Georgia Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 13%

Georgia is a state that has a little bit of everything: history, athletics, academia, nature. People from all over the United States come to the Peach State to see the beautiful Georgia foliage changing and falling from the trees.

The Etowah River, which is located in Georgia, is incredibly famous and historically significant. Many people from all over venture to this beautiful spot to enjoy the magnificent Georgia fall.

This experience is fully enjoyed when one is on the water, but you must first drive to get there. Like many other states, Georgia has many laws regarding driving and car insurance that are important but complicated at times. However complicated they are, it is your responsibility to know them.

We’d love to educate you.

Keep reading to learn about your state so you can save as much money on your insurance as possible.

What Should You Know about Georgia Car Insurance Coverage & Rates?

According to Georgia law, when car owners apply for registration, they must provide proof of liability insurance; this is called a compulsory liability insurance law. The insurance companies themselves are required to submit this information electronically to the Georgia Department of Revenue.

Though there are exceptions to this law (e.g. vehicles covered under a commercial policy and rental cars), the vast majority of Georgians are required to have liability insurance.

What is liability insurance, you may ask? Liability insurance protects you from liabilities from lawsuits or other claims when you’re at fault in an auto accident. It pays medical and property damage claims for any party you injure in the course of an at fault accident. While minimum coverage can be cheap car insurance now, not having coverage for your own car can be expensive in the long run.

There are two types of liability insurance drivers have to carry. The first of these is bodily injury liability coverage. This type of liability insurance covers the medical portion of an at-fault accident for the other party.

The other type of insurance is property damage liability. This type of insurance covers the other party’s property damage whether that be another car, a house or other structure, or something else. Keep in mind, Georgia is an at-fault state. So the responding officer will typically assign fault at the scene, and insurers will work out the details accordingly. Georgia also has proportional fault, meaning both drivers could be at fault in certain percentages.

In regard to the requirements for liability insurance, Georgia requires that bodily injury liability covers at least $25,000 for an injury or death of any single person in an accident you cause, $50,000 for total injuries or deaths of more than one person in an accident, and $25,000 in property damage in an accident you caused. Some people choose to carry higher liability limits on their auto policies. If your limits do not cover the amount needed in an accident, the other driver or party could sue you to make up the difference.

| Minimum Insurance Requirements in Georgia | Minimum Limits 25/50/25 |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person and $50,000 per accident |

| Uninsured Motorist Property Damage | $25,000 with a $250, $500, or $1,000 deductible |

Additionally, there are requirements foruninsured motorist coverage, which, as you can see from the table, are $25,000 per person and $50,000 per accident for bodily injury and $25,000 with a $250-, $500-, or $1,000-deductible for property damage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Much Do Collision Coverages Cost in Georgia?

Liability insurance does not cover your injuries or vehicle damage. For this, you must purchase collision insurance. Many insurers also recommend comprehensive coverage to cover your auto damage in non-collision incidents. Collision insurance in Georgia (and nationally) covers repairs of and replacements to your own car if it is damaged in a collision. While this type of insurance is important, it is not required by Georgia law.

Another type of insurance in Georgia that you should know about is comprehensive insurance. Comprehensive insurance helps repair or replace a vehicle that has been stolen or damaged by vandalism, a storm, or something of a similar ilk. And while this type of insurance is recommended, it is also not required by Georgia law.

Your collision rates will depend on things like the amount of coverage you want and your driving record. Clean driving records go a long way. Auto insurance companies also account for credit score, age, other policies you have with them, and many other factors.

This information is crucial to understanding how to buy car insurance because, as the adage goes, knowledge is power. By learning what you can about car insurance and the costs of car insurance in Georgia, as well as the rest of the country, you can make an intelligent, well-informed decision when you select your insurance.

We know that it can be tedious to sift through a myriad of sources to try to find the right car insurance, especially when there are potentially multiple types of insurance that you need. This is why we’re here.

We are here to help you find the cheapest possible options as quickly as possible and to educate you in simple, clear language about car insurance. We know that Georgians have a lot to deal with already. So we want to make selecting car insurance as stress-free and convenient for you as possible.

Georgia’s Car Culture

The car culture in Georgia is prominent. It might not be a massive manufacturing spot like Michigan or Ohio, but it is the biggest state on the East Coast, which means that many people depend on cars for transportation, and one’s car is a major part of their life.

The car-based classic Dukes of Hazzard takes place in Georgia, which is emblematic of Georgia’s predilection for automobiles.

Because Georgia has comparatively mild winters, it is a great spot for car lovers. One can see numerous classic cars cruising along country roads and streets in the city. There’s a spot called “Old Car City,” which is a 4,000-car junkyard that has some of the most classic retired cars in the world.

Even though there is a historically deep love of cars in Georgia, many Georgian millennials opt for public transportation and other means of getting around. But, this transition is not smooth. Public transportation is not as accessible as it is in other states, even in a major city like Atlanta. Thus, many millennials are still dependent on cars.

Yet, millennials influence transportation, as their lack of interest in cars has an impact. Consequently, city planners and carmakers may have to adjust. Carmakers will have to switch from cars that are powerful and fast to more millennial-friendly vehicles that are better for the environment.

Millennials may push the city of Atlanta toward being a more walkable, transit-based city.

Georgia may be a state that loves its cars, but it seems to be heading in a new direction with the influence of a new generation that places less emphasis on cars and more emphasis on the environment.

Georgia Minimum Coverage

The minimum limits of liability required in Georgia are a Bodily Injury Liability of $25,000 per person, $50,000 per occurrence, and a Property Damage liability of $25,000 per occurrence.

You must have at least this much coverage because, as we’ve previously stated, it is the law, and you will be subject to penalties if you do not have them.

Forms of Financial Responsibility

You must have proof of financial responsibility if you’re a driver in Georgia. This is just another name for liability coverage.

These are the five forms of official proof of vehicle liability insurance coverage in Georgia:

- Rental agreement

- Fleet insurance policy card

- Bill of Sale, dated to within 30 days of the vehicles purchase date, and a valid insurance binder page issued by a Georgia licensed insurer

- A valid Self-Insured Insurance Card/Certificate of Self-Insurance

- A valid insurance policy information card for Georgia International Registration Plan (IRP)

You must have one of these five forms with you at all times when you are driving.

Premiums as a Percentage of Income

Car Insurance is a necessary part of driving, so people are willing to spend their hard-earned money on it. If one looks at the trends from 2012 to 2014, they will see Georgians are spending a bit more on their car insurance as time goes by. In 2012, people who had a disposable income of $33,167 spent around $922.05 on full coverage car insurance, or 2.78 percent of their income.

In 2013, the number that Georgians spent grew a bit. In 2013, Georgians who had a disposable income of $33,100 spent $949.33 on full coverage car insurance, or 2.87 percent of that income. And then in 2014, the percentage remained the same, with Georgians spending $991.25 of their $34,558 disposable income on full coverage car insurance.

The lowest amount spent in this three-year span was 2.78 percent of a Georgian’s disposable income in 2012, and 2013 and 2014 are tied for the highest with a slightly larger 2.87 percent. If you look at the surrounding states, you can see Georgia’s full coverage car insurance spending in 2014 is higher than South Carolina’s (2.81 percent) and Alabama’s (2.50 percent), and lower than Florida’s (3.15 percent).

If you compare Georgia’s spending on full coverage car insurance to the national average, you can see that Georgia is 0.5 percent higher than the national average of 2.37 percent.

Core Coverage

Each type of core coverage insurance has a different cost. Liability insurance (remember the one that’s required by Georgia law) is $490.64 compared to the national average of $516.39. The average cost of collision insurance in Georgia is $320.45 compared to the national average of $299.73. The average cost of comprehensive insurance in Georgia is $153.61, and the national average is $138.87.

Finally, the full coverage premium for Georgia is $964.70 compared with the national average of $954.99

| Type of Insurance | Georgia | National Average |

|---|---|---|

| Liability Insurance | $490.64 | $516.39 |

| Collision Insurance | $320.45 | $299.73 |

| Comprehensive | $153.61 | $138.87 |

| Full Coverage | $964.70 | $954.99 |

It’s also worth noting that this data, which is from the NAIC, is based on the state minimum.

Additional Coverage

Regarding Georgia’s additional liability, there is no Personal Injury Protection listed. For Medical Payments, Georgia’s loss ratio in 2015 was 84.58, in 2014 it was 83.70, and in 2013 it was 86.61.

For uninsured/underinsured, Georgia’s loss ratio in 2015 was 93.68, followed by 87.32 in 2014, and 81.65 in 2013.

Georgia is in the middle of the United States’ rankings for states with the most uninsured drivers, at 25th, and 12 percent of Georgians drive without car insurance.

For the most part, Georgia is in pretty good shape in terms of loss ratio, as their ratio is under 100. Thus, insurance companies there are profiting.

| Georgia Loss Ratio | % |

|---|---|

| Personal Injury Protection (PIP) Loss Ratio | - |

| Medical Payments Loss Ratio | 80.33% |

| UUM Loss Ratio | 22% |

| UUM% | 25% |

– Add-Ons, Endorsements, & Riders

We’ve already established what insurance is required for Georgia drivers (liability insurance), and we’ve shown you some other insurance types that could prove quite useful to you. But these previously listed insurance policies might not cover everything you want.

Here are some add-ons you might want that can protect you from other unforeseen accidents.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive

Pay-As-You-Drive Insurance is a great way to save because the premiums for this insurance are based on your actual mileage driven. While some states have laws that may interfere with Pay-As-You-Drive insurance, in Georgia, as long as your insurance offers the minimum coverage required by the state, you can use Pay-As-You-Drive insurance.

