Washington

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 17.4%

Washington car insurance requires its residents to purchase a minimum coverage of 25/50/10. Although, the 2015 average (annual premium) was $968.80, it is possible to find cheap Washington auto insurance. This guide will help you navigate the waters and get the ideal Washington car insurance rates you need.

Washingtonians have some of the best sightseeing to do in the nation. With so many destinations and activities to visit in Washington from hiking Mount Rainier, surfing in Half Moon Bay, rowing the Wenatchee, or climbing Frenchman Coulee you have a nearly endless stream of year-round fun.

To get to all those places, however, you’re probably going to need a car. And with a car comes insurance. While there are ways to saving on car insurance and finding the best deal (let alone truly understanding all the add-ons, coverage options, and laws) can seem daunting, we’re here to help you.

In this guide, we will go over everything you need to know when it comes to third party car insurance WA. By the end, you’ll be set to hit the roads with confidence (and hopefully some extra cash).

Before we dive into the factors that affect your Washington auto insurance rates and which companies rank the highest, let’s go over some basics.

So let’s get started! And if you want to get right to comparing Washington auto insurance quotes and saving money, enter your ZIP code above.

What are Washington minimum coverage requirements?

Liability insurance covers a minimum of damages if you cause an accident.

| INSURANCE REQUIRED | LIMITS |

|---|---|

| Bodily Injury Coverage | $25,000 per person $50,000 per accident |

| Property Damage Coverage | $10,000 |

Washington is a “comparative fault” state, meaning if an accident is your fault, you’re responsible for all damages unless a judge rules both parties share responsibility.

Washington requires that you carry the following amounts:

- $25,000 – covers bodily injury or death per person

- $50,000 – covers bodily injuries or death per accident

- $10,000 – covers property damage per accident

Remember, these are minimum requirements and do not cover injury, death, or damage to yourself or your passengers. If you want to make sure you are covered for those, you’ll need additional coverages we’ll discuss later on.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are acceptable forms of financial responsibility?

If you own a registered vehicle in Washington and choose not to get liability auto insurance, you will be required to have one of the following forms of financial responsibility:

- Certificate of Deposit: A certificate of deposit applied to from the Department of Licensing (DOL) by submitting Financial Responsibility Application and Affidavit and deposit $60,000 with the DOL.

- Liability Bond: Drivers can purchase a liability bond of $60,000 from a surety bond company authorized to do business in Washington.

- Self Insurance: If you have 26 vehicles or more, you can apply for the self-insurance certificate number.

Liability bonds are a line of credit paid for by an annual premium. In case of a liability claim, you may borrow any required sum of money from your bond; however, drivers are expected to reimburse the surety company for any losses sustained due to your actions.

Now you know how much liability insurance you should carry, but much does the average Washingtonian spend on a Washington automobile insurance plan? In the section, we’ll help fill in the details.

How much are premiums as a percentage of income?

Washington boasts the eleventh-highest average annual disposable income in America — $45,143. Some more good news: even with this increased income, average car insurance cost in Washington State is roughly on par with the national average, at $952.10

| PERCENTAGE OF INCOME | 2014 | 2013 | 2012 |

|---|---|---|---|

| Washington | 2.11% | 2.13% | 2.07% |

| US Average | 2.40% | 2.43% | 2.34% |

As you can see, the is consistently ~0.3 percent beneath the national average. That means Washingtonians can enjoy using their disposable income outside of the car insurance WA market. These figures are average numbers. They do not reflect annual income, driving record, or preferred deductibles.

To figure out what percent of your income goes to your car insurance, use our handy (and free) calculator.

CalculatorPro

What are average monthly car insurance rates in WA (liability, collision, comprehensive)?

The National Association of Insurance Commissioners (NAIC) tracks average rates for each coverage level.

The most recently available data is in this next table.

| COVERAGE TYPES | ANNUAL COSTS IN 2015 |

|---|---|

| Liability | $596.67 |

| Collision | $265.74 |

| Comprehensive | $106.38 |

| Combined | $968.80 |

Washington experienced an 8.15 percent increase in average rates from 2011 to 2015, a bit lower than the nationwide increase of 10 percent over the same period.

Add to this slower increase in rates the chance to shop around for insurance quotes online Washington, and find a plan to fit your budget and needs. You’ll be looking at serious savings. Stick with us to learn more.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Do you need additional damage liability coverage?

We’ve discussed the extra liability coverage you may consider purchasing to protect yourself in the event of an accident. The loss ratio is an essential factor in deciding which company will keep you protected.

In short, loss ratio represents the amount of claims companies settle compared to premiums earned through customers’ monthly payments.

If a company’s loss ratio is higher than 100 percent, the company paid more in claims than it earned through premiums. This wouldn’t be a profitable situation for your insurance company and could mean you end up paying more to cover the difference. A loss ratio under 5 means a company isn’t paying out on claims, not a good sign for making sure you’ll get the money needed if the time comes.

| LOSS RATIO | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection | 76.62 | 74.19 | 76.77 |

| Medical Payments (Med Pay) | 139.33 | 124.33 | 127.61 |

| Uninsured/Underinsured Motorist | 74.89 | 76.00 | 76.36 |

For medical payments, loss ratio has been over 100 percent consistently, meaning insurers in Washington are making losses on Medical Pay coverage.

Another coverage option worth considering in Washington is the uninsured/underinsured motorist coverage (UM/UIM). This protects you if a driver who is not insured or who is underinsured hits you.

As per data from the Insurance Information Institute, around 17.4 percent of motorists in Washington are uninsured. It’s the seventh-ranked state in terms of the number of uninsured motorists.

If you are hit by a motorist who doesn’t have adequate coverage, or no coverage at all, you might end up needing to pay for damages out of pocket, but with UM/UIM coverage, you’re covered by your insurance company for any expenses, even if the driver can’t pay.

What are available add-ons, endorsements, & riders?

To ensure you’re fully protected on the road, you can add on a variety of coverages. Here are some of the most popular:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

To add on any of these coverages, talk to your agent. They will help ensure you are set for all your unique needs and cover any associated costs.

From there, your agent applies the necessary coverages to your policy.

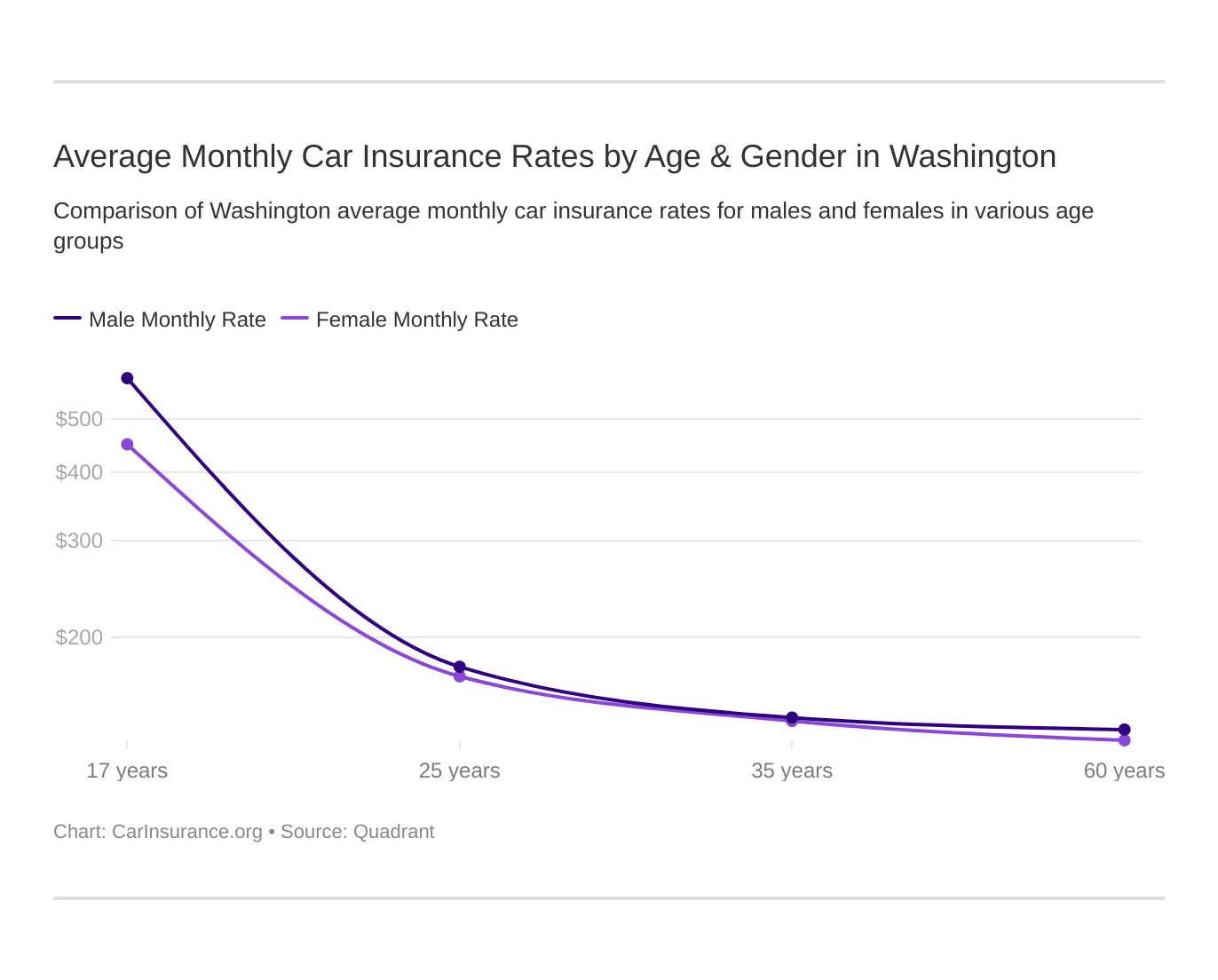

What are the average car insurance rates in Washington state by age & gender?

So, you’re beginning a policy with a new insurance company. You go to your agent, discuss the coverage you want, and poof your premium appears.

Several factors are taken into account when determining your rates. In this section, we’ll look at the impact of age and gender.

| COMPANY | MARRIED 35-YEAR OLD FEMALE ANNUAL RATE | MARRIED 35-YEAR OLD MALE ANNUAL RATE | MARRIED 60-YEAR OLD FEMALE ANNUAL RATE | MARRIED 60-YEAR OLD MALE ANNUAL RATE | SINGLE 17-YEAR OLD FEMALE ANNUAL RATE | SINGLE 17-YEAR OLD MALE ANNUAL RATE | SINGLE 25-YEAR OLD FEMALE ANNUAL RATE | SINGLE 25-YEAR OLD MALE ANNUAL RATE |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,076.46 | $2,054.07 | $1,919.38 | $2,011.85 | $7,306.88 | $8,456.50 | $2,206.95 | $2,292.07 |

| American Family Mutual | $1,958.34 | $1,958.34 | $1,787.39 | $1,787.39 | $7,444.49 | $10,177.95 | $1,958.34 | $2,631.93 |

| Farmers Ins Co of WA | $2,106.20 | $2,160.58 | $1,928.90 | $2,179.61 | $4,781.38 | $5,126.04 | $2,651.77 | $2,761.52 |

| Geico General | $1,741.67 | $1,773.53 | $1,636.13 | $1,636.13 | $3,760.90 | $4,926.25 | $2,930.56 | $2,144.04 |

| First Nat'l Ins Co of America | $1,781.98 | $1,950.41 | $1,596.99 | $1,871.63 | $9,875.56 | $10,891.02 | $1,909.10 | $2,081.18 |

| Allied P&C AXCM | $1,379.41 | $1,410.32 | $1,282.59 | $1,334.83 | $3,703.82 | $4,511.88 | $1,642.80 | $1,773.07 |

| Progressive Direct | $1,528.34 | $1,427.27 | $1,374.92 | $1,392.37 | $7,688.90 | $8,614.41 | $1,828.39 | $1,821.58 |

| State Farm Mutual Auto | $1,565.66 | $1,565.66 | $1,407.45 | $1,407.45 | $4,512.95 | $5,714.10 | $1,779.29 | $2,045.65 |

| USAA | $1,133.34 | $1,118.30 | $1,090.31 | $1,091.29 | $4,883.26 | $5,777.50 | $1,433.41 | $1,569.85 |

Age plays a huge role in premium costs. Single, 17-year-old drivers pay significantly higher rates than any other age group. This is due to the general understanding that they are riskier, less-experienced motorists. Younger males are charged even higher than their female counterparts because younger males are seen as more dangerous drivers.

