New York Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 6.1

Like in most states, insurance in New York is a must. One thing that might surprise you though is the average rate quote for car insurance in New York and all of the factors that go into determining that rate.

With so many car insurance options, you can feel a little confused and wonder where to turn. What’s the cheapest car insurance in NY? Which company offers the most coverage? Are rates different in New York City compared to upstate New York?

We made this car insurance guide to answer those and many other auto insurance-related questions. Among the information it offers is New York car insurance rates, companies, the factors that set prices, laws, and traffic statistics.

If you’re ready to dive in, let’s get started. Looking to buy New York car insurance? If you want to start exploring NY car insurance quotes, enter your ZIP to get free quotes from New York car insurance companies.

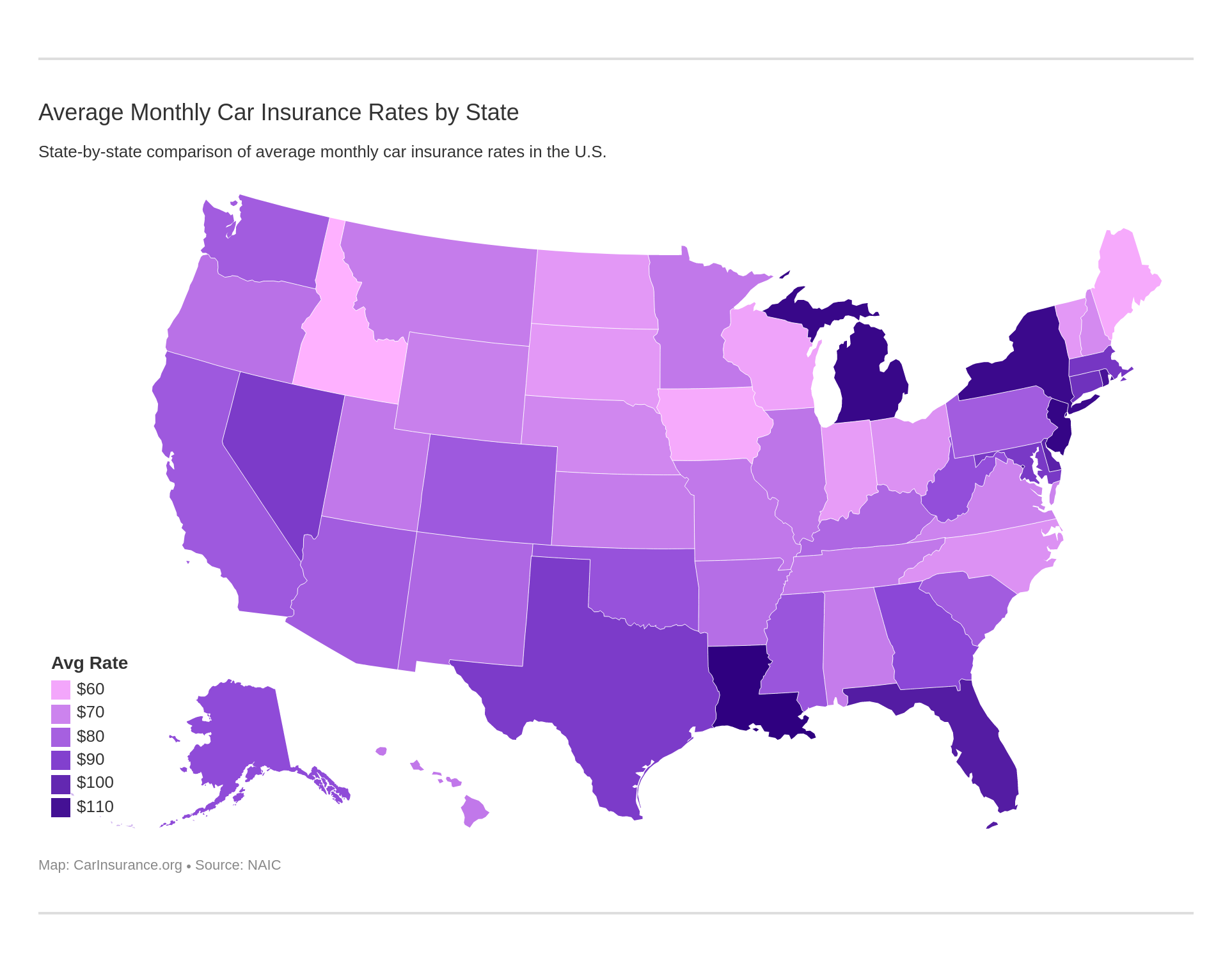

How much are average monthly car insurance rates in NY (liability, collision, comprehensive)?

The below car insurance aggregator from the National Association of Insurance Commissioners (NAIC) shows the price ranges from liability to full coverage. Expect the cost of car insurance to continue to rise in 2019 and beyond.

This table shows you the average rate quote car insurance in New York.

| Core Car Insurance Coverage in New York | |

|---|---|

| Liability | $804.51 |

| Collision | $385.02 |

| Comprehensive | $171.12 |

| Full Coverage | $1,360.66 |

The average cost of New York car insurance tends to cost more than the national average, which isn’t too surprising given that the Empire State ranks as the fourth-most-expensive for full coverage insurance.

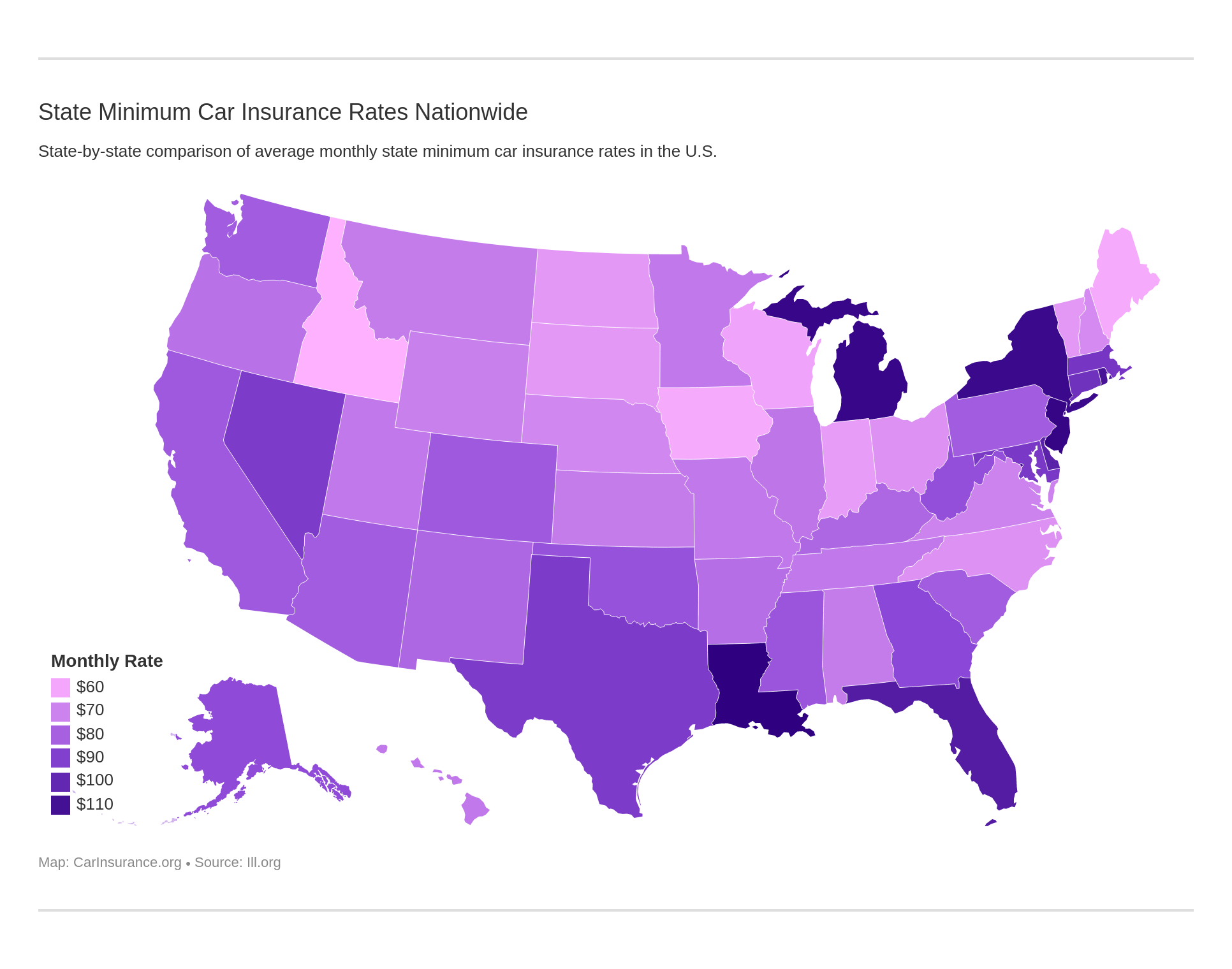

As we mentioned earlier, New York has minimum insurance coverage requirements.

If possible, the insurance experts suggest buying more than the minimum amount required. If you want more information about additional coverage, you’ll find it in the next two sections.

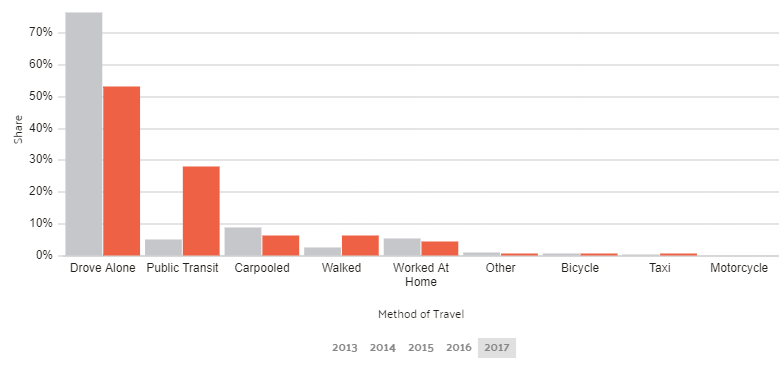

While rates may be higher in New York City, the rates don’t affect the average as much as you might think. A good number of New York City residents don’t have cars, instead opting for public transportation. While upstate New York may not be as crowded, insurers have to consider weather, crime rates, claim rates, and many other factors when issuing auto insurance quotes.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are New York’s minimum coverage requirements for car insurance?

New York is a no-fault insurance state. That means that if another driver causes an accident that harms you, you must file a claim with your own car insurance company to pay your medical bills and damages. It also means you don’t have to wait for the other side to settle their books to get repairs, medical bills, and your rental car paid for. Generally speaking, drivers give up their right to sue over normal damages.

New York minimum auto insurance coverage requires drivers to have minimum liability insurance to pay for accident claims. Per New York law, your insurance coverage must meet these requirements:

- $25,000 of liability coverage for bodily injury per person when you cause a car accident

- $50,000 of total liability bodily injury coverage per accident you cause regardless of how many people are injured

- $10,000 of liability coverage for property damage (per accident you cause)

- $50,000 in no-fault (personal injury protection) coverage

- Uninsured motorist coverage for bodily injury you sustain, limit to match bodily injury coverage

NOLO states that New York’s no-fault car insurance system applies to personal injuries from car accidents, not vehicle damage. You can, however, file a claim for vehicle damage (or a total loss) against the driver responsible, without limitations.

One way to avoid filing a potential lawsuit is to know how much insurance you need for your car and buy more than the minimum required to pay for all your injuries or vehicle damage. Otherwise, you may have to pay or file a case for compensation.

While you’re legally required to carry liability coverage, many drivers also choose to carry collision, comprehensive, and PIP coverage. These premiums cover your auto and medical bills even if you were at fault. Insurance companies work it out with each other in the background. Collision coverage only covers things that are directly collision related. So weather events, animal accidents, and other damage would only be covered under comprehensive coverage.

What are acceptable car insurance forms of financial responsibility?

New York law requires drivers to carry proof of insurance or financial responsibility. Drivers who can’t provide proof will have their licenses suspended.

Acceptable forms of proof of insurance are:

- A paper or electronic insurance ID card

- A copy of your current car’s insurance policy

- A valid insurance binder (a temporary form of car insurance)

- Surety bond

- Register as a self-insurer (if you own 25 vehicles or more)

- Cash/security deposit of $150,000 or more with the Department of Motor Vehicles (DMV)

Any of these are easy to carry in your vehicle or on your phone. If you do not have the proof on hand, officers may issue a ticket requiring you to provide the state with proof of insurance or have your license suspended.

How much are NY car insurance rates as a percentage of income?

In 2014, the average New Yorker’s disposable after-tax income was $47,446. Compare that to the average cost of an annual full coverage rate, $1,327.82. Nearly 3 percent of residents’ annual income goes to car insurance.

Americans themselves pay an average of $981.77 yearly for full coverage. New York’s rates cost nearly $400 more.

Compared to neighboring Pennsylvania, New Jersey, Rhode Island, Connecticut, Massachusetts, and Vermont, only residents in the last three states paid less than New Yorkers.

CalculatorPro

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What additional coverage options are available for NY car insurance?