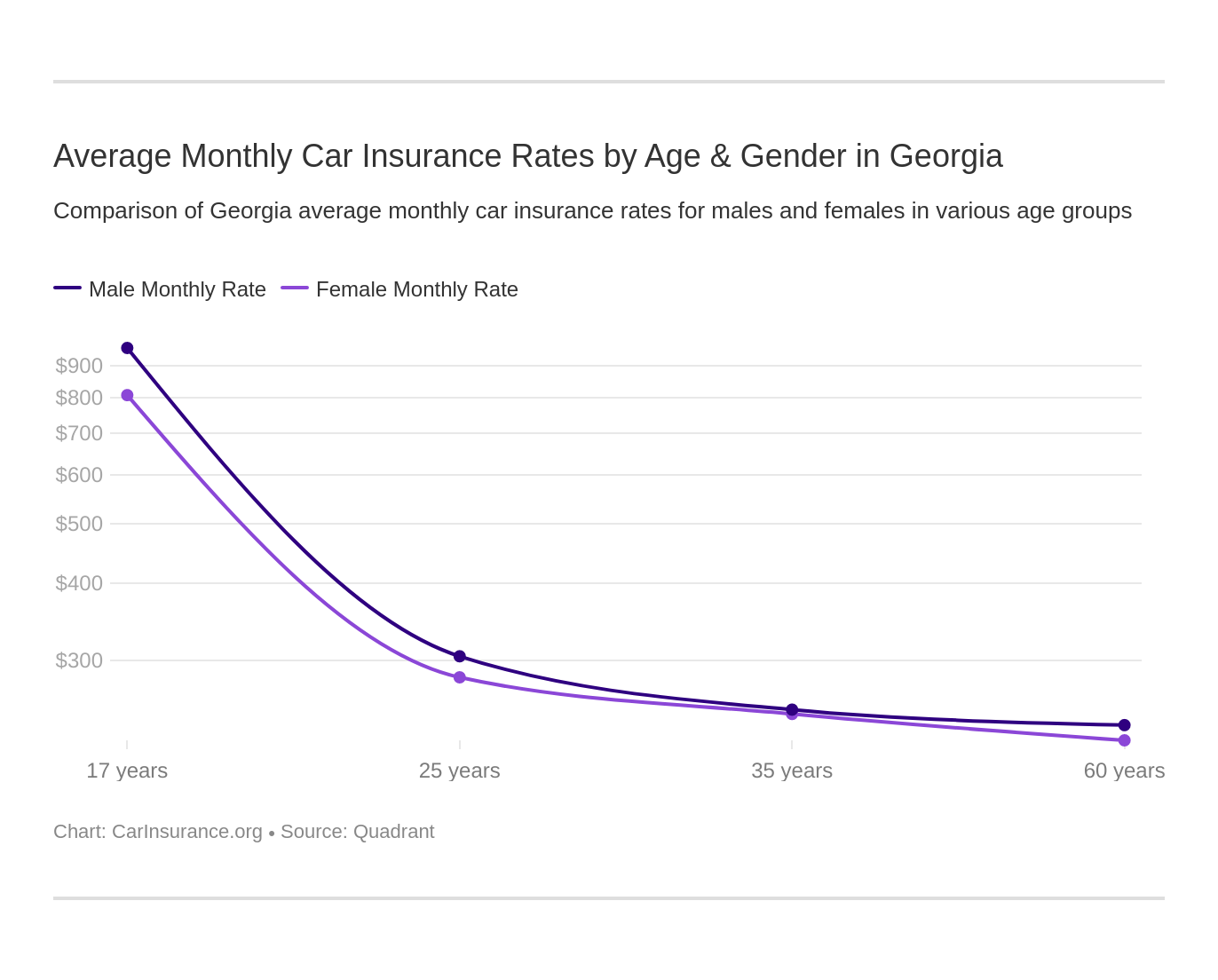

Average Monthly Car Insurance Rates by Age & Gender in GA

Gender is a factor when calculating car insurance in Georgia. And while it is illegal in some states to factor gender into car insurance rates, it’s still legal in Georgia. Gender and age play a big role in insurance rates for many leading companies.

| COMPANY | SINGLE 17-YEAR OLD FEMALE ANNUAL RATE | SINGLE 17-YEAR OLD MALE ANNUAL RATE | SINGLE 25-YEAR OLD FEMALE ANNUAL RATE | SINGLE 25-YEAR OLD MALE ANNUAL RATE | MARRIED 35-YEAR OLD FEMALE ANNUAL RATE | MARRIED 35-YEAR OLD MALE ANNUAL RATE | MARRIED 60-YEAR OLD FEMALE ANNUAL RATE | MARRIED 60-YEAR OLD MALE ANNUAL RATE |

|---|---|---|---|---|---|---|---|---|

| Allstate | $6,787.85 | $8,744.55 | $3,246.86 | $3,545.10 | $2,900.87 | $2,900.87 | $2,779.74 | $2,779.74 |

| Geico | $5,405.23 | $6,468.98 | $2,312.93 | $2,573.90 | $1,798.00 | $1,774.88 | $1,741.80 | $1,741.80 |

| Nationwide | $11,720.53 | $15,095.77 | $4,594.13 | $4,986.39 | $3,767.46 | $3,895.53 | $3,724.66 | $4,094.75 |

| Progressive | $8,918.63 | $9,881.25 | $3,285.16 | $3,438.84 | $2,842.70 | $2,616.94 | $2,442.41 | $2,567.85 |

| Safeco | $22,759.67 | $25,413.76 | $5,674.73 | $6,038.00 | $5,354.43 | $5,828.62 | $4,383.03 | $4,975.31 |

| State Farm | $5,893.47 | $7,744.68 | $2,426.79 | $2,621.78 | $2,211.60 | $2,211.60 | $1,984.58 | $1,984.58 |

| USAA | $6,343.65 | $7,511.58 | $2,192.11 | $2,421.96 | $1,759.52 | $1,757.11 | $1,633.74 | $1,640.04 |

Some interesting data to note from this table are the highest rankings. The consistently highest insurance rankings are for teen drivers, both male and female. In these top rankings males and females are usually alternating pretty consistently as the list goes down.

The highest insurance ranking is for a single, 17-year-old male with Safeco Ins Co of IL insurance. The cheapest insurance is for a married, 60-year-old female with USAA insurance. Marital status consistently influences the cost of one’s insurance.

It’s also worth noting that the Quadrant Data provided is based on the actually purchased coverage by the state population. It includes rates for high-risk drivers, as well as drivers who choose to purchase more than their state minimum.

They also purchase other types of insurance such as uninsured/underinsured insurance, PIP, and MedPay that aren’t required by law.

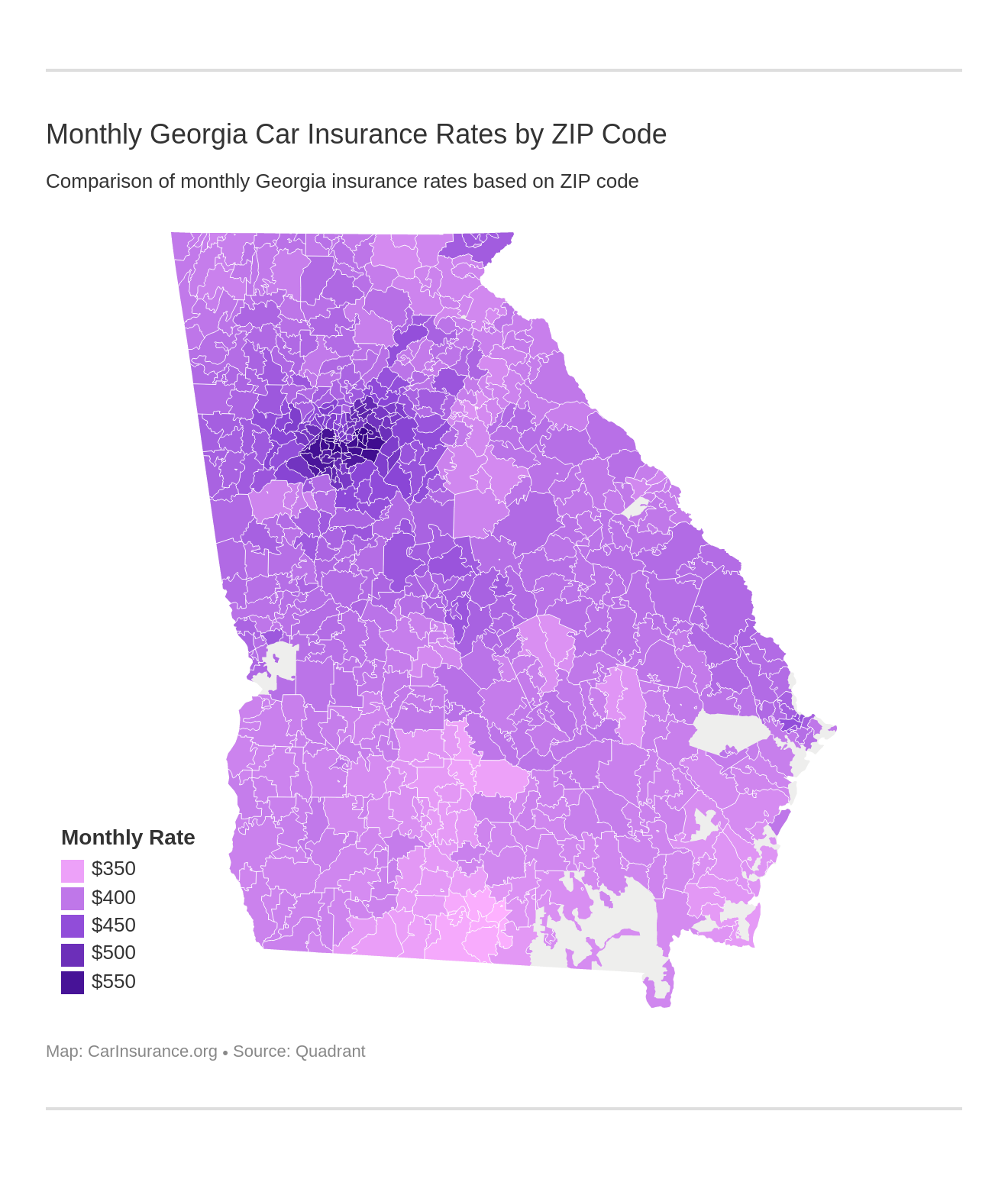

Cheapest Rates by Zip Code

The tables below show some essential information about zip codes in Georgia and their insurance information. You can search for your zip code in the tables below. We have also highlighted some interesting facts from these tables in the following paragraphs.

This first table looks at the 25 ZIP codes in the state with the highest car insurance rates.

| 25 Most Expensive Zip Codes in Georgia | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 30314 | ATLANTA | $6,991.02 | Liberty Mutual | $13,795.98 | Nationwide | $9,315.62 | USAA | $3,886.82 | State Farm | $4,776.36 |

| 30021 | CLARKSTON | $6,944.22 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,459.21 | State Farm | $4,616.14 |

| 30088 | STONE MOUNTAIN | $6,913.82 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,574.28 | State Farm | $4,700.44 |

| 30083 | STONE MOUNTAIN | $6,899.09 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,478.91 | State Farm | $4,726.08 |

| 30035 | DECATUR | $6,893.89 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,734.78 | State Farm | $4,756.96 |

| 30334 | ATLANTA | $6,893.38 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | USAA | $3,591.38 | State Farm | $4,528.97 |

| 30315 | ATLANTA | $6,889.33 | Liberty Mutual | $13,795.98 | Nationwide | $8,322.55 | USAA | $3,865.01 | State Farm | $4,645.27 |

| 30310 | ATLANTA | $6,880.31 | Liberty Mutual | $12,863.94 | Nationwide | $9,315.62 | USAA | $3,762.96 | State Farm | $4,665.43 |

| 30304 | ATLANTA | $6,835.84 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | USAA | $3,544.19 | State Farm | $3,655.92 |

| 30303 | ATLANTA | $6,788.76 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | Geico | $3,398.82 | USAA | $3,544.19 |

| 30311 | ATLANTA | $6,750.28 | Liberty Mutual | $12,863.94 | Nationwide | $9,315.62 | USAA | $3,532.72 | State Farm | $4,454.79 |

| 30058 | LITHONIA | $6,733.62 | Liberty Mutual | $12,998.29 | Nationwide | $8,219.53 | USAA | $3,420.60 | State Farm | $4,587.99 |

| 30038 | LITHONIA | $6,730.99 | Liberty Mutual | $12,998.29 | Nationwide | $8,219.53 | USAA | $3,696.02 | State Farm | $4,472.39 |

| 30032 | DECATUR | $6,699.34 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,402.21 | State Farm | $4,352.35 |

| 30034 | DECATUR | $6,694.70 | Liberty Mutual | $12,998.29 | Nationwide | $8,396.55 | USAA | $3,566.58 | State Farm | $4,628.72 |

| 30079 | SCOTTDALE | $6,686.79 | Liberty Mutual | $13,494.47 | Nationwide | $8,219.53 | USAA | $3,131.70 | State Farm | $4,006.43 |

| 30331 | ATLANTA | $6,657.55 | Liberty Mutual | $12,863.94 | Nationwide | $9,315.62 | USAA | $3,550.46 | State Farm | $4,373.39 |

| 30316 | ATLANTA | $6,647.47 | Liberty Mutual | $13,132.24 | Nationwide | $9,431.20 | USAA | $3,773.63 | State Farm | $4,385.74 |

| 30318 | ATLANTA | $6,621.02 | Liberty Mutual | $13,132.24 | Nationwide | $9,315.62 | USAA | $3,886.82 | Geico | $4,476.31 |

| 30312 | ATLANTA | $6,620.73 | Liberty Mutual | $13,132.24 | Nationwide | $9,240.55 | USAA | $3,544.19 | State Farm | $4,376.84 |

| 30313 | ATLANTA | $6,583.09 | Liberty Mutual | $14,291.57 | Nationwide | $9,240.55 | Geico | $3,398.82 | USAA | $3,532.72 |

| 30072 | PINE LAKE | $6,580.33 | Liberty Mutual | $12,395.60 | Nationwide | $9,476.29 | USAA | $3,544.70 | State Farm | $4,294.43 |

| 30349 | ATLANTA | $6,554.04 | Liberty Mutual | $12,648.11 | Nationwide | $8,322.55 | USAA | $3,646.54 | State Farm | $4,334.90 |

| 30291 | UNION CITY | $6,486.71 | Liberty Mutual | $12,648.11 | Nationwide | $8,322.55 | USAA | $3,838.58 | State Farm | $4,415.71 |

| 30087 | STONE MOUNTAIN | $6,469.78 | Liberty Mutual | $13,494.47 | Nationwide | $6,990.93 | USAA | $3,512.50 | State Farm | $4,600.69 |

