Indiana Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 16.70

Whether it’s known as the Hoosier State or The Crossroads of America, all roads seem to lead to Indiana. Maybe, you’re a follower of NCAA basketball or even perhaps, a devoted race car fan, if so, then the great state of Indiana has you covered.

But if you’re like us, shooting hoops and driving fast are activities we wish we could be doing, instead of spending countless hours jumping through hoops and searching endlessly online looking for the cheapest car insurance.

What if there was a way to help you save on your auto insurance policy? What if it could save you money? Would you take the time? I bet you would and that’s why we’ve compiled this guide to get you started. Everything you need to know about buying cheap car insurance in Indiana is in this comprehensive guide. On your mark! Get set! Score!

Enter your zip code into our free comparison tool above to get started comparing various auto insurance quotes.

What are Indiana car insurance coverage and rates?

The median household income in Indiana in 2017 was over $54,181, and drivers, on average paid over $1,033 for car insurance. That’s way too high for us! However, you feel about it, we think consumers in the Hoosier State are spending way too much money on car insurance.

There has to be a better way.

Below, we have provided information and helpful advice so you can get the best coverage options for your needs.

| INDIANA MINIMUM COVERAGE REQUIREMENTS | AMOUNT |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured/Underinsured Motorist Coverage | $25,000 per person $50,000 per accident |

Okay, you’ve read the numbers, but what do they mean?

What is 25/50/25?

Bodily injury liability?

Accidents?We hope you never have to deal with any of these situations or end up in one of these:

But if you do, the basic coverage requirements in Indiana which all motorists must have for liability insurance are:

- $25,000 to cover the death or injury of one person

- $50,000 to cover the death or injury of more than one person

- $25,000 to cover property damage

Liability insurance pays all individuals drivers, passengers, pedestrians, etc. who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes. If you cause a wreck, liability insurance pays everyone affected by the accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are required forms of financial responsibility for minimum liability insurance?

What are financial responsibility requirements? Basically, financial responsibility is proof that you have Indiana’s minimum liability coverage. State law requires every driver and owner of a vehicle to have proof of financial security that they have at least the minimum levels or liability car insurance at all times.

Here are a few acceptable forms of proof of financial security in Indiana:

- Valid Insurance ID Card

- Electronic proof on a smartphone

- A letter from an insurance agent or insurer on company letterhead.

In the case that you don’t have some sort of financial security documentation on you, the Bureau of Motor Vehicles (BMV) will send a notification to request that you provide proof of financial responsibility. You may receive this notification due to any of the following situations:

- Auto accident

- Moving traffic violation within one year of receiving at least two other moving traffic violations

- Misdemeanor or felony traffic violation

- Traffic violation by a driver who has previously had their license suspended for failing to provide proof of financial responsibility.

If you don’t submit evidence within 90 days of the BMV’s mailing of the request, your driving privileges will be suspended. Once suspended, you will need to have your insurance provider or employer submit proof of financial responsibility, known as an SR-22 form, in order to get that suspension removed from your driving record.

What are premiums as percentage of income in Indiana?

The per capita disposable income in Indiana is $39,364. The average cost annually is $729 a year on car insurance. To put this amount in perspective, the countrywide, annual average for car insurance is $981.

This means people in Indiana pay considerably less than the countrywide average, and less than neighboring states Illinois and Ohio who pay yearly amounts of $854 and $767, respectively.

What are average monthly car insurance rates in IN (liability, collision coverage, and comprehensive coverage)?

The main concern of almost every motorist in Indiana is the rising cost of insurance? The table below shows data provided by the National Association of Insurance Commissioners which is an agency dedicated to keeping up with the changing costs of car insurance.

| Coverage Type | Annual Costs |

|---|---|

| Liability | $382.68 |

| Collision | $250.29 |

| Comprehensive | $122.06 |

| Combined | $755.03 |

Keep in mind with this information, however, that this data was pulled from 2015. Rates in 2019 will likely be higher than these values.

Up next, we take a look at loss ratios and what they mean to a company’s bottom line.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What additional coverage options are available in Indiana?

There are numerous different types of insurance to choose from, especially if you’re looking for insurance for good drivers. To gauge the financial health of insurance companies, you should look at its loss ratios. Loss ratios are explained as: the money insurance companies pay out in claims compared to the money they take in from premiums.

For example, an auto insurer collects $100,000 of premiums in a given year and pays out $45,000 in claims, the company’s loss ratio is 45 percent ($45,000 incurred losses/$100,000 earned premiums).

Check out the loss ratio for these two types of coverage in Indiana.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 85.48 | 82.86 | 79.55 |

| Underinsured Motorists / Uninsured Motorists Property Damage Coverage | 73.42 | 64.13 | 60.33 |

You may want to consider adding additional coverage to your insurance plans, to avoid paying out of pocket in the event of an accident. Without additional coverage, medical bills and payments could reach well into the thousands of dollars for those affected by an uninsured driver and force some into financial difficulty without uninsured motorist coverage.

What add-ons, endorsements, and riders are available?

No one wants to be in a car wreck, but if you are, do you have enough protection for you and your family? Have you considered adding extra coverages to your policy? Do you even know what’s out there? Choosing from a list of options can be daunting, and we know you want the best options for your family at the best price.

To help you decide, we’ve made a list of affordable options to add to your policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)-This can be added to cheap car insurance to add an extra layer of protection and coverage. Many people add an umbrella to their auto, home, and other coverages.

- Rental Reimbursement- Whether your insurer is evaluating the cost of repairs or investigating your case, they generally provide rental car coverage for up to 30 days. The average cost is barely noticeable on your auto insurance premium.

- Emergency Roadside Assistance – If your car breaks down or you have a flat this addition to your policy will help you to pay for the cost of roadside repairs or tow when needed

- Mechanical Breakdown Insurance –Need repairs that were not due to an accident then this type of coverage is for you.

- Non-Owner Car Insurance – This type of coverage is perfect for you if you don’t own a car but still drive on occasion because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage – This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance – This type of coverage helps ensure a classic, antique or vintage car is protected.

- Usage-Based or Pay-As-You-Drive Insurance

Any of the above coverages would be beneficial to add to your policy, so make sure to discuss any options you are interested in with your insurance provider.

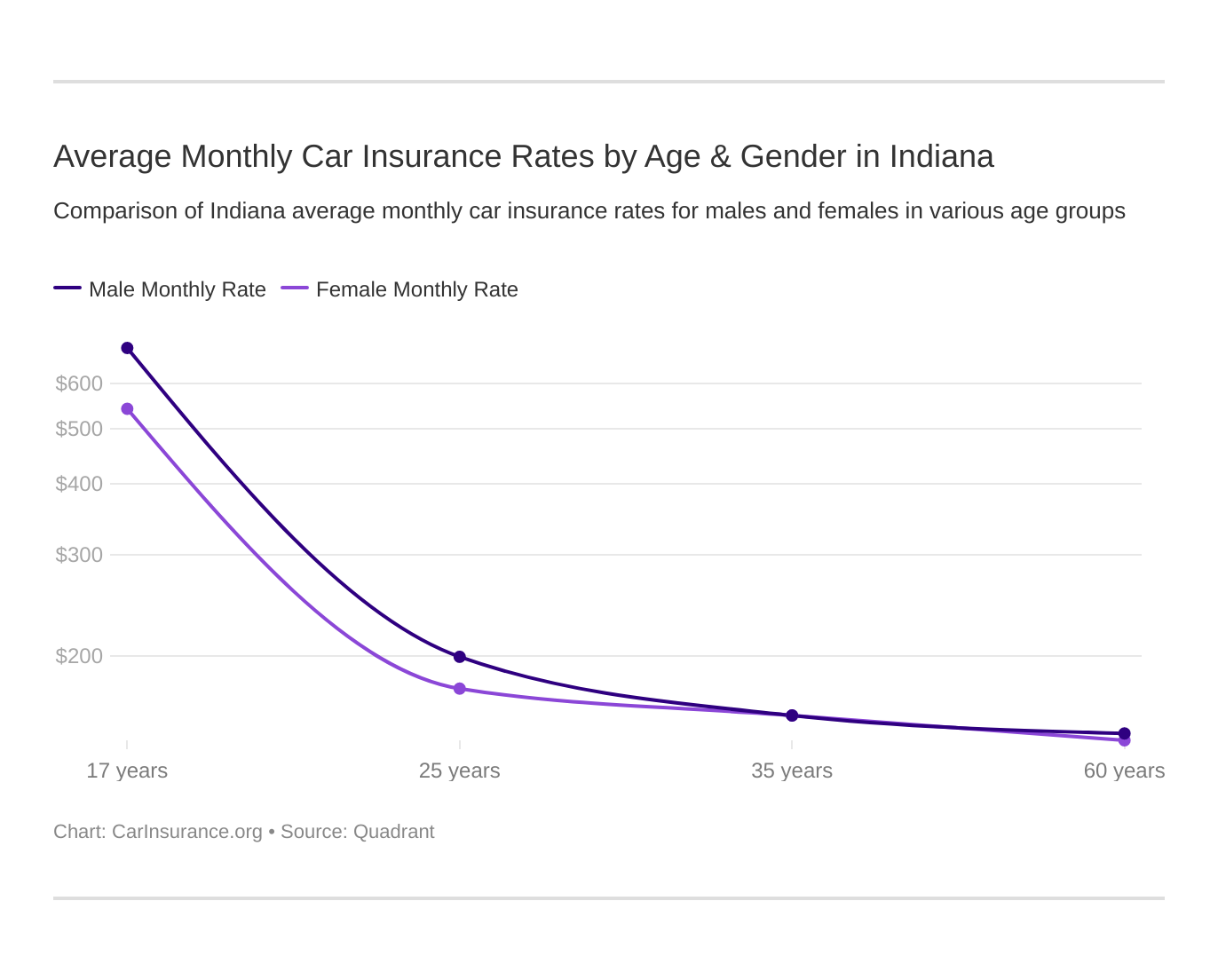

What are average monthly car insurance rates by age & gender in IN?

Inc.com wrote an article that says women pay $100,000 more for the same products as men do. In fact, gender discrimination in car insurance rates is such a problem that California and other states banned gender discrimination and created gender-neutral insurance plans.

Up next, we partnered with Quadrant to show you rates that various folks in Indiana pay for car insurance.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,461.65 | $2,522.04 | $2,161.34 | $2,364.89 | $7,566.53 | $9,542.11 | $2,500.79 | $2,718.57 |

| American Family Mutual | $2,305.56 | $2,305.56 | $2,072.87 | $2,072.87 | $6,342.08 | $9,188.19 | $2,305.56 | $2,839.57 |

| Illinois Farmers Ins 2.0 | $1,558.68 | $1,538.30 | $1,333.35 | $1,497.61 | $8,369.82 | $8,927.88 | $2,053.19 | $2,219.06 |

| Geico Cas | $1,543.08 | $1,533.98 | $1,441.76 | $1,492.21 | $4,534.08 | $4,216.98 | $1,765.37 | $1,558.45 |

| First Liberty Ins Corp | $3,951.85 | $3,951.85 | $3,632.20 | $3,632.20 | $8,652.09 | $13,064.06 | $3,951.85 | $5,418.04 |

| Nationwide Mutual | $1,670.50 | $1,708.99 | $1,463.84 | $1,564.29 | $4,865.35 | $6,323.43 | $1,959.23 | $2,144.10 |

| Progressive Paloverde | $1,659.70 | $1,570.98 | $1,503.23 | $1,513.35 | $9,753.71 | $10,976.02 | $2,081.70 | $2,125.43 |

| State Farm Mutual Auto | $1,480.20 | $1,480.20 | $1,318.52 | $1,318.52 | $4,476.08 | $5,736.50 | $1,637.30 | $1,821.69 |

| Travco Ins Co | $1,225.25 | $1,246.82 | $1,148.12 | $1,147.95 | $7,586.22 | $11,997.40 | $1,295.87 | $1,500.67 |

| USAA | $1,039.00 | $1,023.39 | $966.69 | $974.02 | $2,894.49 | $3,235.29 | $1,404.62 | $1,503.00 |

As you can see from the data, teen drivers pay thousands more than older drivers do for car insurance. Among the major carriers, State Farm and First Mutual have the exact same rates for female and male drivers, excluding teenagers.

