West Virginia

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 10.10%

Everyone knows the classic John Denver hit Country Roads. Every time you hear it, you can’t help but sing along. If you are singing along, then you are probably like millions of other drivers in West Virginia and are in your car headed to the Shenandoah River. One thing you may not be thinking about as you travel the country roads is the cost of car insurance.

Are you paying too much? We hope not, because if you’re like us, no one wants to pay too much for car insurance, no matter what road we find ourselves on.

What if there was a way to help you save on your car insurance? What if it could save you money? Would you take the time? I bet you would, and that’s why we’ve compiled this guide to get you started. Everything you need to know about buying cheap car insurance in West Virginia is in this comprehensive guide. Enter your zip code below to get started.

How to Get West Virginia Car Insurance Coverage and Rates

The median household income in West Virginia in 2017 was over $43,469, and drivers, on average, paid over $1,026 for car insurance. That’s way too high for us. However, you feel about it, we think consumers in West Virginia are spending way too much money on car insurance.

There has to be a better way.

Below, we have provided information and helpful advice so you can get the best coverage options for your needs.

| TYPE OF COVERAGE | PRIOR TO JANUARY 1, 2016 | As Of JANUARY 1, 2016 | Increase |

|---|---|---|---|

| Bodily Injury Liability | $20,000 per person $40,000 per accident | $25,000 per person $50,000 per accident | $5,000 per person $10,000 per accident |

| Property Damage Liability | $10,000 per accident | $20,000 per accident | $10,000 per accident |

| Uninsured/Underinsured Motorist Coverage | Optional | Optional | Cannot be determined |

Okay, you’ve read the numbers, but what do they mean?

What is 25/50/20?

Bodily injury?

Accidents?

We hope you never have to deal with any of these situations or end up in one of these:

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s West Virginia’s Car Culture like?

West Virginia is more than just mountains and country roads. It is a leading coal mining state and has provided fuel for the country for more than a hundred years.

West Virginia does have some transportation options: 32of the state’s 55 counties are served by some form of mass transit. Amtrak and Greyhound also propel residents to various destinations, but for most of the 1.8 million residents, they have to rely on a personal vehicle.

What are West Virginia Minimum Coverage Requirements?

In West Virginia, you aren’t allowed to drive a motor vehicle without the required amount of insurance coverage. That’s why you must carry the state-mandated minimum car insurance coverage.

| Type of Coverage | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $25,000 per person/$50,000 per accident |

| Property Damage Liability | $25,000 |

As per the law in West Virginia, all auto owners must buy bodily injury liability insurance coverage with minimum limits of $25,000 per person and $50,000 for one accident. In addition, you must carry property damage liability coverage of $25,000.

You must carry proof of insurance coverage at all times in your car. West Virginia also allows motorists to show electronic proof of insurance on any wireless device.

One thing you must note about liability coverage is that it only covers third-party expenses of personal injuries and damages in an auto accident. To cover your damages, you will need to buy additional coverage. Remember, the above figures are just the minimum requirements for auto insurance. It is in your best interest to invest in additional coverage.

How is fault or liability determined in a car accident?

Claims for car accidents are pursued differently in at-fault and no-fault states.

Since West Virginia is an at-fault state, the party which is responsible for causing the accident is required to cover the damages sustained by the third-party.

In no-fault states, each party in an accident pursues the insurance claim with their own company irrespective of fault.

As you must cover your expenses after an accident, if you’re the at-fault party, we recommend that you should look at options for additional coverage.

| Types of Coverage | What it Covers |

|---|---|

| Collision | Collision helps to recover the cost of repair or replacement if your car is damaged due to a collision with another object, such as a tree, fence, or another car. |

| Comprehensive | Comprehensive covers damages to your car that happen due to causes out of your control, such as storms, theft, fire, etc. |

| Medical Payments | Med Pay helps to cover the medical expenses from injury to you or your passengers in an accident irrespective of the fault. |

| Personal Injury Protection (PIP) | PIP, as the name suggests, kicks in to cover your personal injury expenses in an accident irrespective of fault. Along with medical expenses, PIP also covers lost wages. |

Collision and comprehensive coverage, though not mandatory, are usually part of the auto insurance policy as these cover damages from any collisions or natural events.

For personal injuries, you can choose either Medical Payments or Personal Injury Protection (PIP). As the names suggest, you would get reimbursed for your medical expenses or personal injuries from both these coverage options.

However, if you choose PIP, it would also cover rehab expenses and lost wages as well.

What Does a Form of Financial Responsibility Mean?

What is financial responsibility? Financial responsibility is proof that you have West Virginia’s minimum liability coverage. State law requires every driver and owner of a vehicle to have proof of financial security at all times.

Here are a few acceptable forms of proof of financial security in West Virginia:

- Valid Insurance ID Card

- Electronic proof on a smartphone

- A letter from an insurance agent or insurer on company letterhead.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Percentage of Income are Insurance Premiums?

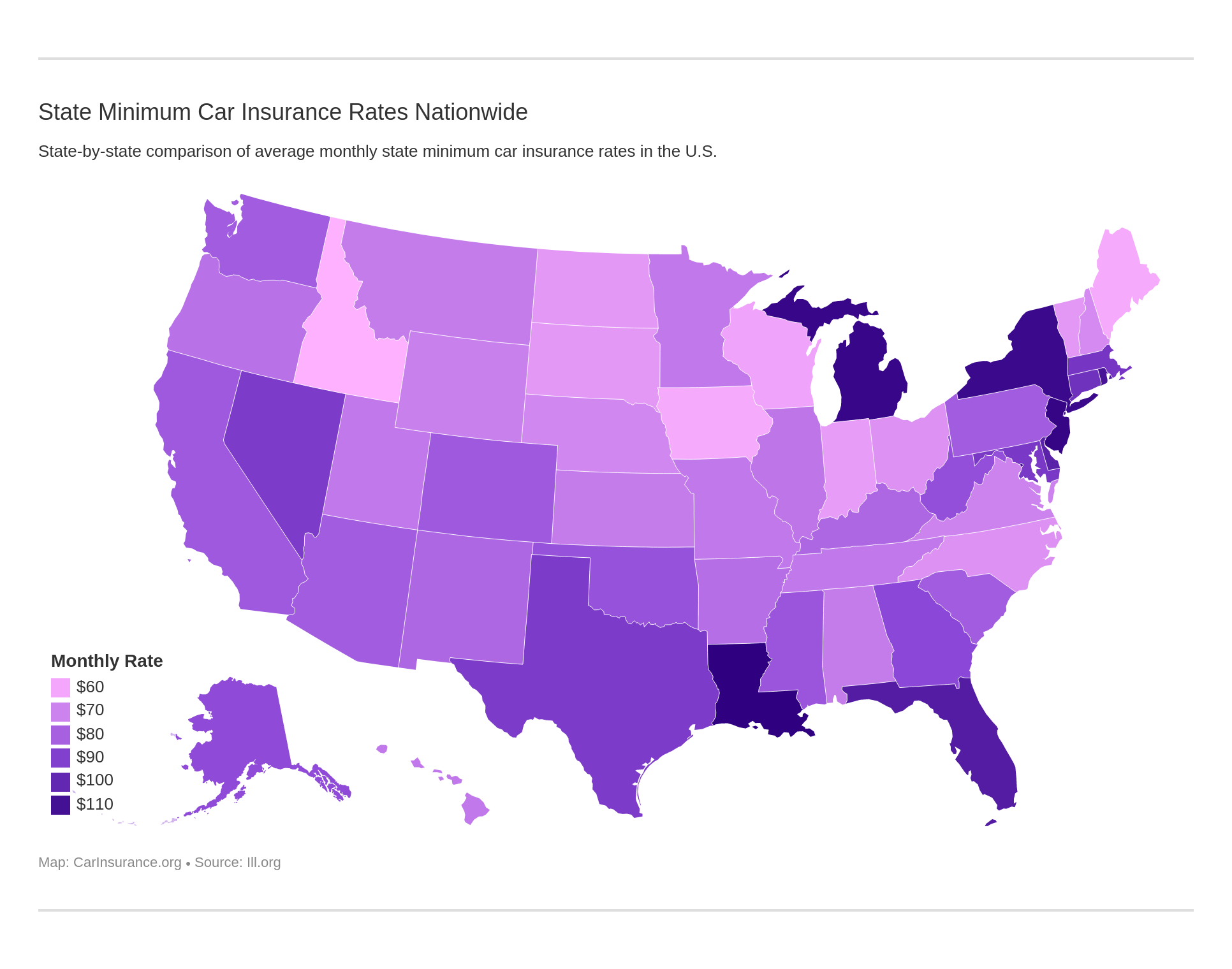

The per capita disposable income in West Virginia is $32,277. On average, residents spend $1,032 a year on car insurance. To put this amount in perspective, the countrywide, annual average for car insurance is $981. This means people in West Virginia are above the countrywide average and pay more than neighboring states, Pennsylvania and Virginia, who pay yearly amounts of $950 and $836, respectively.

What are the Average Monthly Car Insurance Rates in WV (Liability, Collision, Comprehensive)?

