66 | Liberty Mutual | $15,228.53 | Farmers | $4,564.50 | State Farm | $2,148.12 | Nationwide | $2,950.86 |

| St. Francis | $5,003.38 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,460.88 | USAA | $3,193.94 |

| Martin Lake | $5,003.33 | Liberty Mutual | $15,094.54 | Allstate | $4,712.34 | State Farm | $2,459.40 | USAA | $3,193.94 |

| Richfield | $5,002.58 | Liberty Mutual | $14,343.36 | Allstate | $5,308.16 | State Farm | $2,566.97 | USAA | $2,790.97 |

| Lake George | $4,999.75 | Liberty Mutual | $15,228.53 | Farmers | $4,491.44 | State Farm | $2,185.55 | USAA | $3,008.87 |

| South St. Paul | $4,994.42 | Liberty Mutual | $14,314.34 | Allstate | $5,331.35 | State Farm | $2,667.84 | USAA | $2,987.88 |

| Columbus | $4,992.05 | Liberty Mutual | $15,094.54 | Allstate | $4,758.69 | State Farm | $2,382.94 | Nationwide | $3,130.44 |

| Bethel | $4,984.06 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,424.09 | USAA | $3,193.94 |

| East Bethel | $4,978.05 | Liberty Mutual | $15,094.54 | Allstate | $4,712.66 | State Farm | $2,477.33 | USAA | $3,193.94 |

| Fridley | $4,971.65 | Liberty Mutual | $13,733.42 | Allstate | $5,492.04 | State Farm | $2,618.39 | USAA | $2,807.34 |

| Almelund | $4,966.16 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Isanti | $4,955.17 | Liberty Mutual | $15,094.54 | Allstate | $4,790.79 | State Farm | $2,422.96 | Nationwide | $3,215.12 |

| Garrison | $4,948.90 | Liberty Mutual | $15,228.53 | Allstate | $4,537.69 | State Farm | $2,148.12 | USAA | $2,902.05 |

| Andover | $4,946.23 | Liberty Mutual | $15,094.54 | Allstate | $5,081.81 | State Farm | $2,396.83 | USAA | $2,982.27 |

| Grandy | $4,945.76 | Liberty Mutual | $15,094.54 | Allstate | $4,770.32 | State Farm | $2,406.80 | Nationwide | $3,215.12 |

| Swatara | $4,945.15 | Liberty Mutual | $15,228.53 | Allstate | $4,489.01 | State Farm | $2,148.12 | Nationwide | $2,993.69 |

| Taylors Falls | $4,943.22 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Centerville | $4,940.45 | Liberty Mutual | $15,094.54 | Allstate | $4,928.00 | State Farm | $2,248.59 | USAA | $2,780.77 |

More people means more cars on the road which explains the drastic difference in the prices of premiums between Albert Lea and Minneapolis since more cars usually translate into more accidents.

With more accidents comes more claims filed against car insurance companies leading to an increase in rates for everyone overall.

Should you ever find yourself in the unfortunate position of needing to file a claim you will want a great car insurance provider on your side. That is where we come in.

What are the best Minnesota car insurance companies?

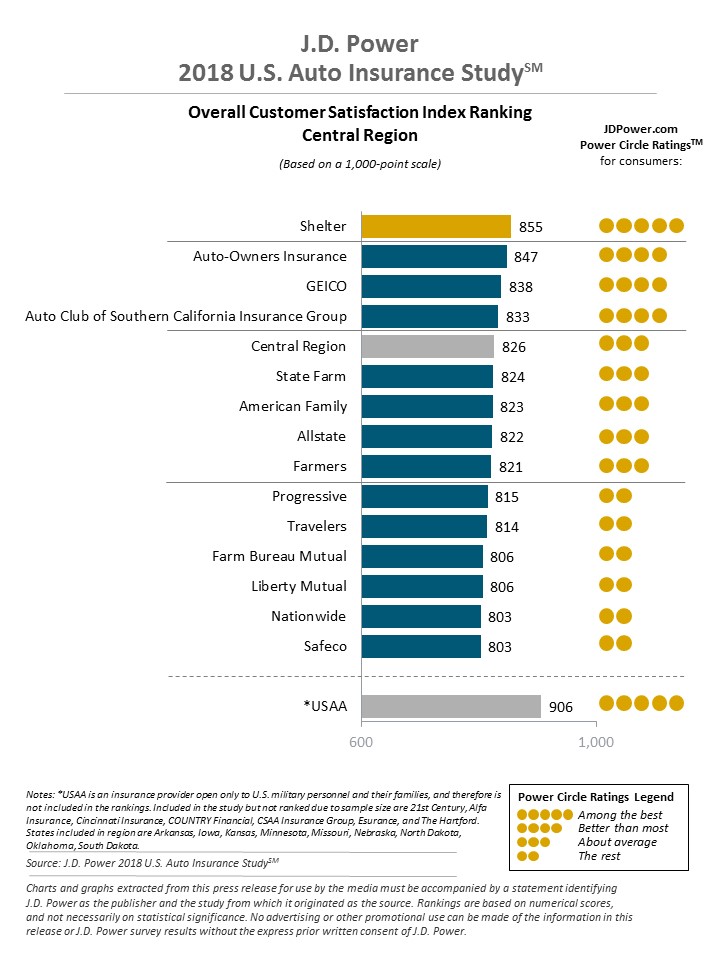

With so many car insurance companies in Minnesota, it can be difficult to determine just which provider is right for you. Having trusted agencies like AM Best and JD Power looking out for makes it easier though. Take a look at what they have to say about the top companies in the North Star State.

What’s the financial rating of the largest auto insurance companies?

As the only worldwide company to have a singular focus on the insurance market, AM Best has become one of the most trusted agencies in the global insurance market used by such organizations as the National Association of Auto Insurance Commissioners (NAIC).

The table below shows you how they have rated the biggest insurance providers in the North Star State.

