Arkansas Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 16.6

What’s better than driving down the asphalt roads of Arkansas on a hot summer’s day? There’s nothing quite as captivating as diving into the Ozarks – certainly not searching for car insurance.

And yet, if you want to enjoy an adventure through Arkansas, you’ll need to wade through a plethora of car insurance options. The good news is that you don’t have to take on that challenge alone.

We’re here to help you muddle your way through the car insurance providers who offer coverage throughout Arkansas.

This is more than a guide to potential insurers, though.

We’ll make sure that you’re up to date on coverage and annual rates, state laws, and can’t-miss facts about the Natural State. You can even start comparing Arkansas auto insurance rates today with our FREE online tool! All you have to do is enter your zip code to get started comparing multiple auto insurance quotes.

Ready to get started? Let’s go!

What are Arkansas minimum coverage requirements?

When you’re first exploring your minimum coverages and in Arkansas, you may find yourself overwhelmed. There’s no need to fret, though!

Let’s start out with a softball: requirements for minimum car insurance for drivers.

| Insurance Required | Minimum Limits: 25/50/25 |

|---|---|

| Bodily Injury Liability Coverage | $25,000 coverage per person $50,000 insurance per accident |

| Property Damage Liability Coverage | $25,000 minimum |

| Personal Injury Protection (optional) | $5,000 minimum |

That sounds a bit intimidating. In order to make accidents that are your fault more manageable, it’s smart to invest in liability coverage.

Liability insurance ensures that everyone involved in a car accident receives the compensation that they’re owed for any injuries they sustain or property that ends up damaged.

At a bare minimum, Arkansas requires these liability coverage amounts:

- $25,000 – to cover bodily injury to a single person in a car accident where you’re found to be at-fault

- $50,000 – this maximum liability per accident amount is to cover bodily injury to all claimants in a car accident in which you’re found to be at-fault

- $25,000 – to cover property damage in a single accident in which you’re found to be at-fault

Note: these minimum rates cover other peoples’ injuries and property damage, not those sustained by the passengers in your car.

It’s also worth noting that Arkansas requires you to have at least $5,000 of no-fault insurance, or personal injury protection (PIP). This coverage will cover any medical bills that apply to you in the case of a wreck, regardless of who is to be found at-fault.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Arkansas’s acceptable forms of financial responsibility?

If you are an Arkansas resident and you end up being involved in a car accident, you are required by law to fill out a Safety Responsibility SR-1 accident report.

Along with the report, you’ll be required to submit proof of insurance within 30 days of the accident – but only if the property damage sustained during the accident exceeds $1,000 or if a person is injured or has died.

As such, you’ll want to keep your insurance card in your glove box or in your wallet, even though the state of Arkansas does not require you to carry proof of insurance on you while driving a car.

You’ll also want to have a copy of an SR-1 on you in case of an accident. $1,000 can get eaten up pretty quickly when you get in a car accident, and it’s more than likely that you’ll have to fill out the required paperwork before the whole debacle is over.

How much are the average cost of premiums as a percentage of income?

If you want to have coverage that exceeds the Arkansas state minimum, you’ll want to get the best deal you can on your coverage. Why? Well, let’s look at some statistics.

As of 2014, the reported annual per capita disposable personal income was reported to be $33,929.

This means that, in an average year, Arkansas residents only have $33,929 of disposable personal income (DPI), to spend after their incomes have been taxed.

Divide that number by 12 months, and you’ll find that Arkansas residents tend to have roughly $2,827 a month to spend on groceries, utilities, and car insurance.

How much does the average car insurance coverage package cost? In Arkansas, residents pay roughly $900 a year for car insurance coverage. That’s 2.7 percent of a person’s DPI.

So, if you’ve got a limited budget to work with, you will want to make sure that you’re getting the insurance package that’s right for your lifestyle.

How much are the average monthly auto insurance rates in AR (liability auto insurance, collision, comprehensive)?

| Coverage Type: | Annual Costs in 2015: |

|---|---|

| Liability | $394.13 |

| Collision | $321.80 |

| Comprehensive | $190.41 |

| Combined | $906.34 |

The National Association of Insurance Commissioners has provided the above data, noting the average costs of the varying types of available coverage in Arkansas as of 2015.

These coverage options extend beyond the minimum insurance requirements stated by the state of Arkansas. That doesn’t mean, though, that you shouldn’t consider investing in them, especially given Arkansas’s “at-fault” status.

It should be noted that insurance rates in Arkansas noted in the above table are going to be much higher as of 2019 and beyond.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What add-ons, endorsements, and riders are available?

If you’re looking for other additions to your car insurance coverage, consider the following:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

These options can be included as part of your cheap car insurance coverage and without issue so long as you know what you’re looking for. Embrace the research process! It’ll serve you well in the long run while also saving you money.

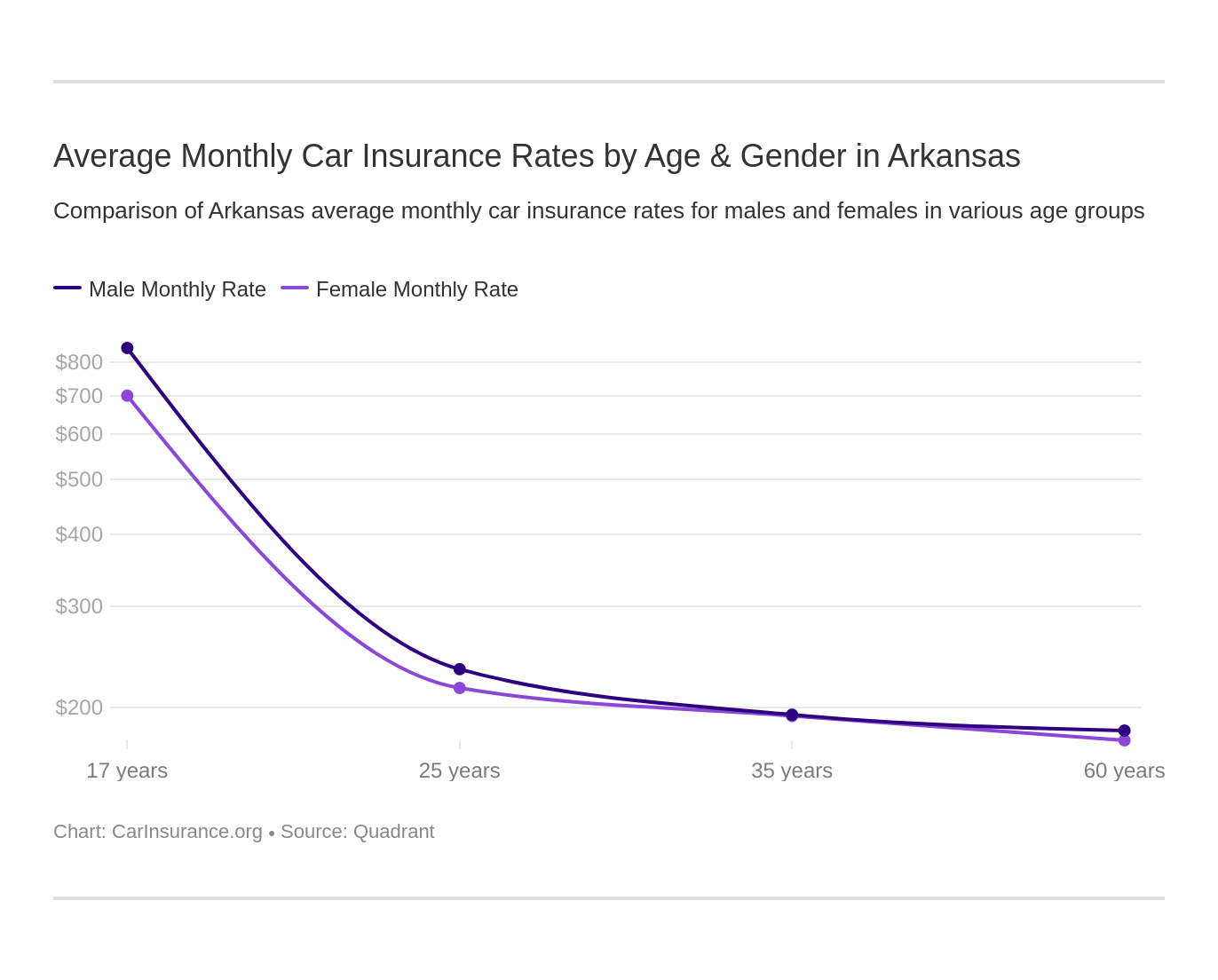

What are the average monthly car insurance rates by age & gender in AR?

It’s a car driving myth that men are worse drivers than women. Even so, the myth has permeated the car insurance industry, and it’s said that men must pay higher car insurance rates than female drivers.

If you live in Arkansas, this myth will cost you money. However, age and carrier actually contribute to cost variance in policy than gender. Funny how that works, right?

So what happens when we combine these variables?

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Travelers Home & Marine Ins Co | Single 17-year old male | $20,822.43 | 1 |

| Progressive NorthWestern | Single 17-year old male | $13,373.52 | 2 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $12,955.34 | 3 |

| Allstate P&C | Single 17-year old male | $12,699.62 | 4 |

| Progressive NorthWestern | Single 17-year old female | $11,868.05 | 5 |

| Allstate P&C | Single 17-year old female | $10,596.85 | 6 |

| Farmers Ins Co | Single 17-year old male | $10,046.95 | 7 |

| Farmers Ins Co | Single 17-year old female | $9,693.38 | 8 |

| Safeco Ins Co of IL | Single 17-year old male | $9,115.49 | 9 |

| Safeco Ins Co of IL | Single 17-year old female | $8,280.70 | 10 |

| Nationwide Mutual | Single 17-year old male | $8,114.04 | 11 |

| Geico General | Single 17-year old male | $6,607.80 | 12 |

| Geico General | Single 17-year old female | $6,588.67 | 13 |

| Nationwide Mutual | Single 17-year old female | $6,363.21 | 14 |

| State Farm Mutual Auto | Single 17-year old male | $6,355.63 | 15 |

| State Farm Mutual Auto | Single 17-year old female | $5,051.46 | 16 |

| USAA | Single 17-year old male | $4,407.45 | 17 |

| USAA | Single 17-year old female | $4,210.03 | 18 |

| Progressive NorthWestern | Single 25-year old male | $3,645.70 | 19 |

| Allstate P&C | Single 25-year old male | $3,487.30 | 20 |

| Progressive NorthWestern | Single 25-year old female | $3,372.76 | 21 |

| Nationwide Mutual | Single 25-year old male | $3,244.81 | 22 |

| Allstate P&C | Single 25-year old female | $3,211.86 | 23 |

| Nationwide Mutual | Single 25-year old female | $3,008.14 | 24 |

| Allstate P&C | Married 35-year old male | $2,928.74 | 25 |

| Allstate P&C | Married 35-year old female | $2,908.00 | 26 |

| Progressive NorthWestern | Married 35-year old female | $2,820.71 | 27 |

| Farmers Ins Co | Single 25-year old male | $2,797.50 | 28 |

| Allstate P&C | Married 60-year old male | $2,774.39 | 29 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $2,746.50 | 30 |

| Nationwide Mutual | Married 35-year old male | $2,679.98 | 31 |

| Progressive NorthWestern | Married 35-year old male | $2,675.07 | 32 |

| Farmers Ins Co | Single 25-year old female | $2,654.22 | 33 |

| Nationwide Mutual | Married 35-year old female | $2,629.04 | 34 |

| Safeco Ins Co of IL | Single 25-year old male | $2,626.04 | 35 |

| Allstate P&C | Married 60-year old female | $2,593.49 | 36 |

| Geico General | Married 35-year old female | $2,536.43 | 37 |

| Geico General | Single 25-year old male | $2,527.69 | 38 |

| Safeco Ins Co of IL | Single 25-year old female | $2,511.18 | 39 |

| Geico General | Married 35-year old male | $2,508.78 | 40 |

| Nationwide Mutual | Married 60-year old male | $2,495.08 | 41 |

| Geico General | Single 25-year old female | $2,492.72 | 42 |

| Safeco Ins Co of IL | Married 35-year old male | $2,488.44 | 43 |

| Safeco Ins Co of IL | Married 60-year old male | $2,477.39 | 44 |

| Progressive NorthWestern | Married 60-year old male | $2,422.91 | 45 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $2,377.54 | 46 |

| Nationwide Mutual | Married 60-year old female | $2,359.97 | 47 |

| Geico General | Married 60-year old female | $2,340.15 | 48 |

| Safeco Ins Co of IL | Married 35-year old female | $2,324.12 | 49 |

| Progressive NorthWestern | Married 60-year old female | $2,318.03 | 50 |

| Farmers Ins Co | Married 35-year old female | $2,316.82 | 51 |

| Farmers Ins Co | Married 35-year old male | $2,306.44 | 52 |

| Geico General | Married 60-year old male | $2,274.76 | 53 |

| State Farm Mutual Auto | Single 25-year old male | $2,268.23 | 54 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $2,265.25 | 55 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $2,222.90 | 56 |

| Safeco Ins Co of IL | Married 60-year old female | $2,220.47 | 57 |

| Travelers Home & Marine Ins Co | Married 60-year old male | $2,201.72 | 58 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $2,194.96 | 59 |

