Delaware Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 11.4

With almost a million cars registered in Delaware, there are quite a few drivers out on Delaware’s roads. Every one of these drivers needs to have car insurance, but researching car insurance can be difficult and time-consuming.

We can help you save time and limit frustration if you need to find car insurance in Delaware.

To help you through the process of purchasing car insurance, we will answer all your car insurance questions! From the best providers to how demographics impact your rates, we cover it all in this comprehensive guide.

So keep scrolling to learn everything you need to know about driving in the state of Delaware!

Want to start comparing rates today? Enter your zip code in our FREE online tool above!

How can you get Delaware car insurance coverage and rates?

Since every state has different coverage options, it can be difficult to understand Delaware’s requirements. Drivers need to make sure their coverage meets Delaware’s legal requirements, but the laws can be confusing.

As well, since drivers have to pay a large sum every year for car insurance, people want to know that their hard-earned money is going to something worthwhile.

It can be frustrating to realize you are paying more than you should, or that your coverages aren’t enough in an accident.

To help you work through Delaware’s coverages and rates to understand BOTH what Delaware requires AND what you should be purchasing, we will dive into everything from minimum coverages to add-on coverages.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Delaware minimum coverage?

Delaware requires all drivers to have bodily injury liability coverage, property damage liability, and personal injury protection (PIP) coverages. If you don’t have these coverages in the required amounts, you face fines and other penalties.

The Insurance Information Institute (iii) details the amounts for bodily injury liability and property damage liability as the following:

- $25,000 for one person injured in an accident you caused

- $50,000 for two or more people injured in an accident you caused

- $10,000 for property damage in an accident you caused

As for personal injury protection, Delaware requires drivers to have the following amount of coverage. The person must be covered under PIP to receive PIP’s benefits.

- $15,000 for one person injured in an accident

- $30,000 for all people injured in an accident

Having these coverages is necessary not only because it’s the law, but because these coverages protect you in an accident.

Are there forms of financial responsibility?

So how do you prove you have Delaware’s required minimum coverage? Luckily, it’s quite easy. You must simply have an acceptable form of financial responsibility that proves you have car insurance.

This form of financial responsibility can be one of the following.

- A valid insurance ID card

- Insurance binder (a temporary form of car insurance)

You must provide proof of insurance anytime you are pulled over in a traffic stop, register a vehicle, or are in an accident. Delaware also performs audits on cars to periodically check for car insurance.

If the Delaware DMV audits you, make sure to contact your insurance provider. Your insurance provider will provide proof of insurance to the DMV, but it is important to note that this proof can only come from your provider, NOT you.

What percentage of income is insurance premiums?

An important part of analyzing a state’s rates is to see how much car insurance takes out of your budget each year.

To see how Delaware ranks, we want to take a look at how much yearly insurance premiums take out of an average per capita disposable income (the amount you have to spend or save after paying taxes).

| Delaware Statistics | 2012 | 2013 | 2014 |

|---|---|---|---|

| Full Coverage | $1,153.59 | $1,187.18 | $1,215.69 |

| Disposable Income | $38,893.00 | $38,879.00 | $40,256.00 |

| Insurance as % of Income | 2.97% | 3.05% | 3.02% |

The percentage of money going to car insurance increased slightly in 2013 before dropping slightly. The decrease is good, as it means less money is going to car insurance each month.

The bad news is that Delaware’s percentages are fairly high the highest state’s rate in the U.S. is 3.71 percent. Since the countrywide percentage is 2.40, Delaware’s percentage is quite a bit higher than most U.S. states.

The countrywide average for car insurance coverage is $981, so Delaware’s average cost of $1,215 is $234 more than most states!

CalculatorPro

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the average monthly car insurance rates in DE (liability, collision, comprehensive)?

While Delaware only requires liability and PIP coverages, most insurance plans include three basic coverages: liability, collision, and comprehensive coverages.

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

So what is the average cost of a comprehensive insurance plan? Below, you will see Delaware’s average costs for liability, collision, and comprehensive.

| Coverage Type | Average Annual Costs (2015) |

|---|---|

| Liability | $799.30 |

| Collision | $318.77 |

| Comprehensive | $122.49 |

| Combined | $1,240.57 |

Since the cost countrywide for a core coverage plan is $1,009, Delaware’s annual costs average $231 MORE than most states.

Is there additional coverage?

Let’s dive into some additional liability coverages in Delaware. Two frequently added coverages are medical payment and uninsured/underinsured motorist coverages.

Why are these coverages important for you to have?

Medical payment covers the medical costs of both you and your passengers in an accident. If you or your passengers need an ambulance ride, emergency treatment, and other medical needs from an accident, medical payments will cover the costs.

Uninsured motorist coverage and underinsured coverage is also a necessity. Why? Because 11.4 percent of Delaware’s drivers are uninsured, ranking Delaware as 28th in the U.S. for its number of uninsured drivers.

If you are in an accident with an uninsured or underinsured driver and that driver is at fault, he or she will usually be unable to pay off all the accident costs. This means you could be stuck paying the bills yourself unless you have uninsured and underinsured coverage!

Let’s dig a little deeper into these coverages and look at the NAIC’s report on the coverage’s loss ratios. We have also included PIP coverage’s loss ratio, which is required in Delaware.

| Coverage | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 79.32 | 75.49 | 81.59 |

| Medical Payments (Medpay) | 86.94 | 169.04 | 135.54 |

| Uninsured/Underinsured Motorist Coverage | 71.16 | 85.48 | 85.08 |

Uninsured/underinsured and PIP coverages’ loss ratios are excellent. Unfortunately, medical payment’s loss ratio has taken a turn for the worse.

A good loss ratio is neither too high nor too low, and medical payment’s loss ratio is over 100 percent. A loss ratio that is over 100 percent means that a company is paying out more claims than it expected based on the premiums it charged and risks going bankrupt if the loss ratio remains high.

Luckily, medical payment’s loss ratio has decreased since the HUGE leap to 169 percent in 2014.

Are there any add-on’s, endorsements, and riders?

If you want a little extra coverage to add to your core insurance plan, make sure to ask about the common (and affordable!) options below.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP) — PUP provides you with extra coverage in case your liability insurance runs out in an accident.

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance — This coverage will pay for vehicle repairs that were NOT caused by an accident.

- Non-Owner Car Insurance — If you are driving a vehicle you don’t own, this extra coverage will provide you with bodily injury liability and property damage coverages.

- Modified Car Insurance Coverage — This will cover you if you modify your car (anything from a custom paint job to a new engine).

- Classic Car Insurance — Because classic cars aren’t used nearly as often, classic car insurance is usually much cheaper.

- Pay-As-You-Drive Insurance — If you drive less, this insurance lets you pay less.

So if you want a little extra coverage for peace of mind, make sure to ask your provider about any of the above coverages that interest you.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

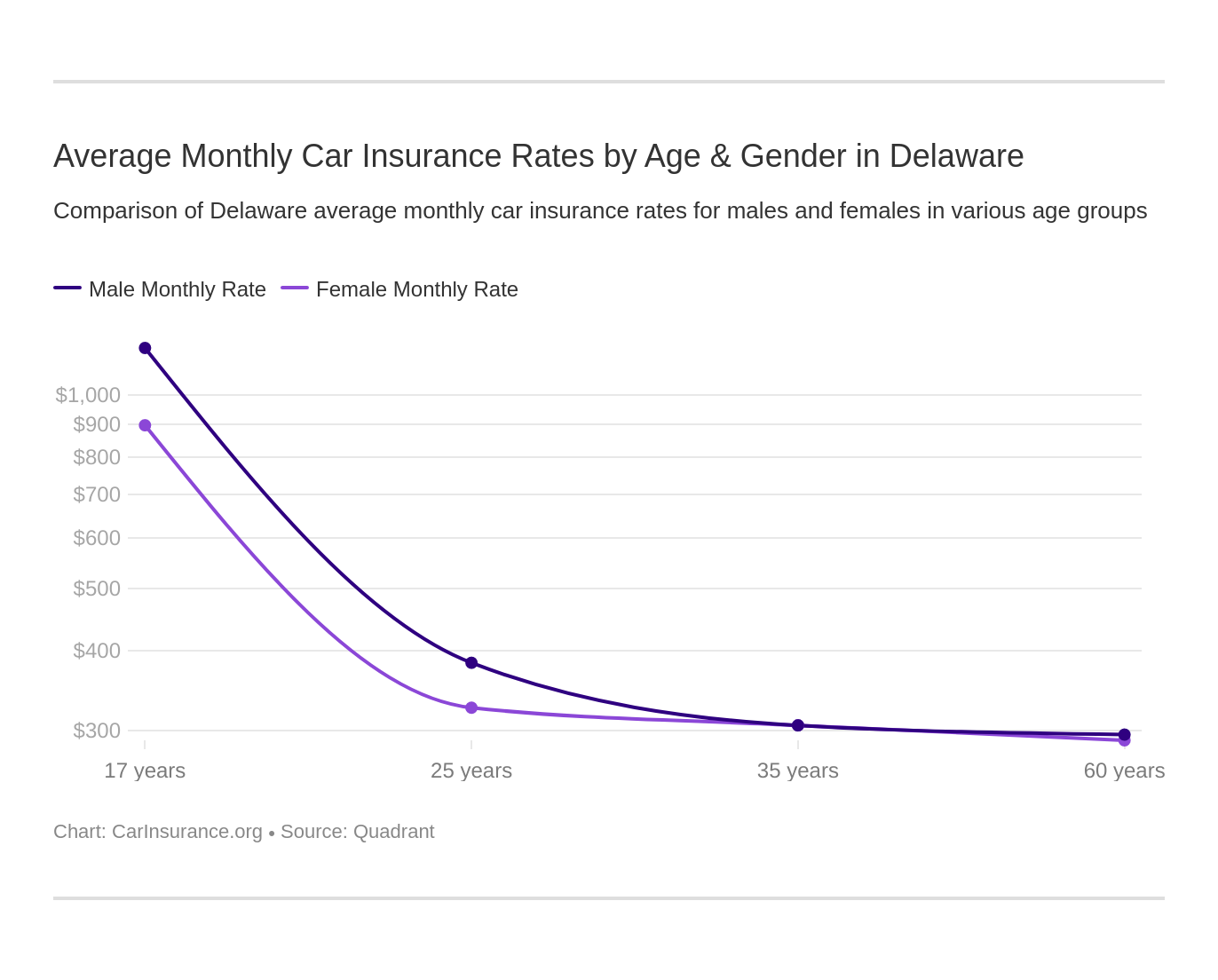

What are the average monthly car insurance rates by age & gender in DE?

Demographics are actually a huge influence on insurers’ rates. While age may be an expected rate changer, gender also plays a role in rate increases.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $3,680.77 | $3,617.49 | $3,230.45 | $3,405.48 | $3,876.03 | $4,113.55 | $13,198.18 | $15,406.57 |

| Geico Advantage | $2,660.39 | $2,952.77 | $2,562.65 | $2,983.93 | $2,798.53 | $2,699.68 | $6,449.50 | $6,710.85 |

| Liberty Mut Fire Ins Co | $12,287.48 | $12,287.48 | $12,138.88 | $12,138.88 | $12,287.48 | $17,022.83 | $27,326.93 | $41,390.16 |

| Nationwide Mutual | $3,017.56 | $2,994.99 | $2,753.71 | $2,742.95 | $3,345.06 | $3,575.26 | $7,151.92 | $9,060.24 |

| Progressive Direct | $1,994.89 | $1,844.62 | $1,754.37 | $1,790.24 | $2,437.17 | $2,371.56 | $10,102.13 | $11,159.65 |

| State Farm Mutual Auto | $2,818.09 | $2,818.09 | $2,600.14 | $2,600.14 | $3,162.14 | $3,294.46 | $8,048.04 | $10,393.68 |

| Travelers Home & Marine Ins Co | $1,634.80 | $1,642.27 | $1,610.37 | $1,568.84 | $1,745.40 | $1,906.92 | $9,243.54 | $14,106.72 |

| USAA | $1,286.77 | $1,265.78 | $1,191.65 | $1,189.30 | $1,615.19 | $1,773.54 | $4,729.53 | $5,556.07 |

Younger drivers pay THOUSANDS more than older drivers. Rates also change between genders, even if females and males have the exact same driving record.