The data below from the NAIC centers on more accident coverage options: MedPay, Personal Injury Protection (PIP), and uninsured/underinsured motorist coverage.

| Additional Liability Coverage in New York | Loss Ratio - 2012 | Loss Ratio - 2013 | Loss Ratio - 2014 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 66.08% | 68.92% | 66.66% |

| Medical Payments (Med Pay) | 49.41% | 53.61% | 64.49% |

| Uninsured/Underinsured Motorist Coverage | 53.69% | 53.84% | 47.49% |

A loss ratio measures how much a company pays in claims to how much it earns in rates.

Looking at the percentages, if a company has a loss ratio of over 100 percent, it pays more in claims than it earns. However, if the loss ratio is too low, at 40 percent, the company pays fewer claims. Companies with ratios that aren’t too high or too low have a balance of profits versus losses.

As shown above, the loss ratios from 2012 – 2014 are low, which could mean insurance companies don’t pay all the claims they receive. PIP coverage requirements could affect these numbers, as insurance companies may pay those claims first.

New York ranks 50th in the U.S. for uninsured drivers — 6.10% of Empire State drivers are uninsured. Though the number is fairly low compared to other states (because New York requires it), you don’t want to be one of them.

The state requires this coverage as part of its “no-fault” insurance system, and it helps pay for damages uninsured or underinsured motorists may cause.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What add-ons, endorsements, and riders are available for NY car insurance?

Below is more coverage you can add to a basic car insurance plan.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Pay-as-You Drive or Usage-Based Insurance

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Among Pay-As-You-Go or Usage-Based insurers, Allstate’s Drivewise program operates in New York. Drivers who qualify may receive discounts of up to 30 percent. The program tracks users’ driving habits through a telematics device installed in the vehicle’s diagnostic port.

If you avoid speeds of 80 miles per hour or above and drive less than 30 miles daily outside of 10 p.m. – 4 a.m. without hard braking, you may get the maximum discount. Users must operate their vehicles at least 90 days over six months to qualify for the discount.

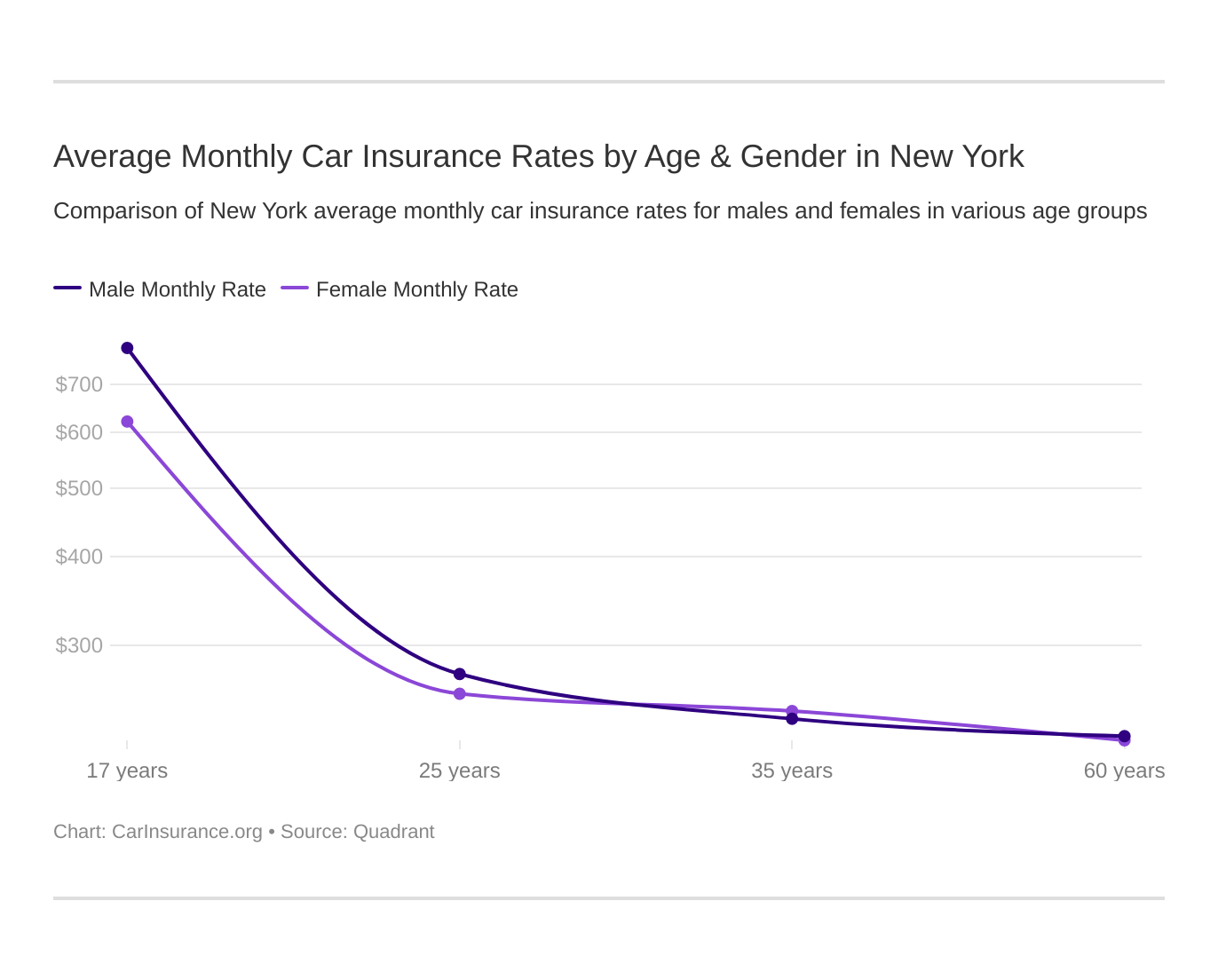

What are average monthly NY car insurance rates by age & gender?

We’ve partnered with Quadrant to bring you the data below. It’s based on coverage the state population has purchased, and it includes rates for high-risk drivers and those who choose to buy more than the state minimum. That covers other types of insurance the state doesn’t require.

As you’ll see below, gender is a major factor in setting car insurance rates, but age affects them, as well.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,193.78 | $2,980.04 | $3,012.93 | $3,052.97 | $9,411.78 | $10,059.13 | $3,106.83 | $3,110.26 |

| Geico | $1,775.96 | $1,709.98 | $1,723.35 | $1,698.04 | $3,737.26 | $5,542.24 | $1,598.20 | $1,640.87 |

| Liberty Mutual | $4,808.02 | $4,808.02 | $4,476.84 | $4,476.84 | $9,371.20 | $14,468.63 | $4,808.02 | $5,108.28 |

| Nationwide | $3,003.69 | $3,003.69 | $2,829.30 | $2,829.30 | $5,431.46 | $8,143.12 | $3,003.69 | $3,859.22 |

| Progressive | $2,317.74 | $2,134.30 | $1,831.64 | $1,867.64 | $7,736.99 | $8,515.77 | $2,948.94 | $2,816.17 |

| State Farm | $2,838.51 | $2,838.51 | $2,481.13 | $2,481.13 | $8,316.70 | $10,504.50 | $3,126.63 | $3,289.54 |

| Travelers | $3,320.74 | $3,298.93 | $3,020.14 | $3,202.94 | $7,651.80 | $9,050.23 | $3,491.99 | $3,593.56 |

| USAA | $1,961.37 | $1,928.07 | $1,776.70 | $1,780.28 | $7,919.49 | $9,428.85 | $2,515.85 | $2,782.87 |

Males in New York generally pay more than females for car insurance, but married men, who are less of a risk to insure, pay almost the same as married women.

Agewise, insurers tend to charge drivers 25 and younger, often with less experience than older drivers, more for car insurance. Auto insurance for a 25-year-old female tends to be less than that for the male counterpart.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the car insurance rates in New York’s 10 largest cities?

Did you know that where you live is one of the car insurance factors affecting the price you pay?

Below are prices in the 10 most and least-expensive Empire State cities.

| Ten Most Expensive Cities | Ten Least Expensive Cities | ||||

|---|---|---|---|---|---|

| City | Zip Code | Average Rate | City | Zip Code | Average Rates |

| Brooklyn | 11212 | $10,751.24 | Vestal | 13850 | $2,833.83 |

| Bronx | 11243 | $9,334.68 | Campbell | 14826 | $2,812.93 |

| Jamaica | 11436 | $9,024.16 | Elmira | 14901 | $2,791.13 |

| St. Albans | 11412 | $9,000.94 | Wellsburg | 14894 | $2,790.81 |

| Rosedale | 11422 | $8,885.68 | Lordsburg | 14871 | $2,789.24 |

| South Ozone Park | 11420 | $8,881.66 | Elmira | 14904 | $2,788.48 |

| Springfield Gardens | 11413 | $8,874.63 | Painted Post | 14870 | $2,761.36 |

| South Richmond Hill | 11419 | $8,831.46 | Big Flats | 14814 | $2,757.47 |

| Far Rockaway | 11691 | $8,814.12 | Horseheads | 14845 | $2,753.21 |

| Arverne | 11692 | $8,802.18 | Corning | 14830 | $2,729.58 |

From the most expensive city — or borough — Brooklyn, to the least expensive, Corning, the price difference is $8,000.

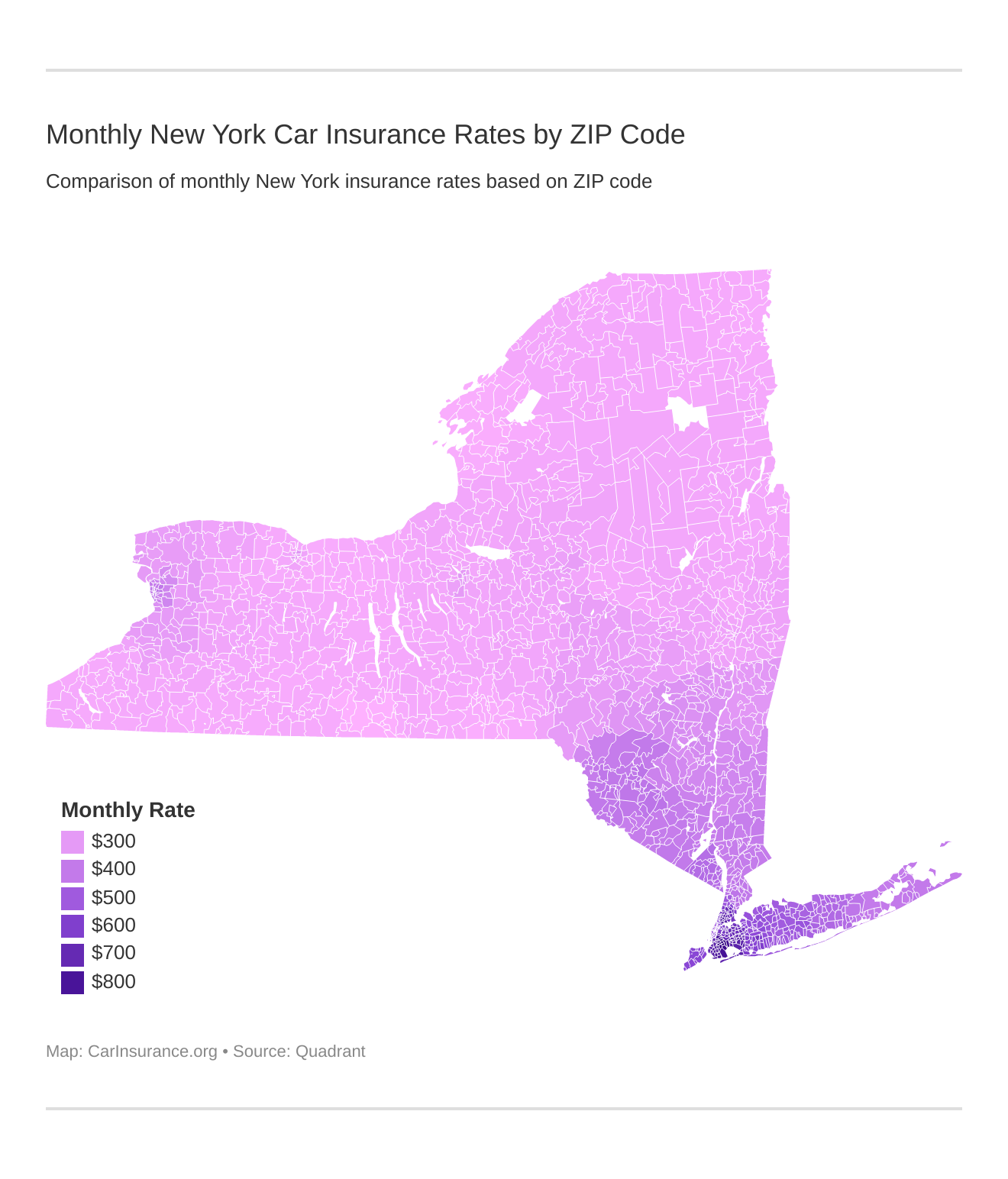

Where are the cheapest NY auto insurance rates by zip code?

As we touched upon above, your location can affect your rates. Cities and towns with higher populations and accident rates are riskier to insure, so rates there may cost more. Here is a chart of New York zip code car insurance rates.

