Maryland Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

t

Uninsured Motorists 12.40

Driving along Maryland’s 4,431 miles of shoreline or through some of its 2.7 million acres of forest can make a person feel like they’ve stepped back in time.

With so much to see its no wonder that approximately 42 million visitors chose to visit the Old Line State annually. Unfortunately, this can lead to more than a few headaches for drivers on Maryland’s roadways.

With tourists adding confusion to Maryland’s already congested roadways it is even more important to have the right car insurance company on your side. That is where we come in. This Maryland car insurance guide gives you all you need to know about Maryland auto insurance laws and regulations.

Do you have to add your teenager to your car insurance in Maryland? What are Maryland auto insurance claims laws? What, if any, Maryland state car insurance programs are available. All these questions and more will be answered.

We are here to provide you with all of the information and tips you need to ensure that you purchase the perfect auto insurance policy to meet all of your unique needs. Keep reading to find out we can help and get quotes on great car insurance rates for any state.

If you are interested in changing car insurance in Maryland, use our free search tool to find great quotes in your area.

What are Maryland car insurance coverage and rates?

What is recommended for car insurance coverage?

Navigating car insurance requirements in Maryland can often leave a person feeling like they want to break the law by swearing from their car window in Rockville. There is no need to resort to such extremes though. We are here to show you how having the right car insurance provider on your side can benefit you in more ways than one.

The benefits of having the right insurance provider go beyond just cheap car insurance rates. Having the right provider can also ensure that if something happens to you or your car all of your bills get paid. This is where we come in.

We have collected and simplified all of the data you require to make an educated and money-conscious decision when choosing both your types of coverage and a provider who understands your specific needs.

Keep scrolling to find out everything you need to know to make purchasing your car insurance policy as pleasant as finding a pearl in an oyster.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Maryland minimum coverage requirements?

Is car insurance required in Maryland? According to the Maryland Department of Transportation Motor Vehicle Administration all vehicles registered in the Old Line State must be insured at all times, and are required to maintain the minimum amount of coverage.

The minimum legal Maryland car insurance coverage is:

- $30,000 for Bodily Injury

- $60,000 for Bodily Injury for two or more people.

- $15,000 for Property Damage

NOLO also notes that:

Maryland follows a traditional “at-fault” system when it comes to financial responsibility for losses stemming from a car accident: injuries, lost income, vehicle damage, and so on.

This means that if you cause an accident in Maryland you will bear the brunt of the financial responsibility for setting things right. Failure to comply with Maryland’s minimum requirements could also cost you your driving privileges, your vehicle tag, and your vehicle’s registration.

Should you find yourself in a position to prove that you are insured it is nice to know that Maryland is one of the 48 states that allow for the use of an electronic copy of your insurance card.

What are acceptable forms of financial responsibility?

The state of Maryland’s Financial Responsibility Law does not just require all drivers to carry the minimum amount of liability and uninsured motorist coverage. This law also requires that evidence of such coverage must be presented before you can register a vehicle.

The evidence of insurance coverage that you provide to the Maryland Vehicle Administration (MVA) must include the following:

- The name of the insurance company

- The name of the authorized agent (if applicable)

- The policy or binder number

In order to register a vehicle you will also be asked to provide proof of ownership of the vehicle, the Application for Certificate of Title (form #VR-005). Maryland also requires that you provide:

- A Maryland Safety Inspection Certificate

- Proof of the vehicle,s value if the value cannot be identified

- Lien information if the car has been purchased with borrowed money

- Lien release if the title is showing that a lien exists but has been paid off

- Power of attorney if someone other than you will be signing the titling forms

Maryland also has an Excise Titling Taxof 6 percent.

Proof of insurance is not just required when purchasing, registering or titling a car in Maryland. As of October 1, 2016 all drivers in the Old Line State are also required to present valid proof of insurance during traffic stops upon the request of law enforcement.

Your Insurance Identification card must have the following information on it:

- The first named person on the liability policy

- The vehicle covered under the liability insurance policy

- And the period of coverage that the liability policy is in effect for

Maryland allows both paper and electronic forms of financial responsibility to be presented. It is tempting to drive without insurance to many people because auto insurance rates can seem high. The risks outweigh the advantages though.

Failure to present proper proof of insurance can result in a ticket and fine. Keep scrolling to find out how we can help you prevent these headaches.

How much are premiums as a percentage of your income?

