Utah

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 8.2%

Howdy, y’all. Welcome to the great state of Utah. You might call it the Salt Lake State. Or maybe the Beehive State. But whatever you call it, there’s a lot to love about Utah.

Did you know, for instance, that an average of 500 inches of snowfall in the mountains near Salt Lake City every year? Or that the state is home to five of our most beautiful national parks Arches, Canyonlands, Zion, Bryce, and Capitol Reef? Utah is certainly a destination for outdoor adventurers of all stripes.

The state also has the highest literacy rate in the nation, which is great, and its capital has more plastic surgeons per capita than any other American city, which is interesting.

With over 46,000 miles of Utah roadways, do you know the best car insurance for you and your family to get from Ogden to St. George?

We’ve created this guide to help you navigate car insurance, rules of the road, and other vehicular safety information in the great state of Utah.

If you’re exploring this great state by car, there may be something you haven’t considered lately: “Am I paying too much for car insurance?”

Consumers in Utah paid an average of $3,602.23 for car insurance in 2018.

We know car insurance isn’t something you want to spend a lot of time on, so that’s why we’ve compiled this comprehensive guide about car insurance in the Beehive State. We’ve done the work for you so that you can get on with living life to its fullest. Simply enter your ZIP code above to get started on finding your car insurance quote today.

What are Utah car insurance coverage and rates?

Utah certainly has a rich history. And its beautiful roadways snake through cities, mountains, and deserts, making it a great place for car enthusiasts, whether you’re out for a casual Sunday drive or you’re a true road warrior.

The Hartford reports that “Utah’s 84,897 square miles are filled with some of America’s most iconic landscapes, like the spectacular red sandstone formation of Delicate Arch, near Moab, and the classic movie backdrop of Monument Valley, on the Arizona border.” Let’s take a look at the car culture of the Beehive State.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Utah’s car culture like?

Utahns love to drive, it’s true.

Auto Alliance reports that in 2018 alone, 143,459 new cars were sold in the state. With a total population of 3.161 million, there are approximately 2.3 million cars registered within the Salt Lake State.

Whether you’re new to Utah, or a long-time resident, it’s important to know what kind of car insurance you need.

Check out the sections below to make your search for affordable car insurance in Utah a bit easier. Or enter your ZIP code below to get started on a quote today.

What is Utah’s minimum coverage requirements?

Driving without minimum car insurance coverage in Utah means you risk big fines, and even having your license revoked.

So how much car insurance do you need in Utah?

Utah drivers must have continuous bodily injury and property damage liability insurance, as well as personal injury protection (PIP). Personal injury protection covers medical, rehabilitation, earning loss, and funeral costs.

The state’s minimum coverage levels are:

- $26,000 to cover costs of injury or death to any single person in an accident

- $65,000 to cover costs of injury or death to all people in an accident

- $15,000 to cover costs of damage to property in an accident

- $3,000 Personal Injury Protection (PIP) coverage per person

Of course, this is just the minimum coverage required.

The more coverage you have the better prepared you will be in case of an accident or other automobile incidents.

What are acceptable forms of financial responsibility?

What happens if you get pulled over in the Beehive State?

Like almost every state in the United States, Utah requires you to prove you have legal, current car insurance that meets or exceeds the state’s minimum coverage requirements.

The easiest way to show proof of financial responsibility under Utah law is to get covered by an auto liability insurance policy that meets the required minimum limits ($26,000 to cover costs of injury or death to any person in an accident; $65,000 to cover costs of injury or death to two or more people in an accident; $15,000 to cover costs of damage to property in an accident; and $3,000 PIP coverage per person).

If you get pulled over in Utah, you must prove you have this insurance by providing the officer with your:

- Insurance ID card,

- Insurance binder, or

- Insurance declaration

If you’re unable to show this proof, you face a fine and possible driving suspension.

So, you might be wondering, how much of their salaries are Utahns spending on car insurance?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much are premiums as a percentage of income?

DataUSA reports that Utah households have a fairly high median household income at $68,358.

With average insurance premiums of $3,602.23 annually, this means Salt Lakers pay an average of 5.26 percent of their income on car insurance premiums.

How much are average monthly car insurance rates in UT (liability, collision, comprehensive)?

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

The National Association of Insurance Commissioners (NAIC) provides the following averages in the table below for core car insurance elements in Utah vs. national averages.

| COVERAGE TYPE | UTAH AVERAGE ANNUAL PREMIUM | COUNTRYWIDE AVERAGE ANNUAL PREMIUM |

|---|---|---|

| Liability | $471.26 | $516.39 |

| Collision | $254.41 | $299.73 |

| Comprehensive | 107 | $138.87 |

| Combined Average | $832.24 | $954.99 |

But what are these different types of coverage? This short video covers the basics.

You may want to increase the amount of auto insurance coverage you carry based on a variety of factors, and most companies offer some pretty affordable options for extra coverage. Read on to look into some of those factors and options.

Most auto insurance providers offer a variety of insurance discounts, such as the safe driver discount, active military discount, or multi-policy discount for purchasing your auto policy along with life or homeowners insurance. There are usually numerous discounts available, so make sure to ask your insurance carrier what kind of deals you might be entitled to, as these discounts can significantly bring down the cost of auto insurance.

What additional coverages can you get?

If you’re interested in expanding your auto coverage, you’ll want to look into additional liability coverage.

The various types of additional coverage can help keep you and your bank account safer in the unfortunate case of a car accident.

Before you go choosing what additional liability limits you may want, though, you’ll need to think about the loss ratios that might come along with it. The table below details the loss ratios each additional form of liability coverage generated for car insurance companies in Utah from 2013 to 2015.

| COVERAGE | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection | 68.56% | 69.28% | 74.22% |

| Medical Payments (Medpay) | 110.60% | 99.16% | 120.63% |

| Uninsured/Underinsured | 120.63% | 99.16% | 110.60% |

Simply put: loss ratios describe the amount of financial security each provider and coverage type can offer a driver.

Higher loss ratios reflect a company’s willingness to pay out on applicable claims, but may also reflect an unstable financial standing. Comparatively, lower loss ratios mean that a company is more financially stable but, perhaps, less likely to pay out claims.

Think about it this way: if a car insurance company pays out $65 in claims for every $100 it earns in premiums, then it has a loss ratio of 65.

Typically, you’ll want to work with a car insurance provider and coverage type with a loss ratio between 60-80 percent. Our research shows that this is the loss ratio sweet spot.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What add-Ons, endorsements, and riders can you get?

For many people, a basic policy isn’t enough, so it’s good to know that a lot of car insurance providers offer some great add-on coverage options that can help protect you, your family, and your pocketbook.

You can explore additional, optional coverage by considering some of the add-ons below. Keep in mind, there are additional costs associated with adding these coverage options to your auto policy. Click on the available links to learn more about each option:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

You might also want to check out personal injury protection (PIP), which is explained in the short video below.

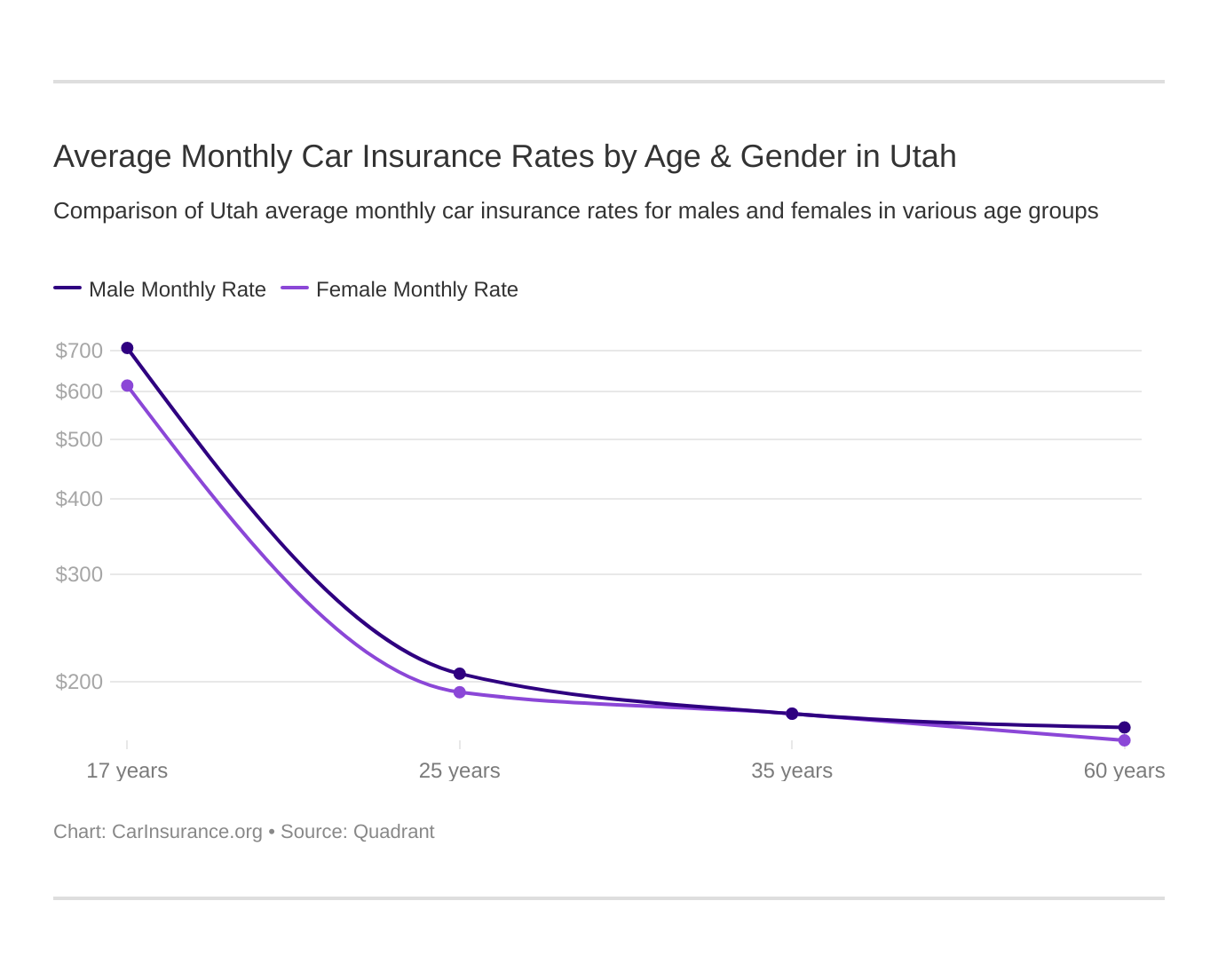

What are average monthly car insurance rates by age & gender in UT?

Do men and women pay different amounts for car insurance?