If you’re young and looking not to break the bank, Geico and Allied P&C AXCM could be your best bet.

After turning 25, rates stay stable, and other factors become more critical in the calculation of rates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

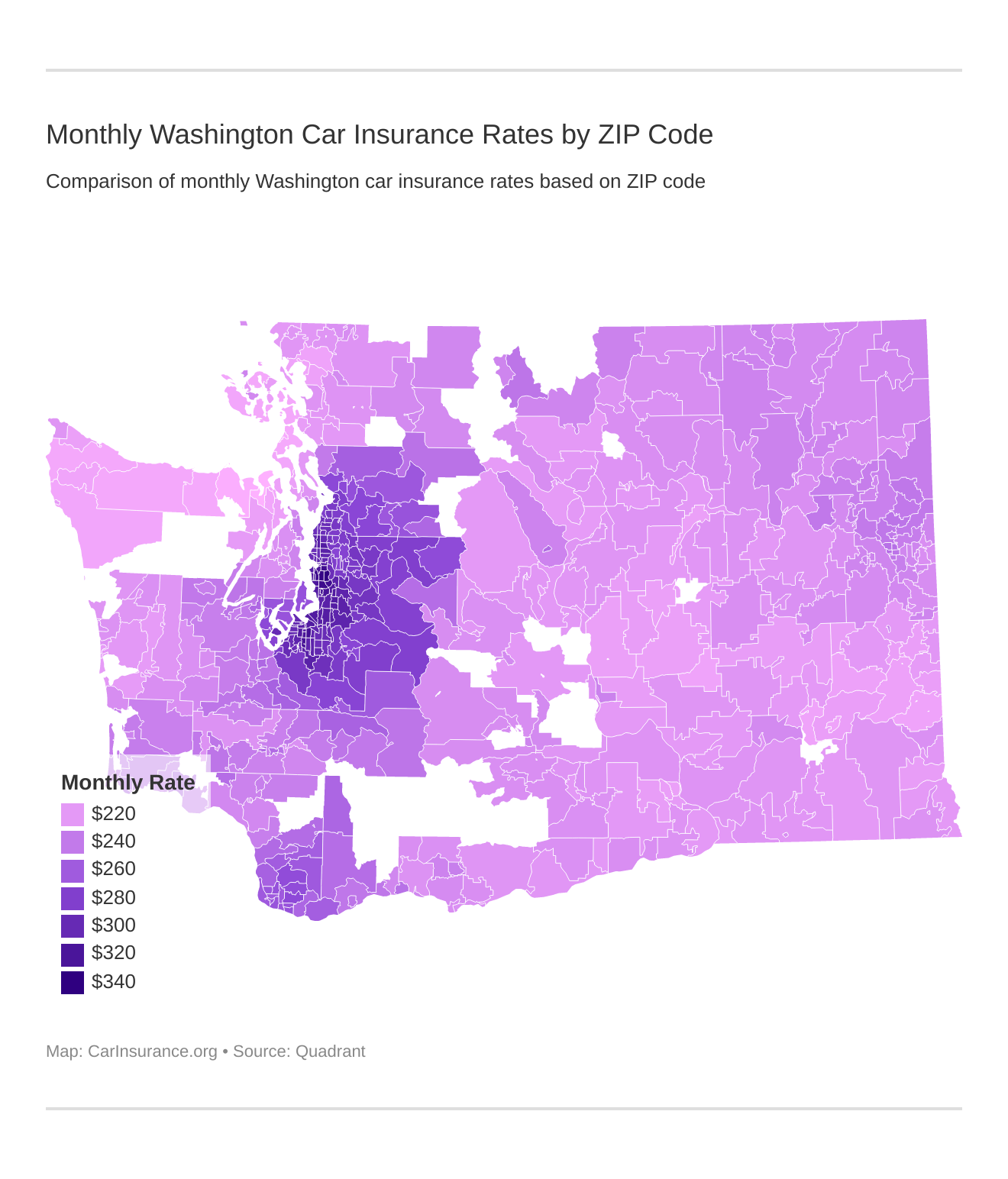

Where are the cheapest rates by ZIP code?

Where you live also influences rates. In general, drivers living in an urban area are more likely to be in an accident and thus, face higher premiums.

| Most Expensive Zip Codes in Washington | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 98118 | SEATTLE | $4,079.23 | American Family | $5,926.17 | Liberty Mutual | $5,257.26 | USAA | $2,872.67 | Nationwide | $2,911.83 |

| 98108 | SEATTLE | $4,032.13 | American Family | $5,698.95 | Liberty Mutual | $5,084.70 | USAA | $2,820.35 | Nationwide | $2,911.83 |

| 98168 | SEATTLE | $3,956.75 | American Family | $5,534.73 | Liberty Mutual | $5,133.20 | USAA | $2,534.97 | Nationwide | $2,796.55 |

| 98144 | SEATTLE | $3,947.84 | American Family | $5,269.57 | Liberty Mutual | $4,923.17 | USAA | $2,730.82 | Nationwide | $2,911.83 |

| 98106 | SEATTLE | $3,946.95 | American Family | $5,269.57 | Liberty Mutual | $5,121.42 | USAA | $2,781.61 | Nationwide | $2,911.83 |

| 98126 | SEATTLE | $3,946.53 | Liberty Mutual | $5,427.31 | American Family | $5,269.57 | USAA | $2,689.39 | Nationwide | $2,911.83 |

| 98178 | SEATTLE | $3,918.31 | American Family | $5,260.03 | Liberty Mutual | $5,020.17 | Nationwide | $2,796.55 | USAA | $2,915.44 |

| 98404 | TACOMA | $3,907.01 | Liberty Mutual | $5,237.40 | Allstate | $4,925.98 | Nationwide | $2,620.93 | USAA | $2,877.60 |

| 98158 | SEATTLE | $3,898.72 | American Family | $5,534.73 | Liberty Mutual | $5,156.82 | USAA | $2,471.62 | Nationwide | $2,694.23 |

| 98444 | TACOMA | $3,875.05 | Liberty Mutual | $5,480.53 | Allstate | $4,797.69 | Nationwide | $2,620.93 | USAA | $2,744.14 |

| 98188 | SEATTLE | $3,869.30 | American Family | $5,534.73 | Liberty Mutual | $5,300.63 | USAA | $2,471.62 | Nationwide | $2,703.77 |

| 98447 | TACOMA | $3,857.85 | Liberty Mutual | $5,480.53 | Allstate | $4,797.69 | Nationwide | $2,620.93 | USAA | $2,744.14 |

| 98408 | TACOMA | $3,852.24 | Liberty Mutual | $5,287.27 | Allstate | $4,925.98 | Nationwide | $2,620.93 | USAA | $2,796.05 |

| 98134 | SEATTLE | $3,831.61 | American Family | $5,269.57 | Liberty Mutual | $5,247.71 | Nationwide | $2,575.17 | Geico | $2,580.97 |

| 98136 | SEATTLE | $3,812.97 | American Family | $5,260.03 | Liberty Mutual | $4,990.17 | USAA | $2,654.45 | State Farm | $2,911.32 |

| 98146 | SEATTLE | $3,812.22 | American Family | $5,260.03 | Liberty Mutual | $4,800.78 | USAA | $2,694.59 | Nationwide | $2,796.55 |

| 98057 | RENTON | $3,790.67 | American Family | $5,260.03 | Liberty Mutual | $5,163.65 | Nationwide | $2,571.50 | USAA | $2,813.89 |

| 98409 | TACOMA | $3,787.39 | Liberty Mutual | $5,101.97 | Allstate | $4,598.34 | Nationwide | $2,620.93 | USAA | $2,808.78 |

| 98055 | RENTON | $3,776.55 | American Family | $5,260.03 | Liberty Mutual | $5,163.65 | Nationwide | $2,571.50 | USAA | $2,813.89 |

| 98422 | TACOMA | $3,774.49 | Allstate | $4,925.98 | Liberty Mutual | $4,907.14 | Nationwide | $2,620.93 | USAA | $2,705.65 |

| 98023 | FEDERAL WAY | $3,772.89 | Liberty Mutual | $4,827.97 | American Family | $4,646.13 | Nationwide | $2,786.48 | USAA | $2,792.23 |

| 98418 | TACOMA | $3,770.43 | Liberty Mutual | $5,287.27 | Allstate | $4,598.34 | USAA | $2,296.38 | Nationwide | $2,620.93 |

| 98031 | KENT | $3,768.74 | Liberty Mutual | $4,856.97 | American Family | $4,818.72 | Nationwide | $2,703.77 | USAA | $2,708.12 |

| 98166 | SEATTLE | $3,768.14 | American Family | $5,132.10 | Liberty Mutual | $4,964.65 | USAA | $2,549.27 | Nationwide | $2,694.23 |

| 98125 | SEATTLE | $3,765.22 | American Family | $5,088.26 | Liberty Mutual | $5,068.33 | USAA | $2,673.53 | Nationwide | $2,705.40 |

USAA and Nationwide offer the cheapest insurance across almost every ZIP code. Although these are average rates and your insurance rates Washington State will depend on your case, these Washington auto insurance companies may be worth checking out.

