Washington, D.C.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 3, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 15.6%

Washington D.C. can be a great place to live if you don’t mind navigating (or avoiding) the traffic congestion.

With all the opportunities and concerns that come with living in one of the major megalopolises in the world, car insurance is on concern that doesn’t have to leave you feeling overwhelmed.

Instead of spending hours upon hours searching all the resources available, we’ll help you figure out where to get started on your journey to find the best car insurance coverage for your situation.

From rates to customer satisfaction to rules of the road, we’ll cover the most important things for you to know.

Ready to compare rates? Use our FREE comparison tool above.

What are Washington D.C. Car Insurance Coverage and Rates?

There’s a lot to know about car insurance in D.C., especially if you’re trying to get the best rates for coverage. We’ll show you how your driving history, age, gender, and even credit score make a difference in your rates.

D.C.’s Minimum Requirements

To register and drive a car in D.C., you are required to have liability insurance. You’ll often see the minimum requirement written out as 25/50/10. In other words:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident (multiple persons)

- $10,000 property damage liability

Let me take a moment right here to point out that these minimums are ridiculously low (especially for property damage) and you’d be wise to consider more adequate coverage. Something around 100/300/70.

This scenario should help you understand why $10,000 property damage coverage is too little. If you cause an accident and you end up causing a brand new full-size SUV to be a total loss, you’re looking at $60,000 of property damage that you’re liable for.

With $10,000 coverage, you’re left with $50,000 of financial responsibility that you owe the other party. And you’ll have to come up with that on your own.

Protect your financial situation and purchase higher liability limits.

If you are in an accident or if you are pulled over, you’re required to show proof of insurance to the law enforcement officer when requested. You may carry electronic proof of insurance or a paper version.

And this proof must be

“a document issued by an insurance company that lists the name of the insurance company, the policy number, the name or names of the insured, and the period of coverage for the insurance.”

So ask your insurance company to send you a pdf that proves your coverage. Then you’ll have what you need to show proof of insurance.

Forms of Financial Responsibility

While some states allow you to purchase a bond or certificate of self-insurance, in Washington D.C., you must have insurance.

Are Premiums based on a percentage of income?

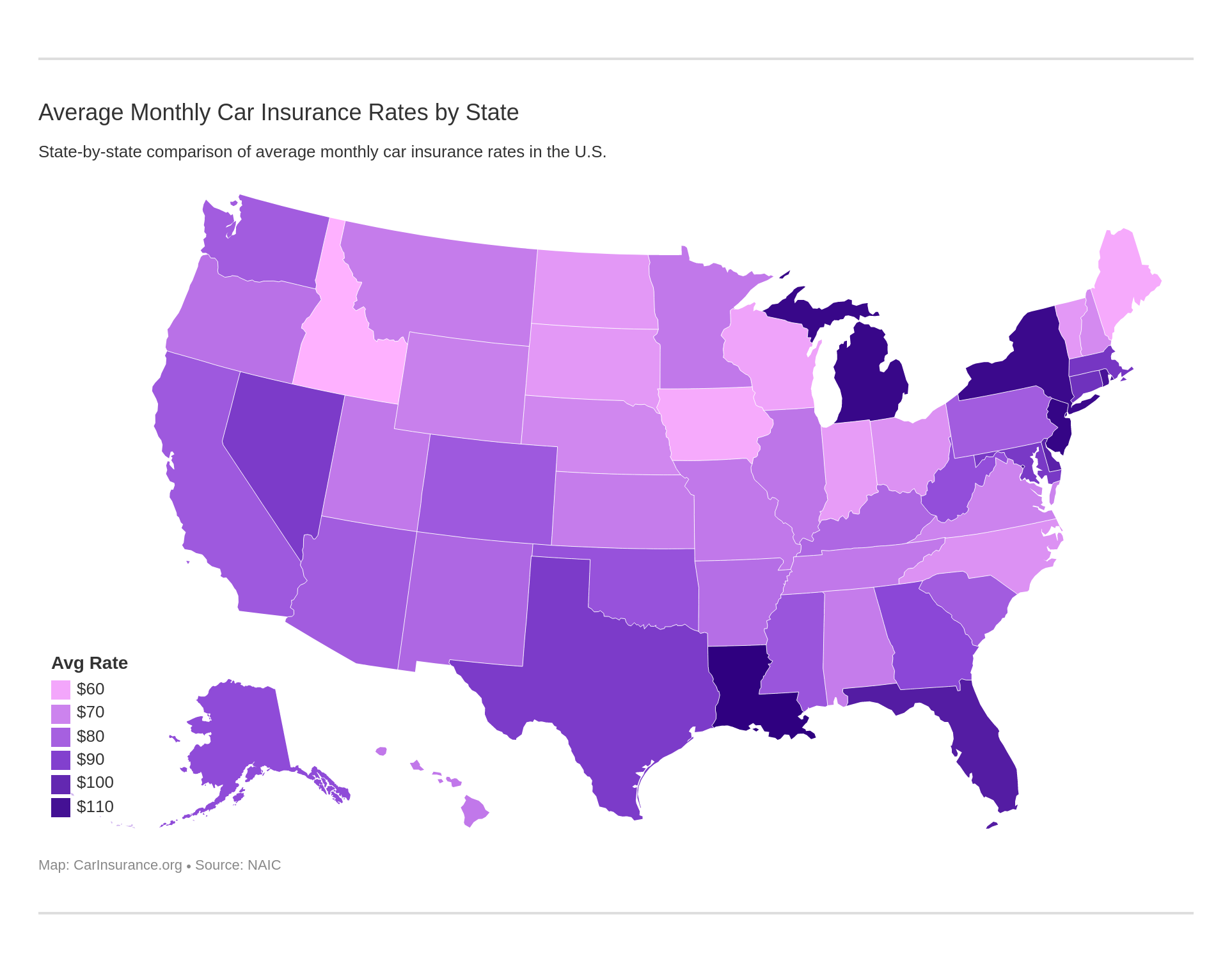

Average auto insurance rates vary greatly depending on where you live. It helps to give those rates some perspective by comparing what the average income is with what the average car insurance rates are.

If rates where you live are high, but people tend to make a lot of money, those high rates are a little easier to handle, compared to people living in where insurance is expensive and the income average is low.

Here’s how premiums as a percentage of income look for Washington D.C.

| Cost Comparison | 2012 | 2013 | 2014 |

|---|---|---|---|

| Full Coverage 2012 | $1,289.49 | $1,316.48 | $1,324.39 |

| Disposable Income 2012 | $57,155.00 | $56,573.00 | $59,936.00 |

| Insurance as % of Income 2012 | 2.26% | 2.33% | 2.21% |

As you can see, the percentage rose in 2013 but settled back down in 2014. When you compare the percentage to the surrounding states, Virginia’s percentage is lower than D.C.’s while Maryland’s is higher, but they’re all within half a percent of each other.

So, while D.C. compares fairly equally to car insurance costs in Virginia and Maryland, how does it stand up to the U.S. average? It’s a little bit lower. The U.S. premiums as a percentage of income was 2.4 percent in 2014 compared to Washington D.C. at 2.2 percent.