This table shows you the most expensive zip codes in New York.

| 25 Most Expensive Zip Codes in New York | City | Average Annual Raet by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 11212 | BROOKLYN | $10,751.24 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,780.57 | USAA | $8,278.50 |

| 11233 | BROOKLYN | $10,703.01 | Liberty Mutual | $17,558.88 | Travelers | $11,775.55 | Geico | $5,780.57 | USAA | $8,278.50 |

| 11213 | BROOKLYN | $10,646.36 | Liberty Mutual | $17,558.88 | Travelers | $11,775.55 | Geico | $5,780.57 | Progressive | $8,079.76 |

| 11207 | BROOKLYN | $10,606.21 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,780.57 | Progressive | $7,402.08 |

| 11225 | BROOKLYN | $10,427.03 | Liberty Mutual | $17,558.88 | State Farm | $11,586.05 | Geico | $5,780.57 | USAA | $7,853.79 |

| 11216 | BROOKLYN | $10,399.95 | Liberty Mutual | $17,558.88 | State Farm | $11,586.05 | Geico | $5,780.57 | Progressive | $7,438.55 |

| 11221 | BROOKLYN | $10,399.36 | Liberty Mutual | $17,558.88 | State Farm | $11,617.80 | Geico | $5,780.57 | Progressive | $7,402.08 |

| 11239 | BROOKLYN | $10,287.12 | Liberty Mutual | $17,558.88 | Allstate | $11,528.93 | Geico | $5,780.57 | Progressive | $7,489.08 |

| 11203 | BROOKLYN | $10,251.67 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,300.14 | Progressive | $8,079.76 |

| 11236 | BROOKLYN | $10,242.23 | Liberty Mutual | $17,558.88 | Travelers | $11,880.71 | Geico | $5,300.14 | USAA | $8,278.50 |

| 11208 | BROOKLYN | $10,105.99 | Liberty Mutual | $17,558.88 | State Farm | $11,613.31 | Geico | $5,780.57 | Progressive | $7,844.91 |

| 11206 | BROOKLYN | $9,964.09 | Liberty Mutual | $17,558.88 | State Farm | $11,642.66 | Geico | $5,780.57 | Progressive | $6,585.30 |

| 11226 | BROOKLYN | $9,920.06 | Liberty Mutual | $17,558.88 | State Farm | $11,144.66 | Geico | $5,300.14 | Progressive | $8,159.70 |

| 11234 | BROOKLYN | $9,739.93 | Liberty Mutual | $15,452.41 | Travelers | $11,651.31 | Geico | $5,300.14 | Progressive | $7,716.90 |

| 11235 | BROOKLYN | $9,670.87 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $8,066.79 |

| 11210 | BROOKLYN | $9,652.77 | Liberty Mutual | $15,452.41 | Travelers | $11,651.31 | Geico | $5,300.14 | Progressive | $7,955.87 |

| 11237 | BROOKLYN | $9,602.92 | Liberty Mutual | $17,558.88 | State Farm | $11,621.22 | Geico | $4,510.55 | Progressive | $7,437.15 |

| 11238 | BROOKLYN | $9,569.83 | Liberty Mutual | $17,558.88 | State Farm | $11,586.05 | Geico | $4,187.43 | Progressive | $7,438.55 |

| 11223 | BROOKLYN | $9,458.27 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $8,066.79 |

| 11230 | BROOKLYN | $9,440.17 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $8,066.79 |

| 11241 | BROOKLYN | $9,410.20 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,457.75 | Progressive | $7,489.08 |

| 11243 | BROOKLYN | $9,410.20 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,457.75 | Progressive | $7,489.08 |

| 11229 | BROOKLYN | $9,387.51 | Liberty Mutual | $15,452.41 | Travelers | $11,115.43 | Geico | $5,300.14 | Progressive | $7,716.90 |

| 11205 | BROOKLYN | $9,370.09 | Liberty Mutual | $17,558.88 | State Farm | $11,180.76 | Geico | $4,510.55 | Progressive | $6,126.60 |

| 11242 | BROOKLYN | $9,364.53 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,457.75 | Progressive | $7,489.08 |

Now check out the least expensive zip codes in the state.

| 25 Least Expensive Zip Codes in New York | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 14830 | CORNING | $2,729.59 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,084.94 |

| 14845 | HORSEHEADS | $2,753.21 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,041.98 |

| 14814 | BIG FLATS | $2,757.47 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,084.94 |

| 14870 | PAINTED POST | $2,761.36 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,367.49 |

| 14903 | ELMIRA | $2,761.81 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,084.94 |

| 14905 | ELMIRA | $2,786.89 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14904 | ELMIRA | $2,788.48 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14871 | PINE CITY | $2,789.24 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,297.44 |

| 14894 | WELLSBURG | $2,790.81 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14901 | ELMIRA | $2,791.14 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| 14821 | CAMPBELL | $2,812.94 | Liberty Mutual | $3,958.87 | Allstate | $3,317.92 | Geico | $1,814.79 | Nationwide | $2,385.41 |

| 13850 | VESTAL | $2,833.83 | Liberty Mutual | $3,888.71 | Allstate | $3,268.98 | Geico | $2,002.78 | Progressive | $2,247.71 |

| 14816 | BREESPORT | $2,873.78 | Liberty Mutual | $3,932.34 | State Farm | $3,505.38 | Geico | $1,756.70 | Nationwide | $2,385.41 |

| 13795 | KIRKWOOD | $2,878.91 | Liberty Mutual | $3,888.71 | Travelers | $3,337.03 | Geico | $2,002.78 | Progressive | $2,428.42 |

| 13748 | CONKLIN | $2,880.00 | Liberty Mutual | $3,888.71 | Travelers | $3,337.03 | Geico | $2,002.78 | Progressive | $2,428.42 |

| 13603 | WATERTOWN | $2,881.06 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13612 | BLACK RIVER | $2,881.46 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13616 | CALCIUM | $2,882.15 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13606 | ADAMS CENTER | $2,884.39 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13601 | WATERTOWN | $2,885.27 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13685 | SACKETS HARBOR | $2,886.18 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13656 | LA FARGEVILLE | $2,887.98 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13640 | WELLESLEY ISLAND | $2,888.38 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13634 | DEXTER | $2,888.57 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

| 13607 | ALEXANDRIA BAY | $2,888.77 | Liberty Mutual | $4,420.81 | Allstate | $3,496.52 | Geico | $1,921.00 | USAA | $2,165.68 |

How does your zip code compare? Is your address saving you money or costing you extra?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where are the cheapest NY car insurance rates by city?

This is the same data by the city name.

| 10 Most Expensive Cities in New York | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brooklyn | $9,347.06 | Liberty Mutual | $17,558.88 | State Farm | $10,797.26 | Geico | $3,940.28 | Progressive | $6,859.27 |

| Saint Albans | $9,000.94 | Liberty Mutual | $12,883.56 | Travelers | $10,495.31 | Geico | $5,686.55 | USAA | $7,089.23 |

| Rosedale | $8,885.68 | Liberty Mutual | $12,883.56 | State Farm | $9,995.10 | Geico | $5,287.14 | USAA | $7,089.23 |

| South Ozone Park | $8,881.66 | Liberty Mutual | $12,883.56 | Travelers | $10,607.53 | Geico | $5,686.55 | USAA | $7,089.23 |

| Springfield Gardens | $8,874.63 | Liberty Mutual | $12,883.56 | State Farm | $9,906.69 | Geico | $5,287.14 | USAA | $7,089.23 |

| South Richmond Hill | $8,831.46 | Liberty Mutual | $12,883.56 | Travelers | $10,607.53 | Geico | $5,287.14 | USAA | $7,089.23 |

| Jamaica | $8,826.92 | Liberty Mutual | $12,883.56 | Travelers | $10,241.08 | Geico | $5,386.99 | USAA | $7,089.23 |

| Arverne | $8,802.18 | Liberty Mutual | $12,883.56 | State Farm | $9,799.24 | Geico | $5,287.14 | USAA | $7,089.23 |

| Woodhaven | $8,773.94 | Liberty Mutual | $12,883.56 | Travelers | $10,302.35 | Geico | $5,096.98 | USAA | $7,089.23 |

| Howard Beach | $8,739.15 | Liberty Mutual | $12,883.56 | Travelers | $9,817.66 | Geico | $5,287.14 | USAA | $7,089.23 |

Many of the most expensive boroughs and cities are in and around Brooklyn.

| 10 Least Expensive Cities in New York | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Corning | $2,729.58 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,084.94 |

| Big Flats | $2,757.50 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,070.62 |

| Coopers Plains | $2,761.36 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,814.79 | Progressive | $2,367.49 |

| Elmira | $2,788.83 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| Pine City | $2,789.24 | Liberty Mutual | $3,958.87 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,297.44 |

| Wellsburg | $2,790.81 | Liberty Mutual | $3,932.34 | Allstate | $3,194.85 | Geico | $1,756.70 | Progressive | $2,254.47 |

| Campbell | $2,812.93 | Liberty Mutual | $3,958.87 | Allstate | $3,317.92 | Geico | $1,814.79 | Nationwide | $2,385.41 |

| Vestal | $2,833.83 | Liberty Mutual | $3,888.71 | Allstate | $3,268.98 | Geico | $2,002.78 | Progressive | $2,247.71 |

| Breesport | $2,873.77 | Liberty Mutual | $3,932.34 | State Farm | $3,505.38 | Geico | $1,756.70 | Nationwide | $2,385.41 |

| Kirkwood | $2,878.90 | Liberty Mutual | $3,888.71 | Travelers | $3,337.03 | Geico | $2,002.78 | Progressive | $2,428.42 |

Where does your city rank?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the best New York car insurance companies?

With so many car insurers out there, it can be hard to determine which one offers the right coverage. Price may affect your decision, but there are other factors to consider, such as coverage levels.

This section will help you evaluate insurance companies based on their financial ratings, reviews, and complaints.

So, read on to find out more and determine who are the best car insurance companies in NY.

What are NY car insurance company financial ratings?

A.M. Best ranks companies based on their financial strength. And, as we discussed above, the loss ratio is part of that. These are their ratings for some of the top companies.

| Company | Financial Rating |

|---|---|

| Geico | A++ |

| Allstate | A+ |

| State Farm | A |

| Progressive | A+ |

| Liberty Mutual | A |

| Travelers Group | A++ |

| USAA | A++ |

| NYCM Insurance | A |

| Nationwide Corp | A+ |

| Amtrust NGH | A- |

State Farm and USAA are among the companies to receive the highest rating of “A++,” which shows that they remain profitable despite paying several claims regularly.

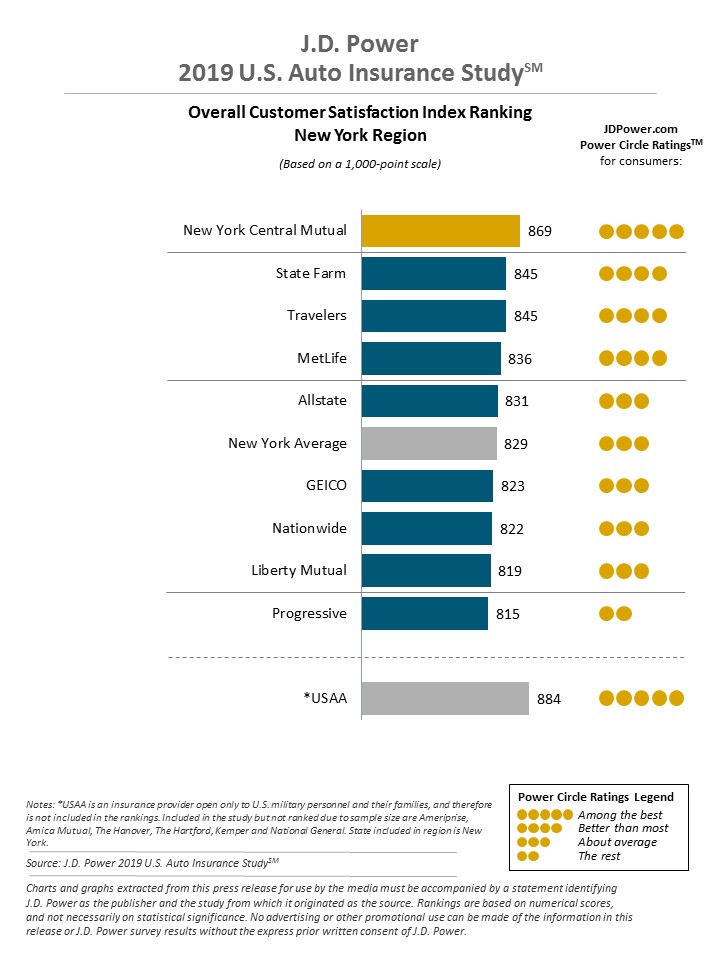

What are NY car insurance companies’ consumer ratings?

J.D. Power’s U.S. Auto Insurance Study measures car insurance customers’ overall satisfaction.

Customer service can be a huge factor in your choice for the best auto insurance companies in New York.

New York Central Mutual was the only company to receive five Power Circles, which means that it’s “among the best.”

What are the NY car insurance companies with the most consumer complaints?

