Ohio Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 12

Welcome to the home state of the Buckeyes! Chances are you have moved here because you are not a fan of Michigan. Okay, maybe that is not the only reason, but hopefully, that is part of it. Go Bucks!

Baseball and cars are two popular things in Ohio. The first professional baseball team, Cincinnati Reds, are from Ohio. Akron is known as the rubber capital of the world with big tire companies like Goodrich, Goodyear, and Firestone setting up their plants in Akron.

No matter the reason you are in Ohio, you will need insurance on your vehicles. We will cover the ins and outs of Ohio insurance.

We look at which companies write in your state and the different coverages you can get. We will also cover rates for different demographics, counties, and other factors taken into consideration with receiving a rate.

Insurance can be a hard thing to understand, which is why we are here. We have done the research and want to help you find the cheapest car insurance for your needs without sacrificing coverage.

We make it so easy that you can even get a quote above. Just enter your zip code to use of free online comparison tool.

How to Get Ohio Car Insurance Coverage and Rates

First up is coverage and rates. How much insurance is required? Who costs the most to insure? We will answer those questions and more below.

We will also cover some additional coverages you can add to your policy to make sure you are fully covered in the case of a claim. The minimum coverage for property damage liability and bodily injury may seem appealing to someone who just wants to save money on their annual premium. Unless you can afford to pay for all your own auto damage and medical bills, you may want to reconsider.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

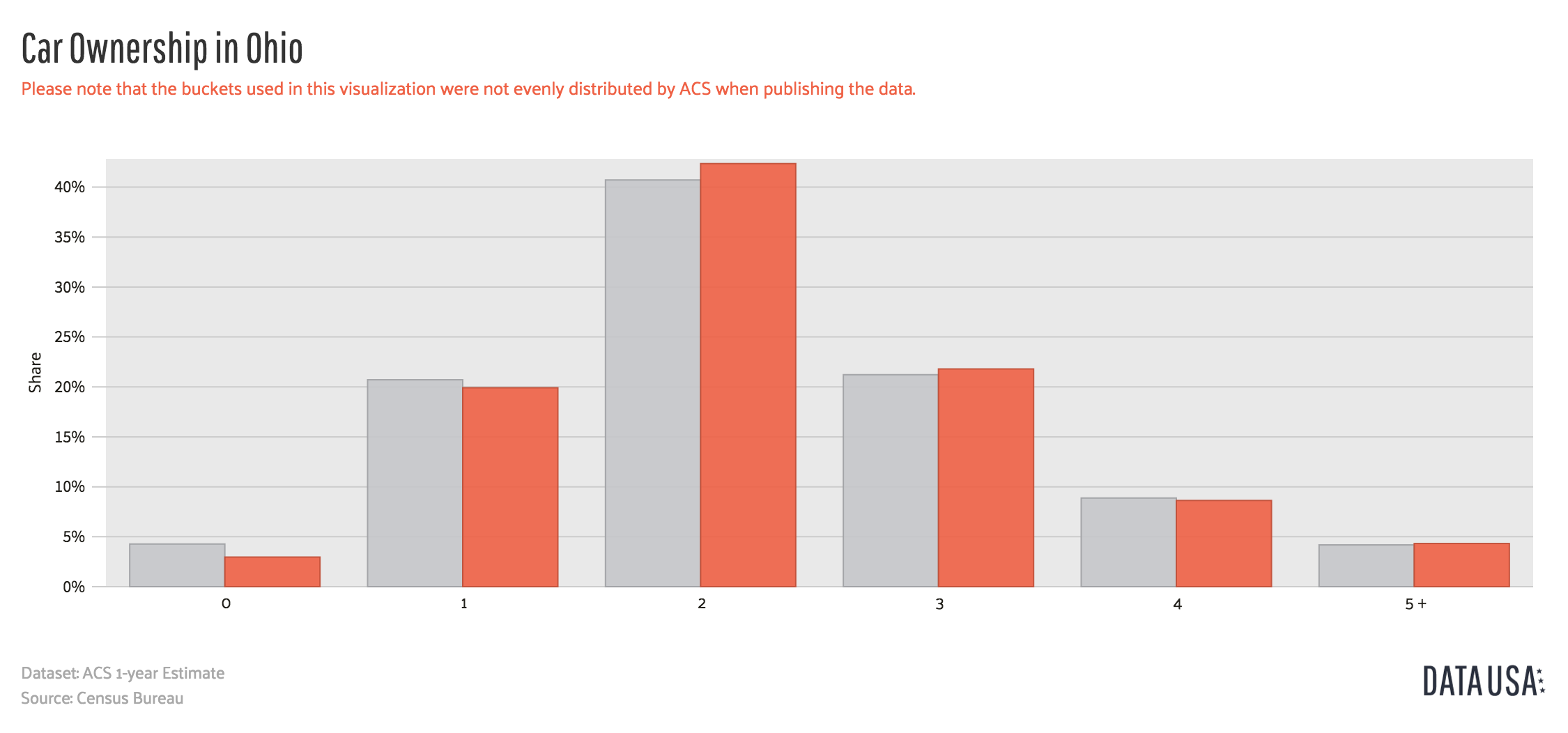

What’s Ohio’s Car Culture like?

Luxury cars and pick up trucks are the vehicles of choice in Ohio. While football is a huge part of Ohio state culture, car racing is becoming a bigger sport. This means a wide range in safety, replacement cost, and much more leading to a wide range of average rates.

There are over 100 race tracks in Ohio. Some tracks, like Mid-Ohio, are home to Nascar and Indy car races.

What are the Ohio State Minimum Coverage Requirements?

If you own a vehicle and drive in Ohio, you must have insurance or proof of financial responsibility. Financial responsibility is the duty to be able to pay for a loss in the event of a claim. Carrying an insurance policy is the most common form of financial responsibility.

If you obtain an insurance policy, you are required to carry at least the minimum limits. Minimum limits in Ohio are as follows:

- $25,000 bodily injury per person

- $50,000 bodily injury for two or more persons per accident

- $25,000 property damage per accident

Liability limits payout when you are found at fault. Liability pays out for the damages and injury you are held liable. So this coverage pays out for the OTHER party involved who was found not at fault.

Remember, these limits are the minimum required amount needed to be legal on the road. It is wise to buy more insurance because if you are in an accident once your limits have been exhausted you could be held liable for the remaining amount. If your car is totaled or you have medical bills, liability insurance also won’t cover your losses. While some people may want to rely on their health insurance, it could come with high deductibles. Some health insurance companies also specifically exclude coverage for auto accident related injuries.

If you were in a serious accident involving the luxury cars Ohio drivers prefer, you would need a lot more coverage than the minimum requirements.

Are There Forms of Financial Responsibility?

Insurance policy is one form of financial responsibility, but what are other ways? Ohio insurance website has the following listed on their website:

Ohio law allows for the following alternatives to automobile insurance:

- A certificate issued by the BMV, after proper application and approval, indicating that money or government bonds in the amount of $30,000 is on deposit with the Ohio Treasurer

- A certificate of bond issued by the BMV, after proper application and approval, in the amount of $30,000 signed by two (2) individuals who own real estate having equity of at least $60,000

- A certificate of self-insurance issued by the BMV, after proper application and approval, to those with more than 25 motor vehicles registered in their name or a company’s name

- A $30,000 bond issued by an authorized surety or insurance company You must show proof of an insurance policy, whether an ID card or electronic card on your smart device. If you chose to have a certificate, you must show that certificate.

You must show the above-mentioned proof at any traffic stop or court appearance. Out of Ohio drivers, 15 percent drive with no insurance.

If you chose to drive without insurance, you could face serious penalties both from the state and insurance companies when you get insured. This is true even if you previously had a clean driving record. We will discuss those more under the Ohio state law section.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Percentage of Income are Insurance Premiums?

So how much is insurance can take out of your paycheck?

| Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|

|---|---|---|---|---|---|---|---|---|---|

| Ohio | $766.66 | $37,490.00 | 2.04% | $738.68 | $36,168.00 | 2.04% | $714.05 | $36,035.00 | 1.98% |

| Countrywide | $981.77 | $40,859.00 | 2.40% | $950.92 | $39,192.00 | 2.43% | $924.45 | $39,473.00 | 2.34% |

The state of Ohio a less percentage for insurance than the average United States driver.

What are the Average Monthly Car Insurance Rates in OH (Liability, Collision, Comprehensive)?

We know to drive legally you must minimum required liability limits. A lot of drivers also chose to have collision and comprehensive coverages as well. If you chose to have all three coverages, it is considered to be combined coverage or full coverage. This is typically required if you lease or finance a vehicle.

Comprehensive and collision are coverages used to protect your vehicle. If you have a lien on your car and making payments, most lienholders require this coverage since it covers the car. Some will even set a certain deductible limit you must have. It’s wise for most people to have more comprehensive coverage.

| Coverage Type: | Annual Costs in 2015: |

|---|---|

| Liability | $397.11 |

| Collision | $269.84 |

| Comprehensive | $121.61 |

| Combined | $788.56 |

Is There an Additional Coverage?

Additional liability coverages are available to add to your policy.

Medical payments is a coverage used to pay for medical bills or funeral bills for anyone in the vehicle at the time of the loss. Uninsured and underinsured motorist coverage are just as they sound. They are coverages you can use if you are involved in an accident that the other person does not have any or enough coverage.

Ohio is ranked 22 out of all the states for uninsured drivers. Due to this fact, drivers in Ohio should strongly consider purchases underinsured and uninsured motorist coverage.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 77% | 76% | 77% |

| Underinsured/Uninsured Motorist Payments | 58% | 57% | 61% |

Loss ratio is a good indicator of whether or not an insurance company is financially stable. Loss ratio simply means the ratio between premium earned and premium paid out for claims. So, if a company has a 50 percent loss ratio, that means they received $100,000 in premiums and paid $50,000 out in claims.

If your ratio is too high, this means the company is not making money. If too low, they may have overpriced their policies. In the event of a loss, you want a stable company that is able to pay out for your covered loss.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are There any Add-ons, Endorsements, and Riders?

There are many additional coverages you can add to your auto policy. We have taken a list of the most common. Always look over available coverages and speak to an agent about what coverages you may need.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

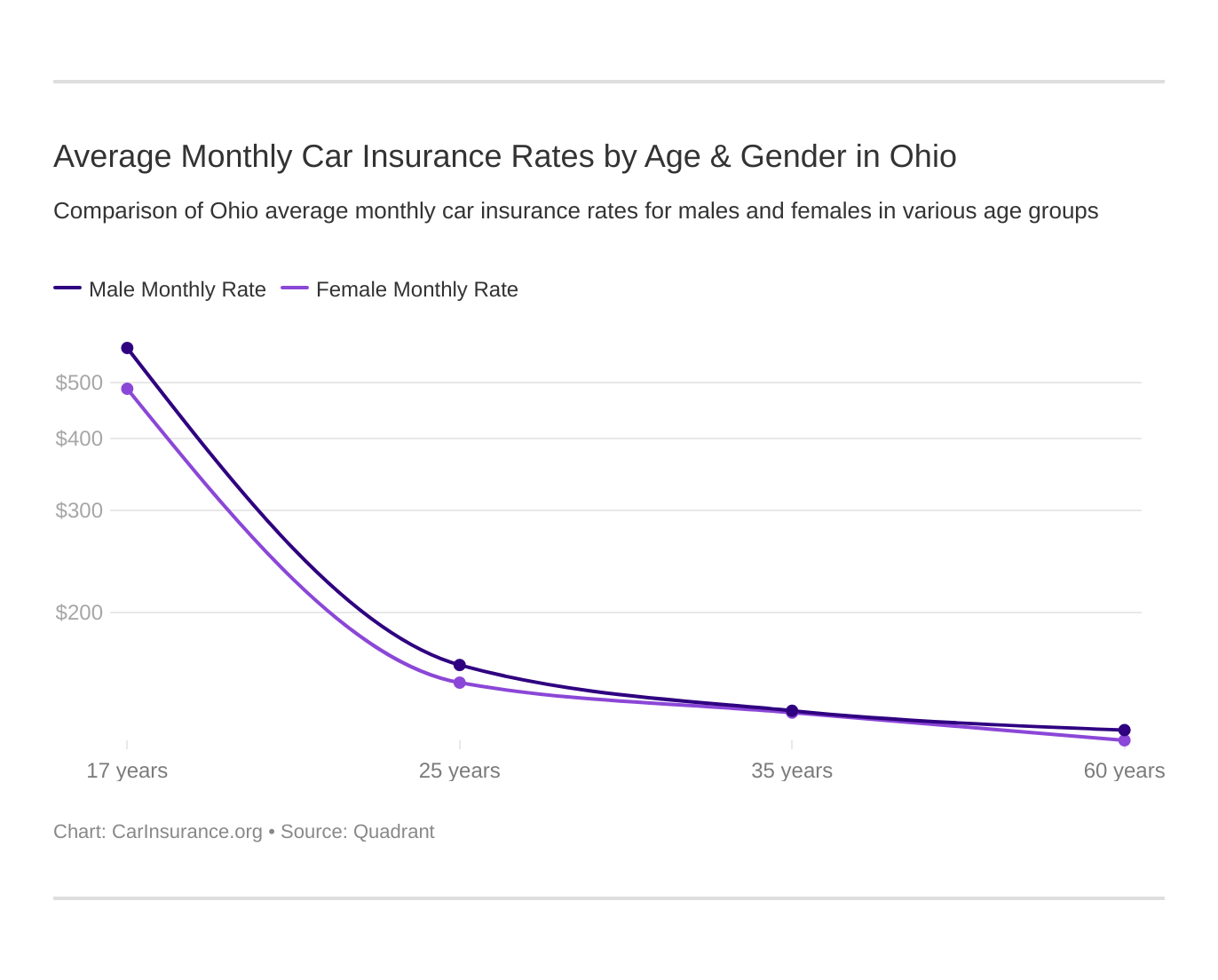

What are the Average Monthly Car Insurance Rates by Age & Gender in OH?