To further see how demographics affect rates, take a look at the table below that details the most to least expensive demographics.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Liberty Mut Fire Ins Co | Single 17-year old male | $41,390.16 |

| Liberty Mut Fire Ins Co | Single 17-year old female | $27,326.93 |

| Liberty Mut Fire Ins Co | Single 25-year old male | $17,022.83 |

| Allstate P&C | Single 17-year old male | $15,406.57 |

| Travelers Home & Marine Ins Co | Single 17-year old male | $14,106.72 |

| Allstate P&C | Single 17-year old female | $13,198.18 |

| Liberty Mut Fire Ins Co | Married 35-year old female | $12,287.48 |

| Liberty Mut Fire Ins Co | Married 35-year old male | $12,287.48 |

| Liberty Mut Fire Ins Co | Single 25-year old female | $12,287.48 |

| Liberty Mut Fire Ins Co | Married 60-year old female | $12,138.88 |

| Liberty Mut Fire Ins Co | Married 60-year old male | $12,138.88 |

| Progressive Direct | Single 17-year old male | $11,159.65 |

| State Farm Mutual Auto | Single 17-year old male | $10,393.68 |

| Progressive Direct | Single 17-year old female | $10,102.13 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $9,243.54 |

| Nationwide Mutual | Single 17-year old male | $9,060.24 |

| State Farm Mutual Auto | Single 17-year old female | $8,048.04 |

| Nationwide Mutual | Single 17-year old female | $7,151.92 |

| Geico Advantage | Single 17-year old male | $6,710.85 |

| Geico Advantage | Single 17-year old female | $6,449.50 |

| USAA | Single 17-year old male | $5,556.07 |

| USAA | Single 17-year old female | $4,729.53 |

| Allstate P&C | Single 25-year old male | $4,113.55 |

| Allstate P&C | Single 25-year old female | $3,876.03 |

| Allstate P&C | Married 35-year old female | $3,680.77 |

| Allstate P&C | Married 35-year old male | $3,617.49 |

| Nationwide Mutual | Single 25-year old male | $3,575.26 |

| Allstate P&C | Married 60-year old male | $3,405.48 |

| Nationwide Mutual | Single 25-year old female | $3,345.06 |

| State Farm Mutual Auto | Single 25-year old male | $3,294.46 |

| Allstate P&C | Married 60-year old female | $3,230.45 |

| State Farm Mutual Auto | Single 25-year old female | $3,162.14 |

| Nationwide Mutual | Married 35-year old female | $3,017.56 |

| Nationwide Mutual | Married 35-year old male | $2,994.99 |

| Geico Advantage | Married 60-year old male | $2,983.93 |

| Geico Advantage | Married 35-year old male | $2,952.77 |

| State Farm Mutual Auto | Married 35-year old female | $2,818.09 |

| State Farm Mutual Auto | Married 35-year old male | $2,818.09 |

| Geico Advantage | Single 25-year old female | $2,798.53 |

| Nationwide Mutual | Married 60-year old female | $2,753.71 |

| Nationwide Mutual | Married 60-year old male | $2,742.95 |

| Geico Advantage | Single 25-year old male | $2,699.68 |

| Geico Advantage | Married 35-year old female | $2,660.39 |

| State Farm Mutual Auto | Married 60-year old female | $2,600.14 |

| State Farm Mutual Auto | Married 60-year old male | $2,600.14 |

| Geico Advantage | Married 60-year old female | $2,562.65 |

| Progressive Direct | Single 25-year old female | $2,437.17 |

| Progressive Direct | Single 25-year old male | $2,371.56 |

| Progressive Direct | Married 35-year old female | $1,994.89 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $1,906.92 |

| Progressive Direct | Married 35-year old male | $1,844.62 |

| Progressive Direct | Married 60-year old male | $1,790.24 |

| USAA | Single 25-year old male | $1,773.54 |

| Progressive Direct | Married 60-year old female | $1,754.37 |

| Travelers Home & Marine Ins Co | Single 25-year old female | $1,745.40 |

| Travelers Home & Marine Ins Co | Married 35-year old male | $1,642.27 |

| Travelers Home & Marine Ins Co | Married 35-year old female | $1,634.80 |

| USAA | Single 25-year old female | $1,615.19 |

| Travelers Home & Marine Ins Co | Married 60-year old female | $1,610.37 |

There is about a 40,000 dollar difference between the most and least expensive demographics! Since teen drivers would never be able to pay over $40,000 a year, most parents add teens to the parent’s insurance rates.

This makes sure insurance rates are MUCH more economical, though rates will still go up on the parents’ policy.

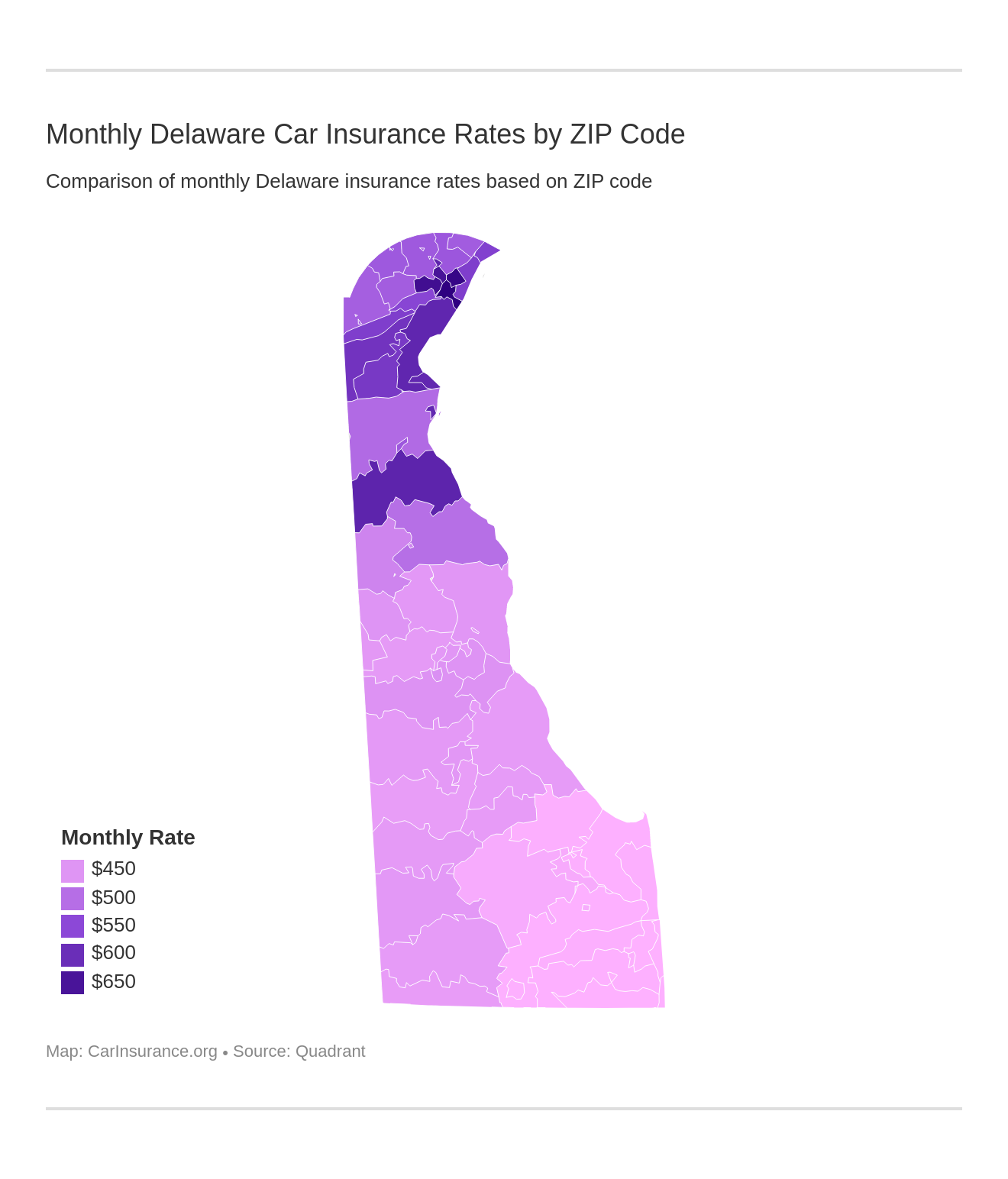

What are the cheapest car insurance rates by ZIP CODE?

In addition to age and gender, where you live can also cause rate changes. Certain areas simply have more risk factors. Traffic congestion, crime rates, and other area-specific factors can increase your annual costs.

If you live in a zip code with higher costs, make sure to check who the cheapest provider is in your area.

| Zipcode | Average Annual Rate | Allstate P&C | Geico Advantage | Liberty Mut Fire Ins Co | Nationwide Mutual | Progressive Direct | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|

| 19801 | $8,265.76 | $7,592.25 | $5,073.26 | $26,050.32 | $6,076.09 | $5,271.17 | $6,650.09 | $6,423.76 | $2,989.12 |

| 19802 | $8,136.26 | $7,208.58 | $5,073.26 | $26,050.32 | $6,076.09 | $4,753.87 | $6,344.73 | $6,341.42 | $3,241.84 |

| 19805 | $7,939.41 | $7,495.23 | $5,073.26 | $26,050.32 | $5,572.97 | $5,271.17 | $5,182.11 | $6,063.95 | $2,806.30 |

| 19736 | $7,863.61 | $7,307.23 | $4,026.75 | $18,084.08 | $4,734.88 | $4,876.62 | $4,971.52 | $16,171.23 | $2,736.58 |

| 19806 | $7,806.15 | $7,495.23 | $4,096.13 | $26,050.32 | $4,797.10 | $4,750.71 | $6,384.81 | $6,067.16 | $2,807.76 |

| 19733 | $7,549.45 | $7,531.58 | $4,594.56 | $26,050.32 | $5,558.03 | $4,949.30 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19734 | $7,434.79 | $7,109.37 | $3,368.23 | $18,248.83 | $4,559.54 | $4,471.08 | $4,785.00 | $14,780.71 | $2,155.61 |

| 19732 | $7,433.65 | $7,307.23 | $4,026.75 | $26,050.32 | $5,558.03 | $4,815.06 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19708 | $7,393.19 | $7,277.45 | $4,594.56 | $26,050.32 | $4,734.88 | $4,608.77 | $4,971.52 | $4,274.36 | $2,633.66 |

| 19720 | $7,378.97 | $7,531.58 | $4,594.56 | $22,574.11 | $5,558.03 | $5,209.07 | $6,083.30 | $4,584.67 | $2,896.48 |

| 19706 | $7,358.23 | $7,531.58 | $4,594.56 | $22,574.11 | $5,558.03 | $5,162.50 | $6,043.01 | $4,505.60 | $2,896.48 |