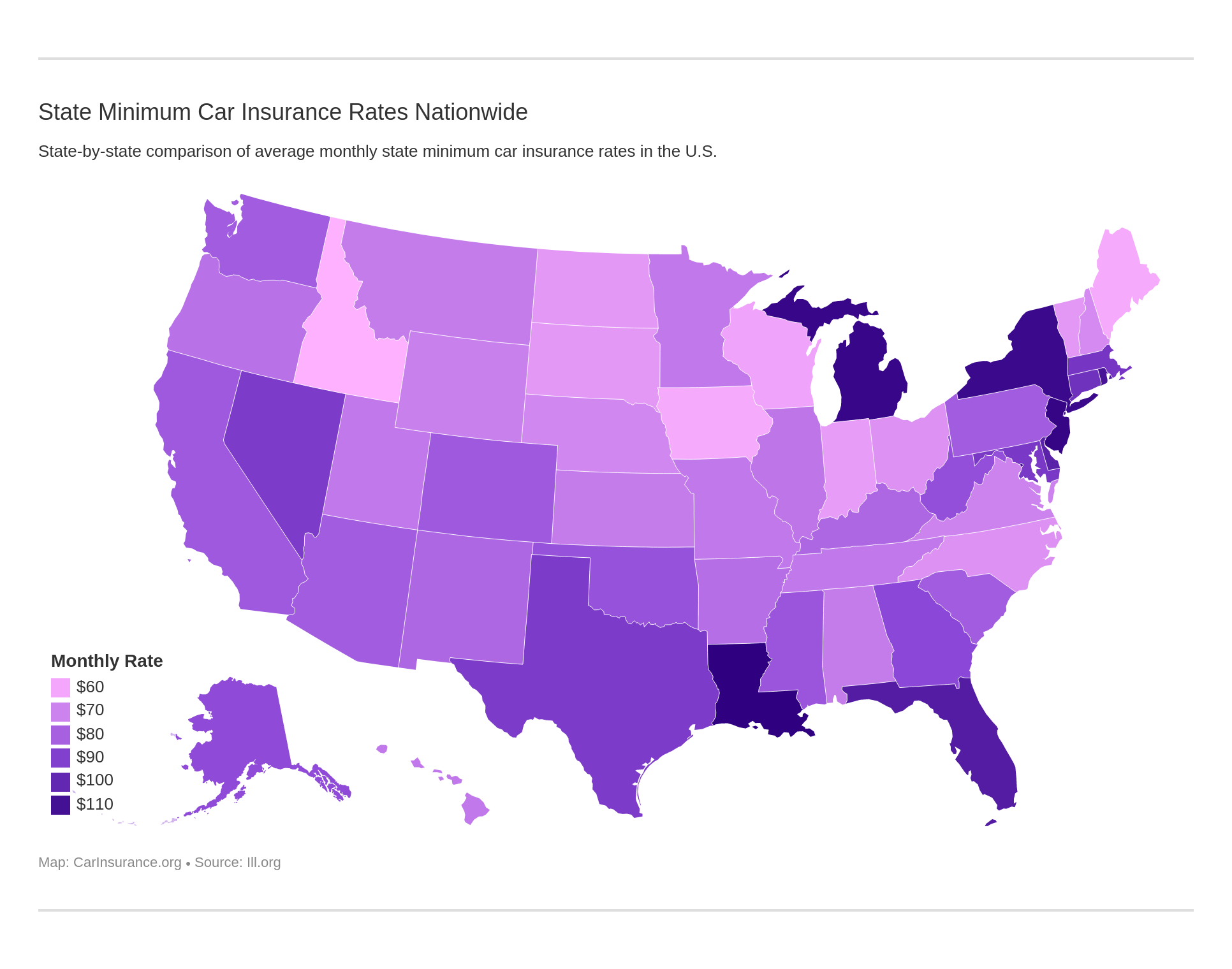

What are Average Monthly Car Insurance Rates in Washington D.C. (Liability, Collision, Comprehensive)?

Car insurance in D.C. costs more than the countrywide average, but the good news is that in five years annual rates in D.C. only increased $54 for full coverage while the U.S. rates increased $101.

Here’s a comparison of rates for different types of coverage in Washington D.C. compared to the countrywide average.

| Year | DC Liability | Countrywide Liability | DC Collision | Countrywide Collision | DC Comprehensive | Countrywide Comprehensive | DC Full Coverage | Countrywide Full Coverage |

|---|---|---|---|---|---|---|---|---|

| 2015 | $629 | $539 | $469 | $323 | $233 | $148 | $1,331 | $1,009 |

| 2014 | $629 | $530 | $461 | $308 | $234 | $143 | $1,324 | $982 |

| 2013 | $635 | $518 | $452 | $295 | $230 | $138 | $1,316 | $951 |

| 2012 | $624 | $503 | $437 | $288 | $228 | $133 | $1,289 | $924 |

| 2011 | $623 | $492 | $427 | $285 | $226 | $132 | $1,277 | $908 |

These averages were published by the National Association of Insurance Commissioners (NAIC) and the liability coverage rates are based on state-required minimum coverage insurance.

What about Additional Liability?

Insurance companies stay in business by offering affordable premiums to attract customers but high enough that they (the insurance company) comes out ahead in the end.

If an insurance company receives $100 in premiums and pays out $67 in claims, we would say their loss ratio is 67 percent. That means they’re left with $33 for their overhead. If that sounds fair to you, you’re right on. That’s a nice healthy ratio.

As you can imagine, a company that earns $100 in premiums and pays out $115 in claims over and over again for several years in a row isn’t going to stay in business very long. Their loss ratio would be over 100 and that would be bad.

Personal injury protection (PIP) and Medical Payments (MedPay) are two similar coverage types that pay for your and your passengers’ injury costs following an accident.

As you can see in the table below, the PIP coverage in D.C. had a rough year in 2013 but has bounced back nicely.

MedPay has had a loss ratio that has been all over the map in recent years while uninsured and underinsured motorist coverage has held fairly steady as far as their losses to earnings.

| Insurance Coverage | 2015 | 2014 | 2013 |

|---|---|---|---|

| Personal Injury Protection | 64.02 | 53.82 | 84.28 |

| Medical Payments | 27.40 | 54.31 | 85.86 |

| Uninsured/Underinsured Motorist Coverage | 78.76 | 82.17 | 71.24 |

Just how many people are driving around D.C. uninsured? A whopping 15.6 percent. That ranks D.C. as number 10 nationally for having the most uninsured drivers.

That knowledge should make you check your policy right now and make sure you have uninsured/underinsured motorist coverage.

Think about it, if an uninsured motorist causes a collision with you and you only have liability coverage, you’re out of luck. You just lost the use of your vehicle for something that wasn’t your fault and you most likely aren’t going to get any compensation.

Add-ons, Endorsements, and Riders

The basic insurance coverages are liability, collision, and comprehensive, but there are more options available for you to consider.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