| Least Expensive Zip Codes in Washington | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 98368 | PORT TOWNSEND | $2,461.54 | Liberty Mutual | $3,312.18 | American Family | $3,040.02 | Nationwide | $1,820.10 | USAA | $1,912.00 |

| 98382 | SEQUIM | $2,482.65 | Liberty Mutual | $3,343.26 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $1,821.70 |

| 98278 | OAK HARBOR | $2,512.24 | Liberty Mutual | $3,560.47 | American Family | $2,989.30 | USAA | $1,745.19 | Nationwide | $1,891.73 |

| 98362 | PORT ANGELES | $2,515.10 | Liberty Mutual | $3,509.95 | American Family | $3,040.02 | Nationwide | $1,820.10 | USAA | $1,986.87 |

| 98277 | OAK HARBOR | $2,515.42 | Liberty Mutual | $3,560.47 | American Family | $2,989.30 | USAA | $1,726.12 | Nationwide | $1,891.73 |

| 98221 | ANACORTES | $2,528.16 | Liberty Mutual | $3,652.24 | Allstate | $3,111.86 | USAA | $1,711.97 | Nationwide | $1,912.08 |

| 98245 | EASTSOUND | $2,528.40 | Liberty Mutual | $3,442.69 | Allstate | $3,070.79 | Nationwide | $1,870.56 | USAA | $1,890.06 |

| 98261 | LOPEZ ISLAND | $2,534.30 | Liberty Mutual | $3,423.17 | Allstate | $3,111.86 | Nationwide | $1,870.56 | USAA | $1,890.06 |

| 98326 | CLALLAM BAY | $2,535.13 | Liberty Mutual | $3,472.71 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| 98363 | PORT ANGELES | $2,536.42 | Liberty Mutual | $3,598.12 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| 98339 | PORT HADLOCK | $2,540.36 | Liberty Mutual | $3,469.33 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,068.16 |

| 98250 | FRIDAY HARBOR | $2,541.29 | Liberty Mutual | $3,624.73 | Allstate | $3,111.86 | USAA | $1,765.85 | Nationwide | $1,870.56 |

| 98325 | CHIMACUM | $2,546.91 | Liberty Mutual | $3,464.63 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,051.90 |

| 98239 | COUPEVILLE | $2,547.28 | Liberty Mutual | $3,567.99 | Progressive | $3,000.27 | Nationwide | $1,891.73 | USAA | $1,962.49 |

| 98331 | FORKS | $2,548.79 | Liberty Mutual | $3,630.14 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| 98305 | BEAVER | $2,560.25 | Liberty Mutual | $3,718.88 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| 98225 | BELLINGHAM | $2,560.50 | Liberty Mutual | $3,468.06 | American Family | $3,215.37 | USAA | $1,897.96 | Nationwide | $1,937.63 |

| 98226 | BELLINGHAM | $2,564.69 | Liberty Mutual | $3,376.85 | American Family | $3,226.63 | Nationwide | $1,937.63 | USAA | $1,998.33 |

| 99163 | PULLMAN | $2,567.07 | Liberty Mutual | $3,688.52 | American Family | $3,494.22 | USAA | $1,760.55 | Nationwide | $1,794.51 |

| 99136 | HAY | $2,568.28 | Liberty Mutual | $3,688.52 | American Family | $3,310.40 | Nationwide | $1,794.51 | State Farm | $1,952.71 |

| 99333 | HOOPER | $2,570.68 | Liberty Mutual | $3,688.52 | Allstate | $3,485.59 | USAA | $1,760.55 | Nationwide | $1,794.51 |

| 98857 | WARDEN | $2,571.68 | Liberty Mutual | $3,483.46 | American Family | $3,310.40 | Nationwide | $1,822.61 | USAA | $1,921.87 |

| 99111 | COLFAX | $2,575.68 | Liberty Mutual | $3,688.52 | American Family | $3,434.49 | Nationwide | $1,794.51 | State Farm | $1,952.71 |

| 98365 | PORT LUDLOW | $2,577.28 | Liberty Mutual | $3,611.58 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,051.90 |

| 99125 | ENDICOTT | $2,580.52 | Liberty Mutual | $3,688.52 | American Family | $3,434.49 | Nationwide | $1,794.51 | State Farm | $1,952.71 |

Where are the cheapest rates by city?

Urban areas like Seattle and Spokane tend to have higher rates than towns in rural areas, though in some cases, only a few dollars more per month.

| Most Expensive Cities in Washington | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Boulevard Park | $3,994.44 | American Family | $5,616.84 | Liberty Mutual | $5,108.95 | USAA | $2,677.66 | Nationwide | $2,854.19 |

| Bryn Mawr-Skyway | $3,918.31 | American Family | $5,260.03 | Liberty Mutual | $5,020.17 | Nationwide | $2,796.55 | USAA | $2,915.44 |

| Midland | $3,907.01 | Liberty Mutual | $5,237.40 | Allstate | $4,925.98 | Nationwide | $2,620.93 | USAA | $2,877.60 |

| Parkland | $3,875.04 | Liberty Mutual | $5,480.53 | Allstate | $4,797.69 | Nationwide | $2,620.93 | USAA | $2,744.14 |

| SEATAC | $3,869.30 | American Family | $5,534.73 | Liberty Mutual | $5,300.63 | USAA | $2,471.62 | Nationwide | $2,703.77 |

| Renton | $3,783.61 | American Family | $5,260.03 | Liberty Mutual | $5,163.65 | Nationwide | $2,571.50 | USAA | $2,813.89 |

| Browns Point | $3,774.49 | Allstate | $4,925.98 | Liberty Mutual | $4,907.14 | Nationwide | $2,620.93 | USAA | $2,705.65 |

| Burien | $3,771.66 | American Family | $5,217.39 | Liberty Mutual | $4,889.82 | USAA | $2,571.83 | Nationwide | $2,728.33 |

| Algona | $3,750.43 | Liberty Mutual | $5,177.43 | American Family | $4,593.45 | Nationwide | $2,633.52 | USAA | $2,747.15 |

| Federal Way | $3,749.88 | Liberty Mutual | $4,761.79 | American Family | $4,603.10 | Nationwide | $2,786.48 | USAA | $2,860.16 |

| Kent | $3,726.02 | Liberty Mutual | $4,762.20 | American Family | $4,760.96 | Nationwide | $2,668.65 | USAA | $2,790.43 |

| Seattle | $3,724.65 | American Family | $5,076.81 | Liberty Mutual | $5,060.37 | USAA | $2,613.06 | Nationwide | $2,687.32 |

| East Hill-Meridian | $3,721.61 | Liberty Mutual | $4,836.29 | American Family | $4,750.66 | Nationwide | $2,637.64 | USAA | $2,674.33 |

| Auburn | $3,710.10 | Liberty Mutual | $4,833.42 | American Family | $4,658.57 | Nationwide | $2,633.52 | USAA | $2,773.88 |

| Tacoma | $3,707.36 | Liberty Mutual | $4,982.08 | Allstate | $4,662.26 | Nationwide | $2,620.93 | USAA | $2,647.08 |

| Newcastle | $3,706.71 | Liberty Mutual | $4,895.49 | American Family | $4,682.60 | Nationwide | $2,579.34 | USAA | $2,604.43 |

| Seahurst | $3,698.19 | Liberty Mutual | $4,964.65 | Allstate | $4,399.28 | USAA | $2,635.41 | Nationwide | $2,694.23 |

| Covington | $3,694.80 | Liberty Mutual | $5,028.45 | American Family | $4,673.55 | Nationwide | $2,625.11 | USAA | $2,706.99 |

| Des Moines | $3,694.01 | American Family | $5,132.10 | Liberty Mutual | $4,586.21 | USAA | $2,551.88 | Nationwide | $2,703.77 |

| Clover Creek | $3,677.71 | Liberty Mutual | $5,138.08 | Allstate | $4,676.26 | Nationwide | $2,620.93 | USAA | $2,713.67 |

| Milton | $3,654.19 | Allstate | $5,160.65 | Liberty Mutual | $4,584.59 | Nationwide | $2,601.58 | USAA | $2,756.13 |

| Pacific | $3,650.77 | American Family | $4,721.34 | Liberty Mutual | $4,482.65 | Nationwide | $2,633.52 | USAA | $2,747.15 |

| Waller | $3,643.68 | Allstate | $5,002.33 | Liberty Mutual | $4,985.35 | Nationwide | $2,620.93 | USAA | $2,743.96 |

| Fife | $3,639.40 | Allstate | $4,925.98 | Liberty Mutual | $4,741.12 | Nationwide | $2,601.58 | USAA | $2,732.13 |

| Lakewood | $3,626.43 | Allstate | $4,730.41 | Liberty Mutual | $4,636.39 | USAA | $2,577.37 | Nationwide | $2,620.93 |

Boulevard Park and Bryn Mawr-Skyway have the highest average premiums in the state, mirroring the national trends.

| Least Expensive Cities in Washington | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Port Townsend | $2,461.54 | Liberty Mutual | $3,312.18 | American Family | $3,040.02 | Nationwide | $1,820.10 | USAA | $1,912.00 |

| Carlsborg | $2,482.64 | Liberty Mutual | $3,343.26 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $1,821.70 |

| Whidbey Island Station | $2,512.24 | Liberty Mutual | $3,560.47 | American Family | $2,989.30 | USAA | $1,745.19 | Nationwide | $1,891.73 |

| Oak Harbor | $2,515.42 | Liberty Mutual | $3,560.47 | American Family | $2,989.30 | USAA | $1,726.12 | Nationwide | $1,891.73 |

| Port Angeles | $2,525.76 | Liberty Mutual | $3,554.04 | American Family | $3,040.02 | Nationwide | $1,844.45 | USAA | $1,970.58 |

| Anacortes | $2,528.16 | Liberty Mutual | $3,652.24 | Allstate | $3,111.86 | USAA | $1,711.97 | Nationwide | $1,912.08 |

| Eastsound | $2,528.40 | Liberty Mutual | $3,442.69 | Allstate | $3,070.79 | Nationwide | $1,870.56 | USAA | $1,890.06 |

| Lopez Island | $2,534.30 | Liberty Mutual | $3,423.17 | Allstate | $3,111.86 | Nationwide | $1,870.56 | USAA | $1,890.06 |

| Clallam Bay | $2,535.12 | Liberty Mutual | $3,472.71 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| Port Hadlock-Irondale | $2,540.36 | Liberty Mutual | $3,469.33 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,068.16 |

| Friday Harbor | $2,541.29 | Liberty Mutual | $3,624.73 | Allstate | $3,111.86 | USAA | $1,765.85 | Nationwide | $1,870.56 |

| Chimacum | $2,546.91 | Liberty Mutual | $3,464.63 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,051.90 |

| Coupeville | $2,547.28 | Liberty Mutual | $3,567.99 | Progressive | $3,000.27 | Nationwide | $1,891.73 | USAA | $1,962.49 |

| Forks | $2,548.79 | Liberty Mutual | $3,630.14 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| Beaver | $2,560.25 | Liberty Mutual | $3,718.88 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| Hay | $2,568.28 | Liberty Mutual | $3,688.52 | American Family | $3,310.40 | Nationwide | $1,794.51 | State Farm | $1,952.71 |

| Bellingham | $2,569.25 | Liberty Mutual | $3,407.26 | American Family | $3,219.12 | Nationwide | $1,937.63 | USAA | $1,971.40 |

| Hooper | $2,570.67 | Liberty Mutual | $3,688.52 | Allstate | $3,485.59 | USAA | $1,760.55 | Nationwide | $1,794.51 |

| Warden | $2,571.68 | Liberty Mutual | $3,483.46 | American Family | $3,310.40 | Nationwide | $1,822.61 | USAA | $1,921.87 |

| Colfax | $2,575.68 | Liberty Mutual | $3,688.52 | American Family | $3,434.49 | Nationwide | $1,794.51 | State Farm | $1,952.71 |

| Port Ludlow | $2,577.28 | Liberty Mutual | $3,611.58 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,051.90 |

| Endicott | $2,580.52 | Liberty Mutual | $3,688.52 | American Family | $3,434.49 | Nationwide | $1,794.51 | State Farm | $1,952.71 |

| Marrowstone | $2,580.67 | Liberty Mutual | $3,520.43 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,068.16 |

| Sekiu | $2,586.92 | Liberty Mutual | $3,868.27 | American Family | $3,040.02 | Nationwide | $1,868.80 | USAA | $1,954.28 |

| Quilcene | $2,587.08 | Liberty Mutual | $3,885.74 | American Family | $3,076.05 | Nationwide | $1,820.10 | USAA | $2,051.90 |

Who are the best auto insurance companies in Washington state?

You’re probably wondering by this point:

“How do I choose which insurance company is best for me?”

While it can be tempting to go with the cheapest provider, there are some other important things to keep in mind. Considerations such as the financial stability of an insurer, customer satisfaction ratings, credit ratings, and loss ratio should all come into play when making your decision.

But don’t get overwhelmed; we’ll go over everything you need to figure out which insurer best suits your needs.

The Largest Companies’ Financial Rating

The first, and maybe most important, aspect to consider when finalizing which companies to look at is financial strength. You want to be sure your insurer isn’t going under any time soon, leaving you with inadequate coverage and probably a lot of lost money.