| Company | Demographic | Average Annual Rate | Rank |

| Travelers Home & Marine Ins Co | Single 17-year old male | $20,822.43 | 1 |

| Progressive NorthWestern | Single 17-year old male | $13,373.52 | 2 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $12,955.34 | 3 |

| Allstate P&C | Single 17-year old male | $12,699.62 | 4 |

| Progressive NorthWestern | Single 17-year old female | $11,868.05 | 5 |

| Allstate P&C | Single 17-year old female | $10,596.85 | 6 |

| Farmers Ins Co | Single 17-year old male | $10,046.95 | 7 |

| Farmers Ins Co | Single 17-year old female | $9,693.38 | 8 |

| Safeco Ins Co of IL | Single 17-year old male | $9,115.49 | 9 |

| Safeco Ins Co of IL | Single 17-year old female | $8,280.70 | 10 |

| Nationwide Mutual | Single 17-year old male | $8,114.04 | 11 |

| Geico General | Single 17-year old male | $6,607.80 | 12 |

| Geico General | Single 17-year old female | $6,588.67 | 13 |

| Nationwide Mutual | Single 17-year old female | $6,363.21 | 14 |

| State Farm Mutual Auto | Single 17-year old male | $6,355.63 | 15 |

| State Farm Mutual Auto | Single 17-year old female | $5,051.46 | 16 |

| USAA | Single 17-year old male | $4,407.45 | 17 |

| USAA | Single 17-year old female | $4,210.03 | 18 |

| Progressive NorthWestern | Single 25-year old male | $3,645.70 | 19 |

| Allstate P&C | Single 25-year old male | $3,487.30 | 20 |

| Progressive NorthWestern | Single 25-year old female | $3,372.76 | 21 |

| Nationwide Mutual | Single 25-year old male | $3,244.81 | 22 |

| Allstate P&C | Single 25-year old female | $3,211.86 | 23 |

| Nationwide Mutual | Single 25-year old female | $3,008.14 | 24 |

| Allstate P&C | Married 35-year old male | $2,928.74 | 25 |

| Allstate P&C | Married 35-year old female | $2,908.00 | 26 |

| Progressive NorthWestern | Married 35-year old female | $2,820.71 | 27 |

| Farmers Ins Co | Single 25-year old male | $2,797.50 | 28 |

| Allstate P&C | Married 60-year old male | $2,774.39 | 29 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $2,746.50 | 30 |

| Nationwide Mutual | Married 35-year old male | $2,679.98 | 31 |

| Progressive NorthWestern | Married 35-year old male | $2,675.07 | 32 |

| Farmers Ins Co | Single 25-year old female | $2,654.22 | 33 |

| Nationwide Mutual | Married 35-year old female | $2,629.04 | 34 |

| Safeco Ins Co of IL | Single 25-year old male | $2,626.04 | 35 |

| Allstate P&C | Married 60-year old female | $2,593.49 | 36 |

| Geico General | Married 35-year old female | $2,536.43 | 37 |

| Geico General | Single 25-year old male | $2,527.69 | 38 |

| Safeco Ins Co of IL | Single 25-year old female | $2,511.18 | 39 |

| Geico General | Married 35-year old male | $2,508.78 | 40 |

| Nationwide Mutual | Married 60-year old male | $2,495.08 | 41 |

| Geico General | Single 25-year old female | $2,492.72 | 42 |

| Safeco Ins Co of IL | Married 35-year old male | $2,488.44 | 43 |

| Safeco Ins Co of IL | Married 60-year old male | $2,477.39 | 44 |

| Progressive NorthWestern | Married 60-year old male | $2,422.91 | 45 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $2,377.54 | 46 |

| Nationwide Mutual | Married 60-year old female | $2,359.97 | 47 |

| Geico General | Married 60-year old female | $2,340.15 | 48 |

| Safeco Ins Co of IL | Married 35-year old female | $2,324.12 | 49 |

| Progressive NorthWestern | Married 60-year old female | $2,318.03 | 50 |

| Farmers Ins Co | Married 35-year old female | $2,316.82 | 51 |

| Farmers Ins Co | Married 35-year old male | $2,306.44 | 52 |

| Geico General | Married 60-year old male | $2,274.76 | 53 |

| State Farm Mutual Auto | Single 25-year old male | $2,268.23 | 54 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $2,265.25 | 55 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $2,222.90 | 56 |

| Safeco Ins Co of IL | Married 60-year old female | $2,220.47 | 57 |

| Travelers Home & Marine Ins Co | Married 60-year old male | $2,201.72 | 58 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $2,194.96 | 59 |

As you can see, younger drivers are charged more for their coverage than older drivers, regardless of gender. However, the difference between these costs will vary dramatically based on the carrier with which a driver has her policy.

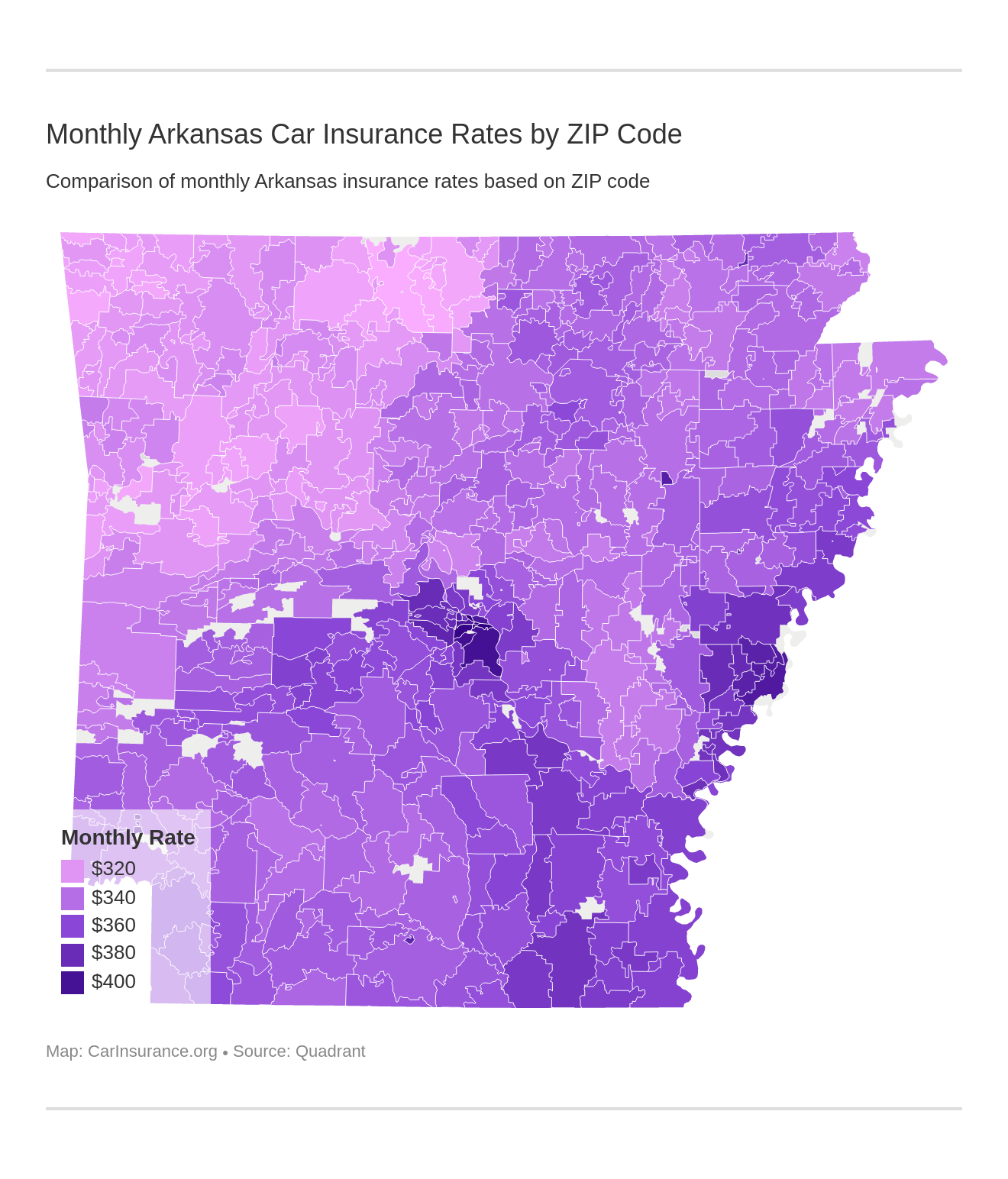

What are rates by Arkansas ZIP codes?

Likewise, the county in which you live in Arkansas will influence your average carrier rate. More urban areas are likely to have higher insurance rates than rural areas – but then again, this isn’t always the case.

Whether you’re a new resident or an old hat, take a look and see how the average insurance rate in your area vary from those in cities like Little Rock.