So who pays more for insurance? I think most people, especially parents, know young drivers cost the most. When you add a young, inexperienced driver on your policy it will go up a lot.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,138.70 | $2,132.00 | $1,926.78 | $2,060.78 | $5,908.09 | $6,758.78 | $2,248.98 | $2,403.62 |

| American Family Mutual | $943.84 | $980.06 | $862.73 | $866.82 | $2,911.29 | $3,161.47 | $1,166.31 | $1,228.84 |

| Farmers Ins of Columbus | $1,814.67 | $1,810.78 | $1,598.65 | $1,686.60 | $8,004.71 | $8,312.21 | $2,032.84 | $2,123.65 |

| Geico Cas | $1,348.45 | $1,310.04 | $1,264.91 | $1,276.23 | $3,611.17 | $3,359.64 | $1,497.90 | $1,269.11 |

| Safeco Ins Co of IL | $2,067.94 | $2,258.05 | $1,589.89 | $1,934.44 | $10,791.30 | $12,192.16 | $2,199.81 | $2,404.29 |

| Nationwide Mutual | $2,202.69 | $2,214.18 | $1,987.35 | $2,002.19 | $5,629.14 | $7,261.11 | $2,361.32 | $2,749.18 |

| Progressive Specialty | $1,774.30 | $1,672.93 | $1,477.06 | $1,525.00 | $7,866.04 | $8,860.06 | $2,124.39 | $2,195.89 |

| State Farm Mutual Auto | $1,505.94 | $1,505.94 | $1,347.85 | $1,347.85 | $4,698.43 | $5,902.29 | $1,749.20 | $2,005.47 |

| Discover Prop & Cas Ins Co | $1,444.26 | $1,466.30 | $1,434.68 | $1,427.12 | $6,234.90 | $9,849.32 | $1,505.60 | $1,719.12 |

| USAA | $895.00 | $902.46 | $851.69 | $850.63 | $2,763.43 | $3,076.83 | $1,196.59 | $1,291.02 |

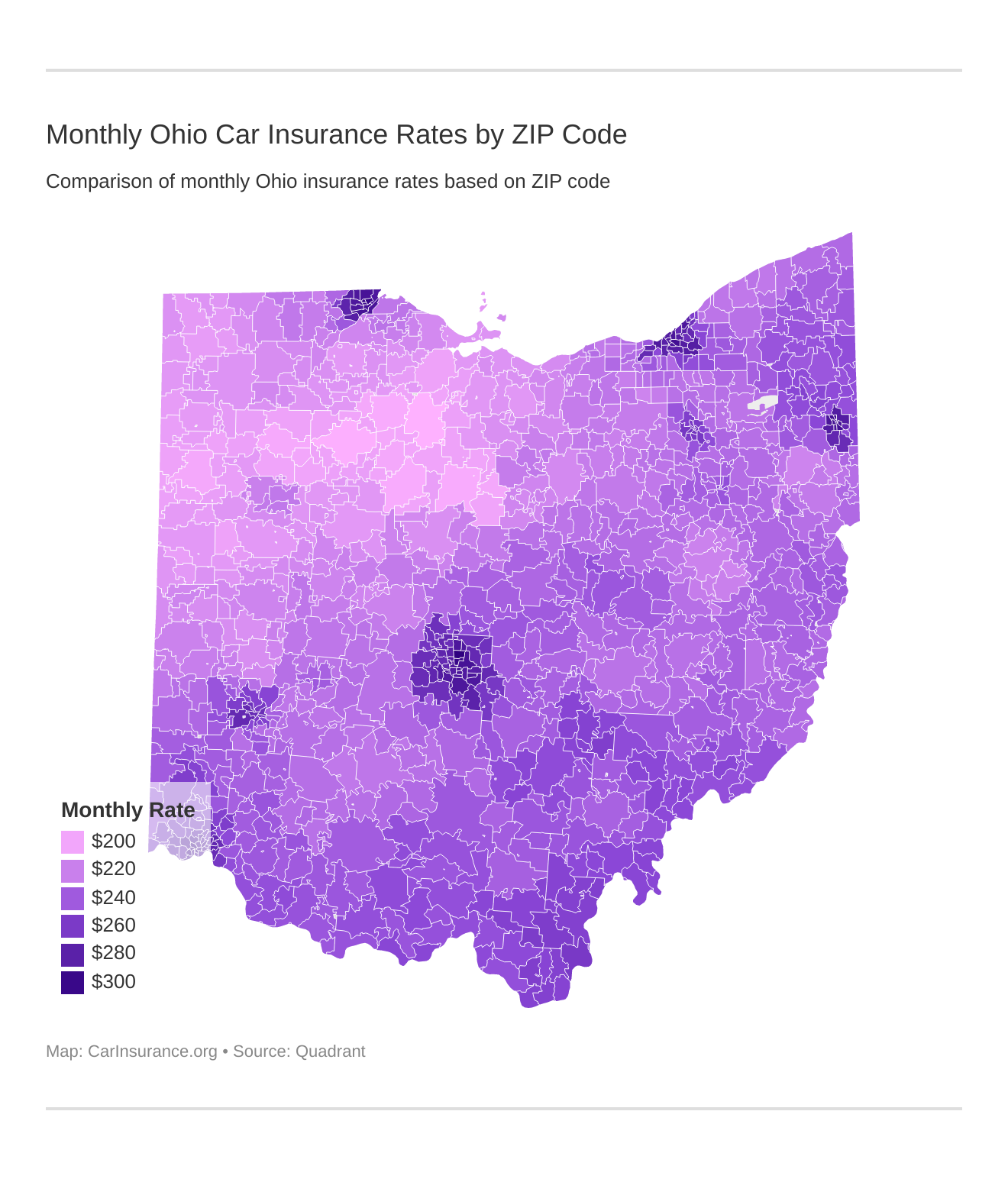

What are the Cheapest Rates by Zip Code?

Your zip code can also determine your rate. Take a look below and see where your zip code lands on the lists.

| 25 Most Expensive Zip Codes in Ohio | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 43224 | COLUMBUS | $3,667.48 | Progressive | $5,629.87 | Liberty Mutual | $5,580.27 | USAA | $1,677.82 | American Family | $1,735.02 |

| 43608 | TOLEDO | $3,629.84 | Liberty Mutual | $5,604.95 | Farmers | $4,702.48 | USAA | $1,752.21 | American Family | $1,917.02 |

| 43211 | COLUMBUS | $3,608.65 | Liberty Mutual | $5,580.27 | Progressive | $5,260.21 | USAA | $1,602.45 | American Family | $1,820.61 |

| 43610 | TOLEDO | $3,603.68 | Liberty Mutual | $5,604.95 | Farmers | $4,702.66 | USAA | $1,752.21 | American Family | $1,916.61 |

| 43620 | TOLEDO | $3,562.98 | Liberty Mutual | $5,604.95 | Farmers | $4,675.36 | USAA | $1,752.21 | American Family | $1,894.20 |

| 45225 | CINCINNATI | $3,553.80 | Liberty Mutual | $5,279.24 | Progressive | $5,142.08 | USAA | $1,615.82 | American Family | $1,879.15 |

| 45214 | CINCINNATI | $3,546.86 | Liberty Mutual | $5,279.24 | Progressive | $4,932.49 | USAA | $1,773.59 | American Family | $1,914.64 |

| 44510 | YOUNGSTOWN | $3,534.06 | Liberty Mutual | $5,196.76 | Farmers | $4,590.33 | American Family | $1,776.30 | USAA | $1,871.55 |

| 44104 | CLEVELAND | $3,529.50 | Liberty Mutual | $5,411.26 | Progressive | $4,557.19 | USAA | $1,623.13 | American Family | $1,841.35 |

| 44502 | YOUNGSTOWN | $3,525.99 | Liberty Mutual | $5,196.76 | Farmers | $4,548.25 | American Family | $1,769.59 | USAA | $1,871.55 |

| 43604 | TOLEDO | $3,517.76 | Liberty Mutual | $5,604.95 | Farmers | $4,431.29 | USAA | $1,752.21 | American Family | $1,854.68 |

| 44503 | YOUNGSTOWN | $3,516.11 | Liberty Mutual | $5,196.76 | Farmers | $4,541.42 | American Family | $1,769.59 | USAA | $1,871.55 |

| 44504 | YOUNGSTOWN | $3,514.38 | Liberty Mutual | $5,196.76 | Farmers | $4,585.91 | American Family | $1,623.63 | USAA | $1,871.55 |

| 45205 | CINCINNATI | $3,513.17 | Liberty Mutual | $5,279.24 | Progressive | $4,572.49 | USAA | $1,773.59 | American Family | $1,896.43 |

| 43203 | COLUMBUS | $3,511.66 | Liberty Mutual | $5,580.27 | Progressive | $4,524.21 | USAA | $1,602.45 | American Family | $1,832.09 |

| 43609 | TOLEDO | $3,508.26 | Liberty Mutual | $5,604.95 | Farmers | $4,427.34 | USAA | $1,632.21 | American Family | $1,854.68 |

| 43219 | COLUMBUS | $3,507.34 | Liberty Mutual | $5,580.27 | Progressive | $4,346.93 | USAA | $1,485.99 | American Family | $1,788.00 |

| 44506 | YOUNGSTOWN | $3,500.25 | Liberty Mutual | $5,196.76 | Farmers | $4,531.75 | American Family | $1,764.69 | USAA | $1,871.55 |

| 44507 | YOUNGSTOWN | $3,497.59 | Liberty Mutual | $5,196.76 | Farmers | $4,608.03 | American Family | $1,779.08 | USAA | $1,871.55 |

| 43612 | TOLEDO | $3,496.23 | Liberty Mutual | $5,604.95 | Farmers | $4,371.09 | USAA | $1,690.58 | American Family | $1,827.44 |

| 43605 | TOLEDO | $3,483.76 | Liberty Mutual | $5,604.95 | Farmers | $4,343.36 | American Family | $1,663.32 | USAA | $1,690.58 |

| 45219 | CINCINNATI | $3,477.52 | Liberty Mutual | $5,279.24 | Farmers | $4,641.51 | USAA | $1,713.89 | American Family | $1,879.84 |

| 44127 | CLEVELAND | $3,472.34 | Liberty Mutual | $5,411.26 | Farmers | $4,386.64 | USAA | $1,623.13 | American Family | $1,821.20 |

| 44103 | CLEVELAND | $3,469.12 | Liberty Mutual | $5,411.26 | Farmers | $4,241.90 | USAA | $1,623.13 | American Family | $1,841.35 |

| 43205 | COLUMBUS | $3,462.57 | Liberty Mutual | $5,580.27 | Progressive | $4,216.52 | USAA | $1,547.76 | American Family | $1,781.09 |

| 25 Least Expensive Zip Codes in Ohio | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 44883 | TIFFIN | $2,325.38 | Liberty Mutual | $3,357.16 | Nationwide | $2,831.42 | USAA | $1,301.36 | American Family | $1,360.24 |

| 45840 | FINDLAY | $2,340.63 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | USAA | $1,357.45 | American Family | $1,374.49 |

| 44861 | OLD FORT | $2,355.45 | Liberty Mutual | $3,357.16 | Farmers | $3,101.73 | USAA | $1,301.36 | American Family | $1,362.16 |

| 45816 | BENTON RIDGE | $2,360.76 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,272.61 | USAA | $1,357.45 |

| 44820 | BUCYRUS | $2,362.24 | Liberty Mutual | $3,357.16 | Progressive | $2,961.66 | American Family | $1,346.67 | USAA | $1,380.40 |

| 44830 | FOSTORIA | $2,366.68 | Liberty Mutual | $3,357.16 | Progressive | $2,942.53 | USAA | $1,301.36 | American Family | $1,332.01 |

| 43351 | UPPER SANDUSKY | $2,367.88 | Liberty Mutual | $3,357.16 | Farmers | $2,847.94 | American Family | $1,329.32 | USAA | $1,380.40 |

| 44809 | BASCOM | $2,376.36 | Liberty Mutual | $3,357.16 | Farmers | $3,205.79 | USAA | $1,301.36 | American Family | $1,317.91 |

| 43330 | KIRBY | $2,377.02 | Liberty Mutual | $3,357.16 | Farmers | $3,022.97 | American Family | $1,353.85 | USAA | $1,380.40 |

| 44845 | MELMORE | $2,377.03 | Liberty Mutual | $3,357.16 | Progressive | $3,100.88 | USAA | $1,301.36 | American Family | $1,329.07 |

| 45875 | OTTAWA | $2,380.80 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,363.80 | USAA | $1,380.40 |

| 44828 | FLAT ROCK | $2,385.20 | Liberty Mutual | $3,357.16 | Farmers | $3,134.66 | USAA | $1,301.36 | American Family | $1,362.08 |

| 44802 | ALVADA | $2,385.94 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,317.91 | USAA | $1,357.45 |

| 44817 | BLOOMDALE | $2,386.88 | Liberty Mutual | $3,357.16 | Nationwide | $3,032.81 | American Family | $1,291.40 | USAA | $1,357.45 |

| 44827 | CRESTLINE | $2,389.32 | Liberty Mutual | $3,357.16 | Allstate | $2,935.13 | American Family | $1,315.21 | USAA | $1,380.40 |

| 45891 | VAN WERT | $2,391.83 | Liberty Mutual | $3,639.93 | Nationwide | $2,910.25 | USAA | $1,380.40 | American Family | $1,434.97 |

| 43316 | CAREY | $2,393.94 | Liberty Mutual | $3,357.16 | Farmers | $2,996.09 | American Family | $1,353.85 | USAA | $1,380.40 |

| 45815 | BELMORE | $2,396.47 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,276.62 | USAA | $1,380.40 |

| 44853 | NEW RIEGEL | $2,396.49 | Liberty Mutual | $3,357.16 | Farmers | $3,084.43 | USAA | $1,301.36 | American Family | $1,385.92 |

| 45877 | PANDORA | $2,397.00 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,317.31 | USAA | $1,380.40 |

| 44844 | MC CUTCHENVILLE | $2,404.82 | Liberty Mutual | $3,357.16 | Progressive | $3,045.60 | American Family | $1,329.07 | USAA | $1,380.40 |

| 45889 | VAN BUREN | $2,406.02 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,272.61 | USAA | $1,357.45 |

| 44836 | GREEN SPRINGS | $2,408.82 | Liberty Mutual | $3,357.16 | Farmers | $3,170.31 | USAA | $1,301.36 | American Family | $1,362.16 |

| 43323 | HARPSTER | $2,409.21 | Liberty Mutual | $3,357.16 | Farmers | $3,026.73 | American Family | $1,329.32 | USAA | $1,380.40 |

| 44854 | NEW WASHINGTON | $2,409.32 | Liberty Mutual | $3,357.16 | Farmers | $3,064.02 | American Family | $1,373.19 | USAA | $1,380.40 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Cheapest Rates by City?