In all instances, male teenage drivers pay more than any other demographic. As with all such information, your rates may be different depending on your location and other circumstances.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

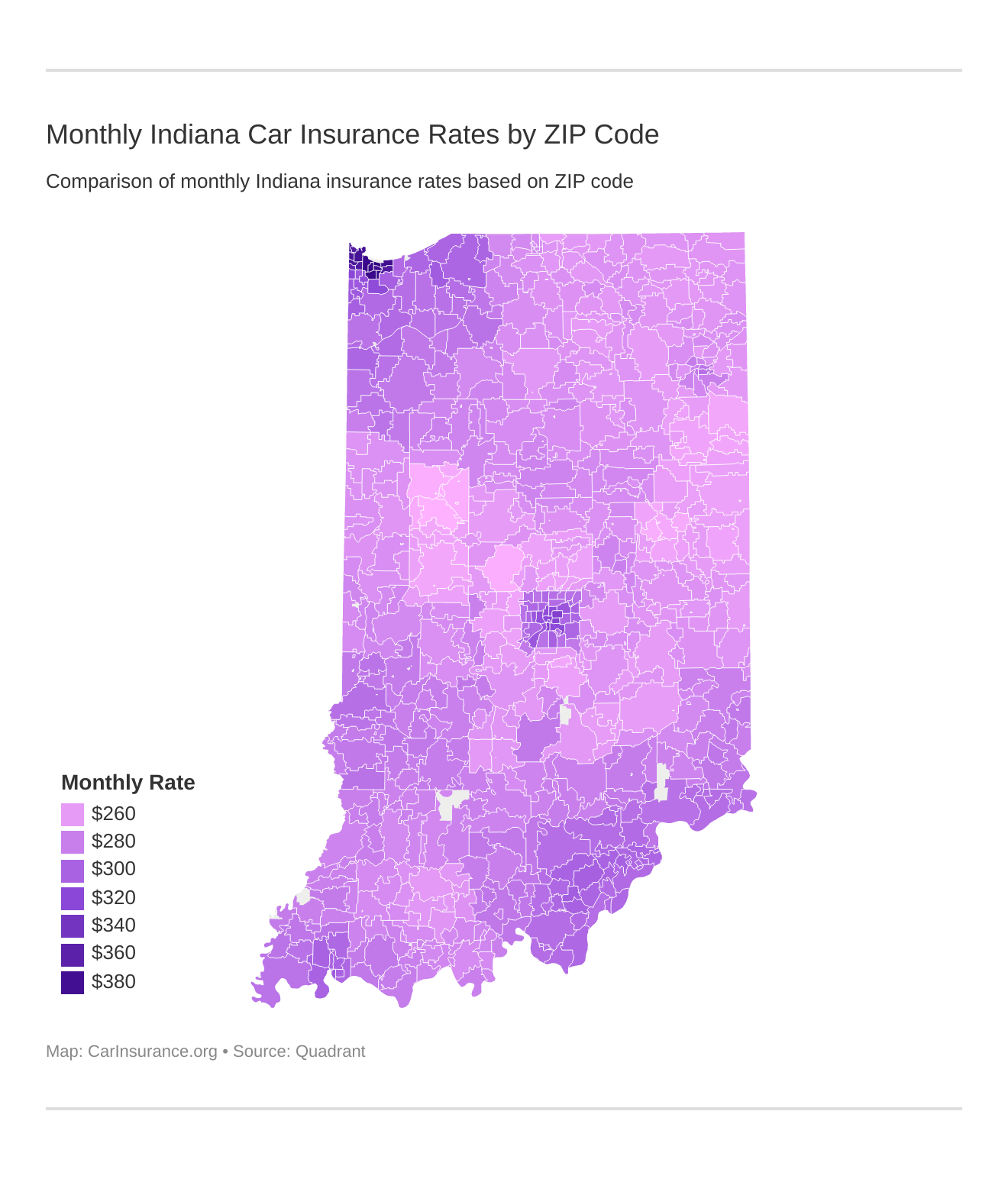

Where are the highest and lowest rates by ZIP code per carrier?

In addition to gender and age, where you live can affect your car insurance rates. We’ve collected data on the least and most expensive zip codes, so search to see where your zip code lands on the list. You’ll also see providers’ costs next to your zip code, providing a helpful snapshot into what you should be paying.

| Cheapest ZIP Codes in Indiana | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 47909 | LAFAYETTE | $2,931.86 | Liberty Mutual | $4,795.80 | Progressive | $3,520.02 | USAA | $1,664.59 | Geico | $1,846.51 |

| 47904 | LAFAYETTE | $2,935.07 | Liberty Mutual | $4,795.80 | Progressive | $3,672.73 | USAA | $1,680.00 | Geico | $1,846.51 |

| 47906 | WEST LAFAYETTE | $2,950.51 | Liberty Mutual | $4,795.80 | Progressive | $3,561.61 | USAA | $1,656.42 | Geico | $1,846.51 |

| 47905 | LAFAYETTE | $2,951.60 | Liberty Mutual | $4,795.80 | Progressive | $3,610.18 | USAA | $1,680.00 | Geico | $1,846.51 |

| 46052 | LEBANON | $2,954.17 | Liberty Mutual | $4,731.27 | Progressive | $3,733.55 | USAA | $1,672.13 | State Farm | $2,025.08 |

| 47304 | MUNCIE | $2,966.03 | Liberty Mutual | $5,135.56 | Progressive | $3,507.11 | USAA | $1,554.19 | Geico | $1,964.87 |

| 47901 | LAFAYETTE | $2,966.62 | Liberty Mutual | $4,795.80 | Progressive | $3,557.08 | USAA | $1,680.00 | Geico | $1,846.51 |

| 47907 | WEST LAFAYETTE | $2,966.92 | Liberty Mutual | $4,795.80 | Progressive | $3,554.69 | USAA | $1,656.42 | Geico | $1,846.51 |

| 47941 | DAYTON | $2,967.67 | Liberty Mutual | $4,795.80 | Progressive | $3,683.95 | USAA | $1,664.59 | Geico | $1,846.51 |

| 47992 | WESTPOINT | $2,979.70 | Liberty Mutual | $4,795.80 | Progressive | $3,619.45 | USAA | $1,664.59 | Geico | $1,846.51 |

| 47320 | ALBANY | $2,992.15 | Liberty Mutual | $5,135.56 | Allstate | $3,790.23 | USAA | $1,557.29 | Geico | $2,086.92 |

| 47303 | MUNCIE | $3,003.06 | Liberty Mutual | $5,135.56 | Allstate | $3,776.91 | USAA | $1,557.29 | Geico | $1,964.87 |

| 47920 | BATTLE GROUND | $3,004.91 | Liberty Mutual | $4,795.80 | Progressive | $3,881.11 | USAA | $1,680.00 | Geico | $1,846.51 |

| 47981 | ROMNEY | $3,009.62 | Liberty Mutual | $4,795.80 | Allstate | $3,828.61 | USAA | $1,664.59 | Geico | $1,846.51 |

| 46733 | DECATUR | $3,011.51 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| 47933 | CRAWFORDSVILLE | $3,016.00 | Liberty Mutual | $4,795.80 | Allstate | $3,810.42 | USAA | $1,751.12 | Geico | $1,846.51 |

| 47305 | MUNCIE | $3,018.08 | Liberty Mutual | $5,135.56 | Allstate | $3,471.39 | USAA | $1,557.29 | Geico | $1,964.87 |

| 47940 | DARLINGTON | $3,019.44 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

| 46711 | BERNE | $3,021.03 | Liberty Mutual | $5,603.67 | Allstate | $3,847.95 | USAA | $1,440.88 | Geico | $1,997.93 |

| 46781 | PONETO | $3,026.33 | Liberty Mutual | $5,603.67 | Allstate | $3,723.28 | USAA | $1,440.88 | Geico | $1,997.93 |

| 46184 | WHITELAND | $3,029.36 | Liberty Mutual | $4,731.27 | Allstate | $3,822.92 | USAA | $1,553.91 | Nationwide | $2,200.66 |

| 46112 | BROWNSBURG | $3,031.44 | Liberty Mutual | $4,731.27 | Progressive | $3,801.39 | USAA | $1,599.04 | Nationwide | $2,168.37 |

| 47302 | MUNCIE | $3,033.48 | Liberty Mutual | $5,135.56 | Progressive | $3,809.05 | USAA | $1,557.29 | Geico | $1,964.87 |

| 46759 | KEYSTONE | $3,034.31 | Liberty Mutual | $5,603.67 | Allstate | $3,893.46 | USAA | $1,440.88 | Geico | $1,997.93 |

| 47955 | LINDEN | $3,047.57 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

The next table shows the most expensive rates in Indiana.

| Most Expensive ZIP Codes in Indiana | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 46402 | GARY | $4,747.17 | Liberty Mutual | $9,628.64 | Travelers | $5,850.12 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46409 | GARY | $4,692.40 | Liberty Mutual | $9,628.64 | Travelers | $5,474.18 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46404 | GARY | $4,666.36 | Liberty Mutual | $9,628.64 | Travelers | $5,474.18 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46406 | GARY | $4,653.94 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,275.82 | State Farm | $3,038.44 |

| 46408 | GARY | $4,643.30 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46407 | GARY | $4,593.71 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,268.89 | Geico | $3,059.32 |

| 46403 | GARY | $4,578.59 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,268.89 | State Farm | $2,999.79 |

| 46312 | EAST CHICAGO | $4,535.08 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46320 | HAMMOND | $4,504.55 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46327 | HAMMOND | $4,484.26 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46323 | HAMMOND | $4,437.39 | Liberty Mutual | $9,628.64 | American Family | $5,005.05 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46405 | LAKE STATION | $4,429.98 | Liberty Mutual | $9,628.64 | Farmers | $4,942.93 | USAA | $2,268.89 | Geico | $2,701.41 |

| 46394 | WHITING | $4,389.62 | Liberty Mutual | $8,830.37 | Travelers | $5,122.67 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46324 | HAMMOND | $4,283.88 | Liberty Mutual | $8,830.37 | American Family | $4,641.89 | USAA | $2,275.82 | Geico | $2,633.18 |

| 46218 | INDIANAPOLIS | $3,918.34 | Liberty Mutual | $6,988.78 | Progressive | $4,785.22 | USAA | $1,807.48 | Geico | $2,935.62 |

| 46225 | INDIANAPOLIS | $3,911.50 | Liberty Mutual | $6,988.78 | Allstate | $4,556.36 | USAA | $1,921.95 | State Farm | $2,849.34 |

| 46201 | INDIANAPOLIS | $3,903.52 | Liberty Mutual | $6,988.78 | Progressive | $4,737.15 | USAA | $1,807.48 | State Farm | $2,765.34 |

| 46321 | MUNSTER | $3,840.34 | Liberty Mutual | $6,539.56 | Progressive | $4,761.83 | USAA | $1,830.24 | State Farm | $2,634.19 |

| 46202 | INDIANAPOLIS | $3,836.94 | Liberty Mutual | $6,988.78 | Allstate | $4,562.82 | USAA | $1,921.95 | State Farm | $2,734.67 |

| 46205 | INDIANAPOLIS | $3,811.23 | Liberty Mutual | $5,987.84 | Progressive | $4,809.00 | USAA | $1,960.16 | Geico | $2,746.89 |

| 46203 | INDIANAPOLIS | $3,810.17 | Liberty Mutual | $6,988.78 | Progressive | $4,393.59 | USAA | $1,890.04 | State Farm | $2,727.33 |

| 46410 | MERRILLVILLE | $3,807.73 | Liberty Mutual | $6,402.26 | Farmers | $4,942.93 | USAA | $1,941.51 | Nationwide | $2,610.30 |

| 46208 | INDIANAPOLIS | $3,803.31 | Liberty Mutual | $5,987.84 | Allstate | $4,774.63 | USAA | $1,927.91 | Geico | $2,746.89 |

| 46204 | INDIANAPOLIS | $3,795.21 | Liberty Mutual | $6,988.78 | Allstate | $4,562.82 | USAA | $1,921.95 | State Farm | $2,707.44 |

| 46319 | GRIFFITH | $3,791.73 | Liberty Mutual | $6,402.26 | Progressive | $4,788.69 | USAA | $1,830.24 | State Farm | $2,666.18 |

Read More: LM General Insurance Company Review

Where are the highest and lowest rates by city per carrier?