| 19731 | $7,329.63 | $7,339.89 | $3,368.23 | $26,050.32 | $5,558.03 | $4,608.77 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19710 | $7,199.39 | $7,307.23 | $4,026.75 | $26,050.32 | $4,559.54 | $4,815.06 | $4,971.52 | $3,709.07 | $2,155.61 |

| 19702 | $7,071.81 | $7,277.45 | $4,024.31 | $21,841.41 | $5,558.03 | $5,204.62 | $6,015.33 | $3,862.66 | $2,790.67 |

| 19701 | $6,949.68 | $7,277.45 | $4,024.31 | $21,841.41 | $5,558.03 | $4,399.78 | $5,533.03 | $4,172.74 | $2,790.67 |

| 19713 | $6,828.11 | $7,491.14 | $4,024.31 | $21,841.41 | $4,734.88 | $5,100.59 | $4,786.53 | $4,038.80 | $2,607.20 |

| 19809 | $6,824.40 | $6,883.73 | $4,334.85 | $20,610.11 | $5,572.97 | $4,833.40 | $4,796.01 | $4,397.52 | $3,166.59 |

| 19703 | $6,767.07 | $6,736.16 | $4,334.85 | $20,610.11 | $5,336.40 | $4,750.15 | $5,015.02 | $4,505.60 | $2,848.28 |

| 19804 | $6,656.56 | $7,524.44 | $4,594.56 | $18,084.08 | $5,572.97 | $5,079.02 | $5,165.81 | $4,242.46 | $2,989.12 |

| 19803 | $6,372.49 | $7,495.23 | $4,541.61 | $18,084.08 | $4,797.10 | $4,553.22 | $4,672.63 | $3,987.81 | $2,848.28 |

| 19730 | $6,354.44 | $7,339.89 | $3,368.23 | $18,248.83 | $5,558.03 | $4,608.77 | $4,971.52 | $4,584.67 | $2,155.61 |

| 19707 | $6,339.10 | $7,307.23 | $4,026.75 | $18,084.08 | $4,734.88 | $4,813.21 | $4,838.60 | $4,274.36 | $2,633.66 |

| 19807 | $6,326.10 | $7,307.23 | $4,026.75 | $18,084.08 | $4,797.10 | $4,859.03 | $4,706.43 | $4,206.58 | $2,621.57 |

| 19716 | $6,296.25 | $7,491.14 | $4,024.31 | $18,084.08 | $4,734.88 | $4,292.53 | $4,971.52 | $4,164.34 | $2,607.20 |

| 19810 | $6,291.90 | $6,883.73 | $4,334.85 | $18,084.08 | $4,734.88 | $4,530.89 | $4,836.82 | $4,179.92 | $2,750.03 |

| 19735 | $6,287.71 | $7,307.23 | $4,026.75 | $18,084.08 | $4,734.88 | $4,815.06 | $4,971.52 | $4,206.58 | $2,155.61 |

| 19717 | $6,279.80 | $7,309.64 | $4,024.31 | $18,084.08 | $4,734.88 | $4,342.44 | $4,971.52 | $4,164.34 | $2,607.20 |

| 19808 | $6,262.76 | $6,906.82 | $4,026.75 | $18,084.08 | $4,734.88 | $4,570.98 | $4,862.81 | $4,282.11 | $2,633.66 |

| 19711 | $6,243.07 | $7,309.64 | $4,024.31 | $18,084.08 | $4,734.88 | $4,542.99 | $4,553.09 | $4,088.40 | $2,607.20 |

| 19709 | $6,072.84 | $7,339.89 | $3,368.23 | $18,248.83 | $4,559.54 | $4,428.68 | $4,701.88 | $3,709.07 | $2,226.61 |

| 19977 | $5,983.51 | $7,109.37 | $3,368.23 | $17,351.40 | $3,941.48 | $3,922.50 | $4,831.43 | $5,188.06 | $2,155.61 |

| 19938 | $5,648.66 | $7,109.37 | $3,368.23 | $17,351.40 | $3,840.72 | $3,974.06 | $3,954.22 | $3,464.10 | $2,127.16 |

| 19979 | $5,466.08 | $6,177.89 | $3,368.23 | $17,098.58 | $3,840.72 | $3,962.85 | $3,931.65 | $3,314.76 | $2,033.95 |

| 19946 | $5,438.33 | $5,733.22 | $3,368.23 | $17,098.58 | $3,840.72 | $3,970.31 | $3,980.80 | $3,362.75 | $2,152.01 |

| 19943 | $5,434.09 | $5,592.47 | $3,368.23 | $17,098.58 | $3,840.72 | $3,970.49 | $4,093.44 | $3,461.26 | $2,047.58 |

| 19962 | $5,423.18 | $5,586.31 | $3,368.23 | $17,098.58 | $3,840.72 | $3,974.06 | $3,998.38 | $3,362.78 | $2,156.35 |

| 19953 | $5,411.87 | $6,478.64 | $3,368.23 | $16,074.32 | $3,840.72 | $3,974.24 | $3,908.92 | $3,437.11 | $2,212.77 |

| 19901 | $5,381.28 | $5,832.22 | $3,476.23 | $16,074.32 | $3,941.48 | $3,922.50 | $4,099.44 | $3,490.80 | $2,213.23 |

| 19954 | $5,367.66 | $5,429.14 | $3,368.23 | $17,098.58 | $3,840.72 | $3,604.09 | $3,924.88 | $3,523.60 | $2,152.01 |

| 19902 | $5,356.71 | $6,184.06 | $3,476.23 | $16,074.32 | $3,941.48 | $3,961.72 | $3,931.65 | $3,490.80 | $1,793.40 |

| 19961 | $5,351.51 | $6,246.83 | $3,368.23 | $16,074.32 | $3,840.72 | $3,878.50 | $3,931.65 | $3,319.81 | $2,152.01 |

| 19964 | $5,351.45 | $5,791.83 | $3,368.23 | $16,074.32 | $3,840.72 | $3,962.85 | $3,931.65 | $3,600.03 | $2,241.97 |

| 19931 | $5,351.04 | $5,412.91 | $3,368.23 | $17,098.58 | $3,618.62 | $3,767.81 | $3,931.65 | $3,376.55 | $2,233.99 |

| 19973 | $5,343.52 | $5,412.91 | $3,368.23 | $17,098.58 | $3,618.62 | $3,819.74 | $3,922.26 | $3,437.43 | $2,070.40 |

| 19904 | $5,341.88 | $5,816.79 | $3,476.23 | $16,074.32 | $3,941.48 | $3,893.58 | $4,075.94 | $3,345.58 | $2,111.16 |

| 19952 | $5,325.34 | $5,429.14 | $3,368.23 | $17,098.58 | $3,840.72 | $3,548.04 | $3,967.94 | $3,343.49 | $2,006.59 |

| 19934 | $5,320.67 | $5,586.31 | $3,476.23 | $16,074.32 | $3,840.72 | $3,922.50 | $4,063.49 | $3,567.87 | $2,033.95 |

| 19906 | $5,312.12 | $5,816.79 | $3,476.23 | $16,074.32 | $3,941.48 | $3,878.50 | $3,931.65 | $3,345.58 | $2,032.44 |

| 19933 | $5,310.53 | $5,412.91 | $3,368.23 | $17,098.58 | $3,618.62 | $3,806.74 | $3,925.01 | $3,226.46 | $2,027.68 |

| 19956 | $5,309.29 | $5,072.47 | $3,368.23 | $17,098.58 | $3,618.62 | $3,805.34 | $3,900.52 | $3,376.55 | $2,233.99 |

| 19963 | $5,309.15 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,589.97 | $3,856.77 | $3,359.91 | $2,152.01 |

| 19960 | $5,300.74 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,575.35 | $3,944.94 | $3,319.81 | $2,051.24 |

| 19941 | $5,296.57 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,551.24 | $3,930.90 | $3,324.60 | $2,051.24 |

| 19940 | $5,280.34 | $5,072.47 | $3,368.23 | $17,098.58 | $3,618.62 | $3,555.71 | $3,839.96 | $3,455.16 | $2,233.99 |

| 19980 | $5,279.24 | $5,791.83 | $3,368.23 | $16,074.32 | $3,840.72 | $3,878.50 | $3,931.65 | $3,314.76 | $2,033.95 |

| 19950 | $5,262.52 | $5,429.14 | $3,368.23 | $17,098.58 | $3,618.62 | $3,565.87 | $3,866.72 | $3,125.36 | $2,027.68 |

| 19951 | $5,058.86 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,548.04 | $3,931.65 | $3,410.96 | $2,228.05 |

| 19947 | $5,051.49 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,821.10 | $3,842.95 | $3,313.53 | $2,082.21 |

| 19969 | $5,009.19 | $5,429.14 | $3,368.23 | $14,952.41 | $3,618.62 | $3,616.52 | $3,931.65 | $3,105.70 | $2,051.24 |

| 19967 | $4,986.08 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,542.67 | $3,931.65 | $3,242.25 | $2,160.30 |

| 19971 | $4,983.50 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,550.32 | $3,682.00 | $3,215.30 | $2,068.21 |

| 19968 | $4,979.39 | $5,429.14 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.32 | $3,739.43 | $3,105.70 | $2,051.24 |

| 19939 | $4,974.65 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,555.71 | $4,016.38 | $3,177.74 | $2,035.63 |

| 19966 | $4,971.33 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.10 | $3,870.21 | $3,236.36 | $2,082.21 |

| 19945 | $4,966.95 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,555.71 | $3,825.60 | $3,306.95 | $2,035.63 |

| 19944 | $4,964.30 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,588.19 | $3,712.08 | $3,242.07 | $2,160.30 |

| 19958 | $4,962.40 | $5,412.91 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.10 | $3,643.17 | $3,065.55 | $2,068.21 |

| 19975 | $4,956.80 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,570.10 | $3,744.19 | $3,292.74 | $2,035.63 |

| 19970 | $4,954.07 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,564.49 | $3,778.49 | $3,242.25 | $2,035.63 |

| 19930 | $4,953.79 | $5,072.47 | $3,368.23 | $14,952.41 | $3,618.62 | $3,579.10 | $3,750.13 | $3,129.09 | $2,160.30 |

Wilmington zip codes are the most expensive, whereas Bethany Beach and Ocean View zip codes are the cheapest.

What are the Cheapest Rates by CITY?

Just like zip codes, city rates demonstrate how the area can affect rates.

| City | Average Grand Total |

|---|---|

| BETHANY BEACH | $4,953.79 |

| OCEAN VIEW | $4,954.07 |

| SELBYVILLE | $4,956.80 |

| LEWES | $4,962.40 |

| FENWICK ISLAND | $4,964.30 |

| FRANKFORD | $4,966.95 |

| MILLSBORO | $4,971.33 |

| DAGSBORO | $4,974.65 |

| MILTON | $4,979.38 |

| REHOBOTH BEACH | $4,983.50 |

| MILLVILLE | $4,986.07 |

| NASSAU | $5,009.19 |

| GEORGETOWN | $5,051.49 |

| HARBESON | $5,058.86 |

| GREENWOOD | $5,262.52 |

| WOODSIDE | $5,279.25 |

| DELMAR | $5,280.34 |

| ELLENDALE | $5,296.57 |

| LINCOLN | $5,300.74 |

| MILFORD | $5,309.15 |

| LAUREL | $5,309.29 |

| BRIDGEVILLE | $5,310.53 |

| CAMDEN WYOMING | $5,320.67 |

| HARRINGTON | $5,325.34 |

| SEAFORD | $5,343.52 |

| DOVER | $5,345.10 |

| BETHEL | $5,351.04 |

| MARYDEL | $5,351.45 |

| LITTLE CREEK | $5,351.51 |

| DOVER AFB | $5,356.71 |

| HOUSTON | $5,367.66 |

| HARTLY | $5,411.87 |

| MAGNOLIA | $5,423.18 |

| FELTON | $5,434.09 |

| FREDERICA | $5,438.33 |

| VIOLA | $5,466.08 |

| CLAYTON | $5,648.66 |

| SMYRNA | $5,983.51 |

| MIDDLETOWN | $6,072.84 |

| WINTERTHUR | $6,287.71 |

| HOCKESSIN | $6,339.10 |

| ODESSA | $6,354.44 |

| NEWARK | $6,543.81 |

| CLAYMONT | $6,767.07 |

| BEAR | $6,949.68 |

| WILMINGTON | $7,088.18 |

| MONTCHANIN | $7,199.39 |

| PORT PENN | $7,329.63 |

| DELAWARE CITY | $7,358.23 |

| NEW CASTLE | $7,378.97 |

| KIRKWOOD | $7,393.19 |

| ROCKLAND | $7,433.65 |

| TOWNSEND | $7,434.80 |

| SAINT GEORGES | $7,549.45 |

| YORKLYN | $7,863.61 |

Bethany Beach is the cheapest city to pay for car insurance, costing $2,910 less than Yorklyn City.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Who are the Best Delaware Car Insurance Companies?