We have also taken that information and broken it down by city.

| 10 Most Expensive Cities in Ohio | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Youngstown | $3,471.04 | Liberty Mutual | $5,116.26 | Farmers | $4,491.06 | American Family | $1,720.93 | USAA | $1,834.62 |

| Toledo | $3,462.84 | Liberty Mutual | $5,528.64 | Farmers | $4,373.06 | USAA | $1,682.66 | American Family | $1,747.29 |

| Blacklick Estates | $3,449.06 | Liberty Mutual | $5,580.27 | Progressive | $4,254.54 | American Family | $1,696.72 | USAA | $1,699.83 |

| Bexley | $3,433.05 | Liberty Mutual | $5,580.27 | Travelers | $4,212.62 | USAA | $1,705.29 | American Family | $1,776.08 |

| Beachwood | $3,397.39 | Liberty Mutual | $5,411.26 | Farmers | $4,311.60 | USAA | $1,623.13 | American Family | $1,633.38 |

| Ottawa Hills | $3,396.30 | Liberty Mutual | $5,604.95 | Nationwide | $4,141.77 | USAA | $1,632.21 | American Family | $1,664.03 |

| Cleveland | $3,395.66 | Liberty Mutual | $5,411.26 | Farmers | $4,164.61 | USAA | $1,622.29 | American Family | $1,765.02 |

| Columbus | $3,340.94 | Liberty Mutual | $5,580.27 | Travelers | $4,153.84 | USAA | $1,551.12 | American Family | $1,683.71 |

| Bridgetown | $3,314.15 | Liberty Mutual | $5,279.24 | Progressive | $4,179.06 | USAA | $1,710.83 | American Family | $1,823.10 |

| Cincinnati | $3,303.69 | Liberty Mutual | $5,126.55 | Progressive | $4,086.64 | USAA | $1,617.73 | American Family | $1,784.34 |

| 10 Least Expensive Cities in Ohio | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Bettsville | $2,325.38 | Liberty Mutual | $3,357.16 | Nationwide | $2,831.42 | USAA | $1,301.36 | American Family | $1,360.24 |

| Findlay | $2,340.63 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | USAA | $1,357.45 | American Family | $1,374.49 |

| Old Fort | $2,355.45 | Liberty Mutual | $3,357.16 | Farmers | $3,101.73 | USAA | $1,301.36 | American Family | $1,362.16 |

| Benton Ridge | $2,360.75 | Liberty Mutual | $3,357.16 | Nationwide | $2,970.73 | American Family | $1,272.61 | USAA | $1,357.45 |

| Bucyrus | $2,362.24 | Liberty Mutual | $3,357.16 | Progressive | $2,961.66 | American Family | $1,346.67 | USAA | $1,380.40 |

| Fostoria | $2,366.68 | Liberty Mutual | $3,357.16 | Progressive | $2,942.53 | USAA | $1,301.36 | American Family | $1,332.01 |

| Upper Sandusky | $2,367.88 | Liberty Mutual | $3,357.16 | Farmers | $2,847.94 | American Family | $1,329.32 | USAA | $1,380.40 |

| Bascom | $2,376.36 | Liberty Mutual | $3,357.16 | Farmers | $3,205.79 | USAA | $1,301.36 | American Family | $1,317.91 |

| Kirby | $2,377.02 | Liberty Mutual | $3,357.16 | Farmers | $3,022.97 | American Family | $1,353.85 | USAA | $1,380.40 |

| Melmore | $2,377.03 | Liberty Mutual | $3,357.16 | Progressive | $3,100.88 | USAA | $1,301.36 | American Family | $1,329.07 |

Who are the Best Ohio Car Insurance Companies?

You know you need insurance, now where do you get it? In this next section, we are going to take a look at the insurance providers that do business in Ohio.

When you do a google search for insurance companies in any state you get a lengthy list of various companies. How do you really know which one will work for you and your needs? We are going to see which companies are better for certain rating factors and which ones have the best financial and customer satisfaction ratings.

So sit back and enjoy an OSU game or head out to watch some car racing.

What’s the Financial Rating of the Largest Companies?

Who is AM Best? You can find on their website the following:

AM Best is the only global credit rating agency with a unique focus on the insurance industry. Best’s Credit Ratings, which are issued through A.M. Best Rating Services, Inc., are a recognized indicator of insurer financial strength and creditworthiness.

So we took the top ten largest insurance companies in Ohio and found their rating.

| Company | AM Best Rating | Direct Premium | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A++ | $1,316,297 | 64.59% | 19.69% |

| Allstate Insurance Group | A+ | $687,527 | 51.79% | 10.29% |

| American Family Insurance Group | A | $176,153 | 57.43% | 2.64% |

| Erie Insurance Group | A+ | $222,863 | 65.38% | 3.33% |

| Geico | A++ | $466,535 | 65.43% | 6.98% |

| Grange Mutual Casualty Group | A | $344,399 | 60.74% | 5.15% |

| Liberty Mutual Group | A | $315,308 | 58.71% | 4.72% |

| Nationwide Corp Group | A+ | $536,768 | 60.88% | 8.03% |

| Progressive Group | A+ | $903,179 | 61.44% | 13.51% |

| USAA Group | A++ | $198,016 | 69.89% | 2.96% |

Luckily, for Ohioans, the largest companies all carry an A or higher rating.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which Companies have the Best Ratings?

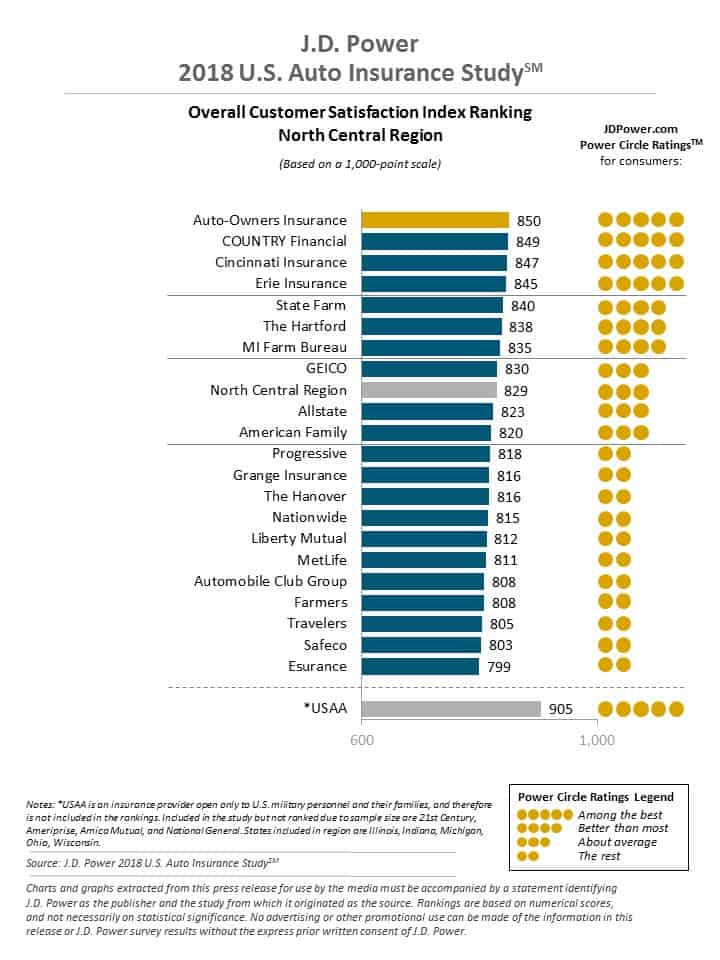

Financial ratings aren’t the only thing to look at when trying to find a company. We also took a look at customer service.

Customer service is a huge factor for most consumers. You may like your company’s price, but there are times some would stay with a company due to their excellent customer service even with a price increase.

JD Power uses real consumers to get their opinion and candidness on how auto insurance products and companies are doing.

Which Companies have the Most Complaints in Ohio?

If you are not satisfied with your insurer, you can make a complaint with the state insurance department. Complaints are then compiled into a ratio of complaint per one million dollars of premium.

| Company | 2013 Written Premiums | Market Share (%) | 2013 Complaint Ratio |

|---|---|---|---|

| Central Mutual | $26,440,517 | 0.49 | 0.04 |

| State Auto | 69,644,140 | 1.28 | 0.07 |

| Motorists Mutual | 88,632,756 | 1.63 | 0.11 |

| Cincinnati Insurance | 128,477,590 | 2.36 | 0.12 |

| Travelers | 42,467,217 | 0.78 | 0.12 |

| Western Reserve | 40,102,403 | 0.74 | 0.12 |

| Auto-Owners | 30,341,579 | 0.56 | 0.13 |

| American family | 103,200,599 | 1.89 | 0.15 |

| Nationwide | 454,751,466 | 8.35 | 0.15 |

| Westfield | 148,615,095 | 2.73 | 0.16 |

| Ohio Mutual | 37,139,756 | 0.68 | 0.16 |

| Erie | 151,364,563 | 2.78 | 0.18 |

| State Farm | 1,029,509,479 | 18.9 | 0.19 |

| Safeco | 109,992,905 | 2.02 | 0.19 |

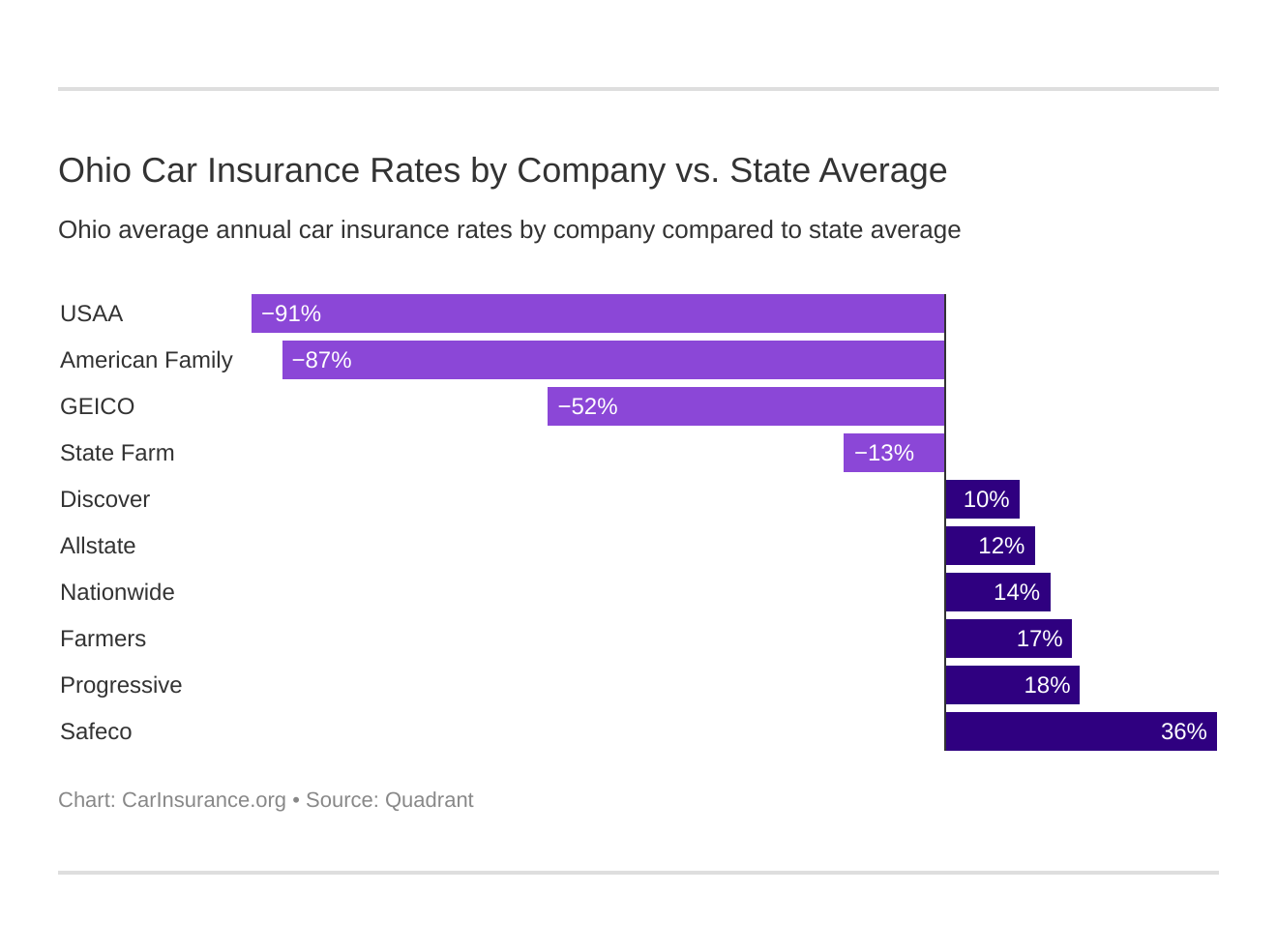

Who are the Cheapest Car Insurance Companies in Ohio?

