Oregon Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 12.70

Question: Do you ford the river or try to walk across?

That’s a critical question in one of the most popular games for young children in the 90’s Oregon Trail.

The Oregon Trail serves as a seminal moment in Oregon’s history when thousands of Americans traveled across the country to settle in the Pacific Northwest.

Today, Oregon is home to one of the most culturally-rich cities in the country in Portland and has all the ecological and geographical beauty rivaling any other state.

Crater Lake, Mount Hood, the Valley of the Giants…there’s a reason Oregon was named “Top Moving Destination” in 2013 and ’14.

But we’re here to talk about something a little less fancy than beautiful vistas in the natural world.

Something, however, that is quite important. It protects you from financial losses, sometimes small, sometimes large. Most importantly, it doesn’t have to cost you a bundle.

We’re here to talk about car insurance.

If you’re on this page, you’re likely looking for car insurance for yourself, a family member, or a friend. And you may have found that researching car insurance can be, well, confusing.

All those technical terms—deductibles, premiums, GAP coverage, comprehensive vs collision—may leave you wanting to hit your head against a wall.

We understand.

We boil down the concepts into easy-to-understand ways to take your car insurance and make it better. We also cover important aspects specific to Oregon which highway is the most dangerous, for instance, or which cars thieves are stealing the most.

Grab your keys and hop in the car. We’re going to take a drive.

Ready to compare rates? Try our FREE online tool.

What Should You Expect from Oregon Car Insurance and Coverage Rates?

If you’ve ever talked to a car insurance agent—or even browsed a company’s website—you’ve probably encountered some strange terms. Many people just want cheap car insurance that makes sense for them, and instead they get a bunch of industry lingo.

There’s everything from GAP coverage to collision insurance, It seems designed, by its very nature, to be confusing. Some companies created online calculator that will make suggestions offering you basic, moderate, and advanced coverage (for example). They might fill in bodily injury liability and property damage with progressively higher numbers and include collision and comprehensive coverage on 2 of the 3 quotes. There are still some things many drivers want to understand before they buy.

In this section, you’ll encounter all those terms with explanations as well as numerous topics that will help you get a better understanding of car insurance in Oregon.

If you’ve ever wondered what rates were in different zip codes in Oregon, how rates differ by being male or female, what core coverage costs in Oregon, this section is for you.

Oregon’s Car Culture

It may be difficult to ascertain a state’s car culture in a single glance but one thing is clear: Oregon likes to race.

With over 10 race tracks spread out across Oregon, and quite a few in its largest city Portland, racing whether on dirt tracks, short loops, or more complex tracks is popular.

And just south of Portland in Wilsonville is the World of Speed Motorsports Museum, where you can learn about all things motorsports from drag racing to NASCAR.

There’s also the history of Portland being the destination of the first transcontinental race in 1905.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Is Oregon’s Minimum Coverage Requirement?

Most states require someone to have car insurance before they are legally able to drive. Generally, states that are more flexible still require other proof of financial responsibility. In other words, they want to see that you can cover a reasonable amount of liability per person if you cause an accident.

Not knowing the minimum insurance coverage limits of your state can lead to a fine, license suspension, and possibly being labeled as a high-risk driver if you have under it and are caught.

NOLO, which is one of the foremost legal authorities on the internet, advises the minimum insurance requirements for Oregon are stricter than some states. If followed, it offers more protection if you’re in an accident. There’s the liability coverage, which is 25/50/25.

- Bodily injury liability – $25,000 per person (the maximum amount payable to one person)/$50,000 per accident (the maximum amount payable to all people injured in one accident). Bodily injury liability provides coverage for claims brought against you for bodily injury caused to another person through the operation of your vehicle.

- Property damage liability – $25,000 per accident. Property damage liability provides coverage for claims brought against you for damage caused to someone else’s property through the operation of your vehicle. Also covers damage to a car you rent for personal use on a short-term basis.

- Uninsured/underinsured motorist coverage – $25,000 per person and $50,000 per accident. This protects insured parties in the event that they’re hit by an uninsured or underinsured driver. You can buy these coverages stacked or unstacked depending on how much coverage you want overall.

- PIP (personal injury protection) – $15,000 per person. This covers your injuries in the event of an accident. You can get more protection for yourself and your passengers by raising your PIP limits.

Now, what does this all mean?

Liability coverages occur when you are found responsible for an accident. When you are, you (and your insurance company) are responsible for the financial damages caused in that accident.

That means broken windshields, busted street signs, and even the other person’s (or persons’) medical bills. (For more information, read our “Is a broken side mirror covered by car insurance?“).

Uninsured motorist coverage occurs when you are hit by someone who doesn’t have insurance. Because they might not be able to pay for the damage to your car, this insurance covers the cost of the damage.

As the Insurance Information Institute notes, this can be a major issue in Oregon as 12.7 percent of drivers are uninsured.

However, you might ask, what happens if I get hit by an uninsured motorist and I have medical bills? That’s where PIP comes in.

It covers your medical bills (and lost wages) in the event you get in an accident and the other person’s coverage doesn’t cover all of them or they don’t have coverage at all.

Forms of Financial Responsibility

If you’re in an accident or pulled over for a moving violation, the officer is likely to ask for proof of insurance. In Oregon, it’s simple to prove you have insurance, but there are just two options.

According to Oregon Statute 742.447, proof of insurance means two things:

- A physical copy of an insurance card

- An electronic copy of an insurance card

The electronic card option has been around since 2013.

You might ask: if I show my insurance card through my cell phone, will police have the right to search it?

As Allstate notes, consumer rights and privacy activists have raised this concern.

Thankfully, no, according to Oregon Statute 806.011:

The use of an electronic device to display proof of insurance does not constitute consent for a police officer to access other contents of the electronic device.

Failure to provide proof of insurance is a Class B Traffic Violation, with a presumptive fine of $260.

Premiums as a Percentage of Income

Sometimes it’s not enough to know what the average premium in a state like Oregon is. The state is large, and there are a lot of income levels.

Therefore, we, here at CarInsurance.org, have a handy statistic that tells how much someone is paying for their car insurance, as a percentage of their disposable income.

The following information comes from a company we work with called Quadrant, which supplies data from the top property and casualty insurance companies in the United States.

According to the data, from 2012 to 2014, the average Oregonian had disposable income between $34,000 and $37,000. Full coverage cost varied between $820 and $900.

| Premiums as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Oregon | 2.36% | 2.48% | 2.45% |

| Nationwide | 2.34% | 2.43% | 2.40% |

When the average full coverage premium is divided by the disposable income, Oregonians spend between 2.36 and 2.48 percent of their income on insurance.

This is fairly comparable to the nationwide averages.

| Premiums as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Washington | 2.07% | 2.13% | 2.11% |

| California | 2.10% | 2.20% | 2.16% |

| Idaho | 2.02% | 2.01% | 2.00% |

However, both are significantly more than the amount paid in Oregon’s neighboring states.

Many factors can go into this, including the driving behaviors of Oregonians versus residents of other states, vehicle theft rates, the number of road fatalities, and more.

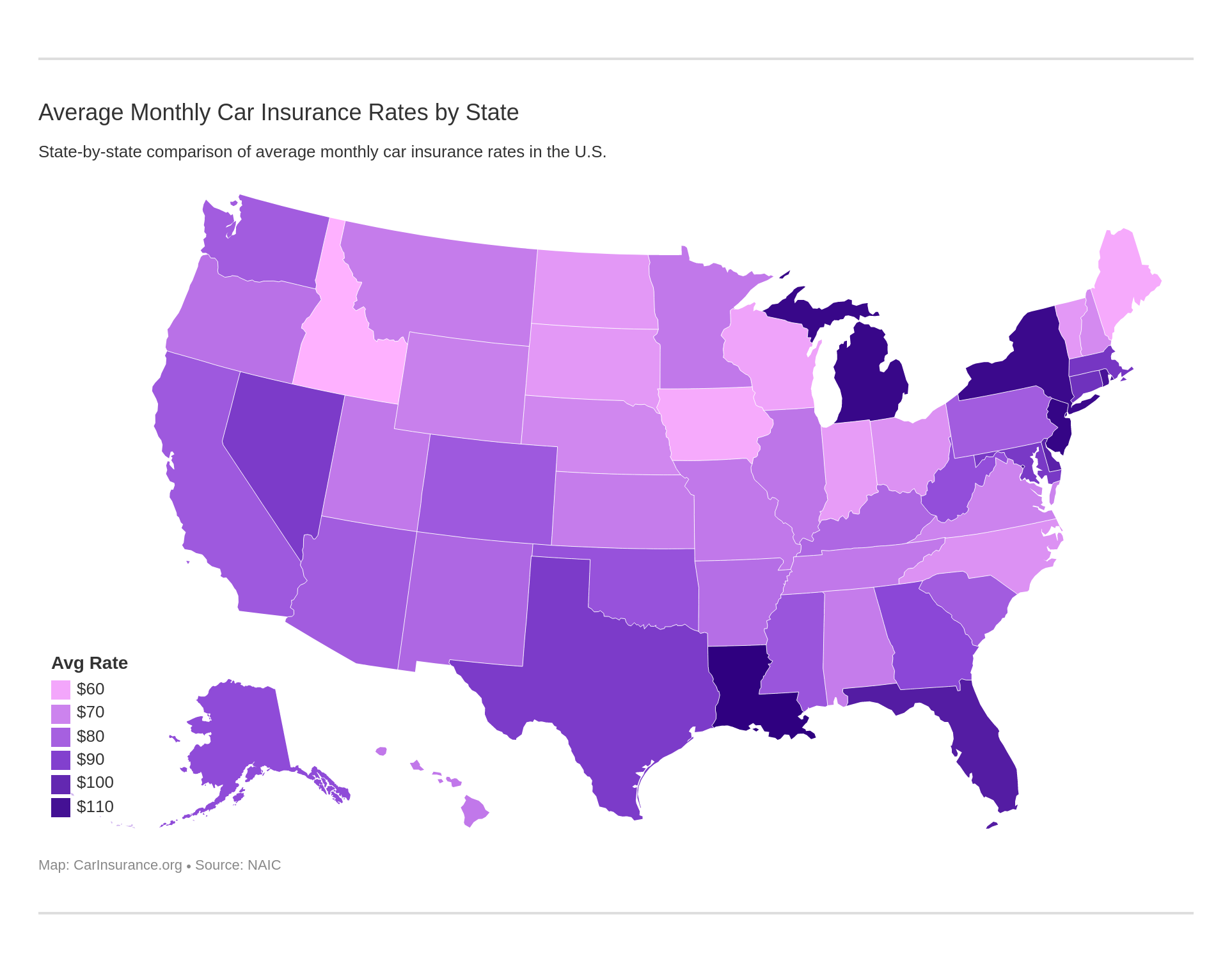

Average Monthly Car Insurance Rates in OR (Liability, Collision, Comprehensive)

Core coverage is just that—the centerpieces to your policy that protect you from almost anything (certainly most common situations).

It’s built out of three parts: liability, comprehensive, and collision.

- Liability keeps you from paying out of pocket for damages in an accident you caused

- Comprehensive covers the cost of repairs to your car from anything other than an accident

- Collision covers the cost of repairs to your car when you are in an accident

Generally, liability is the most expensive, followed by collision, and then comprehensive.

| Core Coverage Insurance Costs | Oregon | National Average |

|---|---|---|

| Liability | $584.13 | $538.73 |

| Collision | $226.83 | $322.61 |

| Comprehensive | $93.87 | $194.99 |

| Combined | $904.83 | $1056.33 |

Oregon is a full $150 less than the national average, which bodes well.

Additional Coverage

When it comes to car insurance coverages beyond core coverage, there are a few options.

Three of those options are medical payment (Med Pay), personal injury protection (PIP), and uninsured/underinsured motorist.

- Med Pay covers your medical bills in the event of an accident

- PIP takes it a step further and covers your lost wages in addition to your medical bills

- Uninsured/Underinsured Motorist covers you when you’re hit by someone who doesn’t have insurance—and can’t pay.