Though Utah is not one of the six states — North Carolina, Hawaii, Massachusetts, Pennsylvania, California, and Montana — that have outlawed gender discrimination in car insurance premiums, our research shows that gender isn’t a huge difference-maker in premiums across the state.

What is more significant to car insurance providers in determining your premium? Age and marital status.

The following table provides the average annual car insurance premiums for Utahns of different demographics for the state’s top car insurers.

| COMPANY | SINGLE 17-YEAR OLD FEMALE ANNUAL RATE | SINGLE 17-YEAR OLD MALE ANNUAL RATE | SINGLE 25-YEAR OLD FEMALE ANNUAL RATE | SINGLE 25-YEAR OLD MALE ANNUAL RATE | MARRIED 35-YEAR OLD FEMALE ANNUAL RATE | MARRIED 35-YEAR OLD MALE ANNUAL RATE | MARRIED 60-YEAR OLD FEMALE ANNUAL RATE | MARRIED 60-YEAR OLD MALE ANNUAL RATE |

|---|---|---|---|---|---|---|---|---|

| Allstate | $7,131.66 | $7,968.85 | $2,433.88 | $2,420.66 | $2,291.16 | $2,124.28 | $2,080.31 | $2,080.58 |

| American Family | $7,447.08 | $9,734.69 | $2,061.52 | $2,432.42 | $2,061.52 | $2,061.52 | $1,895.69 | $1,895.69 |

| Mid-Century | $9,007.70 | $9,276.70 | $2,403.87 | $2,484.88 | $2,122.25 | $2,096.76 | $1,874.89 | $1,996.87 |

| Geico | $5,712.14 | $6,093.85 | $1,659.40 | $1,666.10 | $1,913.89 | $2,132.40 | $2,102.55 | $2,444.23 |

| SafeCo | $9,510.32 | $10,560.25 | $2,555.09 | $2,712.73 | $2,424.16 | $2,609.54 | $2,009.88 | $2,240.08 |

| Depositors | $5,226.02 | $6,649.99 | $2,224.59 | $2,384.61 | $1,925.73 | $1,948.00 | $1,721.22 | $1,812.40 |

| Progressive | $8,562.83 | $9,521.67 | $2,421.45 | $2,541.96 | $2,097.59 | $1,950.05 | $1,716.07 | $1,829.17 |

| State Farm | $8,675.15 | $10,787.39 | $3,211.87 | $3,678.46 | $2,831.94 | $2,831.94 | $2,574.96 | $2,574.96 |

| USAA | $5,021.49 | $5,867.34 | $1,738.92 | $1,900.76 | $1,429.68 | $1,404.80 | $1,283.35 | $1,282.42 |

But where can you find the cheapest car insurance rates in the Beehive State?

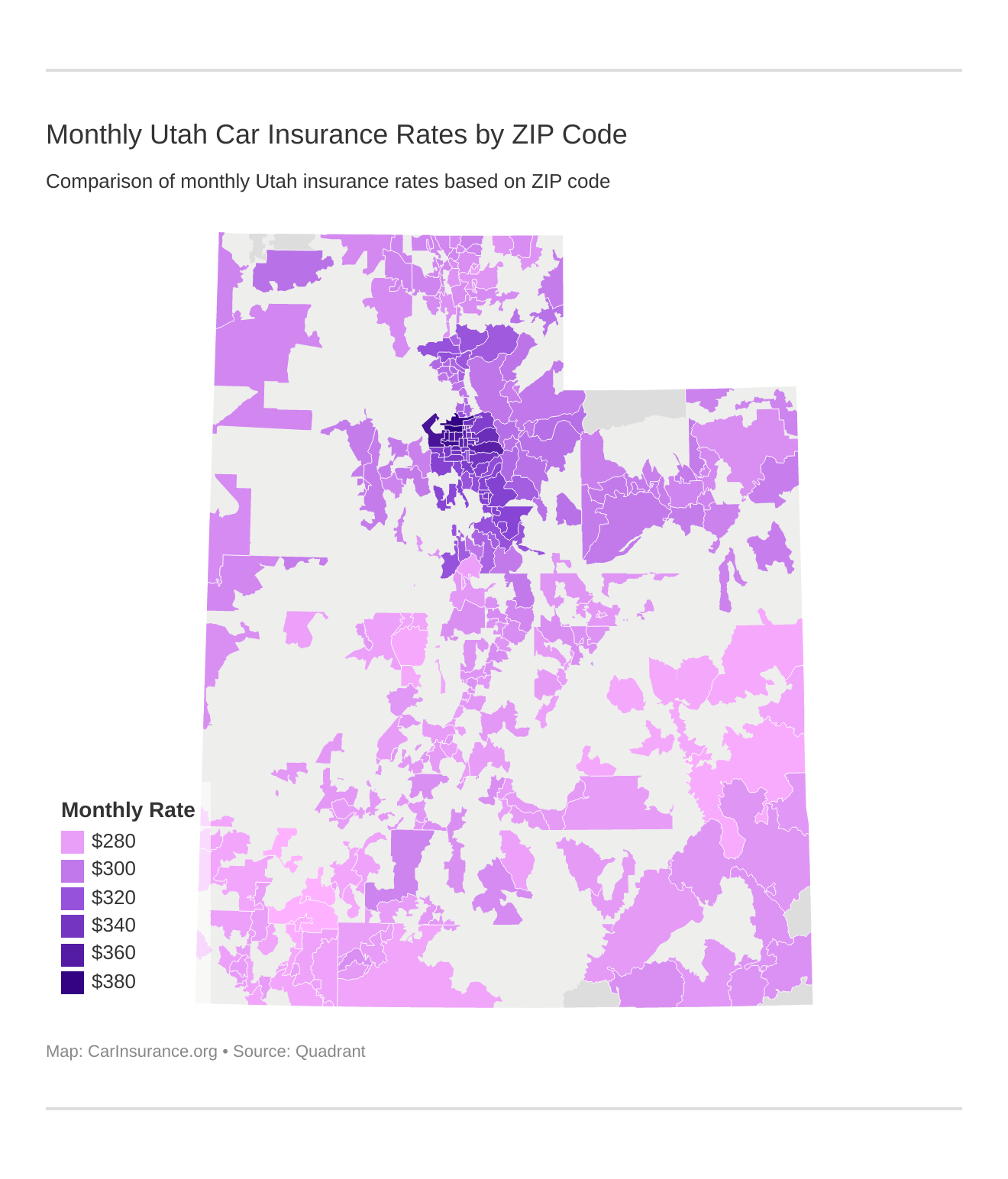

Where are the cheapest rates by ZIP code?

Did you know that car insurance rates vary not only by what state you live in but also by where you live in your state?

Where are the most expensive car insurance rates on average in Utah? Take a look at the table below to find out.

| Most Expensive ZIP Codes in Utah | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 84104 | SALT LAKE CITY | $4,580.22 | State Farm | $5,906.45 | Liberty Mutual | $5,552.83 | USAA | $3,213.30 | Geico | $3,434.35 |

| 84116 | SALT LAKE CITY | $4,555.57 | State Farm | $6,058.29 | Liberty Mutual | $5,552.83 | USAA | $3,213.30 | Nationwide | $3,418.87 |

| 84128 | SALT LAKE CITY | $4,451.69 | State Farm | $5,757.21 | Liberty Mutual | $5,388.11 | USAA | $3,213.30 | Geico | $3,363.55 |

| 84118 | SALT LAKE CITY | $4,447.21 | State Farm | $6,337.83 | Liberty Mutual | $5,360.65 | USAA | $3,213.30 | Geico | $3,261.84 |

| 84129 | TAYLORSVILLE | $4,445.90 | State Farm | $5,882.61 | Liberty Mutual | $5,388.11 | USAA | $3,213.30 | Geico | $3,363.55 |

| 84180 | SALT LAKE CITY | $4,440.15 | Progressive | $7,409.56 | State Farm | $5,882.61 | USAA | $2,634.25 | Geico | $3,299.16 |

| 84044 | MAGNA | $4,405.29 | State Farm | $5,861.32 | Liberty Mutual | $5,393.49 | USAA | $3,213.30 | Geico | $3,405.05 |

| 84120 | SALT LAKE CITY | $4,376.36 | State Farm | $5,861.93 | Progressive | $5,327.91 | USAA | $3,213.30 | Geico | $3,305.07 |

| 84119 | SALT LAKE CITY | $4,359.40 | State Farm | $6,314.32 | Progressive | $5,179.80 | USAA | $3,213.30 | Geico | $3,314.74 |

| 84101 | SALT LAKE CITY | $4,349.91 | State Farm | $5,804.48 | Progressive | $5,238.79 | USAA | $2,634.25 | Geico | $3,299.16 |

| 84115 | SALT LAKE CITY | $4,310.49 | State Farm | $5,378.87 | Progressive | $5,010.63 | USAA | $3,213.30 | Geico | $3,369.43 |

| 84123 | SALT LAKE CITY | $4,271.70 | State Farm | $6,314.32 | Liberty Mutual | $5,242.38 | USAA | $2,822.35 | Geico | $3,293.89 |

| 84121 | SALT LAKE CITY | $4,267.68 | State Farm | $5,315.94 | Liberty Mutual | $5,219.22 | USAA | $2,696.20 | Geico | $3,332.05 |

| 84084 | WEST JORDAN | $4,265.62 | State Farm | $6,110.62 | Liberty Mutual | $4,684.43 | USAA | $2,975.32 | Geico | $3,282.22 |

| 84107 | SALT LAKE CITY | $4,235.20 | State Farm | $5,533.57 | Progressive | $5,037.17 | USAA | $2,822.35 | Nationwide | $3,421.41 |

| 84117 | SALT LAKE CITY | $4,200.92 | State Farm | $5,448.85 | Progressive | $5,412.85 | USAA | $2,677.95 | Geico | $3,269.97 |

| 84111 | SALT LAKE CITY | $4,183.18 | State Farm | $4,991.84 | Progressive | $4,841.35 | USAA | $2,629.89 | Geico | $3,291.39 |

| 84133 | SALT LAKE CITY | $4,171.57 | Progressive | $5,167.90 | State Farm | $5,153.15 | USAA | $3,213.30 | Geico | $3,237.95 |

| 84138 | SALT LAKE CITY | $4,148.80 | Progressive | $5,167.90 | State Farm | $5,153.15 | USAA | $3,213.30 | Geico | $3,237.95 |

| 84112 | SALT LAKE CITY | $4,148.07 | State Farm | $5,066.03 | Progressive | $4,863.59 | USAA | $2,634.25 | Geico | $3,198.85 |

| 84109 | SALT LAKE CITY | $4,147.22 | State Farm | $5,268.67 | Progressive | $5,055.11 | USAA | $2,634.25 | Nationwide | $3,263.91 |

| 84047 | MIDVALE | $4,126.41 | Liberty Mutual | $5,370.77 | State Farm | $4,981.04 | USAA | $2,696.20 | Geico | $3,154.67 |

| 84103 | SALT LAKE CITY | $4,118.16 | State Farm | $4,963.85 | Liberty Mutual | $4,953.73 | USAA | $2,634.25 | Geico | $3,254.63 |

| 84124 | SALT LAKE CITY | $4,108.36 | Progressive | $5,376.42 | State Farm | $4,935.71 | USAA | $2,699.73 | Geico | $3,294.70 |

| 84132 | SALT LAKE CITY | $4,107.90 | Progressive | $5,167.90 | State Farm | $5,153.15 | Geico | $3,198.85 | USAA | $3,213.30 |