It can be nearly impossible to find the right car insurance company without support and guidance. When sifting through insurance information, it can all blur into a mess of similar insurer promises and expensive rates.

To help you make the right choice, we’ve done the hard work of researching companies for you.

From everything to financial ratings to customer satisfaction ratings, it is all coming up next! So keep reading to learn everything you need to know about Delaware’s car insurance companies.

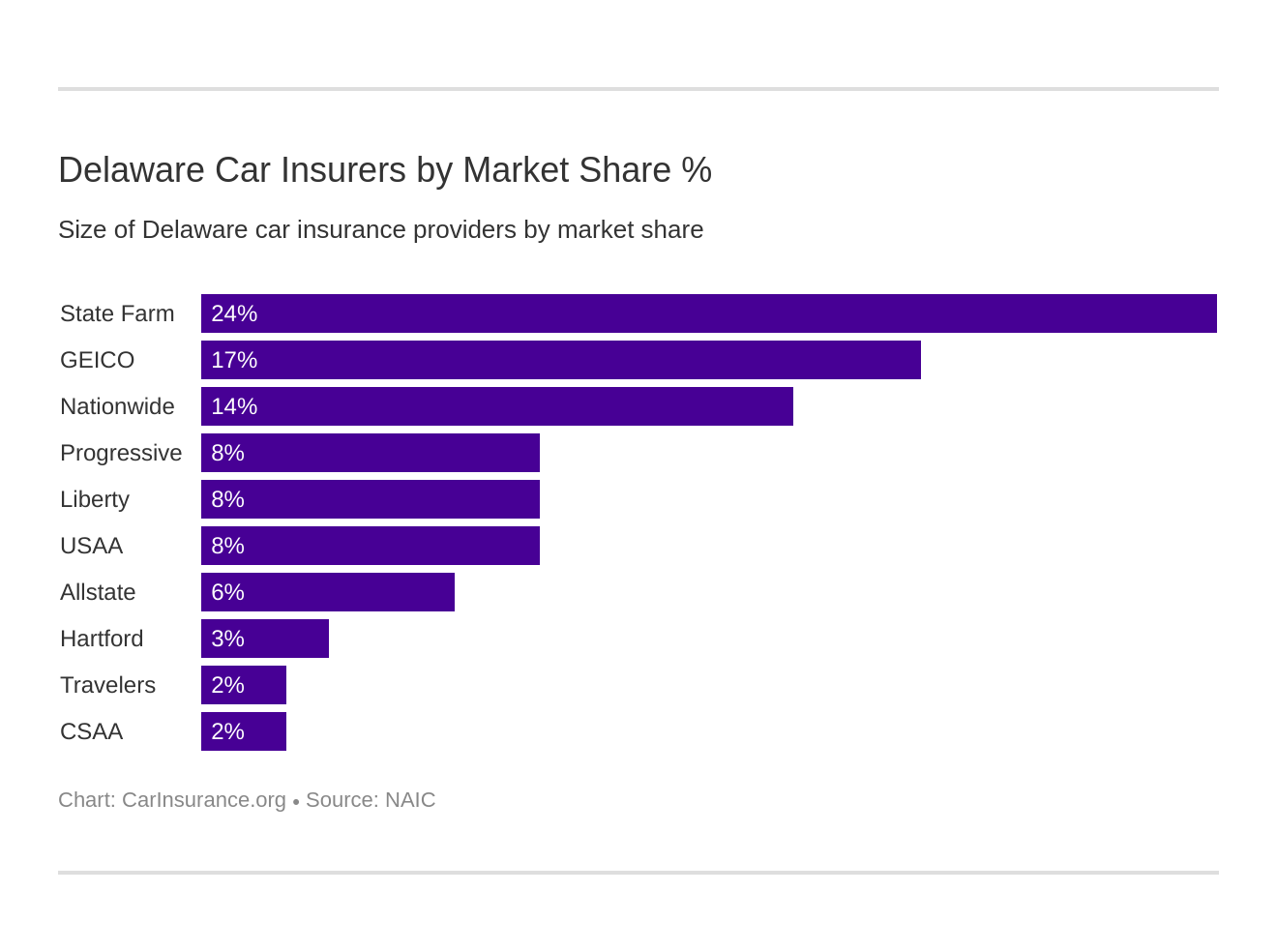

What’s the Financial Rating of the Largest Companies?

Financial ratings may be the last thing on anyone’s mind when shopping for car insurance, but financial ratings tell you how secure a company is. After all, the last thing you want is for a company to go bankrupt right after you purchase car insurance from it!

AM Best measures companies’ financial ratings to determine their financial future. Below, you will see AM Best’s ratings for the largest insurance companies in Delaware.

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A++ | $208,113 | 69.02% | 24.36% |

| Geico | A++ | $149,130 | 83.24% | 17.46% |

| Nationwide Corp Group | A+ | $117,716 | 60.95% | 13.78% |

| Progressive Group | A+ | $71,536 | 59.97% | 8.37% |

| Liberty Mutual Group | A | $65,887 | 66.90% | 7.71% |

| USAA Group | A++ | $65,690 | 82.08% | 7.69% |

| Allstate Insurance Group | A+ | $50,794 | 57.40% | 5.95% |

| Hartford Fire & Casualty Group | A+ | $22,107 | 65.96% | 2.59% |

| Travelers Group | A++ | $16,349 | 54.73% | 1.91% |

| CSAA Insurance Group | A | $13,997 | 120.36% | 1.64% |

CSSA Insurance Group has an A rating from AM Best, but you may have noticed that its loss ratio is over 100 percent. If you are thinking about this company as a potential insurer, you should keep this high loss ratio in mind.

All of the other companies, though, have good loss ratios and great AM Best ratings (the highest rating possible is A++). This means AM Best considers these companies to be more financially secure than other companies.

Which Companies have the Best Ratings?

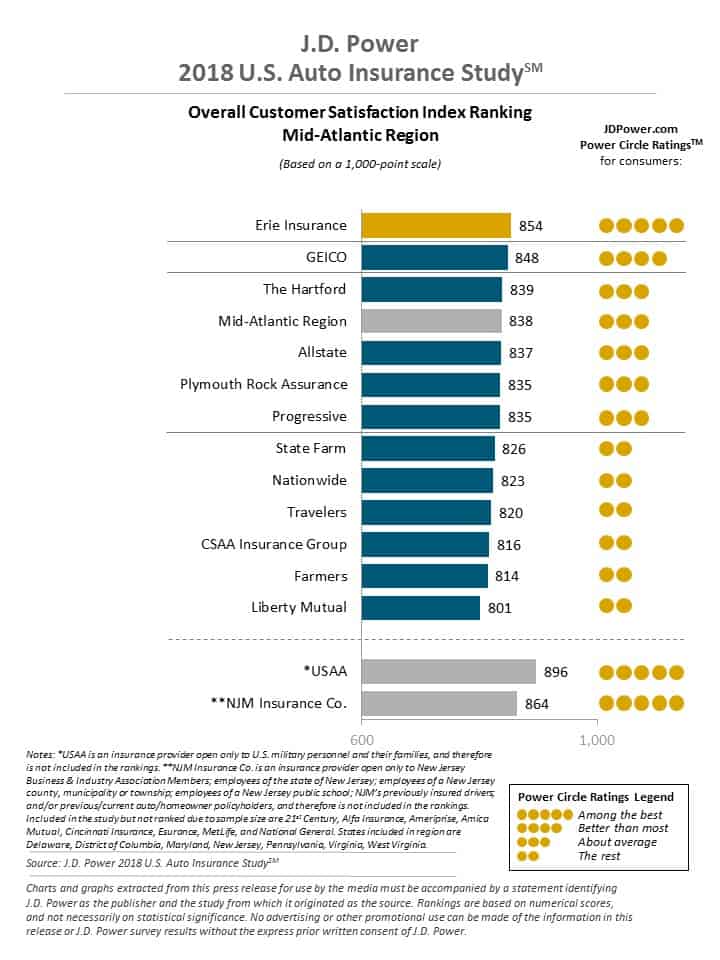

Now that we’ve covered the financial aspect of companies, let’s look at how well Delaware companies serve their customers. J.D. Power is a leading ranker of companies’ customer satisfaction, and it’s 2008 study surveyed multiple customers.

Take a look at the graphic below to see how Delaware’s companies performed in the study.

Geico received a “better than most” rating from J.D.Power, which is actually the second highest rating. Other Delaware auto insurance companies only earned an “about average” score, such as Allstate and Progressive.

USAA received the highest rating possible, but because USAA only provides insurance to U.S. military personnel it was not included in the overall list.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Companies have the Most Complaints in Delaware?

One factor in figuring out customer satisfaction is looking at the number of consumer complaints a company receives. Of course, knowing how a company resolves complaints is also important.

To see how Delaware’s companies are doing, we’ve included NAIC’s list of the major companies’ complaint ratios.

| Company | Total Complaints 2017 | Complaint Ratio 2017 |

|---|---|---|

| State Farm Group | 1,482 | 0.44 |

| Liberty Mutual Group | 222 | 5.95 |

| Allstate Insurance Group | 163 | 0.5 |

| Progressive Group | 120 | 0.75 |

| Nationwide Corp Group | 25 | 0.28 |

| Hartford Fire & Casualty Group | 9 | 4.68 |

| CSAA Insurance Group | 6 | 3.97 |

| Geico | 2 | 0 |

| USAA Group | 2 | 0 |

| Travelers Group | 2 | 0.09 |

You might be wondering why some of the companies with a high number of complaints have low complaint ratios. Basically, it all depends on the company’s size.

A large company may have a thousand complaints, but a thousand customers may only make up a minuscule portion of its overall customers, resulting in a low complaint ratio.