When looking at these three optional insurance coverages, it can be helpful to look at something called the loss ratio to determine how many claims a company is paying out.

These statistics are taken from the National Association of Insurance Commissioners (NAIC), a leading authority when it comes to specific insurance companies and statistics.

For loss ratio, anything between 50 percent and 100 percent is solid with 60 percent to 80 percent being the sweet spot.

Anything over 100 percent and the company is losing money. Anything below 50 percent and the company might have overpriced their policies.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payment (Med Pay) | 124.89 | 116.36 | 115.5 |

| Personal Injury Protection (PIP) | 68.9 | 65.04 | 71.3 |

| Uninsured/Underinsured Motorist | 64.68 | 72.79 | 76.53 |

Both PIP and Uninsured/Underinsured Motorist are solid. However, Med Pay is well over 100 percent.

This means that the cost of paying claims is exceeding the amount of money gained from writing premiums.

Add-ons, Endorsements, and Riders

There are other optional coverages as well, including some that are helpful in a pinch.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

There is one coverage on that list that can help with more than just auto insurance: Personal Umbrella Policy (PUP).

This increases your overall liability coverage limits, whether you cause a significant auto accident or have a dog that bites someone.

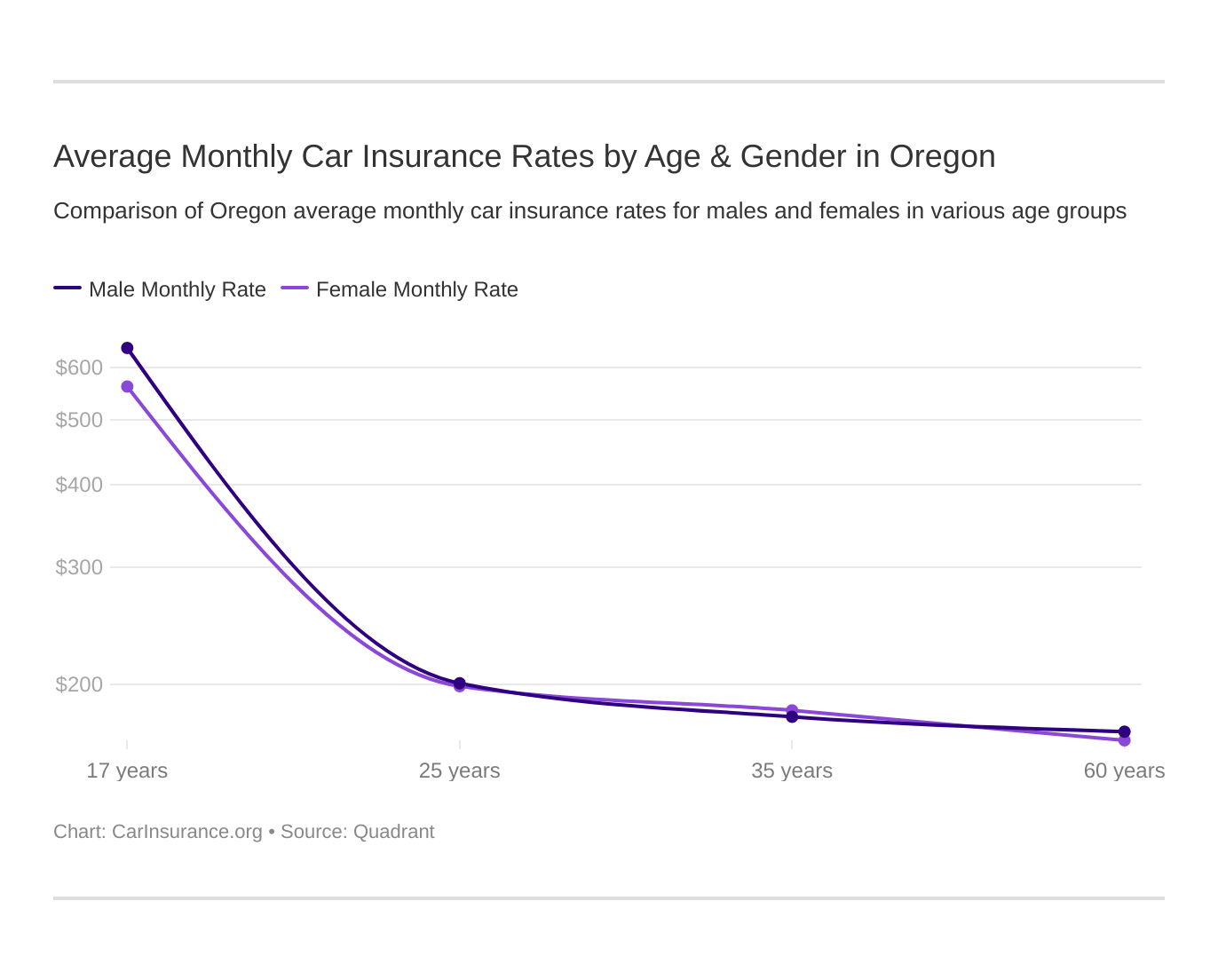

Average Monthly Car Insurance Rates by Age & Gender in OR

Being male or female affects your rates, as insurance companies believe that women are safer drivers than men.

Statistics back this up: The Insurance Institute for Highway Safety did a study looking at 2015 accident data according to gender and found that 71 percent of fatalities were men.

Men typically drive more miles than women and more often engage in risky driving practices including not using safety belts, driving while impaired by alcohol, and speeding.

So, how does this impact Oregon drivers?

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Blank | $1,914.64 | $1,904.00 | $1,723.47 | $1,794.06 | $5,037.55 | $6,279.58 | $2,206.08 | $2,312.57 |

| Allstate F&C | $3,116.60 | $2,896.79 | $2,841.32 | $2,868.61 | $9,332.73 | $10,401.52 | $3,262.94 | $3,277.55 |

| American Family Mutual | $2,304.32 | $2,304.32 | $2,054.19 | $2,054.19 | $5,697.93 | $8,930.71 | $2,304.32 | $2,413.79 |

| Farmers Ins Co Of OR | $2,069.68 | $2,024.02 | $1,829.43 | $1,945.91 | $8,559.72 | $8,752.78 | $2,317.92 | $2,376.37 |

| Geico Cas | $2,392.62 | $2,311.56 | $2,226.68 | $2,240.44 | $6,189.22 | $5,642.07 | $2,548.10 | $2,200.85 |

| Safeco Ins Co of OR | $2,776.95 | $2,928.21 | $2,411.66 | $2,679.41 | $8,850.63 | $9,545.05 | $2,670.62 | $2,692.84 |

| NICOA | $2,222.89 | $2,212.78 | $1,980.76 | $2,071.14 | $5,087.37 | $6,359.30 | $2,592.14 | $2,729.36 |

| Progressive Universal | $1,926.67 | $1,745.84 | $1,672.83 | $1,722.85 | $8,277.50 | $9,124.21 | $2,301.66 | $2,177.58 |

| State Farm Mutual Auto | $1,618.73 | $1,618.73 | $1,481.05 | $1,481.05 | $5,136.09 | $6,447.93 | $1,836.59 | $2,105.82 |

| Standard Fire Insurance Co | $1,887.50 | $1,902.25 | $1,699.83 | $1,768.58 | $5,296.68 | $6,424.93 | $1,969.94 | $2,002.27 |

| USAA CIC | $1,608.07 | $1,560.55 | $1,590.69 | $1,535.96 | $4,886.29 | $5,247.50 | $2,068.24 | $2,149.86 |

The statistics bear this out. Across the board, the highest rates are for 17-year-old males, while the lowest rates are for 60-year-old women.

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Allstate F&C | Single 17-year old male | $10,401.52 | 1 |

| Safeco Ins Co of OR | Single 17-year old male | $9,545.05 | 2 |

| Allstate F&C | Single 17-year old female | $9,332.73 | 3 |

| Progressive Universal | Single 17-year old male | $9,124.21 | 4 |

| American Family Mutual | Single 17-year old male | $8,930.71 | 5 |

| Safeco Ins Co of OR | Single 17-year old female | $8,850.63 | 6 |

| Farmers Ins Co Of OR | Single 17-year old male | $8,752.78 | 7 |

| Farmers Ins Co Of OR | Single 17-year old female | $8,559.72 | 8 |

| Progressive Universal | Single 17-year old female | $8,277.50 | 9 |

| State Farm Mutual Auto | Single 17-year old male | $6,447.93 | 10 |

| Standard Fire Insurance Co | Single 17-year old male | $6,424.93 | 11 |

| NICOA | Single 17-year old male | $6,359.30 | 12 |

| Blank | Single 17-year old male | $6,279.58 | 13 |

| Geico Cas | Single 17-year old female | $6,189.22 | 14 |

| American Family Mutual | Single 17-year old female | $5,697.93 | 15 |

| Geico Cas | Single 17-year old male | $5,642.07 | 16 |

| Standard Fire Insurance Co | Single 17-year old female | $5,296.68 | 17 |

| State Farm Mutual Auto | Single 17-year old female | $5,136.09 | 18 |

| NICOA | Single 17-year old female | $5,087.37 | 19 |

| Blank | Single 17-year old female | $5,037.55 | 20 |

| Allstate F&C | Single 25-year old male | $3,277.55 | 21 |

| Allstate F&C | Single 25-year old female | $3,262.94 | 22 |

| Allstate F&C | Married 35-year old female | $3,116.60 | 23 |

| Safeco Ins Co of OR | Married 35-year old male | $2,928.21 | 24 |

| Allstate F&C | Married 35-year old male | $2,896.79 | 25 |

| Allstate F&C | Married 60-year old male | $2,868.61 | 26 |

| Allstate F&C | Married 60-year old female | $2,841.32 | 27 |

| Safeco Ins Co of OR | Married 35-year old female | $2,776.95 | 28 |

| NICOA | Single 25-year old male | $2,729.36 | 29 |

| Safeco Ins Co of OR | Single 25-year old male | $2,692.84 | 30 |

| Safeco Ins Co of OR | Married 60-year old male | $2,679.41 | 31 |

| Safeco Ins Co of OR | Single 25-year old female | $2,670.62 | 32 |

| NICOA | Single 25-year old female | $2,592.14 | 33 |

| Geico Cas | Single 25-year old female | $2,548.10 | 34 |

| American Family Mutual | Single 25-year old male | $2,413.79 | 35 |

| Safeco Ins Co of OR | Married 60-year old female | $2,411.66 | 36 |

| Geico Cas | Married 35-year old female | $2,392.62 | 37 |

| Farmers Ins Co Of OR | Single 25-year old male | $2,376.37 | 38 |

| Farmers Ins Co Of OR | Single 25-year old female | $2,317.92 | 39 |

| Blank | Single 25-year old male | $2,312.57 | 40 |

| Geico Cas | Married 35-year old male | $2,311.56 | 41 |

| American Family Mutual | Married 35-year old female | $2,304.32 | 42 |

| American Family Mutual | Married 35-year old male | $2,304.32 | 42 |

| American Family Mutual | Single 25-year old female | $2,304.32 | 42 |

| Progressive Universal | Single 25-year old female | $2,301.66 | 45 |

| Geico Cas | Married 60-year old male | $2,240.44 | 46 |

| Geico Cas | Married 60-year old female | $2,226.68 | 47 |

| NICOA | Married 35-year old female | $2,222.89 | 48 |

| NICOA | Married 35-year old male | $2,212.78 | 49 |

| Blank | Single 25-year old female | $2,206.08 | 50 |

| Geico Cas | Single 25-year old male | $2,200.85 | 51 |

| Progressive Universal | Single 25-year old male | $2,177.58 | 52 |

| State Farm Mutual Auto | Single 25-year old male | $2,105.82 | 53 |

| NICOA | Married 60-year old male | $2,071.14 | 54 |

| Farmers Ins Co Of OR | Married 35-year old female | $2,069.68 | 55 |

| American Family Mutual | Married 60-year old female | $2,054.19 | 56 |

| American Family Mutual | Married 60-year old male | $2,054.19 | 56 |

| Farmers Ins Co Of OR | Married 35-year old male | $2,024.02 | 58 |

| Standard Fire Insurance Co | Single 25-year old male | $2,002.27 | 59 |

Why age?

