Mississippi Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 23.70

Mississippi is a state with a unique blend of history and modern conveniences. There is also a lot to see and do in the Magnolia State.

Boasting such sites as the historic Fort Massachusetts and the birthplaces of both Kermit the Frog and Elvis Presley, it is no wonder that Mississippi hosts around 23 million tourists annually.

While these visitors are great for the state’s economy, combining 23 million tourists with the nearly 3 million people who call the Magnolia State home can sometimes make traffic a nightmare. This is why it’s so important to have the right car insurance provider on your side.

How do you know which company will have your back if you ever need to file a claim? Keep reading to find out some of the best ways to find the right company to help you out if you ever find yourself in a jam.

Enter your zip code on our site to start comparison shopping today.

How to Get Mississippi Auto Insurance Rates

When shopping for car insurance the first things to consider are types and amounts of coverage that the Magnolia State requires you to purchase as a responsible driver on the Mississippi roadways.

Knowing where to find the state minimum insurance requirements and understanding what they cost and what they cover can sometimes be overwhelming. That is where we come in.

We have collected the data from places like the Insurance Information Institute (III), the National Association of Insurance Commissioners (NAIC), and the U.S. Census Bureau to help you get the most for your money when purchasing your car insurance policy.

Keep scrolling to find out what is required by law and about all of the types of coverage offered to you in the great state of Mississippi at the best prices in town.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s Mississippi car culture like?

Taking a ride along the Natchez Trace Parkway makes it obvious why the Magnolia State is so popular to drivers and cyclists alike. The morning fog that drifts up between the trees and the quiet seclusion that the Parkway offers is a nice contrast to the hustle and bustle found on I-55 or I-20.

From the highway to the byway, the roads in Mississippi really are laid back compared to most states though. So laid back in fact that many people simply forget to use their blinkers at intersections and crossroads.

While this behavior is fine on the back roads paved with dirt, it can cause major issues in some of the larger cities and towns that make up the Magnolia State.

Another issue is the number of large passenger vehicles and pickup trucks found on the roads in Mississippi which can make seeing around into oncoming traffic difficult when attempting to pass.

Jacked-up pickup trucks aren’t just found on rural roads either. You can expect to see a muddied-up pickup truck throughout the state of Mississippi from Tishomingo to Jackson.

No matter what you drive or where you are headed in the Magnolia State, if you are driving a car you are required to carry a minimum amount of car insurance coverage.

What is the minimum coverage in Mississippi?

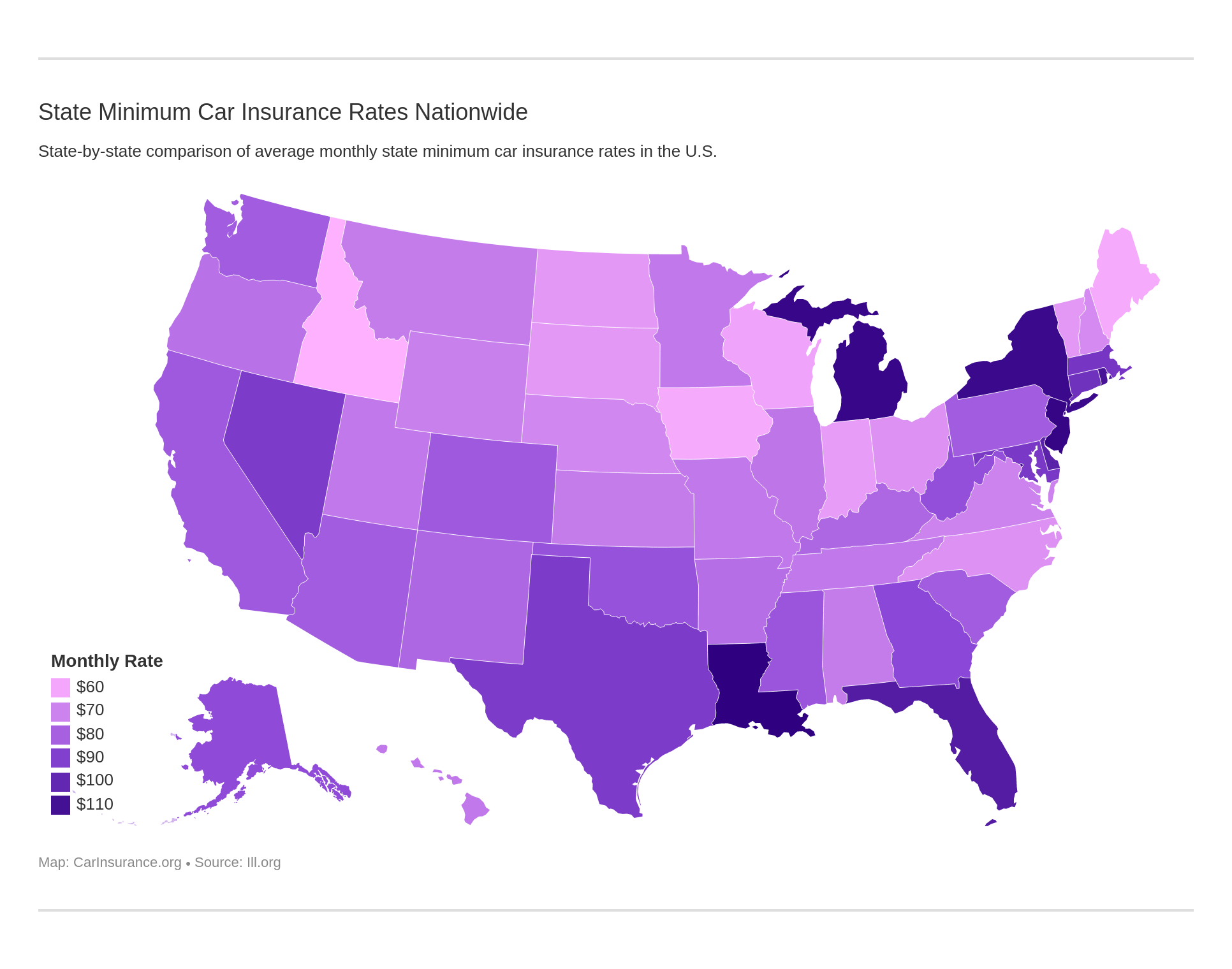

Take a look at how state minimum car insurance rates vary from state to state.

According to NOLO, all drivers in the Magnolia State are required to maintain the minimum coverage amounts:

- $25,000 bodily injury coverage for bodily injury and/or death of one person in an accident which is caused by the owner or driver of the vehicle.

- $50,000 bodily injury coverage for total bodily injury and/or death of all persons in an accident which is caused by the owner or driver of the vehicle.

- $25,000 for property damage per accident caused by the owner or driver of the insured vehicle.

NOLO also notes that :

Mississippi vehicle owners can also post a bond in these same amounts, or make an equivalent cash of secirity deposit at these minimums in order to demonstrate financial responsibility.

If you chose to ignore the law and drive without insurance you could be subject to a misdemeanor conviction, a fine of up to $500, and a license suspension for up to one year.

What are the forms of financial responsibility?

According to the Insurance Industry Committee on Motor Vehicle Administration (HCMVA), a general condition for operating a motor vehicle on any state’s roadways is acceptance of, and agreement to, the financial responsibility statutes put forth by that state.

In Mississippi, these statutes require that a driver must have proof of insurance in the vehicle that they are driving at all times.

Mississippi Statues allow drivers to carry the following forms of financial responsibility (proof of insurance):

- A paper copy of your car insurance ID card is usually mailed to you or available to print through your car insurance provider’s website.

- An e-insurance card can be accessed in electronic format as an image on a cell phone, tablet, or another electronic device.

- Proof of a Surety Bond in the same amount as the minimum liability requirements.

- A Self-Insurance Certificate informs the requesting party that you have made a cash or security deposit that is equal to the minimum state requirements for car insurance.

Surety Bonds and Self-Insurance Certificates are an unusual way to go about maintaining financial responsibility which makes navigating the ins and outs of them difficult sometimes.

One of the major differences is that Self-Insurance Certificates and Surety Bonds are issued by the state rather than a car insurance provider. These certificates must include the following information:

- The effective date of the certificate

- The name of the driver covered by the certificate

- The make and model of the covered vehicle certificate number

- The certificate number

- The name of the company that issued the bond

- The Bond number

- the name of the driver on the bond.

If you choose to go the more traditional route then your paper insurance ID card and/or e-insurance card must have the following information on it:

- The name of the insurance company

- The policy number

- The effective dates

- the make, model, and VIN of the covered vehicle

- The name of the person(s) covered by the policy

- Insurance agent contact information

These forms of financial responsibility must be produced upon the request made by law enforcement should you ever be in an accident or get pulled over.

If you fail to show proper proof of insurance you could be subject to:

- First violation a $300 fine

- Second violation a $400 fine

- Third violation a $500 fine

Violations after the third one could result in a suspension of your driver’s license for up to a year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What percentage of income are insurance premiums?

Knowing what the state requires and how you can prove that you are in compliance with the law is only part of what you need to know when purchasing car insurance. The most important part of most people is knowing how much they will spend in the process.

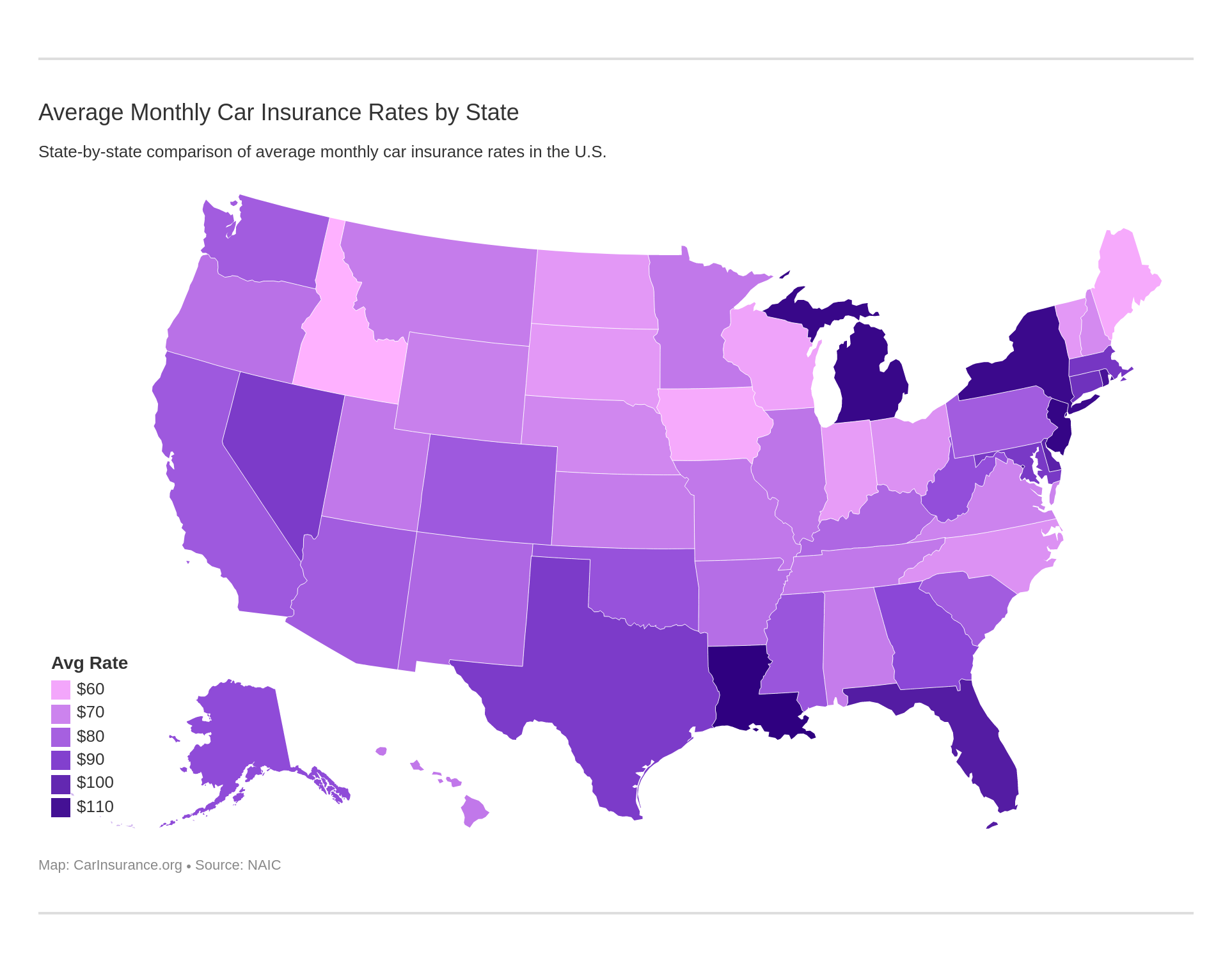

The typical resident of the Magnolia State spends around 3.05 percent of their annual disposable income on car insurance premiums.

With a per capita disposable income of $31,365 per year earned by each resident of the Magnolia State, and $994.05 of that being spent to maintain insurance coverage on your vehicle this means that on average $83 is spent on car insurance from a monthly budget of $2,614.

Car insurance rates have been slowly and steadily creeping up in Mississippi over the last few years as well which is why it is so important to get the best price for your car insurance policy.

These savings are doubly important when you consider that Mississippi is slightly over the national average expenditure amount for car insurance which the Insurance Information Institute places at $935.80.

Residents of the Magnolia State are luckier than their neighbors in Louisiana though. Residents there pay just over $1,300 for their car insurance premiums. Residents of Tennesse might boast that they are the luckiest of all though because on average residents there only pay around $856 a year in car insurance.

Mississippians know better though. Nothing can replace the smell of fresh magnolia blooms drifting on the crisp spring air or the laid-back feeling that friends and neighbors have when sharing the road.

The beauty of magnolias and bragging rights over Louisiana aside, spending $995 a tear n average for car insurance could make you feel like you’re being treated like a red-headed stepchild.

You can avoid this by choosing the right car insurance provider who can help you understand exactly which types of car insurance coverage are for you.

What are the average monthly car insurance rates in MS (liability, collision, comprehensive)?

Knowing what is required of you as a car owner in the Magnolia State can help you get the most for your money when you go to buy car insurance. Knowing your options and what these options will cost can go a long way too.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $460.50 |

| Collision | $323.22 |

| Comprehensive | $210.33 |

| Combined Total | $994.05 |

Rates in the table above reflect market prices for 2015 so rates for 2019 might be slightly higher. No matter how much rates might fluctuate though, shopping around and educating yourself on the car insurance requirements in the Magnolia State can go a long way towards saving you money.

