Missouri Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 14

From the beautiful scenery found in Mark Twain National Forest to the Gateway Arch that celebrates America’s expansion into the West, the Show-Me State is filled with some wonderful things that everyone ought to see!

Getting from place to place in Missouri is not always a pleasant ride though.

In fact, according to Smartasset.com, Missouri ties at third with California for having some of the worst drivers in the nation.

Getting from point A to point B in the Show-Me State isn’t the only hassle that Missouri drivers face either. Sometimes finding the right car insurance provider can be quite the hassle too. That is where we come in.

We have collected all of the information that you need in one place to help you get the best price when shopping for your car insurance policy.

This information can also help you pick the best provider and get the most coverage for your money just in case something happens when you are out on the Missouri roadway. Keep scrolling to find out more.

Enter your zip code at CarInsurnace.org to start comparing car insurance rates today!

How much are Missouri car insurance coverage and rates?

When shopping car insurance it can sometimes be difficult to understand things like Missouri’s minimum state requirements for car insurance and just who has the best rates and why.

Having the right car insurance provider is important to protecting your family and your property if something should happen when you are behind the wheel though.

The right car insurance provider can help you negotiate the ins and outs of paperwork and even understand the laws in the Show-Me State should you ever need to file a claim.

We are here to help you get started with that. From helping you understand Missouri’s car culture to basic information on the state’s minimum requirements, we have put together all of the essential information you will need when determining which car insurance provider is right for you.

Keep reading to find out more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Missouri’s car culture?

Living and driving in the Show-Me State really does offer Missouri residents the best of both worlds. You could be cruising the bustling city streets of Kansas City one minute and find yourself among the quaint little town of Parkville just 20 minutes later.

Missouri residents are also a varied bunch of folks to which is why it is not unusual for families to own both a large pick-up truck for hauling things and a passenger vehicle for family outings.

For as tranquil as Missouri roadways can be driving in the Show-Me State does not come without risks.

According to the National Highway Traffic Safety Administration (NHTSA):

In 2014, there were 29,989 fatal moror vehicle traffic crashes resulting in 32,675 fatalities.

Most of these crashes occurred in rural areas as well according to the NHTSA. The reasons for this vary from the possibility of an animal strike at certain times of the year to winter driving conditions that can make roadways slick and unpredictable.

This is why the Missouri Department of Transportation has dedicated an entire page just to help you prevent winter driving accidents.

Knowing that a 2017 study conducted by the National Transportation Research Group TRIP rated Missouri 11th on their list of the states with the worst rural road conditions drives home why it is so important to always drive defensively and shop smart when looking for the right car insurance provider.

Part of being a savvy shopper means knowing just how much coverage the state of Missouri requires you to carry on your car insurance policy.

What are the minimum coverage requirements in Missouri?

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

According to the Missouri Department of Revenue, the Show-Me State requires that all drivers carry the following type of coverage:

- Bodily Injury Liability-in the amount of $25,000 per person

- Bodily Injury Liability-in the amount of $50,000 per accident involving more than one person

- Property Damage Liability–in the amount of $10,000 per accident

- Uninsured Motorist Coverage-in the amount of $25,000 per person

- Uninsured Motorist Coverage-in the amount of $50.000 per accident involving more than one person

Missouri also has penalties for driving without the proper coverage amounts that could include4 points on your driver’s license and a license suspension.

AAA also notes that an insurance ID card must be in the insured vehicle at all times and:

A motor vehicle liability insurance policy, a motor vehicle liability insurance binder, or receipt which contains the policy information is satisfactory evidence of insurance in lieu of an insurance identification card.

As of August 28, 2013, it is now legal to present an e-insurance card as proof of insurance in the Show-Me State as well.

What counts as forms of financial responsibility?

According to the Missouri Department of Revenue, motorists in the Show-Me State are required to show proof of insurance when registering a vehicle and upon request of law enforcement.

In order to be in compliance with Missouri’s Financial Responsibility Law, Missouri drivers can have one of the following proofs of financial responsibility:

- A Liability Policy-This is your traditional car insurance policy which has the minimum coverage amounts required by the state.

- A Surety Bond, Real Estate Bond, or Deposit of Cash or Negotiable Securities-This must be filed with the Department of Revenue in Missouri.

- A Certificate of Self-Insurance-This is generally for a company or religious organization and must be issued by the Missouri Department of Revenu.

Nonresidents must maintain car insurance coverage amounts that meet the minimum state requirements of their home state.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much are premiums as a percentage of income?

Knowing what the state of Missouri requires and how you can comply with the Show-Me State’s Financial Responsibility Law is only part of purchasing your car insurance policy.

As you start to consider how much coverage you will need you will also want to consider just how much that coverage is going to cost you.

The average resident of Missouri spends around 2.3 percent of their annual disposable income on car insurance.

With a per capita disposable income of $36,690 per year earned by each Missourian, and $872 of that being spent to maintain car insurance on your vehicle, this means that on average $73 is spent on car insurance from a monthly budget of $3,080.

This is slightly better than Missouri’s neighbors in Kentucky who shell out around $918 for the same amount of coverage. Missouri is also on par with its neighbor Illinois whose residents pay about $854 annually.

Missouri is also on the low side of the national average according to the Insurance Information Institute (III) which places the average expenditure for car insurance at $935.80 per year.

When you are the one fitting the bill it may not seem like it though which is why you will want to shop around.

What are the average monthly car insurance rates in MO (liability, comprehensive, collision coverage)?

Getting the most for your money when purchasing car insurance in Missouri means understanding just where every penny is going.

| Coverage Type | Annual Cost (2015) |

|---|---|

| Liability | $415.88 |

| Collision | $275.28 |

| Comprehensive | $181.27 |

| Combined Total | $872.43 |

The rates reflected above are from 2015 so premiums for 2019 might be slightly higher given that in recent years the cost of car insurance in the Show-Me State has been slightly on the rise.

Knowing what your fellow residents of Missouri are paying each year for car insurance can help you make sure that you are not being overcharged for your car insurance policy. Saving money on the core types of coverage could also leave you room in your budget should you decide that you need or want to add to your policy.

What additional coverage options are available?

You already know that the Show-Me State has minimum state requirements that include bodily injury liability, property damage liability, and uninsured drivers. There are additional types of liability coverage available to you as well.

Three of the most recognizable additional coverage options are:

- Personal Injury Protection– This coverage handles medical expenses regardless of who is at fault in an auto accident.

- Medical Payments (MedPay)-This addition will cover the medical payments of all passengers in a vehicle that are injured in an accident. This includes the ambulance ride and treatment.

- Uninsured/Underinsured Motorist-This is not an addition to the traditional policy in Missouri because it is part of the state’s minimum requirements. This type of coverage pays out if you are hit by a driver who either does not have car insurance or does not have enough car insurance coverage according to state law. It can help cover damages and medical expenses incurred during an accident.

As you decide whether or not you will want to add either of these to your policy it is helpful to consider the loss ratio for the companies that you are considering as well as the loss ratio for the Missouri car insurance market as a whole.

Below are the loss ratios trends for Missouri according to the National Association of Insurance Commissioners (NAIC).

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 66% | 67% | 74% |

| Uninsured/Underinsured Motorist | 79% | 75% | 87% |

The loss ratio numbers for Missouri indicate that the market, on the whole, is performing well. How do you know? It starts by understanding what the loss ratio itself means.

- A High Loss Ratio (over 75 percent) indicates that the companies underestimated the frequency and severity of losses and how much premium would be needed to cover them. A high loss ratio is a good indicator of future rate increases.

- A Low Loss Ratio (under 35 percent) could indicate that companies overestimated the frequency and severity of claims or overpriced their policies.

As you can see then, the numbers are quite good because they indicate that the car insurance companies in the Show-Me State are not paying out to many claims, nor are they rejecting too many.

Considering that about 14 percent of drivers in Missouri are uninsured it might be a good idea for you to purchase a little more coverage to protect your family and property in case of an accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What add-ons and endorsements are available?

One of the Joys of owning a car is the freedom and independence that it can provide you. Cars are not just a way for us to claim our independence though. They are also a way for us to show off our personalities.

Some people do this by choosing a specific make or model car while others might modify what they have or restore a classic as a hobby.

No matter what you drive you will want to make sure that it has the right type of coverage o protect all of the time and energy that you spend to maintain it. This is where add-ons and endorsements can help.

Some of the most popular types of these additions to your policy include:

- Rental Reimbursement-If you ever need to leave your car in the shop, rental reimbursement could help you pay the costs of renting a car until your repairs are finished. (For more information, read our “Pros and Cons of Renting Your Car to Others“).

- Emergency Roadside Assistance-If your car breaks down or you have a flat emergency roadside assistance will be there for you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance-This type of coverage can help you pay for the cost of repairs to your car which did not result from an accident.

- Non-Owner Car Insurance-If you don’t own a car, but you still drive on occasion this type of coverage provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Guaranteed Auto Protection (GAP)-If your car is ever totaled or stolen, GAP coverage will pay any money that is remains owed on the lease or loan after the auto policy has made its payment.

- Personal Umbrella Policy-When you have reached your underlying liability limits PUP kicks in to help protect you from lawsuits which may result from an auto accident.

- Classic Car Insurance-Cheaper than traditional insurance, this type of coverage is specifically geared towards helping you protect your classic beauty.

- Modified Car Insurance-If Classic isn’t your style and stock just won’t do you should consider this type of car insurance coverage. This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

Before you modify your vehicle though you should check the Missouri state laws regarding things like the height of a lift kit or window tinting.

Missouri does not restrict how high you can jack your car up, but it does restrict how low you can go. It also restricts the type of window tint you can put on your car’s windows and where.

