Pennsylvania Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 7.60

Pennsylvania is home to a rich history. Philadelphia, a major city in Pennsylvania, has witnessed major revolutionary events like the signing of the Declaration of Independence and the Constitution. So if you live in Pennsylvania, you may just find yourself humming Hamilton songs when you visit historical sights.

A less-interesting past time when living in this historically rich state, though, is purchasing car insurance.

We understand that researching car insurance can be hard, as there are tons of resources to slog through. To help you avoid wasting valuable time, we’ve done all the hard work for you.

Our guide will cover everything you need to know about car insurance in Pennsylvania, from car insurance rates to must-know driving laws. Keep reading for the only guide you need to learn about Pennsylvania’s car insurance.

And if you’re ready to compare quotes today, use our FREE tool above.

What Should You Know about Car Insurance Coverage and Rates in Pennsylvania?

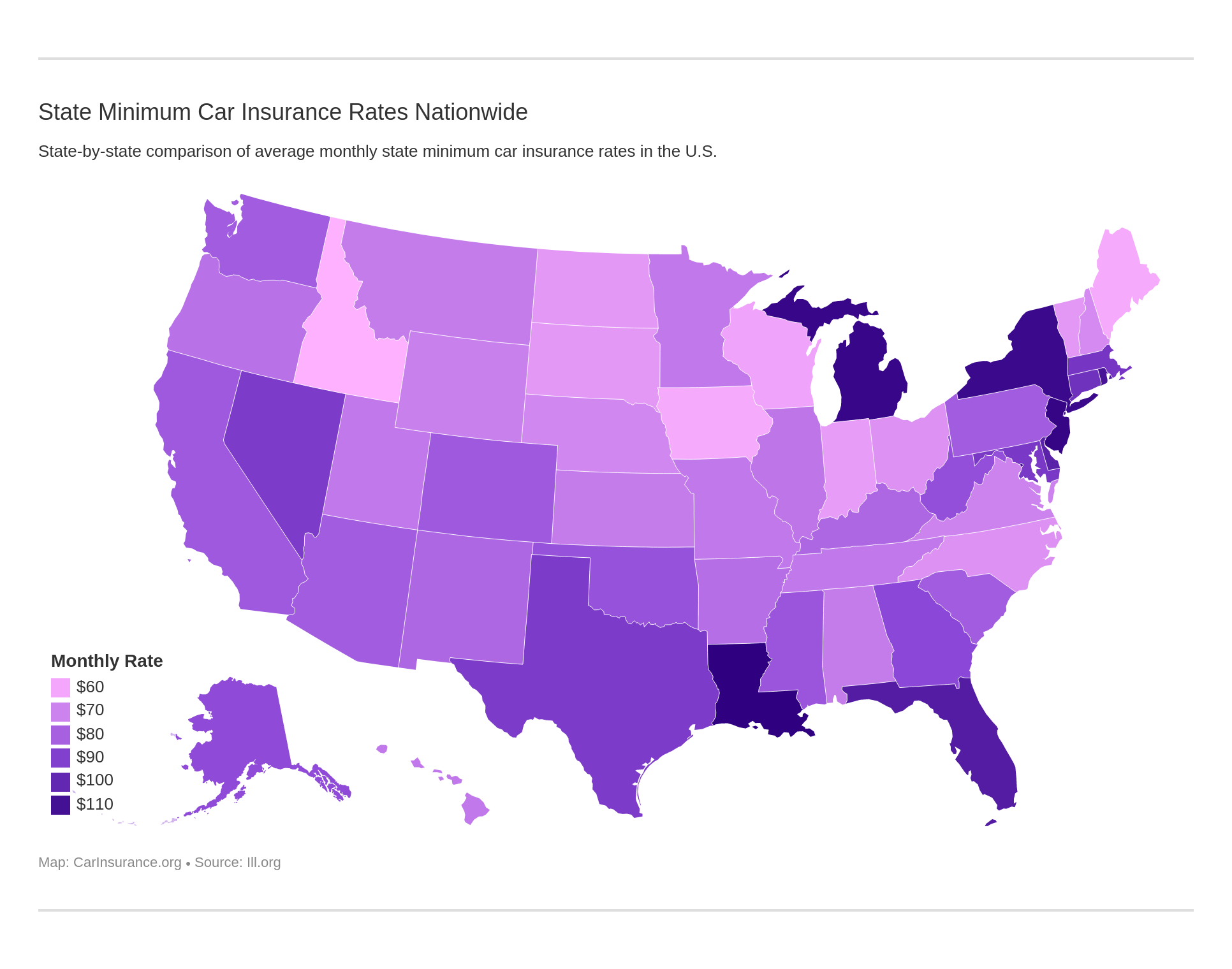

Every state has different rates. Some states simply have more expensive for car insurance because of several factors, such as what coverages the states require.

In all states, you can expect to pay a significant amount each month on car insurance. The good news is that with careful planning, you can bring your costs down to a manageable level while still getting great coverage. We understand it’s a balancing act. But you don’t want to get caught with no insurance for legal and liability reasons.

To see how much car insurance in Pennsylvania will cost, we will go through the required auto insurance coverages and the factors that influence rates in Pennsylvania.

Let’s begin!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s Pennsylvania’s Car Culture like?

Before we get into coverage and rates, let’s see what vehicles most Pennsylvania residents own.

According to The Hartford, Pennsylvania drivers stick with “practical vehicles,” such as SUVs and minivans.

This doesn’t mean the car culture in Pennsylvania is limited to minivans. The Hartford says there are numerous racetracks in Pennsylvania, such as the NASCAR race track.

So if you move to Pennsylvania, don’t be surprised if your minivan-driving neighbors are enthusiastic.

What’s Pennsylvania Minimum Coverage?

Pennsylvania requires every driver to carry a minimum amount of liability coverage to protect others in an at-fault accident. This is true whether you have a DUI or a clean driving record for the past 20 years.

Unless you want heavy fines, you’ll need to have Pennsylvania’s minimum coverage on your vehicle. NOLO lists the required minimum coverages as follows:

| Pennsylvania Required Coverage | Minimum Coverage Amount | Purpose |

|---|---|---|

| Bodily Injury Liability | $15,000 per person $30,000 per accident | For when you cause an accident and injure someone else |

| Property Damage Liability | $5,000 per accident | For when you cause an accident and damage someone else's property |

| Medical Benefits Coverage | $5,000 | Pays medical bills of anyone under the policy after an accident (regardless of who caused the accident) |

In Pennsylvania, an all-purpose policy (of at least $35,000 total coverage) can also suffice to meet Pennsylvania’s minimum requirements. Bear in mind that these are just the minimum car insurance requirements.

It’s always better to have more than the state minimum, as better coverage will help prevent the possibility of you paying out of pocket in an accident. The minimums are also only meant to cover other parties you may injure in some way while behind the wheel. If you want coverage for your auto damage and injuries, you’ll need collision coverage, comprehensive, and PIP. All this can be worked into insurance quotes.

What does the Form of Financial Responsibility mean?

Pennsylvania state laws requires all drivers to maintain proof of financial responsibility. You’ll need to produce this any time you get pulled over by a police officer. Your insurance company may also file proof with the state. Acceptable forms of financial responsibility include:

- Insurance ID card

- Declaration page of an issued insurance policy

- Valid insurance binder (temporary proof of insurance valid for 30 or 60 days)

- Copy of application for Pennsylvania Assigned Risk Plan

- Letter from your insurance carrier that verifies financial responsibility

Pennsylvania also allows drivers to provide electronic proof of insurance. This means that you can download the electronic version of your ID card onto your phone and show it to officers.

Of course, we also recommend that you carry a paper version in case of technical difficulties.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Percentage of Income are Premiums?

A percentage of your annual income is eaten up every year by car insurance payments. To see what percentage of Pennsylvania residents’ income goes toward car insurance, let’s take a look at three years of data that we brought you by partnering with Quadrant.

| Pennsylvania Statistics | 2012 | 2013 | 2014 |

|---|---|---|---|

| Full Coverage | $915.83 | $930.48 | $950.42 |

| Disposable Income | $41,020.00 | $40,840.00 | $42,414.00 |

| Insurance as % of Income | 2.23% | 2.28% | 2.24% |

You may be wondering what disposable income is. Disposable income is the amount you have left to spend after paying taxes.

The percentage of income going to car insurance has remained steady over the years, which is good news. While the cost of car insurance did increase slightly, the average income also increased, meaning the percentage didn’t change drastically.

The percentage of income going to car insurance in Pennsylvania in 2014 is just under the 2014 countrywide average of 2.4 percent.

Pennsylvania’s percentage of income going to car insurance is solidly in the middle out of all states, neither the cheapest nor the most expensive (the most expensive state is 3.5 percent, while the cheapest is 1.42 percent).

So rest assured that Pennsylvania is average — you won’t be paying exorbitant amounts of income on car insurance.

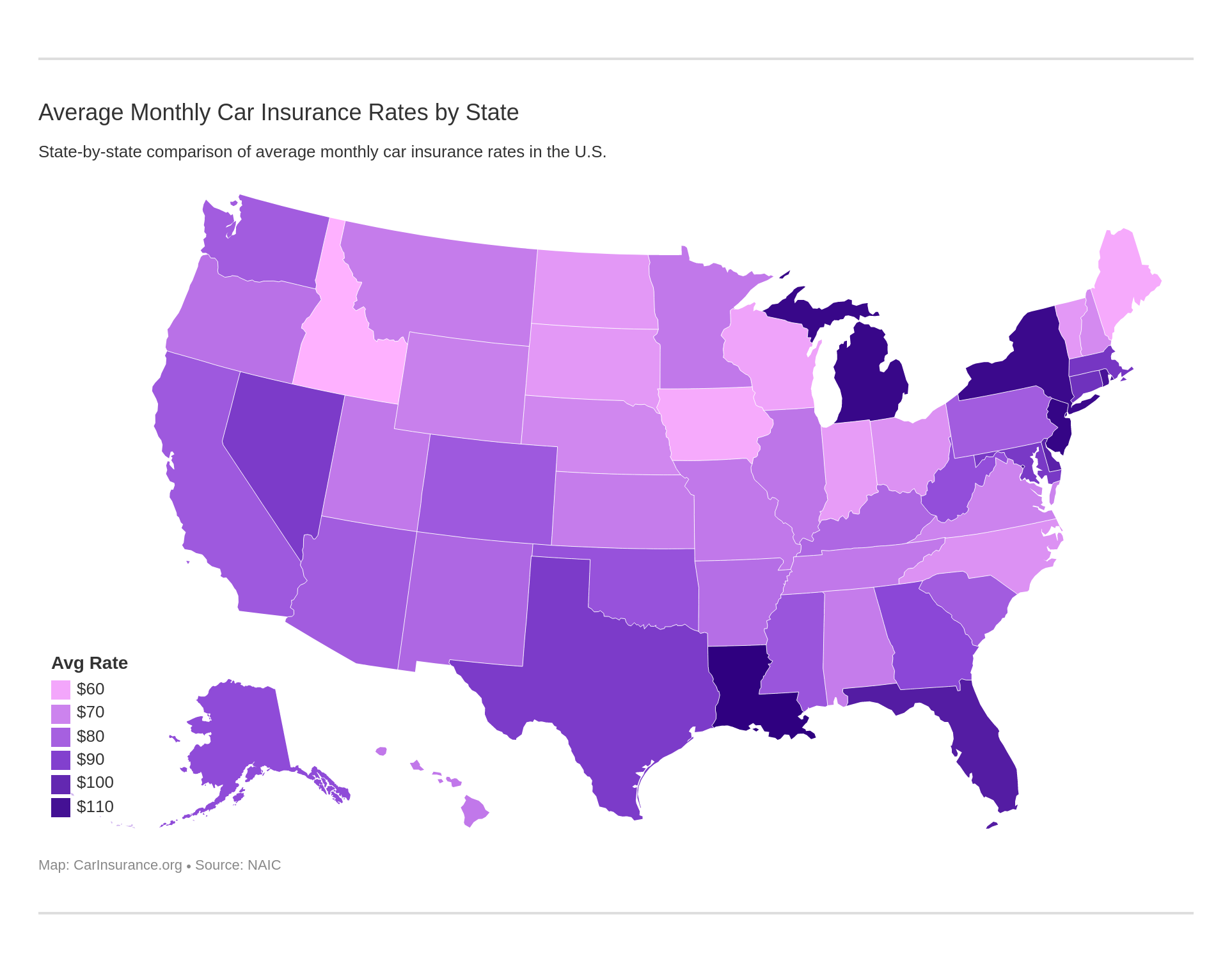

What are the Average Monthly Car Insurance Rates in PA (Liability, Collision, Comprehensive)?