Every company gets complaints, but a true measure of customer service lies in how it handles them. The data below shows complaints about the top New York insurers in 2017.

| Company Name | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| Geico | N/A | N/A | N/A |

| Allstate Insurance Group | 1 | .5 | 163 |

| State Farm Group | 1 | .44 | 1482 |

| Progressive Group | 1 | .75 | 120 |

| Liberty Mutual Group | 1 | 5.95 | 222 |

| Travelers Group | 1 | .09 | 2 |

| USAA Group | N/A | N/A | N/A |

| NYCM Insurance Group | 1 | 0 | 2 |

| Nationwide Corp Group | 1 | .28 | 25 |

| Amtrust NGH Group | 1 | 0 | 2 |

At 44 percent, State Farm had the highest complaints and complaint ratio, but these numbers are fairly low compared to the number of customers they serve.

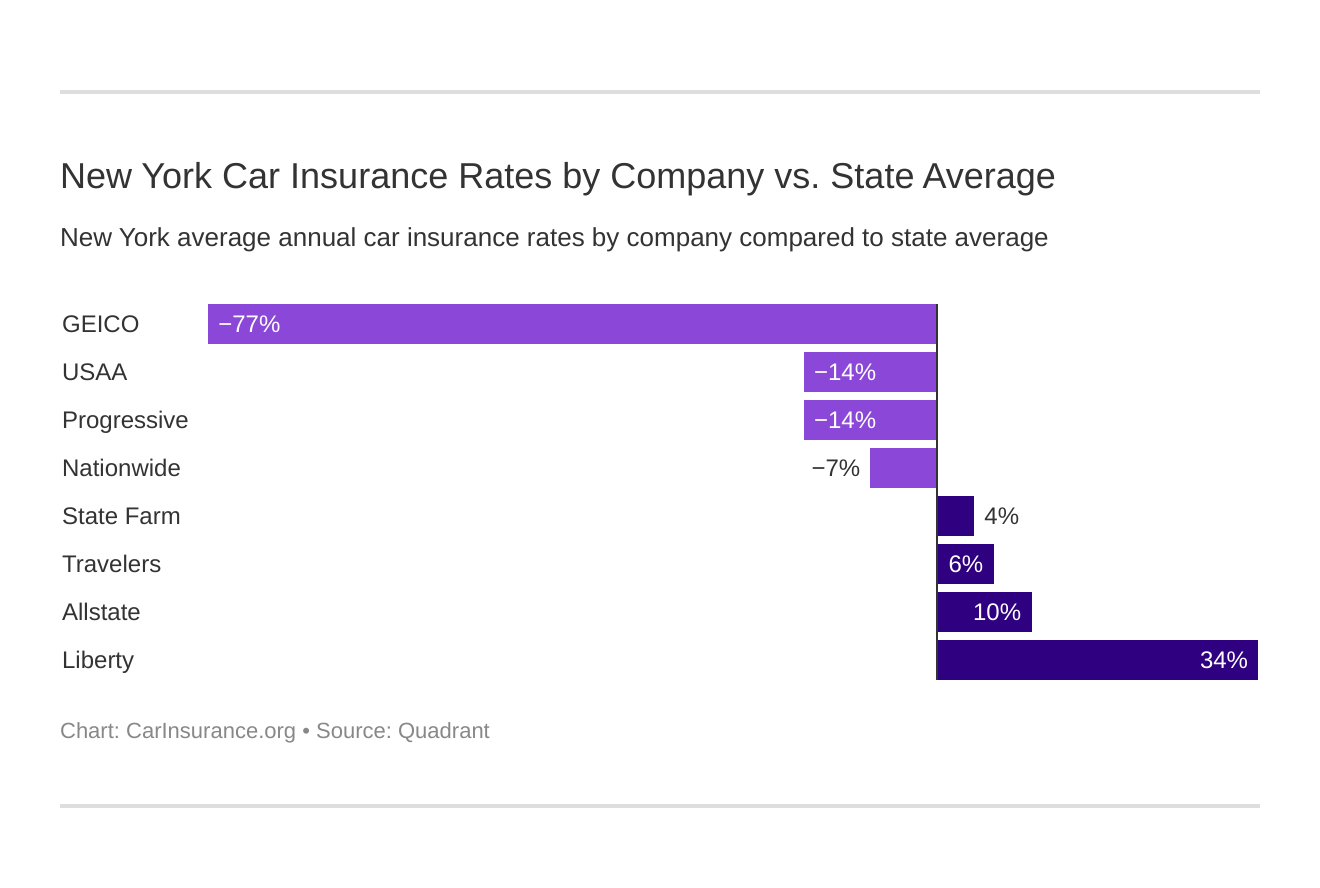

What are the cheapest car insurance companies in New York?

Below are the rates for the top insurers compared to the state average prices. Who has cheap car insurance in NY state?

| Company | Average Annual Rate |

|---|---|

| Allstate | $4,740.96 |

| Geico | $2,428.24 |

| Liberty Mutual | $6,540.73 |

| Nationwide | $4,012.93 |

| Progressive | $3,771.15 |

| State Farm | $4,484.58 |

| Travelers | $4,578.79 |

| USAA | $3,761.69 |

Geico comes out on top as the cheapest company, at almost 77 percent less than the state average.

What are NY car insurance companies’ commute rates?

With some insurers, the longer your commute, the more you’ll pay.

| Company | 10 Mile Commute | 25 Mile Commute |

|---|---|---|

| Allstate | $4,675.15 | $4,806.77 |

| Geico | $2,358.45 | $2,498.03 |

| Liberty Mutual | $6,354.63 | $6,726.83 |

| Nationwide | $4,012.93 | $4,012.93 |

| Progressive | $3,771.15 | $3,771.15 |

| State Farm | $4,322.30 | $4,646.86 |

| Travelers | $4,578.79 | $4,578.79 |

| USAA | $3,723.73 | $3,799.64 |

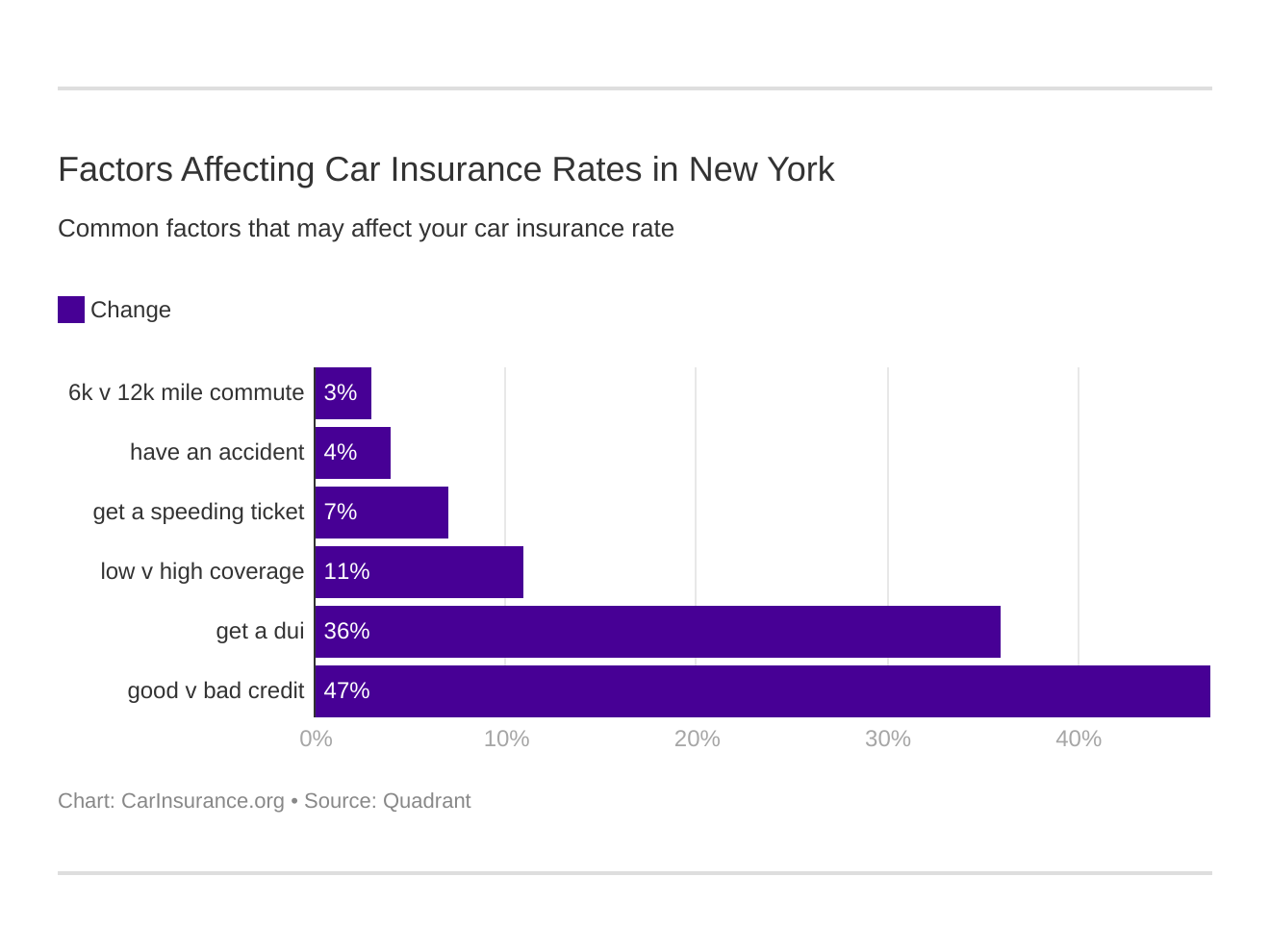

Take a look at these 6 major factors affecting auto insurance rates in New York.

Nationwide, Progressive, and Travelers don’t factor distance into their rates. Of the insurers who do, USAA had a price difference of less than $100 for 10- versus 25-mile commutes. Many of the rest charged as much as $150 or more from the shorter to the longer distance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are NY car insurance companies’ coverage level rates?

Let’s see how rates vary among the top insurers for high, medium, and low coverage.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,372.19 | $4,372.19 | $5,134.16 |

| Geico | $2,287.62 | $2,416.55 | $2,580.54 |

| Liberty Mutual | $6,237.28 | $6,520.87 | $6,864.04 |

| Nationwide | $3,752.51 | $3,975.76 | $4,310.54 |

| Progressive | $3,559.37 | $3,745.62 | $4,008.45 |

| State Farm | $4,240.05 | $4,511.46 | $4,702.24 |

| Travelers | $4,309.32 | $4,522.76 | $4,904.29 |

| USAA | $3,644.21 | $3,741.21 | $3,899.63 |

USAA had among the lowest price difference, at roughly $25 from the lowest to the highest coverage, while Allstate had the highest difference (about $800).

What are NY car insurance companies’ credit history rates?

Your credit score also affects your rates. Generally, consumers with excellent credit pay less than those who have poor credit.

| Company | Poor Credit Rating | Fair Credit Rating | Good Credit Rating |

|---|---|---|---|

| Allstate | $6,865.50 | $5,985.24 | $5,985.24 |

| Geico | $3,042.53 | $4,012.93 | $4,012.93 |

| Liberty Mutual | $9,156.87 | $3,970.78 | $3,970.78 |

| Nationwide | $4,012.93 | $3,961.90 | $3,961.90 |

| Progressive | $6,065.81 | $3,944.57 | $3,944.57 |

| State Farm | $6,331.07 | $3,041.52 | $3,041.52 |

| Travelers | $6,396.79 | $2,913.64 | $2,913.64 |

| USAA | $5,800.63 | $2,235.78 | $2,235.78 |

Geico had the lowest rates for consumers with poor credit.

According to Experian, in 2018, New York’s average credit score was 688, which is lower than the national score of 704. New Yorkers own an average of 3.34 credit cards and have over $6,000 of credit card debt.

What are NY car insurance companies’ driving record rates?