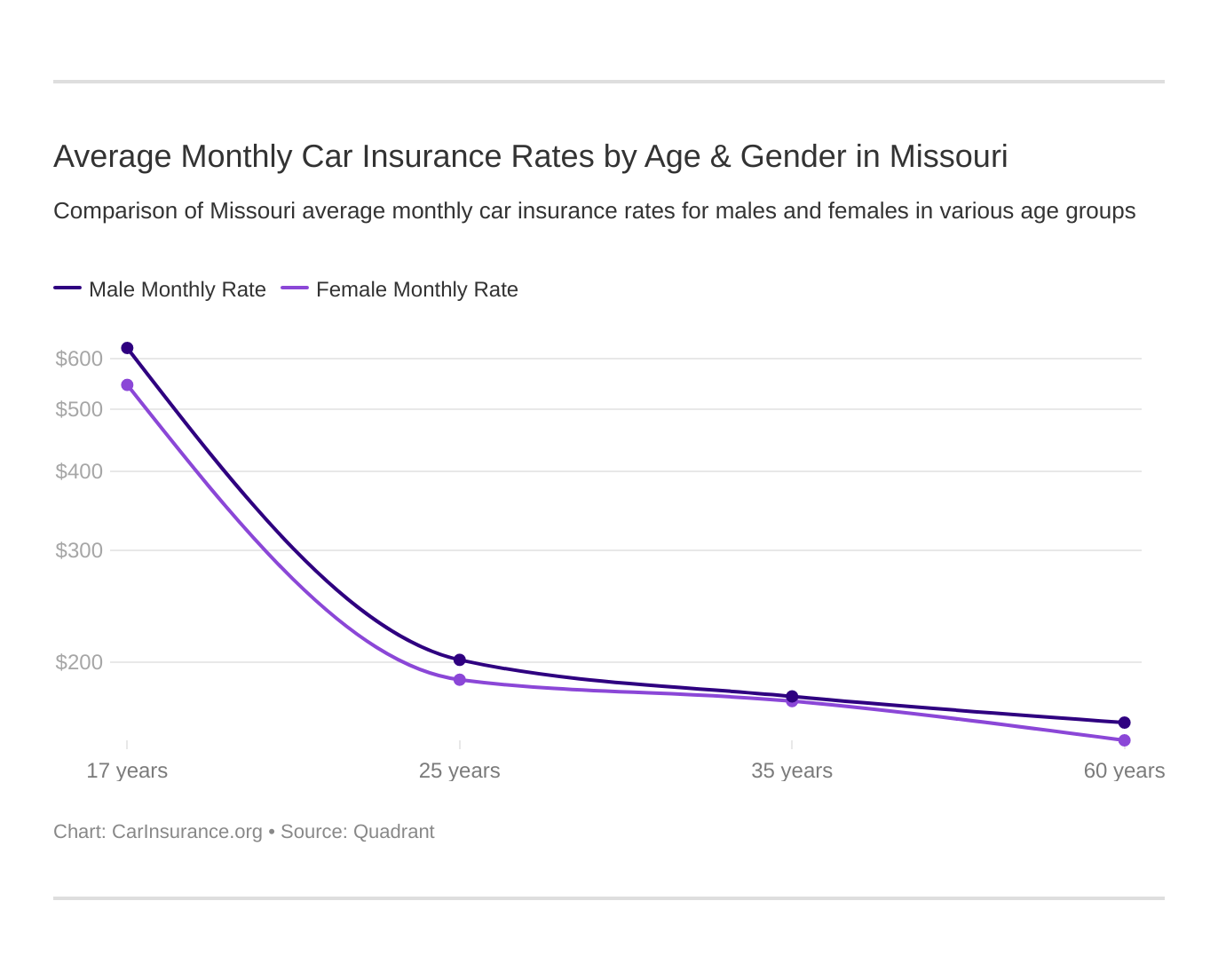

What are the average monthly car insurance rates by age & gender in MO?

The type of car you own is not the only thing that you have to consider when determining which car insurance provider is right for you.

Sometimes just being who you were born to be could end up costing you a few dollars more on car insurance which is why it pays to compare companies and policies against each other.

Consumer Federation of America released a study in 2017 that revealed just how much being who you were born o be could cost you if you were born a woman instead of a man. What they found was also in direct opposition to what most people believe about the differences in gender when it comes to paying for car insurance. Specifically:

In ten cities studied, CFA found that 40- and 60-year old women with perfect driving records were charged more than men for basic coverage nearly twice as often as men were charged the higher rate.

Gender and age certainly can make a difference in how much you pay for your car insurance premiums. Take a look at the table below to see by how much in the Show-Me State.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,837.73 | $2,745.70 | $2,554.13 | $2,634.98 | $7,907.03 | $8,568.17 | $2,716.60 | $2,804.86 |

| American Family Mutual | $2,149.34 | $2,149.34 | $1,913.91 | $1,913.91 | $5,870.28 | $7,634.60 | $2,149.34 | $2,514.45 |

| Farmers Ins Co | $2,371.17 | $2,364.03 | $2,117.42 | $2,242.40 | $9,764.18 | $10,105.80 | $2,703.97 | $2,828.55 |

| Geico Cas | $1,900.51 | $2,128.97 | $1,478.32 | $1,889.46 | $5,917.54 | $6,266.65 | $1,744.68 | $1,756.44 |

| Safeco Ins Co of IL | $2,721.34 | $2,950.25 | $2,240.72 | $2,513.42 | $9,379.72 | $10,416.74 | $2,867.37 | $3,059.82 |

| Allied P&C | $1,502.66 | $1,534.92 | $1,344.89 | $1,424.62 | $3,832.35 | $4,908.75 | $1,717.22 | $1,857.41 |

| Progressive Casualty | $2,112.60 | $1,960.45 | $1,728.12 | $1,780.37 | $6,864.63 | $7,708.61 | $2,572.89 | $2,625.46 |

| State Farm Mutual Auto | $1,696.91 | $1,696.91 | $1,517.71 | $1,517.71 | $4,878.94 | $6,150.91 | $1,907.72 | $2,176.45 |

| USAA | $1,551.68 | $1,539.81 | $1,394.40 | $1,421.78 | $4,594.51 | $5,616.45 | $1,934.27 | $2,153.35 |

Knowing which company is the cheapest in your area based on your age and gender is not all there is to purchase your car insurance policy.

Sometimes the neighborhood or even the city that you call home can cost you big bucks. Keep scrolling to find out how.

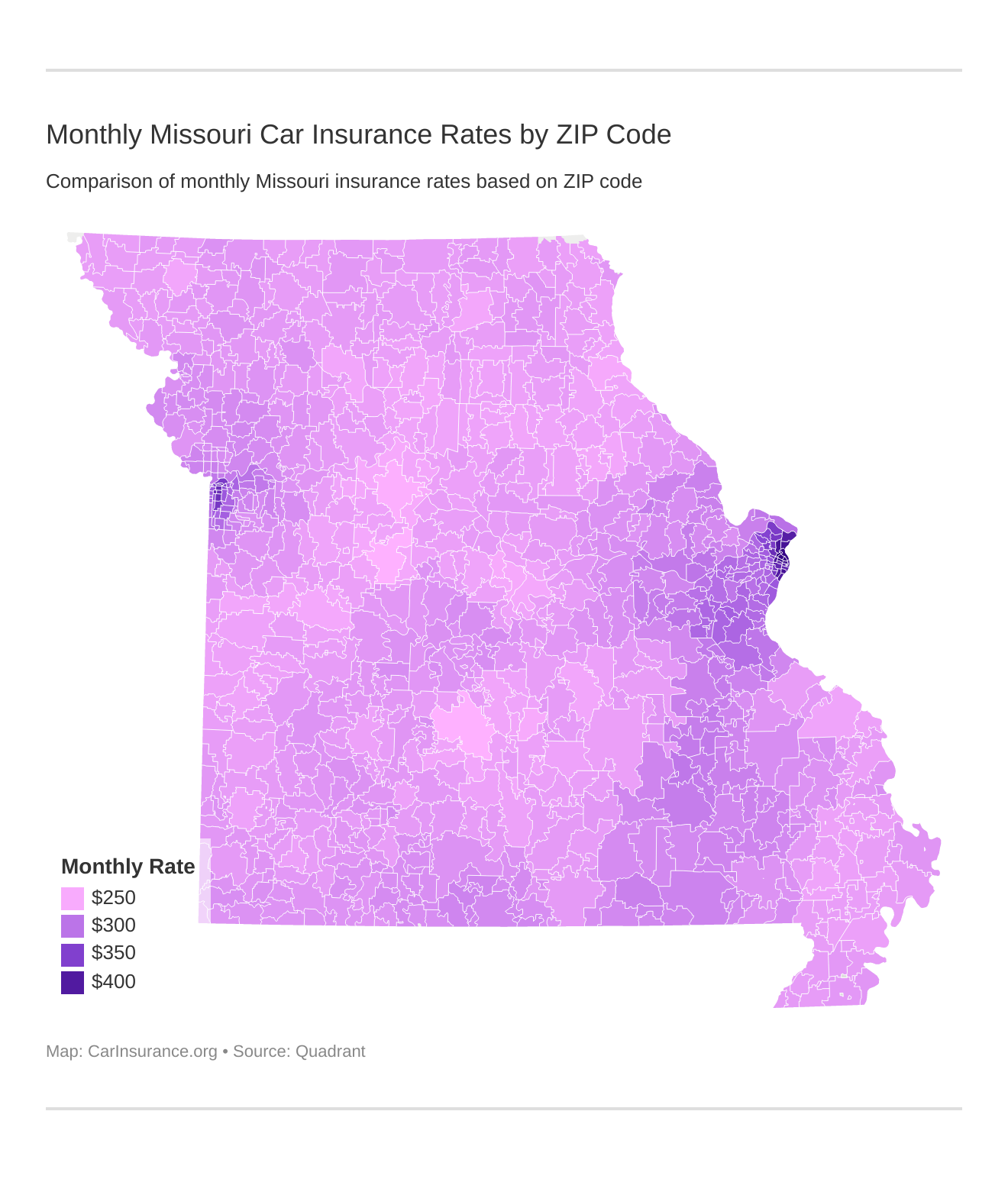

Where are the cheapest rates by ZIP code?

Living in the best street in the city has its advantages. Your neighbors are friendly and all of the amenities that your part of town has to offer are conveniently located.