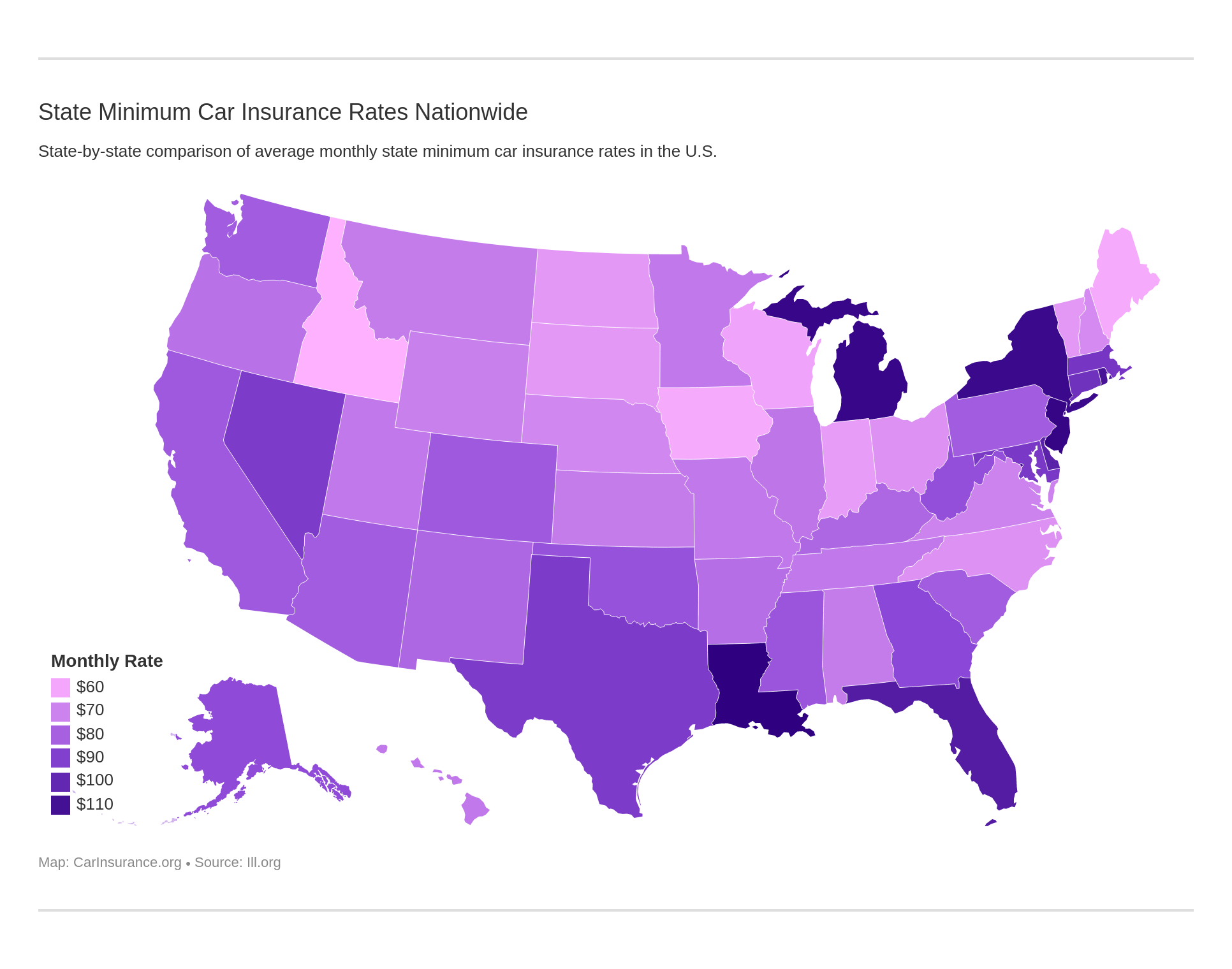

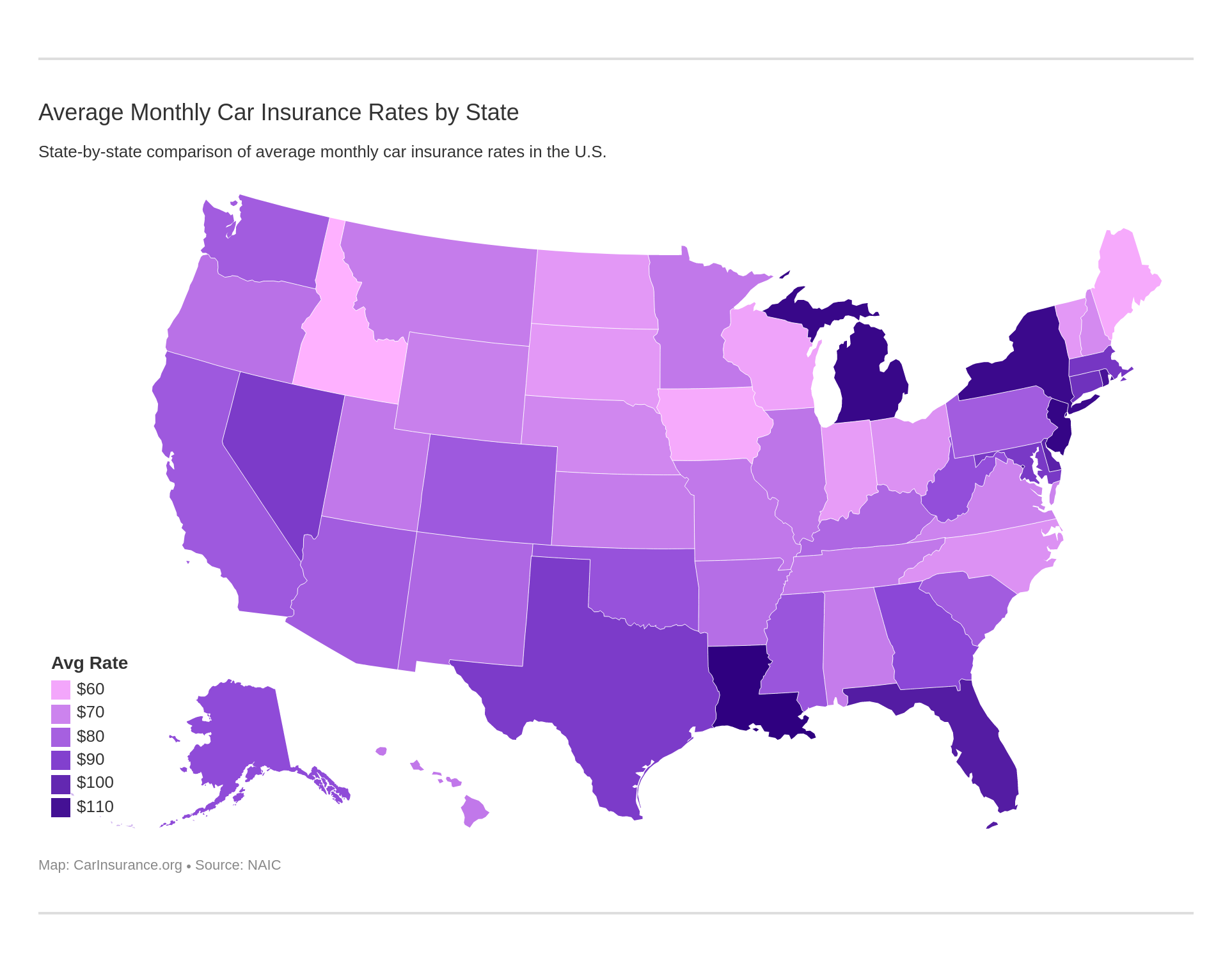

Maryland ranks 34th in the nation when it comes to the price of car insurance. Insurance premiums are also projected to keep rising across the United States in the next few years.

Given the rising costs of insurance premiums, getting the most for your money when purchasing your policy is important. Consider that, as a resident of the Old Line State, around 2.34 percent of your annual income will be dedicated to paying for car insurance it literally pays to make an educated decision when buying car insurance.

With a per capita disposable income of $46, 875 per year earned each year by residents of Maryland and $1,116.45 of that being spent annually to maintain insurance on your vehicle, this means that on average $93 is spent on car insurance from a monthly budget of $3,906.

The rates for car insurance in Maryland demonstrate only a slight rise in consumer costs, but in today’s economy every penny counts.

This is especially true when you consider that Maryland’s neighbor Delaware ranks 43rd nationally when it comes to the cost of insurance whereas Pennsylvania ranks 11th even though the annual percentage of disposable income spent on car insurance in each of these three states is not all that different.

Maryland is a great state to live in if you are purchasing car insurance overall because it ranks mid-range on the national average which places the average expenditure for car insurance nationwide at $935.80 per year. On the whole, Maryland residents are paying about $140 more than the rest of the country to drive in Old Line State though.

There are ways to lower the amount that you pay out of pocket for your insurance policy each year such as adjusting your coverage amounts or asking about safe driver or student discounts.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the average monthly car insurance rates in MD (liability, collision, comprehensive)?

The average cost of car insurance in Maryland is not the same in all areas. Some cities may offer cheaper auto insurance coverage. Insurance coverage is mandatory in Maryland and all drivers must carry it as proof to register a vehicle and keep the car tagged. An important factor that determines your rates is where you live. Even though rates are higher compared to other states in the U.S, there are some ways to get lower rates. Shopping around for insurance quotes and researching different insurance carriers might help you find the best fit for you.

Insuring that you get the most out of every dollar that you spend on car insurance means understanding what is required of you as a car owner in the state of Maryland.

| Coverage Type | Annual Cost (2015) |

|---|---|

| Liability | $609.74 |

| Collision | $353.99 |

| Comprehensive | $152.72 |

| Combined Total | $1,116.45 |

The rates reflected above are from 2015 so premiums for 2019 might be slightly higher. Educating yourself on the car insurance requirements for Maryland, the insurance providers available in your area, and shopping around for the best rates from each of them can go a long way towards keeping your premiums low though.

Because Maryland ranks middle of the road for annual average car insurance expenditures it is easy to think that all car insurance companies are the same in the Old Line State. This could end up costing precious time and money in the future though if you don’t put the work in up front.

Keep reading to find out how we can help you make a good decision now rather than wishing you did later.

What additional coverage options are available?

Even though purchasing only what the state requires from the cheapest car insurance company in town sounds like the best way to save money it could end up costing you in the long run. Sometimes adding just a little more to your policy can go a long way.

One of the options for giving you added protection in Maryland is MedPay. MedPay will pay for medical expenses and costs related to you or others who might be injured or killed while riding in your vehicle.

Some of what MedPay covers includes:

- Surgical costs

- Medical expenses including prescriptions

- Dental expenses

- And funeral costs

These are expenses that no one likes to think they will incur as a result of an accident but can end up sending you into financial ruin if you are not prepared.

How do you decide whether or not to pick up additional liability coverage? One of the best things to consider in this decision is the loss ratios of the companies that you are considering. Below are the loss ratio trends for Maryland statewide which can give you an indication of how the overall car insurance market in the state is doing.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection | 78% | 77% | 77% |

| Medical Payments (MedPay) | 88% | 88% | 78% |

| Uninsured/Underinsured Motorist (UUM) | 69% | 69% | 67% |

The loss ratios for PIP, MedPay, and Uninsured/Underinsured motorist coverage are good news to you as a Maryland driver. Why? Because loss ratio is a good way to determine the overall health of the car insurance market. Specifically:

- A High Loss Ratio (over 100 percent) indicates that the companies are losing money because they are paying out to many claims which might force them to raise rates.

- A Low Loss Ratio indicates that companies overestimated the number and severity of claims and probably charged too much premium as a result.

A car insurance company with a high loss ratio is one that is one who is willing to pay out a claim should you ever need to file a claim.

Considering that on average 12 percent of all Maryland drivers are uninsured ranking it 23rd in the nation this means that it could benefit you greatly if you have an insurer on your side who is more willing to help you out when you need it.

There are other ways to protect yourself besides ensuring that you provider has a good loss ration. Some of these ways include purchasing add-ons or endorsements to your policy. Keep scrolling to find out which ones might be right for you.

What add-ons and endorsements are available?

Although not required by law in Maryland, add-ons and endorsements can provide you an added layer protection should you find yourself in need of it.

Some of these benefits of adding onto your minimum coverage include help with recovery from a total loss of your vehicle after an accident or helping you out if your car breaks down and you find yourself in need of a tow.

Some of the most useful add-ons and endorsements include:

- Guaranteed Auto Protection (GAP) insurance-If your car is ever totaled or stolen GAP will pay any money that is remains owed on the lease or loan.

- Personal Umbrella Policy (PUP)–When your underlying liability limits have been reached PUP kicks in to help protect you from lawsuits which may result from an auto accident.

- Rental Reimbursement–Should you ever need to leave your car in the shop, rental reimbursement will help you pay the costs of renting a car until your repairs are finished. (For more information, read our “Pros and Cons of Renting Your Car to Others“).

- Emergency Roadside Assistance–Take the stress out of being stranded on the side of the road with this nifty little add-on. If your car breaks down or you have a flat emergency roadside assistance will be there for you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance–This type of coverage helps pay for the cost of repairs to your car which did not result from an accident.

- Non-Owner Car Insurance–If you don’t own a car but still drive then this type of coverage is perfect for you. Non-Owner Car Insurance provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage–If a basic model just isn’t for you then modified car insurance should be. This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance–Classic cars need special maintenance and special insurance. Classic Car Insurance coverage helps ensure that if something happens to your pride and joy both of you will be protected. This type of insurance typically costs less too since classic cars are usually not driven as much as your average automobile.

- Pay-As-You-Drive or Usage-Based Insurance–This type of coverage is based on the way you drive. The insurance provider takes into account your speed, distance traveled, and other such factors and issues discounts based on that information.

- Transportation Expense Coverage-If you need additional transportation costs such as bus or cab fare while your vehicle is being repaired after an accident having this type of coverage can really help out.