We’ve also collected data on car insurance rates by city. Below is a list of the least expensive and most expensive cities for car insurance. Simply look for your city to see your city’s auto insurance cost.

| Cheapest Cities in Indiana | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Lafayette | $2,950.11 | Liberty Mutual | $4,795.80 | Progressive | $3,576.13 | USAA | $1,670.25 | Geico | $1,846.51 |

| Montmorenci | $2,950.51 | Liberty Mutual | $4,795.80 | Progressive | $3,561.61 | USAA | $1,656.42 | Geico | $1,846.51 |

| Americus | $2,951.59 | Liberty Mutual | $4,795.80 | Progressive | $3,610.18 | USAA | $1,680.00 | Geico | $1,846.51 |

| Lebanon | $2,954.16 | Liberty Mutual | $4,731.27 | Progressive | $3,733.55 | USAA | $1,672.13 | State Farm | $2,025.08 |

| Dayton | $2,967.66 | Liberty Mutual | $4,795.80 | Progressive | $3,683.95 | USAA | $1,664.59 | Geico | $1,846.51 |

| Westpoint | $2,979.70 | Liberty Mutual | $4,795.80 | Progressive | $3,619.45 | USAA | $1,664.59 | Geico | $1,846.51 |

| Albany | $2,992.15 | Liberty Mutual | $5,135.56 | Allstate | $3,790.23 | USAA | $1,557.29 | Geico | $2,086.92 |

| Battle Ground | $3,004.91 | Liberty Mutual | $4,795.80 | Progressive | $3,881.11 | USAA | $1,680.00 | Geico | $1,846.51 |

| Romney | $3,009.62 | Liberty Mutual | $4,795.80 | Allstate | $3,828.61 | USAA | $1,664.59 | Geico | $1,846.51 |

| Decatur | $3,011.51 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| Crawfordsville | $3,016.00 | Liberty Mutual | $4,795.80 | Allstate | $3,810.42 | USAA | $1,751.12 | Geico | $1,846.51 |

| Muncie | $3,018.33 | Liberty Mutual | $5,135.56 | Allstate | $3,600.35 | USAA | $1,556.05 | Geico | $1,964.87 |

| Darlington | $3,019.44 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

| Berne | $3,021.03 | Liberty Mutual | $5,603.67 | Allstate | $3,847.95 | USAA | $1,440.88 | Geico | $1,997.93 |

| Poneto | $3,026.33 | Liberty Mutual | $5,603.67 | Allstate | $3,723.28 | USAA | $1,440.88 | Geico | $1,997.93 |

| New Whiteland | $3,029.36 | Liberty Mutual | $4,731.27 | Allstate | $3,822.92 | USAA | $1,553.91 | Nationwide | $2,200.66 |

| Brownsburg | $3,031.44 | Liberty Mutual | $4,731.27 | Progressive | $3,801.39 | USAA | $1,599.04 | Nationwide | $2,168.37 |

| Keystone | $3,034.31 | Liberty Mutual | $5,603.67 | Allstate | $3,893.46 | USAA | $1,440.88 | Geico | $1,997.93 |

| Linden | $3,047.56 | Liberty Mutual | $4,795.80 | Allstate | $3,848.70 | USAA | $1,751.12 | Geico | $1,846.51 |

| Monroe | $3,047.88 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| Bluffton | $3,048.12 | Liberty Mutual | $5,603.67 | Allstate | $3,843.74 | USAA | $1,440.88 | Geico | $1,997.93 |

| Winchester | $3,048.99 | Liberty Mutual | $5,603.67 | Allstate | $3,855.97 | USAA | $1,551.34 | Geico | $2,086.92 |

| Gaston | $3,049.64 | Liberty Mutual | $5,135.56 | Progressive | $3,481.03 | USAA | $1,554.19 | Geico | $1,964.87 |

| Waynetown | $3,055.37 | Liberty Mutual | $4,795.80 | Progressive | $3,902.82 | USAA | $1,751.12 | Geico | $1,846.51 |

| Clarks Hill | $3,055.48 | Liberty Mutual | $4,795.80 | Allstate | $4,021.48 | USAA | $1,664.59 | Geico | $1,846.51 |

As you can see from the tables, where you live can impact your wallet when purchasing auto insurance coverage. Folks in urban areas like Indianapolis pay hundreds more than those living in a smaller city like Lafayette. Population density isn’t the only factor, though. Insurers also consider crime rates, accident rates, and more.

| Most Expensive Cities in Indiana | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Gary | $4,653.64 | Liberty Mutual | $9,628.64 | Travelers | $5,300.76 | USAA | $2,269.88 | Geico | $3,059.32 |

| East Chicago | $4,535.08 | Liberty Mutual | $9,628.64 | Travelers | $5,122.67 | USAA | $2,275.82 | Geico | $2,633.18 |

| Lake Station | $4,429.98 | Liberty Mutual | $9,628.64 | Farmers | $4,942.93 | USAA | $2,268.89 | Geico | $2,701.41 |

| Hammond | $4,419.94 | Liberty Mutual | $9,309.33 | American Family | $4,859.78 | USAA | $2,275.82 | Geico | $2,633.18 |

| Munster | $3,840.34 | Liberty Mutual | $6,539.56 | Progressive | $4,761.83 | USAA | $1,830.24 | State Farm | $2,634.19 |

| Griffith | $3,791.73 | Liberty Mutual | $6,402.26 | Progressive | $4,788.69 | USAA | $1,830.24 | State Farm | $2,666.18 |

| Hobart | $3,723.86 | Liberty Mutual | $6,402.26 | Farmers | $4,377.50 | USAA | $1,941.51 | Nationwide | $2,610.30 |

| Highland | $3,696.55 | Liberty Mutual | $6,539.56 | Allstate | $4,381.45 | USAA | $1,830.24 | State Farm | $2,647.19 |

| Schererville | $3,695.41 | Liberty Mutual | $6,402.26 | Progressive | $4,590.37 | USAA | $1,706.16 | State Farm | $2,586.38 |

| Dyer | $3,678.46 | Liberty Mutual | $6,402.26 | American Family | $4,299.79 | USAA | $1,706.16 | State Farm | $2,645.06 |

| St. John | $3,678.32 | Liberty Mutual | $6,402.26 | American Family | $4,299.79 | USAA | $1,706.16 | Geico | $2,701.41 |

| Westville | $3,661.15 | Liberty Mutual | $6,926.39 | American Family | $4,218.96 | USAA | $1,610.51 | Geico | $2,353.77 |

| Beverly Shores | $3,640.46 | Liberty Mutual | $6,926.39 | Progressive | $4,241.52 | USAA | $1,904.61 | Geico | $2,353.77 |

| Borden | $3,625.98 | Liberty Mutual | $5,937.41 | Progressive | $4,459.13 | USAA | $1,897.73 | Geico | $2,437.68 |

| Kingsbury | $3,625.44 | Liberty Mutual | $6,926.39 | Progressive | $4,338.11 | USAA | $1,610.51 | Geico | $2,233.98 |

| Homecroft | $3,623.82 | Liberty Mutual | $5,987.84 | Progressive | $4,872.69 | USAA | $1,771.02 | Geico | $2,369.70 |

| Otisco | $3,614.57 | Liberty Mutual | $5,937.41 | Progressive | $4,528.25 | USAA | $1,897.73 | Geico | $2,437.68 |

| Boone Grove | $3,611.22 | Liberty Mutual | $6,535.71 | Progressive | $4,624.80 | USAA | $1,904.61 | Geico | $2,138.50 |

| Evansville | $3,611.05 | Liberty Mutual | $6,594.45 | Progressive | $4,151.10 | USAA | $1,825.34 | Geico | $2,402.59 |

| Georgetown | $3,606.56 | Liberty Mutual | $5,875.05 | Progressive | $4,388.15 | USAA | $1,734.46 | Geico | $2,556.33 |

| Indianapolis | $3,604.96 | Liberty Mutual | $6,140.11 | Progressive | $4,316.55 | USAA | $1,837.91 | Geico | $2,604.98 |

| Henryville | $3,602.10 | Liberty Mutual | $5,937.41 | Progressive | $4,509.85 | USAA | $1,897.73 | Geico | $2,437.68 |

| Pekin | $3,595.20 | Liberty Mutual | $5,937.41 | Progressive | $4,464.19 | USAA | $1,716.22 | Geico | $2,437.68 |

| Wheeler | $3,593.95 | Liberty Mutual | $6,535.71 | Progressive | $4,392.97 | USAA | $1,760.45 | Nationwide | $2,610.30 |

| Nabb | $3,593.87 | Liberty Mutual | $5,937.41 | Progressive | $4,355.40 | USAA | $1,897.73 | Geico | $2,437.68 |

What are the best Indiana car insurance companies?

From the Indianapolis Speedway to the shores of Lake Michigan, folks in Indiana have numerous opportunities to discover everything their great state has to offer. One thing we know for sure is that most of those folks would rather be out exploring, instead of looking and searching for cheaper rates on car insurance.

That’s why we’ve done all of the work for you and researched the best auto insurance companies in Indiana, so you can make the best choice for your situation. We’ve looked at these major insurance companies’ financial ratings, AM’s best ratings, and which companies have the most complaints. We’ve gathered customer rating to see how people really experience coverage with different carriers from national giants to small local providers. We’ve heard about everything from annual premiums to the mobile app and more. Unfortunately, no insurance company is perfect, but many are providing great coverage and service at affordable prices around the country.

Keep reading to learn about Indiana’s auto insurance providers.

The Largest Companies’ Financial Stability Ratings

Loss ratios play a large part in how a company is doing financially. That’s why we want to include AM Best ratings, which look at loss ratios to determine if a company has solid financial security.

Now let’s see who is the cheapest car insurance company in Indiana.

View as image

So to see how the 10 largest companies in Indiana are doing, we’ve included the AM Best ratings for each.

| Providers (Based on Size, From Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Farm | A++ |

| Progressive | A+ |

| Allstate | A+ |

| Indiana Farm Bureau | A- |

| Geico | A++ |

| Liberty Mutual | A |

| American Family Insurance | A |

| Erie Insurance | A+ |

| USAA | A++ |

| Auto-Owners Group | A++ |

Companies with the Best Ratings

A good financial rating means the insurance carrier has the funds available to pay any claims. But customer service is also an important part of any company, from restaurants to car insurance companies. That’s why we’ve looked at companies with the best overall customer satisfaction ratings.

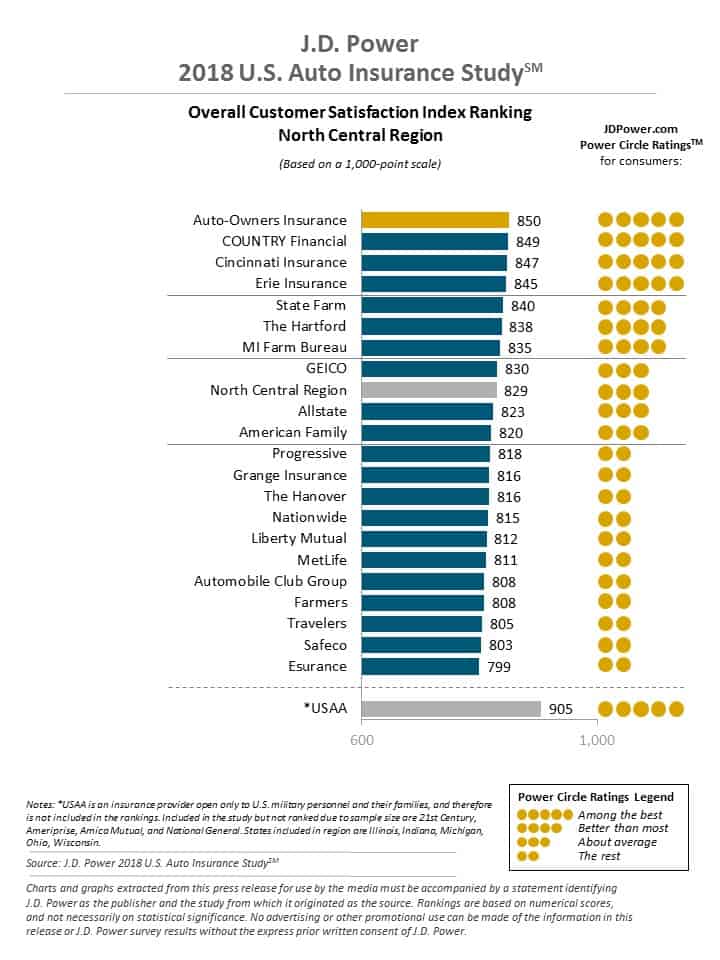

Check out these ratings from J. D. Power.

State Farm ranks near the top of the list proving that State Farm is great at customer satisfaction levels.

Just because a company has a good rating for financial stability doesn’t mean their customers are always happy.

Let’s check out their record of official complaints.