Insurance companies believe that if you’re younger (particularly between 17 and 24), you’re less experienced as a driver and more likely to engage in risky behavior.

There is a small push to get rid of using gender as a determining factor for car insurance rates.

Experts believe this will push rates toward the middle so that women will pay more and men will pay less. 17-year-old boys should receive the most benefit.

Rates in Oregon’s 10 Largest Cities

Car insurance rates vary according to the city as well. The reason is that car insurance companies look at the likelihood to file a claim when setting rates.

The rate at which a city’s residents have accidents, get tickets or have their cars stolen all impact the general rate for a city.

The following population information was taken from World Population Review.

| City | Population | County | Rates |

|---|---|---|---|

| Portland | 667,589 | Clackamas | $4,296.40 |

| Salem | 177,019 | Marion | $3,723.10 |

| Eugene | 175,803 | Lane | $3,063.60 |

| Gresham | 114,835 | Multnomah | $4,503.13 |

| Hillsboro | 122,427 | Washington | $3,853.16 |

| Beaverton | 102,177 | Washington | $3,970.31 |

| Bend | 103,962 | Deschutes | $3,103.20 |

| Medford | 85,518 | Jackson | $3,091.18 |

| Springfield | 65,301 | Henry | $3,149.09 |

| Corvallis | 59,081 | Benton | $4,280.75 |

Generally, bigger cities have higher rates than smaller cities or rural areas, though this is not always the case.

A case in point would be Gresham, which has a higher average premium than Portland, with just a one-sixth of its population size.

The lowest on this list is Eugene with the third-most population size.

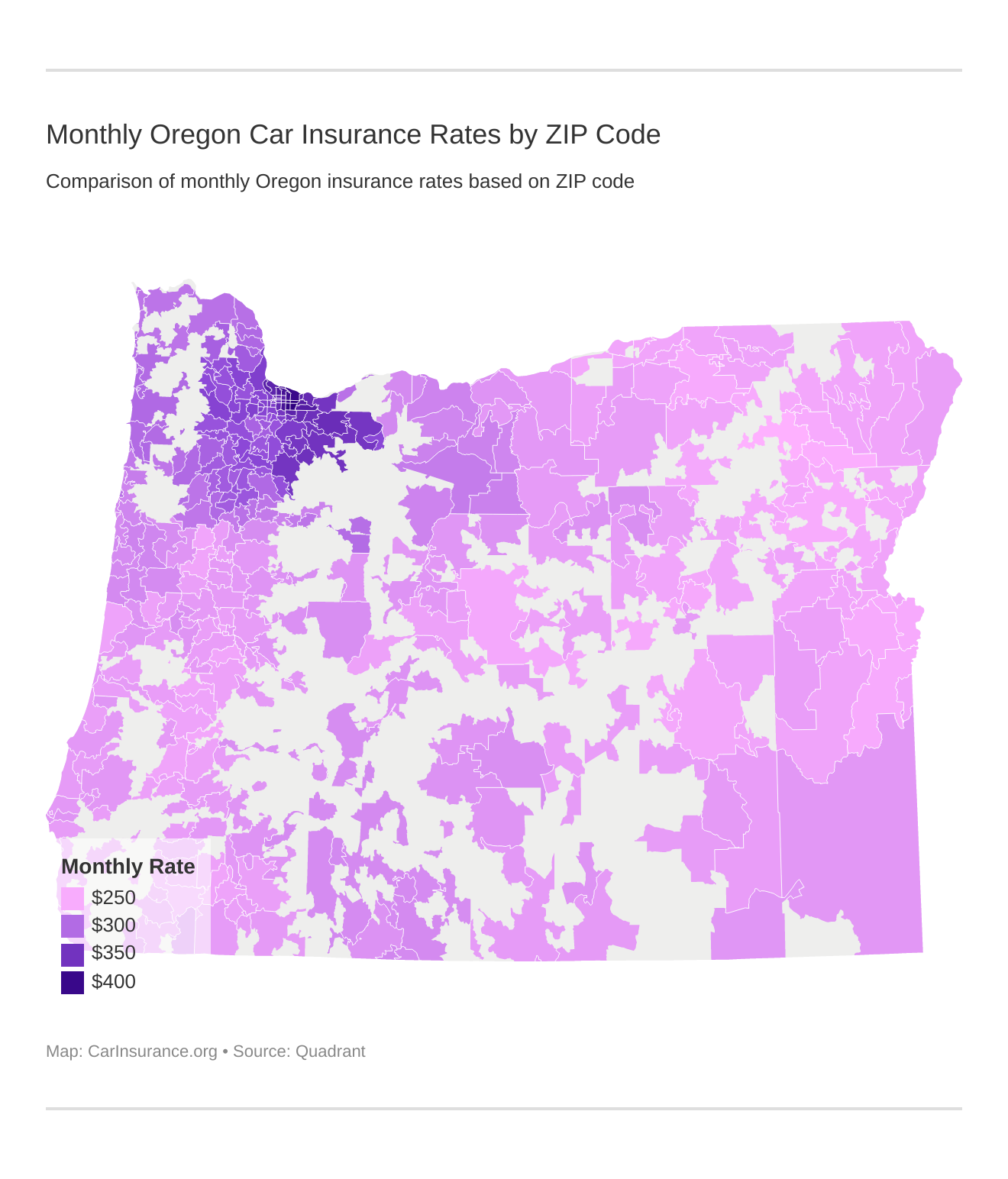

Cheapest Rates by ZIP Code

Your car insurance rate can vary depending on which ZIP code you live in.

This is for the same reason rates in cities vary: Actuaries attempt to predict the number of claims each year by zipcode and set rates accordingly.

| Most Expensive ZIP Codes in Oregon | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 97236 | PORTLAND | $4,908.54 | Allstate | $5,782.60 | Liberty Mutual | $5,661.06 | USAA | $2,996.88 | Geico | $4,370.90 |

| 97233 | PORTLAND | $4,879.89 | Liberty Mutual | $5,703.38 | Allstate | $5,474.80 | USAA | $3,363.24 | Geico | $4,394.08 |

| 97266 | PORTLAND | $4,879.16 | Liberty Mutual | $5,712.95 | Allstate | $5,465.51 | USAA | $3,087.87 | Geico | $4,394.08 |

| 97230 | PORTLAND | $4,798.11 | Allstate | $5,857.67 | Liberty Mutual | $5,741.60 | USAA | $3,274.95 | State Farm | $4,023.41 |

| 97216 | PORTLAND | $4,786.62 | Liberty Mutual | $5,710.85 | Allstate | $5,707.26 | USAA | $3,028.60 | Travelers | $4,100.87 |

| 97220 | PORTLAND | $4,750.30 | Liberty Mutual | $5,698.92 | Allstate | $5,578.29 | USAA | $3,028.60 | Travelers | $4,031.94 |

| 97218 | PORTLAND | $4,666.61 | Liberty Mutual | $5,754.02 | Allstate | $5,626.35 | USAA | $3,289.55 | Geico | $3,826.42 |

| 97206 | PORTLAND | $4,660.64 | Liberty Mutual | $5,773.06 | Allstate | $5,669.04 | USAA | $3,216.99 | Geico | $3,832.06 |

| 97211 | PORTLAND | $4,562.34 | Allstate | $5,851.02 | Liberty Mutual | $5,742.16 | USAA | $3,033.79 | Geico | $3,767.19 |

| 97215 | PORTLAND | $4,538.22 | Allstate | $5,841.08 | Liberty Mutual | $5,752.02 | USAA | $3,049.18 | State Farm | $3,765.55 |

| 97030 | GRESHAM | $4,530.67 | Allstate | $5,865.83 | Liberty Mutual | $5,505.50 | USAA | $3,154.31 | State Farm | $3,821.03 |

| 97080 | GRESHAM | $4,516.29 | Allstate | $5,782.60 | Liberty Mutual | $5,483.47 | USAA | $2,962.46 | Geico | $3,944.10 |

| 97213 | PORTLAND | $4,466.19 | Allstate | $5,851.02 | Liberty Mutual | $5,658.97 | USAA | $3,049.18 | Geico | $3,725.49 |

| 97203 | PORTLAND | $4,447.21 | Allstate | $5,800.34 | Liberty Mutual | $5,316.10 | USAA | $3,005.93 | Geico | $3,725.49 |

| 97024 | FAIRVIEW | $4,436.31 | Allstate | $5,857.67 | Liberty Mutual | $5,522.75 | USAA | $3,154.31 | State Farm | $3,782.98 |

| 97086 | HAPPY VALLEY | $4,429.53 | Liberty Mutual | $5,703.12 | Allstate | $5,503.60 | USAA | $2,996.88 | State Farm | $3,712.10 |

| 97217 | PORTLAND | $4,413.23 | Allstate | $5,800.34 | Liberty Mutual | $5,181.26 | USAA | $3,106.33 | Geico | $3,450.53 |

| 97212 | PORTLAND | $4,371.73 | Allstate | $5,851.02 | Liberty Mutual | $5,703.36 | USAA | $3,046.69 | Geico | $3,765.67 |

| 97202 | PORTLAND | $4,353.56 | Allstate | $5,841.08 | Farmers | $5,463.28 | USAA | $3,022.62 | Geico | $3,734.01 |

| 97060 | TROUTDALE | $4,342.93 | Allstate | $5,814.37 | Liberty Mutual | $5,413.34 | USAA | $3,040.93 | State Farm | $3,642.90 |

| 97227 | PORTLAND | $4,322.28 | Allstate | $5,851.02 | Liberty Mutual | $5,496.16 | USAA | $2,972.83 | Geico | $3,430.64 |

| 97089 | DAMASCUS | $4,310.96 | Allstate | $5,503.60 | Farmers | $5,017.98 | USAA | $2,962.46 | Geico | $3,595.29 |

| 97010 | BRIDAL VEIL | $4,298.84 | Allstate | $5,865.83 | Liberty Mutual | $5,248.54 | USAA | $2,860.84 | State Farm | $3,312.38 |

| 97055 | SANDY | $4,281.70 | Allstate | $5,865.83 | Liberty Mutual | $5,008.93 | USAA | $3,025.65 | State Farm | $3,537.30 |

| 97009 | BORING | $4,251.54 | Allstate | $5,548.53 | Farmers | $5,033.00 | USAA | $2,860.84 | State Farm | $3,369.54 |

There have been instances where two neighbors in different ZIP codes have different rates—sometimes hundreds of dollars worth.