The type of car you own or how to best protect yourself in case of the loss of it are not the only things to consider when you are shopping for your policy. Sometimes factors you never even considered can impact how much you pay.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

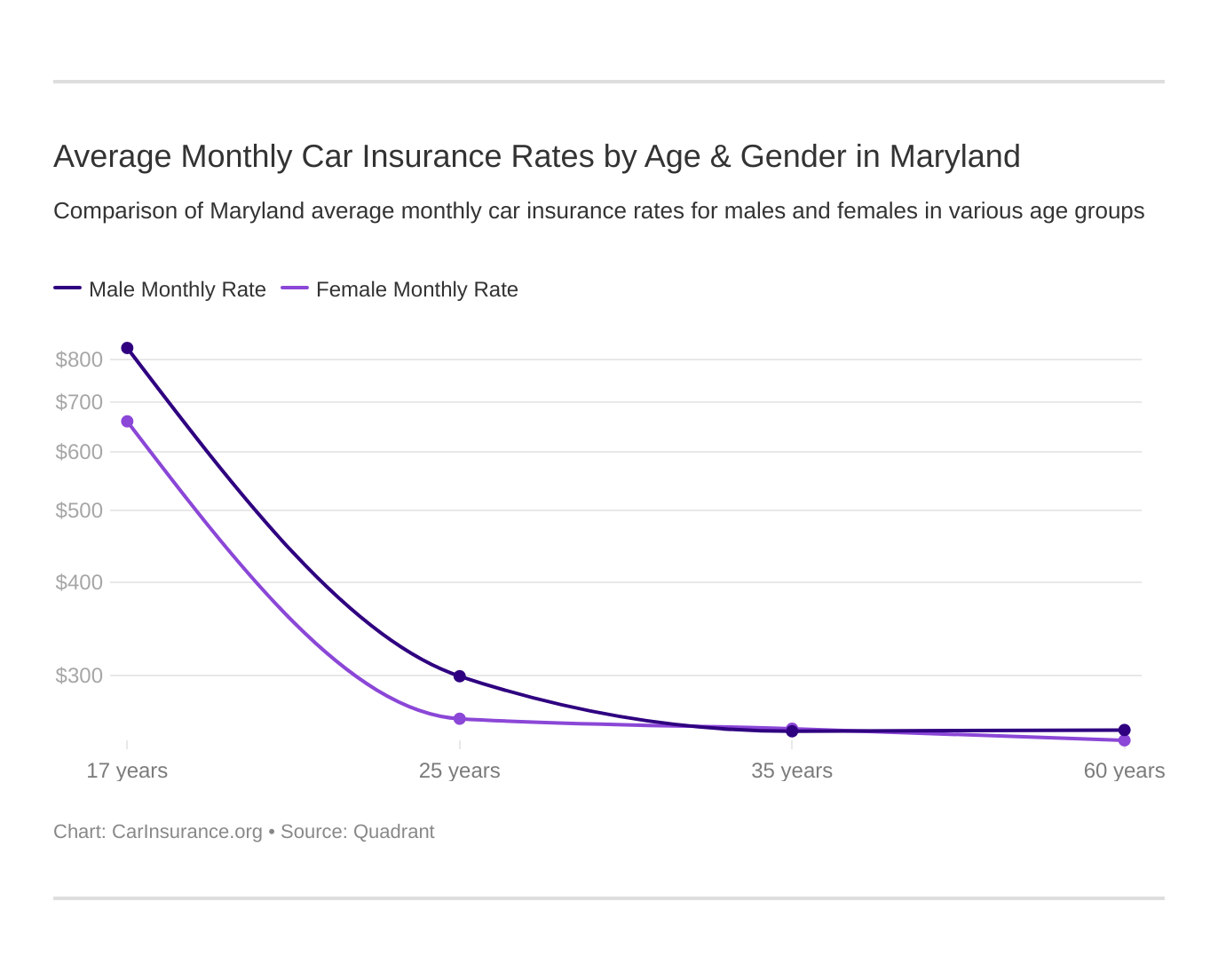

What are male vs. female rates?

Almost everyone believes that if they maintain a clean driving record then their rates will remain low. This is not always the case. the reality is that your age, gender, and many other factors go into determining what you will pay for car insurance. In fact, according to CFA,

48 percent of Americans think auto insurers charge men more for coverage than women, while only 23 percent of Americans think women are charged more.

The reality is that older women usually pay more than their male counterparts according to the national average.

Take a look at the table below to see how your age group stacks up in the Old Line State.

| Company | Married 35-year-old Female Annual Rate | Married 35-year-old Male Annual Rate | Married 60-year-old Female Annual Rate | Married 60-year-old Male Annual Rate | Single 17-year-old Female Annual Rate | Single 17-year-old Male Annual Rate | Single 25-year-old Female Annual Rate | Single 25-year-old Male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,479.22 | $3,341.48 | $3,315.46 | $3,402.86 | $10,126.25 | $11,877.20 | $3,142.00 | $3,180.86 |

| Geico General | $2,409.20 | $2,633.97 | $2,737.58 | $3,154.25 | $7,238.09 | $8,259.04 | $2,057.84 | $2,171.06 |

| Liberty Mutual Ins. | $6,671.15 | $6,671.15 | $6,594.83 | $6,594.83 | $12,964.69 | $19,221.87 | $6,671.15 | $8,990.68 |

| Nationwide Affinity Ins Co Of America (NAICOA) | $2,001.73 | $2,008.48 | $1,810.88 | $1,863.99 | $4,680.47 | $6,150.29 | $2,316.18 | $2,493.50 |

| Progressive Select | $2,445.57 | $2,204.58 | $2,128.62 | $2,74.55 | $8,688.04 | $9,494.13 | $2,844.89 | $2,778.79 |

| State Farm Mutual Auto | $2,384.38 | $2,384.38 | $2,189.99 | $2,89.99 | $7,402.28 | $9,470.28 | $2,661.50 | $3,004.10 |

| USAA | $1,974.24 | $1,939.21 | $1,843.88 | $1,839.49 | $5,166.68 | $4,378.75 | $2,274.19 | $2,536.67 |

Looking at the table reveals that teenagers are still the most expensive age group to insure. What’s surprising though is that the rest of the rates really do not shift too far up or down for the rest of the age groups based on gender.

There are other factors that could be at play when shopping for the best rates for your car insurance policy besides age and gender. Keeps reading to find out what they are.

Read More: LM General Insurance Company Review

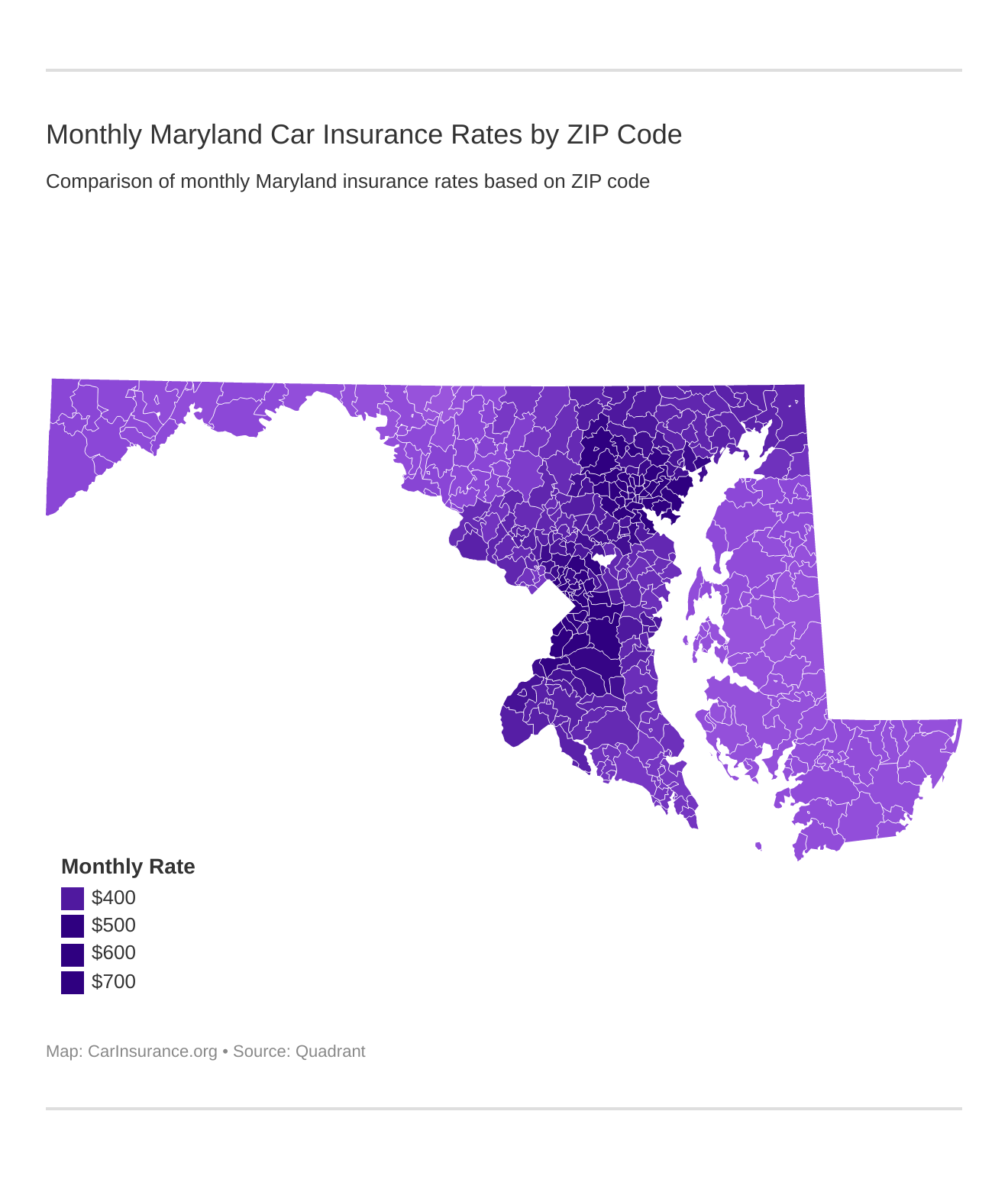

Where are the cheapest rates by ZIP code?