Now let’s take a look at the 25 cheapest Georgia ZIP codes for car insurance.

| 25 Least Expensive Zip Codes in Georgia | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 31699 | MOODY A F B | $3,976.82 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,101.36 | USAA | $2,430.99 |

| 31605 | VALDOSTA | $3,977.77 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,101.36 | USAA | $2,389.89 |

| 31606 | VALDOSTA | $4,020.26 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,313.11 | USAA | $2,512.28 |

| 31632 | HAHIRA | $4,022.80 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,248.83 | USAA | $2,525.57 |

| 31698 | VALDOSTA | $4,030.81 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,120.11 | USAA | $2,513.70 |

| 31602 | VALDOSTA | $4,044.80 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,120.11 | USAA | $2,525.57 |

| 31601 | VALDOSTA | $4,058.10 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,303.12 | USAA | $2,522.26 |

| 31625 | BARNEY | $4,079.38 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| 31638 | MORVEN | $4,093.21 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| 31643 | QUITMAN | $4,095.02 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| 31750 | FITZGERALD | $4,197.86 | Liberty Mutual | $9,217.46 | Nationwide | $4,957.00 | Geico | $2,580.05 | State Farm | $2,717.52 |

| 31783 | REBECCA | $4,202.67 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,751.23 | Geico | $3,030.56 |

| 31079 | ROCHELLE | $4,205.41 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,868.06 | USAA | $2,921.31 |

| 31629 | DIXIE | $4,206.31 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,727.01 | USAA | $2,777.49 |

| 31626 | BOSTON | $4,210.42 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,456.21 | State Farm | $2,967.64 |

| 31792 | THOMASVILLE | $4,231.02 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,456.21 | State Farm | $2,901.62 |

| 31757 | THOMASVILLE | $4,236.28 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,456.21 | State Farm | $2,946.56 |

| 31627 | CECIL | $4,244.75 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,612.68 | State Farm | $2,715.08 |

| 31620 | ADEL | $4,247.91 | Liberty Mutual | $9,257.13 | Nationwide | $4,819.43 | Geico | $2,612.68 | State Farm | $2,702.55 |

| 31778 | PAVO | $4,284.48 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,613.34 | State Farm | $2,924.94 |

| 31738 | COOLIDGE | $4,289.46 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,613.34 | State Farm | $2,959.80 |

| 31558 | SAINT MARYS | $4,291.24 | Liberty Mutual | $9,023.13 | Nationwide | $5,784.34 | Geico | $2,431.31 | USAA | $2,437.65 |

| 31714 | ASHBURN | $4,295.11 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | Geico | $2,680.97 | USAA | $2,912.71 |

| 31569 | WOODBINE | $4,296.42 | Liberty Mutual | $9,023.13 | Nationwide | $5,550.45 | Geico | $2,431.31 | USAA | $2,518.86 |

| 31793 | TIFTON | $4,300.63 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | State Farm | $2,760.31 | Geico | $2,764.28 |

It’s worth noting that a zip code in Atlanta, on average, has the highest insurance rankings. This makes sense, of course, as it’s the most populated city in Georgia. The lowest car insurance ranking is the zip code for the Moody Air Force Base.

The next two lowest rankings in Georgia for car insurance costs are zip codes in Valdosta, Georgia. This is interesting because it’s a city that has a moderately sized population of about 56,000 people.

Finally, it’s also worth noting that though Atlanta has the zip code with the highest insurance ranking in the state, there are zip codes from less populated cities that rank higher than some of Atlanta’s other zip codes.

Cheapest Rates by City

Atlanta is not the most expensive city in Georgia for car insurance. In fact, it’s not even in the top 10 most expensive cities. The most expensive city in Georgia is Clarkston (30021), and the least expensive city is the Moody Air Force Base (31699).

These 10 cities have the highest car insurance rates in Georgia.

| 10 Most Expensive Cities in Georgia | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Clarkston | $6,944.22 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,459.21 | State Farm | $4,616.14 |

| Redan | $6,913.82 | Liberty Mutual | $12,998.29 | Nationwide | $8,631.83 | USAA | $3,574.28 | State Farm | $4,700.44 |

| Stone Mountain | $6,899.09 | Liberty Mutual | $13,494.47 | Nationwide | $8,631.83 | USAA | $3,478.91 | State Farm | $4,726.08 |

| Lithonia | $6,732.30 | Liberty Mutual | $12,998.29 | Nationwide | $8,219.53 | USAA | $3,558.31 | State Farm | $4,530.19 |

| Scottdale | $6,686.79 | Liberty Mutual | $13,494.47 | Nationwide | $8,219.53 | USAA | $3,131.70 | State Farm | $4,006.43 |

| Pine Lake | $6,580.33 | Liberty Mutual | $12,395.60 | Nationwide | $9,476.29 | USAA | $3,544.70 | State Farm | $4,294.43 |

| Decatur | $6,512.61 | Liberty Mutual | $12,755.96 | Nationwide | $8,274.74 | USAA | $3,491.47 | State Farm | $4,464.04 |

| Union City | $6,486.71 | Liberty Mutual | $12,648.11 | Nationwide | $8,322.55 | USAA | $3,838.58 | State Farm | $4,415.71 |

| Mountain Park | $6,469.78 | Liberty Mutual | $13,494.47 | Nationwide | $6,990.93 | USAA | $3,512.50 | State Farm | $4,600.69 |

| Ellenwood | $6,468.98 | Liberty Mutual | $12,669.13 | Nationwide | $7,813.72 | USAA | $3,739.84 | State Farm | $4,719.07 |

The table below shows the 10 cities in Georgia with the lowest car insurance rates.

| 10 Least Expensive Cities in Georgia | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Moody AFB | $3,976.82 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,101.36 | USAA | $2,430.99 |

| Valdosta | $4,018.41 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,163.67 | USAA | $2,485.36 |

| Hahira | $4,022.80 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,248.83 | USAA | $2,525.57 |

| Barney | $4,079.37 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| Morven | $4,093.21 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| Quitman | $4,095.01 | Liberty Mutual | $9,217.46 | Nationwide | $4,819.43 | Geico | $2,342.51 | USAA | $2,777.49 |

| Dasher | $4,195.16 | Liberty Mutual | $9,217.46 | Nationwide | $6,001.75 | Geico | $2,290.32 | USAA | $2,522.26 |

| Fitzgerald | $4,197.86 | Liberty Mutual | $9,217.46 | Nationwide | $4,957.00 | Geico | $2,580.05 | State Farm | $2,717.52 |

| Rebecca | $4,202.67 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,751.23 | Geico | $3,030.56 |

| Rochelle | $4,205.41 | Liberty Mutual | $9,217.46 | Nationwide | $4,162.32 | State Farm | $2,868.06 | USAA | $2,921.31 |

Clarkston is a smaller city compared to many others (the population of Clarkston is only about 12,000 people). Compare that to Atlanta, which has a population of approximately 486,000, and it’s curious as to why such a smaller city ranks so much higher than Georgia’s most populated one.

The second-most expensive city in Georgia for car insurance is Stone Mountain (30088, 30083, and 30087). This city has a smaller population, too, of about 6,000 people.

The next few cities that are the most expensive in Georgia when it comes to car insurance are Lithonia (30058 and 30038), Scottdale (30079), and Pine Lake (30072). None of these cities have very high populations. In fact, Pine Lake only has a population of about 800 people.

The least expensive “city,” Moody Air Force Base, makes sense, as it is primarily military drivers in a rather confined space that has a smaller population of about 4,499 military personnel, 476 civilian employees, and 6,252 family members.

The second-least expensive car insurance city in Georgia, which is Hahira (31632), also makes sense, as it only has a population of about 3,000.

Valdosta (31601, 31602, 31698, 31606, and 31605), which we have previously mentioned, has a medium-sized population of about 56,000, and it’s the third-least expensive car insurance city in Georgia.

From this information, we can infer that the population affects how much car insurance costs in Georgia cities, but there are many other factors involved when the average price of car insurance per city is determined.

The cities with the highest car insurance prices are suburban and rural cities just outside of Atlanta.

Best Georgia Car Insurance Companies

Finding car insurance is quite a hassle for many people. There are, ostensibly, innumerable insurance companies out there that seem to be the same, and most people who aren’t familiar with insurance can get confused by a lot of the coverages that are offered and by insurance jargon.

Fortunately for you, Georgia residents, we’re here to help you out. We’re going to give you the top insurance companies in Georgia so you can easily find the best car insurance for you.

We’ll show you each companies’ financial rating, the companies with the best ratings, the companies with the most complaints, the cheapest companies, and a lot of other information that will make it that much easier for you to find car insurance.

The Largest Companies’ Financial Rating

Using a third-party review website such as A.M. Best can be helpful when determining which car insurance company has the best financial rating. They consider numerous factors and ultimately provide a complete and accurate rating of each car insurance company, which will make the search for your ideal car insurance even easier.

In the table below, you can see what these ratings are in a simple, easy-to-understand letter grade.

| PROVIDERS (LISTED BY SIZE, LARGEST AT THE TOP): | A.M. BEST RATING: |

|---|---|

| Allstate | A+ |

| Auto Owners | A++ |

| Berkshire Hathaway | A++ |

| Georgia Farm Bureau | B+ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | A++ |

| Travelers | A++ |

| United Service Automobile Association | A++ |

As you can see, there are quite a few companies with an exceptional rating of A+ or higher. These companies are Allstate, Auto-Owners, Berkshire Hathaway, Nationwide, and Progressive. Even the lowest-rated company on here, Georgia Farm Bureau, has an impressive rating of B+.

All these high ratings are great for you, as you have many different options when you’re choosing a reputable car insurance company.

If you want a more in-depth look at the numbers behind some of the financial ratings of car insurance companies, the following table is an excellent source.

| Rank | Company Group/group/code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 1 | State Farm | $1,937,806 | 68.72% | 22.49% |

| 2 | Geico | $1,051,005 | 81.23% | 12.20% |

| 3 | Progressive | $1,001,828 | 63.09% | 11.63% |

| 4 | Allstate Insurance | $820,479 | 51.96% | 9.52% |

| 5 | USAA | $706,276 | 91.01% | 8.20% |

| 6 | Liberty Mutual | $335,540 | 66.84% | 3.89% |

| 7 | Nationwide | $267,971 | 77.10% | 3.11% |

| 8 | Travelers | $266,864 | 71.60% | 3.10% |

| 9 | Georgia Farm Bureau | $261,432 | 64.70% | 3.03% |

| 10 | Auto-Owners | $224,705 | 70.36% | 2.61% |

Companies with Best Ratings

Now, let’s check out the companies with the best ratings, according to the reputable J.D. Power Press Release. According to this information, the highest-ranking car insurance company available in Georgia is Alfa Insurance.