Convenience comes at a cost though. Take a look at the tables below to see just how much your neighbors are paying for their car insurance policy.

| Cheapest ZIP Codes in Missouri | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 65301 | SEDALIA | $2,938.18 | Liberty Mutual | $4,135.77 | Farmers | $3,867.71 | Nationwide | $1,998.41 | USAA | $2,379.83 |

| 65536 | LEBANON | $2,938.32 | Liberty Mutual | $4,158.01 | Farmers | $3,822.03 | Nationwide | $1,979.14 | State Farm | $2,246.40 |

| 65340 | MARSHALL | $2,962.97 | Liberty Mutual | $4,111.86 | Allstate | $3,961.88 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| 65347 | NELSON | $3,010.40 | Liberty Mutual | $4,085.36 | Allstate | $3,961.88 | Nationwide | $2,013.02 | State Farm | $2,097.73 |

| 65023 | CENTERTOWN | $3,015.33 | Liberty Mutual | $4,171.24 | Allstate | $3,872.65 | Nationwide | $2,071.90 | State Farm | $2,283.73 |

| 65473 | FORT LEONARD WOOD | $3,016.38 | Liberty Mutual | $4,283.07 | Farmers | $4,211.44 | Nationwide | $1,979.14 | USAA | $2,337.98 |

| 65109 | JEFFERSON CITY | $3,019.92 | Liberty Mutual | $4,206.59 | Farmers | $3,693.79 | Nationwide | $2,071.90 | State Farm | $2,325.82 |

| 65339 | MALTA BEND | $3,021.23 | Liberty Mutual | $4,178.74 | Farmers | $4,066.80 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| 63461 | PALMYRA | $3,025.53 | Liberty Mutual | $4,088.17 | Allstate | $3,961.88 | Nationwide | $1,961.94 | State Farm | $2,474.26 |

| 65344 | MIAMI | $3,029.18 | Liberty Mutual | $4,242.32 | Allstate | $3,961.88 | Nationwide | $2,013.02 | State Farm | $2,097.73 |

| 65337 | LA MONTE | $3,034.71 | Liberty Mutual | $4,148.79 | Allstate | $3,961.88 | Nationwide | $1,998.41 | State Farm | $2,299.73 |

| 65101 | JEFFERSON CITY | $3,036.06 | Liberty Mutual | $4,236.38 | Allstate | $3,872.65 | Nationwide | $2,071.90 | State Farm | $2,338.55 |

| 64735 | CLINTON | $3,036.94 | Liberty Mutual | $4,117.90 | Allstate | $3,994.53 | Nationwide | $2,036.09 | State Farm | $2,275.74 |

| 65350 | SMITHTON | $3,037.12 | Liberty Mutual | $4,135.77 | Allstate | $3,961.88 | Nationwide | $1,998.41 | USAA | $2,379.83 |

| 65053 | LOHMAN | $3,040.44 | Liberty Mutual | $4,171.24 | Farmers | $3,895.84 | Nationwide | $2,071.90 | State Farm | $2,297.75 |

| 64658 | MARCELINE | $3,045.13 | Liberty Mutual | $4,319.53 | Allstate | $3,961.88 | Nationwide | $1,975.18 | State Farm | $2,324.69 |

| 63352 | LADDONIA | $3,047.73 | Liberty Mutual | $4,297.83 | Allstate | $3,961.88 | Nationwide | $2,084.58 | State Farm | $2,213.46 |

| 63501 | KIRKSVILLE | $3,049.19 | Liberty Mutual | $4,338.31 | Allstate | $3,961.88 | Nationwide | $1,997.44 | State Farm | $2,466.78 |

| 64001 | ALMA | $3,050.25 | Liberty Mutual | $4,189.26 | Farmers | $4,098.07 | Nationwide | $2,071.13 | State Farm | $2,289.20 |

| 65330 | GILLIAM | $3,053.62 | Liberty Mutual | $4,215.27 | Allstate | $3,961.88 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| 65321 | BLACKBURN | $3,053.88 | Farmers | $4,320.44 | Liberty Mutual | $4,189.26 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| 65349 | SLATER | $3,054.78 | Liberty Mutual | $4,215.27 | Allstate | $3,961.88 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| 65323 | CALHOUN | $3,055.29 | Liberty Mutual | $4,117.90 | Farmers | $3,970.47 | Nationwide | $2,036.09 | USAA | $2,112.00 |

| 65320 | ARROW ROCK | $3,056.42 | Liberty Mutual | $4,238.71 | Allstate | $3,961.88 | Nationwide | $2,013.02 | State Farm | $2,097.73 |

| 65401 | ROLLA | $3,056.42 | Liberty Mutual | $4,353.06 | Farmers | $4,087.84 | Nationwide | $2,094.65 | State Farm | $2,220.45 |

Looking at the data reveals that those residents of St. Louis who live near Russell Park pay almost $300 less than their neighbors who make their home near Tandy Recreation Center.

| Most Expensive ZIP Codes in Missouri | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 63120 | SAINT LOUIS | $5,220.97 | Progressive | $7,750.45 | Liberty Mutual | $6,552.51 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| 63113 | SAINT LOUIS | $5,219.91 | Progressive | $8,264.00 | Farmers | $6,518.81 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| 63115 | SAINT LOUIS | $5,177.26 | Progressive | $7,879.35 | Farmers | $6,566.91 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| 63107 | SAINT LOUIS | $5,156.22 | Progressive | $8,031.09 | Liberty Mutual | $6,517.96 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| 63147 | SAINT LOUIS | $5,131.13 | Progressive | $7,589.00 | Farmers | $6,718.68 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| 63106 | SAINT LOUIS | $5,071.81 | Progressive | $7,068.45 | Farmers | $6,971.63 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| 63118 | SAINT LOUIS | $4,941.63 | Liberty Mutual | $6,517.96 | Farmers | $6,475.17 | USAA | $2,726.89 | Nationwide | $3,343.55 |

| 63137 | SAINT LOUIS | $4,931.78 | Progressive | $7,523.21 | Farmers | $5,932.82 | USAA | $2,726.89 | Nationwide | $3,353.82 |

| 63136 | SAINT LOUIS | $4,907.41 | Progressive | $6,735.66 | Farmers | $6,386.93 | USAA | $2,726.89 | Nationwide | $3,315.23 |

| 63112 | SAINT LOUIS | $4,867.49 | Liberty Mutual | $6,517.96 | Farmers | $6,286.35 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| 63111 | SAINT LOUIS | $4,798.75 | Liberty Mutual | $6,517.96 | Farmers | $6,453.23 | USAA | $2,726.89 | Nationwide | $3,444.71 |

| 63116 | SAINT LOUIS | $4,776.27 | Liberty Mutual | $6,517.96 | Farmers | $6,199.07 | USAA | $2,726.89 | Nationwide | $3,395.04 |

| 63101 | SAINT LOUIS | $4,769.06 | Liberty Mutual | $6,517.96 | Farmers | $6,085.60 | USAA | $2,726.89 | Nationwide | $3,343.55 |

| 63102 | SAINT LOUIS | $4,749.36 | Liberty Mutual | $6,517.96 | Farmers | $6,002.14 | USAA | $2,726.89 | Nationwide | $3,343.55 |

| 63138 | SAINT LOUIS | $4,737.81 | Progressive | $6,876.18 | Farmers | $5,929.77 | USAA | $2,726.89 | Nationwide | $3,293.47 |

| 63103 | SAINT LOUIS | $4,717.32 | Liberty Mutual | $6,517.96 | Farmers | $6,092.26 | USAA | $2,726.89 | Nationwide | $3,343.55 |

| 63108 | SAINT LOUIS | $4,689.62 | Liberty Mutual | $6,517.96 | Farmers | $6,215.11 | USAA | $2,726.89 | Nationwide | $3,316.55 |

| 63155 | SAINT LOUIS | $4,688.52 | Liberty Mutual | $6,517.96 | Progressive | $5,582.20 | USAA | $2,726.89 | Nationwide | $3,343.55 |

| 63104 | SAINT LOUIS | $4,597.70 | Liberty Mutual | $6,517.96 | Farmers | $5,743.00 | USAA | $2,726.89 | Nationwide | $3,343.55 |

| 63110 | SAINT LOUIS | $4,573.32 | Liberty Mutual | $6,517.96 | Farmers | $5,899.56 | USAA | $2,726.89 | Nationwide | $3,252.72 |

| 64124 | KANSAS CITY | $4,527.14 | Liberty Mutual | $6,653.85 | Progressive | $5,510.01 | USAA | $2,525.57 | Nationwide | $3,513.54 |

| 64127 | KANSAS CITY | $4,516.27 | Liberty Mutual | $6,653.85 | Farmers | $5,398.15 | USAA | $2,525.57 | Nationwide | $3,513.54 |

| 64123 | KANSAS CITY | $4,501.38 | Progressive | $6,121.06 | Liberty Mutual | $5,960.22 | USAA | $2,525.57 | Nationwide | $3,513.54 |

| 64128 | KANSAS CITY | $4,498.89 | Liberty Mutual | $6,653.85 | Farmers | $5,583.59 | USAA | $2,525.57 | Nationwide | $3,513.54 |

| 63121 | SAINT LOUIS | $4,496.11 | Liberty Mutual | $5,879.55 | Farmers | $5,792.05 | USAA | $2,726.89 | Nationwide | $3,207.49 |

As you can see, where you live can make a huge difference in what you pay for car insurance. It is not just the neighborhood you live in that can raise or lower your rates.

Sometimes the city that you love can end up costing you more to drive in.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where are the cheapest rates by city?

The Show-Me State boasts some of the most beautiful historic neighborhoods in the United States. All that beauty can come at a price when it comes to buying car insurance though.

Take a look at the tables below to see just how your city compares to those around it when it comes to the price of car insurance.

| Cheapest Cities in Missouri | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Sedalia | $2,938.18 | Liberty Mutual | $4,135.77 | Farmers | $3,867.71 | Nationwide | $1,998.41 | USAA | $2,379.83 |

| Lebanon | $2,938.32 | Liberty Mutual | $4,158.01 | Farmers | $3,822.03 | Nationwide | $1,979.14 | State Farm | $2,246.40 |

| Marshall | $2,962.96 | Liberty Mutual | $4,111.86 | Allstate | $3,961.88 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| Nelson | $3,010.40 | Liberty Mutual | $4,085.36 | Allstate | $3,961.88 | Nationwide | $2,013.02 | State Farm | $2,097.73 |

| Centertown | $3,015.32 | Liberty Mutual | $4,171.24 | Allstate | $3,872.65 | Nationwide | $2,071.90 | State Farm | $2,283.73 |

| Fort Leonard Wood | $3,016.38 | Liberty Mutual | $4,283.07 | Farmers | $4,211.44 | Nationwide | $1,979.14 | USAA | $2,337.98 |

| Malta Bend | $3,021.23 | Liberty Mutual | $4,178.74 | Farmers | $4,066.80 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| Palmyra | $3,025.53 | Liberty Mutual | $4,088.17 | Allstate | $3,961.88 | Nationwide | $1,961.94 | State Farm | $2,474.26 |

| Jefferson City | $3,027.99 | Liberty Mutual | $4,221.49 | Allstate | $3,691.09 | Nationwide | $2,071.90 | State Farm | $2,332.19 |

| Miami | $3,029.18 | Liberty Mutual | $4,242.32 | Allstate | $3,961.88 | Nationwide | $2,013.02 | State Farm | $2,097.73 |

| La Monte | $3,034.71 | Liberty Mutual | $4,148.79 | Allstate | $3,961.88 | Nationwide | $1,998.41 | State Farm | $2,299.73 |

| Clinton | $3,036.94 | Liberty Mutual | $4,117.90 | Allstate | $3,994.53 | Nationwide | $2,036.09 | State Farm | $2,275.74 |

| Smithton | $3,037.12 | Liberty Mutual | $4,135.77 | Allstate | $3,961.88 | Nationwide | $1,998.41 | USAA | $2,379.83 |

| Lohman | $3,040.44 | Liberty Mutual | $4,171.24 | Farmers | $3,895.84 | Nationwide | $2,071.90 | State Farm | $2,297.75 |

| Marceline | $3,045.13 | Liberty Mutual | $4,319.53 | Allstate | $3,961.88 | Nationwide | $1,975.18 | State Farm | $2,324.69 |