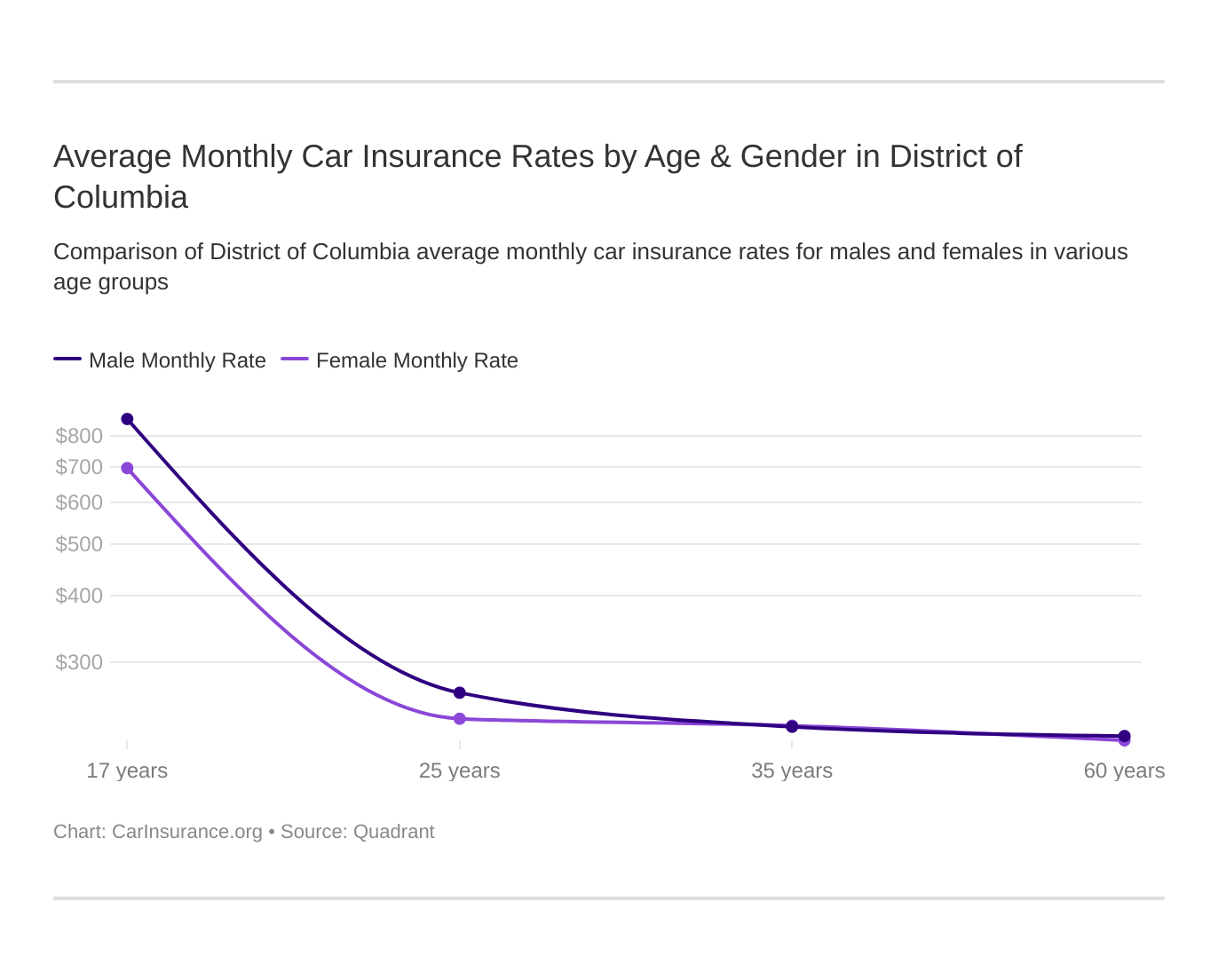

What are the Average Monthly Car Insurance Rates by Age & Gender in Washington D.C.?

There’s a hot topic in car insurance and it concerns the difference in rates between males and females. Some states have outlawed using gender in car insurance rate formulation.

Car insurance companies claim that different demographic groups pose more risk to them and riskier groups should pay higher rates. That sounds fair, but it’s interesting that who pays more in each age group – men or women – varies between states and companies.

So, it can’t be as cut and dry as the insurance companies make it out to be. The one place where we can all agree that the stats back up the rates is with teen males. They consistently have demonstrated a higher rate of accidents and dangerous driving behavior.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $12,590.85 | $15,874.46 | $4,059.66 | $4,403.29 | $3,732.35 | $3,880.10 | $3,440.27 | $3,770.41 |

| Geico | $6,282.32 | $7,523.64 | $2,606.50 | $2,076.67 | $2,782.63 | $2,626.29 | $2,949.59 | $2,694.87 |

| NICOA | $7,768.94 | $9,857.18 | $3,851.14 | $4,139.93 | $3,437.91 | $3,453.36 | $3,102.55 | $3,180.87 |

| Progressive | $10,819.70 | $12,660.17 | $3,064.98 | $3,231.19 | $2,626.08 | $2,537.25 | $2,386.96 | $2,435.74 |

| State Farm | $7,573.00 | $10,041.93 | $2,714.97 | $2,989.94 | $2,445.38 | $2,445.38 | $2,190.89 | $2,190.89 |

| USAA | $5,047.10 | $6,001.61 | $1,891.88 | $2,086.10 | $1,419.48 | $1,434.98 | $1,367.92 | $1,394.43 |

In D.C., the teenage age group is the only one where males pay more than females across the board. For the other age groups, males tend to pay higher rates than females although there are exceptions depending on the company.

You may be wondering where we got our rate data. It’s based on coverage that has actually been purchased. It includes everything from rates for high-risk drivers to rates for minimum coverage insurance. If you have a good driving record, it’s likely your rates will be quite a bit lower.

On the other hand, if you’re a high-risk driver, your rates will likely be a lot higher.

These rates give you a baseline idea of what to expect but your rates could vary greatly. That’s why it’s so important that you do a rate comparison search. That will help you find the best rates for your situation.

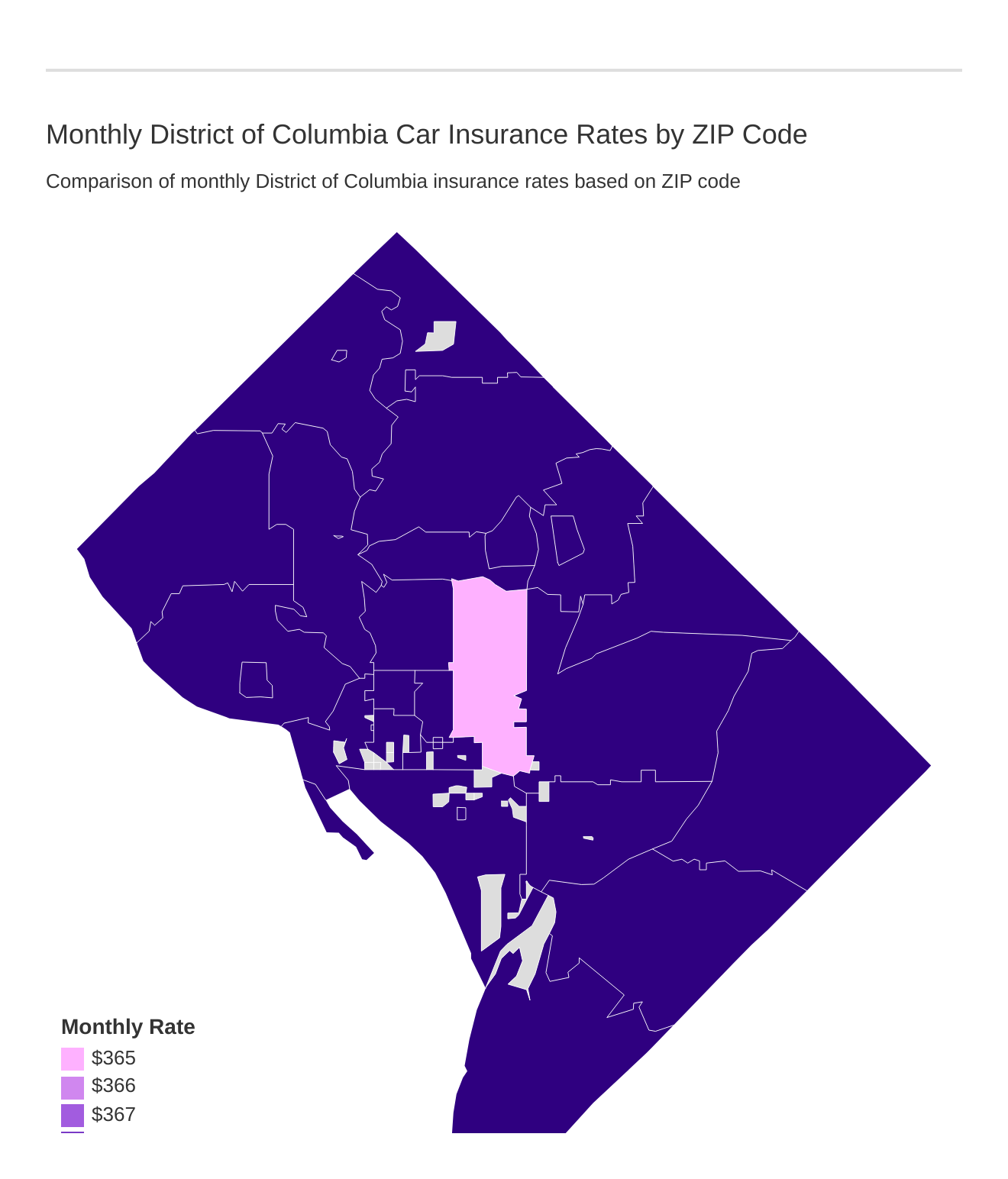

What are the Cheapest Rates by Zip Code?

Normally, rates within a state or city vary greatly, sometimes up to $400 annually within the same city. This is not the case with D.C. Their rates don’t change at all between ZIP codes with one exception.

In zip code 20001, Progressive charges $343 less than in every other ZIP code. Other than that, rates are equal across ZIP /codes.

| Zipcode | Average Annual Rate | Allstate | Geico | NICOA | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|

| 20001 | $4,383.61 | $6,468.92 | $3,692.81 | $4,848.99 | $4,636.43 | $4,074.05 | $2,580.44 |

| 20002 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20003 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20004 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20005 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20006 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20007 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20008 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20009 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20010 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20011 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20012 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20015 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20016 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20017 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20018 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20019 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20020 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20024 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20026 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20032 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20036 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20037 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20045 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20052 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20057 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20059 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20060 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20064 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20260 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20317 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20374 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20376 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20388 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20391 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20398 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

| 20500 | $4,440.79 | $6,468.92 | $3,692.81 | $4,848.99 | $4,979.53 | $4,074.05 | $2,580.44 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Best Washington D.C. Car Insurance Companies?