Some U.S. reps have gone so far as to draft legislation abolishing this practice.

| Cheapest ZIP Codes in Oregon | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 97850 | LA GRANDE | $2,953.60 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,090.46 | Travelers | $2,170.40 |

| 97883 | UNION | $2,977.42 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,106.65 | Travelers | $2,233.29 |

| 97814 | BAKER CITY | $3,001.96 | Allstate | $4,267.33 | Liberty Mutual | $3,778.56 | State Farm | $2,168.88 | Travelers | $2,396.87 |

| 97914 | ONTARIO | $3,007.22 | Allstate | $4,267.33 | Liberty Mutual | $3,758.49 | State Farm | $2,238.81 | USAA | $2,307.45 |

| 97918 | VALE | $3,009.25 | Allstate | $4,267.33 | Liberty Mutual | $3,764.81 | State Farm | $2,217.80 | USAA | $2,307.45 |

| 97824 | COVE | $3,010.45 | Allstate | $4,267.33 | Liberty Mutual | $3,647.03 | State Farm | $2,126.04 | Travelers | $2,202.86 |

| 97801 | PENDLETON | $3,011.07 | Allstate | $4,267.33 | Liberty Mutual | $3,563.87 | State Farm | $2,229.13 | Travelers | $2,465.98 |

| 97859 | MEACHAM | $3,015.05 | Allstate | $4,267.33 | Liberty Mutual | $3,585.86 | Travelers | $2,276.14 | State Farm | $2,280.15 |

| 97913 | NYSSA | $3,016.37 | Allstate | $4,267.33 | Liberty Mutual | $3,765.91 | State Farm | $2,224.92 | USAA | $2,307.45 |

| 97867 | NORTH POWDER | $3,018.90 | Allstate | $4,267.33 | Liberty Mutual | $3,748.20 | Travelers | $2,178.01 | State Farm | $2,187.18 |

| 97841 | IMBLER | $3,025.25 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,115.80 | Travelers | $2,216.69 |

| 97820 | CANYON CITY | $3,025.33 | Allstate | $4,267.33 | Liberty Mutual | $3,639.63 | State Farm | $2,280.15 | USAA | $2,369.88 |

| 97876 | SUMMERVILLE | $3,029.90 | Allstate | $4,267.33 | Liberty Mutual | $3,667.90 | State Farm | $2,146.14 | Travelers | $2,228.17 |

| 97819 | BRIDGEPORT | $3,030.22 | Allstate | $4,267.33 | Liberty Mutual | $3,874.82 | Travelers | $2,278.06 | State Farm | $2,280.15 |

| 97880 | UKIAH | $3,030.50 | Allstate | $4,267.33 | Liberty Mutual | $3,648.13 | Travelers | $2,234.80 | State Farm | $2,280.15 |

| 97870 | RICHLAND | $3,033.13 | Allstate | $4,267.33 | Liberty Mutual | $3,884.16 | State Farm | $2,310.69 | Travelers | $2,318.29 |

| 97833 | HAINES | $3,036.74 | Allstate | $4,267.33 | Liberty Mutual | $3,773.47 | Travelers | $2,206.06 | State Farm | $2,224.38 |

| 97877 | SUMPTER | $3,038.47 | Allstate | $4,267.33 | Liberty Mutual | $3,900.47 | State Farm | $2,280.15 | Travelers | $2,294.11 |

| 97905 | DURKEE | $3,040.56 | Allstate | $4,267.33 | Liberty Mutual | $3,848.77 | Travelers | $2,264.88 | State Farm | $2,280.15 |

| 97754 | PRINEVILLE | $3,041.45 | Liberty Mutual | $3,688.59 | Allstate | $3,589.44 | State Farm | $2,332.45 | USAA | $2,540.44 |

| 97738 | HINES | $3,041.62 | Allstate | $4,727.79 | Liberty Mutual | $3,748.20 | State Farm | $2,191.69 | Travelers | $2,251.62 |

| 97818 | BOARDMAN | $3,043.38 | Allstate | $4,267.33 | Liberty Mutual | $3,848.36 | State Farm | $2,327.10 | Travelers | $2,386.93 |

| 97827 | ELGIN | $3,044.26 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,146.14 | Travelers | $2,307.56 |

| 97479 | SUTHERLIN | $3,044.45 | Liberty Mutual | $3,946.48 | Allstate | $3,933.63 | State Farm | $2,219.39 | USAA | $2,363.60 |

| 97834 | HALFWAY | $3,046.41 | Allstate | $4,267.33 | Liberty Mutual | $3,890.44 | Travelers | $2,296.88 | State Farm | $2,380.44 |

Look to see how your rates match up per your ZIP code and other ZIP codes. You might end up wanting to abolish the ZIP code practice too.

Cheapest Rates by City

In this table, we’ve pulled together data from cities and insurance companies: Essentially, what each insurance company is charging in your city.

| Most Expensive Cities in Oregon | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Maywood Park | $4,750.30 | Liberty Mutual | $5,698.92 | Allstate | $5,578.29 | USAA | $3,028.60 | Travelers | $4,031.94 |

| Gresham | $4,726.70 | Allstate | $5,752.70 | Liberty Mutual | $5,619.00 | USAA | $3,150.37 | State Farm | $4,163.67 |

| Fairview | $4,436.31 | Allstate | $5,857.67 | Liberty Mutual | $5,522.75 | USAA | $3,154.31 | State Farm | $3,782.98 |

| Happy Valley | $4,429.53 | Liberty Mutual | $5,703.12 | Allstate | $5,503.60 | USAA | $2,996.88 | State Farm | $3,712.10 |

| Troutdale | $4,342.93 | Allstate | $5,814.37 | Liberty Mutual | $5,413.34 | USAA | $3,040.93 | State Farm | $3,642.90 |

| Portland | $4,315.24 | Allstate | $5,732.23 | Liberty Mutual | $5,322.54 | USAA | $2,932.74 | Geico | $3,669.55 |

| Damascus | $4,310.96 | Allstate | $5,503.60 | Farmers | $5,017.98 | USAA | $2,962.46 | Geico | $3,595.29 |

| Bridal Veil | $4,298.84 | Allstate | $5,865.83 | Liberty Mutual | $5,248.54 | USAA | $2,860.84 | State Farm | $3,312.38 |

| Sandy | $4,281.70 | Allstate | $5,865.83 | Liberty Mutual | $5,008.93 | USAA | $3,025.65 | State Farm | $3,537.30 |

| Boring | $4,251.54 | Allstate | $5,548.53 | Farmers | $5,033.00 | USAA | $2,860.84 | State Farm | $3,369.54 |

| Clackamas | $4,220.48 | Allstate | $5,270.25 | Farmers | $5,164.30 | USAA | $2,962.46 | State Farm | $3,582.78 |

| Eagle Creek | $4,214.68 | Allstate | $5,358.66 | Liberty Mutual | $5,207.17 | USAA | $2,844.93 | State Farm | $3,547.67 |

| Estacada | $4,200.61 | Allstate | $5,673.25 | Liberty Mutual | $5,173.44 | USAA | $2,860.84 | State Farm | $3,570.65 |

| Welches | $4,186.59 | Allstate | $5,865.83 | Farmers | $4,990.88 | USAA | $2,860.84 | State Farm | $3,155.29 |

| Brightwood | $4,182.88 | Allstate | $5,865.83 | Farmers | $4,838.29 | USAA | $2,860.84 | State Farm | $3,312.38 |

| Milwaukie | $4,174.20 | Farmers | $5,177.68 | Allstate | $5,137.74 | USAA | $2,914.03 | Travelers | $3,490.77 |

| Molalla | $4,171.20 | Allstate | $5,410.11 | Farmers | $4,926.99 | USAA | $2,958.61 | Travelers | $3,452.72 |

| Rhododendron | $4,162.53 | Allstate | $5,865.83 | Farmers | $4,920.48 | USAA | $2,860.84 | State Farm | $3,126.15 |

| Mulino | $4,149.58 | Allstate | $5,725.75 | Farmers | $5,080.44 | USAA | $2,958.61 | Travelers | $3,336.50 |

| Beavercreek | $4,119.60 | Allstate | $5,581.98 | Farmers | $4,954.21 | USAA | $2,844.93 | State Farm | $3,401.99 |

| Marylhurst | $4,059.09 | Allstate | $5,503.60 | Liberty Mutual | $4,823.25 | USAA | $2,729.08 | State Farm | $3,312.38 |

| Oak Grove | $4,058.14 | Allstate | $5,137.74 | Farmers | $5,088.29 | USAA | $3,039.25 | Travelers | $3,328.53 |

| Beaverton | $4,023.12 | Allstate | $5,331.96 | Liberty Mutual | $4,980.72 | USAA | $2,767.48 | State Farm | $3,405.82 |

| Gladstone | $4,014.25 | Allstate | $5,137.74 | Liberty Mutual | $4,813.85 | USAA | $3,039.25 | Travelers | $3,362.22 |

| Aloha | $3,989.37 | Allstate | $5,231.84 | Liberty Mutual | $4,810.17 | USAA | $2,777.79 | Travelers | $3,412.14 |

These tables run from highest to lowest per price, which gives you a good idea of which companies are charging the most.

| Cheapest Cities in Oregon | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| La Grande | $2,953.60 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,090.46 | Travelers | $2,170.40 |

| Union | $2,977.42 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,106.65 | Travelers | $2,233.29 |

| Baker City | $3,001.96 | Allstate | $4,267.33 | Liberty Mutual | $3,778.56 | State Farm | $2,168.88 | Travelers | $2,396.87 |

| Ontario | $3,007.22 | Allstate | $4,267.33 | Liberty Mutual | $3,758.49 | State Farm | $2,238.81 | USAA | $2,307.45 |

| Vale | $3,009.25 | Allstate | $4,267.33 | Liberty Mutual | $3,764.81 | State Farm | $2,217.80 | USAA | $2,307.45 |

| Cove | $3,010.45 | Allstate | $4,267.33 | Liberty Mutual | $3,647.03 | State Farm | $2,126.04 | Travelers | $2,202.86 |

| Mission | $3,011.07 | Allstate | $4,267.33 | Liberty Mutual | $3,563.87 | State Farm | $2,229.13 | Travelers | $2,465.98 |

| Meacham | $3,015.05 | Allstate | $4,267.33 | Liberty Mutual | $3,585.86 | Travelers | $2,276.14 | State Farm | $2,280.15 |

| Nyssa | $3,016.37 | Allstate | $4,267.33 | Liberty Mutual | $3,765.91 | State Farm | $2,224.92 | USAA | $2,307.45 |

| North Powder | $3,018.90 | Allstate | $4,267.33 | Liberty Mutual | $3,748.20 | Travelers | $2,178.01 | State Farm | $2,187.18 |

| Imbler | $3,025.25 | Allstate | $4,267.33 | Liberty Mutual | $3,645.90 | State Farm | $2,115.80 | Travelers | $2,216.69 |

| Canyon City | $3,025.33 | Allstate | $4,267.33 | Liberty Mutual | $3,639.63 | State Farm | $2,280.15 | USAA | $2,369.88 |

| Summerville | $3,029.90 | Allstate | $4,267.33 | Liberty Mutual | $3,667.90 | State Farm | $2,146.14 | Travelers | $2,228.17 |

| Bridgeport | $3,030.22 | Allstate | $4,267.33 | Liberty Mutual | $3,874.82 | Travelers | $2,278.06 | State Farm | $2,280.15 |

| Dale | $3,030.50 | Allstate | $4,267.33 | Liberty Mutual | $3,648.13 | Travelers | $2,234.80 | State Farm | $2,280.15 |

| Richland | $3,033.13 | Allstate | $4,267.33 | Liberty Mutual | $3,884.16 | State Farm | $2,310.69 | Travelers | $2,318.29 |

| Haines | $3,036.74 | Allstate | $4,267.33 | Liberty Mutual | $3,773.47 | Travelers | $2,206.06 | State Farm | $2,224.38 |

| Granite | $3,038.46 | Allstate | $4,267.33 | Liberty Mutual | $3,900.47 | State Farm | $2,280.15 | Travelers | $2,294.11 |

| Durkee | $3,040.55 | Allstate | $4,267.33 | Liberty Mutual | $3,848.77 | Travelers | $2,264.88 | State Farm | $2,280.15 |

| Prineville | $3,041.45 | Liberty Mutual | $3,688.59 | Allstate | $3,589.44 | State Farm | $2,332.45 | USAA | $2,540.44 |

| Hines | $3,041.62 | Allstate | $4,727.79 | Liberty Mutual | $3,748.20 | State Farm | $2,191.69 | Travelers | $2,251.62 |

| Boardman | $3,043.38 | Allstate | $4,267.33 | Liberty Mutual | $3,848.36 | State Farm | $2,327.10 | Travelers | $2,386.93 |

| Elgin | $3,044.26 | Allstate | $4,267.33 | Liberty Mutual | $3,689.90 | State Farm | $2,146.14 | Travelers | $2,307.56 |

| Sutherlin | $3,044.45 | Liberty Mutual | $3,946.48 | Allstate | $3,933.63 | State Farm | $2,219.39 | USAA | $2,363.60 |

| Jamieson | $3,047.01 | Allstate | $4,267.33 | Liberty Mutual | $3,720.33 | State Farm | $2,280.15 | USAA | $2,307.45 |

Best Oregon Car Insurance Companies

You’ve probably been in this scenario. It’s the end of the month and the letter comes in. You know, that letter—the one with the colors and logo of your car insurance company.