Like all good investments, taking the time to do the background research can really pay off over the long haul. Understanding when and if you might need additional liability coverage on your vehicle can also pay big dividends.

Is there any additional coverage?

While the Magnolia State may only require you to carry bodily injury liability coverage and property damage coverage, looking into additional coverage options is always a good idea. Some of the most popular options are:

- Collision– This type of coverage can help pay to repair or replace your car if it is damaged in an accident.

- Comprehensive– This coverage type protects you in case of an animal strike, natural disaster, or another total loss event.

- MedPay- This will cover the medical payments of all passengers in a vehicle that are injured in an accident. This includes the ambulance ride and treatment.

- Uninsured/Underinsured Motorist– This coverage protects you if you are in an accident with a driver who isn’t carrying liability insurance.

- Personal Injury Protection- If you have this type of coverage it can help pay for lost wages and medical bills regardless of who is at fault in an accident.

When deciding which additional liability insurance types might be right for you it helps to consider the loss ratios of the companies that you are considering. Below are the loss ratio trends for Mississippi as a whole which can give you an indication of how the car insurance market in Mississippi is doing on the whole.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 74.81 | 77.44 | 80.03 |

| Uninsured/Underinsured Motorist | 69.10 | 74.67 | 79.20 |

The table above contains data collected by the National Association of Insurance Commissioners(NAIC), and what it reveals is that while there is room for a bit of improvement in the car insurance market of the great state of Mississippi overall the market is faring pretty well.

How can you tell as a consumer? You can tell by understanding what the loss ratio means to you before you buy into the market.

The loss ratio works as follows:

- A High Loss Ratio (over 100 percent) indicates that the companies are losing money because they are paying out to many claims for the amount of premium they collected and that rate increases could occur in the future

- A Low Loss Ratio indicates that companies may have underestimated the number of claims received or that their auto policies are overpriced.

Putting this into context using the loss ratios for the Magnolia State means that because they are all below 100 percent, but not below 50 percent, the market is stable. This stability could help you is you ever need to file a claim.

This is good to know considering that around 24 percent of drivers on Mississippi roadways are uninsured. Having an uninsured motorist bump into you in traffic could become a real headache if you don’t have the right car insurance provider on your side.

Keep reading to find out what else you can do to protect yourself and yours should you be involved in an accident with another driver whether or not they are covered by car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any add-ons and endorsements?

Now that you know what the state requires and what additional types of liability coverage is available to you in the Magnolia State, it is time to start thinking about how to cater your policy to your lifestyle. This is where add-ons and endorsements come in.

Understanding what each type of add-on or endorsement is, and how each one protects you in case of an accident, can help make decisions about which ones are right for you easier.

Typical add-ons and endorsements include:

- Guaranteed Auto Protection (GAP)–If your car is ever totaled or stolen GAP will pay any money that is remains owed on the lease or loan.

- Personal Umbrella Policy (PUP)–When your underlying liability limits have been reached PUP kicks in to help protect you from lawsuits that may result from an auto accident.

- Rental Reimbursement–Should you ever need to leave your car in the shop, rental reimbursement will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance–This is just what it sounds like. If your car breaks down or you have a flat emergency roadside assistance will be there for you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance–This type of coverage helps pay for the cost of repairs to your car which did not result from an accident.

- Non-Owner Car Insurance–Don’t own a car, but still drive on occasion? This type of coverage is perfect for you then because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage–If a basic model just isn’t your style then modified car insurance should be. This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance–Just like a classic car needs special attention when it comes to its care and maintenance it also needs a special kind of insurance. Classic Car Insurance coverage helps ensure that if something happens to the baby you both will be well protected. This type of insurance typically costs less as well since classic cars are generally not driven as much as their contemporary counterparts.

- Pay-As-You-Drive or Usage-Based Insurance–This type of coverage is based on the way you drive. The insurance provider takes into account your speed, distance traveled, and other such factors and issues discounts based on that information.

Not all insurance providers will offer all of these options so be sure to ask your independent agent about the ones that you want before signing on the dotted line.

The type of car that you drive, the modifications that you have made to it, and whether or not you trust your mechanic skills in the event of a roadside emergency are not the only things that you should think about when looking for the right car insurance provider.

Sometimes just being who you are can cost you a few dollars extra on y our rates if you don’t shop around.

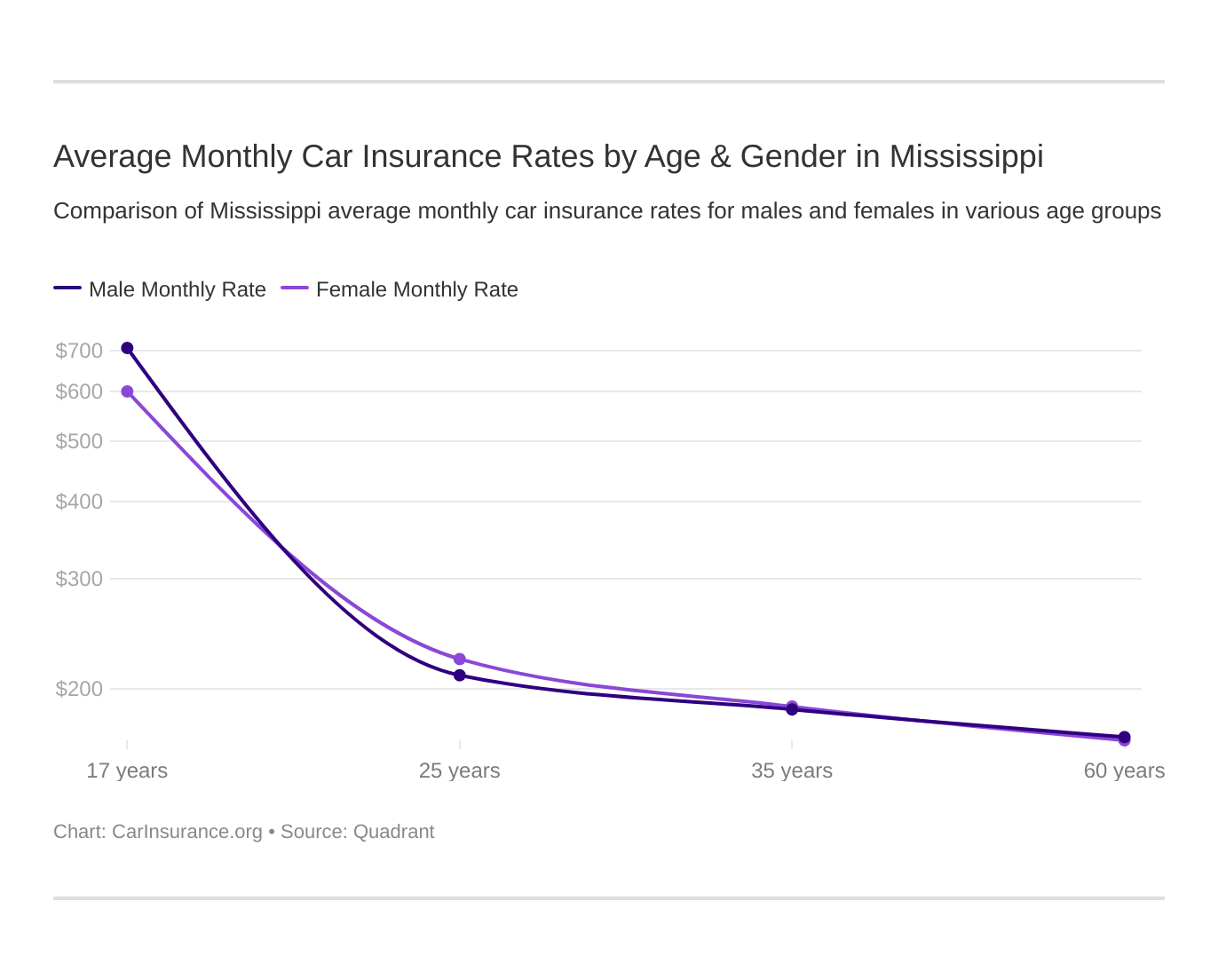

What are the average monthly car insurance rates by age & gender in MS?

In 2017 Consumer Federation of America conducted an interesting study when it came to the difference in price that men and women pay for car insurance rates.

What they found was:

That 40-year-old women were most likely to be charged more than men, and 60-year-old women were also penalized more often, facing higher premiums than their male counterparts in 58% of the instances in which companies used a driver’s sex to alter coverage rates.

Gender isn’t the only thing that can impact your rates either. Sometimes just saying “I do” can raise or lower your rates, and so can having another birthday.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,759.49 | $2,635.21 | $2,463.36 | $2,519.32 | $11,031.99 | $11,772.88 | $3,133.31 | $3,215.18 |

| Geico General | $2,966.41 | $2,806.48 | $2,694.14 | $2,503.52 | $7,389.86 | $6,979.27 | $4,950.27 | $2,400.88 |

| SAFECO Ins Co of IL | $2,629.22 | $2,846.39 | $2,112.59 | $2,370.20 | $9,446.38 | $10,504.45 | $2,794.00 | $2,941.24 |

| Nationwide P&C | $2,046.11 | $2,102.48 | $1,835.74 | $1,945.49 | $4,088.44 | $5,202.84 | $2,318.23 | $2,510.05 |

| Progressive Gulf Ins | $2,591.63 | $2,419.61 | $2,124.47 | $2,061.68 | $9,375.44 | $10,495.41 | $2,662.75 | $2,769.80 |

| State Farm Mutual Auto | $1,877.59 | $1,877.59 | $1,680.17 | $1,680.17 | $5,427.70 | $6,823.62 | $2,091.75 | $2,382.03 |

| Travelers Home & Marine Ins Co | $1,683.09 | $1,713.42 | $1,600.71 | $1,602.55 | $7,522.15 | $11,907.14 | $1,765.06 | $2,047.25 |

| USAA | $1,385.56 | $1,371.97 | $1,293.28 | $1,308.31 | $3,448.85 | $4,091.04 | $1,689.16 | $1,861.86 |

Looking at the table reveals that Mississippi treats men and women pretty equally when it comes to setting their car insurance rates even though it doesn’t have any specific laws on the books requiring that car insurance companies forego using this factor as a determinant in setting car insurance rates.

That’s just Southern Hospitality for ya then.

No matter how polite Mississippians are you are still going to pay more if you are a teen driver though.

You might also be asked to pay more depending on the neighborhood that you call home to.

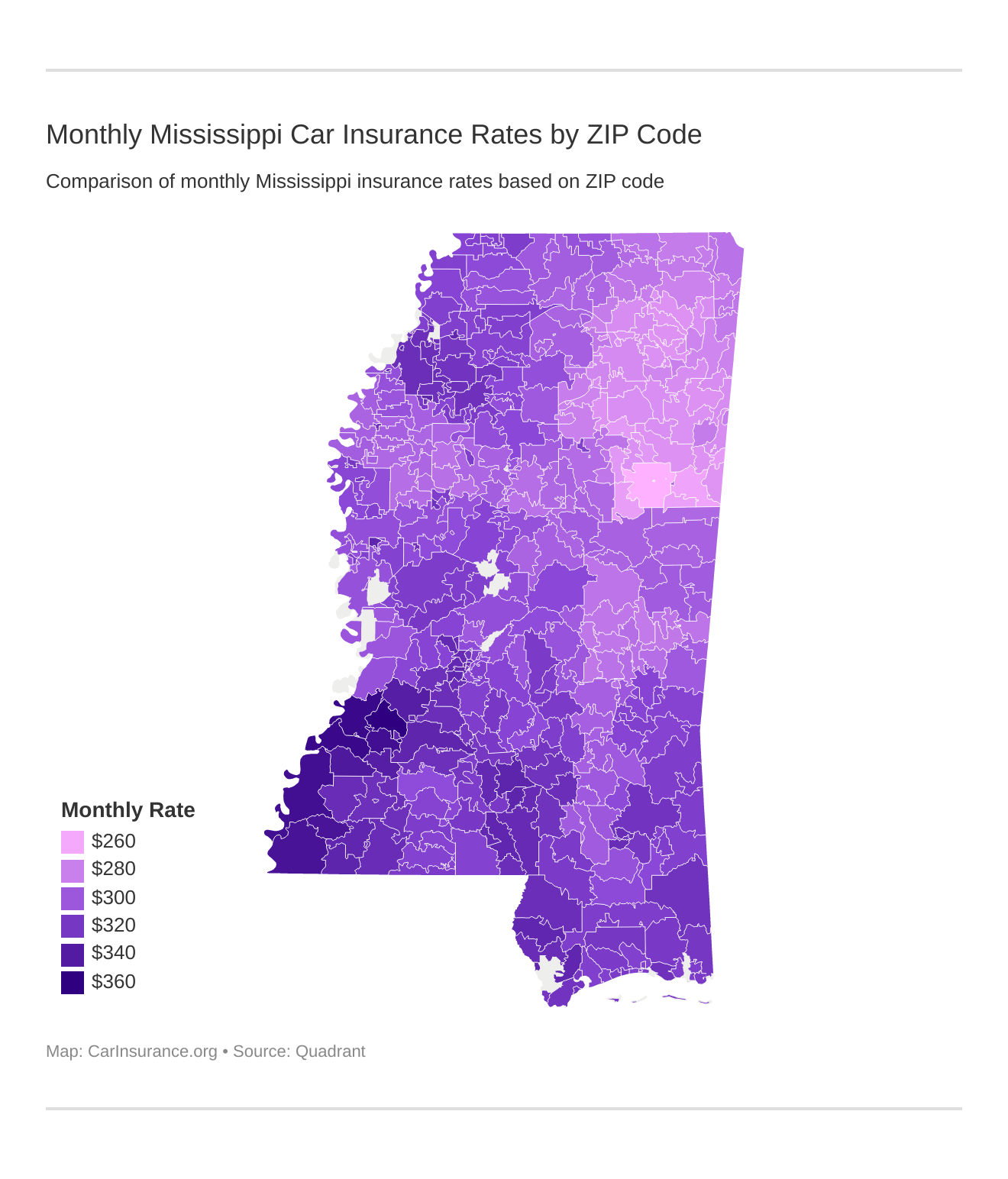

What are the cheapest auto insurance rates by Zip code?

There is no denying that Southerners are some of the most neighborly people you will ever come across. Residents of Mississippi are no different.

Always there to lend a helping hand, sit tea on the porch with you, or share the latest recipe for Mississippi Mud Pie, you can always count on your neighbors to be warm and welcoming in the Magnolia State.

Sometimes what they do behind the wheel could end up costing you when it comes time to buy car insurance though.