| Highest Average Rate by Zip Code | Lowest Average Rate by Zip Code | ||

|---|---|---|---|

| 72202 | $4,957.15 | 72626 | $3,675.93 |

| 72204 | $4,910.68 | 72687 | $3,701.73 |

| 72201 | $4,910.28 | 72634 | $3,706.66 |

| 72209 | $4,824.25 | 72761 | $3,714.85 |

| 72206 | $4,813.84 | 72619 | $3,719.26 |

| 72332 | $4,759.29 | 72941 | $3,727.89 |

| 72205 | $4,748.91 | 72768 | $3,730.83 |

| 72114 | $4,747.38 | 72745 | $3,732.84 |

| 72342 | $4,725.99 | 72653 | $3,733.80 |

| 72390 | $4,698.75 | 72635 | $3,737.78 |

| 72169 | $4,681.81 | 72633 | $3,740.11 |

| 72227 | $4,667.26 | 72719 | $3,740.12 |

| 72355 | $4,660.25 | 72658 | $3,744.24 |

| 71759 | $4,632.65 | 72951 | $3,746.65 |

| 72210 | $4,617.77 | 72642 | $3,750.39 |

| 72369 | $4,603.82 | 72840 | $3,752.32 |

| 71823 | $4,602.56 | 72758 | $3,753.45 |

| 72312 | $4,594.10 | 72712 | $3,756.99 |

| 72322 | $4,591.51 | 72747 | $3,760.25 |

| 72211 | $4,574.12 | 72601 | $3,760.28 |

| 72374 | $4,570.51 | 72661 | $3,760.68 |

| 72366 | $4,559.19 | 72832 | $3,761.40 |

| 72135 | $4,559.09 | 72820 | $3,763.31 |

| 72462 | $4,558.66 | 72644 | $3,764.03 |

| 72383 | $4,554.58 | 72830 | $3,764.38 |

| 72037 | $4,554.52 | 72839 | $3,766.14 |

| 72223 | $4,533.10 | 72943 | $3,766.31 |

| 72212 | $4,518.98 | 72733 | $3,768.92 |

| 72207 | $4,514.46 | 72903 | $3,772.41 |

| 72328 | $4,508.83 | 72735 | $3,773.59 |

| 72360 | $4,494.46 | 72937 | $3,775.02 |

| 71646 | $4,493.87 | 72949 | $3,775.82 |

| 72367 | $4,492.81 | 72734 | $3,777.59 |

| 72333 | $4,478.22 | 72821 | $3,778.37 |

| 71601 | $4,473.72 | 72636 | $3,778.47 |

| 72065 | $4,472.74 | 72801 | $3,779.21 |

| 72103 | $4,467.04 | 72651 | $3,786.15 |

| 72180 | $4,442.86 | 72936 | $3,788.31 |

| 71675 | $4,442.85 | 72682 | $3,788.34 |

| 71635 | $4,441.80 | 72847 | $3,788.68 |

| 72118 | $4,441.33 | 72715 | $3,790.40 |

| 71603 | $4,440.98 | 72722 | $3,792.36 |

| 72389 | $4,440.61 | 72729 | $3,792.99 |

| 71663 | $4,437.39 | 72908 | $3,793.25 |

| 72132 | $4,435.04 | 72732 | $3,793.96 |

| 72113 | $4,433.50 | 72742 | $3,794.09 |

| 71654 | $4,432.27 | 72714 | $3,794.62 |

| 72376 | $4,431.21 | 72615 | $3,794.88 |

| 71667 | $4,425.08 | 72923 | $3,798.08 |

| 72142 | $4,416.88 | 72959 | $3,803.91 |

| 71666 | $4,415.56 | 72769 | $3,804.01 |

| 71676 | $4,412.43 | 72744 | $3,805.26 |

| 72183 | $4,409.46 | 72756 | $3,805.92 |

| 72348 | $4,406.93 | 72855 | $3,805.98 |

| 72311 | $4,402.16 | 72631 | $3,810.69 |

| 72320 | $4,401.91 | 72751 | $3,810.74 |

| 72341 | $4,400.52 | 72749 | $3,811.51 |

| 71678 | $4,397.31 | 72537 | $3,813.14 |

| 71956 | $4,383.58 | 72672 | $3,815.53 |

| 71658 | $4,383.44 | 72675 | $3,815.59 |

| 71630 | $4,382.04 | 72753 | $3,816.07 |

| 71674 | $4,381.23 | 72752 | $3,817.02 |

| 71661 | $4,376.79 | 72916 | $3,817.20 |

| 72164 | $4,376.40 | 72739 | $3,820.14 |

| 71659 | $4,374.66 | 72865 | $3,820.19 |

| 71968 | $4,371.56 | 72685 | $3,820.75 |

| 72133 | $4,371.05 | 72773 | $3,821.96 |

| 72368 | $4,369.60 | 72764 | $3,823.90 |

| 72011 | $4,362.21 | 72736 | $3,825.09 |

| 71964 | $4,362.07 | 72704 | $3,825.45 |

| 71677 | $4,360.04 | 72933 | $3,828.13 |

| 72117 | $4,359.45 | 72774 | $3,828.56 |

| 71640 | $4,358.38 | 72854 | $3,828.88 |

| 71653 | $4,352.05 | 72823 | $3,828.93 |

| 71639 | $4,351.53 | 72762 | $3,829.02 |

| 71913 | $4,347.83 | 72617 | $3,829.04 |

| 71655 | $4,344.26 | 72616 | $3,829.30 |

| 71643 | $4,340.30 | 72666 | $3,829.81 |

| 72122 | $4,338.14 | 72718 | $3,833.38 |

| 71901 | $4,337.65 | 72659 | $3,835.29 |

| 72022 | $4,335.55 | 72930 | $3,835.64 |

| 71602 | $4,333.70 | 72927 | $3,837.27 |

| 72129 | $4,332.53 | 72852 | $3,838.35 |

| 71671 | $4,330.68 | 72737 | $3,838.46 |

| 71642 | $4,330.49 | 72837 | $3,838.64 |

| 72339 | $4,329.53 | 72835 | $3,840.28 |

| 72379 | $4,326.46 | 72624 | $3,840.63 |

| 71929 | $4,324.82 | 72904 | $3,841.68 |

| 72002 | $4,324.68 | 72628 | $3,842.72 |

| 72384 | $4,323.47 | 72863 | $3,842.80 |

| 71949 | $4,319.67 | 72901 | $3,843.14 |

| 72120 | $4,318.37 | 72727 | $3,843.47 |

| 71662 | $4,316.95 | 72717 | $3,844.04 |

| 71652 | $4,311.87 | 72845 | $3,844.41 |

| 72128 | $4,311.68 | 72802 | $3,845.20 |

| 72364 | $4,310.91 | 72858 | $3,847.39 |

| 72550 | $4,308.99 | 72938 | $3,850.23 |

| 72327 | $4,303.32 | 72668 | $3,850.55 |

| 71854 | $4,302.63 | 72544 | $3,855.55 |

| 72087 | $4,300.42 | 72843 | $3,855.82 |

| 71837 | $4,299.13 | 72660 | $3,856.90 |

| 71826 | $4,297.97 | 72856 | $3,858.60 |

| 71748 | $4,295.79 | 72662 | $3,861.27 |

| 72152 | $4,290.97 | 72928 | $3,861.77 |

| 72079 | $4,290.20 | 72932 | $3,862.21 |

| 71644 | $4,289.86 | 72738 | $3,863.57 |

| 71670 | $4,289.53 | 72640 | $3,870.89 |

| 72373 | $4,286.72 | 72703 | $3,874.93 |

| 72340 | $4,285.59 | 72956 | $3,876.27 |

| 72301 | $4,284.61 | 72632 | $3,878.35 |

| 72168 | $4,279.80 | 72721 | $3,879.99 |

| 71660 | $4,276.86 | 72921 | $3,882.75 |

| 71747 | $4,276.65 | 72701 | $3,883.42 |

| 72116 | $4,276.11 | 72940 | $3,884.38 |

| 72015 | $4,275.51 | 72669 | $3,885.12 |

| 71933 | $4,271.32 | 72740 | $3,886.97 |

| 71943 | $4,271.16 | 72842 | $3,889.58 |

| 72353 | $4,270.99 | 72730 | $3,890.25 |

| 71638 | $4,269.21 | 72679 | $3,890.86 |

| 72019 | $4,268.89 | 72846 | $3,893.18 |

| 72377 | $4,266.81 | 72611 | $3,893.59 |

| 72331 | $4,264.95 | 72683 | $3,895.67 |

| 72352 | $4,263.41 | 72686 | $3,896.04 |

| 71909 | $4,262.17 | 72655 | $3,903.55 |

| 72329 | $4,261.40 | 72641 | $3,905.27 |

| 72568 | $4,260.62 | 72650 | $3,905.47 |

| 72105 | $4,260.57 | 72623 | $3,909.73 |

| 72527 | $4,260.33 | 72638 | $3,912.51 |

| 72396 | $4,258.84 | 72776 | $3,918.25 |

| 71631 | $4,258.47 | 72945 | $3,918.96 |

| 72346 | $4,257.42 | 72648 | $3,921.34 |

| 71647 | $4,257.02 | 72934 | $3,925.17 |

| 72046 | $4,256.42 | 72851 | $3,926.14 |

| 72076 | $4,255.86 | 72946 | $3,929.74 |

| 71651 | $4,254.78 | 72947 | $3,931.69 |

| 72472 | $4,254.21 | 72034 | $3,937.61 |

| 71952 | $4,252.86 | 72110 | $3,940.34 |

| 71935 | $4,250.88 | 72958 | $3,943.41 |

| 71845 | $4,247.19 | 72760 | $3,946.03 |

| 72175 | $4,241.28 | 71945 | $3,947.54 |

| 71921 | $4,240.74 | 72032 | $3,951.48 |

| 72150 | $4,240.42 | 71953 | $3,955.98 |

| 72072 | $4,236.09 | 72070 | $3,956.09 |

| 72004 | $4,235.40 | 72952 | $3,956.38 |

| 71765 | $4,235.27 | 72001 | $3,957.08 |

| 72391 | $4,230.92 | 72454 | $3,962.19 |

| 72167 | $4,230.06 | 72080 | $3,964.23 |

| 71861 | $4,229.17 | 72045 | $3,968.01 |

| 72529 | $4,226.68 | 72415 | $3,968.65 |

| 71665 | $4,224.73 | 72834 | $3,969.59 |

| 71750 | $4,224.30 | 72955 | $3,970.21 |

| 71950 | $4,224.18 | 72063 | $3,974.36 |

| 71749 | $4,221.91 | 72944 | $3,975.03 |

| 72566 | $4,221.41 | 71937 | $3,975.95 |

| 72387 | $4,220.12 | 72434 | $3,976.25 |

| 72677 | $4,219.69 | 72125 | $3,980.21 |

| 72084 | $4,218.27 | 72160 | $3,981.55 |

| 72386 | $4,214.88 | 72035 | $3,981.80 |

| 71834 | $4,212.74 | 72141 | $3,982.05 |

| 72099 | $4,212.41 | 72060 | $3,983.23 |

| 71940 | $4,211.90 | 72670 | $3,983.66 |

| 72350 | $4,211.04 | 72460 | $3,985.96 |

| 72556 | $4,210.37 | 72003 | $3,989.59 |

| 71762 | $4,210.09 | 72315 | $3,991.65 |

| 72534 | $4,209.82 | 72948 | $3,992.81 |

| 71959 | $4,208.24 | 72833 | $3,993.79 |

| 71971 | $4,207.15 | 72181 | $3,994.77 |

| 71840 | $4,206.98 | 72170 | $3,996.48 |

| 72069 | $4,205.59 | 72370 | $3,996.61 |

| 71853 | $4,203.87 | 72426 | $3,997.00 |

| 72016 | $4,201.32 | 71973 | $3,998.59 |

| 71770 | $4,199.99 | 72433 | $4,000.00 |

| 72313 | $4,199.15 | 72088 | $4,002.60 |

| 72338 | $4,199.15 | 72156 | $4,005.88 |

| 72513 | $4,198.05 | 72012 | $4,006.27 |

| 71965 | $4,195.59 | 72824 | $4,007.32 |

| 72123 | $4,194.77 | 72438 | $4,008.51 |

| 72561 | $4,194.19 | 72629 | $4,009.96 |

| 72470 | $4,193.83 | 72419 | $4,010.65 |

| 72395 | $4,193.07 | 72017 | $4,011.75 |

| 71831 | $4,192.85 | 72157 | $4,012.83 |

| 72567 | $4,192.76 | 72442 | $4,013.02 |

| 71764 | $4,190.66 | 72149 | $4,013.44 |

| 71724 | $4,190.51 | 72657 | $4,013.94 |

| 72467 | $4,190.43 | 72853 | $4,015.16 |

| 72530 | $4,189.94 | 72068 | $4,016.31 |

| 71860 | $4,189.06 | 72042 | $4,018.57 |

| 72577 | $4,188.23 | 72461 | $4,018.76 |

| 71839 | $4,187.38 | 72445 | $4,019.14 |

| 72432 | $4,186.68 | 72950 | $4,019.82 |

| 71725 | $4,186.21 | 72841 | $4,020.76 |

| 71758 | $4,185.88 | 72153 | $4,021.57 |

| 71832 | $4,185.68 | 72059 | $4,021.90 |

| 72501 | $4,185.68 | 72531 | $4,023.62 |