For many people, it is a shock to learn that where they live matters when it comes to buying car insurance. People who live in the same city but have a different zip code often find it hard to swallow that their neighbors are enjoying up to hundreds of dollars in car insurance savings just because the chose the right street to live on.

Love it or hate it; that is the reality of the car insurance market which is why it pays to shop around.

Take a look at the following tables to see how your zip code compares to those around you.

| Cheapest ZIP Codes in Maryland | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 21783 | SMITHSBURG | $3,658.86 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21629 | DENTON | $3,679.84 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21767 | MAUGANSVILLE | $3,680.30 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,451.41 |

| 21721 | CHEWSVILLE | $3,682.15 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21660 | RIDGELY | $3,683.98 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21641 | HILLSBORO | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21670 | TEMPLEVILLE | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21655 | PRESTON | $3,689.34 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21601 | EASTON | $3,689.45 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,283.88 |

| 21719 | CASCADE | $3,696.13 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21811 | BERLIN | $3,696.78 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,322.55 |

| 21632 | FEDERALSBURG | $3,697.12 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| 21742 | HAGERSTOWN | $3,697.62 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21842 | OCEAN CITY | $3,698.26 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,322.55 |

| 21862 | SHOWELL | $3,699.60 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,407.74 |

| 21810 | ALLEN | $3,699.92 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,247.24 | USAA | $2,424.67 |

| 21627 | CROCHERON | $3,701.33 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| 21663 | SAINT MICHAELS | $3,702.10 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,278.74 |

| 21652 | NEAVITT | $3,702.66 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| 21653 | NEWCOMB | $3,702.66 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| 21795 | WILLIAMSPORT | $3,706.29 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,451.41 |

| 21852 | POWELLVILLE | $3,706.88 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,247.24 | USAA | $2,424.67 |

| 21654 | OXFORD | $3,708.41 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| 21659 | RHODESDALE | $3,711.42 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| 21734 | FUNKSTOWN | $3,711.93 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

Zip code 21783 in Smithsburg has the cheapest car insurance rates.

| Most Expensive ZIP Codes in Maryland | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 21216 | BALTIMORE | $8,830.19 | Liberty Mutual | $18,053.57 | Progressive | $9,230.34 | USAA | $4,945.10 | Nationwide | $5,400.63 |

| 21215 | BALTIMORE | $8,651.27 | Liberty Mutual | $18,053.57 | Progressive | $9,004.76 | USAA | $4,632.39 | Nationwide | $5,400.63 |

| 21213 | BALTIMORE | $8,455.92 | Liberty Mutual | $16,417.60 | State Farm | $8,891.65 | USAA | $4,390.01 | Nationwide | $5,201.68 |

| 21217 | BALTIMORE | $8,407.60 | Liberty Mutual | $18,053.57 | Progressive | $8,410.13 | USAA | $4,625.95 | Nationwide | $5,400.63 |

| 21223 | BALTIMORE | $8,230.60 | Liberty Mutual | $15,383.48 | Progressive | $8,481.40 | USAA | $4,945.10 | Nationwide | $5,201.68 |

| 21205 | BALTIMORE | $7,886.36 | Liberty Mutual | $16,417.60 | State Farm | $8,088.92 | USAA | $3,761.94 | Nationwide | $5,201.68 |

| 21207 | GWYNN OAK | $7,721.94 | Liberty Mutual | $15,383.48 | Progressive | $7,844.78 | USAA | $4,882.32 | Nationwide | $5,400.63 |

| 21251 | BALTIMORE | $7,596.61 | Liberty Mutual | $15,383.48 | Progressive | $7,616.45 | USAA | $4,158.69 | Nationwide | $5,201.68 |

| 21218 | BALTIMORE | $7,591.34 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,928.12 | Nationwide | $5,201.68 |

| 21239 | BALTIMORE | $7,485.36 | Liberty Mutual | $15,481.52 | Allstate | $7,585.22 | USAA | $4,158.69 | Nationwide | $4,504.09 |

| 21202 | BALTIMORE | $7,310.39 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,761.94 | Nationwide | $5,201.68 |

| 21206 | BALTIMORE | $7,306.98 | Liberty Mutual | $12,595.13 | Progressive | $8,639.76 | USAA | $4,219.07 | Nationwide | $4,504.09 |

| 21133 | RANDALLSTOWN | $7,288.96 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,682.84 | Nationwide | $4,860.80 |

| 21244 | WINDSOR MILL | $7,164.27 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,906.13 | Nationwide | $4,509.81 |

| 21233 | BALTIMORE | $7,044.14 | Liberty Mutual | $15,383.48 | Progressive | $7,721.98 | USAA | $3,831.40 | Nationwide | $4,504.09 |

| 21201 | BALTIMORE | $7,013.37 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,734.89 | Geico | $4,760.90 |

| 21231 | BALTIMORE | $6,850.34 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,831.40 | Progressive | $4,824.71 |

| 21208 | PIKESVILLE | $6,777.46 | Liberty Mutual | $14,015.81 | Allstate | $7,585.22 | USAA | $3,662.08 | Nationwide | $3,990.65 |

| 21214 | BALTIMORE | $6,699.88 | Liberty Mutual | $10,811.14 | Allstate | $7,693.18 | USAA | $3,954.72 | Nationwide | $4,504.09 |

| 21209 | BALTIMORE | $6,520.50 | Liberty Mutual | $14,015.81 | Allstate | $7,585.22 | USAA | $3,358.11 | Nationwide | $4,504.09 |

| 20743 | CAPITOL HEIGHTS | $6,517.08 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | Nationwide | $4,077.69 | USAA | $4,095.03 |

| 20747 | DISTRICT HEIGHTS | $6,402.12 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,040.83 | Nationwide | $4,077.69 |

| 20785 | HYATTSVILLE | $6,358.32 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,032.68 | Nationwide | $4,077.69 |

| 21212 | BALTIMORE | $6,321.77 | Liberty Mutual | $11,974.20 | Allstate | $7,585.22 | USAA | $3,832.56 | Nationwide | $4,504.09 |

| 20710 | BLADENSBURG | $6,313.14 | Liberty Mutual | $14,583.12 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $3,865.45 |

City life has its advantages when it comes to ease of access to amenities but it could end up costing you more money for car insurance.

This can be seen by looking at Baltimore which boasts a population of 611,648 where the average person pays about $8,830.19 annually compared to Smithsburg with a population of 2,976 where the average person only pays around $3,658.86 for car insurance in the same period.

The difference is not just in urban to rural living. A person living in the Inner Harbor neighborhood pays about $1,000 less annually for their car insurance policy than a person who resides just a few miles away in Midtown Edmonson. Keep scrolling to find how why.

What are the cheapest rates by city?

There is no denying that a town like Baltimore has its advantages for residents and tourists alike. Making your way through the historic streets of Mobtown can be tricky though just like navigating car insurance options to find the best price.

Not to worry though. We are here to provide you with all of the information you need to make a smart decision when it comes to choosing the right car insurance provider to help you protect yourself and your loved ones.

Take a look at the tables below to see how the zip code you live in and the city that you love play a role in determining just what you will pay for your car insurance.

| Cheapest Cities in Maryland | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Cavetown | $3,658.86 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| Denton | $3,679.84 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Maugansville | $3,680.30 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,451.41 |

| Chewsville | $3,682.15 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| Ridgely | $3,683.98 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Hillsboro | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Templeville | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Preston | $3,689.34 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Easton | $3,689.44 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,283.88 |

| Cascade | $3,696.13 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| Berlin | $3,696.78 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,322.55 |

| Federalsburg | $3,697.12 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| Fountainhead-Orchard Hills | $3,697.62 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| Ocean City | $3,698.26 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,322.55 |

| Showell | $3,699.60 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,407.74 |

| Allen | $3,699.92 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,247.24 | USAA | $2,424.67 |

| Crocheron | $3,701.33 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| St. Michaels | $3,702.09 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,278.74 |

| Neavitt | $3,702.66 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| Newcomb | $3,702.66 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| Halfway | $3,706.29 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,451.41 |

| Powellville | $3,706.88 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,247.24 | USAA | $2,424.67 |

| Oxford | $3,708.41 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| Rhodesdale | $3,711.42 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| Funkstown | $3,711.93 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

Cavetown has the cheapest car insurance rates in Maryland.