Take a look at the table below to see how much.

| City | Zipcode | Average Annual Rate | Allstate P&C | Geico General | SAFECO Ins Co of IL | Nationwide P&C | Progressive Gulf Ins | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| HERMANVILLE | 39086 | $4,323.64 | $5,937.03 | $5,029.37 | $4,987.59 | $3,172.69 | $5,343.98 | $3,750.24 | $4,122.10 | $2,246.10 |

| LORMAN | 39096 | $4,250.87 | $5,952.13 | $5,029.37 | $4,987.59 | $3,172.69 | $4,786.78 | $3,640.79 | $4,191.49 | $2,246.10 |

| PORT GIBSON | 39150 | $4,242.24 | $5,952.13 | $5,029.37 | $4,987.59 | $3,172.69 | $4,633.82 | $3,724.69 | $4,191.49 | $2,246.10 |

| NATCHEZ | 39120 | $4,189.65 | $5,776.88 | $4,843.48 | $4,809.69 | $3,408.49 | $4,765.89 | $3,637.59 | $4,185.69 | $2,089.52 |

| PATTISON | 39144 | $4,185.94 | $4,913.98 | $5,029.37 | $4,987.59 | $3,172.69 | $5,243.77 | $3,702.49 | $4,191.49 | $2,246.10 |

| FERNWOOD | 39635 | $4,170.57 | $5,666.66 | $4,413.77 | $4,809.69 | $2,904.76 | $6,115.20 | $3,086.49 | $4,275.68 | $2,092.33 |

| WASHINGTON | 39190 | $4,157.25 | $5,776.88 | $4,843.48 | $4,455.43 | $3,408.49 | $6,109.19 | $3,257.71 | $3,317.33 | $2,089.52 |

| WOODVILLE | 39669 | $4,149.93 | $5,666.66 | $4,843.48 | $4,809.69 | $3,179.85 | $4,763.60 | $3,414.41 | $4,275.68 | $2,246.10 |

| CROSBY | 39633 | $4,144.61 | $5,666.66 | $4,843.48 | $4,809.69 | $3,179.85 | $4,675.36 | $3,460.09 | $4,275.68 | $2,246.10 |

| TOUGALOO | 39174 | $4,138.74 | $5,685.01 | $5,029.37 | $4,580.96 | $2,855.35 | $6,070.04 | $3,009.23 | $3,763.32 | $2,116.62 |

| LAKESHORE | 39558 | $4,129.33 | $5,414.07 | $4,249.19 | $4,791.37 | $2,903.45 | $6,133.27 | $3,402.87 | $3,914.68 | $2,225.77 |

| TINSLEY | 39173 | $4,112.92 | $5,685.01 | $4,465.85 | $4,580.96 | $2,921.61 | $6,033.91 | $3,203.44 | $3,763.32 | $2,249.27 |

| FAYETTE | 39069 | $4,107.16 | $4,738.71 | $5,029.37 | $4,987.59 | $3,408.49 | $4,747.18 | $3,508.36 | $4,191.49 | $2,246.10 |

| JACKSON | 39210 | $4,105.52 | $5,531.13 | $4,306.19 | $4,511.45 | $2,960.85 | $6,145.30 | $3,132.64 | $3,932.01 | $2,324.60 |

| UTICA | 39175 | $4,053.43 | $6,044.71 | $5,029.37 | $4,580.96 | $2,747.96 | $4,832.26 | $3,575.66 | $3,403.71 | $2,212.86 |

| UNION CHURCH | 39668 | $4,050.99 | $4,738.71 | $5,029.37 | $4,987.59 | $3,408.49 | $4,365.76 | $3,440.44 | $4,191.49 | $2,246.10 |

| CHATAWA | 39632 | $4,041.93 | $4,628.49 | $4,413.77 | $4,809.69 | $2,904.76 | $6,124.21 | $3,086.49 | $4,275.68 | $2,092.33 |

| HURLEY | 39555 | $4,024.29 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $6,199.53 | $3,027.85 | $4,008.74 | $2,191.87 |

| PRENTISS | 39474 | $4,013.94 | $5,952.13 | $4,738.27 | $4,757.59 | $2,904.76 | $4,530.70 | $3,124.12 | $3,964.07 | $2,139.85 |

| ROME | 38768 | $4,009.06 | $5,050.32 | $4,708.47 | $4,592.13 | $2,592.31 | $6,051.98 | $2,914.98 | $3,914.43 | $2,247.83 |

| CENTREVILLE | 39631 | $4,006.38 | $4,628.49 | $4,843.48 | $4,809.69 | $3,179.85 | $4,676.86 | $3,390.87 | $4,275.68 | $2,246.10 |

| CARSON | 39427 | $4,005.18 | $5,937.03 | $4,738.27 | $4,757.59 | $2,904.76 | $4,454.93 | $3,144.92 | $3,964.07 | $2,139.85 |

| JACKSON | 39204 | $3,996.62 | $5,688.01 | $4,306.19 | $4,511.45 | $2,960.85 | $4,858.31 | $3,566.53 | $3,757.06 | $2,324.60 |

| WHITFIELD | 39193 | $3,994.81 | $5,685.01 | $4,050.47 | $4,522.87 | $2,666.99 | $6,030.89 | $3,132.64 | $3,769.73 | $2,099.87 |

| FARRELL | 38630 | $3,994.56 | $4,971.83 | $4,708.47 | $4,318.54 | $2,758.50 | $6,202.51 | $3,303.85 | $3,565.68 | $2,127.07 |

| HAZLEHURST | 39083 | $3,990.92 | $3,927.40 | $1,923.75 | ||||||

| DARLING | 38623 | $3,989.17 | $3,863.33 | $2,247.83 | ||||||

| PANTHER BURN | 38765 | $3,988.98 | $3,914.43 | $2,127.07 | ||||||

| GALLMAN | 39077 | $3,988.22 | $3,317.33 | $1,923.75 | ||||||

| FOXWORTH | 39483 | $3,987.89 | $4,048.19 | $2,248.35 | ||||||

| JACKSON | 39212 | $3,984.87 | $3,654.63 | $2,306.61 | ||||||

| GLOSTER | 39638 | $3,984.59 | $4,628.49 | $4,843.48 | $4,809.69 | $3,179.85 | $4,774.93 | $3,118.50 | $4,275.68 | $2,246.10 |

| CARRIERE | 39426 | $3,984.17 | $4,897.64 | $4,647.79 | $4,804.74 | $2,972.56 | $5,272.45 | $3,393.67 | $3,809.96 | $2,074.54 |

| KILN | 39556 | $3,979.89 | $5,414.07 | $4,249.19 | $4,791.37 | $2,903.45 | $5,185.34 | $3,155.23 | $3,914.68 | $2,225.77 |

| JACKSON | 39209 | $3,962.53 | $5,448.28 | $4,306.19 | $4,511.45 | $2,960.85 | $4,694.09 | $3,522.80 | $3,932.01 | $2,324.60 |

| KOKOMO | 39643 | $3,956.73 | $4,803.76 | $4,912.62 | $4,757.59 | $2,904.76 | $4,698.69 | $3,400.43 | $3,927.68 | $2,248.35 |

| SILVER CREEK | 39663 | $3,955.17 | $5,952.13 | $4,252.38 | $4,757.59 | $2,904.76 | $4,788.62 | $3,006.02 | $3,840.01 | $2,139.85 |

| JACKSON | 39213 | $3,953.96 | $5,531.13 | $4,306.19 | $4,511.45 | $2,960.85 | $4,726.00 | $3,701.57 | $3,569.87 | $2,324.60 |

| RENA LARA | 38767 | $3,953.83 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $6,190.47 | $3,303.85 | $3,914.43 | $2,127.07 |

| JACKSON | 39217 | $3,953.54 | $5,531.13 | $4,306.19 | $4,511.45 | $2,960.85 | $4,730.51 | $3,475.39 | $3,788.22 | $2,324.60 |

| COLUMBIA | 39429 | $3,946.60 | $4,931.49 | $4,912.62 | $4,757.59 | $2,904.76 | $4,517.10 | $3,262.77 | $4,038.10 | $2,248.35 |

| BASSFIELD | 39421 | $3,944.37 | $5,464.00 | $4,738.27 | $4,757.59 | $2,904.76 | $4,295.20 | $3,182.70 | $3,964.07 | $2,248.35 |

| JACKSON | 39202 | $3,943.82 | $5,448.28 | $4,306.19 | $4,511.45 | $2,960.85 | $4,714.95 | $3,443.15 | $3,850.15 | $2,315.50 |

| ROXIE | 39661 | $3,941.64 | $4,628.49 | $4,843.48 | $4,809.69 | $3,179.85 | $4,598.66 | $3,149.51 | $4,077.32 | $2,246.10 |

| D LO | 39062 | $3,934.82 | $6,127.59 | $4,561.80 | $4,987.59 | $2,598.83 | $4,524.22 | $2,942.37 | $3,812.45 | $1,923.75 |

| TIE PLANT | 38960 | $3,934.31 | $4,584.66 | $4,291.72 | $4,279.76 | $2,921.61 | $6,042.94 | $3,231.82 | $4,006.32 | $2,115.65 |

| PICAYUNE | 39466 | $3,932.75 | $4,897.64 | $4,647.79 | $4,804.74 | $2,972.56 | $4,985.54 | $3,324.79 | $3,754.41 | $2,074.54 |

| JACKSON | 39203 | $3,932.74 | $5,448.28 | $4,306.19 | $4,511.45 | $2,960.85 | $4,730.51 | $3,442.43 | $3,737.63 | $2,324.60 |

| VANCE | 38964 | $3,932.66 | $4,971.83 | $4,708.47 | $4,592.13 | $2,758.50 | $4,574.33 | $3,303.85 | $4,304.35 | $2,247.83 |

| LIBERTY | 39645 | $3,932.21 | $4,628.49 | $4,843.48 | $4,809.69 | $3,179.85 | $4,439.20 | $3,035.15 | $4,275.68 | $2,246.10 |

| NEW AUGUSTA | 39462 | $3,930.59 | $6,104.92 | $5,027.66 | $4,560.02 | $2,895.77 | $4,074.28 | $2,930.19 | $3,768.14 | $2,083.71 |

| BYRAM | 39272 | $3,928.45 | $5,685.01 | $4,179.42 | $4,511.45 | $2,747.96 | $4,824.30 | $3,450.22 | $3,722.67 | $2,306.61 |

| MC CALL CREEK | 39647 | $3,921.02 | $4,738.71 | $4,843.48 | $4,809.69 | $3,179.85 | $4,514.40 | $3,098.52 | $3,937.45 | $2,246.10 |

| LYON | 38645 | $3,917.55 | $4,971.83 | $4,708.47 | $4,592.13 | $2,758.50 | $4,843.68 | $3,332.67 | $4,006.08 | $2,127.07 |

| CRYSTAL SPRINGS | 39059 | $3,917.41 | $6,127.59 | $4,465.85 | $4,987.59 | $2,598.83 | $4,282.61 | $3,140.64 | $3,812.45 | $1,923.75 |

| JACKSON | 39216 | $3,917.37 | $5,531.13 | $4,306.19 | $4,511.45 | $2,960.85 | $4,630.73 | $3,285.79 | $3,788.22 | $2,324.60 |

| ELLIOTT | 38926 | $3,913.97 | $4,584.66 | $4,291.72 | $4,279.76 | $2,921.61 | $6,042.94 | $3,231.82 | $4,035.49 | $1,923.75 |

| SANDY HOOK | 39478 | $3,912.19 | $4,803.76 | $4,912.62 | $4,757.59 | $2,904.76 | $4,949.20 | $3,015.30 | $3,705.90 | $2,248.35 |

| CLARKSDALE | 38614 | $3,910.45 | $4,971.83 | $4,708.47 | $4,592.13 | $2,758.50 | $4,696.93 | $3,274.31 | $4,154.36 | $2,127.07 |

| TERRY | 39170 | $3,909.79 | $5,685.01 | $4,179.42 | $4,580.96 | $2,747.96 | $4,779.74 | $3,545.51 | $3,546.90 | $2,212.86 |

| COAHOMA | 38617 | $3,907.93 | $4,800.81 | $4,708.47 | $4,592.13 | $2,758.50 | $4,966.56 | $3,303.85 | $4,006.08 | $2,127.07 |

| POPLARVILLE | 39470 | $3,906.10 | $4,897.64 | $4,647.79 | $4,804.74 | $2,972.56 | $4,839.96 | $3,108.63 | $3,770.35 | $2,207.10 |

| SEMINARY | 39479 | $3,906.08 | $5,937.03 | $4,726.58 | $4,561.97 | $2,904.76 | $4,214.54 | $3,135.65 | $3,844.40 | $1,923.75 |

| TUTWILER | 38963 | $3,905.77 | $4,971.83 | $4,708.47 | $4,592.13 | $2,592.31 | $4,567.43 | $3,261.85 | $4,304.35 | $2,247.83 |

| WINTERVILLE | 38782 | $3,905.29 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $6,051.98 | $3,092.19 | $3,579.15 | $2,127.07 |

| PUCKETT | 39151 | $3,904.26 | $5,952.13 | $4,073.21 | $4,987.59 | $2,666.99 | $4,125.63 | $3,132.64 | $4,191.49 | $2,104.35 |

| SIBLEY | 39165 | $3,901.71 | $4,733.37 | $4,843.48 | $4,522.87 | $3,408.49 | $4,498.32 | $3,257.71 | $3,859.95 | $2,089.52 |

| RAYMOND | 39154 | $3,901.26 | $5,602.15 | $4,179.42 | $4,580.96 | $2,747.96 | $4,635.35 | $3,667.53 | $3,583.89 | $2,212.86 |

| HARPERVILLE | 39080 | $3,899.88 | $4,733.37 | $4,837.80 | $4,522.87 | $2,523.40 | $6,109.19 | $2,749.21 | $3,799.47 | $1,923.75 |

| MEADVILLE | 39653 | $3,896.44 | $4,738.71 | $4,843.48 | $4,809.69 | $3,179.85 | $4,225.82 | $3,024.41 | $4,103.48 | $2,246.10 |

| JACKSON | 39269 | $3,895.61 | $5,685.01 | $4,306.19 | $4,511.45 | $2,747.96 | $4,466.03 | $3,475.39 | $3,657.35 | $2,315.50 |

| WESSON | 39191 | $3,894.35 | $5,776.88 | $4,465.85 | $4,987.59 | $2,598.83 | $4,223.77 | $3,239.71 | $3,938.40 | $1,923.75 |

| SMITHDALE | 39664 | $3,894.09 | $4,628.49 | $4,843.48 | $4,809.69 | $3,179.85 | $4,288.82 | $3,034.35 | $4,275.68 | $2,092.33 |

| CHARLESTON | 38921 | $3,893.53 | $4,971.83 | $4,708.47 | $4,592.13 | $2,592.31 | $4,658.85 | $3,301.31 | $4,075.50 | $2,247.83 |