| 72523 | $4,185.60 | 72476 | $4,024.13 |

| 71842 | $4,185.35 | 72041 | $4,024.90 |

| 72365 | $4,184.60 | 72121 | $4,024.93 |

| 71958 | $4,184.60 | 72926 | $4,026.54 |

| 72569 | $4,184.46 | 72064 | $4,026.55 |

| 72166 | $4,183.96 | 72639 | $4,027.03 |

| 72104 | $4,183.46 | 72578 | $4,027.33 |

| 71753 | $4,182.60 | 72029 | $4,029.70 |

| 72140 | $4,180.87 | 72437 | $4,029.71 |

| 71742 | $4,178.48 | 72458 | $4,030.37 |

| 71730 | $4,178.47 | 72083 | $4,030.58 |

| 72126 | $4,177.89 | 72827 | $4,032.91 |

| 72521 | $4,177.61 | 72027 | $4,033.28 |

| 72057 | $4,176.87 | 71944 | $4,033.79 |

| 71957 | $4,176.62 | 72471 | $4,034.86 |

| 71969 | $4,176.06 | 72473 | $4,037.03 |

| 71923 | $4,174.56 | 72134 | $4,037.85 |

| 72422 | $4,173.80 | 72102 | $4,040.32 |

| 72325 | $4,172.64 | 72838 | $4,044.67 |

| 72321 | $4,171.84 | 72330 | $4,047.96 |

| 72101 | $4,171.31 | 72524 | $4,048.63 |

| 72526 | $4,171.17 | 72130 | $4,049.19 |

| 71961 | $4,171.13 | 72455 | $4,051.89 |

| 72579 | $4,171.11 | 71972 | $4,051.95 |

| 71836 | $4,170.57 | 72082 | $4,053.36 |

| 71833 | $4,169.44 | 72061 | $4,053.82 |

| 72517 | $4,168.43 | 71857 | $4,055.81 |

| 72392 | $4,168.41 | 72058 | $4,057.14 |

| 72394 | $4,168.23 | 72358 | $4,057.43 |

| 72048 | $4,167.60 | 72447 | $4,058.14 |

| 71970 | $4,167.51 | 72410 | $4,058.32 |

| 71922 | $4,167.39 | 72431 | $4,059.56 |

| 72522 | $4,166.31 | 72428 | $4,061.12 |

| 72542 | $4,165.37 | 72075 | $4,061.31 |

| 72540 | $4,165.28 | 72565 | $4,061.66 |

| 71960 | $4,164.49 | 72546 | $4,062.02 |

| 71941 | $4,162.71 | 72519 | $4,062.33 |

| 71820 | $4,160.96 | 72026 | $4,062.53 |

| 72039 | $4,160.26 | 72044 | $4,063.60 |

| 71847 | $4,158.33 | 72013 | $4,064.16 |

| 72179 | $4,158.20 | 72178 | $4,064.71 |

| 72023 | $4,157.53 | 72031 | $4,064.91 |

| 72429 | $4,154.86 | 72107 | $4,065.41 |

| 72335 | $4,153.88 | 72351 | $4,066.53 |

| 71744 | $4,153.21 | 72857 | $4,066.85 |

| 71801 | $4,152.39 | 71722 | $4,067.73 |

| 72137 | $4,151.71 | 72020 | $4,067.74 |

| 72572 | $4,151.60 | 72538 | $4,068.32 |

| 71862 | $4,149.92 | 72520 | $4,069.16 |

| 72475 | $4,149.91 | 72047 | $4,069.46 |

| 72441 | $4,148.51 | 72465 | $4,070.35 |

| 72131 | $4,147.92 | 72413 | $4,070.60 |

| 71825 | $4,147.12 | 72310 | $4,070.80 |

| 71751 | $4,146.62 | 72560 | $4,071.01 |

| 71962 | $4,146.61 | 72414 | $4,073.09 |

| 72584 | $4,146.15 | 72474 | $4,074.34 |

| 72562 | $4,145.67 | 72680 | $4,074.39 |

| 72571 | $4,143.83 | 72112 | $4,074.50 |

| 72165 | $4,142.87 | 72010 | $4,077.27 |

| 72066 | $4,142.02 | 72543 | $4,078.00 |

| 72421 | $4,140.09 | 72006 | $4,078.23 |

| 72424 | $4,139.99 | 72176 | $4,079.23 |

| 72469 | $4,139.72 | 72055 | $4,079.64 |

| 72417 | $4,139.64 | 71721 | $4,082.83 |

| 72074 | $4,139.52 | 72581 | $4,083.46 |

| 71859 | $4,139.39 | 72576 | $4,085.37 |

| 72372 | $4,138.89 | 72040 | $4,086.07 |

| 72324 | $4,138.82 | 72404 | $4,086.26 |

| 72052 | $4,138.36 | 72127 | $4,087.64 |

| 71745 | $4,138.26 | 71858 | $4,088.10 |

| 72425 | $4,138.24 | 72663 | $4,088.11 |

| 72478 | $4,136.39 | 72536 | $4,088.67 |

| 72051 | $4,135.83 | 72073 | $4,088.75 |

| 72347 | $4,134.89 | 72512 | $4,089.98 |

| 72007 | $4,134.10 | 72587 | $4,090.11 |

| 72024 | $4,133.63 | 71772 | $4,091.54 |

| 71999 | $4,132.54 | 72025 | $4,091.83 |

| 71740 | $4,132.35 | 72111 | $4,092.60 |

| 72326 | $4,132.16 | 72440 | $4,093.60 |

| 71838 | $4,131.06 | 72354 | $4,094.01 |

| 72573 | $4,130.20 | 72436 | $4,094.57 |

| 71835 | $4,129.66 | 72143 | $4,095.71 |

| 71822 | $4,128.51 | 71851 | $4,096.05 |

| 72435 | $4,128.07 | 72430 | $4,096.77 |

| 72401 | $4,128.01 | 72555 | $4,097.05 |

| 71841 | $4,127.77 | 71720 | $4,097.81 |

| 71942 | $4,127.16 | 72450 | $4,098.11 |

| 72021 | $4,125.66 | 71743 | $4,098.90 |

| 72136 | $4,125.54 | 72457 | $4,099.55 |

| 72585 | $4,125.45 | 72036 | $4,099.70 |

| 71846 | $4,125.34 | 72038 | $4,099.73 |

| 72139 | $4,125.07 | 72030 | $4,099.78 |

| 71766 | $4,124.99 | 72412 | $4,100.53 |

| 71763 | $4,124.98 | 71852 | $4,101.58 |

| 71866 | $4,124.16 | 72539 | $4,101.73 |

| 71726 | $4,123.73 | 72533 | $4,102.16 |

| 72528 | $4,122.63 | 72449 | $4,102.24 |

| 72860 | $4,122.46 | 71701 | $4,102.55 |

| 72479 | $4,122.16 | 72453 | $4,102.70 |

| 72182 | $4,121.61 | 72086 | $4,103.61 |

| 71932 | $4,121.32 | 72416 | $4,103.63 |

| 72411 | $4,121.24 | 72444 | $4,103.75 |

| 72464 | $4,120.15 | 72173 | $4,103.85 |

| 71920 | $4,118.45 | 72081 | $4,103.88 |

| 72067 | $4,117.82 | 72482 | $4,104.47 |

| 72085 | $4,117.72 | 71998 | $4,105.14 |

| 71828 | $4,117.52 | 72459 | $4,105.16 |

| 71827 | $4,117.06 | 72005 | $4,105.59 |

| 72014 | $4,116.08 | 72828 | $4,107.19 |

| 72515 | $4,115.38 | 71855 | $4,107.57 |

| 71752 | $4,115.33 | 72456 | $4,108.16 |

| 72645 | $4,113.80 | 72583 | $4,108.27 |

| 72564 | $4,113.19 | 72554 | $4,108.73 |

| 71728 | $4,112.91 | 72443 | $4,110.26 |

| 72106 | $4,111.71 | 72466 | $4,110.68 |

| 71865 | $4,111.54 | 71864 | $4,110.98 |

| 72532 | $4,111.44 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where are the most expensive and least expensive carrier rates by city?

To put a finer point on it: the cost of your insurance will vary depending on where you’re located. As the table below will show you, location-location-location matters a lot when you’re working out your car insurance budget.

| 25 Most Expensive Cities | 25 Least Expensive Cities | ||

|---|---|---|---|

| ASHDOWN | $4,957.15 | UNIONTOWN | $3,675.93 |

| KNOBEL | $4,910.68 | EUREKA SPRINGS | $3,701.73 |

| EMMET | $4,910.28 | ADONA | $3,706.66 |

| BRINKLEY | $4,824.25 | SPRINGDALE | $3,714.85 |

| GILLHAM | $4,813.84 | COVE | $3,719.26 |

| MC NEIL | $4,759.29 | LAKEVIEW | $3,727.89 |

| JONESBORO | $4,748.91 | WEST FORK | $3,730.83 |

| CHARLOTTE | $4,747.38 | GREENLAND | $3,732.84 |

| WILLISVILLE | $4,725.99 | CHESTER | $3,733.80 |

| BEARDEN | $4,698.75 | RUDY | $3,737.78 |

| DELAPLAINE | $4,681.81 | PIGGOTT | $3,740.11 |

| THORNTON | $4,667.26 | OAK GROVE | $3,740.12 |

| RAVENDEN | $4,660.25 | WITTER | $3,744.24 |

| YORKTOWN | $4,632.65 | LAVACA | $3,746.65 |

| ROMANCE | $4,617.77 | WALDRON | $3,750.39 |

| PEACH ORCHARD | $4,603.82 | SUMMERS | $3,752.32 |

| BAUXITE | $4,602.56 | BERRYVILLE | $3,753.45 |

| DOLPH | $4,594.10 | HINDSVILLE | $3,756.99 |

| BAY | $4,591.51 | OARK | $3,760.25 |

| WIDEMAN | $4,574.12 | SCOTLAND | $3,760.28 |

| GLENCOE | $4,570.51 | MARSHALL | $3,760.68 |

| MAYNARD | $4,559.19 | GAMALIEL | $3,761.40 |

| MC DOUGAL | $4,559.09 | SUBIACO | $3,763.31 |

| OXFORD | $4,558.66 | MORRILTON | $3,764.03 |

| CROCKETTS BLUFF | $4,554.58 | PYATT | $3,764.38 |

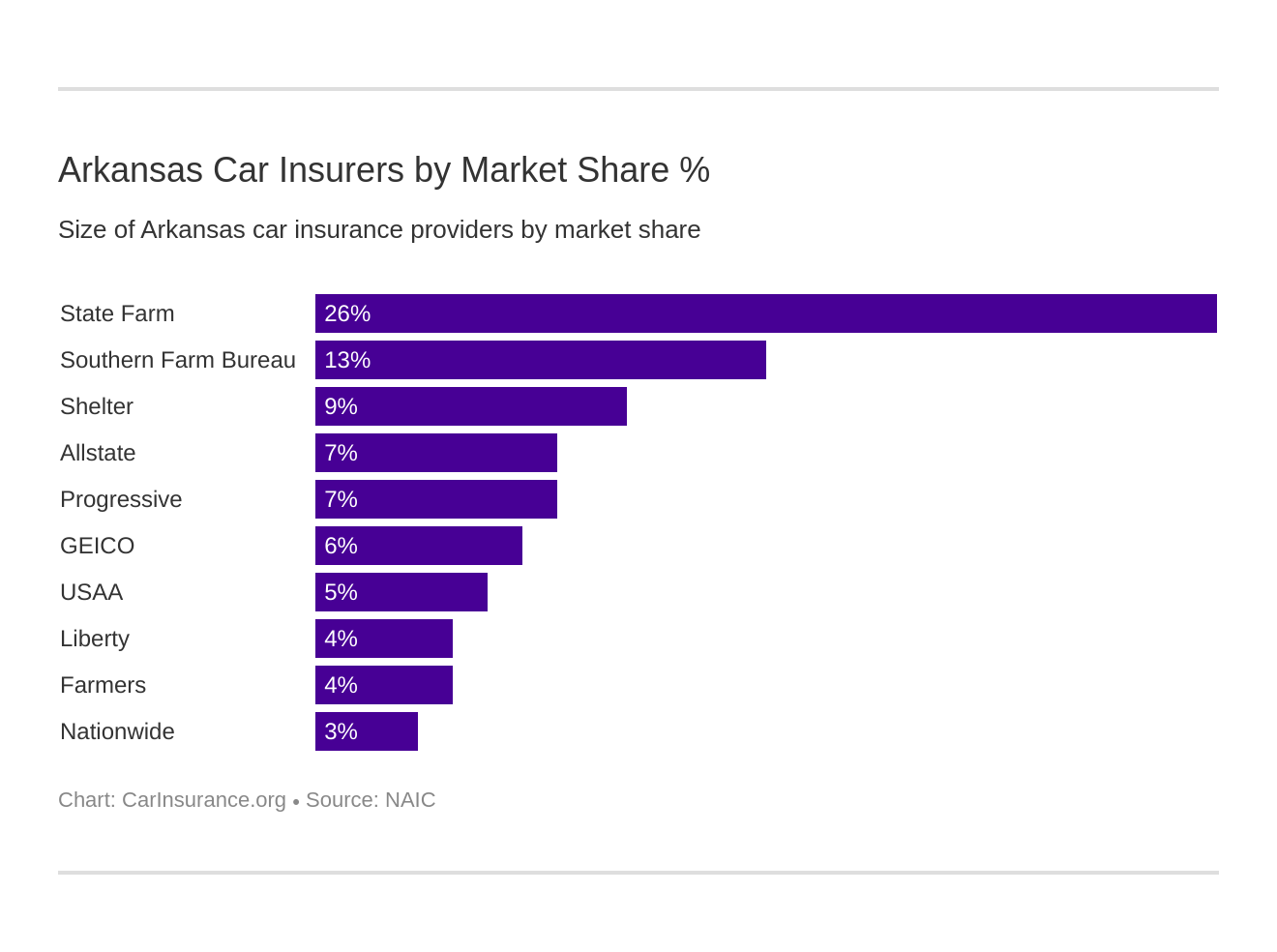

Which are the best Arkansas auto insurance companies?

So, we have some good news, and we have some bad news. The good news is that there are dozens upon dozens of car insurance providers for you to pick a plan within this day and age.

The bad news is that there are dozens upon dozens of car insurance providers for you to pick a plan within this day and age.

Comparing car insurance rates isn’t easy. That’s why you’ve got us, though!

Let’s explore Arkansas’s largest auto insurance companies, their ratings, and the way their plans stack up when compared to one another.

The Largest Arkansas Companies’ Financial Rating

Let’s start with an overview. AM Best awards Arkansas’s insurance provider’s financial ratings in order to let potential consumers know how they stack up in terms of loss ratio, market share, and direct premium composition.

The higher the AM Best rating, the more likely that the car insurance provider is a reliable one.

| State Farm Group | A | 195 | 66.99% | 25.69% |

| Southern Farm Bureau Casualty Group | A+ | 792 | 69.46% | 12.78% |

| Shelter Insurance Group | A | 424 | 67.43% | 8.60% |

| Allstate Insurance Group | A+ | 053 | 47.21% | 7.24% |

| Progressive Group | A+ | 855 | 58.71% | 7.18% |

| Geico | A++ | 940 | 70.69% | 5.65% |

| USAA Group | NR | 071 | 73.14% | 4.73% |

| Liberty Mutual Group | A | 245 | 61.30% | 4.12% |

| Farmers Insurance Group | NR | 776 | 52.42% | 4.10% |

| Nationwide Corp Group | A+ | 506 | 51.80% | 2.95% |

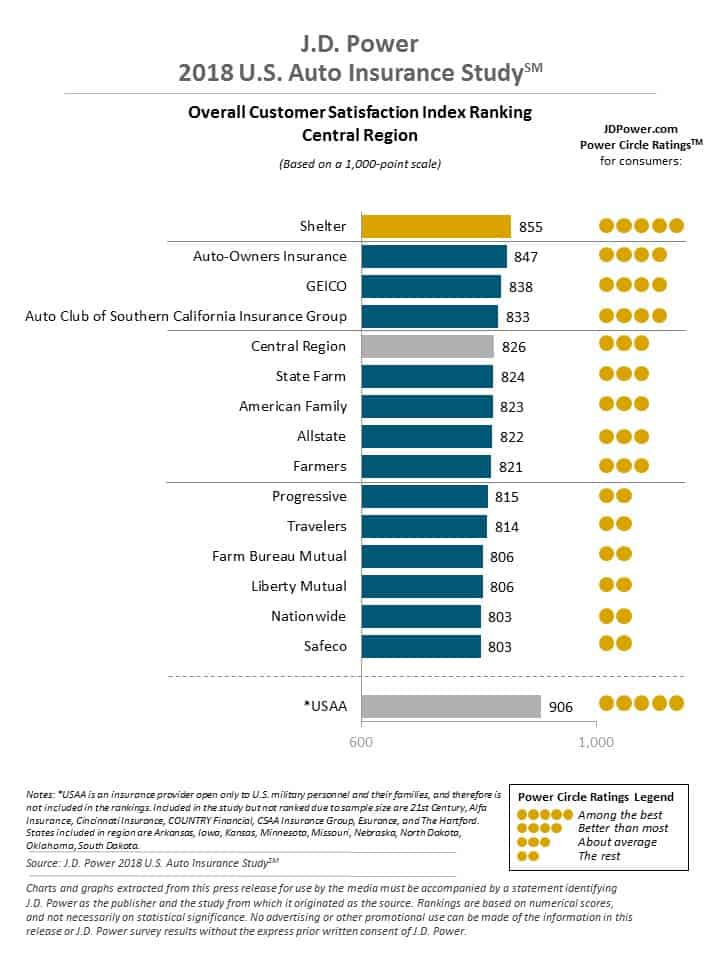

Companies with Best Ratings

Customer ratings also go far in determining a car insurance provider’s reputation. JD Power ranks the car insurance companies in Arkansas against one another in terms of customer rating, as displayed below.