Southeast JD Power Ratings

| Company | Rating |

|---|---|

| Farm Bureau Insurance-Tennessee | 888 |

| Erie | 870 |

| Alfa | 855 |

| NC Farm | 855 |

| State Farm | 853 |

| Auto Owners | 852 |

| Southeast Average | 841 |

| Geico | 838 |

| KY Farm Bureau | 830 |

| Safeco | 829 |

| Nationwide | 828 |

| Progressive | 824 |

| Travelers | 822 |

| National General | 820 |

| MetLife | 814 |

| Allstate | 813 |

| Liberty | 809 |

Alfa Insurance has a rating of 855, which is pretty impressive considering the highest-rated insurance in the Southeast is Farm Bureau Insurance-Tennessee with a rating of 888.

Some other popular insurances in the Southeast with higher ratings are State Farm, with a rating of 853, and Auto-Owners Insurance, with a rating of 852. Considering the average rating for car insurance in the Southeast is 841, anything over this number is impressive.

Companies with Most Complaints in Georgia

We’ve also made sure to add data collected from the Department of Professional and Financial Regulation that shows the complaints against the 10 largest insurance companies in Georgia.

To help read the table, remember the following:

- A complaint index of one is average

- A complaint index of less than one is better than average

- A complaint index of greater than one is worse than average

While some insurance companies may have a high complaint index, that doesn’t necessarily mean you shouldn’t use them. It’s also important to factor in the customer satisfaction ratings so you can see how well the company deals with the complaints.

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| Allstate | 1 | 0.5 | 163 |

| Auto-Owners Group | - | - | - |

| Geico | - | - | - |

| Liberty Mutual Group | 1 | 5.95 | 222 |

| Nationwide | 1 | 0.28 | 25 |

| Progressive | - | - | - |

| State Farm | 1 | 0.44 | 1,482 |

| Travelers Group | 1 | 0.09 | 2 |

| USAA | - | - | - |

According to this table, the majority of the companies have a complaint ratio of less than one. These companies are Allstate, Nationwide, Travelers Group, and State Farm. The company on this list that has a complaint ratio higher than one, and that’s Liberty Mutual.

Concerning total complaints from 2017, Allstate had 163, Liberty Mutual had 222, Nationwide had 25, State Farm had 1482, and Travelers Group had two.

(Also note: for the companies with dashes, there was no information. It does not mean that they were complaint-free.)

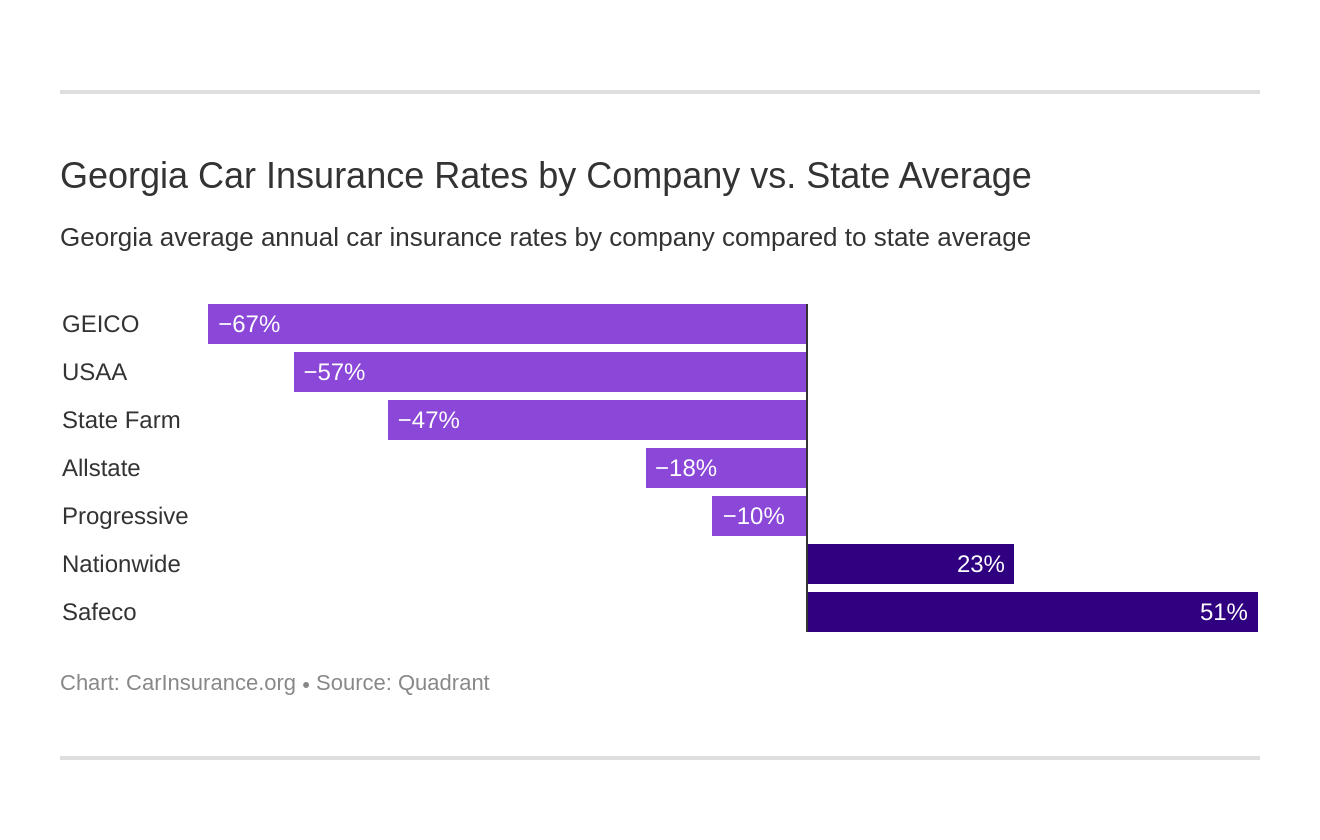

Cheapest Companies in Georgia

The table below shows the cheapest insurance companies in Georgia. And while cheaper doesn’t always necessarily mean better, this information is helpful to know when deciding on buying car insurance.

| Company | Average Annual Rate | Compared to State Average | Percentage |

|---|---|---|---|

| Allstate | $4,210.70 | -$756.13 | -17.96% |

| Geico | $2,977.19 | -$1,989.64 | -66.83% |

| Nationwide | $6,484.90 | $1,518.07 | 23.41% |

| Progressive | $4,499.22 | -$467.61 | -10.39% |

| Safeco | $10,053.44 | $5,086.61 | 50.60% |

| State Farm | $3,384.88 | -$1,581.95 | -46.74% |

| USAA | $3,157.46 | -$1,809.37 | -57.30% |

Note: the average to which these companies are being compared is $4,966.83

The most expensive company on this list is Safeco Ins Co of IL, and the least expensive is Geico. This makes sense, as Geico is the cheapest policy for many other factors for insurance (e.g. credit ratings, coverage levels, commuting), too.

Commute Rates by Companies

This data represents how your insurance at some companies is affected by your commute.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,115.26 | $4,306.14 |

| Geico | $2,926.71 | $3,027.68 |

| Liberty Mutual | $10,053.44 | $10,053.44 |

| Nationwide | $6,484.90 | $6,484.90 |

| Progressive | $4,499.22 | $4,499.22 |

| State Farm | $3,384.88 | $3,384.88 |

| USAA | $3,301.21 | $3,013.71 |

As you can see, Liberty Mutual’s and Geico’s prices are affected very differently by the same number of commuting miles. It’s also interesting to note that Liberty Mutual is the same cost for a commute that is twice as long as their 10-mile, 6,000-annual mileage.

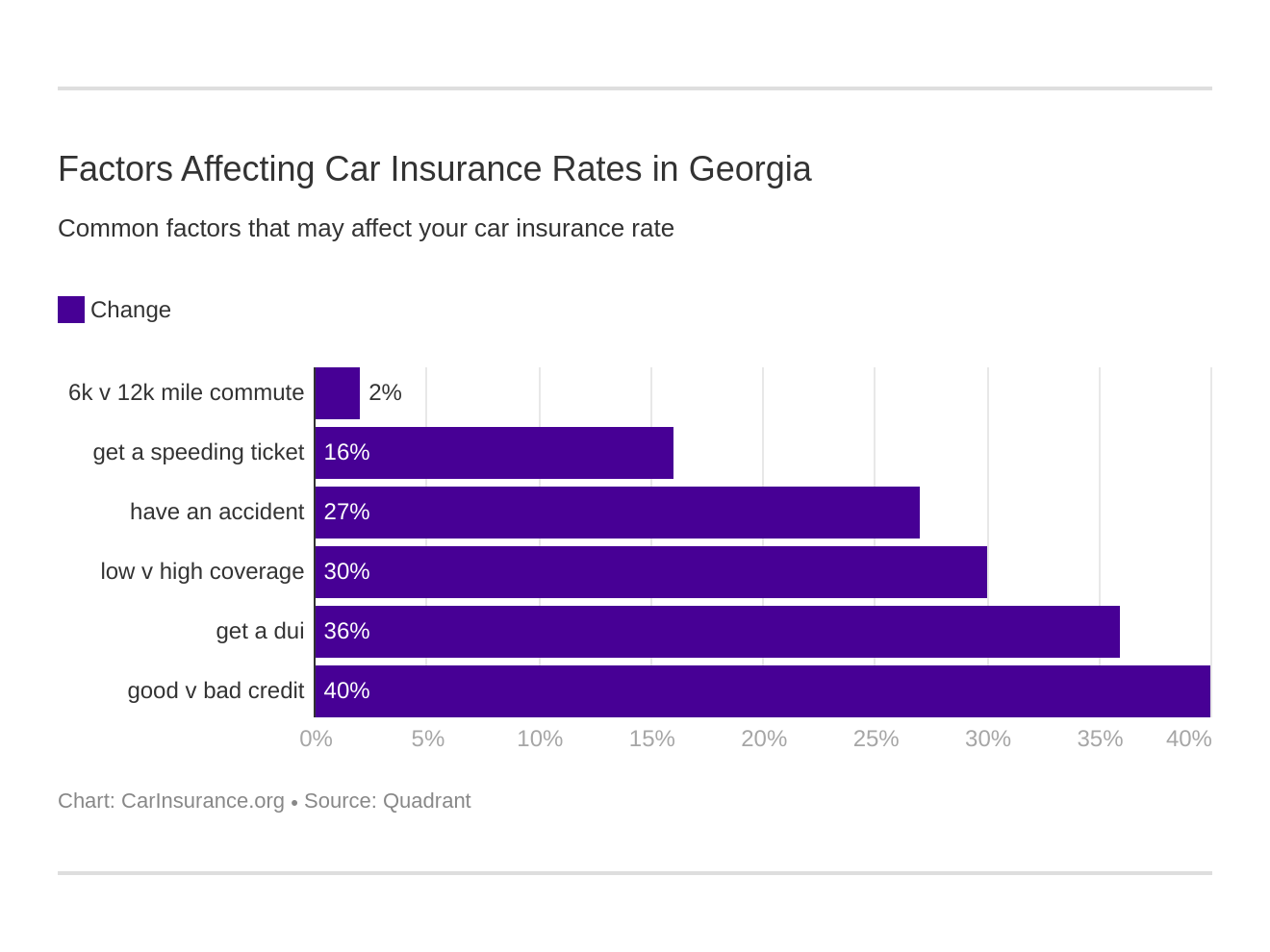

Take a look at these 6 major factors affecting auto insurance rates in Georgia.