Companies with the Most Complaints in Indiana

Keep in mind that a high complaint index doesn’t necessarily mean you should avoid a company. You should also look at a company’s customer satisfaction ratings because how a company deals with complaints is also important.

| NAIC # | Company Name | Premium | Number of Complaints | Complaint Index |

|---|---|---|---|---|

| 44245 | 21st Century Assur Co | $1,126,992 | 1 | 12.98 |

| 22667 | Ace Amer Ins Co | $6,818,835 | 1 | 2.15 |

| 42579 | Allied Prop & Cas Ins Co | $9,348,636 | 1 | 1.56 |

| 19240 | Allstate Ind Co | $9,380,967 | 2 | 3.12 |

| 19232 | Allstate Ins Co | $26,803,382 | 4 | 2.18 |

| 17230 | Allstate Prop & Cas Ins Co | $233,727,004 | 16 | 1 |

| 10730 | American Access Cas Co | $18,370,556 | 6 | 4.78 |

| 19275 | American Family Mut Ins Co SI | $105,497,365 | 12 | 1.66 |

| 10864 | American Freedom Ins Co | $10,464,341 | 10 | 13.98 |

| 28401 | American Natl Prop & Cas Co | $6,334,686 | 1 | 2.31 |

| 19992 | American Select Ins Co | $19,593,305 | 2 | 1.49 |

| 19283 | American Standard Ins Co of WI | $5,478,415 | 1 | 2.67 |

| 37214 | American States Preferred Ins Co | $10,456,815 | 1 | 1.4 |

| 11150 | Arch Ins Co | $6,453,691 | 1 | 2.27 |

| 11558 | AssuranceAmerica Ins Co | $5,463,895 | 1 | 2.68 |

| 18988 | Auto Owners Ins Co | $114,691,864 | 5 | 0.64 |

| 19658 | Bristol W Ins Co | $15,258,233 | 3 | 2.88 |

| 22640 | Consolidated Ins Co | $55,840,770 | 10 | 2.62 |

| 35289 | Continental Ins Co | $1,001,305 | 1 | 14.61 |

| 37770 | CSAA Gen Ins Co | $21,594,213 | 1 | 0.68 |

| 42587 | Depositors Ins Co | $30,041,847 | 1 | 0.49 |

| 13688 | Elephant Ins Co | $4,742,452 | 1 | 3.08 |

| 21326 | Empire Fire & Marine Ins Co | $6,279,485 | 1 | 2.33 |

| 26271 | Erie Ins Exchange | $156,630 | 4 | DN |

| 25712 | Esurance Ins Co | $17,490,230 | 2 | 1.67 |

| 10336 | First Acceptance Ins Co Inc | $9,721,986 | 4 | 6.02 |

| 13587 | First Chicago Ins Co | $22,770,536 | 3 | 1.93 |

| 11185 | Foremost Ins Co Grand Rapids MI | $3,035,976 | 1 | 4.82 |

| 14249 | Founders Ins Co | $24,516,935 | 18 | 10.74 |

| 13986 | Frankenmuth Mut Ins Co | $3,510,809 | 1 | 4.17 |

| 21253 | Garrison Prop & Cas Ins Co | $10,799 | 2 | DN |

| 14138 | Geico Advantage Ins Co | $29,078,992 | 2 | 1.01 |

| 41491 | Geico Cas Co | $98,966,033 | 9 | 1.33 |

| 14139 | Geico Choice Ins Co | $27,158,942 | 3 | 1.62 |

| 35882 | Geico Gen Ins Co | $31,271,436 | 1 | 0.47 |

| 22055 | Geico Ind Co | $17,446,916 | 1 | 0.84 |

| 14137 | Geico Secure Ins Co | $20,362,765 | 1 | 0.72 |

| 10648 | Geneva Ins Co | $1,641,309 | 3 | 26.74 |

| 22063 | Government Employees Ins Co | $9,882,976 | 1 | 1.48 |

| 10322 | Grange Ind Ins Co | $6,853,804 | 1 | 2.13 |

| 16144 | Grinnell Select Ins Co | $6,124,176 | 1 | 2.39 |

| 15032 | Guideone Mut Ins Co | $595,878 | 1 | DN |

| 22292 | Hanover Ins Co | $17,744,284 | 1 | 0.82 |

| 25054 | Hudson Ins Co | $604,842 | 1 | DN |

| 22624 | Indiana Farmers Mut Ins Co | $93,833,871 | 1 | 0.16 |

| 42404 | Liberty Ins Corp | $815,224 | 1 | DN |

| 14941 | Lighthouse Cas Co | $2,775,797 | 2 | 10.54 |

| 36447 | LM Gen Ins Co | None | 1 | DN |

| 33600 | LM Ins Corp | $1,666,446 | 2 | 17.56 |

| 11198 | Loya Ins Co | $1,020,790 | 2 | 28.66 |

| 26298 | Metropolitan Prop & Cas Ins Co | $10,736,831 | 2 | 2.72 |

| 41653 | Milbank Ins Co | $9,508,880 | 1 | 1.54 |

| 28223 | Nationwide Agribusiness Ins Co | $5,052,021 | 1 | 2.9 |

| 23787 | Nationwide Mut Ins Co | $31,025,294 | 2 | 0.94 |

| 24082 | Ohio Security Ins Co | $10,299,628 | 1 | 1.42 |

| 39098 | Omni Ins Co | $2,107,044 | 3 | 20.83 |

| 37648 | Permanent Gen Assur Corp | $21,944,533 | 8 | 5.33 |

| 44695 | Progressive Paloverde Ins Co | $247,444,249 | 18 | 1.06 |

| 38784 | Progressive Southeastern Ins Co | $226,241,918 | 8 | 0.52 |

| 34690 | Property & Cas Ins Co Of Hartford | $4,753,235 | 1 | 3.08 |

| 39217 | QBE Ins Corp | $264,894 | 1 | DN |

| 13056 | RLI Ins Co | $1,763,035 | 1 | 8.3 |

| 25405 | Safe Auto Ins Co | $31,047,710 | 6 | 2.83 |

| 11215 | Safeco Ins Co Of IN | $119,087,321 | 11 | 1.35 |

| 19259 | Selective Ins Co Of SC | $15,184,280 | 1 | 0.96 |

| 19070 | Standard Fire Ins Co | $46,312,500 | 7 | 2.21 |

| 15199 | Standard Prop & Cas Ins Co | $6,548,561 | 2 | 4.47 |

| 25143 | State Farm Fire & Cas Co | $65,484,851 | 9 | 2.01 |

| 25178 | State Farm Mut Auto Ins Co | $847,420,643 | 26 | 0.45 |

| 28188 | Travco Ins Co | $14,005,377 | 3 | 3.13 |

| 12188 | Trexis Ins Corp | $14,274,557 | 4 | 4.1 |

| 11004 | Trexis One Ins Corp | $4,207,389 | 1 | 3.48 |

| 27120 | Trumbull Ins Co | $19,962,617 | 1 | 0.73 |

| 40118 | Trustgard Ins Co | $20,860,827 | 1 | 0.7 |

| 10655 | Unique Ins Co | $2,087,202 | 2 | 14.02 |

| 15288 | United Farm Family Mut Ins Co | $291,607,837 | 11 | 0.55 |

| 25941 | United Serv Automobile Assn | $33,342 | 2 | DN |

| 25968 | USAA Cas Ins Co | $25,866,514 | 4 | 2.26 |

| 18600 | USAA Gen Ind Co | $28,393,360 | 1 | 0.52 |

| 13137 | Viking Ins Co Of WI | $4,368,438 | 1 | 3.35 |

| 15350 | West Bend Mut Ins Co | $23,598,227 | 2 | 1.24 |

| 24112 | Westfield Ins Co | $13,384,635 | 1 | 1.09 |

Read more:

- AssuranceAmerica Review

- Continental Car Insurance Review

- Ohio Security Insurance Company Review

- Omni Insurance Review

If a car insurance company’s complaint index is lower than one, they are better than the average. If the index is higher than one, they are worse than the average. American Freedom and InsureMax have the highest complaint ratios in Indiana.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

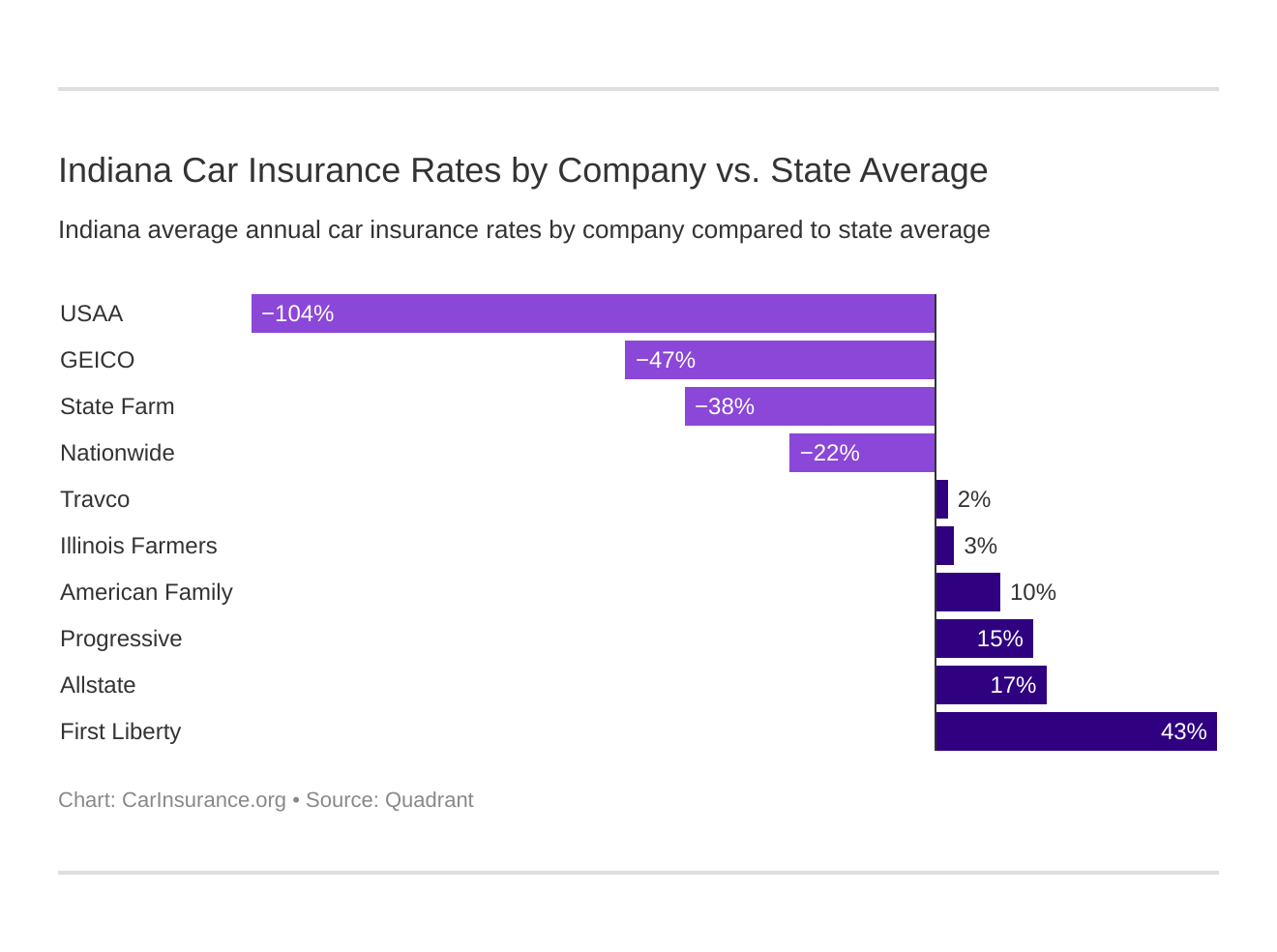

What are the cheapest companies in Indiana?

Nobody wants to be considered cheap, except when it comes to finding cheaper car insurance. In order to save money, you should be shopping around to see what’s available. The table below displays the top carriers in Indiana with their average rate for all drivers and compares it to the state average of all companies. These are sample drivers. The exact rates and cheapest companies could vary based on your unique profile.

| Company | Average Annual Rate | Compared to State Average | Percentage |

|---|---|---|---|

| Allstate P&C | $3,979.74 | $661.62 | 16.62% |

| American Family Mutual | $3,679.03 | $360.91 | 9.81% |

| Illinois Farmers Ins 2.0 | $3,437.24 | $119.11 | 3.47% |

| Geico Cas | $2,260.74 | -$1,057.38 | -46.77% |

| First Liberty Ins Corp | $5,781.77 | $2,463.65 | 42.61% |

| Nationwide Mutual | $2,712.47 | -$605.66 | -22.33% |

| Progressive Paloverde | $3,898.01 | $579.89 | 14.88% |

| State Farm Mutual Auto | $2,408.63 | -$909.49 | -37.76% |

| Travco Ins Co | $3,393.54 | $75.42 | 2.22% |

| USAA | $1,630.06 | -$1,688.06 | -103.56% |

Looking at different providers can save a lot of money. For example, Nationwide is $600 BELOW the state average, which, over time, could add up to thousands of dollars saved.