We can go even further, though, and dive into the nitty-gritty of customer car insurance comparisons.

Companies with the Most Complaints in Arkansas

While complaints aren’t always the best meter on which to measure the reliability of a car insurance provider, they do offer insight into the way a company will treat those people it represents.

| Company | Direct Written Premiums | Complaint Index |

|---|---|---|

| Columbia Insurance Group | $11,471,686 | 0 |

| Cornerstone | $6,669,115 | 0 |

| Esurance | $5,691,830 | 0 |

| MetLife | $14,463,757 | 0.2562 |

| Auto-Owners | $10,892,419 | 0.3402 |

| Southern Farm Bureau | $206,211,166 | 0.4312 |

| Nationwide | $61,851,329 | 0.4792 |

| ANPAC | $7,675,988 | 0.4827 |

| State Farm | $375,631,848 | 0.503 |

| Cincinnati Ins Co | $6,993,252 | 0.5298 |

| Shelter | $125,866,966 | 0.5593 |

| AAA / Automobile Club | $26,115,598 | 0.5675 |

| Liberty Mutual | $11,136,725 | 0.6654 |

| Travelers | $26,897,523 | 0.6887 |

| Allstate | $109,194,732 | 0.7804 |

| Safeco | $33,813,210 | 0.9862 |

| USAA | $67,525,883 | 1.0425 |

| Fairfax / American Underwriters | $10,462,806 | 1.0624 |

| State Auto | $19,414,847 | 1.145 |

| Hartford | $24,437,324 | 1.2129 |

| Progressive | $93,506,250 | 1.2283 |

| Farmers | $78,015,367 | 1.4722 |

| Geico | $81,792,529 | 1.4949 |

| 21st Century | $8,493,667 | 2.1811 |

| Dairyland | $6,473,624 | 2.8617 |

| Imperial Fire & Casualty | $6,296,510 | 2.9422 |

| Hanover | $14,669,056 | 3.0309 |

| Direct General | $11,892,584 | 3.427 |

| Alfa | $26,366,435 | 4.0752 |

| United Automobile | $5,921,761 | 11.8878 |

Car insurance providers with ratings on the higher side of the complaint index have had more negative interactions with their audience than those with lower scores, as you might expect.

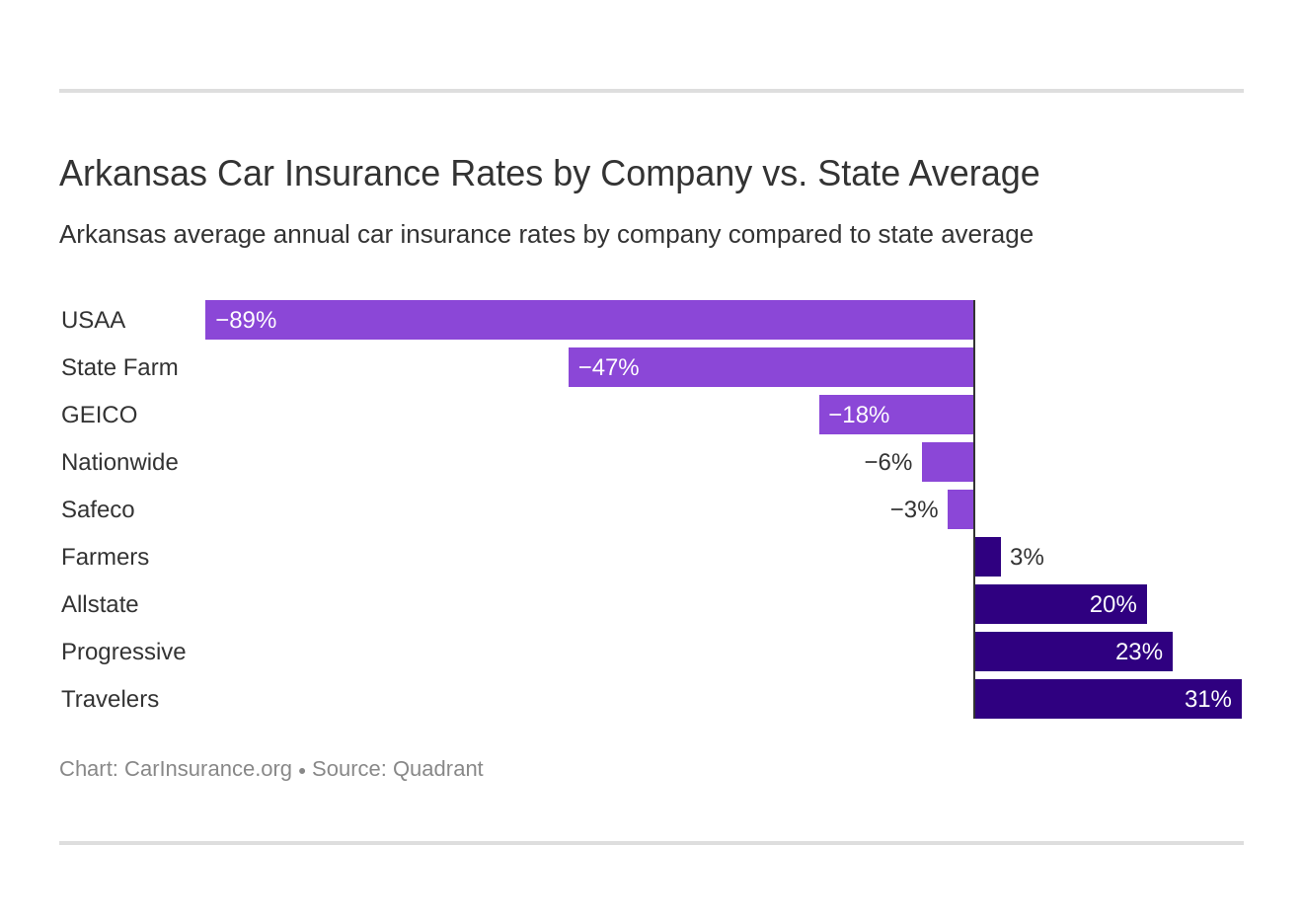

What are Arkansas car insurance premiums by company?

Rates also contribute to the reputation that a car insurance provider develops. We know that when you’re looking for a provider, you want to get the best deal possible. Take a look at the top carrier in the Natural State and see what your options as a resident look like.

| Company | Average Annual Rate | Compared to State Average | Percentage Over/Under State Average |

|---|---|---|---|

| Allstate P&C | $5,150.03 | $1,038.33 | +20.16% |

| Farmers Ins Co | $4,257.88 | $146.18 | +3.43% |

| Geico General | $3,484.63 | -$627.07 | -18.00% |

| Safeco Ins Co of IL | $4,005.48 | -$106.22 | -2.65% |

| Nationwide Mutual | $3,861.78 | -$249.92 | -6.47% |

| Progressive NorthWestern | $5,312.09 | $1,200.39 | +22.60% |

| State Farm Mutual Auto | $2,789.02 | -$1,322.68 | -47.42% |

| Travelers Home & Marine Ins Co | $5,973.33 | $1,861.63 | +31.17% |

| USAA | $2,171.05 | -$1,940.65 | -89.39% |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

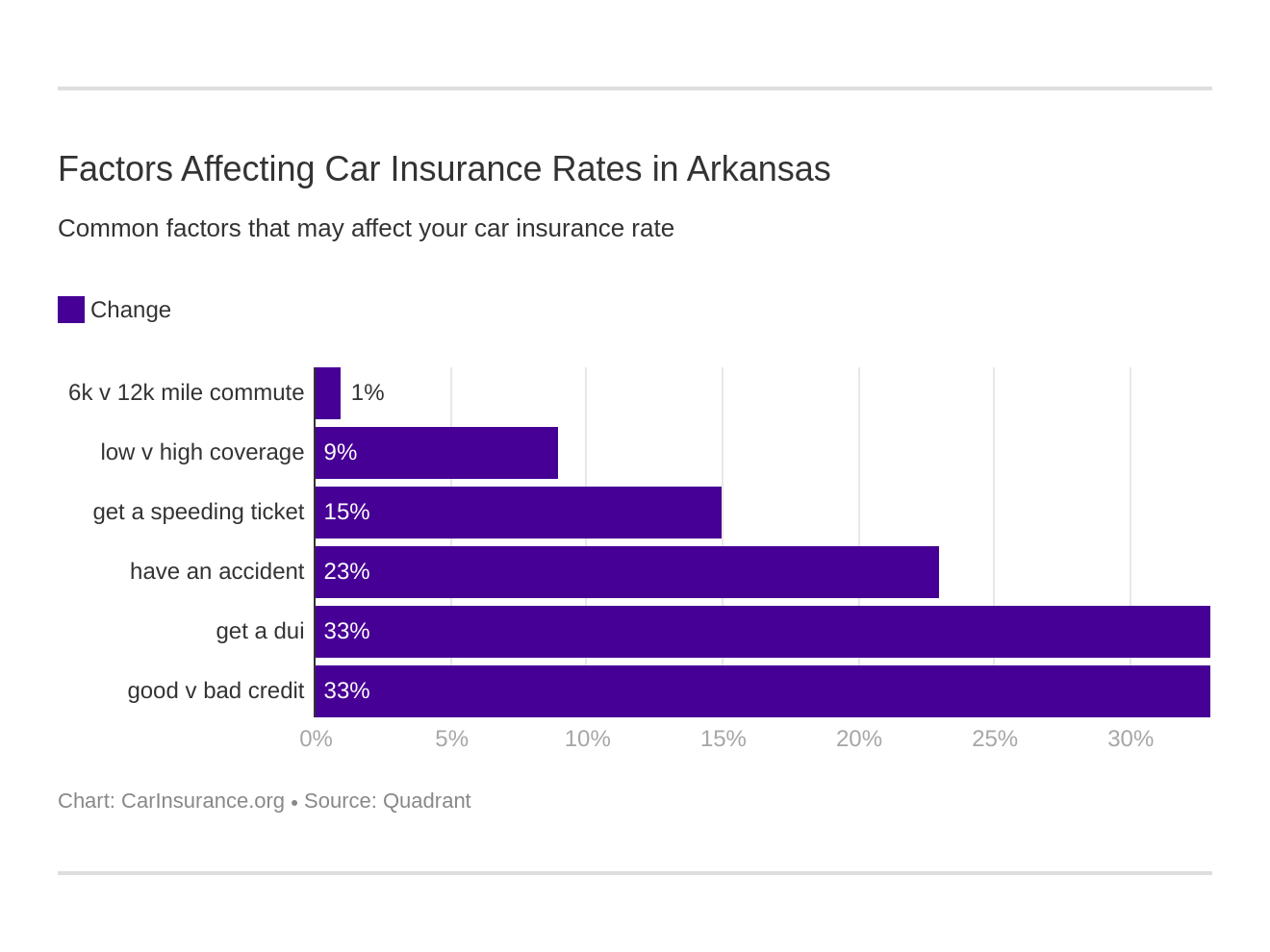

What are Arkansas car insurance rates by commute?

Sometimes a carrier will vary their rates based on the amount of time you spend commuting or traveling around the country. The more time you spend on the road, the more likely it is that you’ll have a higher insurance rate.

| Group | 10 miles commute/6,000 annual mileage | 25 miles commute/12,000 annual mileage |

|---|---|---|

| Travelers | $5,973.33 | $5,973.33 |

| Progressive | $5,312.09 | $5,312.09 |

| Allstate | $5,150.03 | $5,150.03 |

| Farmers | $4,257.87 | $4,257.87 |

| Liberty Mutual | $4,005.48 | $4,005.48 |

| Nationwide | $3,861.78 | $3,861.78 |

| Geico | $3,461.03 | $3,508.22 |

| State Farm | $2,721.97 | $2,856.08 |

| USAA | $2,109.20 | $2,232.91 |

As you can see, the monetary difference between drivers with longer commutes and shorter commutes varies per provider. The difference tends to stick between $100, but some of the best and cheapest companies, like Liberty Mutual, have no difference in rate at all in terms of commute.

What are Arkansas car insurance rates by coverage level?