Coverage Level Rates by Companies

Now, let’s move onto coverage level rates by companies. The best car insurance company for higher coverage rates in Georgia is Geico, as their high coverage rate is $3,175.82.

However, remember that price is not always the most important factor to consider. Some companies might have a better value for a low or medium coverage rate. Here is a complete list of the car insurance companies in Georgia and their rates for high, medium, and low coverage.

| GROUP | COVERAGE TYPE | ANNUAL AVERAGE |

|---|---|---|

| Liberty Mutual | High | $10,524.93 |

| Liberty Mutual | Medium | $9,998.75 |

| Liberty Mutual | Low | $9,636.66 |

| Nationwide | Medium | $6,602.52 |

| Nationwide | High | $6,518.06 |

| Nationwide | Low | $6,334.12 |

| Progressive | High | $4,949.64 |

| Allstate | High | $4,496.20 |

| Progressive | Medium | $4,426.83 |

| Allstate | Medium | $4,254.86 |

| Progressive | Low | $4,121.20 |

| Allstate | Low | $3,881.04 |

| State Farm | High | $3,599.32 |

| State Farm | Medium | $3,387.35 |

| USAA | High | $3,317.90 |

| Geico | High | $3,175.82 |

| State Farm | Low | $3,167.98 |

| USAA | Medium | $3,141.23 |

| USAA | Low | $3,013.26 |

| Geico | Medium | $2,991.78 |

| Geico | Low | $2,763.97 |

As you can see, Liberty Mutual costs the most overall, and Geico costs the least. Another interesting factor to consider is that many companies’ coverage plans seem to be only a few hundred dollars apart, so to get the most for your money, it might make sense to go with the high coverage for these companies.

Credit History Rates by Companies

Your credit is something that affects the cost of your insurance, so it’s important to know the cost of each company depending on whether your credit is good, fair, or poor.

The company that is cheapest in Georgia for bad credit scores is Geico, with an annual average of $3,780.93. Of course, it is also important to know what the costs of other insurance companies are and what the costs for different credit scores are for these companies. We’ve compiled that data in the list below.

| GROUP | CREDIT HISTORY | ANNUAL AVERAGE |

|---|---|---|

| Allstate | Good | $3,382.87 |

| Allstate | Poor | $5,456.39 |

| Allstate | Fair | $3,792.84 |

| Geico | Fair | $2,607.81 |

| Geico | Good | $2,542.83 |

| Geico | Poor | $3,780.93 |

| Liberty Mutual | Good | $6,923.06 |

| Liberty Mutual | Poor | $14,403.23 |

| Liberty Mutual | Fair | $8,834.05 |

| Nationwide | Poor | $7,719.34 |

| Nationwide | Good | $5,476.79 |

| Nationwide | Fair | $6,258.58 |

| Progressive | Good | $4,045.92 |

| Progressive | Poor | $5,074.80 |

| Progressive | Fair | $4,376.95 |

| State Farm | Fair | $2,988.35 |

| State Farm | Good | $2,368.08 |

| State Farm | Poor | $4,798.23 |

| USAA | Fair | $2,892.23 |

| USAA | Good | $2,469.31 |

| USAA | Poor | $4,110.85 |

According to Experian, the average credit score in Georgia in 2019 is 682, which is considered good. Therefore, the companies that offer the best rates for good credit scores are most pertinent to Georgia drivers.

As you can see, Geico is once again the cheapest company for all credit scores. Liberty Mutual is the most expensive, and they have a big difference between good and poor credit ratings. For the other companies, the difference between the credit ratings isn’t too large.

Finally, here’s an average of all the insurance companies’ rates for each credit rating.

- Good: $5,054.22

- Fair: $4,535.83

- Poor: $388

Driving Record Rates by Companies

Another important element a car insurance company considers is your driving record. Any trustworthy insurance company considers your record when you want to purchase a plan, so it’s very helpful to know as much as you can about how they charge you based on your driving history.

Here’s a list of some major insurance companies in Georgia and the varying prices for different driving records.

| GROUP | DRIVING RECORD | ANNUAL AVERAGE |

|---|---|---|

| Allstate | Clean record | $3,465.70 |

| Allstate | With 1 speeding violation | $3,647.83 |

| Allstate | With 1 accident | $5,365.97 |

| Allstate | With 1 DUI | $4363.29 |

| Geico | Clean record | $1,991.22 |

| Geico | With 1 speeding violation | $2244.40 |

| Geico | With 1 accident | $2,493.90 |

| Geico | With 1 DUI | $5,179.25 |

| Liberty Mutual | With 1 speeding violation | $10,164.83 |

| Liberty Mutual | With 1 DUI | $11,988.03 |

| Liberty Mutual | With 1 accident | $10,428.16 |

| Liberty Mutual | Clean record | $7,632.75 |

| Nationwide | Clean record | $4,993.04 |

| Nationwide | With 1 accident | $5,859.64 |

| Nationwide | With 1 speeding violation | $6,053.51 |

| Nationwide | With 1 DUI | $9,033.42 |

| Progressive | With 1 speeding violation | $4102.75 |

| Progressive | Clean record | $3,524.11 |

| Progressive | With 1 DUI | $4,157.29 |

| Progressive | With 1 accident | $6,212.74 |

| State Farm | With 1 accident | $3,684.98 |

| State Farm | Clean record | $3,084.80 |

| State Farm | With 1 speeding violation | $3,384.88 |

| State Farm | With 1 DUI | $3,384.88 |

| USAA | With 1 speeding violation | $2,693.63 |

| USAA | Clean record | $2,416.20 |

| USAA | With 1 accident | $3,058.95 |

| USAA | With 1 DUI | $4,461.07 |

As you can see, Geico is the cheapest overall and Liberty Mutual is the most expensive. Some other things to note are that some companies (such as USAA) charge more for a DUI than an accident, and some companies (such as Progressive) charge more for an accident than a DUI. Other companies sometimes charge the same amount for certain records.

An example of this is State Farm, which charges the same amount for a DUI as a speeding ticket.

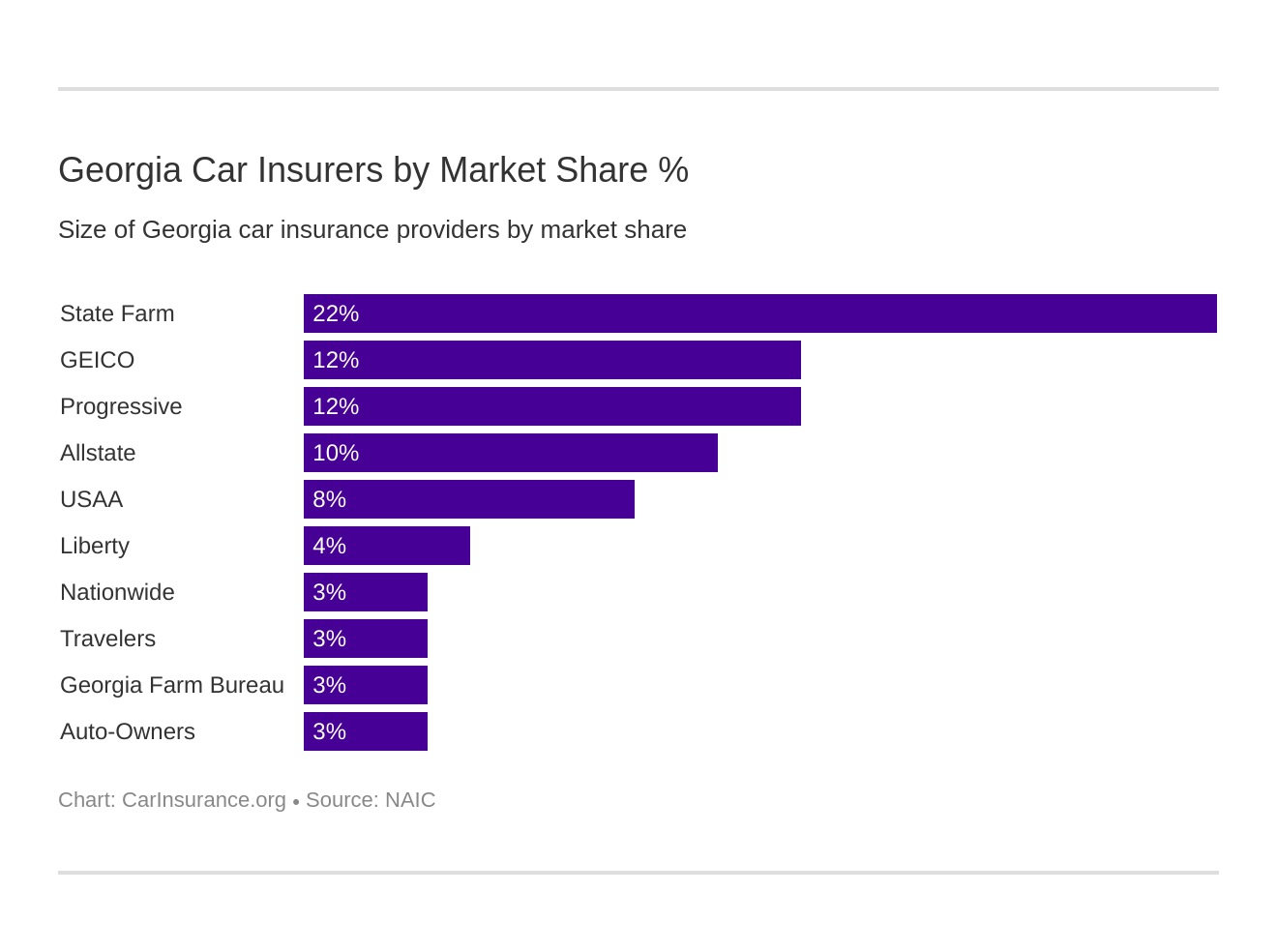

Largest Car Insurance Companies in Georgia

The following is a list of the 10 largest car insurance companies in Georgia, which should help give you an idea about which company can best help you with your car insurance needs.

| RANK | COMPANY GROUP | DIRECT PREMIUMS WRITTEN | LOSS RATIO | MARKET SHARE |

|---|---|---|---|---|

| 1 | State Farm | $1,937,806 | 68.72% | 22.49% |

| 2 | Geico | $1,051,005 | 81.23% | 12.20% |

| 3 | Progressive | $1,001,828 | 63.09% | 11.63% |

| 4 | Allstate Insurance | $820,479 | 51.96% | 9.52% |

| 5 | USAA | $706,276 | 91.01% | 8.20% |

| 6 | Liberty Mutual | $335,540 | 66.84% | 3.89% |

| 7 | Nationwide | $267,971 | 77.10% | 3.11% |

| 8 | Travelers | $266,864 | 71.60% | 3.10% |

| 9 | Georgia Farm Bureau | $261,432 | 64.70% | 3.03% |

| 10 | Auto-Owners | $224,705 | 70.36% | 2.61% |

The total for the state is $8,614,981 for direct premiums written, 71.09 percent for loss ratio, and 100 percent for market share.

Number of Insurers by Georgia

In Georgia, there are 23 domestic insurance providers — those based in and operating in the state — and 988 foreign insurance providers — those based elsewhere and operating throughout the country.