Let’s break down the average premium in Pennsylvania by looking at the cost of different core coverages from the National Association of Insurance Commissioners (NAIC).

| Coverage Type | Average Annual Costs |

|---|---|

| Liability | $495.02 |

| Collision | $307.31 |

| Comprehensive | $132.01 |

| Combined Total | $934.34 |

NAIC’s data is based on the state minimum, so you may find car insurance costs to be a little higher.

Pennsylvania’s average is $20 less than the countrywide average, so insurance costs in Pennsylvania are average. While they won’t be the cheapest, they also won’t cost you a month’s paycheck.

Is There an Additional Coverage?

To see if the additional coverages in Pennsylvania are worth the added cost, we are going to take a look at their loss ratios. Why do we care about loss ratios?

Because loss ratios show us whether or not companies are profitable and stable.

- A High Loss Ratio (over 75 percent) indicates that the companies underestimated the frequency and severity of losses and how much premium would be needed to cover them. A high loss ratio is a good indicator of future rate increases.

- A Low Loss Ratio (under 35 percent) could indicate that companies overestimated the frequency and severity of claims or overpriced their policies.

Broken down further, this means that if a company has a loss ratio of 50, it is paying out $50 in claims for every $100 earned in premiums.

With this in mind, let’s take a look at loss ratios for additional liability coverages in Pennsylvania.

| Additional Liability Coverage in Pennsylvania | Loss Ratio - 2013 | Loss Ratio - 2014 | Loss Ratio - 2015 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 73.89% | 71.08% | 71.28% |

| Medical Payments (Med Pay) | 252.44% | 37.16% | 9.24% |

| Uninsured/Underinsured Motorist Coverage | 65.97% | 66.61% | 63.50% |

While PIP’s loss ratios have remained steady at a fantastic percentage, MedPay’s loss ratios were extremely high in 2013 before plummeting to less than 10 percent in 2015.

As for uninsured and underinsured’s loss ratios, the percentages look decent, as they’ve stayed steadily around 60 percent. What is uninsured and underinsured additional coverage?

If you are in an accident with uninsured or underinsured drivers, they will likely be unable to pay your accident costs if they are at fault. If you don’t have additional uninsured motorist coverage protecting you from uninsured/underinsured drivers, you’ll be forced to pay out of pocket.

The good news is Pennsylvania is ranked as 43rd in the U.S. for its number of uninsured drivers. This means that only 7.6 percent of drivers on the road in Pennsylvania are uninsured.

Still, to eliminate your chance of having to pay out pocket, consider getting additional coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are There any Add-Ons, Endorsements, and Riders?

Thought we were done talking about your options for car insurance coverages? Not quite. While these coverages aren’t required in Pennsylvania, insurers offer them in case drivers want to add extra protection.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Usage-Based Insurance

These additional add-ons can be useful if you want a specific service, such as emergency roadside assistance. Some of the options can also save you money, such as classic car insurance (classic car policies are cheaper than regular car policies) or usage-based insurance.

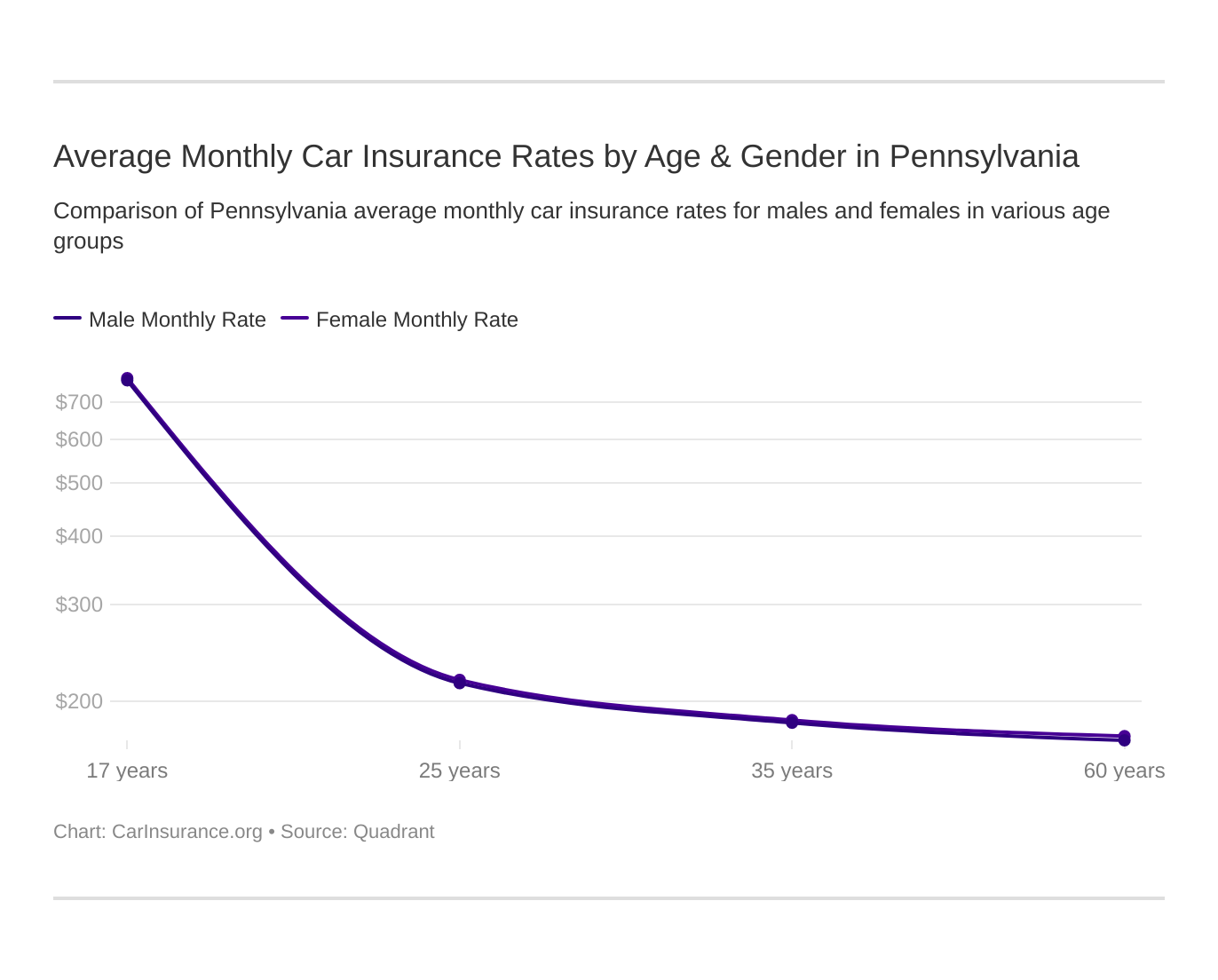

What are the Average Monthly Car Insurance Rates by Age & Gender in PA?

Now that we’ve covered car insurance coverages, let’s start diving into rates with data from Quadrant.

In Pennsylvania, insurers are not allowed to base rates based on drivers’ gender. Pennsylvania is one of the first states to outlaw gender discrimination in car insurance, with states like Calfornia recently passing similar laws.

In fact, Pennsylvania will soon offer a gender-neutral driver’s license.

Let’s take a look at male versus female rates to see the rates for gender and age.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $8,377.10 | $8,377.10 | $2,751.49 | $2,751.49 | $2,500.83 | $2,500.83 | $2,307.05 | $2,307.05 |

| Geico Cas | $5,122.03 | $4,441.41 | $2,063.97 | $1,785.69 | $2,050.13 | $1,773.78 | $1,932.09 | $1,672.62 |

| First Liberty Ins Corp | $11,576.65 | $11,576.65 | $5,037.27 | $5,037.27 | $3,969.70 | $3,969.70 | $3,637.16 | $3,637.16 |

| Nationwide P&C | $5,346.15 | $5,346.15 | $2,138.83 | $2,138.83 | $1,909.07 | $1,909.07 | $1,807.43 | $1,807.43 |

| Progressive Specialty | $8,952.27 | $8,952.27 | $3,557.57 | $3,557.57 | $2,795.84 | $2,795.84 | $2,498.30 | $2,498.30 |

| State Farm Mutual Auto | $5,944.71 | $5,944.71 | $1,859.05 | $1,859.05 | $1,685.65 | $1,685.65 | $1,487.48 | $1,487.48 |

| Travelers Home & Marine Ins Co | $25,635.88 | $25,635.88 | $2,104.67 | $2,104.67 | $1,747.11 | $1,747.11 | $1,882.23 | $1,882.23 |

| USAA | $3,463.40 | $3,463.40 | $1,524.42 | $1,524.42 | $1,148.03 | $1,148.03 | $1,037.62 | $1,037.62 |

We should note that this Quadrant data is based on purchased coverages by Pennsylvania’s residents. Because of this, it includes rates for high-risk drivers, drivers who purchase more than the state minimum, and drivers who purchase additional coverages.

This means that depending on what you purchase, your rates could be higher or lower than the average rates shown above.

So now you know that providers in Pennsylvania do not base rates on gender. Age, however, does not get this same treatment; the younger you are in Pennsylvania, the more you pay.

This makes sense when you consider the driving experience of a teenager compared to that of a 60-year-old.

What are the Rates in Pennsylvania’s 10 Largest Cities?

Some of Pennsylvania’s largest cities are infamous in pop culture — think Rocky running up the stairs in Philadephia or Micheal Scott working in Scranton.

So let’s take a look at the costs of car insurance in the 10-most-populated cities in Pennsylvania.

| City | County | Average Annual Rate |

|---|---|---|

| Philadelphia | Philadelphia | $7,482.34 |

| Upper Darby | Delaware | $6,231.76 |

| Bensalem | Bucks | $5,764.41 |

| Allentown | Lehigh | $4,300.91 |

| Pittsburgh | Allegheny | $4,202.06 |

| Reading | Berks | $4,195.76 |

| Erie | Erie | $4,154.81 |

| Bethlehem | Northampton/Lehigh | $4,043.19 |

| Scranton | Lackawanna | $4,015.43 |

| Lancaster | Lancaster | $3,615.61 |

Philadelphia is the most populated city in Pennsylvania, and it also has the most expensive rates. The cheapest of the largest cities in Pennsylvania in Lancaster, also known to locals as Amish Country.

If you drive in Lancaster, you are likely to see multiple horse-drawn buggies, so be careful and keep an eye on the side of the road.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

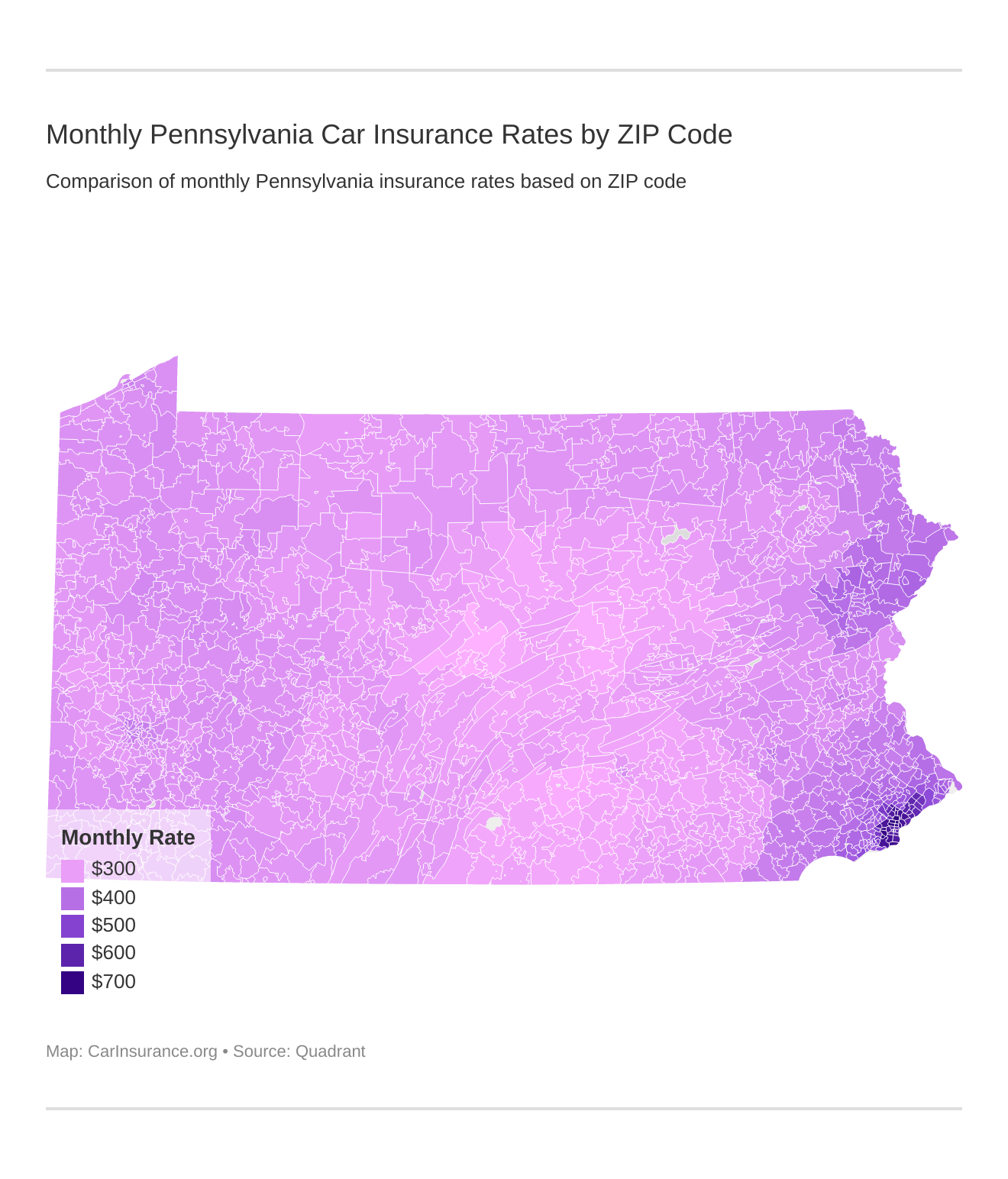

What are the Cheapest Car Insurance Rates by ZIP Code?