You can find the most expensive rates at ZIP code 84104, an area on the west side of Salt Lake, just south of the airport running along Interstate 80. The next table lists the average rates at Utah’s cheapest ZIP codes.

| Cheapest ZIP Codes in Utah | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 84721 | CEDAR CITY | $3,239.58 | State Farm | $3,973.46 | Liberty Mutual | $3,862.42 | USAA | $2,331.35 | Nationwide | $2,671.38 |

| 84720 | CEDAR CITY | $3,244.93 | State Farm | $3,992.78 | Liberty Mutual | $3,955.90 | USAA | $2,331.35 | Nationwide | $2,671.38 |

| 84757 | NEW HARMONY | $3,267.24 | State Farm | $4,114.12 | Farmers | $3,769.91 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| 84742 | KANARRAVILLE | $3,269.05 | State Farm | $3,949.40 | Liberty Mutual | $3,862.42 | USAA | $2,331.35 | Nationwide | $2,671.38 |

| 84532 | MOAB | $3,275.27 | Liberty Mutual | $4,079.43 | State Farm | $3,591.34 | USAA | $2,360.15 | Geico | $2,926.51 |

| 84649 | OAK CITY | $3,288.54 | Liberty Mutual | $4,151.14 | State Farm | $3,905.21 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| 84540 | THOMPSON | $3,289.83 | Liberty Mutual | $4,079.43 | Progressive | $3,571.58 | USAA | $2,360.15 | Geico | $2,926.51 |

| 84719 | BRIAN HEAD | $3,294.63 | State Farm | $3,949.40 | Liberty Mutual | $3,862.42 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| 84636 | HOLDEN | $3,300.64 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| 84774 | TOQUERVILLE | $3,304.82 | State Farm | $4,214.71 | Liberty Mutual | $3,769.47 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| 84525 | GREEN RIVER | $3,304.97 | Liberty Mutual | $4,079.43 | State Farm | $4,016.70 | USAA | $2,360.15 | Nationwide | $2,785.39 |

| 84784 | HILDALE | $3,307.22 | State Farm | $4,447.24 | Liberty Mutual | $3,862.42 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| 84515 | CISCO | $3,308.30 | Liberty Mutual | $4,079.43 | Progressive | $3,635.34 | USAA | $2,360.15 | Geico | $2,926.51 |

| 84714 | BERYL | $3,311.07 | Farmers | $4,005.75 | State Farm | $3,949.40 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| 84761 | PAROWAN | $3,312.96 | Farmers | $3,998.69 | State Farm | $3,923.68 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| 84790 | SAINT GEORGE | $3,315.08 | State Farm | $4,443.84 | Liberty Mutual | $3,754.41 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| 84737 | HURRICANE | $3,315.28 | State Farm | $4,196.21 | Liberty Mutual | $4,182.76 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| 84753 | MODENA | $3,317.42 | State Farm | $3,949.40 | Farmers | $3,856.04 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| 84656 | SCIPIO | $3,321.37 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| 84781 | PINE VALLEY | $3,325.28 | State Farm | $4,280.53 | Farmers | $4,064.34 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| 84638 | LEAMINGTON | $3,326.99 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| 84741 | KANAB | $3,328.46 | State Farm | $3,936.21 | Liberty Mutual | $3,862.42 | USAA | $2,430.03 | Geico | $2,926.51 |

| 84746 | LEEDS | $3,329.12 | Liberty Mutual | $4,182.76 | State Farm | $4,174.69 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| 84640 | LYNNDYL | $3,329.91 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| 84770 | SAINT GEORGE | $3,332.72 | State Farm | $4,434.42 | Liberty Mutual | $3,754.41 | USAA | $2,349.23 | Nationwide | $2,762.45 |

It’s easy to find the cheapest car insurance rates for you and your family. Just enter your ZIP code below to get started.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where are the cheapest rates by city?

We broken up the location information further so that you can look for your city to get a general idea of car insurance rates.

| Most Expensive Cities in Utah | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Kearns | $4,447.21 | State Farm | $6,337.83 | Liberty Mutual | $5,360.65 | USAA | $3,213.30 | Geico | $3,261.84 |

| West Valley City | $4,414.03 | State Farm | $5,809.57 | Progressive | $5,257.80 | USAA | $3,213.30 | Geico | $3,334.31 |

| Magna | $4,405.29 | State Farm | $5,861.32 | Liberty Mutual | $5,393.49 | USAA | $3,213.30 | Geico | $3,405.05 |

| South Salt Lake | $4,359.40 | State Farm | $6,314.32 | Progressive | $5,179.80 | USAA | $3,213.30 | Geico | $3,314.74 |

| Taylorsville | $4,265.62 | State Farm | $6,110.62 | Liberty Mutual | $4,684.43 | USAA | $2,975.32 | Geico | $3,282.22 |

| Salt Lake City | $4,228.11 | State Farm | $5,362.05 | Progressive | $5,020.05 | USAA | $2,887.03 | Geico | $3,283.39 |

| Millcreek | $4,181.11 | State Farm | $5,547.25 | Progressive | $4,895.15 | USAA | $2,728.30 | Geico | $3,335.67 |

| Cottonwood Heights | $4,173.41 | Liberty Mutual | $5,295.00 | State Farm | $5,285.88 | USAA | $2,696.20 | Geico | $3,257.89 |

| Holladay | $4,154.64 | Progressive | $5,394.64 | State Farm | $5,192.28 | USAA | $2,688.84 | Geico | $3,282.33 |

| West Jordan | $4,072.61 | State Farm | $5,267.47 | American Family | $4,536.24 | USAA | $2,777.70 | Geico | $3,091.76 |

| Midvale | $4,044.66 | Liberty Mutual | $5,033.64 | State Farm | $4,926.35 | USAA | $2,687.08 | Geico | $3,140.31 |

| Sandy | $4,031.45 | State Farm | $5,261.35 | Liberty Mutual | $5,033.64 | USAA | $2,677.95 | Geico | $3,131.85 |

| South Jordan | $4,018.60 | State Farm | $5,224.22 | Liberty Mutual | $4,639.54 | USAA | $2,814.19 | Geico | $3,131.32 |

| Bingham Canyon | $4,017.19 | State Farm | $5,284.91 | Liberty Mutual | $5,025.49 | USAA | $2,777.70 | Geico | $2,920.63 |

| Draper | $4,007.79 | State Farm | $5,495.45 | Liberty Mutual | $4,719.10 | USAA | $2,677.95 | Geico | $3,220.79 |

| Orem | $4,003.90 | State Farm | $5,497.53 | Liberty Mutual | $4,840.01 | USAA | $2,687.41 | Nationwide | $3,141.09 |

| Lindon | $3,987.75 | State Farm | $5,553.45 | Liberty Mutual | $4,754.32 | USAA | $2,638.75 | Geico | $3,147.84 |

| Emigration Canyon | $3,985.17 | State Farm | $4,929.84 | Liberty Mutual | $4,749.90 | USAA | $2,628.81 | Geico | $3,198.85 |

| Alpine | $3,976.31 | State Farm | $5,744.46 | Liberty Mutual | $4,575.83 | USAA | $2,721.26 | Geico | $3,164.98 |

| Herriman | $3,949.52 | State Farm | $5,092.12 | Liberty Mutual | $4,820.38 | USAA | $2,677.95 | Geico | $3,069.09 |

| Cedar Hills | $3,948.42 | State Farm | $5,334.70 | Liberty Mutual | $4,754.32 | USAA | $2,622.83 | Nationwide | $3,216.35 |

| Provo | $3,937.62 | State Farm | $5,442.59 | Liberty Mutual | $4,746.35 | USAA | $2,696.40 | Geico | $3,086.53 |

| Springville | $3,935.40 | State Farm | $5,444.67 | Liberty Mutual | $4,670.48 | USAA | $2,751.07 | Geico | $3,057.05 |

| Saratoga Springs | $3,934.85 | State Farm | $5,339.17 | Liberty Mutual | $4,575.83 | USAA | $2,725.20 | Geico | $3,110.40 |

| Mapleton | $3,934.32 | State Farm | $5,305.53 | Liberty Mutual | $4,718.89 | USAA | $2,751.07 | Nationwide | $3,011.35 |

Don’t see your city on the above table? That’s a good thing. It means your city isn’t one of the most expensive cities for car insurance.

| Cheapest Cities in Utah | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Cedar City | $3,242.26 | State Farm | $3,983.12 | Liberty Mutual | $3,909.16 | USAA | $2,331.35 | Nationwide | $2,671.38 |

| New Harmony | $3,267.24 | State Farm | $4,114.12 | Farmers | $3,769.91 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Kanarraville | $3,269.05 | State Farm | $3,949.40 | Liberty Mutual | $3,862.42 | USAA | $2,331.35 | Nationwide | $2,671.38 |

| Moab | $3,275.27 | Liberty Mutual | $4,079.43 | State Farm | $3,591.34 | USAA | $2,360.15 | Geico | $2,926.51 |

| Oak City | $3,288.54 | Liberty Mutual | $4,151.14 | State Farm | $3,905.21 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| Thompson | $3,289.82 | Liberty Mutual | $4,079.43 | Progressive | $3,571.58 | USAA | $2,360.15 | Geico | $2,926.51 |

| Brian Head | $3,294.63 | State Farm | $3,949.40 | Liberty Mutual | $3,862.42 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| Holden | $3,300.64 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| Toquerville | $3,304.82 | State Farm | $4,214.71 | Liberty Mutual | $3,769.47 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Green River | $3,304.96 | Liberty Mutual | $4,079.43 | State Farm | $4,016.70 | USAA | $2,360.15 | Nationwide | $2,785.39 |

| Hildale | $3,307.22 | State Farm | $4,447.24 | Liberty Mutual | $3,862.42 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Cisco | $3,308.30 | Liberty Mutual | $4,079.43 | Progressive | $3,635.34 | USAA | $2,360.15 | Geico | $2,926.51 |

| Beryl | $3,311.07 | Farmers | $4,005.75 | State Farm | $3,949.40 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| Parowan | $3,312.95 | Farmers | $3,998.69 | State Farm | $3,923.68 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| Hurricane | $3,315.28 | State Farm | $4,196.21 | Liberty Mutual | $4,182.76 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Modena | $3,317.42 | State Farm | $3,949.40 | Farmers | $3,856.04 | USAA | $2,331.35 | Nationwide | $2,785.39 |

| Scipio | $3,321.37 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| St. George | $3,323.90 | State Farm | $4,439.13 | Liberty Mutual | $3,754.41 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Pine Valley | $3,325.28 | State Farm | $4,280.53 | Farmers | $4,064.34 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Leamington | $3,326.99 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| Kanab | $3,328.46 | State Farm | $3,936.21 | Liberty Mutual | $3,862.42 | USAA | $2,430.03 | Geico | $2,926.51 |

| Leeds | $3,329.12 | Liberty Mutual | $4,182.76 | State Farm | $4,174.69 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Lynndyl | $3,329.91 | Liberty Mutual | $4,151.14 | State Farm | $4,106.93 | USAA | $2,331.35 | Nationwide | $2,844.57 |

| Springdale | $3,333.99 | State Farm | $4,310.38 | Liberty Mutual | $4,182.76 | USAA | $2,349.23 | Nationwide | $2,762.45 |

| Summit | $3,335.26 | State Farm | $3,949.40 | Farmers | $3,918.93 | USAA | $2,331.35 | Nationwide | $2,785.39 |

What are the best Utah car insurance companies?