| Laddonia | $3,047.73 | Liberty Mutual | $4,297.83 | Allstate | $3,961.88 | Nationwide | $2,084.58 | State Farm | $2,213.46 |

| Kirksville | $3,049.19 | Liberty Mutual | $4,338.31 | Allstate | $3,961.88 | Nationwide | $1,997.44 | State Farm | $2,466.78 |

| Alma | $3,050.25 | Liberty Mutual | $4,189.26 | Farmers | $4,098.07 | Nationwide | $2,071.13 | State Farm | $2,289.20 |

| Gilliam | $3,053.62 | Liberty Mutual | $4,215.27 | Allstate | $3,961.88 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| Blackburn | $3,053.88 | Farmers | $4,320.44 | Liberty Mutual | $4,189.26 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| Slater | $3,054.78 | Liberty Mutual | $4,215.27 | Allstate | $3,961.88 | Nationwide | $2,013.02 | USAA | $2,112.00 |

| Calhoun | $3,055.29 | Liberty Mutual | $4,117.90 | Farmers | $3,970.47 | Nationwide | $2,036.09 | USAA | $2,112.00 |

| Arrow Rock | $3,056.42 | Liberty Mutual | $4,238.71 | Allstate | $3,961.88 | Nationwide | $2,013.02 | State Farm | $2,097.73 |

| Rolla | $3,056.42 | Liberty Mutual | $4,353.06 | Farmers | $4,087.84 | Nationwide | $2,094.65 | State Farm | $2,220.45 |

| Vandalia | $3,059.82 | Liberty Mutual | $4,338.91 | Farmers | $4,012.74 | Nationwide | $2,084.58 | State Farm | $2,203.83 |

Sedalia has the cheapest rates, so if you live in this city you are saving on car insurance.

| Most Expensive Cities in Missouri | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Pine Lawn | $5,220.97 | Progressive | $7,750.45 | Liberty Mutual | $6,552.51 | USAA | $2,726.89 | Nationwide | $3,631.66 |

| Bellefontaine Neighbors | $4,931.78 | Progressive | $7,523.21 | Farmers | $5,932.82 | USAA | $2,726.89 | Nationwide | $3,353.82 |

| Castle Point | $4,907.41 | Progressive | $6,735.66 | Farmers | $6,386.93 | USAA | $2,726.89 | Nationwide | $3,315.23 |

| St. Louis | $4,788.76 | Liberty Mutual | $6,471.28 | Farmers | $6,141.48 | USAA | $2,726.89 | Nationwide | $3,389.49 |

| Spanish Lake | $4,737.81 | Progressive | $6,876.18 | Farmers | $5,929.77 | USAA | $2,726.89 | Nationwide | $3,293.47 |

| Bel-Nor | $4,496.11 | Liberty Mutual | $5,879.55 | Farmers | $5,792.05 | USAA | $2,726.89 | Nationwide | $3,207.49 |

| Hanley Hills | $4,380.21 | Liberty Mutual | $6,167.47 | Farmers | $5,844.01 | USAA | $2,726.89 | Nationwide | $3,207.49 |

| Calverton Park | $4,323.89 | Farmers | $5,629.02 | Allstate | $5,557.57 | USAA | $2,726.89 | Nationwide | $2,980.64 |

| Black Jack | $4,323.75 | Farmers | $5,639.46 | Liberty Mutual | $5,580.91 | USAA | $2,455.64 | Nationwide | $3,088.75 |

| Old Jamestown | $4,270.14 | Farmers | $5,738.36 | Allstate | $5,557.57 | USAA | $2,455.64 | Nationwide | $3,130.76 |

| Berkeley | $4,217.00 | Liberty Mutual | $5,640.51 | Allstate | $5,549.63 | USAA | $2,726.89 | Nationwide | $3,015.07 |

| Clayton | $4,200.08 | Liberty Mutual | $6,517.96 | Allstate | $5,557.57 | USAA | $2,726.89 | Nationwide | $2,874.54 |

| Florissant | $4,158.74 | Farmers | $5,564.76 | Allstate | $5,557.57 | USAA | $2,455.64 | Nationwide | $2,890.76 |

| Hazelwood | $4,100.07 | Allstate | $5,549.63 | Farmers | $5,505.55 | USAA | $2,455.64 | Nationwide | $2,700.99 |

| University City | $3,978.05 | Liberty Mutual | $5,705.26 | Farmers | $4,920.54 | USAA | $2,726.89 | Nationwide | $2,862.98 |

| Bella Villa | $3,912.51 | Farmers | $5,202.22 | Liberty Mutual | $5,167.71 | USAA | $2,726.89 | Nationwide | $2,846.19 |

| Richmond Heights | $3,908.89 | Liberty Mutual | $5,427.05 | Allstate | $5,271.27 | USAA | $2,726.89 | Nationwide | $2,810.43 |

| Breckenridge Hills | $3,891.60 | Liberty Mutual | $5,801.31 | Farmers | $5,047.65 | USAA | $2,455.64 | Nationwide | $2,857.79 |

| Maplewood | $3,881.90 | Liberty Mutual | $5,633.13 | Farmers | $4,968.12 | USAA | $2,726.89 | Nationwide | $2,810.43 |

| Mehlville | $3,879.40 | Farmers | $5,340.86 | Liberty Mutual | $5,232.01 | Nationwide | $2,648.00 | USAA | $2,726.89 |

| Olivette | $3,860.85 | Liberty Mutual | $5,288.31 | Farmers | $4,966.42 | USAA | $2,726.89 | Nationwide | $2,849.81 |

| Bel-Ridge | $3,839.35 | Liberty Mutual | $5,354.84 | Farmers | $4,903.23 | USAA | $2,726.89 | Nationwide | $2,857.79 |

| Cedar Hill | $3,828.32 | Liberty Mutual | $5,253.06 | Farmers | $4,970.86 | USAA | $2,726.89 | Nationwide | $2,781.08 |

| Kansas City | $3,803.99 | Liberty Mutual | $5,328.57 | Farmers | $4,820.22 | USAA | $2,525.57 | Nationwide | $2,716.19 |

| Luebbering | $3,791.75 | Liberty Mutual | $5,042.93 | Farmers | $4,852.98 | USAA | $2,455.64 | Nationwide | $2,643.58 |

As you can see, residents of St. Louis are paying $4,361 on average for their car insurance policy. That is almost $1,300 more than the residents of Sedalia who shell out $2,938 on average for the same coverage.

Given that St. Louis has a population of nearly 320,000 people whereas Sedalia is only around 22,000 people string this isn’t surprising since more people mean more cars on the road and thereby more chances of an accident.

Having an accident means filing a claim in most cases and that can drive rates up for you and your neighbors. This is why it is so important to choose the right provider. That is where we come in.

What are the best Missouri car insurance companies?

Knowing who the best car insurance companies are in your area can help you choose a provider that will be there for you should the worst happen and you find yourself having to file a claim. We have collected a list of the top-rated providers in the Show-Me State according to AM Best to help you make the best decision for you and your family.

What are the largest companies’ financial ratings?

AM Best is the only credit agency in the world with a singular focus on the insurance industry. For this reason, it has become a trusted agency by which other agencies, such as the National Association of Insurance Commissioners (NAIC), rely on.

This means that you can rely on them when it comes to sorting out which car insurance companies in your area are best at what they do. Looking at how they have scored the companies that you are choosing from can give you insight into the overall health of the car insurance market in the state of Missouri.

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| State Farm Group | A++ | Stable |

| American Family Insurance Group | A | Stable |

| Progressive Group | A+ | Stable |

| Liberty Mutual Group | A | Stable |

| Geico | A++ | Stable |

| Farmers Insurance Group | A | Stable |

| Shelter Insurance Group | A | Stable |

| Allstate Insurance Group | A+ | Stable |

| USAA Group | A++ | Stable |

| Auto Club Enterprises Insurance Group | A | Stable |

When you choose a company with a high rating from AM Best you are choosing one that has a good loss ratio and whose financial outlook is stable.

This stability could save you money. It could also make filing a claim less stressful for you since companies with better financial loss ratios and stronger financial ratings don’t reject claims as often.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Companies with Best Ratings

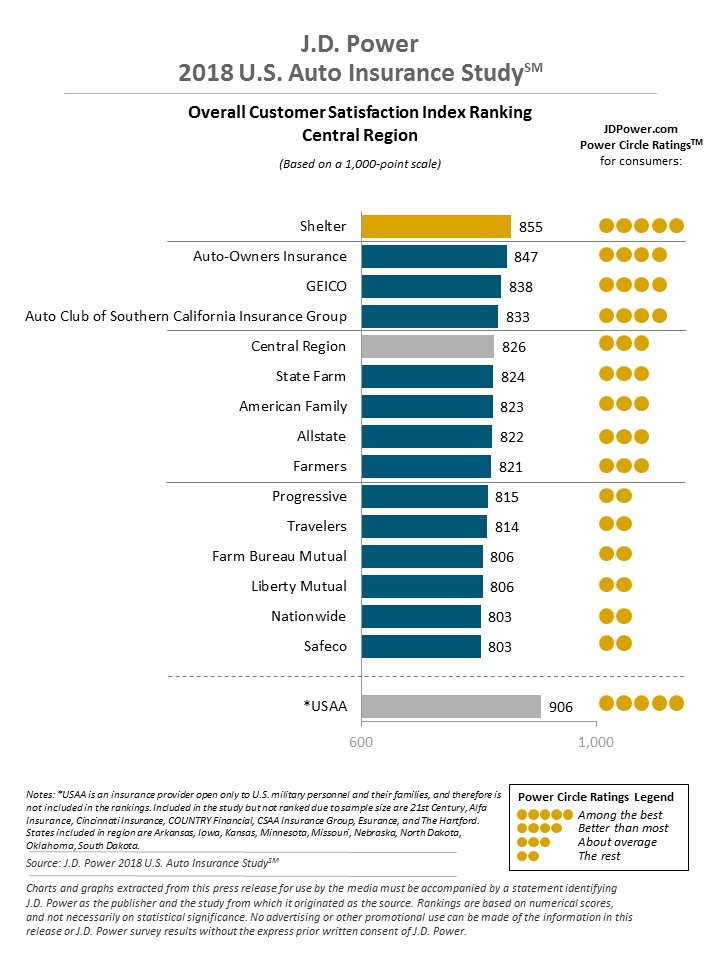

AM Best is not the only company that is looking out for you. JD Power has also been watching the car insurance market, and what it has discovered is that consumer satisfaction with car insurance providers is at a high.

As satisfied as car insurance consumers seem to be everyone knows that filing a claim isn’t always as delightful as a warm roll from Bread Co. That is why we are here to help you find the right car insurance provider before anything goes wrong.