We took the top ten insurance companies in Ohio and compared rates for different rating factors.

| Company | Average Annual Rate | Compared to State Average | |

|---|---|---|---|

| Allstate F&C | $3,197.22 | $368.05 | 11.51% |

| American Family Mutual | $1,515.17 | -$1,314.00 | -86.72% |

| Farmers Ins of Columbus | $3,423.01 | $593.85 | 17.35% |

| Geico Cas | $1,867.18 | -$961.98 | -51.52% |

| Safeco Ins Co of IL | $4,429.74 | $1,600.57 | 36.13% |

| Nationwide Mutual | $3,300.89 | $471.73 | 14.29% |

| Progressive Specialty | $3,436.96 | $607.79 | 17.68% |

| State Farm Mutual Auto | $2,507.87 | -$321.30 | -12.81% |

| Discover Prop & Cas Ins Co | $3,135.16 | $306.00 | 9.76% |

| USAA | $1,478.46 | -$1,350.71 | -91.36% |

USAA and American Family Mutual have the lowest premiums compared to state average rates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

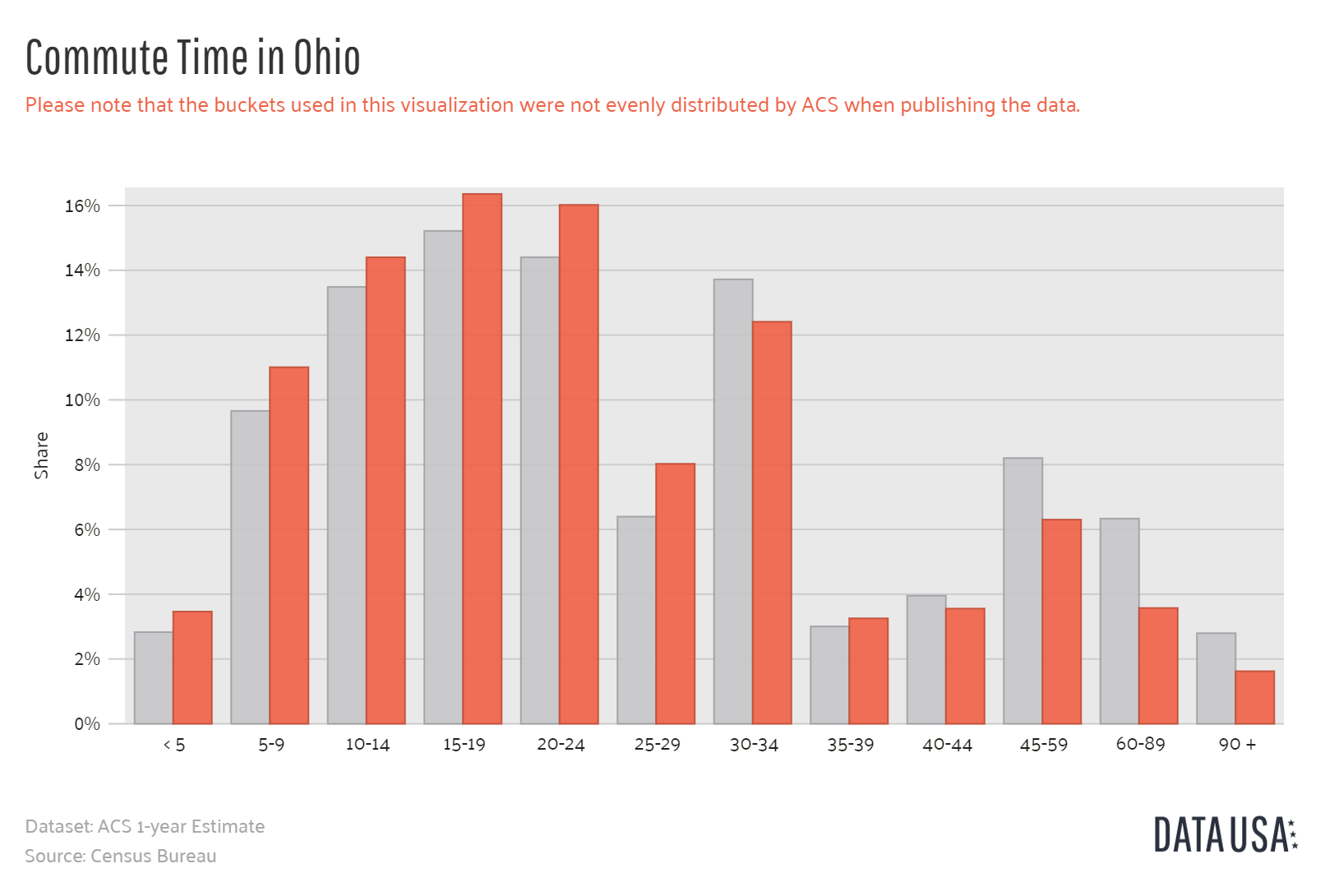

What’s the Commute Rate by Companies?

Do you have to commute to work? If so, take a look at the rates by commute.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $4,429.74 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $4,429.74 |

| Progressive | 10 miles commute. 6000 annual mileage. | $3,436.96 |

| Progressive | 25 miles commute. 12000 annual mileage. | $3,436.96 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,423.01 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,423.01 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,300.89 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,300.89 |

| Allstate | 10 miles commute. 6000 annual mileage. | $3,197.22 |

| Allstate | 25 miles commute. 12000 annual mileage. | $3,197.22 |

| Travelers | 10 miles commute. 6000 annual mileage. | $3,135.16 |

| Travelers | 25 miles commute. 12000 annual mileage. | $3,135.16 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,569.94 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,445.81 |

| Geico | 25 miles commute. 12000 annual mileage. | $1,899.95 |

| Geico | 10 miles commute. 6000 annual mileage. | $1,834.42 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,534.83 |

| American Family | 25 miles commute. 12000 annual mileage. | $1,533.50 |

| American Family | 10 miles commute. 6000 annual mileage. | $1,496.84 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,422.09 |

Most companies do not rate or heavily rate for commuting miles.

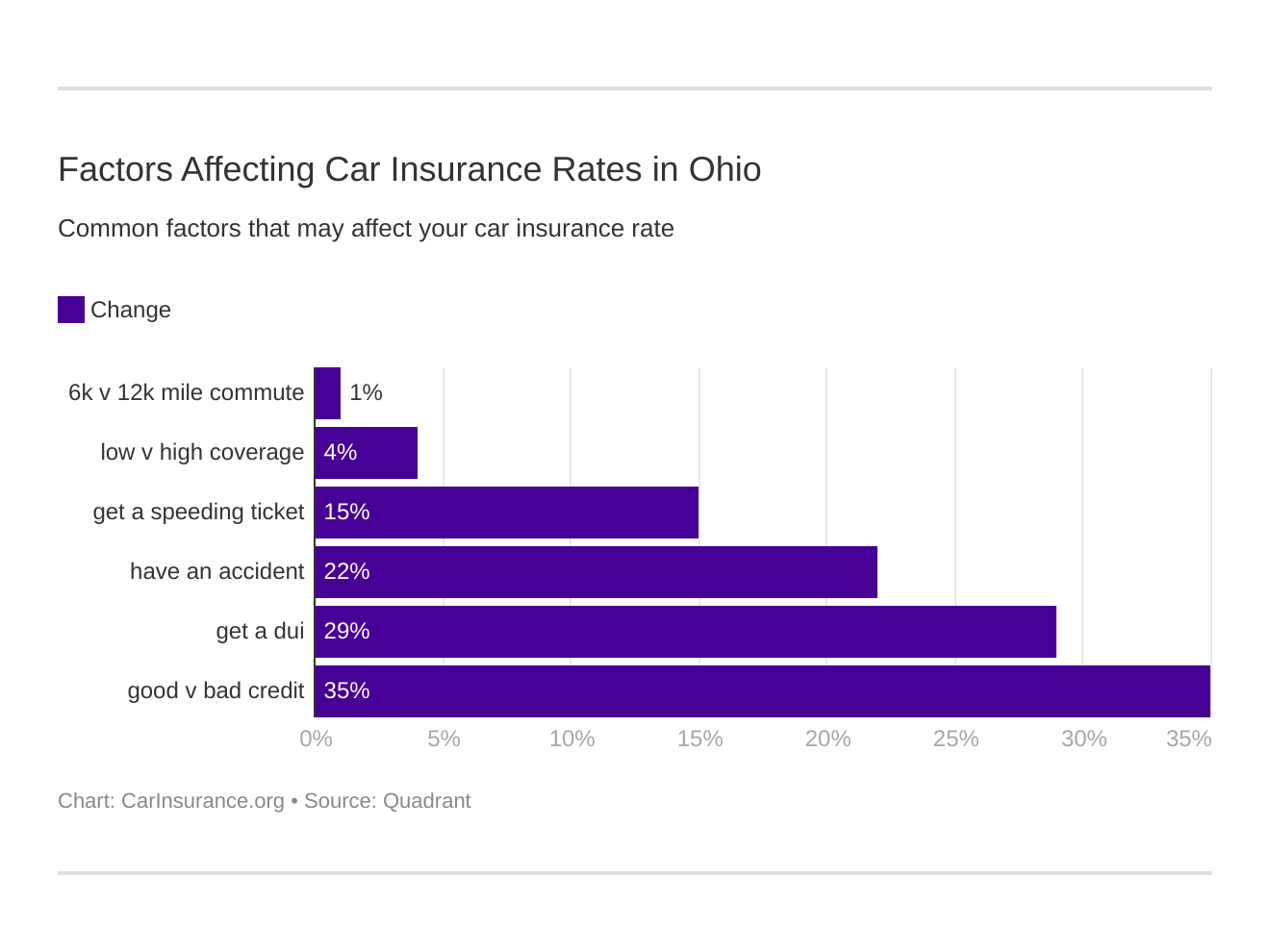

Take a look at these 6 major factors affecting auto insurance rates in Ohio.

What are the Coverage Level Rates by Companies?

More coverage means more premium, right? Not necessarily.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Liberty Mutual | High | $4,573.32 |

| Liberty Mutual | Medium | $4,451.75 |

| Liberty Mutual | Low | $4,264.14 |

| Farmers | High | $3,655.55 |

| Nationwide | Low | $3,647.54 |

| Progressive | High | $3,597.09 |

| Progressive | Medium | $3,408.32 |

| Farmers | Medium | $3,370.12 |

| Allstate | High | $3,308.32 |

| Progressive | Low | $3,305.47 |

| Farmers | Low | $3,243.37 |

| Nationwide | Medium | $3,199.58 |

| Allstate | Medium | $3,190.74 |

| Travelers | High | $3,178.51 |

| Travelers | Medium | $3,176.78 |

| Allstate | Low | $3,092.59 |

| Nationwide | High | $3,055.56 |

| Travelers | Low | $3,050.20 |

| State Farm | High | $2,623.40 |

| State Farm | Medium | $2,515.42 |

| State Farm | Low | $2,384.79 |

| Geico | High | $1,935.16 |

| Geico | Medium | $1,858.73 |

| Geico | Low | $1,807.66 |

| USAA | High | $1,544.99 |

| American Family | High | $1,530.18 |

| American Family | Medium | $1,526.68 |

| American Family | Low | $1,488.65 |

| USAA | Medium | $1,477.00 |

| USAA | Low | $1,413.38 |

A company like Nationwide actually gives you a lower premium for more coverage. It is always good to compare rates and even if you think your premium might be too high, get quotes for more coverage.

What are the Credit History Rates by Companies?

Your credit history is a major factor when obtaining rates for insurance. Most consumers think credit history follows you for larger purchases, like a home or car.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $6,349.68 |

| Allstate | Poor | $4,109.54 |

| Nationwide | Poor | $3,983.93 |

| Liberty Mutual | Fair | $3,890.18 |

| Farmers | Poor | $3,877.82 |

| Progressive | Poor | $3,860.18 |

| State Farm | Poor | $3,573.32 |

| Travelers | Poor | $3,505.29 |

| Progressive | Fair | $3,335.09 |

| Farmers | Fair | $3,273.78 |

| Nationwide | Fair | $3,209.33 |

| Farmers | Good | $3,117.43 |

| Progressive | Good | $3,115.60 |

| Travelers | Fair | $3,050.60 |

| Liberty Mutual | Good | $3,049.35 |

| Allstate | Fair | $2,987.92 |

| Travelers | Good | $2,849.59 |

| Nationwide | Good | $2,709.43 |

| Allstate | Good | $2,494.19 |

| Geico | Poor | $2,239.10 |

| State Farm | Fair | $2,208.94 |

| American Family | Poor | $2,010.87 |

| USAA | Poor | $1,919.04 |

| Geico | Fair | $1,867.18 |

| State Farm | Good | $1,741.35 |

| Geico | Good | $1,495.27 |

| American Family | Fair | $1,372.30 |

| USAA | Fair | $1,358.48 |

| American Family | Good | $1,162.34 |

| USAA | Good | $1,157.84 |

The average Ohio resident has a credit score of 678, which is considered a prime credit score.

As you can tell from the table above, poor credit history can cost you thousands in insurance premiums.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Driving Record Rates by Companies?

Driving record is probably the most obvious factor that affect your insurance rate. Driving safe and cautiously is your best precaution against moving violations on your record. Unfortunately, accidents happen or you are in a rush and go over the speed limit.