You might be wondering: how do you find the best car insurance company to meet you and your family’s needs?

From company financial ratings to rates for drivers of various histories, you’ll want to consider the pros and cons of each insurer.

When shopping for car insurance, the key issues you need to prioritize include:

- The level of insurance coverage you need,

- The amount of money you can afford to pay for your car insurance premium, and

- The type of insurance company you want to do business with.

Let’s cover some of the factors that can help you figure out the best car insurance company for you and your family in the Salt Lake State.

Which are the largest companies’ financial ratings?

AM Best ranks America’s insurance companies by financial solvency. But what does it even mean for a company to receive a high grade? This video explains their methodology and meaning well.

The table below provides the financial ratings for Utah’s ten largest car insurance providers.

| COMPANY | AM BEST RATING | DIRECT PREMIUMS WRITTEN | LOSS RATIO | MARKET SHARE |

|---|---|---|---|---|

| USAA | A++ | $91,547 | 73.34% | 4.74% |

| Geico | A++ | $169,933.00 | 77.67% | 8.79% |

| Allstate | A+ | $217,324.00 | 57.30% | 11.24% |

| Nationwide | A+ | $52,126.00 | 70.19% | 2.70% |

| Progressive | A+ | $160,684.00 | 65.16% | 8.31% |

| American Family | A | $87,583.00 | 82.77% | 4.53% |

| Farmers | A | $183,973.00 | 54.43% | 9.52% |

| Liberty Mutual | A | $86,034.00 | 66.67% | 4.45% |

| State Farm | A | $323,026.00 | 64.11% | 16.71% |

| Bear River Mutual | A- | $117,031.00 | 81.12% | 6.05% |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which companies have the best ratings?

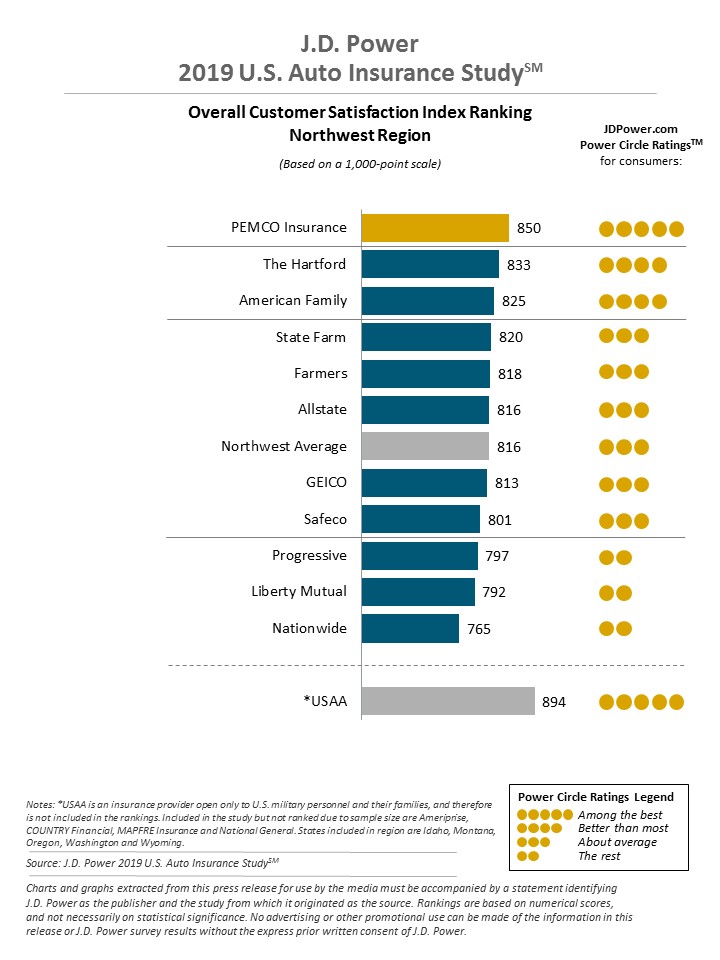

According to J.D. Power and Associates’ U.S. Auto Insurance Study, the best-rated insurance company in the great state of Utah is PEMCO Insurance.

The graph below offers J.D. Power’s ratings of the top insurance providers in the Northwest Region, which includes Utah.

But who are the cheapest car insurance providers in Utah?

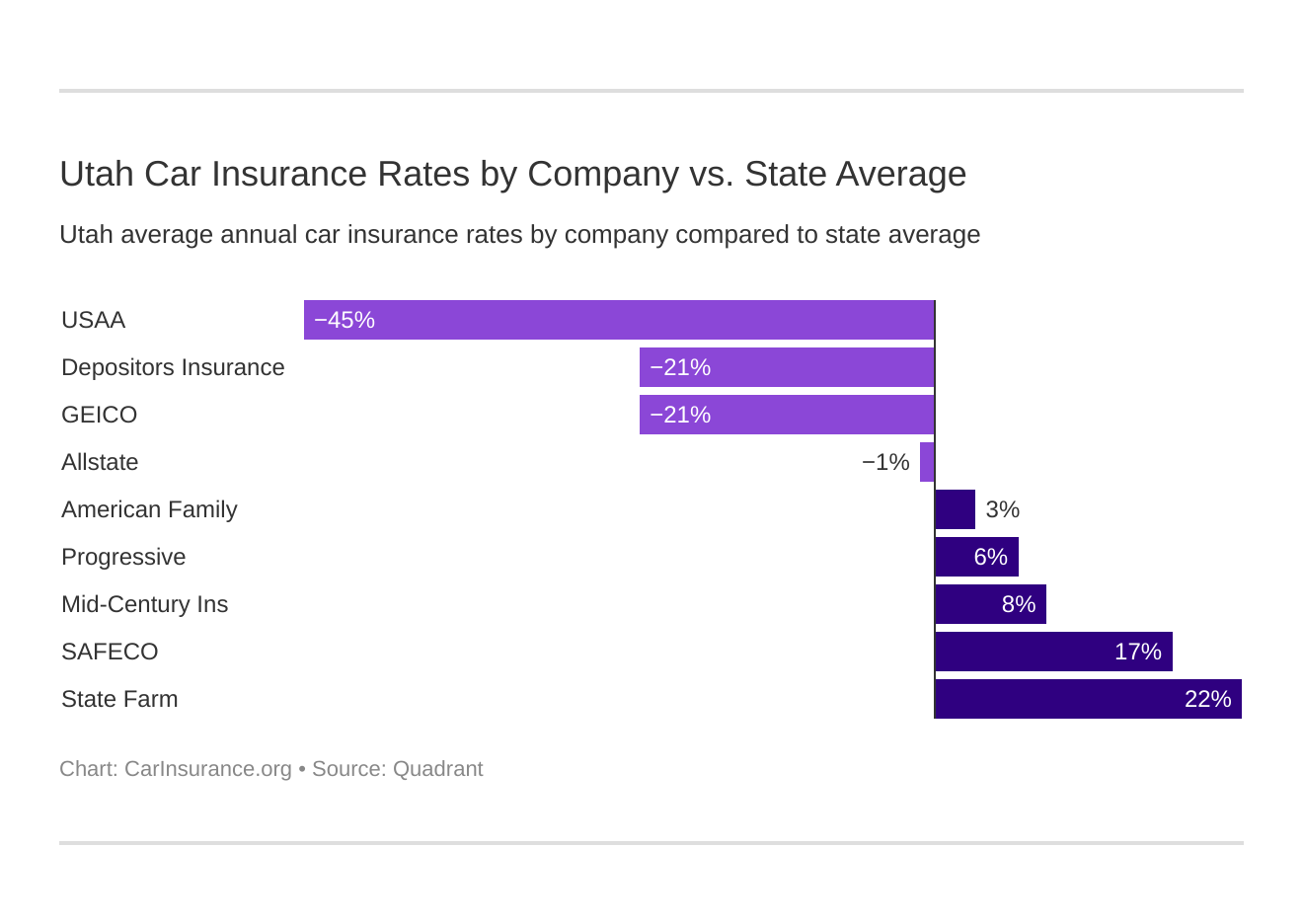

Which are the cheapest companies in Utah?