Companies with the Most Complaints

Knowing which companies that consumers complain about the most can really help you make a decision about which provider might be right for you. There is more to it though than just seeing how many complaints that each company has lodged against it.

This is where the complaint ratio comes in. This ratio tells you just where the providers in your area stand in relation to their competition.

Below is a list of the top 10 best car insurance companies in Missouri along with their complaint ratios so that you can see how each one compares.

| Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | $937,742.00 | 0.09 | 65.35% | 24.06% |

| American Family Insurance Group | $506,153.00 | 0.01 | 66.85% | 12.99% |

| Progressive Group | $370,336.00 | 0.09 | 58.99% | 9.50% |

| Liberty Mutual Group | $256,156.00 | 0.02 | 64.67% | 6.57% |

| Geico | $253,457.00 | 0.01 | 75.07% | 6.50% |

| Farmers Insurance Group | $219,419.00 | 0,01 | 66.63% | 5.63% |

| Shelter Insurance Group | $206,083.00 | 0 | 70.23% | 5.29% |

| Allstate Insurance Group | $163,137.00 | 0.03 | 60.06% | 4.19% |

| USAA Group | $154,615.00 | 0 | 87.73% | 3.97% |

| Auto Club Enterprises Insurance Group | $146,330.00 | 0 | 68.51% | 3.75% |

The baseline for the complaint ratio is 1.0. This means that a company with a complaint ratio of 1.0 has an average number of complaints. The higher the complaint ratio the higher the number of complaints lodged against the company then.

That doesn’t necessarily mean that the company with the highest complaint ratio is the worst company around. When considering how many complaints each company has you also have to consider how much or the market share they hold as well.

The larger the market share the more customers that the company will have which increases the chance that a complaint might be lodged against it.

Should you ever need to file a complaint against your car insurance provider here are a couple of ways to do it in the Show-Me State.

- Phone at 800-726-7390

- FAX at 573-526-4898

- Mail your complaint to the Missouri Department of Insurance, P.O. Box 690, Jefferson City, MO 65102-0690

- Or you can file online

Be aware that your complaint may be forwarded to your insurance company by the Missouri Department of Insurance.

Now that you are beginning to see how all of the moving parts work together to determine which companies are the best ones in your area its time to start talking price.

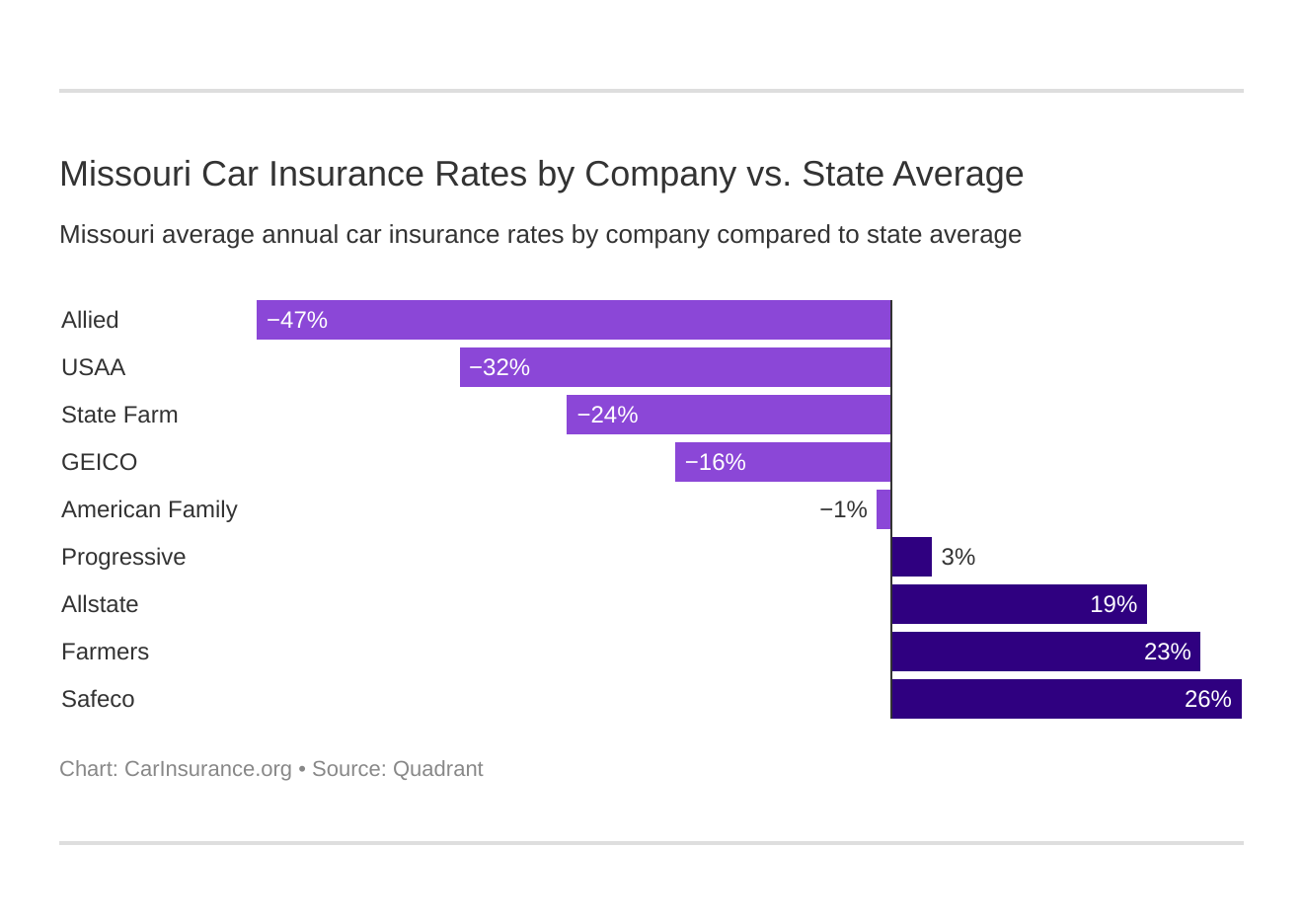

What are the cheapest companies in Missouri?

All savvy shoppers know that cheaper doesn’t always mean better, but it is the best place to start. With that in mind, we have collected a list of the cheapest car insurance providers in the Show-Me State. Take a look at the table below.

| Company | Average Annual Rate | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allstate F&C | $4,096.15 | $762.55 | 18.62% |

| American Family Mutual | $3,286.90 | -$46.70 | -1.42% |

| Farmers Ins Co | $4,312.19 | $978.59 | 22.69% |

| Geico Cas | $2,885.32 | -$448.28 | -15.54% |

| Safeco Ins Co of IL | $4,518.67 | $1,185.07 | 26.23% |

| Allied P&C | $2,265.35 | -$1,068.25 | -47.16% |

| Progressive Casualty | $3,419.14 | $85.54 | 2.50% |

| State Farm Mutual Auto | $2,692.91 | -$640.70 | -23.79% |

| USAA | $2,525.78 | -$807.82 | -31.98% |

This information helps you understand just how much purchasing power you have when shopping for your car insurance policy. Knowing who is the cheapest car insurance provider in Missouri is not the only way to save money on your car insurance policy though.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are commute rates by company?

Sometimes adjusting how much you drive can lower your car insurance rates. For some people though that is not always possible which is why it pays to shop around.

The table below can help you see what each mile under your tires could be costing you which could help you save money in the long run by choosing the right car insurance provider.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,096.15 | $4,096.15 |

| American Family | $3,254.30 | $3,319.49 |

| Farmers | $4,312.19 | $4,312.19 |

| Geico | $2,830.47 | $2,940.17 |

| Liberty Mutual | $4,518.67 | $4,518.67 |

| Nationwide | $2,265.35 | $2,265.35 |

| Progressive | $3,419.14 | $3,419.14 |

| State Farm | $2,627.16 | $2,758.65 |

| USAA | $2,434.31 | $2,617.25 |

Looking at the numbers you can see that USAA has the cheapest rate no matter how far you drive. That isn’t the only thing to consider though.

If you have a long commute you may want to look at the complaint ratios and loss ratios of some of the other companies before making your decision since more time on the road means an increased chance for an accident.

Paying a bit more for your car insurance policy with a company that is less likely to reject your claim is something to consider before you buy. You should also consider how much coverage you might need.

What are coverage level rates by company?

The only thing worse than having your claim rejected is finding out that you don’t have enough coverage after an accident. This is why it is always a good idea to consider the cost of the various levels of coverage before you purchase your car insurance policy.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,945.84 | $4,087.71 | $4,254.90 |

| American Family | $3,188.97 | $3,390.79 | $3,280.93 |

| Farmers | $4,037.99 | $4,270.52 | $4,628.06 |

| Geico | $2,699.84 | $2,906.16 | $3,049.96 |

| Liberty Mutual | $4,263.43 | $4,540.46 | $4,752.13 |

| Nationwide | $2,128.01 | $2,286.38 | $2,381.67 |

| Progressive | $3,056.63 | $3,427.58 | $3,773.22 |

| State Farm | $2,524.26 | $2,702.01 | $2,852.45 |

| USAA | $2,419.58 | $2,517.25 | $2,640.50 |

Generally speaking the higher your coverage level the higher the price you will pay for your policy. You may or may not need all of that coverage though.

For example, if you have an older car you might want to consider a lower amount of coverage just because if your car is hit in an accident it has a greater chance of being totaled out by the car insurance company.

If you have a brand new car though, your lienholder may require you to have higher amounts of coverage to protect you both in case the worst should happen.