If you are looking to save on car insurance, then take a look at the complete list of ZIP codes below to see what the cheapest and what the most-expensive ZIP codes are in Pennsylvania. We’ve also included providers’ prices for each ZIP code, so you can see who the cheapest provider is in your area.

| 25 Most Expensive Zip Codes in Pennsylvania | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 19133 | PHILADELPHIA | $8,527.54 | Travelers | $16,347.78 | Liberty Mutual | $14,953.09 | USAA | $3,130.55 | Nationwide | $5,516.08 |

| 19132 | PHILADELPHIA | $8,485.99 | Travelers | $16,434.31 | Liberty Mutual | $14,953.09 | USAA | $2,979.83 | State Farm | $5,345.97 |

| 19140 | PHILADELPHIA | $8,482.06 | Travelers | $15,656.34 | Liberty Mutual | $14,953.09 | USAA | $3,130.55 | Nationwide | $5,531.40 |

| 19142 | PHILADELPHIA | $8,438.04 | Travelers | $16,063.64 | Liberty Mutual | $14,953.09 | USAA | $3,118.87 | Geico | $5,402.37 |

| 19139 | PHILADELPHIA | $8,431.95 | Travelers | $15,900.83 | Liberty Mutual | $14,953.09 | USAA | $3,067.37 | Geico | $5,332.66 |

| 19121 | PHILADELPHIA | $8,402.97 | Travelers | $15,667.55 | Liberty Mutual | $14,953.09 | USAA | $2,979.83 | Nationwide | $5,103.03 |

| 19143 | PHILADELPHIA | $8,335.24 | Travelers | $15,329.68 | Liberty Mutual | $14,953.09 | USAA | $3,040.28 | Geico | $5,332.66 |

| 19122 | PHILADELPHIA | $8,251.79 | Travelers | $15,965.31 | Liberty Mutual | $14,953.09 | USAA | $2,977.25 | Geico | $5,059.59 |

| 19112 | PHILADELPHIA | $8,120.94 | Travelers | $15,996.78 | Liberty Mutual | $14,953.09 | USAA | $3,040.28 | State Farm | $4,159.60 |

| 19141 | PHILADELPHIA | $7,951.26 | Travelers | $15,628.00 | Liberty Mutual | $11,848.69 | USAA | $3,168.09 | State Farm | $5,393.39 |

| 19120 | PHILADELPHIA | $7,934.92 | Travelers | $15,270.43 | Liberty Mutual | $11,848.69 | USAA | $3,130.55 | Geico | $5,059.59 |

| 19126 | PHILADELPHIA | $7,875.75 | Travelers | $15,023.64 | Liberty Mutual | $11,848.69 | USAA | $3,132.85 | State Farm | $4,926.72 |

| 19145 | PHILADELPHIA | $7,875.23 | Travelers | $15,797.70 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | State Farm | $4,614.78 |

| 19125 | PHILADELPHIA | $7,867.88 | Travelers | $15,280.25 | Liberty Mutual | $13,185.12 | USAA | $2,977.25 | Geico | $5,059.59 |

| 19124 | PHILADELPHIA | $7,839.78 | Travelers | $15,192.97 | Liberty Mutual | $11,848.69 | USAA | $3,170.44 | Geico | $5,059.59 |

| 19138 | PHILADELPHIA | $7,813.73 | Travelers | $15,422.93 | Liberty Mutual | $11,848.69 | USAA | $3,018.01 | State Farm | $4,962.95 |

| 19153 | PHILADELPHIA | $7,809.79 | Travelers | $15,950.73 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | Nationwide | $4,431.54 |

| 19134 | PHILADELPHIA | $7,792.20 | Travelers | $15,369.32 | Liberty Mutual | $13,185.12 | USAA | $3,130.55 | State Farm | $5,003.80 |

| 19104 | PHILADELPHIA | $7,718.61 | Travelers | $15,015.69 | Liberty Mutual | $14,953.09 | USAA | $2,979.83 | Geico | $3,727.54 |

| 19131 | PHILADELPHIA | $7,711.11 | Travelers | $15,520.29 | Liberty Mutual | $11,848.69 | USAA | $2,979.83 | State Farm | $5,173.58 |

| 19190 | PHILADELPHIA | $7,619.01 | Travelers | $15,996.78 | Liberty Mutual | $14,953.09 | USAA | $2,684.13 | Geico | $3,727.54 |

| 19109 | PHILADELPHIA | $7,590.79 | Liberty Mutual | $14,953.09 | Travelers | $14,644.96 | USAA | $2,802.84 | Geico | $3,727.54 |

| 19148 | PHILADELPHIA | $7,551.17 | Travelers | $16,231.94 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | Geico | $3,727.54 |

| 19144 | PHILADELPHIA | $7,532.62 | Travelers | $15,516.37 | Liberty Mutual | $11,848.69 | USAA | $2,864.58 | Geico | $4,546.01 |

| 19147 | PHILADELPHIA | $7,504.11 | Travelers | $15,857.48 | Liberty Mutual | $13,185.12 | USAA | $3,040.28 | Geico | $3,727.54 |

| 25 Least Expensive Zip Codes in Pennsylvania | City | Average Annual by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 16823 | BELLEFONTE | $3,116.01 | Travelers | $5,623.33 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16801 | STATE COLLEGE | $3,156.82 | Travelers | $6,027.64 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16803 | STATE COLLEGE | $3,205.35 | Travelers | $6,206.11 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 17844 | MIFFLINBURG | $3,205.40 | Travelers | $5,668.37 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 16828 | CENTRE HALL | $3,207.80 | Travelers | $5,600.96 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | State Farm | $1,979.70 |

| 16802 | UNIVERSITY PARK | $3,211.08 | Travelers | $6,155.13 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 16870 | PORT MATILDA | $3,212.75 | Travelers | $5,804.33 | Liberty Mutual | $5,301.56 | USAA | $1,385.22 | Geico | $1,816.07 |

| 17013 | CARLISLE | $3,217.12 | Travelers | $6,210.08 | Liberty Mutual | $4,364.46 | USAA | $1,561.10 | Geico | $1,897.92 |

| 17015 | CARLISLE | $3,217.18 | Travelers | $6,210.08 | Liberty Mutual | $4,364.46 | USAA | $1,561.10 | Geico | $1,897.92 |

| 17837 | LEWISBURG | $3,223.56 | Travelers | $5,861.05 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 17065 | MOUNT HOLLY SPRINGS | $3,237.78 | Travelers | $6,004.88 | Liberty Mutual | $4,801.54 | USAA | $1,561.08 | Geico | $1,897.92 |

| 16826 | BLANCHARD | $3,242.81 | Travelers | $5,623.33 | Liberty Mutual | $5,301.56 | USAA | $1,385.22 | State Farm | $2,062.44 |

| 17842 | MIDDLEBURG | $3,243.72 | Travelers | $5,719.63 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 17887 | WHITE DEER | $3,263.23 | Travelers | $6,414.92 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | State Farm | $2,038.07 |

| 17266 | WALNUT BOTTOM | $3,264.01 | Travelers | $6,163.01 | Liberty Mutual | $4,801.54 | USAA | $1,561.11 | Geico | $1,897.92 |

| 17324 | GARDNERS | $3,275.34 | Travelers | $5,874.51 | Liberty Mutual | $4,801.54 | USAA | $1,561.11 | Geico | $2,153.91 |

| 17343 | MC KNIGHTSTOWN | $3,275.41 | Travelers | $5,709.54 | Liberty Mutual | $4,835.16 | USAA | $1,540.87 | Geico | $2,153.91 |

| 17007 | BOILING SPRINGS | $3,282.20 | Travelers | $6,303.42 | Liberty Mutual | $4,801.54 | USAA | $1,561.08 | Geico | $1,897.92 |

| 17241 | NEWVILLE | $3,288.08 | Travelers | $6,018.29 | Liberty Mutual | $4,801.54 | USAA | $1,561.11 | Geico | $1,897.92 |

| 16827 | BOALSBURG | $3,288.82 | Travelers | $6,427.94 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| 17050 | MECHANICSBURG | $3,290.99 | Travelers | $6,645.72 | Liberty Mutual | $4,364.46 | USAA | $1,561.19 | Geico | $1,897.92 |

| 17055 | MECHANICSBURG | $3,291.15 | Travelers | $6,761.33 | Liberty Mutual | $4,364.46 | USAA | $1,561.19 | Geico | $1,897.92 |

| 16875 | SPRING MILLS | $3,298.88 | Travelers | $5,708.01 | Liberty Mutual | $5,301.56 | USAA | $1,384.72 | State Farm | $2,096.21 |

| 17889 | WINFIELD | $3,300.90 | Travelers | $6,327.37 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| 17870 | SELINSGROVE | $3,301.85 | Travelers | $6,493.74 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

The variance in cost between the most and least expensive ZIP codes is over $5,300. If you live in a more expensive ZIP code, make sure you are picking a cheaper provider.

What are the Cheapest Car Insurance Rates by City?

While we’ve covered ZIP codes, we want to broaden our information a bit by looking at the most and least expensive cities in Pennsylvania.

| 10 Most Expensive Cities in Pennsylvania | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Philadelphia | $7,482.34 | Travelers | $15,126.36 | Liberty Mutual | $12,538.89 | USAA | $2,954.06 | Geico | $4,621.12 |

| Sharon Hill | $6,392.50 | Travelers | $13,460.15 | Liberty Mutual | $8,630.14 | USAA | $2,363.32 | Nationwide | $4,102.98 |

| East Lansdowne | $6,347.36 | Travelers | $12,468.46 | Liberty Mutual | $8,630.14 | USAA | $2,511.37 | Nationwide | $4,210.51 |

| Collingdale | $6,270.41 | Travelers | $12,886.09 | Liberty Mutual | $8,630.14 | USAA | $2,511.37 | Nationwide | $4,212.45 |

| Millbourne | $6,231.76 | Travelers | $12,160.58 | Liberty Mutual | $8,630.14 | USAA | $2,207.63 | Nationwide | $4,241.54 |

| Bensalem | $5,764.41 | Travelers | $12,296.07 | Liberty Mutual | $8,344.78 | USAA | $1,908.22 | Geico | $3,568.65 |

| Cheltenham | $5,733.79 | Travelers | $12,436.54 | Liberty Mutual | $7,629.84 | USAA | $2,456.44 | Nationwide | $3,835.72 |

| Elkins Park | $5,727.39 | Travelers | $12,174.44 | Liberty Mutual | $7,629.84 | USAA | $2,154.94 | Nationwide | $3,745.21 |

| Chester | $5,723.20 | Travelers | $12,415.25 | Liberty Mutual | $8,630.14 | USAA | $2,363.32 | Geico | $3,596.36 |

| Glenolden | $5,720.42 | Travelers | $12,887.96 | Liberty Mutual | $8,630.14 | USAA | $2,395.86 | State Farm | $3,491.05 |

| 10 Least Expensive Cities in Pennsylvania | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bellefonte | $3,116.01 | Travelers | $5,623.33 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Houserville | $3,156.81 | Travelers | $6,027.64 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Park Forest Village | $3,205.35 | Travelers | $6,206.11 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Mifflinburg | $3,205.40 | Travelers | $5,668.37 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| Centre Hall | $3,207.80 | Travelers | $5,600.96 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | State Farm | $1,979.70 |

| University Park | $3,211.08 | Travelers | $6,155.13 | Liberty Mutual | $4,826.44 | USAA | $1,384.72 | Geico | $1,816.07 |

| Port Matilda | $3,212.75 | Travelers | $5,804.33 | Liberty Mutual | $5,301.56 | USAA | $1,385.22 | Geico | $1,816.07 |

| Carlisle | $3,217.14 | Travelers | $6,210.08 | Liberty Mutual | $4,364.46 | USAA | $1,561.10 | Geico | $1,897.92 |

| Lewisburg | $3,223.56 | Travelers | $5,861.05 | Liberty Mutual | $4,835.16 | USAA | $1,467.86 | Geico | $2,051.84 |

| Mount Holly Springs | $3,237.78 | Travelers | $6,004.88 | Liberty Mutual | $4,801.54 | USAA | $1,561.08 | Geico | $1,897.92 |

Philadelphia is the most populated city in Pennsylvania and also the most expensive city for car insurance. Bellefonte, a small town with a population of less than 6,500, is the cheapest area for car insurance.