Since not everyone has a business degree to analyze the balance sheet of insurance providers, we’ve consulted the financial ratings from A.M. Best Credit Rating. A.M. Best is one of the most reputable credit rating agencies in the insurance industry.

| Leading Insurance Providers | A.M. Best Ratings |

|---|---|

| State Farm | A++ |

| Geico | A++ |

| Liberty Mutual | A |

| Allstate Insurance | A+ |

| Progressive | A+ |

| USAA | A++ |

| Farmers Insurance | A |

| PEMCO Mutual Insurance Co | B++ |

| American Family Insurance | A |

| Hartford Fire & Casualty | A+ |

A.M. Best assigns ratings in the scale of A++ to D, which rate insurance providers from superior to poor ability to meet insurance obligations in the long term.

Washington car insurance companies are doing incredibly well across the board. The lowest grade (PEMCO Mutual Insurance Co with a B++) is still well above average. So wherever you get your insurance from, you shouldn’t have to worry about your company going under.

Companies with Best Ratings

Customer satisfaction, for many drivers, is their top priority. No one wants to be treated poorly by their insurance company in the event of an accident.

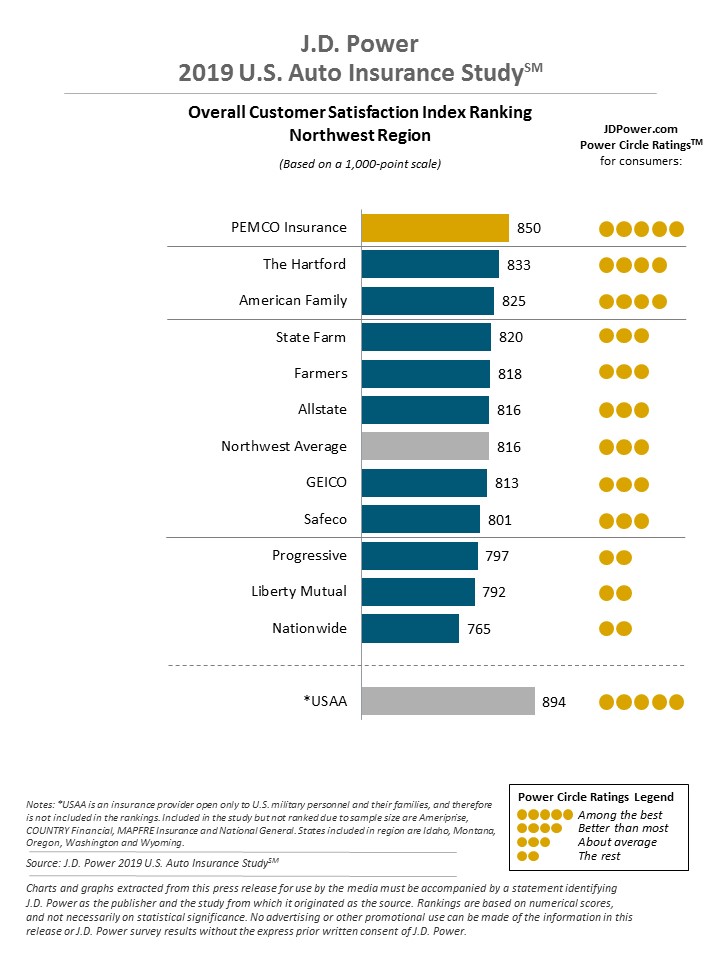

J.D. Power Circle Ratings looks at a wide variety of auto insurance customer satisfaction variables. These ratings cover the northwest region, which is comprised of five states, including Washington.

USAA, PEMCO, and The Hartford have the highest customer satisfaction ratings in the northwest region.

Companies with Most Complaints in Washington

On the other side of things, knowing which companies have the highest complaint rates also matters. This next table looks at the complaint ratio of companies and includes all successful complaints lodged against an insurer.

The complaint ratio is the number of complaints received per 100,000 policies written. A high ratio for a company compared to peers indicate that the quality of service may be less than satisfactory.

Here’s the data for complaints in Washington:

| INSURER | LOSS RATIO | COMPANY COMPLAINT RATIO 2017 |

|---|---|---|

| State Farm Group | 66.82% | 0.44 |

| Geico | 73.35% | 0.68 |

| Liberty Mutual Group | 66.42% | 5.95 |

| Allstate Insurance Group | 55.27% | 0.5 |

| Progressive Group | 62.83% | 0.75 |

| USAA Group | 79.28% | 0.74 |

| Farmers Insurance Group | 59.54% | 0 |

| PEMCO Mutual Insurance Co | 66.30% | 0.14 |

| American Family Insurance Group | 78.07% | 0.79 |

| Hartford Fire & Casualty Group | 73.22% | 4.68 |

Just because a company is ahead in the Washington market doesn’t always mean customers are satisfied. If you feel unhappy with the service provided by an insurer, you can complain to the Office of the Insurance Commissioner.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much are average car insurance rates in Washington state?

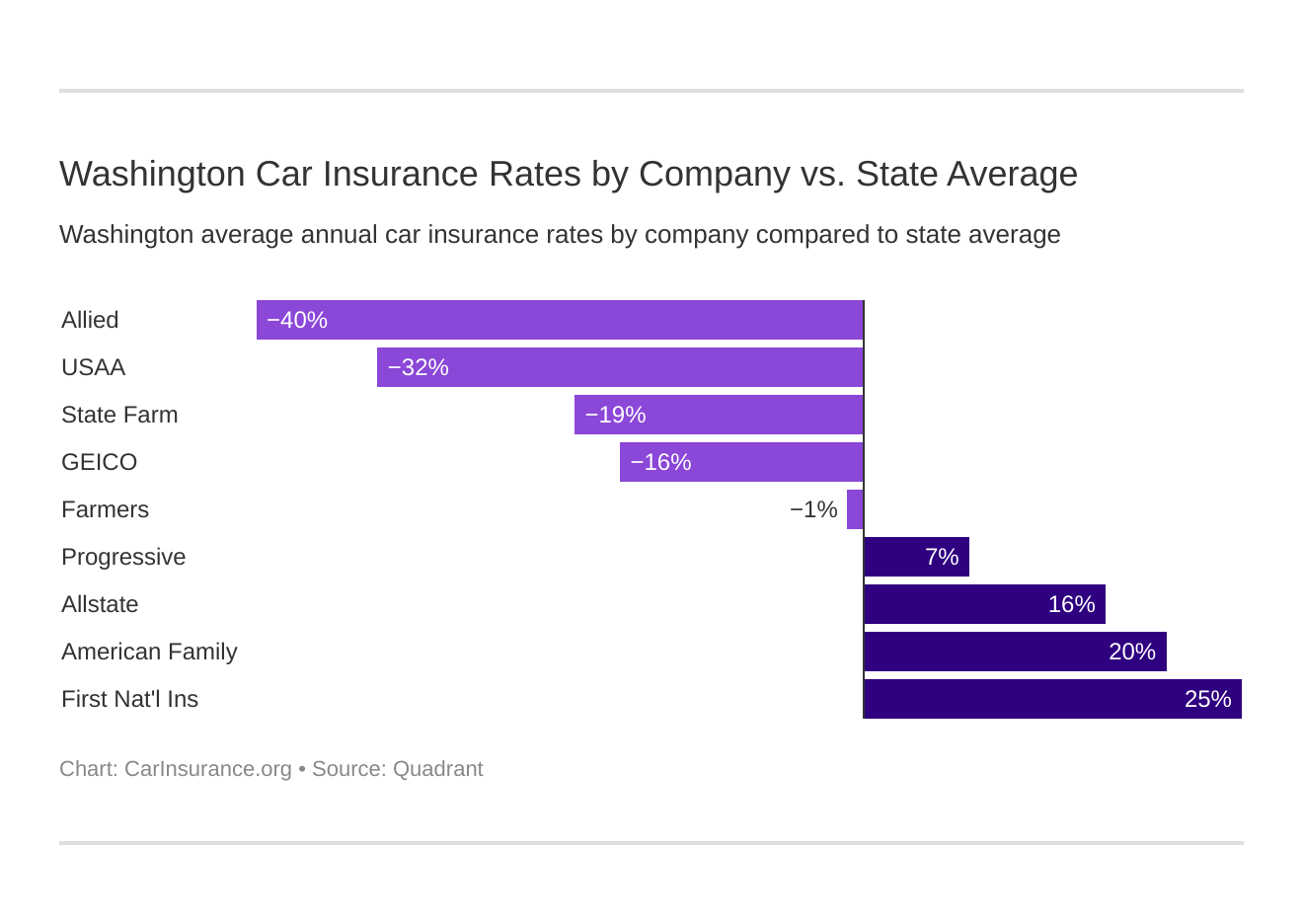

While customer service may keep your business, price usually gets you in the door. Each company takes different factors into account when they quote you, and by shopping around, you’ll find the best rates.

| COMPANY | AVERAGE PREMIUM | COMPARED TO STATE AVERAGE ($2,986.69) |

|---|---|---|

| Allstate F&C | $3540.52 | +$553.83 |

| American Family Mutual | $3713.02 | +$726.33 |

| Farmers Ins Co of WA | $2962.00 | -$24.69 |

| Geico | $2568.65 | -$418.04 |

| First Nat'l Ins Co of America | $3994.73 | +$1008.04 |

| Allied P&C | $2129.84 | -$856.85 |

| Progressive | $3209.52 | +$222.83 |

| State Farm | $2499.78 | -$486.91 |

| USAA | $2262.16 | -$724.53 |

On average, USAA, Allied, and State Farm offer the cheapest policies in Washington.

What are commute rates by companies?