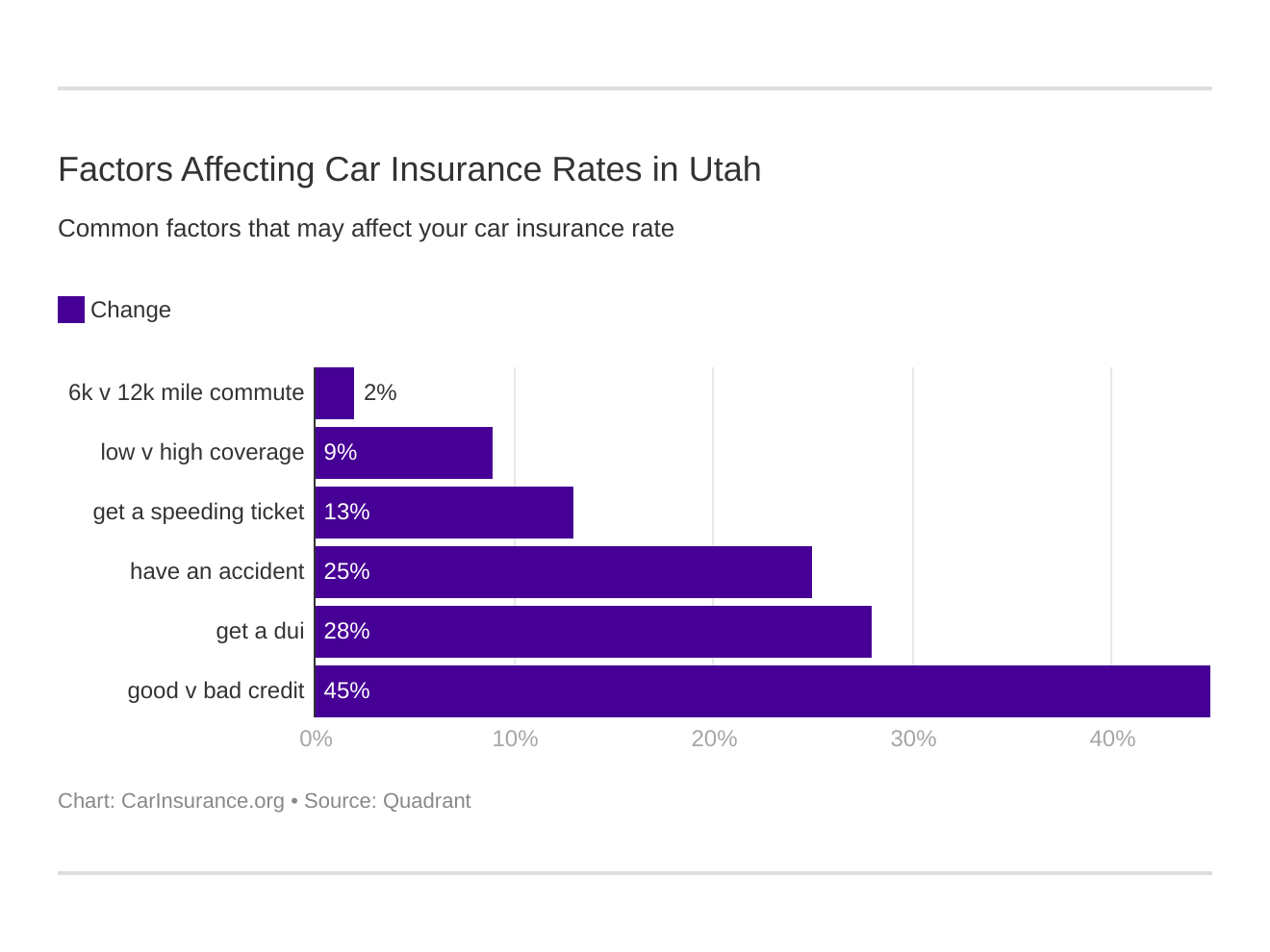

As you might already know, many factors can affect your car insurance premium. In the sections below, we’ll explore the most significant ones.

All things considered, Geico is the cheapest car insurance company in Utah on average.

That is unless you qualify for USAA, which is often ranked as one of the best and cheapest car insurance providers everywhere, including Utah. USAA is an insurance company specifically for military members, active or retired, and their families. The table below provides the cheapest insurers in Utah overall.

| COMPANY | AVERAGE ANNUAL RATE | COMPARED TO STATE AVERAGE (+/-) | COMPARED TO STATE AVERAGE (%) |

|---|---|---|---|

| State Farm | $4,645.83 | $1,044 | 22.46% |

| SafeCo | $4,327.76 | $725.52 | 16.76% |

| Mid-Century | $3,907.99 | $305.76 | 7.82% |

| Progressive | $3,830.10 | $227.87 | 5.95% |

| American Family | $3,698.77 | $96.53 | 2.61% |

| Allstate | $3,566.42 | -$35.81 | -1.00% |

| Depositors | $2,986.57 | -$615.66 | -20.61% |

| Geico | $2,965.57 | -$636.66 | -21.47% |

| USAA | $2,491.10 | -$1,111.14 | -44.60% |

But did you know your average commute can affect your car insurance premiums?

What are commute rates by companies?

Utahns have an average one-way commute of 20.5 minutes, well below the national average of 25.5 minutes. Still, their insurance premiums are affected by their commute distance.

But whether you drive a little or a lot, Geico or Nationwide is likely to be your cheapest insurance provider in the Beehive State.

The following table lists Utah’s biggest car insurance providers and their corresponding average rates for both a 10- and 25-mile average commute distance.

| COMPANY | COMMUTE AND ANNUAL MILEAGE | ANNUAL AVERAGE |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $3,566 |

| Allstate | 25 miles commute. 12000 annual mileage. | $3,566.42 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,696.47 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,701.06 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,907.99 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,907.99 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,915.00 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,016.15 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $4,257.17 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $4,398.34 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,986.57 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,986.57 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,830.10 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,830.10 |

| State Farm | 25 miles commute. 12000 annual mileage. | $4,763.81 |

| State Farm | 10 miles commute. 6000 annual mileage. | $4,527.85 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,463.59 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,518.60 |

It’s important to ask yourself: how much car insurance do I need?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are rates by coverage level by companies?

The more insurance you need, the higher the premium you’ll pay, right? Often, but not always.

In Utah, a high level of coverage with Geico will only cost you a few hundred dollars a year more than the bare minimum insurance you’re required to have by law, for instance.

And remember: more insurance equals more protection when it comes to you and your family’s driving. The table below provides average rates for low, medium, and high coverage levels for the top ten insurance providers in the Beehive State.

| Company | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $3,735.35 |

| Allstate | Medium | $3,559.01 |

| Allstate | Low | $3,404.92 |

| American Family | High | $3,752.75 |

| American Family | Medium | $3,747.39 |

| American Family | Low | $3,596.17 |

| Farmers | High | $4,297.41 |

| Farmers | Medium | $3,852.63 |

| Farmers | Low | $3,573.93 |

| Geico | High | $3,188.43 |

| Geico | Medium | $2,953.94 |

| Geico | Low | $2,754.34 |

| Liberty Mutual | High | $4,561.77 |

| Liberty Mutual | Medium | $4,310.56 |

| Liberty Mutual | Low | $4,110.94 |

| Nationwide | Low | $3,272.27 |

| Nationwide | High | $2,849.61 |

| Nationwide | Medium | $2,837.83 |

| Progressive | High | $4,283.39 |

| Progressive | Medium | $3,697.49 |

| Progressive | Low | $3,509.42 |

| State Farm | High | $4,922 |

| State Farm | Medium | $4,658.86 |

| State Farm | Low | $4,356.81 |

| USAA | High | $2,598.91 |

| USAA | Medium | $2,492.87 |

| USAA | Low | $2,381.51 |

This short video offers some helpful advice in determining how much car insurance you actually need.

But did you know your credit history also affects your car insurance premiums?

What are credit history rates by companies?

Credit history is a big factor for insurance companies when they’re calculating your insurance premium.

On average, Utahns do well in this department. With an average Experian score of 683, Beehive Staters have an above average credit score compared to other states across the U.S. (The national average? 675.)

Just as an example of how credit scores can affect your premiums, in Utah, a poor credit history can raise your State Farm premium as much as $5,000 a year. And that’s something to get salty about.

The table below shows average rates for those with a good, fair, or poor credit rating for Utah’s top car insurance providers.

| Company | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $4,771.61 |

| Allstate | Fair | $3,199.61 |

| Allstate | Good | $2,728.04 |

| American Family | Poor | $4,648.73 |

| American Family | Fair | $3,486.39 |

| American Family | Good | $2,961.19 |

| Farmers | Poor | $4,470.84 |

| Farmers | Fair | $3,719.82 |

| Farmers | Good | $3,533.31 |

| Geico | Poor | $4,519.94 |

| Geico | Fair | $2,503.04 |

| Geico | Good | $1,873.73 |

| Liberty Mutual | Poor | $6,171.64 |

| Liberty Mutual | Fair | $3,807.29 |

| Liberty Mutual | Good | $3,004.33 |

| Nationwide | Poor | $3,696.25 |

| Nationwide | Fair | $2,796.09 |

| Nationwide | Good | $2,467.37 |

| Progressive | Poor | $4,330.83 |

| Progressive | Fair | $3,709.85 |

| Progressive | Good | $3,449.62 |

| State Farm | Poor | $7,561 |

| State Farm | Fair | $3,805.27 |

| State Farm | Good | $2,570.80 |

| USAA | Poor | $3,572.35 |

| USAA | Fair | $2,276.89 |

| USAA | Good | $1,624.05 |

But do you know what affects your car insurance premium even more than your credit history? It’s a factor that worries a lot of folks: your driving record.

What are driving record rates by companies?

Do you have a spotless driving record?

Most of us don’t, and we need to be prepared for our car insurance premiums to reflect that.

If you live in Utah and have a DUI in your past, for example, Progressive will likely be your most cost-effective car insurance provider.

The table below illustrates the average you can expect to pay in Utah whether you have a clean driving record, a DUI, a speeding ticket, or an accident in your past.

| Company | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $4,232.55 |

| Allstate | With 1 accident | $3,629.16 |

| Allstate | With 1 speeding violation | $3,393.73 |

| Allstate | Clean record | $3,010.26 |

| American Family | With 1 DUI | $4,505.19 |

| American Family | With 1 accident | $3,808.97 |

| American Family | With 1 speeding violation | $3,429.99 |

| American Family | Clean record | $3,050.91 |

| Farmers | With 1 accident | $4,326.75 |

| Farmers | With 1 DUI | $4,200.44 |

| Farmers | With 1 speeding violation | $3,779.88 |

| Farmers | Clean record | $3,324.89 |

| Geico | With 1 DUI | $3,882.19 |

| Geico | With 1 accident | $3,340.13 |

| Geico | With 1 speeding violation | $2,493.28 |

| Geico | Clean record | $2,146.67 |

| Liberty Mutual | With 1 DUI | $5,007.04 |

| Liberty Mutual | With 1 accident | $4,650.33 |

| Liberty Mutual | With 1 speeding violation | $4,262.72 |

| Liberty Mutual | Clean record | $3,390.93 |

| Nationwide | With 1 DUI | $3,740.78 |

| Nationwide | With 1 accident | $3,191.57 |

| Nationwide | With 1 speeding violation | $2,644.32 |

| Nationwide | Clean record | $2,369.61 |

| Progressive | With 1 accident | $4,895.50 |

| Progressive | With 1 speeding violation | $3,793.05 |

| Progressive | With 1 DUI | $3,390.52 |

| Progressive | Clean record | $3,241.33 |

| State Farm | With 1 accident | $5,069 |

| State Farm | With 1 DUI | $4,645.83 |

| State Farm | With 1 speeding violation | $4,645.83 |

| State Farm | Clean record | $4,222.84 |

| USAA | With 1 DUI | $3,335.98 |

| USAA | With 1 accident | $2,476.70 |

| USAA | With 1 speeding violation | $2,193.89 |

| USAA | Clean record | $1,957.81 |

But who are the biggest car insurance companies in Utah?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