You might be feeling like you just got a whole lot of car insurance information, but it’s just way out there, out of practical reach. We’ll try to bring it home to you so you have a really good idea about what company is best for your situation.

Not only will we look at car insurance rates, but we’ll examine some other important topics like companies’ financial ratings and customer service reviews.

What Are the Largest Companies’ Financial Ratings?

AM Best is an independent company that rates the financial standings of insurance companies. As you can see, the 10 largest insurers in D.C. received good grades from AM Best.

It’s not surprising that the larger companies perform so well. They earned their market share by providing solid policies for many years.

| Company | AM Best Rating |

|---|---|

| Geico | A+ |

| State Farm | A++ |

| USAA | A++ |

| Progressive | A+ |

| Allstate | A+ |

| Travelers | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Erie | A+ |

| Hartford | A+ |

What Are the Companies with the Best Ratings?

Customer satisfaction reports should matter to you because if a company tends to have happy customers, it’s because they treat them right, so if you were a customer, they’re more likely to treat you right.

Here are the results from the J.D. Power Auto Insurance Satisfaction Survey. The Power Circles listed below are the equivalent of stars. So a Five Power Circle Rating would be like a Five-Star Rating

- USAA – 898 – 5 Power Circles

- NJM Insurance Co. – 861 – 5 Power Circles

- Erie Insurance – 852 – 5 Power Circles

- Geico – 845 – 4 Power Circles

- The Hartford – 842 – 4 Power Circles

- Mid-Atlantic Average – 838 – 3 Power Circles

- State Farm – 834 – 3 Power Circles

- Progressive – 828 – 2 Power Circles

- Farmers – 826 – 2 Power Circles

- Plymouth Rock Assurance – 826 – 2 Power Circles

- Nationwide – 822 – 2 Power Circles

- Travelers – 821 – 2 Power Circles

- CSAA Insurance Group – 817 – 2 Power Circles

- Liberty Mutual – 817 – 2 Power Circles

- Allstate – 816 – 2 Power Circles

What Are the Companies with the Most Complaints in D.C.?

Bigger companies have more customers and they’ll get more complaints. What really matters is the complaint ratio. If a company sells 100,000 policies and receives 10 complaints, they’re doing a whole lot better than a company that sells 10 policies and gets five complaints.

| Company | Complaint Ratio | Number of Complaints |

|---|---|---|

| Geico | 0.68 | 333 |

| State Farm | 0.44 | 1,482 |

| USAA | 0.74 | 296 |

| Progressive | 0.75 | 120 |

| Allstate | 0.50 | 163 |

| Travelers | 0.09 | 2 |

| Liberty Mutual | 5.95 | 222 |

| Nationwide | 0.28 | 25 |

| Erie | 0.70 | 22 |

| Hartford | 4.68 | 9 |

| Countrywide Median | 1.00 | n/a |

The complaint information in the table above is from national data. It’s not specific to the D.C. region but it gives a good overall picture of each company’s complaint data.

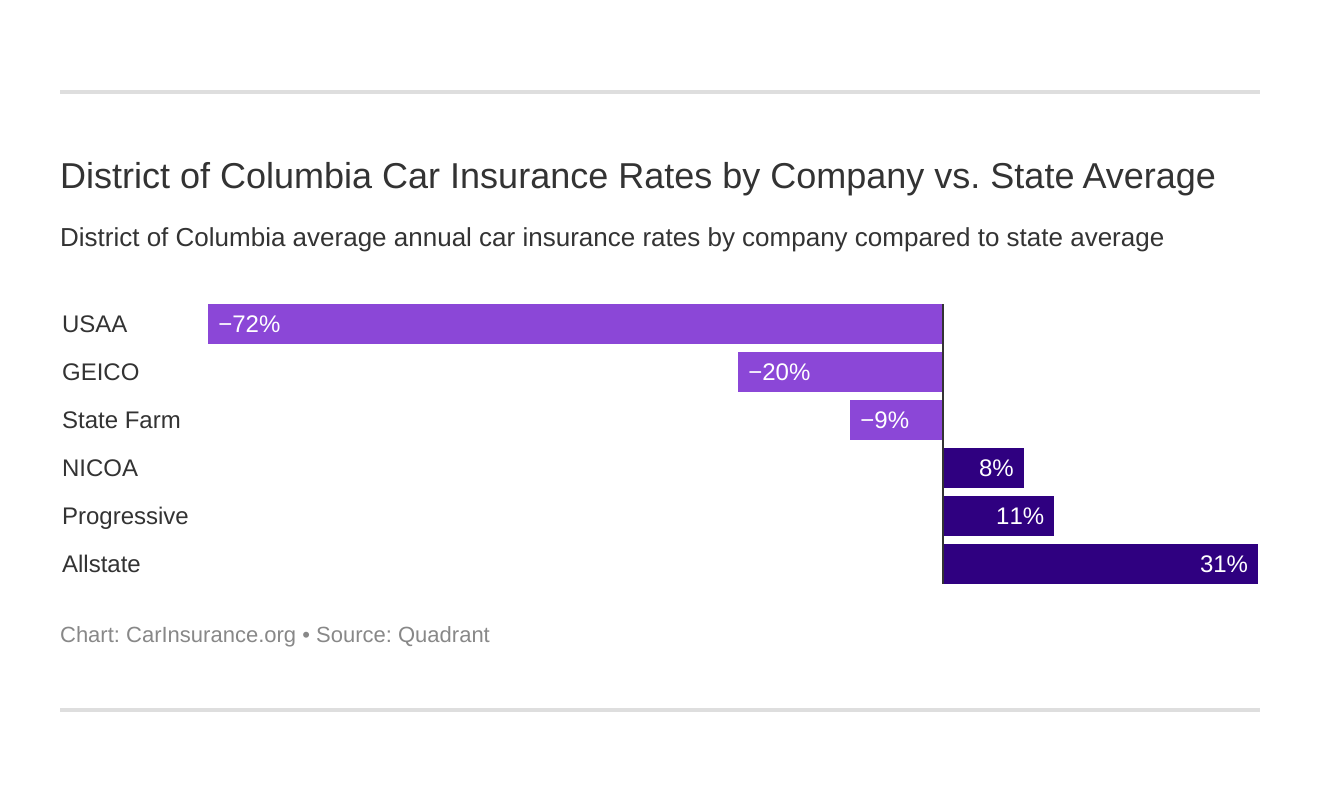

What Are the Cheapest Companies in D.C.?

We partnered with Quadrant to bring you this data that shows what actual D.C. customers are paying for car insurance.

| Company | Annual Rate | Over/Under State Average | % Over/Under State Average |

|---|---|---|---|

| Allstate | $6,468.92 | +$2,030 | +31% |

| Geico | $3,692.81 | -$746 | -20% |

| NICOA | $4,848.99 | +$410 | +8% |

| Progressive | $4,970.26 | +$531 | +11% |

| State Farm | $4,074.05 | -$365 | -9% |

| USAA | $2,580.44 | -$1,859 | -72% |

What Are the Commute Rates by Company?

| Company | 10-mile commute | 25-mile commute |

|---|---|---|

| Allstate | $6,468.92 | $6,468.92 |

| Geico | $3,626.75 | $3,758.87 |

| NICOA | $4,848.98 | $4,848.98 |

| Progressive | $4,970.26 | $4,970.26 |

| State Farm | $3,931.51 | $4,216.58 |

| USAA | $2,533.45 | $2,627.43 |

As you can see, half of the companies we studied didn’t change their rates between a 10- and 25-mile commute. It would make sense that the more miles you drive, the higher your risk of being in an accident and the more expensive your rates, but not every company feels that way.

What Are the Coverage Level Rates by Company?

| Group | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $6,197 | $6,450 | $6,760 |

| Geico | $3,543 | $3,694 | $3,841 |

| Nationwide | $4,723 | $4,919 | $4,905 |

| Progressive | $4,718 | $4,983 | $5,210 |

| State Farm | $3,801 | $4,095 | $4,326 |

| USAA | $2,471 | $2,579 | $2,691 |

When you have more coverage, the insurance company takes on a great risk. Insurance is all about risk, so more risk means more cost to the consumer.

Surprisingly, Nationwide’s rates drop slightly when you purchase high-level coverage instead of medium.

What Are the Credit History Rates by Company?