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| State Farm Group | A++ | Stable |

| Progressive Group | A+ | Stable |

| American Family Insurance Group | A | Stable |

| Farmers Insurance Group | A | Stable |

| Allstate Insurance Group | A+ | Stable |

| Geico | A++ | Stable |

| USAA Group | A++ | Stable |

| Liberty Mutual Group | A | Stable |

| Travelers Group | A++ | Stable |

| Auto-Owners Group | A++ | Stable |

When you choose a company that has been given an A++ rating and/or a stable outlook by AM Best you are choosing a company that has a good loss ratio and a great outlook for future growth and prosperity.

Understanding both what the financial stability of a company is and what its loss ratio looks like can help you choose a car insurance provider who will be more likely to pay out your claim should you ever need to file one.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which companies have the best ratings?

Just like AM Best has your back when it comes to understanding the car insurance market and its overall viability so too does JD Power, and what they have found is that customer satisfaction ratings with car insurance providers are at a record high.

Buying car insurance in Minnesota isn’t always as great as the perfect pan of “Hot Dish”. Making sure that you have all the information you need to make an educated decision before purchasing your car insurance policy can make the experience a more pleasant one though.

Which companies have the most complaints?

Before you choose a car insurance provider to help protect you and your family it is a good idea to find out what their complaint ratio is.

This complaint ratio can help you figure out just where each car insurance provider in your area stands in relation to their competitors. That can help save you money since it gives you insight into just who is competing for your business.

The baseline for the complaint ratio is 1.0. This means that the higher that the complaint ratio is above the baseline of 1.0 the higher the number of complaints against it a car insurance company has.

Below is a list of the top ten car insurance companies in the North Star State along with their complaint ratios so that you can see just how each one stacks up.

| Company | Direct Premiums written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | $891,085 | 0.44 | 65.52% | 24.73% |

| Progressive Group | $586,357 | 0.75 | 62.53% | 16.27% |

| American Family Insurance Group | $418,487 | 0.79 | 62.97% | 11.62% |

| Farmers Insurance Group | $212,804 | 0.00 | 56.43% | 5.91% |

| Allstate Insurance Group | $200,235 | 0.50 | 60.51% | 5.56% |

| Geico | $129,987 | 0.68 | 74.00% | 3.61% |

| USAA Group | $110,895 | 0.74 | 73.57% | 3.08% |

| Liberty Mutual Group | $110,671 | 5.95 | 60.04% | 3.07% |

| Travelers Group | $106,222 | 0.09 | 65.96% | 2.95% |

| Auto-Owners Group | $103,671 | 0.53 | 61.26% | 2.88% |

Don’t let the raw numbers fool you. Just because a company has a high complaint ratio doesn’t mean that they are terrible to do business with.

When looking at the complaint ratio you have to consider the market share that the company holds in order to gain a fuller picture.

Looking at the table in this light reveals that although American Family Insurance Group has a complaint ratio that is a bit on the high side also has a higher portion of the market share. More market share means more customers which means a higher possibility for complaints overall.

We truly hope that you never need to file a complaint against your car insurance provider, but if it should come to that then the state of Minnesota has a few ways that you can do it.

Some of these ways include:

- Online at https://mn.gov/commerce/consumers/file-a-complaint/

- Email your questions to [email protected]

- By Mail at 85 7th Place East, Suite 500, St. Paul, MN 55101

Now that you are gaining a better grasp of how to use the loss ratio and complaint ratio to negotiate a better price on your car insurance policy it is time to start looking at what those companies are charging for coverage.

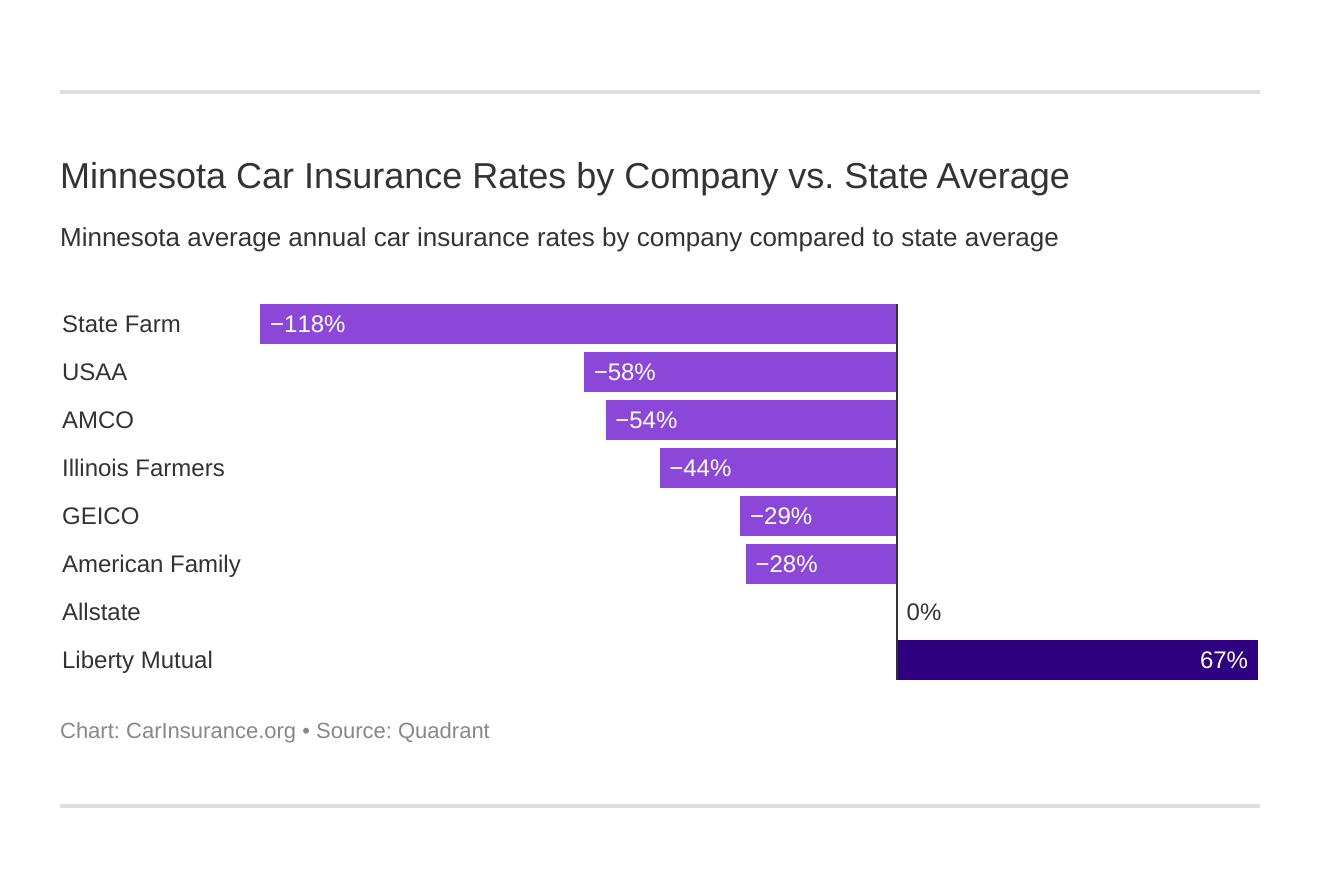

Who are the cheapest companies in Minnesota?