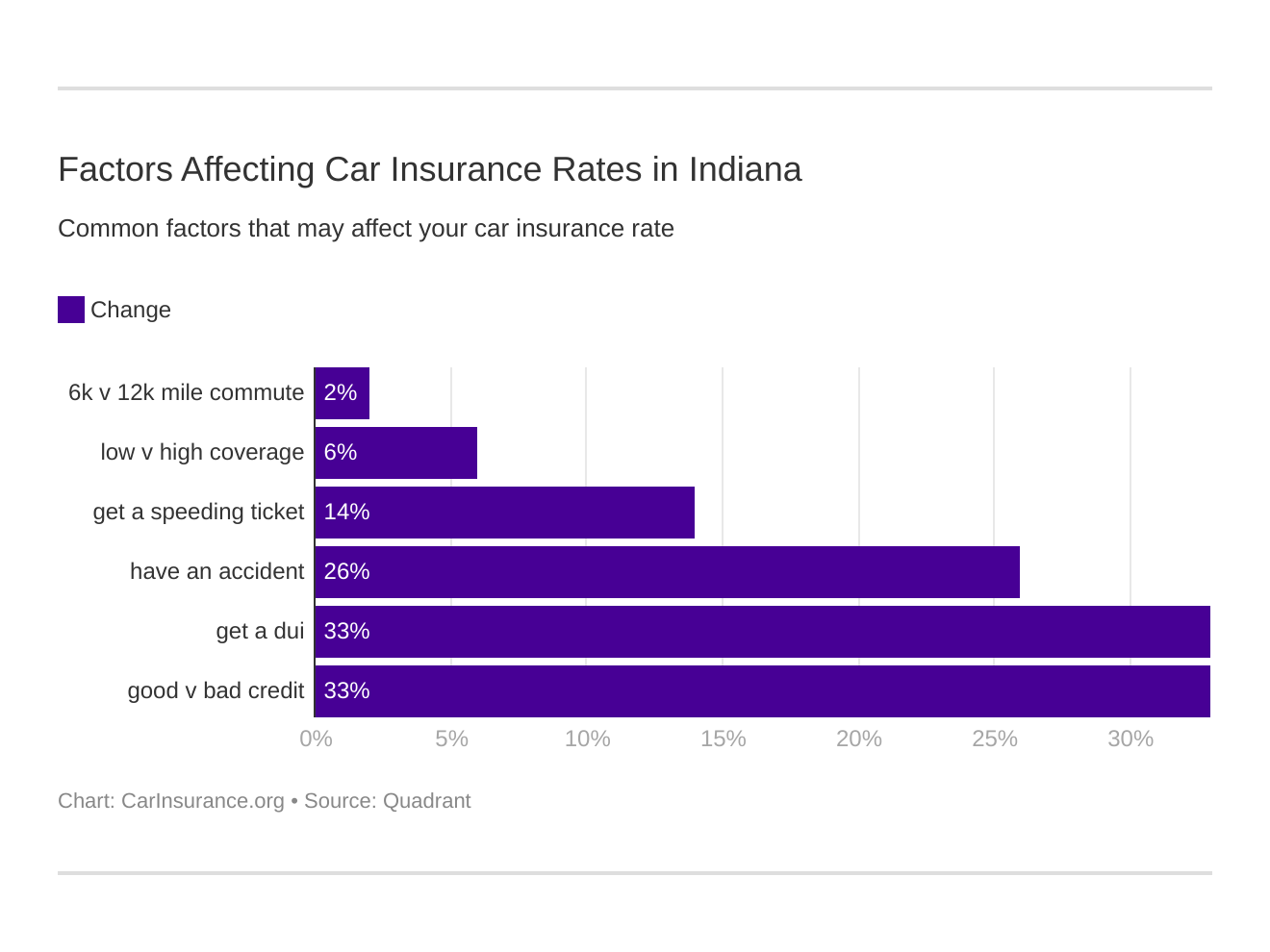

What are commute rates by company?

At some companies, how far you commute each day influences your insurance rates. Beyond age, gender, location, marital status, and carrier, other factors that affect your quoted rates from each carrier are those that are specific to your individual situation such as how much coverage you want, credit history, and driving record.

The tables below compare such factors based on each carrier.

| Group | Daily Commute | Annual Mileage | Annual Average |

|---|---|---|---|

| Allstate | 10 miles | 6000 | $3,979.74 |

| Allstate | 25 miles | 12,000 | $3,979.74 |

| American Family | 10 miles | 6,000 | $3,634.66 |

| American Family | 25 miles | 12,000 | $3,723.40 |

| Farmers | 10 miles | 6,000 | $3,437.24 |

| Farmers | 25 miles | 12,000 | $3,437.24 |

| Geico | 10 miles | 6,000 | $2,220.59 |

| Geico | 25 miles | 12,000 | $2,300.89 |

| Liberty Mutual | 10 miles | 6,000 | $5,628.11 |

| Liberty Mutual | 25 miles | 12,000 | $5,935.42 |

| Nationwide | 10 miles | 6,000 | $2,712.47 |

| Nationwide | 25 miles | 12,000 | $2,712.47 |

| Progressive | 10 miles | 6,000 | $3,898.01 |

| Progressive | 25 miles | 12,000 | $3,898.01 |

| State Farm | 10 miles | 6,000 | $2,340.29 |

| State Farm | 25 miles | 12,000 | $2,476.96 |

| Travelers | 10 miles | 6,000 | $3,393.54 |

| Travelers | 25 miles | 12,000 | $3,393.54 |

| USAA | 10 miles | 6,000 | $1,608.43 |

| USAA | 25 miles | 12,000 | $1,651.69 |

Most company rates don’t change when the drive is shortened to a 10-mile commute, except for Liberty Mutual, who offers rate reductions over $300.

Up next, a break-down of coverage level rates in Indiana.

What are rates by coverage level?

Do you want better coverage, but are reluctant to spend more money? You may be surprised some insurance carriers offer more coverage with minimal increases in rates.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $4,185.52 |

| Allstate | Medium | $3,964.38 |

| Allstate | Low | $3,789.32 |

| American Family | High | $3,591.92 |

| American Family | Medium | $3,800.78 |

| American Family | Low | $3,644.40 |

| Farmers | High | $3,565.78 |

| Farmers | Medium | $3,430.50 |

| Farmers | Low | $3,315.42 |

| Geico | High | $2,407.42 |

| Geico | Medium | $2,254.59 |

| Geico | Low | $2,120.21 |

| Liberty Mutual | High | $5,985.03 |

| Liberty Mutual | Medium | $5,766.94 |

| Liberty Mutual | Low | $5,593.34 |

| Nationwide | High | $2,691.75 |

| Nationwide | Medium | $2,690.85 |

| Nationwide | Low | $2,754.80 |

| Progressive | High | $4,174.68 |

| Progressive | Medium | $3,837.21 |

| Progressive | Low | $3,682.14 |

| State Farm | High | $2,522.50 |

| State Farm | Medium | $2,407.80 |

| State Farm | Low | $2,295.59 |

| Travelers | High | $3,428.83 |

| Travelers | Medium | $3,425.20 |

| Travelers | Low | $3,326.58 |

| USAA | High | $1,692.31 |

| USAA | Medium | $1,626.02 |

| USAA | Low | $1,571.85 |

For example, the data above shows Travelers and State Farm have less than $300 increases from low to high coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are rates by credit history per company?

The quality of your credit score impacts your insurance rates. In Indiana, the average credit score is 667, which is below the nationwide average of 675. Basically, this means motorists may have to pay more for their coverage based on their credit history.

The table below shows what you can expect to pay yearly on car insurance based on your credit history.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $4,935.01 |

| Allstate | Fair | $3,670.06 |

| Allstate | Good | $3,334.15 |

| American Family | Poor | $5,032.66 |

| American Family | Fair | $3,268.20 |

| American Family | Good | $2,736.23 |

| Farmers | Poor | $4,010.86 |

| Farmers | Fair | $3,270.65 |

| Farmers | Good | $3,030.19 |

| Geico | Poor | $2,719.94 |

| Geico | Fair | $2,260.74 |

| Geico | Good | $1,801.53 |

| Liberty Mutual | Poor | $7,698.61 |

| Liberty Mutual | Fair | $5,011.70 |

| Liberty Mutual | Good | $4,635.00 |

| Nationwide | Poor | $3,088.75 |

| Nationwide | Fair | $2,608.92 |

| Nationwide | Good | $2,439.73 |

| Progressive | Poor | $4,299.10 |

| Progressive | Fair | $3,806.34 |

| Progressive | Good | $3,588.61 |

| State Farm | Poor | $3,508.97 |

| State Farm | Fair | $2,093.59 |

| State Farm | Good | $1,623.32 |

| Travelers | Poor | $3,778.81 |

| Travelers | Fair | $3,202.05 |

| Travelers | Good | $3,199.76 |

| USAA | Poor | $2,195.89 |

| USAA | Fair | $1,450.78 |

| USAA | Good | $1,243.51 |

If you have insurance through Liberty Mutual and have poor credit, you can expect to pay nearly $3000 more for car insurance than someone with good credit.

What are driving record rates?

A clean driving record is the EASIEST way to keep rates down. As you can see from the information below, at Farmers, just one speeding violation can raise your rate by over $300.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | Clean record | $3,175.58 |

| Allstate | With 1 speeding violation | $3,777.03 |

| Allstate | With 1 accident | $4,665.22 |

| Allstate | With 1 DUI | $4,301.12 |

| American Family | Clean record | $2,536.03 |

| American Family | With 1 speeding violation | $3,020.98 |

| American Family | With 1 accident | $4,041.92 |

| American Family | With 1 DUI | $5,117.20 |

| Farmers | Clean record | $3,075.51 |

| Farmers | With 1 speeding violation | $3,395.05 |

| Farmers | With 1 accident | $3,585.45 |

| Farmers | With 1 DUI | $3,692.93 |

| Geico | Clean record | $1,483.91 |

| Geico | With 1 speeding violation | $2,060.50 |

| Geico | With 1 accident | $2,335.58 |

| Geico | With 1 DUI | $3,162.96 |

| Liberty Mutual | Clean record | $4,509.08 |

| Liberty Mutual | With 1 speeding violation | $4,969.05 |

| Liberty Mutual | With 1 accident | $5,317.03 |

| Liberty Mutual | With 1 DUI | $8,331.91 |

| Nationwide | Clean record | $2,332.31 |

| Nationwide | With 1 speeding violation | $2,627.10 |

| Nationwide | With 1 accident | $3,007.11 |

| Nationwide | With 1 DUI | $2,883.35 |

| Progressive | Clean record | $2,920.42 |

| Progressive | With 1 speeding violation | $4,063.99 |

| Progressive | With 1 accident | $5,121.94 |

| Progressive | With 1 DUI | $3,485.71 |

| State Farm | Clean record | $2,352.06 |

| State Farm | With 1 speeding violation | $2,352.06 |

| State Farm | With 1 accident | $2,578.33 |

| State Farm | With 1 DUI | $2,352.06 |

| Travelers | Clean record | $2,882.59 |

| Travelers | With 1 speeding violation | $3,092.54 |

| Travelers | With 1 accident | $3,562.38 |

| Travelers | With 1 DUI | $4,036.63 |

| USAA | Clean record | $1,231.12 |

| USAA | With 1 speeding violation | $1,526.13 |

| USAA | With 1 accident | $1,752.37 |

| USAA | With 1 DUI | $2,010.62 |

A better record equals better rates. We encourage you to obey posted speed limit signs and NOT drink and drive.