| Most Expensive Cities in Maryland | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Randallstown | $7,288.96 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,682.84 | Nationwide | $4,860.80 |

| Windsor Mill | $7,164.27 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,906.13 | Nationwide | $4,509.81 |

| Baltimore | $6,862.78 | Liberty Mutual | $13,543.49 | Allstate | $7,512.52 | USAA | $3,899.06 | Nationwide | $4,576.97 |

| Capitol Heights | $6,517.08 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | Nationwide | $4,077.69 | USAA | $4,095.03 |

| District Heights | $6,402.12 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,040.83 | Nationwide | $4,077.69 |

| Cheverly | $6,358.32 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,032.68 | Nationwide | $4,077.69 |

| Bladensburg | $6,313.13 | Liberty Mutual | $14,583.12 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $3,865.45 |

| Forest Heights | $6,203.36 | Liberty Mutual | $13,517.97 | Allstate | $5,762.95 | USAA | $4,029.40 | Nationwide | $4,077.69 |

| East Riverdale | $6,143.03 | Liberty Mutual | $14,583.12 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $4,003.22 |

| Garrison | $6,113.39 | Liberty Mutual | $11,974.20 | Allstate | $7,529.77 | USAA | $3,552.82 | Nationwide | $4,160.22 |

| Camp Springs | $6,017.80 | Liberty Mutual | $13,119.41 | Allstate | $5,901.97 | USAA | $3,873.61 | Nationwide | $3,944.81 |

| Hyattsville | $5,969.59 | Liberty Mutual | $12,306.94 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $3,865.45 |

| Arbutus | $5,965.66 | Liberty Mutual | $9,170.39 | Allstate | $7,639.20 | USAA | $3,039.87 | Nationwide | $3,878.95 |

| Brentwood | $5,917.22 | Liberty Mutual | $12,306.94 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $4,003.22 |

| Adelphi | $5,893.97 | Liberty Mutual | $12,626.36 | Allstate | $6,090.60 | Nationwide | $3,779.60 | USAA | $3,809.53 |

| Riverdale | $5,880.83 | Liberty Mutual | $12,306.94 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $4,003.22 |

| Essex | $5,871.01 | Liberty Mutual | $10,811.14 | Allstate | $7,307.83 | USAA | $3,220.02 | Nationwide | $3,767.26 |

| Mount Rainier | $5,870.98 | Liberty Mutual | $12,306.94 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $4,003.22 |

| Glenarden | $5,728.56 | Liberty Mutual | $12,306.94 | Allstate | $6,070.33 | USAA | $3,262.16 | Nationwide | $3,588.66 |

| Bowleys Quarters | $5,711.38 | Liberty Mutual | $10,811.14 | Allstate | $6,509.97 | USAA | $3,401.99 | Nationwide | $3,767.26 |

| Clinton | $5,633.08 | Liberty Mutual | $12,322.28 | Allstate | $5,701.21 | USAA | $3,348.43 | Nationwide | $3,679.06 |

| Reisterstown | $5,628.38 | Liberty Mutual | $10,684.93 | Allstate | $6,016.35 | USAA | $3,302.66 | Nationwide | $3,449.67 |

| Edgemere | $5,593.30 | Liberty Mutual | $10,104.80 | Allstate | $7,693.18 | USAA | $3,220.02 | Nationwide | $3,767.26 |

| Kettering | $5,586.04 | Liberty Mutual | $12,306.94 | Allstate | $6,008.58 | USAA | $3,239.35 | Nationwide | $3,588.66 |

| Cheltenham | $5,585.48 | Liberty Mutual | $12,322.28 | Allstate | $5,701.21 | USAA | $3,348.43 | Nationwide | $3,679.06 |

The rates of someone who lives in Smithsburg where the population is around 2,900 versus a person who lives in Randallstown with a population of approximately 32,000 is quite substantial.

Given the fact that more people means more cars on the road, it is no surprise that places that are more densely populated have higher rates. After all, more cars on the road usually translate to more traffic incidents which inevitably results in more claims.

If you ever find yourself in the unfortunate position of having to file a claim it will be a comfort to know how your car insurance provider stacks up among the others. That is where we come in.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the best Maryland car insurance companies?

Sometimes driving a car is not as pleasant as finding a pearl in an oyster. Traffic accidents and incidents can often lead to frustration and confusion if you don’t have the right people on your side.

Knowing where the car insurance providers in your area rank according to AM Best before you purchase can go a long way towards helping you make the best choice for you and your family before you ever need to file a claim.

The Largest Companies Financial Ratings

AM Best has become a trusted agency to use when it comes to determining the overall health and viability of insurance providers. AM Best is also the only worldwide credit agency to have a particular focus on the insurance industry. Take a look at the table below to see what their top ten highest rated companies are.

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| ACE American Insurance Company | A++ | Stable |

| Agri General Insurance Company | A++ | Stable |

| Auto-Owners Insurance Company | A++ | Stable |

| Automobile Ins Co of Hartford, CT | A++ | Stable |

| Chubb Insurance Company | A++ | Stable |

| Columbia Insurance Company | A++ | Stable |

| Continental Divide Insurance Company | A++ | Stable |

| Geico | A++ | Stable |

| Great Northern Insurance Company | A++ | Stable |

| Owners Insurance Company | A++ | Stable |

When you choose a company with an A++ rating from AM Best you are choosing one that has a good loss ratio meaning that they will be more willing to pay out if you ever need to file a claim.

The higher the AM Best rating the more stable the overall financial outlook is for your car insurance provider which translates to more power in your corner should someone bump into you or your car in traffic.

You are also less likely to face any negative consequences which could result if your insurance provider goes bankrupt.

Companies with the Best Ratings

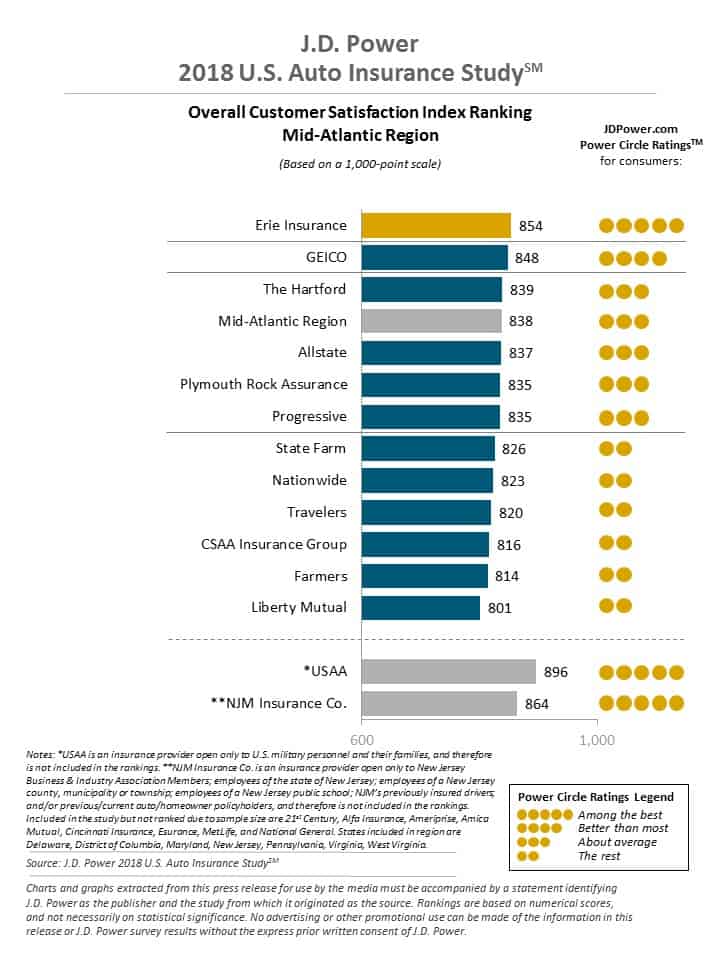

AM Best is not the only entity keeping its eye on the car insurance market for you. J.D. Power is also on your side and what they have uncovered is that customer satisfaction with car insurance providers is at a record high.

Purchasing car insurance is not always a pleasant experience for everyone though. Keep reading to find out which companies receive the most complaints and why that matters to you when shopping for your policy.

Companies with the Most Complaints in Maryland

Knowing who customers complain about can be a powerful tool when shopping around for car insurance. This is where the complaint ratio comes in. The complaint ratio tells you the consumer where each provider that you may be looking at stands in relation to their competitors.

Still don’t understand why the complaint ratio matters to you? We are here to help you make sense of it all.

The baseline for the complaint ratio is 1.0 which means that a company with a complaint ratio of 1.0 has an average number of complaints. Simply put, the higher the complaint ratio the higher the number of complaints lodged against the company then.

Below is a list of the top 10 best car insurance companies in Maryland along with their complaint ratios so that you can see how each one compares.

| Company | Direct Premiums Written | Complaint Ratio (2017) | Loss Ratio | Market Share |

|---|---|---|---|---|

| Travelers Group | $81,122 | 0.09 | 63.94% | 1.66% |

| Nationwide Corp Group | $373,032 | 0.28 | 63.41% | 7.62% |

| State Farm Group | $940,404 | 0.44 | 76.11% | 19.21% |

| Allstate Insurance Group | $582,872 | 0.50 | 56.19% | 11.91% |

| Geico | $1,173,739.00 | 0.68 | 71.93% | 23.98% |

| Erie Insurance Group | $376,241 | 0.70 | 78.20% | 7.69% |

| USAA Group | $422,116 | 0.74 | 78.75% | 8.62% |

| Progressive Group | $310,170 | 0.75 | 59.90% | 6.34% |

| Hartford Fire & Casualty Group | $50,075 | 4.68 | 61.65% | 1.02% |

| Liberty Mutual Group | $185,153 | 5.95 | 61.25% | 3.78% |

These numbers aren’t what they seem at first glance though.

In order to make sense of what loss ratio means you must also consider the size of the market share that each company holds.

Doing so reveals that while Hartford Fire & Casualty might appear to have the worst customer satisfaction it only holds 1.02 percent of the market share. Fewer customers mean that complaints are not spread out as far as they would be in a company such as Geico which services a good deal more customers keeping its complaint ration in check.

A company such as USAA, on the other hand, has a good complaint ratio in comparison to its market share.