Your driving record is one of the most crucial factors that affect the price of car insurance.

| Company | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $4,004.39 | $4,004.39 | $5,884.41 | $5,884.41 |

| Geico | $1,894.00 | $2,064.88 | $3,860.07 | $3,860.07 |

| Liberty Mutual | $5,197.79 | $5,197.79 | $10,569.55 | $10,569.55 |

| Nationwide | $3,042.44 | $3,042.44 | $6,853.01 | $6,853.01 |

| Progressive | $3,664.67 | $3,664.67 | $4,066.27 | $4,066.27 |

| State Farm | $4,267.85 | $4,267.85 | $4,701.32 | $4,701.32 |

| Travelers | $3,901.71 | $4,896.91 | $4,964.33 | $4,964.33 |

| USAA | $3,348.28 | $3,402.69 | $4,893.09 | $4,893.09 |

Nationwide has lower rates for drivers who have been in one accident compared to other insurers. Even if you have one speeding ticket, you may end up paying as much as $1,000 more for car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

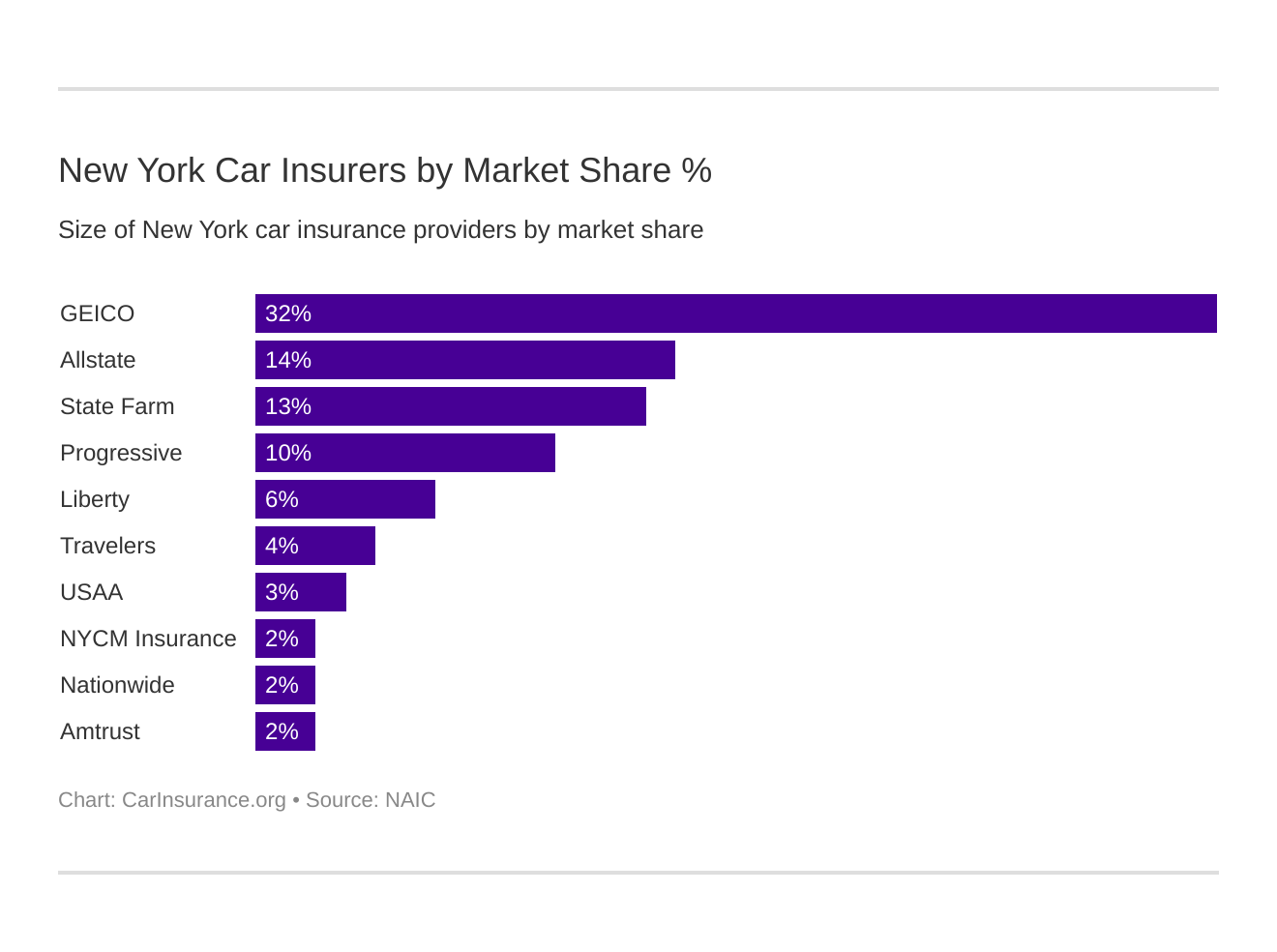

What are the largest car insurance companies in New York?

This is how the top insurers compare by loss ratio, market share, and direct policies written.

Which auto insurance companies in NY are in the lead when it comes to policies?

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| Geico | $4,233,525 | 31.93% |

| Allstate Insurance Group | $1,843,730 | 13.90% |

| State Farm Group | $1,758,370 | 13.26% |

| Progressive Group | $1,284,132 | 9.68% |

| Liberty Mutual Group | $731,396 | 5.52% |

| Travelers Group | $529,676 | 3.99% |

| USAA Group | $392,346 | 2.96% |

| NYCM Insurance Group | $327,366 | 2.47% |

| Nationwide Corp Group | $302,854 | 2.28% |

| Amtrust NGH Group | $291,750 | 2.20% |

As with other data we’ve already looked at, Geico comes out on top. It has the largest market share and has written the most policies.

Number of Insurers by State

Domestic insurers were formed in New York law, while foreign insurers were founded out of state. Out of a total of 882 insurers who operate in the Empire State, 173 are domestic and 709 are foreign.

What New York car insurance laws do you need to know?

The Empire State has enacted lots of laws. It can be hard to keep track of them all, whether they cover car insurance, vehicle licensing, safety, or driving. We’ve simplified the complex aspects of the laws and will cover the ones that you need to pay attention to most.

So read on to learn more about the laws you should obey as a responsible citizen.

How New York Car Insurance Rates are Determined

In this section, we’ll go over what sets New York car insurance rates and the laws governing windshield replacement, high-risk drivers, and fraud.

The State of New York and the Department of Financial Services set insurance rates based on the National Association of Insurance Commissioners’ standards.

Insurance companies must get prior approval from the state insurance department before filing rates and forms in New York. For prices, the department requires prior approval only if they are a certain percentage above or sometimes below the rates the company has filed before.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Windshield Coverage

New York lets you replace a windshield with aftermarket parts if they are “equal or exceed the comparable OEM crash part in terms of fit, form, finish quality, and performance.” If you use them, the information must appear on the estimate.

Insurers may also offer zero-deductible policies for windshield glass replacement. Comprehensive coverage, which covers damage from “acts of God” such as vandalism, theft, fire, and natural disasters, may also cover windshield replacement.

High-Risk Insurance

If you’ve been convicted of several driving offenses, such as driving without insurance or a DUI, insurance companies may consider you a high risk to insure. That may make it harder to get insured through the open marketplace.

But, “high-risk” drivers have an alternative.

The New York Automobile Insurance Plan (NYAIP) will cover motorists who have tried and failed to get automobile insurance within the past 60 days at rates not above those applicable under the plan. The coverage, however, isn’t cheap. The average NYAIP policy in 2012 was $2,283.

Low-Cost Insurance

Though New York has a program to help high-risk drivers, it doesn’t have one for low-income drivers.

California, Hawaii, and New Jersey are the only states with government-funded programs to help low-income drivers pay for their car insurance.

What do I need to know about NY car insurance fraud?

Misrepresenting facts on insurance claims, submitting false claims, and faking accidents are among the most common forms of car insurance fraud.

According to the Insurance Information Institute (III), insurance applicants, policyholders, third-party claimants, and insurance professionals are among those who commit fraud.

Car insurance fraud is a serious crime under Article 176. New York law defines six degrees of fraud penalties:

- Fifth degree: Committing any fraudulent act to get insurance payments improperly, which is a Class A misdemeanor (176.10).

- Fourth degree: Committing insurance fraud and wrongfully receiving assets of more than $1,000 is insurance fraud, which is a Class E felony (176.15)

- Third degree: Carrying out insurance fraud and unfairly gaining $3,000 or more in assets is insurance fraud, which is a Class D felony (176.20).

- Second degree: Committing insurance fraud and getting $50,000 or more of assets is insurance fraud, which is a Class C felony (176.25).

- First degree: Committing insurance fraud and obtaining $1 million or more in assets is insurance fraud, which is a Class B felony. (176.30).

- Aggravated insurance fraud: Committing another act of insurance fraud within five years of a prior conviction, which is a Class D felony (176.35).

If you’ve been a victim of insurance fraud, you may file a complaint online with the New York Attorney General’s Auto Insurance Fraud Unit.

Statute of Limitations

The statute of limitations is the time you have left to file a legal claim. In New York state, drivers have three years to file a personal injury or a property damage insurance claim or lawsuit.

Evidence can degrade and witnesses can be hard to keep track of over time, so it’s best to file sooner rather than later.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the NY vehicle licensing laws?

Here we’ll cover the laws that control getting and maintaining a license to drive in the Empire State. This includes the recent Real ID law, penalties, and driver licensing requirements.

Real ID

Starting October 1, 2020, to comply with the federal REAL ID Act, you’ll need a REAL ID driver’s license, permit, or identification card to board domestic flights or enter federal buildings.

A valid U.S. Passport is already REAL ID-compliant; you can use it to board a flight.

To apply for a REAL ID, you can visit your local Department of Motor Vehicles. Below are the original or certified documents the DMV suggests you bring:

- Proof of identity, such as a valid license, birth certificate, or passport, with your full first, middle (if applicable), and last name. Your name, as it appears on your proof of identity, will be displayed on your card as required by federal law. If the name on your application doesn’t match the one on your identity, lawful status, and social security proof, you must bring court- or government-issued proof. This includes a marriage license, divorce decree, adoption, or court order.

- Proof of Social Security Number or Social Security Number ineligibility. If you have a valid NY license, permit, or ID card, you must bring your original social security card or W-2 with full SSN. If you do not have a New York State driver’s license or identification card, you must bring your Social Security Card or a letter from the Social Security Administration proving your ineligibility to have a social security number.

- Proof of your date of birth.

- Proof of U.S. citizenship, lawful permanent residency, or temporary lawful status in the U.S.

- Two different proofs of New York State residence such as a utility bill, bank statement, or mortgage statement (P.O. Box not acceptable). This address will be displayed on your card.

Watch this video to learn more about the REAL ID.

The next time you renew your license, make sure to get a REAL ID if you haven’t already.

Penalties for Driving Without Insurance

Whenever law enforcement pulls you over, you must show your license, registration, and insurance.

As we mentioned before, in New York, you must carry proof of insurance or financial responsibility with you at all times. If you can’t, according to the NY DMV, you’ll face the following penalties:

- A fine of up to $1500 if you’re involved in an accident and a $750 civil penalty

- License and registration suspension for up to one year if you’re without insurance after 90 days and can’t pay the below fees

If you let your insurance lapse, the DMV will charge you per day at the following rates:

- For 1 – 30 days: $8 per day.

- For 31 – 60 days: $10 per day.

- For 61 – 90 days: $12 per day.

A lapse in insurance and a conviction for driving without insurance can cost you up to $2,400.

Teen Driver Laws

In New York, you must be at least 16 years and six months old to drive without adult supervision. Below are the requirements for getting a learner’s license, per New York’s graduated licensing law.

| Requirements for Getting a Learners License | Time/Age |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours, 15 of which must be at night |

| Minimum Age | 16-years-old |

Young drivers with a learner’s permit must follow these rules:

| New York Learners License Restrictions | Details |

|---|---|

| Nighttime restrictions | 9 p.m.-5 a.m. except for NYC (unsupervised driving prohibited at all times) and Long Island (limited daytime unsupervised driving) |

| Passenger restrictions (family members excepted unless noted otherwise) | no more than 1 passenger younger than 21 |

These are the requirements to follow to receive a full license:

| Minimum age at which restrictions may be lifted: | Details |

|---|---|

| Nighttime restrictions | until age 17 with driver education; until age 18 without (min. age: 17) |

| Passenger restrictions | until age 17 with driver education; until age 18 without (min. age: 17) |

Definitely follow the rules for new drivers in New York. Teen drivers face many obstacles, including inexperience behind the wheel.

Older Driver License Renewal Procedures

According to the Insurance Institute for Highway Safety, these are the requirements for older drivers to renew their licenses:

- Older drivers can renew their licenses every eight years

- They must show proof of adequate vision at every renewal

- The DMV allows renewal by mail or online at every renewal, without restrictions.

New Residents

If you’ve moved from out of state, you must apply for a New York driver’s license at a DMV office within 30 days after you establish your residency.

Your out-of-state license must meet the following requirements:

- have a picture

- be valid or expired for less than 24 months

- have been issued at least six months before your New York license application

You can’t exchange your license if it is or has been:

- suspended or revoked

- lost or stolen

- a hardship or “employment only” license

- non-renewable or non-transferable

The news report below details a new Empire State law that allows undocumented immigrants to get driver’s licenses:

Your New York license is valid for five years from the day it was issued.

License Renewal Procedures

The IIHS reports that drivers with New York licenses must renew them every eight years and provide proof of adequate vision at every renewal. They may renew online or through the mail.

Negligent Operator Treatment System (NOTS)

NOLO states that in New York, reckless driving involves driving in a manner that unreasonably interferes with the free and proper use of a public highway, or unreasonably endangers other drivers.

Reckless driving is generally considered a misdemeanor in New York. These are the potential penalties:

- First offense: up to 30 days in jail and/or $100 – $300 in fines

- Second offense (within 18 months): up to 90 days in prison and/or $100 – $525 in fines

- Third offense (in 18 months): up to 180 days in jail and/or $100 – $1,125 in fines

One reckless driving conviction can add five points to your driving record and increase your insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the rules of the road in NY?

Below are some more driving laws. These laws regulate seat-belt and car-seat use, when you should keep right and move over, speed limits, ridesharing, and automation.

Fault vs. No-Fault

As a “no-fault” state, drivers must file claims with their own insurance company, even when they’re not responsible for an accident. The Empire State follows a doctrine of comparative fault for personal injury cases.

This means that a judge or a jury assigns a percentage of fault or responsibility to each party involved in an accident. For example, if a plaintiff who ran a red light was 60 percent at fault, and the other driver, who was speeding, was 40 percent responsible, the judge would reduce the plaintiff’s award by 60 percent.