Take a look below to see just how much that speeding ticket costs you.

| Group | Driving Record | Annual Average |

|---|---|---|

| Liberty Mutual | With 1 DUI | $4,880.34 |

| Liberty Mutual | With 1 accident | $4,775.12 |

| Travelers | With 1 DUI | $4,539.26 |

| Liberty Mutual | With 1 speeding violation | $4,341.01 |

| Nationwide | With 1 DUI | $4,269.79 |

| Progressive | With 1 accident | $4,028.09 |

| Allstate | With 1 DUI | $3,808.65 |

| Liberty Mutual | Clean record | $3,722.47 |

| Farmers | With 1 speeding violation | $3,688.92 |

| Farmers | With 1 accident | $3,634.83 |

| Progressive | With 1 speeding violation | $3,599.93 |

| Farmers | With 1 DUI | $3,544.94 |

| Nationwide | With 1 accident | $3,364.88 |

| Allstate | With 1 accident | $3,250.76 |

| Progressive | With 1 DUI | $3,156.21 |

| Allstate | With 1 speeding violation | $3,040.34 |

| Travelers | With 1 accident | $3,009.00 |

| Progressive | Clean record | $2,963.60 |

| Nationwide | With 1 speeding violation | $2,924.39 |

| Farmers | Clean record | $2,823.36 |

| State Farm | With 1 accident | $2,730.70 |

| Allstate | Clean record | $2,689.12 |

| Travelers | With 1 speeding violation | $2,683.62 |

| Geico | With 1 DUI | $2,645.09 |

| Nationwide | Clean record | $2,644.52 |

| State Farm | With 1 DUI | $2,507.87 |

| State Farm | With 1 speeding violation | $2,507.87 |

| Travelers | Clean record | $2,308.77 |

| State Farm | Clean record | $2,285.04 |

| USAA | With 1 DUI | $1,999.49 |

| Geico | With 1 accident | $1,828.67 |

| Geico | With 1 speeding violation | $1,725.85 |

| American Family | With 1 DUI | $1,536.30 |

| American Family | With 1 accident | $1,536.30 |

| American Family | With 1 speeding violation | $1,536.30 |

| USAA | With 1 accident | $1,521.70 |

| American Family | Clean record | $1,451.77 |

| Geico | Clean record | $1,269.11 |

| USAA | With 1 speeding violation | $1,257.56 |

| USAA | Clean record | $1,135.07 |

A DUI conviction will definitely cost you, not only in your insurance premium but with fines and penalties that we will cover as you continue to read.

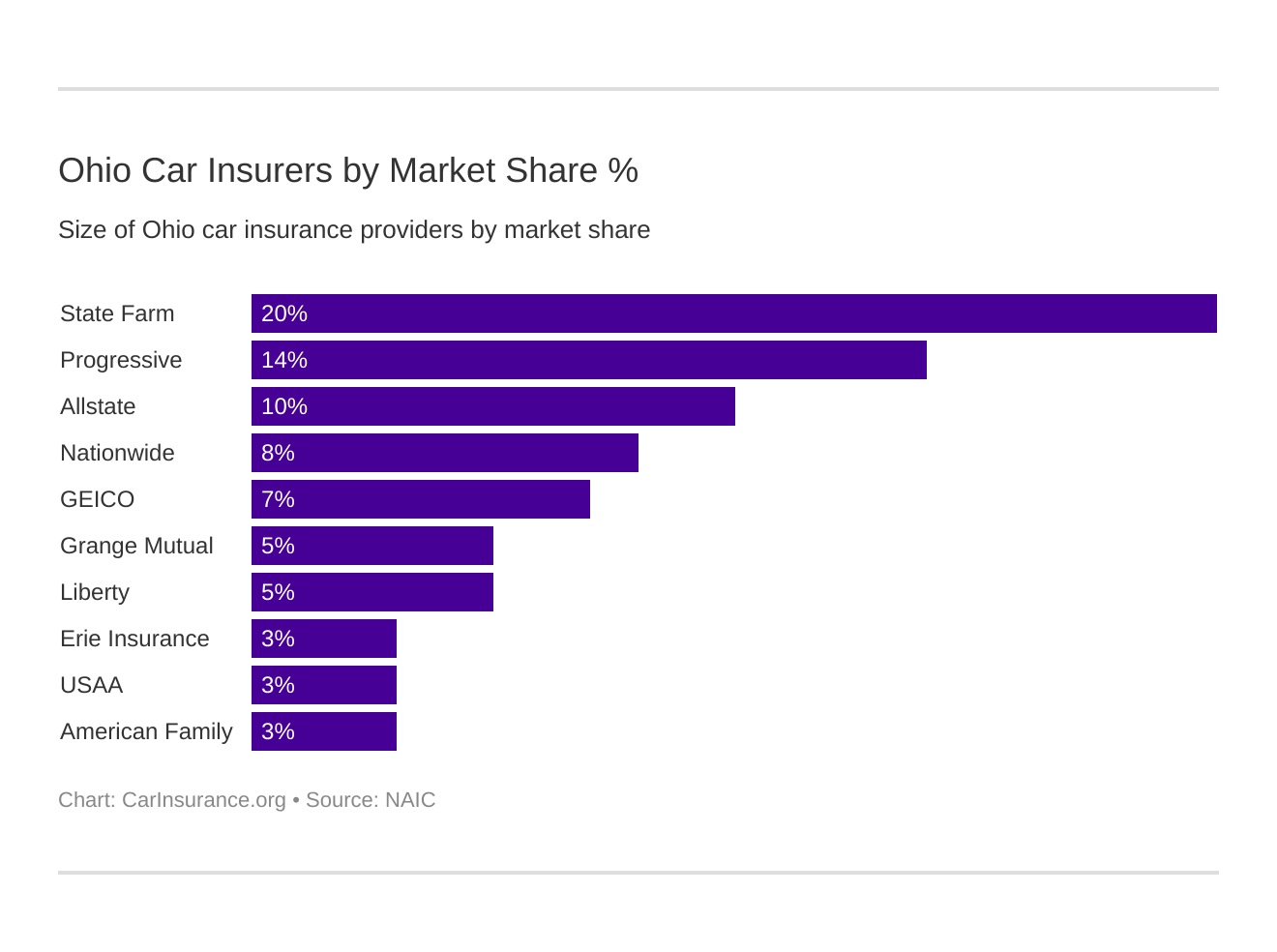

Who are the Largest Car Insurance Companies in Ohio?

| Company | Direct Premiums | Market Share |

|---|---|---|

| State Farm Group | $1,316,297 | 19.69% |

| Allstate Insurance Group | $687,527 | 10.29% |

| American Family Insurance Group | $176,153 | 2.64% |

| Erie Insurance Group | $222,863 | 3.33% |

| Geico | $466,535 | 6.98% |

| Grange Mutual Casualty Group | $344,399 | 5.15% |

| Liberty Mutual Group | $315,308 | 4.72% |

| Nationwide Corp Group | $536,768 | 8.03% |

| Progressive Group | $903,179 | 13.51% |

| USAA Group | $198,016 | 2.96% |

| Total | $6,684,674 | 100% |

Who are the largest car insurance companies in Ohio?

What’s the Number of Insurers in Ohio?

Ohio has a lot of insurers you can choose from. Insurers are separated into two categories, domestic and foreign. Domestic means the insurer was formed under Ohio state law, while foreign means the insurer was formed in another state.

Ohio has 138 domestic and 851 foreign insurers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Ohio State Laws?

Insurance can keep you covered on the road, but state laws can protect and keep you safe. Police cars were first used in Akron, so Ohioans are not messing around when it comes to safety and laws.

We are going to hit some major laws like driving under the influence and speeding to licensing requirements.

It is difficult keeping up with all the different laws, so keep reading and we break them down for you.

What are the Car Insurance Laws?

You must have car insurance to legally drive in the state of Ohio. State laws can influence auto insurance, whether that be with minimum limits or how rates are determined.

According to the National Association of Insurance Commissioners, Ohio must file rate changes before they use them for giving quotes to consumers.

How to Get Windshield Coverage

When you are driving down Interstate 80 and you hear the crack of the windshield from a rock being thrown. There it is, a huge crack stretching over your windshield.

Is it covered? Some insurance carriers will cover the loss under comprehensive coverage, but you will want to check with your company.

Ohio has no specific laws on windshields. You can use aftermarket parts and you can also choose whichever shop you take your car.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get High-Risk Insurance

SR-22 is filing that may be requested by the courts if you are considered a high-risk driver.

Your insurance company will have to file the SR-22, usually electronically, with the Bureau of Motor Vehicles. This is costly and usually gives you higher rates.

You are considered a high-risk driver for driving under the influence, driving with no insurance, or too many points on your license. Those are just a few violations that can get the unwanted title of a high-risk driver.

Since you are required to have insurance, Ohio has the Ohio Automobile Insurance Plan. This method of insurance is used for drivers that can not get insurance through a voluntary market.

Insurance from the OAIP is usually very expensive and the following requirements are listed on their website:

To be eligible for bodily injury, property damage, medical payments, and physical damage coverages, the applicant must meet the following criteria:

As a prerequisite to consideration for assignment under the Plan, the applicant must certify, in the prescribed application form, that he has attempted, within 60 days prior to the date of application, to obtain automobile insurance in the state, and that he has been unable to obtain such insurance rates equal or less than the Plan.

An applicant so certifying shall be considered for assignment provided that he reports in the prescribed application form all information of a material nature and does not willfully make incorrect or misleading statements in the prescribed application form, or does not come within any of the prohibitions or exclusions shown in Section 2.C.

For bodily injury, property damage, and medical payments coverage, the Plan shall be available to residents and non-residents of the state only with respect to automobiles that are registered or will be registered in the state within 15 days, except that non-residents who are members of the United States military forces, shall be eligible with respect to automobiles registered in other states provided such military non-residents are stationed in this state at the time application is made and are otherwise eligible for insurance under the Plan.

For physical damage coverage, the Plan shall be available to residents and non-residents of the state only with respect to motor vehicles that are registered or will be registered in the state within 15 days and garaged in Ohio, except that non-residents who are members of the United States military forces shall be eligible with respect to motor vehicles registered in other states provided such military non-residents are stationed in this state at the time application is made and are otherwise eligible for insurance under the Plan.

How to Get Low-Cost Insurance

Currently, there are no low-cost insurance options available to Ohio residents. The best way to get the lowest insurance rate is to shop for your insurance.

Luckily you can enter your zipcode below and see if you are getting the best rates.

Is There an Automobile Insurance Fraud in Ohio?

Insurance fraud is a growing and costly problem. The Insurance Information Institute states workers comp, healthcare, and auto insurance are the most susceptible to fraud.

Fraud can be separated into two different categories, soft and hard. Soft fraud is usually considered a misrepresentation of facts or adding extra costs to an existing claim. While hard fraud is a purposefully makes up a claim with no validity.

Fraud is a serious crime and should be reported to the Ohio Insurance Department.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Statute of Limitations?

The statute of limitations is the time limit you have to file a claim. Once a loss has occurred, in Ohio, you have two years to file a claim for personal property damage or bodily injury.

It is always important to file a claim as soon as possible to provide accurate information and get your claim settled quickly.

What are the Vehicle Licensing Laws?

Just like insurance, you need a license to drive. In this next section, we are going to go over licensing requirements and the penalties for driving without insurance.

What is a Real ID?

In 2005, Congress enacted the Real Id Act. This act sets strict standards for the issuance of a driver’s license.

If a state is compliant, you can use your real ID driver’s license to board commercial flights and enter government buildings.

Ohio is a compliant state of the Real ID Act.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Penalties for Driving Without Insurance?

If you are required to have insurance, there are going to be penalties for not having it.

| 1st Offense | 2nd Offense |

|---|---|

| License/plates/registration suspension until requirements are met and $100 reinstatement fee is paid; maintain special high-risk coverage on file with the BMV for three to five years; If involved in accident without insurance: all above penalties and a security suspension for two plus years and an indefinite judgment suspension (until all damages are satisfied) | License/plates/registration suspension for one year; $300 reinstatement fee; maintain special high-risk coverage on file with the BMV for three or five years; if involved in accident without insurance: all above penalties and a security suspension for two plus years and an indefinite judgment suspension (until all damages are satisfied) |

You are required to show proof of insurance any time requested at a traffic stop or other time asked for by a police officer. You can show proof with a valid insurance id card, copy of the current policy, or electronic copy on your smart device.

What are the Teen Driver Laws?

| Young Driver Licensing Laws | Minimum Age | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 15 years, six months | first 12 months—no more than one passenger (family members excepted) | 50 hours of driving, ten of which must be at night |

| Provisional License | 16 years old | first 12 months—no more than one passenger (family members excepted) | midnight-6 a.m. (first 12 months), 1 a.m.-5 a.m. (second 12 months); secondary enforcement |

| Full License | 16 years old | restrictions lifted in 12 months (min. age: 17) | restrictions lifted in 24 months (min. age: 18) |

Teen drivers have different restrictions they have to follow while driving.

| Restricted License Laws in Ohio | Details |

|---|---|

| Nighttime restrictions | midnight-6 a.m. (first 12 months), 1 a.m.-5 a.m. (second 12 months) secondary enforcement |

| Passenger restrictions (family members excepted unless noted otherwise) | first 12 months—no more than 1 passenger |

| Minimum age at which restrictions may be lifted: | |

| Nighttime restrictions | 24 months (min. age: 18) |

| Passenger restrictions | 12 months (min. age: 17) |

What are the License Renewal Procedures for Older Drivers?

Older drivers are not treated any differently than other drivers at renewal time. See below for all renewal information for any age.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the Procedure for New Residents of Ohio?

If you are new, welcome to Ohio! You have 30 days to change your license to an Ohio state license. You will also need to title your vehicle and get Ohio state tags.

What are the License renewal procedures?

License renewal for all drivers is every four years. You can not renew online or by mail, so you must go to a local licensing office in person for your renewal. A vision exam is also required at every renewal.

Who is Considered a Negligent Operator?

Ohio considers any driver that operates a vehicle under such disregard for the lives of others, knowing they are driving carelessly, as reckless driving.

Penalties for driving recklessly can be found here or below:

The consequences of a reckless driving conviction depend on the circumstances. But generally, the possible penalties are:

- No prior traffic convictions. When a motorist has had no prior motor vehicle or traffic convictions within the past year, reckless operation is a minor misdemeanor. The maximum punishment for a minor misdemeanor is a $100 fine—jail time isn’t a possibility.