Maybe you’ve gotten a ticket or a recent fender-bender. You open it, fingers crossed, then see the numbers in bold. You say, how did they get that?

We understand.

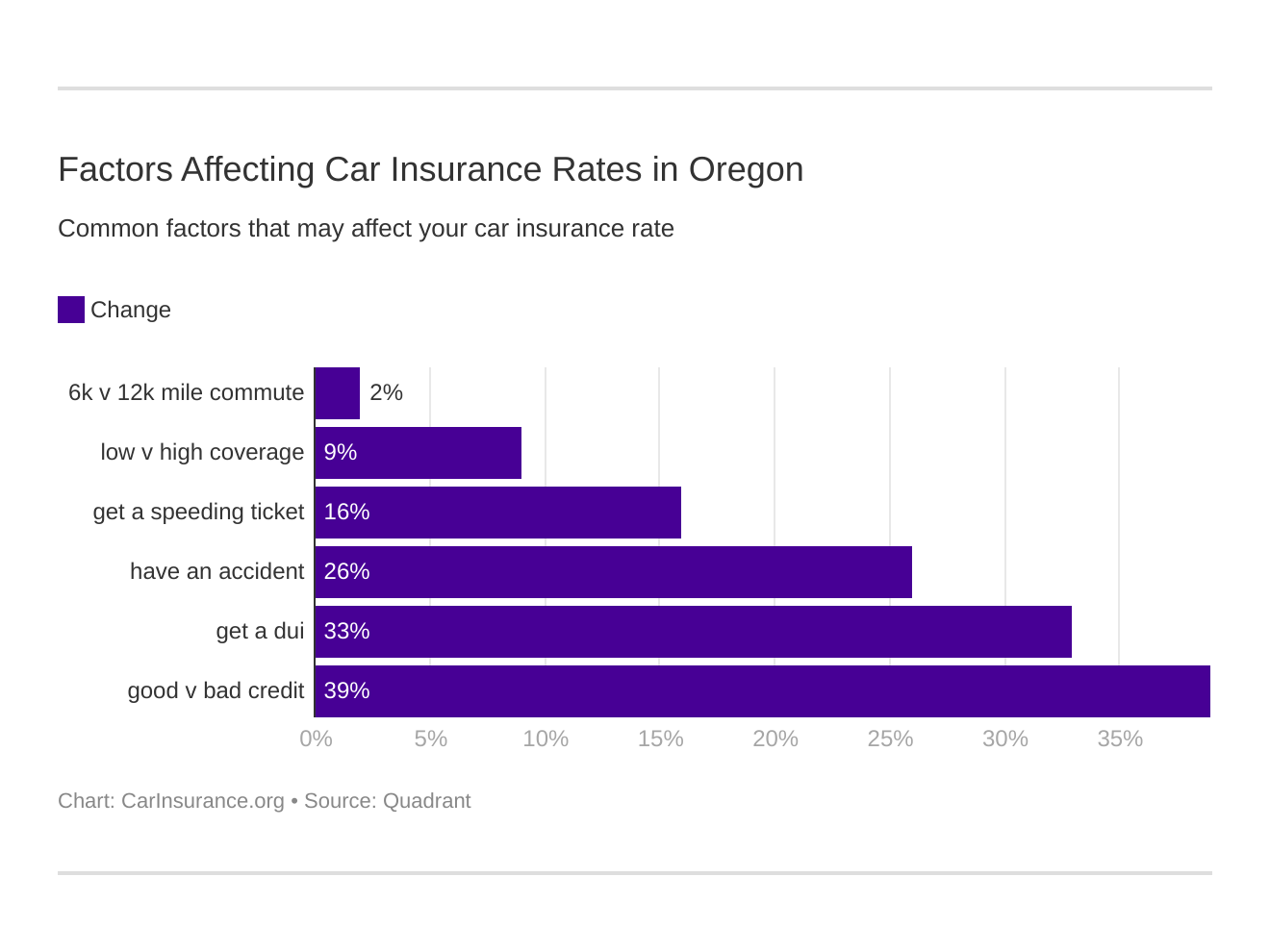

How insurance companies set rates can be confusing. Gender and zip code are just two factors. So, what are the rest?

Have you ever wondered what your car insurance company’s financial rating is, how their customers feel about them, or how many complaints they have?

We’re rounding the bend and starting on the second leg.

The Largest Companies Financial Ratings

There’s a score that determines what rent you’ll pay, what interest rates you’ll get, even if you’ll get a loan at all. It assesses your financial status, your debt, how likely you are to pay it back.

It’s your credit score.

Like you have a credit score, companies have financial ratings.

These financial ratings assess a company’s stability—how much revenue they’re producing compared to how much debt they have.

The companies that issue these ratings are large and often do so worldwide. For these ratings below, we took a look at AM Best.

| Company | Rating |

|---|---|

| Allstate | A+ |

| American Family | A |

| Farmers | A |

| Geico | A++ |

| Safeco | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | A++ |

| Standard Fire | A++ |

| USAA | A++ |

The ratings are Financial Strength Ratings (FSR) and are defined as:

- A++: Superior in meeting insurance financial obligations

- A+: Still superior, but not as superior as A++

- A: Excellent in meeting insurance financial obligations

In general, each company is very good.

They are stable, economically, with a good revenue stream. They are able to pay their debts and are likely poised for continued economic growth.

One of the underscored parts of this (when you get down to the B ratings) is being adversely affected by economic conditions.

According to AM Best, none of the companies listed above would be affected by a downturn in the economy.

If you’re really interested in financial ratings and want to learn more, you can visit AM Best’s website or check out a couple of other rating companies—Moody’s and Standard and Poor’s.

Companies with the Best Ratings

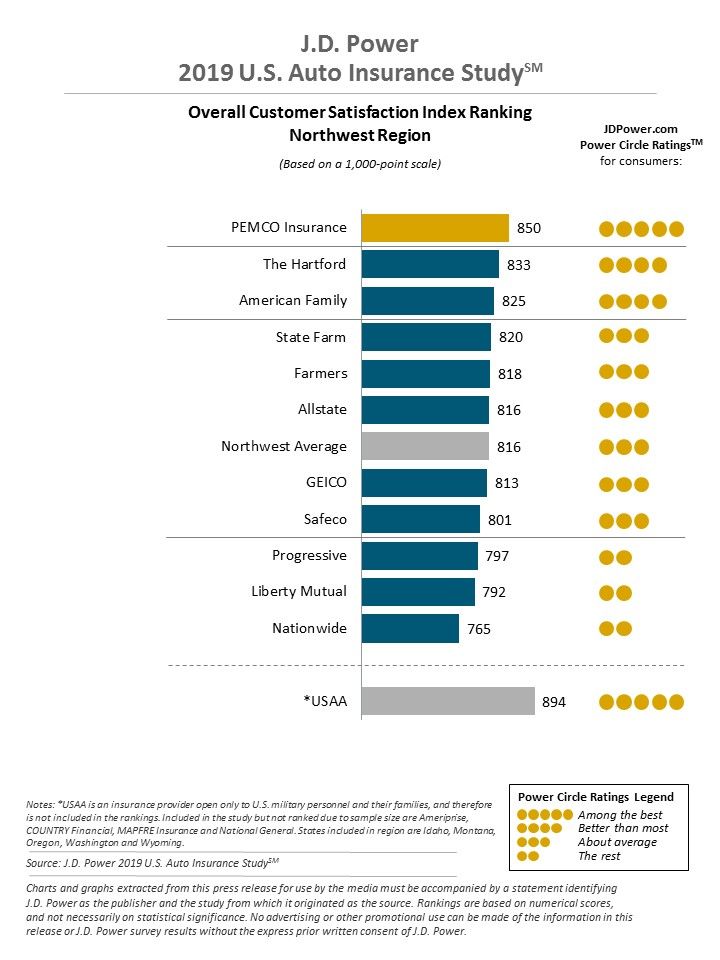

Every year, J.D. Power does an auto insurance study that examines customer satisfaction in terms of five factors:

- Interaction

- Policy offerings

- Price

- Billing process

- Policy information

It takes this information and calculates which company has the most customer satisfaction, both nationwide and for different parts of the country, like the Northwest.

PEMCO Insurance, The Hartford, and American Family are listed at the top, with five and four power circles respectively.

There’s a bunch of five major companies at three power circles, which is just about average.

Then there are three below that mark—Progressive, Liberty Mutual, and Nationwide

USAA is actually the highest of all at five power circles and an 894 overall rating, but because they are a military-only insurance company, they weren’t included in the rankings.

Now, PEMCO Insurance and The Hartford are tops in the Northwest but don’t have much of a presence in Oregon.

For the next several sections, we’ll be taking a look at the major companies in Oregon, listed in order of J.D. Power ranking:

- American Family

- State Farm

- Farmers

- Allstate

- Geico

- Safeco

- Progressive

- Nationwide

- Liberty Mutual (on occasion)

- USAA

And one last company not listed in the study because they are that small: Standard Fire Insurance Company.

Companies with the Most Complaints in Oregon

Have you ever wondered if your company has the most complaints? Or the least? The National Association of Insurance Commissioners has compiled all the complaint data year after year to form a complaint ratio. This ratio is based on how many complaints they’re getting per premium written.

| Company | Complaint Index | Total Complaints |

|---|---|---|

| Allstate | 0.5 | 163 |

| American Family | 0.79 | 73 |

| Farmers | 0.97 | 145 |

| Geico | 0.68 | 333 |

| Safeco | 1.68 | 124 |

| Nationwide | 0.28 | 25 |

| Progressive | 0.75 | 120 |

| State Farm | 0.44 | 1482 |

| Standard Fire | 0.57 | 66 |

| USAA | 0.74 | 296 |

There’s a large range, with the lowest being Nationwide at .28 versus Safeco at 1.68. Some of those with the largest number of complaints have relatively good complaint ratios: State Farm at 1,482 complaints for a .44 ratio.

That’s simply because they do that much business.

The bottom two—Safeco and Farmers—have much worse ratios than the rest.

The top two—Nationwide and State Farm—have below .5 levels, meaning they are receiving less than half a complaint for every policy written.

Standard Fire, the one not listed in the J.D. Power study, has a .57 ratio, good for fourth-best.