| SWAN LAKE | 38958 | $3,892.34 | $4,971.83 | $3,693.89 | $4,279.76 | $2,592.31 | $6,042.94 | $3,303.85 | $4,006.32 | $2,247.83 |

| FRIARS POINT | 38631 | $3,890.85 | $4,971.83 | $4,708.47 | $4,592.13 | $2,758.50 | $5,025.33 | $3,377.77 | $3,565.68 | $2,127.07 |

| CLINTON | 39058 | $3,890.11 | $4,830.69 | $4,179.42 | $4,580.96 | $2,747.96 | $6,094.13 | $2,926.75 | $3,548.11 | $2,212.86 |

| PACE | 38764 | $3,887.91 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $6,051.98 | $2,914.98 | $3,914.43 | $2,127.07 |

| OCEAN SPRINGS | 39564 | $3,887.70 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $5,030.28 | $3,052.22 | $4,081.55 | $2,171.22 |

| MIDNIGHT | 39115 | $3,887.65 | $5,050.32 | $4,236.64 | $4,455.43 | $2,592.31 | $6,039.93 | $3,211.38 | $3,591.43 | $1,923.75 |

| JACKSON | 39206 | $3,878.24 | $5,531.13 | $4,050.47 | $4,511.45 | $2,960.85 | $4,441.33 | $3,449.05 | $3,757.06 | $2,324.60 |

| BUDE | 39630 | $3,878.24 | $4,738.71 | $4,843.48 | $4,809.69 | $3,179.85 | $4,225.82 | $3,074.00 | $3,908.28 | $2,246.10 |

| WAVELAND | 39576 | $3,878.23 | $4,894.47 | $4,249.19 | $4,791.37 | $2,903.45 | $4,926.39 | $3,122.42 | $3,912.76 | $2,225.77 |

| WINSTONVILLE | 38781 | $3,877.63 | $5,050.32 | $3,693.89 | $4,706.68 | $2,758.50 | $6,190.47 | $2,914.98 | $3,579.15 | $2,127.07 |

| SUMRALL | 39482 | $3,875.20 | $5,496.61 | $4,647.79 | $4,501.83 | $2,904.76 | $4,386.85 | $3,170.21 | $3,645.22 | $2,248.35 |

| COLLINS | 39428 | $3,874.34 | $5,937.03 | $4,726.58 | $4,561.97 | $2,904.76 | $4,191.82 | $3,122.34 | $3,626.43 | $1,923.75 |

| LUCEDALE | 39452 | $3,870.67 | $5,547.81 | $4,406.38 | $4,560.02 | $2,895.77 | $4,508.95 | $3,169.86 | $3,792.83 | $2,083.71 |

| LAMBERT | 38643 | $3,868.11 | $4,971.83 | $4,708.47 | $4,592.13 | $2,758.50 | $4,325.88 | $3,334.19 | $4,006.08 | $2,247.83 |

| BAY SAINT LOUIS | 39520 | $3,866.44 | $4,894.47 | $4,249.19 | $4,791.37 | $2,903.45 | $4,878.92 | $3,128.27 | $4,008.35 | $2,077.50 |

| SUMNER | 38957 | $3,863.48 | $5,050.32 | $4,708.47 | $4,279.76 | $2,592.31 | $4,784.42 | $3,238.40 | $4,006.32 | $2,247.83 |

| METCALFE | 38760 | $3,858.94 | $5,050.32 | $3,865.80 | $4,592.13 | $2,769.13 | $6,045.94 | $2,973.90 | $3,447.18 | $2,127.07 |

| RICHTON | 39476 | $3,858.15 | $5,615.87 | $5,027.66 | $4,560.02 | $2,895.77 | $3,659.76 | $2,981.14 | $4,041.24 | $2,083.71 |

| PEARLINGTON | 39572 | $3,857.61 | $4,894.47 | $4,249.19 | $4,791.37 | $2,903.45 | $4,785.19 | $3,003.07 | $4,008.35 | $2,225.77 |

| MOUNT OLIVE | 39119 | $3,855.45 | $5,937.03 | $4,726.58 | $4,561.97 | $2,904.76 | $4,407.48 | $3,028.69 | $3,353.36 | $1,923.75 |

| GEORGETOWN | 39078 | $3,854.09 | $5,776.88 | $4,465.85 | $4,987.59 | $2,598.83 | $4,475.95 | $3,064.15 | $3,539.68 | $1,923.75 |

| SONTAG | 39665 | $3,853.84 | $5,666.66 | $4,252.38 | $4,757.59 | $2,904.76 | $4,239.34 | $3,070.69 | $3,799.47 | $2,139.85 |

| ENID | 38927 | $3,850.63 | $4,971.83 | $4,708.47 | $4,592.13 | $2,592.31 | $4,345.69 | $3,451.76 | $3,895.03 | $2,247.83 |

| MOSS POINT | 39562 | $3,845.78 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $4,775.34 | $3,063.96 | $3,930.98 | $2,229.63 |

| DIAMONDHEAD | 39525 | $3,845.45 | $4,845.77 | $4,249.19 | $4,791.37 | $2,903.45 | $4,778.30 | $3,203.33 | $3,914.68 | $2,077.50 |

| BEAUMONT | 39423 | $3,842.30 | $5,294.06 | $5,027.66 | $4,560.02 | $2,895.77 | $4,200.56 | $2,908.45 | $3,768.14 | $2,083.71 |

| NEWHEBRON | 39140 | $3,841.08 | $5,776.88 | $4,252.38 | $4,757.59 | $2,904.76 | $4,413.87 | $2,943.59 | $3,539.68 | $2,139.85 |

| SHERARD | 38669 | $3,838.40 | $4,971.83 | $4,708.47 | $4,318.54 | $2,758.50 | $4,573.14 | $3,303.85 | $3,945.81 | $2,127.07 |

| SAUCIER | 39574 | $3,838.19 | $5,518.57 | $3,835.37 | $4,794.79 | $2,903.45 | $4,663.88 | $2,987.85 | $3,908.82 | $2,092.77 |

| MARKS | 38646 | $3,837.93 | $4,971.83 | $4,708.47 | $4,592.13 | $2,758.50 | $4,055.36 | $3,363.25 | $4,006.08 | $2,247.83 |

| SCOTT | 38772 | $3,834.98 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $6,051.98 | $2,914.98 | $3,490.94 | $2,127.07 |

| JACKSON | 39201 | $3,834.60 | $4,913.56 | $4,306.19 | $4,511.45 | $2,960.85 | $4,640.93 | $3,356.76 | $3,671.59 | $2,315.50 |

| BRAXTON | 39044 | $3,829.25 | $6,127.59 | $4,561.80 | $4,455.43 | $2,598.83 | $4,431.88 | $2,943.27 | $3,591.43 | $1,923.75 |

| DELTA CITY | 39061 | $3,826.84 | $5,050.32 | $3,865.80 | $4,987.59 | $2,769.13 | $4,512.17 | $3,490.20 | $3,812.45 | $2,127.07 |

| GULFPORT | 39507 | $3,826.06 | $5,157.06 | $3,835.37 | $4,794.79 | $2,903.45 | $4,701.80 | $3,033.88 | $4,052.03 | $2,130.13 |

| BENTONIA | 39040 | $3,824.41 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,466.11 | $3,396.36 | $3,839.79 | $2,249.27 |

| JAYESS | 39641 | $3,823.17 | $4,803.76 | $4,252.38 | $4,757.59 | $2,904.76 | $4,725.75 | $3,201.79 | $3,799.47 | $2,139.85 |

| PINOLA | 39149 | $3,818.60 | $6,127.59 | $4,561.80 | $4,455.43 | $2,598.83 | $4,481.22 | $2,860.50 | $3,539.68 | $1,923.75 |

| OAK VALE | 39656 | $3,814.87 | $4,628.49 | $4,252.38 | $4,757.59 | $2,904.76 | $4,809.44 | $3,186.45 | $3,840.01 | $2,139.85 |

| PARCHMAN | 38738 | $3,812.76 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $6,051.98 | $2,885.53 | $3,388.10 | $2,247.83 |

| JONESTOWN | 38639 | $3,811.84 | $4,971.83 | $4,708.47 | $4,465.68 | $2,758.50 | $4,363.81 | $3,353.04 | $3,746.34 | $2,127.07 |

| VANCLEAVE | 39565 | $3,811.40 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $4,737.69 | $3,064.18 | $3,825.29 | $2,097.72 |

| LULA | 38644 | $3,811.03 | $4,800.81 | $4,708.47 | $4,592.13 | $2,758.50 | $4,191.36 | $3,303.85 | $4,006.08 | $2,127.07 |

| BELEN | 38609 | $3,808.67 | $4,971.83 | $4,708.47 | $4,318.54 | $2,758.50 | $4,154.25 | $3,303.85 | $4,006.08 | $2,247.83 |

| LUMBERTON | 39455 | $3,807.38 | $5,480.64 | $4,647.79 | $4,501.83 | $2,773.49 | $4,399.42 | $3,094.64 | $3,537.79 | $2,023.48 |

| GULFPORT | 39503 | $3,806.41 | $5,222.62 | $3,835.37 | $4,794.79 | $2,903.45 | $4,824.98 | $2,950.33 | $3,840.63 | $2,079.11 |

| PURVIS | 39475 | $3,806.35 | $5,480.64 | $4,647.79 | $4,501.83 | $2,773.49 | $4,256.70 | $3,099.40 | $3,667.47 | $2,023.48 |

| BILOXI | 39530 | $3,805.23 | $4,976.87 | $3,835.37 | $4,794.79 | $2,903.45 | $4,682.32 | $3,154.22 | $4,003.42 | $2,091.39 |

| MC NEILL | 39457 | $3,804.09 | $5,142.81 | $4,647.79 | $4,560.02 | $2,972.56 | $3,915.41 | $3,402.54 | $3,768.14 | $2,023.48 |

| CASCILLA | 38920 | $3,803.75 | $4,584.66 | $4,708.47 | $4,592.13 | $2,592.31 | $4,358.40 | $3,270.73 | $4,075.50 | $2,247.83 |

| GULFPORT | 39501 | $3,803.48 | $4,976.87 | $3,835.37 | $4,794.79 | $2,903.45 | $4,648.19 | $3,161.11 | $3,914.01 | $2,194.04 |

| MORTON | 39117 | $3,803.32 | $5,685.01 | $4,837.80 | $4,455.43 | $2,534.32 | $4,257.27 | $3,047.80 | $3,685.17 | $1,923.75 |

| RALEIGH | 39153 | $3,803.11 | $6,127.59 | $4,837.80 | $4,455.43 | $2,534.32 | $4,061.15 | $2,930.89 | $3,553.93 | $1,923.75 |

| BUCKATUNNA | 39322 | $3,799.94 | $5,599.20 | $4,406.38 | $4,561.97 | $2,895.77 | $4,310.90 | $2,766.29 | $3,775.30 | $2,083.71 |

| MC HENRY | 39561 | $3,799.93 | $5,268.00 | $4,109.96 | $4,560.02 | $2,972.56 | $4,606.82 | $2,948.02 | $4,010.27 | $1,923.75 |

| PASCAGOULA | 39581 | $3,799.78 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $4,419.54 | $3,051.81 | $3,930.98 | $2,229.63 |

| GLENDORA | 38928 | $3,799.62 | $4,971.83 | $4,708.47 | $4,592.13 | $2,592.31 | $3,856.43 | $3,303.85 | $4,124.10 | $2,247.83 |

| OSYKA | 39657 | $3,798.18 | $4,628.49 | $4,413.77 | $4,757.59 | $3,179.85 | $4,223.63 | $2,949.88 | $4,139.93 | $2,092.33 |

| YAZOO CITY | 39194 | $3,796.49 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,225.48 | $3,490.14 | $3,763.32 | $2,249.27 |

| PASCAGOULA | 39567 | $3,796.13 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $4,419.54 | $3,022.61 | $3,930.98 | $2,229.63 |

| SATARTIA | 39162 | $3,792.33 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,382.28 | $3,203.44 | $3,859.95 | $2,249.27 |

| SUMMIT | 39666 | $3,791.10 | $4,803.76 | $4,413.77 | $4,757.59 | $2,904.76 | $4,272.18 | $2,967.91 | $4,116.48 | $2,092.33 |

| PULASKI | 39152 | $3,790.79 | $5,981.08 | $4,837.80 | $4,455.43 | $2,534.32 | $3,936.48 | $2,972.28 | $3,685.17 | $1,923.75 |

| MOSS POINT | 39563 | $3,790.24 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $4,441.59 | $2,953.40 | $3,930.98 | $2,229.63 |

| MONTICELLO | 39654 | $3,788.18 | $4,628.49 | $4,252.38 | $4,757.59 | $2,904.76 | $4,754.25 | $3,068.65 | $3,799.47 | $2,139.85 |

| CROWDER | 38622 | $3,786.36 | $4,971.83 | $4,146.65 | $4,592.13 | $2,758.50 | $4,406.76 | $3,303.85 | $3,863.33 | $2,247.83 |

| WAYNESBORO | 39367 | $3,785.18 | $5,599.20 | $4,406.38 | $4,561.97 | $2,895.77 | $4,230.87 | $2,728.25 | $3,775.30 | $2,083.71 |

| STATE LINE | 39362 | $3,783.41 | $5,615.87 | $4,406.38 | $4,560.02 | $2,895.77 | $4,180.43 | $2,756.99 | $3,768.14 | $2,083.71 |

| PERKINSTON | 39573 | $3,782.76 | $5,142.81 | $4,109.96 | $4,560.02 | $2,972.56 | $4,774.74 | $2,768.00 | $4,010.27 | $1,923.75 |

| DUBLIN | 38739 | $3,780.58 | $4,971.83 | $4,708.47 | $4,592.13 | $2,758.50 | $4,394.72 | $3,303.85 | $3,388.10 | $2,127.07 |

| GAUTIER | 39553 | $3,780.36 | $5,226.77 | $4,111.73 | $4,729.40 | $2,698.41 | $4,499.29 | $2,776.69 | $4,008.74 | $2,191.87 |

| BENTON | 39039 | $3,779.30 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,312.44 | $3,229.55 | $3,799.47 | $2,249.27 |

| MONEY | 38945 | $3,778.84 | $4,584.66 | $3,693.89 | $4,279.76 | $2,592.31 | $6,042.94 | $2,797.43 | $4,124.10 | $2,115.65 |

| SWIFTOWN | 38959 | $3,778.81 | $4,584.66 | $3,693.89 | $4,279.76 | $2,592.31 | $6,042.94 | $2,914.98 | $4,006.32 | $2,115.65 |