Geico has great rates for those with good credit scores and even for those with fair credit scores, but their rates jump dramatically for customers with poor credit. Keep that in mind depending on where your credit rating is.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $5,575.84 | $6,163.24 | $7,667.69 |

| Geico | $2,017.71 | $3,001.96 | $6,058.76 |

| Nationwide | $3,959.80 | $4,319.64 | $6,267.51 |

| Progressive | $4,357.13 | $4,772.75 | $5,780.90 |

| State Farm | $2,847.98 | $3,595.91 | $5,778.24 |

| USAA | $1,709.33 | $2,164.52 | $3,867.47 |

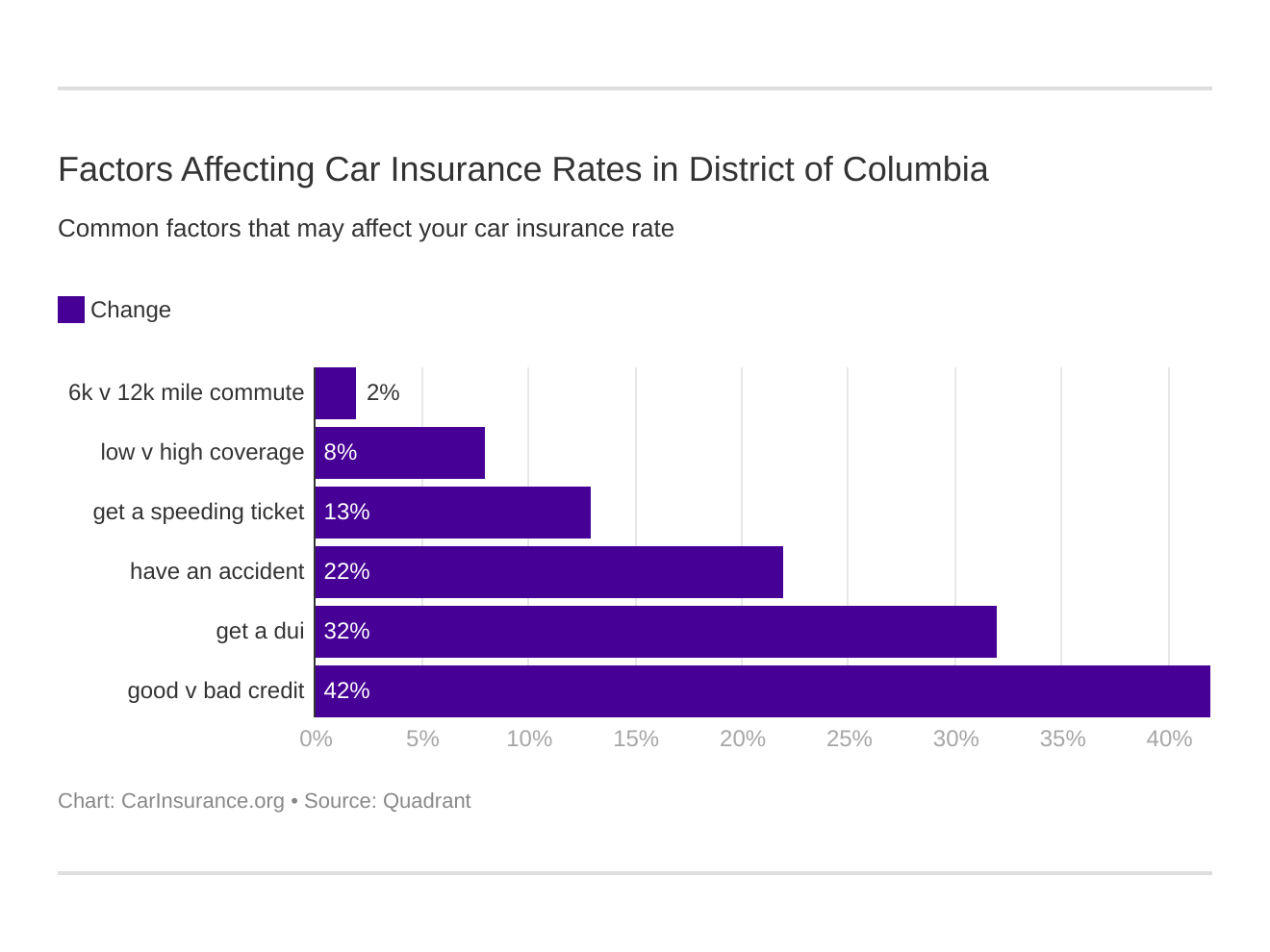

Credit score has a huge impact on car insurance rates in Washington D.C. Like rates based on gender, rates based on credit is a hotly debated topic. Several states have banned credit scores in the formulation of car insurance rates.

Insurance companies argue that those with lower credit scores are more risk to them.

Your credit rating for insurance is not the same as your credit score. They’re both based on your credit report, though. The insurance companies pull the information they think is the most relevant so although it’s similar, it’s not the same as your credit score.

According to Experian’s State of Credit report, the average credit score in D.C. is 670 which is just below the national average of 675 and they come in seventh place for the state with the most credit card debt.

What Are the Driver Record Rates by Company?

| Company | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $5,526.28 | $6,499.40 | $6,624.38 | $7,225.63 |

| Geico | $2,255.62 | $2,813.29 | $3,832.82 | $5,869.52 |

| Nationwide | $3,904.62 | $4,273.26 | $4,982.97 | $6,235.08 |

| Progressive | $4,332.07 | $5,091.60 | $5,478.69 | $4,978.67 |

| State Farm | $3,703.83 | $4,074.05 | $4,444.25 | $4,074.05 |

| USAA | $1,969.44 | $2,212.93 | $2,510.06 | $3,629.33 |

It seems a little crazy that a poor credit score would have a greater effect on your rates than having a DUI on your record, but that’s what the data shows us is the case for most car insurance companies in D.C.

Progressive and State Farm both charge policyholders less for a DUI on record than they do for an accident on record. You would think that DUI would have the greatest impact on rates because of all the statistics about repeat offenders.

This table shows you just how much your rate is likely to increase after a violation when compared to a clean record.

| Company | Clean Record | Rate Increase Following One Speeding Ticket | Rate Increase Following One Accident | Rate Increase Following One DUI |