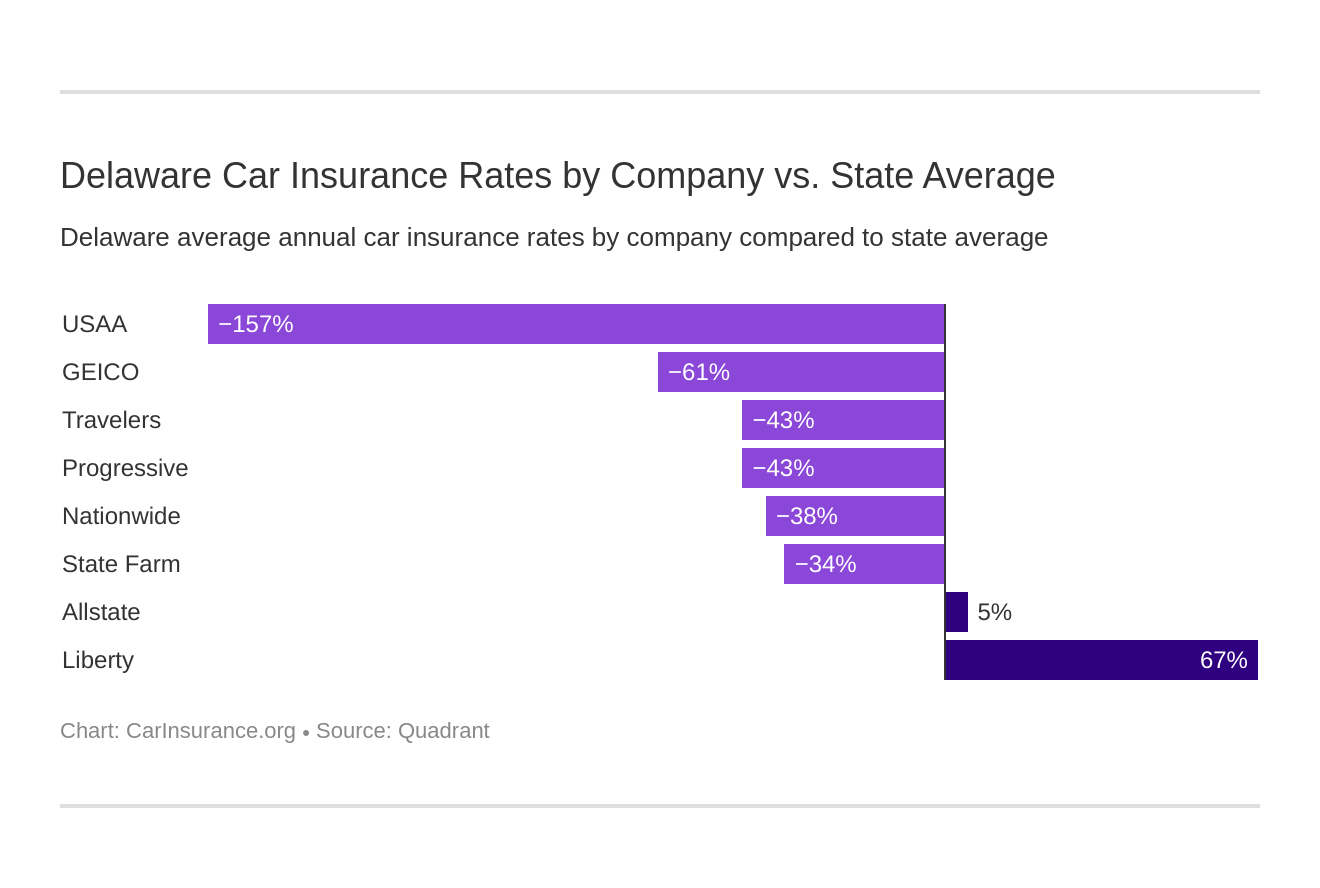

Who are the cheapest auto insurance companies in Delaware?

Everyone wants to save! By shopping around for an auto insurance provider, you can save a tidy sum each year. We’ve partnered with Quadrant to make a list of the cheapest providers in Delaware, as well as important rate changes at companies caused by everything from commute time to credit history.

The table below shows the cheapest car insurance providers in Delaware.

| Company | Average Annual Rate | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Liberty Mutual Fire Insurance Co | $18,360.01 | $12,373.69 | 67.39% |

| Allstate P&C | $6,316.07 | $329.74 | 5.22% |

| State Farm Mutual Auto | $4,466.85 | -$1,519.48 | -34.02% |

| Nationwide Mutual | $4,330.21 | -$1,656.11 | -38.25% |

| Travelers Home & Marine Insurance Co | $4,182.36 | -$1,803.97 | -43.13% |

| Progressive Direct | $4,181.83 | -$1,804.50 | -43.15% |

| Geico Advantage | $3,727.29 | -$2,259.04 | -60.61% |

| USAA | $2,325.98 | -$3,660.34 | -157.37% |

USAA is almost 160 percent cheaper than the state average! If you aren’t military personnel, though, don’t worry. Other companies also have rates significantly beneath the state average rates.

For instance, Geico’s advantage is over two thousand dollars LESS than the average state cost.

What are the commute rates by companies?

Surprisingly, how far you drive each day can sometimes affect your yearly rates. While not all companies charge more for longer commutes, a few companies charge more.

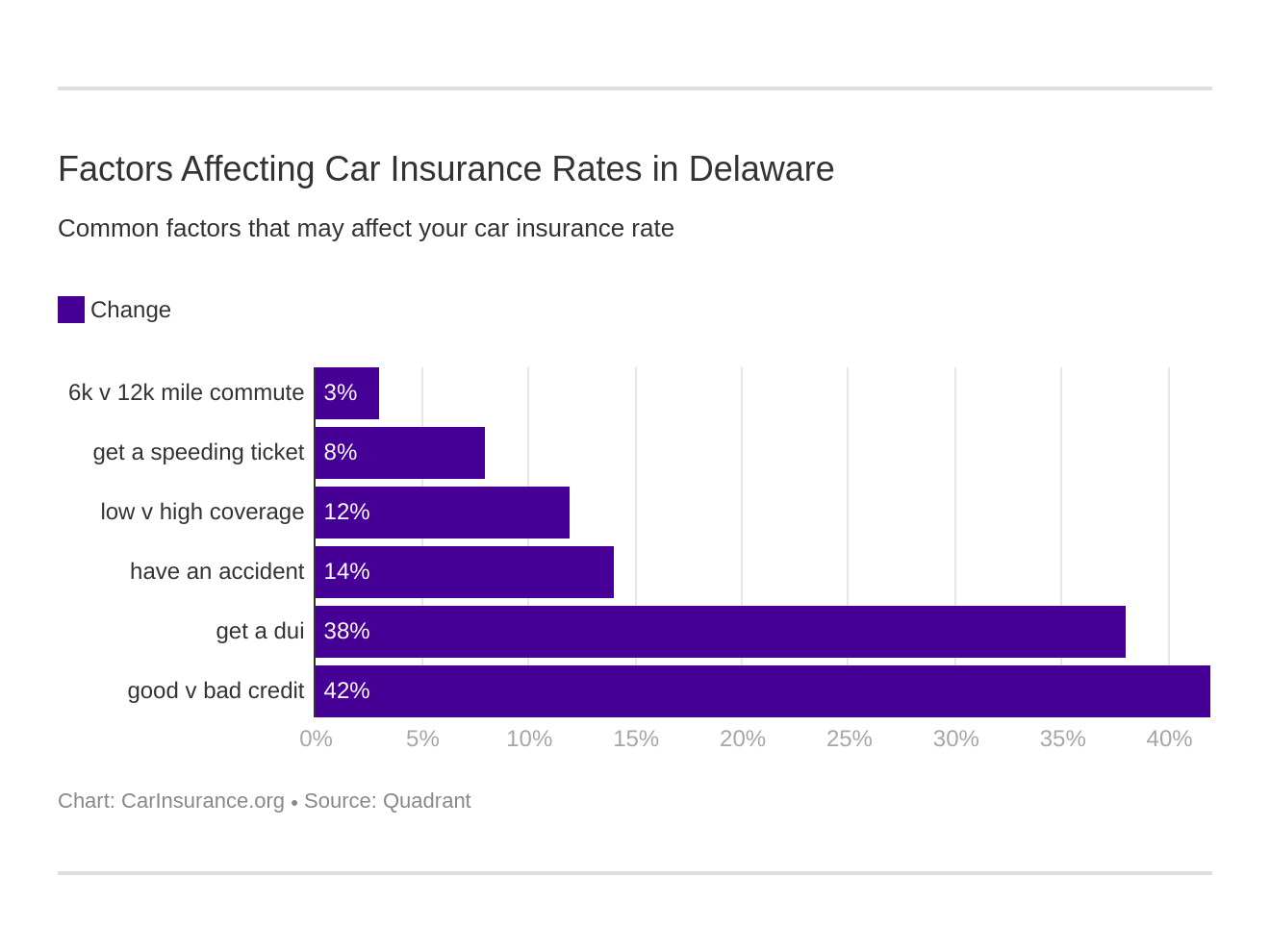

Six major factors affect auto insurance rates in Delaware. Which auto insurance factors will affect rates the most? Find out below:

Check the table below to see how commuter distance can impact prices.

| Group | Commute and Annual Mileage | Annual Average |

|---|---|---|

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $18,868.27 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $17,851.76 |

| Allstate | 10 miles commute. 6000 annual mileage. | $6,316.06 |

| Allstate | 25 miles commute. 12000 annual mileage. | $6,316.06 |

| State Farm | 25 miles commute. 12000 annual mileage. | $4,619.47 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $4,330.21 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $4,330.21 |

| State Farm | 10 miles commute. 6000 annual mileage. | $4,314.22 |

| Travelers | 10 miles commute. 6000 annual mileage. | $4,182.36 |

| Travelers | 25 miles commute. 12000 annual mileage. | $4,182.36 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,181.83 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,181.83 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,786.48 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,668.09 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,350.62 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,301.33 |

While most companies only increase prices by $100-200 for a longer commute, Liberty Mutual charges over a THOUSAND dollars! If you are a Liberty Mutual customer with a long commute, it may be time to start looking for other providers.

Not to mention that Liberty Mutual has the highest annual cost, pricing in at $17,000.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the coverage level rates by companies?

It can be tempting to opt for lower auto insurance coverage to save money. If you are in an accident, though, that lower coverage could cost you. Purchasing higher coverage doesn’t have to be a major expense.

Some companies offer affordable higher coverage that doesn’t cost an astronomical amount. Take a look at the table below to see how coverage options compare.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Liberty Mutual | High | $19,461.69 |

| Liberty Mutual | Medium | $18,149.05 |

| Liberty Mutual | Low | $17,469.29 |

| Allstate | High | $6,780.70 |

| Allstate | Medium | $6,390.63 |

| Allstate | Low | $5,776.86 |

| State Farm | High | $4,756.42 |

| Progressive | High | $4,650.79 |

| State Farm | Medium | $4,477.15 |

| Nationwide | High | $4,427.19 |

| Travelers | Medium | $4,310.79 |

| Nationwide | Low | $4,306.39 |

| Travelers | High | $4,274.89 |

| Nationwide | Medium | $4,257.06 |

| Progressive | Medium | $4,231.00 |

| State Farm | Low | $4,166.98 |

| Geico | High | $4,053.82 |

| Travelers | Low | $3,961.39 |

| Geico | Medium | $3,781.75 |

| Progressive | Low | $3,663.70 |

| Geico | Low | $3,346.29 |

| USAA | High | $2,478.30 |

| USAA | Medium | $2,322.08 |

| USAA | Low | $2,177.57 |

While some companies have a thousand-dollar increase between low and high coverage, there are few affordable options on the list. USAA has a very small increase, as does Nationwide.

Spending an extra few hundred a year is manageable, and having high insurance coverages in an accident is important. So make sure to shop around at providers to find a high coverage that is within your price range.

What are the credit history rates by companies?

Most companies look at your credit history and factor that into their rate determination process. In the U.S., the national average credit score is 675. Delaware’s credit score is slightly below this at 672.

Delaware residents with credit scores lower than Delaware’s average credit score may receive higher rates.