- One prior traffic conviction. Reckless driving is a fourth-degree misdemeanor if the driver has been convicted of one motor vehicle or traffic offense within the past year. A fourth-degree misdemeanor carries up to 30 days in jail and/or a maximum $250 in fines.

- Two prior traffic convictions. If a driver has been convicted of two or more motor vehicle or traffic offenses within the past year, reckless driving is a third-degree misdemeanor. Convicted motorists face up to 60 days in jail and/or a maximum $500 in fines.

For any reckless operation conviction, a judge can—but isn’t required to—suspend the driver’s license for six months to three years.

That is right, any reckless operation conviction can mean no driving for up to three years.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Rules of the Road?

The rules of the road are enforced to keep you and other drivers or passengers safe when on Ohio roadways. Keep reading to find out important information about speed limits, seat belts, and more.

Is Ohio at Fault or No-Fault State?

Ohio is an at-fault state for car accidents. This means whoever is at fault for the accident must payout from their insurance policy.

What are the Seat Belt and Car Seat Laws?

Most states have seat belt requirements, Ohio has the below seat belt laws.

| Seat Belt Laws in Ohio | Details |

|---|---|

| Effective Since | May 6, 1986 |

| Primary Enforcement | no |

| Age/Seats Applicable | 8 through 14 in all seats; 15+ years in front seat |

| 1st Offense Max Fine | $30 driver/$20 passenger |

Read more: What are the Ohio car seat laws?

The following table will help you have children in the car needing a child restraint or booster seat.

| Type of Car Seat Required | Age |

|---|---|

| Rear-Facing Child Restraint | 3 years and younger or less than 40 pounds |

| Child Booster Seat | 4 through 7 years who weigh 40 pounds or more and who are shorter than 57 inches in a child restraint or booster seat |

| Adult Belt Permissible | 8 through 14 years |

Ohio has restrictions for riding int he cargo area of a truck. The below are the exceptions to these restrictions:

- passengers 16 and older

- passengers 15 and younger if driven less than 25 mph or seated and belted

- emergencies

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Keep Right and Move Over Laws?

In order to drive in the left lane in Ohio, you must be going at least the speed limit. Driving under the speed limit needs to be in the right lane only.

Move over laws include not only police and emergency vehicles, but also waste collection vehicles and road maintenance. When traveling the same direction, drivers must slow and vacate the closet lane to emergency or designated vehicle.

What’s the Speed Limit?

Speed limits are vital laws that keep drivers and passengers safe.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 55 mph |

Please remember, roads are subject to change speed limits especially during construction.

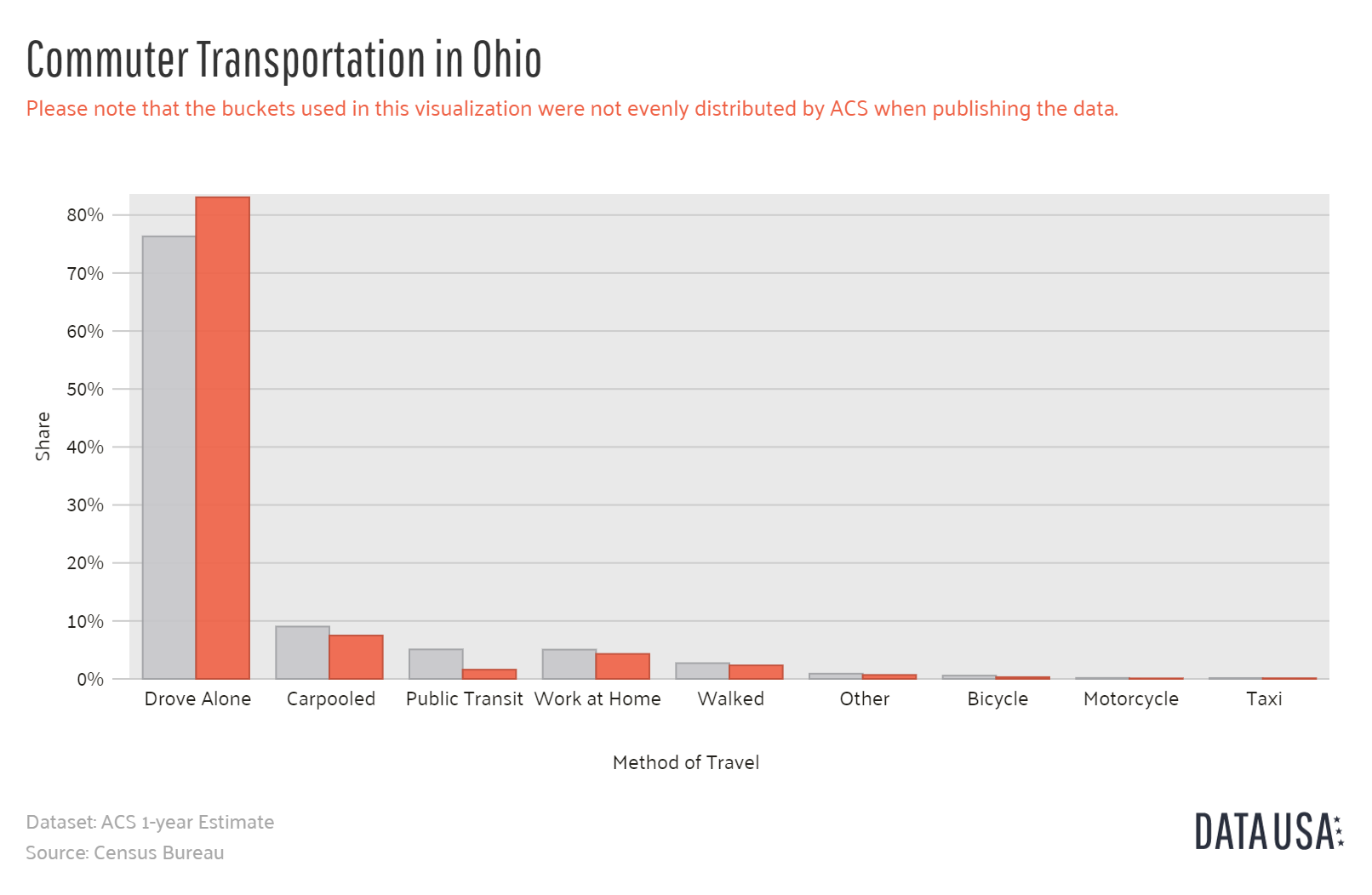

How Does Ridesharing Work?

Ridesharing has become a widely popular form of transportation and a valuable way to make some extra money. If you chose to drive for a ridesharing company, such as Uber or Lyft, you will need to make sure you are covered by your insurance carrier.

The following companies in Ohio provide ridesharing insurance:

- Allstate

- Erie

- Farmers

- Geico

- State Farm

- USAA

You must inform your insurance of your ridesharing to verify you have coverage.

Read More: Rideshare Insurance Coverage

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There an Automation on the Road?

Cars driving by themselves are no longer a thing of the future. Ohio currently is testing automation on their roadways. You must have liability insurance and the operator must be licensed.

What are the Safety Laws?

Next up are the major safety laws. Driving under the influence and distracted driving are two major hazards of any roadway.

What are the DUI Laws?

| DUI LAW IN Ohio | Details |

|---|---|

| Name for Offense | Operating a Vehicle Under the Influence (OVI) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.17 |

| Criminal Status | 1st-2nd first degree misdemeanors, 3rd misdemeanor, 4th in 6 years fourth degree felony, + in any time period third degree felony |

| Look Back Period | 10 years |

Driving while intoxicated can lead to much higher insurance premiums as we saw earlier, but that is not the only thing. If convicted of operating a vehicle while under the influence, you can face high fines and fees, jail time, and license suspensions.

| DUI LAW IN Ohio | Details |

|---|---|

| Name for Offense | Operating a Vehicle Under the Influence (OVI) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.17 |

| Criminal Status | 1st-2nd first degree misdemeanors, 3rd misdemeanor, 4th in 6 years fourth degree felony, + in any time period third degree felony |

| Look Back Period | 10 years |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Marijuana-Impaired Driving Laws?

It is also illegal to be operating a vehicle while impaired by illegal drugs. If two nanograms of THC is found in your system, you can be convicted of driving while under the influence of marijuana.

What are the Distracted Driving Laws?

Cell phones continue to be a huge distraction for any driver. Ohio has some specific laws against the use of cellular devices to help keep roads safe.

There is currently no hand-held band on devices while driving, but if you are found guilty of a moving violation and your use of a device impeded your driving ability you could face a $100 fine on top of any other fines incurred.

Drivers 18 and under are to have no device usage. There is a texting ban on all drivers.

What’s Driving in Ohio like?

Even if you follow all of the above laws in Ohio, there are still dangers from driving on any road. This last section we are going to cover the bad of driving. We will look at auto theft, fatalities, and transportation for Ohio residents.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is There a Vehicle Theft in Ohio?

Have you ever walked to your car just to find that it wasn’t there? Dodge Caravans seem to be the hot choice of car thefts in Ohio.

| Make/Model | Most Popular Vehicle Year | Thefts |

|---|---|---|

| Dodge Caravan | 2003 | 679 |

| Chevrolet Impala | 2007 | 441 |

| Chevrolet Malibu | 2015 | 343 |

| Chevrolet Pickup (Full Size) | 1999 | 579 |

| Dodge Pickup (Full Size) | 2005 | 297 |

| Ford Pickup (Full Size) | 2004 | 540 |

| Honda Accord | 1997 | 437 |

| Honda Civic | 2000 | 325 |

| Jeep Cherokee/Grand Cherokee | 2000 | 467 |

| Toyota Camry | 2014 | 308 |

We also took a look at each city in Ohio and how many car thefts occur.