Between these two cities, there is a difference of over $4,000.

As the ZIP code data showed, even within a city the rates can vary, but the costs for cities should give you a good idea of what you’ll be paying on your vehicle. (For more information, read our “Car Insurance Rates by City“).

Who are the Best Pennsylvania Car Insurance Companies?

With so many drivers on the roads these days, there’s an equally large number of car insurance companies. It can be difficult to find the right car insurance company for your needs, which is why we are going to break down Pennsylvania companies.

This way, you can pick a car insurance company that has the right services and rates for you.

So stick with us as we go through everything from companies’ financial ratings to costs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Financial Rating of the Largest Companies?

A company’s financial rating will give you a good idea of a company’s stability. To see what Pennsylvania’s companies’ financial ratings are, we are going to look at AM Best ratings.

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A | $1,779,915 | 63.70% | 20.35% |

| Erie Insurance Group | A+ | $1,153,856 | 64.93% | 13.19% |

| Allstate Insurance Group | A+ | $998,919 | 55.64% | 11.42% |

| Progressive Group | A+ | $875,579 | 58.55% | 10.01% |

| Nationwide Corp Group | A+ | $786,109 | 59.96% | 8.99% |

| Geico | A++ | $706,897 | 74.24% | 8.08% |

| Liberty Mutual Group | A | $424,106 | 61.06% | 4.85% |

| Travelers Group | A++ | $335,963 | 62.41% | 3.84% |

| USAA Group | A++ | $299,488 | 72.05% | 3.42% |

| Farmers Insurance Group | A | $192,162 | 74.14% | 2.20% |

All of the companies earned an A or higher (A++ is the highest possible), which means all the companies have a financial stability. Looking at the loss ratios confirms AM Best’s ratings, as all the loss ratios are great.

Which Companies have the Best Ratings?

While a stable financial future is great, another important part of a company’s success is customer satisfaction. JD Power’s recent study rates companies based on customer satisfaction surveys, which means JD Power is a good source to look at to see how well a company serves its customers.

Erie Insurance earned the highest customer satisfaction rating in Pennsylvania, with Geico close behind. Allstate had the lowest number of points, earning only 816 points out of 1,000.

We should note that USAA earned the highest rating, but wasn’t included with the other companies because USAA is only available for military personnel and their families.

Which Companies have the Most Complaints in Pennsylvania?

Since complaints go along with customer satisfaction, we want to take a look at the NAIC’s data on complaint ratios for the top largest companies in Pennsylvania.

| Company | 2017 Complaint Ratio | 2017 Number of Complaints |

|---|---|---|

| State Farm Group | 0.44 | 1,482 |

| Liberty Mutual Group | 5.95 | 222 |

| Allstate Insurance Group | 0.5 | 163 |

| Progressive Group | 0.75 | 120 |

| Nationwide Corp Group | 0.28 | 25 |

| Erie Insurance Group | 0.7 | 22 |

| Geico | 0 | 2 |

| Travelers Group | 0.09 | 2 |

| USAA Group | 0 | 2 |

| Farmers Insurance Group | 0 | 0 |

A high number of complaints doesn’t necessarily mean a company will have a high complaint ratio. While State Farm Group has a high number of complaints, the complainants only make up a small percentage of State Farm Group’s customers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

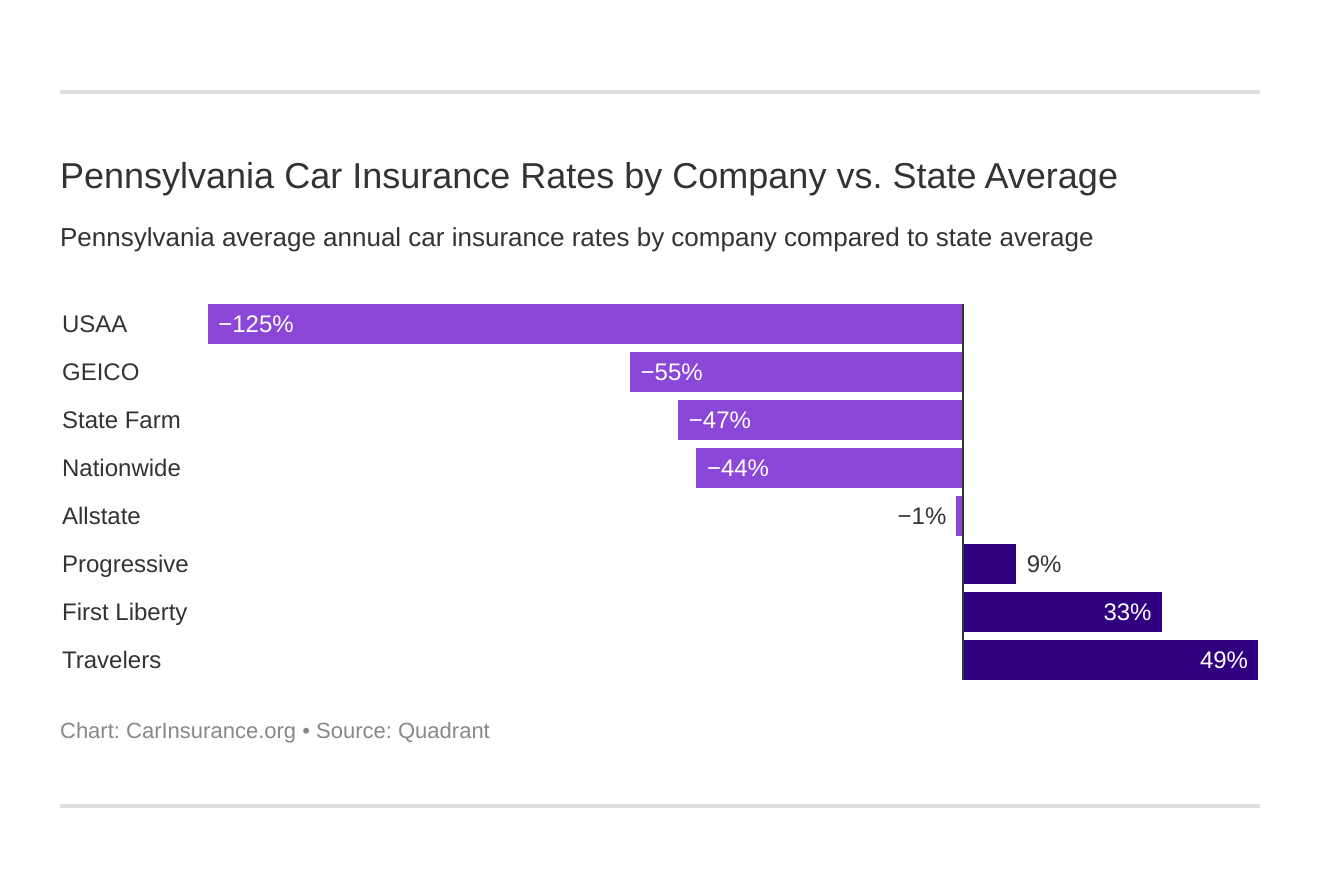

Who are the Cheapest Car Insurance Companies in Pennsylvania?

Shopping around for rates can save you a significant amount each year, which is why we are going to go through Quadrant Information Services data on everything that impacts rates. Let’s start by seeing which Pennsylvania companies have the cheapest car insurance rates.

| Company | Average Annual Rate | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Travelers Home & Marine Ins Co | $7,842.47 | $3,807.98 | 48.56% |

| First Liberty Ins Corp | $6,055.19 | $2,020.70 | 33.37% |

| Progressive Specialty | $4,451.00 | $416.50 | 9.36% |

| Allstate F&C | $3,984.12 | -$50.37 | -1.26% |

| Nationwide P&C | $2,800.37 | -$1,234.13 | -44.07% |

| State Farm Mutual Auto | $2,744.22 | -$1,290.27 | -47.02% |

| Geico Cas | $2,605.22 | -$1,429.28 | -54.86% |

| USAA | $1,793.37 | -$2,241.13 | -124.97% |

USAA and Geico have the cheapest rates in Pennsylvania, as they are significantly less than the state average.

Progressive is the most expensive out of the cheapest companies, costing almost 10 percent more than the state average in Pennsylvania.

What’s the Commute Rate by Companies?

Did you know that how far you drive can change your car insurance rates? Drivers with long commutes may find their insurers charge them a few hundred more.

Let’s see what Pennsylvania insurers charge based on commute distance.

| Group | 10 Miles Commute. 6,000 Annual Mileage. | 25 Miles Commute. 1,2000 Annual Mileage. |

|---|---|---|

| Travelers | $7,842.47 | $7,842.47 |

| Liberty Mutual | $5,900.24 | $6,210.14 |

| Progressive | $4,451.00 | $4,451.00 |

| Allstate | $3,904.16 | $4,064.08 |

| State Farm | $2,661.82 | $2,826.63 |

| Nationwide | $2,800.37 | $2,800.37 |

| Geico | $2,562.81 | $2,647.62 |

| USAA | $1,742.14 | $1,844.59 |

Travelers, Nationwide, and Progressive are the only companies who don’t increase rates based on commute distance, although Travelers has the highest rates, which means that a company that charges for commute distance will still be cheaper than Travelers.

As for companies that do increase costs, Liberty Mutual has the highest price increase — about $300.

Of course, don’t just go off of price increases. Instead, look at how much the final amount is when picking a provider. A company may have a high increase but still cost less than another company.

What are the Coverage Level Rates by Companies?

High coverage levels are always the best option in case of an accident, but the higher price tag most providers put on this coverage can make most consumers think twice.

To help you find a high coverage level at a reasonable cost, let’s take a look at companies’ prices.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,794.20 | $4,010.08 | $4,148.08 |

| Geico | $2,375.50 | $2,629.30 | $2,810.85 |

| Liberty Mutual | $5,760.21 | $6,098.96 | $6,306.41 |

| Nationwide | $2,751.91 | 2,813.46 | $2,835.74 |

| Progressive | $4,058.80 | $4,484.26 | $4,809.93 |

| State Farm | $2,566.42 | $2,780.67 | $2,885.58 |

| Travelers | $7,782.26 | $7,848.30 | $7,896.86 |

| USAA | $1,662.36 | $1,810.30 | $1,907.44 |

Progressive has the highest rate increase between low and high coverage, coming in at around $750. This isn’t terrible, but other companies have rate increases under a few hundred.