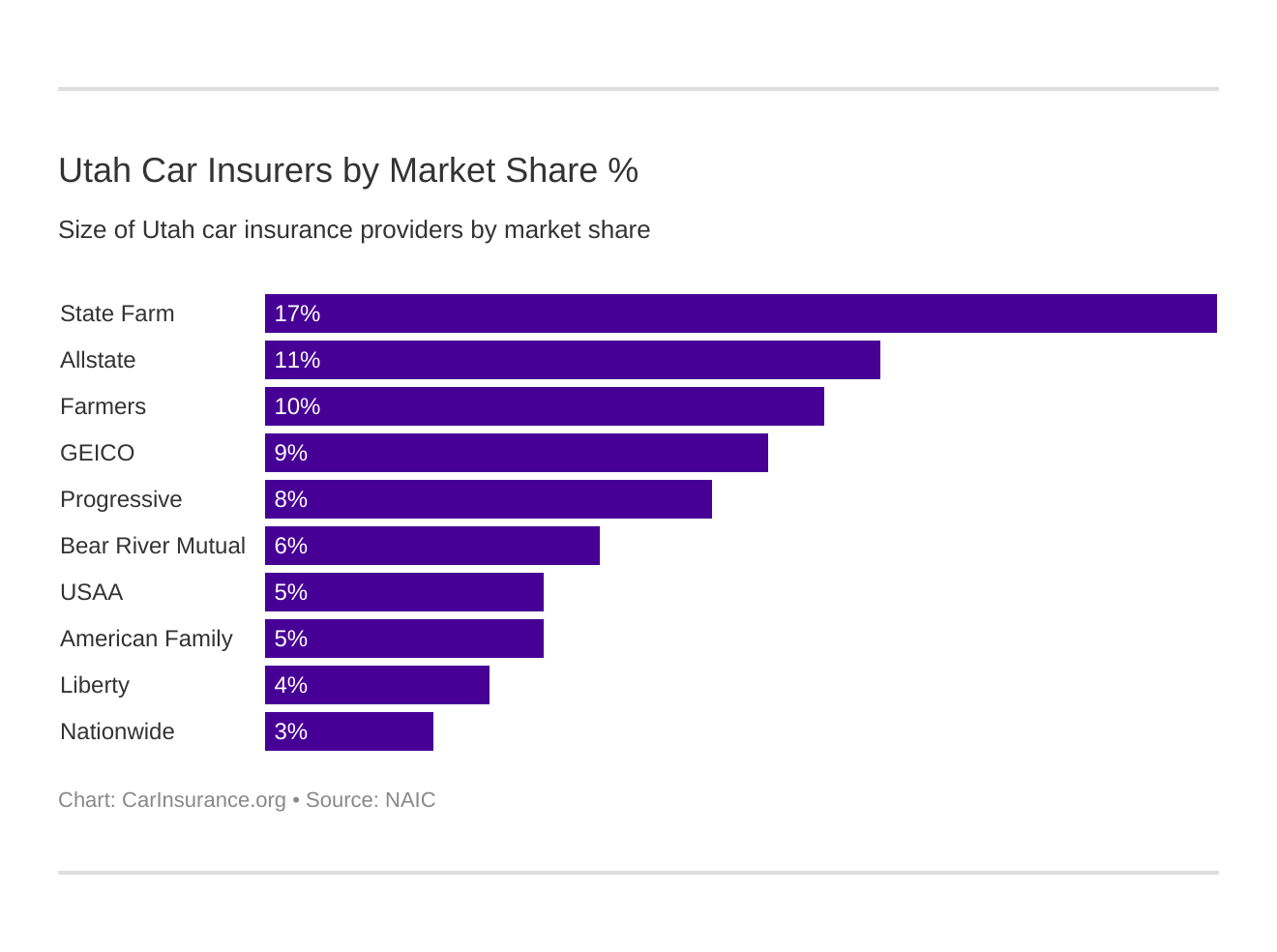

What are the largest car insurance companies in Utah?

Who are the largest car insurance providers in Utah? State Farm Insurance has the highest market share in The Salt Lake State, as you can see in the table below.

| COMPANY | DIRECT PREMIUMS WRITTEN | LOSS RATIO | MARKET SHARE |

|---|---|---|---|

| State Farm | $323,026.00 | 64.11% | 16.71% |

| Allstate | $217,324.00 | 57.30% | 11.24% |

| Farmers | $183,973.00 | 54.43% | 9.52% |

| Geico | $169,933.00 | 77.67% | 8.79% |

| Progressive | $160,684.00 | 65.16% | 8.31% |

| Bear River Mutual | $117,031.00 | 81.12% | 6.05% |

| USAA | $91,547.00 | 73.34% | 4.74% |

| American Family | $87,583.00 | 82.77% | 4.53% |

| Liberty Mutual | $86,034.00 | 66.67% | 4.45% |

| Nationwide | $52,126.00 | 70.19% | 2.70% |

Who are the largest car insurance companies in Utah?

How many foreign vs. domestic insurers are in Utah?

When you hear the phrase “foreign or domestic car insurance company,” what do you think that means?

When it comes to auto insurers, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Utah has 9 domestic car insurance companies and 878 foreign car insurance providers.

What are Utah’s laws?

Do you know all the specific laws for the great state of Utah?

Each state has a unique set of laws, and we’re here to help you navigate the insurance and driving laws of the Salt Lake State.

Whether you’re a Utah native or just passing through, the National Motorists Association guide to driving in the state can be an excellent resource.

You’ll want to make sure that you know precisely what you’re allowed to do on the road so you stay out of trouble in Utah. In order to help you avoid an unfortunate situation, we’ve collected some of the most important driving laws in Utah below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the state’s car insurance laws?

As we’ve already discussed, Utah requires you to have minimum liability insurance with at least:

- $25,000 to cover costs of injury or death to any one person in an accident

- $65,000 to cover costs of injury or death to two or more people in an accident

- $15,000 to cover costs of damage to property in an accident

- $3,000 PIP coverage per person

And remember, these just are minimums.

Your driving record, your credit history, and your typical commute might mean more comprehensive coverage will best serve you and your family.

How State Laws for Insurance are Determined

How do insurance laws get made? Is it as simple as Schoolhouse Rock taught us?

Do you know about the National Association of Insurance Commissioners (NAIC)?

Well, unless you’re an insurance nerd like us, you probably haven’t heard of them before. But that’s okay.

The NAIC is the U.S. standard-setting and regulatory support organization for the insurance industry, including car insurance. They were created and are governed by the chief insurance regulators from all 50 states, the District of Columbia, and five U.S. territories.

And in case you’re curious how insurance laws actually get made, they offer this great white paper to help you understand.

Windshield Coverage

Some insurance companies may offer windshield replacement with comprehensive coverage, but Utah laws, like the laws in a lot of states, have no regulations that are unique or specific to windshields.

But remember, windshield or glass coverage might be an easy add-on to your insurance policy, and our research shows that it’s included in most comprehensive plans.

Thinking about using a kit to do glass repair yourself? Check out the video below.

Automobile Insurance Fraud in Utah

Automobile insurance fraud is a serious crime. Just ask this lawyer.

So what is insurance fraud?

Essentially, insurance fraud is when someone tries to benefit, financially or otherwise, in the course of an insurance transaction to get something that they would not otherwise be due. The most common type of insurance fraud? False claims.

In Utah, insurance fraud carries some hefty penalties. The state calculates these penalties based on what kind of misdemeanor or felony the fraud amounts to:

- A class B misdemeanor if the value of the benefits sought or obtained is less than $500

- A class A misdemeanor punishable by up to one year in prison and up to $2,500 in fines if the benefits sought or obtained is more than $500 but less than $1,500

- A third-degree felony punishable by up to five years in prison and up to $5,000 in fines if the value of the benefits sought or obtained is $1,500 or more but less than $5,000

- A second-degree felony punishable by up to 15 years in prison and up to $10,000 in fines if the value of the benefits sought or obtained is $5,000 or more

The easiest way to avoid committing insurance fraud is to always be as honest and accurate as possible when filing insurance claims.

Statute of Limitations

Do you know what a statute of limitations is?

Put simply, a statute of limitations is the amount of time you have to file and resolve a claim following an accident or to file a lawsuit.

In Utah, you have four years on personal injury claims and three years on property damage claims in court.

Utah Specific Laws

Every state has its quirks when it comes to driving and insurance laws. For instance, in Utah, you always have the right to a trial by a jury of your peers, whether your infraction is a parking ticket or a DUI. Again, we urge you to check out the National Motorists Association guide to driving in Utah. (For more information, read our “Does a parking ticket affect your insurance?“).

But let’s look at some licensing laws for the Beehive State.

What are the vehicle licensing laws?

In the sections below, we’ll learn more about vehicle licensing laws in the Salt Lake State.

Penalties for Driving Without Insurance

As you’ve read above, Utah requires all drivers to have insurance. Here are the penalties for being caught without it:

- First Offense: $400 fine; license suspension until proof of insurance (maintained for three years) and $100 reinstatement fee.

- Second Offense:Fine: $1000 — with three years; license suspension until proof of insurance (maintained for three years) and $100 reinstatement

Do you know about Utah’s REAL ID law?

REAL ID

Do you have some business to do with the Social Security Administration in Salt Lake City?

A REAL ID can save you the hassle of bringing other forms of identification with you to conduct official state or federal government business. According to Utah’s Department of Public Safety, “Utah has been issuing REAL ID-compliant driver licenses and identification cards since January 1, 2010.”

Federal REAL ID laws can affect your travel, especially if you’re traveling by air. So it’s good to know about these before you go.

Teen Driver Laws

Like many states, Utah requires a specific permit for teen drivers.

In Utah, teen drivers must be at least 15 years of age to get their learner’s permit. Before a teen driver can get a license or restricted license, they must meet the requirements listed in the table below.

| UTAH TEEN DRIVER RESTRICTED LICENSE AND LICENSE REQUIREMENTS | DETAILS |

|---|---|

| Mandatory Holding Period of Learner's License | 6 months |

| Minimum Supervised Driving Time | 40 hours (10 of which must be at night) |

| Minimum Age | 16 |

But what if you’re an older driver in Utah?

Older Driver License Renewal Procedures

Utah’s older drivers don’t differ greatly in their renewal procedures from other citizens.

In Utah, everyone, no matter their age, must renew their license every five years, and it can be done online every other renewal.

For drivers 65 and over, however, you must provide proof of adequate vision at every renewal.

New Residents

Utah’s Department of Public Safety provides a great guide for the state’s lucky new residents.

They explain that you must:

- Schedule an appointment for your visit (recommended) or walk-in at a driver’s license office. If you plan to walk-in for your visit you can complete the driver’s license application in the office, or ahead of time online.