Georgia Laws

Now we’re going to discuss the laws pertaining to car insurance and driving in Georgia. Trust us — we know that learning about laws in your state, especially about something as complicated as car insurance, can be frustrating and confusing. But we’re here to guide you and educate you about these laws in a way that is understandable and useful.

You’ll be an expert on Georgia driving and car insurance laws after this. You might even feel like you went to law school but in much less time (and for much less money).

So keep reading to learn about topics ranging from Georgia’s car insurance laws and how these laws are determined to windshield coverage and high-risk insurance.

You’ll also find out about low-cost insurance, automobile insurance fraud, the statute of limitations in Georgia, state-specific laws, and various other laws that are essential to all drivers.

Car Insurance Laws

As promised, here are the car insurance laws you need to know.

How State Laws for Insurance are Determined

According to the NAIC, Georgia car insurance laws are determined by prior approval. This prior approval is for statutory coverages only, and all other coverages are file-and-use. Very quickly, file-and-use ratings are insurance regulations allowing an insurance company to use new rates prior to receiving state approval. File-and-use rating laws allow the insurer to immediately use the new rates.

You must always drive with car insurance, but you don’t need to have your insurance card as proof of insurance.

Georgia law allows insurance companies to base their rates on factors such as marital status, gender, and credit history, but the best way to ensure a low insurance rate is by being a safe driver.

Windshield Coverage

For windshield replacements in Georgia, insurers can use aftermarket parts as long as they are listed on the estimate and the guarantee is on the estimate. You can also use OEM parts, but you have to pay the difference in price.

You’re allowed to choose where to have the repair done, but you might have to pay the difference between the cost of where you want it done and where the insurance company would have the work done.

It’s also not a law, but individual insurance companies may offer windshield repair with comprehensive coverage.

High-Risk Insurance

In some cases, Georgia drivers have to fill out an SR-22 form so they can buy high-risk insurance. You would have to do this for the following reasons:

- License suspension or revocation due to a DUI

- Being involved in an accident without insurance

- Getting labeled a negligent operator

- Having too many points on your driving record

You’ll need to contact your insurance company to have them include an SR-22 form for your policy. You also may need to pay higher rates. If you don’t fill out an SR-22, your driving privileges won’t be reinstated, your license will be suspended, and you will be given additional fines. Your vehicle’s registration will also be suspended.

Fill out an SR-22 form if you’re a high-risk driver; if you don’t, you could lose your right to drive.

Low-Cost Insurance

While Georgia does have a program for high-risk drivers, unfortunately, it does not have one for low-income drivers.

The only states that have a government-funded program to help low-income families get affordable car insurance are California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Georgia

You may be unsure of what automobile insurance fraud is. We’ll explain it to you.

- Creating a claim for damages or injuries that never occurred (e.g. faking an accident)

- Adding “extra” costs onto a legitimate claim

- Faking an injury after getting into an accident

- Staging car accidents

- Giving false personal information to your insurance carrier (also called rate avoidance)

- Overcharging for treatment, if you’re a medical professional

In Georgia, automobile insurance fraud is a crime. If you’re found guilty of automobile insurance fraud in Georgia you could receive jail time and/or fines.

You can contact the Georgia Department of Insurance from their website or via phone: 404-656-2070

Statute of Limitations

In Georgia, there is a statute of limitations if you want to file a claim. A statute of limitations is the amount of time you have you have to file a claim after an accident occurs. The countdown begins the day the accident happens, so you must file right away.

According to Georgia law, there are two types of statutes of limitations relevant to insurance: personal injury and property damage.

Here is a chart displaying the time limits for both:

| GEORGIA STATUTES OF LIMITATIONS | YEARS |

|---|---|

| Personal Injury | 2 Years |

| Property Damage | 4 Years |

As you can see, if there is a personal injury, you have two years to file a claim, and for property damage, it’s four years.

State-Specific Laws

As previously mentioned, in Georgia you’re required to have car insurance, but the law doesn’t require you to have an insurance card as proof of insurance. In fact, a car insurance ID card cannot be accepted as proof of insurance.

Instead, all government agencies, including police officers performing a traffic stop, can check the Georgia Electronic Insurance Compliance System to electronically verify that you have valid car insurance.

However, it’s still a good idea to have a physical copy of your insurance card so you can exchange it with an officer in case of an accident.

If your license gets suspended for driving without insurance, you can get it reinstated after your first accident by:

- Waiting until your driver’s license has been suspended for a minimum of 60 days

- Purchasing at least the minimum auto insurance coverage required in GA

- Paying a reinstatement fee of:

- $200 by mail to:

Department of Driver Services (DDS)

Validation Unit

P.O. Box 80447

Conyers, GA 30013 - $210 in person at your local DDS office

- $200 by mail to:

Georgia has also enacted a law that protects the insured from unfair claims and protects your coverage, too. The law is appropriately called the Unfair Claims Settlement Practices Act.

Familiarize yourself with the Unfair Claims Settlement PracticesAct so you can protect yourself from illegal and unethical acts committed by car insurance companies.

Vehicle Licensing Laws

If you are purchasing or transferring ownership of your car, you should immediately apply for your title and obtain or transfer a Georgia license plate at your County Tag Office.

Georgia law requires that you apply for or transfer your title and registration for your vehicle within 30 days of moving to Georgia or moving counties.

REAL ID

Georgia is compliant with the REAL ID Act. Federal agencies will accept driver’s licenses and identification cards from Georgia at federal facilities and nuclear power plants.

Secure driver’s licenses and identification documents are essential to national security. Law enforcement has to be able to rely on government-issued identification documents and know that the person that has the document is who they claim to be.

The REAL ID Act is coordinated by the state and Federal Government to improve the reliability and accuracy of state-issued documents.

Penalties for Driving Without Insurance

Make sure to always drive with insurance in Georgia, or you could face some serious consequences.

If you’re caught for the first time driving without insurance, your registration will be suspended, and you’ll be required to pay a $25 lapse fee and $60 reinstatement fee. You’ll also have to pay any other registration fees and vehicle ad valorem taxes that are due.

If you’re caught a second time within five years, your registration will be suspended with a $25 lapse fee and a $60 reinstatement fee. You’ll also have to pay any other registration fees and vehicle ad valorem taxes due.

As mentioned a few times in this post, a car insurance ID cannot be accepted as insurance proof. Instead, all of Georgia’s government agencies check the Georgia Electronic Insurance Compliance System (GEICS) to electronically verify that you have valid car insurance.

It is your car insurance carrier’s responsibility to provide your car insurance status to the GEICS.

Make sure to check that all your information is correct on your card because if it’s not, it’s likely incorrect in the electronic system, too. If there are any issues, contact your insurance carrier.

Your registration will be suspended and revoked if you do not maintain mandatory continuous motor vehicle liability insurance.

Teen Driver Laws

If you’re a teenager in Georgia, you can get your leaner’s permit when you’re 15. After you’ve gone through the mandatory period required for the learner’s permit and have met all requirements, you can apply for a regular or restricted license.

| YOUNG DRIVER LICENSING SYSTEM | FIRST REQUIREMENT | SECOND REQUIREMENT | THIRD REQUIREMENT | |

|---|---|---|---|---|

| To get a learners license you must: | Have a minimum age of | 15 | - | - |

| Before getting a license or restricted license you must: | Have a mandatory holding period of 12 months | Have a minimum supervised driving time of 40 hours, 6 of which must be at night | Have a minimum age of 16 | |

| Restrictions during intermediate or restricted license stage: | Nighttime restrictions – midnight-5 a.m. secondary enforcement | Passenger restrictions (family members excepted unless otherwise noted) – first 6 months—no passengers; second 6 months—no more than 1 passenger younger than 21; thereafter, no more than 3 passengers secondary enforcement | - | |

| Minimum age at which restrictions may be lifted: | Nighttime restrictions – until age 18 (min. age: 18) | Passenger restrictions – until age 18 (min. age: 18) | - |

Older Driver License Renewal Procedures

If you’re an older resident in Georgia, you have the same renewal procedures as the general population. If you’re a driver in Georgia, you are required to renew your license every eight years. You must also pass a mandatory eye exam.

You can renew your license at your local department of driver services or you can renew online every other renewal.

New Residents

When you move to Georgia, you must apply for a Georgia driver’s license within 30 days. You can surrender an out-of-state license or expired license (of less than two years) and exchange it for a Georgia license without having to take the written test or the road test. You still must prove that your vision is adequate.

License Renewal Procedures

Your license will expire on the birthday of your eighth year of having the license. If you’re 65 or older, you must complete an eyesight exam. Driver’s licenses can be issued to non-citizens for their authorized period of lawful presence, up to a maximum of 5 years.

Licenses are renewable 150 days prior to expiration.

If you’re active-duty military or a full-time student (or dependent of same) living out of the state, you can get a non-photo renewal of your Georgia driver’s license by mail.

You can renew online or in person. If you renew in person, you need to fill out an application form and take a photo. You are required to bring documentation showing your identity, residential address, full social security number, and U.S. citizenship or proof of lawful presence in the United State.

If your Georgia driver’s license has been expired for two years or more, you must complete the following tests to renew your license:

- Road Signs

- Road Rules

- Road Skills Test

- Vision Exam

Negligent Operator Treatment System (NOTS)

While California is the only state that has the “Official” NOTS, Georgia also punishes negligent drivers by adding points to their licenses. The Georgia point system ranges from two to six points. If you have 15 points in 24 months, your license will be suspended.

Rules of the Road

Let’s examine some rules of the road for Georgia drivers. By following these laws, you’ll not only avoid tickets and higher rates, but you’ll also make the road safer for everyone.

Fault vs. No-Fault

Georgia is an at-fault state, which means you’ll be liable for damages in an accident during which you’re the at-fault driver. Therefore, it is essential that you not only have insurance but the right coverage, too.

Seat Belt & Car Seat Laws

Make sure to check out the seat belt and car seat laws in the table below so you can avoid injuries and fines.

| SEAT BELT LAW IN GEORGIA | DETAILS |

|---|---|

| Effective Since | September, 1, 1988 |

| Primary Enforcement | Yes; effective since July 1, 1996 |

| Age/Seats Applicable | 18+ years old in front seat |

| 1st Offense Max Fine | $15 |

There are also laws about children’s safety that you must adhere to. If you have children, make sure to follow these laws.

| MUST BE IN CHILD SAFETY SEAT | ADULT BELT PERMISSIBLE | MAXIMUM BASE FINE, 1ST OFFENSE, ADDITIONAL FEES MAY APPLY | PREFERENCE FOR REAR SEAT |

|---|---|---|---|

| 7 years and younger and 57 inches or less | more than 57 inches | $50 | 7 years and younger must be in rear seat if available |

It’s also important to know about restrictions when riding in cargo areas in pickup trucks. In Georgia, you are allowed to ride in the cargo areas if you’re 18 and older, or if you’re 17 and younger in pickup trucks with covered cargo areas. If you’re 17 and younger, you can be in any pickup truck off the interstate.

Keep Right & Move Over Laws

There are also keep right and move over laws that you should be abreast of if you’re living in Georgia. Georgia law requires you to yield, which means you move right if you’re blocking traffic in the left lane. Basically, you need to let faster traffic pass if you’re moving more slowly than traffic.

So, slower traffic keeps to the right, and all traffic moves right if it’s blocking overtaking traffic.