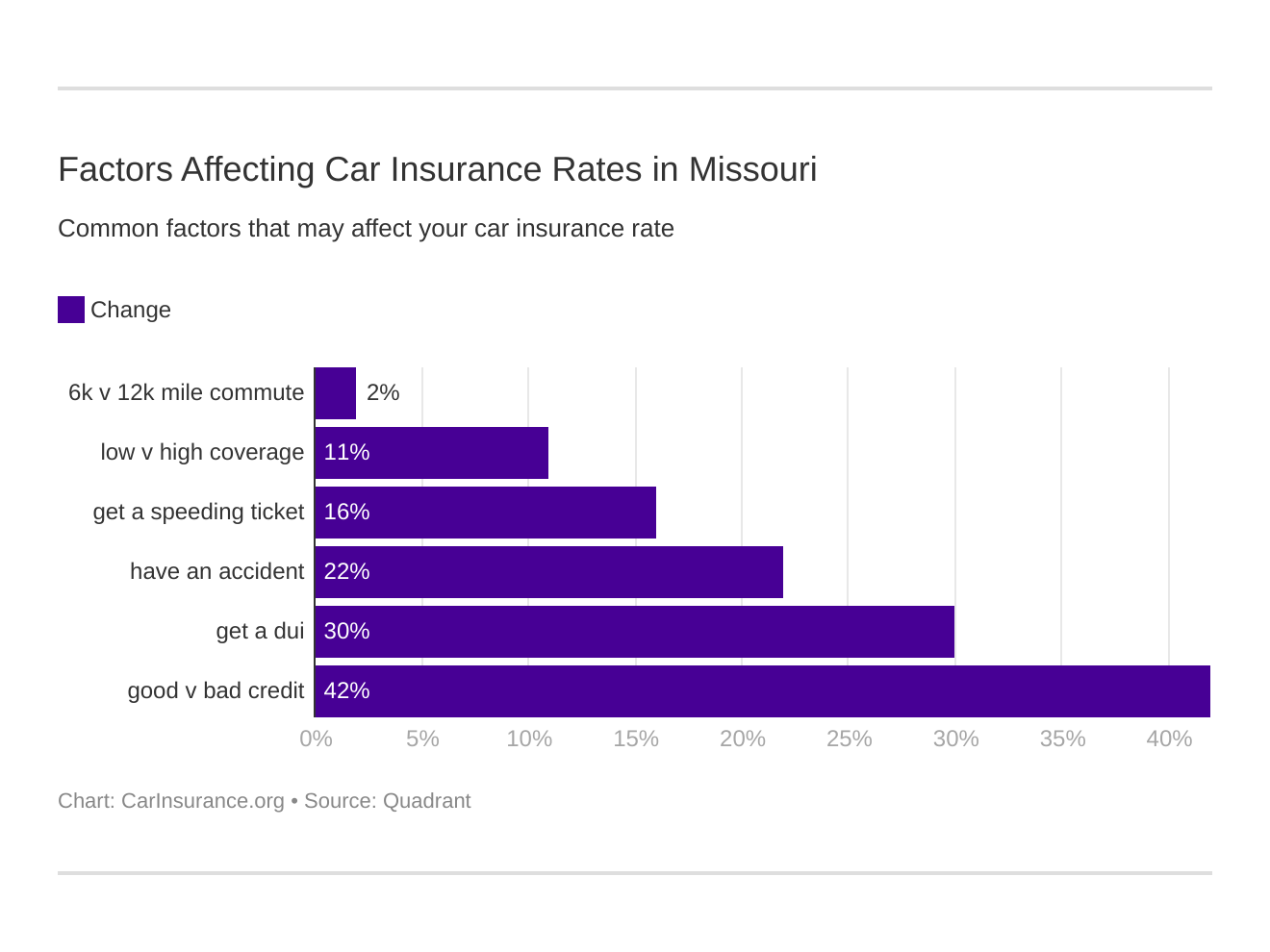

What are credit history rates by company?

The age of your car and the distance you travel are not the only factors that determine your rates. In 2015 Consumer Reports published an article that came as a shock for a lot of people.

What this article revealed was that if car insurance companies don’t like your credit score they could charge you more money in some states.

Take a look at the table below to see what this means for you as a resident of the Show-Me State.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $3,001.92 | $3,635.18 | $5,651.36 |

| American Family | $2,544.91 | $3,021.03 | $4,294.74 |

| Farmers | $3,904.85 | $4,105.51 | $4,926.22 |

| Geico | $2,076.11 | $2,595.41 | $3,984.44 |

| Liberty Mutual | $3,113.69 | $3,955.62 | $6,486.70 |

| Nationwide | $1,917.26 | $2,206.14 | $2,672.67 |

| Progressive | $3,017.40 | $3,275.50 | $3,964.53 |

| State Farm | $1,981.21 | $2,409.46 | $3,688.05 |

| USAA | $1,404.32 | $1,960.03 | $4,212.99 |

You may be asking yourself why having a higher credit score can save you so much money on car insurance. The reason is that most car insurance companies assume that a person with a higher credit score is less likely to file a claim if they have an accident.

While cleaning up your credit score is one way to save yourself some money on your car insurance policy, maintaining a clean driving record is the best way.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the driving record rates by company?

The state of Missouri operates under a points system when it comes to your driving record. This means that if you get caught speeding in the Show-Me State you could be dragging points around on your driver’s license for 18 months as a determinant for possible license suspension as a consequence.

Other traffic violations can stay on your record for up to 3 years as well. These violations could also cost you big bucks on your car insurance rates too. Take a look at the table below to see how much we are talking.

| Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| Allstate | $3,512.16 | $3,976.44 | $4,932.33 | $3,963.68 |

| American Family | $2,464.75 | $2,810.96 | $4,323.36 | $3,548.51 |

| Farmers | $3,735.40 | $4,343.83 | $4,533.97 | $4,635.57 |

| Geico | $2,251.53 | $2,441.95 | $3,930.78 | $2,917.03 |

| Liberty Mutual | $3,282.75 | $5,222.59 | $4,857.97 | $4,711.37 |

| Nationwide | $1,781.84 | $1,949.48 | $3,045.90 | $2,284.19 |

| Progressive | $2,965.00 | $3,467.90 | $3,283.46 | $3,960.21 |

| State Farm | $2,476.06 | $2,692.90 | $2,692.90 | $2,909.75 |

| USAA | $2,030.33 | $2,215.48 | $3,399.34 | $2,457.96 |

Driving defensively in the Show-Me State can really save you money. So can designating a driver and lightening up that led foot.

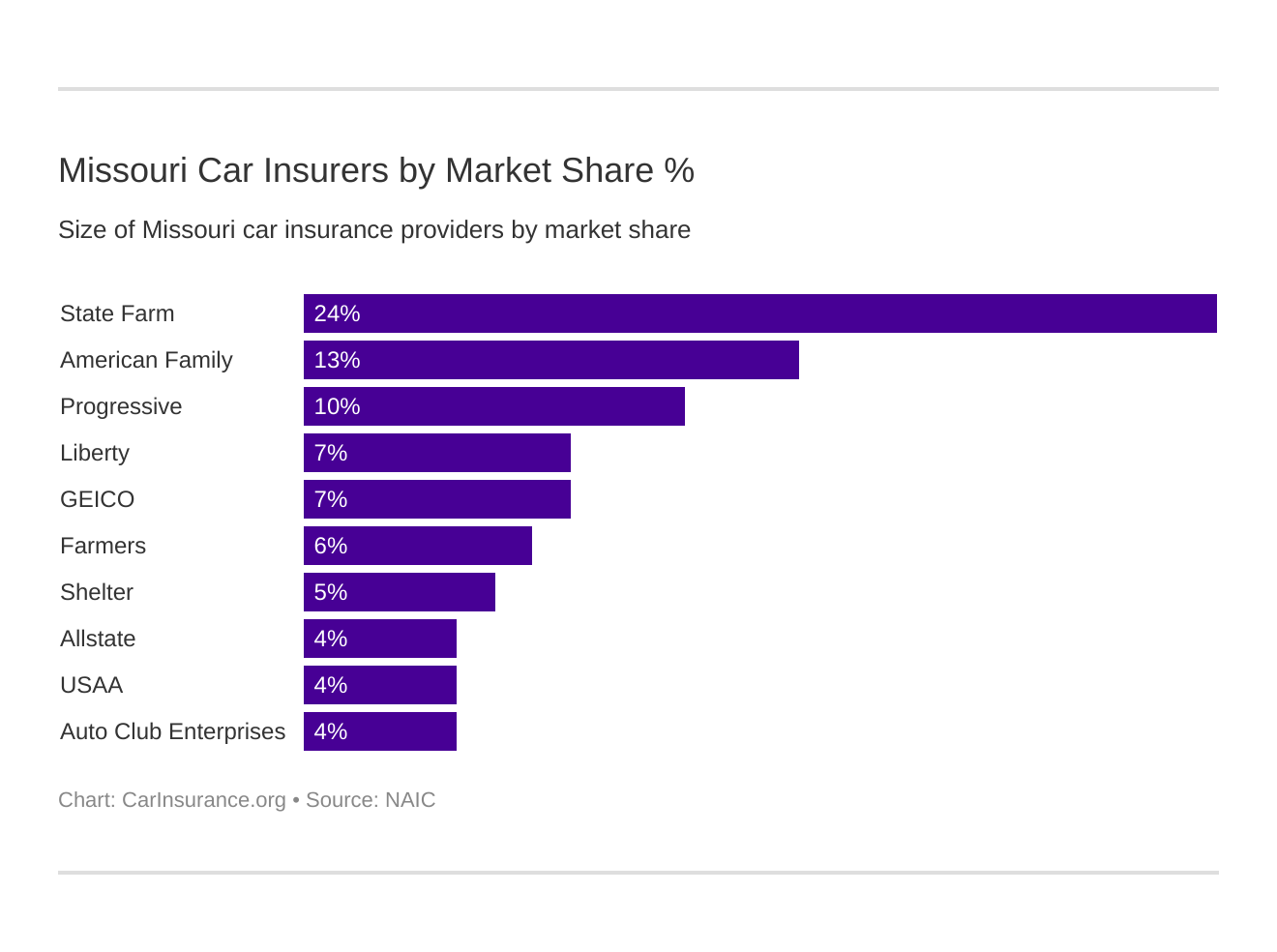

Who are the largest car insurance companies in Missouri?

Now that you know how slowing down and driving responsibly can save you money it is time to consider the real value of looking at the market share of the companies that you are considering.

You already know that the market share works with the loss ratio and complaint ratio to help you determine how many complaints are too many and how likely a company is to pay out if you should need to file a claim.

What does the market share really mean on its own though? Plainly stated, the market share is the percentage of the overall market that a particular company holds.

Looking at the market share next to the number of direct premiums written by that same company can also tell you how healthy the company is so that you can avoid a headache down the road.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $937,742 | 24.06% |

| American Family Insurance Group | $506,153 | 12.99% |

| Progressive Group | $370,336 | 9.50% |

| Liberty Mutual Group | $256,156 | 6.57% |

| Geico | $253,457 | 6.50% |

| Farmers Insurance Group | $219,419 | 5.63% |

| Shelter Insurance Group | $206,083 | 5.29% |

| Allstate Insurance Group | $163,137 | 4.19% |

| USAA Group | $154,615 | 3.97% |

| Auto Club Enterprises Insurance Group | $146,330 | 3.75% |

As you can see, State Farm controls nearly 25 percent of the market in the Show-Me State. Using them as an example you can see that they have $937,742 in Direct Premiums Written. This means that they are not only large, they are also healthy since Investopedia points out that:

While insurance companies can increase revenue by increasing premiums on policies that have come up for renewal, the main driver for growth in this area is writing new policies.

Looking at the rest of the companies on the list also demonstrates that they are on the right track for good growth and financial stability in Missouri which can help keep premiums down for all of the residents of the Show-Me State.

Number of Insurers by State

There are 43 domestic insurers in the Show-Me State and 900 foreign ones. This means that when you are shopping for your car insurance policy you have 943 options to choose from.