| OLIVE BRANCH | 38654 | $3,777.42 | $5,223.69 | $4,031.98 | $4,465.68 | $2,808.19 | $4,544.22 | $3,219.68 | $3,751.11 | $2,174.85 |

| NEELY | 39461 | $3,776.69 | $5,142.81 | $4,406.38 | $4,560.02 | $2,895.77 | $4,177.42 | $3,179.22 | $3,768.14 | $2,083.71 |

| HARRISVILLE | 39082 | $3,775.82 | $6,127.59 | $4,561.80 | $4,455.43 | $2,598.83 | $4,150.48 | $2,849.04 | $3,539.68 | $1,923.75 |

| MORGAN CITY | 38946 | $3,774.88 | $4,584.66 | $3,693.89 | $4,279.76 | $2,592.31 | $6,042.94 | $2,765.74 | $4,124.10 | $2,115.65 |

| MIZE | 39116 | $3,774.16 | $5,599.20 | $4,837.80 | $4,455.43 | $2,534.32 | $4,259.14 | $3,044.67 | $3,539.00 | $1,923.75 |

| PASS CHRISTIAN | 39571 | $3,773.31 | $4,953.46 | $3,835.37 | $4,794.79 | $2,903.45 | $4,917.38 | $2,865.81 | $3,836.93 | $2,079.28 |

| VAUGHAN | 39179 | $3,773.12 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,232.39 | $3,260.16 | $3,799.47 | $2,249.27 |

| GRACE | 38745 | $3,773.09 | $5,050.32 | $3,919.62 | $4,706.68 | $2,769.13 | $4,202.18 | $3,211.38 | $4,198.37 | $2,127.07 |

| VOSSBURG | 39366 | $3,770.60 | $5,768.73 | $4,431.58 | $4,455.43 | $2,534.32 | $4,095.16 | $2,942.37 | $3,853.54 | $2,083.71 |

| SARDIS | 38666 | $3,770.51 | $5,243.10 | $4,146.65 | $4,556.74 | $2,546.56 | $4,355.99 | $3,262.13 | $3,805.05 | $2,247.83 |

| COMO | 38619 | $3,766.41 | $5,243.10 | $4,146.65 | $4,556.74 | $2,546.56 | $4,328.89 | $3,164.39 | $3,897.11 | $2,247.83 |

| SLEDGE | 38670 | $3,766.40 | $4,846.94 | $4,001.43 | $4,592.13 | $2,758.50 | $4,272.19 | $3,303.50 | $4,108.65 | $2,247.83 |

| PEARL | 39208 | $3,766.27 | $5,685.01 | $4,050.47 | $4,511.45 | $2,666.99 | $4,243.89 | $3,181.44 | $3,691.04 | $2,099.87 |

| WALLS | 38680 | $3,765.54 | $5,223.69 | $4,031.98 | $4,465.68 | $2,554.86 | $4,501.03 | $3,393.54 | $3,778.70 | $2,174.85 |

| BELLEFONTAINE | 39737 | $3,764.74 | $4,562.00 | $4,046.98 | $4,194.64 | $2,956.33 | $6,045.94 | $2,742.54 | $3,645.77 | $1,923.75 |

| SOUTHAVEN | 38671 | $3,764.60 | $5,223.69 | $4,031.98 | $4,465.68 | $2,808.19 | $4,499.71 | $3,150.61 | $3,762.11 | $2,174.85 |

| JACKSON | 39211 | $3,763.62 | $5,531.13 | $4,050.47 | $4,306.81 | $2,960.85 | $4,440.07 | $3,246.56 | $3,457.42 | $2,115.66 |

| AVON | 38723 | $3,763.33 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $4,297.06 | $3,092.19 | $4,198.37 | $2,127.07 |

| BILOXI | 39531 | $3,761.10 | $4,976.87 | $3,835.37 | $4,794.79 | $2,903.45 | $4,564.16 | $3,049.45 | $3,964.55 | $2,000.16 |

| TIPPO | 38962 | $3,761.01 | $4,971.83 | $4,708.47 | $4,592.13 | $2,592.31 | $3,636.15 | $3,303.85 | $4,035.49 | $2,247.83 |

| BILOXI | 39532 | $3,759.95 | $5,065.84 | $3,835.37 | $4,794.79 | $2,903.45 | $4,636.98 | $3,043.92 | $3,751.19 | $2,048.06 |

| POPE | 38658 | $3,759.59 | $4,949.19 | $4,146.65 | $4,556.74 | $2,546.56 | $4,528.66 | $3,235.20 | $3,865.85 | $2,247.83 |

| ARCOLA | 38722 | $3,756.01 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $4,416.58 | $2,914.16 | $4,198.37 | $2,127.07 |

| LEAKESVILLE | 39451 | $3,753.90 | $5,142.81 | $4,406.38 | $4,560.02 | $2,895.77 | $4,177.42 | $2,996.92 | $3,768.14 | $2,083.71 |

| ROBINSONVILLE | 38664 | $3,753.89 | $5,094.73 | $4,001.43 | $4,592.13 | $2,758.50 | $4,160.45 | $2,932.09 | $4,243.96 | $2,247.83 |

| DUNDEE | 38626 | $3,753.83 | $4,800.81 | $4,001.43 | $4,592.13 | $2,758.50 | $4,339.27 | $3,302.80 | $4,108.65 | $2,127.07 |

| TAYLORSVILLE | 39168 | $3,753.10 | $5,599.20 | $4,837.80 | $4,455.43 | $2,534.32 | $4,241.44 | $3,006.11 | $3,277.47 | $2,073.07 |

| DIBERVILLE | 39540 | $3,752.09 | $5,065.84 | $3,835.37 | $4,794.79 | $2,903.45 | $4,556.18 | $3,057.57 | $3,801.07 | $2,002.42 |

| LONG BEACH | 39560 | $3,752.02 | $5,133.65 | $3,835.37 | $4,794.79 | $2,903.45 | $4,347.13 | $2,980.32 | $3,964.55 | $2,056.88 |

| STONEWALL | 39363 | $3,751.02 | $5,768.73 | $3,840.24 | $4,561.97 | $2,895.77 | $4,205.41 | $2,798.77 | $3,853.54 | $2,083.71 |

| FLORENCE | 39073 | $3,750.39 | $5,685.01 | $4,179.42 | $4,306.81 | $2,666.99 | $4,343.96 | $3,250.22 | $3,404.81 | $2,165.87 |

| MAGNOLIA | 39652 | $3,749.56 | $4,628.49 | $4,413.77 | $4,757.59 | $2,904.76 | $4,179.55 | $2,858.02 | $4,162.00 | $2,092.33 |

| ANGUILLA | 38721 | $3,746.71 | $5,050.32 | $3,919.62 | $4,706.68 | $2,769.13 | $4,137.66 | $3,064.87 | $4,198.37 | $2,127.07 |

| HOLLY BLUFF | 39088 | $3,744.73 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $3,846.78 | $3,203.44 | $4,014.62 | $2,249.27 |

| TYLERTOWN | 39667 | $3,741.79 | $4,628.49 | $4,413.77 | $4,757.59 | $2,904.76 | $4,179.55 | $2,982.63 | $3,927.68 | $2,139.85 |

| PAULDING | 39348 | $3,740.64 | $5,790.53 | $4,431.58 | $4,455.43 | $2,534.32 | $4,124.56 | $2,811.42 | $3,853.54 | $1,923.75 |

| FALCON | 38628 | $3,738.19 | $4,846.94 | $4,001.43 | $4,194.64 | $2,758.50 | $4,443.68 | $3,303.85 | $4,108.65 | $2,247.83 |

| SOUTHAVEN | 38672 | $3,737.03 | $5,223.69 | $4,031.98 | $4,465.68 | $2,808.19 | $4,399.18 | $3,190.41 | $3,673.35 | $2,103.81 |

| COURTLAND | 38620 | $3,735.76 | $4,949.19 | $4,146.65 | $4,556.74 | $2,546.56 | $4,343.15 | $3,230.14 | $3,865.85 | $2,247.83 |

| SHUBUTA | 39360 | $3,735.32 | $5,790.53 | $3,840.24 | $4,561.97 | $2,895.77 | $4,219.64 | $2,715.37 | $3,775.30 | $2,083.71 |

| CRENSHAW | 38621 | $3,733.97 | $5,017.94 | $4,146.65 | $4,592.13 | $2,546.56 | $4,251.12 | $3,206.21 | $3,863.33 | $2,247.83 |

| BATESVILLE | 38606 | $3,732.00 | $4,949.19 | $4,146.65 | $4,556.74 | $2,546.56 | $4,332.60 | $3,218.21 | $3,858.24 | $2,247.83 |

| WALTHALL | 39771 | $3,729.29 | $4,562.00 | $4,046.98 | $4,194.64 | $2,956.33 | $6,045.94 | $2,770.22 | $3,334.50 | $1,923.75 |

| BOGUE CHITTO | 39629 | $3,728.91 | $4,628.49 | $4,413.77 | $4,757.59 | $2,598.83 | $4,483.34 | $3,052.14 | $3,908.28 | $1,988.80 |

| QUITMAN | 39355 | $3,728.41 | $5,768.73 | $3,840.24 | $4,561.97 | $2,895.77 | $4,029.45 | $2,793.85 | $3,853.54 | $2,083.71 |

| BILOXI | 39534 | $3,726.87 | $4,976.87 | $3,835.37 | $4,794.79 | $2,903.45 | $4,482.99 | $3,118.80 | $3,751.19 | $1,951.48 |

| MCCOMB | 39648 | $3,726.10 | $4,628.49 | $4,413.77 | $4,757.59 | $2,904.76 | $4,152.97 | $2,926.24 | $3,932.64 | $2,092.33 |

| ENTERPRISE | 39330 | $3,725.47 | $5,768.73 | $3,840.24 | $4,561.97 | $2,895.77 | $3,959.06 | $2,852.43 | $3,841.83 | $2,083.71 |

| WEBB | 38966 | $3,725.45 | $4,949.19 | $4,708.47 | $4,194.64 | $2,592.31 | $3,802.99 | $3,184.07 | $4,124.10 | $2,247.83 |

| CLINTON | 39056 | $3,724.16 | $4,830.69 | $4,179.42 | $4,580.96 | $2,747.96 | $4,671.23 | $3,042.77 | $3,527.40 | $2,212.86 |

| BOLTON | 39041 | $3,723.62 | $4,733.37 | $4,179.42 | $4,580.96 | $2,747.96 | $4,600.32 | $3,110.49 | $3,623.59 | $2,212.86 |

| HORN LAKE | 38637 | $3,723.28 | $5,223.69 | $4,031.98 | $4,465.68 | $2,554.86 | $4,548.65 | $3,083.79 | $3,746.34 | $2,131.29 |

| FLORA | 39071 | $3,722.60 | $4,830.69 | $4,179.42 | $4,306.81 | $2,855.35 | $4,549.30 | $3,396.31 | $3,413.64 | $2,249.27 |

| PICKENS | 39146 | $3,721.72 | $4,723.01 | $4,465.85 | $4,522.87 | $2,921.61 | $4,232.39 | $3,184.77 | $3,799.47 | $1,923.75 |

| MENDENHALL | 39114 | $3,719.91 | $5,685.01 | $4,561.80 | $4,455.43 | $2,598.83 | $4,054.69 | $2,888.32 | $3,591.43 | $1,923.75 |

| TUNICA | 38676 | $3,719.33 | $5,094.73 | $4,001.43 | $4,592.13 | $2,758.50 | $3,954.49 | $2,871.28 | $4,234.22 | $2,247.83 |

| LAKE CORMORANT | 38641 | $3,719.02 | $5,094.73 | $4,031.98 | $4,465.68 | $2,554.86 | $4,489.72 | $3,176.53 | $3,763.83 | $2,174.85 |

| LEXINGTON | 39095 | $3,716.05 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,136.92 | $3,178.76 | $3,845.26 | $1,923.75 |

| BRANDON | 39042 | $3,715.66 | $5,685.01 | $4,073.21 | $4,306.81 | $2,666.99 | $4,427.52 | $3,186.97 | $3,339.14 | $2,039.59 |

| HEIDELBERG | 39439 | $3,715.21 | $5,790.53 | $4,431.58 | $4,455.43 | $2,534.32 | $3,985.89 | $2,796.80 | $3,654.07 | $2,073.07 |

| PACHUTA | 39347 | $3,715.17 | $5,768.73 | $3,840.24 | $4,561.97 | $2,895.77 | $3,981.01 | $2,736.35 | $3,853.54 | $2,083.71 |

| GOODMAN | 39079 | $3,713.87 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,204.69 | $3,139.37 | $3,799.47 | $1,923.75 |

| GREENVILLE | 38703 | $3,712.66 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $4,106.64 | $2,946.07 | $4,129.55 | $2,127.07 |

| EDWARDS | 39066 | $3,710.36 | $4,745.50 | $4,179.42 | $4,580.96 | $2,747.96 | $4,335.72 | $3,357.29 | $3,523.21 | $2,212.86 |

| SLATE SPRING | 38955 | $3,708.50 | $4,562.00 | $3,379.63 | $4,279.76 | $2,956.33 | $6,042.94 | $2,517.29 | $4,006.32 | $1,923.75 |

| RICHLAND | 39218 | $3,702.94 | $4,913.56 | $4,306.19 | $4,511.45 | $2,666.99 | $4,344.95 | $3,176.92 | $3,603.59 | $2,099.87 |

| PINEY WOODS | 39148 | $3,702.55 | $4,723.01 | $4,179.42 | $4,522.87 | $2,666.99 | $4,491.62 | $3,132.64 | $3,799.47 | $2,104.35 |

| TILLATOBA | 38961 | $3,702.54 | $4,971.83 | $4,146.65 | $4,194.64 | $2,592.31 | $4,181.62 | $3,249.97 | $4,035.49 | $2,247.83 |

| RUTH | 39662 | $3,702.34 | $4,628.49 | $4,413.77 | $4,757.59 | $2,598.83 | $4,383.29 | $3,048.50 | $3,799.47 | $1,988.80 |

| GRENADA | 38901 | $3,701.07 | $4,584.66 | $4,291.72 | $4,279.76 | $2,921.61 | $4,185.64 | $3,194.01 | $4,035.49 | $2,115.65 |

| OAKLAND | 38948 | $3,699.62 | $4,971.83 | $4,146.65 | $4,194.64 | $2,921.61 | $4,397.11 | $3,196.10 | $3,845.26 | $1,923.75 |

| MC LAIN | 39456 | $3,698.94 | $5,142.81 | $4,406.38 | $4,560.02 | $2,895.77 | $3,697.07 | $3,037.57 | $3,768.14 | $2,083.71 |