- You can file a complain online through the Maryland.gov website portal

- You can also hand-deliver your complaint form

- MAIL: Maryland Insurance Administration, Attn: MIA Enforcement Unit, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202

- FAX: (410) 468-2245

- EMAIL: [email protected]

Now that you know what the loss ratio and complaint ratio mean to you as a consumer its time to start shopping and comparing rates.

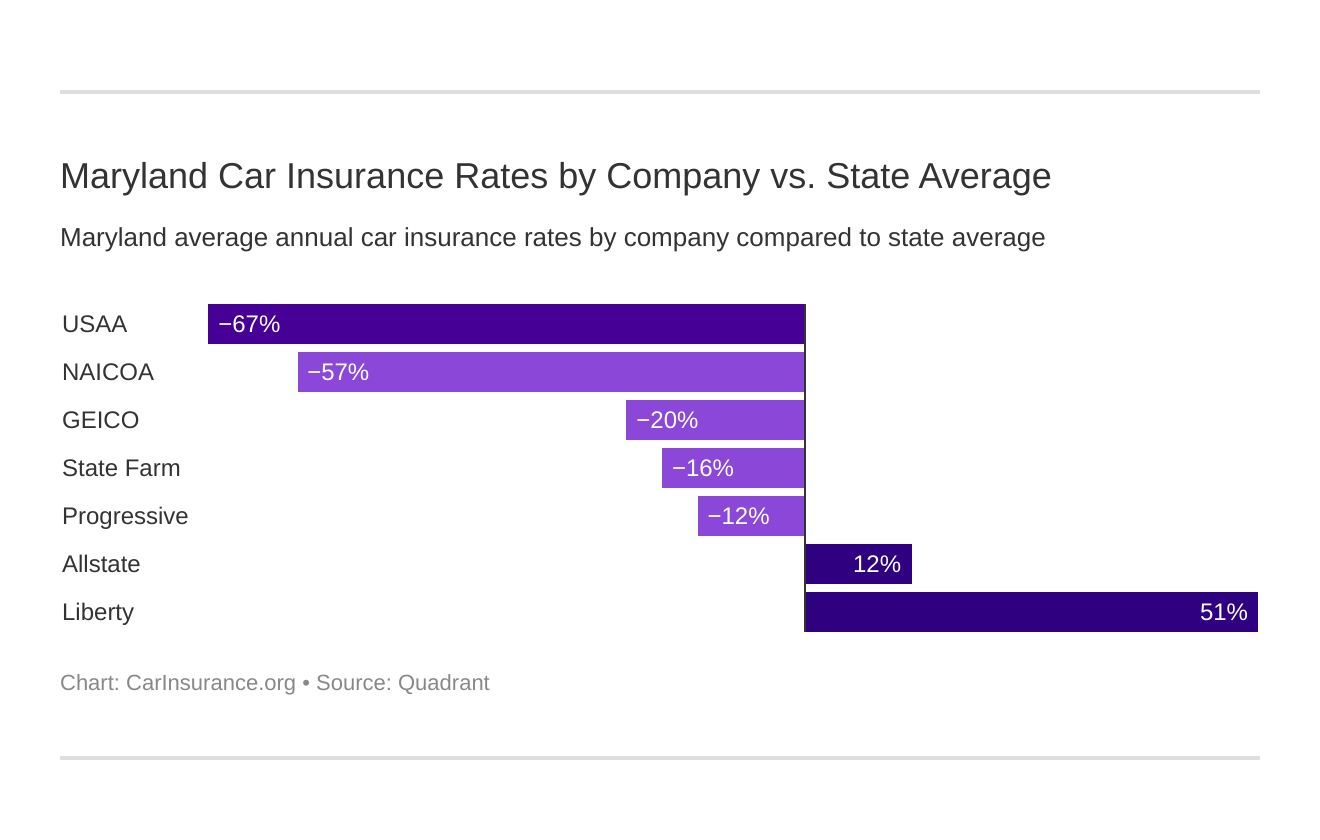

What are the cheapest companies in Maryland?

Being a smart, money-conscious shopper means starting with the companies with the cheapest rates in Maryland. We are here to help you do just that!

The table helps steer you in the right direction when it comes to choosing the best car insurance provider that your hard-earned dollar can buy.

| Company | Average Annual Rate | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allstate Indemnity | $5,233.17 | $650.47 | 12.43% |

| Geico Cas | $3,832.63 | ($750.07) | -19.57% |

| Liberty Mutual Fire Ins Co | $9,297.55 | $4,714.85 | 50.71% |

| NAICOA | $2,915.69 | ($1,667.01) | -57.17% |

| Progressive Select | $4,094.86 | ($487.84) | -11.91% |

| State Farm Mutual Auto | $3,960.86 | ($621.83) | -15.70% |

| USAA | $2,744.14 | ($1,838.56) | -67.00% |

Understanding the amount of purchasing power you have when shopping for your policy is an important part of the whole car insurance buying process. It is also important to understand the other factors that might impact your rates once you decide on a company to insure you.

There really is more to your rates than where you live or whether you are male or female. Scroll on down to find out all of the other things that car insurance companies consider when adjusting your rates.

What are commute rates by company?

One of the many things that car insurance companies consider when setting your rates is how much you use your car.

This means that the longer your commute is the higher your rates are most likely to be which is why it pays to compare the annual rates that Maryland car insurance providers are charging their customers based on the number of miles they drive a year.

The table below can help you put these numbers in perspective as you make your informed decision about which car insurance provider is best for you.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $5,159.18 | $5,307.15 |

| Geico | $3,768.30 | $3,896.96 |

| Liberty Mutual | $9,048.56 | $9,546.53 |

| Nationwide | $2,915.69 | $2,915.69 |

| Progressive | $4,094.86 | $4,094.86 |

| State Farm | $3,858.87 | $4,062.86 |

| USAA | $2,658.84 | $2,829.44 |

The numbers above reveal that if you have a short commute then USAA might be the best provider for you. If you are a road warrior though then State Farm might be the better option for you because it holds a bigger portion of the market share and has a lower complaint ratio by comparison.

Keep in mind that the more time you spend on the road the more your chances for an accident increase. This means that a company like State Farm which has a good loss ratio might also be the better option for you if you have a long commute since they will be more likely to pay out in case you need to file a claim.

You will also want to consider the coverage level rates of each company as you weigh your options for the best value in car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are coverage level rates by company?

Now that things like the loss ratio and market share are beginning to make more sense to you, and you are beginning to understand how your time spent on the road can impact your rates, it is wise to start considering what type of coverage you might need.

The table below can help you sort through some of the chaos.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $5,102.42 | $5,199.95 | $5,397.13 |

| Geico | $3,694.42 | $3,808.14 | $3,995.32 |

| Liberty Mutual | $9,027.48 | $9,275.12 | $9,590.04 |

| Nationwide | $2,792.62 | $2,924.01 | $3,030.44 |

| Progressive | $3,907.33 | $4,095.34 | $4,281.91 |

| State Farm | $3,753.81 | $3,972.14 | $4,156.65 |

| USAA | $2,601.17 | $2,753.05 | $2,878.19 |

Looking at the table makes it obvious that the more coverage you purchase the higher your rates will be which is one of the many reasons that you should shop around.

Some of the other reasons that you should shop around might be that you own an older car that may not need as much coverage or a classic car which might require a special type of coverage altogether.

If you have a clean driving record but your credit isn’t in the best shape you could also benefit from shopping around for a cheaper rate or adjusting your coverage.