Speed Limits

There are speed limits in Georgia that you need to follow or you’ll receive a ticket and a fine. Here are Georgia’s speed limits on different roads. Speed limits may change depending on the road and weather conditions.

| Road Type | Speed Limit |

|---|---|

| Urban Interstates | 70 |

| Rural Interstates | 70 |

| Other Roads | 65 |

| Other Limited Access Roads | 65 |

Ridesharing

You’ve probably heard of ridesharing (e.g. Uber and Lyft). If you want to start ridesharing, you need to purchase ridesharing insurance from one of the following car insurance companies in Georgia:

- Allstate

- Farmers

- Geico

- State Farm

- USAA

It’s also crucial that you have the minimum insurance that Georgia requires. Ridesharing companies require your vehicle is registered, and it must go under an inspection where it’s checked to see if it’s safe to drive.

Automation on the Road

Before starting, let’s define what automation is:

In driving, automation involves using radar, camera, and other sensors to perform parts or all of the driving task on a sustained basis instead of the driver. One example is adaptive cruise control, which continually adjusts the vehicle’s speed to maintain a set minimum following distance. (Source: IIHS )

Georgia allows autonomous vehicles on its roadways. Georgia doesn’t require a licensed operator in the vehicle while the automated driving system is being used. Georgia law also requires that all autonomous vehicles have liability insurance.

Safety Laws

Some of the most important laws in Georgia (and any state, really) are their safety laws. Make sure to know about these laws so you can protect yourself and other drivers from danger. Additionally, it is also important to know about these laws because you’ll still suffer a penalty if one is broken and no one is injured.

Keep reading to learn more about the safety laws in Georgia.

DUI Laws

DUIs are some of the most serious offenses that one could make while driving. This is because so many deaths are caused by this crime. In 2017, there were 10,874 deaths caused by DUIs in America and 366 deaths in Georgia alone.

The penalties for drinking and driving vary from state to state. Here are Georgia’s laws:

| FORMAL NAME FOR OFFENSE | BAC LIMIT | HIGH BAC LIMIT | CRIMINAL STATUS | LOOK BACK PERIOD | 1st Offense -Imprisonment | 1st Offense - Fine | 1st Offense - ALS or Revocation | 1st Offense - Other |

|---|---|---|---|---|---|---|---|---|

| Driving Under The Influence (DUI) | 0.08 | 0.15 | 1st-2nd misdemeanors, 3rd high and aggravated misdemeanor, 4th+ felony | 10 Years | 10 days-12 months | $300-$1000 | 120 Days Minimum, up to a Year | 20-40 Hours of Community Service |

Your punishment increases with each offense, so don’t drink and drive. Call a cab, order a rideshare, do anything but drive while under the influence. If you don’t do it for yourself, do it for your fellow drivers.

Marijuana-Impaired Driving Laws

For marijuana-impaired driving laws, Georgia has a zero-tolerance policy for driving with THC or metabolites one’s system.

Distracted Driving Laws

In some ways, distracted driving is more dangerous than DUI, as your attention is completely off the road. This is why laws are becoming increasingly strict about distracted driving and cellphone use.

According to Georgia law, all drivers have to follow the handheld ban, and if you’re under 18, you can’t use your phone at all. Primary law enforcement can pull you over for even being on your cellphone.

Since we’ve wrapped up the majority of the laws about driving in Georgia, let’s move on to some necessary facts about driving in the Goober State.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving in Georgia

Each state has so much information on driving, it’s hard to keep up with everything that’s going on; Georgia is no exception to this struggle. Luckily, we’re going to give you some information about driving in the Peach State that will help you stay safe, save money, and make intelligent driving decisions.

In this section, we’re going to discuss vehicle theft, driving fatalities, trends, arrests, and many other facts that will help you immensely.

Vehicle Theft in Georgia

Here are the top 10 types of cars stolen in Georgia (note: the data is from 2016; the years listed next to the data are the years of the model).

| Rank | MAKE/MODEL | YEAR | NUMBER OF THEFTS |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 1,052 |

| 2 | Ford Pickup (Full Size) | 2006 | 954 |

| 3 | Chevrolet Pickup (Full Size) | 1999 | 948 |

| 4 | Honda Civic | 2000 | 653 |

| 5 | Toyota Camry | 2014 | 568 |

| 6 | Chevrolet Impala | 2008 | 512 |

| 7 | Nissan Altima | 2014 | 484 |

| 8 | Dodge Pickup (Full Size) | 2003 | 452 |

| 9 | Jeep Cherokee/Grand Cherokee | 2001 | 449 |

| 10 | Dodge Caravan | 2002 | 425 |

This table ranks the model of car which is most stolen in Georgia and shows how many of these vehicles have been stolen.

The vehicle that is most stolen on this list is a 1997 Honda Accord, with 1,052 models stolen. Tenth on the list is 2002 Dodge Caravan, with 425 models stolen.

The city in which you reside also has an impact on vehicle theft. Here is a table with information from the FBI that shows Georgia’s vehicle theft by city.

| State | Motor vehicle theft |

|---|---|

| Atlanta | 3297 |

| Savannah-Chatham Metropolitan | 940 |

| Columbus | 704 |

| East Point | 493 |

| Union City | 336 |

| Valdosta | 232 |

| Athens-Clarke County | 230 |

| Warner Robins | 230 |

| College Park | 229 |

| Smyrna | 226 |

| Albany | 189 |

| Marietta | 182 |

| Sandy Springs | 178 |

| Forest Park | 139 |

| Brookhaven | 125 |

| Roswell | 109 |

| Gainesville | 104 |

| Hapeville | 101 |

| Dunwoody | 92 |

| Riverdale | 87 |

| Douglasville | 85 |

| Peachtree City | 78 |

| Chamblee | 78 |

| Dalton | 73 |

| Morrow | 73 |

| Doraville | 71 |

| Fairburn | 71 |

| LaGrange | 71 |

| Newnan | 68 |

| Pooler | 63 |

| Conyers | 61 |

| Rome | 61 |

| Cartersville | 57 |

| Carrollton | 53 |

| Norcross | 53 |

| Griffin | 51 |

| Covington | 49 |

| McDonough | 47 |

| Lawrenceville | 46 |

| Brunswick | 44 |

| Clarkston | 41 |

| Tifton | 41 |

| Statesboro | 36 |

| Alpharetta | 35 |

| Duluth | 33 |

| Snellville | 32 |

| Cedartown | 32 |

| Jesup | 32 |

| Stone Mountain | 31 |

| Cordele | 30 |

| Dublin | 30 |

| Canton | 30 |

| Monroe | 29 |

| Villa Rica | 29 |

| Moultrie | 28 |

| Decatur | 27 |

| Kingsland | 25 |

| Hiram | 25 |

| Acworth | 23 |

| Kennesaw | 23 |

| Lilburn | 22 |

| Fort Oglethorpe | 22 |

| Suwanee | 22 |

| Port Wentworth | 21 |

| Woodstock | 21 |

| Thomasville | 21 |

| Loganville | 21 |

| Milledgeville | 20 |

| Dallas | 20 |

| Lake City | 19 |

| Winder | 19 |

| Johns Creek | 18 |

| Bainbridge | 17 |

| Fitzgerald | 17 |

| Adairsville | 17 |

| Bremen | 17 |

| Calhoun | 16 |

| Cumming | 16 |

| Jonesboro | 16 |

| Lithonia | 16 |

| Waynesboro | 15 |

| Quitman | 14 |

| Fayetteville | 14 |

| Fort Valley | 14 |

| Eastman | 14 |

| Ringgold | 14 |

| Locust Grove | 14 |

| Auburn | 14 |

| Grovetown | 13 |

| Barnesville | 13 |

| Palmetto | 13 |

| Vidalia | 13 |

| Rockmart | 13 |

| Powder Springs | 13 |

| Adel | 12 |

| Camilla | 12 |

| Jasper | 12 |

| Alma | 12 |

| Commerce | 11 |

| Milton | 11 |

| Bloomingdale | 10 |

| Byron | 10 |

| Temple | 10 |

| Jefferson | 10 |

| Ashburn | 9 |

| Pelham | 9 |

| Hampton | 9 |

| Rincon | 9 |

| Thunderbolt | 9 |

| Braselton | 8 |

| Hartwell | 8 |

| Toccoa | 8 |

| Remerton | 7 |

| Baxley | 7 |

| Centerville | 7 |

| Holly Springs | 7 |

| Millen | 7 |

| Cairo | 7 |

| Lakeland | 7 |

| Montezuma | 7 |

| Cleveland | 6 |

| Cornelia | 6 |

| Dawson | 6 |

| Sandersville | 6 |

| Blackshear | 6 |

| Hazlehurst | 6 |

| Madison | 6 |

| Elberton | 6 |

| Midway | 6 |

| Metter | 6 |

| Cochran | 6 |

| Swainsboro | 6 |

| West Point | 5 |

| Emerson | 5 |

| Homerville | 5 |

| Jackson | 5 |

| Grantville | 5 |

| Glennville | 5 |

| Forsyth | 5 |

| Donalsonville | 5 |

| Folkston | 5 |

| Porterdale | 5 |

| Garden City3 | 5 |

| Wrens | 5 |

| Arcade | 4 |

| Oxford | 4 |

| Tybee Island | 4 |

| Manchester | 4 |

| Tallapoosa | 4 |

| Enigma | 4 |

| Nashville | 4 |

| Sylvania | 4 |

| Sardis | 4 |

| Lookout Mountain | 4 |

| Avondale Estates | 4 |

| Ocilla | 3 |

| Pine Lake | 3 |

| Hiawassee | 3 |

| Ludowici | 3 |

| Social Circle | 3 |

| Helen | 3 |

| Buchanan | 3 |

| Gordon | 3 |

| Oak Park | 3 |

| Sparks | 3 |

| East Ellijay | 3 |

| Blakely | 3 |

| Greenville | 3 |

| Lyons | 3 |

| Pine Mountain | 3 |

| Chattahoochee Hills | 3 |

| Talbotton | 2 |

| Reynolds | 2 |

| Eatonton | 2 |

| Hogansville | 2 |

| Mount Airy | 2 |

| Darien | 2 |

| Fairmount | 2 |

| Tennille | 2 |

| Vienna | 2 |

| Arlington | 2 |

| Claxton | 2 |

| Warrenton | 2 |

| Aragon | 2 |

| Ellijay | 2 |

| McRae-Helena | 2 |

| Demorest | 1 |

| Marshallville | 1 |

| Flowery Branch | 1 |

| Danielsville | 1 |

| Maysville | 1 |

| Harlem | 1 |

| Screven | 1 |

| Ball Ground | 1 |

| Senoia | 1 |

| Trenton | 1 |

| Tunnel Hill | 1 |

| Lumber City | 1 |

| Tyrone | 1 |

| Blue Ridge | 1 |

| Lavonia | 1 |

| Oglethorpe | 1 |

| Sparta | 1 |

| Omega | 1 |

| Lake Park | 1 |

| Summerville | 1 |

| Watkinsville | 1 |

| Waverly Hall | 1 |

| Franklin | 1 |

| Guyton | 1 |

| Alamo | 1 |

| Butler | 1 |

| Blythe | 0 |

| Irwinton | 0 |

| Dillard | 0 |

| Homeland | 0 |

| McIntyre | 0 |

| Sale City | 0 |

| Doerun | 0 |

| Bowdon | 0 |

| Midville | 0 |

| Ivey | 0 |

| Abbeville | 0 |

| Canon | 0 |

| Shiloh | 0 |

| Braswell | 0 |

| Molena | 0 |

| Franklin Springs | 0 |

| Berlin | 0 |

| Coolidge | 0 |

| Springfield | 0 |

| Alto | 0 |

| Mountain City | 0 |

| Cave Spring | 0 |

| Mount Zion | 0 |

| Nahunta | 0 |

| Kingston | 0 |

| Graham | 0 |

| Brooklet | 0 |

| Norman Park | 0 |

| Rochelle | 0 |

| Cuthbert | 0 |

| Ellaville | 0 |

| Baldwin | 0 |

| Leary | 0 |

| Leslie | 0 |

| Patterson | 0 |

| Hagan | 0 |

| Buena Vista | 0 |

| Pembroke | 0 |

| Clarkesville | 0 |

| Ephesus | 0 |

| Plains | 0 |

| Eton | 0 |

| Louisville | 0 |

| Attapulgus | 0 |

| Warwick | 0 |

| Davisboro | 0 |

| Lumpkin | 0 |

| Hephzibah | 0 |

| Alapaha | 0 |

| Whitesburg | 0 |

| Willacoochee | 0 |

| Clayton | 0 |

| Winterville | 0 |

| Woodland | 0 |

| Hoboken | 0 |

| Blairsville | 0 |

Road Fatalities in Georgia

Though these facts are depressing, it is important to know about road fatality statistics in Georgia for car insurance purposes.