The table below shows just how important credit history is.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $24,846.46 |

| Liberty Mutual | Fair | $16,738.18 |

| Liberty Mutual | Good | $13,495.40 |

| Allstate | Poor | $8,105.13 |

| State Farm | Poor | $6,836.26 |

| Geico | Poor | $5,781.10 |

| Allstate | Fair | $5,748.80 |

| Allstate | Good | $5,094.26 |

| Nationwide | Poor | $5,022.69 |

| Progressive | Poor | $4,674.19 |

| Travelers | Poor | $4,666.75 |

| Nationwide | Fair | $4,170.85 |

| Progressive | Fair | $4,090.99 |

| Travelers | Good | $4,028.81 |

| Travelers | Fair | $3,851.51 |

| USAA | Poor | $3,809.76 |

| Nationwide | Good | $3,797.09 |

| Progressive | Good | $3,780.31 |

| State Farm | Fair | $3,767.83 |

| Geico | Fair | $3,205.19 |

| State Farm | Good | $2,796.45 |

| Geico | Good | $2,195.57 |

| USAA | Fair | $1,841.00 |

| USAA | Good | $1,327.18 |

Yikes! At Liberty Mutual, poor credit will cost you $11,000! While other companies don’t have increases as shocking as Liberty Mutual’s increase, poor credit history will still cost you an extra few thousand dollars a year at most companies.

What are the driving record rates by companies?

Your driving record is another major factor in companies’ rate determination process. If you have a DUI, accident, or speeding violation added to your driving record, you can expect your rates to increase.

| Group | Driving Record | Annual Average |

|---|---|---|

| Liberty Mutual | With 1 DUI | $26,825.11 |

| Liberty Mutual | With 1 accident | $16,885.42 |

| Liberty Mutual | With 1 speeding violation | $15,044.50 |

| Liberty Mutual | Clean record | $14,685.04 |

| Allstate | With 1 DUI | $7,464.16 |

| Allstate | With 1 accident | $6,398.38 |

| Nationwide | With 1 DUI | $6,329.52 |

| Allstate | With 1 speeding violation | $6,062.01 |

| Travelers | With 1 DUI | $5,847.26 |

| Allstate | Clean record | $5,339.71 |

| State Farm | With 1 accident | $4,885.02 |

| Geico | With 1 DUI | $4,842.11 |

| Progressive | With 1 accident | $4,773.89 |

| State Farm | With 1 DUI | $4,466.85 |

| State Farm | With 1 speeding violation | $4,466.85 |

| Progressive | With 1 speeding violation | $4,247.32 |

| Progressive | With 1 DUI | $4,103.13 |

| Nationwide | With 1 speeding violation | $4,081.55 |

| State Farm | Clean record | $4,048.67 |

| Geico | With 1 accident | $3,960.12 |

| Travelers | With 1 speeding violation | $3,744.85 |

| Progressive | Clean record | $3,602.97 |

| Travelers | With 1 accident | $3,573.78 |

| Travelers | Clean record | $3,563.54 |

| Nationwide | Clean record | $3,454.89 |

| Nationwide | With 1 accident | $3,454.89 |

| USAA | With 1 DUI | $3,280.40 |

| Geico | With 1 speeding violation | $3,247.89 |

| Geico | Clean record | $2,859.02 |

| USAA | With 1 speeding violation | $2,189.94 |

| USAA | Clean record | $1,916.79 |

| USAA | With 1 accident | $1,916.79 |

Liberty Mutual once again has the worst rate increase, with a DUI raising rates over $12,000. At other companies like Allstate, a DUI will raise your rates over $2,000.

DUIs tend to increase rates the worst, followed by accidents. Speeding violations will raise your rates, but usually, the increase will be under $1,000.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of insurers in Delaware?

So how many insurers do you have to choose from in Delaware? The good news is that there are a lot of options, but the bad news is that so many insurers can make the process of picking one overwhelming!

- Domestic Insurers: 101

- Foreign Insurers: 766

With a total of 867 insurers available, that’s a lot of insurers to choose from! If it helps you make a decision, there is a slight difference between domestic and foreign insurers.

Domestic insurers are formed under Delaware’s state laws. Foreign insurers are formed under another state’s laws and can sell in multiple states.

The difference is like the difference between a local grocery store available only in Delaware and a chain of grocery stores countrywide.

What are the Delaware State Laws?

Nobody wants a driving ticket! But if you aren’t familiar with your state laws, it is inevitable that officers will ticket you.

Since each state creates its own laws, though, new residents and new drivers may be confused by Delaware’s driving laws. That’s why we’ve covered everything from car insurance laws to rules of the road.

Keep reading to learn everything you need to know about Delaware’s laws to avoid expensive tickets!

What are the car insurance laws?

We’ve talked about Delaware’s insurance requirements before, but there is more to Delaware’s insurance laws than minimum coverage. There are also laws regulating coverages, high-risk insurance, and much more!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How are state laws for insurance determined?

Every state has different processing laws for insurance filings. The NAIC describes Delaware’s filing process as the following:

“Regarding form filings, commissioner may exempt insurer from filing requirements, if deemed that requirements may not be practically applied or if not necessary for the protection of public.”

So what does this mean? Basically, insurers may not have to file their auto insurance policy with Delaware’s state department if a commissioner exempts them.

Usually, state departments require forms to be filed to make sure insurers are providing drivers with the required minimum car insurance coverage.

How can you get windshield coverage?

In Delaware, the law doesn’t require insurers to replace your broken windshield. Luckily, comprehensive coverage will usually cover the cost of repair or replacement. Insurers who offer windshield replacement must follow the laws below.

- Insurers may use aftermarket/used parts but must notify you. If you refuse aftermarket parts, you may have to pay the price difference.

- You may choose the repair vendor, but you may have to pay the price difference.

It is important to repair or replace your windshield as soon as possible, as driving with cracks that impair vision is illegal. If you don’t repair large cracks or broken windshields, you face the following penalties.

- First Offense — Fine of $25 to $115

- Second and Subsequent Offenses — $57 to $230 and/or 10 to 30 days jail time

Having comprehensive coverage to provide you with repairs will prevent you from accumulating fines.

How can you get high-risk insurance?

Currently, Delaware is one of the few states that DOESN’T require drivers to fill out an SR-22 form to purchase high-risk insurance. This doesn’t mean that insurance providers won’t consider you a high-risk driver and increase your rates!

Below are some common reasons that cause insurers to label you a high-risk driver.

- Serious driving violation

- Serious accidents

- Bad driving record

- New drivers

- Drivers over 70

- Car insurance coverage lapse

- High-risk vehicle

If drivers meet any of the above criteria, insurers may increase their rates. As well, Delaware law doesn’t require insurers to cover high-risk drivers. Insurers may refuse to cover drivers if they are high-risk drivers.

If insurers refuse coverage, drivers must turn to Delaware’s Automobile Insurance Plan (DAIP). Drivers can apply to DAIP through any insurance company in Delaware.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How can you get low-cost insurance?

Delaware does not have a low-cost insurance program, but there are still plenty of ways to make car insurance more affordable. Every insurer offers multiple discounts that help bring insurance costs down.

- Safety device discount

- Good driver discount

- Good student discount – Usually need a B+ average

- Defensive driver discount

- Anti-theft device discount

These are just a few of the most common discounts offered, so make sure to ask your insurer for a complete list.

By combining multiple discounts on your policy, you can save on your yearly bill.

Is there automobile insurance fraud in Delaware?

The Insurance Information Institute (iii) reported that about $30 billion is stolen each year in fraudulent insurance claims. The result is that states like Delaware have created fraud bureaus to catch fraudulent activity.

According to the Delaware Department of Insurance, Delaware has ruled the following actions as automobile fraud.

- Application Fraud: not disclosing information honestly, such as omitting past accidents or the number of actual drivers in the household

- Claim Fraud: exaggerating accident costs, such as altering receipts or creating false receipts for injuries/damages that never occurred

People charged with insurance fraud face the following penalties.

- Fines: up to $10,000

- Jail time: up to two years

A basic rule to follow is to be as honest and accurate as possible when filling out applications and claim forms. Doing so will prevent you from being investigated and perhaps charged with automobile insurance fraud.

What’s the statute of limitations?

Every state has a different statute of limitations on the amount of time you have to file and resolve your claim after an accident. Delaware’s statute of limitations is fairly short compared to other states, so make sure to file the claim as soon as possible.

- Bodily Injury: Two years

- Property Damage: Two years

As well, the sooner you file a claim the sooner you will receive the money you need to pay off your accident bills.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Delaware’s Unfair Claims Settlement Practice Act for?

Delaware has an Unfair Claims Settlement Practice Act, which ensures sure insurers are following ethical guidelines. The law requires insurers to respond to claims promptly and disclose all information on policies.

This ensures people receive all the benefits owed to them, and that insurers don’t try to pay less for a claim.

While this law is great, make sure to be familiar with your policy so you can catch discrepancies that might fall under Delaware’s Unfair Claims Settlement Practice.

After all, the law can only be enforced if a problem is discovered.

What is the vehicle licensing laws?

Do you know everything you need to about Delaware’s vehicle licensing system? To help guide you, we’ve included everything from teen driver laws to license renewal procedures.

What are the penalties for driving without insurance?

Since Delaware requires all drivers to have insurance, driving without insurance will result in multiple penalties.

| Offense | Fine | License Suspension |

|---|---|---|

| First Offense | Minimum $1,500 | 6 months |

| Second Offense | Minimum $3,000 | 6 months |

As a reminder, the following are acceptable proof of insurance forms in Delaware.

- A valid insurance ID card

- Insurance binder (a temporary form of car insurance)

Proof of insurance must be provided at traffic stops, registering a vehicle, or accidents. As well, Delaware also periodically performs audits on cars to make sure drivers have car insurance.

If you don’t follow Delaware’s car insurance laws or fail to respond to an audit, you will receive a notice of intent to suspend your car’s registration.

According to the Delaware DMV, you will need to pay off any penalties for the insurance lapse as well as a $50 reinstatement fee before you can be re-registered.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the teen driver laws?

Teen drivers in Delaware have to be at least 16 years old to have a learner’s license. Teens with learner’s licenses will have to meet the requirements below before they can apply for an adult license or a restricted license.

| Learner's License Requirements | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours (10 of which must be at night) |

| Minimum Age | 16 years and 6 months |

If a teen driver receives a restricted license, there are further requirements in place to ensure teen drivers’ safety.

| Restricted License Requirements | Details |

|---|---|

| Nighttime Restrictions | 10 p.m. to 6 a.m. |

| Passenger Restrictions (family members excepted unless noted otherwise) | No more than 1 passenger |

| When Restrictions can be Lifted | Details |

| Nighttime Restrictions | 6 months or issuance of class D license (minimum age: 17) |

| Passenger Restrictions | 6 months or issuance of class D license (minimum age: 17) |

These regulations are important to follow, as nighttime and passenger restrictions limit distractions that can lead to accidents.

What are the license renewal procedures for older drivers?

Luckily, older driver license renewal procedures in Delaware are incredibly easy to follow. Why? Because, unlike most states, the older driver population has the EXACT same renewal process as the general population.

Below is the basic renewal procedure process.

- License Renewal Cycle: every EIGHT years

- Proof of Adequate Vision: required at EVERY renewal

- Mail or Online Renewal: NOT permitted

Delaware’s license renewal procedure is simple. Every eight years, drivers must go to their local DMV to renew their licenses and provide proof of adequate vision.

What is the procedure for new residents?

If you are new to Delaware, the law requires you to update your information at a local DMV. You will have to register your car at a Delaware DMV within 60 days.

When registering your car, you will need proof of insurance. Because of this, make sure to contact your current insurance provider so your provider can make sure you meet Delaware’s required minimum insurance.