Seat Belt & Car Seat Laws

Below are the seat-belt and car-seat laws in the Empire State.

| Seat Belt Laws in New York | Details |

|---|---|

| Effective Since | December 1, 1984 |

| Primary Enforcement | yes; effective 12/01/84 |

| Age/Seats Applicable | 16+ years in front seat |

| 1st Offense Max Fine | $50 |

Follow these car-seat laws to keep your child safe.

| New York Car Seat Requirements | Details |

|---|---|

| Type of Car Seat Required | Age |

| Child Booster Seat | younger than 2 years or until a child outgrows the manufacturer's top height or weight recommendations in a rear-facing child restraint; younger than 4 years unless they weigh more than 40 pounds and are seated where there is no available lap/shoulder belt; 4 through 7 years unless they are seated where there is no available lap/shoulder belt(effective |

| Adult Belt Permissible | 8 through 15 years; children who weigh more than 40 pounds or children 4 through 7 years in a seating position where there is no available lap/shoulder belt |

| Preference for Rear Seat | law states no preference for rear seat |

| Maximum Base Fine 1st Offense | $100 |

Regarding riding in the cargo areas of pickup trucks, it’s illegal in New York except in the following situations:

- If the trip is five miles or less.

- If the trip is five miles or more and if one-third or fewer of the passengers are standing, if suitable seats are securely attached, or there are side rails and a tailgate.

- If the trip is five miles or more and if fewer than five people aged 17 or younger are in the cargo area or if at least one person 18 or older is there.

Generally, riding in the back of a truck is pretty dangerous and should be avoided if possible.

Keep Right & Move Over Laws

If you drive slower than the average speed of traffic in New York, you must keep right.

However, according to AAA, when an emergency vehicle, tow truck, or a maintenance vehicle with flashing lights is traveling in the same direction, you must use care, reduce speed, and move to a nearby lane.

Speed Limits

These are the speed limits on New York roads.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 65 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 55 mph |

Obey the speed limit to stay safe and save money on car insurance and fines.

Ridesharing

If you want to drive for rideshare services such as Uber and Lyft, you must have a license from the New York Taxi and Limousine Commission.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS), New York is among the states that are currently testing automated or driverless vehicles. The tests require operators to be licensed and inside the car. They must also have liability insurance of $5,000,000.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the driving safety laws in NY?

New York State has several safety laws that control Driving Under the Influence (DUI) and marijuana-impaired and distracted driving. Let’s explore the penalties involved.

DUI Laws

Driving while under the influence (DUI) is a crime in New York. Below are some facts about the legal Blood Alcohol Content (BAC) limit and the different levels of offenses:

| DUI Laws in New York | Details |

|---|---|

| Name for Offense | Driving While Intoxicated (DWI); High BAC Aggravated Driving While Intoxicated (ADWI) |

| BAC Limit | 0.05 - DWAI, 0.08 - DUI |

| High BAC Limit | 0.18 |

| Criminal Status | DWAI:1st traffic violation, 2nd+ misdemeanors; DWI: 1st misdemeanor, 2nd in 10 years class E felony, 3rd+ in 10 years class D felony |

| Look Back Period | 10 years for 2nd offense, 15 years for 3rd+ |

The table below reveals more details about DUI penalties and fines:

| DUI Penalities | ALS or Revocation | Imprisonment | Fine |

|---|---|---|---|

| 1st Offense | revoked for at least 6 months; ADWI: 1 year min | no minimum, but up to 1 year; ADWI: up to 1 year | $500-$1000; ADWI: $1000-$2500 |

| 2nd Offense | 2nd in 10 years: 1 year min; ADWI: 18 months min | 5 days minimum. 2nd in 10 years: up to 4 years; ADWI: up to 4 years | 2nd in 10 years: $1000-$5000; ADWI: $1000-$5000 |

| 3rd Offense | 3rd in 10 years: 1 year min; ADWI: 18 months min | 10 days minimum. 3rd in 10 years: up to 7 years; ADWI: up to 7 years | 3rd in 10 years: $2000-$10000; ADWI: $2000-$10000 |

These laws are strict for a reason and act as a deterrent. The safest thing to do to prevent severe injuries and death is to not drink and drive.

Marijuana-Impaired Driving Laws

New York doesn’t have any specific laws about marijuana-impaired driving. However, that doesn’t mean you can’t get caught for impaired driving or driving under the influence.

Recreational marijuana use is illegal in New York, but the state legislature has considered legalizing it.

Distracted Driving Laws

With the rise of the smartphone, distracted driving has become more of a road hazard. Below are the New York laws controlling cell phone use while driving.

| Hand-held ban | Young drivers all cellphone ban | Texting ban | Enforcement |

|---|---|---|---|

| All Drivers | Not a law | All Drivers | Primary |

AAA states that “no person shall operate a motor vehicle while using a mobile telephone to engage in a call while the vehicle is in motion unless that person is using a hands-free device. Text messaging while driving is prohibited for all drivers.”

These laws are primary enforcement, which means that a police offer can pull you over for using your cell phone.

What are New York auto theft rates?

Sometimes it’s hard to handle driving hazards, especially in high-traffic areas like New York City, which is a reason why some people take public transportation.

The driving and safety laws we’ve covered are meant to protect you and others, yet the statistics make the dangers seem even more real. Now, we’ll look at statistics regarding vehicle theft, traffic fatalities, and EMS response times.

So, let’s find out about some of the biggest risks on the road.

Some vehicles are more popular to steal than others. These are the top 10 most-stolen vehicles in the Empire State.

| Type of Vehicle | Model Year | Number Stolen |

|---|---|---|

| Honda Accord | 1997 | 724 |

| Honda Civic | 1998 | 707 |

| Toyota Camry | 2014 | 500 |

| Nissan Altima | 2015 | 374 |

| Dodge Caravan | 2000 | 368 |

| Ford Econoline E350 | 2011 | 339 |

| Nissan Maxima | 1998 | 328 |

| Honda CR-V | 1997 | 283 |

| Toyota Corolla | 2010 | 280 |

| Jeep Cherokee/Grand Cherokee | 2015 | 263 |

Read more: Best Car Insurance for a Honda CR-V

As we mentioned earlier, many New Yorkers drive practical cars, such as the Honda Accord and the Toyota Camry, which top the list.

Vehicle Theft by City

These 2017 FBI crime statistics reveal which cities in New York have the most vehicle thefts. How does your city rank?