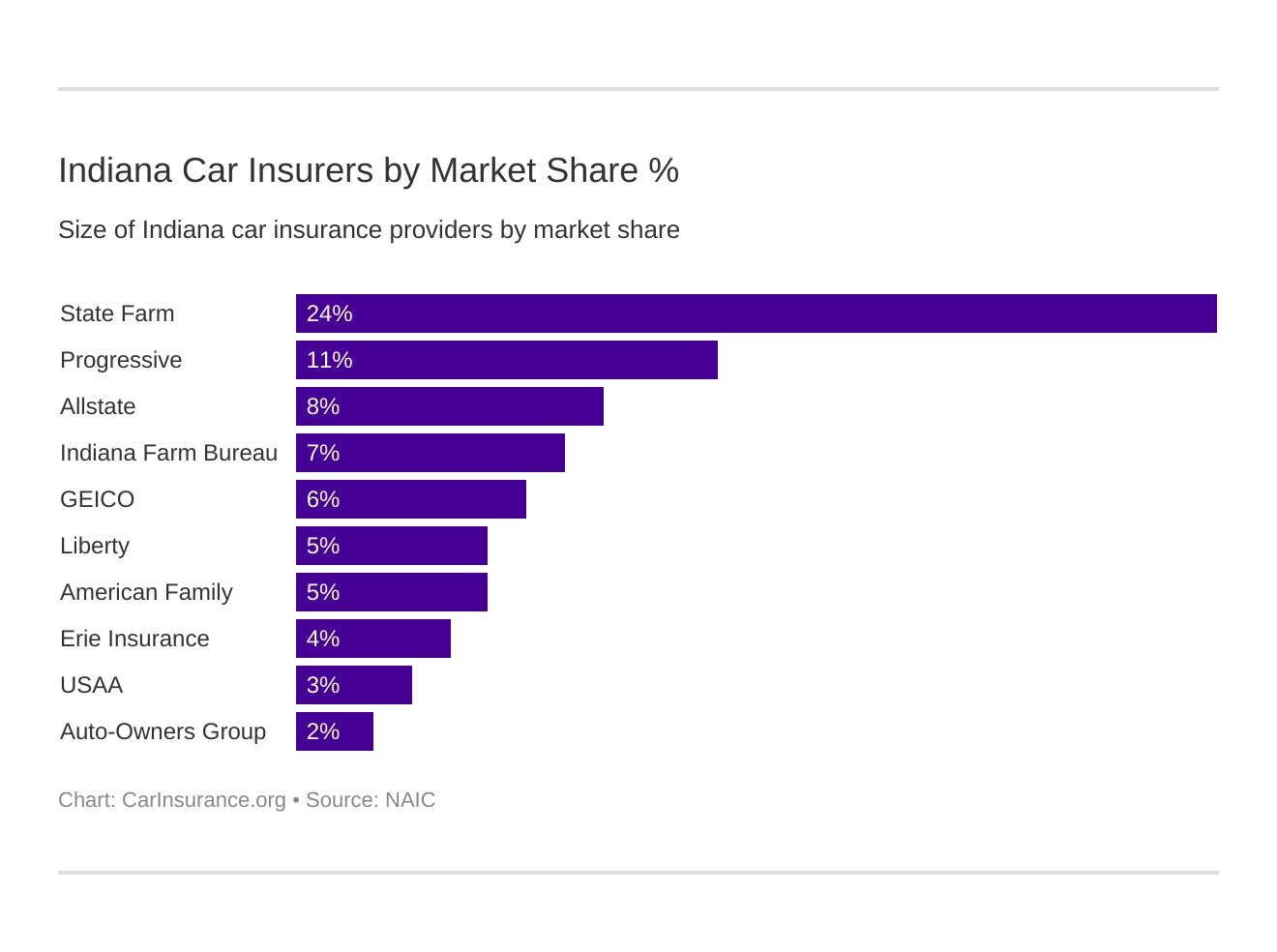

What are the largest car insurance companies in Indiana?

Who are the largest car insurance companies in IN?

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $907,710 | 60.03% | 24.05% |

| Progressive Group | $428,466 | 58.96% | 11.35% |

| Allstate Insurance Group | $287,390 | 51.71% | 7.61% |

| Indiana Farm Bureau Group | $277,065 | 68.18% | 7.34% |

| Geico | $233,428 | 67.85% | 6.18% |

| Liberty Mutual Group | $185,530 | 63.31% | 4.92% |

| American Family Insurance Group | $171,186 | 61.90% | 4.54% |

| Erie Insurance Group | $143,261 | 72.18% | 3.80% |

| USAA Group | $98,402 | 72.82% | 2.61% |

| Auto-Owners Group | $91,976 | 66.46% | 2.44% |

Number of Property and Casualty Insurance Companies in Indiana

Domestic insurance means a company is formed under Indiana’s state laws, whereas a foreign provider is formed under the laws of any state in the country.

- Domestic Insurers: 64

- Foreign Insurers: 958

Comparing quotes will help you know where to get started. Once you find the company that offers the best rates to you, do some more research into their financial rating, customer satisfaction rating, and complaint ratios. Then, you can confidently choose your insurer.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Indiana state laws do you need to know?

Does something smell? We hope if you do smell something, it’s something pleasant and not yourself or your neighbor. But it could be something else.

According to state law in Indiana, it’s illegal to take a bath between the months of October through March. Thank goodness, it isn’t enforced, because we’re thinking that trying to fill a job vacancy for “Chief Sniffer” would probably be hard to fill.

We know, state laws are odd and sometimes confusing and vary from state to state. New residents may receive tickets for laws they didn’t know existed.

Next, we help you uncover what the laws are, so check out our roundup of Indiana’s driving laws.

Insurance companies are subject to certain rules and regulations.

Let’s look at some of the specific laws for consumers regarding car insurance.

Windshield Coverage

Certain states mandate a waived deductible if you need to have your windshield repaired, while other states only let you use manufacturer replacement parts if a repair is needed.

Indiana car insurance laws don’t currently anything specific to windshields. If your car is under five years old, you can opt for used, aftermarket, or OEM (original equipment manufacturer) parts as you prefer.

High-Risk Insurance

If you have a bad driving record, it may be difficult to find an insurance company that is willing to insure you as a driver. Luckily, in most states, insurance companies have made programs available to provide affordable coverage for those who are high-risk drivers.

In Indiana, this program is known as the Indiana Automobile Insurance Plan. The idea behind IN AIP is to ensure that motorists in the state who fulfill the eligibility requirements can obtain coverage, particularly if they have not been able to secure insurance the standard route.

The program’s approach of distributing high-risk drivers to carriers based on the company’s share of the insurance market in the state ensures that no single insurer bears too heavy of losses.

According to the plan:

In order to be able to apply to AIP, you must show proof that you have applied to, and have been declined by a minimum of three different insurance companies within a 60-day period.

Low-Cost Insurance Premiums

Some states have programs set up for those who receive benefits from government assistance programs, or those who have a combined family income that is below the poverty level. Unfortunately, Indiana has no such plan in place. In order to obey the law, you must carry the minimum liability coverage.

Automobile Insurance Fraud in Indiana

What is automobile insurance fraud?

- Creating a claim for damages or injuries that NEVER occurred (such as faking an accident)

- Adding “extra” costs onto a claim that is legitimate

Indiana has employed an Insurance Fraud Unit to investigate fraudulent activity throughout the state.

Committing insurance fraud can result in fines and/or jail time.

Statute of Limitations

If you are in a car accident in Indiana, there is a statute of limitations in which you must file and resolve your claim or file a lawsuit.

- Property Damage – Two Years

- Bodily Injury – Two Years

What are Indiana’s vehicle licensing laws?

Indiana, just like every other state, has mandatory licensing laws in addition to the statute of limitations and car insurance laws, which we previously covered.

Up next, we delve further into the state’s licensing requirements for teen drivers, older drivers, the general population and much more.

REAL ID

Indiana is in full compliance with the REAL ID Act passed by Congress and enforced by Homeland Security. This means that a driver’s license or state ID issued by the Hoosier State is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

As of October 1, 2020, anyone wishing to fly on a commercial flight or enter a federal facility must have a REAL ID-compliant form of identification.

Penalties For Driving Without Insurance

| DRIVING WITHOUT INSURANCE | Penalty |

|---|---|

| First Offense | License/registration suspension for 90 days to one year |

| Second Offense | Within three years: license/registration suspension for one year |

Proof of Insurance

You need to keep proof of insurance with you at all times and always when you get behind the wheel.

Remember if you:

- Were involved an auto accident in which the Bureau of Motor Vehicles is sent a copy of the accident report

- Received a pointable moving violation with a year of being issued two additional pointable moving violations

- Were found guilty of a grave traffic violation like a felony or misdemeanor

- Were issued a pointable violation and had your license suspended previously for failure to offer proof of financial responsibility

The Indiana BMV will send a verification form to your address, requiring your insurer to file a Certificate of Compliance electronically within 90 days of the request being issued.

If the verification form is not filed and processed within 90-days of it being mailed out, your driving privileges will be revoked and may only be reinstated once the Certificate of Compliance is filed.

Teen Driver Laws

To begin driving in Indiana, teens must be 15 to apply for a learner’s license. Before teens can apply for a regular license or a restricted license, the Insurance Institute for Highway Safety (IIHS) specifies that teens must meet the requirements below.

| TEEN REQUIREMENTS FOR GETTING A LICENSE IN INDIANA | Time |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours, 10 of which must be at night |

| Minimum Age | 16 years old (3 months with drivers education ; 9 months without) |

In addition to these requirements, teen drivers must also follow the following rules:

| TEEN RESTRICTIONS FOR RESTRICTED LICENSES IN INDIANA | Time | MINIMUM AGE AT WHICH RESTRICTIONS MAY BE LIFTED: | Age |

|---|---|---|---|

| Nighttime restrictions | First 6 months, 10 p.m.-5 a.m.; thereafter, 11 p.m.-5 a.m. Sun.–Fri.; 1 a.m.-5 a.m. Sat.–Sun | Nighttime restrictions | 6 months and age 18 or until age 21, whichever occurs first (min. age 18) |

| Passenger restrictions (family members excepted unless noted otherwise) | No passengers younger than 21 years old | Passenger restrictions | 6 months or until age 21, whichever occurs first (min. age: 16, 9 or 17, 3 mos. without driver education) |

Older Driver License Renewal Procedures

Older drivers who wish to renew their license must:

- Renew once every three years if between the ages of 75 and 84

- Renew once every two years if 85 or older

- If 75 or older, provide proof of adequate vision at each renewal

- Mail or online renewal is not allowed for drivers 75 and up

The license renewal procedures for the general population are as follows:

- Renew once every six years

- Proof of adequate vision is required if renewing in person

- You can renew online every other renewal

New Residents

Considering a move to the Hoosier State? Here are the guidelines for getting a new Indiana driver’s license.

- One document as proof of identity

- One document proving your legal status in the U.S.

- One document as proof of your Social Security number

- Two documents as proof of your Indiana residency

You will need to provide proof of adequate vision at least once every ten years, so you will still have to make at least one visit to the DMV in person.

License Renewal Procedures

The license renewal procedures for the general population are as follows:

- Renew once every six years

- Proof of adequate vision is required if renewing in person

- You can renew online every other renewal

Negligent Operator Treatment System

In the state of Indiana, under Indiana Code Title 9-21-8-52, reckless driving includes:

- Driving at such high or low speeds that you endanger the wellbeing of individuals or property or impede the flow of traffic

- Passing another car on a curve or slope where your visibility is impaired to under 500 feet

- Passing a school bus that is stopped and has the arm-signal out

Reckless driving isn’t safe and it can make your insurance rates go up. Try to avoid speeding and obey posted speed limit laws.

What are Indiana’s rules of the road?

We all should obey the rules, but if you’re new to the state, there may be laws you’re unfamiliar with. That’s why we’ve assembled a list of several important laws to help keep you in good standing and on the road.

Fault vs. No-Fault

Indiana is a fault-based state which means if you are the cause of a car accident, you are responsible for any damage caused. The at-fault party’s insurance company will handle such losses up to and until the policy limits are exhausted.

Seat Belt and Car Seat Laws

All passengers in the front seat of a vehicle driven in Indiana must be wearing a seat belt. Additionally, children 16 years and younger are required to be properly restrained no matter where they are sitting.

Indiana doesn’t currently have any legislation restricting passengers from riding in the cargo seat areas of pick up trucks. (For more information, read our “What are the Ohio car seat laws?“).

Keep Right and Move Over Laws

Indiana’s keep right law requires drivers in the left lanes on highways to move over to the right lane so faster cars can pass. Penalties for violating the keep right rule include traffic citations and potentially up to $500 in fines.

Speed Limits

Maximum posted speed limits are 70 mph on rural interstates, 55 mph on urban interstates, 60 mph on limited-access roads and 55 mph on all other roads.

Ridesharing

Rideshare services like Uber and Lyft mandate that all their drivers carry personal car insurance that meets the minimum requirements. However, if drivers wish to purchase a commercial insurance policy, these are the companies who provide coverage.

- Allstate

- Erie

- Farmers

- Geico

- Safeco

- State Farm

- USAA

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS),

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Currently, Indiana has approved the use of what is known as “regulated platooning technology”. This allows groups of buses or trucks to travel with set intervals between each at electronically controlled rates of speed.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the safety laws?

Up next, we look closer at the safety laws in Indiana, so you can arrive alive. Please don’t drink and drive.

DUI Laws

Driving under the influence has disastrous results for everyone involved, that’s why strict laws are in place to prevent such tragedies. In Indiana alone, drunk driving caused 177 deaths in 2017. Each state differs in how they address drunk driving and therefore have different penalties.

Below, we’ve listed the details about Indiana’s impaired driving laws.

| Indiana's DUI Laws | Info |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status by Offense | 1st offense is a Class C misdemeanor. 1st High BAC is a Class A misdemeanor. All subsequent convictions within 5 years are Class D felonies. |

| Formal Name for Offense | Operating While Intoxicated (OWI) |

| Look Back Period/Washout Period | 5 years |

| 1st Offense - ALS or Revocation | 30 days - 2 years OR probation with a rehabilitation course. |

| 1st Offense - Imprisonment | No minimum, but up to 1 year. |

| 1st Offense - Fine | $500 to $5,000. |

| 1st Offense - Other | May be required to: attend victim impact panel, submit to urine testing and other terms of probation. |

| 2nd Offense - DL Revocation | 180 days - 2 years. |

| 2nd Offense - Imprisonment | 5 days - 3 years and/or community service. |

| 2nd Offense - Fine | No minimum, but up to $10,000. |

| 2nd Offense - Other | Same as the first. |

| 3rd Offense - DL Revocation | 1-10 years. |

| 3rd Offense - Imprisonment | 10 days - 3 years and/or community service. |

| 3rd Offense - Fine | No minimum, but up to $10,000. |

| 3rd Offense - Other | Same as the first. |

| Mandatory Interlock | No |

Marijuana-Impaired Driving Laws

In the state of Indiana, the possession and use of marijuana are illegal. Therefore, the state adheres to a zero-tolerance policy for THC and metabolites. In fact, individuals convicted of driving under the influence of a drug face penalties of:

- 60 days to one year’s imprisonment and up to $5,000 in fines for the first offense

- Five days to three year’s imprisonment and up to $10,000 in fines for a second offense

- 10 days to three year’s imprisonment and up to $10,000 in fines for a third offense

Distracted Driving Laws

Individuals under the age of 21 are forbidden from using a cellphone while driving, and texting is banned for all drivers.