|---|---|---|---|---|

| Allstate | $5,526.28 | 18% | 20% | 31% |

| Geico | $2,255.62 | 25% | 70% | 160% |

| Nationwide | $3,904.62 | 9% | 28% | 60% |

| Progressive | $4,332.07 | 18% | 26% | 15% |

| State Farm | $3,703.83 | 10% | 20% | 10% |

| USAA | $1,969.44 | 12% | 27% | 84% |

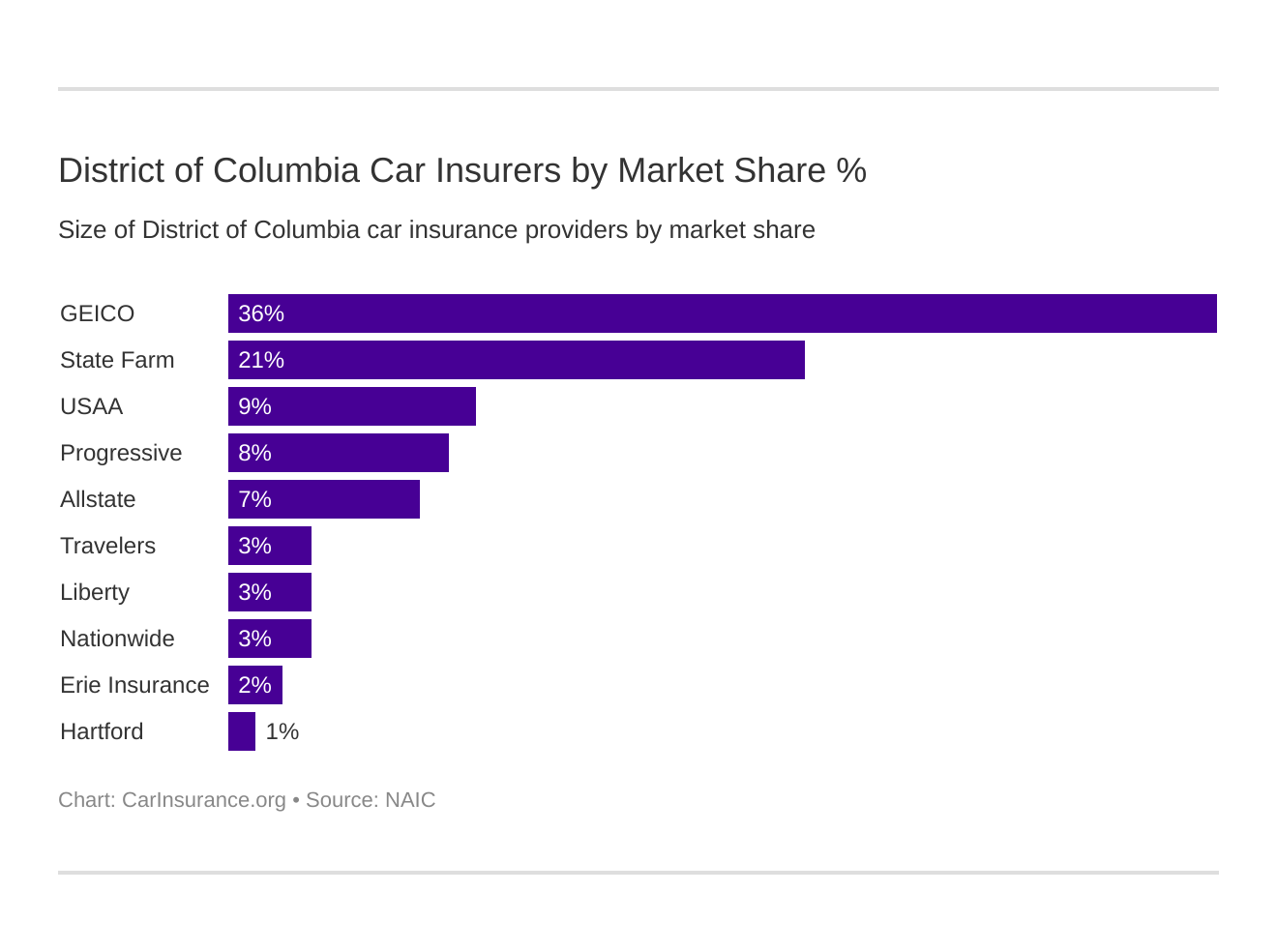

Who are the Largest Car Insurance Companies in Washington D.C.

| Company | Market Share |

|---|---|

| Geico | 36.22% |

| State Farm | 20.74% |

| USAA | 9.06% |

| Progressive | 8.48% |

| Allstate | 6.73% |

| Travelers | 3.46% |

| Liberty Mutual | 3.42% |

| Nationwide | 3.38% |

| Erie | 2.41% |

| Hartford | 1.46% |

Geico has a huge slice of the pie when it comes to market share in D.C. In fact, they own over one-third of the car insurance market. Likely, that’s because it started as an insurance company for government employees, and, well, D.C. has a lot of those.

What Are the Number of Insurers in Washington D.C.?

There are 790 out-of-state property and casualty insurance companies licensed in D.C. and six in-state companies licensed.

With a little math, you’ll see that there are 796 companies licensed to sell policies in D.C. That’s a lot of companies to choose from.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are Washington D.C. Laws?

With all the laws that vary in each state, it can be hard to grasp what’s important to know. We’ll show you the highlights so you can be confident with all things driving-related.

We’ll start by explaining what you need to know about insurance in D.C., then we’ll cover licensing laws, so if you’re new to the area, you’ll definitely want to read that over a time or two.

Finally, we’ll go over the rules of the road. Even if you’ve been driving a long time, you’ll probably learn something you didn’t know.

Car Insurance Laws

With all the laws that vary in each state, it can be hard to grasp what’s important to know. We’ll show you the highlights so you can be confident with all things driving-related.

We’ll start by explaining what you need to know about insurance in D.C., then we’ll cover licensing laws, so if you’re new to the area, you’ll definitely want to read that over a time or two.

Finally, we’ll go over the rules of the road. Even if you’ve been driving a long time, you’ll probably learn something you didn’t know.

Car insurance is required in Washington D.C., and that’s the most important law you need to know. You’d benefit from knowing a little more than that, though, so we’ll cover that next.

How State Laws for Insurance are Determined

Form filings must be approved prior to use, but rate filings don’t need approval. They must be filed but can be used without approval.

Windshield Coverage

There are no specific laws concerning windshield coverage in D.C. How an insurance company handles glass coverage is up to them, so if you’re wondering, ask your insurer.

High-Risk Coverage

If your driving record is bad enough, insurance companies aren’t going to want to take on your risk. The problem is, no matter how risky you are, you still have to have insurance to drive.

To make sure that everyone can get insurance, insurance providers share risk in the D.C. Automobile Insurance Plan (DCAIP). So, if you can’t find insurance on the competitive market, you will be able to find some with DCAIP.

Some high-risk drivers, especially those with a DUI on their record, will be required to file an SR22. An SR22 is not insurance, it’s just a form that your insurance company files with the state that says you will have insurance for the required period.

In D.C., the SR22 filing goes hand-in-hand with an ignition interlock device requirement if you want to reinstate your license following a DUI conviction.

Low-Cost Insurance

There are just a few states that offer a low-income, low-cost insurance program. D.C. is not one of them. Your best strategies to obtain the lowest cost insurance possible are as follows:

- Compare rates to find lower-cost insurance

- Cut down on coverage if you have to

- Increase your deductible

- Ask your insurer about discounts or other ways to save

How do I Report Automobile Insurance Fraud in Washington D.C.?

If you’re a law-abiding citizen, you may be wondering why fraud even matters to you. Well, it’s estimated that fraud makes up 10 percent of insurance companies’ losses.

If fraud wasn’t taking place, that savings could be passed on to the customer.

There are two types of fraud. Hard fraud is the most obvious. Staged accidents, false claims, and lying about injuries are examples of hard fraud.

Soft fraud seems like a white lie, but it costs the insurance companies considerable. Lying about your address, or people in your household or any other personal information is considered soft fraud.

It’s illegal, and if your insurance company finds out, you could be denied coverage.

Here are the penalties for committing insurance fraud in D.C.

| Crime | Penalty |

|---|---|

| Insurance Fraud First Degree | Fine up to $50,000, 15 years imprisonment, or both |

| Insurance Fraud Second Degree | Fine up to $10,000, 5 years imprisonment, or both |

| Insurance Fraud Second Degree Second Offense | Fine up to $20,000, 10 years imprisonment, or both |

| Insurance Fraud Misdemeanor | Fine up to $1,000, 180 days imprisonment, or both |

Here’s what Washington D.C. has established to fight fraud:

- Insurance fraud is classified as a crime

- Immunity statues are in place

- A fraud bureau has been established

- A mandatory insurer fraud plan is required

If you suspect insurance fraud, you can file a complaint at disb.dc.gov, by phone at (202) 727-8000 or in person at 1050 First St., NE, Suite 801, Washington, D.C.

What is the Statute of Limitations in Washington D.C.?

The statute of limitations in Washington D.C. is three years for both property damage and personal injury.

The statute of limitations is hard and fast. If you want to file a claim or lawsuit following a car accident or damage, you have three years. If you don’t file within three years, you have no case.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Specific Laws in Washington D.C.?

Auto insurance companies are required to notify the Department of Motor Vehicles (DMV) any time someone cancels coverage. The DMV will then send the individual a proof of insurance notification.

If you don’t maintain continuous insurance, your registration will be suspended and you will be subject to fines.

Accident reports are to be filed with the Metropolitan Police Department and not with the D.C. DMV.

What Are Washington D.C.’s Vehicle Licensing Laws?

Every state has a slightly different system for vehicle licensing. Here’s how D.C. handles it.

REAL ID

Washington D.C. has been issuing REAL IDs since May 1, 2014.

If you’re unsure if you have a REAL ID, you need to make sure you know because starting in October of 2020, you have to have one (or a passport) to fly domestically in the U.S.

How can you tell? If your driver’s license is REAL ID compliant, you will see a star in the upper right-hand corner of your license.

If you still need to get a REAL ID, you’ll have to do it in person, and you should take care of it soon so you’re not stuck needing to fly but not being able to.

These are the documents needed to get a REAL ID for the first time:

- Proof of ID

- Proof of Social Security Number

- Two proofs of residency

A REAL ID license is valid for 8 years.

