Wyoming

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 7.80%

Wyoming, home of the world-famous Yellowstone National Park, some of the globe’s most astounding natural splendor and rolling hills as far as you can see. This state makes an ideal home for nature enthusiasts and adventurers alike.

To guarantee you’re safely (and legally) driving in this breathtaking state, you’ll need a good car insurance policy. While we know you’d rather be cruising around and exploring the Equality State, learning the essentials about Wyoming state law and insurance policies is vital. That’s why we’ve made this guide to make sure you’re prepared to hit the roads without worries (or having to do hours of research).

Though choosing a policy might seem overwhelming, we’ve broken down everything you need to shop with confidence. From pricing to legal minimums, and so much more by the time you finish this article, you’ll be an auto insurance master.

So let’s get to it! If you want to get to comparing quotes and saving money, use our FREE quote tool above.

What Are Wyoming Car Insurance Coverage & Rates?

First up, we’ll go in-depth into coverages and rates you can expect when driving in Wyoming. Below we go into the details of minimum liability coverage, core coverage, rates by city and zip code, and more.

On we go!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Wyoming’s Car Culture?

Known for its sprawling expanses, majestic mountain ranges, and world-class skiing this is a state residents love to cruise around. Indeed, Wyomingites drive more than residents of every other state in the union.

Of course, the unique terrain also poses unique challenges in comparison to the rest of the country.

While traffic jams and toll roads are on the minds of drivers in most states, in Wyoming, you’re far more likely to face steep mountain climbs and snow-covered roadways. To make sure you’re covered in every condition (especially for those snowy roads), you’ll need to understand the necessary and minimum coverages in Wyoming.

What is the Wyoming Minimum Coverage?

In most states, drivers have to meet minimum liability insurance requirements to drive on the roads legally. If you’ve been in an accident, chances are you’re glad you or the other car had insurance to save you from paying for damages out of pockets.

In Wyoming, all registered vehicles are required to meet minimum limits before hitting the roadways.

Here are the Wyoming minimums:

- $25,000 liability coverage for bodily injury

- $50,000 liability coverage for total bodily injury or death liability in an accident

- $20,000 liability coverage for property damage per accident

Remember, these are minimum limits and are intended to protect the other driver if you are found at fault (they will not cover your damages or passenger injuries). Also, if you cause significant financial losses or hit a luxury vehicle, the cost of an accident may be much higher than what liability coverage offers. Any costs above your limits will need to be paid out of your pocket.

For more comprehensive coverage, you should always look into higher limits. Sometimes, the price difference isn’t that sizeable. We’ll go into more detail about fuller coverage later on.

What Are Forms of Financial Responsibility?

In Wyoming, drivers also must be able to show proof of financial responsibility. Generally, this means carrying a certificate of insurance. However, in the Equality State, you have some other options, as well.

Wyoming drivers may provide proof through a surety bond obtained from a licensed company. You are also legally allowed to provide proof with a $25,000 deposit in cash or securities held by the state treasurer.

No matter what option you choose, drivers must have evidence of one of the above financial responsibilities. To make matters a bit easier, Wyoming drivers are legally permitted to carry electronic proof of insurance on their smartphone or tablet.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Premiums as a Percentage of Income?

One of the major concerns when it comes to insurance is how much it will cost. One of the best ways to get a picture of how much your fellow Wyomingites pay is to look at premiums as a percentage of disposable income. Did you know Wyoming citizen’s average disposable income is on the high side compared to the rest of the nation?

Check out the chart below to see how Wyomingites compare.

| YEAR | INSURANCE % OF INCOME |

|---|---|

| 2014 | 1.69% |

| 2013 | 1.72% |

| 2012 | 1.70% |

This table outlines premiums as a percentage of income over three years. Great news: in recent years, the percentage has gotten consistently smaller.

In 2014, Wyoming residents’ annual per capita disposable personal income was $49,918. Insurance costs Wyomingites (as of 2014), on average $844.33 per year.

That’s about 1.69 percent of an average resident’s disposable income. Wyoming sits right in the middle of national averages, as this percentage varies between 1-3 percent depending on your state. To see what percentage of income your insurance premiums take up, try out our handy calculator.

CalculatorPro

What Are the Average Monthly Car Insurance Rates in WY (Liability, Collision, Comprehensive)?

So now you know about the minimum required liability limits to drive on Wyoming roads. Next, we’ll take a look at some core coverages most drivers opt for.

Both comprehensive and collision coverages can be added to your auto policy. These pay for damages and medical bills for you, your vehicle, and your passengers if you are found to be at fault in the event of an accident. They also cover windshield repairs, theft, and weather-related damages such as hail.

If you choose all three coverages on your policy, it is considered “full coverage.”

| COVERAGE | AVERAGE COST, WYOMING | AVERAGE COST, NATIONWIDE |

|---|---|---|

| Liability | $321.04 | $538.73 |

| Collision | $278.83 | $322.61 |

| Comprehension | $247.57 | $148.04 |

| Full Coverage | $847.44 | $1,009.38 |

Above is a table breaking down premium costs depending on your level of coverage. As you can see, Wyoming sits below the national average for most coverages.

What About Additional Liability?

Additional liability coverage options are another possible add-on to your minimum coverage. Personal Injury Protection (PIP) and uninsured/underinsured motorist coverage are the most common.

As of writing, there isn’t much data on optional Personal Injury Protection in Wyoming, but there is for uninsured/underinsured motorist coverage. This coverage comes into play if you get into an accident caused by someone without insurance or with an inadequate policy limit to cover damages.

| YEAR | LOSS RATIO |

|---|---|

| 2013 | 49.08 |

| 2014 | 56.18 |

| 2015 | 49.32 |

This data shows the loss ratio of insurance companies for this type of coverage.

A loss ratio shows how much a company is earning through premiums in comparison to how much they are paying out in claims.

Companies with a loss ratio that’s over 100 percent probably aren’t taking enough in through premiums to cover their payouts. This means a company is at a much higher risk of bankruptcy and should be avoided.

As for low loss ratios, they mean a company isn’t paying out enough to its customers in claims. Still confused? Here’s a video to help:

As you can see in the above table, the loss ratios for Wyoming are on the lower side. That means companies are likely not paying out enough to their clients; you may see a premium reduction in the future to counteract this difference.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About Add-Ons, Endorsements, & Riders?

As we’ve mentioned, to ensure you’re fully protected on the road, you can add on a variety of coverages. Here are some of the most popular to suit every driver’s lifestyle:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

To add on any of these coverages, talk to your agent. They will help set you up to meet all your unique needs and go over any associated costs.

From there, your agent applies the necessary coverages to your policy.

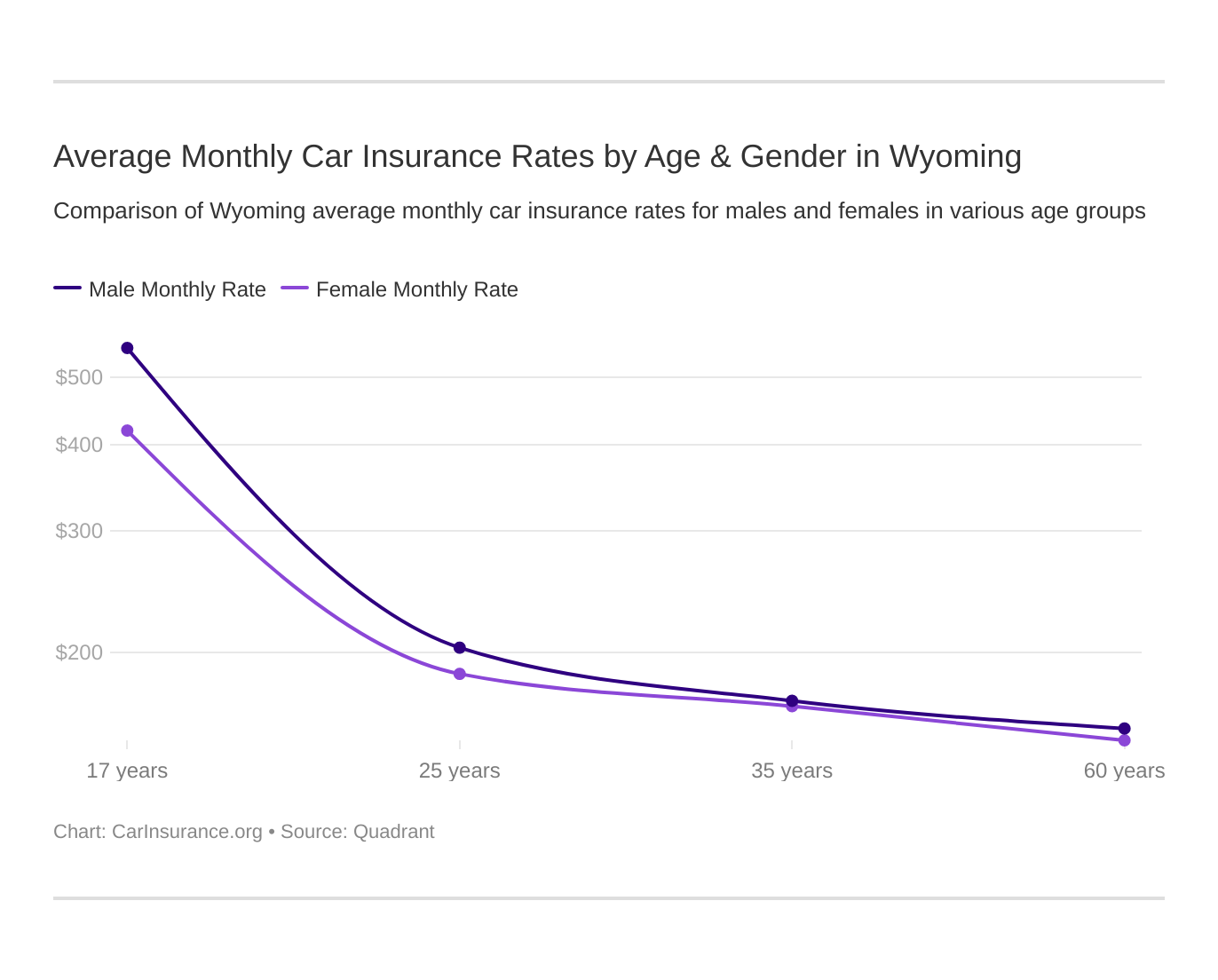

What Are the Average Monthly Car Insurance Rates by Age & Gender in WY?