Every good shopper knows that you never take the first price given to you if you can help it. Being able to haggle means knowing what all of the competitors on the market are charging for the same goods or services. We are here to help you with that.

The table below gives you a glimpse into what the biggest competitors in your area are charging on average. This is information that can help you gain the upper hand when shopping for your car insurance policy.

| Company | Average Annual Rate | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allstate Indemnity | $4,532.01 | $18.51 | 0.41% |

| American Family Mutual | $3,521.29 | -$992.21 | -28.18% |

| Illinois Farmers Ins | $3,137.45 | -$1,376.04 | -43.86% |

| Geico General | $3,498.53 | -$1,014.96 | -29.01% |

| Liberty Mutual Fire | $13,563.61 | $9,050.11 | 66.72% |

| AMCO Insurance | $2,926.49 | -$1,587.01 | -54.23% |

| State Farm Mutual Auto | $2,066.99 | -$2,446.51 | -118.36% |

| USAA CIC | $2,861.60 | -$1,651.89 | -57.73% |

Knowing how far your dollar will stretch with each competitor on the market can go a long way towards saving you money.

Before you become a customer though you will want to know just how each of these companies determines your rates.

We have talked a little about your age and gender, as well as how where you live can impact your rates. Did you know that how much you drive can also play a role in how companies decide how much they should charge you? Keep reading to find out more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the commute rates by company?

Driving is a game of chance for the most part. One thing that you can pretty much count on though is the fact that the more you drive the higher your insurance premiums will most likely be. This is why it pays big dividends sometimes to shop before you buy.

Across the country, car insurance providers charge customers based on the number of miles that these customers travel annually, and looking at the numbers reveals that residents of the North Star State really are on the go.

More people on the roads means a greater chance for traffic incidents which can lead to higher rates. This is why car insurance providers look at how much you drive as they determine the price of your premiums.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,532.01 | $4,532.01 |

| American Family | $3,480.06 | $3,562.51 |

| Farmers | $3,137.45 | $3,137.45 |

| Geico | $3,452.20 | $3,544.87 |

| Liberty Mutual | $13,165.37 | $13,961.85 |

| Nationwide | $2,926.49 | $2,926.49 |

| State Farm | $2,011.15 | $2,122.82 |

| USAA | $2,824.14 | $2,899.06 |

Looking at the table reveals that car insurance companies across the board in Minnesota are pretty fair when it comes to charging you for every mile that you drive. This is where a fine eye for detail comes in though.

Choosing a company like State Farm or USAA could save you money no matter long your commute is because they are both the lowest priced carriers in this category and their rates do not fluctuate all that much with every mile that you put behind you.

Keep in mind though that these companies might also have a complaint ratio or loss ratio that might cause you to reconsider so getting all of your ducks in a row before targeting an insurance provider is always the best decision.

What are the coverage level rates by company?

Understanding how where you live, who you are, or how healthy a particular car insurance company might be is only part of what goes into purchasing your car insurance policy.

You will also need to consider just how much coverage you need and find out what that coverage is going to cost you. The table below can help you get started.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,467.02 | $4,528.59 | $4,600.41 |

| American Family | $3,512.68 | $3,618.33 | $3,432.86 |

| Farmers | $3,022.58 | $3,150.22 | $3,239.56 |

| Geico | $3,394.84 | $3,497.28 | $3,603.48 |

| Liberty Mutual | $13,241.20 | $13,574.70 | $13,874.92 |

| Nationwide | $2,767.43 | $2,947.12 | $3,064.92 |

| State Farm | $1,985.35 | $2,074.23 | $2,141.38 |

| USAA | $2,779.67 | $2,859.57 | $2,945.57 |

It goes without saying that the higher your coverage level is the more money you will pay out for car insurance premiums. That is not all there is to it though.

For instance, a new car may require more coverage while an older car with high mileage might require less. The price for these coverage amounts might also be influenced by other factors such as where you live or the length of your commute.