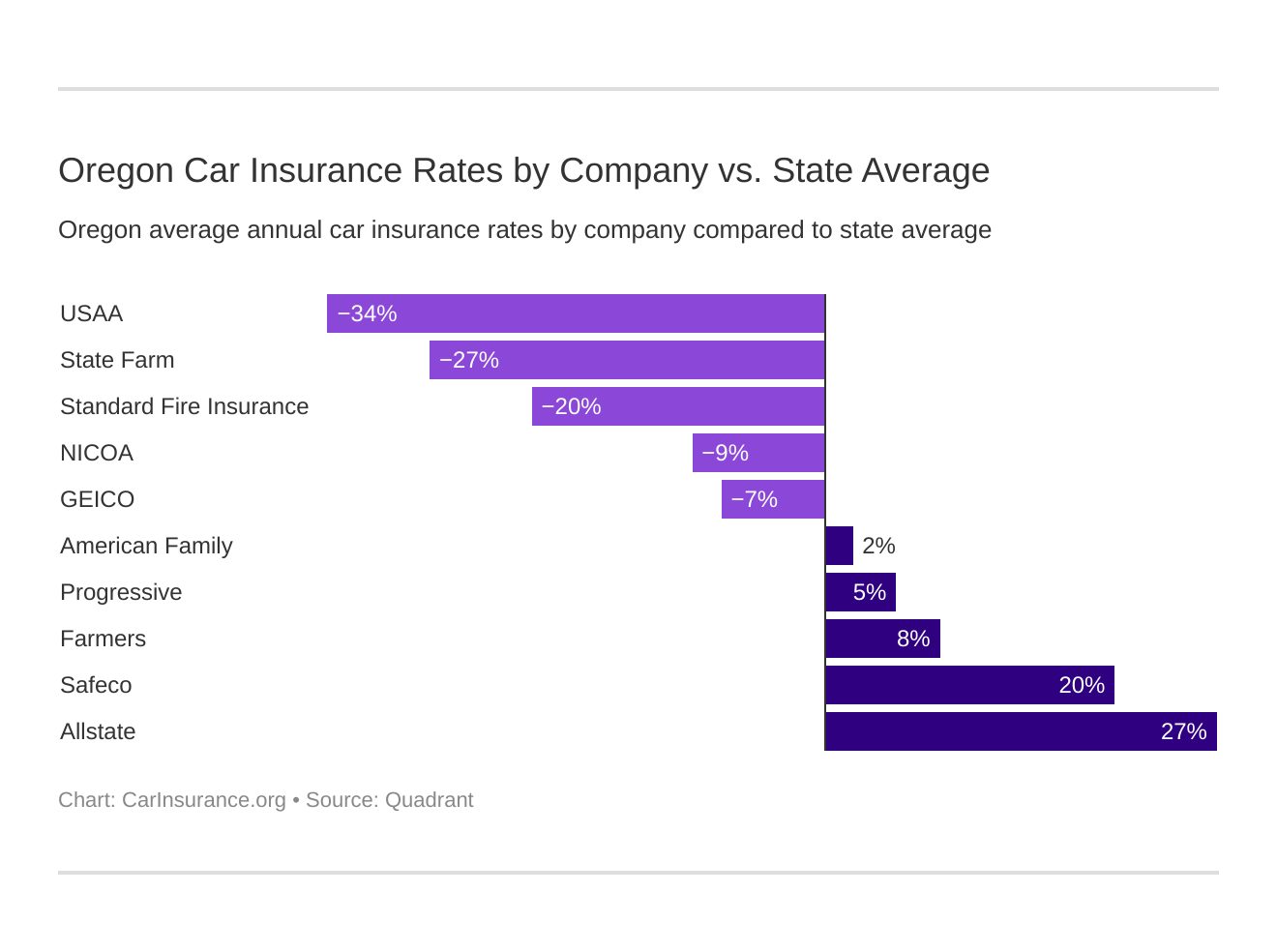

Cheapest Companies in Oregon

Knowing the average premium for companies can save you hundreds, if not thousands of dollars. For the purposes of the next few sections, the formal terms of the companies are used in the tables (Allstate F&C: Allstate).

There is one term that is a little different: NICOA is Nationwide.

| Company | Average Annual Rate | Compared to State Average | Percentage |

|---|---|---|---|

| Blank | $2,896.49 | -$500.63 | -17.28% |

| Allstate F&C | $4,749.76 | $1,352.64 | 28.48% |

| American Family Mutual | $3,507.97 | $110.85 | 3.16% |

| Farmers Ins Co Of OR | $3,734.48 | $337.36 | 9.03% |

| Geico Cas | $3,218.94 | -$178.18 | -5.54% |

| Safeco Ins Co of OR | $4,319.42 | $922.30 | 21.35% |

| NICOA | $3,156.97 | -$240.15 | -7.61% |

| Progressive Universal | $3,618.64 | $221.52 | 6.12% |

| State Farm Mutual Auto | $2,715.75 | -$681.37 | -25.09% |

| Standard Fire Insurance Co | $2,869.00 | -$528.12 | -18.41% |

| USAA CIC | $2,580.90 | -$816.22 | -31.63% |

It’s quick to see which company is the most expensive and not.

- Allstate is at the top of the list with a $4,750 premium.

- USAA is at the bottom with a $2,600 premium.

That’s a split difference of over $2,000 from high to low.

State Farm and Standard Fire are also hundreds of dollars below the average, while Safeco and Farmers are hundreds above. Nationwide, Progressive, Geico, and American Family are all in the middle.

Commute Rates by Companies

Your insurance rates can vary according to your commute rate.

Insurance companies believe, logically, that the more you drive, the more likely you are to get into an accident, get a citation, and/or file a claim.

Read more: Citation vs Ticket: Are they the same thing?

This affects men the most because men drive more than women.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $4,749.76 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,749.76 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $4,319.42 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $4,319.42 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,734.48 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,734.48 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,618.64 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,618.64 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,562.34 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,453.60 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,272.06 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,165.82 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,156.97 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,156.97 |

| Travelers | 25 miles commute. 12000 annual mileage. | $2,983.68 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,785.80 |

| Travelers | 10 miles commute. 6000 annual mileage. | $2,754.32 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,654.80 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,645.69 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,506.99 |

Four insurance companies change their rates according to how much you drive:

- American Family: about $110

- Geico: about $110

- Travelers: about $230

- State Farm: about $130

- USAA: about $150

Some companies don’t factor it in at all.

Coverage Level Rates by Companies

Your coverage level, in terms of liability, depends on one important factor: how much can your coverage pay before you have to pay out of pocket.

These are called coverage limits.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $4,940.50 |

| Allstate | Medium | $4,739.52 |

| Liberty Mutual | High | $4,598.16 |

| Allstate | Low | $4,569.25 |

| Liberty Mutual | Medium | $4,308.05 |

| Liberty Mutual | Low | $4,052.06 |

| Farmers | High | $4,017.90 |

| Progressive | High | $3,763.21 |

| American Family | Medium | $3,709.39 |

| Farmers | Medium | $3,685.73 |

| Progressive | Medium | $3,601.67 |

| Farmers | Low | $3,499.81 |

| Progressive | Low | $3,491.04 |

| American Family | Low | $3,490.82 |

| Geico | High | $3,465.92 |

| American Family | High | $3,323.69 |

| Nationwide | Medium | $3,241.68 |

| Geico | Medium | $3,234.73 |

| Nationwide | High | $3,220.33 |

| Travelers | High | $3,063.38 |

| Nationwide | Low | $3,008.89 |

| Geico | Low | $2,956.17 |

| State Farm | High | $2,863.31 |

| Travelers | Medium | $2,853.40 |

| State Farm | Medium | $2,719.79 |

| USAA | High | $2,690.90 |

| Travelers | Low | $2,690.23 |

| USAA | Medium | $2,583.40 |

| State Farm | Low | $2,564.14 |

| USAA | Low | $2,468.39 |

There are three clusters here:

- Allstate, Liberty Mutual, Progressive, and Farmers are the most expensive

- Geico, American Family, Travelers, and Nationwide are in the middle

- State Farm and USAA are the least expensive

Why are some consistently more (or less) expensive than others? When it comes to factoring in rates, a company looks at more than claims.

The cost of doing business, the salaries of its employees, the general operational costs, can influence rates. A company that believes it offers more in some way, customer service, for instance, might charge more. These are just some of the factors that make a company charge consistently higher rates or consistently lower.

Credit History Rates by Companies

Those credit scores again. Your credit history influences rates for several reasons, perhaps the most important reason would be if you’d be able to keep paying.

Insurance companies don’t follow the FICO or normal credit scores; they have their own in-house teams come up with a score.

They say this score can be predictive of the likelihood an individual will file a claim.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $6,333.87 |

| Allstate | Poor | $6,237.94 |

| American Family | Poor | $4,455.98 |

| Allstate | Fair | $4,389.68 |

| Farmers | Poor | $4,316.37 |

| Progressive | Poor | $4,065.88 |

| Geico | Poor | $3,883.45 |

| USAA | Poor | $3,865.69 |

| Nationwide | Poor | $3,817.24 |

| State Farm | Poor | $3,793.17 |

| Liberty Mutual | Fair | $3,737.43 |

| Allstate | Good | $3,621.66 |

| Travelers | Poor | $3,586.68 |

| Farmers | Fair | $3,535.79 |

| Progressive | Fair | $3,515.16 |

| Farmers | Good | $3,351.28 |

| American Family | Fair | $3,288.44 |

| Progressive | Good | $3,274.88 |

| Geico | Fair | $3,218.94 |

| Nationwide | Fair | $3,028.06 |

| Liberty Mutual | Good | $2,886.97 |

| Travelers | Fair | $2,810.04 |

| American Family | Good | $2,779.49 |

| Nationwide | Good | $2,625.62 |

| Geico | Good | $2,554.43 |

| State Farm | Fair | $2,419.05 |

| Travelers | Good | $2,210.28 |

| USAA | Fair | $2,157.98 |

| State Farm | Good | $1,935.03 |

| USAA | Good | $1,719.01 |

Total, between all companies, there’s a $5,600 difference between the poor category (Liberty Mutual; $6,300) and good category (USAA).

The largest difference between a poor score and a good score is with Liberty Mutual for around $3,500. The smallest difference is with Progressive for around $800.

The largest difference within any individual category is the poor credit score—about $2,800 between Travelers and Liberty Mutual.

Driving Record Rates by Companies

Your driving record also affects your rates. Getting into an accident, getting a speeding ticket, getting other moving violations can raise your rates by hundreds of dollars. And if you get a DUI, you’re looking at thousands.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $5,337.70 |

| Allstate | With 1 accident | $5,162.22 |

| Progressive | With 1 accident | $4,977.18 |

| Liberty Mutual | With 1 DUI | $4,914.58 |

| American Family | With 1 DUI | $4,719.97 |

| Allstate | With 1 speeding violation | $4,670.30 |

| Geico | With 1 DUI | $4,447.98 |

| Liberty Mutual | With 1 accident | $4,282.10 |

| Liberty Mutual | With 1 speeding violation | $4,254.32 |

| Farmers | With 1 accident | $4,057.67 |

| Nationwide | With 1 DUI | $4,056.64 |

| Farmers | With 1 DUI | $3,968.02 |

| Allstate | Clean record | $3,828.80 |

| Liberty Mutual | Clean record | $3,826.69 |

| Farmers | With 1 speeding violation | $3,763.01 |

| American Family | With 1 accident | $3,743.66 |

| USAA | With 1 DUI | $3,638.37 |

| Progressive | With 1 DUI | $3,516.70 |

| Geico | With 1 accident | $3,378.95 |

| Travelers | With 1 DUI | $3,341.03 |

| Progressive | With 1 speeding violation | $3,251.19 |

| Farmers | Clean record | $3,149.22 |

| State Farm | With 1 accident | $3,145.65 |

| American Family | With 1 speeding violation | $3,127.99 |

| Nationwide | With 1 speeding violation | $3,027.83 |

| Travelers | With 1 accident | $2,973.80 |

| Geico | With 1 speeding violation | $2,928.42 |

| Nationwide | With 1 accident | $2,866.59 |

| Travelers | With 1 speeding violation | $2,836.34 |

| Progressive | Clean record | $2,729.50 |

| Nationwide | Clean record | $2,676.81 |

| State Farm | With 1 DUI | $2,654.33 |

| State Farm | With 1 speeding violation | $2,654.33 |

| USAA | With 1 accident | $2,616.67 |

| American Family | Clean record | $2,440.25 |

| State Farm | Clean record | $2,408.68 |

| Travelers | Clean record | $2,324.83 |

| USAA | With 1 speeding violation | $2,194.01 |

| Geico | Clean record | $2,120.41 |

| USAA | Clean record | $1,874.54 |

Allstate has the highest general rate for all violations when they are averaged, with a single DUI raising rates to $5,300. Liberty Mutual is second, with a DUI raising rates to $4,900.

There are certain insurances that are more lenient:

- The best insurance for one DUI: State Farm at $2,600

- The best insurance for one accident: USAA at $2,600

- The best insurance for one speeding ticket: USAA at $2,200

Averaging them out shows the difference in rates for each violation.

| Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|

| $2,737.97 | $3,720.45 | $4,059.53 | $3,270.77 |

A speeding violation is the least expensive infraction, just $500 higher than a clean record. An accident adds about $1,000 to a clean record premium, and a DUI adds about $1,300.