So you get an insurance quote and the company shows you what your premiums look like. How do they calculate this number?

They take several factors into account, primarily your demographics. Depending on your age, gender, and even marital status, rates will vary. Young people tend to have much higher rates. This is due to a lack of experience and companies assuming they may be riskier drivers more likely to get in an accident.

| COMPANY | MARRIED 35-YEAR OLD FEMALE ANNUAL RATE | MARRIED 35-YEAR OLD MALE ANNUAL RATE | MARRIED 60-YEAR OLD FEMALE ANNUAL RATE | MARRIED 60-YEAR OLD MALE ANNUAL RATE | SINGLE 17-YEAR OLD FEMALE ANNUAL RATE | SINGLE 17-YEAR OLD MALE ANNUAL RATE | SINGLE 25-YEAR OLD FEMALE ANNUAL RATE | SINGLE 25-YEAR OLD MALE ANNUAL RATE |

|---|---|---|---|---|---|---|---|---|

| Allstate | $2,548.54 | $2,687.45 | $2,135.78 | $2,333.15 | $8,513.43 | $10,794.53 | $2,849.40 | $3,129.16 |

| Mid-Century Ins Co | $2,261.19 | $2,261.19 | $2,126.25 | $2,126.25 | $4,109.04 | $6,979.72 | $2,345.57 | $2,345.57 |

| Geico | $2,689.63 | $2,743.19 | $2,602.22 | $2,602.22 | $4,875.40 | $6,318.07 | $2,988.60 | $3,153.08 |

| Safeco | $1,363.71 | $1,371.22 | $1,114.24 | $1,283.71 | $3,605.13 | $4,046.51 | $1,478.54 | $1,651.78 |

| State Farm | $1,504.53 | $1,504.53 | $1,294.51 | $1,294.51 | $4,032.03 | $5,368.95 | $1,568.23 | $1,861.11 |

| USAA | $1,655.42 | $1,661.22 | $1,435.20 | $1,505.63 | $5,059.24 | $6,245.07 | $2,191.51 | $2,482.95 |

As you can see from the data, on average, married and older drivers have considerably lower rates. Next, we’ll break down the other factors insurance companies use to determine your premiums.

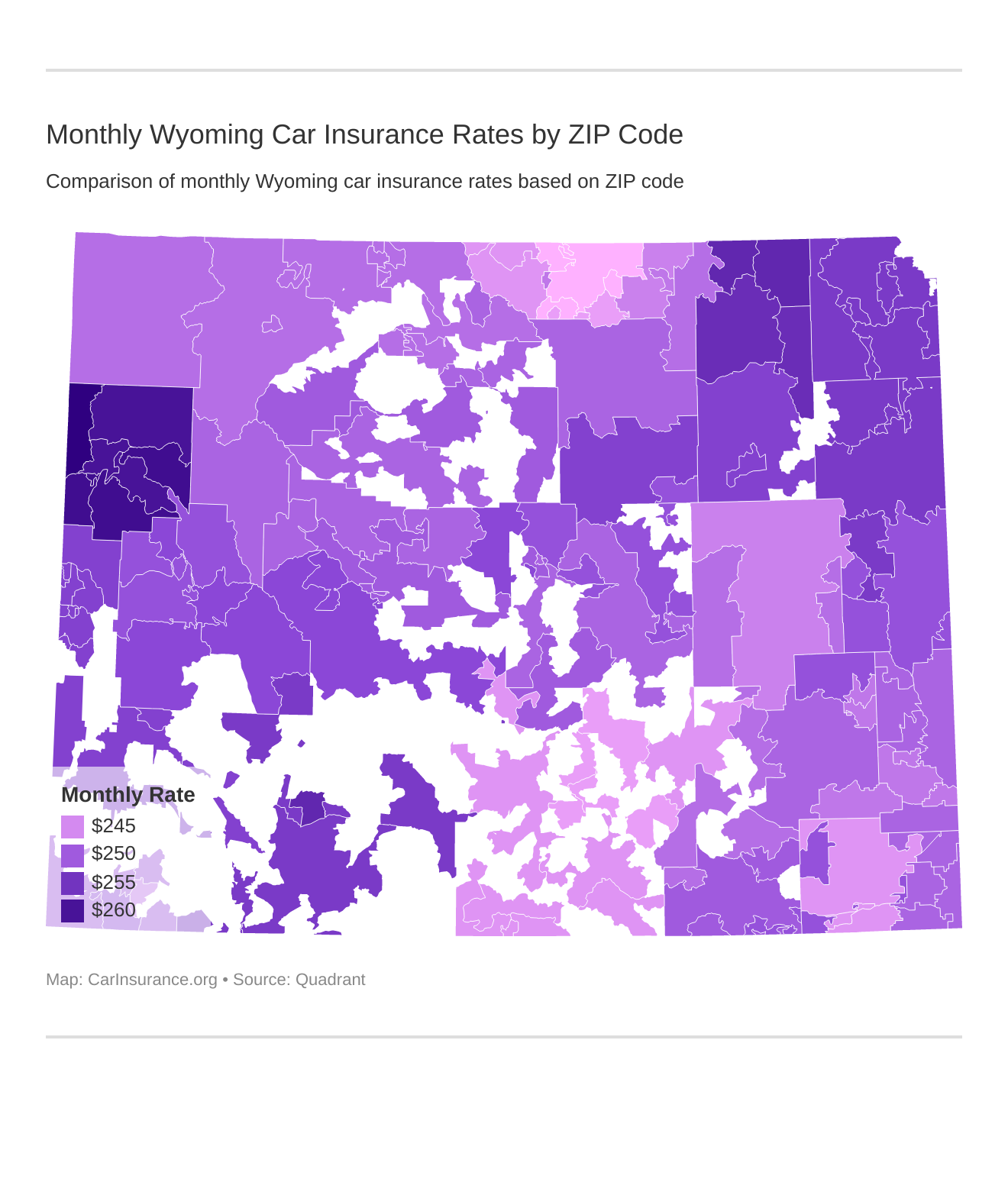

What Are the Cheapest Rates by Zip Code?

Did you know your zip code can affect your rate? Here are charts on the most and least expensive zip codes so you can see what the average cost of insurance may be in yours. See where your zip code lands on the list. Up first, the 25 most expensive zip codes.

| Zip Code | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 83414 | ALTA | $3,156.85 | Allstate | $4,258.41 | Geico | $3,576.30 | Liberty Mutual | $2,148.31 | State Farm | $2,688.77 |

| 83001 | JACKSON | $3,136.29 | Allstate | $4,330.91 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| 83014 | WILSON | $3,136.29 | Allstate | $4,330.91 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| 83025 | TETON VILLAGE | $3,136.29 | Allstate | $4,330.91 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| 83012 | MOOSE | $3,124.21 | Allstate | $4,258.41 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| 83011 | KELLY | $3,121.13 | Allstate | $4,239.90 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| 83013 | MORAN | $3,117.92 | Allstate | $4,220.65 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| 82945 | SUPERIOR | $3,087.11 | Allstate | $4,425.07 | Geico | $3,591.27 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82725 | RECLUSE | $3,081.33 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $2,016.76 | State Farm | $2,295.47 |

| 82731 | WESTON | $3,081.33 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $2,016.76 | State Farm | $2,295.47 |

| 82716 | GILLETTE | $3,076.27 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $1,986.42 | State Farm | $2,295.47 |

| 82727 | ROZET | $3,076.27 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $1,986.42 | State Farm | $2,295.47 |

| 82336 | WAMSUTTER | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82901 | ROCK SPRINGS | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82942 | POINT OF ROCKS | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82943 | RELIANCE | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82932 | FARSON | $3,052.11 | Allstate | $4,418.96 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82938 | MC KINNON | $3,052.11 | Allstate | $4,418.96 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82322 | BAIROIL | $3,045.81 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| 82222 | LANCE CREEK | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| 82701 | NEWCASTLE | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| 82710 | ALADDIN | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| 82711 | ALVA | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| 82712 | BEULAH | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| 82714 | DEVILS TOWER | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

As you can see, the most expensive zip codes fall in a variety of cities and towns around the state. Population and particular location don’t seem to have as much of an effect on rates as in other states.

Across the board, Allstate has the most expensive rates.

If you live in one of these more expensive zip codes, consider a policy with Liberty Mutual for maximum savings.