The main concern of almost every West Virginia motorist is the rising cost of car insurance? The table below shows data provided by the National Association of Insurance Commissioners, which is an agency dedicated to keeping up with the changing costs of car insurance.

| Type of Coverage | Average Annual Premiums |

|---|---|

| Liability | $491.83 |

| Collision | $329.67 |

| Comprehensive | $204.28 |

| Combined | $1,025.78 |

Up next, we take a look at loss ratios and what they mean to a company’s bottom line.

Is There an Additional Liability?

To gauge the financial health of insurance companies, you should look at its loss ratios. Loss ratios are explained as: the money insurance companies pay out on claims compared to the money they take in on premiums is the loss ratio.

For example, an auto insurer collects $100,000 of premiums in a given year and pays out $55,000 in claims, the company’s loss ratio is 55 percent ($55,000 incurred losses/$100,000 earned premiums).

Check out the loss ratio for these two types of coverage in West Virginia.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (Med Pay) | 64.70% | 66.43% | 66.16% |

| Uninsured/Underinsured | 49.24% | 51.71% | 58.05% |

You may want to consider additional coverage to your insurance plans, to avoid paying out of pocket in the event of an accident. Without additional coverage, medical bills and payments could reach well into the thousands of dollars for those affected by an uninsured driver and force some into financial difficulty.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are There any Add-ons, Endorsements, and Riders?

No one wants to have a car wreck, but if you are, do you have enough protection for you and your family? Have you considered adding extra coverages to your policy? Do you even know what’s out there? Choosing from a list of options can be daunting, and we know you want the best options for your family at the best price.

To help you decide, we’ve made a list of affordable car insurance options to add to your policy. Check out the selections below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Usage-Based Insurance programs (UBI) are active and available to residents of West Virginia. Programs like Drivewise from Allstate or Snapshot from Progressive offer insurance discounts to drivers based on how well and how often they drive.

Any of the above coverages would be beneficial to add to your policy, so make sure to discuss any options you are interested in with your insurance provider.

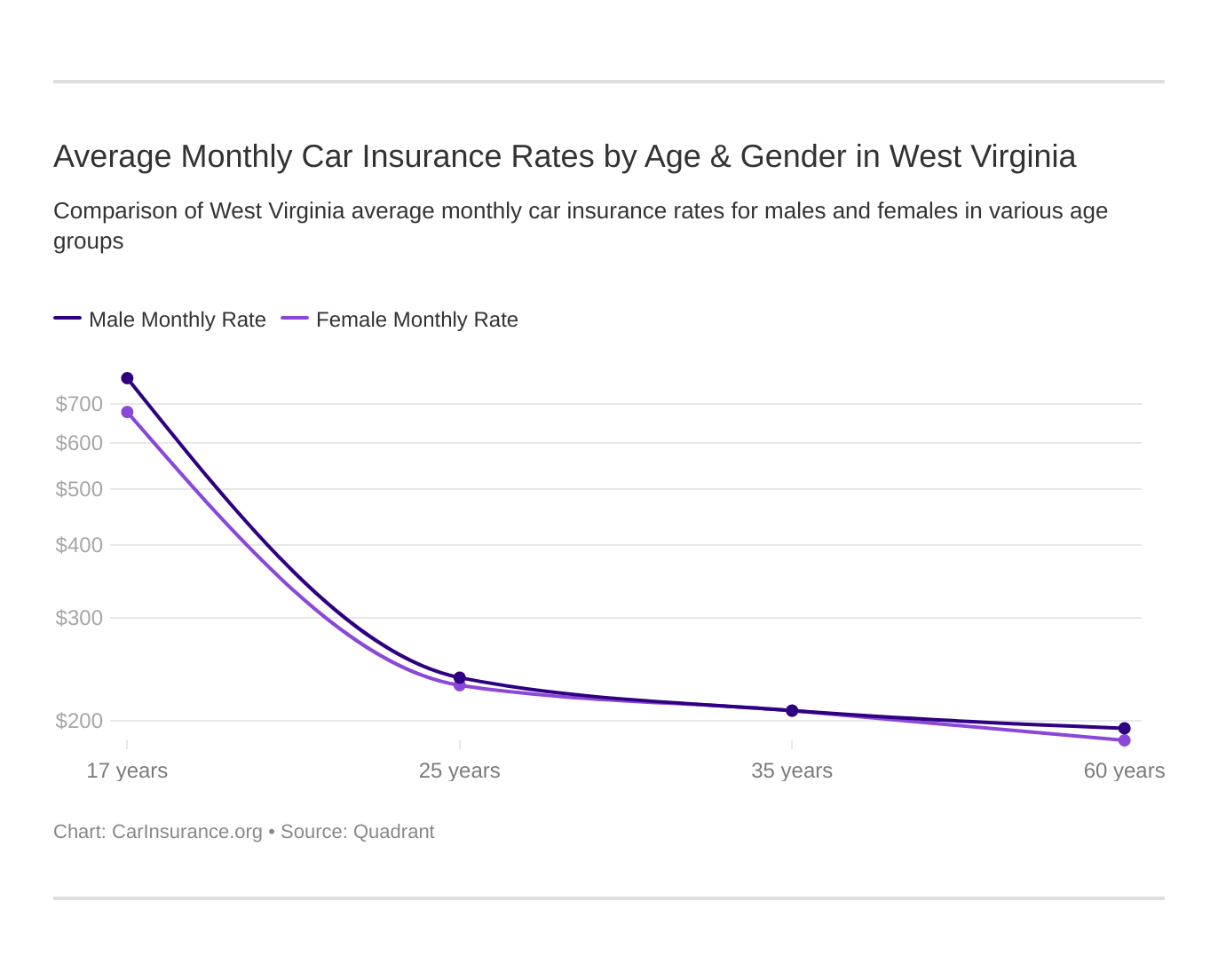

What are the Average Monthly Car Insurance Rates by Age & Gender in WV?

Inc.com wrote an article that says women pay $100,000 more for the same products as men do. In fact, gender discrimination in auto insurance rates is such a problem that California and other states banned gender discrimination and created gender-neutral insurance plans.

Up next, we partnered with Quadrant Information Services to show you rates that various folks in West Virginia pay for car insurance.

| Insurance Providers | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $10,480.93 | $10,920.44 | $3,247.28 | $3,253.31 | $2,933.38 | $2,724.76 | $2,620.92 | $2,627.69 |

| Geico General | $6,862.60 | $8,279.02 | $2,682.48 | $2,796.00 | $2,789.69 | $2,751.21 | $2,655.37 | $2,573.55 |

| Safeco Ins Co of America | $14,459.89 | $16,320.56 | $3,981.38 | $4,388.29 | $3,850.36 | $4,184.55 | $3,092.94 | $3,766.95 |

| Nationwide Mutual | $5,477.19 | $6,941.22 | $2,371.35 | $2,541.49 | $2,101.13 | $2,135.83 | $1,908.82 | $2,004.02 |

| Progressive Max | $9,871.04 | $11,125.46 | $2,731.41 | $2,821.68 | $2,269.67 | $2,185.59 | $2,090.92 | $2,088.98 |

| State Farm Mutual Auto | $3,855.91 | $4,979.67 | $2,049.92 | $1,620.39 | $1,734.04 | $1,734.04 | $1,557.19 | $1,557.19 |

| USAA | $5,831.46 | $6,456.12 | $2,277.84 | $2,448.74 | $1,760.92 | $1,736.48 | $1,635.09 | $1,649.46 |

As you can see from the data, teen drivers pay thousands more than older drivers do for car insurance. Among the major carriers, State Farm has the cheapest car insurance rates when it comes to teen drivers. While Nationwide has the lowest increase from young to older drivers. As with all such information, your rates may be different depending on your location and other circumstances.