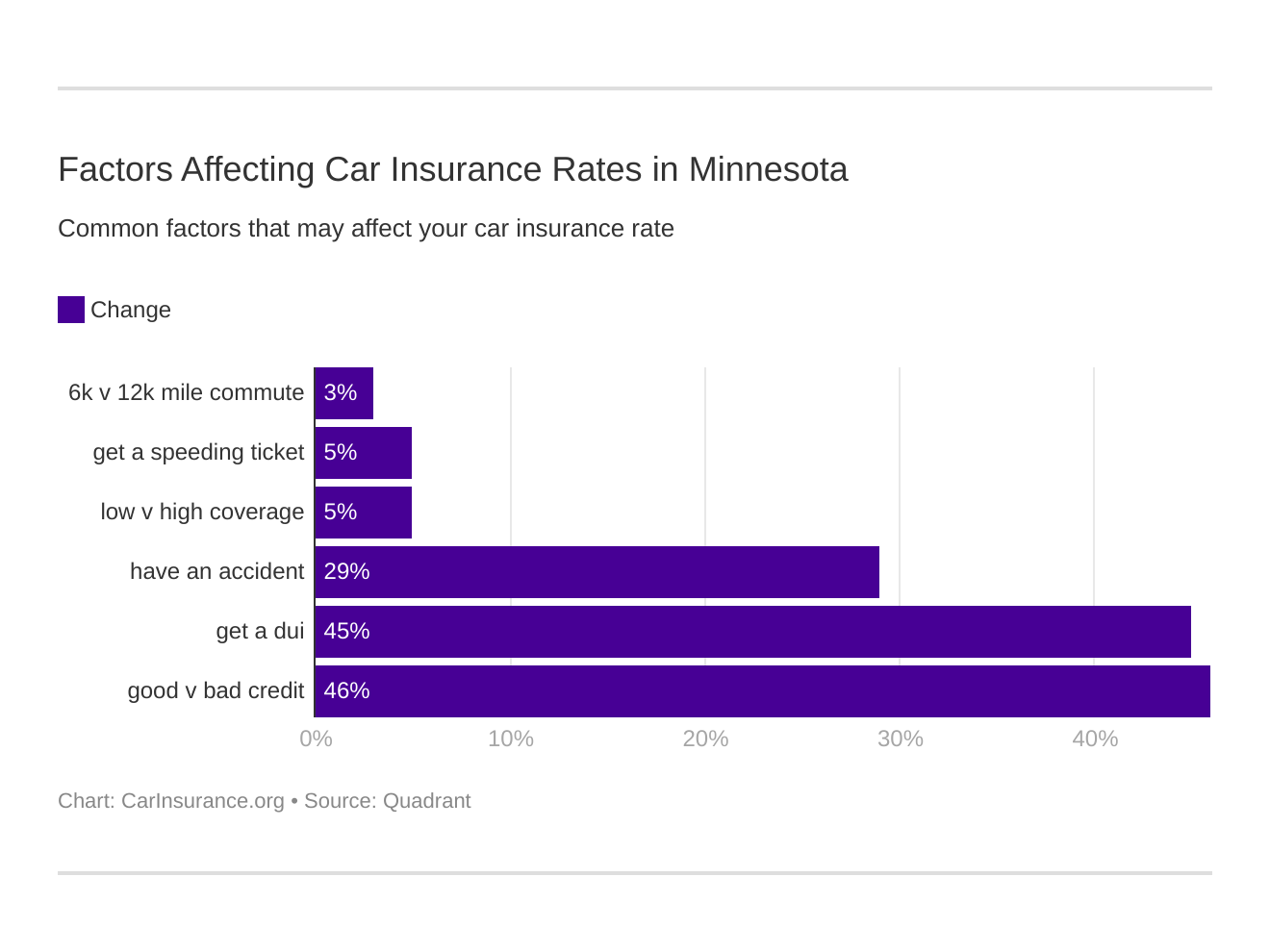

Another one of these factors is your driving record of course, but did you know that things like your education level and credit score can also impact how much you pay? Keep reading to find out how.

What are the credit history rates by company?

What you do on the road has obvious consequences when it comes to paying for car insurance. What you do with your personal finances can also play a part though.

According to a 2015 article published by Consumer Reports, like car dealerships and credit card companies who use your credit score to determine your risk level:

Car insurers are also rifling through your credit files to…predict the odds that you’ll file a claim.

This means that too many unpaid or delinquent bills on your credit report could cost you big time when it comes time to purchase your car insurance policy.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $3,344.12 | $3,603.11 | $6,648.80 |

| American Family | $2,564.44 | $3,190.11 | $4,809.31 |

| Farmers | $2,654.85 | $2,840.59 | $3,916.92 |

| Geico | $2,861.19 | $3,433.78 | $4,200.64 |

| Liberty Mutual | $9,555.18 | $12,227.54 | $18,908.11 |

| Nationwide | $2,490.14 | $2,807.41 | $3,481.91 |

| State Farm | $1,344.22 | $1,842.99 | $3,013.76 |

| USAA | $1,905.46 | $2,192.66 | $4,486.70 |

People with better credit scores get better rates on car insurance because it is assumed by the car insurance provider that if a person with good credit has an accident they will most likely pay out-of-pocket rather than filing a claim.

This doesn’t mean that maintaining a clean driving record doesn’t have its advantages though.

Keep scrolling to find out some of the ways that defensive driving and responsible behavior behind the wheel can save you money on car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the driving record rates by company?

What you do behind the wheel in the North Star State is important not just for the safety of others with who you share the road.

Your behavior behind the wheel can also cost you more money when it comes time to invest in car insurance. Take a look at the table below to see how.

| Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| Allstate | $3,292.72 | $4,316.11 | $5,738.97 | $4,780.23 |

| American Family | $2,367.00 | $2,682.98 | $4,775.76 | $4,259.41 |

| Farmers | $2,686.69 | $3,053.56 | $3,427.73 | $3,381.83 |

| Geico | $2,318.73 | $2,484.09 | $5,500.20 | $3,691.11 |

| Liberty Mutual | $9,956.63 | $10,738.20 | $19,913.12 | $13,646.49 |

| Nationwide | $2,322.48 | $2,753.24 | $3,547.09 | $3,083.13 |

| State Farm | $1,900.45 | $2,066.98 | $2,066.98 | $2,233.53 |

| USAA | $2,126.06 | $2,531.74 | $4,082.21 | $2,706.41 |

Looking at the drastic difference in rates between a driver with a clean record and one who might have one speeding ticket or accident illustrates how important it is to exercise good driving habits while on Minnesota roadways.

If you think that your driving skills might need work then the North Star State also has a list of approved accident prevention courses.

You can also request a certified copy of your Minnesota driving record by printing out the request form and mailing it to the Driver and Vehicle Services Unit at 445 Minnesota Street, Suite 161, St. Paul, MN, 55101-5161.

You can request one online for your convenience as well.