| NESBIT | 38651 | $3,698.93 | $5,094.73 | $4,031.98 | $4,465.68 | $2,554.86 | $4,381.45 | $3,191.44 | $3,696.47 | $2,174.85 |

| GREENVILLE | 38701 | $3,697.29 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $4,100.65 | $2,946.07 | $4,012.62 | $2,127.07 |

| CARTHAGE | 39051 | $3,696.62 | $4,733.37 | $4,837.80 | $4,455.43 | $2,523.40 | $4,172.17 | $3,082.64 | $3,844.40 | $1,923.75 |

| FLOWOOD | 39232 | $3,694.35 | $4,913.56 | $4,050.47 | $4,511.45 | $2,666.99 | $4,467.41 | $3,187.73 | $3,657.35 | $2,099.87 |

| SANDERSVILLE | 39477 | $3,690.13 | $4,715.31 | $4,406.38 | $4,560.02 | $2,534.32 | $4,250.68 | $2,939.99 | $4,041.24 | $2,073.07 |

| EASTABUCHIE | 39436 | $3,690.06 | $4,715.31 | $4,223.33 | $4,561.97 | $2,534.32 | $4,516.19 | $3,007.48 | $4,038.10 | $1,923.75 |

| WAYSIDE | 38780 | $3,689.71 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $4,327.36 | $3,092.19 | $3,579.15 | $2,127.07 |

| DURANT | 39063 | $3,689.07 | $4,733.37 | $4,465.85 | $4,522.87 | $2,921.61 | $4,087.99 | $3,087.40 | $3,769.73 | $1,923.75 |

| HERNANDO | 38632 | $3,682.39 | $5,094.73 | $4,031.98 | $4,465.68 | $2,554.86 | $4,255.84 | $2,940.12 | $4,012.12 | $2,103.81 |

| WIGGINS | 39577 | $3,682.18 | $5,142.81 | $4,109.96 | $4,560.02 | $2,972.56 | $4,181.27 | $2,761.84 | $3,805.22 | $1,923.75 |

| RIDGELAND | 39157 | $3,679.51 | $5,531.13 | $4,050.47 | $4,306.81 | $2,855.35 | $4,234.44 | $2,948.96 | $3,392.28 | $2,116.62 |

| OVETT | 39464 | $3,679.49 | $4,715.31 | $4,223.33 | $4,561.97 | $2,895.77 | $3,993.40 | $3,202.60 | $3,820.07 | $2,023.48 |

| BROOKHAVEN | 39601 | $3,677.90 | $4,628.49 | $4,413.77 | $4,757.59 | $2,598.83 | $4,093.27 | $3,034.19 | $3,908.28 | $1,988.80 |

| MAGEE | 39111 | $3,675.57 | $5,494.47 | $4,561.80 | $4,455.43 | $2,598.83 | $4,151.77 | $2,791.43 | $3,427.11 | $1,923.75 |

| SILVER CITY | 39166 | $3,675.49 | $5,050.32 | $4,236.64 | $4,522.87 | $2,592.31 | $4,158.74 | $3,156.00 | $3,763.32 | $1,923.75 |

| LOUISE | 39097 | $3,675.04 | $5,050.32 | $4,236.64 | $4,522.87 | $2,592.31 | $4,137.66 | $3,173.47 | $3,763.32 | $1,923.75 |

| CLARA | 39324 | $3,675.00 | $4,708.59 | $4,406.38 | $4,455.43 | $2,895.77 | $4,418.75 | $2,942.37 | $3,489.05 | $2,083.71 |

| LENA | 39094 | $3,674.46 | $4,730.40 | $4,837.80 | $4,455.43 | $2,523.40 | $4,497.85 | $3,109.71 | $3,317.33 | $1,923.75 |

| TCHULA | 39169 | $3,672.14 | $4,355.22 | $4,465.85 | $4,522.87 | $2,921.61 | $4,175.13 | $3,213.23 | $3,799.47 | $1,923.75 |

| BELZONI | 39038 | $3,664.36 | $5,050.32 | $4,236.64 | $4,522.87 | $2,592.31 | $3,829.41 | $3,106.67 | $4,052.89 | $1,923.75 |

| HOLLANDALE | 38748 | $3,662.26 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $3,680.18 | $2,900.55 | $4,198.37 | $2,127.07 |

| CHATHAM | 38731 | $3,661.77 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $3,484.59 | $3,092.19 | $4,198.37 | $2,127.07 |

| BRANDON | 39047 | $3,660.84 | $4,929.60 | $4,073.21 | $4,306.81 | $2,666.99 | $4,287.55 | $3,469.40 | $3,453.32 | $2,099.87 |

| CANTON | 39046 | $3,659.71 | $4,723.01 | $4,073.21 | $4,306.81 | $2,855.35 | $4,427.68 | $3,511.17 | $3,456.66 | $1,923.75 |

| LELAND | 38756 | $3,658.99 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $3,653.09 | $2,914.16 | $4,185.69 | $2,127.07 |

| CARY | 39054 | $3,657.05 | $5,050.32 | $3,919.62 | $4,455.43 | $2,769.13 | $3,600.27 | $3,490.20 | $3,844.40 | $2,127.07 |

| HOLCOMB | 38940 | $3,655.46 | $4,584.66 | $4,291.72 | $4,279.76 | $2,921.61 | $3,928.71 | $3,086.08 | $4,035.49 | $2,115.65 |

| CAMDEN | 39045 | $3,655.41 | $4,733.37 | $4,465.85 | $4,306.81 | $2,855.35 | $4,136.03 | $3,365.44 | $3,456.66 | $1,923.75 |

| STONEVILLE | 38776 | $3,653.82 | $5,050.32 | $3,865.80 | $4,592.13 | $2,769.13 | $4,132.75 | $3,092.19 | $3,601.13 | $2,127.07 |

| SARAH | 38665 | $3,651.72 | $4,971.83 | $4,146.65 | $4,318.54 | $2,546.56 | $4,072.30 | $2,879.65 | $4,146.92 | $2,131.29 |

| GLEN ALLAN | 38744 | $3,651.42 | $5,050.32 | $3,865.80 | $4,706.68 | $2,769.13 | $3,600.27 | $2,893.75 | $4,198.37 | $2,127.07 |

| SCOBEY | 38953 | $3,650.55 | $4,584.66 | $4,146.65 | $4,194.64 | $2,921.61 | $4,218.37 | $3,179.22 | $4,035.49 | $1,923.75 |

| ALLIGATOR | 38720 | $3,649.03 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $4,451.92 | $2,914.98 | $3,603.47 | $2,127.07 |

| PHILIPP | 38950 | $3,646.01 | $4,584.66 | $4,708.47 | $4,279.76 | $2,592.31 | $3,711.98 | $3,036.80 | $4,006.32 | $2,247.83 |

| WATER VALLEY | 38965 | $3,643.19 | $4,949.19 | $4,146.65 | $4,194.64 | $2,921.61 | $4,119.88 | $3,212.26 | $3,677.55 | $1,923.75 |

| WEST | 39192 | $3,639.14 | $4,584.66 | $4,465.85 | $4,522.87 | $2,921.61 | $3,863.05 | $3,061.57 | $3,769.73 | $1,923.75 |

| LAMAR | 38642 | $3,638.78 | $5,196.99 | $3,660.79 | $4,318.54 | $2,893.18 | $4,438.70 | $2,776.02 | $3,731.99 | $2,094.06 |

| BROOKLYN | 39425 | $3,638.61 | $4,715.31 | $4,109.96 | $4,501.83 | $2,895.77 | $4,240.81 | $2,931.26 | $3,790.20 | $1,923.75 |

| VICKSBURG | 39180 | $3,638.12 | $4,891.99 | $4,028.32 | $4,352.07 | $2,806.44 | $4,430.01 | $3,000.45 | $3,392.98 | $2,202.72 |

| DUNCAN | 38740 | $3,637.80 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $4,451.92 | $2,914.98 | $3,513.62 | $2,127.07 |

| LUDLOW | 39098 | $3,637.11 | $4,584.66 | $4,837.80 | $4,522.87 | $2,523.40 | $4,191.89 | $2,749.21 | $3,763.32 | $1,923.75 |

| ROLLING FORK | 39159 | $3,636.31 | $5,050.32 | $3,919.62 | $4,522.87 | $2,769.13 | $3,591.25 | $3,047.04 | $4,063.21 | $2,127.07 |

| MOUND BAYOU | 38762 | $3,632.23 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $4,019.62 | $2,901.92 | $3,914.43 | $2,127.07 |

| CRUGER | 38924 | $3,628.78 | $4,503.94 | $4,465.85 | $4,522.87 | $2,921.61 | $3,643.52 | $3,203.44 | $3,845.26 | $1,923.75 |

| PELAHATCHIE | 39145 | $3,625.04 | $4,929.60 | $4,073.21 | $4,306.81 | $2,666.99 | $4,373.30 | $3,157.40 | $3,388.68 | $2,104.35 |

| STAR | 39167 | $3,624.79 | $4,355.22 | $4,179.42 | $4,522.87 | $2,666.99 | $4,212.00 | $3,132.64 | $3,763.32 | $2,165.87 |

| MADDEN | 39109 | $3,624.08 | $4,685.49 | $4,837.80 | $4,194.64 | $2,523.40 | $3,896.67 | $3,086.49 | $3,844.40 | $1,923.75 |

| SENATOBIA | 38668 | $3,622.60 | $5,243.10 | $4,001.43 | $4,318.54 | $2,546.56 | $4,113.18 | $2,888.46 | $3,945.81 | $1,923.75 |

| COLDWATER | 38618 | $3,621.23 | $5,243.10 | $4,001.43 | $4,318.54 | $2,546.56 | $4,273.56 | $2,827.77 | $3,835.09 | $1,923.75 |

| FOREST | 39074 | $3,621.23 | $5,347.97 | $4,837.80 | $4,455.43 | $2,523.40 | $3,889.54 | $2,674.59 | $3,317.33 | $1,923.75 |

| THOMASTOWN | 39171 | $3,621.20 | $4,733.37 | $4,046.98 | $4,580.96 | $2,523.40 | $4,527.76 | $3,086.49 | $3,546.90 | $1,923.75 |

| ISOLA | 38754 | $3,620.77 | $5,050.32 | $4,236.64 | $4,522.87 | $2,592.31 | $3,622.89 | $2,909.25 | $4,108.11 | $1,923.75 |

| MC CARLEY | 38943 | $3,619.19 | $4,584.66 | $3,952.82 | $4,279.76 | $2,921.61 | $4,182.63 | $3,035.84 | $3,880.59 | $2,115.65 |

| CLEVELAND | 38733 | $3,619.01 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $4,145.99 | $2,914.98 | $3,669.17 | $2,127.07 |

| INDEPENDENCE | 38638 | $3,619.00 | $5,243.10 | $4,001.43 | $4,465.68 | $2,546.56 | $4,146.93 | $2,878.20 | $3,746.34 | $1,923.75 |

| SEBASTOPOL | 39359 | $3,618.76 | $4,711.59 | $4,837.80 | $4,455.43 | $2,523.40 | $3,821.55 | $2,749.21 | $3,927.40 | $1,923.75 |

| SHELBY | 38774 | $3,614.79 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $4,272.50 | $2,822.80 | $3,601.13 | $2,127.07 |

| MICHIGAN CITY | 38647 | $3,614.30 | $5,196.99 | $3,660.79 | $4,318.54 | $2,893.18 | $4,266.30 | $2,752.58 | $3,731.99 | $2,094.06 |

| ARKABUTLA | 38602 | $3,613.97 | $5,243.10 | $4,001.43 | $4,321.94 | $2,546.56 | $4,145.99 | $2,878.20 | $3,643.26 | $2,131.29 |

| VICKSBURG | 39183 | $3,612.05 | $4,879.89 | $4,028.32 | $4,352.07 | $2,806.44 | $4,338.73 | $3,201.28 | $3,159.21 | $2,130.47 |

| MOSS | 39460 | $3,610.80 | $4,539.07 | $4,223.33 | $4,561.97 | $2,534.32 | $4,181.54 | $2,942.37 | $3,820.07 | $2,083.71 |

| ARTESIA | 39736 | $3,605.47 | $4,286.97 | $3,494.31 | $4,194.64 | $2,410.97 | $6,015.84 | $2,749.21 | $3,803.71 | $1,888.14 |

| LAKE | 39092 | $3,600.62 | $4,688.94 | $4,837.80 | $4,455.43 | $2,523.40 | $3,818.54 | $2,693.95 | $3,863.19 | $1,923.75 |

| UNIVERSITY | 38677 | $3,600.13 | $5,196.99 | $3,660.79 | $4,321.94 | $2,536.40 | $4,129.53 | $2,839.24 | $4,234.22 | $1,881.96 |

| VALLEY PARK | 39177 | $3,598.46 | $4,733.37 | $3,919.62 | $4,522.87 | $2,769.13 | $3,875.07 | $3,211.38 | $3,629.17 | $2,127.07 |

| PETAL | 39465 | $3,595.96 | $4,715.31 | $4,109.96 | $4,501.83 | $2,673.60 | $4,296.54 | $2,871.49 | $3,575.49 | $2,023.48 |

| MONTPELIER | 39754 | $3,594.89 | $4,286.97 | $3,615.39 | $3,806.80 | $2,956.33 | $6,006.80 | $2,517.29 | $3,645.77 | $1,923.75 |

| ROSE HILL | 39356 | $3,594.35 | $4,708.59 | $4,431.58 | $4,455.43 | $2,534.32 | $3,929.66 | $2,917.90 | $3,853.54 | $1,923.75 |

| GORE SPRINGS | 38929 | $3,592.64 | $4,286.97 | $4,146.65 | $4,279.76 | $2,921.61 | $4,097.07 | $3,049.85 | $4,035.49 | $1,923.75 |

| ELLISVILLE | 39437 | $3,591.52 | $4,715.31 | $4,223.33 | $4,561.97 | $2,534.32 | $4,023.91 | $2,780.18 | $3,820.07 | $2,073.07 |

| MERIDIAN | 39301 | $3,590.48 | $5,768.73 | $3,704.64 | $4,097.05 | $2,895.77 | $4,120.87 | $2,874.24 | $3,189.60 | $2,072.95 |

| MOSELLE | 39459 | $3,588.62 | $4,715.31 | $4,223.33 | $4,561.97 | $2,534.32 | $4,119.04 | $2,811.19 | $3,820.07 | $1,923.75 |

| REDWOOD | 39156 | $3,588.08 | $4,733.37 | $4,028.32 | $4,352.07 | $2,806.44 | $4,402.60 | $3,092.19 | $3,159.21 | $2,130.47 |