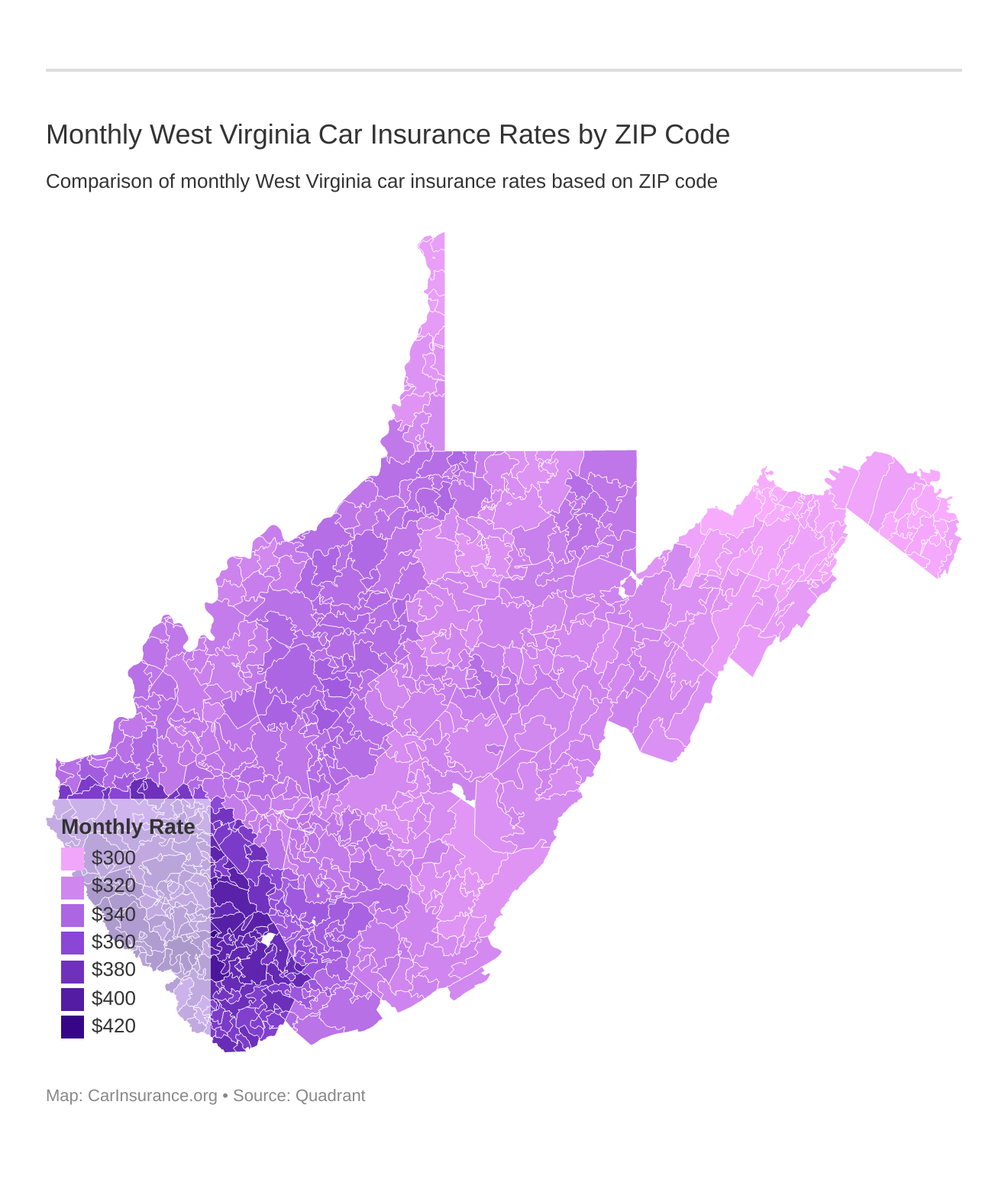

What are the Cheapest Car Insurance Rates by City?

Drivers in Charleston, which is the capital of West Virginia, pay about $1,070 yearly for car insurance. Whereas, motorists in a smaller city like Parkersburg pay $1,031. For even smaller cities and towns, your rates could be less.

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in WV.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Best West Virginia Car Insurance Companies?

From Harper’s Ferry to the New River Gorge National River Park, folks in West Virginia have ample opportunities to hike and explore ridges, plateaus, and other places. One thing we know is that most of those folks would rather be out exploring, instead of searching for cheaper rates on car insurance.

That is why we’ve done all of the work for you and researched the best insurance carriers in West Virginia so that you can make the best choice. We’ve looked at companies’ financial ratings, AM’s best ratings, and which companies have the most complaints.

Keep reading to learn about West Virginia’s auto insurance providers.

What is the Financial Rating of the Largest Companies?

Loss ratios play a large part in how secure a company is doing financially. That’s why we want to include AM Best ratings, which look at loss ratios to determine if a company has solid financial security.

So to see how the 10 largest companies in West Virginia are doing, we’ve included the AM Best ratings for each.

| Leading Insurance Providers | A.M. Best Rating |

|---|---|

| State Farm Group | A |

| Erie Insurance Group | A+ |

| Nationwide Corp Group | A+ |

| Geico | A++ |

| Allstate Insurance Group | A+ |

| Progressive Group | A+ |

| Liberty Mutual Group | A |

| USAA Group | A++ |

| Hartford Fire & Casualty Group | A+ |

| Westfield Group | A |

Which Companies Have the Best Ratings?

A good financial rating means the insurance carrier has the funds available to pay any claims. But customer service is also an important part of any company, from restaurants to car insurance companies. That’s why we’ve looked at companies with the best overall customer satisfaction ratings.

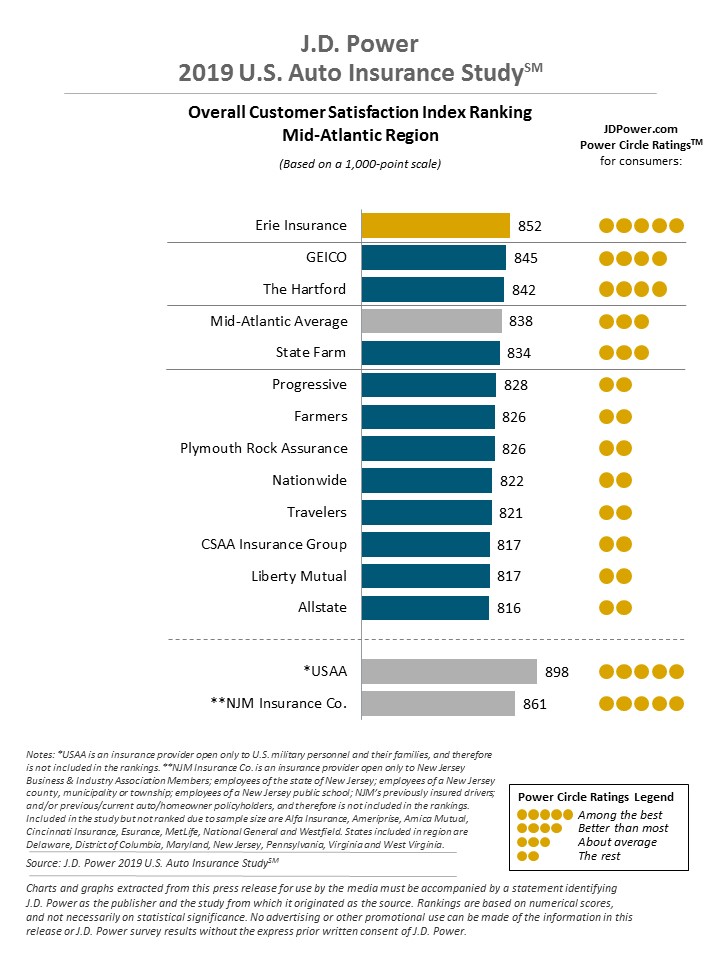

Check out these ratings from J. D. Power.

Geico ranks near the top of the list — proving that Geico is excellent at customer satisfaction.

Just because a company has a good rating for financial stability doesn’t mean their customers are always happy.

Let’s check out their record of official complaints.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Companies Have the Most Complaints in West Virginia?

Keep in mind that a high complaint index doesn’t necessarily mean you should avoid a company. You should also look at a company’s customer satisfaction ratings because how a company deals with complaints is also important.

| Leading Insurance Providers | Complaint Numbers |

|---|---|

| State Farm Group | 1482 |

| Erie Insurance Group | 22 |

| Nationwide Corp Group | 25 |

| Geico | 333 |

| Allstate Insurance Group | 163 |

| Progressive Group | 120 |

| Liberty Mutual Group | 222 |

| USAA Group | 296 |

| Hartford Fire & Casualty Group | 9 |

| Westfield Group | 7 |

State Farm has more complaints than any other provider in the state.