At Nationwide, for example, the price increase from low to high coverage is less than $100. This is a fantastic rate increase and makes Nationwide’s high coverage affordable for everyone.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

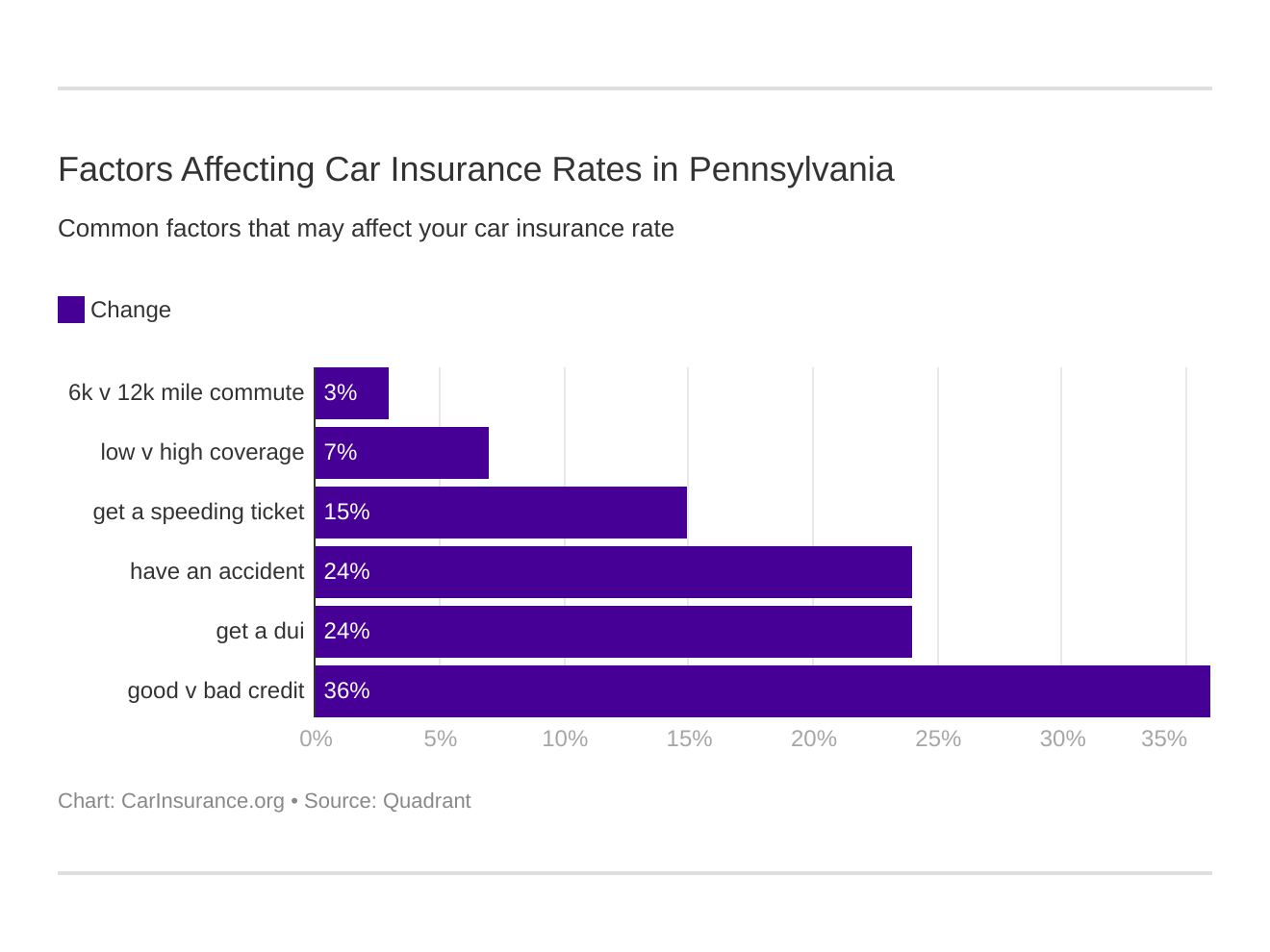

What are the Credit History Rates by Companies?

A credit score is vital in today’s world, as it is used for everything from bank loans to car insurance.

The average credit score in Pennsylvania is 687, which is higher than the national average of 675. This means most Pennsylvania residents have good credit scores.

A good credit score will save you hundreds a year, as insurers increase rates for poor and fair credit scores.

Below you can see rate increases for credit scores at Pennsylvania companies.

| Company | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $3,060.28 | $3,798.36 | $5,093.72 |

| Geico | $1,701.51 | $2,202.65 | $3,911.48 |

| Liberty Mutual | $4,895.54 | $5,542.86 | $7,727.18 |

| Nationwide | $2,411.94 | $2,701.68 | $3,287.49 |

| Progressive | $3,319.35 | $4,136.56 | $5,897.08 |

| State Farm | $1,909.14 | $2,418.55 | $3,904.98 |

| Travelers | $7,282.50 | $7,710.22 | $8,534.70 |

| USAA | $1,473.98 | $1,664.45 | $2,241.67 |

If you have a poor credit history, picking a company with the least amount of penalty is important. For example, Nationwide’s and USAA’s price increases from poor to bad credit are less than $1,000.

This may seem like a lot, but other companies in Pennsylvania add on thousands to drivers’ insurance premiums, such as Allstate’s almost $2,000-price increase from good to bad credit.

So make sure to shop around if you don’t have good credit.

What are the Driving Record Rates by Companies?

Just like your credit score, your driving record plays a significant part in how much you’ll pay for car insurance. Any DUIs, accidents, or speeding tickets on your record will increase your insurance premiums.

Below you can see just how much Pennsylvania companies increase their prices based on driving records.

| Company | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $3,813.11 | $3,813.11 | $4,497.16 | $3,813.11 |

| Geico | $1,916.13 | $2,653.35 | $3,282.78 | $2,568.60 |

| Liberty Mutual | $5,525.34 | $6,183.64 | $6,328.15 | $6,183.64 |

| Nationwide | $2,021.90 | $2,707.29 | $2,703.02 | $3,769.26 |

| Progressive | $4,034.71 | $4,045.00 | $5,570.34 | $4,153.94 |

| State Farm | $2,512.31 | $2,744.22 | $2,976.14 | $2,744.22 |

| Travelers | $5,566.16 | $7,914.42 | $7,914.42 | $9,974.88 |

| USAA | $1,442.82 | $1,612.21 | $1,992.43 | $2,126.01 |

Companies in Pennsylvania vary in what they deem the worst offense to be. For example, Geico charges more for a speeding violation than a DUI, while other companies charge more for a DUI or accident than a speeding violation.

Whatever companies charge for individual offenses, a bad driving record will cost drivers hundreds or thousands at insurance providers.

Keep in mind, too, that the table shows the average price increases for the first offense. Subsequent offenses will cost more.

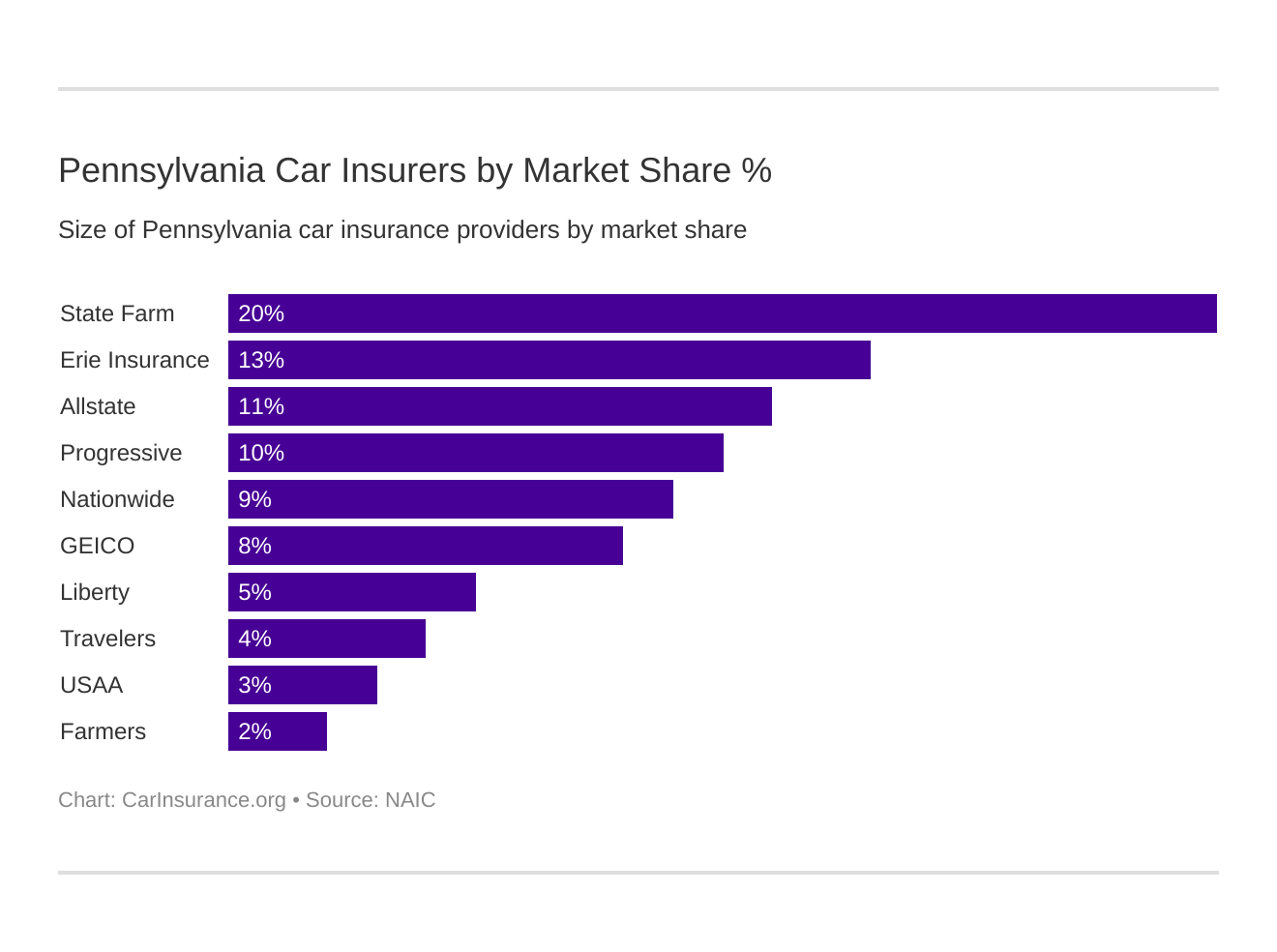

Who are the Largest Car Insurance Companies in State?

While we’ve gone through companies’ rates and customer satisfaction ratings, we want to take a look at the largest companies in Pennsylvania.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $1,779,915 | 63.70% | 20.35% |

| Erie Insurance Group | $1,153,856 | 64.93% | 13.19% |

| Allstate Insurance Group | $998,919 | 55.64% | 11.42% |

| Progressive Group | $875,579 | 58.55% | 10.01% |

| Nationwide Corp Group | $786,109 | 59.96% | 8.99% |

| Geico | $706,897 | 74.24% | 8.08% |

| Liberty Mutual Group | $424,106 | 61.06% | 4.85% |

| Travelers Group | $335,963 | 62.41% | 3.84% |

| USAA Group | $299,488 | 72.05% | 3.42% |

| Farmers Insurance Group | $192,162 | 74.14% | 2.20% |

State Farm has the largest market share in Pennsylvania, followed by Erie Insurance. Farmers Insurance has the smallest market share, but don’t let this turn you away.