Infractions, overall, are expensive.

Because everyone makes mistakes, some companies are aware of that and offer programs like Accident Forgiveness to keep rates from jumping on a first infraction.

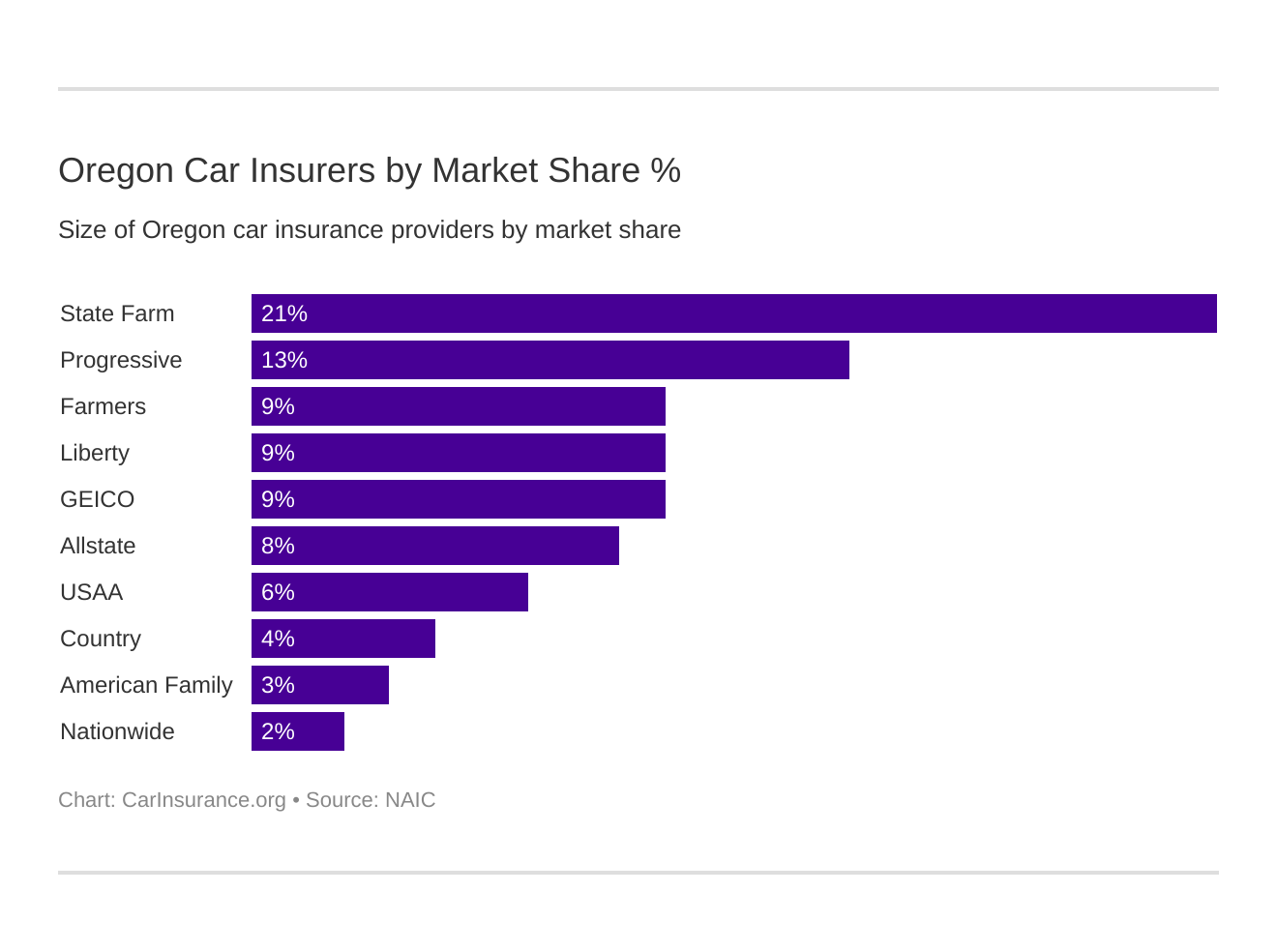

Largest Insurance Companies in Oregon

Sometimes, the market in a state will be split significantly between different companies. In Oregon, that is not really the case.

| Group | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $620,489 | 0.60 | 21.28% |

| Progressive Group | $370,678 | 0.62 | 12.71% |

| Farmers Insurance Group | $275,252 | 0.54 | 9.44% |

| Liberty Mutual Group | $261,291 | 0.68 | 8.96% |

| Geico | $260,828 | 0.71 | 8.95% |

| Allstate Insurance Group | $237,418 | 0.54 | 8.14% |

| USAA Group | $164,064 | 0.77 | 5.63% |

| Country Insurance & Financial Service Group | $104,849 | 0.59 | 3.60% |

| American Family Insurance Group | $91,870 | 0.67 | 3.15% |

| Nationwide Corp Group | $68,651 | 0.72 | 2.35% |

In the Beaver State, the top six companies own nearly 70 percent of the market. State Farm has the biggest market share at 21 percent.

The companies’ loss ratios seem good: They’re all between .5 and .8, which is in, or near, the sweet spot (.6 to .8).

It means they’re paying out on claims but don’t have too many to the point where they’re losing money.

Comparing their market shares in Oregon to their national market shares shows which companies are outperforming their competition compared to the norm. These statistics come from the National Association of Insurance Commissioners report on the 2018 market shares of insurance companies.

| Group | Market Share |

|---|---|

| State Farm | 16.97% |

| Geico | 13.69% |

| Progressive | 11.80% |

| Allstate | 8.92% |

| USAA | 5.55% |

| Liberty Mutual | 4.65% |

| Farmers | 4.35% |

| Nationwide | 2.65% |

| Travelers | 1.96% |

| American Family | 1.94% |

Farmers (+5 percent), State Farm (+4 percent), and Liberty Mutual (+3.5 percent) are outperforming the general competition. Geico is the big faller, at about -5 percent.

Number of Insurers in Oregon

Oregon has 848 foreign insurers and 18 domestic.

What does this mean?

- A domestic insurer is a company that was founded in the state it solely does business in (your mom and pop insurance company)

- A foreign insurer is a company that does business in a state but does business in other states as well (your Nationwide or State Farm)

There is no difference legally between using a domestic or foreign insurer for your car insurance.

The main difference is more logistical: If you move from Oregon and want to take your insurance with you, you won’t be able to with a domestic insurer.

State Laws

You may know this feeling. You’re up late at night, sitting at a desk where the lamp light bathes in a small yellow glow.

The book in front of you is massive and the print is small. You’re squinting, your eyes hurt, and you’re getting a headache.

If you’ve ever tried to parse the state law to find what you need, you may have experienced this.

Poring over the city code, its legalese, all the statutes, trying to find how to get this or that can be difficult. That’s why we’ve taken the searching away from you. We’ve combed through the laws and have the data to explain, well, just about everything you need for cars and insurance.

From high-risk insurance to license renewal procedures. From automobile insurance fraud to penalties for driving without insurance.

Car Insurance Laws

This is the bread and butter.

Your car insurance laws determine everything from windshield coverage to automobile insurance fraud with things in-between. Laws and stipulations can be frustrating, and a little worse than running into issues with your DMV or local police because one didn’t get followed.

We’ve broken this section into eight subsections for easy reading.

Ready?

How Oregon Laws for Car Insurance Are Determined

Although we won’t get too much into how the insurance sausage gets made, it still may help to understand how the insurance laws work—and how the process may influence your rates.

Oregon, like all states in the Union, works as a three-branch government: executive, legislative, and judicial. An insurance law, like every law, starts with someone having an idea.

That idea becomes a bill, it gets bounced around, then is eventually voted on by the entire legislature.

The National Association of Insurance Commissioners has put together a list of some of those laws that govern car insurance.

One thing you might be happy to note: car insurance rates are regulated by the government.

According to the NAIC, there are seven mechanisms state governments use to regulate rates:

- Determined by commissioner

- Prior approval

- Modified prior approval

- Flex rating

- File and use

- Use and file

- No file

Oregon is a file and use state, which means that the insurance company has to file their rates with the government before they are put into use.

Some other Oregon laws that the NAIC includes in its listing:

- The minimum insurance requirements for someone who has been convicted a DUI is 50/100/10

- The minimum coverage limit for Personal Injury Protection is $15,000

Laws can get passed through the legislature that change how insurance is conducted.

As is the case with the DUI minimum insurance requirements; as we’ll see later, it wasn’t just the 50/100/10 that got stipulated.

Windshield Coverage

Whether you’re in an accident and bust your windshield or a rock flies up from the road and cracks it, it can be helpful to know the Oregon laws governing windshield repair.

According to CarWindshields.info, Oregon has no particularly special law governing windshields.

In fact, it may be more flexible than some other states.

According to Oregon Statute 746.287, a manufacturer is not required to replace a broken windshield with an OEM product.

An aftermarket product can be used as long as it is at least the same quality with respect to fit, finish, function and corrosion resistance.

Furthermore, an insurance company may not require a specific repair shop, meaning if that were true, you could take your car to the repair shop you want.

High-Risk Insurance

Everyone makes mistakes, and those mistakes, when it comes to driving, can be costly.

Fortunately, when it comes to making mistakes behind the wheel, Oregon offers one particular option to get high-risk drivers back on the road.

This comes in a form of financial responsibility called an SR-22.

An SR-22 is a certificate you need to get from an insurance company; it often costs extra, as it is a statement that you’re a high-risk driver.

The government of Oregon lists some common instances where you might need this:

- You’ve been convicted of driving without insurance.

- You are the owner of a vehicle that was uninsured at the time of an accident.

- You are trying to reinstate your driving privileges.

- You are applying for a hardship or probationary permit.

It can also happen (in the third instance most notably) if you’re convicted of a DUI.

Oregon considers an SR-22 future responsibility and the note is added to your driving record. Now, if you can’t get an SR-22 from any insurance company, you can try the Automobile Insurance Plan of Oregon.

This is a last-ditch marketplace pairing insurance companies with high-risk drivers.

Low-Cost Insurance

While Oregon has a program for high-risk drivers, it does not have a car insurance program for low-income families. Only California, Hawaii, and New Jersey do.

Automobile Insurance Fraud in Oregon

According to the Insurance Information Institute, insurance fraud costs insurance companies about 10 percent of their losses each year.

Using this measure, over the five-year period from 2013 to 2017, property/casualty fraud amounted to about $30 billion each year.

Some common types of fraud include padding or inflating the claim, misrepresenting facts, or filing claims for something that never occurred.

As of now, Oregon has no formal law describing car insurance fraud, though there are laws against health insurance fraud and workers compensation fraud.

It also has a fraud and deception law against selling a drugged horse.

If you do suspect fraud, however, you can always file a complaint with Oregon’s Division of Financial Regulation or call 1-888-877-4894.

Oregon offers many protections for whistleblowers as well.

Statute of Limitations

The statute of limitations varies in Oregon, with different crimes having different amounts of time needed to prosecute or enter into court.

When you are in an accident in Oregon, you have 72 hours to report it if the following conditions have happened:

- Any vehicle has sustained $2,500 damage or over

- Any vehicle has been towed

- There has been an injury

- There has been a death

If you haven’t by that time, your license could be suspended.

If you’re involved in an accident, there are two deadlines you need to watch out for:

- You have two years to recoup damages from a personal injury

- You have six years to recoup damages towards personal property

For further information about statutes, you can refer FindLaw for a breakdown of time limitations for civil cases.

State Specific Laws

Every state has unusual laws; for instance, there’s a law in Arizona where you need a permit to feed garbage to a pig.

Most of these are all in good fun, having likely been holdovers from the 19th or early 20th centuries. There’s a law like that in Oregon—but it pertains to cars.