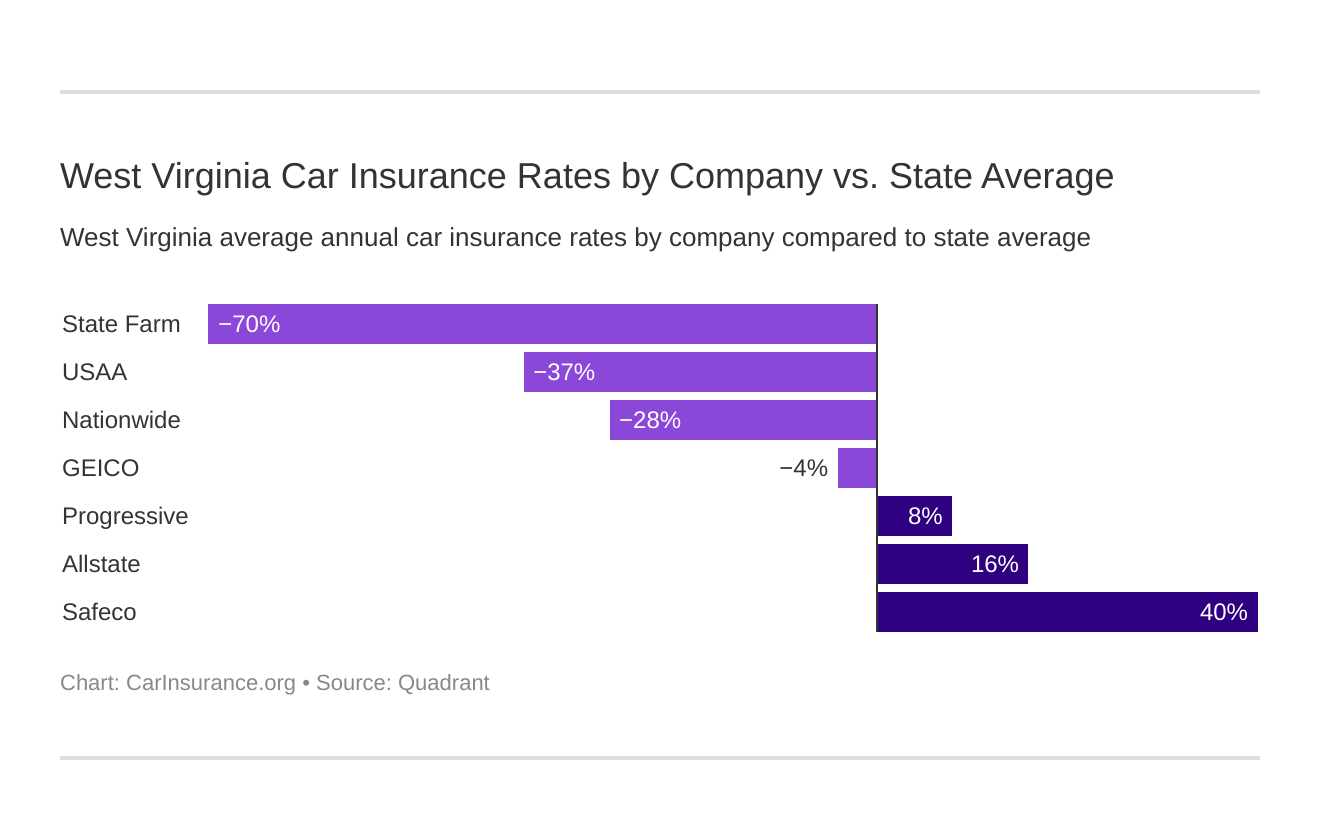

What are the Cheapest Car Insurance Companies in West Virginia?

Nobody likes to be considered cheap, except when it comes to finding cheaper car insurance. To save money, you should shop around to see what’s available. The table below displays the top carriers in West Virginia with their average rate for all drivers and compares it to the state average of all companies.

| Insurance Providers | Average Annual Premiums | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allstate P&C | $4,851.09 | $783.34 | 16.15% |

| Geico General | $3,923.74 | -$144.01 | -3.67% |

| Safeco Ins Co of America | $6,755.62 | $2,687.87 | 39.79% |

| Nationwide Mutual | $3,185.13 | -$882.62 | -27.71% |

| Progressive Max | $4,398.09 | $330.35 | 7.51% |

| State Farm Mutual Auto | $2,386.04 | -$1,681.70 | -70.48% |

| USAA | $2,974.52 | -$1,093.23 | -36.75% |

Looking at different providers can save a lot of money. For example, State Farm is $1,600 BELOW the state average, which, over time, could add up to thousands of dollars saved.

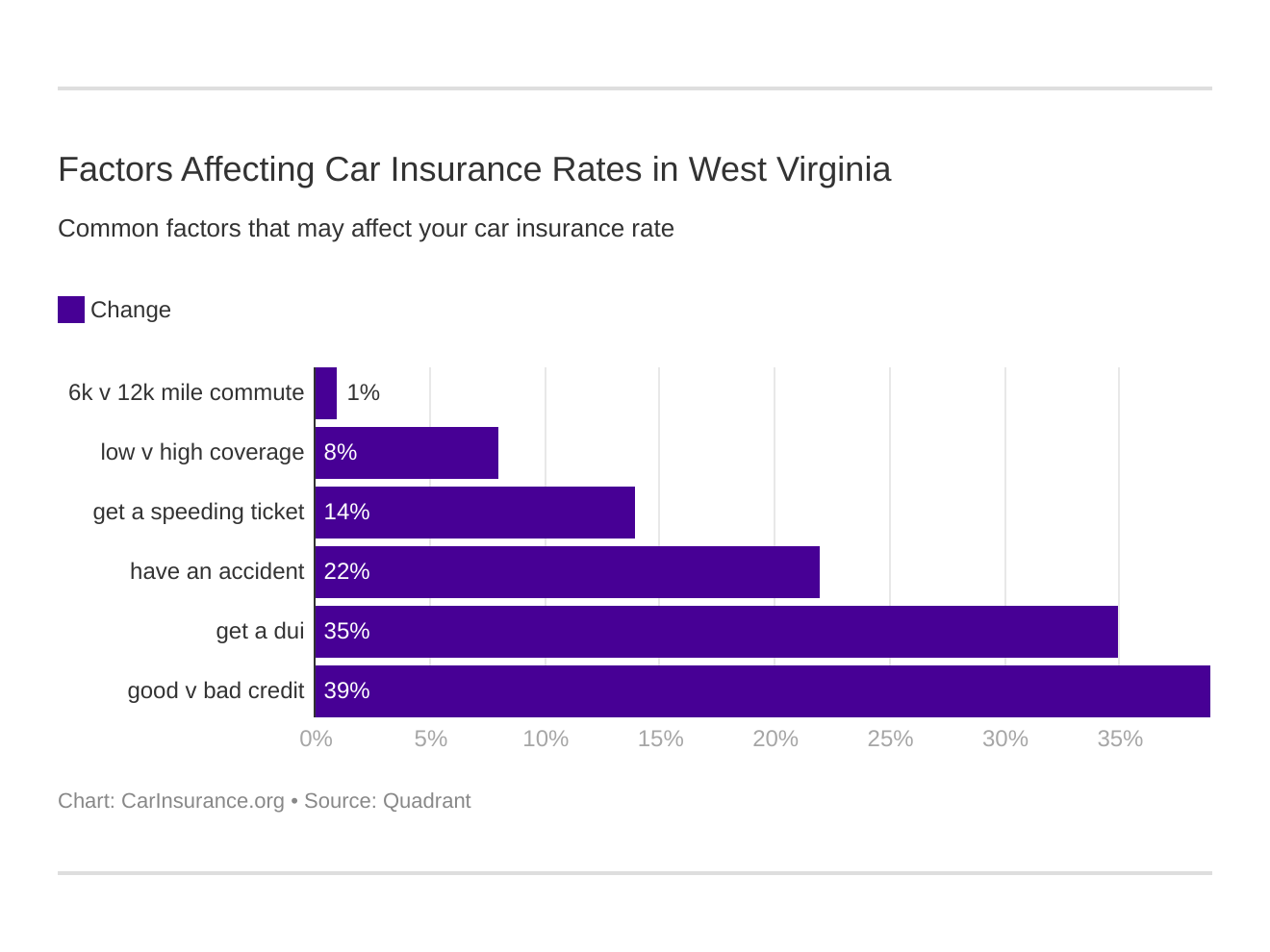

What are the Commute Rates by Companies?

At some companies, how far you commute each day influences your insurance rates. Beyond age, gender, location, marital status, and carrier, other factors that affect your quoted rates from each carrier are those that are specific to your situation, such as how much coverage you want, credit history, and driving record.

The tables below compare such factors based on each carrier.

| Company | 10 Miles Commute/6,000 Annual Mileage | 25 Miles Commute/12,000 Annual Mileage |

|---|---|---|

| Allstate | $4,851.09 | $4,851.09 |

| Geico | $3,881.27 | $3,966.21 |

| Liberty Mutual | $6,755.62 | $6,755.62 |

| Nationwide | $3,185.13 | $3,185.13 |

| Progressive | $4,398.09 | $4,398.09 |

| State Farm | $2,323.16 | $2,448.93 |

| USAA | $2,939.80 | $3,009.23 |

Most company rates don’t change when the drive shortens to a 10-mile commute, except for State Farm, who offers rate reductions over $125.

Up next, a break-down of coverage level rates in West Virginia.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Coverage Level Rates by Companies?

Do you need better coverage, but don’t want to spend any more money? You may be surprised some companies offer more coverage with only small increases in rates.

| Insurance Providers | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,677.67 | $4,842.82 | $5,032.78 |

| Geico | $3,702.07 | $3,933.44 | $4,135.71 |

| Liberty Mutual | $6,416.80 | $6,739.44 | $7,110.61 |

| Nationwide | $3,125.26 | $3,170.62 | $3,259.52 |

| Progressive | $4,221.37 | $4,351.48 | $4,621.43 |

| State Farm | $2,249.30 | $2,379.66 | $2,529.17 |

| USAA | $2,870.21 | $2,969.49 | $3,083.84 |

For example, the data above shows State Farm and Nationwide have less than $300 increases from low to high coverage.

What are the Credit History Rates by Companies?

The quality of your credit score impacts your insurance rates. In West Virginia, the average credit score is 658, which is well below the nationwide average of 675. This means motorists may have difficulty getting great rates because of their below-average credit scores.

The table below shows what you can expect to pay yearly on car insurance based on your credit history.

| Insurance Providers | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $3,991.23 | $4,672.88 | $5,889.16 |

| Geico | $3,192.68 | $3,847.51 | $4,731.03 |

| Liberty Mutual | $4,658.77 | $5,929.53 | $9,678.55 |

| Nationwide | $2,861.73 | $3,063.65 | $3,630.02 |

| Progressive | $3,981.11 | $4,286.12 | $4,927.05 |

| State Farm | $1,638.11 | $2,088.16 | $3,431.87 |

| USAA | $2,015.24 | $2,520.35 | $4,387.96 |

If you have insurance through Liberty Mutual and have poor credit, you can expect to pay nearly $3000 more for car insurance than someone with good credit.