Here’s a list of the cheapest zip codes in Wyoming.

| Zip Code | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 82801 | SHERIDAN | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82833 | BIG HORN | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82839 | RANCHESTER | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82845 | WYARNO | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82324 | ELK MOUNTAIN | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82327 | HANNA | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82334 | SINCLAIR | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82335 | WALCOTT | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82615 | SHIRLEY BASIN | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82832 | BANNER | $2,921.32 | Allstate | $4,160.17 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82842 | STORY | $2,921.32 | Allstate | $4,160.17 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82007 | CHEYENNE | $2,922.78 | Allstate | $4,398.39 | Geico | $3,286.65 | Liberty Mutual | $2,042.51 | USAA | $2,283.32 |

| 82301 | RAWLINS | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82321 | BAGGS | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82323 | DIXON | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82325 | ENCAMPMENT | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82329 | MEDICINE BOW | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82331 | SARATOGA | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82332 | SAVERY | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| 82001 | CHEYENNE | $2,931.29 | Allstate | $4,449.45 | Geico | $3,286.65 | Liberty Mutual | $2,042.51 | USAA | $2,283.32 |

| 82009 | CHEYENNE | $2,931.29 | Allstate | $4,449.45 | Geico | $3,286.65 | Liberty Mutual | $2,042.51 | USAA | $2,283.32 |

| 82836 | DAYTON | $2,931.40 | Allstate | $4,220.65 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82838 | PARKMAN | $2,931.40 | Allstate | $4,220.65 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| 82633 | DOUGLAS | $2,953.92 | Allstate | $4,417.02 | Geico | $3,387.40 | Liberty Mutual | $2,016.76 | State Farm | $2,295.47 |

| 82835 | CLEARMONT | $2,955.90 | Allstate | $4,367.66 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

Even in the cheapest zip codes, rates sometimes don’t vary that much from more expensive locales. While the overall average is considerably lower, if you have a policy with the cheapest carrier, Liberty Mutual, your rates are sometimes only a few dollars cheaper than the most expensive zip codes.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Cheapest Rates by City?

Sometimes the city you live in is an even more influential factor than your zip code. Below, we’ve broken down the 25 most and least expensive cities.

| City | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Alta | $3,156.84 | Allstate | $4,258.41 | Geico | $3,576.30 | Liberty Mutual | $2,148.31 | State Farm | $2,688.77 |

| Hoback | $3,136.29 | Allstate | $4,330.91 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| Moose Wilson Road | $3,136.29 | Allstate | $4,330.91 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| Teton Village | $3,136.29 | Allstate | $4,330.91 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| Moose | $3,124.21 | Allstate | $4,258.41 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| Kelly | $3,121.12 | Allstate | $4,239.90 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| Moran | $3,117.92 | Allstate | $4,220.65 | Geico | $3,576.30 | Liberty Mutual | $1,952.50 | State Farm | $2,688.77 |

| Superior | $3,087.10 | Allstate | $4,425.07 | Geico | $3,591.27 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Recluse | $3,081.33 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $2,016.76 | State Farm | $2,295.47 |

| Weston | $3,081.33 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $2,016.76 | State Farm | $2,295.47 |

| Gillette | $3,076.27 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $1,986.42 | State Farm | $2,295.47 |

| Rozet | $3,076.27 | Allstate | $4,624.49 | Geico | $3,387.40 | Liberty Mutual | $1,986.42 | State Farm | $2,295.47 |

| North Rock Springs | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Point Of Rocks | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Reliance | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Wamsutter | $3,053.13 | Allstate | $4,425.07 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Farson | $3,052.11 | Allstate | $4,418.96 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Mc Kinnon | $3,052.11 | Allstate | $4,418.96 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Bairoil | $3,045.81 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $2,066.89 | State Farm | $2,295.47 |

| Aladdin | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| Alva | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| Beulah | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| Devils Tower | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

| Four Corners | $3,043.46 | Allstate | $4,624.49 | Geico | $3,591.27 | Liberty Mutual | $2,016.76 | State Farm | $2,296.14 |

Unlike most other states in the U.S., where the largest cities hold the most expensive rates, in Wyoming, Alta holds the most expensive average and Recluse the highest overall rates. Both of these towns are quite small, with populations numbering just a couple hundred people. The rural nature and tougher driving conditions may be causing rates to rise.

| City | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Big Horn | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Ranchester | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Sheridan | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Wyarno | $2,896.66 | Allstate | $4,012.21 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Elk Mountain | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Hanna | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Shirley Basin | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Sinclair | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Walcott | $2,920.50 | Allstate | $4,381.19 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Banner | $2,921.32 | Allstate | $4,160.17 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Story | $2,921.32 | Allstate | $4,160.17 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Baggs | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Dixon | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Encampment | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Medicine Bow | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Rawlins | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Saratoga | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Savery | $2,924.73 | Allstate | $4,406.56 | Geico | $3,387.40 | Liberty Mutual | $1,847.42 | State Farm | $2,295.47 |

| Cheyenne | $2,928.45 | Allstate | $4,432.43 | Geico | $3,286.65 | Liberty Mutual | $2,042.51 | USAA | $2,283.32 |

| Dayton | $2,931.40 | Allstate | $4,220.65 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Parkman | $2,931.40 | Allstate | $4,220.65 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Douglas | $2,953.92 | Allstate | $4,417.02 | Geico | $3,387.40 | Liberty Mutual | $2,016.76 | State Farm | $2,295.47 |

| Clearmont | $2,955.90 | Allstate | $4,367.66 | Geico | $3,347.54 | Liberty Mutual | $1,967.37 | State Farm | $2,136.33 |

| Mountain View | $2,960.14 | Allstate | $4,335.30 | Geico | $3,387.40 | Liberty Mutual | $2,148.31 | State Farm | $2,296.14 |

However, living in a rural community won’t necessarily cost you more. The cheapest rates in the state are located in Big Horn, WY, an unincorporated town with 429 residents. Do your research and check out where in the state you’ll get the best rates.

What Are the Best Wyoming Car Insurance Companies?

Every driver is unique, and the things that make one company perfect for one person might be very different for another driver. In this section, we’ll go over some important factors for everyone, and compare the top insurance providers to help you make an informed decision.

It might seem intimidating with so many factors to consider and every company claiming to be the best. But we’re here to help.

What’s the Largest Companies’ Financial Rating?

First and foremost, you want to choose a company that’s able to pay for any claims in the event of an accident. The best way to figure out if your company is financially stable is to check out its financial ratings. A.M. Best is one of the most trusted names in the insurance industry. Each year they release “grades” for the largest providers’ financial ratings. Here’s a table breaking it down:

| INSURANCE COMPANY | AM BEST RATING |

|---|---|

| State Farm Group | A++ |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| Mountain West Farm Group | B++ |

| Geico | A++ |

| USAA Group | A++ |

| Liberty Mutual Group | A |

| Allstate Insurance Group | A+ |

| Nationwide Corp Group | A+ |

| Hartford Fire & Casualty Group | A+ |

Good news for Wyomingites, of the 10 largest companies in your state, all are stable and have very high grades. The biggest names often have the strongest financial stability, something worth considering before you sign on to an unknown provider.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Companies with Best Ratings?

When shopping for insurance, most drivers jump on the best deal and cheapest rates. But you should also consider how well your fellow customers rate a provider. A price tag can get you in the door, but good customer service will keep you happy with your insurer for years to come.

According to J.D. Power, PEMCO has the highest customer satisfaction ratings in the Northwestern region (where Wyoming is located) by a long shot. The Hartford and American Family round out the top three.

What Are the Companies with Most Complaints in Wyoming?

The other side of the customer satisfaction coin is complaints. It’s just as important to take into account which companies have the most unhappy customers. No one wants to deal with bad customer service after an accident or during any part of the claims process.

The number of complaints themself doesn’t necessarily paint the most honest picture of an insurance company’s service. By looking at the complaint ratio, you get a better idea of what’s going on.

The more customers a company has, the more likely they’ll have a higher number of complaints. However, the ratio of complaints to total claims places all companies (no matter their size) on an even playing field. Here’s a breakdown:

| INSURANCE COMPANY | COMPLAINT RATIO (NATIONAL AVERAGE 1.0) | TOTAL COMPLAINTS 2017 |

|---|---|---|

| State Farm | 0.44 | 1482 |

| Progressive | 0.75 | 120 |

| Farmers Insurance | 0.59 | 7 |

| Mountain West Farm | 1.47 | 10 |

| Geico | 0.68 | 333 |

| USAA | 0.74 | 296 |

| Liberty Mutual | 5.95 | 222 |

| Allstate | 0.5 | 163 |

| Nationwide | 0.28 | 25 |

| Hartford Fire & Casualty | 4.68 | 9 |

As you can see from the chart, the ratio is a more helpful reflection of how a company is doing in terms of complaining customers. State Farm has a higher number of complaints, but a very low complaint ratio due to its large size.