- Have a photo taken.

- Submit proof of driver education, or have a valid driver’s license from another state (which you will surrender upon application), or country, to avoid having to carry a learner’s permit for 90 days and completing the online Traffic Safety and Trends Exam.

- Provide proof of identity (name and DOB). Provide a social security card. Provide two (2) documents with a Utah residence address. Visit the required documentation page for what is acceptable proof of each type of document required.

- Pass the eye (vision) test.

- Pass a written knowledge test and driving skills test (one or both may be required).

- Submit a nonrefundable fee of $32 if 21 and older; $39 for provisional (20 and under).

What are the rules of the road?

Now that we’ve gone over basic license procedures for the state of Utah, what rules do you need to know about while driving down the road on an average day?

As you probably know, Utah has some beautiful scenic drives.

Fault vs. No-Fault

Utah is one of only 12 states that with no-fault auto insurance laws. The video below explains what this means.

Utah’s McMullin Legal Group explains that in an accident, “each party’s own insurance provider pays for the initial medical bills. The victim only has a claim against the at-fault party once a statutory threshold amount has been exceeded by medical bills. In the great state of Utah, that amount is $3,000.”

But remember, the more comprehensive your insurance, the better prepared you are to face accidents and other auto incidents head-on, whether or not you are found at fault.

Seat Belt and Car Seat Laws

According to the Utah Department of Public Safety, “ALL passengers must wear seat belts in all seating positions and children up to age 8 must be properly restrained in a car seat or booster seat.”

A good thing to know: Utah offers a number of safety stations where you can have a nationally certified child passenger safety technician ensure your child’s car or booster seat is safe and legal.

Keep Right and Move Over Laws

As you might suspect, in Utah you must drive on the right side of the road unless passing a slower vehicle.

According to the McMullen Legal Group, vehicles must not pass or drive on the left side of the road:

- When coming upon a curve in a road where the view is obstructed and it may cause danger for a driver coming in the opposite direction.

- Within 100 feet of any intersection or railroad crossing.

- When approaching a bridge or tunnel that may also obstruct the view for drivers in either direction.

According to Utah’s Highway Patrol, “Utah’s Move Over Law is contained in Utah Code 41-6a-904.

Drivers approaching stationary emergency vehicles, highway maintenance vehicles, or towing vehicles displaying flashing red, red and white, red and blue lights, or amber lights need to slow down, provide as much space as practical to the stationary vehicles, and move over a lane if it’s safe and clear.

This law requires drivers to move over and/or slow down when approaching stopped emergency or maintenance vehicles. They offer this great video on the importance of moving over for emergency vehicles.

Speed Limits

Knowing the speed limit is important wherever you’re driving, as our research shows that speeding is one of the easiest ways to increase your car insurance premium.

In Utah, the maximum speed limits for both cars and trucks are:

- Rural Interstates: 75 MPH (80 MPH on specified segments)

- Urban Interstates: 65 MPH (70 MPH on specified segments)

- Other Limited Access Roads: 75 MPH

Slow down to keep you and your family safe. Oh, and to keep your car insurance affordable.

Ridesharing

Thinking about taking an Uber or Lyft in Utah? That’s probably fine, but the state is lagging in enacting insurance requirements for ridesharing options.

But rest assured that these companies’ driver requirements are pretty clear: most rideshare services require that all their drivers carry personal car insurance policies that align or exceed the minimum coverage dictated by the law in the state where they’re operating.

So don’t fret if you need a Lyft from the airport in Salt Lake City.

Automation on the Road

What the heck is automation?

The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task previously carried out by a human. When it comes to automation, typically think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

According to the IIHS, Utah has authorized the deployment of autonomous vehicles, though the operator must be licensed and hold minimum insurance. (They don’t, however, have to be in the vehicle itself.)

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the safety laws?

You know driving safely is important, no matter where you are.

What’s the first step in driving safely? Knowing a state’s safety laws and regulations.

Since you now know the proper way to insure and register your vehicle in Utah, let’s take a look at some important safety information to keep you, your family, and your vehicles safe in the Salt Lake State.

DUI Laws

Put simply: don’t drink and drive. In 2017, 53 people died from alcohol-impaired accidents in Utah.

And you should know: Utah has some of the strictest alcohol laws across the United States.

For instance, Utah has a BAC (Blood Alcohol Content) limit of 0.05, lower than any other state.

The table below provides the basics of Utah’s DUI laws.

| DUI LAW IN UTAH | DETAILS |

|---|---|

| Name for Offense | Driving Under the Influence (DUI) |

| BAC Limit | 0.05 |

| High BAC Limit | 0.16 |

| Criminal Status | 1st-2nd class B misdemeanors |

| 3rd+ in 10 years third degree felonies | |

| Look Back Period | 10 years |

And the following table provides the strict penalties for DUI conviction in Utah.

| OFFENSE | LICENSE SUSPENSION | JAIL TIME | FINE | OTHER |

|---|---|---|---|---|

| 1st Offense | 120 days. 2 years alcohol restricted driving privileges | Minimum 48 consecutive hours OR 48 hours community service OR home confinement | $1,310 minimum | IID 18 months |

| 2nd Offense | 2 years. 10 years alcohol restricted driving privilege | Minimum 240 consecutive hours OR 240 hours community service OR home confinement | $1,560 minimum | NA |

| 3rd Offense | 2 years. Alcohol restricted driving privilege for life | 62 days up to 5 years | $2,850 up to $5000 | IID 18 months |

The video below offers some great information about how alcohol can affect your body.

Marijuana-Impaired Driving Laws

Utah law has a zero-tolerance legal policy for THC and metabolites. Drive high in The Salt Lake State and you face the same penalties applicable for driving under the influence of alcohol.

Distracted Driving Laws

Utah has an all-encompassing ban on texting while driving. Utahns under the age of 18 are banned from using any type of hand-held device.

You should know: Utah’s texting ban is primarily enforced, meaning a police officer can pull you over for no other reason than sending a text.

Your text or hand-held phone call can wait in the Ocean State.

What do you need to know about driving safely in Utah?

Now that you’ve learned some of the basic rules of the road in the great state of Utah, let’s look at some key driver safety statistics.

How bad is vehicle theft in Utah?

The Federal Bureau of Investigation (FBI) tracks vehicle theft in all states and reports that in 2016, 1,930 cars were stolen in Salt Lake City alone. But you might also want to know what vehicles are stolen the most in the Beehive State.

The table below shows the top ten most-stolen cars in Utah for 2016 by make, model, and model year.

| VEHICLE MAKE AND MODEL | VEHICLE YEAR | TOTAL STOLEN |

|---|---|---|

| Honda Accord | 1997 | 938 |

| Honda Civic | 1998 | 915 |

| Subaru Legacy | 1996 | 262 |

| Ford Pickup (Full Size) | 2006 | 238 |

| Chevrolet Pickup (Full Size) | 2004 | 225 |

| Dodge Pickup (Full Size) | 2012 | 117 |

| Subaru Impreza | 1997 | 106 |

| Acura Integra | 1995 | 103 |

| Jeep Cherokee/Grand Cherokee | 1996 | 102 |

| Nissan Altima | 1997 | 97 |

It’s a sad question to ask, but how many people die on Utah’s roads?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How many road fatalities are there in Utah?

According to Utah’s Department of Safety, 273 people were killed on Utah roadways in 2017. In the sections below, we’ll take a closer look at the types and causes of these fatalities.

Most fatal highway in Utah

GeoTab reports that U.S. Route 89 is the most fatal highway in Utah. Route 89 basically splits the state in half, running north to south through several national parks.

Fatal Crashes by Weather and Light Conditions

We’ve already discussed how Utah gets a lot of snow. This extreme snowfall can be beautiful, sure, but it can also become deadly.

Light and weather conditions are a key factor for crashes on Utah’s roadways. The table below provides the number of fatal crashes based on weather and light conditions across Utah in 2017.

| WEATHER CONDITION | DAYLIGHT | DARK, BUT LIGHTED | DARK | DAWN OR DUSK | OTHER / UNKNOWN | TOTAL |

|---|---|---|---|---|---|---|

| Normal | 127 | 24 | 53 | 11 | 0 | 215 |

| Rain | 7 | 5 | 4 | 0 | 0 | 16 |

| Snow/Sleet | 6 | 0 | 2 | 0 | 0 | 8 |

| Other | 1 | 1 | 1 | 1 | 0 | 4 |

| Unknown | 0 | 0 | 0 | 3 | 1 | 4 |

| TOTAL | 141 | 30 | 60 | 15 | 1 | 247 |

Fatalities (All Crashes) Five-Year Trend for the Top Ten Counties

More people often means more roadway fatalities.

The table below provides the number of crash fatalities for Utah’s ten biggest counties from 2014 to 2018, according to the National Highway Transportation Safety Administration.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Salt Lake County | 66 | 76 | 69 | 69 | 67 |

| Utah County | 24 | 39 | 31 | 25 | 41 |

| Davis County | 11 | 11 | 27 | 11 | 19 |

| Weber County | 16 | 21 | 19 | 15 | 19 |

| Wasatch County | 5 | 9 | 7 | 10 | 12 |

| Cache County | 12 | 4 | 12 | 21 | 10 |

| Tooele County | 15 | 14 | 20 | 9 | 9 |

| Washington County | 18 | 17 | 15 | 15 | 9 |

| Box Elder County | 13 | 16 | 10 | 12 | 8 |

| Kane County | 3 | 5 | 2 | 1 | 8 |

Fatalities by Passenger Type

What kind of vehicles are Utahns riding in or driving when they’re in a deadly car crash? The table below shows fatalities by passenger type from 2013 to 2017.

| PERSON TYPE | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 69 | 89 | 95 | 85 | 89 |

| Light Truck - Pickup | 40 | 27 | 38 | 38 | 32 |

| Light Truck - Utility | 24 | 29 | 30 | 43 | 41 |

| Light Truck - Van | 7 | 11 | 12 | 8 | 5 |

| Light Truck - Other | 0 | 0 | 0 | 0 | 2 |

| Large Truck | 5 | 4 | 6 | 4 | 8 |

| Bus | 2 | 0 | 0 | 0 | 1 |

| Other/Unknown Occupants | 5 | 5 | 7 | 18 | 7 |

| Total Occupants | 152 | 165 | 188 | 196 | 185 |

| Total Motorcyclists | 31 | 45 | 36 | 41 | 39 |

| Pedestrian | 28 | 32 | 47 | 35 | 42 |

| Bicyclist and Other Cyclist | 6 | 9 | 5 | 5 | 6 |

| Other/Unknown Nonoccupants | 3 | 5 | 2 | 4 | 1 |

| Total Nonoccupants | 37 | 46 | 54 | 44 | 49 |

| Total | 220 | 256 | 278 | 281 | 273 |

Fatalities by Crash Type

Similarly, how many vehicles are involved in deadly crashes across the Beehive State? And what causes these crashes? The table below shows the number of vehicle fatalities in Utah by crash type from 2013 to 2017.