| City | Motor Vehicle Theft |

|---|---|

| Adams Village | 1 |

| Addison Town and Village | 0 |

| Akron Village | 1 |

| Albany | 112 |

| Albion Village | 11 |

| Alexandria Bay Village | 0 |

| Alfred Village | 1 |

| Allegany Village | 0 |

| Altamont Village | 0 |

| Amherst Town | 41 |

| Amity Town and Belmont Village | 0 |

| Amityville Village | 3 |

| Amsterdam | 9 |

| Andover Village | 1 |

| Angelica Village | 0 |

| Arcade Village | 0 |

| Ardsley Village | 0 |

| Asharoken Village | 0 |

| Attica Village | 0 |

| Auburn | 16 |

| Avon Village | 0 |

| Bainbridge Village | 0 |

| Baldwinsville Village | 0 |

| Ballston Spa Village | 1 |

| Batavia | 12 |

| Bath Village | 1 |

| Beacon | 6 |

| Bedford Town | 4 |

| Bethlehem Town | 6 |

| Binghamton | 102 |

| Black River | 0 |

| Blooming Grove Town | 8 |

| Bolton Town | 1 |

| Boonville Village | 0 |

| Brant Town | 2 |

| Brewster | 1 |

| Briarcliff Manor Village | 0 |

| Brighton Town | 18 |

| Brockport Village | 3 |

| Brownville Village | 0 |

| Buffalo | 835 |

| Cairo Town | 0 |

| Caledonia Village | 0 |

| Cambridge Village | 0 |

| Camden Village | 0 |

| Camillus Town and Village | 8 |

| Canajoharie Village | 2 |

| Canandaigua | 5 |

| Canastota Village | 5 |

| Canisteo Village | 0 |

| Canton Village | 0 |

| Cape Vincent Village | 0 |

| Carmel Town | 10 |

| Carroll Town | 0 |

| Carthage Village | 0 |

| Cattaraugus Village | 0 |

| Cayuga Heights Village | 0 |

| Cazenovia Village | 0 |

| Central Square Village | 0 |

| Centre Island Village | 1 |

| Cheektowaga Town | 115 |

| Chester Town | 1 |

| Chester Village | 3 |

| Chittenango Village | 0 |

| Cicero Town | 4 |

| Clarkstown Town | 33 |

| Clayton Village | 0 |

| Clyde Village | 0 |

| Cobleskill Village | 2 |

| Coeymans Town | 4 |

| Cohocton Town | 0 |

| Cohoes | 18 |

| Colonie Town | 38 |

| Cooperstown Village | 0 |

| Corning | 4 |

| Cornwall-on-Hudson Village | 0 |

| Cornwall Town | 1 |

| Cortland | 5 |

| Coxsackie Village | 0 |

| Crawford Town | 2 |

| Croton-on-Hudson Village | 0 |

| Cuba Town | 0 |

| Dansville Village | 1 |

| Deerpark Town | 3 |

| Delhi Village | 1 |

| Depew Village | 6 |

| DeWitt Town | 33 |

| Dexter Village | 0 |

| Dobbs Ferry Village | 1 |

| Dolgeville Village | 0 |

| Dryden Village | 0 |

| Dunkirk | 14 |

| Durham Town | 0 |

| East Aurora-Aurora Town | 2 |

| Eastchester Town | 3 |

| East Fishkill Town | 10 |

| East Greenbush Town | 7 |

| East Hampton Town | 4 |

| East Hampton Village | 2 |

| East Rochester Village | 2 |

| Eden Town | 2 |

| Ellenville Village | 1 |

| Ellicott Town | 4 |

| Ellicottville | 0 |

| Elmira | 27 |

| Elmira Heights Village | 0 |

| Elmira Town | 1 |

| Elmsford Village | 2 |

| Endicott Village | 14 |

| Evans Town | 8 |

| Fairport Village | 0 |

| Fallsburg Town | 2 |

| Fishkill Town | 6 |

| Fishkill Village | 0 |

| Floral Park Village | 4 |

| Florida Village | 0 |

| Fort Edward Village | 0 |

| Fort Plain Village | 1 |

| Frankfort Town | 1 |

| Frankfort Village | 0 |

| Fredonia Village | 2 |

| Freeport Village | 35 |

| Friendship Town | 0 |

| Fulton City | 2 |

| Garden City Village | 6 |

| Gates Town | 49 |

| Geddes Town | 5 |

| Geneseo Village | 0 |

| Geneva | 1 |

| Germantown Town | 0 |

| Glen Cove4 | 8 |

| Glen Park Village | 0 |

| Glens Falls | 1 |

| Glenville Town | 7 |

| Gloversville | 9 |

| Goshen Town | 6 |

| Goshen Village | 1 |

| Gowanda Village | 3 |

| Granville Village | 0 |

| Great Neck Estates Village | 0 |

| Greece Town | 77 |

| Greenburgh Town | 22 |

| Greene Village | 0 |

| Green Island Village | 4 |

| Greenport Town | 0 |

| Greenwich Village | 0 |

| Greenwood Lake Village | 5 |

| Groton Village | 1 |

| Guilderland Town | 1 |

| Hamburg Town | 24 |

| Hamburg Village | 2 |

| Hamilton Village | 0 |

| Hammondsport Village | 0 |

| Hancock Village | 0 |

| Harriman Village | 0 |

| Harrison Town | 1 |

| Hastings-on-Hudson Village | 3 |

| Haverstraw Town | 20 |

| Hempstead Village | 135 |

| Herkimer Village4 | 0 |

| Highlands Town | 0 |

| Holley Village | 3 |

| Homer Village | 0 |

| Hoosick Falls Village | 1 |

| Hornell | 0 |

| Horseheads Village | 0 |

| Hudson | 4 |

| Hudson Falls Village | 2 |

| Hunter Town | 0 |

| Huntington Bay Village | 0 |

| Hyde Park Town | 1 |

| Ilion Village | 2 |

| Independence Town | 0 |

| Inlet Town | 0 |

| Irvington Village | 0 |

| Ithaca | 19 |

| Jamestown | 53 |

| Johnson City Village | 22 |

| Jordan Village | 0 |

| Kenmore Village | 5 |

| Kensington Village | 1 |

| Kent Town | 2 |

| Kings Point Village | 2 |

| Kingston | 9 |

| Kirkland Town | 0 |

| Lackawanna | 30 |

| Lake Placid Village | 4 |

| Lake Success Village | 0 |

| Lakewood-Busti | 2 |

| Lancaster Town | 11 |

| Larchmont Village | 3 |

| Le Roy Village | 0 |

| Lewisboro Town | 0 |

| Lewiston Town and Village | 12 |

| Liberty Village | 6 |

| Little Falls | 3 |

| Liverpool Village | 0 |

| Lloyd Harbor Village | 1 |

| Lloyd Town | 6 |

| Lockport | 22 |

| Long Beach | 14 |

| Lowville Village | 2 |

| Lynbrook Village | 8 |

| Macedon Town and Village | 3 |

| Malone Village | 0 |

| Malverne Village | 0 |

| Mamaroneck Town | 3 |

| Mamaroneck Village | 3 |

| Manchester Village | 0 |

| Manlius Town | 11 |

| Marcellus Village | 0 |

| Marlborough Town | 3 |

| Massena Village | 6 |

| Maybrook Village | 1 |

| Mechanicville | 4 |

| Medina Village | 7 |

| Menands Village | 5 |

| Middleport Village | 0 |

| Middletown | 21 |

| Monroe Village | 3 |

| Montgomery Village | 2 |

| Monticello Village | 7 |

| Moravia Village | 0 |

| Moriah Town | 0 |

| Mount Hope Town | 2 |

| Mount Morris Village | 3 |

| Mount Pleasant Town | 0 |

| Mount Vernon | 117 |

| Nassau Village | 0 |

| Newark Village | 5 |

| New Berlin Town | 0 |

| Newburgh | 53 |

| Newburgh Town | 12 |

| New Castle Town | 1 |

| New Hartford Town and Village | 5 |

| New Paltz Town and Village | 1 |

| New Rochelle | 61 |

| New Windsor Town | 7 |

| New York | 6,369 |

| New York Mills Village | 1 |

| Niagara Falls | 186 |

| Niagara Town | 8 |

| Niskayuna Town | 11 |

| Nissequogue Village | 1 |

| Norfolk Town | 1 |

| North Castle Town | 2 |

| North Greenbush Town | 9 |

| Northport Village | 3 |

| North Syracuse Village | 3 |

| North Tonawanda | 36 |

| Northville Village | 0 |

| Norwich | 1 |

| Nunda Town and Village | 0 |

| Ocean Beach Village | 2 |

| Ogdensburg | 2 |

| Ogden Town | 6 |

| Old Brookville Village | 2 |

| Old Westbury Village | 1 |

| Olean | 10 |

| Olive Town | 1 |

| Oneida | 9 |

| Oneonta City | 4 |

| Orangetown Town | 8 |

| Orchard Park Town | 5 |

| Oriskany Village | 0 |

| Ossining Village | 6 |

| Oswego City | 16 |

| Owego Village | 5 |

| Oxford Village | 0 |

| Oyster Bay Cove Village | 1 |

| Palmyra Village | 0 |

| Peekskill | 8 |

| Pelham Manor Village | 13 |

| Pelham Village | 4 |

| Penn Yan Village | 0 |

| Perry Village | 1 |

| Phoenix Village | 1 |

| Piermont Village | 0 |

| Pine Plains Town | 0 |

| Plattekill Town | 4 |

| Plattsburgh City | 3 |

| Pleasantville Village | 2 |

| Port Byron Village | 0 |

| Port Chester Village | 18 |

| Port Dickinson Village | 2 |

| Port Jervis | 2 |

| Port Washington | 1 |

| Potsdam Village | 0 |

| Poughkeepsie | 28 |

| Poughkeepsie Town | 6 |

| Pound Ridge Town | 1 |

| Pulaski Village | 1 |

| Quogue Village | 2 |

| Ramapo Town | 34 |

| Red Hook Village | 0 |

| Rensselaer City | 5 |

| Rhinebeck Village | 0 |

| Rochester | 664 |

| Rockville Centre Village | 8 |

| Rome | 28 |

| Rosendale Town | 0 |

| Rotterdam Town | 23 |

| Rouses Point Village | 0 |

| Rye | 4 |

| Rye Brook Village4 | 5 |

| Sackets Harbor Village | 0 |

| Sag Harbor Village | 0 |

| Salamanca | 5 |

| Sands Point Village | 0 |

| Saranac Lake Village | 1 |

| Saratoga Springs | 32 |

| Saugerties Town | 6 |

| Scarsdale Village | 3 |

| Schenectady | 197 |

| Schodack Town | 1 |

| Schoharie Village | 0 |

| Scotia Village | 5 |

| Seneca Falls Town | 5 |

| Shandaken Town | 0 |

| Shawangunk Town | 3 |

| Shelter Island Town | 0 |

| Sherburne Village | 0 |

| Sherrill | 1 |

| Shortsville Village | 0 |

| Sidney Village | 2 |

| Skaneateles Village | 0 |

| Sleepy Hollow Village | 1 |

| Sodus Point Village | 0 |

| Sodus Village | 0 |

| Solvay Village4 | 9 |

| Southampton Town | 48 |

| Southampton Village | 3 |

| South Glens Falls Village | 4 |

| South Nyack Village | 0 |

| Southold Town | 5 |

| Spring Valley Village | 13 |

| Stillwater Town | 0 |

| St. Johnsville Village | 1 |

| Stockport Town | 0 |

| Stony Point Town | 5 |

| Suffern Village | 3 |

| Syracuse | 340 |

| Tarrytown Village | 1 |

| Ticonderoga Town | 0 |

| Tonawanda | 4 |

| Tonawanda Town | 38 |

| Troy | 90 |

| Trumansburg Village | 0 |

| Tuckahoe Village | 5 |

| Tupper Lake Village | 3 |

| Ulster Town | 7 |

| Utica | 79 |

| Vernon Village | 0 |

| Vestal Town | 7 |

| Walden Village | 3 |

| Wallkill Town | 21 |

| Walton Village | 1 |

| Wappingers Falls Village | 0 |

| Warsaw Village | 0 |

| Warwick Town | 6 |

| Washingtonville Village | 1 |

| Waterford Town and Village4 | 3 |

| Waterloo Village | 2 |

| Watertown | 24 |

| Watervliet | 11 |

| Watkins Glen Village | 0 |

| Waverly Village | 0 |

| Wayland Village | 0 |

| Webb Town | 0 |

| Webster Town and Village | 12 |

| Weedsport Village | 0 |

| Wellsville Village | 3 |

| West Carthage Village | 1 |

| Westfield Village | 1 |

| Westhampton Beach Village | 0 |

| West Seneca Town | 15 |

| White Plains | 24 |

| Whitesboro Village | 0 |

| Whitestown Town | 0 |

| Windham Town | 0 |

| Woodbury Town | 4 |

| Woodridge Village | 0 |

| Woodstock Town | 0 |

| Yonkers | 250 |

| Yorktown Town | 4 |

| Yorkville Village | 0 |

| Youngstown Village | 1 |

New York City had over 6,000 thefts in 2017.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the NY road fatalities?

Here we’ll examine the fatal crashes on the road and potential contributing factors, including weather and light conditions, speeding, and alcohol impairment. This data comes from the National Highway Traffic Safety Administration (NHTSA).

But first, let’s see which Empire State highway is the most deadly.

Most Fatal Highway in New York

According to Geotab, over the past decade, 156 crashes that led to deaths have occurred along Interstate 87 (I-87) from New York City to Montreal, Quebec in Canada.

Fatal Crashes by Weather & Light Conditions

The table below shows how many fatal accidents happened in different weather and light conditions in New York.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown |

|---|---|---|---|---|---|

| Normal | 409 | 238 | 128 | 36 | 1 |

| Rain | 34 | 28 | 14 | 4 | 0 |

| Snow/Sleet | 12 | 5 | 4 | 0 | 0 |

| Other | 2 | 0 | 6 | 0 | 0 |

| Unknown | 4 | 2 | 3 | 1 | 2 |

Despite the dangers of rain, snow, sleet, and darkness, most of the fatalities occurred in normal daylight conditions.

Fatalities (All Crashes) by County

Let’s see how many fatal crashes took place in each Empire State county.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany | 10 | 25 | 22 | 24 | 19 |

| Allegany | 5 | 2 | 4 | 5 | 2 |

| Bronx | 52 | 35 | 40 | 49 | 40 |

| Broome | 13 | 11 | 15 | 18 | 9 |

| Cattaraugus | 11 | 4 | 7 | 5 | 11 |

| Cayuga | 7 | 4 | 8 | 11 | 8 |

| Chautauqua | 11 | 10 | 10 | 13 | 9 |

| Chemung | 7 | 3 | 11 | 5 | 5 |

| Chenango | 9 | 4 | 6 | 5 | 6 |

| Clinton | 8 | 6 | 3 | 9 | 4 |

| Columbia | 9 | 6 | 8 | 8 | 11 |

| Cortland | 9 | 6 | 6 | 4 | 5 |

| Delaware | 9 | 6 | 8 | 2 | 7 |

| Dutchess | 30 | 22 | 26 | 20 | 19 |

| Erie | 57 | 47 | 44 | 50 | 43 |

| Essex | 1 | 8 | 2 | 3 | 3 |

| Franklin | 1 | 6 | 6 | 3 | 3 |

| Fulton | 5 | 7 | 6 | 0 | 6 |

| Genesee | 8 | 5 | 7 | 5 | 14 |

| Greene | 12 | 3 | 10 | 7 | 6 |

| Hamilton | 2 | 0 | 0 | 1 | 0 |

| Herkimer | 6 | 7 | 4 | 8 | 10 |

| Jefferson | 12 | 8 | 12 | 9 | 4 |

| Kings | 87 | 78 | 69 | 53 | 56 |

| Lewis | 6 | 4 | 4 | 3 | 5 |

| Livingston | 1 | 9 | 3 | 7 | 6 |

| Madison | 8 | 7 | 9 | 3 | 6 |

| Monroe | 37 | 43 | 33 | 45 | 45 |

| Montgomery | 7 | 3 | 5 | 5 | 5 |

| Nassau | 83 | 81 | 95 | 80 | 78 |

| New York | 45 | 39 | 28 | 48 | 38 |

| Niagara | 27 | 18 | 18 | 17 | 15 |

| Oneida | 21 | 15 | 12 | 22 | 18 |

| Onondaga | 30 | 25 | 33 | 27 | 34 |

| Ontario | 11 | 16 | 16 | 9 | 8 |

| Orange | 35 | 36 | 28 | 32 | 35 |

| Orleans | 7 | 4 | 0 | 4 | 11 |

| Oswego | 22 | 20 | 19 | 17 | 16 |

| Otsego | 5 | 4 | 7 | 4 | 6 |

| Putnam | 4 | 7 | 9 | 5 | 7 |

| Queens | 99 | 86 | 78 | 61 | 59 |

| Rensselaer | 11 | 10 | 9 | 8 | 9 |

| Richmond | 12 | 12 | 26 | 19 | 14 |

| Rockland | 17 | 17 | 15 | 11 | 18 |

| Saratoga | 18 | 11 | 18 | 19 | 18 |

| Schenectady | 4 | 6 | 10 | 7 | 9 |

| Schoharie | 2 | 4 | 2 | 2 | 2 |

| Schuyler | 3 | 1 | 2 | 3 | 3 |

| Seneca | 5 | 5 | 7 | 4 | 5 |

| St. Lawrence | 19 | 9 | 11 | 10 | 10 |

| Steuben | 12 | 12 | 7 | 10 | 3 |

| Suffolk | 145 | 123 | 168 | 139 | 121 |

| Sullivan | 14 | 13 | 13 | 9 | 6 |

| Tioga | 1 | 5 | 3 | 7 | 3 |

| Tompkins | 8 | 8 | 13 | 10 | 8 |

| Ulster | 24 | 12 | 16 | 14 | 23 |

| Warren | 6 | 9 | 2 | 2 | 6 |

| Washington | 8 | 8 | 10 | 8 | 3 |

| Wayne | 10 | 10 | 13 | 12 | 9 |

| Westchester | 52 | 27 | 51 | 37 | 32 |

| Wyoming | 2 | 5 | 7 | 3 | 5 |

| Yates | 3 | 4 | 2 | 1 | 0 |

As you might expect, many of the fatalities occurred in more populated counties, such as Suffolk.

Traffic Fatalities: Rural vs. Urban

These numbers reveal how many traffic deaths happened in rural versus urban areas of New York.

| Details | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 622 | 582 | 571 | 534 | 618 | 630 | 390 | 455 | 463 | 472 |

| Urban | 616 | 576 | 630 | 637 | 562 | 572 | 651 | 681 | 578 | 527 |

Despite the remoteness of rural areas, the number of crash deaths between rural and urban areas was almost even from 2008 – 2017.

Fatalities by Person Type

These are the fatalities by type of vehicle and transportation used in New York.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 423 | 375 | 368 | 330 | 339 |

| Light Truck - Pickup | 59 | 49 | 49 | 70 | 47 |

| Light Truck - Utility | 93 | 90 | 113 | 91 | 119 |

| Light Truck - Van | 41 | 26 | 41 | 33 | 33 |

| Large Truck | 16 | 14 | 15 | 11 | 13 |

| Bus | 0 | 3 | 4 | 0 | 1 |

| Light Truck - Other | 0 | 0 | 1 | 0 | 1 |

| Motorcyclists | 170 | 148 | 163 | 136 | 145 |

| Pedestrian | 336 | 264 | 311 | 307 | 242 |

| Bicyclist and Other Cyclist | 40 | 46 | 36 | 39 | 46 |

Passenger cars were involved in the most accidents, while pedestrian deaths weren’t far behind.