A company’s loss ratio is important, and Farmers Insurance has a great loss ratio. All of the largest companies earned their spots on the list, as they all have good loss ratios that show a solid financial future.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

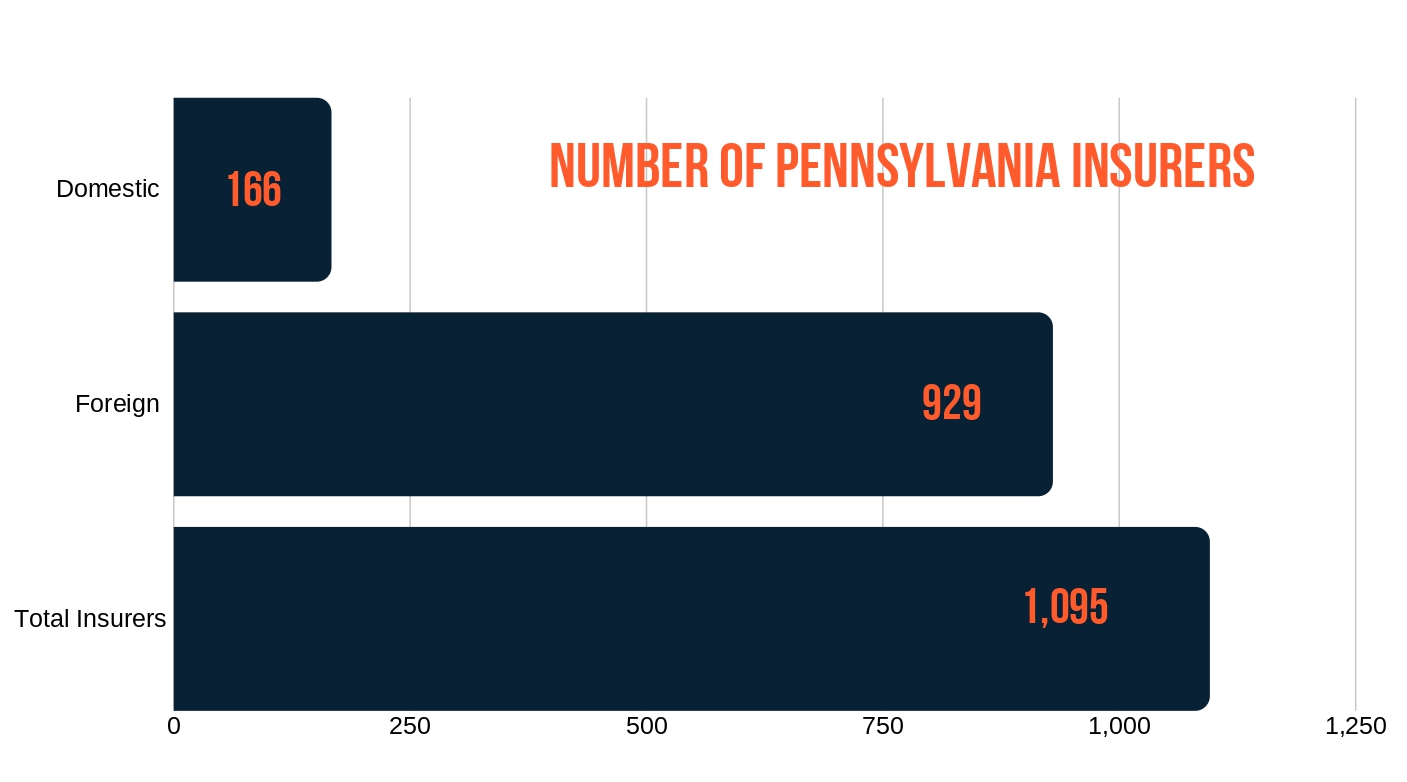

What’s the Number of Insurers in Pennsylvania?

While we’ve looked at the largest insurers in Pennsylvania, there are quite a few more insurers than we’ve previously shown you.

With over a thousand insurers to choose from, it’s important to narrow down your choices. If it helps, the difference between domestic and foreign is the following:

Domestic insurers are in-state (local to your area), while foreign insurers are out-of-state but still insure in your area.

So if you want a local provider, a domestic insurer may be for you. Pennsylvania has a large number of domestic insurers — some states have less than 10.

What are the Pennsylvania State Laws?

Every state has different driving laws, which can be confusing when you move to a new state. Unfortunately, cops won’t take ignorance as an excuse if you break a state driving law.

To help you avoid a ticket, we are going to go through the state laws in Pennsylvania that you need to know. So keep reading to learn about everything from Pennsylvania’s car insurance laws to driver safety laws.

What are the Car Insurance Laws?

As we mentioned before, every state has different requirements on what amounts of insurance you need to have on your vehicle. Not having the proper auto insurance coverage is breaking the law, which is why we are going to go into what Pennsylvania requires.

From how state laws are determined to who’s eligible for low-cost insurance, it’s all covered here. Let’s begin.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How State Laws for Insurance are Determined

According to the NAIC, the current rate filing law in Pennsylvania is that rates must have prior approval. This means that insurers must submit rates to a Pennsylvania state authority.

Before insurers can use rates, they must get approval from state authority. Because insurers take care of the legal side of rate approval, all you have to worry about is picking a provider with good rates.

How to Get Windshield Coverage

In Pennsylvania, the law doesn’t require insurers to replace windshields. However, comprehensive coverage will usually cover windshield repairs and replacements.

You also don’t have to use a specific repair shop of the insurer’s choosing, as you have the right to use whichever repair shop you want. It’s a good idea to get that windshield repaired promptly, as you could receive a ticket if a crack obscures your view of the road. (For more information, read our “Does Progressive cover windshield replacement?“).

How to Get High-Risk Insurance

High-risk insurance is for drivers who have severe violations on their records, such as DUIs. However, high-risk insurance is not required in Pennsylvania (some states make high-risk drivers purchase a high-risk plan).

Because insurers have the right to refuse high-risk drivers, though, drivers may have to turn to the Pennsylvania Assigned Risk Plan for car insurance.

Insurers must accept drivers who apply through the Pennsylvania Assigned Risk Plan, regardless of what’s on the drivers’ records. If you are a high-risk driver, make sure to shop around for rates at different providers, because high-risk insurance is expensive.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Low-Cost Insurance

Pennsylvania may have high-risk insurance, but it lacks a low-cost insurance program for low-income families.

Only three states have low-income car insurance programs: California, Hawaii, and New Jersey.

While Pennsylvania doesn’t offer a program for low-cost insurance, finding a provider with low rates will help make car insurance affordable.

Is There an Automobile Insurance Fraud in Pennsylvania?

Automobile insurance fraud is illegal in Pennsylvania. According to the Insurance Information Institute (iii), property and casualty insurance fraud equals about 30 billion a year.

The main ways people commit fraud are filing claims for accidents that never happened, adding fake costs onto an existing claim, or staging an accident.

Because insurance fraud is prevalent, Pennsylvania has four established fraud bureaus to catch fraudulent claims. If you want to learn more about insurance fraud, you can contact the Pennsylvania Insurance Department through their online contact form.

Although we can tell you that the best way to avoid committing an insurance fraud crime is to be honest about your claim.

What’s the Statute of Limitations?

After an accident happens, you only have a certain amount of time to file a claim (a statute of limitations). If you wait too long, your claim will be rejected. Why?

Because insurers and courts don’t want claims to drag on for years past the accident. Plus, details grow blurrier the longer the wait is between the accident and the claim.

So how long do you have to file a claim in Pennsylvania?

- Personal Injury: Two years

- Property Damage Liability coverage: Two years

Pennsylvania’s statute of limitations is fairly long, as you are allowed two years to file a claim. Of course, it’s always better to file a claim right away so you get the needed funds sooner.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What does the Pennsylvania Unfair Claims Settlement Practices mean?

Pennsylvania has a law called the Unfair Claims Settlement Practices. What does this mean?

Insurers are held to fair business practices. This means they are required to reply promptly to claims, as well as disclose all information to customers.

The complete disclosure of all information is important, as insurers may “forget” benefits that you are eligible for in a claim. The Unfair Claims Settlement Practices Act ensures insurers are held to ethical business standards.

What are the Vehicle Licensing Laws?

Just like coverage laws, states have different laws and procedures for vehicle licensing. If you aren’t familiar with a state’s laws, you may find yourself with an expired license.

To help you navigate vehicle licensing, we are going to go through everything from REAL ID to how often you need to renew your license. So let’s jump right in.

Is Real ID Required in Pennsylvania?

If you’ve recently been to an airport, you may have noticed signs advertising REAL ID. In Pennsylvania, REAL IDs will be required on October 1, 2020, if you want to do the following:

- Board a domestic commercial flight

- Enter a federal building

- Enter a military installation

If you don’t have a REAL ID, you won’t be able to fly out of Pennsylvania. Luckily, you may already have a REAL ID waiting for you if you got a driver’s license after September 1, 2003.

This is because PennDot will already have your required documents on file. If you got a driver’s license before 2003, you’ll need the following to apply for a REAL ID:

- Birth certificate or valid U.S. passport

- Social Security Card

- Two proofs of current Pennsylvania address

- Proof of legal name changes (if applicable)

A REAL ID is optional, but if you fly or enter federal/military buildings, you will need to get one. You don’t need a REAL ID to drive, vote, or any of the other things you use your driver’s license for.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Penalties for Driving Without Insurance?

Since car insurance is a legal requirement in Pennsylvania, officials will check for proof of insurance if you are pulled over or are in an accident. As a reminder, the following are acceptable proofs of insurance in Pennsylvania:

- Insurance ID card

- Declaration page of an issued insurance policy

- Valid insurance binder (temporary proof of insurance valid for 30 or 60 days)

- Copy of application for Pennsylvania Assigned Risk Plan

- Letter from your insurance carrier that verifies financial responsibility

If you don’t have insurance, there are penalties enforced by the state.

| Offense | Registration Suspension | Restoration Fee | Civil Penalty Fee |

|---|---|---|---|

| First Offense | 3 months (unless lapse was for less than 31 days and the vehicle was not operated during that time) | $88 plus proof of insurance required to get it back | $500 is optional in lieu of registration suspension plus $88 restoration fee — can only use this option once within a 12-month period. |

We should also note that insurers’ rates go up if they see insurance lapses on your record, so driving without insurance will cost you more than the fines shown above.

How do you know when PennDot is suspending your registration? PennDot should send you an intent to suspend registration letter if you have done any of the following:

- You didn’t respond to proof of insurance request.

- You didn’t provide proof of insurance within 30 days of the cancellation date of previous insurance.

- You didn’t submit a Statement of Non-Operation of Vehicle.

- You didn’t provide proof of insurance at the time of a traffic offense.

- You didn’t provide proof of insurance at the time of an accident.

Make sure to have proof of insurance on you at all times or you’ll have to fill out additional paperwork to prove you did have insurance after incidents.

What are the Teen Driver Laws?

Because teen drivers are inexperienced, there are laws in place to restrict their driving until they are prepared to drive alone. In Pennsylvania, teens must be at least 16-years-old to apply for a learner’s permit.

The Insurance Institute for Highway Safety (IIHS) lists restrictions for learner permit holders as the following:

| Pennsylvania Learner Permit Requirements for Getting a License | Time Restrictions |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 65 hours (10 must be at night and 5 must be in inclement weather) |

| Minimum Age | 16 years and 6 months |

Once learner permit holders complete the required time requirements and pass a driver’s test, they will have an intermediate driver’s license that has further restrictions.

| Pennsylvania Restrictions for Intermediate Licenses | Details |

|---|---|

| Nighttime restrictions | 11 p.m. to 5 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | First 6 months: no more than 1 passenger younger than 18 After 6 months: no more than 3 passengers |

| Minimum age at which restrictions may be lifted | Details |

| Nighttime restrictions | 12 months and age 17 (if completed driver education) or age 18 |

| Passenger restrictions | 12 months and age 17 (if completed driver education) or age 18 |

Pennsylvania intermediate drivers aren’t allowed to drive after 11 p.m., and they are only allowed to have a certain amount of passengers. These rules are intended to protect teen drivers by limiting dangerous driving conditions and distractions.

What are the License Renewal Procedures for Older Drivers?

Just like teen drivers, older drivers may have special licensing requirements. Let’s take a look at the licensing procedures for drivers older than 65.

| Renewal Cycle | Proof of Adequate Vision Required | Mail Renewal Permitted | Online Renewal Permitted |

|---|---|---|---|

| 2 or 4 years (depends on personal preference) | No | Yes | Yes |

Older drivers have the same renewal options as the general population, although they have the option to renew their license every two years instead of four.

Older drivers can also renew their licenses online or through the mail, which means they can skip on visits to the DMV.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Procedure for New Residents?

If you are new to Pennsylvania, you’ll have to go to a local DMV and get a Pennsylvania driver’s license. You’ll also need to contact your insurance provider with your change of address because your provider will need to change your rates and coverages to match Pennsylvania’s requirements.

So you can expect your rates to change if you move to Pennsylvania.

What is the License Renewal Procedure?

For those past their teen years and under the age of 65, the following license renewal procedures are in place:

| Renewal Cycle | Proof of Adequate Vision Required | Mail Renewal Permitted | Online Renewal Permitted |

|---|---|---|---|

| 4 years | No | Yes | Yes |

Drivers only have to renew their licenses every four years, and since it can be done through mail or online, you won’t have to go in-person.

What does the Negligent Operator Treatment System mean?

If you drive recklessly or carelessly and are caught, you will face penalties. Below are the penalties for driving recklessly in Pennsylvania.

| Offense | Crime Classification | Fine | Jail Time | License Suspension |

|---|---|---|---|---|

| First | Summary Offense | $200 | Up to 90 days | 6 months |

However, if you cause serious bodily injuries to another person by driving recklessly, the offenses are much stricter than the ones shown above. You will be charged with assault by vehicle, face up to seven years in prison, have a one-year license suspension, and pay up to $15,000 in fines.

Pennsylvania takes reckless driving seriously, as reckless driving endangers everyone on the road. Careless driving is also serious, though it carries lesser penalties than reckless driving.

| Offense | Crime Classification | Fine | Jail Time | License Suspension |

|---|---|---|---|---|

| Careless Driving | Summary Offense | Maximum $300 | Up to 90 days | None |

| Careless Driving that Caused Serious Bodily Injury to Another Person | Summary Offense | $250 $500 if caused death of another person | Up to 90 days | 6 months |

Please, be a careful driver. Not just to avoid fines but also to avoid injuring someone else or yourself.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Rules of the Road?