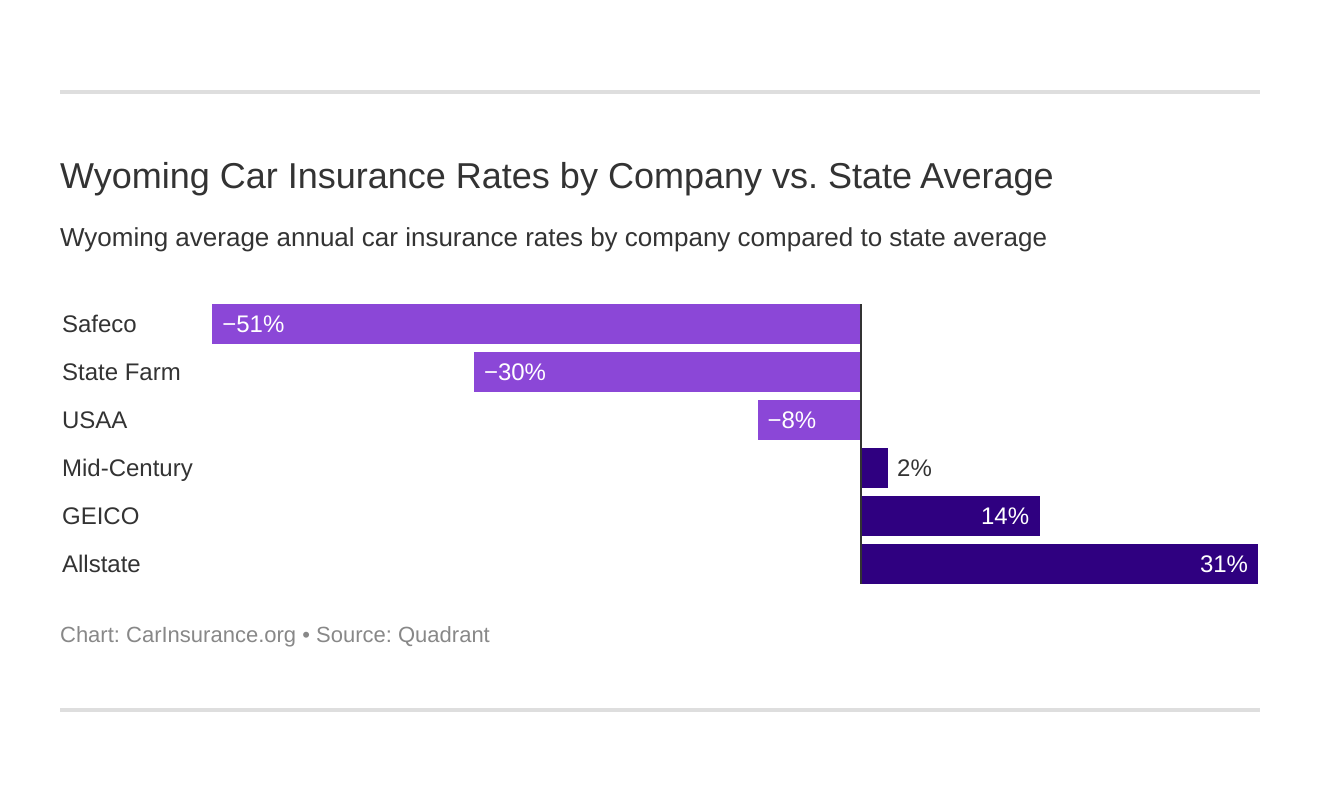

What Are the Cheapest Companies in Wyoming?

So here’s where we get into what many people find most important when it comes to shopping for car insurance: a cheap policy.

This table shows the top six Wyoming car insurance companies, as well as their average rates.

| COMPANY | AVERAGE ANNUAL RATE | COMPARED TO STATE AVERAGE | PERCENTAGE COMPARED TO STATE AVERAGE |

|---|---|---|---|

| Allstate F&C | $4,373.93 | $1,371.89 | 31.37% |

| Mid-Century Ins Co | $3,069.35 | $67.30 | 2.19% |

| Geico | $3,496.55 | $494.51 | 14.14% |

| Safeco Ins Co of IL | $1,989.36 | -$1,012.69 | -50.91% |

| State Farm | $2,303.55 | -$698.49 | -30.32% |

| USAA | $2,779.53 | -$222.51 | -8.01% |

If you’re looking for the cheapest options, Safeco Insurance and State Farm are two good bets.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Commute Rates by Companies?

With so much space to drive and things spread so far apart, many Wyoming residents have very long commutes. Every day, some rural residents may drive an hour or more to work.

What’s more, during winter, long commutes can be accompanied by dangerous hazards, such as snowstorms, howling winds, and mountain roads.

These hours spent driving each day can end up affecting your insurance rates. We’ve compiled a table to show the impact your commute can have on car insurance rates:

| Company | 10 Miles Commute 6000 Annual Mileage | 25 Miles Commute 12000 Annual Mileage |

|---|---|---|

| Allstate | $4,270.81 | $4,477.05 |

| Geico | $3,440.58 | $3,552.52 |

| Farmers | $3,069.35 | $3,069.35 |

| USAA | $2,747.30 | $2,811.77 |

| State Farm | $2,222.40 | $2,384.70 |

| Liberty Mutual | $1,989.35 | $1,989.35 |

Luckily, most companies don’t upcharge for longer commutes. But, as you can see, some companies do have a slightly higher rate. If you’re a driver with a super commute, consider sticking to one of the providers who don’t charge for greater annual mileage.

What About Coverage Level Rates by Companies?

More coverage means higher premiums, right? Maybe not.

As we’ve said before (and we’ll say again), shopping around can get you the same or even better coverage for a lower price tag by finding the right company for you. In this next chart, we break down coverage levels into tiers and compare prices.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,264.74 | $4,365.39 | $4,491.67 |

| Geico | $3,445.96 | $3,499.83 | $3,543.86 |

| Farmers | $2,991.48 | $3,064.88 | $3,151.68 |

| USAA | $2,715.01 | $2,777.42 | $2,846.16 |

| State Farm | $2,229.01 | $2,304.26 | $2,377.38 |

| Liberty Mutual | $1,899.46 | $1,982.49 | $2,086.12 |

As you can see, there are some shocking differences. With some companies, you might only have to pay a little under $100 for a higher coverage level. We recommend quoting from several companies, and chances are at least one will offer a much lower price tag than you expected for high levels of coverage.

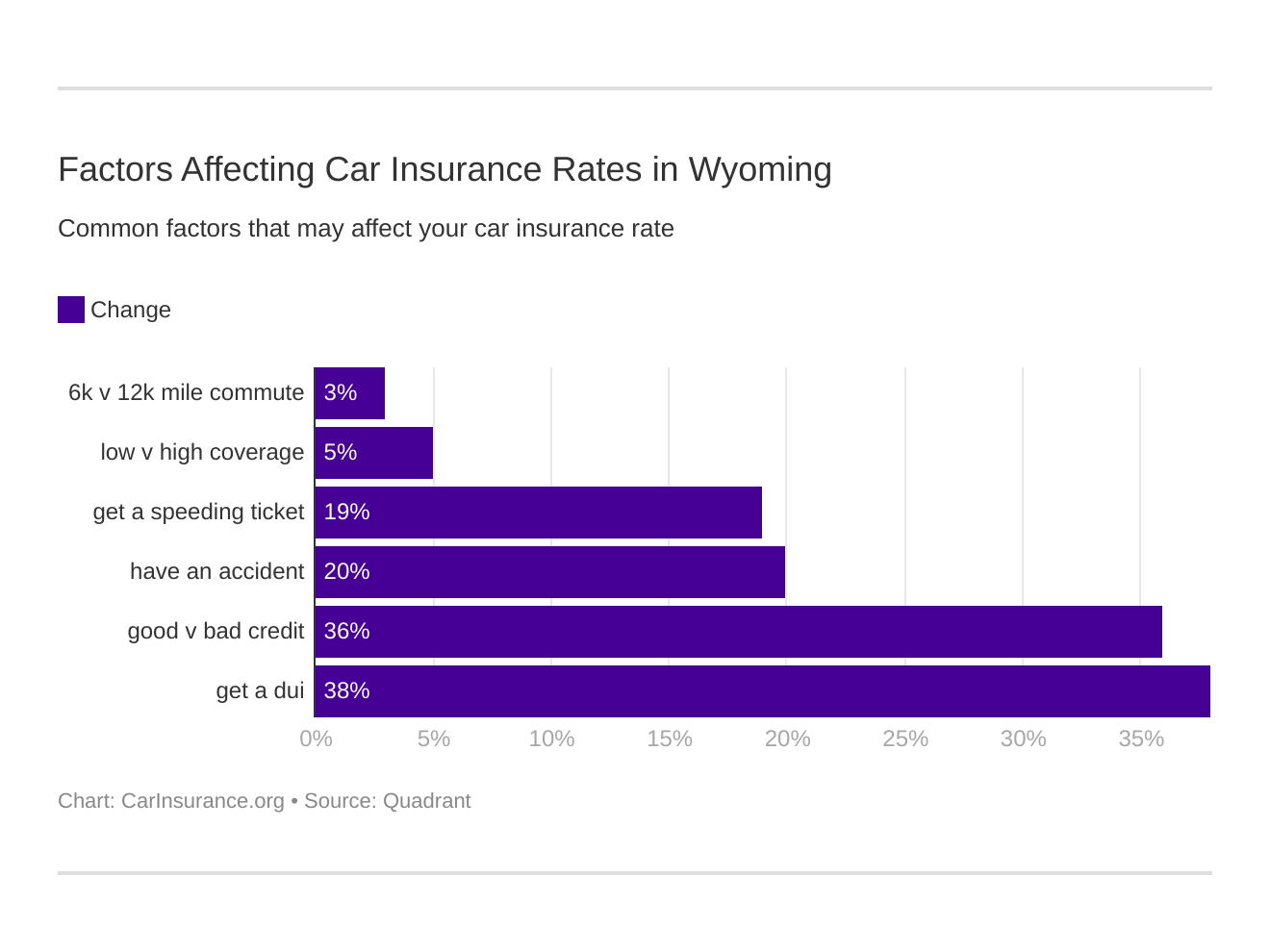

What Are Credit History Rates by Companies?

In Wyoming, auto insurance companies can legally use your credit score to determining rates. With a better credit history, you’ll end up with considerably lower premiums. Lower scores, unfortunately, generally mean you’ll end up paying more.

To help you sort this out, and make sure you can find the company with the best rates to fit your credit history, here’s a chart showing full coverage insurance costs by companies and credit scores. Some good news, Good and Fair scores generally receive similar rates.

| Company | Good Credit History | Fair Credit History | Poor Credit History |

|---|---|---|---|

| Allstate | $3,524.08 | $4,138.37 | $5,459.34 |

| USAA | $1,496.84 | $2,124.46 | $4,717.29 |

| Geico | $3,166.77 | $3,364.95 | $3,957.93 |

| Farmers | $2,809.91 | $3,106.41 | $3,291.73 |

| State Farm | $1,789.00 | $2,123.67 | $2,997.98 |

| Liberty Mutual | $1,752.67 | $1,956.81 | $2,258.58 |

The table proves it, credit makes a big difference in your premium, sometimes costing or saving you thousands of dollars. For people with good credit scores, USAA and Liberty Mutual offer incredible savings. If you have a poor score, Liberty Mutual is a good option, as well Allstate, on the other hand, will charge drivers with poor credit history a huge increase.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Driving Record Rates by Companies?

Your driving record also plays a part in determining premiums. If you’ve received a speeding ticket or been in an accident, you most likely know the rate increases can be steep.