Fatalities by Crash Type

This is more information about the types of vehicles and the accidents that led to fatalities from 2013 – 2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 784 | 674 | 709 | 660 | 602 |

| Involving a Large Truck | 118 | 98 | 126 | 106 | 121 |

| Involving a Rollover | 160 | 144 | 160 | 144 | 127 |

| Involving a Roadway Departure | 580 | 509 | 513 | 471 | 450 |

| Involving an Intersection (or Intersection Related) | 467 | 377 | 419 | 385 | 373 |

During that five-year timeframe, most of the crashes involved single vehicles and roadway departures.

Five-Year Trend for the Top 10 Counties

These are the numbers of fatalities in the most populated New York counties from 2013 – 2017.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Suffolk County | 145 | 123 | 168 | 139 | 121 |

| Nassau County | 83 | 81 | 95 | 80 | 78 |

| Queens County | 99 | 86 | 78 | 61 | 59 |

| Kings County | 87 | 78 | 69 | 53 | 56 |

| Monroe County | 37 | 43 | 33 | 45 | 45 |

| Erie County | 57 | 47 | 44 | 50 | 43 |

| Bronx County | 52 | 35 | 40 | 49 | 40 |

| New York County | 45 | 39 | 28 | 48 | 38 |

| Orange County | 35 | 36 | 28 | 32 | 35 |

| Onondaga County | 30 | 25 | 33 | 27 | 34 |

Generally, these statistics show that the higher the population, the more traffic fatalities tend to occur in a given county.

Fatalities Involving Speed by County

Speed is among the many factors involved in crash deaths.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany | 1 | 7 | 7 | 3 | 5 |

| Allegany | 2 | 0 | 0 | 3 | 0 |

| Bronx | 12 | 13 | 10 | 11 | 12 |

| Broome | 1 | 4 | 5 | 4 | 4 |

| Cattaraugus | 3 | 2 | 2 | 0 | 1 |

| Cayuga | 1 | 1 | 3 | 2 | 3 |

| Chautauqua | 4 | 3 | 3 | 3 | 0 |

| Chemung | 1 | 0 | 7 | 1 | 1 |

| Chenango | 7 | 2 | 1 | 3 | 1 |

| Clinton | 1 | 3 | 2 | 4 | 2 |

| Columbia | 3 | 2 | 1 | 1 | 4 |

| Cortland | 1 | 4 | 2 | 1 | 2 |

| Delaware | 3 | 2 | 4 | 0 | 4 |

| Dutchess | 17 | 7 | 12 | 8 | 5 |

| Erie | 19 | 12 | 12 | 17 | 11 |

| Essex | 1 | 3 | 0 | 1 | 1 |

| Franklin | 1 | 3 | 2 | 0 | 2 |

| Fulton | 1 | 2 | 2 | 0 | 2 |

| Genesee | 0 | 2 | 6 | 1 | 2 |

| Greene | 4 | 2 | 2 | 2 | 3 |

| Hamilton | 0 | 0 | 0 | 1 | 0 |

| Herkimer | 4 | 3 | 2 | 5 | 2 |

| Jefferson | 6 | 3 | 4 | 3 | 1 |

| Kings | 31 | 18 | 15 | 11 | 13 |

| Lewis | 4 | 2 | 4 | 2 | 3 |

| Livingston | 1 | 2 | 0 | 1 | 0 |

| Madison | 3 | 1 | 1 | 1 | 4 |

| Monroe | 13 | 8 | 12 | 18 | 15 |

| Montgomery | 0 | 1 | 1 | 3 | 2 |

| Nassau | 14 | 32 | 28 | 26 | 20 |

| New York | 6 | 6 | 6 | 1 | 6 |

| Niagara | 10 | 6 | 6 | 9 | 3 |

| Oneida | 10 | 5 | 2 | 10 | 8 |

| Onondaga | 9 | 10 | 9 | 10 | 13 |

| Ontario | 4 | 3 | 9 | 3 | 2 |

| Orange | 11 | 12 | 11 | 15 | 12 |

| Orleans | 3 | 2 | 0 | 0 | 2 |

| Oswego | 13 | 10 | 7 | 9 | 7 |

| Otsego | 2 | 1 | 3 | 4 | 2 |

| Putnam | 0 | 3 | 3 | 1 | 2 |

| Queens | 29 | 22 | 29 | 19 | 18 |

| Rensselaer | 5 | 1 | 2 | 2 | 2 |

| Richmond | 3 | 1 | 8 | 6 | 5 |

| Rockland | 7 | 8 | 4 | 6 | 4 |

| Saratoga | 6 | 6 | 9 | 1 | 11 |

| Schenectady | 0 | 0 | 8 | 0 | 1 |

| Schoharie | 0 | 1 | 1 | 2 | 1 |

| Schuyler | 1 | 0 | 1 | 1 | 0 |

| Seneca | 1 | 3 | 0 | 1 | 2 |

| St. Lawrence | 7 | 4 | 2 | 2 | 3 |

| Steuben | 5 | 4 | 2 | 2 | 0 |

| Suffolk | 36 | 32 | 33 | 44 | 41 |

| Sullivan | 7 | 5 | 9 | 3 | 2 |

| Tioga | 0 | 1 | 1 | 2 | 1 |

| Tompkins | 3 | 4 | 1 | 2 | 3 |

| Ulster | 4 | 4 | 5 | 2 | 8 |

| Warren | 1 | 3 | 1 | 0 | 2 |

| Washington | 3 | 1 | 3 | 3 | 2 |

| Wayne | 3 | 4 | 2 | 6 | 2 |

| Westchester | 10 | 12 | 18 | 10 | 16 |

| Wyoming | 1 | 3 | 1 | 1 | 2 |

| Yates | 0 | 1 | 1 | 1 | 0 |

Fortunately, few speeding-related deaths have happened throughout New York counties.

Fatalities In Crashes Involving an Alcohol-Impaired Driver

Another major contributor to crashes in New York is alcohol consumption.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany | 2 | 8 | 9 | 5 | 4 |

| Allegany | 0 | 0 | 1 | 2 | 1 |

| Bronx | 16 | 12 | 8 | 12 | 15 |

| Broome | 5 | 6 | 6 | 8 | 4 |

| Cattaraugus | 4 | 2 | 1 | 2 | 4 |

| Cayuga | 2 | 1 | 2 | 6 | 2 |

| Chautauqua | 2 | 5 | 3 | 5 | 1 |

| Chemung | 2 | 0 | 1 | 1 | 1 |

| Chenango | 4 | 2 | 1 | 1 | 2 |

| Clinton | 3 | 1 | 2 | 1 | 1 |

| Columbia | 1 | 2 | 2 | 3 | 4 |

| Cortland | 0 | 2 | 2 | 0 | 4 |

| Delaware | 2 | 0 | 5 | 0 | 2 |

| Dutchess | 9 | 8 | 9 | 7 | 2 |

| Erie | 14 | 13 | 13 | 12 | 16 |

| Essex | 0 | 2 | 0 | 2 | 0 |

| Franklin | 1 | 3 | 1 | 1 | 1 |

| Fulton | 2 | 1 | 1 | 0 | 3 |

| Genesee | 3 | 2 | 1 | 1 | 3 |

| Greene | 6 | 0 | 3 | 2 | 1 |

| Hamilton | 2 | 0 | 0 | 0 | 0 |

| Herkimer | 4 | 3 | 2 | 2 | 2 |

| Jefferson | 5 | 4 | 5 | 4 | 1 |

| Kings | 27 | 17 | 14 | 14 | 15 |

| Lewis | 3 | 1 | 2 | 2 | 3 |

| Livingston | 0 | 3 | 2 | 1 | 2 |

| Madison | 2 | 3 | 3 | 1 | 1 |

| Monroe | 15 | 13 | 9 | 11 | 15 |

| Montgomery | 4 | 1 | 0 | 1 | 1 |

| Nassau | 24 | 22 | 27 | 18 | 20 |

| New York | 9 | 8 | 5 | 8 | 10 |

| Niagara | 11 | 5 | 4 | 4 | 3 |

| Oneida | 9 | 7 | 5 | 9 | 8 |

| Onondaga | 13 | 5 | 9 | 10 | 9 |

| Ontario | 3 | 5 | 6 | 2 | 3 |

| Orange | 13 | 11 | 4 | 14 | 7 |

| Orleans | 2 | 0 | 0 | 1 | 2 |

| Oswego | 7 | 8 | 5 | 10 | 6 |

| Otsego | 2 | 1 | 2 | 3 | 2 |

| Putnam | 1 | 2 | 5 | 1 | 3 |

| Queens | 28 | 20 | 22 | 19 | 21 |

| Rensselaer | 3 | 2 | 3 | 2 | 3 |

| Richmond | 3 | 4 | 6 | 2 | 5 |

| Rockland | 6 | 7 | 4 | 2 | 4 |

| Saratoga | 3 | 6 | 8 | 4 | 6 |

| Schenectady | 0 | 1 | 5 | 1 | 2 |

| Schoharie | 0 | 1 | 1 | 1 | 0 |

| Schuyler | 1 | 0 | 0 | 1 | 1 |

| Seneca | 2 | 1 | 4 | 2 | 2 |

| St. Lawrence | 7 | 3 | 4 | 2 | 4 |

| Steuben | 2 | 5 | 0 | 1 | 1 |

| Suffolk | 45 | 39 | 51 | 42 | 37 |

| Sullivan | 2 | 6 | 1 | 2 | 1 |

| Tioga | 0 | 1 | 2 | 3 | 2 |

| Tompkins | 2 | 4 | 2 | 2 | 3 |

| Ulster | 8 | 3 | 3 | 4 | 7 |

| Warren | 3 | 3 | 1 | 0 | 1 |

| Washington | 5 | 2 | 3 | 2 | 2 |

| Wayne | 4 | 5 | 3 | 4 | 3 |

| Westchester | 11 | 10 | 14 | 12 | 11 |

| Wyoming | 1 | 2 | 1 | 1 | 2 |

| Yates | 2 | 2 | 0 | 1 | 0 |

Suffolk and Queens Counties were among those with the highest alcohol-related fatalities.

Teen Drinking & Driving

Let’s look at the trends in underage drinking in New York.

| DUI Arrest (Under 18 years old) | DUI Arrests (Under 18 years old) Total Per Million People | Rank |

|---|---|---|

| 113 | 27.03 | 46 |

Fortunately, New York is among the states with the lowest number of alcohol-impaired fatalities for those under age 21, ranking 46th out of 50 states. Nationally, according to The Foundation for Advancing Alcohol Responsibility, the average is 1.2 deaths per 100,000.

EMS Response Time

These are the EMS response times for crashes in rural and urban areas.

What is NY transportation like?

Response times in rural parts of New York were, unfortunately, three times higher than those in cities and suburbs. This may be due to difficulties getting to more remote areas.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Transportation

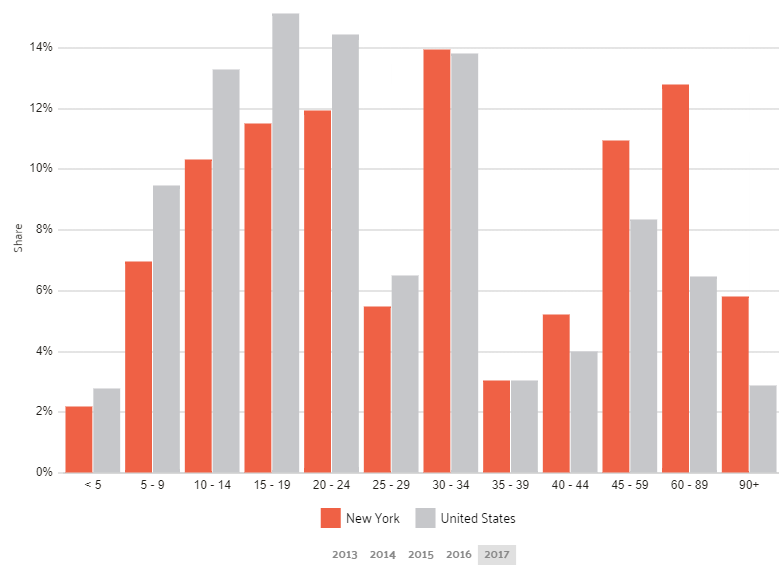

The below information from Data USA reveals how many cars New Yorkers own on average, the forms of transportation they take in their commutes and the average length of those commutes.

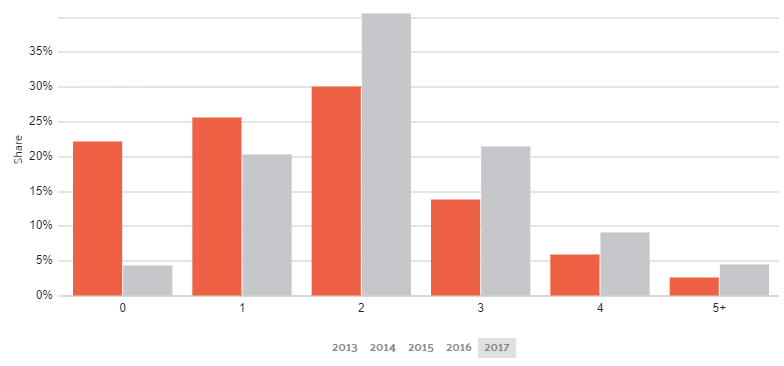

The gray bars represent the U.S. and the orange bars show New York.

Car Ownership