You may be wondering what the difference is between the two. That is simple.

- A Domestic insurer is one that has been formed under the laws of the state of Missouri.

- A Foreign insurer has been formed under the laws of any state, district, territory, or commonwealth of the United States other than the state of Missouri.

Both types of insurers are required to follow the laws that govern car insurance in the Show-Me State regardless of where or how they were formed so the choice between which type you want really is a personal one.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Missouri state laws you should know?

The law is filled with hurdles and loopholes. Understanding the laws that insurance companies and drivers in the Show-Me State must follow can go a long way towards helping you save money on your car insurance policy though.

After all, the more you know the better your chances are of avoiding future problems. We are here to help you with that. Keep reading to find out about the laws and regulations that keep you and your family safe while driving in the Show-Me State.

The Show-Me State has various laws and regulations put in place to keep you safe behind the wheel.

Some of these mandate how much car insurance coverage that you must purchase as we discussed in a previous section. Other laws dictate the process for which you can become a licensed driver in the Show-Me State and how you can go about registering your vehicle.

We have done the leg work for you and put the most relevant information regarding all of these types of things in one convenient place. Keep scrolling to find out what these laws and regulations mean to you as you shop for your car insurance policy.

How are state laws determined?

As with most states, the laws in Missouri begin in the State Legislative Branch. This branch of your state government doesn’t work alone though.

The State legislature works with the Missouri Department of Revenue and the Missouri Department of Transportation to help determine the types of laws that can help make residents of Missouri safer when out on the roadways.

One of the ways that the Missouri State Legislature has worked to protect you as a responsible motorist is through its passage of HB339 in 2013. This law states that:

An uninsured motorist waives the ability to collect of non-economic loss as the result of a car accident.

The only exceptions to this law are if the accident was caused by a driver who was under the influence or if your car insurance policy had been canceled in the last 6 months without proper notification.

Missouri is also a fault state which means that the fault of the accident must be determined first before any claims can be settled.

If you are found to be at d=fault for an accident, or you have one too many points on your driver’s license, you could be placed into the high-risk category.

High-Risk Insurance

If you are found to be a high-risk driver in the Show-Me State you could be forced to pay more for your car insurance policy. You may also find it difficult to find coverage at all through the normal marketplace.

The Missouri Department of Insurance can help you if that becomes the case. In an effort to ensure that all drivers on the roadways in the Show-Me State have car insurance Missouri has created the Missouri Automobile Insurance Plan.

In order to qualify for this plan, you must declare and certify that you have tried through traditional means to obtain car insurance but have been denied within the 60 day period prior to your application to this plan.

You must also have a valid driver’s license to be eligible. You can ask a car insurance agent for more information or you can contact the Missouri Department of Insurance through one of the following ways:

- Calling the Consumer Hotline at 800-726-7390

- Email [email protected]

High-risk drivers are not the only ones who can sometimes find it difficult to get car insurance. Sometimes just making ends meet makes it tough.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Low-Cost Insurance

Missouri does not have a specific program geared towards low-income drivers but it never hurts to ask the Missouri Department of Insurance if you qualify for the Missouri Automobile Insurance Plan.

You can also ask your car insurance provider if you qualify for particular types of discounts such as student, safe driver, or military personnel discounts. Shopping around and maintaining a clean driving record can also help keep your costs down.

Taking a defensive driving course can also go a long way towards bringing down your car insurance rates.

Windshield Coverage

Sometimes no matter how safe you drive something always seems to happen. When it does it is comforting to know that you have chosen the right car insurance provider.

Having the right car insurer on your side can make all the difference when it comes to filing a claim. One claim that most people never see coming usually revolves around the replacement of their windshield.

According to Carwindshields.info, there are no unique laws regarding windshields and how car insurance providers must handle claims. Your car insurance provider may designate a specific shop to do the repairs though, and if you deviate from their recommendation you could be left paying the difference.

The Show-Me State does require that your car have a windshield too and that it is free from obstructions such as stickers, posters, or signage.

Your windshield must also be free from cracks longer than 3 inches and breakage that has missing pieces.

Penalties for violations are determined by the county and could result in a fine as well as the failure to pass the State Safety Inspection.

Automobile Insurance Fraud in Missouri

Missouri does not just have laws governing the state of your windshield. There are also laws that help protect you from fraud after a car accident.

The Missouri Department of Insurance takes fraud so seriously that it even provides an online quiz to help you understand how to protect yourself.

According to FindLaw.com, some of the penalties for committing fraud can include:

- Jail time

- Fines

- Restitution

Some types of fraud include the following:

- Unbundling-This is when a medical professional includes several smaller procedures in the place of a comprehensive one.

- Upcoding-This is when a medical provider claims more serious of extensive procedures than the ones actually being performed.

- Duplicating-This is what insurance investigators call it when a medical provider submits the same claim to several agencies.

Medical providers are not the only ones who can commit fraud either. The repair shop and your car insurance provider can also be guilty of it.

Usually, when this occurs it is because a repair shop has claimed more extensive damage than what was actually done during an accident or when your car insurance provider takes the money for your premiums and does not deposit it.

Consumers can also be found guilty of fraud if they claim previous injuries or property damage as part of a car accident. Failure to report any change in your status that might impact your discounts or policy may also make you guilty of fraud.

If you feel that you or someone you love has been the victim of fraud you should report it to the Missouri Department of Insurance:

- By phone at 573-751-2640

- Or by contacting the Office of Mary Johnson, Chief of Investigations for the Missouri Department of Insurance by mail at P.O. Box 690, Jefferson City, MO 65102-0690

Fraud has a 10-year statute of limitations in the Show-Me State.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Statute of Limitations

The crime of fraud is not the only thing to carry a statute of limitations in the state of Missouri.

There is also a statute of limitations on personal injury claims which runs five years from the date of the incident.

While statutes of limitations are pretty commonplace nationwide, there are some laws that are unique to the Show-Me State.

Missouri Specific Driving Laws

If you are a side street driver it could pay to keep your hands to yourself because in the state of Missouri it is illegal to honk the horn of someone else’s car.

Don’t leave your car parked while it is running in the Show-Me State either or you might scare the horses and be breaking the law.

These laws seem funny to many of us today but they were passed for a reason in their day, and they still stand on the books. There are also more practical laws on the books in the Show-Me State. Keep scrolling to find out what they are.

What are the state’s vehicle licensing laws?

Some of the laws in the great state of Missouri regulate how you register your vehicle and how you go about getting a driver’s license.

According to the Missouri Department of Revenue, you do not have to register your moped or bicycle and neither one requires a state inspection.

Moped operators and drivers of motorized bicycles do need to have a driver’s license though.

If you are a resident of Missouri you must also register your vehicle with the state and obtain both car insurance and a driver’s license before hitting the open road.

To register a vehicle you must bring the following documents to your local licensing office:

- Proof of ownership of the vehicle

- Application for Missouri Title and License (if applicable)

- Your current car insurance ID card

- Your safety inspection documents

- the VIN of the vehicle

- And enough money to pay all of the fees.

There are specific documents that you will need to bring with you to an unrestricted driver’s license as well.

- Proof of identity

- Proof of Social Security number

- Proof of residency

The state of Missouri also requires that you take the vision test, road test, and written test if you have never had a license before.

Missouri is also REAL ID compliant.

In order to get a REAL ID in the Show-Me State, you must bring 1 of the following to the licensing office:

- Valid U.S. Passport

- Valid U.S. Passport card

- Certified copy of your birth certificate or proof of U.S. birth abroad

- Certification of Naturalization

- Certificate of citizenship

- Valid Permanent Resident Card

- Valid Foreign Passport stamped approved or processed for an I-551

- Valid Arrival/Departure Record I-94 with “Temporary I-551” stamp

- Valid Employment Authorization Document (EAD)

- Valid Foreign Passport with a valid, unexpired US visa accompanied by an I-94

- Valid Out of State Real ID driver’s license, permit or identification card

- Valid Missouri Real ID driver’s license, permit, or identification card

You must also prove your lawful status within the United States, and provide your social security number with proof such as:

- A Social Security Card

- W-2 form

- SSA-1099 Form

- Non-SSA-1099 Form

- A paystub with your Social Security number on it

If you want to fly or enter government buildings within the United States you are going to need a REAL ID. To make sure that you have all that you need, the Missouri Department of Revenu has provided an interactive online guide.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Penalties for Driving Without Insurance

Whether you are registering your vehicle or getting your driver’s license you are going to need car insurance to do it. You are also required to maintain continuous coverage thereafter so long as you are on Missouri’s roadways.

Should you choose to drive without insurance in the Show-Me State the penalties are as follows:

- Four points on your license

- Up to a $300 fine

- Possible jail for 15 days

- Possible license suspension

If you get a ticket for driving without insurance be aware that the points you get for it will stay on your Missouri driver’s license forever.

Insurance is connected to the vehicle and not the person as well so if you drive your buddy’s car and it is uninsured you will get the points even if you can prove that you have a car insurance policy in your name on another vehicle.

Missouri is not messing around, and you shouldn’t either. Keep reading and let us help you find the right car insurance provider to help you stay out of trouble.

Teen Driving Laws

Just like the laws that mandate the purchase of car insurance and those that determine how you register your car there are a specific set of laws geared towards teen drivers.

Some of these laws are specific to how teen drivers become drivers in Missouri in the first place.

The Show-Me State uses a graduated licensing procedure for teens.

In order to apply for a driver’s license, the teenager must present the same forms of identity as those applying for an unrestricted license. The teenage driver must also complete the written exam at the Missouri State Highway Patrol Station and bring proof of that completion with them to the licensing office.

According to the Insurance Institute for Highway Safety (IIHS), you must be at least 15 years old to apply for an instructional permit in Missouri. You must also hold that permit without incident for 12 months before you can move onto the next stage.

During the holding period, you must complete 40 hours of supervised daytime driving and 10 hours of supervised nighttime driving that must be logged by an accompanying licensed driver who is over the age of 21 years.

At age 16 you may apply for an intermediate driver’s license if you have completed the previously mentioned requirements.

You will be allowed to drive unsupervised at this stage except for between the hours of 10 pm to 6 pm Sunday through Thursday and 11;30 pm to 6 am on Friday through Saturday. Nightime restrictions are lifted after 6 months of incident-free driving.

Older Drivers

Young drivers have their own unique sets of challenges, but so do older drivers. As we age our response times slow and our vision can sometimes deteriorate.

Because of the age-related limitations, the Show-Me State has specific regulations that limit the renewal process or licensing cycles for older drivers according to the IIHS.

Residents of the state of Missouri who are 70 years of age or older must renew their license every three years. They must also pass a vision test every cycle.

Sometimes it is just time to give up the keys though, and if you notice that an elderly friend or family member has reached that stage then you will need to have the hard talk with them in order to keep them safe.