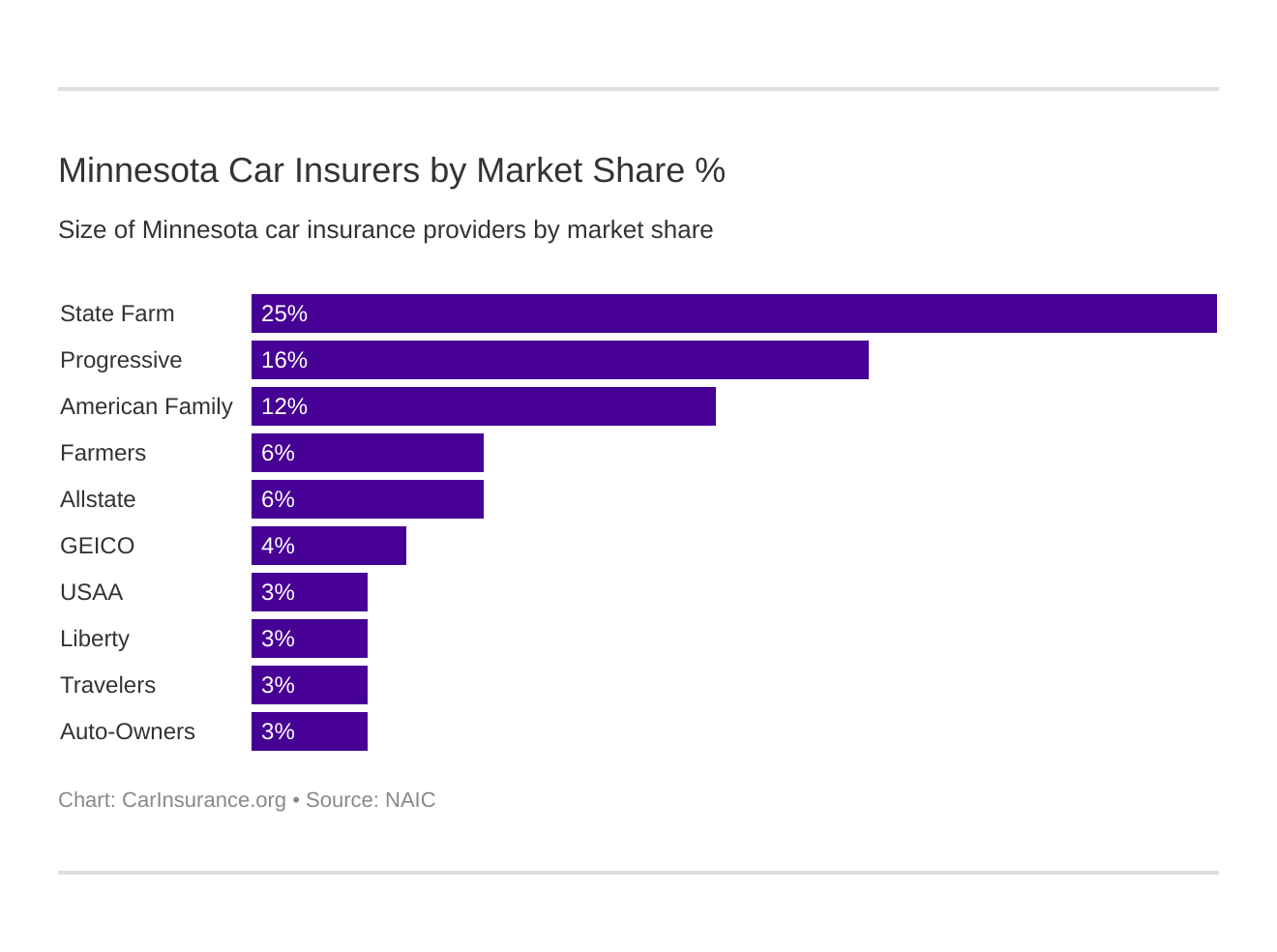

Who are the largest car insurance companies in Minnesota?

We have talked a little bit about the market share and how it is the percentage of the overall market that is controlled by a particular car insurance company.

Market share is s much more than that though. It is the key to unlocking the way that loss ratio and complaint ratio work to save you money on car insurance by looking at how the market share relates to direct premiums written.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $891,085 | 24.73% |

| Progressive Group | $586,357 | 16.27% |

| American Family Insurance Group | $418,487 | 11.62% |

| Farmers Insurance Group | $212,804 | 5.91% |

| Allstate Insurance Group | $200,235 | 5.56% |

| Geico | $129,987 | 3.61% |

| USAA Group | $110,895 | 3.08% |

| Liberty Mutual Group | $110,671 | 3.07% |

| Travelers Group | $106,222 | 2.95% |

| Auto-Owners Group | $103,671 | 2.88% |

As you can see from the table, State Farm holds the largest share of the Minnesota car insurance market with almost $900,000 in Direct Premiums Written.

This indicates that the car insurance market as a whole is pretty healthy in the North Star State which translates into safety for you as a consumer once you purchase your car insurance policy since these companies are writing new policies as means for growth rather than raising your rates to increase their bottom line.

What’s the number of insurers by state?

Minnesota has 39 domestic insurers and 816 foreign ones all operating in the North Star State. That is 855 options for car insurance companies in the Land of 10,000 Lakes.

So what is the difference between the two? Simply states:

- A domestic insurer is one that has been formed under the laws of the state of Minnesota.

- And a foreign insurer is one that has been formed under the laws of any state, district, territory, or commonwealth of the United States other than the state of Minnesota.

Both types of insurers must adhere to the laws that govern car insurance providers in the North Star State no matter where they are formed so a choice between one or the other is a personal one for you.

Dealing with either type of insurer is easier though when you understand the laws under which they are formed, and the ones that they must comply with.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Minnesota state laws?

Trying to navigate your way through all of the laws that govern car insurance in the North Star State can be a confusing and frustrating task. Attempting to understand just which laws apply to who after an accident can complicate things even more.

Gaining a good grasp of these laws before you are ever involved in an accident can help. This is where we come in.

We are here to guide you through the ins and outs of Minnesota laws concerning car insurance so that, should you ever need to negotiate them, you won’t find yourself drowning in legal jargon and feeling deflated like an old tire on the side of the road.

What are the car insurance laws?

We have already discussed the minimum requirements for car insurance coverage in the North Star State. Did you know that there are insurance requirements for registering a vehicle and age-related factors for getting your driver’s license in Minnesota too?

Almost every aspect of vehicle ownership and operation in the North Star State is regulated to keep drivers, passengers, and the population at large protected against injury, loss, or damage.

How are state laws determined?

You may be wondering just who is responsible for writing the laws that govern car ownership, vehicle registration, and driver’s licenses in the Land of 10,000 Lakes.