| COFFEEVILLE | 38922 | $3,587.49 | $4,309.62 | $4,146.65 | $4,194.64 | $2,921.61 | $4,100.07 | $3,068.13 | $4,035.49 | $1,923.75 |

| TREBLOC | 38875 | $3,587.22 | $4,286.97 | $3,484.78 | $4,318.54 | $2,956.33 | $6,006.80 | $2,598.08 | $3,122.51 | $1,923.75 |

| MADISON | 39110 | $3,585.80 | $4,772.75 | $4,050.47 | $4,306.81 | $2,855.35 | $4,117.96 | $2,999.52 | $3,362.89 | $2,220.64 |

| MAYHEW | 39753 | $3,585.73 | $4,286.97 | $3,494.31 | $4,194.64 | $2,410.97 | $6,015.84 | $2,749.21 | $3,645.77 | $1,888.14 |

| BYHALIA | 38611 | $3,585.69 | $5,094.73 | $3,660.79 | $4,318.54 | $2,536.40 | $4,318.94 | $2,915.82 | $3,916.58 | $1,923.75 |

| LAUREL | 39443 | $3,584.35 | $4,715.31 | $4,223.33 | $4,561.97 | $2,534.32 | $4,036.61 | $2,876.15 | $3,654.07 | $2,073.07 |

| DE KALB | 39328 | $3,581.19 | $4,688.94 | $3,901.14 | $4,194.64 | $2,956.33 | $4,066.73 | $2,990.56 | $3,927.40 | $1,923.75 |

| WALNUT GROVE | 39189 | $3,580.07 | $4,688.94 | $4,837.80 | $4,455.43 | $2,523.40 | $3,880.50 | $3,013.43 | $3,317.33 | $1,923.75 |

| MC COOL | 39108 | $3,579.90 | $4,685.49 | $4,046.98 | $4,194.64 | $2,956.33 | $4,146.42 | $2,841.21 | $3,844.40 | $1,923.75 |

| MAYERSVILLE | 39113 | $3,577.34 | $5,050.32 | $3,919.62 | $4,522.87 | $2,769.13 | $3,591.25 | $3,211.38 | $3,427.11 | $2,127.07 |

| PORTERVILLE | 39352 | $3,577.24 | $4,688.94 | $3,901.14 | $4,194.64 | $2,956.33 | $4,059.29 | $2,966.45 | $3,927.40 | $1,923.75 |

| HATTIESBURG | 39401 | $3,576.03 | $4,715.31 | $4,109.96 | $4,501.83 | $2,673.60 | $4,247.66 | $2,830.48 | $3,633.79 | $1,895.59 |

| SANDHILL | 39161 | $3,572.20 | $4,707.28 | $4,073.21 | $4,194.64 | $2,666.99 | $3,792.59 | $3,132.64 | $3,844.40 | $2,165.87 |

| SCOOBA | 39358 | $3,571.39 | $4,662.83 | $3,901.14 | $4,194.64 | $2,956.33 | $3,990.05 | $3,014.98 | $3,927.40 | $1,923.75 |

| HATTIESBURG | 39402 | $3,570.70 | $4,715.31 | $4,109.96 | $4,501.83 | $2,673.60 | $4,175.32 | $2,742.92 | $3,751.11 | $1,895.59 |

| WHEELER | 38880 | $3,569.73 | $4,645.52 | $3,484.78 | $4,194.64 | $2,376.76 | $6,061.00 | $2,598.08 | $3,317.33 | $1,879.74 |

| HATTIESBURG | 39406 | $3,569.43 | $4,715.31 | $4,109.96 | $4,501.83 | $2,673.60 | $4,175.32 | $2,732.68 | $3,751.11 | $1,895.59 |

| COILA | 38923 | $3,568.65 | $4,584.66 | $3,952.82 | $4,279.76 | $2,921.61 | $3,658.22 | $2,990.05 | $4,046.41 | $2,115.65 |

| ASHLAND | 38603 | $3,568.33 | $5,196.99 | $3,660.79 | $4,318.54 | $2,893.18 | $4,082.12 | $2,735.29 | $3,565.68 | $2,094.06 |

| DUCK HILL | 38925 | $3,567.82 | $4,584.66 | $3,952.82 | $4,279.76 | $2,921.61 | $3,650.99 | $3,001.56 | $4,035.49 | $2,115.65 |

| BENOIT | 38725 | $3,567.45 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $3,802.76 | $2,845.89 | $3,669.07 | $2,127.07 |

| PRESTON | 39354 | $3,566.10 | $4,662.83 | $3,901.14 | $4,194.64 | $2,956.33 | $4,153.63 | $3,000.76 | $3,735.68 | $1,923.75 |

| HOLLY SPRINGS | 38635 | $3,565.45 | $5,243.10 | $3,660.79 | $4,318.54 | $2,536.40 | $4,214.62 | $2,793.16 | $3,833.22 | $1,923.75 |

| TULA | 38675 | $3,565.33 | $5,196.99 | $3,660.79 | $4,318.54 | $2,536.40 | $4,439.08 | $2,696.43 | $3,792.50 | $1,881.96 |

| GUNNISON | 38746 | $3,565.13 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $4,019.62 | $2,765.88 | $3,513.62 | $2,127.07 |

| LAUREL | 39440 | $3,563.50 | $4,715.31 | $4,223.33 | $4,561.97 | $2,534.32 | $3,780.72 | $2,909.03 | $3,710.26 | $2,073.07 |

| MARION | 39342 | $3,563.25 | $5,768.73 | $3,704.64 | $4,097.05 | $2,644.77 | $4,120.87 | $2,960.44 | $3,199.34 | $2,010.15 |

| RED BANKS | 38661 | $3,563.18 | $5,094.73 | $3,660.79 | $4,318.54 | $2,536.40 | $4,214.62 | $2,944.78 | $3,811.81 | $1,923.75 |

| DREW | 38737 | $3,557.39 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $4,134.01 | $2,881.29 | $3,388.10 | $2,127.07 |

| KOSCIUSKO | 39090 | $3,555.26 | $4,685.49 | $4,046.98 | $4,194.64 | $2,956.33 | $3,995.00 | $2,795.52 | $3,844.40 | $1,923.75 |

| VICTORIA | 38679 | $3,554.17 | $5,196.99 | $3,660.79 | $4,465.68 | $2,536.40 | $3,719.10 | $2,696.43 | $4,234.22 | $1,923.75 |

| BEULAH | 38726 | $3,553.33 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $3,641.31 | $2,914.98 | $3,648.42 | $2,127.07 |

| LOUIN | 39338 | $3,551.31 | $4,730.40 | $4,431.58 | $4,455.43 | $2,534.32 | $3,929.66 | $2,851.39 | $3,553.93 | $1,923.75 |

| BAY SPRINGS | 39422 | $3,551.23 | $4,730.40 | $4,431.58 | $4,455.43 | $2,534.32 | $4,184.36 | $2,872.51 | $3,277.47 | $1,923.75 |

| STRINGER | 39481 | $3,550.30 | $4,539.07 | $4,431.58 | $4,455.43 | $2,534.32 | $4,184.36 | $2,896.43 | $3,277.47 | $2,083.71 |

| TOOMSUBA | 39364 | $3,550.22 | $5,768.73 | $3,704.64 | $4,097.05 | $2,644.77 | $3,989.71 | $2,890.32 | $3,330.24 | $1,976.27 |

| SOSO | 39480 | $3,547.87 | $4,715.31 | $4,223.33 | $4,561.97 | $2,534.32 | $4,048.19 | $2,949.31 | $3,277.47 | $2,073.07 |

| CLEVELAND | 38732 | $3,547.21 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $3,603.96 | $2,882.62 | $3,669.17 | $2,127.07 |

| OXFORD | 38655 | $3,546.16 | $5,196.99 | $3,660.79 | $4,321.94 | $2,536.40 | $4,129.53 | $2,867.95 | $3,773.77 | $1,881.96 |

| CARROLLTON | 38917 | $3,545.33 | $4,584.66 | $3,952.82 | $4,279.76 | $2,921.61 | $3,591.68 | $3,035.84 | $3,880.59 | $2,115.65 |

| LOUISVILLE | 39339 | $3,545.05 | $4,662.83 | $3,901.14 | $4,194.64 | $2,956.33 | $4,033.05 | $2,884.94 | $3,803.71 | $1,923.75 |

| MERIGOLD | 38759 | $3,536.26 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $3,739.13 | $2,881.89 | $3,447.18 | $2,127.07 |

| MACON | 39341 | $3,535.00 | $4,662.83 | $3,901.14 | $4,194.64 | $2,956.33 | $4,121.10 | $3,220.98 | $3,299.27 | $1,923.75 |

| ETHEL | 39067 | $3,533.98 | $4,685.49 | $4,046.98 | $4,194.64 | $2,956.33 | $3,815.65 | $2,804.58 | $3,844.40 | $1,923.75 |

| WEIR | 39772 | $3,533.04 | $4,309.62 | $4,046.98 | $4,194.64 | $2,956.33 | $3,995.64 | $2,770.22 | $4,067.12 | $1,923.75 |

| NOXAPATER | 39346 | $3,531.74 | $4,662.83 | $3,901.14 | $4,194.64 | $2,956.33 | $3,977.84 | $2,901.68 | $3,735.68 | $1,923.75 |

| MOUNT PLEASANT | 38649 | $3,531.38 | $5,243.10 | $3,660.79 | $4,194.64 | $2,536.40 | $4,263.93 | $2,696.43 | $3,731.99 | $1,923.75 |

| STEWART | 39767 | $3,530.20 | $4,286.97 | $3,952.82 | $4,279.76 | $2,921.61 | $3,496.26 | $3,092.22 | $4,096.28 | $2,115.65 |

| ABBEVILLE | 38601 | $3,529.60 | $5,196.99 | $3,660.79 | $4,321.94 | $2,536.40 | $4,079.58 | $2,703.79 | $3,643.26 | $2,094.06 |

| TAYLOR | 38673 | $3,529.00 | $4,949.19 | $3,660.79 | $4,321.94 | $2,536.40 | $4,116.13 | $2,991.80 | $3,773.77 | $1,881.96 |

| ROSEDALE | 38769 | $3,528.71 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $3,641.31 | $2,718.08 | $3,648.42 | $2,127.07 |

| BOYLE | 38730 | $3,526.44 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $3,603.96 | $2,832.94 | $3,552.73 | $2,127.07 |

| SALLIS | 39160 | $3,524.48 | $4,707.28 | $4,046.98 | $4,194.64 | $2,956.33 | $3,783.68 | $2,738.82 | $3,844.40 | $1,923.75 |

| SHUQUALAK | 39361 | $3,523.19 | $4,662.83 | $3,901.14 | $4,194.64 | $2,956.33 | $4,153.63 | $3,093.95 | $3,299.27 | $1,923.75 |

| WATERFORD | 38685 | $3,521.01 | $5,196.99 | $3,660.79 | $4,318.54 | $2,536.40 | $4,191.95 | $2,696.43 | $3,643.26 | $1,923.75 |

| GREENWOOD | 38930 | $3,515.83 | $4,584.66 | $3,693.89 | $4,279.76 | $2,921.61 | $3,567.50 | $2,957.25 | $4,006.32 | $2,115.65 |

| POTTS CAMP | 38659 | $3,515.40 | $5,196.99 | $3,660.79 | $4,318.54 | $2,536.40 | $4,131.26 | $2,623.48 | $3,731.99 | $1,923.75 |

| MC ADAMS | 39107 | $3,515.10 | $4,707.28 | $4,046.98 | $4,194.64 | $2,956.33 | $3,758.27 | $2,770.22 | $3,763.32 | $1,923.75 |

| DODDSVILLE | 38736 | $3,514.71 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $3,656.01 | $2,914.98 | $3,490.94 | $2,127.07 |

| HICKORY FLAT | 38633 | $3,512.62 | $4,921.93 | $3,660.79 | $4,318.54 | $2,893.18 | $3,801.90 | $2,678.60 | $3,731.99 | $2,094.06 |

| SUNFLOWER | 38778 | $3,512.44 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $3,744.72 | $2,719.91 | $3,579.15 | $2,127.07 |

| RULEVILLE | 38771 | $3,511.46 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $3,656.01 | $2,889.05 | $3,490.94 | $2,127.07 |

| MINTER CITY | 38944 | $3,510.10 | $4,584.66 | $3,693.89 | $4,279.76 | $2,592.31 | $3,833.72 | $2,856.69 | $4,124.10 | $2,115.65 |

| ACKERMAN | 39735 | $3,507.47 | $4,286.97 | $4,046.98 | $4,194.64 | $2,956.33 | $4,021.95 | $2,825.43 | $3,803.71 | $1,923.75 |

| SHAW | 38773 | $3,507.10 | $5,050.32 | $3,693.89 | $4,592.13 | $2,758.50 | $3,496.93 | $2,799.31 | $3,538.66 | $2,127.07 |

| BROOKSVILLE | 39739 | $3,505.06 | $4,662.83 | $3,901.14 | $4,194.64 | $2,956.33 | $3,694.62 | $3,128.79 | $3,578.39 | $1,923.75 |

| ALGOMA | 38820 | $3,502.51 | $4,388.22 | $3,484.78 | $4,194.64 | $2,376.76 | $6,024.88 | $2,598.08 | $2,999.66 | $1,953.10 |

| KILMICHAEL | 39747 | $3,501.38 | $4,286.97 | $3,952.82 | $4,279.76 | $2,921.61 | $3,496.26 | $2,861.73 | $4,096.28 | $2,115.65 |

| FRENCH CAMP | 39745 | $3,491.89 | $4,309.62 | $4,046.98 | $4,194.64 | $2,956.33 | $3,675.66 | $2,761.07 | $4,067.12 | $1,923.75 |

| FALKNER | 38629 | $3,489.04 | $4,809.80 | $3,660.79 | $4,318.54 | $2,893.18 | $3,930.40 | $2,639.83 | $3,565.68 | $2,094.06 |

| MOORHEAD | 38761 | $3,488.52 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $3,597.93 | $2,675.37 | $3,579.15 | $2,127.07 |

| HICKORY | 39332 | $3,483.53 | $4,688.94 | $3,880.71 | $4,455.43 | $2,534.32 | $3,848.13 | $2,685.20 | $3,851.75 | $1,923.75 |

| EUPORA | 39744 | $3,482.78 | $4,286.97 | $4,046.98 | $4,194.64 | $2,956.33 | $3,652.34 | $2,734.09 | $4,067.12 | $1,923.75 |

| INVERNESS | 38753 | $3,479.37 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $3,534.94 | $2,665.16 | $3,579.15 | $2,127.07 |

| PARIS | 38949 | $3,474.25 | $4,674.15 | $3,660.79 | $4,321.94 | $2,536.40 | $4,119.14 | $2,696.43 | $3,861.38 | $1,923.75 |