Most Fatal Highway in Georgia

According to Geotab.com, the most dangerous highway in Georgia is State Route 11, which bisects the state north to south. On average, it has about 12 accidents per year.

Fatal Crashes by Weather Condition & Light Condition

The following table contains information about fatal crashes in specific weather and light conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 690 | 140 | 448 | 44 | 1 | 1,323 |

| Rain | 44 | 7 | 39 | 2 | 0 | 92 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 3 | 1 | 14 | 1 | 0 | 19 |

| Unknown | 1 | 0 | 1 | 0 | 0 | 2 |

| TOTAL | 741 | 148 | 503 | 47 | 1 | 1,440 |

This table shows the accidents that occur in various weather conditions (e.g. normal, rain, snow/sleet, other, and unknown) and light conditions (e.g. daylight, dark but lighted, dark, dawn or dusk, and other/unknown). It also shows the combination of weather conditions and light conditions for when accidents occurred (for example rain during daylight, snow/sleet during the dark, etc.)

Fatalities (All Crashes) by County

The table shows each fatality for every county in Georgia every year from 2013-2017. It’s also organized in such a way that ranks the counties from the most amount of fatalities to the least amount of fatalities.

| County Name | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|

| Fulton | 115 | 130 | 104 | 77 | 85 |

| Dekalb | 95 | 80 | 83 | 55 | 70 |

| Cobb | 53 | 59 | 49 | 49 | 59 |

| Gwinnett | 66 | 61 | 67 | 55 | 45 |

| Chatham | 29 | 44 | 54 | 26 | 44 |

| Bibb | 34 | 28 | 21 | 23 | 31 |

| Clayton | 32 | 48 | 26 | 21 | 26 |

| Henry | 27 | 26 | 29 | 26 | 26 |

| Richmond | 32 | 17 | 27 | 27 | 23 |

| Douglas | 17 | 21 | 22 | 12 | 19 |

| Troup | 15 | 16 | 9 | 14 | 19 |

| Newton | 17 | 21 | 18 | 7 | 18 |

| Hall | 31 | 31 | 33 | 21 | 17 |

| Bartow | 17 | 26 | 29 | 21 | 17 |

| Forsyth | 15 | 11 | 13 | 11 | 17 |

| Cherokee | 32 | 7 | 12 | 12 | 16 |

| Carroll | 28 | 20 | 27 | 21 | 16 |

| Laurens | 13 | 9 | 11 | 8 | 16 |

| Bulloch | 14 | 18 | 15 | 16 | 15 |

| Muscogee | 26 | 27 | 14 | 17 | 14 |

| Paulding | 15 | 21 | 24 | 8 | 14 |

| Effingham | 6 | 12 | 5 | 16 | 14 |

| Glynn | 16 | 7 | 9 | 16 | 13 |

| Whitfield | 13 | 13 | 17 | 13 | 12 |

| Burke | 12 | 8 | 3 | 7 | 12 |

| Murray | 6 | 8 | 9 | 18 | 12 |

| Monroe | 12 | 14 | 6 | 7 | 11 |

| Barrow | 12 | 10 | 12 | 9 | 11 |

| Madison | 5 | 4 | 4 | 7 | 11 |

| Gordon | 5 | 13 | 8 | 5 | 11 |

| Coweta | 23 | 22 | 18 | 12 | 10 |

| Columbia | 21 | 17 | 15 | 7 | 10 |

| Dougherty | 13 | 20 | 13 | 12 | 10 |

| Decatur | 12 | 12 | 6 | 7 | 10 |

| Floyd | 12 | 18 | 14 | 16 | 10 |

| Houston | 12 | 17 | 11 | 8 | 9 |

| Spalding | 10 | 11 | 9 | 9 | 9 |

| Fayette | 14 | 8 | 7 | 10 | 8 |

| Rockdale | 14 | 13 | 7 | 9 | 8 |

| Walker | 8 | 9 | 11 | 4 | 8 |

| Greene | 5 | 4 | 8 | 4 | 8 |

| Haralson | 5 | 7 | 7 | 3 | 8 |

| Brooks | 0 | 4 | 6 | 3 | 8 |

| Lowndes | 17 | 17 | 18 | 13 | 7 |

| Emanuel | 8 | 5 | 10 | 12 | 7 |

| Polk | 7 | 13 | 5 | 7 | 7 |

| Dawson | 7 | 5 | 12 | 5 | 7 |

| Habersham | 7 | 12 | 9 | 5 | 7 |

| Clarke | 6 | 13 | 15 | 9 | 7 |

| Jackson | 24 | 23 | 19 | 7 | 6 |

| Liberty | 14 | 8 | 8 | 7 | 6 |

| Camden | 10 | 7 | 5 | 9 | 6 |

| Tift | 10 | 12 | 5 | 8 | 6 |

| Baldwin | 8 | 12 | 5 | 5 | 6 |

| Macon | 7 | 2 | 2 | 4 | 6 |

| Fannin | 6 | 1 | 3 | 4 | 6 |

| Talbot | 5 | 0 | 1 | 2 | 6 |

| Meriwether | 4 | 8 | 6 | 3 | 6 |

| Jeff Davis | 3 | 4 | 3 | 2 | 6 |

| Dooly | 1 | 6 | 2 | 4 | 6 |

| Stephens | 12 | 3 | 5 | 4 | 5 |

| Colquitt | 12 | 8 | 13 | 17 | 5 |

| Gilmer | 10 | 6 | 7 | 7 | 5 |

| Thomas | 10 | 10 | 4 | 6 | 5 |

| Wayne | 9 | 3 | 4 | 5 | 5 |

| Chattooga | 6 | 7 | 4 | 4 | 5 |

| Toombs | 4 | 3 | 5 | 5 | 5 |

| Towns | 3 | 2 | 3 | 3 | 5 |

| Warren | 3 | 5 | 6 | 4 | 5 |

| Catoosa | 3 | 13 | 9 | 8 | 5 |

| Irwin | 2 | 3 | 1 | 4 | 5 |

| Walton | 11 | 16 | 10 | 4 | 4 |

| Worth | 10 | 2 | 10 | 11 | 4 |

| Lumpkin | 9 | 5 | 6 | 3 | 4 |

| Mitchell | 9 | 4 | 3 | 5 | 4 |

| Pickens | 8 | 3 | 7 | 5 | 4 |

| Early | 7 | 7 | 8 | 2 | 4 |

| Oconee | 6 | 9 | 5 | 3 | 4 |

| Dodge | 6 | 4 | 5 | 2 | 4 |

| Mcintosh | 6 | 5 | 2 | 4 | 4 |

| Telfair | 5 | 3 | 4 | 1 | 4 |

| Montgomery | 5 | 3 | 2 | 1 | 4 |

| Berrien | 4 | 4 | 2 | 2 | 4 |

| Jefferson | 4 | 9 | 6 | 4 | 4 |

| Evans | 4 | 4 | 0 | 6 | 4 |

| Lee | 2 | 3 | 3 | 3 | 4 |

| Dade | 2 | 3 | 5 | 6 | 4 |

| Charlton | 2 | 2 | 3 | 1 | 4 |

| Taliaferro | 1 | 1 | 2 | 1 | 4 |

| Washington | 9 | 6 | 9 | 1 | 3 |

| Morgan | 9 | 10 | 8 | 5 | 3 |

| Peach | 9 | 6 | 10 | 1 | 3 |

| Coffee | 8 | 7 | 7 | 6 | 3 |

| Jones | 8 | 8 | 3 | 4 | 3 |

| Pike | 8 | 2 | 9 | 2 | 3 |

| Franklin | 8 | 7 | 6 | 4 | 3 |

| Grady | 7 | 5 | 9 | 4 | 3 |

| Union | 7 | 7 | 4 | 1 | 3 |

| Screven | 6 | 4 | 6 | 7 | 3 |

| Mcduffie | 6 | 6 | 4 | 12 | 3 |

| Ware | 6 | 11 | 5 | 2 | 3 |

| Brantley | 4 | 4 | 2 | 2 | 3 |

| Treutlen | 3 | 2 | 6 | 2 | 3 |

| Butts | 3 | 3 | 8 | 5 | 3 |

| Lamar | 3 | 3 | 6 | 8 | 3 |

| Pierce | 2 | 4 | 5 | 3 | 3 |

| Harris | 9 | 9 | 8 | 4 | 2 |

| Putnam | 8 | 8 | 6 | 1 | 2 |

| Jasper | 7 | 5 | 3 | 2 | 2 |

| White | 7 | 9 | 4 | 4 | 2 |

| Rabun | 6 | 3 | 7 | 4 | 2 |

| Taylor | 6 | 3 | 1 | 0 | 2 |

| Cook | 5 | 8 | 6 | 5 | 2 |

| Candler | 4 | 4 | 3 | 2 | 2 |

| Bryan | 4 | 13 | 8 | 5 | 2 |

| Bacon | 4 | 4 | 6 | 1 | 2 |

| Terrell | 4 | 2 | 1 | 1 | 2 |

| Elbert | 3 | 7 | 3 | 7 | 2 |

| Banks | 3 | 8 | 7 | 7 | 2 |

| Clinch | 3 | 3 | 1 | 1 | 2 |

| Crisp | 2 | 2 | 5 | 4 | 2 |

| Randolph | 1 | 0 | 1 | 3 | 2 |

| Pulaski | 1 | 1 | 2 | 2 | 2 |

| Bleckley | 1 | 2 | 5 | 0 | 2 |

| Schley | 0 | 2 | 0 | 0 | 2 |

| Jenkins | 0 | 8 | 4 | 1 | 2 |

| Oglethorpe | 0 | 2 | 4 | 3 | 2 |

| Clay | 0 | 1 | 0 | 1 | 2 |

| Upson | 0 | 4 | 5 | 3 | 2 |

| Long | 8 | 2 | 2 | 2 | 1 |

| Appling | 7 | 5 | 4 | 8 | 1 |

| Hart | 7 | 5 | 5 | 6 | 1 |

| Sumter | 6 | 7 | 2 | 7 | 1 |

| Twiggs | 6 | 7 | 5 | 2 | 1 |

| Tattnall | 5 | 2 | 5 | 6 | 1 |

| Crawford | 5 | 4 | 4 | 4 | 1 |

| Hancock | 3 | 2 | 7 | 3 | 1 |

| Ben Hill | 3 | 2 | 0 | 3 | 1 |

| Turner | 2 | 4 | 2 | 3 | 1 |

| Wheeler | 2 | 3 | 3 | 0 | 1 |

| Heard | 2 | 4 | 3 | 1 | 1 |

| Marion | 1 | 3 | 1 | 2 | 1 |

| Lincoln | 0 | 2 | 2 | 0 | 1 |