What are the Driving Record Rates by Companies?

A clean driving record is the EASIEST way to keep rates down. As you can see from the information below, at Liberty Mutual, just one speeding violation can raise your rate by over $1,200.

| Insurance Providers | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $4,102.62 | $4,654.26 | $4,857.47 | $5,790.00 |

| Geico | $2,424.33 | $2,601.64 | $3,903.47 | $6,765.51 |

| Liberty Mutual | $5,535.75 | $6,758.42 | $6,985.26 | $7,743.03 |

| Nationwide | $2,539.67 | $2,835.12 | $3,395.88 | $3,969.85 |

| Progressive | $3,732.27 | $4,387.77 | $5,004.45 | $4,467.89 |

| State Farm | $2,192.53 | $2,386.05 | $2,579.56 | $2,386.05 |

| USAA | $2,337.82 | $2,850.58 | $2,764.77 | $3,944.88 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

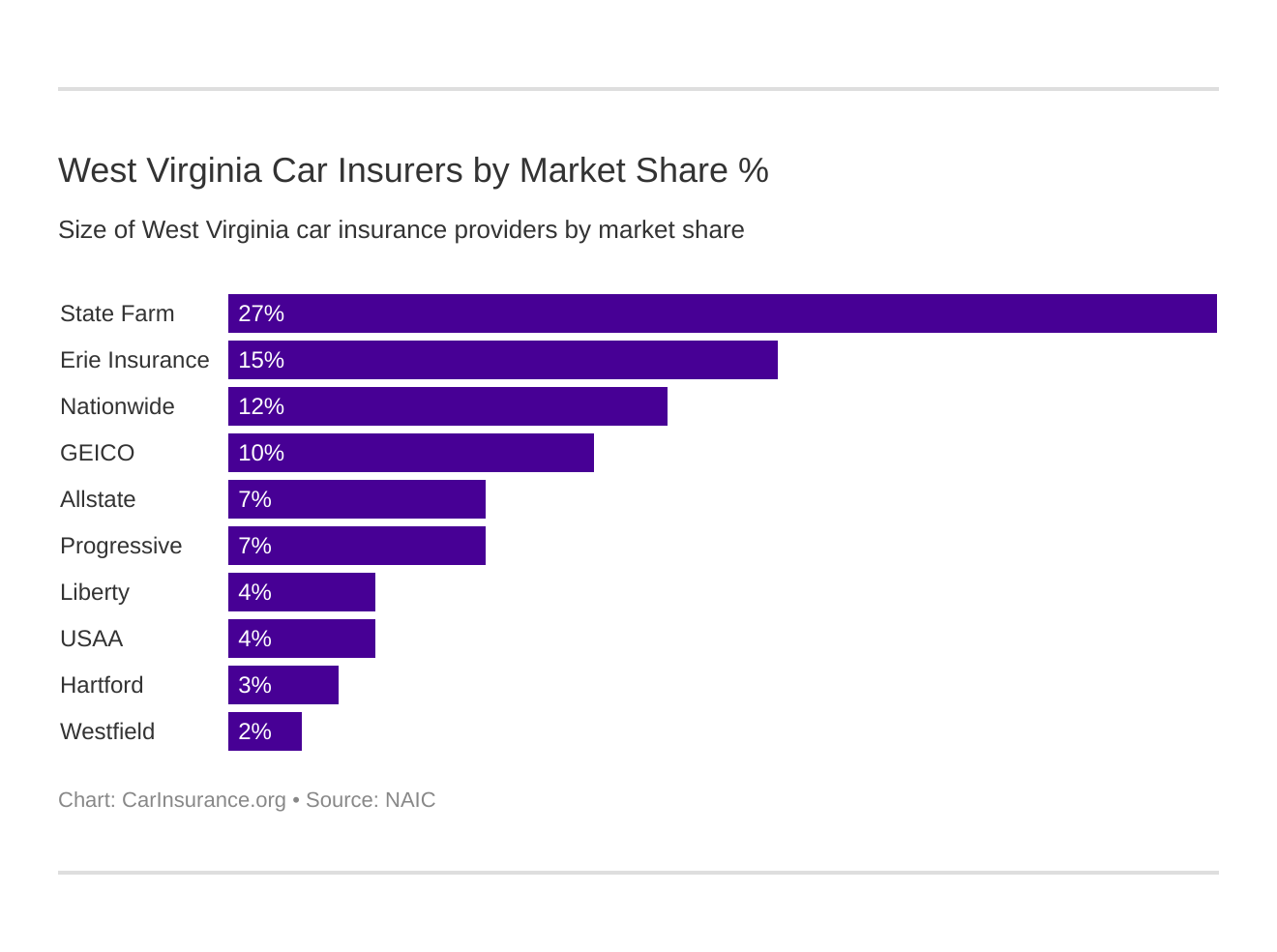

What are the Largest Car Insurance Companies in West Virginia?

| Insurance Providers | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|

| State Farm Group | $329,651 | 26.62% | 56.63% |

| Erie Insurance Group | $182,120 | 14.71% | 61.97% |

| Nationwide Corp Group | $145,858 | 11.78% | 48.02% |

| Geico | $124,709 | 10.07% | 66.00% |

| Allstate Insurance Group | $92,007 | 7.43% | 43.68% |

| Progressive Group | $84,332 | 6.81% | 54.33% |

| Liberty Mutual Group | $54,356 | 4.39% | 52.21% |

| USAA Group | $48,434 | 3.91% | 63.07% |

| Hartford Fire & Casualty Group | $38,099 | 3.08% | 49.28% |

| Westfield Group | $30,163 | 2.44% | 48.25% |

What Is the Number of Insurers?

| Type of Insurer | Number |

|---|---|

| Foreign | 793 |

| Domestic | 19 |

What Are the West Virginia Laws?

We know, state laws are odd and sometimes confusing and vary from state to state. New residents may receive tickets for laws they didn’t know existed.

Next, we help you uncover what the laws are, so check out our roundup of West Virginia’s driving laws.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Car Insurance Laws?

Insurance companies are subject to specific rules and regulations.

Let’s look at some of the specific laws for consumers regarding car insurance.

How State Laws for Insurance are Determined

Everything from minimum liability insurance requirements to base premium rates to tort laws to seat belt law and speed limits are determined by the state legislature. These laws are in place to regulate the functions of insurers and keep the driving behavior of motorists in check.

For the use of rates, each state has to follow one of the mechanisms – determined by

Commissioner; prior approval; modified prior approval; flex rating; file and use; use and

file and no file.

In West Virginia, insurance companies need to file rates with the state insurance department which must be approved before being used. If there is no response in 60 days, the deemer provision indicates that the rate stands approved.

Just like rate approval, the financial responsibility laws of the state require motorists to carry minimum liability coverage with limits of 25/50/25 so that it protects everyone on the roads.

How to Get Windshield Coverage

There aren’t any specific laws for windshield coverage in West Virginia. However, there are specifications related to cracks and chips on the windshield.

- Chips and cracks in the area blocking the view (8-1/2 by 11-inch area) of the driver aren’t permitted

- Chips and cracks bigger than one and a half inches along the area that is used by the wipers aren’t permitted

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get High-Risk Auto Insurance

If you have a bad driving record, it may be challenging to find an auto insurance company that is willing to insure you as a driver. Luckily, in most states, insurance companies have made programs available to provide affordable car insurance coverage for those who are high-risk drivers.

In West Virginia, if a motorist is denied insurance in the voluntary market because they are high-risk, they are able to get coverage through the West Virginia Automobile Insurance Plan (WVAIP).

Is There an Automobile Insurance Fraud in West Virginia?

What is automobile insurance fraud?

- Creating a claim for damages or injuries that NEVER occurred (such as faking an accident)

- Adding “extra” costs onto a legitimate claim

Fraud can happen at any time during the process of buying, selling, underwriting, or claims settlement – and many auto insurers and independent agents are also involved in fraudulent activities.

The cost of these insurance frauds – estimated to be around $30 billion annually – isn’t only dertimental to the operations of an insurer but hurts consumers in the long run as well since the losses are passed on to them.

If you’re ever involved in a fraudulent insurance claim, you might have to face severe penalties and an increase in premiums.

- If the benefit sought for fraudulent activity is lower than $1,000, you might be charged a fine up to $2,500 and face prison time of up to one year

- If the benefit sought for fraudulent activity is $1,000 or above, you might be imprisoned in a correction facility for a period of one to ten years and fined up to $10,000

It will always help law enforcement if you report any fraudulent activity that you come across with the Office of the Inspector General by e-mailing at [email protected] or calling on 304-558-5241.

You can also send mail a letter to the department – WV Offices of the Insurance Commissioner, Fraud Division, One Players Club Drive, P.O. Box 2901, Charleston, West Virginia 25330-2901.

What’s the Statute of Limitations?

If you are in a car accident in West Virginia, there is a statute of limitations if you want to file a claim.

- Property Damage – Two Years

- Bodily Injury Coverage – Two Years

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Vehicle Licensing Laws?