What Are the Penalties for Driving Without Insurance?

If you’re caught driving without insurance, you’re going to get penalized. Here’s what you’re looking at.

| Offense | Penalty |

|---|---|

| Driving Without Insurance First Offense | $500 civil fine, license suspension up to 30 days, or both |

| Driving Without Insurance Second and Subsequent Offenses | An increase of 50% over the civil fine for the first offense for each subsequent offense, license suspension up to 60 days, or both |

Acceptable proof of insurance includes both paper and electronic proof of coverage. Your insurance card is valid, as is a copy of your coverage through your insurance provider’s app.

Insurance providers in D.C. have to notify the DMV if you cancel coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Teen Driver Laws?

Washington D.C. has a G.R.A.D. program for teen drivers. If you’re between the ages of 16 and 21, you must comply with this program.

You must go through the intermediate license stage unless you get you’re over 21 years old.

| Restrictions | Learners Stage | Intermediate Stage | Provisional License | Unrestricted License |

|---|---|---|---|---|

| Minimum Age | 16 years | 16 year 6 months | 17 years | 18 |

| Supervised Driving | 40 hours | 10 at night | n/a | n/a |

| Holding Period | 6 months | 6 months | Until age 18 | n/a |

| Time of day restrictions | Can only drive between 6:00 a.m. and 9:00 p.m. | September–June: 11 p.m. - 6:00 a.m. Sun.–Thur., 12:01 a.m. - 6:00 a.m. Sat.–Sun.; July–August: 12:01 a.m. - 6:00 a.m | 6 months or until age 21, whichever occurs first (min. age: 18) | n/a |

| Passenger restrictions | Must be supervised by a licensed driver over 21 years old | No passengers except family members | 6 months or until age 21, whichever occurs first (min. age: 18) | No more than two passengers until driver is 21 or older |

How Can Older Drivers Renew Their License?

Like the general population, older drivers have to renew their licenses every eight years, and they have to have proof of adequate vision at every renewal.

The difference between older drivers and the general population as far as license renewal requirements is that the general population may renew by mail or online every other renewal, but drivers over 70 years old must renew in person every time.

What do New Residents Need to Register Their Car in Washington D.C.?

To register a vehicle in D.C., you must first have a D.C. license or ID. The D.C. government website recommends not waiting until your out-of-state license expires but instead starting the process of getting a D.C. license started early.

To get your vehicle registered, it must be inspected. You can have your vehicle inspected with out-of-state registration. The fee for the inspection is collected when you register.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the License Renewal Procedures?

You must get your license renewed every eight years. You can do this online, by mail, or in person. You must renew in person at every other renewal at least.

What Are the Rules of the Road?

In our final section regarding the laws in D.C., we’ll examine the laws for when you’re actually driving. Disobeying these regulations could result in a ticket, and you definitely want to avoid that.

You’ll be able to follow these rules best if you know them, obviously.

Fault vs. No-Fault

Most states have tort laws where the at-fault party in a crash is responsible for all damages. Some states have no-fault laws where each part has to pay for their own injury costs regardless of who is at fault.

Washington D.C. does its own thing with a contributory fault system which is closer to no-fault than it is to torte.

If one party is 100 percent at fault, they are responsible for damages and injuries, but if any bit of fault is attributed to the other driver, the majority-fault party is not responsible for injury costs.

What Are the Seat Belt and Car Seat Laws?

Seat belt laws are primary in Washington D.C. That means that you can be pulled over not wearing a seatbelt. The law applies to anyone over 16 years old and the penalty for the first offense is $50.

Children under 16 years old are under child safety seat laws.

| Requirement | Age |

|---|---|

| Rear Facing Seat | younger than 2 years must be in a rear-facing child restraint unless the child weighs 40 or more pounds or is 40 or more inches tall |

| Child Safety Seat (can be forward facing) | 3 years and younger in a child restraint |

| Booster Seat (can be in a safety seat) | 4 years through 7 years must be in a child restraint or booster seat |

| Adult belt permissible | 8 through 15 years old |

The fine is $75 for a child safety seat violation and the enforcement is primary.

D.C. has restrictions on riding in a truck’s cargo area. It’s not permissible except for employees on duty.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is it a Law to Keep Right and Move Over?

Drivers must move over for emergency vehicles with sirens or lights on if it’s safe to do so. If it’s not safe to move to the adjacent lane, drivers must use caution and maintain a safe speed.

Washington D.C. doesn’t have laws requiring slower traffic to keep right. Maybe that’s part of their out-of-control traffic problem.

Speed Limits

The speed limits must be followed or you could get a speeding ticket which not only costs money in itself but could also make your car insurance rates rise.

| Type of Roadway | Speed Limit |

|---|---|

| Streets and Highways With No Posted Speed Limit | 25 mph |

| Alleyways | 15 mph |

| Streets Adjacent to Schools | 15 mph during times listed |

| Streets Adjacent to Parks | 15 mph |

| Interstates | 55 mph |

Ridesharing

D.C.’s Department of Public Works set up a program called Via for government employees. The program’s shared-ride program works like carpooling, and they also have standard rideshare and taxi programs for an increased cost.

Via sends the invoices to the Department of Public Works who sends the bill to the appropriate government agencies of the employees who used the program.

If you’re a government employee, this program sounds like a win-win. It reduces the volume of traffic on the road and it doesn’t cost you anything.

Of course, the usual rideshare options are also available in Washington D.C. and more and more auto insurance companies are offering supplemental insurance plans for rideshare drivers.

How is Automation on the Road?

Washington D.C. is pretty progressive when it comes to automated vehicles. They have already been deployed on the roadways although a licensed operator must be present in the vehicle.

There are no specific liability insurance laws for autonomous vehicles in D.C.

What Are the Unique Laws?

Washington D.C. is cracking down on speeding. They aim to eliminate traffic deaths by 2024. Their strategy? Extreme penalties.

- Driving 25 mph or more over the speed limit – $400 fine on highways, $500 fine on city streets

- Driving 30 mph or more over the speed limit – criminal offense

In addition to heightened penalties, there are some other new laws to pay attention to:

- School zone speed limits are between the hours of 7:00 am and 11:00 pm

- Delivery truck and Uber drivers face $150 penalties for blocking bike lanes

- Riding a bike with headphones in both ears could cost you a $50 fine

What Are the Safety Laws in Washington D.C.?

These laws deal with impaired and distracted driving. Both of these are dangerous activities and should be eliminated.

What Are the DUI Laws?

Driving under the Influence (DUI) is a misdemeanor offense in Washington D.C. The lookback period where previous offenses are considered in the penalties for a subsequent offense is 15 years.

| Penalty | First Offense | Second Offense | Third Offense |

|---|---|---|---|

| License Suspension | 6 months | 1 year | 2 years |

| Imprisonment | No minimum, but up to 90 days. BAC 0.20-0.25: mandatory 5 days. BAC 0.25+: mandatory 10 days | up to 1 year with 5 mandatory days or 30 days community service. BAC 0.20-0.25: mandatory 10 days. BAC 0.25+: mandatory 20 days | Up to 1 year with 5 mandatory days or 30 days community service. BAC 0.20-0.25: mandatory 15 days. BAC 0.25+: mandatory 25 days |

| Fine | Up to $300 | $1000-$5000 | $2,000-$10,000 |

| Other | Possible alcohol diversion program requirement if BAC>0.16 Ignition Interlock Device | Ignition Interlock Device | Ignition Interlock Device |

All those convicted of a DUI are required to install an ignition interlock device (IID).

Are there Marijuana-Impaired Driving Laws?

There are no marijuana-specific driving laws in D.C. If you’re caught driving impaired because of marijuana use, you’re subject to the same penalties as a DUI.

DUI laws in D.C. cover both alcohol and drug-impaired driving.

What is Included in Distracted Driving Laws?

Washington D.C. has a handheld ban for all drivers. That means you cannot use your phone or another electronic device for making or receiving calls unless it’s on handsfree mode.

Texting is prohibited for all drivers. Drivers with a learner’s permit may not use a cellphone at all, even in handsfree mode.

These laws are primary and you can be pulled over for a violation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is it Difficult to Drive in Washington D.C.?

Everything we’ve talked about, insurance, laws, vehicles, etc. all centers around driving. If we didn’t need to drive, we wouldn’t need any of those other things.