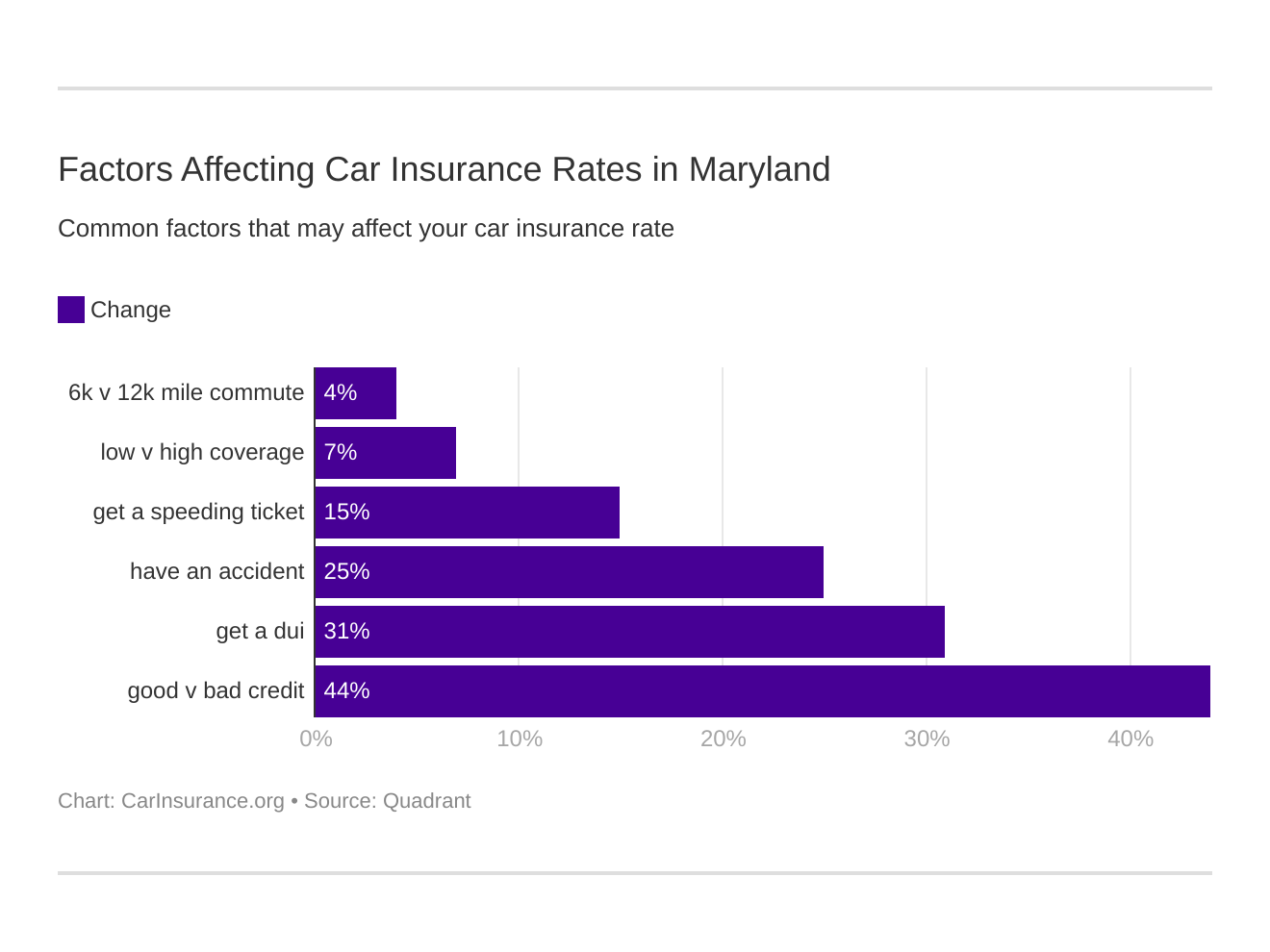

What are credit history rates by company?

You may be wondering what your credit rating has to do with the price that you pay for car insurance. In 2015 Consumer Reports gave all of America the answer with its surprising study which revealed that:

Your credit score could have more of an impact on your auto insurance premium price than any other factor.

Take a look at the table below to see just how your credit score might impact your car insurance rates in the First Line State.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $4,188.63 | $4,730.97 | $6,779.90 |

| Geico | $3,554.85 | $3,598.70 | $4,344.33 |

| Liberty Mutual | $6,040.99 | $8,563.61 | $13,288.03 |

| Nationwide | $2,384.07 | $2,636.53 | $3,726.47 |

| Progressive | $3,247.40 | $3,875.85 | $5,161.32 |

| State Farm | $2,650.60 | $3,437.51 | $5,794.48 |

| USAA | $2,063.46 | $2,509.68 | $3,659.27 |

The biggest reason that people who have higher credit ratings enjoy lower car insurance premiums is that they are more likely to pay out of pocket for any damages or injuries sustained in an accident than to file a claim against their policy.

Just because your credit score is one of the biggest factors that impact your car insurance rates does not mean that maintaining a good driving record can’t go a long way towards getting you an affordable policy with great coverage.

Keep reading to find out how this is possible.

What are driving record rates by company?

The Old Line State employs a demerit driver’s license point system which means that what you do behind the wheel really counts when it comes to purchasing your car insurance policy.

What you do behind the wheel outside of Maryland may also end up costing you according to the MVA. The types of out-of-state violations that can be attached to your Maryland driving record include:

- Alcohol and/or drug offenses

- Vehicular manslaughter or homicide

- Using a motor vehicle during the commission of a felony

- And leaving the scene of an accident that involves bodily injury

Any points on your driver’s license are also considered part of the public record for 3 years from the date of the violation. The table below shows just how much these violations could cost you.

| Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| Allstate | $4,632.04 | $5,510.30 | $4,632.04 | $6,158.29 |

| Geico | $2,719.17 | $3,232.71 | $5,144.48 | $4,234.15 |

| Liberty Mutual | $6,722.01 | $8,465.21 | $13,177.49 | $8,825.47 |

| Nationwide | $2,565.95 | $2,908.52 | $2,744.79 | $3,443.50 |

| Progressive | $3,496.06 | $4,020.51 | $4,229.05 | $4,633.82 |

| State Farm | $3,551.42 | $3,915.37 | $3,915.37 | $4,461.30 |

| USAA | $2,158.09 | $2,323.31 | $3,849.72 | $2,645.44 |

The data above demonstrates that just one ticket or accident can have a significant impact on your car insurance rates. This is why it is so important that you carefully and responsibly at all times.

If you do have infractions then you will want to keep a close eye on your driving record until those demerit points clear. You might also want to keep an eye on your credit report since cleaning up your credit is another way to lower your rates.

Keep scrolling to find out other ways to save money when shopping for your policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

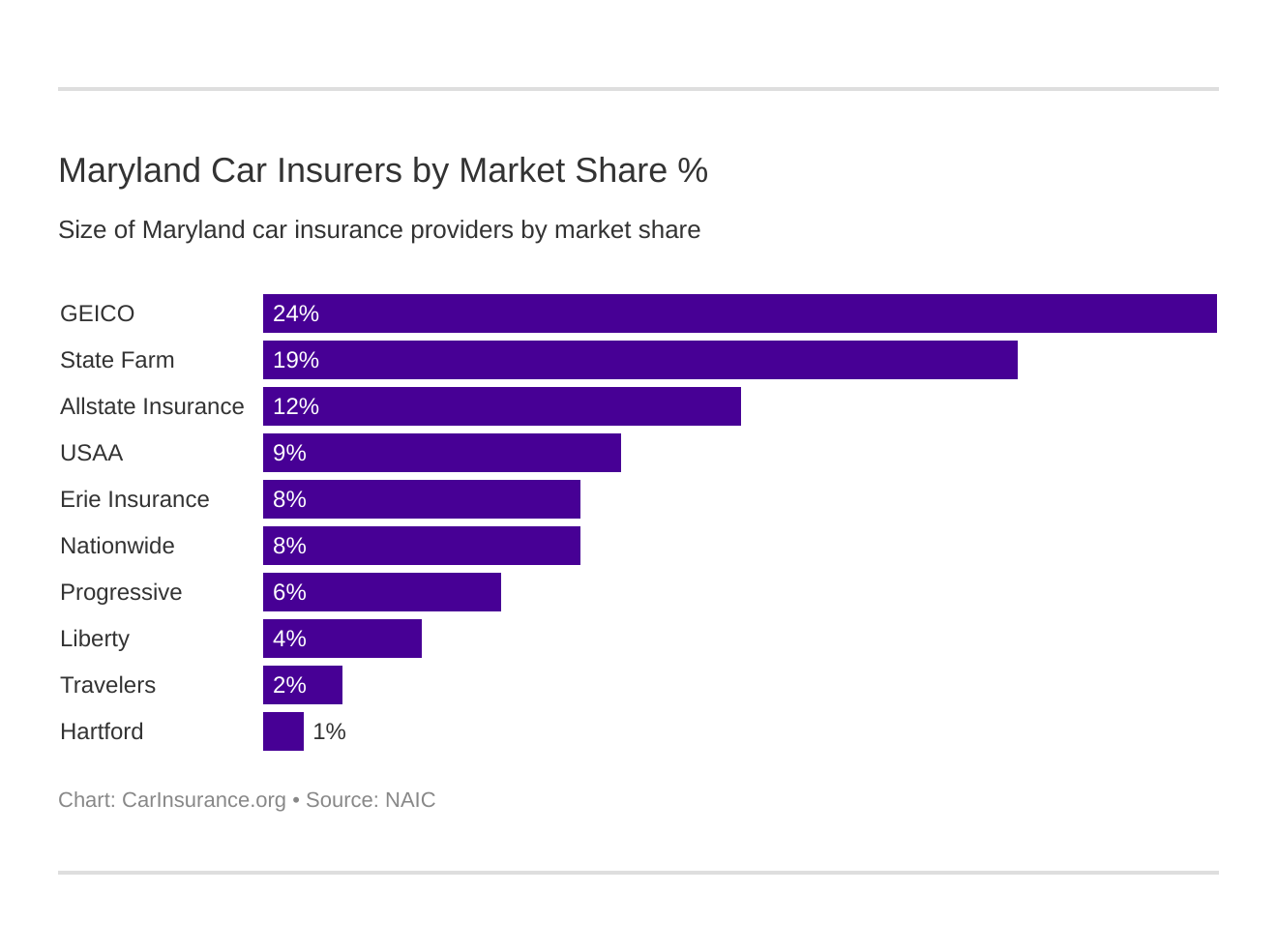

What are the largest auto insurance companies in Maryland?

When it comes to choosing your car insurance provider bigger does not always mean better. Taking a closer look at how market share works can help you understand why.

Plainly stated, market share is:

The percentage of an industry, or market’s total sales, that is earned by a particular company over a specified time period.

In this instance, the industry is the car insurance industry. Take a look at the table below to see how this definition translates into real numbers and what those numbers mean to you.

| Company | Direct Premium Written | Market Share |

|---|---|---|

| Geico | $1,173,739 | 23.98% |

| State Farm Group | $940,404 | 19.21% |

| Allstate Insurance Group | $582,872 | 11.91% |

| USAA Group | $422,116 | 8.62% |

| Erie Insurance Group | $376,241 | 7.69% |

| Nationwide Corp Group | $373,032 | 7.62% |

| Progressive Group | $310,170 | 6.34% |

| Liberty Mutual Group | $185,153 | 3.78% |

| Travelers Group | $81,122 | 1.66% |

| Hartford Fire & Casualty Group | $50,075 | 1.02% |

There are about 1.95 million vehicles registered in the Old Line State which is a pretty big market to share.