West Virginia, just like every other state, has mandatory licensing laws in addition to the statute of limitations and car insurance laws, which we previously covered.

What is a Real ID?

Beginning October 1, 2020, federal agencies will endorse what is known as the REAL ID Act, which requires you to have a REAL ID U.S. Passport or another federally approved ID to board flights or enter federal buildings.

West Virginia does not require a REAL ID to drive, but it’s recommended if you fly domestically, or if you work in federal buildings.

What are the Penalties for Driving Without Insurance?

All drivers are required to carry at least the mandatory liability insurance coverage in West Virginia. If you think you can let your insurance policy lapse, it will reflect in the monthly insurance verification checks of the state.

The West Virginia Online Verification (WVOLV) was designed to help the DMV in electronic verification of your auto insurance coverage during citations, crashes, registration, and monthly checks on all vehicles.

Driving without insurance would attract penalties since you’re putting everyone at risk.

- First Offense: During the insurance verification process, if the DMV sends a notice for lack of coverage information on file and you fail to provide proof, your vehicle registration would be suspended. Once you show the proof of insurance, you can get your registration reinstated by paying $100. Also, your driving privilege can be suspended.

- Second Offense: If you’re sent a second notice within five years of the first one, your driving privileges would be suspended for much longer.

Drivers who provide false insurance information would face a 90-day suspension of their driver’s license, vehicle revocation, and the possibility of prosecution that could lead to fines of up to $1,000 and prison time of up to one year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Teen Driver Laws?

Most kids can’t wait to get behind the wheel, but the West Virginia DMV has designed a Graduated Driver’s License program (GDL) to ensure that teens, 15 to 17-year-olds, have enough practice before they can drive on their own.

Eligibility Requirements for GDL:

| Licensing Type | Minimum Age | School Enrollment or Completion | Tests | Previous Permit |

|---|---|---|---|---|

| Instruction Permit (Level 1) | 15 | Must show a Driver's Eligibility Certificate from your county school board | Pass the written test and vision exam | Get written permission from a parent or legal guardian on form DMV-23 |

| Intermediate License (Level 2) | 16 | Must show a Driver's Eligibility Certificate from your county school board | Pass the road test Must complete 50 hours of practice driving with 10 hours of night time driving | Must have held the level 1 permit without any violations for a minimum of six months |

| Unrestricted License (Level 3) | 17 | Must show a Driver's Eligibility Certificate from your county school board | None | Must have held the level 2 permit for one year at least without any violations |

Each level has different eligibility requirements and requires new drivers to abide by certain terms. Let’s look at those requirements:

| Licensing Type | Passenger Requirements | Passenger Restrictions | Driving Time |

|---|---|---|---|

| Level 1 | Must drive with an adult licensed driver (above 21) at all times | Along with the supervising adult, you can not be accompanied by more than two people who aren't your family members | You're allowed to drive between the hours of 5 am and 10 pm only |

| Level 2 | During the night hours of 10 pm to 5 am, you can only drive if accompanied by an adult licensed driver (above 21) | First six months - You aren't allowed to drive with passengers below the age of 20 who aren't family members Next six months - You can't drive with more than one passenger below the age of 20 who isn't a family member | During the hours of 10 am to 5 pm, you must be accompanied by a licensed adult driver above 21 except when: 1. traveling due to work, school activity, or religious activity 2. traveling for an emergency intended to prevent personal injury or death |

What are the License Renewal Procedures for Older Drivers?

Under the West Virginia DMVs “Drive for Five” program, all driver’s licenses expire in five years or at an age which is a multiple of five. This program was introduced to make it easier for motorists to remember the expiration year.

The DMV might issue a license with a shorter or longer duration to enable adherence to the new program. For instance, if you’re 32 right now, you would be issued a license for three years so that it expires when you’re 35. The next cycle would be for five years.

The license renewal fee is $5 every year plus 0.50 cents.

Renewal would be a good time to get a federal driver’s license or a Read ID license, which would cost you $10 more.

What is the Procedure for New Residents?

If you’re relocating to West Virginia with a valid out-of-state driver’s license, you can transfer the license after your move.

If you have an expired license, you would have to take all the tests, complete an alcohol awareness course, and surrender your expired out-of-state license to get a West Virginia license.

New residents must also get their vehicles titled and registered in West Virginia within 30 days of residency.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Rules of the Road in West Virginia?

We all should obey the rules, but if you’re new to the state, there may be laws you’re unfamiliar with. That’s why we’ve assembled a list of several important laws to help keep you in good standing and on the road.

Is West Virginia at Fault or No-Fault State?

West Virginia follows the traditional tort law for determining liability in car accidents. If you accidentally hit someone, it becomes your responsibility to compensate the injured parties.

Your liability coverage protects you from your mistakes on the road.

What Are the Seat Belt and Car Seat Laws?

Many fatalities are prevented in car crashes because of seat belts.

In West Virginia, all front-seat passengers are required to wear a seat belt and failure to do so might result in a fine of $25 along with points on the driving record.

Every driver of a motor vehicle is also required to properly secure children below the age of eight in a car seat. Children who are above eight or taller than 4 feet 9 inches should wear seat belts.

The West Virginia DMV provides a few guidelines on choosing the right seats for children.

- Until the age of two, children should ride in rear-facing seats

- When they turn two, children can be restricted in a forward-facing seat with a harness

- At age four or when the child weighs 40 pounds, a booster seat can be used

- Children should be restricted in a booster seat until the age of 8 or when they are at least 4 feet 9 inches tall

- It’s recommended to keep children in the back seat until the age of 13

Any violations of the car seat law can lead to fines between $10 and $25.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Keep Right and Move Over Laws?

In the state of West Virginia, the laws are as follows according to AAA:

State law requires drivers approaching and traveling in the same direction as a stationary authorized emergency vehicle, including a tow truck, displaying flashing lights, to change to a non-adjacent lane if safe to do so, or to slow to no more than 15 mph on a non-divided highway or 25 mph on a divided highway.

The left lane is only allowed for passing or turning left.

What is the Maximum Speed Limit?

Maximum posted speed limits are 70 mph on rural interstates, 55-65 mph on urban interstates, and 65 mph on all other roads.

How Does Ridesharing Work?

Ridesharing has become wide-spread across the country, and many states have enacted laws to help keep you safe.

As per the ridesharing law of West Virginia, Uber or Lyft drivers must carry liability coverage of:

- $50,000 for bodily injury of one person and $100,000 for one accident while the driver is logged-in the mobile app and waiting to pick a ride. In addition, drivers must carry property damage insurance of $25,000 per incident.

- $1 million combined for bodily injury, death, and property damage when the driver is engaged in a ride through the mobile app

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There an Automation on the Road?

According to the Insurance Institute for Highway Safety (IIHS),

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Until now, West Virginia hasn’t enacted any legislation for autonomous vehicles and doesn’t allow testing on its roads.

What are the Safety Laws?

Up next, we take a closer look at the safety laws in West Virginia so that you can arrive alive. Please don’t drink and drive.

What are the DUI Laws?

As per the state law, motorists with a Blood Alcohol Level (BAC) of more than 0.08 percent can be convicted for DUI. For those under the age of 21, the BAC threshold is 0.02 percent, and for commercial drivers, its 0.04 percent.

Penalties for a DUI offense can include both fines and prison time.

| Offense Type | Prison Time | Fines |

|---|---|---|

| First Offense | Up to six months | $100 to $500 |

| Second Offense | Six months to one year | $1,000 to $3,000 |

| Third Offense | Two to five years | $3,000 to $5,000 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Marijuana-Impaired Driving Laws?

West Virginia is among one of the few states that have implemented a marijuana-impaired driving law and those found with a THC of three nanograms after the test can be convicted for impairment.

What are the Distracted Driving Laws?

Drivers in West Virginia aren’t allowed to text while driving or use an electronic device unless the device is hands-free.

Any violations of the distracted driving law can lead to a fine of $100 for the first offense, $200 for the second offense, and $300 for a third or subsequent offense.

How to Drive Safely in West Virginia?

Now that you have a good understanding of West Virginia state laws let’s dive into some facts that you might not know. While insurance is essential, it’s also crucial to know what to keep your eyes out for on the road.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There a Vehicle Theft in West Virginia?

When considering your next car purchase, one thing to consider is that certain vehicles are stolen more frequently, and thus, may have higher insurance rates.