Your insurance provider will also give you updated insurance ID cards with your new address. Once all this is taken care of, all you have to do is get a free car inspection.

Though it’s not an insurance requirement, make sure to also get a new driver’s license!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the license renewal procedures?

The license renewal process for the general population is the same as for the older population. For reference, here are the requirements again.

- License Renewal Cycle: every EIGHT years

- Proof of Adequate Vision: required at EVERY renewal

- Mail or Online Renewal: NOT permitted

Although mail or online renewal is not permitted, there is still an eight-year gap between license renewals. As well, if you are worried about forgetting when your license needs to be renewed, the DMV will send you multiple reminders before it expires.

What does the term “negligent operator treatment system” mean?

Delaware has laws prohibiting reckless or careless driving practices. If drivers drive in a manner that endangers themselves, others, or property, they will earn a reckless or careless driving charge.

Reckless driving carries more serious charges than careless driving, as shown by the list of penalties below.

| Offense | Demerit Points | Fine | Jail Time |

|---|---|---|---|

| First Offense | 6 | $100 to $300 | 10 to 30 days |

| Second/Subsequent Offenses | 6 | $300 to $1,000 | 30 to 60 days |

Deleware will also suspend drivers’ licenses if they earn 14 (or more) points within two years. As for careless driving, the penalties are less strict.

| Offense | Demerit Points | Fine |

|---|---|---|

| First Offense | 2 | $25 to $75 |

| Second/Subsequent Offenses | 2 | $50 to $95 |

A careless driving charge has fewer points and fines accumulated, as well as the absence of jail time.

What are the rules of the road?

Knowing the rules of the road is a necessity for staying as safe as possible when driving. Since every state has slightly different road rules, we are going to go through Delaware’s most important rules of the road.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is Delaware at Fault or No-Fault State?

Knowing how Delaware’s fault system works is important in an accident. Delaware is an at-fault state, which means the driver who caused the accident is liable for all of the accident’s injury and property damage costs.

This means that if a driver doesn’t have insurance and is at fault, the driver may face bankruptcy if unable to pay off all the accident costs.

Don’t let this be you! Follow Delaware law and have at least the minimum insurance coverages.

What are the seat belt and car seat laws?

Delaware has specific seat belt laws that NEED to be followed. These laws are meant to ensure the driver’s and passengers’ safety in case of an accident.

| Initial Effective Date | Enforcement | Who is Covered? In What Seats? | Maximum Fine |

|---|---|---|---|

| January 1, 1992 | Primary | 16+ in all seats | $25 plus fees |

Primary enforcement means an officer can pull drivers over and ticket them if the officer sees someone without a seatbelt.

As for car seat laws, Delaware only has basic rules on car seats, so make sure to carefully follow car seat manufacturers’ size and weight regulations when picking out car seats for younger passengers.

| Must be in Child Safety Seat | Adult Belt Permissible | Preference for Rear Seat | Maximum Fine | |

|---|---|---|---|---|

| 7 years and younger and less than 66 pounds | 8 through 15 years or 66+ pounds | 11 years and younger and 65 inches or less must be in rear seat if passenger air bag is active | $25 plus fees |

As for riding in the cargo area of a pickup truck, Delaware has no laws restricting riding in a cargo area. While there are no pickup truck regulations, make sure to exercise common sense to keep safe.

What are the keep right and move over laws?

The keep right law is simple. If you are driving slower than the average speed of traffic around you, make sure to keep to the right lane. Generally, the left lane is faster traffic and passing, though passing on the right is allowed under certain circumstances.

Likewise, the move over law is also simple to follow. If you see a stationary emergency vehicle, public utility vehicle, or tow truck with flashing lights, you must slow down and move over a lane.

If you are unable to move over, you must slow down as much as possible!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the speed limit?

Speed limits often frustrate people, especially when they drive too fast and receive a ticket! Below, you will see Delaware’s maximum speed limits by road type.

| Rural Interstates | Urban Interstates | Other Limited Access Roads | Other Roads |

|---|---|---|---|

| 65 mph | 55 mph | 65 mph | 55 mph |

Since these are the maximum speed limits, you could still receive a ticket if you are driving below the maximum speed limit BUT ABOVE the posted speed limit.

How does ridesharing work?

If you are planning on joining a company like Uber or Lyft, you will have to purchase ridesharing insurance. The ridesharing company should provide a list of acceptable insurers, and you must also meet basic requirements.

- At least 21 years old

- Driving experience

- Clean driving record

- Registered and inspected vehicle

Ridesharing companies may differ slightly on requirements, but you can expect to have to meet at least the requirements above.

Is there automation on the road?

Currently, Delaware does not have any laws regulating automation on the road. What is automation? According to the Insurance Institute for Highway Safety (IIHS), automation can be defined as the following.

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human.”

There are multiple levels of automation, ranging from cruise control to fully self-driving cars.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the safety laws?

As the name suggests, Delaware created safety laws to keep drivers safe on the road. Delaware has multiple laws prohibiting and penalizing drunk driving, marijuana-impaired driving, and distracted driving.

What are the DUI laws?

In 2017, there were 32 alcohol-impaired fatalities in Delaware. To help discourage drivers from being one of these statistics, Delaware created the following law.

| BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back/Washout Period |

|---|---|---|---|---|

| 0.08 | 0.15 to 0.2+ | 1st to 2nd unclassified misdemeanors 3rd class G felony 4th to 5th class E felonies 6th class D felony 7th class C felony | Driving Under the Influence (DUI) | 2nd offense 10 years 3rd+ unlimited/lifetime |

The lookback or washout period is how long the offense will remain on your driving record. Remember, a DUI will SIGNIFICANTLY raise your insurance rates.

In case increased rates aren’t enough to discourage drunk driving, Delaware has the following penalties in place for DUIs.

| Offense | License Suspension | Jail Time | Fine | IID | Other |

|---|---|---|---|---|---|

| 1st Offense | 12 months | No minimum | $500 | 12 to 23 months on one vehicle registered in offender's name | 30 days revocation period and enrollment in rehabilitation period |

| 2nd Offense | 2 years | Minimum 60 days up to 18 months | $750 to $2,400 | 16 to 48 months on all vehicles registered in offender's name | Enrollment in rehabilitation program |

| 3rd Offense | 2 years | 1 to 2 years | $1,500 to $5,000 | NA | NA |

| 4th Offense | 60 months | 2 to 5 years | Up to $7,000 | NA | NA |

| 5th Offense | 60 months | 3 to 5 years | Up to $10,000 | NA | NA |

| 6th Offense | 60 months | 4 to 8 years | Up to $10,000 | NA | NA |

| 7th Offense | 60 months | 5 to 15 years | Up to 15,000 | NA | NA |

If a driver is charged with drunk driving, he or she faces jail time, license suspension, fines, and other penalties.

What are the marijuana-impaired driving laws?

Delaware has a zero-tolerance policy for marijuana (THC) and metabolite use. This means that if a driver is charged with driving under the influence of marijuana, that driver will face multiple penalties for impaired driving.

Impaired driving comes with similar penalties as a DUI: license suspension, fines, and/or jail time.

Even in states where recreational marijuana use is legal, driving under the influence of marijuana is illegal. Marijuana impairs drivers’ judgment, which inevitably leads to accidents.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the distracted driving laws?

Distracted driving is whenever an activity distracts a driver from the road, such as texting, brushing hair, or eating. To help prevent accidents, Delaware has a law limiting cellphone use, which is one of the biggest distractors in the 21st century.

| Hand-Held Ban | Young Drivers All Cellphone Ban | Texting Ban | Enforcement |

|---|---|---|---|

| All drivers | Learner's permit and restricted license holders | All drivers | Primary |

Texting is prohibited for all drivers, as is handheld devices.

What are the Delaware can’t-miss facts?

While you may think you are fully prepared now to drive in Delaware, there are still a few important things to cover. Mainly, the dangers of Delaware’s roads.

Knowing what risk factors to watch out for can help you avoid being in an accident.

So to stay as safe as possible, keep reading to learn about everything from road dangers to causes of fatalities.

Is there vehicle theft in Delaware?

If you own one of the following vehicles in Delaware, be aware that is one of the top ten most stolen Delaware vehicles.

| Vehicle Make and Model | Vehicle Year | Total Stolen |

|---|---|---|

| Honda Civic | 2000 | 53 |

| Honda Accord | 2004 | 43 |

| Chevrolet Pickup (Full Size) | 2005 | 36 |

| Ford Pickup (Full Size) | 1999 | 31 |

| Chevrolet Impala | 2007 | 28 |

| Nissan Altima | 2006 | 23 |

| Honda CR-V | 2001 | 23 |

| Ford Taurus | 2002 | 22 |

| Toyota Corolla | 2010 | 21 |

| Toyota Camry | 2012 | 20 |

The Honda brand is one of the more popular vehicles for theft, with 53 Honda Civics and 43 Honda Accords stolen. Up next, we also have the FBI’s crime report on Delaware’s vehicle theft by cities.

City 2013 Motor

Vehicle

Thefts

Bethany Beach 0

Blades 0

Bridgeville 1

Camden 2

Cheswold 2

Clayton 0

Dagsboro 1

Delaware City 3

Delmar 3

Dewey Beach 0

Dover 86

Elsmere 9

Felton 0

Fenwick Island 0

Georgetown 6

Greenwood 1

Harrington 3

Laurel 5

Lewes 3

Middletown 9

Milford 20

Millsboro 6

Milton 2

Newark 14

New Castle 5

Newport 3

Ocean View 0

Rehoboth Beach 7

Seaford 9

Selbyville 2

Smyrna 9

Wilmington 371

Wyoming 1

Wilmington is the worst city for vehicle theft, with 371 cars stolen in 2013!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the road dangers in Delaware?

Every state has different road dangers to watch out for. To help you know what Delaware’s risks are, we’ve taken a look at NHTSA’s data on everything from crashes by weather conditions to factors in fatalities.

What’s the number of fatal crashes by weather condition and light condition?

Below, you will see information from 2017 on Delaware’s crashes.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 41 | 15 | 38 | 5 | 0 | 99 |

| Rain | 2 | 2 | 8 | 1 | 0 | 13 |

| Snow/Sleet | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 0 | 0 | 0 | 0 | 0 | 0 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 43 | 17 | 46 | 6 | 0 | 112 |

While most fatal accidents occurred in normal conditions, rain conditions in Delaware also contributed to fatal crashes.

What’s the number of fatalities (all crashes) by county?

Over the years, New Castle County has had the highest fatality rates. The table below shows the fatality rates for Delaware’s counties over a five-year period.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent County | 14 | 21 | 27 | 31 | 21 |

| New Castle County | 48 | 59 | 63 | 53 | 59 |

| Sussex County | 36 | 44 | 41 | 35 | 39 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the number of traffic fatalities?

Often, the type of road you are driving on carries unique risk factors. Urban roads tend to be more congested, but drivers on rural roads are more prone to speeding.

| Road Types | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 74 | 68 | 65 | 58 | 57 | 51 | 64 | 62 | 69 | 61 |

| Urban | 47 | 48 | 36 | 41 | 57 | 48 | 60 | 69 | 50 | 56 |

| Total | 121 | 116 | 101 | 99 | 124 | 99 | 124 | 131 | 119 | 119 |

In Delaware, more fatal crashes occur on rural roads than on urban roads.

What’s the Number of Fatalities by Person Type?