Wyoming drivers with relatively clean records tend to see very low rates. Speeding violations, DUIs, and accidents can all land you a big increase when it comes to auto insurance.

| Company | Clean Record | With One Speeding Violation | With One Accident | With One DUI |

|---|---|---|---|---|

| Allstate | $3,787.57 | $4,387.13 | $4,507.89 | $4,813.14 |

| Geico | $2,294.34 | $3,845.09 | $3,061.85 | $4,784.93 |

| Farmers | $2,324.65 | $2,466.47 | $2,750.20 | $4,736.07 |

| USAA | $2,184.09 | $2,380.48 | $2,649.43 | $3,904.12 |

| State Farm | $2,129.24 | $2,303.46 | $2,478.05 | $2,303.46 |

| Liberty Mutual | $1,427.24 | $1,980.39 | $2,184.19 | $2,365.60 |

As you can see, across the board, a clean record gets you the best rates. Out of all possible traffic violations, being charged with a DUI increases rates the most. Just like when it comes to credit history, Liberty Mutual is the most forgiving company, charging a little under $1,000 extra after a DUI.

Please drive safely to protect yourself and other drivers and keep rates low.

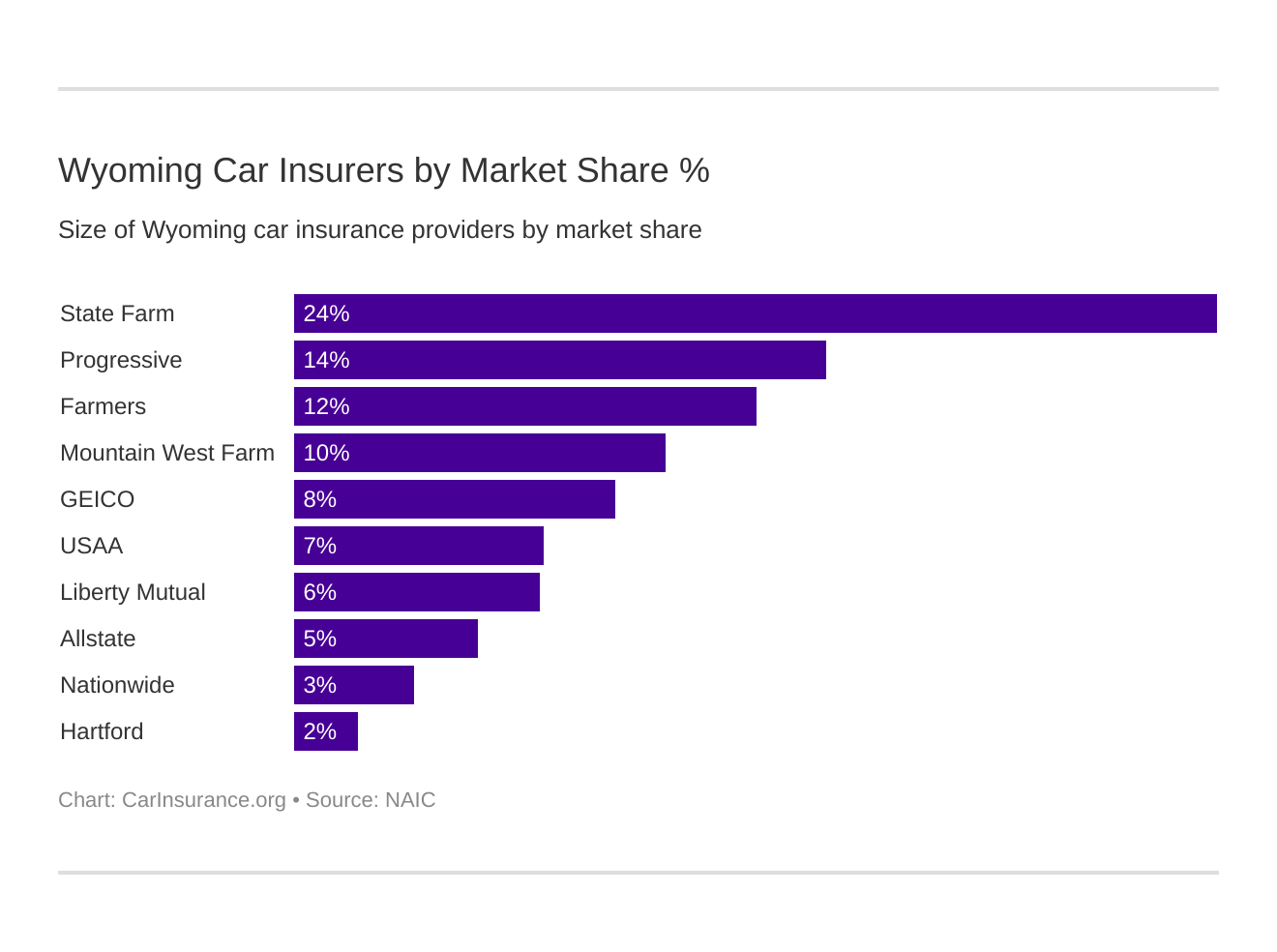

What Are the Largest Car Insurance Companies in Wyoming?

Companies end up with a lot of customers for a reason. Popularity can mean a company is providing your fellow Wyoming residents with affordable rates and excellent service.

Here are the 10 largest auto insurance companies in Wyoming:

| COMPANY | DIRECT PREMIUM WRITTEN | LOSS RATIO | MARKET SHARE |

|---|---|---|---|

| State Farm | $94,390 | 63.63% | 24.09% |

| Progressive | $54,498 | 58.45% | 13.91% |

| Farmers Insurance | $47,277 | 58.92% | 12.07% |

| Mountain West Farm | $38,093 | 76.48% | 9.72% |

| Geico | $32,878 | 68.11% | 8.39% |

| USAA | $25,560 | 108.79% | 6.52% |

| Liberty Mutual | $25,238 | 60.95% | 6.44% |

| Allstate | $18,926 | 64.59% | 4.83% |

| Nationwide | $12,398 | 46.68% | 3.16% |

| Hartford F&C | $6,638 | 51.79% | 1.69% |

State Farm holds the top spot when it comes to doing business in Wyoming. Progressive and Farmers Insurance follow closely behind.

What Are the Number of Insurers by State?

Wyoming drivers have several auto insurance companies to choose from. Here’s the total:

| Domestic | 2 |

|---|---|

| Foreign | 693 |

As you see, the list is broken down into “domestic” and “foreign” providers. In the insurance world, foreign means something a little different than what might come to mind.

- A foreign provider is an insurance company based out of state, but providing coverage for citizens in that state (for example, large companies USAA, Allstate, etc.)

- A domestic provider is only located in a particular state and provides coverage only for the citizens of that state (mom and pop providers are a good example)

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Should I Know About Wyoming Laws?

Think you’re ready to get behind the wheel and take a trip through Wyoming? Well, while we’re close, we still have some important info to cover before you’re set to go.

In this section, we’ll help make sure you have a comprehensive understanding of Wyoming’s driving laws. That way, you can stay safe and secure on your next trip to the Tetons. Plus, learning these laws can be the difference between you and a violation, which, as we’ve mentioned, can cause your rates to skyrocket.

The laws regarding auto insurance, road safety, and driving can vastly differ from state to state. Whether you’re taking a trip or planning a move, now’s a perfect time to read up on Wyoming’s laws.

What Are Car Insurance Laws?

The laws concerning car insurance can be confusing and frustrating. Especially if you’re just trying to find coverage that will legally protect you and your loved ones, trying to understand everything can be a burden.

In this section, we’ve done the work for you and will break down the details you should know to understand car insurance law. Say goodbye to any lingering questions and concerns.

How Are Wyoming Laws for Insurance Determined?

Each state has a unique legislative branch that handles laws regarding automobiles and car insurance. Each state determines the tort laws and thresholds applicable within their borders, as well as the type and amount of required liability insurance.

You’ve already learned some of the most critical laws in Wyoming, required liability insurance, and minimum coverages. Wyoming’s Department of Transportation is in charge of almost everything involving drivers, car insurance, registration, and operating a vehicle in Wyoming.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About Windshield Coverage?

Some states designate specific laws pertaining to windshield coverage and repairs. In some states, broken and cracked windshield replacements and auto insurers’ obligations to customers when it comes to windshields are all regulated.

Unfortunately, as of 2019, Wyoming doesn’t have any state laws specific to windshields.

What About High-Risk Insurance?

Sometimes, drivers who have particularly spotty driving records become designated as “high-risk.”

For these drivers, finding auto insurance can be quite tricky, even though insurance is required in Wyoming. Companies can refuse to insure a driver due to a “high-risk” status.

Drivers who have had multiple DUIs are often considered high-risk.

If the traditional insurance market is denying you, Wyoming offers its residents the Wyoming Automobile Insurance Plan or WAIP. This program means drivers who can’t find an insurer can get coverage.

WAIP isn’t an insurance provider, though. It’s an entity responsible for connecting drivers with insurance companies that will insure them. WAIP belongs to an association sharing the risk among many companies. If a driver applies for WAIP, they must show proof of having been unable to obtain other auto insurance through regular channels.

You also need a valid driver’s license and finances to pay your premium, as well as proven arrangements to pay any past-due charges.

For more info or to apply for WAIP, contact any agent licensed to sell auto insurance.

What About Low-Cost Insurance?

While Wyoming does offer a program for high-risk drivers, it doesn’t currently offer a similar program for low-income families or individuals who are struggling to pay for car insurance.

However, if you are struggling to get your vehicle insured, there are other means of lowering your costs. Shopping around is one of the best ways to find low rates. Once you’ve found some low-cost companies, ask your agent about any discounts or savings you qualify for.

Most popular car insurance companies offer discounts for paperless billing, for active duty military service members, and for taking part in usage-based insurance programs. These programs involve installing a mobile app on your phone or electronic device in your vehicle that monitors your driving habits. You get a discount just for driving safely. There are many opportunities to save, so make sure to look into any additional discounts you might be entitled to.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There Much Automobile Insurance Fraud in Wyoming?