Here’s a list of the top ten stolen vehicles in West Virginia.

| Vehicle Make & Model | Vehicle Year | Number of Stolen Vehicles |

|---|---|---|

| Ford Pickup (Full Size) | 2003 | 87 |

| Chevrolet Pickup (Full Size) | 2000 | 76 |

| Jeep Cherokee/Grand Cherokee | 1996 | 36 |

| Dodge Pickup (Full Size) | 2003 | 29 |

| Chevrolet Pickup (Small Size) | 1999 | 29 |

| Chevrolet Impala | 2006 | 24 |

| Toyota Camry | 2014 | 20 |

| Ford Taurus | 1995 | 19 |

| GMC Pickup (Full Size) | 2011 | 18 |

| Chevrolet Cavalier | 2002 | 17 |

You can also search for your city in the table to see the number of stolen vehicles, data provided by the FBI.

| City | Motor vehicle theft |

|---|---|

| Alderson | 0 |

| Barboursville | 7 |

| Beckley | 43 |

| Bluefield | 15 |

| Bridgeport | 9 |

| Buckhannon | 16 |

| Ceredo | 1 |

| Charleston | 353 |

| Charles Town | 1 |

| Dunbar | 38 |

| Fairmont | 50 |

| Fayetteville | 3 |

| Glen Dale | 1 |

| Grafton | 0 |

| Huntington | 180 |

| Kenova | 6 |

| Lewisburg | 0 |

| Madison | 5 |

| Martinsburg | 21 |

| Mason | 0 |

| Moorefield | 2 |

| Morgantown | 23 |

| Moundsville | 9 |

| Mount Hope | 0 |

| Nitro | 16 |

| Oak Hill | 10 |

| Parkersburg | 113 |

| Point Pleasant | 4 |

| Princeton | 10 |

| Ridgeley | 0 |

| Ripley | 0 |

| Ronceverte | 1 |

| South Charleston | 79 |

| St. Albans2 | 32 |

| Summersville | 5 |

| Vienna | 9 |

| Weirton | 15 |

| Wellsburg | 2 |

| Weston | 2 |

| Wheeling | 24 |

| Williamson | 0 |

What’s the Number of Road Fatalities in West Virginia?

The National Highway Traffic Safety Administration regularly publishes data about crashes, fatalities, and how these crashes happen. Let’s take a look at the numbers.

What is the Most Fatal Highway in West Virginia?

The portion of US-19 passing through West Virginia is the most dangerous highway of the state and has seen around 101 crashes until now.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Number of Fatal Crashes by Weather Condition and Light Condition?

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 131 | 12 | 76 | 7 | 0 | 226 |

| Rain | 20 | 5 | 15 | 4 | 0 | 44 |

| Snow/Sleet | 0 | 1 | 2 | 0 | 0 | 3 |

| Other | 0 | 0 | 4 | 1 | 0 | 5 |

| Unknown | 2 | 0 | 0 | 0 | 0 | 2 |

| Total | 153 | 18 | 97 | 12 | 0 | 280 |

As you can see, most accidents occur during daylight hours.

What is the Number of Fatalities (All Crashes) by County?

Here are the West Virginia counties with the most fatalities over the past five years.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Barbour | 6 | 7 | 2 | 6 | 4 |

| Berkeley | 20 | 12 | 10 | 16 | 10 |

| Boone | 5 | 13 | 1 | 5 | 3 |

| Braxton | 7 | 4 | 7 | 5 | 3 |

| Brooke | 1 | 0 | 0 | 0 | 1 |

| Cabell | 14 | 9 | 15 | 11 | 16 |

| Calhoun | 0 | 1 | 0 | 0 | 1 |

| Clay | 2 | 4 | 1 | 2 | 0 |

| Doddridge | 3 | 1 | 0 | 1 | 3 |

| Fayette | 14 | 5 | 10 | 4 | 10 |

| Gilmer | 0 | 2 | 0 | 4 | 3 |

| Grant | 3 | 2 | 3 | 4 | 2 |

| Greenbrier | 14 | 2 | 7 | 6 | 6 |

| Hampshire | 6 | 5 | 8 | 6 | 3 |

| Hancock | 1 | 6 | 1 | 1 | 4 |

| Hardy | 4 | 3 | 5 | 2 | 3 |

| Harrison | 18 | 11 | 6 | 10 | 12 |

| Jackson | 12 | 10 | 6 | 4 | 8 |

| Jefferson | 4 | 6 | 11 | 7 | 6 |

| Kanawha | 29 | 20 | 23 | 21 | 31 |

| Lewis | 10 | 3 | 4 | 9 | 8 |

| Lincoln | 5 | 4 | 3 | 2 | 5 |

| Logan | 7 | 9 | 3 | 4 | 12 |

| Marion | 3 | 4 | 6 | 7 | 7 |

| Marshall | 3 | 1 | 6 | 1 | 5 |

| Mason | 4 | 9 | 5 | 5 | 3 |

| Mcdowell | 4 | 4 | 4 | 7 | 5 |

| Mercer | 10 | 11 | 7 | 8 | 12 |

| Mineral | 2 | 2 | 3 | 3 | 5 |

| Mingo | 4 | 8 | 8 | 1 | 5 |

| Monongalia | 14 | 10 | 13 | 12 | 7 |

| Monroe | 3 | 3 | 1 | 2 | 5 |

| Morgan | 1 | 3 | 0 | 4 | 1 |

| Nicholas | 8 | 3 | 1 | 9 | 8 |

| Ohio | 5 | 3 | 7 | 3 | 2 |

| Pendleton | 7 | 4 | 1 | 4 | 0 |

| Pleasants | 1 | 0 | 3 | 0 | 0 |

| Pocahontas | 1 | 3 | 1 | 1 | 3 |

| Preston | 2 | 4 | 6 | 10 | 4 |

| Putnam | 4 | 9 | 4 | 5 | 10 |

| Raleigh | 13 | 9 | 17 | 14 | 11 |

| Randolph | 9 | 3 | 5 | 8 | 6 |

| Ritchie | 2 | 3 | 2 | 3 | 1 |

| Roane | 2 | 0 | 3 | 3 | 8 |

| Summers | 2 | 2 | 4 | 1 | 3 |

| Taylor | 4 | 1 | 0 | 1 | 2 |

| Tucker | 5 | 1 | 1 | 0 | 0 |

| Tyler | 2 | 2 | 0 | 4 | 4 |

| Upshur | 2 | 1 | 7 | 2 | 0 |

| Wayne | 6 | 7 | 9 | 6 | 13 |

| Webster | 2 | 1 | 3 | 3 | 2 |

| Wetzel | 6 | 3 | 3 | 0 | 2 |

| Wirt | 0 | 0 | 1 | 1 | 2 |

| Wood | 9 | 15 | 8 | 8 | 10 |

| Wyoming | 7 | 4 | 3 | 3 | 3 |

What is the Number of Traffic Fatalities by Road Type?

Next, we have a 10-year comparison of traffic fatalities on urban vs. rural roadways.

| Type of Road | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 263 | 252 | 228 | 239 | 261 | 241 | 205 | 190 | 169 | 202 |

| Urban | 112 | 105 | 87 | 99 | 78 | 91 | 67 | 78 | 99 | 98 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Number of Fatalities by Person Type?

Up next, we have a 5-year comparison of traffic fatalities by Vehicle Type.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 128 | 99 | 90 | 85 | 104 |

| Light Truck - Pickup | 73 | 50 | 45 | 47 | 40 |

| Light Truck - Utility | 40 | 48 | 50 | 39 | 66 |

| Light Truck - Van | 6 | 5 | 5 | 14 | 7 |

| Large Truck | 9 | 6 | 4 | 6 | 9 |

| Light Truck - Other | 0 | 0 | 2 | 1 | 1 |

| Total Motorcyclists | 24 | 26 | 32 | 29 | 26 |

| Pedestrian | 28 | 19 | 19 | 24 | 26 |

| Bicyclist and Other Cyclist | 0 | 2 | 1 | 1 | 3 |

| Total | 332 | 272 | 268 | 269 | 303 |

What is the Number of Fatalities by Crash Type?

Next, we have a 5-year comparison of traffic fatalities by crash type.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 214 | 164 | 160 | 167 | 189 |

| Involving a Large Truck | 46 | 30 | 22 | 27 | 52 |

| Involving Speeding | 130 | 66 | 66 | 60 | 84 |

| Involving a Rollover | 106 | 91 | 88 | 86 | 85 |

| Involving a Roadway Departure | 242 | 205 | 191 | 179 | 214 |

| Involving an Intersection (or Intersection Related) | 37 | 31 | 30 | 33 | 41 |

5 Year Trend For The Top 10 Counties

Up next, we have a five-year fatality tend for the top 10 counties in West Virginia.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Kanawha County | 29 | 20 | 23 | 21 | 31 |

| Cabell County | 14 | 9 | 15 | 11 | 16 |

| Wayne County | 6 | 7 | 9 | 6 | 13 |

| Harrison County | 18 | 11 | 6 | 10 | 12 |

| Logan County | 7 | 9 | 3 | 4 | 12 |

| Mercer County | 10 | 11 | 7 | 8 | 12 |

| Raleigh County | 13 | 9 | 17 | 14 | 11 |

| Berkeley County | 20 | 12 | 10 | 16 | 10 |

| Putnam County | 4 | 9 | 4 | 5 | 10 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Number of Fatalities Involving Speeding by County?