Person type doesn’t mean a driver’s personality, such as if a driver has road rage. Rather, person type looks at the type of vehicle driven and if the fatality is a car occupant or pedestrian.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 30 | 45 | 50 | 42 | 44 |

| Light Truck - Pickup | 6 | 9 | 5 | 8 | 8 |

| Light Truck - Utility | 10 | 13 | 11 | 14 | 14 |

| Light Truck - Van | 4 | 6 | 3 | 8 | 3 |

| Light Truck - Other | 0 | 0 | 0 | 1 | 0 |

| Large Truck | 2 | 4 | 2 | 1 | 0 |

| Bus | 1 | 3 | 0 | 0 | 0 |

| Other/Unknown Occupants | 0 | 0 | 1 | 0 | 1 |

| Motorcyclists | 20 | 15 | 19 | 14 | 10 |

| Pedestrian | 25 | 26 | 36 | 27 | 33 |

| Bicyclist and Other Cyclist | 1 | 3 | 3 | 2 | 5 |

| Other/Unknown Nonoccupants | 0 | 0 | 1 | 2 | 1 |

| Total Fatalities | 99 | 124 | 131 | 119 | 119 |

If you are a pedestrian or cyclist, make sure to always be aware of your surroundings and passing cars, as drivers may not be paying close enough attention to their surroundings.

What’s the number of fatalities by crash type?

The type of crash can play a significant role in the fatality risk. Below is Delaware’s data on fatalities by crash type.

| Delaware Traffic Fatalities by Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle Crash | 51 | 67 | 71 | 71 | 62 |

| Large Truck Involved | 10 | 12 | 12 | 9 | 14 |

| Speeding Involved | 37 | 45 | 35 | 39 | 33 |

| Rollover Involved | 13 | 23 | 16 | 20 | 13 |

| Roadway Departure Involved | 39 | 63 | 48 | 57 | 47 |

| Involving an Intersection | 25 | 26 | 36 | 37 | 39 |

| State Total | 99 | 124 | 131 | 119 | 119 |

Single-vehicle crashes are the deadliest in Delaware, followed by roadway departures and intersections.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the five-year trend for the top counties?

To see how fatalities range from county to county, check out the table below. Seeing as there are only three counties in Delaware, we have included each county’s fatality rate over the years.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| New Castle County | 48 | 59 | 63 | 53 | 59 |

| Sussex County | 36 | 44 | 41 | 35 | 39 |

| Kent County | 14 | 21 | 27 | 31 | 21 |

| All Counties Total | 98 | 124 | 131 | 119 | 119 |

New Castle County has the highest fatality rates over the years, followed by Sussex County.

What’s the number of fatalities involving speeding by county?

Speeding is a major risk factor. Every year, speeding contributes to multiple fatalities statewide. Take a look at the speeding deaths by county below to see where your county ranks.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent County | 8 | 5 | 3 | 14 | 8 |

| New Castle County | 13 | 27 | 18 | 12 | 16 |

| Sussex County | 16 | 13 | 14 | 13 | 9 |

New Castle and Sussex County consistently alternate between the highest number of crashes, with Kent County remaining steady in its place as the county with the least amount of fatalities in Delaware.

What’s the number of fatalities in crashes involving an alcohol-impaired driver (BAC = 0.8+) by county?

Drunk driving is another culprit in most fatalities. Kent County has the least amount of drunk driving fatalities, though the ideal number would be zero.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kent County | 8 | 10 | 7 | 7 | 10 |

| New Castle County | 16 | 23 | 19 | 16 | 15 |

| Sussex County | 14 | 18 | 14 | 14 | 7 |

Drunk driving is simply not worth the risk of dying or killing others! These numbers may not seem large but bear in mind that Delaware is a small state. In proportion to the population, drunk driving is claiming a large percentage of lives each year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the ranking for teen drinking and driving?

Teens are known for taking risks. Unfortunately, teens’ risk-taking often crosses over into their driving. Every year, numerous teenagers will drink and drive. What is the cost of underage drinking and driving? Sometimes, it’s the teen’s life.

In 2016, 1.7 teens per 100,000 population in Delaware died from drinking and driving. This number is above the national average of 1.2 deaths per 100,000 population.

To see how well Delaware is working to end teenage drinking and driving, let’s look at Delaware’s arrest record.

| DUI Arrests (Under 18-years-old) | DUI Arrests (Under 18-years-old) Total Per Million People | Rank |

|---|---|---|

| 0 | 0.00 | 50 |

With ZERO arrests in 2016, Delaware needs to improve their arrest record. After all, arresting underage drunk drivers will prevent accidents and fatalities!

What’s the EMS response time?

Let’s take a look at the aftermath of accidents by looking at EMS response times in Delaware.

| Road Type | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 3.04 minutes | 7.78 minutes | 39.27 minutes | 47.79 minutes | 67 |

| Urban | 2.06 minutes | 4.33 minutes | 20.32 minutes | 26.92 minutes | 49 |

In both rural and urban areas, people injured in car accidents will be at the hospital in under an hour from the emergency call.

What’s the Transportation in Delaware like?

Transportation is vital. We use transportation to get to work, to doctors, and travel across states. Because transportation is such a necessary part of our lives, we want to see how it functions in Delaware by looking at information from Data USA.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

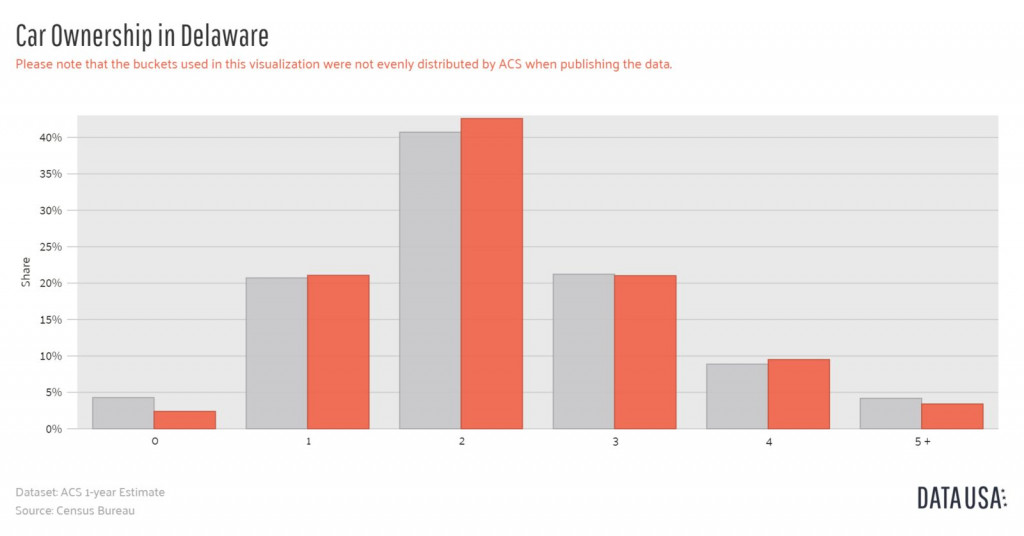

What is the percentage of car ownership?

In Delaware, most residents own an average of one to three cars.

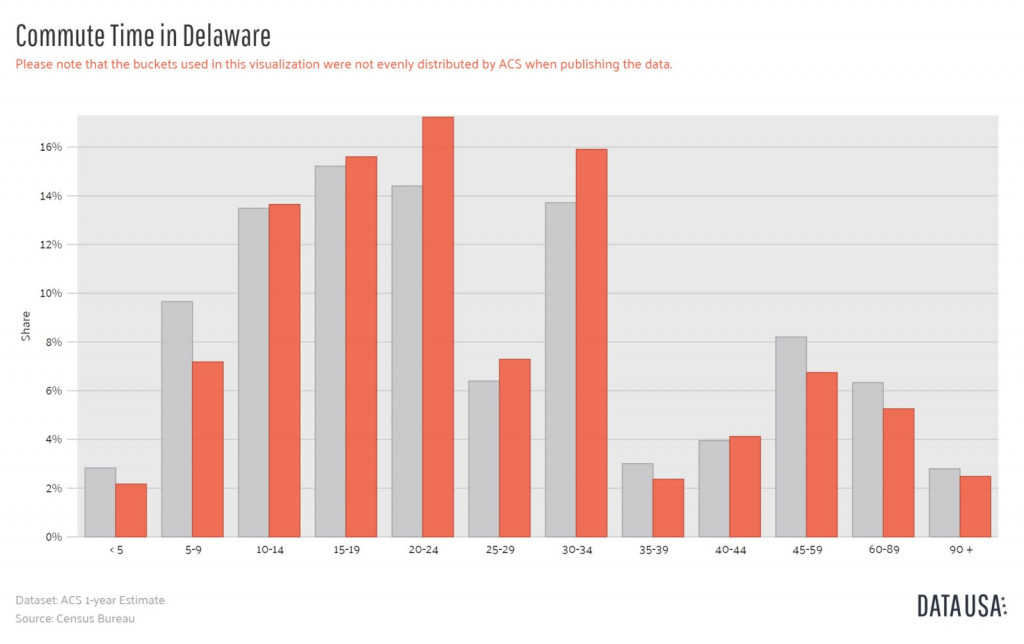

What’s the average commute time?

Spending time driving to work each day is a necessary evil. In Delaware, most residents spend 25 minutes driving to work each day, which is just below the national average of 25.3 minutes.

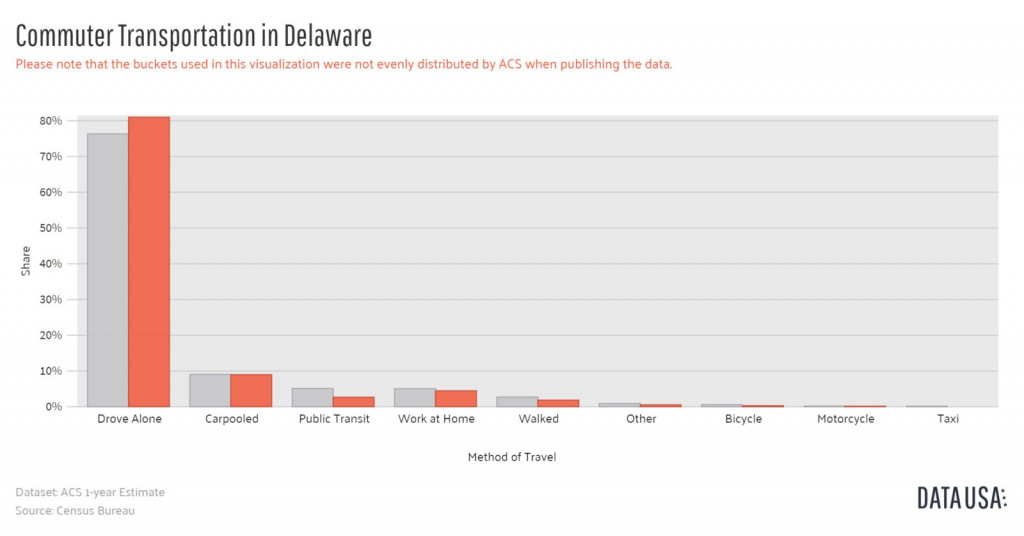

What’s the preferred commuter transportation?

As you can see from the graphic below, some Delaware residents choose to skip the work commute altogether by working from home.

Driving alone is still the most popular option, though, followed by carpooling.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is there traffic congestion in Delaware?

Luckily for Delaware residents, none of Delaware’s cities made it onto major traffic scorecards. This means Delaware’s traffic congestion is not noteworthy enough to mention.

Seeing as most Delaware residents only have a 25-minute commute, it doesn’t seem like Delaware residents are spending a significant amount of time in traffic.

Whew! You’ve made it through our comprehensive guide on Delaware! Now that you are an expert on all things insurance and car-related, you are ready to start driving on Delaware’s roads.

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Enter your zip code below to start comparison shopping with our FREE online tool!