“Insurance fraud” might sound scary, and though penalties are steep, still this crime is one of the most common in America. (For more information, read our “What You Need to Know About Fraud“)

Insurance fraud happens across industries. Automobile insurance fraud can be committed by policyholders, insurance applicants, claimants, and even insurance agents.

Any misrepresentation of facts on an insurance application is fraud, and so is submitting false claims. Fraud often consists of “padding” or inflating claim amounts to get more money from insurance companies.

Some people even stage fake accidents.

Insurance companies, on the other hand, can commit auto insurance fraud if they refuse to pay valid claims or sell faulty insurance policies.

Wyoming is among the 10states that don’t have an insurance fraud bureau to deal with situations like these. However, in Wyoming, insurance fraud is considered to be a crime.

If you suspect a company or an individual of committing insurance fraud, contact the Wyoming Department of Insurance. Likely, you will be redirected and asked to file a report through the National Association of Insurance Commissioners.

The NAIC online fraud reporting form can be directly accessed here.

What is the Statute of Limitations?

The statute of limitations dictates the amount of time a person has after an auto accident to issue an insurance claim or file a lawsuit. In Wyoming, drivers have four years to issue a claim related to personal injury. The same period of four years applies to claims related to property damage.

To best receive the financial support you need, it is best to file as soon as possible.

What Are Wyoming Specific Laws?

Wyoming has a few new and unique laws when it comes to driving.

In July 2013, a law was introduced stating Wyoming drivers can legally exceed a speed limit by up to 10 mph on two-lane highways but only when passing vehicles traveling slower than the posted speed limit.

To fall under the jurisdiction of this law, the posted limit must be 50 mph or more. Motorists can only pass one vehicle at a time.

The Wyoming Department of Transportation is authorized to charge a $125 fee for drivers applying for an ignition interlock restricted license.

Below, we’ll cover even more info about speeding laws and DUI-related policies and penalties in Wyoming.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Vehicle Licensing Laws?

So you’ve learned about insurance laws, but what about the laws concerning getting and maintaining a valid license? Like many aspects of Wyoming law, these regulations are relatively straightforward. Let’s dive in.

What is REAL ID?

You may have heard about the impending federal ID act coming into play in 2020. REAL ID, passed in 2005, set new federal standards for the issuance of driver’s licenses and which forms of ID American residents can use for domestic flights or enter federal buildings.

Many states have taken their time implementing the act, and may not even offer licenses that qualify.

Luckily, Wyoming is on the “compliant states” list. Wyoming drivers with REAL IDs will have no trouble when it comes to flying across the United States with their licenses. To check if your license qualifies, check for a star in the upper corner of your license.

What Are the Penalties for Driving Without Insurance?

As we mentioned earlier on, Wyoming uses an online-verification-of-insurance system. Driving without insurance is considered a misdemeanor and can carry serious fines and imprisonment.

Fines range from $500-$1500 and/or up-to six months in jail.

These penalties could be the beginning of your worries if you’re driving without insurance. If you cause an accident without insurance, you would need to deal with the legal issues alongside massive bills covering the costs of damages to you and whoever you hit.

If found guilty of a second or subsequent offense, a driver is required to turn in their registration and plates to the county treasurer’s office. Once a driver can prove they’ve obtained insurance, they can then retrieve registration and plates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Teen Driver Laws?

Though drivers of all ages have to follow generally the same rules and regulations, one population tends to be particularly regulated: teens. Teen drivers are a large portion of the driving population in Wyoming.

Young, inexperienced, but excited to get behind the wheel, teens need to gain proper training before driving by themselves. That’s why Wyoming requires plenty of practice before a teen can test for a license.

In Wyoming, restrictions are in place to help protect young drivers and those on the road with them. Being aware of these restrictions if you are a teenager or have a teen in your family is vital to helping them keep safe and legally compliant. Here’s a list of restrictions:

| Minimum Entry Age | 15 |

|---|---|

| Mandatory Holding Period | 10 Days |

| Minimum Supervised Driving Time | 50 hours, 10 of which must be at night |

| Minimum Age | 16 |

| Unsupervised Driving Prohibited | 11 p.m.-5 a.m. |

| Nighttime Restrictions | 6 months or until age 17, whichever occurs first (min. age: 16, 6 mos.) |

Wyoming also has a Parent’s Supervised Driving Program. This helps parents be prepared for guiding their teenage drivers. Driver’s manuals are given out at exam stations or can be downloaded here.

What Are Older Driver License Renewal Procedures?

In Wyoming, older drivers and the general population face identical regulations for license renewal. Drivers must renew their licenses every five years. Every 10 years, proof of adequate vision is required.

All renewals must be completed in-person at the DMV or by mail.

Wyoming drivers are not eligible for online renewals, no matter their age. Drivers can submit by mail every other license renewal.

What About New Residents?

Just moved to Wyoming? Welcome to a friendly population of drivers and fellow residents.

New Wyoming residents are required to appear in person at a local driver exam station to get a Wyoming driver’s license. You should complete the process within one year of moving to the state. At the time of getting your new license, you will need to surrender your out-of-state license.

During that visit, you will be photographed and complete a vision screening. You’ll also need to bring along several documents. For a full list of required documents, click here.

If you are active-duty military personnel or their dependents, you do not need to obtain Wyoming driver’s license while living in the state.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the License Renewal Procedures?

As we mentioned above, Wyoming drivers must renew their licenses every five years. Proof of adequate vision is required every 10 years. Most drivers do not need to take any written or driving exams at the time of renewal.

Every other renewal must be done in person at the DMV. Otherwise, you can complete a mail-in renewal.

What is the Negligent Operator Treatment System (NOTS)?

Unlike most other states, Wyoming doesn’t track traffic violations through a formal point system. Wyoming drivers do have official driving records, though, and traffic violations are tracked there. Each county has authority over how they penalize violations.

If several minor traffic violations do go on your record and build up over time, it can result in the loss of driving privileges. Minor infractions include speeding and improper lane usage.

More severe violations such as DUIs, serious accidents, and drug-related offenses often result in license suspension, revocation, or cancellation. Major violations can also incur fines, community service, jail time, and driving course requirements.

If you want to check the status of your driving record, You can order a driving record report online.

What Are the Rules of the Road?

This section will cover laws concerning cruising on Wyoming’s roads.

These laws keep traffic moving safely, efficiently, and with respect for other vehicles and drivers. Here we go!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What about Fault vs. No-Fault?

When it comes to auto accidents, Wyoming is an at-fault state, just like most states in the U.S.

This means in the event of an auto accident in Wyoming, the blame will be legally placed on one driver. The party who caused the incident or accident is financially responsible for all damages to other parties.

This is why it’s both very smart (and legally required) to carry auto insurance in Wyoming.

What Are the Seat Belt & Car Seat Laws?

Wyoming has required drivers and passengers to wear seat belts since 1989. Seat belts save lives if you end up in an accident. Currently, Wyoming has no restrictions on riding in cargo areas of pickup trucks.

If you want to learn more, here is an overview of Wyoming seat belt laws.

Anyone nine years old or older, in the front or back seat, must use a seat belt. Children eight years old or younger are required to be in a child seat and in the rear, if possible.

Are There Keep Right & Move Over Laws?

Almost every driver has experienced the frustrating situation of getting stuck behind a driver traveling below the speed of traffic on a highway. In those situations, what can you legally do?

In Wyoming, the laws are clear. Drivers should stay to the right when driving slower than the average speed of traffic. Only move into the left lane when intending to pass.

If you see an official vehicle or emergency medical vehicle on the highway, such as a parked police car with its lights on or a tow truck, move into the lane farthest away from the vehicle. If that’s not possible, you can slow down to a speed of 20 mph less than the posted speed limit.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Speed Limits?

Speed limits are vital to keeping drivers safe, and following them saves you from expensive fines and higher insurance rates. What’s more, they help prevent deadly accidents.

Here’s a chart on Wyoming’s speed limits on various roadway types:

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75; 80 on specified segments of road |

| Urban Interstates | 75; 80 on specified segments of road |

| Other Limited Access Roads | 70 |

| Other Roads | 70 |

Of course, several factors can lead to posted limits differing from this chart. Please follow all local signage.

What About Ridesharing?

These days, ridesharing is growing more and more popular. Companies like Lyft and Uber are changing the face of transportation across the globe.

For rideshare drivers, this can mean a great side hustle and income stream. However, if you drive for Uber or Lyft, you’ll want to be sure you’re adequately protected with car insurance.

Only a few of Wyoming’s insurance providers offer coverage for rideshare drivers.

If you drive for a ridesharing service, check out these providers:

- State Farm

- Geico

- USAA

Some coverages function as extensions to your regular insurance policy. As with your normal auto insurance, to find the best deals, your best bet is to shop around for rideshare insurance and see which company can offer the best quote.

How About Automation on the Road?

More and more, “self-driving,” “autonomous,” and “connected” seem to be popping up in news outlets across the globe, especially when it comes to driving technology.

The age of self-driving cars could be sooner than you think. Car manufacturers, legislatures, and consumers are all looking ahead and doing their best to plan.

As of 2019, Wyoming is one of the few states that have yet to pass legislation concerning testing or deployment of autonomous vehicles.

However, Wyoming, Florida, and New York received a grant in 2015 from the U.S. Department of Transportation to participate in a pilot program for connected vehicles. Currently, the program is being tested along the I-80 corridor in southern Wyoming.

The connected vehicles in question are likely snowplows, trucks, and emergency vehicles — they aren’t autonomous, just connected to advanced tech systems.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Safety Laws?

Even if you follow all the driving rules you learned in Driver’s Ed — sticking to posted speed limits, wearing a seatbelt, and driving defensively — every day, some drivers still run into trouble on Wyoming’s roads.

Beyond rules governing driving in Wyoming, there are several laws set to enforce penalties for and combat impaired driving, distracted driving, and other safety issues. Below, we’ll cover all you should know.