| City | Motor vehicle theft |

|---|---|

| Ada | 0 |

| Akron | 631 |

| Albany | 0 |

| Alliance | 22 |

| Amberley Village | 6 |

| Amelia | 1 |

| American Township | 5 |

| Amherst | 3 |

| Arcanum | 2 |

| Ashland | 6 |

| Ashville | 1 |

| Athens | 4 |

| Aurora | 5 |

| Austintown | 27 |

| Bainbridge Township | 1 |

| Barberton | 24 |

| Batavia | 0 |

| Bath Township, Summit County | 2 |

| Bazetta Township | 6 |

| Beavercreek | 33 |

| Beaver Township | 4 |

| Bedford | 45 |

| Bellaire | 1 |

| Bellbrook | 1 |

| Bellefontaine | 9 |

| Belpre | 4 |

| Berea | 13 |

| Bethel | 1 |

| Beverly | 0 |

| Bexley | 12 |

| Blanchester | 3 |

| Blendon Township | 13 |

| Blue Ash | 9 |

| Bluffton | 0 |

| Bowling Green | 11 |

| Brecksville | 0 |

| Brewster | 0 |

| Bridgeport | 0 |

| Brimfield Township | 6 |

| Broadview Heights | 0 |

| Brooklyn | 68 |

| Brookville | 7 |

| Brunswick | 17 |

| Brunswick Hills Township | 4 |

| Bryan | 0 |

| Burton | 0 |

| Cambridge | 21 |

| Canal Fulton | 2 |

| Canfield | 2 |

| Canton | 438 |

| Cardington | 2 |

| Celina | 11 |

| Centerville | 18 |

| Chagrin Falls | 2 |

| Champion Township | 12 |

| Chardon | 0 |

| Chillicothe | 33 |

| Cincinnati | 1,276 |

| Circleville | 59 |

| Clayton | 21 |

| Clearcreek Township | 1 |

| Cleveland | 4,125 |

| Cleveland Heights | 76 |

| Clinton Township | 10 |

| Coalton | 1 |

| Coitsville Township | 2 |

| Colerain Township | 46 |

| Columbiana | 2 |

| Commercial Point | 0 |

| Conneaut | 5 |

| Cortland | 0 |

| Covington | 0 |

| Crestline | 2 |

| Cuyahoga Falls | 35 |

| Danville | 1 |

| Dayton | 615 |

| Deer Park | 3 |

| Defiance | 2 |

| Delaware | 37 |

| Delhi Township | 17 |

| Delphos | 4 |

| Delta | 1 |

| Dover | 3 |

| Dublin | 8 |

| Eastlake | 12 |

| East Palestine | 2 |

| Eaton | 16 |

| Englewood | 14 |

| Evendale | 6 |

| Fairborn | 24 |

| Fairfax | 1 |

| Fairfield | 46 |

| Fairfield Township | 12 |

| Fairport Harbor | 6 |

| Findlay | 27 |

| Forest Park | 31 |

| Fort Recovery | 0 |

| Franklin Township | 2 |

| Fredericktown | 1 |

| Fremont | 17 |

| Gahanna | 15 |

| Galion | 10 |

| Gallipolis | 4 |

| Gates Mills | 1 |

| Georgetown | 1 |

| Germantown | 1 |

| German Township, Clark County | 0 |

| German Township, Montgomery County | 0 |

| Girard | 10 |

| Goshen Township, Mahoning County | 7 |

| Grafton | 1 |

| Grandview Heights | 6 |

| Greenfield | 6 |

| Greenhills | 0 |

| Greenville | 15 |

| Grove City | 46 |

| Groveport | 9 |

| Hamilton | 202 |

| Hamilton Township, Warren County | 5 |

| Harrison | 5 |

| Hartville | 2 |

| Heath | 22 |

| Hebron | 0 |

| Highland Heights | 4 |

| Hilliard | 27 |

| Hillsboro | 6 |

| Hinckley Township | 1 |

| Holland | 2 |

| Howland Township | 18 |

| Hubbard | 7 |

| Hubbard Township | 4 |

| Huber Heights | 46 |

| Hudson | 5 |

| Hunting Valley | 0 |

| Independence | 0 |

| Indian Hill | 0 |

| Jackson | 9 |

| Jackson Center | 3 |

| Jackson Township, Montgomery County | 2 |

| Jackson Township, Stark County | 23 |

| Johnstown | 0 |

| Kent | 16 |

| Kenton | 2 |

| Kettering | 60 |

| Kirtland | 2 |

| Kirtland Hills | 0 |

| Lawrence Township | 6 |

| Lebanon | 14 |

| Liberty Township | 7 |

| Lima | 95 |

| Lithopolis | 0 |

| Lockland | 18 |

| Lodi | 2 |

| Logan | 10 |

| London | 4 |

| Lorain | 79 |

| Loudonville | 1 |

| Louisville | 6 |

| Loveland | 1 |

| Lowellville | 0 |

| Lyndhurst | 0 |

| Madeira | 1 |

| Mansfield | 74 |

| Mariemont | 0 |

| Marietta | 7 |

| Martins Ferry | 2 |

| Marysville | 8 |

| Mason | 13 |

| Massillon | 31 |

| Matamoras | 0 |

| Maumee | 19 |

| McArthur | 2 |

| McConnelsville | 0 |

| Medina | 0 |

| Medina Township | 1 |

| Mentor | 40 |

| Miamisburg | 25 |

| Miami Township, Clermont County | 17 |

| Miami Township, Montgomery County | 26 |

| Middlefield | 1 |

| Middleport | 1 |

| Middletown | 95 |

| Mifflin Township | 6 |

| Milford | 3 |

| Millersburg | 4 |

| Minerva Park | 0 |

| Monroe | 11 |

| Monroeville | 2 |

| Montgomery | 2 |

| Montpelier | 2 |

| Montville Township | 0 |

| Moraine | 17 |

| Moreland Hills | 0 |

| Mount Vernon | 1 |

| Napoleon | 1 |

| Navarre | 3 |

| Nelsonville | 5 |

| New Albany | 0 |

| Newark | 74 |

| New Boston | 8 |

| Newcomerstown | 3 |

| New Concord | 0 |

| New Franklin | 2 |

| New Lebanon | 4 |

| New Lexington | 1 |

| New London | 0 |

| New Philadelphia | 3 |

| Newtown | 2 |

| Niles | 28 |

| North Canton | 12 |

| North College Hill | 23 |

| North Ridgeville | 5 |

| Northwood | 6 |

| Norton | 8 |

| Norwalk | 3 |

| Norwood | 40 |

| Oak Harbor | 1 |

| Oak Hill | 1 |

| Oberlin | 2 |

| Obetz | 12 |

| Olmsted Falls | 0 |

| Olmsted Township | 4 |

| Ontario | 7 |

| Oregon | 30 |

| Orrville | 0 |

| Ottawa Hills | 3 |

| Oxford | 13 |

| Painesville | 9 |

| Parma Heights | 12 |

| Paulding | 0 |

| Perrysburg | 11 |

| Perrysville | 0 |

| Perry Township, Columbiana County | 0 |

| Perry Township, Franklin County | 0 |

| Perry Township, Montgomery County | 5 |

| Pierce Township | 4 |

| Pioneer | 0 |

| Piqua | 23 |

| Poland Township | 2 |

| Poland Village | 0 |

| Port Clinton | 2 |

| Portsmouth | 51 |

| Powell | 2 |

| Powhatan Point | 0 |

| Reminderville | 3 |

| Richfield | 4 |

| Richmond Heights | 23 |

| Richwood | 3 |

| Rio Grande | 0 |

| Rittman | 9 |

| Riverside | 46 |

| Rocky Ridge | 0 |

| Roseville | 1 |

| Rossford | 1 |

| Russell Township | 0 |

| Sabina | 2 |

| Sagamore Hills | 1 |

| Salem | 6 |

| Salineville | 0 |

| Sandusky | 21 |

| Sebring | 1 |

| Seven Hills | 1 |

| Shaker Heights | 49 |

| Shawnee Township | 3 |

| Sheffield Lake | 1 |

| Shelby | 5 |

| Sidney | 21 |

| Silverton | 16 |

| Solon | 13 |

| South Bloomfield | 4 |

| South Charleston | 2 |

| South Euclid | 15 |

| South Point | 0 |

| South Russell | 0 |

| Spencerville | 0 |

| Springboro | 7 |

| Springdale | 31 |

| Springfield | 236 |

| Springfield Township, Hamilton County | 57 |

| Springfield Township, Mahoning County | 3 |

| Springfield Township, Summit County | 8 |

| St. Clair Township | 0 |

| Stow | 3 |

| Strasburg | 1 |

| Streetsboro | 1 |

| Strongsville | 20 |

| Struthers | 3 |

| Sugarcreek Township | 2 |

| Sylvania Township | 34 |

| Tallmadge | 10 |

| Tipp City | 5 |

| Toledo4 | 1,064 |

| Toronto | 0 |

| Trotwood | 88 |

| Troy | 25 |

| Twinsburg | 8 |

| Uhrichsville | 3 |

| Union | 3 |

| Uniontown | 5 |

| University Heights | 6 |

| Upper Arlington | 3 |

| Upper Sandusky | 1 |

| Urbana | 3 |

| Utica | 5 |

| Vandalia | 32 |

| Van Wert | 2 |

| Vermilion | 3 |

| Village of Leesburg | 2 |

| Wadsworth | 8 |

| Waite Hill | 0 |

| Walbridge | 0 |

| Walton Hills | 0 |

| Wapakoneta | 2 |

| Warren | 130 |

| Warren Township | 5 |

| Washington Court House | 5 |

| Waterville | 0 |

| Wauseon | 0 |

| Waverly | 1 |

| Weathersfield | 6 |

| Wellston | 12 |

| Wells Township | 2 |

| West Alexandria | 0 |

| West Carrollton | 35 |

| West Chester Township | 29 |

| Westerville | 9 |

| West Jefferson | 9 |

| West Lafayette | 1 |

| West Liberty | 1 |

| Whitehall | 72 |

| Whitehouse | 2 |

| Williamsburg | 2 |

| Willoughby | 20 |

| Wintersville | 1 |

| Woodlawn | 4 |

| Woodmere Village | 0 |

| Wooster | 25 |

| Worthington | 5 |

| Wyoming | 8 |

| Xenia | 25 |

| Yellow Springs | 0 |

| Youngstown | 297 |

| Zanesville | 32 |

What’s the Number of Road Fatalities in Ohio?

Next, we are going to cover fatalities on the roads of Ohio. We give you this information to help educate drivers to help prevent other fatalities from happening.

What’s the Most Fatal Highway in Ohio?

Interstate 71 is the most fatal highway in Ohio. This road has an average of 18 fatal crashes in one year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Fatal Crashes by Weather Condition and Light Condition?

Drivers often think accidents happen in bad weather or late at night. While those times do make driving more difficult and safety is definitely an issue, more accidents happen in normal weather conditions and daylight hours.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 507 | 172 | 237 | 42 | 1 | 959 |

| Rain | 36 | 21 | 28 | 4 | 1 | 90 |

| Snow/Sleet | 12 | 4 | 12 | 1 | 0 | 29 |

| Other | 1 | 1 | 7 | 2 | 0 | 11 |

| Unknown | 0 | 0 | 3 | 0 | 2 | 5 |

| TOTAL | 556 | 198 | 287 | 49 | 4 | 1,094 |

What’s the Number of Fatalities by Ohio County?

Below is a list of Ohio counties and fatalities in each county.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 2 | 5 | 5 | 5 | 4 |

| Allen | 7 | 9 | 8 | 14 | 11 |

| Ashland | 5 | 8 | 5 | 6 | 9 |

| Ashtabula | 20 | 9 | 18 | 16 | 17 |

| Athens | 7 | 13 | 5 | 6 | 1 |

| Auglaize | 10 | 7 | 8 | 4 | 4 |

| Belmont | 11 | 6 | 10 | 4 | 10 |

| Brown | 7 | 5 | 5 | 5 | 7 |

| Butler | 19 | 29 | 29 | 23 | 31 |

| Carroll | 4 | 5 | 3 | 4 | 5 |

| Champaign | 6 | 1 | 5 | 11 | 6 |

| Clark | 14 | 16 | 24 | 12 | 17 |

| Clermont | 21 | 26 | 16 | 19 | 11 |

| Clinton | 4 | 12 | 3 | 3 | 10 |

| Columbiana | 11 | 20 | 8 | 8 | 5 |

| Coshocton | 2 | 7 | 7 | 11 | 6 |

| Crawford | 6 | 7 | 5 | 1 | 3 |

| Cuyahoga | 56 | 46 | 75 | 82 | 95 |

| Darke | 6 | 7 | 13 | 7 | 4 |

| Defiance | 4 | 8 | 7 | 6 | 9 |

| Delaware | 10 | 12 | 13 | 23 | 14 |

| Erie | 10 | 5 | 11 | 11 | 8 |

| Fairfield | 9 | 16 | 14 | 12 | 14 |

| Fayette | 8 | 7 | 9 | 9 | 7 |

| Franklin | 76 | 74 | 85 | 94 | 88 |

| Fulton | 12 | 11 | 11 | 11 | 9 |

| Gallia | 4 | 1 | 6 | 2 | 6 |

| Geauga | 10 | 14 | 10 | 16 | 11 |

| Greene | 4 | 5 | 8 | 11 | 22 |

| Guernsey | 9 | 7 | 1 | 9 | 10 |

| Hamilton | 38 | 49 | 54 | 62 | 58 |

| Hancock | 6 | 8 | 10 | 18 | 4 |

| Hardin | 9 | 3 | 6 | 4 | 6 |

| Harrison | 4 | 6 | 3 | 5 | 4 |

| Henry | 2 | 2 | 10 | 5 | 10 |

| Highland | 5 | 3 | 7 | 9 | 4 |

| Hocking | 6 | 1 | 4 | 4 | 6 |

| Holmes | 6 | 3 | 4 | 4 | 5 |

| Huron | 9 | 6 | 10 | 9 | 6 |

| Jackson | 7 | 3 | 5 | 7 | 10 |

| Jefferson | 3 | 6 | 11 | 1 | 4 |

| Knox | 3 | 6 | 6 | 8 | 6 |

| Lake | 14 | 10 | 14 | 11 | 9 |

| Lawrence | 7 | 4 | 5 | 3 | 4 |

| Licking | 14 | 19 | 23 | 20 | 30 |

| Logan | 6 | 8 | 9 | 3 | 9 |

| Lorain | 14 | 10 | 34 | 38 | 33 |

| Lucas | 34 | 41 | 34 | 35 | 49 |

| Madison | 4 | 9 | 8 | 5 | 10 |

| Mahoning | 25 | 18 | 22 | 21 | 19 |

| Marion | 11 | 13 | 5 | 8 | 12 |

| Medina | 2 | 15 | 11 | 8 | 18 |

| Meigs | 5 | 3 | 6 | 5 | 4 |

| Mercer | 7 | 4 | 5 | 4 | 7 |

| Miami | 9 | 10 | 11 | 14 | 13 |

| Monroe | 3 | 4 | 2 | 3 | 3 |

| Montgomery | 55 | 42 | 56 | 60 | 49 |

| Morgan | 4 | 0 | 6 | 6 | 4 |

| Morrow | 11 | 5 | 12 | 10 | 12 |

| Muskingum | 9 | 13 | 10 | 6 | 9 |

| Noble | 3 | 5 | 4 | 2 | 0 |

| Ottawa | 9 | 7 | 4 | 6 | 6 |

| Paulding | 6 | 3 | 4 | 6 | 2 |

| Perry | 3 | 4 | 4 | 5 | 2 |

| Pickaway | 14 | 13 | 5 | 13 | 10 |

| Pike | 8 | 11 | 3 | 3 | 8 |

| Portage | 12 | 8 | 21 | 14 | 9 |

| Preble | 6 | 5 | 10 | 8 | 16 |

| Putnam | 0 | 5 | 3 | 3 | 3 |

| Richland | 9 | 12 | 17 | 6 | 10 |

| Ross | 10 | 9 | 7 | 20 | 7 |

| Sandusky | 10 | 11 | 10 | 12 | 11 |

| Scioto | 10 | 9 | 13 | 11 | 8 |

| Seneca | 14 | 3 | 4 | 3 | 11 |

| Shelby | 6 | 8 | 5 | 8 | 11 |

| Stark | 26 | 44 | 19 | 32 | 33 |

| Summit | 29 | 32 | 25 | 41 | 47 |

| Trumbull | 21 | 12 | 18 | 14 | 12 |

| Tuscarawas | 8 | 8 | 7 | 6 | 20 |

| Union | 8 | 6 | 9 | 6 | 4 |

| Van Wert | 7 | 4 | 3 | 5 | 4 |

| Vinton | 3 | 7 | 7 | 6 | 3 |

| Warren | 17 | 10 | 15 | 16 | 15 |

| Washington | 9 | 6 | 6 | 7 | 13 |

| Wayne | 11 | 18 | 14 | 13 | 20 |

| Williams | 4 | 6 | 9 | 10 | 4 |

| Wood | 19 | 15 | 30 | 13 | 16 |

| Wyandot | 1 | 3 | 4 | 2 | 3 |

What’s the Number of Traffic Fatalities?

| Roadway Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 762 | 660 | 713 | 661 | 640 | 513 | 496 | 492 | 508 | 552 |

| Urban | 429 | 362 | 366 | 356 | 481 | 471 | 506 | 610 | 614 | 620 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Fatalities by Person Type?

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Vehicle Occupant | 744 | 764 | 793 | 773 | 851 |

| Motorcyclists | 132 | 136 | 168 | 199 | 157 |

| Pedestrian | 85 | 87 | 116 | 134 | 142 |

| Bicyclist and Other Cyclist | 19 | 11 | 25 | 18 | 19 |

| Other/Unknown Nonoccupants | 9 | 8 | 8 | 8 | 10 |

What’s the Number of Fatalities by Crash Type?