Next, we have a five-year comparison of fatalities involving speeding by county in West Virginia.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Barbour | 2 | 0 | 0 | 0 | 1 |

| Berkeley | 6 | 4 | 4 | 4 | 3 |

| Boone | 3 | 3 | 0 | 0 | 0 |

| Braxton | 5 | 0 | 2 | 1 | 0 |

| Brooke | 0 | 0 | 0 | 0 | 0 |

| Cabell | 2 | 1 | 6 | 1 | 1 |

| Calhoun | 0 | 1 | 0 | 0 | 1 |

| Clay | 0 | 2 | 1 | 2 | 0 |

| Doddridge | 2 | 0 | 0 | 0 | 2 |

| Fayette | 8 | 0 | 2 | 1 | 2 |

| Gilmer | 0 | 0 | 0 | 2 | 3 |

| Grant | 0 | 1 | 2 | 2 | 1 |

| Greenbrier | 4 | 0 | 0 | 1 | 1 |

| Hampshire | 3 | 4 | 1 | 1 | 1 |

| Hancock | 1 | 3 | 1 | 1 | 2 |

| Hardy | 3 | 1 | 0 | 0 | 1 |

| Harrison | 7 | 2 | 3 | 1 | 4 |

| Jackson | 6 | 5 | 2 | 1 | 2 |

| Jefferson | 2 | 1 | 2 | 3 | 2 |

| Kanawha | 13 | 7 | 8 | 4 | 13 |

| Lewis | 3 | 0 | 3 | 4 | 0 |

| Lincoln | 2 | 1 | 1 | 0 | 0 |

| Logan | 3 | 2 | 2 | 1 | 3 |

| Marion | 1 | 2 | 3 | 5 | 1 |

| Marshall | 1 | 0 | 2 | 0 | 2 |

| Mason | 0 | 1 | 2 | 2 | 2 |

| Mcdowell | 2 | 2 | 0 | 1 | 1 |

| Mercer | 5 | 2 | 1 | 2 | 2 |

| Mineral | 2 | 1 | 0 | 1 | 2 |

| Mingo | 1 | 1 | 2 | 0 | 2 |

| Monongalia | 5 | 0 | 2 | 3 | 2 |

| Monroe | 1 | 0 | 0 | 1 | 0 |

| Morgan | 1 | 1 | 0 | 0 | 1 |

| Nicholas | 2 | 0 | 0 | 1 | 3 |

| Ohio | 3 | 0 | 1 | 2 | 1 |

| Pendleton | 5 | 1 | 1 | 1 | 0 |

| Pleasants | 1 | 0 | 0 | 0 | 0 |

| Pocahontas | 1 | 0 | 0 | 0 | 1 |

| Preston | 0 | 2 | 1 | 1 | 1 |

| Putnam | 2 | 3 | 1 | 1 | 4 |

| Raleigh | 6 | 2 | 4 | 0 | 1 |

| Randolph | 4 | 1 | 0 | 1 | 0 |

| Ritchie | 0 | 1 | 0 | 0 | 0 |

| Roane | 2 | 0 | 2 | 1 | 5 |

| Summers | 0 | 0 | 1 | 0 | 1 |

| Taylor | 2 | 1 | 0 | 1 | 0 |

| Tucker | 1 | 0 | 1 | 0 | 0 |

| Tyler | 1 | 0 | 0 | 1 | 1 |

| Upshur | 0 | 0 | 0 | 0 | 0 |

| Wayne | 0 | 1 | 0 | 2 | 1 |

| Webster | 0 | 0 | 0 | 1 | 2 |

| Wetzel | 1 | 0 | 0 | 0 | 1 |

| Wirt | 0 | 0 | 0 | 0 | 0 |

| Wood | 4 | 5 | 1 | 2 | 4 |

| Wyoming | 1 | 1 | 1 | 0 | 0 |

What is the Number of Fatalities in Crashes Involving an Alcohol-Impaired Driver by County?

Up next, we have a five-year comparison of fatalities in crashes involving an alcohol-impaired driver (BAC = .08+) by county in West Virginia.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Barbour County | 0 | 1 | 0 | 2 | 1 |

| Berkeley County | 5 | 4 | 2 | 3 | 2 |

| Boone County | 2 | 6 | 0 | 0 | 0 |

| Braxton County | 1 | 1 | 3 | 0 | 0 |

| Brooke County | 0 | 0 | 0 | 0 | 1 |

| Cabell County | 3 | 4 | 3 | 3 | 7 |

| Calhoun County | 0 | 0 | 0 | 0 | 0 |

| Clay County | 0 | 0 | 1 | 0 | 0 |

| Doddridge County | 2 | 0 | 0 | 0 | 0 |

| Fayette County | 7 | 0 | 3 | 0 | 0 |

| Gilmer County | 0 | 0 | 0 | 2 | 0 |

| Grant County | 0 | 1 | 0 | 0 | 1 |

| Greenbrier County | 4 | 1 | 2 | 1 | 1 |

| Hampshire County | 1 | 1 | 1 | 3 | 1 |

| Hancock County | 1 | 0 | 0 | 1 | 0 |

| Hardy County | 2 | 0 | 2 | 0 | 0 |

| Harrison County | 2 | 2 | 5 | 2 | 6 |

| Jackson County | 5 | 0 | 2 | 1 | 1 |

| Jefferson County | 1 | 2 | 4 | 3 | 1 |

| Kanawha County | 6 | 6 | 7 | 7 | 6 |

| Lewis County | 3 | 2 | 2 | 1 | 1 |

| Lincoln County | 2 | 1 | 0 | 0 | 2 |

| Logan County | 0 | 4 | 2 | 1 | 3 |

| Marion County | 2 | 0 | 0 | 3 | 1 |

| Marshall County | 1 | 0 | 1 | 1 | 2 |

| Mason County | 0 | 1 | 2 | 1 | 2 |

| Mcdowell County | 1 | 2 | 2 | 4 | 1 |

| Mercer County | 3 | 4 | 2 | 1 | 1 |

| Mineral County | 1 | 0 | 1 | 1 | 1 |

| Mingo County | 0 | 4 | 1 | 0 | 3 |

| Monongalia County | 1 | 4 | 4 | 1 | 2 |

| Monroe County | 2 | 1 | 0 | 0 | 1 |

| Morgan County | 0 | 1 | 0 | 1 | 0 |

| Nicholas County | 2 | 3 | 0 | 1 | 2 |

| Ohio County | 2 | 2 | 3 | 2 | 1 |

| Pendleton County | 4 | 1 | 1 | 1 | 0 |

| Pleasants County | 0 | 0 | 0 | 0 | 0 |

| Pocahontas County | 0 | 1 | 0 | 0 | 2 |

| Preston County | 0 | 2 | 0 | 5 | 2 |

| Putnam County | 1 | 4 | 0 | 1 | 4 |

| Raleigh County | 5 | 3 | 3 | 4 | 2 |

| Randolph County | 3 | 1 | 1 | 2 | 0 |

| Ritchie County | 0 | 2 | 1 | 1 | 0 |

| Roane County | 1 | 0 | 0 | 0 | 2 |

| Summers County | 1 | 0 | 1 | 0 | 1 |

| Taylor County | 1 | 0 | 0 | 0 | 2 |

| Tucker County | 1 | 1 | 1 | 0 | 0 |

| Tyler County | 0 | 1 | 0 | 3 | 0 |

| Upshur County | 1 | 0 | 0 | 0 | 0 |

| Wayne County | 0 | 3 | 1 | 3 | 1 |

| Webster County | 2 | 0 | 0 | 1 | 0 |

| Wetzel County | 3 | 1 | 2 | 0 | 0 |

| Wirt County | 0 | 0 | 0 | 0 | 0 |

| Wood County | 2 | 5 | 2 | 3 | 3 |

| Wyoming County | 3 | 0 | 1 | 0 | 1 |

What Are the Teen Drinking and Driving Laws?

In 2016, West Virginia law enforcement officers arrested 11 teenagers (under the age of 18) for drunk driving.

This number places WestVirginia as the 44th worst state in the U.S. for underage drinking and driving.

Below are the facts concerning underage (under 21 years old) drinking-related fatalities:

- 1.1 fatalities per 100,000 people in West Virginia

- 1.2 fatalities per 100,000 people national average

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the EMS Response Time?

If you or someone you know is in an accident, you want help to arrive as FAST as possible. Check out the response times for emergency personnel in rural and urban areas.

| Type of Road | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 6.05 | 14.57 | 37.38 | 54.78 | 188 |

| Urban | 3.67 | 9.50 | 30.00 | 42.84 | 89 |

What’s Transportation in West Virginia like?

When you drive through your neighborhood, do you ever notice how many cars are sitting in your neighbors’ driveways? Usually, we can tell if someone is visiting by that extra car parked outside the house.

The data for Car Ownership, Commute Time, and Commuter Transportation was sourced from the Census Bureau via DataUSA.io.

What is the Percentage of Car Ownership?

The average household in West Virginia has two cars.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Commute Time?

The average commute time in the U.S. is 25.3 minutes. Fortunately, for West Virginia commuters, their commute time is slightly below this at 25.1 minutes.

In comparison to its neighboring geographies, West Virginia has a shorter commute time than Pennsylvania, Virginia, and Maryland.

What is the Preferred Commuter Transportation?

In every state, driving alone is the most common commute option, though people are beginning to turn to other commute options like carpooling and working from home. (For more information, read our “Carpooling: Saving Time, Money, and the Planet“).

Now that you’ve read through this comprehensive guide, is there anything that we missed? Which section was most helpful to you?

We’ve filled this guide with everything you need to know about buying car insurance in West Virginia.

Now, it’s time to hit the road. Enter your zip code to get started.