Like all other laws in Minnesota, the laws and regulations for such things begin in the various chambers and sub-committees that make up the Minnesota State Legislature.

The State Legislature, in conjunction with the Minnesota Department of Commerce, and the Minnesota Department of Transportation have come together to determine the various safety, vehicle registration, driver’s license, and insurance laws in the North Star State.

Chief among these, when it comes to car insurance is that Minnesota has been designated as a “No-Fault” state.

What this means is that:

Certian expenses resulting from the personal injuries of a car owner, the owner’s family, and the driver and occupants of the owner’s car are paid by the car owner’s insurance company regardless of who is at fault in causing an auto accident.

This system is designed so that the delay in the ability to pay for medical or rehabilitation services after an accident is minimized.

After the passage of the laws that designated Minnesota as a “No-Fault” state companies operating in the North Star State were asked to sign the No-Fault-Certificate Form. This form stated that:

These companies formally agreed to provide Minnesota no-fault benefits to their non-Minnesota insureds if those insureds are involved in an accident while driving their vehicle in Minnesota.

This means that all drivers and passengers involved in a car accident with a Minnesota driver will be taken care of.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Windshield Coverage

Accidents are not the only thing that the right car insurance provider can help you pay for. Damage to your windshield is also covered under certain provisions within your standard car insurance policy.

This is important to know considering that in Minnesota:

It is illegal to drive a vehicle if the windshield is discolored or cracked in a way that limits the driver’s clear view.

If you are found in violation you could be subject to citations and fees.

When it comes time to repair your windshield you do have the right to choose who provides you with service. Keep in mind though that if you choose a vendor who is not preferred by your car insurance provider you might be stuck paying the difference in cost.

How to Get High-Risk Auto Insurance

The more tickets, accidents, and claims that you have the higher your rates are going to be. That is just an unavoidable fact of driving no matter which state you live in.

If you live in the North Star State though you could be required to obtain an SR-22 form if you are determined to be a high-risk driver.

While there is no state requirement in Minnesota regarding the SR22 form you could be required to obtain a certificate of insurance in order to get your license reinstated if it is revoked.

The North Star State also has the Minnesota Automobile Insurance Plan which is meant to provide insurance for drivers who cannot obtain car insurance on the open market due to the risk that they propose to car insurance providers.

How to Get Low-Cost Insurance

Drivers who pose a greater risk to the bottom line of insurance companies are not the only ones who have specific protections under Minnesota state laws and provisions.

In the Land of 10,000 Lakes, the Minnesota Automobile Insurance Plan also assists low-income drivers who are in need of a fair price on car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is there automobile insurance fraud in Minnesota?

Because Minnesota is a no-fault state the chances of insurance fraud being committed in the North Star State are increased.

In fact, according to Consumer Watchdog:

No-fault’s mandatory payments create incentives to increase medical treatment and encourage fraud for those people without other forms of health coverage.

This increase in fraudulent claims is one of the reasons why car insurance rates in no-fault states like Minnesota are generally higher.

Some opponents to the no-fault system also believe that when you limit a person’s responsibility for their poor driving habits you are actually encouraging them to behave recklessly behind the wheel since the financial responsibility for causing an accident will not fall on them as the at-fault driver.

Reckless drivers or people without health insurance are not the only ones who may be responsible for committing fraud.

According to iii fraud may also be committed by:

- Applicants for insurance

- Policy-holders

- Third-party claimants

- Doctors or other healthcare professionals who might inflate the billing costs

- Repair shops and mechanics who claim damage in excess of what is actually present or who claim previous damages on a new claim

These are just some of the people or vendors that might be liable for committing insurance fraud. The bottom line then is that you should always keep track of all transactions and billing invoices after a car accident just to be safe.

Penalties for committing insurance fraud could include:

- 90 days in jail and a fine up to $1,000 for a charge of fraud where the value is up to $500

- Up to 5 years in jail and a fine of no more than $10,000 for a charge of fraud where the value is between $1,000 and $5,000

- Up to 10 years imprisonment and a fine of up to $20,000 for a charge of fraud where the value is between $5,000 and $35,000

- 20 years in prison and a fine of up to $100,000 for a charge of fraud where the value is more than $35,000

If you think that you have been the victim of fraud you can visit the Minnesota Attorney General’s website and report it to the authorities.

What’s the statute of limitations?

The statute of limitations on claims of insurance fraud begins the moment a loss occurs and lasts 7 years.

Fraud cases are not the only things that have a statute of limitations though. There is also a statute of limitations on how long you have to report a claim after you have a traffic accident or incident.

NOLO states that if you are injured in a car accident you have a two-year statute of limitations to file a claim which begins to run from the date of the accident.

Wrongful death claims have a three-year statute of limitations that also begin to run from the date of the accident.

What are the specific Minnesota driving laws?

Minnesotans aren’t serious all of the time as the law that states that you can not cross state lines with a duck on your head proves.

The North Star state also has a strange law that says that all bathtubs must have feet. You are also not allowed to park your elephant on Main Street. Okay, so the last one was just an old Minnesota urban legend.

A law that is not an urban legend is the one that states that it is perfectly legal to drive in reverse without a seatbelt on. It is illegal though to drive down Lake Street in Minneapolis if you are in a red car.

Zipper-merging is not law though, but it is strongly recommended by MnDOT.

There are a lot of other general traffic regulations in Minnesota as well that can be found in more detail on the Minnesota Legislature website.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the vehicle licensing laws?

Minnesota does not just have general traffic regulations or car insurance laws on the books. The North Star State also has laws that determine the requirements for registering your vehicle in the Land of 10,000 Lakes.

Some of these requirements may include the following:

- Presenting the foreign state title of a vehicle previously registered or purchased out-of-state

- Providing an odometer reading

- Presenting your driver’s license or state-issued ID

- And presenting proof of insurance

The North Star State also participates in the REAL ID program which will require that you bring specific forms of identification when seeking you Minnesota driver’s license or state ID with the REAL ID endorsement attached to it.

A printable version of the REAL ID identification and accepted documents list can be found on the Minnesota DVS website.

What are the penalties for driving without insurance?

Just like there are penalties for driving with an expired tag in Minnesota there are also penalties for driving without car insurance.