| CRASH TYPE | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 141 | 146 | 150 | 161 | 146 |

| Involving a Large Truck | 20 | 18 | 39 | 20 | 36 |

| Involving Speeding | 75 | 90 | 64 | 72 | 78 |

| Involving a Rollover | 79 | 80 | 82 | 93 | 79 |

| Involving a Roadway Departure | 126 | 128 | 118 | 137 | 142 |

| Involving an Intersection (or Intersection Related) | 36 | 72 | 62 | 78 | 58 |

| Total Fatalities (All Crashes) | 220 | 256 | 278 | 281 | 273 |

Fatalities Involving Speeding by County

The following table illustrates the 2014-2018 statistics on fatalities caused by speeding in Utah by county according to the National Highway Transportation Safety Administration.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Beaver County | 1 | 1 | 0 | 1 | 0 |

| Box Elder County | 1 | 6 | 3 | 2 | 3 |

| Cache County | 4 | 0 | 4 | 5 | 1 |

| Carbon County | 3 | 3 | 2 | 0 | 1 |

| Daggett County | 0 | 0 | 1 | 0 | 1 |

| Davis County | 4 | 2 | 7 | 4 | 2 |

| Duchesne County | 3 | 0 | 0 | 0 | 2 |

| Emery County | 2 | 0 | 2 | 0 | 2 |

| Garfield County | 2 | 0 | 2 | 0 | 2 |

| Grand County | 1 | 1 | 1 | 6 | 0 |

| Iron County | 1 | 2 | 1 | 0 | 2 |

| Juab County | 0 | 0 | 2 | 4 | 0 |

| Kane County | 0 | 0 | 0 | 0 | 2 |

| Millard County | 0 | 1 | 1 | 4 | 3 |

| Morgan County | 3 | 1 | 1 | 3 | 2 |

| Piute County | 0 | 0 | 0 | 0 | 0 |

| Rich County | 1 | 0 | 0 | 1 | 2 |

| Salt Lake County | 23 | 16 | 13 | 17 | 23 |

| San Juan County | 7 | 0 | 1 | 3 | 1 |

| Sanpete County | 0 | 1 | 2 | 2 | 0 |

| Sevier County | 0 | 0 | 0 | 0 | 0 |

| Summit County | 0 | 1 | 3 | 0 | 1 |

| Tooele County | 6 | 6 | 5 | 1 | 3 |

| Uintah County | 6 | 2 | 2 | 6 | 1 |

| Utah County | 10 | 9 | 6 | 5 | 10 |

| Wasatch County | 2 | 3 | 1 | 6 | 1 |

| Washington County | 6 | 7 | 6 | 7 | 2 |

| Wayne County | 0 | 0 | 0 | 0 | 0 |

| Weber County | 4 | 2 | 6 | 5 | 3 |

| Wasatch County | 2 | 3 | 1 | 6 | 1 |

| Washington County | 6 | 7 | 6 | 7 | 2 |

| Wayne County | 0 | 0 | 0 | 0 | 0 |

| Weber County | 4 | 2 | 6 | 5 | 3 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Drunk driving is one of the most avoidable causes of road fatalities.

This table offers the 2014-2018 statistics on crash fatalities involving an alcohol-impaired driver in Utah by county according to the National Highway Transportation Safety Administration.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Beaver County | 0 | 0 | 0 | 0 | 0 |

| Box Elder County | 2 | 2 | 2 | 4 | 1 |

| Cache County | 2 | 0 | 1 | 1 | 1 |

| Carbon County | 2 | 1 | 1 | 1 | 1 |

| Daggett County | 0 | 0 | 0 | 1 | 0 |

| Davis County | 2 | 1 | 5 | 2 | 6 |

| Duchesne County | 2 | 0 | 0 | 0 | 0 |

| Emery County | 0 | 2 | 2 | 2 | 1 |

| Garfield County | 0 | 0 | 1 | 0 | 2 |

| Grand County | 0 | 3 | 0 | 3 | 1 |

| Iron County | 0 | 0 | 0 | 0 | 1 |

| Juab County | 0 | 0 | 1 | 2 | 0 |

| Kane County | 1 | 0 | 2 | 0 | 2 |

| Millard County | 2 | 4 | 1 | 0 | 1 |

| Morgan County | 0 | 0 | 0 | 0 | 2 |

| Piute County | 0 | 0 | 1 | 0 | 0 |

| Rich County | 1 | 0 | 0 | 1 | 2 |

| Salt Lake County | 24 | 13 | 11 | 21 | 19 |

| San Juan County | 1 | 3 | 5 | 3 | 1 |

| Sanpete County | 0 | 0 | 1 | 1 | 0 |

| Sevier County | 0 | 0 | 1 | 0 | 0 |

| Summit County | 0 | 3 | 2 | 0 | 0 |

| Tooele County | 4 | 1 | 6 | 0 | 3 |

| Uintah County | 5 | 2 | 0 | 3 | 2 |

| Utah County | 3 | 5 | 5 | 4 | 6 |

| Wasatch County | 0 | 1 | 0 | 1 | 7 |

| Washington County | 2 | 2 | 3 | 2 | 1 |

| Wayne County | 0 | 1 | 0 | 0 | 0 |

| Weber County | 3 | 3 | 2 | 2 | 0 |

Salt Lake County — home of the urban center of Salt Lake City and many of the state’s major institutions — leads the state in both alcohol-impaired and speeding fatalities.

Teen Drinking and Driving

On average, teen drinking and driving is less of a problem in Utah than it is across the United States.

Whereas America has a national average of 1.2 teen deaths from drunk driving per 100,000 people, the rate is only 0.5 underage alcohol-related deaths per 100,000 people in Utah.

The state ranks third-best in the nation for its low number of teen drinking and driving arrests.

EMS Response Time

EMS response time is largely dependent on whether a crash happens in an urban or rural area.

This table shows the average EMS response time for urban and rural areas of Utah, from time of the crash to EMS notification, to time of the crash to hospital arrival.

| ROAD TYPE | TIME OF CRASH TO EMS NOTIFICATION | EMS NOTIFICATION TO EMS ARRIVAL | EMS ARRIVAL AT SCENE TO HOSPITAL ARRIVAL | TIME OF CRASH TO HOSPITAL ARRIVAL | TOTAL FATAL CRASHES |

|---|---|---|---|---|---|

| Rural | 5.44 minutes | 19.48 minutes | 40.13 minutes | 59.19 minutes | 107 |

| Urban | 3.46 minutes | 6.64 minutes | 25.78 minutes | 36.35 minutes | 152 |

What do you need to know about transportation in Utah?

If you call Utah home, you likely live in a household with two or more vehicles, drive alone to work, and have an average commute time of 20.5 minutes each way.

Car Ownership

According to DataUSA, 38.6 percent of Utah’s households own two cars. 13.7 percent own one vehicle, and 25.2 percent own three.

Commute Time

DataUSA also reports that Utahns have an average commute of 20.5 minutes each way, well below the national average of 25.5 minutes.

Commuter Transportation

According to DataUSA, “in 2017, the most common method of travel for workers in Utah was Drove Alone (76.1%), followed by those who Carpooled (10.7%) and those who Worked At Home (6.81%).”

Public transit is fairly popular in Salt Lake City, but not in other parts of the state.

Traffic Congestion

Here’s some good news: none of Utah’s cities are listed on the INRIX’s scorecard for global traffic.

We hope this guide has helped you learn more about your liabilities as a driver in the great state of Utah, the Beehive State, the Salt Lake State.

Which part was the most helpful? Was there something we’ve left out? Just let us know.

Simply by entering your ZIP code below, you can take the next step in getting the best auto insurance quotes for Utah, the beautiful Salt Lake State.

- https://autoalliance.org/in-your-state/UT/

- https://datausa.io/profile/geo/utah

- https://content.naic.org/

- https://web.ambest.com/home

- https://www.jdpower.com/business/press-releases/2019-us-auto-insurance-study

- https://www.experian.com/blogs/ask-experian/consumer-credit-review/

- https://content.naic.org/

- https://ww2.motorists.org/chapters/utah/motorists-info/

- https://www.naic.org/documents/topics_white_paper_hist_ins_reg.pdf

- https://publicsafety.utah.gov/2020/03/26/real-id-what-you-need-to-know/

- https://dld.utah.gov/i-am-new-to-utah/

- https://secure.utah.gov/dlscheduler/scheduler/index.uii?null

- https://dld.utah.gov/offices/

- https://dld.utah.gov/wp-content/uploads/sites/17/2019/06/Driver-License-Application.pdf

- https://dld.utah.gov/driver-education/

- https://secure.utah.gov/account/login.html

- http://site.utah.gov/dps-driver/required-documentation/

- https://site.utah.gov/dps-driver/eye-vision-test/

- https://dld.utah.gov/written-knowledge-test/

- https://dld.utah.gov/driving-skills-test/

- https://stgeorgeutahattorneys.com/fault-and-no-fault-car-accidents-understanding-utahs-liability-laws/

- https://highwaysafety.utah.gov/seat-belts-and-car-seats/car-seat-safety/

- https://site.utah.gov/dps-highwaysafe/wp-content/uploads/sites/22/2018/10/Is-Your-Child-Safe-Oct-18.pdf

- https://stgeorgeutahattorneys.com/utah-law-safe-lane-travel/

- https://le.utah.gov/xcode/Title41/Chapter6A/41-6a-S904.html?v=C41-6a-S904_2016051020160510

- https://www.nolo.com/legal-encyclopedia/i-was-hit-by-an-uber-or-lyft-driver-what-now.html

- https://www.iihs.org/topics/advanced-driver-assistance#automation

- https://www.responsibility.org/alcohol-statistics/state-map/state/utah/

- https://www.responsibility.org/alcohol-statistics/state-map/state/utah/issue/marijuana-drug-impaired-driving-laws/

- https://ucr.fbi.gov/crime-in-the-u.s/2016/crime-in-the-u.s.-2016/tables/table-6/table-6-state-cuts/utah.xls

- https://site.utah.gov/dps-highwaysafe/wp-content/uploads/sites/22/2019/01/2017FatalCrashSummary-revised-01-25-2019.pdf

- https://www.geotab.com/the-most-dangerous-highways-in-america/

- https://cdan.dot.gov/

- https://datausa.io/profile/geo/utah#num_vehicles

- https://datausa.io/profile/geo/utah#commute_time

- https://datausa.io/profile/geo/utah#mode_transport

- https://inrix.com/scorecard/

[/su_spoil