| LITTLE ROCK | 39337 | $3,471.13 | $4,688.94 | $3,880.71 | $4,455.43 | $2,534.32 | $3,847.02 | $2,607.29 | $3,831.56 | $1,923.75 |

| MERIDIAN | 39307 | $3,469.69 | $4,708.59 | $3,704.64 | $4,097.05 | $2,644.77 | $3,957.78 | $3,117.06 | $3,454.71 | $2,072.95 |

| INDIANOLA | 38751 | $3,465.74 | $5,050.32 | $3,693.89 | $4,592.13 | $2,592.31 | $3,408.89 | $2,682.13 | $3,579.15 | $2,127.07 |

| WINONA | 38967 | $3,462.61 | $4,309.62 | $3,952.82 | $4,279.76 | $2,921.61 | $3,540.34 | $2,951.92 | $3,629.17 | $2,115.65 |

| SIDON | 38954 | $3,461.84 | $4,355.22 | $3,952.82 | $4,279.76 | $2,592.31 | $3,643.52 | $2,749.14 | $4,006.32 | $2,115.65 |

| ITTA BENA | 38941 | $3,459.81 | $4,584.66 | $3,693.89 | $4,279.76 | $2,592.31 | $3,646.53 | $2,759.36 | $4,006.32 | $2,115.65 |

| CHUNKY | 39323 | $3,452.16 | $4,708.59 | $3,880.71 | $4,455.43 | $2,534.32 | $3,918.02 | $2,707.45 | $3,489.05 | $1,923.75 |

| VAIDEN | 39176 | $3,449.52 | $4,309.62 | $3,952.82 | $4,279.76 | $2,921.61 | $3,526.98 | $2,860.57 | $3,629.17 | $2,115.65 |

| SCHLATER | 38952 | $3,445.67 | $4,355.22 | $3,693.89 | $4,279.76 | $2,592.31 | $3,711.98 | $2,810.23 | $4,006.32 | $2,115.65 |

| WALNUT | 38683 | $3,443.86 | $4,809.80 | $3,660.79 | $4,318.54 | $2,893.18 | $3,909.86 | $2,644.79 | $3,434.21 | $1,879.74 |

| BANNER | 38913 | $3,442.80 | $4,674.15 | $3,379.63 | $4,194.64 | $2,956.33 | $4,001.59 | $2,550.94 | $3,861.38 | $1,923.75 |

| NEWTON | 39345 | $3,441.63 | $4,688.94 | $3,880.71 | $4,455.43 | $2,534.32 | $3,848.13 | $2,653.66 | $3,548.11 | $1,923.75 |

| IUKA | 38852 | $3,441.34 | $4,388.22 | $3,858.85 | $4,318.54 | $2,893.18 | $3,987.77 | $2,647.29 | $3,557.11 | $1,879.74 |

| BURNSVILLE | 38833 | $3,435.53 | $4,388.22 | $3,858.85 | $4,318.54 | $2,893.18 | $3,993.80 | $2,594.79 | $3,557.11 | $1,879.74 |

| BAILEY | 39320 | $3,435.11 | $4,688.94 | $3,704.64 | $4,097.05 | $2,644.77 | $4,120.92 | $2,952.24 | $3,199.34 | $2,072.95 |

| PHILADELPHIA | 39350 | $3,433.57 | $4,688.94 | $3,704.64 | $4,455.43 | $2,523.40 | $3,998.76 | $2,831.17 | $3,342.49 | $1,923.75 |

| DALEVILLE | 39326 | $3,433.51 | $4,688.94 | $3,704.64 | $4,097.05 | $2,644.77 | $4,213.65 | $2,878.20 | $3,288.73 | $1,952.10 |

| TIPLERSVILLE | 38674 | $3,432.60 | $4,663.27 | $3,660.79 | $4,318.54 | $2,893.18 | $3,895.17 | $2,696.43 | $3,453.69 | $1,879.74 |

| RIPLEY | 38663 | $3,430.33 | $4,663.27 | $3,660.79 | $4,318.54 | $2,893.18 | $3,715.71 | $2,643.42 | $3,453.69 | $2,094.06 |

| LAUDERDALE | 39335 | $3,428.04 | $4,688.94 | $3,704.64 | $4,097.05 | $2,644.77 | $4,147.53 | $2,900.53 | $3,288.73 | $1,952.10 |

| MANTEE | 39751 | $3,427.87 | $4,286.97 | $4,046.98 | $4,194.64 | $2,956.33 | $3,652.34 | $2,716.19 | $3,645.77 | $1,923.75 |

| CONEHATTA | 39057 | $3,425.08 | $4,688.94 | $3,880.71 | $4,455.43 | $2,534.32 | $3,762.48 | $2,606.89 | $3,548.11 | $1,923.75 |

| MATHISTON | 39752 | $3,422.43 | $4,286.97 | $4,046.98 | $4,194.64 | $2,956.33 | $3,652.34 | $2,672.65 | $3,645.77 | $1,923.75 |

| DECATUR | 39327 | $3,422.39 | $4,688.94 | $3,880.71 | $4,455.43 | $2,534.32 | $3,765.49 | $2,582.36 | $3,548.11 | $1,923.75 |

| DENNIS | 38838 | $3,419.25 | $4,388.22 | $3,858.85 | $4,318.54 | $2,893.18 | $3,902.78 | $2,572.21 | $3,540.48 | $1,879.74 |

| BELMONT | 38827 | $3,415.14 | $4,388.22 | $3,858.85 | $4,318.54 | $2,893.18 | $3,902.78 | $2,539.35 | $3,540.48 | $1,879.74 |

| UNION | 39365 | $3,414.63 | $4,688.94 | $3,704.64 | $4,455.43 | $2,534.32 | $3,765.49 | $2,696.41 | $3,548.11 | $1,923.75 |

| THAXTON | 38871 | $3,412.67 | $5,196.99 | $3,484.78 | $4,194.64 | $2,376.76 | $3,946.19 | $2,598.08 | $3,550.86 | $1,953.10 |

| BLUE MOUNTAIN | 38610 | $3,410.42 | $4,388.22 | $3,660.79 | $4,318.54 | $2,893.18 | $3,820.66 | $2,654.24 | $3,453.69 | $2,094.06 |

| MERIDIAN | 39305 | $3,408.00 | $4,708.59 | $3,704.64 | $4,097.05 | $2,644.77 | $3,957.78 | $2,975.60 | $3,199.34 | $1,976.27 |

| LAWRENCE | 39336 | $3,406.58 | $4,708.59 | $3,880.71 | $4,455.43 | $2,534.32 | $3,736.09 | $2,696.43 | $3,317.33 | $1,923.75 |

| RIENZI | 38865 | $3,394.09 | $4,388.22 | $3,484.78 | $4,318.54 | $2,893.18 | $3,995.22 | $2,635.93 | $3,557.11 | $1,879.74 |

| GOLDEN | 38847 | $3,392.76 | $4,645.52 | $3,858.85 | $4,318.54 | $2,376.76 | $3,902.78 | $2,619.46 | $3,540.48 | $1,879.74 |

| COLLINSVILLE | 39325 | $3,391.49 | $4,688.94 | $3,704.64 | $4,097.05 | $2,644.77 | $3,870.44 | $2,830.54 | $3,371.82 | $1,923.75 |

| HAMILTON | 39746 | $3,383.81 | $4,286.97 | $3,494.31 | $4,194.64 | $2,956.33 | $4,127.19 | $2,728.33 | $3,358.94 | $1,923.75 |

| CORINTH | 38834 | $3,383.63 | $4,388.22 | $3,484.78 | $4,318.54 | $2,893.18 | $3,826.15 | $2,721.30 | $3,557.11 | $1,879.74 |

| GLEN | 38846 | $3,382.11 | $4,388.22 | $3,484.78 | $4,318.54 | $2,893.18 | $3,863.34 | $2,671.96 | $3,557.11 | $1,879.74 |

| MYRTLE | 38650 | $3,381.54 | $4,921.93 | $3,484.78 | $4,194.64 | $2,376.76 | $3,967.42 | $2,570.82 | $3,582.85 | $1,953.10 |

| DUMAS | 38625 | $3,374.28 | $4,388.22 | $3,660.79 | $4,318.54 | $2,893.18 | $3,703.67 | $2,696.43 | $3,453.69 | $1,879.74 |

| TISHOMINGO | 38873 | $3,370.72 | $4,388.22 | $3,858.85 | $4,318.54 | $2,893.18 | $3,914.31 | $2,590.43 | $3,122.51 | $1,879.74 |

| GATTMAN | 38844 | $3,369.73 | $4,286.97 | $3,494.31 | $4,194.64 | $2,956.33 | $3,993.71 | $2,749.21 | $3,358.94 | $1,923.75 |

| BRUCE | 38915 | $3,366.35 | $4,286.97 | $3,379.63 | $4,194.64 | $2,956.33 | $3,732.95 | $2,595.20 | $3,861.38 | $1,923.75 |

| CALHOUN CITY | 38916 | $3,364.61 | $4,286.97 | $3,379.63 | $4,194.64 | $2,956.33 | $3,686.06 | $2,628.15 | $3,861.38 | $1,923.75 |

| PLANTERSVILLE | 38862 | $3,357.07 | $4,645.52 | $3,484.78 | $4,018.35 | $2,376.76 | $3,917.15 | $2,717.52 | $3,759.16 | $1,937.35 |

| BIG CREEK | 38914 | $3,357.04 | $4,286.97 | $3,379.63 | $4,194.64 | $2,956.33 | $3,736.31 | $2,517.29 | $3,861.38 | $1,923.75 |

| ETTA | 38627 | $3,353.55 | $4,775.39 | $3,484.78 | $4,194.64 | $2,376.76 | $3,967.42 | $2,525.50 | $3,550.86 | $1,953.10 |

| SHERMAN | 38869 | $3,350.42 | $4,388.22 | $3,484.78 | $4,194.64 | $2,376.76 | $4,155.75 | $2,598.08 | $3,681.40 | $1,923.75 |

| BOONEVILLE | 38829 | $3,346.49 | $4,645.52 | $3,484.78 | $4,318.54 | $2,376.76 | $3,884.35 | $2,628.37 | $3,553.89 | $1,879.74 |

| TREMONT | 38876 | $3,343.84 | $4,645.52 | $3,494.31 | $4,318.54 | $2,376.76 | $3,902.78 | $2,592.63 | $3,540.48 | $1,879.74 |

| MANTACHIE | 38855 | $3,336.26 | $4,645.52 | $3,494.31 | $4,318.54 | $2,376.76 | $3,852.37 | $2,665.45 | $3,457.38 | $1,879.74 |

| VAN VLEET | 38877 | $3,334.47 | $4,286.97 | $3,484.78 | $4,194.64 | $2,956.33 | $3,690.72 | $2,598.08 | $3,540.48 | $1,923.75 |

| PITTSBORO | 38951 | $3,333.71 | $4,286.97 | $3,379.63 | $4,194.64 | $2,956.33 | $3,499.95 | $2,567.02 | $3,861.38 | $1,923.75 |

| SHANNON | 38868 | $3,329.58 | $4,645.52 | $3,484.78 | $4,018.35 | $2,376.76 | $3,815.71 | $2,690.36 | $3,681.40 | $1,923.75 |

| RANDOLPH | 38864 | $3,329.46 | $4,286.97 | $3,484.78 | $4,194.64 | $2,376.76 | $3,967.26 | $2,510.78 | $3,861.38 | $1,953.10 |

| FULTON | 38843 | $3,318.23 | $4,645.52 | $3,494.31 | $4,318.54 | $2,376.76 | $3,653.42 | $2,637.11 | $3,540.48 | $1,879.74 |

| BECKER | 38825 | $3,314.90 | $4,388.22 | $3,494.31 | $4,194.64 | $2,956.33 | $3,690.21 | $2,749.21 | $3,122.51 | $1,923.75 |

| PONTOTOC | 38863 | $3,305.09 | $4,663.27 | $3,484.78 | $4,194.64 | $2,376.76 | $3,703.68 | $2,513.65 | $3,550.86 | $1,953.10 |

| BLUE SPRINGS | 38828 | $3,293.99 | $4,388.22 | $3,484.78 | $4,194.64 | $2,376.76 | $3,648.75 | $2,672.81 | $3,632.89 | $1,953.10 |

| NEW SITE | 38859 | $3,293.38 | $4,645.52 | $3,484.78 | $4,318.54 | $2,376.76 | $3,865.45 | $2,653.73 | $3,122.51 | $1,879.74 |

| VERONA | 38879 | $3,289.64 | $4,645.52 | $3,484.78 | $4,194.64 | $2,376.76 | $3,702.26 | $2,672.10 | $3,317.33 | $1,923.75 |

| NETTLETON | 38858 | $3,288.88 | $4,645.52 | $3,494.31 | $4,194.64 | $2,376.76 | $3,407.95 | $2,586.75 | $3,681.40 | $1,923.75 |

| GREENWOOD SPRINGS | 38848 | $3,288.04 | $4,286.97 | $3,494.31 | $4,194.64 | $2,956.33 | $3,686.08 | $2,600.26 | $3,161.95 | $1,923.75 |

| SMITHVILLE | 38870 | $3,287.96 | $4,286.97 | $3,494.31 | $4,194.64 | $2,956.33 | $3,690.75 | $2,595.00 | $3,161.95 | $1,923.75 |

| MOOREVILLE | 38857 | $3,287.84 | $4,645.52 | $3,484.78 | $4,018.35 | $2,376.76 | $3,806.47 | $2,576.11 | $3,457.38 | $1,937.35 |

| NEW ALBANY | 38652 | $3,284.97 | $4,388.22 | $3,484.78 | $4,194.64 | $2,376.76 | $3,718.36 | $2,581.03 | $3,582.85 | $1,953.10 |

| TOCCOPOLA | 38874 | $3,284.95 | $4,388.22 | $3,484.78 | $4,318.54 | $2,536.40 | $3,850.79 | $2,696.43 | $3,122.51 | $1,881.96 |

| HOULKA | 38850 | $3,284.84 | $4,286.97 | $3,484.78 | $4,194.64 | $2,956.33 | $3,624.67 | $2,490.24 | $3,317.33 | $1,923.75 |

| CALEDONIA | 39740 | $3,283.58 | $4,286.97 | $3,494.31 | $3,806.80 | $2,410.97 | $4,192.57 | $2,829.95 | $3,358.94 | $1,888.14 |

| HOUSTON | 38851 | $3,277.10 | $4,286.97 | $3,484.78 | $4,194.64 | $2,956.33 | $3,522.78 | $2,530.20 | $3,317.33 | $1,923.75 |