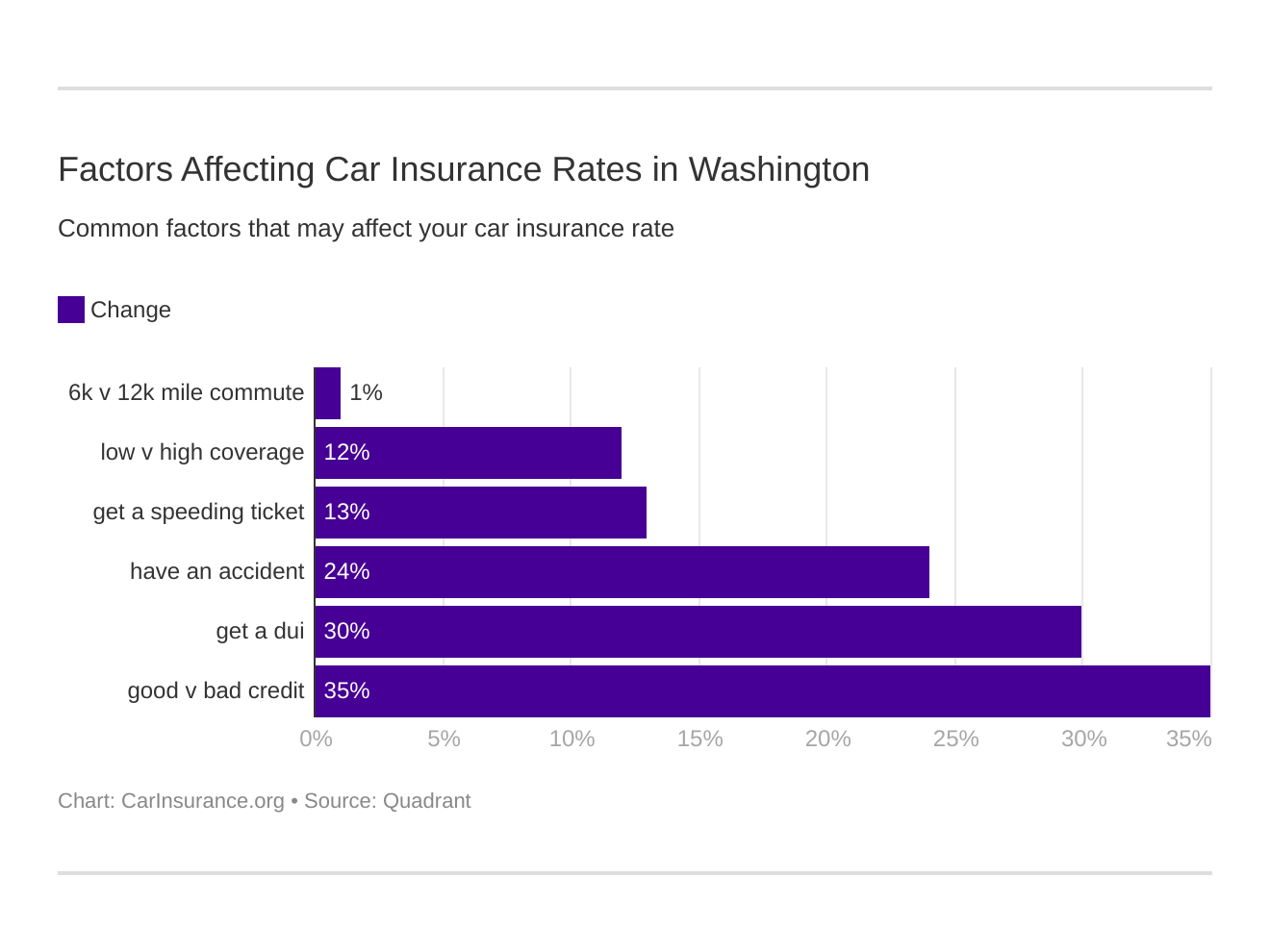

Across Washington insurers, increases in your annual mileage don’t have much impact on premiums. So head to the beautiful Olympic National Park, or wherever your adventures in the Evergreen State take you, without worry.

| Insurance Providers | 10 miles commute/6000 annual mileage | 25 miles commute/12000 annual mileage |

|---|---|---|

| Allstate | $3,540.52 | $3,540.52 |

| American Family | $3,636.77 | $3,789.27 |

| Farmers | $2,962.00 | $2,962.00 |

| Geico | $2,536.39 | $2,600.92 |

| Liberty Mutual | $3,994.73 | $3,994.73 |

| Nationwide | $2,129.84 | $2,129.84 |

| Progressive | $3,209.52 | $3,209.52 |

| State Farm | $2,431.07 | $2,568.48 |

| USAA | $2,239.79 | $2,284.53 |

While most of the companies don’t show any increase, there are very slight Washington State auto insurance rate increases with some providers. So if you have a long commute, a policy with Allstate, Progressive, Farmers, or Liberty Mutual might fit best, as they don’t charge any extra for extra miles driven.

What are coverage level rates by companies?

Many drivers think more coverage means higher rates, and while Washington insurers do tend to charge more for more extensive policies, by shopping around, you can get higher levels and still save a good deal of money.

Here’s a table comparing rates by coverage level across companies.

| Insurance Providers | Low | Medium | High |

|---|---|---|---|

| Allstate | $3,340.56 | $3,529.25 | $3,751.75 |

| American Family | $3,514.54 | $3,708.11 | $3,916.41 |

| Farmers | $2,760.41 | $2,963.13 | $3,162.46 |

| Geico | $2,415.05 | $2,570.26 | $2,720.65 |

| Liberty Mutual | $3,755.57 | $4,001.80 | $4,226.82 |

| Nationwide | $2,015.38 | $2,129.08 | $2,245.06 |

| Progressive | $2,916.39 | $3,128.02 | $3,584.15 |

| State Farm | $2,334.70 | $2,510.27 | $2,654.36 |

| USAA | $2,119.91 | $2,260.74 | $2,405.82 |

If you want higher coverage, Nationwide and USAA offer the cheapest policies in Washington and could save around $2,000 annually compared to more expensive insurers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are credit history rates by companies?

If you received a premium rate in the mail with a high price tag, your credit score might be to blame.

Insurance companies use your credit history to judge your likelihood of making a claim and the ability to pay on time.

The table below compares each company alongside average rates for good, fair, and poor credit scores.

| Insurance Providers | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $4,390.41 | $3,354.12 | $2,877.04 |

| American Family | $4,383.33 | $3,578.15 | $3,177.58 |

| Farmers | $3,619.24 | $2,726.81 | $2,539.95 |

| Geico | $3,057.61 | $2,446.29 | $2,202.06 |

| Liberty Mutual | $5,710.24 | $3,515.42 | $2,758.54 |

| Nationwide | $2,532.91 | $1,993.82 | $1,862.79 |

| Progressive | $3,538.50 | $3,154.29 | $2,935.78 |

| State Farm | $3,631.16 | $2,177.12 | $1,691.05 |

| USAA | $2,854.97 | $2,092.36 | $1,839.15 |

According to the data, Progressive is the most forgiving if your credit score suddenly plummets.

However, Liberty Mutual’s and State Farm’s rates increase the most and charge folks with poor credit scores the highest rates.

What are driving record rates by companies?

Expect your premium to increase when the unfortunate happens: a speeding ticket, an accident, or a DUI.

| COMPANY | CLEAN RECORD | WITH 1 SPEEDING VIOLATION | WITH 1 ACCIDENT | WITH 1 DUI |

|---|---|---|---|---|

| Allstate | $2,978.15 | $3,331.86 | $3,724.36 | $4,127.71 |

| American Family | $2,978.87 | $3,649.37 | $3,811.59 | $4,412.26 |

| Farmers | $2,454.67 | $3,045.19 | $3,052.21 | $3,295.93 |

| Geico | $1,980.32 | $1,980.32 | $2,534.71 | $3,779.26 |

| Liberty Mutual | $3,409.23 | $3,899.59 | $4,290.97 | $4,379.12 |

| Nationwide | $1,657.44 | $1,811.31 | $2,240.59 | $2,810.03 |

| Progressive | $2,600.49 | $3,138.85 | $4,063.71 | $3,035.03 |

| State Farm | $2,273.58 | $2,499.77 | $2,726.00 | $2,499.77 |

| USAA | $1,664.33 | $1,966.78 | $2,409.13 | $3,008.40 |

Rates increase 10-24 percent when you get a speeding ticket, 20-56 percent when you get into an accident, and 10-91 percent when you get a DUI.

In Washington, it looks like Geico and Nationwide are the most lenient when it comes to speeding tickets. However, State Farm and Progressive are the most lenient when it comes to DUIs.

It’s no surprise that, with any company, an accident guarantees a rate increase.

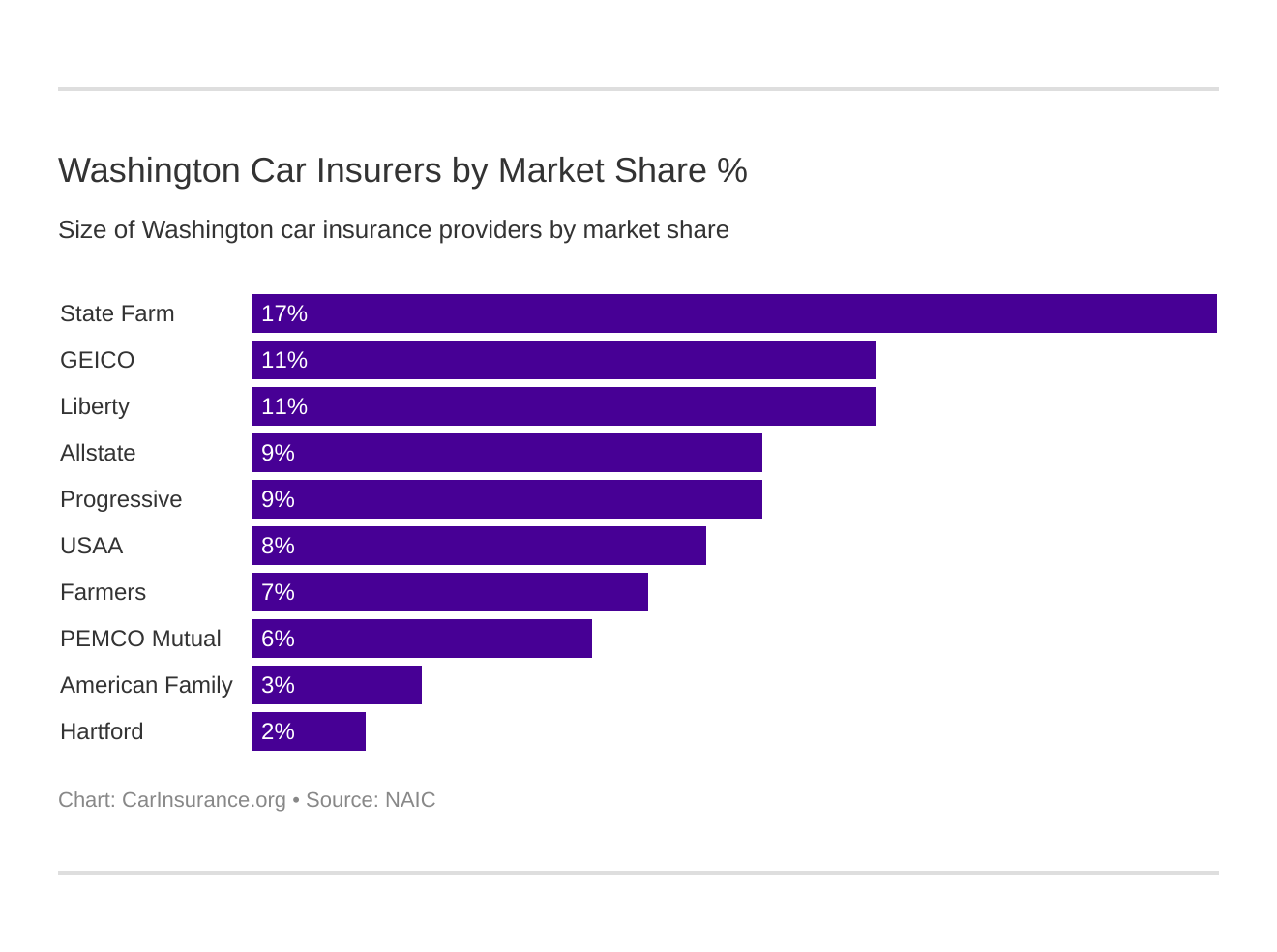

Which are the largest car insurance companies in Washington?

The below chart will show which companies write the most in Washington.

| Insurance Providers | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm | $867,121 | 66.82% | 16.75% |

| Geico | $563,543 | 73.35% | 10.89% |

| Liberty Mutual | $549,853 | 66.42% | 10.62% |

| Allstate | $485,508 | 55.27% | 9.38% |

| Progressive | $440,839 | 62.83% | 8.52% |

| USAA | $406,048 | 79.28% | 7.85% |

| Farmers | $384,645 | 59.54% | 7.43% |

| PEMCO Mutual Insurance Co | $287,313 | 66.30% | 5.55% |

| American Family Insurance | $178,684 | 78.07% | 3.45% |

| Hartford Fire & Casualty | $127,979 | 73.22% | 2.47% |

State Farm and Geico, two of the largest providers nationwide, hold the most market share in Washington.