We want to help you be the safest driver possible, which is why we are going to cover must-know rules of the road in Pennsylvania. Not only will following the rules of the road help you avoid a driving ticket, but it will keep you and others safe.

So let’s jump into everything from seat belt laws to automation laws.

Is Pennsylvania at Fault or No-Fault State?

Before we get into laws, we want to clarify that Pennsylvania is a combination of no-fault and at-fault. No-fault means the insurers will cover you regardless of who caused the accident.

However, Pennsylvania is tricky because it also allows drivers to file at-fault claims.

You can choose to have no-fault insurance or at-fault insurance, so make sure to choose one that fits your needs best. If you want your insurer to cover you each time, pick no-fault.

If you want the driver who caused the accident to pay, then at-fault insurance may be a better option.

What are the Seat Belt and Car Seat Laws?

Buckling up is the law in Pennsylvania.

Let’s take a look at IIHS’s information on the seat belt and car seat laws.

| Pennsylvania Safety Belt Laws | Details |

|---|---|

| Effective Since | November 23, 1987 |

| Primary Enforcement | No (yes for children younger than 18) |

| Age/Seats Applicable | 18+ years old in front seat |

| 1st Offense Max Fine | $10 plus fees |

While seat belt enforcement isn’t primary in Pennsylvania (meaning officers need a reason besides seat belt use to pull you over), enforcement is primary for drivers and passengers under 18.

This means that if officers see drivers or passengers under 18 not wearing seat belts, they can pull the vehicle over and ticket the driver.

Now that we’ve covered seat belts, let’s take a look at laws for younger passengers.

| Type of Car Seat Required | Age/Weight |

|---|---|

| Rear-Facing Child Restraint | Younger than two years (until child outgrows manufacturer's age/weight recommendations) |

| Forward-Facing Child Restraint | Two to three years old |

| Child Booster Seat | Four to seven years old |

| Adult Belt Permissible | Eight through 17 years in all seats |

The fine for violating car seat laws is $75, significantly higher than the fine for seat belt violations. Seeing as these laws are made to keep children safe, the higher fine makes sense.

There are also restrictions in Pennsylvania on riding in the cargo areas of vehicles. The following types of passengers are exceptions to the prohibition on riding in cargo areas:

- People 18 and older (vehicle must be going less than 35 mph)

- People 17 and younger if the cargo area is enclosed

- Parade, hunting, and farm operations

Children are only allowed to ride in enclosed cargo areas because there is always a risk of being thrown from a vehicle (even when driving slow).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Keep Right and Move Over Laws?

The keep right law in Pennsylvania is simple. If you are traveling slower than the speed of traffic, keep to the right. Generally, the left lane should be for passing slower vehicles only.

The move over law is also simple, but it has the potential to save lives if all drivers follow it.

You must move over in the following circumstances (unless it’s not safe to do so, then you must slow down):

- When coming up on an emergency response area

- Tow trucks

- Utility vehicles

It’s also good practice to move over or slow down for any vehicle with flashing hazard lights, as someone may be walking around the vehicle.

If you ever pulled over with your hazard lights on and felt uncomfortable getting out of the vehicle with traffic speeding by, you can understand the importance of the move over law.

What’s the Speed Limit?

Speeding is one of the number-one cause of fatalities, which is why states have strictly enforced speed limits. Below are the speed limits for Pennsylvania.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 55 mph |

These are the maximum speed limits, which means you won’t get out of a ticket if you ignore a posted speed limit and argue the maximum is 70 mph.

The maximum speed limit is simply the highest speed limit that can be posted, so follow posted speed limits to avoid tickets and increased premiums.

How does Ridesharing work?

All rideshare drivers must have ridesharing insurance on their vehicles. If you are driving your vehicle for a service like Uber or Lyft, then you need to buy ridesharing insurance.

The following providers offer rideshare insurance in Pennsylvania.

- Erie

- Geico

- Liberty Mutual

- Progressive

Beyond ridesharing insurance, you’ll also have to pass rideshare companies’ requirements. Generally, this means you have to have a clean record and at least a few years of driving experience.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There an Automation on the Road?

Pennsylvania does have rules about the use of automated vehicles, although these regulations depend on the type of vehicle.

- Type of driving automation allowed on public roads: PennDot authorizes the testing of vehicles that are highly automated and deployment of work-zone vehicles that are highly automated. Effective since April 22, 2019.

- Operator license: Operators have to be licensed to test highly automated vehicles.

- Operators in vehicles: Operators do not have to be in work-zone vehicles that are highly automated.

Unless you have a highly automated vehicle, you won’t need to worry about Pennsylvania’s laws. Most vehicles today have some level of automation, such as lane departure warning, but these vehicles don’t count as automated vehicles.

What are the Safety Laws?

Safety laws are important, as they discourage drivers from driving drunk or distracted. A state that has strict safety laws will probably have fewer dangerous drivers on the road.

So let’s go through the major safety laws in Pennsylvania and the penalties for breaking them.

What are the DUI Laws?

When you’re drunk, you’re more likely to make poor decisions like cutting your hair or blowing through a stop sign. Drunk driving is extremely dangerous, but sometimes people are a poor judge of deciding if they’re sober or buzzed.

In 2017, there was a total of 314 alcohol-impaired driving fatalities in Pennsylvania.

Below are the details of the DAI law in Pennsylvania.

| DUI Law in Pennsylvania | Details |

|---|---|

| Name for Offense | Driving After Imbibing (DAI) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.16 |

| Criminal Status | 1st to 2nd offenses are misdemeanors; 3rd+ are second degree misdemeanors |

| Look Back Period | 10 years |

A lookback period is how long a DAI remains on your record. Pennsylvania has also put the following penalties in place to discourage drunk driving:

| Number of Offense | License Revocation | Jail Time | Fines | IID Lock | Other |

|---|---|---|---|---|---|

| 1st | No minimum | No minimum, but up to 6 months probation | $300 | NA | Alcohol highway safety school, treatment when ordered |

| 2nd | 1 year | 5 days to 6 months | $300 to $1,500 | 1 year | Alcohol highway safety school, treatment when ordered |

| 3rd | 1 year | 10 days to 2 years | $500 to $5,000 | 1 year | Treatment when ordered |

Remember that a DAI will raise insurance rates, and will cost drivers more than just the fines shown above.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Marijuana-Impaired Driving Laws?

Although medical marijuana has been legalized in the state, recreational marijuana is still illegal in Pennsylvania. Those with medical marijuana cards can drive as long as there is less than one nanogram of THC in their system.

THC is the active substance in marijuana that leads to inebriation and can make a person unsafe to drive.

This amount of THC is considered safe by the state, as any more will impair a driver’s ability to drive. The best rule of thumb is to not drive while even slightly high, as it’s impossible to determine the amount of THC in your system on your own.

Driving under the influence of marijuana will earn drivers the same penalties as drunk driving, such as fines, jail time, and license suspension.

What are the Distracted Driving Laws?

Distracted driving is another driving habit that is just as dangerous as impaired driving. Because of this, Pennsylvania has laws restricting drivers’ cellphone use in cars.

| Penalty | Banned Status |

|---|---|

| Hand-Held Ban | No |

| Young Drivers All Cellphone Ban | No |

| Texting Ban | Yes, all drivers |

| Enforcement | Primary |

Primary enforcement means law enforcement can pull drivers over if officers notice drivers texting. While Pennsylvania doesn’t have a hand-held ban (meaning you can use it for GPS or changing the music), it’s still a good idea to put the phone down in the car.

Some insurers even have safe-driving apps that reward you for not being on your phone in the car.

What’s Driving in Pennsylvania like?

There are always risks when you drive, no matter how good a driver you are. Inattentive drivers, iced-over roads, or an abundance of wildlife can all contribute to a crash.

Since every state has slightly different risks, being prepared for Pennsylvania’s road dangers can help you stay alert and avoid an accident.

For example, Pennsylvania is considered the likeliest state for deer collisions. Staying alert for deer during dusk and dawn can help you avoid a collision.

So let’s jump into the troublesome factors on Pennsylvania’s roads, from vehicle theft to traffic.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There a Vehicle Theft in Pennsylvania?

Any time you own something valuable, it is at risk of being stolen. If you own one of the following vehicles, be aware that it is one of the top 10 stolen vehicles in Pennsylvania:

| Make and Model | Vehicle Year | Total Thefts |

|---|---|---|

| Honda Accord | 1997 | 544 |

| Honda Civic | 1998 | 539 |

| Ford Pickup (Full Size) | 2006 | 303 |

| Toyota Camry | 2014 | 269 |

| Nissan Altima | 2015 | 261 |

| Chevrolet Impala | 2006 | 224 |

| Toyota Corolla | 2014 | 210 |

| Chevrolet Pickup (Full Size) | 2003 | 203 |

| Jeep Cherokee/Grand Cherokee | 1999 | 188 |

| Chevrolet Malibu | 2015 | 159 |

The vehicle year simply means that’s the most popular model year stolen. For example, there were 544 Honda Accords stolen (covering a wide range of years), but the most-popular majority stolen was 1997 Honda Accords.

Let’s dig a little deeper by looking at the FBI’s 2013 report on the number of vehicles stolen by city.