Likewise, the amount of coverage you sign up for will change the amount a company charges you. Consider the following:

| Company | High Coverage Level | Medium Coverage Level | Low Coverage Level |

|---|---|---|---|

| Allstate | $5,296.98 | $5,146.99 | $5,006.12 |

| Farmers | $4,509.37 | $4,214.22 | $4,050.03 |

| Geico | $3,628.49 | $3,483.6 | $3,341.79 |

| Liberty Mutual | $4,170.01 | $3,977.85 | $3,868.57 |

| Nationwide | $3,915.62 | $3,783.13 | $3,886.6 |

| Progressive | $5,831.14 | $5,221.81 | $4,883.32 |

| State Farm | $2,927.56 | $2,786.42 | $2,653.1 |

| Travelers | $6,245.09 | $5,989.75 | $5,685.15 |

| USAA | $2,268.89 | $2,163.34 | $2,080.93 |

As you’d expect, the less coverage you have, the lower your rate will be. However, keep in mind that not having enough coverage can cost you serious money in the long run.

What are Arkansas auto insurance costs by credit history?

Your credit history‘s impact on your insurance rate can be seen in the amount you pay your provider on an annual basis, as most companies will look at your credit tier. Poor credit is likely to result in a significantly higher rate than good credit.

| Company | Annual Rate Poor Credit | Annual Rate Fair Credit | Annual Rate Good Credit |

|---|---|---|---|

| Allstate | $6,472.14 | $4,957.59 | $4,020.37 |

| Farmers | $4,845.12 | $4,060.17 | $3,868.33 |

| Geico | $4,174.77 | $3,431.81 | $2,847.29 |

| Liberty Mutual | $5,786.43 | $3,493.43 | $2,736.58 |

| Nationwide | $4,566.24 | $3,673.03 | $3,346.08 |

| Progressive | $6,026.44 | $5,135.36 | $4,774.48 |

| State Farm | $4,040.73 | $2,432.50 | $1,893.84 |

| Travelers | $6,854.36 | $5,719.88 | $5,345.75 |

| USAA | $2,875.86 | $1,963.67 | $1,673.63 |

On average, Arkansas residents have a credit score of 657. Your credit score will rely entirely on how you use your credit card or how you choose to pay back any loans you may have taken out.

Do what you can to stay on top of your credit, and you’ll see your efforts rewarded with an improved annual car insurance rate.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Arkansas car insurance rates by driving record?

In a similar vein, your good or bad driving record as a driver will impact the rate you’re offered from an insurance provider.

| Company | Clean Driving Record | One Speeding Citation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $4,247.65 | $5,074.04 | $5,344.99 | $5,933.45 |

| Farmers | $3,599.68 | $4,315.87 | $4,611.04 | $4,504.91 |

| Geico | $2,361.95 | $2,541.89 | $3,625.74 | $5,408.92 |

| Liberty Mutual | $2,728.95 | $3,668.24 | $4,435.22 | $5,189.50 |

| Nationwide | $3,003.05 | $3,306.76 | $3,881.91 | $5,255.42 |

| Progressive | $4,579.61 | $5,496.11 | $6,359.88 | $4,812.78 |

| State Farm | $2,561.18 | $2,789.02 | $3,016.88 | $2,789.02 |

| Travelers | $5,005.97 | $6,145.34 | $5,171.93 | $7,570.08 |

| USAA | $1,667.81 | $1,850.74 | $2,115.02 | $3,050.64 |

We’ve touched on the differences between a high-risk driver and a general driver with clean records. It’s worth noting, though, that higher-risk drivers can pay up to nearly $2,500 more on their premiums than a driver with a clean driving record.

That’s enough to make driving a little more cautiously worth it, don’t you think?

Which are the largest car insurance companies in Arkansas?

With all of that in mind, which car insurance companies have the most presence in Arkansas?

| Company Direct | Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $500,195 | 66.99% | 25.69% |

| Southern Farm Bureau Casualty Group | $248,792 | 69.46% | 12.78% |

| Shelter Insurance Group | $167,424 | 67.43% | 8.60% |

| Allstate Insurance Group | $141,053 | 47.21% | 7.24% |

| Progressive Group | $139,855 | 58.71% | 7.18% |

| Geico | $109,940 | 70.69% | 5.65% |

| USAA Group | $92,071 | 73.14% | 4.73% |

| Liberty Mutual Group | $80,245 | 61.30% | 4.12% |

| Farmers Insurance Group | $79,776 | 52.42% | 4.10% |

| Nationwide Corp Group | $57,506 | 51.80% | 2.95% |

| **State Total** | $1,947,179 | 63.32% | 100.00% |

Number of Insurers in Arkansas

| Property & Casualty Insurance | |

|---|---|

| Domestic | 12 |

| Foreign | 887 |

| Total | 899 |

What are Arkansas state driving laws?

Now that you know a little more about your car , you’ll want to do what you can to ensure that your can insurance rates remain low.

Even so, trying to understand every driving-related law in the state of Arkansas? That’s a challenge.

That’s why we’re here. You can take a look at our summations of Arkansas’s state driving laws and get an idea of what rules you’ll need to follow in order to avoid getting fined.

So, where do we begin?

High-Risk Insurance

Are you a high-risk driver? That depends on your driving history. If you’ve found that you’re prone to accidents or traffic violations, you may also discover that car insurance providers are less willing to provide you with coverage.

Car insurance providers are not required to cover high-risk drivers. This means that if your driving history is questionable, you may be out of luck when it comes to securing car insurance coverage.

If you are a high-risk driver, though, you can’t just forgo car insurance. This is where one of Arkansas’s residential provisions comes in handy.

If you’re a resident of Arkansas, you can apply for insurance through the state’s Arkansas Automobile Insurance Plan.

Every car insurance provider in the state of Arkansas is required to participate within the bounds of this plan. You’ll be able to submit your application for the Arkansas Automobile Insurance Plan through a representative from any of the car insurance providers in Arkansas.

Once your application is submitted and reviewed, you’ll be assigned to a car insurance provider of the state’s choosing.

Low-Cost Insurance

Not having car insurance as a driver in Arkansas is a bad idea. You might think you’re saving money by avoiding insurance policies and payments, but the fines you might receive for getting caught driving without insurance are far more expensive to deal with in the long run.

Unfortunately, Arkansas doesn’t have a program that ensures low-cost insurance for under-privileged families.

Drivers have to have the minimum amount of liability insurance in order to be on the road and will have to work with their individual insurers in order to remain within a budget. Once you’ve assessed your needs, you can start comparing insurance providers and find the best plan for you and your family.

Windshield Coverage

| Replacement | Repair | Zero Deductible with Comprehensive Coverage | |

|---|---|---|---|

| Arkansas | Aftermarket parts allowed with written notice and at least equal in terms of fit, quality, performance, and warranty | Consumer has right to choose repair vendor | Not a law - Individual insurance companies may offer with comprehensive coverage. |

However, depending on individual insurers and the details of your comprehensive coverage, you may be able to replace a broken or cracked windshield with after-market parts.

Keep in mind, though, that’ll you’ll need written notice in order to make use of the after-market parts that you want.

The repair vendor you reach out to, though, is entirely up to you.

Automobile Insurance Fraud in Arkansas

Insurance fraud is a complex topic. You can intentionally and unintentionally commit insurance fraud, which makes it an especially important issue to consider.

In Arkansas, insurance fraud is considered a criminal offense. Insurance fraud can occur in many ways, below are a few of the most common.

- You purposefully misreport or hide the details regarding a fatality or accident in order to receive compensation

- You help someone else misreport or hide the details regarding a fatality or accident in order to help them receive compensation

- You purposefully lie, make false claims, or assert false statements on the behalf of another person in the midst of an official, insurance-related proceeding

You’ll note that all of these forms of insurance fraud require intentionality on the offender’s part. Mistakes are human! Do what you can, regardless, to stay as honest as possible when addressing what occurred during or after an accident.

In Arkansas, specifically, insurance fraud is considered a felony at varying levels, depending on the amount of damage that has been sustained to property or a person.

| Value in Question | Consequences | |

|---|---|---|

| Misdemeanor | >$300 | One year's imprisonment and/or $2,000 fine |

| Class C Felony | Between $19,999 and $301 | Five years imprisonment and/or $10,000 fine |

| Class B Felony | <$20,000 | 10 years imprisonment and/or $25,000 fine |

Statute of Limitations

After getting into a car accident, you’ll have a limited amount of time to bring your grievances to court. This time block is referred to as a statute of limitations.

In Arkansas, the Arkansas Code Annotated Section 16-56-105 allows drivers found to be at-fault or their victims up to three years to bring their grievances to court.

This means that if you get in an accident and choose to file a lawsuit, you’ll have to present a state court with evidence of personal injury or damage to personal property within the statute of limitations.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are vehicle licensing laws?

There are consequences in Arkansas not only for driving without insurance but for driving without a license. These penalties will vary based on the number of offenses that you have on your record.

| Fines | Additional Consequences | Reinstatement Fee | |

|---|---|---|---|

| First Offense | $50 to $250 | Suspended registration; no plates until proof of coverage is provided; court may order a car impoundment | $20 |

| Second Offense | $250 to $500 | Suspended registration; no plates until proof of coverage; court may order car impound | $20 |

Teen Driver Laws

There are also specific Arkansas state laws that apply to drivers who are just getting their licenses or learning the rules of the road.

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit: | 14 years | no more than 1 passenger younger than 21 | Between 11 p.m. and 4 a.m. Teens are not required to have any number of hours of supervised driving. |

| Provisional License | Must be 16 years old and have held learner's permit for at least 6 months. | no more than 1 passenger younger than 21 | Nighttime restrictions will be lifted at age 18. |

| Full License | Must be 16 years old and have held provisional license for at least 6 months. | None. | None. |

Older Driver License Renewal Procedures

If the time has come to renew your license, don’t fret. Arkansas makes it easy for you to keep on top of your license’s expiration date.

| License renewal cycle | General population: 8 years | Older Population: 4 or 8 years for people 70 and older, personal option | ||

| Mail or online renewal permitted | General Population: no | Older Population: no | ||

| Proof of adequate vision required at renewal | General population: every renewal | Older population: every renewal |

New Residents

For people just moving into Arkansas and jumping through all of those hoops, there are some additional steps to take in order to update a driver’s license.

New Arkansas residents must apply for an Arkansas driver’s license within 30 days of moving into the state.

You can still go to the DMV in order to get your new license, but make note that the Arkansas Department of Finance and Administration takes care of any and all processes that deal with vehicle licensing.

Alternatively, you can avoid the DMV entirely. Arkansas wants its residents to “skip the trip” to the DMV and, in order to facilitate that, has moved most of the license renewal services online.

Negligent Operator Treatment System

Arkansas is a unique state in that while it addresses “at-fault” accidents indiscriminately, it also enables a sharing of the blame. This is referred to as contributory and comparative negligence.

By enacting contributory and comparative negligence laws, the Arkansas courts ensure that a percentage of the fault endured in an accident can be applied to the total coverage needed to attend to personal injury or property damage.

What are the rules of the road?

With all of that in mind, let’s get down to the nitty-gritty of roadway driving in Arkansas.

Fault vs. No-Fault

As we’ve mentioned, Arkansas is an at-fault state which operates on fault-based legislation.

The driver who is determined to be at-fault has to take responsibility for the costs of personal injury or property damage that arise in the aftermath of an accident.

Keep Right and Move Over Laws

Like most other states, Arkansas requires that you stick to the right-hand lane on two or more-lane roads, especially if you’re driving slower than the posted speed limit.

However, in Arkansas, there are six exceptions to this rule:

- When one car passes another in the same direction

- When the right half of the roadway is closed to traffic due to construction

- When a roadway is divided into three (3) lanes

- When a sign is posted indicated directions for one-way traffic

- When the right half of the road is undrivable

- When a vehicle is exiting the roadway on the left-hand side

Move over laws, comparatively, requires that all drivers move over to the side of the road when an emergency vehicle, representative of the Arkansas State High way and Transportation Department, or affiliated contractor needs to get by.

Speed Limits

| Posted Speed Limits | |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 75 mph |

| Limited Access Roads | 75 mph |

| Other | 65 mph |

Keep in mind that speed limits will vary for passenger cars and trucks, respectively.

Car Seat and Cargo Area Laws

| Child Age | Seat Requirements | Exceptions | Consequences |

|---|---|---|---|

| 5 or younger | A child safety seat - but the child can be kept either in the front or back seats | A child over 60 pounds does not have to be restrained by a child safety seat | $100 fine if caught |

| 6-14 | No seating requirements |

Seating laws regarding children are dictated with the intent of keeping children in cars as safe as possible.

Arkansas does allow for employees on duty – who are not children, obvious – to ride in the bed of trucks without violating the law.

Ridesharing

Drivers who operate for Lyft or Uber must carry evidence of individual car insurance on them at the time that they’re driving and must have at least minimum Arkansas state coverage.

What are the DUI and impaired driving laws?

| BAC Limit | 0.08 |

| HIGH BAC Limit | N/A |

| Criminal Status by Offense | 4th+ within 5 years is a felony. (otherwise unclassified) |

| Formal Name for Offense | Driving While Intoxicated (DWI) |

| Look Back Period/Washout Period | 5 years |

| 1st Offense-ALS or Revocation | 6 months |

| 1st Offense Imprisonment | 24 hours - 1 year, or community service |

| 1st Offense-Fine | $150-$1000 |

| 1st Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time |

| 2nd Offense-DL Revocation | 2nd offense in 5 years - 2 year revocation |

| 2nd Offense-Imprisonment | 7 days-1 year |

| 2nd Offense-Fine | $400-$3000 |

| 2nd Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time. |

| 3rd Offense-DL Revocation | 3rd offense in 5 years - 30 month revocation |

| 3rd Offense-Imprisonment | 90 days to 1 year |

| 3rd Offense-Fine | $900-$5000 |

| 3rd Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time |

| 4th Offense-DL Revocation | 4 years |

| 4th Offense-Imprisonment | 1-6 years |

| 4th Offense-Fine | $900-$5000 |

| 4th Offense-Other | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; interlock device equal to license suspension time |

| Mandatory Interlock | No |

While at this point there are no marijuana-related laws that relate specifically to driving in Arkansas, a person who is caught impaired by marijuana while driving will face similar consequences to those who drive while intoxicated by alcohol.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the distracted driving laws?