How bad is vehicle theft in Indiana?

Now that you have a good understanding of Indiana state laws, let’s dive into some facts that you might not know. While insurance is important, it’s also crucial to know what to keep your eyes out for on the road.

Believe it or not, over 10,904 vehicle thefts occurred in 2016 alone in Indiana. When considering your next car purchase, one thing to consider is that certain vehicles are stolen more frequently, and thus, may have higher insurance rates.

Here’s a list of the top 10 stolen vehicles in Indiana.

| Model | Year | Number of Thefts |

|---|---|---|

| Ford Pickup (Full Size) | 2005 | 659 |

| Chevrolet Pickup (Full Size) | 1994 | 619 |

| Chevrolet Impala | 2004 | 423 |

| Dodge Pickup (Full Size) | 2001 | 263 |

| Chevrolet Malibu | 2005 | 238 |

| GMC Pickup (Full Size) | 1995 | 192 |

| Honda Accord | 1994 | 186 |

| Chevrolet Pickup (Small Size) | 1998 | 186 |

| Pontiac Grand Prix | 2004 | 183 |

| Ford Taurus | 2003 | 182 |

The full-size Ford pickup is the most stolen vehicle in the state.

Vehicle Theft by City

Where you live also plays a role in the number of vehicle thefts. The FBI created a 2016 report on Indiana’s vehicle thefts by cities, which are listed below.

| Indiana Vehicle Thefts by City | City Population | Motor Vehicle Theft |

|---|---|---|

| Albion | 2,344 | 0 |

| Alexandria | 5,060 | 7 |

| Anderson | 55,367 | 230 |

| Angola | 8,587 | 4 |

| Auburn | 12,802 | 12 |

| Aurora | 3,721 | 4 |

| Batesville | 6,489 | 4 |

| Bedford | 13,400 | 32 |

| Beech Grove | 14,384 | 64 |

| Berne | 3,964 | 3 |

| Bloomington | 82,415 | 148 |

| Boonville | 6,197 | 9 |

| Bremen | 4,597 | 4 |

| Brownsburg | 22,908 | 26 |

| Carmel | 84,880 | 43 |

| Cedar Lake | 11,688 | 12 |

| Chesterfield | 2,508 | 3 |

| Clarksville | 21,865 | 47 |

| Clinton | 4,810 | 5 |

| Columbia City | 8,850 | 7 |

| Columbus | 45,874 | 129 |

| Crawfordsville | 16,055 | 21 |

| Cumberland | 5,218 | 8 |

| Danville | 9,151 | 7 |

| Decatur | 9,345 | 10 |

| Delphi | 2,887 | 2 |

| Dyer | 16,369 | 13 |

| East Chicago | 29,397 | 225 |

| Edinburgh | 4,509 | 3 |

| Ellettsville | 6,584 | 1 |

| Elwood | 8,492 | 19 |

| Evansville | 120,284 | 492 |

| Fairmount | 2,906 | 1 |

| Fishers | 83,358 | 29 |

| Fort Wayne | 254,820 | 386 |

| Franklin | 24,034 | 9 |

| Garrett | 6,291 | 16 |

| Gary | 78,819 | 732 |

| Goshen | 32,195 | 70 |

| Greenfield | 21,175 | 17 |

| Greensburg | 11,675 | 2 |

| Greenwood | 53,208 | 88 |

| Griffith | 16,671 | 54 |

| Hagerstown | 1,764 | 3 |

| Hammond | 79,329 | 406 |

| Hartford City | 6,053 | 4 |

| Highland | 23,372 | 54 |

| Hobart | 28,631 | 85 |

| Huntington | 17,271 | 9 |

| Indianapolis | 850,220 | 5,005 |

| Jasper | 15,195 | 6 |

| Jeffersonville | 45,846 | 139 |

| Knox | 3,657 | 0 |

| Kokomo | 56,878 | 114 |

| Lafayette | 68,173 | 232 |

| Lake Station | 12,335 | 61 |

| La Porte | 22,112 | 29 |

| Lawrenceburg | 5,012 | 0 |

| Ligonier | 4,385 | 3 |

| Linton | 5,359 | 1 |

| Long Beach | 1,173 | 3 |

| Lowell | 1,173 | 3 |

| Marion | 29,549 | 75 |

| Martinsville | 11,823 | 36 |

| Merrillville | 35,756 | 112 |

| Mishawaka | 47,967 | 140 |

| Mooresville | 9,490 | 30 |

| Mount Vernon | 6,586 | 19 |

| Muncie | 70,059 | 154 |

| Nappanee | 6,694 | 5 |

| New Albany | 36,490 | 134 |

| New Haven | 15,575 | 27 |

| New Whiteland | 5,668 | 3 |

| North Judson | 1,759 | 1 |

| North Liberty | 1,890 | 0 |

| North Manchester | 5,987 | 0 |

| North Vernon | 6,640 | 16 |

| Peru | 11,219 | 5 |

| Plainfield | 29,644 | 53 |

| Plymouth | 10,034 | 9 |

| Portage | 36,862 | 45 |

| Porter | 4,883 | 6 |

| Portland | 6,278 | 18 |

| Rensselaer | 5,905 | 2 |

| Rushville | 6,204 | 8 |

| Schererville | 28,054 | 32 |

| Scottsburg | 6,614 | 7 |

| Sellersburg | 6,150 | 15 |

| Seymour | 18,655 | 100 |

| Shelbyville | 19,159 | 28 |

| South Bend | 100,711 | 326 |

| South Whitley | 1,728 | 1 |

| Speedway | 11,967 | 46 |

| Tell City | 7,228 | 7 |

| Terre Haute | 61,215 | 281 |

| Tipton | 4,983 | 5 |

| Valparaiso | 32,090 | 23 |

| Walkerton | 2,284 | 5 |

| Warsaw | 13,897 | 16 |

| Washington | 11,813 | 40 |

| Waterloo | 2,240 | 4 |

| Westfield | 32,698 | 12 |

| West Lafayette | 30,687 | 16 |

| Whitestown | 3,778 | 5 |

| Whiting | 4,918 | 20 |

| Winchester | 4,866 | 6 |

| Winona Lake | 4,934 | 0 |

| Zionsville | 24,433 | 3 |

Indianapolis leads the way with 5,005 vehicle thefts in 2016. Be sure to lock your vehicle whenever you aren’t driving it.

Are there a lot of road fatalities in Indiana?

Accidents can and do happen, and next, we’re going to show you statistics for different kinds of accidents in Indiana.

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lit | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 412 | 110 | 203 | 26 | 1 | 752 |

| Rain | 23 | 8 | 23 | 3 | 0 | 57 |

| Snow/Sleet | 10 | 1 | 5 | 0 | 0 | 16 |

| Other | 5 | 0 | 6 | 0 | 0 | 11 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 450 | 119 | 237 | 29 | 1 | 836 |

As you can see, most accidents occur during daylight hours.

Fatalities (All Crashes) by County

Here are the Indiana counties with the most fatalities over the past five years.

| County Name | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalities 2015 | Total Fatalities 2016 | Total Fatalities 2017 | Fatalities Per 100K 2013 | Fatalities Per 100K 2014 | Fatalities Per 100K 2015 | Fatalities Per 100K 2016 | Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Adams County | 2 | 5 | 7 | 2 | 8 | 5.77 | 14.38 | 20.03 | 5.68 | 22.54 |

| Allen County | 31 | 31 | 30 | 36 | 43 | 8.54 | 8.49 | 8.16 | 9.73 | 11.53 |

| Bartholomew County | 6 | 12 | 20 | 14 | 16 | 7.54 | 14.93 | 24.6 | 17.1 | 19.5 |

| Benton County | 1 | 2 | 1 | 2 | 1 | 11.43 | 22.94 | 11.5 | 23.11 | 11.61 |

| Blackford County | 1 | 0 | 1 | 3 | 1 | 8.03 | 0 | 8.18 | 24.84 | 8.35 |

| Boone County | 7 | 13 | 12 | 5 | 7 | 11.61 | 21.1 | 19.04 | 7.78 | 10.63 |

| Brown County | 4 | 5 | 2 | 1 | 7 | 26.57 | 33.46 | 13.34 | 6.66 | 46.56 |

| Carroll County | 9 | 6 | 3 | 5 | 2 | 44.73 | 30.07 | 15.08 | 25.04 | 9.98 |

| Cass County | 5 | 6 | 3 | 9 | 8 | 12.96 | 15.59 | 7.86 | 23.68 | 21.06 |

| Clark County | 8 | 11 | 15 | 10 | 15 | 7.1 | 9.64 | 13.05 | 8.64 | 12.82 |

| Clay County | 9 | 1 | 7 | 5 | 5 | 33.76 | 3.78 | 26.53 | 19.08 | 19.09 |

| Clinton County | 7 | 3 | 7 | 4 | 12 | 21.35 | 9.23 | 21.6 | 12.4 | 37.13 |

| Crawford County | 4 | 1 | 7 | 2 | 2 | 37.66 | 9.37 | 66.32 | 18.9 | 18.93 |

| Daviess County | 6 | 8 | 7 | 5 | 7 | 18.59 | 24.48 | 21.33 | 15.15 | 21.14 |

| De Kalb County | 7 | 9 | 7 | 7 | 4 | 16.54 | 21.23 | 16.49 | 16.42 | 9.34 |

| Dearborn County | 8 | 1 | 8 | 5 | 7 | 16.08 | 2.02 | 16.18 | 10.11 | 14.07 |

| Decatur County | 6 | 6 | 0 | 17 | 1 | 22.89 | 22.7 | 0 | 63.81 | 3.74 |

| Delaware County | 12 | 15 | 10 | 10 | 8 | 10.28 | 12.88 | 8.63 | 8.66 | 6.95 |

| Dubois County | 10 | 7 | 6 | 3 | 6 | 23.66 | 16.55 | 14.18 | 7.07 | 14.1 |

| Elkhart County | 21 | 20 | 33 | 16 | 26 | 10.48 | 9.92 | 16.22 | 7.84 | 12.68 |

| Fayette County | 2 | 3 | 3 | 3 | 4 | 8.39 | 12.8 | 12.83 | 12.9 | 17.23 |

| Floyd County | 4 | 5 | 8 | 8 | 11 | 5.26 | 6.57 | 10.45 | 10.43 | 14.27 |

| Fountain County | 4 | 4 | 1 | 2 | 1 | 23.69 | 23.96 | 6.05 | 12.14 | 6.06 |

| Franklin County | 4 | 1 | 2 | 3 | 4 | 17.42 | 4.36 | 8.73 | 13.2 | 17.68 |

| Fulton County | 2 | 1 | 3 | 2 | 3 | 9.78 | 4.88 | 14.76 | 9.93 | 14.96 |

| Gibson County | 4 | 6 | 14 | 10 | 19 | 11.95 | 17.79 | 41.64 | 29.78 | 56.59 |

| Grant County | 9 | 7 | 7 | 11 | 9 | 13.06 | 10.24 | 10.37 | 16.47 | 13.54 |

| Greene County | 5 | 9 | 2 | 7 | 11 | 15.28 | 27.58 | 6.17 | 21.72 | 34.19 |

| Hamilton County | 13 | 14 | 14 | 16 | 10 | 4.38 | 4.62 | 4.53 | 5.06 | 3.09 |

| Hancock County | 5 | 5 | 6 | 7 | 16 | 7.05 | 6.97 | 8.29 | 9.49 | 21.34 |

| Harrison County | 16 | 5 | 10 | 13 | 10 | 41.04 | 12.77 | 25.3 | 32.76 | 25.06 |