For your first offense, you could be fined between $200 to $1000 or be given community service. You could also face imprisonment for up to 90 days.

Why risk it though when you have all of the information you need right here to make an educated decision that could save you money when purchasing your car insurance policy?

Should you get pulled over or need to prove that you have car insurance to register a vehicle the North Star State allows you to use the following ways to prove your financial responsibility:

- A printed car insurance ID card

- An e-insurance card which can be presented on your cell phone or other handheld devices

In addition to laws that govern the requirements for registering a vehicle in Minnesota the North Star State also has laws that regulate who can become a licensed driver in the state.

What are the teen driver laws?

Most teenagers can’t wait to experience the freedom that the open road provides. In Minnesota though that freedom has limits.

Some of these limits dictate the hours that teenagers can be on the road. For instance, for the first 6 months of licensure, a teenager can not drive between the hour of 12 a.m. and 5 a.m.

There are also passenger limits for that first 6 month period which limits the number of passengers in a teenaged driver’s car to 1 person under the age of 20. For the second 6 months that limit increases to 3.

Cell phone use and texting are also completely illegal for drivers under the age of 18 unless they are dialing 911.

Any underaged driver who is caught drinking and driving is also subject to the regular DWI laws and sanctions mandated by the state of Minnesota.

Teenagers in Minnesota can obtain their Instructional Permit at age 15 with parental consent. This type of license requires that a licensed adult over the age of 21 be in the vehicle with them though when is in operation.

At 16 years of age, a Minnesota teen can apply for their Provisional License. They must have 40 hours of logged supervised driving hours prior to application though.

The person who signed the driving log must also have completed a 90-minute supplemental parental curriculum unless the teenager has 50 hours of logged practice behind the wheel.

A full, unrestricted driver’s license becomes an option upon the teenager’s 18th birthday. This is of course if the teenager does not have any legal restrictions attached to their driving records such as suspensions or revocations.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the driver’s license renewal procedures?

Teen drivers are not the only ones with some restrictions on the way that they obtain and maintain their driver’s license in the North Star State.

The general population is required to renew their Minnesota driver’s license every four years and must do so in person every time because they must prove that they have adequate vision to operate a motor vehicle.

Older drivers are subject to the same renewal regulations as well. The Minnesota Office of Traffic Safety also offers a four-hour Defensive Driving Training Course for folks over age 55 at a variety of locations.

The State of Minnesota Department of Public Safety offers some tips and considerations for older drivers and/or their family members who might be concerned with safety while on the road in the North Star State as well.

The Hartford also offers tips for talking to aging family members about the possibility that they might not be the safest when they are behind the wheel.

Getting older doesn’t mean that you become a bad driver. It just means that as the Minnesota Office of Traffic Safety points out:

Older drivers are morelike.y to get killed or injured because they are more likely to become physically fragile and less able to recover from injuries.

The Minnesota Office of Traffic Safety also notes that one out of every four traffic fatalities in Minnesota traffic is a person over the age of 65 so be careful out there.

What is the procedure for new residents?

Teenage drivers and older Minnesotans are not the only ones that are subject to specific types of license renewal procedures of driving laws.

New residents of the North Star State also have their own requirements that they must meet in order to become legally sanctioned drivers in the state of Minnesota.

According to the Minnesota Department of Human Services, you are considered a resident of Minnesota based on the following criteria:

- If you are physically present in the state

- If you reside in Minnesota voluntarily and do not maintain a home elsewhere and have done so for 30 days

The Minnesota Department of Public Safety then requires that you obtain insurance before registering your vehicle in the North Star State and that you pass a knowledge test regarding Minnesota’s driving laws if you have a valid license from another state.

As a new resident you will need to:

- Complete the Minnesota Driver’s License Application

- Present one primary and one secondary form of identification

- Present your license from your previous state of residence

- Pass the vision test

If you would like to study the Minnesota driving laws before attempting to obtain your driver’s license in the North Star State the Minnesota DVS has an online driver’s handbook to help you.

Now that you know how to get your driver’s license and register your vehicle it is time for us to help you understand how to keep them in good standing. This means understanding just what types of things that the driving and safety laws in Minnesota prohibit.

What is the negligent operator treatment system?

Unlike most states, Minnesota does not operate under a point system. Instead, the North Star State depends on the Minnesota Safe and Sober Campaign.

Just because the North Star State does not mean that you can drive like a maniac. The Minnesota Department of Driver and Vehicle Services will still suspend your driver’s license if you get too many moving violations in a said amount of time.

The Minnesota DVS considers the following as major violations:

- Reckless Driving

- Not carrying enough insurance

- Driving under the Influence (DUI)

Minnesota DVS also considers the following as Non-Moving violations but still ticket worthy offenses:

- Inattentive driving

- Driving while talking on your cell phone

- Driving without a seatbelt

Should your driver’s license be suspended or revoked you can visit the Minnesota DVS online portal to take care of fees for reinstatement.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the rules of the road?

Don’t let Minnesota’s lack of a point system fool you. If you get too many tickets or have too many accidents your car insurance rates will go up. This an evitable rule of the road.

There are also plenty of other rules for driving on Minnesota’s roadways.

Knowing what these rules are and following them can help you out immensely when it comes time to purchase your car insurance policy.

Keep scrolling to find out all the information you need to be a well-informed and safe driver when out on the Minnesota highway.

Is Minessota a no-fault or at-fault state?

You already know that Minnesota is a no-fault state. What does this mean to you though if you are ever involved in an accident?

What this means to you as a driver in the North State is that if you are ever in an accident your own car insurance coverage will be responsible for paying your medical bills regardless of who caused the crash.

These bills will be paid out of your Personal Injury Protection (PIP) coverage benefits.

Under PIP you can not get paid for pain and suffering or any other non-monetary damages.

According to NOLO:

No-Fault/PIP also does not appply to a motorcyclist’s injuries after and accident in Minnesota.

These rules are vastly different from the ones in an at-fault state where all medical and damage payments are initially made by the insurance company of the driver who is deemed to be at fault for a car accident.

Whether you live in a no-fault state like Minnesota or an at-fault state like Texas there are certain rules of the road that cross state lines. Seatbelt laws are among these. The requirements and penalties vary by state though.