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Involving a Single Vehicle | 560 | 540 | 593 | 593 | 641 |

| Involving a Large Truck | 131 | 130 | 167 | 123 | 164 |

| Involving Speeding | 273 | 274 | 207 | 257 | 252 |

| Involving a Rollover | 232 | 253 | 231 | 241 | 254 |

| Involving a Roadway Departure | 590 | 625 | 658 | 670 | 670 |

| Involving an Intersection (or Intersection Related) | 217 | 256 | 295 | 320 | 327 |

Five-Year Trend For The Top 10 Counties

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Cuyahoga | 56 | 46 | 75 | 82 | 95 |

| Franklin | 76 | 74 | 85 | 94 | 88 |

| Hamilton | 38 | 49 | 54 | 62 | 58 |

| Lucas | 34 | 41 | 34 | 35 | 49 |

| Montgomery | 55 | 42 | 56 | 60 | 49 |

| Summit | 29 | 32 | 25 | 41 | 47 |

| Lorain | 14 | 10 | 34 | 38 | 33 |

| Stark | 26 | 44 | 19 | 32 | 33 |

| Butler | 19 | 29 | 29 | 23 | 31 |

| Licking | 14 | 19 | 23 | 20 | 30 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Fatalities Involving Speeding by County?

Speeding is a big factor in many accidents. Take a look below to find your county and see how many speeding fatalities occur.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 1 | 1 | 0 | 2 | 0 |

| Allen | 2 | 1 | 1 | 2 | 2 |

| Ashland | 3 | 2 | 1 | 2 | 2 |

| Ashtabula | 6 | 2 | 1 | 4 | 6 |

| Athens | 2 | 3 | 1 | 0 | 1 |

| Auglaize | 3 | 1 | 3 | 0 | 0 |

| Belmont | 4 | 3 | 2 | 3 | 2 |

| Brown | 0 | 2 | 2 | 0 | 0 |

| Butler | 7 | 9 | 6 | 4 | 5 |

| Carroll | 2 | 0 | 0 | 0 | 0 |

| Champaign | 2 | 0 | 1 | 2 | 1 |

| Clark | 4 | 6 | 4 | 2 | 1 |

| Clermont | 5 | 15 | 6 | 3 | 1 |

| Clinton | 3 | 4 | 2 | 0 | 1 |

| Columbiana | 4 | 8 | 0 | 3 | 0 |

| Coshocton | 2 | 2 | 0 | 4 | 1 |

| Crawford | 0 | 3 | 2 | 0 | 1 |

| Cuyahoga | 26 | 18 | 31 | 34 | 34 |

| Darke | 1 | 0 | 0 | 0 | 0 |

| Defiance | 0 | 3 | 3 | 0 | 2 |

| Delaware | 6 | 2 | 4 | 4 | 0 |

| Erie | 2 | 1 | 2 | 5 | 2 |

| Fairfield | 2 | 2 | 1 | 0 | 0 |

| Fayette | 1 | 3 | 4 | 1 | 3 |

| Franklin | 10 | 16 | 9 | 15 | 8 |

| Fulton | 1 | 1 | 0 | 0 | 0 |

| Gallia | 1 | 0 | 1 | 0 | 2 |

| Geauga | 2 | 5 | 1 | 3 | 1 |

| Greene | 0 | 1 | 3 | 1 | 2 |

| Guernsey | 2 | 2 | 0 | 4 | 4 |

| Hamilton | 12 | 13 | 5 | 16 | 17 |

| Hancock | 0 | 2 | 1 | 1 | 2 |

| Hardin | 0 | 1 | 0 | 1 | 1 |

| Harrison | 1 | 3 | 1 | 2 | 1 |

| Henry | 1 | 0 | 2 | 2 | 1 |

| Highland | 1 | 0 | 3 | 2 | 1 |

| Hocking | 3 | 1 | 2 | 2 | 1 |

| Holmes | 2 | 2 | 0 | 0 | 1 |

| Huron | 1 | 1 | 1 | 4 | 1 |

| Jackson | 1 | 1 | 1 | 1 | 2 |

| Jefferson | 2 | 1 | 3 | 0 | 3 |

| Knox | 2 | 2 | 1 | 0 | 2 |

| Lake | 5 | 3 | 4 | 0 | 2 |

| Lawrence | 3 | 0 | 2 | 0 | 2 |

| Licking | 5 | 6 | 1 | 4 | 9 |

| Logan | 1 | 2 | 1 | 0 | 1 |

| Lorain | 4 | 2 | 4 | 11 | 8 |

| Lucas | 10 | 13 | 6 | 5 | 7 |

| Madison | 1 | 1 | 4 | 2 | 3 |

| Mahoning | 8 | 3 | 2 | 6 | 5 |

| Marion | 1 | 1 | 0 | 0 | 0 |

| Medina | 1 | 3 | 4 | 2 | 5 |

| Meigs | 0 | 0 | 1 | 2 | 1 |

| Mercer | 0 | 0 | 0 | 0 | 1 |

| Miami | 3 | 0 | 0 | 2 | 3 |

| Monroe | 0 | 1 | 0 | 1 | 1 |

| Montgomery | 19 | 9 | 15 | 16 | 13 |

| Morgan | 2 | 0 | 1 | 1 | 2 |

| Morrow | 2 | 1 | 2 | 2 | 2 |

| Muskingum | 4 | 5 | 0 | 3 | 4 |

| Noble | 0 | 0 | 1 | 2 | 0 |

| Ottawa | 0 | 0 | 1 | 1 | 0 |

| Paulding | 0 | 0 | 1 | 0 | 0 |

| Perry | 2 | 1 | 0 | 0 | 1 |

| Pickaway | 3 | 5 | 0 | 1 | 2 |

| Pike | 1 | 3 | 0 | 1 | 3 |

| Portage | 4 | 1 | 5 | 1 | 2 |

| Preble | 1 | 1 | 1 | 2 | 5 |

| Putnam | 0 | 1 | 1 | 1 | 2 |

| Richland | 1 | 5 | 7 | 2 | 3 |

| Ross | 3 | 3 | 0 | 9 | 0 |

| Sandusky | 5 | 6 | 2 | 2 | 1 |

| Scioto | 2 | 2 | 3 | 3 | 0 |

| Seneca | 2 | 0 | 0 | 0 | 0 |

| Shelby | 2 | 2 | 1 | 2 | 3 |

| Stark | 5 | 13 | 3 | 9 | 10 |

| Summit | 14 | 11 | 2 | 12 | 10 |

| Trumbull | 8 | 4 | 4 | 3 | 2 |

| Tuscarawas | 2 | 3 | 3 | 2 | 10 |

| Union | 5 | 1 | 1 | 2 | 0 |

| Van Wert | 1 | 2 | 0 | 1 | 0 |

| Vinton | 0 | 0 | 1 | 1 | 1 |

| Warren | 4 | 3 | 4 | 3 | 2 |

| Washington | 1 | 3 | 4 | 4 | 5 |

| Wayne | 2 | 3 | 2 | 4 | 3 |

| Williams | 1 | 3 | 0 | 2 | 1 |

| Wood | 5 | 3 | 2 | 1 | 2 |

| Wyandot | 0 | 2 | 0 | 0 | 0 |

What’s the Number of Fatalities in Crashes Involving an Alcohol-Impaired Driver by County?

We saw earlier the penalties for driving under the influence. You can lose your license, get jail time, and have fines. Sadly, you can also lose your life or take the life of someone else.

Below we have tables showing the number of fatalities in alcohol-related accidents by Ohio county.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 1 | 1 | 2 | 2 | 0 |

| Allen | 2 | 2 | 2 | 4 | 5 |

| Ashland | 1 | 2 | 1 | 2 | 2 |

| Ashtabula | 7 | 4 | 7 | 7 | 5 |

| Athens | 2 | 3 | 1 | 0 | 0 |

| Auglaize | 1 | 3 | 0 | 1 | 0 |

| Belmont | 3 | 1 | 3 | 1 | 2 |

| Brown | 1 | 3 | 1 | 0 | 0 |

| Butler | 6 | 11 | 7 | 8 | 9 |

| Carroll | 0 | 0 | 1 | 0 | 1 |

| Champaign | 0 | 0 | 2 | 3 | 2 |

| Clark | 8 | 9 | 7 | 2 | 2 |

| Clermont | 2 | 6 | 7 | 6 | 2 |

| Clinton | 2 | 2 | 1 | 0 | 1 |

| Columbiana | 2 | 7 | 1 | 5 | 3 |

| Coshocton | 0 | 2 | 2 | 4 | 1 |

| Crawford | 0 | 0 | 1 | 0 | 1 |

| Cuyahoga | 19 | 25 | 29 | 34 | 32 |

| Darke | 1 | 2 | 5 | 2 | 2 |

| Defiance | 1 | 4 | 2 | 2 | 3 |

| Delaware | 2 | 2 | 6 | 4 | 3 |

| Erie | 0 | 0 | 3 | 4 | 1 |

| Fairfield | 4 | 2 | 4 | 5 | 4 |

| Fayette | 2 | 1 | 1 | 1 | 3 |

| Franklin | 20 | 27 | 25 | 34 | 27 |

| Fulton | 3 | 0 | 4 | 2 | 1 |

| Gallia | 3 | 0 | 1 | 0 | 3 |

| Geauga | 1 | 6 | 3 | 4 | 2 |

| Greene | 2 | 2 | 2 | 5 | 5 |

| Guernsey | 4 | 1 | 0 | 2 | 3 |

| Hamilton | 23 | 18 | 16 | 20 | 22 |

| Hancock | 2 | 4 | 3 | 3 | 1 |

| Hardin | 0 | 0 | 0 | 2 | 0 |

| Harrison | 0 | 1 | 2 | 2 | 0 |

| Henry | 0 | 0 | 5 | 2 | 4 |

| Highland | 1 | 1 | 2 | 3 | 1 |

| Hocking | 2 | 0 | 3 | 0 | 0 |

| Holmes | 1 | 0 | 0 | 0 | 0 |

| Huron | 1 | 0 | 2 | 3 | 1 |

| Jackson | 5 | 1 | 0 | 4 | 2 |

| Jefferson | 1 | 4 | 4 | 0 | 1 |

| Knox | 2 | 3 | 0 | 0 | 3 |

| Lake | 4 | 2 | 3 | 6 | 7 |

| Lawrence | 2 | 1 | 1 | 0 | 1 |

| Licking | 3 | 3 | 3 | 4 | 10 |

| Logan | 1 | 2 | 1 | 0 | 1 |

| Lorain | 7 | 4 | 10 | 11 | 10 |

| Lucas | 11 | 13 | 12 | 10 | 18 |

| Madison | 1 | 3 | 4 | 1 | 1 |

| Mahoning | 1 | 5 | 7 | 6 | 8 |

| Marion | 3 | 4 | 0 | 2 | 2 |

| Medina | 1 | 5 | 6 | 4 | 4 |

| Meigs | 0 | 0 | 2 | 1 | 3 |

| Mercer | 0 | 0 | 2 | 0 | 3 |

| Miami | 1 | 1 | 3 | 3 | 1 |

| Monroe | 1 | 1 | 0 | 1 | 1 |

| Montgomery | 16 | 20 | 19 | 17 | 20 |

| Morgan | 1 | 0 | 1 | 0 | 1 |

| Morrow | 1 | 0 | 3 | 1 | 2 |

| Muskingum | 2 | 1 | 2 | 3 | 0 |

| Noble | 1 | 2 | 1 | 1 | 0 |

| Ottawa | 2 | 2 | 2 | 0 | 2 |

| Paulding | 2 | 0 | 0 | 3 | 0 |

| Perry | 2 | 1 | 0 | 2 | 0 |

| Pickaway | 3 | 3 | 0 | 3 | 5 |

| Pike | 0 | 2 | 0 | 1 | 1 |

| Portage | 2 | 3 | 3 | 4 | 3 |

| Preble | 1 | 3 | 3 | 1 | 1 |

| Putnam | 0 | 1 | 2 | 1 | 1 |

| Richland | 5 | 2 | 6 | 2 | 4 |

| Ross | 4 | 0 | 2 | 4 | 0 |

| Sandusky | 2 | 1 | 2 | 4 | 2 |

| Scioto | 4 | 2 | 3 | 2 | 0 |

| Seneca | 2 | 2 | 1 | 0 | 6 |

| Shelby | 2 | 3 | 2 | 4 | 5 |

| Stark | 10 | 16 | 4 | 10 | 10 |

| Summit | 12 | 14 | 6 | 18 | 9 |

| Trumbull | 2 | 4 | 4 | 2 | 2 |

| Tuscarawas | 5 | 1 | 1 | 1 | 8 |

| Union | 0 | 0 | 3 | 2 | 0 |

| Van Wert | 0 | 0 | 0 | 0 | 0 |

| Vinton | 0 | 1 | 1 | 0 | 1 |

| Warren | 5 | 4 | 1 | 1 | 5 |

| Washington | 1 | 0 | 3 | 1 | 4 |

| Wayne | 1 | 4 | 1 | 4 | 2 |

| Williams | 1 | 1 | 3 | 2 | 0 |

| Wood | 2 | 3 | 6 | 3 | 4 |

| Wyandot | 0 | 0 | 1 | 0 | 0 |

| Alcohol-Impaired Driving Fatalities Involving High BAC | Ohio | National |

|---|---|---|

| BAC=.15+ | 73.1 | 70.1 |

What’s the Ranking for Teen Drinking and Driving?

Ohio is ranked 43rd in the nation for underage drinking arrests.

Ohio is cracking down on laws regarding the “social host liability”. This means the following which can be found on the FindLaw website:

Under these laws, a “social host” (an individual or business who serves alcohol in a social setting) is not only prohibited from providing alcohol to people under the age of 21, but he or she may also be responsible if these minors kill or injure someone while intoxicated from alcohol served by the social host. Note that a host is only liable to a third party when the injury is caused by a guest under 21 years old.

So if you are hosting a party with alcohol, please be aware of underage party guests that could be consuming alcohol.

Compare Quotes From Top Companies and Save