Number of Insurers in Washington

Usually, when one hears “foreign,” they automatically think outside of the United States. In the insurance world, “foreign” means a company is based outside of the operating state. So, if the home office is located in Florida, but they are writing in Washington, they are considered foreign. Domestic, meanwhile, are companies based out of, and only operating in, the state.

| Type of Insurer | Number |

|---|---|

| Foreign | 854 |

| Domestic | 7 |

As you can see, there are many more foreign insurers in Washington than there are domestic.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Washington laws do you need to know?

Before you consider yourself a master of the Evergreen State roadways, you have to know more than just the types of insurance coverage and best car insurance companies. You need a good understanding of state laws related to driving and car insurance to stay safe (and ticket-free) on the road.

Too many drivers end up with skyrocketing premiums after getting ticketed for a violation they weren’t aware existed. With laws changing and getting updated so frequently, it can be hard to keep up. That’s where this section comes in.

Let’s get started!

Washington enacted a mandatory liability insurance law in 1989 under the authority of the Washington State Department of Licensing.

The law mandates drivers carry liability insurance above the state-mandated minimum levels.

Now, let’s get into a few rules and regulations to keep your drive safe.

Windshield Coverage

In Washington, insurance law does not mandate providers to offer any exclusive coverage for windshield repair or replacement. However, most insurers provide glass protection with comprehensive coverage.

Your insurer may provide aftermarket or used parts as a replacement for a damaged windshield. You can choose to stick with an OEM part, but any difference in cost will have to come out of pocket.

High-Risk Insurance

If you have a poor driving record, you might face difficulties in finding insurance coverage. The Office of the Insurance Commissioner of Washington State recommends you shop around to seek insurance coverage.

However, in the event, you are denied coverage by the voluntary market, you can contact the Automobile Insurance Plan (AIP) to get an insurance provider assigned to you. Premium rates under the AIP are generally higher than the voluntary market, and you will have to submit an SR-22 form with the Washington State Department of Licensing (DOL).

An SR-22 form is submitted to the DOL on your behalf by the insurer and proves you have valid liability insurance for a designated period.

To avoid these hassles, stay safe and follow the laws on Washington roads.

Low Income Auto Insurance Washington State

Currently, Washington doesn’t offer a specific plan for low-cost insurance.

The best bet for cheaper rates, according to the Office of Insurance Commissioner, is to shop around. You can also check out if you qualify for any discounts, here’s a quick tip guide.

Automobile Insurance Fraud in Washington

Insurance fraud can be (and is) committed by any party involved in insurance transactions — applicants, policyholders, providers, or professional service firms and health care providers working on behalf of the needs of claimants.

The insurance industry estimates that from 2013-2017, the annual cost of property and casualty insurance fraud was $30 billion.

Auto insurance fraud includes the filing of the intentionally false claim amounts, staged accidents, submitting claims for accidents that didn’t happen, and providing incorrect information on an insurance application. While it may seem like only companies suffer from fraud, consumers face a lot of the consequences.

Losses from fraud end up passed on to the cost premiums. That means a part of your monthly dues go to covering the false statements of other claimants and companies. Rates can be exceptionally high in ZIP codes where fraud is more common.

In Washington, per the state legislature, fraudulent claims are considered a gross misdemeanor or a class C felony if the claim amount is more than $1,500.

If you come across a person, provider, or situation that seems fraudulent, you can report to the Office of the Insurance Commissioner.

Statute of Limitations

A statute of limitations is the amount of time you have from the time of an accident to bring your lawsuit and claim to court.

Washington permits three years from the date and time of the accident to the filing.

If the driver or a passenger dies after the accident (before the end of the three years), an exception is made. In this case, the statute of limitations timeline starts on the date of death.

Comparative Negligence

Washington is a “pure comparative fault” state. This means if you choose to take an at-fault driver to court, and you are found to be partly responsible for the accident, the amount of damages you recover will be reduced by the percentage that you are at fault.

For example, if the other driver ran a red light, but you turned right on red somewhere it is prohibited, a judge or jury will decide the percentage of fault each driver had in the accident.

What are the vehicle licensing laws?

Maintaining a valid license is an essential component of driving throughout the U.S. Let’s find out about Washington’s licensing requirements for various demographics.

REAL ID

The Federal REAL ID Act was passed in 2005 and will come into effect in October 2020. From October 1, 2020, onward, citizens will need a REAL ID-compliant ID to board domestic flights, enter federal buildings, or cross U.S. border crossings.

But what is a REAL ID-compliant ID, and do Washingtonians need an Enhanced Driver’s License?

If you possess any of the following documents, you already in compliance with REAL ID:

- U.S. Passport

- Foreign Passport

- U.S. Military ID

- Permanent Resident Card (Green Card)

In case you do not have any of the above documents, you should opt into an Enhanced Driver License (EDL). To apply for the EDL, you need to carry this documentation to a nearby Driver Licensing Office.

Penalties for Driving Without Insurance

If caught driving without insurance, you could be fined upwards of $550. If you cause a collision and cannot cover damages in the absence of liability insurance, you may have your driver’s license suspended.

Aside from the penalties, drivers put themselves in substantial financial risk if they get into an accident without having insurance. If you are at fault, you will be personally responsible for all costs of damages and/or injuries.

Don’t get caught with hundreds or thousands of dollars to pay out of pocket. Compare quotes and find a policy right for you.

Teen Driver Laws

| YOUNG DRIVER LICENSING LAWS | AGE RESTRICTIONS | PASSENGER RESTRICTIONS | PASSENGER RESTRICTIONS |

|---|---|---|---|

| Learner's Permit | 15 and 6 months or 15 with driver's education | Supervised driving and family members only | 1 a.m. - 5 a.m. (secondarily enforced) |

| Provisional License | 6-month holding period; completion of driver's education if under 18; supervised driving of 50 hours, 10 of which must be at night | First 6 months: no passengers under 20 Second 6 months; no more than 3 passengers under 20 (secondarily enforced) | 1 a.m. - 5 a.m. (secondarily enforced) |

| Full License | 16; completion of driver's education if under 18; with a violation, must wait until 18 | Lifted at age 17 | Lifted after 12 months or age 18 (minimum age 17) |

In Washington, just like most other states in the union, teen drivers have to follow some particular rules and jump through some hoops before legally being allowed behind the wheel.

In 2016, 2,433 teenagers between the age of 16 and 19 were killed in motor vehicle accidents, and 292,742 received emergency treatments as a result of injuries.

With such high rates of teen accidents, it’s no wonder rates are so high and lawmakers are more strict when it comes to teenage driving regulations.

Older Driver License Renewal Procedures

Older drivers don’t have to do much extra to get a license renewal in the state of Washington than the general population. Here’s a table of all the requirements:

| RENEWAL PROCEDURES | GENERAL POPULATION | OLDER POPULATION |

|---|---|---|

| License renewal cycle | 6 years | 6 years |

| Mail or online renewal permitted | both, every other renewal | not permitted 70 and older |

| Proof of adequate vision required at renewal | every renewal | 70 and older, every renewal |

Mostly, the policies are the same. The only difference is that after the age of 70, drivers will need to complete their license renewals in person rather than by mail or online.

New Residents

Welcome to the Evergreen State, new residents. Now that you’re here, soon enough you’ll be enjoying the outdoorsy activities, food capitals, and perfect weather this beautiful state offers.

But, before you hit the roads, you need to sort out your new Washington driver’s license.

The law states as a new resident, you must get a Washington driver’s license within 30 days of the date you became a resident. The good news is that drivers can exchange valid out-of-state licenses for a Washington driver license — no tests needed!

For non-citizens, the licensing process is identical to the described process above.

However, when you head to the Department of Licensing offices, bring along your residency paperwork (including visa, residency status documents, etc.). To apply for a standard Washington driver’s license, drivers need:

- Proof of your identity

- Proof of Washington residence

- To pass a written knowledge test and driving test (if you have a medical condition)

- To pass a vision exam

Not every Department of Licensing offices administers both the written knowledge and driving test.

What are the rules of the road?

Washington’s driving laws keep you safe and help keep rates at a happy low cost.

Let’s check them out.

Fault vs. No-Fault

As we mentioned above, Washington follows the Pure Comparative Negligence at-fault system. To refresh, what is Pure Comparative Negligence?

In Washington, drivers are only liable to cover their percentage of fault.

The at-fault driver can also recover damages from you in proportion to the percentage of your responsibility for an accident.

Take this example: a driver merges into your lane without indication and hits you – they might be deemed at fault for the accident. Suppose you take this driver to court, and the judge finds you partially responsible due to speeding. Consequently, your accident settlement may be reduced according to the percentage of your fault for the accident.

Seat Belt & Car Seat Laws

Seat belts are vital in keeping passengers safe in case of an accident.

Washington law requires all people 16 or older driving or riding in a car to wear seatbelts. Washington follows primary enforcement for seat belt laws, meaning a police officer can pull you over if they see you or your passengers riding without a seatbelt. The base fine for the first offense is $124.

In early 2019, the child restraint legislation was amended to include the following:

| AGE | TYPE OF SEAT |

|---|---|

| 2 years or younger | Rear-facing car seats |

| 4 years or younger | Forward-facing child harness seat |

| 4 years and older | Older than 4 but less 57 inches tall should use booster seats |

| 12 years and older | If the height is more than 47 inches should use adult seats with lap and shoulder seat belts |

If you are looking for a car seat for your child, check out this buying guide from consumer reports:

Keep Right & Move Over Laws

If driving below the average speed of traffic, Washington drivers must keep right unless turning left or passing on the left.

Washington’s move over laws also requires drivers to vacate the lane closest to emergency vehicles and tow trucks.

If unable to move into another lane, drivers must slow down within 200 feet of the vehicle and are not permitted to speed up until 200 feet past the vehicle.

Speed Limits

The maximum posted speed limits in Washington are 70 mph (60 mph for trucks) on rural interstates, 60 mph on urban interstates, 60 mph on limited-access roads, and 60 mph on all other roads.

Certain rural interstates may have 75 mph speed limits posted if based on traffic and engineering studies.

Of course, these are maximums. Please follow all posted speed limits to avoid ticketing.

Ridesharing

Rideshare services like Uber and Lyft require all their drivers to maintain personal car insurance policies. These must meet, at the minimum, coverages required by Washington law.

If a driver wishes to obtain special coverage, which can keep them covered when driving for a rideshare service (but without an active passenger in the vehicle), there are five companies to choose from in Washington.

For specialized rideshare coverage, drivers can contact Allstate, Metlife, Metromile, State Farm, and USAA.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS), “automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera, and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Currently, Washington is testing automated vehicles per a June 2017 executive order. Operators are not required to be in the vehicle, but if there is an operator present in the car, they must be licensed and carry liability insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the safety laws?

In this section, we’ll look into laws on distracted and impaired driving and some other pertinent info to stay safe on Washington roadways.

DUI Laws

In Washington, the first through fourth driving-under-the-influence offenses are considered misdemeanors. A fifth violation is regarded as a felony. The lookback period is seven years.

| Offense | Prison Time | Fines |

|---|---|---|

| First Offense | Jail Time: 1 day Electronic home monitoring of 15 days or 30 days in 24/7 Sobriety Program | $350 to $5,000 |

| Second Offense | Jail Time: 30 days | $500 to $5,000 |

| Third Offense | Jail Time: 90 days | $1,000 to $5,000 |

Washington is one of 10 states requiring a treatment and/or prevention education program after a first offense.

Marijuana-Impaired Driving Laws

The Washington State Liquor and Cannabis Board states that if you are 21 years or older, it is illegal for you to drive with five ng/ml of THC or more.

For drivers 21 years or younger, Washington State has a zero-tolerance policy for driving with any amount of THC in your system.