What are the seat belt and car seat laws?

According to the Insurance Institute for Highway Safety (IIHS), driving without a seat belt is a primary offense as of June 6, 2009.

This means that you can be pulled over and ticketed for no other reason than other than not having yourself or your passengers properly secured by a seat belt or child safety restraint device.

Minnesota law requires that children 7 years or younger who are more than 57 inches tall wear a seat belt at all times. The fine for failing to comply is $25.

If the child is less than 8 years old and less than 57 inches tall they must be in a child safety seat. If you break this law you will be fined $50.

The Minnesota Office of Traffic Safety also states that there is no law against children on the front seat; although the rear seat is always the safest place for them.

The Minnesota Office of Traffic Safety also warns that all passengers of all ages must be legally restrained while in a motor vehicle, and any unbelted passenger who is over the age of 15 will be ticketed directly.

Riding in the cargo area of a pickup truck is legal in the Land of 10,000 Lakes according to AAA.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the keep right and move over laws?

While almost everyone knows that they are supposed to buckle up when riding in a moving vehicle a lot of people don’t realize that it is illegal to camp out in the left lane in Minnesota if you are traveling slower than the rest of the traffic.

This law is designed to cut down on the number of accidents by limiting the number of lane changes done by faster-moving drivers.

The North Star State also has a Move Over Law aimed at keeping law enforcement and emergency services personnel safe when operating on the side of the road.

Specifically, the law states that if the road has more than two lanes you must keep over one full lane from stopped emergency vehicles who have their lights engaged. If you can not move over you must reduce your rate of speed.

You can be fined in excess of $100 if you fail to do so.

What’s the speed limit?

The North Star State recognizes speed as one of its major issues when it comes to highway safety. The Minnesota Department of Public Safety even released a fact sheet on the topic which states that between 2013 and 2017:

Fatalities resultung from speed-related crashes costs Minnesota over $639 million.

Speed increases the chances that you could lose control of your vehicle or fail to stop in time if the driver in front of your brakes suddenly.

Because Minnesota recognizes the dangers in excess speed the Minnesota Department of Transportation has set out some of the following speed limits:

- 10 MPH in alleys

- 30 MPH on urban streets

- 55 MPH on most other roadways

- 65 MPH on expressways and urban interstates

- 70 MPH on rural interstates

School zones in Minnesota have a speed limit of no less than 15 MPH but no more than 30.

How does ridesharing work?

One of the most popular ways to get around these days is through Ridesharing. Companies such as Uber and Lyft just pick you up and handle all of the traffic headaches for you.

Ridesharing does not come without its insurance and other regulations though.

Investopedia points out that drivers of Rideshare vehicles used to be forced to get commercial insurance. That is now a thing of the past.

Many major car insurance companies are now offering Rideshare policies or allowing policyholders to add them to their traditional ones.

Be aware though that if you get caught driving for a rideshare company and you haven’t notified your car insurance carrier of your intentions to use your private passenger vehicle for that purpose your coverage could be dropped.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is there automation on the road?

Like Rideshare, Automated Vehicles are all the rage these days. The idea that the future is now is fascinating, but self-driving cars do not come without risks.

These risks have caused the Governor of Minnesota to issue an Executive Order on the matter.

In this EO, the governor created an advisory board to develop recommendations for changes in the laws, rules, and policies of the state to deal with autonomous technology.

It seems then that in this area there is still more to come so stay tuned.

What are the safety laws?

There are a number of laws on the books in the North Star State which are designed with the sole purpose of keeping you and others safe while on Minnesota roadways.

Some of these laws deal with speeding which we have talked about a little. Others have to do with things like DUIs and distracted driving.

As a responsible citizen, you will want to keep yourself up-to-date on all of these laws. Keep scrolling to get the latest information to keep you safe.

What are the DUI laws?

Drinking and driving statistics in the North Star State are nothing to celebrate. This is especially true when you consider that in 2017 alone 85 people lost their lives to drunk driving accidents in Minnesota according to Responsibility.org.

This places Minnesota just under the national average for total fatalities related to alcohol-impaired driving for that year by only 6 percent.

According to the Minnesota Office of Traffic Safety, the legal limit in the North Star State is 0.08 BAC.

The typical penalty for a first-time offense is the loss of your license for a minimum of 30 days and possible jail time.

You will also be responsible for your court costs and legal fees which could drive the price even higher.

Your BAC could also determine just how stiff the penalty is for drinking and driving leading you to have to install an Ignition Interlock Device.

NOLO also points out that in order to regain your license you could be charged a reinstatement fee and surcharge of upwards of $680.

No price is higher than the potential for the loss of human life so don’t drink and drive.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the marijuana-impaired driving laws?

While many states are legalizing the use of marijuana Minnesota is not one of them.

Even as it is illegal to possess or use marijuana in the North Star State there are no specific driving laws related to being caught while under its influences.

Don’t think that you can get away with doing it though. If you are caught driving while under the effects of marijuana you will be charged under the state’s laws that govern DUIs.

Some of these penalties include:

- First Offense-Fine of up to $1,000 and up to 90 days in jail with a license suspension of up to 180 days

- Second Offense-A minimum of 30 days in jail or community service and up to a 1-year license suspension

- Third Offense a minimum of 90 days in jail and up to 2 years of a license suspension

Like drinking and driving, driving under the influence of Marijuana is not worth the risk so just don’t do it.

What are the distracted driving laws?

The Minnesota Office of Traffic Safety has enacted rules and regulations regarding distracted driving that you should be aware of.

It is specifically against the law to:

- Read, compose, or send a text or email or access the internet using a wireless device while in motion. This includes sitting at a traffic light.

- Use a cell phone at all if you are driving a school bus.

- There is also a total ban on cell phone use for teen drivers with their permit or provisional license.

According to The Capital View, as of August 1, 2019, Minnesota will also be one of 17 states that are now totally hands-free.

What’s driving in Minnesota like?

With distracted drivers and DUI offenders on the road in Minnesota on occasion driving in the North Star State does not come without risk.

There are also risks that come with owning a vehicle that has nothing to do with what happens while you are behind the wheel