| Pennsylvania Cities | 2013 Total Motor Vehicle Thefts |

|---|---|

| Abington Township, Montgomery County | 25 |

| Adamstown | 1 |

| Adams Township, Butler County | 2 |

| Adams Township, Cambria County | 1 |

| Akron | 0 |

| Albion | 0 |

| Alburtis | 0 |

| Aldan | 3 |

| Aleppo Township | 0 |

| Aliquippa | 13 |

| Allegheny Township, Blair County | 3 |

| Allentown | 306 |

| Altoona | 43 |

| Ambler | 5 |

| Ambridge | 12 |

| Amity Township | 7 |

| Annville Township | 0 |

| Apollo | 0 |

| Archbald | 2 |

| Armagh Township | 0 |

| Arnold | 12 |

| Ashland | 4 |

| Ashley | 1 |

| Ashville | 0 |

| Aspinwall | 0 |

| Aston Township | 6 |

| Athens | 0 |

| Athens Township | 2 |

| Avalon | 6 |

| Avis | 0 |

| Avoca | 1 |

| Avondale | 0 |

| Avonmore Boro | 0 |

| Baden | 0 |

| Baldwin Borough | 10 |

| Baldwin Township | 1 |

| Bally | 0 |

| Bangor | 2 |

| Beallsville | 0 |

| Beaver | 4 |

| Beaver Falls | 14 |

| Beaver Meadows | 0 |

| Bedford | 1 |

| Bedminster Township | 1 |

| Bell Acres | 0 |

| Bellefonte | 0 |

| Bellevue | 11 |

| Bellwood | 1 |

| Ben Avon | 0 |

| Ben Avon Heights | 0 |

| Bensalem Township | 70 |

| Bentleyville | 1 |

| Benton Area | 0 |

| Berlin | 0 |

| Bern Township | 6 |

| Bernville | 0 |

| Berwick | 5 |

| Bessemer | 0 |

| Bethel Park | 6 |

| Bethel Township, Berks County | 2 |

| Bethel Township, Delaware County | 0 |

| Bethlehem | 48 |

| Bethlehem Township | 19 |

| Biglerville | 0 |

| Birdsboro | 2 |

| Birmingham Township | 0 |

| Blacklick Township | 0 |

| Blairsville | 2 |

| Blair Township | 0 |

| Blakely | 1 |

| Blawnox | 0 |

| Bloomsburg Town | 2 |

| Blossburg | 0 |

| Bonneauville | 2 |

| Boyertown | 2 |

| Brackenridge | 3 |

| Braddock | 7 |

| Braddock Hills | 0 |

| Bradford | 5 |

| Bradford Township | 0 |

| Branch Township | 1 |

| Brecknock Township, Berks County | 0 |

| Brentwood | 4 |

| Briar Creek Township | 1 |

| Bridgeport | 2 |

| Bridgeville | 0 |

| Bridgewater | 0 |

| Brighton Township | 0 |

| Bristol | 8 |

| Bristol Township | 85 |

| Brockway | 0 |

| Brookhaven | 5 |

| Brookville | 0 |

| Brownsville | 2 |

| Bryn Athyn | 0 |

| Buckingham Township | 3 |

| Buffalo Township | 0 |

| Buffalo Valley Regional | 0 |

| Burgettstown | 0 |

| Bushkill Township | 0 |

| Butler | 17 |

| Butler Township, Butler County | 5 |

| Butler Township, Luzerne County | 4 |

| Butler Township, Schuykill County | 2 |

| Caernarvon Township, Berks County | 3 |

| California | 2 |

| Callery | 0 |

| Caln Township | 17 |

| Cambria Township | 2 |

| Cambridge Springs | 0 |

| Camp Hill | 2 |

| Canonsburg | 0 |

| Canton | 0 |

| Carbondale | 2 |

| Carlisle | 5 |

| Carnegie | 0 |

| Carrolltown | 0 |

| Carroll Township, Washington County | 3 |

| Carroll Township, York County | 5 |

| Carroll Valley | 0 |

| Cass Township | 1 |

| Castle Shannon | 2 |

| Catasauqua | 7 |

| Catawissa | 0 |

| Cecil Township | 1 |

| Center Township | 0 |

| Centerville | 0 |

| Central Berks Regional | 5 |

| Central Bucks Regional | 4 |

| Chambersburg | 17 |

| Charleroi Regional | 0 |

| Chartiers Township | 1 |

| Cherry Tree | 0 |

| Chester | 141 |

| Chester Township | 15 |

| Cheswick | 0 |

| Chippewa Township | 1 |

| Christiana | 2 |

| Churchill | 2 |

| Clairton | 19 |

| Clarion | 0 |

| Clarks Summit | 1 |

| Clearfield | 3 |

| Cleona | 0 |

| Clifton Heights | 10 |

| Clymer | 0 |

| Coaldale | 0 |

| Coal Township | 5 |

| Coatesville | 21 |

| Cochranton | 0 |

| Colebrookdale District | 0 |

| Collegeville | 3 |

| Collier Township | 3 |

| Collingdale | 24 |

| Colonial Regional | 7 |

| Columbia | 5 |

| Colwyn | 9 |

| Conemaugh Township, Cambria County | 0 |

| Conemaugh Township, Somerset County | 0 |

| Conewago Township, Adams County | 2 |

| Conewango Township | 0 |

| Conneaut Lake Regional | 2 |

| Connellsville | 11 |

| Conoy Township | 2 |

| Conshohocken | 4 |

| Conway | 5 |

| Conyngham | 0 |

| Coopersburg | 3 |

| Coplay | 0 |

| Coraopolis | 3 |

| Cornwall | 0 |

| Corry | 2 |

| Coudersport | 0 |

| Courtdale | 0 |

| Covington Township | 2 |

| Crafton | 5 |

| Cranberry Township | 7 |

| Crescent Township | 0 |

| Cresson | 0 |

| Cresson Township | 0 |

| Croyle Township | 0 |

| Cumberland Township, Adams County | 6 |

| Cumberland Township, Greene County | 9 |

| Cumru Township | 7 |

| Curwensville | 1 |

| Dallas | 0 |

| Dallas Township | 0 |

| Dalton | 0 |

| Danville | 4 |

| Darby | 37 |

| Darby Township | 16 |

| Darlington Township | 1 |

| Decatur Township | 0 |

| Delano Township | 0 |

| Delaware Water Gap | 0 |

| Delmont | 0 |

| Denver | 1 |

| Derry | 0 |

| Derry Township, Dauphin County | 4 |

| Dickson City | 5 |

| Donegal Township | 2 |

| Donora | 0 |

| Dormont | 6 |

| Douglass Township, Berks County | 2 |

| Douglass Township, Montgomery County | 1 |

| Downingtown | 6 |

| Doylestown Township | 2 |

| Dublin Borough | 1 |

| Du Bois | 1 |

| Duboistown | 0 |

| Dunbar | 0 |

| Duncansville | 0 |

| Dunnstable Township | 0 |

| Dupont | 0 |

| Duquesne | 26 |

| Duryea | 4 |

| Earl Township | 12 |

| East Bangor | 0 |

| East Berlin | 0 |

| East Brandywine Township | 1 |

| East Cocalico Township | 1 |

| East Conemaugh | 1 |

| East Coventry Township | 2 |

| East Deer Township | 0 |

| East Earl Township | 2 |

| Eastern Adams Regional | 3 |

| Eastern Pike Regional | 2 |

| East Fallowfield Township | 2 |

| East Franklin Township | 0 |

| East Hempfield Township | 1 |

| East Lampeter Township | 14 |

| East Lansdowne | 1 |

| East Marlborough Township | 0 |

| East McKeesport | 1 |

| East Norriton Township | 3 |

| Easton | 25 |

| East Pennsboro Township | 7 |

| East Petersburg | 4 |

| East Pikeland Township | 3 |

| East Pittsburgh | 14 |

| East Rochester | 0 |

| East Taylor Township | 0 |

| Easttown Township | 4 |

| East Union Township | 1 |

| East Vincent Township | 1 |

| East Washington | 0 |

| East Whiteland Township | 5 |

| Ebensburg | 1 |

| Economy | 1 |

| Eddystone | 3 |

| Edgewood | 2 |

| Edgeworth | 0 |

| Edinboro | 2 |

| Edwardsville | 1 |

| Elderton | 0 |

| Elizabeth | 4 |

| Elizabethtown | 2 |

| Elizabeth Township | 0 |

| Elkland | 3 |

| Elk Lick Township | 0 |

| Ellwood City | 5 |

| Emlenton Borough | 1 |

| Emmaus | 24 |

| Emporium | 0 |

| Emsworth | 0 |

| Ephrata | 5 |

| Ephrata Township | 4 |

| Erie | 108 |

| Etna | 4 |

| Evans City-Seven Fields Regional | 0 |

| Everett | 0 |

| Everson | 0 |

| Exeter | 3 |

| Exeter Township, Berks County | 8 |

| Fairfield | 0 |

| Fairview Township, Luzerne County | 0 |

| Fairview Township, York County | 1 |

| Falls Township, Bucks County | 39 |

| Farrell | 6 |

| Fawn Township | 2 |

| Fayette City | 0 |

| Ferguson Township | 4 |

| Ferndale | 0 |

| Findlay Township | 2 |

| Fleetwood | 6 |

| Folcroft | 17 |

| Ford City | 0 |

| Forest City | 0 |

| Forest Hills | 9 |

| Forks Township | 2 |

| Forty Fort | 1 |

| Forward Township | 2 |

| Foster Township, McKean County | 0 |

| Foster Township, Schuykill County | 0 |

| Fountain Hill | 4 |

| Fox Chapel | 0 |

| Frackville | 1 |

| Franconia Township | 3 |

| Franklin | 6 |

| Franklin Park | 0 |

| Franklin Township, Beaver County | 1 |

| Franklin Township, Carbon County | 1 |

| Franklin Township, Columbia County | 0 |

| Frazer Township | 0 |

| Freedom | 3 |

| Freedom Township | 0 |

| Freemansburg | 2 |

| Freeport | 0 |

| Gaines Township | 0 |

| Galeton | 0 |

| Gallitzin | 0 |

| Gallitzin Township | 0 |

| Garrett | 0 |

| Geistown | 2 |

| Gettysburg | 1 |

| Gilpin Township | 0 |

| Girard | 4 |

| Girardville | 0 |

| Glassport | 7 |

| Glenolden | 17 |

| Granville Township | 0 |

| Great Bend | 0 |

| Greencastle | 1 |

| Greenfield Township, Blair County | 1 |

| Greensburg | 4 |

| Green Tree | 1 |

| Greenville | 4 |

| Greenwood Township | 0 |

| Grove City | 2 |

| Halifax | 0 |

| Hamburg | 3 |

| Hampden Township | 4 |

| Hampton Township | 1 |

| Hanover | 6 |

| Hanover Township, Luzerne County | 4 |

| Harmar Township | 4 |

| Harmony Township | 2 |

| Harrisburg | 183 |

| Harrison Township | 4 |

| Harrisville | 0 |

| Hartleton | 0 |

| Harveys Lake | 2 |

| Hastings | 1 |

| Hatboro | 6 |

| Hatfield Township | 8 |

| Haverford Township | 16 |

| Hawley | 0 |

| Hazleton | 31 |

| Hegins Township | 1 |

| Heidelberg | 0 |

| Heidelberg Township, Berks County | 0 |

| Hellam Township | 3 |

| Hellertown | 1 |

| Hemlock Township | 1 |

| Hempfield Township, Mercer County | 1 |

| Hermitage | 8 |

| Hickory Township | 0 |

| Highland Township | 0 |

| Highspire | 0 |

| Hilltown Township | 7 |

| Hollidaysburg | 2 |

| Homer City | 0 |

| Homestead | 18 |

| Honesdale | 2 |

| Honey Brook | 2 |

| Hooversville | 0 |

| Hopewell Township | 4 |

| Horsham Township | 14 |

| Houston | 0 |

| Hughestown | 1 |

| Hughesville | 0 |

| Hulmeville | 1 |

| Hummelstown | 0 |

| Huntingdon | 0 |

| Independence Township, Beaver County | 4 |

| Independence Township, Washington County | 0 |

| Indiana | 4 |

| Indiana Township | 1 |

| Indian Lake | 0 |

| Ingram | 2 |

| Irwin | 0 |

| Ivyland | 0 |

| Jackson Township, Cambria County | 0 |

| Jackson Township, Luzerne County | 0 |

| Jamestown | 0 |

| Jeannette | 0 |

| Jefferson Hills Borough | 1 |

| Jefferson Township, Lackawanna County | 0 |

| Jefferson Township, Mercer County | 0 |

| Jefferson Township, Washington County | 0 |

| Jenkins Township | 1 |

| Jenkintown | 1 |

| Jennerstown | 0 |

| Jermyn | 4 |

| Jessup | 3 |

| Jim Thorpe | 5 |

| Johnsonburg | 2 |

| Johnstown | 25 |

| Kane | 1 |

| Kenhorst | 3 |

| Kennedy Township | 2 |

| Kennett Square | 10 |

| Kennett Township | 2 |

| Kidder Township | 0 |

| Kilbuck Township | 0 |

| Kingston | 7 |

| Kingston Township | 1 |

| Kiskiminetas Township | 0 |

| Kittanning | 9 |

| Kline Township | 1 |

| Knox | 0 |

| Koppel | 1 |

| Kulpmont | 1 |

| Kutztown | 1 |

| Lake City | 0 |

| Lamar Township | 1 |

| Lancaster | 105 |

| Lancaster Township, Butler County | 0 |

| Lancaster Township, Lancaster County | 25 |

| Lanesboro | 0 |

| Langhorne Manor | 0 |

| Lansdale | 6 |

| Lansdowne | 18 |

| Lansford | 7 |

| Larksville | 1 |

| Latimore Township | 0 |

| Latrobe | 4 |

| Laureldale | 3 |

| Lawrence Park Township | 0 |

| Lawrence Township, Clearfield County | 6 |

| Lawrence Township, Tioga County | 0 |

| Lawrenceville | 0 |

| Lebanon | 23 |

| Leechburg | 5 |

| Leetsdale | 0 |

| Leet Township | 1 |

| Lehighton | 5 |

| Lehigh Township, Northampton County | 3 |

| Lehigh Township, Wayne County | 0 |

| Lehman Township | 1 |

| Lewistown | 5 |

| Liberty | 0 |

| Liberty Township, Adams County | 0 |

| Ligonier | 0 |

| Ligonier Township | 3 |

| Limerick Township | 7 |

| Lincoln | 0 |

| Linesville | 0 |

| Lititz | 1 |

| Little Beaver Township | 0 |

| Littlestown | 0 |

| Lock Haven | 2 |

| Locust Township | 0 |

| Logan Township | 5 |

| Loretto | 0 |

| Lower Allen Township | 4 |

| Lower Burrell | 4 |

| Lower Chichester Township | 10 |

| Lower Frederick Township | 0 |

| Lower Gwynedd Township | 9 |

| Lower Heidelberg Township | 2 |

| Lower Mahanoy Township | 0 |

| Lower Makefield Township | 6 |

| Lower Merion Township | 46 |

| Lower Moreland Township | 9 |

| Lower Paxton Township | 21 |

| Lower Pottsgrove Township | 4 |

| Lower Providence Township | 11 |

| Lower Salford Township | 4 |

| Lower Saucon Township | 2 |

| Lower Southampton Township | 19 |

| Lower Swatara Township | 0 |

| Lower Windsor Township | 2 |

| Luzerne Township | 0 |

| Lykens | 0 |

| Macungie | 0 |

| Madison Township | 0 |

| Mahanoy City | 0 |

| Mahanoy Township | 0 |

| Mahoning Township, Carbon County | 6 |

| Mahoning Township, Lawrence County | 0 |