Driving is pretty important but you might feel weighed down by the vast amount of information available. What do you need to know and what can you skip over? Don’t worry. We’ll help you!

We’ll look at some sober statistics because sometimes just knowing how dangerous driving can be will help us to be more careful. We’ll also go over commuter options, including what is available as alternatives to driving.

And finally, we’ll deal with the very frustrating subject of traffic. By the time you’re finished, you’ll feel pretty well-educated about driving in D.C.

What is the Frequency of Vehicle Theft in Washington D.C.?

Some vehicles are more appealing to car thieves than others for various reasons. In D.C., if you have a Dodge Caravan, you’ll want to be extra cautious about keeping it locked and not storing valuables in it because it’s the most stolen vehicle.

According to the FBI, 2,545 were stolen in the District of Columbia in 2017. Here’s the breakdown of the top ten most popular stolen vehicles and how many were stolen.

| Vehicle | Number Stolen |

|---|---|

| Dodge Caravan | 167 |

| Honda Accord | 132 |

| Jeep Cherokee/Grand Cherokee | 109 |

| Toyota Camry | 95 |

| Toyota Corolla | 70 |

| Nissan Altima | 62 |

| Ford Pickup (Full Size) | 49 |

| Chevrolet Pickup (Full Size) | 41 |

| Chevrolet Impala | 40 |

| Chrysler 300/300M | 40 |

How Many Road Fatalities Are in Washington D.C.?

Weather, congestion, and other factors all play a role in the safety of a roadway. Here are some statistics about road-related deaths.

Most Fatal Highway in the D.C. Area

One of the most dangerous routes in the area is Route 1. As the highway cuts across Maryland on its way to and from D.C. the fatality rate is 0.7.

What Are the Fatal Crashes by Weather Condition and Light Condition?

It’s pretty clear by the statistics in the table below that the most dangerous time to drive is when it’s dark but lighted. The majority of fatal crashes happened in those conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Total |

|---|---|---|---|---|

| Normal | 5 | 21 | 1 | 27 |

| Rain | 0 | 2 | 0 | 2 |

| Snow/Sleet | 0 | 0 | 0 | 0 |

| Other | 0 | 0 | 0 | 0 |

| Unknown | 0 | 0 | 0 | 0 |

| TOTAL | 5 | 23 | 1 | 29 |

Traffic Fatalities

It shouldn’t be surprising that all traffic fatalities were on urban highways because there aren’t any rural highways in D.C.

| Type of Roadway | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 29 | 24 | 27 | 15 | 20 | 23 | 23 | 27 | 31 | 31 |

| Rural | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Urban | 29 | 24 | 27 | 15 | 20 | 23 | 23 | 26 | 31 | 30 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

What Are Fatalities by Person Type?

| Person Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Passenger Car | 7 | 6 | 8 | 12 | 7 |

| Light Truck - Utility | 3 | 0 | 4 | 1 | 1 |

| Light Truck - Pickup | 0 | 0 | 0 | 1 | 0 |

| Total Occupants | 10 | 6 | 12 | 14 | 8 |

| Motorcyclists | 3 | 3 | 6 | 4 | 8 |

| Pedestrian | 9 | 13 | 8 | 11 | 11 |

| Bicyclist and Other Cyclist | 1 | 1 | 1 | 2 | 3 |

| Unknown Nonoccupants | 0 | 0 | 0 | 0 | 1 |

| Total Nonoccupants | 10 | 14 | 9 | 13 | 15 |

| Total | 23 | 23 | 27 | 31 | 31 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are Fatalities by Crash Type?

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 23 | 23 | 27 | 31 | 31 |

| Single Vehicle | 16 | 17 | 18 | 24 | 20 |

| Involving a Large Truck | 5 | 2 | 0 | 0 | 3 |

| Involving Speeding | 12 | 7 | 16 | 17 | 15 |

| Involving a Rollover | 4 | 1 | 3 | 4 | 3 |

| Involving a Roadway Departure | 7 | 5 | 11 | 13 | 7 |

| Involving an Intersection (or Intersection Related) | 10 | 10 | 10 | 10 | 19 |

What Are Fatalities Involving Speeding?

| Fatalities | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Speeding-Related | 10 | 8 | 10 | 6 | 9 | 12 | 7 | 16 | 17 | 15 |

What Are Fatalities Involving an Alcohol-Impaired Driver?

| Fatalities | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Alcohol-Impaired (BAC=0.08+) | 11 | 7 | 8 | 3 | 7 | 5 | 7 | 10 | 15 | 9 |

Teen Drinking and Driving

When compared to the 50 states in the U.S., Washington D.C. is at the bottom not only for drunk driving as a whole but also for teen drinking and driving.

They have the fewest – zero, in fact – teen drinking and driving arrests in the nation, and that puts them in the best position.

EMS Response Time

Even though complete data is only available for about 7 percent of crashes, we can get a little bit of an idea about how long it takes on average from the time you call emergency services until you arrive at the hospital, if necessary.

| Average Time of Crash to EMS Notification | Percent Unknown of Time of Crash to EMS Notification | Average Time EMS Notification to EMS Arrival | Percent Unknown EMS Notification to EMS Arrival | Average Time EMS Arrival at Scene to Hospital Arrival | Percent Unknown Time EMS Arrival at Scene to Hospital Arrival | Average Time Time of Crash to Hospital Arrival | Percent Unknown Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|---|---|---|

| 1.74 minutes | 34.5% | 3.5 minutes | 44.8% | 30 minutes | 93.1% | 29 minutes | 93.1% | 29 |

Transportation

A lot of U.S. cities don’t have many options for how to get around. You either drive yourself or you have someone drive you. D.C. has another option, and that is mass transit.

Let’s see how Washington D.C. compares to the U.S. as a whole as far as transportation statistics go.

Car Ownership

In the U.S. as a whole, more households have two vehicles than any number of vehicles, but in D.C., far more households have only one car. It’s not as difficult to get by with one car when public transportation is an option, which is in D.C.

Nationally, about 20 percent of households have one vehicle while just over 40 percent of households have two vehicles. Washington D.C.’s statistics are close to the reverse of that. Over 40 percent of households have one vehicle while just over 20 percent have two.

Another area where they’re way off the national average is in households with no vehicles. More households in D.C. have no vehicles (about 25 percent of households) than have two cars, while nationally, less than five percent of households have no vehicles.

Commute Time

When you average the commute times, D.C.’s commute of 28.6 minutes is over three minutes longer than the U.S. average of 25.5 minutes. Nearly 20 percent of D.C.’s residents have a commute time between 30 and 34 minutes.

Commuter Transportation

By far, the two most popular forms of commuter transportation over the past five years have been driving alone and public transportation. The next most common mode of transportation is walking to work.

| Year | Drove Alone | Carpooled | Public Transit | Taxi | Motorcycle | Bicycle | Walked | Other | Worked at Home |

|---|---|---|---|---|---|---|---|---|---|

| 2013 | 106,657 | 17,512 | 127,045 | 1,643 | 934 | 14,986 | 45,003 | 1,833 | 14,474 |

| 2014 | 120,528 | 19,166 | 123,707 | 1,861 | 724 | 13,330 | 44.965 | 1,769 | 17,012 |

| 2015 | 120,333 | 18,456 | 128,135 | 1,804 | 567 | 14,718 | 50,165 | 2,443 | 21,529 |

| 2016 | 119,642 | 18,358 | 130,451 | 2,327 | 741 | 16,647 | 49,514 | 2,763 | 21,761 |

| 2017 | 129,051 | 19,495 | 122,643 | 5,379 | 362 | 18,624 | 47,625 | 4,534 | 27,667 |

Washington D.C. has a great public transit system going for it. If you need to, you can get anywhere you need to go without ever sitting in a car. In fact, almost as many people take public transportation to work as drive alone to work.

Traffic Congestion in Washington District of Columbia

The traffic in D.C. is some of the worst in the U.S.

| Facts | Stats |

|---|---|

| Hours Spent in Congestion | 155 |

| Innercity Travel Time | 5 minutes |

| Inner City Last Mile Speed | 11 mph |

| Cost of Congestion (per driver) | $2,161 |

| Percent Change in the Last Year | down 3% |

Now that you know everything you need to about driving and insurance in Washington D.C., you’ll be able to make an educated choice about how to choose an insurance provider.

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Ready to compare rates? Use our FREE comparison tool above.