Because it is difficult to determine your ng/mL based on how high you feel, and THC can stay in your system for hours after consumption, the best way to safely operate a motor vehicle without taking the chance of being issued a DUI is to avoid recreational use of marijuana altogether. Consider public transport or ridesharing services.

For cannabis users who plan to drive, the Washington State Liquor and Cannabis Board provides some guidance: published research says that for some, it can take up to three hours for THC levels to drop below five ng/ml after using marijuana — or longer, depending on body size.

The Board also reports some people may still exhibit impaired behavior with less than five ng/ml of THC in their blood.

The Board encourages marijuana smokers or vapors to wait five hours at least before getting behind the wheel. For those who use marijuana edibles, they recommend waiting 10 hours, because THC can remain in your system much longer.

In a 2014 Washington roadside survey conducted by the Pacific Institute for Research & Evaluation, 44 percent of the drivers reported driving within two hours of using marijuana in the past year.

Distracted Driving Laws

While some state’s distracted driving laws are vague, like “no texting,” others are more specific. Washington has precise laws. Essentially, drivers can receive citations for engaging in any activity not related to the operation of the vehicle if it makes them a dangerous driver.

Drivers are prohibited from holding any personal electronic device or using fingers to interact with a device. One-touch activation of an app or function is the sole exception.

Don’t be tempted to check your email or texts while stopped in traffic or at a traffic light. Effective July 2017, drivers are not permitted to touch devices while stationary on a public highway.

How bad is vehicle theft in Washington?

Insurers also consider theft and accident data in your locale when calculating premiums. While driving involves inherent risk, knowing about theft and accident data can help you stay safe.

These are the top 10 stolen cars in Washington:

| Vehicle | Total Thefts (2016) |

|---|---|

| Honda Accord | 3,757 |

| Honda Civic | 3,113 |

| Ford Pickup (Full Size) | 745 |

| Acura Integra | 640 |

| Toyota Camry | 602 |

| Subaru Legacy | 599 |

| Chevrolet Pickup (Full Size) | 562 |

| Jeep Cherokee/Grand Cherokee | 362 |

| Toyota Corolla | 332 |

| Nissan Sentra | 296 |

The most stolen car in Washington is a 1997 Honda Accord.

The following data, sourced from the FBI, shows the number of vehicle thefts in Washington cities in 2018.

| CITY | MOTOR VEHICLE THEFT |

|---|---|

| Aberdeen | 61 |

| Airway Heights | 28 |

| Algona | 2 |

| Anacortes | 20 |

| Arlington | 107 |

| Auburn2 | 653 |

| Bainbridge Island | 7 |

| Battle Ground | 23 |

| Bellevue | 309 |

| Bellingham | 164 |

| Bingen | 1 |

| Black Diamond | 0 |

| Blaine | 9 |

| Bonney Lake | 58 |

| Bothell | 106 |

| Bremerton | 200 |

| Brier | 1 |

| Buckley | 0 |

| Burien3 | 543 |

| Camas | 36 |

| Carnation3 | 6 |

| Castle Rock | 2 |

| Centralia | 115 |

| Chehalis | 32 |

| Cheney | 23 |

| Chewelah | 3 |

| Cle Elum | 3 |

| Clyde Hill | 2 |

| College Place | 20 |

| Colville | 5 |

| Connell | 1 |

| Cosmopolis | 1 |

| Covington3 | 60 |

| Darrington | 4 |

| Des Moines | 242 |

| Dupont | 5 |

| Duvall | 3 |

| East Wenatchee | 14 |

| Eatonville | 6 |

| Edgewood | 38 |

| Edmonds | 71 |

| Ellensburg | 49 |

| Elma | 12 |

| Enumclaw | 24 |

| Ephrata | 22 |

| Everett | 938 |

| Everson | 1 |

| Federal Way | 944 |

| Ferndale | 24 |

| Fife | 161 |

| Fircrest | 7 |

| Forks | 2 |

| Gig Harbor | 23 |

| Gold Bar | 4 |

| Goldendale | 7 |

| Grand Coulee | 13 |

| Grandview | 28 |

| Granite Falls | 18 |

| Hoquiam | 21 |

| Ilwaco | 5 |

| Issaquah | 103 |

| Kalama | 4 |

| Kelso | 45 |

| Kenmore3 | 44 |

| Kennewick | 189 |

| Kent | 1,314 |

| Kettle Falls | 1 |

| Kirkland | 226 |

| Kittitas | 0 |

| La Center | 7 |

| Lacey | 126 |

| Lake Forest Park | 23 |

| Lake Stevens | 80 |

| Lakewood | 378 |

| Liberty Lake | 17 |

| Long Beach | 11 |

| Longview | 142 |

| Lynden | 4 |

| Lynnwood | 180 |

| Mabton | 6 |

| Maple Valley3 | 37 |

| Marysville | 301 |

| Mattawa | 11 |

| Medina | 0 |

| Mercer Island | 22 |

| Mill Creek | 45 |

| Milton | 46 |

| Monroe | 49 |

| Montesano | 2 |

| Morton | 1 |

| Moses Lake | 85 |

| Mossyrock | 1 |

| Mountlake Terrace | 86 |

| Mount Vernon | 121 |

| Moxee | 1 |

| Mukilteo | 49 |

| Napavine | 6 |

| Newcastle3 | 25 |

| Normandy Park | 17 |

| North Bend | 9 |

| Oak Harbor | 27 |

| Oakville | 0 |

| Ocean Shores | 2 |

| Odessa | 1 |

| Olympia | 204 |

| Oroville | 0 |

| Orting | 15 |

| Othello | 30 |

| Pacific | 38 |

| Pasco | 167 |

| Port Angeles | 55 |

| Port Orchard | 66 |

| Port Townsend | 11 |

| Poulsbo | 27 |

| Prosser | 16 |

| Pullman | 10 |

| Puyallup | 226 |

| Quincy | 15 |

| Raymond | 0 |

| Reardan | 1 |

| Redmond | 111 |

| Renton | 881 |

| Richland | 51 |

| Ridgefield | 12 |

| Ritzville | 5 |

| Roy | 3 |

| Royal City | 7 |

| Ruston | 11 |

| Sammamish3 | 39 |

| SeaTac3 | 471 |

| Seattle | 3,630 |

| Sedro Woolley | 24 |

| Selah | 10 |

| Sequim | 11 |

| Shelton | 46 |

| Shoreline3 | 176 |

| Snohomish | 50 |

| Snoqualmie | 9 |

| Soap Lake | 2 |

| South Bend | 1 |

| Spokane | 1,737 |

| Spokane Valley | 435 |

| Stanwood | 22 |

| Steilacoom | 9 |

| Sultan | 15 |

| Sumas | 2 |

| Sumner | 65 |

| Sunnyside | 52 |

| Tacoma | 2,086 |

| Tenino | 3 |

| Toledo | 0 |

| Toppenish | 70 |

| Tumwater | 96 |

| Twisp | 2 |

| Union Gap | 39 |

| University Place | 88 |

| Vancouver | 1,063 |

| Walla Walla | 66 |

| Wapato | 54 |

| Warden | 17 |

| Washougal | 18 |

| Wenatchee | 48 |

| West Richland | 6 |

| White Salmon | 4 |

| Winlock | 3 |

| Winthrop | 0 |

| Woodinville3 | 53 |

| Woodland | 22 |

| Woodway | 0 |

| Yakima | 564 |

| Yelm | 30 |

| Zillah | 3 |

How many road fatalities occur in Washington?

In this section, we will analyze some of the data on driving fatalities in Washington.

Most Fatal Highway in Washington

The Washington section of the I-5 is the busiest and most dangerous in the state. On average, 25 fatal crashes are reported each year. The highway has seen 245 crashes and 258 fatalities in its history.

Fatal Crashes by Weather Condition & Light Condition

Light and driving conditions can also increase the risk of accidents.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 198 | 88 | 88 | 28 | 1 | 403 |

| Rain | 27 | 16 | 17 | 1 | 0 | 61 |

| Snow/Sleet | 6 | 4 | 5 | 1 | 0 | 16 |

| Other | 2 | 3 | 7 | 0 | 1 | 13 |

| Unknown | 15 | 9 | 13 | 2 | 4 | 43 |

| Total | 248 | 120 | 130 | 32 | 6 | 536 |

Though some may be surprised that most accidents happen in daylight, this is when the majority of drivers are on the road. In comparison to the percentage of drivers operating vehicles at night, crashes are statistically more likely.

Fatalities (All Crashes) by County

Next, we compare the counties’ fatal crash rates.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams County | 5 | 8 | 11 | 5 | 10 |

| Asotin County | 0 | 0 | 1 | 2 | 1 |

| Benton County | 9 | 10 | 11 | 22 | 15 |

| Chelan County | 7 | 8 | 6 | 6 | 2 |

| Clallam County | 6 | 4 | 6 | 7 | 11 |

| Clark County | 20 | 35 | 24 | 20 | 28 |

| Columbia County | 0 | 0 | 1 | 0 | 0 |

| Cowlitz County | 14 | 9 | 7 | 5 | 12 |

| Douglas County | 2 | 7 | 3 | 6 | 1 |

| Ferry County | 4 | 1 | 2 | 4 | 2 |

| Franklin County | 6 | 6 | 5 | 8 | 10 |

| Garfield County | 0 | 2 | 0 | 0 | 2 |

| Grant County | 24 | 13 | 17 | 19 | 16 |

| Grays Harbor County | 7 | 4 | 5 | 7 | 10 |

| Island County | 6 | 1 | 9 | 5 | 5 |

| Jefferson County | 3 | 3 | 8 | 2 | 2 |

| King County | 80 | 83 | 109 | 100 | 111 |

| Kitsap County | 8 | 16 | 18 | 21 | 17 |

| Kittitas County | 3 | 3 | 8 | 19 | 12 |

| Klickitat County | 8 | 4 | 1 | 2 | 3 |

| Lewis County | 5 | 6 | 14 | 13 | 14 |

| Lincoln County | 1 | 2 | 6 | 5 | 3 |

| Mason County | 12 | 8 | 8 | 7 | 6 |

| Okanogan County | 7 | 9 | 6 | 10 | 11 |

| Pacific County | 3 | 0 | 1 | 5 | 0 |

| Pend Oreille County | 5 | 4 | 3 | 3 | 2 |

| Pierce County | 42 | 48 | 66 | 73 | 57 |

| San Juan County | 0 | 1 | 1 | 1 | 0 |

| Skagit County | 10 | 11 | 14 | 8 | 11 |

| Skamania County | 0 | 4 | 8 | 3 | 2 |

| Snohomish County | 32 | 33 | 53 | 44 | 42 |

| Spokane County | 36 | 29 | 36 | 26 | 41 |

| Stevens County | 7 | 10 | 9 | 8 | 4 |

| Thurston County | 14 | 15 | 14 | 17 | 19 |

| Wahkiakum County | 0 | 0 | 1 | 1 | 0 |

| Walla Walla County | 4 | 11 | 7 | 5 | 2 |

| Whatcom County | 18 | 15 | 11 | 12 | 25 |

| Whitman County | 4 | 4 | 6 | 5 | 8 |

| Yakima County | 24 | 35 | 35 | 30 | 48 |

Much like other states, Washington’s largest counties have the highest fatality rates.