What Are the DUI Laws?

Driving under the influence of alcohol can be deadly for you and other drivers on the road. In 2017, Wyoming had 44 alcohol-impaired driving fatalities. In total, alcohol-impaired driving accounted for one-third of all driving fatalities in the state.

In Wyoming that same year, 3,253 people were arrested for driving under the influence of alcohol. Twenty-eight of those drivers were under the age of 18.

The table below outlines the legal consequences of getting caught driving while intoxicated in Wyoming.

| NUMBER OF OFFENSES | ALS OR REVOCATION | IMPRISONMENT | FINE | OTHER |

|---|---|---|---|---|

| 1st Offense | 90 days | no minimum, but up to 6 months | no minimum, but up to $750 | Substance Abuse Assessment required; IID required for 6 months if HBAC |

| 2nd Offense | 1 year | 7 days - 6 months | $250-$750 | IID 1 year, substance abuse assessment required |

| 3rd Offense | 3 years | 30 days - 6 months | $250-$3000 | IID 2 years, substance abuse assessment required |

| 4th Offense | 3 years | up to 2 years | up to $10000 | IID for life but may apply for removal after 5 years |

If caught drinking and driving, you will face serious consequences, including jail time, license revocation, and steep fines. What’s more, you could cause the death of an innocent person or yourself.

What Are the Marijuana-Impaired Driving Laws?

In recent years, several of Wyoming’s neighboring states have relaxed their laws regarding marijuana consumption. Colorado and some other nearby states no longer consider marijuana to be an illegal substance. But Wyoming does.

In the Equality State, it is illegal to use, possess, grow, or sell marijuana. It is not approved for medical or recreational use within the state.

If you are caught driving while under the influence of marijuana, you can face penalization. The penalties are identical to those drivers found under the influence of alcohol face. You can be subject to fines, prison time, and license revocation.

So, when returning to Wyoming after a trip to Colorado or if you’re only passing through, be smart: don’t use marijuana while or several hours before driving.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About Distracted Driving Laws?

It’s clear alcohol and drugs don’t mix with operating your vehicle. Neither does using an electronic device. To deal with the safety hazards that smartphones and other devices pose drivers, many states issue laws and rules to regulate the use of cell phones while driving.

As for Wyoming, texting is banned for all drivers.

If you’re planning a trip to Wyoming or visiting a different city from where you live, be sure to check out the laws in individual cities.

Cheyenne and Green River both ban handheld cell phone use, but those rules aren’t in effect beyond city limits. Elsewhere in the state, handheld cell phones are not prohibited for drivers.

How is Driving in Wyoming?

Don’t let some of the hazards drivers face in Wyoming make you think driving within the state isn’t a pleasure. Sure, the intense winter conditions, winding roads, and storms can seem to last forever. Still, the state also offers breathtaking sunrises and sunsets stretching across the plains, gorgeous panoramas of dappled valleys, and some of the most incredible National Parks in the country.

Driving in Wyoming is, if anything, an adventure. There’s always something new to see or do.

Hopefully, all your experiences behind the wheel in Wyoming will be positive. But, just like in any other state, you may run into trouble in the Cowboy State. In this next section, we’ll face some of the less pleasant realities of driving to help you prepare and stay safe.

Is There Much Vehicle Theft in Wyoming?

Hopefully, you’ll never have to deal with your vehicle being stolen. But, sometimes, it does happen, even in rural and generally safe Wyoming.

These were the top stolen vehicles in the state for 2017.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2007 | 32 |

| Ford Pickup (Full Size) | 2000 | 29 |

| Dodge Pickup (Full Size) | 2004 | 13 |

| GMC Pickup (Full Size) | 2007 | 10 |

| Jeep Cherokee/Grand Cherokee | 2000 | 10 |

| Dodge Durango | 2002 | 9 |

| Toyota Camry | 1997 | 9 |

| GMC Yukon | 2002 | 8 |

| Honda Accord | 1997 | 8 |

| Chevrolet Cavalier | 2003 | 6 |

A full-size Chevy Pickup is the most likely to be stolen in Wyoming. The 2007 make was most stolen, but other years are also at risk. Trucks of varying make and models are stolen throughout Wyoming each year.

So, where does this vehicle theft happen in Wyoming? Here’s some data provided by the FBI breaking down thefts by city.

| CITY | MOTOR VEHICLE THEFT |

|---|---|

| Afton | 0 |

| Buffalo | 3 |

| Casper | 128 |

| Cheyenne | 184 |

| Cody | 3 |

| Diamondville | 0 |

| Douglas | 2 |

| Evanston | 14 |

| Evansville | 7 |

| Gillette | 27 |

| Glenrock | 2 |

| Green River | 7 |

| Greybull | 3 |

| Hanna | 0 |

| Jackson | 12 |

| Kemmerer | 0 |

| Lander | 8 |

| Laramie | 20 |

| Mills | 11 |

| Moorcroft | 1 |

| Newcastle | 3 |

| Pine Bluffs | 2 |

| Powell | 4 |

| Rawlins | 13 |

| Riverton | 28 |

| Rock Springs | 25 |

| Saratoga | 0 |

| Sheridan | 20 |

| Sundance | 0 |

| Thermopolis | 0 |

| Torrington | 3 |

| Wheatland | 7 |

| Worland | 3 |

Unsurprisingly, Cheyenne, one of Wyoming’s most populated locales, is the biggest site of thefts. Casper, in central Wyoming, follows closely behind.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Number of Road Fatalities in Wyoming?

Next, we’re going to spend a few sections discussing road fatalities. While this certainly isn’t a pleasant subject, it’s important to understand this information to make informed choices about where and how you drive in Wyoming.

There are some insightful ways to look at the statistics on road fatalities. We’ll show you a few that hopefully will give you a deeper understanding of the risks and realities of road fatalities in Wyoming.

What is the Most Fatal Highway in Wyoming?

Each state has a highway considered the most fatal. Long, busy stretches of road can be hazardous, especially if they are the most heavily trafficked in a state.

In Wyoming, the section of I-80 sees over 17 fatal crashes each year. Snaking across the southern third of the state, this interstate follows part of the old Oregon Trail. Over 10 years, there were 175 crashes and 207 fatalities on the Wyoming section of this road.

How About Fatal Crashes by Weather Condition & Light Condition?

Weather and light also contribute to automobile accident rates and accident-related deaths.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 50 | 3 | 31 | 7 | 0 | 91 |

| Rain | 3 | 0 | 1 | 0 | 0 | 4 |

| Snow/Sleet | 3 | 0 | 4 | 0 | 0 | 7 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 2 | 2 |

| TOTAL | 56 | 3 | 37 | 7 | 2 | 105 |

The results in this table might be surprising to you. Most fatal accidents occur during normal weather and light conditions, rather than icy or otherwise troublesome conditions. However, when you take into account that normal conditions are the times when most drivers are on the road, it makes sense.

In comparison to the number of drivers on the road during darkness or bad weather, accidents make up a higher percentage of the total drivers. If you drive in the dark, choose areas that are well-lit and be cautious.

Here are some tips for navigating bad weather in a vehicle:

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Fatalities (All Crashes) by County?

Here, we’ll take a look at the number of fatalities in various Wyoming counties.

| COUNTY | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany | 10 | 7 | 8 | 8 | 6 |

| Big Horn | 7 | 8 | 5 | 1 | 5 |

| Campbell | 3 | 16 | 9 | 2 | 5 |

| Carbon | 5 | 10 | 7 | 7 | 12 |

| Converse | 3 | 7 | 10 | 2 | 4 |

| Crook | 4 | 2 | 2 | 1 | 3 |

| Fremont | 4 | 12 | 17 | 13 | 16 |

| Goshen | 3 | 2 | 2 | 0 | 2 |

| Hot Springs | 1 | 2 | 3 | 1 | 1 |

| Johnson | 2 | 4 | 5 | 5 | 0 |

| Laramie | 10 | 21 | 13 | 15 | 11 |

| Lincoln | 4 | 3 | 5 | 5 | 5 |

| Natrona | 12 | 13 | 19 | 6 | 18 |

| Niobrara | 2 | 5 | 2 | 3 | 0 |

| Park | 1 | 3 | 8 | 5 | 6 |

| Platte | 5 | 7 | 4 | 7 | 5 |

| Sheridan | 3 | 2 | 5 | 7 | 1 |

| Sublette | 2 | 4 | 2 | 0 | 1 |

| Sweetwater | 2 | 13 | 11 | 10 | 12 |

| Teton | 1 | 2 | 2 | 2 | 3 |

| Uinta | 2 | 3 | 3 | 7 | 5 |

| Washakie | 0 | 2 | 1 | 1 | 1 |

| Weston | 1 | 2 | 2 | 4 | 1 |

Natrona and Fremont Counties see the highest numbers of fatalities. Natrona County is the second-most populous county in Wyoming and contains the city of Casper.

Natrona County is also home to a stretch of I-25 runs.

Fremont County encompasses some forest lands, winding roads, and the Wind River Reservation.

Carbon County, which rounds out the top three, is sparsely populated but includes a portion of I-80, Wyoming’s deadliest highway.

What Are the Traffic Fatalities?

Rural and urban areas can also vary widely in the number of traffic fatalities. To compare the two, we’ve used data provided by the NHTSA.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 137 | 115 | 133 | 97 | 101 | 72 | 121 | 119 | 91 | 95 |

| Urban | 22 | 19 | 22 | 38 | 22 | 15 | 29 | 24 | 21 | 28 |

| Total | 159 | 134 | 155 | 135 | 123 | 87 | 150 | 145 | 112 | 123 |

As you can see, fatal car accidents occur far more often in rural areas across nine years. This is partly because most of Wyoming is considered “rural,” and because rural areas also have some of the most difficult and winding drives versus straightforward, low-speed driving in cities and towns.

What Are the Fatalities by Person Type?