| Hendricks County | 10 | 7 | 11 | 17 | 8 | 6.52 | 4.5 | 6.97 | 10.6 | 4.89 |

| Henry County | 10 | 7 | 9 | 10 | 4 | 20.47 | 14.32 | 18.49 | 20.68 | 8.25 |

| Howard County | 8 | 10 | 13 | 17 | 12 | 9.67 | 12.11 | 15.79 | 20.65 | 14.57 |

| Huntington County | 5 | 1 | 8 | 5 | 4 | 13.6 | 2.73 | 21.91 | 13.75 | 11.01 |

| Jackson County | 8 | 8 | 7 | 4 | 11 | 18.41 | 18.3 | 15.94 | 9.1 | 25.07 |

| Jasper County | 18 | 13 | 7 | 7 | 7 | 53.86 | 38.8 | 20.91 | 20.96 | 20.93 |

| Jay County | 5 | 8 | 6 | 3 | 3 | 23.51 | 37.84 | 28.38 | 14.26 | 14.32 |

| Jefferson County | 5 | 7 | 4 | 5 | 9 | 15.43 | 21.6 | 12.38 | 15.5 | 28.05 |

| Jennings County | 9 | 5 | 4 | 7 | 11 | 31.89 | 17.91 | 14.38 | 25.34 | 39.82 |

| Johnson County | 12 | 8 | 9 | 6 | 12 | 8.25 | 5.44 | 6.04 | 3.96 | 7.8 |

| Knox County | 7 | 5 | 3 | 3 | 9 | 18.4 | 13.17 | 7.95 | 7.99 | 23.99 |

| Kosciusko County | 6 | 8 | 8 | 17 | 15 | 7.69 | 10.18 | 10.15 | 21.54 | 18.94 |

| La Porte County | 18 | 21 | 10 | 19 | 27 | 16.16 | 18.8 | 9.02 | 17.24 | 24.54 |

| Lagrange County | 10 | 7 | 7 | 6 | 10 | 26.26 | 18.21 | 18.12 | 15.33 | 25.44 |

| Lake County | 47 | 48 | 59 | 50 | 51 | 9.56 | 9.77 | 12.08 | 10.28 | 10.5 |

| Lawrence County | 9 | 8 | 3 | 6 | 13 | 19.62 | 17.53 | 6.58 | 13.17 | 28.47 |

| Madison County | 10 | 23 | 15 | 13 | 17 | 7.68 | 17.73 | 11.59 | 10.05 | 13.13 |

| Marion County | 80 | 83 | 97 | 104 | 102 | 8.6 | 8.87 | 10.32 | 11.02 | 10.74 |

| Marshall County | 12 | 7 | 3 | 9 | 6 | 25.58 | 14.91 | 6.42 | 19.29 | 12.9 |

| Martin County | 1 | 0 | 3 | 2 | 4 | 9.78 | 0 | 29.37 | 19.6 | 39.16 |

| Miami County | 8 | 4 | 9 | 4 | 9 | 22.12 | 11.09 | 24.99 | 11.09 | 25.11 |

| Monroe County | 5 | 7 | 6 | 16 | 10 | 3.52 | 4.88 | 4.16 | 10.98 | 6.8 |

| Montgomery County | 5 | 3 | 5 | 6 | 5 | 13.11 | 7.86 | 13.06 | 15.66 | 12.98 |

| Morgan County | 8 | 10 | 17 | 14 | 4 | 11.54 | 14.39 | 24.44 | 20.13 | 5.74 |

| Newton County | 3 | 3 | 4 | 3 | 8 | 21.39 | 21.29 | 28.6 | 21.35 | 56.62 |

| Noble County | 9 | 7 | 5 | 4 | 7 | 19.04 | 14.77 | 10.52 | 8.43 | 14.75 |

| Ohio County | 1 | 1 | 1 | 2 | 1 | 16.68 | 16.77 | 17 | 33.97 | 17.16 |

| Orange County | 5 | 1 | 3 | 2 | 3 | 25.22 | 5.06 | 15.29 | 10.27 | 15.44 |

| Owen County | 5 | 3 | 7 | 5 | 6 | 23.62 | 14.27 | 33.6 | 23.9 | 28.79 |

| Parke County | 5 | 4 | 3 | 7 | 3 | 28.99 | 23.2 | 17.67 | 41.28 | 17.77 |

| Perry County | 3 | 4 | 4 | 1 | 1 | 15.45 | 20.69 | 20.72 | 5.26 | 5.24 |

| Pike County | 1 | 1 | 6 | 6 | 1 | 7.96 | 7.97 | 48.16 | 48.28 | 8.09 |

| Porter County | 16 | 13 | 22 | 19 | 28 | 9.61 | 7.78 | 13.14 | 11.35 | 16.63 |

| Posey County | 6 | 4 | 4 | 2 | 3 | 23.48 | 15.63 | 15.62 | 7.8 | 11.72 |

| Pulaski County | 2 | 2 | 1 | 2 | 4 | 15.45 | 15.48 | 7.81 | 15.86 | 31.91 |

| Putnam County | 6 | 11 | 8 | 1 | 9 | 15.97 | 29.2 | 21.33 | 2.68 | 23.87 |

| Randolph County | 2 | 4 | 8 | 8 | 8 | 7.81 | 15.8 | 31.86 | 31.92 | 32.1 |

| Ripley County | 5 | 5 | 1 | 11 | 6 | 17.68 | 17.65 | 3.52 | 38.72 | 21.1 |

| Rush County | 0 | 2 | 3 | 3 | 0 | 0 | 11.87 | 17.95 | 18.04 | 0 |

| Scott County | 9 | 6 | 1 | 9 | 5 | 37.9 | 25.39 | 4.23 | 37.96 | 20.95 |

| Shelby County | 10 | 6 | 9 | 11 | 7 | 22.54 | 13.52 | 20.29 | 24.87 | 15.77 |

| Spencer County | 5 | 2 | 8 | 3 | 7 | 24.08 | 9.63 | 38.76 | 14.64 | 34.32 |

| St. Joseph County | 20 | 23 | 12 | 22 | 27 | 7.49 | 8.59 | 4.47 | 8.16 | 9.98 |

| Starke County | 2 | 5 | 4 | 5 | 4 | 8.64 | 21.78 | 17.5 | 21.75 | 17.47 |

| Steuben County | 3 | 6 | 5 | 12 | 5 | 8.72 | 17.38 | 14.49 | 34.9 | 14.5 |

| Sullivan County | 5 | 2 | 5 | 4 | 2 | 23.65 | 9.52 | 23.95 | 19.29 | 9.64 |

| Switzerland County | 2 | 4 | 2 | 2 | 2 | 18.91 | 37.91 | 18.84 | 18.78 | 18.7 |

| Tippecanoe County | 24 | 6 | 19 | 7 | 23 | 13.23 | 3.27 | 10.21 | 3.71 | 12.07 |

| Tipton County | 3 | 10 | 2 | 3 | 4 | 19.3 | 64.97 | 13.13 | 19.8 | 26.44 |

| Union County | 2 | 2 | 2 | 0 | 2 | 27.37 | 27.59 | 27.78 | 0 | 27.78 |

| Vanderburgh County | 21 | 20 | 15 | 16 | 21 | 11.56 | 10.98 | 8.25 | 8.8 | 11.56 |

| Vermillion County | 2 | 4 | 7 | 4 | 7 | 12.62 | 25.55 | 44.89 | 25.62 | 45.15 |

| Vigo County | 14 | 9 | 12 | 14 | 16 | 12.95 | 8.35 | 11.17 | 13 | 14.88 |

| Wabash County | 6 | 7 | 14 | 10 | 1 | 18.59 | 21.8 | 43.93 | 31.69 | 3.18 |

| Warren County | 1 | 1 | 2 | 2 | 3 | 11.96 | 12 | 24.18 | 24.47 | 36.58 |

| Warrick County | 3 | 3 | 4 | 8 | 5 | 4.93 | 4.92 | 6.5 | 12.89 | 8 |

| Washington County | 12 | 7 | 5 | 3 | 13 | 43.18 | 25.1 | 18 | 10.81 | 46.72 |

| Wayne County | 14 | 9 | 7 | 10 | 7 | 20.65 | 13.36 | 10.46 | 15.02 | 10.58 |

| Wells County | 2 | 4 | 6 | 7 | 4 | 7.22 | 14.39 | 21.56 | 25.14 | 14.29 |

| White County | 4 | 7 | 13 | 3 | 6 | 16.39 | 28.65 | 53.54 | 12.45 | 24.81 |

| Whitley County | 3 | 7 | 4 | 5 | 8 | 9.01 | 20.93 | 11.96 | 14.93 | 23.7 |

Fatalities by Roadway

Next, we have a 10-year comparison of traffic fatalities on urban vs. rural roadways.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 530 | 418 | 474 | 477 | 524 | 535 | 472 | 521 | 543 | 555 |

| Urban | 290 | 275 | 280 | 274 | 257 | 249 | 273 | 296 | 285 | 357 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 |

| Total | 820 | 693 | 754 | 751 | 781 | 784 | 745 | 817 | 829 | 914 |

Rural roads in Indiana see far more fatalities than urban roads.

Next, we’ll look at the different individuals that contribute to fatal crashes, such as vehicle type and pedestrian/occupants.

Fatalities by Person Type

| Indiana Traffic Fatalities by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 321 | 258 | 326 | 331 | 355 |

| Light Pickup Truck Occupants | 95 | 101 | 88 | 118 | 90 |

| Light Utility Truck Occupants | 84 | 92 | 115 | 98 | 124 |

| Large Truck Occupants | 16 | 15 | 16 | 14 | 17 |

| Other/Unknown Occupants | 9 | 11 | 9 | 18 | 14 |

| Van Occupants | 45 | 42 | 41 | 34 | 44 |

| Bus Occupants | 4 | 1 | 0 | 0 | 1 |

| Motorcyclists | 115 | 124 | 108 | 101 | 149 |

| Pedestrians | 76 | 78 | 96 | 87 | 101 |

| Bicyclists and Other Cyclists | 14 | 12 | 12 | 19 | 13 |

| Other/Unknown Non-occupants | 5 | 8 | 5 | 7 | 6 |

| State Total | 784 | 745 | 817 | 829 | 914 |

Fatalities by Crash Type

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 431 | 397 | 443 | 436 | 455 |

| Involving a Large Truck | 117 | 128 | 118 | 108 | 138 |

| Involving Speeding | 218 | 204 | 233 | 213 | 208 |

| Involving a Rollover | 162 | 166 | 181 | 176 | 173 |

| Involving a Roadway Departure | 447 | 406 | 435 | 454 | 471 |

| Involving an Intersection (or Intersection Related) | 192 | 189 | 217 | 221 | 261 |

| Total Fatalities (All Crashes) | 784 | 745 | 817 | 829 | 914 |

Five Year Trend for the Top 10 Counties

| County | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalities 2015 | Total Fatalities 2016 | Total Fatalities 2017 |

|---|---|---|---|---|---|

| Marion County | 80 | 83 | 97 | 104 | 102 |

| Lake County | 47 | 48 | 59 | 50 | 51 |

| Allen County | 31 | 31 | 30 | 36 | 43 |

| Porter County | 16 | 13 | 22 | 19 | 28 |

| La Porte County | 18 | 21 | 10 | 19 | 27 |

| St. Joseph County | 20 | 23 | 12 | 22 | 27 |

| Eikhart County | 21 | 20 | 33 | 16 | 26 |

| Tippecanoe County | 24 | 6 | 19 | 7 | 23 |

| Vanderburgh County | 21 | 20 | 15 | 16 | 21 |

| Gibson County | 4 | 6 | 14 | 10 | 19 |

Fatalities Involving Speeding by Top 10 Counties

| County | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalities 2015 | Total Fatalities 2016 | Total Fatalities 2017 | Total Fatalities Per 100K 2013 | Total Fatalities Per 100K 2014 | Total Fatalities Per 100K 2015 | Total Fatalities Per 100K 2016 | Total Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Adams County | 0 | 1 | 3 | 0 | 1 | 0 | 2.88 | 8.58 | 0 | 2.82 |

| Allen County | 8 | 10 | 8 | 7 | 15 | 2.2 | 2.74 | 2.18 | 1.89 | 4.02 |

| Bartholomew County | 0 | 3 | 5 | 3 | 1 | 0 | 3.73 | 6.15 | 3.66 | 1.22 |

| Benton County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Blackford County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Boone County | 0 | 2 | 3 | 1 | 2 | 0 | 3.25 | 4.76 | 1.56 | 3.04 |

| Brown County | 3 | 0 | 1 | 0 | 1 | 19.93 | 0 | 6.67 | 0 | 6.65 |

| Carroll County | 3 | 3 | 1 | 1 | 0 | 14.91 | 15.03 | 5.03 | 5.01 | 0 |

| Cass County | 1 | 2 | 1 | 3 | 1 | 2.59 | 5.2 | 2.62 | 7.89 | 2.63 |

| Clark County | 4 | 1 | 6 | 3 | 4 | 3.55 | 0.88 | 5.22 | 2.59 | 3.42 |

Drunk driving is also a major contributor to crash fatalities. Below we’ve listed all of the fatalities involving a drunk driver.

Fatalities Involving Drunk Driving By County

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|