Arkansas has intense laws in place when it comes to distracted driving. Its legislation regarding cell phone use, hand-held devices, and texting while driving are all in place to keep drivers safer.

Let’s try to take this slowly.

The state does not permit drivers under 18 to have a cellphone on them while they drive. Only after a driver turns 18 are they allowed to have a cellphone with them while driving, but they are not allowed any other hand-held devices.

Drivers of all ages are not permitted to text while driving and will be fined or cited if they are caught doing so while on the road.

These bans change when drivers enter into a school or work zone. Drivers must be in violation of a primarily enforced law to be fined or cited for using a phone or hand-held device in these areas.

Should a school bus driver be caught using a cellphone or hand-held device while on duty, though, it will be considered a primarily-enforced violation?

What are the vehicle theft rates in Arkansas?

So: we’ve covered the finer points of car insurance in Arkansas as well as many of the laws that keep the roads safe. What’s life like for a driver in Arkansas on a daily basis, though? What kind of risks could a driver face?

We’ve done a bit of digging and are more than ready to share our findings with you.

Some cars are more likely to get stolen than others. That’s the reality of convenience and automobiles. If you’re living in Arkansas, though, you can assess car theft in order to find some pretty interesting trends.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2004 | 402 |

| Ford Pickup (Full Size) | 2008 | 252 |

| GMC Pickup (Full Size) | 1997 | 174 |

| Dodge Pickup (Full Size) | 1999 | 127 |

| Honda Accord | 1997 | 122 |

| Nissan Altima | 2015 | 89 |

| Toyota Camry | 2013 | 82 |

| Chevrolet Impala | 2012 | 76 |

| Chevrolet Malibu | 2006 | 72 |

| Chevrolet Tahoe | 2003 | 68 |

As you can see, pickups are among the most frequently stolen cars in the state of Arkansas. If you’ve got a truck with a nice bed, then, do your best to keep an eye out.

As of 2016, nearly 4,900 cars were stolen from registered drivers in Arkansas. If you take the right safety measures, you can make sure that even if you fall victim to vehicle theft, you’ll be covered.

Risky/Harmful Behavior While Driving

What qualifies as risky driving? In Arkansas, it includes driving while intoxicated, driving too quickly down an urban or rural road, or driving while distracted. If you’re out on the road, you’ll want to do what you can to ensure that you’re motoring as safely as possible.

Take a look at some of the statistics collected as of 2017, and you’ll see how distracted, risky, or harmful driving behaviors impacted Arkansas residents.

Are there a lot of fatal accidents on Arkansas’s roads?

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 493 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 351 |

| Motorcyclist Fatalities | 65 |

| Drivers Involved in Fatal Crashes | 687 |

| Pedestrian Fatalities | 42 |

| Bicyclist and other Cyclist Fatalities | 3 |

Luckily, bicyclists and pedestrians range within a lower percentile of the state’s overall fatalities. This one statistics, though, reveals the different potential dangers of driving while distracted.

Fatalities by Person Type

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 382 |

| Motorcyclists | 65 |

| Nonoccupants | 46 |

In much the same vein, you can see here that occupants within cars are most likely to be the victims in car accidents.

Fatalities by Crash Type

| Crash Type | Number |

|---|---|

| Single Vehicle | 275 |

| Involving a Large Truck | 84 |

| Involving Speeding | 116 |

| Involving a Rollover | 155 |

| Involving a Roadway Departure | 331 |

| Involving an Intersection (or Intersection Related) | 52 |

The data we have here is a little more complicated than that which we’ve already addressed. Let’s break this down.

As you can see, single vehicles make up a fair percentage of car accidents and fatalities which occur in Arkansas on a yearly basis.

However, these drivers are less likely to hit other cars in an intersection or other location than they are to experience a fatality during a roadway departure.

This means that a driver is more likely to hit another car or obstacle when pulling off of a highway, into a driveway, or generally moving away from the road that they’ve been driving down for some time.

This may be because roadway departures are sites of heavier traffic. However, these departures also require drivers to break through “highway hypnosis,” or the meditative state that some drivers enter into while heading down long stretches of interstate.

Five-Year Trend for the Top 10 Countries

| Arkansas Counties by 2017 Ranking | Fatalities | ||||

|---|---|---|---|---|---|

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

| Pulaski County | 59 | 40 | 53 | 43 | 51 |

| Washington County | 16 | 19 | 22 | 34 | 21 |

| Miller County | 9 | 6 | 11 | 10 | 18 |

| Craighead County | 14 | 12 | 17 | 18 | 17 |

| Faulkner County | 14 | 14 | 14 | 15 | 16 |

| Jefferson County | 10 | 16 | 9 | 11 | 15 |

| Benton County | 18 | 13 | 25 | 30 | 14 |

| Garland County | 21 | 18 | 26 | 31 | 13 |

| Hot Spring County | 13 | 17 | 17 | 15 | 13 |

| Sebastian County | 10 | 5 | 6 | 15 | 12 |

| Top Ten Counties | 205 | 184 | 221 | 236 | 190 |

| All Other Counties | 293 | 286 | 329 | 325 | 303 |

| All Counties | 498 | 470 | 550 | 561 | 493 |

We’ve already touched on how living in a particular Arkansas county can impact the amount of money you spend on your insurance annually. The place you live in Arkansas also has its own fatality likelihood.

Pulaski County, as you can see, is not only the most populated county within the state of Arkansas. It’s also the county that sees the most fatalities on a yearly basis. Naturally, fatalities and population correlate.

This also suggests that drivers in Pulaski County need to take extra care when they take to the roads on a daily basis.

Fatalities Involving Speeding by County

| Fatalities | Fatalities Per 100,000 Population | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Arkansas County | 1 | 1 | 1 | 1 | 0 | 5.33 | 5.41 | 5.45 | 5.49 | 0 |

| Ashley County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 4.88 | 0 |

| Baxter County | 1 | 0 | 1 | 2 | 2 | 2.44 | 0 | 2.43 | 4.86 | 4.84 |

| Benton County | 6 | 4 | 4 | 3 | 3 | 2.51 | 1.64 | 1.59 | 1.16 | 1.13 |

| Boone County | 0 | 1 | 3 | 2 | 3 | 0 | 2.7 | 8.09 | 5.38 | 8.03 |

| Bradley County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 9.11 | 0 |

| Calhoun County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Carroll County | 1 | 0 | 4 | 1 | 3 | 3.6 | 0 | 14.41 | 3.61 | 10.74 |

| Chicot County | 0 | 0 | 3 | 2 | 1 | 0 | 0 | 27.38 | 18.33 | 9.4 |

| Clark County | 2 | 2 | 0 | 2 | 2 | 8.86 | 8.87 | 0 | 8.87 | 8.97 |

| Clay County | 0 | 1 | 0 | 3 | 0 | 0 | 6.54 | 0 | 19.92 | 0 |

| Cleburne County | 1 | 0 | 3 | 1 | 3 | 3.9 | 0 | 11.83 | 3.97 | 11.98 |

| Cleveland County | 0 | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 24.21 | 12.19 |

| Columbia County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 4.15 | 0 | 4.23 |

| Conway County | 1 | 1 | 1 | 1 | 1 | 4.75 | 4.77 | 4.78 | 4.79 | 4.78 |

| Craighead County | 2 | 2 | 0 | 1 | 3 | 1.97 | 1.95 | 0 | 0.95 | 2.8 |

| Crawford County | 0 | 1 | 1 | 5 | 2 | 0 | 1.62 | 1.62 | 8.03 | 3.17 |

| Crittenden County | 1 | 1 | 1 | 3 | 0 | 2.01 | 2.02 | 2.04 | 6.08 | 0 |

| Cross County | 0 | 1 | 1 | 0 | 2 | 0 | 5.82 | 5.8 | 0 | 11.86 |

| Dallas County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 13.28 | 0 | 13.53 |

| Desha County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Drew County | 1 | 1 | 0 | 0 | 2 | 5.36 | 5.37 | 0 | 0 | 10.78 |

| Faulkner County | 1 | 1 | 3 | 1 | 4 | 0.84 | 0.83 | 2.48 | 0.82 | 3.23 |

| Franklin County | 0 | 2 | 1 | 5 | 2 | 0 | 11.23 | 5.64 | 28.29 | 11.18 |

| Fulton County | 1 | 0 | 0 | 3 | 1 | 8.22 | 0 | 0 | 24.92 | 8.3 |

| Garland County | 3 | 3 | 5 | 13 | 3 | 3.07 | 3.07 | 5.12 | 13.23 | 3.04 |

| Grant County | 0 | 1 | 1 | 1 | 3 | 0 | 5.53 | 5.55 | 5.53 | 16.52 |

| Greene County | 0 | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 6.66 |

| Hempstead County | 0 | 1 | 3 | 1 | 2 | 0 | 4.47 | 13.57 | 4.54 | 9.15 |

| Hot Spring County | 1 | 1 | 2 | 4 | 3 | 2.98 | 2.99 | 5.97 | 11.96 | 8.94 |

| Howard County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 7.48 | 0 | 14.84 |

| Independence County | 0 | 0 | 2 | 4 | 2 | 0 | 0 | 5.4 | 10.78 | 5.33 |

| Izard County | 1 | 0 | 0 | 0 | 2 | 7.46 | 0 | 0 | 0 | 14.61 |

| Jackson County | 0 | 0 | 2 | 1 | 1 | 0 | 0 | 11.51 | 5.78 | 5.84 |

| Jefferson County | 1 | 1 | 0 | 0 | 3 | 1.37 | 1.38 | 0 | 0 | 4.34 |

| Johnson County | 1 | 0 | 0 | 2 | 0 | 3.86 | 0 | 0 | 7.63 | 0 |

| Lafayette County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Lawrence County | 2 | 1 | 0 | 2 | 2 | 11.73 | 5.89 | 0 | 12.02 | 12.1 |

| Lee County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Lincoln County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 14.41 | 0 | 0 |

| Little River County | 2 | 1 | 1 | 0 | 1 | 15.7 | 7.99 | 8.05 | 0 | 8.09 |

| Logan County | 3 | 0 | 2 | 1 | 0 | 13.63 | 0 | 9.21 | 4.61 | 0 |

| Lonoke County | 4 | 1 | 0 | 1 | 2 | 5.66 | 1.4 | 0 | 1.39 | 2.74 |

| Madison County | 1 | 1 | 1 | 1 | 0 | 6.38 | 6.36 | 6.37 | 6.21 | 0 |

| Marion County | 0 | 1 | 2 | 0 | 0 | 0 | 6.09 | 12.34 | 0 | 0 |

| Miller County | 0 | 0 | 1 | 1 | 6 | 0 | 0 | 2.28 | 2.28 | 13.64 |

| Mississippi County | 1 | 0 | 0 | 0 | 0 | 2.24 | 0 | 0 | 0 | 0 |

| Monroe County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Montgomery County | 0 | 2 | 0 | 0 | 0 | 0 | 21.85 | 0 | 0 | 0 |

| Nevada County | 1 | 1 | 0 | 0 | 1 | 11.4 | 11.56 | 0 | 0 | 12.01 |

| Newton County | 1 | 0 | 0 | 1 | 0 | 12.42 | 0 | 0 | 12.71 | 0 |

| Ouachita County | 0 | 0 | 0 | 1 | 4 | 0 | 0 | 0 | 4.16 | 16.76 |

| Perry County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 9.73 | 0 |

| Phillips County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pike County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Poinsett County | 1 | 0 | 0 | 0 | 0 | 4.14 | 0 | 0 | 0 | 0 |

| Polk County | 2 | 0 | 1 | 1 | 0 | 9.83 | 0 | 4.95 | 4.96 | 0 |

| Pope County | 1 | 1 | 0 | 3 | 3 | 1.6 | 1.59 | 0 | 4.7 | 4.7 |

| Prairie County | 0 | 1 | 0 | 0 | 2 | 0 | 11.98 | 0 | 0 | 24.25 |

| Pulaski County | 14 | 4 | 12 | 7 | 7 | 3.58 | 1.02 | 3.05 | 1.78 | 1.78 |

| Randolph County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 5.74 | 0 | 5.7 |

| Saline County | 7 | 2 | 5 | 3 | 3 | 6.18 | 1.74 | 4.3 | 2.55 | 2.51 |

| Scott County | 0 | 1 | 0 | 0 | 1 | 0 | 9.38 | 0 | 0 | 9.57 |

| Searcy County | 2 | 0 | 0 | 1 | 0 | 25.06 | 0 | 0 | 12.55 | 0 |

| Sebastian County | 1 | 0 | 1 | 4 | 2 | 0.79 | 0 | 0.79 | 3.14 | 1.56 |

| Sevier County | 0 | 1 | 1 | 2 | 0 | 0 | 5.75 | 5.8 | 11.8 | 0 |

| Sharp County | 0 | 0 | 1 | 0 | 4 | 0 | 0 | 5.95 | 0 | 23 |

| St. Francis County | 0 | 0 | 2 | 0 | 2 | 0 | 0 | 7.51 | 0 | 7.71 |

| Stone County | 1 | 0 | 0 | 1 | 1 | 8.05 | 0 | 0 | 8 | 7.98 |

| Union County | 0 | 1 | 3 | 2 | 3 | 0 | 2.49 | 7.49 | 5.02 | 7.6 |

| Van Buren County | 1 | 0 | 0 | 0 | 2 | 5.89 | 0 | 0 | 0 | 12.12 |

| Washington County | 1 | 5 | 4 | 10 | 6 | 0.46 | 2.28 | 1.79 | 4.39 | 2.59 |

| White County | 1 | 1 | 6 | 6 | 2 | 1.27 | 1.28 | 7.61 | 7.61 | 2.53 |

| Woodruff County | 0 | 3 | 0 | 0 | 0 | 0 | 43.66 | 0 | 0 | 0 |

| Yell County | 0 | 2 | 1 | 3 | 0 | 0 | 9.2 | 4.66 | 13.96 | 0 |

Speeding, of course, also influences the number of fatalities the counties in Arkansas see on a yearly basis. It doesn’t matter if you feel like you “gotta go fast.” Take it slow on the roads and do what you can to keep the other drivers around you – and not to mention, yourself – a little safer.