According to Oregon Statute 811.490, you can’t leave your car door open on the side of the road—unless it is in the time shorter than letting a passenger get in.

Weird but true. If a cop catches you and cites you for it, the violation is a Class D traffic violation. This has a presumptive fine of $110.

And your insurance rates will go up.

So, next time you get out of the car to take a look at Oregon’s beautiful cliffside, it might be in your best interest to close the door.

Vehicle Licensing Laws

If car insurance laws are like bread and butter, vehicle licensing laws are like an overcooked baked potato: dry, kind of crusty, but full of nutrition.

Laws like the ones for teen drivers or the processes by which people renew licenses are not shiny objects by any means.

But without knowing those laws, we’d probably run the risk of a fine.

So, prepare your fork, spork, or spoon and get ready to dig in. We’ll spice it up with some bacon bites (videos); just for fun.

REAL ID

Because of 9/11, Congress passed a sweeping bill called the REAL ID Act to provide new security measures to driver’s licenses.

These REAL IDs were supposed to be harder to forge, and the Department of Homeland Security put pressure on the states to abide by the stipulations of the act.

There were issues.

Civil liberties activists were concerned about the Act’s effect on undocumented immigrants. State officials were concerned about the costs of overhauling the driver’s license systems.

Most states eventually complied.

But then there is Oregon.

According to the Department of Homeland Security, Oregon is one of only four states not currently complying with the READ ID Act. The others are Oklahoma, Maine, and New Jersey.

According to Willamette Week,

This state’s progress toward meeting the standard has been slowed by civil liberties concerns—the law punishes undocumented immigrants—and by the massive cost of upgrading Oregon Driving & Motor Vehicle Services’ computer system

Oregon is aiming to make REAL ID-compliant licenses starting on July 2020, but for now, it appears they will be optional.

Penalties for Driving Without Insurance

Driving without insurance is like hunting hippotamus without a 12-inch knife: You may be a-OK, but if something happens, you’ll have little to protect yourself with.

Car insurance is something of a protector; it protects against financial losses, whether those are from an accident, vandalism, theft, or an act of God (see: comprehensive insurance).

Without it, a totaled car is $15,000 lost.

With it, it’s just a matter of the claims process. Governments understand this.

That’s why 48 out of 50 states in the country mandate that drivers have insurance (New Hampshire and Virginia are the ones that don’t).

So, what are Oregon’s penalties for driving without insurance?

| Offense | Fine | License Suspension (if in an accident) | Proof of Financial Responsibility (if in an accident) |

|---|---|---|---|

| 1st | $130-$1000 | At least 1 year | Required for 3 years |

The big deal is if you’re in an accident.

In those cases, the penalties are generally steeper; Oregon has a one-year license suspension, for instance, and a three-year requirement for a form of financial responsibility (SR-22).

If you’re pulled over for a moving violation, an officer will likely ask you for proof of insurance.

If you have insurance, using the electronic copy from the insurance company’s website or app is fine, along with a paper copy.

Teen Driver Laws

If you’re a teenager getting your first car, congrats. If you’re a parent with a teenager getting your first car, that racing heart rate probably won’t go away for a bit.

It’s an empowering thing to get a car; the ability to go where you want to go, visit who you want to visit, find a job farther than walking distance.

But there are laws governing it, which is important: According to the CDC, car crashes are the leading cause of death for teens.

Fortunately, these crashes can be prevented. Looking at the laws can help.

| Minimum Age | Mandatory Holding Period | Minimum Amount of Supervised Driving | Minimum Age for DL |

|---|---|---|---|

| 15 | 6 months | 50 hours (100 without driver education) | 16 |

The minimum age for a driver’s license is 16, and the minimum for a learner’s permit 15. The driver must be skilled, either taking a driver education course or having 100 hours of supervised driving time.

Once you get it, the laws are still strict.

| Unsupervised Driving Prohibited | Restrictions on Passengers | Nighttime Restrictions | Minimum Age for Unrestricted License |

|---|---|---|---|

| Midnight - 5 am | First six months - no passengers under 20 Next six months - no more than 3 passengers under 20 | 12 months or 18th birthday | 12 months or 18th birthday |

The idea here is to eliminate distracts and dangerous situations: no early morning driving and reducing the young passengers in a car.

Although it may be dangerous to be a novice behind the wheel, there are things you can do better your driving skills or reduce dangerous situations.

Older Driver License Renewal Procedures

Older drivers, like younger drivers, face challenges associated with their age group, many of these being the natural consequences of aging.

The National Institue of Aging lists several of these:

- Stiff muscles

- Slower reaction times

- Eye deterioration or illnesses

- Medications that may affect physical or mental functions

- Trouble hearing

Although it is difficult to drive with these, some elderly drivers manage to do it. And, fortunately, Oregon has systems in place to keep elderly drivers who can’t drive off the road. This starts with the older driver’s license renewal process.

| Renewal Cycle | Proof of Adequate Vision Required | Mail Renewal Permitted | Online Renewal Permitted |

|---|---|---|---|

| 8 years | 50 and older; very renewal | No | No |

While the renewal cycle is eight years like the rest of Oregon, older drivers must submit to a vision test at every renewal.

There are also other systems in place that reduce the risk of an elderly driver on the road.

According to Nolo, the DMV may impose driving restrictions on older drivers including having an additional outside mirror, no nighttime driving, and driving with specific hand controls.

Nolo also writes,

Oregon is one of only a few states that require doctors who diagnose a patient with a “severe and uncontrollable” condition or impairment likely to affect driving ability to report that diagnosis to the DMV

Many older drivers can drive safely; however, determining which ones can’t is important for safety.

New Residents

Congrats. You’re moving to the Beaver State.

You’re probably thinking of when you can visit Crater Lake or sample one of the dozens of breweries in Portland, but there’s a hold-up.

In this case, you need to take a look at some of the more bureaucratic parts of car insurance regulations, like the vehicle licensing procedures.

According to the Oregon.gov, you must get your new Oregon driver’s license and vehicle registration within 30 days, along with transferring over the title of your vehicle.

According to Driving Tests-Guides, you only need to pass the vision and knowledge test to get an Oregon license if you have a current out-of-state license.

You’ll want to apply at your local DMV and will need all the required items for a regular license renewal, which we will cover in the next section.

After that, you’re all set, ready to rock ‘n roll.

But what are those required items?

License Renewal Procedures

License renewal procedures in Oregon are simple and straightforward.

| Renewal Cycle | Proof of Adequate Vision Required | Mail Renewal Permitted | Online Renewal Permitted |

|---|---|---|---|

| 8 years | No | No | No |

The renewal cycle is every eight years.

In addition, according to Oregon.gov, you can renew 12 months before or after your license expires or six months after military discharge.

They write,

You will have to apply for a new driver license, pay the original fee and take tests if your license has been expired for more than a year.

There are a few steps you’ll need to take:

- Fill out an application

- Apply at a DMV

- Show proof of address and identity

- Pay the $40 fee

You’ll have your picture taken too, of course. If you’re over 50 years old, you’ll need to have your vision tested and if you’re a teen driver, you have your own requirements.

Negligent Operator Treatment System

Oregon does not have a point system for traffic violations, but they do have a long list of things you shouldn’t do.

Some include:

811.135 Careless driving; penalty. (1) A person commits the offense of careless driving if the person drives any vehicle upon a highway or other premises described in this section in a manner that endangers or would be likely to endanger any person or property.

811.130 Impeding traffic; penalty. (1) A person commits the offense of impeding traffic if the person drives a motor vehicle or a combination of motor vehicles in a manner that impedes or blocks the normal and reasonable movement of traffic.

Among, many, many others.

Rules of the Road

Rules of the road are the barbecue nachos: Smooth going in, but if they’re not cooked well, watch out. These laws are the digestible ones and easily applicable. Fault vs no-fault has immediate value for instance, as it’s important to know for accidents.

But taken the wrong way, or incorrectly digested, and a fine (or worse) is heading your way. It’s time now for the third course.

Fault vs No-Fault

Oregon is an at-fault state.

This means that the person who is found at-fault in an accident is held liable for all the property damage and all the medical bills of the other passenger.

So, who determines who is at-fault?

Generally, that falls into the hands of the police officer who is on the scene. Police are required to file an accident report for the situation at the scene.

This means they generally talk to both (or all) drivers, witnesses, get statements, and try to get a clear picture of what happened.

If the driver who is determined to be at-fault denies responsibility for the accident, the report (and any other information) is often reviewed by insurance agencies to determine fault.

When you are found at-fault, generally that’s when your insurance kicks in.

- If the damage is under your coverage limit, you won’t have to pay anything but the deductible.

- If the damage is over your coverage limit, you’ll have to pay everything over.

The minimum insurance in Oregon, again, is 25/50/25, with 25 for UM and 15 for PIP.

If you are in an accident and found to not have insurance, your license will be suspended and you’ll face additional charges.

Seat Belt and Car Seat Laws

Early in the 20th century, Cornell Aeronautical Labs did some of the first crash testings on vehicles.

In 1957, Cornell teamed up with a well-known insurance company to test out some safety features, safety features (head rests, padded interiors) that are used today.

One of these was the seat belt. Seat belts save lives; that much is known.

According to the National Highway Traffic Safety Administration,

Of the 37,000 people killed in motor vehicle crashes in 2017, 47 percent were not wearing seat belts

Further, seat belts saved around 15,000 lives in 2017, and 2,500 could have been saved if they were wearing them.

Those are some bold statistics. So what is the seat belt law in Oregon?

| Initial Effective Date | Primary Enforcement | Who Is Covered/What Seats | Maximum 1st Fine |

|---|---|---|---|

| 12/07/09 | Yes, from 12/07/09 | 16+, all seats | $115 |

It started in 2009 and is effective for 16-year-olds and older for all seats. It’s a primary enforcement law, meaning if a police officer sees the violation, they can pull you over and ticket you without having to see anything else.

The maximum first fine is $115. Car seats, like seat belts, also save lives.

| Child Restraint Facing Rear | Child Restraint | Booster Seat | Adult Belt Permissible |

|---|---|---|---|

| younger than 2 years old | 7 years of younger, 40 pounds or less | more than 40 pounds but less than 4'9 | taller than 4'9, age between 8-15 |

With these, the maximum fine is still $115, and there is no preference for rear seating.

Oregon takes these seriously, to the point where it has created a webpage solely with videos about seat belts and car seats.

Keep Right and Move Over Laws

Keeping right is more than just making sure that person going 50 mph in the speed lane on the interstate gets out of your way; it keeps the flow of traffic clean.

Oregon has a straightforward keep right and move-over law:

Keep right when moving slower than the rest of traffic; can only pass on right when the other car is making a left, there are two free lanes, and everything is clear ahead.

That data was taking from Quadrant.

Speed Limits

Some people may view speed limits as guidelines, but they serve a purpose as well. And it’s a big one as an Insurance Institute for Highway Safety showed, speed limit increases are tied to 37,000 deaths in the past 25 years.

In the article, Darrin Grondel, then-chair of the GHSA’s Executive Board and director of the Washington Traffic Safety Commission, said,

Speeding has become almost a forgotten issue in traffic safety discussions, and clearly we’re losing any sense of limits

Oregon’s speed limits are actually at the low-end of the high-speed limits that have become more typical.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstate | Regular vehicles: 65 (70 on specified roads) Trucks: 55 (65 on specified roads) |

| Urban Interstate | 55 |

| Other Limited Access Roads | 65 |

| Other Roads | 65 |

Note that in rural interstates it varies depending on the road with 65 being the norm; trucks go 5 mph slower.

Ridesharing

There are many ways you can rideshare: Uber and Lyft are the most popular for taxis, but there are others for delivery (takeout and groceries).

If you are a rideshare driver, you might have been concerned about the possibility of an accident; for instance, does my company cover accidents while I’m working?

Generally, the answer is yes and your general coverage should be fine.