Just remember that if you have to talk with someone you love about hanging up the keys for good you are doing it out of love.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Residents

If you are new to the Show-Me State then you will certainly have a lot of questions. Some of these questions will inevitably surround how you go about tagging your out-of-state vehicle or exchanging your license from your previous home state for a new Missouri driver’s license.

Thankfully the requirements for new residents are pretty much the same as they are for current ones. The only difference is that when titling and tagging a vehicle in the Show-Me State which has previously been registered in a different state you will need to bring all of your paperwork from that state with you to the tag office.

This includes your out-of-state titling paperwork and the out-of-state title.

If you are trying to get a Missouri driver’s license and you have held one in your previous home state them you must bring that out-of-state license with you for surrender.

Driver’s License Renewal Procedures

Once you get your license you will need to keep it up-to-date. This means going through the renewal procedure.

AAA states that drivers who are between the age of 18 and 20 have a license that expires in a three-year time period. At that point, they will need to renew it.

If you are between the ages of 21 and 69 you may get a license every six years, but once you reach the age of 70 your driver’s license renewal cycle will revert back to three years.

You can renew your driver’s license in-office, or by mail.

Military personnel and their dependents are exempt from exchanging their out-of-state license for ones issued by the state of Missouri if they claim a place of residence in a different state.

If you are not a U.S. citizen then your renewal cycle may be different based on the expiration dates on the documentation that you submitted when obtaining your license.

Negligent Operator Treatment Systems

Now that you have your driver’s license you will want to keep it blemish-free. Doing this will help you keep your car insurance premiums at a minimum.

The best way to keep your driving record clean is to understand how the point system in Missouri works in order to avoid accruing any.

Some of the usual ways that drivers rack up points (along with their point values) are as follows:

- First Conviction DUI (two points)

- Speeding (three points)

- Reckless Driving (four points)

- A Felony involving a motor vehicle (12 points)

- Driving with a suspended or revoked license (12 points)

If you accrue 4-12 points in a 12 month period you will receive a letter from the Missouri Department of Insurance warning you about your situation.

If you add eight more points from that moment forward into the next 18 months you will have your driving privileges suspended for 30 days for the first offense, 60 days for the second, and 990 days for a third.

Once you have your driving privileges reinstated you will see a four-point reduction on your driving record.

The Department of Revenu will revoke your driving privileges if you get the following:

- 12 or more points in 12 months

- 18 or more points in 24 months

- 24 or more points in 36 months

To find out how many points that you have against your Missouri driver’s license you can call (573) 526-2407 or send an e-mail to [email protected].

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the rules of the road?

Now that you know what the penalties are for breaking the rules of the road you are probably curious to know more about what some of those rules are.

Knowing what they are can help you stay out of trouble and save money on your car insurance policy. Keep scrolling to find out how we can help.

No-Fault Vs. At-Fault

If you have been shopping for car insurance then you have definitely come across the terms “no-fault” and “at-fault” in reference to state laws. So what do these terms mean?

- A no-fault state is one in which everyone involved in an accident is responsible for paying for their own medical expenses and property damage.

- An at-fault state makes the person deemed to be “at-fault” for the accident assume responsibility for the injuries and property damage that they have caused.

Missouri is an at-fault state which means that if you cause an accident you will have to take care of anyone that was harmed by your actions.

This is why it is so important to choose the right provider who can help you out if you are ever found at fault.

Seat Belt and Car Seat Laws

While at-fault and no-fault systems may vary from state to state almost every state requires the use of seat belts and car seats when traveling in a motor vehicle.

According to IIHS, failure to wear a seat belt while traveling in a motor vehicle is a primary offense. This means that law enforcement does not need any other reason to pull you over and ticket you for it. The fine is $10.

All persons riding in a motor vehicle who are 16 years of age or above in the front seat must be belted. All children 3 years of age or younger who are under 40 pounds must be in a child restraint.

If the child is between the ages of 4-7 years old and weighs at least 40 pounds but is still less than 80 pounds they must be in either a child restraint or booster seat.

Children over 4 years of age who are over 80 pounds or over four feet, nine inches tall must be in either a booster seat or seat belt.

Violation of the child safety bet laws will result in a fine of $50 if the child is less than 80 pounds or four feet, nine inches tall.

The law in Missouri does not preference the back seat but studies have shown that children are safest when riding there.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Keep Right and Move Over Laws

The Show-Me State wants to ensure that every motorist on Missouri roadways stays safe. For this reason, the Missouri State Highway Patrol has tried to make everyone aware of the laws that govern passing and lane usage.

These laws also state that it is illegal to linger in the left lane if there are two or more lanes. Failure to keep right could result in a fine.

Missouri also has a Move Over law which is designed to keep members of law enforcement and emergency personnel safe while they are working along the roadside.

This law requires that drivers move over one lane if they see law enforcement, emergency vehicles, or transportation workers displaying red, red, and blue, or amber lights. If you can’t move over safely then you must reduce your speed.

Violation of this law could result in fines and/or imprisonment.

Speed Limits

Missouri also has various laws that govern just how fast you can drive and where. According to IIHS, these speed limits for interstate driving are 70 MPH.

Interstates aren’t the only roadways to have speed limits in the Show-Me State. Missouri also has the following limits on speed in other areas:

- 65 MPH on rural expressways

- 55 MPH on state lettered highways

- 25 MPH in cities, towns, and villages where posted

- 20 MPH in most school zones

Missouri law also states that:

No vehicle shall be operated at a speed of less than forty miles per hour on any highway which is part of the interstate system of highways.

The only exception to this law is for weather conditions or agricultural equipment and the like.

Ridesharing

While speeding laws have been around forever and go through slow changes over time, not all laws in the Show-Me State seem so constant.

The rise in popularity of rideshare apps like Uber and Lyft has cause Missouri lawmakers to rethink the laws that govern taxis in an effort to change with the times.

One of the most sweeping changes regarding rideshare in the Show-Me State occurred with the passage of HB130 in 2017.

This law allowed rideshare companies to expand across Missouri causing concerns for insurance companies who are still trying to figure out who should cover what in case a rideshare vehicle should be involved in a car accident.

When rideshare first emerged drivers wishing to take up the occupation were covered under their traditional policies so long as they notified their car insurance provider.

The Show-Me State now has three car insurance companies that offer specific rideshare endorsements on the policies that they write for customers wishing to use their personal vehicle for ridesharing.

State Farm, USAA, and American Family have made good strides to stay as current as of the Missouri laws when it comes to ridesharing. You don’t necessarily have to choose one of these carriers though.

If you are with another car insurance provider or leaning towards one as you shop, be sure to ask your agent what the policies and costs of being a rideshare driver might be should you choose to purchase a policy from them.

According to the Insurance Journal, Missouri has also advanced legislature that will require all rideshare drivers to undergo a background check before taking on passengers. This legislation would also require rideshare companies to ensure that vehicles in their service are covered by car insurance.

As you can see, Missouri has been busy trying to protect you and all drivers on its roadways.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automation on the Road

There are currently no laws on the books that govern the use of autonomous use on Missouri roadways. That doesn’t mean that lawmakers aren’t thinking about them though.

In 2018 legislation that was related to self-driving cars was being filed by both the state House and Senate. These proposals discussed the possibility of vehicle platooning as a means for introducing autonomous vehicles onto the roadways in the Show-Me State.

According to the National Conference of State Legislatures (NCSL), these proposals failed in early 2019, but that doesn’t mean this is the end of the story.

Lawmakers in Missouri will go back to the drawing board and draft new proposals that could bring self-driving cars to a road near you in the near future so stay tuned.

What are the safety laws?

As you can see, there are a number of laws in Missouri that are designed to keep you and your fellow drivers safe while in the road. Laws in the Show-Me State don’t just cover ridesharing or autonomous technology either.

Missouri has also enacted laws regarding things such as driving under the influence and distracted driving. Knowing what these laws are can help keep you safe and your car insurance rates down. Scroll down to find out how.

DUI Laws

If you are pulled over in Missouri and are found to have a BAC higher than 0.08 you will be cited for DUI. If your BAC is 0.15 it is considered high and the penalties will be increased.

According to NOLO, some of these penalties include:

- First Offense-The first time you are charged with DUI you could face up to six months in jail, a fine of up to $1,000, a license suspension of 30 days followed by a 60 day period of a restricted license, and the possibility of an Ignition Interlock Device installed on your vehicle.

- Second Offense-Your second offense could result in up to 1 year in jail, a fine of up to $2,000, a five-year license revocation, and six-month minimum use of an Ignition Interlock Device.

- Third Offense-The third time that you are caught driving under the influence you will face up to four years in jail, a fine of up to $10,000, a 10-year license revocation, and six-months minimum use of an Ignition Interlock Device once you get your driving privileges back.

There is also a five-year Look-Back Period in Missouri which means that a drunk driving offense will remain on your driving record for five years after you have been charged.

The consequences could be much worse than a revoked license if you choose to drink and drive so always designate a driver.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Marijuana-Impaired Driving Laws

Missouri also has a number of fines and penalties that you could face if you are convicted of DWI.

Some of these include:

- First Offense-The first time that you are convicted you could face up to six months in jail, be required to participate in a substance abuse program, and a 30-day mandatory license suspension.

- Second Offense-A second offense within five years is considered a class A misdemeanor and carries with it the possibility of jail time of up to 1 year, 30 days of community service, a fine of up to $1,000, and a two-year license suspension,

- Third Offense-This is a class D felony that carries with it up to four years in jail, 60 days of community service, a fine of up to $5,000, and a three-year license revocation

- Fourth Offense-This class C felony carries with it up to seven years in jail, a fine of up to $5,000, and a license revocation of three years at a minimum.

- Fifth Offense-Considered a class B felony, if you are caught drugged driving a fifth time you will face up to 15 years in jail, and your license will be revoked for three or more years.

The Show-Me State is also entitled to conduct sobriety check-points according to the Missouri State Constitution. Like drinking and driving then, the risk is just not worth it.

Distracted Driving

Everyone has been guilty of distracted driving at some point. In Missouri, though this behavior could cost you. This is especially true if you are caught texting and driving under the age of 21 which is a primary offense in the Show-Me State according to the National Conference of State Legislatures (NCSL).

A primary offense means that law enforcement does not need any other reason to pull you over outside of being caught texting and driving.

Missouri is also looking to expand the texting ban in the very near future.

According to AAA, several cities in the Show-Me State already have such a ban so if you are traveling through Chesterfield, Ellisville, Florissant, Kirkwood, Lake St. Louis, Manchester, O’Fallon, St. Charles, or St. John be aware that it doesn’t matter how old you are because texting and driving in these cities is illegal full stop.

What do you need to know about driving in Missouri?

Driving comes with risks no matter where you live. Sometimes these risks aren’t even from other drivers either.