Auto accident fatalities can also be analyzed by “person type.” This means whether a person was within a vehicle, what kind of vehicle, or if they were a pedestrian or cyclist.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 24 | 36 | 37 | 18 | 36 |

| Light Truck - Pickup | 23 | 40 | 37 | 20 | 28 |

| Light Truck - Utility | 15 | 28 | 33 | 26 | 21 |

| Light Truck - Van | 4 | 14 | 0 | 8 | 3 |

| Large Truck | 7 | 5 | 7 | 7 | 7 |

| Other/Unknown Occupants | 1 | 1 | 2 | 3 | 5 |

| Total Occupants | 74 | 124 | 116 | 82 | 100 |

| Total Motorcyclists | 9 | 16 | 24 | 24 | 17 |

| Pedestrian | 4 | 5 | 5 | 4 | 6 |

| Bicyclist and Other Cyclist | 0 | 5 | 0 | 1 | 0 |

| Other/Unknown Nonoccupants | 0 | 0 | 0 | 1 | 0 |

| Total Nonoccupants | 4 | 10 | 5 | 6 | 6 |

| Total | 87 | 150 | 145 | 112 | 123 |

As we’ve mentioned, Wyoming drivers love their trucks. Many accidents in this state involve various types of trucks. There are also a fair number of motorcycle accident fatalities. Historically, few accidents involved pedestrians or cyclists.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Fatalities by Crash Type?

Crash type, meaning the type of vehicle involved, is another useful way to consider Wyoming auto accident fatalities.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 87 | 150 | 145 | 112 | 123 |

| Single Vehicle | 53 | 91 | 93 | 69 | 74 |

| Involving a Large Truck | 25 | 34 | 28 | 21 | 17 |

| Involving Speeding | 40 | 48 | 46 | 28 | 37 |

| Involving a Rollover | 49 | 78 | 78 | 55 | 60 |

| Involving a Roadway Departure | 67 | 104 | 109 | 78 | 83 |

| Involving an Intersection (or Intersection Related) | 9 | 13 | 14 | 11 | 15 |

As you can see, many crashes involve just one vehicle. Road departures, speeding, and rollovers are fairly common. Most do not involve large trucks. Be extra careful when driving alone.

What is the Five-Year Trend For the Top 10 Counties?

Looking at the trend of the largest counties in Wyoming can also provide insight. We’ve done the math, and this next table shows the five-year trends for Wyoming’s various counties.

| County Names | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Natrona County | 12 | 13 | 19 | 6 | 18 |

| Fremont County | 4 | 12 | 17 | 13 | 16 |

| Carbon County | 5 | 10 | 7 | 7 | 12 |

| Sweetwater County | 2 | 13 | 11 | 10 | 12 |

| Laramie County | 10 | 21 | 13 | 15 | 11 |

| Albany County | 10 | 7 | 8 | 8 | 6 |

| Park County | 1 | 3 | 8 | 5 | 6 |

| Big Horn County | 7 | 8 | 5 | 1 | 5 |

| Campbell County | 3 | 16 | 9 | 2 | 5 |

| Lincoln County | 4 | 3 | 5 | 5 | 5 |

Unfortunately, many of the largest counties have seen slow but steady increases in road fatalities from 2013-2017. Albany County, however, has seen an almost 50 percent reduction in fatalities.

What Are the Fatalities Involving Speeding by County?

High-speed crashes can greatly increase the likelihood of an accident resulting in a fatality. We’ve crunched the numbers and broken down the number of fatal crashes involving speeding for each county.

| COUNTY | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany | 3 | 1 | 3 | 1 | 4 |

| Big Horn | 0 | 5 | 2 | 0 | 1 |

| Campbell | 1 | 5 | 2 | 0 | 1 |

| Carbon | 1 | 4 | 3 | 4 | 10 |

| Converse | 1 | 5 | 3 | 0 | 1 |

| Crook | 2 | 1 | 1 | 0 | 1 |

| Fremont | 3 | 7 | 8 | 4 | 2 |

| Goshen | 2 | 1 | 1 | 0 | 0 |

| Hot Springs | 0 | 0 | 0 | 0 | 0 |

| Johnson | 1 | 0 | 0 | 2 | 0 |

| Laramie | 4 | 5 | 3 | 3 | 2 |

| Lincoln | 3 | 0 | 1 | 4 | 2 |

| Natrona | 11 | 3 | 6 | 2 | 7 |

| Niobrara | 1 | 0 | 0 | 0 | 0 |

| Park | 1 | 2 | 4 | 0 | 1 |

| Platte | 2 | 3 | 0 | 2 | 1 |

| Sheridan | 1 | 0 | 2 | 0 | 0 |

| Sublette | 0 | 0 | 1 | 0 | 0 |

| Sweetwater | 2 | 5 | 3 | 2 | 1 |

| Teton | 0 | 0 | 0 | 2 | 0 |

| Uinta | 0 | 0 | 2 | 2 | 1 |

| Washakie | 0 | 0 | 0 | 0 | 1 |

| Weston | 1 | 1 | 1 | 0 | 1 |

Even though Albany County has seen lower rates of fatalities over the last few years, they are the county with the most speeding fatalities in Wyoming.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Fatalities in Crashes Involving an Alcohol-Impaired Driver by County?

We discussed the importance and severity of DUI laws earlier, but unfortunately, drivers still choose to get behind the wheel while intoxicated. Sadly, this causes serious accidents and fatalities on the road. Below is a chart showing fatalities involving alcohol-impaired driver broken down by county.

| COUNTY | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Albany | 2 | 1 | 3 | 0 | 4 |

| Big Horn | 0 | 5 | 3 | 1 | 1 |

| Campbell | 0 | 8 | 2 | 0 | 2 |

| Carbon | 1 | 2 | 2 | 3 | 1 |

| Converse | 0 | 4 | 3 | 0 | 1 |

| Crook | 2 | 1 | 0 | 0 | 1 |

| Fremont | 3 | 3 | 13 | 7 | 13 |

| Goshen | 2 | 0 | 1 | 0 | 2 |

| Hot Springs | 1 | 0 | 1 | 0 | 1 |

| Johnson | 0 | 1 | 0 | 2 | 0 |

| Laramie | 2 | 2 | 4 | 3 | 2 |

| Lincoln | 3 | 1 | 1 | 1 | 1 |

| Natrona | 4 | 3 | 10 | 3 | 6 |

| Niobrara | 0 | 1 | 0 | 0 | 0 |

| Park | 1 | 2 | 2 | 0 | 4 |

| Platte | 1 | 1 | 2 | 2 | 0 |

| Sheridan | 0 | 1 | 2 | 4 | 0 |

| Sublette | 0 | 2 | 1 | 0 | 1 |

| Sweetwater | 1 | 9 | 3 | 2 | 1 |

| Teton | 0 | 0 | 1 | 0 | 1 |

| Uinta | 0 | 0 | 1 | 3 | 1 |

| Washakie | 0 | 1 | 0 | 0 | 0 |

| Weston | 0 | 0 | 0 | 1 | 0 |

Just as with speeding, Albany County sees the highest rates of alcohol-impaired driver fatalities, as well. Albany County residents, please stay safe on the roads, especially when operating your vehicle at night.

What About Teen Drinking & Driving?

Regrettably, drinking and driving doesn’t only happen amongst people 21 and over; teenagers can also make this deadly decision.

In Wyoming, in 2016, alcohol-related teenage driving deaths made up of 1.9 per 100,000 people. That’s significantly higher than the national average of 1.2.

In 2016, Wyoming police arrested 26 people under the age of 18 for driving under the influence. That places Wyoming fourth in the nation for teen DUI arrests, based on population. In general, Wyoming ranks third out of the 50 states for total DUI arrests. In 2016, police arrested 3,082 individuals for this serious charge.

What is the EMS Response Time?

Another critical factor to consider when it comes to accidents is EMS response time. While accidents can be fatal, if emergency services can work quickly and get you to medical care, many lives can be saved each year.

In this next table, you can see a comparison of EMS response times between urban and rural parts of Wyoming.

| Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes | |

|---|---|---|---|---|---|

| Rural | 6.38 | 21.04 | 42.17 | 61.22 | 80 |

| Urban | 2.95 | 5.83 | 24.75 | 33.50 | 25 |

In general, EMS response is faster in urban areas closer to hospitals and other medical services. However, unfortunately, the majority of fatal crashes in Wyoming happen in rural areas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How’s the Transportation in Wyoming?

Now that we’ve covered the types of insurance necessary for traveling in the Equality State and the laws and regulations you need to follow, you’re ready to drive across Wyoming.

Last but not least, before we finish, we’ll look at just what you can expect when it comes to transportation in your state. From car ownership to commute time and types of commutes will all be explained.

What Are the Statistics for Car Ownership?

Even though we know Wyomingites love their trucks, in general, they have about as many cars on average as most Americans. The majority of Wyoming households are home to two or three vehicles.

What’s the Average Commute Time?

Finally, some truly great news. Wyoming’s average commute time is actually 16 minutes shorter than the national average.

This can partly be explained by how many Wyomingites work on their property or nearby land. Whatever the reason, there’s no need to complain about less time commuting.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What About Commuter Transportation?

Mirroring the rest of the United States, Wyoming drivers usually drive to work alone. Just about 10 percent of workers in the state use a carpool of some kind. Crank up the radio, and enjoy your short commute in peace!

Is There Much Traffic Congestion?

Earlier, we mentioned Wyoming drivers drive more miles than any other state annually. Unsurprisingly, the hours spent exploring Wyoming’s splendor aren’t riddled with traffic jams. You’ll be cruising through some of the most open roadways in the nation. Even Wyoming’s biggest cities don’t make it onto lists of congested cities nationally or globally.

You did it! We’ve made it through everything you need to know about driving in Wyoming. So get out there and enjoy safe driving with an excellent insurance policy. If you’re ready to start comparing rates, click below to get quotes and begin saving.