Fatalities by Person Type

Here, we look at fatalities broken down by type of person: meaning what kind of vehicle they were driving or if they were a pedestrian.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 183 | 177 | 230 | 192 | 190 |

| Light Truck - Pickup | 52 | 56 | 67 | 54 | 63 |

| Light Truck - Utility | 42 | 46 | 43 | 64 | 64 |

| Light Truck - Van | 10 | 17 | 17 | 19 | 25 |

| Large Truck | 5 | 5 | 3 | 10 | 9 |

| Other/Unknown Occupants | 9 | 4 | 9 | 6 | 8 |

| Total Occupants | 301 | 307 | 375 | 348 | 362 |

| Light Truck - Other | 0 | 1 | 1 | 3 | 3 |

| Bus | 0 | 1 | 5 | 0 | 0 |

| Total Motorcyclists | 73 | 69 | 75 | 81 | 80 |

| Pedestrian | 49 | 75 | 84 | 83 | 103 |

| Bicyclist and Other Cyclist | 11 | 7 | 14 | 17 | 14 |

| Other/Unknown Nonoccupants | 2 | 4 | 3 | 7 | 6 |

| Total Nonoccupants | 62 | 86 | 101 | 107 | 123 |

| Total | 436 | 462 | 551 | 536 | 565 |

The vast majority of accidents involve a passenger vehicle. Motorcycle fatalities are the second most common, accidents involving pickup trucks following closely behind.

Fatalities by Crash Type

Shockingly, single-car accidents are the second-leading cause of traffic fatalities.

| Crash Type | Number of Fatalities (2017) |

|---|---|

| Single Vehicle | 340 |

| Involving a Large Truck | 77 |

| Involving Speeding | 172 |

| Involving a Rollover | 101 |

| Involving a Roadway Departure | 306 |

| Involving an Intersection (or Intersection Related) | 122 |

Stay vigilant when driving by yourself.

Five-Year Trend For the Top 10 Counties

Unfortunately, the state totals of traffic fatalities have been on a steady rise for the last five years.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| King County | 80 | 83 | 109 | 100 | 111 |

| Pierce County | 42 | 48 | 66 | 73 | 57 |

| Yakima County | 24 | 35 | 35 | 30 | 48 |

| Snohomish County | 32 | 33 | 53 | 44 | 42 |

| Spokane County | 36 | 29 | 36 | 26 | 41 |

| Clark County | 20 | 35 | 24 | 20 | 28 |

| Whatcom County | 18 | 15 | 11 | 12 | 25 |

| Thurston County | 14 | 15 | 14 | 17 | 19 |

| Kitsap County | 8 | 16 | 18 | 21 | 17 |

| Grant County | 24 | 13 | 17 | 19 | 16 |

| Top Ten Counties | 304 | 322 | 386 | 374 | 404 |

| All Other Counties | 132 | 140 | 165 | 162 | 161 |

| All Counties | 436 | 462 | 551 | 536 | 565 |

Some of the more rural counties, like Grant County, have seen a slight decrease over the same period.

Fatalities Involving Speeding by County

Speeding continues to be a problem across the country. See the next table for data on fatalities involving speeding.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 1 | 1 | 4 | 0 | 4 |

| Asotin | 0 | 0 | 1 | 0 | 0 |

| Benton | 2 | 1 | 0 | 7 | 4 |

| Chelan | 3 | 2 | 2 | 1 | 0 |

| Clallam | 0 | 1 | 0 | 1 | 0 |

| Clark | 13 | 10 | 7 | 4 | 9 |

| Columbia | 0 | 0 | 1 | 0 | 0 |

| Cowlitz | 8 | 2 | 1 | 3 | 4 |

| Douglas | 1 | 2 | 0 | 2 | 0 |

| Ferry | 1 | 0 | 2 | 1 | 1 |

| Franklin | 1 | 5 | 1 | 4 | 1 |

| Garfield | 0 | 0 | 0 | 0 | 1 |

| Grant | 6 | 1 | 4 | 5 | 4 |

| Grays Harbor | 1 | 1 | 2 | 1 | 3 |

| Island | 1 | 0 | 3 | 1 | 2 |

| Jefferson | 1 | 1 | 1 | 0 | 0 |

| King | 30 | 38 | 37 | 30 | 41 |

| Kitsap | 8 | 9 | 9 | 7 | 5 |

| Kittitas | 1 | 1 | 2 | 4 | 3 |

| Klickitat | 2 | 0 | 0 | 1 | 1 |

| Lewis | 3 | 1 | 1 | 3 | 2 |

| Lincoln | 1 | 1 | 0 | 1 | 0 |

| Mason | 0 | 4 | 1 | 5 | 1 |

| Okanogan | 2 | 3 | 4 | 2 | 1 |

| Pacific | 1 | 0 | 0 | 2 | 0 |

| Pend Oreille | 5 | 2 | 2 | 2 | 1 |

| Pierce | 26 | 17 | 22 | 19 | 22 |

| San Juan | 0 | 0 | 1 | 0 | 0 |

| Skagit | 5 | 6 | 3 | 1 | 3 |

| Skamania | 0 | 2 | 2 | 0 | 1 |

| Snohomish | 17 | 13 | 14 | 16 | 17 |

| Spokane | 10 | 7 | 5 | 5 | 10 |

| Stevens | 2 | 4 | 3 | 1 | 2 |

| Thurston | 7 | 7 | 7 | 6 | 5 |

| Wahkiakum | 0 | 0 | 0 | 1 | 0 |

| Walla Walla | 0 | 3 | 0 | 0 | 1 |

| Whatcom | 12 | 4 | 4 | 6 | 12 |

| Whitman | 2 | 2 | 3 | 3 | 1 |

| Yakima | 11 | 11 | 8 | 9 | 10 |

King and Pierce Counties, two of the largest in the state have the most speeding fatalities. Generally, across the nation, the more drivers are in an area, the more likely a speeding fatality becomes.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Here, we look at the rates of alcohol-impaired driver accident fatalities.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 0 | 0 | 1 | 1 | 2 |

| Asotin | 0 | 0 | 1 | 2 | 0 |

| Benton | 1 | 3 | 3 | 8 | 5 |

| Chelan | 2 | 1 | 1 | 2 | 0 |

| Clallam | 2 | 2 | 0 | 5 | 2 |

| Clark | 9 | 10 | 8 | 6 | 8 |

| Columbia | 0 | 0 | 0 | 0 | 0 |

| Cowlitz | 5 | 1 | 3 | 1 | 2 |

| Douglas | 1 | 2 | 0 | 2 | 1 |

| Ferry | 2 | 1 | 1 | 2 | 0 |

| Franklin | 2 | 3 | 1 | 1 | 4 |

| Garfield | 0 | 0 | 0 | 0 | 1 |

| Grant | 6 | 4 | 5 | 7 | 5 |

| Grays Harbor | 2 | 1 | 0 | 2 | 2 |

| Island | 1 | 0 | 3 | 0 | 2 |

| Jefferson | 0 | 1 | 1 | 1 | 0 |

| King | 31 | 27 | 31 | 25 | 41 |

| Kitsap | 4 | 4 | 4 | 4 | 4 |

| Kittitas | 1 | 0 | 4 | 2 | 2 |

| Klickitat | 1 | 1 | 0 | 0 | 0 |

| Lewis | 4 | 2 | 4 | 2 | 4 |

| Lincoln | 0 | 0 | 0 | 1 | 1 |

| Mason | 2 | 2 | 3 | 4 | 2 |

| Okanogan | 2 | 6 | 3 | 3 | 3 |

| Pacific | 1 | 0 | 0 | 2 | 0 |

| Pend Oreille | 2 | 2 | 2 | 2 | 1 |

| Pierce | 22 | 15 | 15 | 26 | 21 |

| San Juan | 0 | 1 | 1 | 0 | 0 |

| Skagit | 3 | 5 | 4 | 1 | 4 |

| Skamania | 0 | 1 | 5 | 0 | 1 |

| Snohomish | 11 | 3 | 14 | 13 | 10 |

| Spokane | 10 | 10 | 13 | 11 | 9 |

| Stevens | 4 | 2 | 2 | 2 | 3 |

| Thurston | 2 | 3 | 4 | 6 | 6 |

| Wahkiakum | 0 | 0 | 0 | 1 | 0 |

| Walla Walla | 1 | 2 | 1 | 2 | 1 |

| Whatcom | 4 | 4 | 1 | 3 | 8 |

| Whitman | 0 | 0 | 1 | 2 | 2 |

| Yakima | 13 | 14 | 7 | 10 | 21 |

Once again, King and Pierce Counties hold the top spot. If you live in a densely populated area take caution when driving on the roads, especially late at night when drunk driving is most common.

Teen Drinking & Driving

In 2017, Washington police arrested 167 teens for driving under the influence. This number grew from 121 arrests in 2016.

Some good news: in 2016, Washington saw 0.7 under-21, alcohol-impaired driving fatalities per 100,000 population.

This is significantly less than the national average of 1.2 deaths per 100,000 population.

| Teens and Drunk Driving | Data |

|---|---|

| Under 21 Alcohol-Impaired Driving Fatalities Per 100K Population | 0.7 |

| Higher/Lower Than National Average (1.2) | Lower |

| DUI Arrest (Under 18 years old) | 121 |

| Rank in US | 29th |

| DUI Arrests (Under 18 years old) Total Per Million People | 74.26 |

As the table above shows, compared to other states, Washington ranks 29th in the nation for DUI arrests amongst teens per million. However, fatality rates for teens who drink and drive are slightly higher than the national average.

EMS Response Time

Depending on where an accident happens, EMS arrival times can vary widely.

| Type of Road | Time of Crash to Notification | Arrival | Arrival at Scene to Hospital | Time of Crash to Hospital |

|---|---|---|---|---|

| Rural | 5 minutes | 14 minutes | 45 minutes | 1 hour, 3 minutes |

| Urban | 4 minutes | 8 minutes | 33 minutes | 35 minutes |

Like most of the country, rural accidents face longer wait times and arrivals at hospitals.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the transportation situation in Washington?

Chances are, If you live in Washington, you are part of a two-to-three-car household. You also most likely drive alone to work and spend 10-34 minutes commuting.

These next sections all feature data sourced from DataUSA.

Car Ownership

On average, households in Washington owns two cars, on par with the national average.

Commute Time

Washington ranked above the national average commute of 25.3 minutes in 2017, with an average commute time of 26.1 minutes, and 3.01 percent of Washington residents suffer a “super commute,” spending 90 minutes or more in the car.

Commuter Transportation

As per DataUSA, almost 72 percent of commuters in Washington drive alone to work, a bit less than the national average of 76 percent.

Traffic Congestion

As 84 percent of Washington residents live in urban areas, traffic can be tough in the Evergreen State.

Seatle ranked sixth in the U.S. for worst traffic, according to the INRIX Scorecard. Seattle drivers sit in traffic for 138 hours per year — equating to $1,932 annually per driver.

The average speed is just under 22 mph during peak commute hours in Seattle. During off-peak times, the average speed is just over 39 mph.

What is Washington’s car culture like?

Subarus reign supreme in Washington. With so much outdoor terrain to explore, these cars make a perfect fit for comfort, safety, and adventure. If they aren’t using all-wheel-drive to drive through rugged terrain, Washingtonians are likely lowering their carbon footprint and hitting the roads in electric cars.

Survey data showed one out of 10 car owners in Seattle and Spokane own a Subaru. That’s a considerable increase compared to the national average of one out of every 35.

Washingtonians care so much for the planet, they set a goal to get 50,000 electric cars on the road by 2020. Residents reached the halfway point in June 2017, showing a 36 percent increase from the prior year.

The effort put Washington into the number-one spot for electric car motorists nationwide.

Regardless of what you drive, you’re going to need to meet the state’s minimum car insurance requirements. Let’s take a look.

You did it!

We made it through everything you need to know about driving in Washington. So get out there and enjoy driving safely. If you’re ready to begin comparing third party car insurance WA, click below to get quotes and start saving on affordable Washington auto insurance.