Fatalities in Crashes Involving an Alcohol-Impaired Driver

| Fatalities | Fatalities Per 100,000 Population | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Arkansas County | 0 | 2 | 0 | 2 | 1 | 0 | 10.82 | 0 | 10.98 | 5.57 |

| Ashley County | 0 | 0 | 3 | 0 | 2 | 0 | 0 | 14.4 | 0 | 9.86 |

| Baxter County | 1 | 1 | 2 | 0 | 1 | 2.44 | 2.45 | 4.86 | 0 | 2.42 |

| Benton County | 2 | 2 | 12 | 4 | 5 | 0.84 | 0.82 | 4.78 | 1.55 | 1.88 |

| Boone County | 2 | 1 | 2 | 1 | 2 | 5.36 | 2.7 | 5.39 | 2.69 | 5.35 |

| Bradley County | 1 | 0 | 0 | 0 | 0 | 8.99 | 0 | 0 | 0 | 0 |

| Calhoun County | 0 | 1 | 0 | 0 | 0 | 0 | 19.35 | 0 | 0 | 0 |

| Carroll County | 0 | 2 | 5 | 4 | 4 | 0 | 7.22 | 18.02 | 14.43 | 14.31 |

| Chicot County | 0 | 0 | 0 | 2 | 2 | 0 | 0 | 0 | 18.33 | 18.8 |

| Clark County | 0 | 3 | 0 | 1 | 1 | 0 | 13.3 | 0 | 4.43 | 4.49 |

| Clay County | 0 | 1 | 2 | 0 | 1 | 0 | 6.54 | 13.16 | 0 | 6.7 |

| Cleburne County | 1 | 1 | 1 | 1 | 2 | 3.9 | 3.91 | 3.94 | 3.97 | 7.98 |

| Cleveland County | 1 | 0 | 0 | 1 | 1 | 11.74 | 0 | 0 | 12.11 | 12.19 |

| Columbia County | 3 | 1 | 1 | 0 | 3 | 12.37 | 4.16 | 4.15 | 0 | 12.7 |

| Conway County | 3 | 2 | 1 | 1 | 0 | 14.24 | 9.53 | 4.78 | 4.79 | 0 |

| Craighead County | 4 | 4 | 4 | 6 | 6 | 3.94 | 3.9 | 3.84 | 5.67 | 5.6 |

| Crawford County | 1 | 5 | 1 | 3 | 4 | 1.62 | 8.09 | 1.62 | 4.82 | 6.35 |

| Crittenden County | 2 | 6 | 1 | 3 | 1 | 4.02 | 12.11 | 2.04 | 6.08 | 2.05 |

| Cross County | 1 | 1 | 0 | 0 | 2 | 5.71 | 5.82 | 0 | 0 | 11.86 |

| Dallas County | 1 | 0 | 2 | 0 | 0 | 12.68 | 0 | 26.56 | 0 | 0 |

| Desha County | 1 | 0 | 1 | 2 | 1 | 8.01 | 0 | 8.31 | 16.78 | 8.5 |

| Drew County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 5.37 | 0 | 10.78 |

| Faulkner County | 3 | 2 | 6 | 1 | 4 | 2.52 | 1.66 | 4.95 | 0.82 | 3.23 |

| Franklin County | 0 | 3 | 1 | 1 | 1 | 0 | 16.84 | 5.64 | 5.66 | 5.59 |

| Fulton County | 1 | 1 | 1 | 0 | 1 | 8.22 | 8.28 | 8.25 | 0 | 8.3 |

| Garland County | 10 | 9 | 9 | 9 | 1 | 10.24 | 9.21 | 9.21 | 9.16 | 1.01 |

| Grant County | 0 | 0 | 1 | 0 | 2 | 0 | 0 | 5.55 | 0 | 11.01 |

| Greene County | 1 | 2 | 2 | 1 | 0 | 2.32 | 4.57 | 4.51 | 2.24 | 0 |

| Hempstead County | 4 | 3 | 1 | 2 | 2 | 17.83 | 13.42 | 4.52 | 9.08 | 9.15 |

| Hot Spring County | 3 | 4 | 7 | 3 | 1 | 8.95 | 11.98 | 20.91 | 8.97 | 2.98 |

| Howard County | 0 | 1 | 3 | 1 | 0 | 0 | 7.4 | 22.43 | 7.44 | 0 |

| Independence County | 2 | 4 | 2 | 4 | 2 | 5.43 | 10.8 | 5.4 | 10.78 | 5.33 |

| Izard County | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 14.61 |

| Jackson County | 1 | 0 | 2 | 4 | 2 | 5.64 | 0 | 11.51 | 23.11 | 11.67 |

| Jefferson County | 3 | 7 | 7 | 2 | 2 | 4.1 | 9.67 | 9.75 | 2.84 | 2.89 |

| Johnson County | 1 | 1 | 0 | 0 | 1 | 3.86 | 3.85 | 0 | 0 | 3.77 |

| Lafayette County | 0 | 1 | 0 | 1 | 0 | 0 | 13.96 | 0 | 14.43 | 0 |

| Lawrence County | 1 | 3 | 0 | 1 | 1 | 5.87 | 17.68 | 0 | 6.01 | 6.05 |

| Lee County | 0 | 0 | 4 | 0 | 2 | 0 | 0 | 41.33 | 0 | 21.8 |

| Lincoln County | 0 | 2 | 1 | 0 | 1 | 0 | 14.25 | 7.21 | 0 | 7.33 |

| Little River County | 2 | 0 | 0 | 2 | 1 | 15.7 | 0 | 0 | 16.09 | 8.09 |

| Logan County | 3 | 0 | 2 | 1 | 2 | 13.63 | 0 | 9.21 | 4.61 | 9.21 |

| Lonoke County | 4 | 2 | 5 | 4 | 2 | 5.66 | 2.81 | 7.02 | 5.57 | 2.74 |

| Madison County | 2 | 3 | 2 | 1 | 1 | 12.76 | 19.08 | 12.74 | 6.21 | 6.12 |

| Marion County | 2 | 0 | 1 | 0 | 0 | 12.16 | 0 | 6.17 | 0 | 0 |

| Miller County | 1 | 0 | 4 | 1 | 5 | 2.3 | 0 | 9.11 | 2.28 | 11.37 |

| Mississippi County | 4 | 2 | 1 | 2 | 3 | 8.95 | 4.52 | 2.29 | 4.66 | 7.12 |

| Monroe County | 1 | 0 | 1 | 4 | 2 | 13 | 0 | 13.42 | 55.29 | 28.23 |

| Montgomery County | 0 | 2 | 1 | 1 | 2 | 0 | 21.85 | 11.08 | 11.17 | 22.42 |

| Nevada County | 1 | 0 | 0 | 1 | 0 | 11.4 | 0 | 0 | 11.94 | 0 |

| Newton County | 0 | 1 | 0 | 0 | 0 | 0 | 12.69 | 0 | 0 | 0 |

| Ouachita County | 1 | 0 | 1 | 0 | 3 | 4.01 | 0 | 4.11 | 0 | 12.57 |

| Perry County | 1 | 0 | 1 | 1 | 2 | 9.68 | 0 | 9.71 | 9.73 | 19.33 |

| Phillips County | 1 | 3 | 1 | 0 | 1 | 4.89 | 15.03 | 5.11 | 0 | 5.38 |

| Pike County | 1 | 1 | 0 | 0 | 0 | 9 | 9.11 | 0 | 0 | 0 |

| Poinsett County | 1 | 0 | 4 | 1 | 2 | 4.14 | 0 | 16.66 | 4.17 | 8.28 |

| Polk County | 2 | 1 | 3 | 0 | 1 | 9.83 | 4.94 | 14.85 | 0 | 4.97 |

| Pope County | 1 | 1 | 1 | 1 | 4 | 1.6 | 1.59 | 1.57 | 1.57 | 6.27 |

| Prairie County | 1 | 1 | 0 | 1 | 4 | 11.94 | 11.98 | 0 | 12.09 | 48.5 |

| Pulaski County | 21 | 14 | 16 | 14 | 13 | 5.37 | 3.57 | 4.07 | 3.56 | 3.3 |

| Randolph County | 0 | 1 | 2 | 2 | 1 | 0 | 5.69 | 11.48 | 11.49 | 5.7 |

| Saline County | 6 | 5 | 5 | 3 | 1 | 5.3 | 4.36 | 4.3 | 2.55 | 0.84 |

| Scott County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 9.48 | 9.65 | 0 |

| Searcy County | 0 | 0 | 2 | 0 | 1 | 0 | 0 | 25.55 | 0 | 12.6 |

| Sebastian County | 3 | 3 | 1 | 5 | 4 | 2.36 | 2.37 | 0.79 | 3.92 | 3.12 |

| Sevier County | 0 | 1 | 1 | 2 | 1 | 0 | 5.75 | 5.8 | 11.8 | 5.84 |

| Sharp County | 2 | 0 | 2 | 2 | 2 | 11.74 | 0 | 11.89 | 11.67 | 11.5 |

| St. Francis County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 3.75 | 0 | 0 |

| Stone County | 0 | 0 | 2 | 1 | 1 | 0 | 0 | 16.16 | 8 | 7.98 |

| Union County | 0 | 1 | 4 | 2 | 1 | 0 | 2.49 | 9.98 | 5.02 | 2.53 |

| Van Buren County | 1 | 2 | 0 | 0 | 1 | 5.89 | 11.84 | 0 | 0 | 6.06 |

| Washington County | 3 | 11 | 5 | 8 | 7 | 1.39 | 5.01 | 2.23 | 3.51 | 3.02 |

| White County | 2 | 4 | 4 | 8 | 2 | 2.55 | 5.1 | 5.07 | 10.15 | 2.53 |

| Woodruff County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Yell County | 0 | 1 | 0 | 3 | 5 | 0 | 4.6 | 0 | 13.96 | 23.23 |

It should be obvious, but do not drive while intoxicated. You put yourself and other drivers on the road at risk. Before you get behind the wheel, be honest with yourself and check-in with friends to see whether or not it’s safe for you to drive.

Teen Drinking and Driving

| Details | Numbers |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 1.2 |

| Higher/Lower Than National Average (1.2) | equal |

| DUI Arrest (Under 18 years old) | 44 |

| DUI Arrests (Under 18 years old) Total Per Million People | 62.41 |

Teenage drunk driving is more common than it should be. The separation between rural and urban teenage drunk driving in Arkansas is worth noting, though.

The fatality rate of teenage drunk drivers in Arkansas is equivalent to the national average of 1.2.

While this isn’t a statistic to be proud of, it also suggests that the issue of teenage drunk driving in Arkansas is not as bad as it could be.

Teenagers in urban areas experience also fewer fatalities than those in rural areas, and the time it takes response teams to get these teens to the hospital is markedly different.

EMS Response Time

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 6.08 | 13.94 | 42.27 | 60.84 |

| Urban Fatal Crashes | 3.84 | 6.78 | 28.05 | 39.07 |

Teenager or otherwise, you can always count on an EMS response team to react to news of an accident or fatality as quickly as possible. Response times in rural areas are understandably slower than those in urban areas due to population density.

However, the notable lengthiness of EMS response time in rural areas should be enough to discourage drivers from distracted, risky, or dangerous behaviors while on the road in rural areas.

While EMS team members will do everything they can to ensure that an accident’s victims are taken care of quickly and responsibly, the location of an accident can play into how quickly that help will arrive.

In short: be responsible. You’ll never know how your decisions will impact not only your health but the health of the people around you.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is transportation like?

Car Ownership