As you can see from the table, Geico controls approximately 24 percent of the overall car insurance market in the Old Line State. Geico is also demonstrating that it is financially sound since it has $1,173,739 in Direct Premiums Written.

Number of Insurers by State

Maryland boasts 32 domestic insurers and 860 foreign ones giving you 892 insurers to choose from. Don’t know what the difference is between the two? You are not alone.

Simply put:

- A domestic insurer is one which has been formed under laws of the state of Maryland.

- A foreign insurer is one that has been formed under the laws and jurisdiction of a state other than Maryland.

The bottom line is that neither one is better or worse when it comes to providing you with the coverage required by the Old Line State. It is up to you then to decide which one makes you feel the most comfortable.

Whichever one you choose dealing with them will be easier once you understand the laws that each one was formed under in order to operate in Maryland. Keep reading to get a brief overview of these laws in the next section.

What Maryland state laws do you need to know?

For many people negotiating their way through the law can be exhausting and confusing. It can also become frustrating after an accident or incident. This is why having a general grasp of the laws that affect you before you find yourself being forced to navigate them can help.

This is where we come in. We are here to help guide you through the ins and outs of the laws that might impact you should you find yourself in the unfortunate situation of being involved in an accident. Keep reading to get the basics of what you will need to know should the unfortunate become reality.

We mentioned previously that there are minimum coverage requirements in the Old Line State. What you may not know though is that Maryland is an “add-on state” which means that, according to NAIC, there are no restrictions on lawsuits. This makes knowing the law before an accident all the more important.

Knowing the law means understanding that a car insurance provider can deny you coverage if they deem you to be a high-risk driver.

This means that driving defensively and responsibly can save you time, money, and frustration in the long run. Obeying all traffic laws is not just an important part of saving you money on car insurance, it can also save lives.

You can do your part to ensure that your passengers, fellow drivers, bicyclists and pedestrians remain safe and protected by understanding just how Maryland determines its laws.

How State Laws are Determined

As with all laws in Maryland, the state legislature determines what is right and just for drivers in the Old Line State, and what they have determined is best for all involved is to declare Maryland a “Fault State”.

This means that:

Maryland follows a traditional “fault” system when it comes to financial responsibility for losses stemming from a car accident: injuries, lost income, vehicle damage, and so on. This means that the person who was at fault for causing the accident is also responsible for any resulting harm (from a practical standpoint, the at-fault driver’s insurance carrier will absorb these losses, up to policy limits).

There is a statute of limitations in Maryland which begins on the date of an accident as well, so time is of the essence if you are the injured party. If you are the one at fault in the accident though it does increase your chances of being placed into the high-risk driver category. This could make finding a car insurance provider a bit more tricky.

Keep scrolling to find out how we can help.

High-Risk Insurance

If, despite your best effort, you find yourself categorized as a high-risk driver all is not lost. Although the demerit driver’s license point system ensures that your points remain on your license for three years you can still save money on car insurance if you know how to shop.

Finding ways to prove to your car insurance provider that you are worth the risk that they are taking by writing a policy for you can do just that.

Some of the ways that you can build confidence in potential insurance providers are:

- Cleaning up your credit

- Avoiding more tickets and accidents

- Taking a defensive driving class

This might also mean that you might not be able to get that chip in your windshield fixed without some out-of-pocket expenses.

Windshield Coverage

Because Maryland requires state safety inspections, making sure that your windshield and wiper blades are in functioning order is extremely important. This goes beyond just ensuring proper function though. The Old Line State also requires that:

- All vehicles that were originally equipped with a windshield by the manufacturer do indeed have a windshield

- Windshield wipers must have blades that are capable of clearing rain or other types of moisture from the field of view effectively

- The windshield is made of safety glass

- Stickers are only present in lower corners out of the field of view

- No items can be hung from rearview mirrors

- Only the top five inches of the windshield can have non-reflective tint

- Cracks cannot intersect with other cracks

- And chips must be under 3/4 of an inch and they must be more than three inches from other damage

Generally speaking, your comprehensive coverage will usually pay for windshield damage, but filing a claim could increase your chances of a rate increase just like risky behavior behind the wheel can.

All is not lost though. Keeps reading to find out about some low-cost options available to you as a driver in the great state of Maryland.

Low-Cost Insurance

If you have a good driving record, good credit, and just the right combination of demographics then getting low-cost insurance is easy to come by. If you are like most people though chances are that not all of your ducks are quite I the same row.

There are more than a few options for the average person with a few flaws on their driving record, credit report, or who might find themselves living just outside of the right zip code. Some of these options include looking for just the right discounts when shopping for your policy.

Some of the most common discounts include:

- Military Discounts

- Good Student Discounts

- Safe Driver Discounts

Be aware though that providing your car insurance provider with false information in order to get these discounts could land you in hot water.

Automobile Insurance Fraud in Maryland

When a person or entity commits fraud it raises the prices for everyone. This is why it is best to avoid it at all costs.

Beyond your responsibility as a good citizen to refrain from committing fraud, committing car insurance fraud, in particular, could cost you more than you would ever save on your policy.

According to the Insurance Journal:

For the calendar year 2017, Maryland Insurance Commissioner Al Redmer Jr. authorized civil orders and criminal charges totaling $466.261 in fines, penalties and restitution to 77 citizens charged with committing insurance fraud.

In this instance, the risks do not outweigh the benefits so why even try?

Be aware that if you do try it and are caught criminal penalties include:

- Imprisonment for up to five years and a fine of $5000 for a person caught burning with the intent to defraud

- For code fraud acts where the value of the fraud is over $300 you could face felony charges

- For presenting false insurance claims the fine can be up to three times the value of the claim and imprisonment for up to 15 years if you are charged with a felony

There are also criminal and civil penalties for insurance fraud that include penalties such as:

- An administrative penalty up to $25,000

- Civil action taken by the insurance company

At the end of the day it really is not worth it.

Statute of Limitations

As with all matters of law you are required to file claims and lawsuits in a timely fashion. In the Old Line State the time limit begins on the date of the accident and ends three years from that date.

Maryland has a contributory negligence rule as well that persons filing a law suit should consider which could prevent an injured person from collecting damages from an at-fault driver if it can be proven that the injured person’s own negligence also played a part in the accident.

That is not the only law unique to Maryland either.

Maryland Specific Driving Laws

In the city of Rockville it is illegal to curse while driving which makes for some inventive linguistics when stuck in traffic.

It is also illegal to import wild rabbits or hares, regardless of their living or deceased status, into the city of Baltimore for the purpose of selling them so you should probably leave them on the edge of town before driving through.

Alcohol critics must be certified in Maryland as well, and after they receive certification they are permitted to receive free samples. If this is your chosen profession then we suggest you designate a driver before heading to work.

What are vehicle licensing laws?

Although Maryland has more than a few strange laws the ones regarding vehicle licensing are pretty normal.

According to MVA new residents to Maryland have 60 days to get their driver’s license changed over. Some of the documentation that you should bring with you includes:

- Proof of identity and residency

- Your out-of-state license if you are a new resident, and certified driving record from the previous licensing agency

- Proof of age

- Acceptable proof of current active duty status for military members

- Proof of discharge if you are non-active duty

Test might also be allowed to be waived for active-duty military members and their dependents in some instance.

MVA also provides an Online Document Guide for Immigrants who have foreign documentation but that do not have valid accompanying U.S. Citizenship and Immigration Services documentation. If you are a foreign driver you may also be required to bring the following with you:

- Your out-of-country license

- And proof that you completed a 3-hour drug and alcohol program if you have never had a U.S. driver’s license before

Maryland also participates in the federal program known as Real ID. For more information about how Real ID works in the Old Line State MVA has provided a FAQ page.

While Real ID is still being debated the penalties for driving without insurance on Maryland are not.

Keep scrolling to find out what they are.

Penalties for Driving Without Insurance

Driving without car insurance in the Old Line State could cost you big time. Some of these penalties include the loss of your license plates and vehicle registration privileges.

Driving without car insurance in Maryland could see you paying uninsured motorist coverage fees for each lapse in coverage of $150 for the first 30 days, and $7 for each day thereafter. You could also be forced to pay a restoration fee of $25 for your vehicle’s registration.

MVA also states that you could also be faced with:

A fine of up to $1,00 and/or one year imprisonment for providing false evidence of vehicle insurance.

For this reason alone the smartest thing you can do is to maintain your auto insurance coverage in Maryland and refrain from false representation when dealing with the MVA.

Teen Driving Laws

Just like the law regarding car insurance requirements and driver licensing there are also laws that are specific to teenagers behind the wheel. The laws begin with the Rookie Driver Program which is aimed at all new drivers regardless of age.

There are three stages to the Rookie Driver Program

- A learner permit

- A provisional license

- And a full license

Requirements for the learner’s permit are:

- Minimum age of 15

- If under 16 proof of attendance in school is required in a sealed envelope from the applicant’s school

- Parent or guardian must sign for minors

- Proper documentation demonstrating proof of residency and address (read our full “Learner’s Permit Insurance Coverage” for more information)

Restrictions include:

- Prohibition against cell phone use of any kind (including Bluetooth and hands-free devices)

- Must be accompanied by a qualified person who is over 21 years old

- Accompanying supervisory driver must complete the practice skill log

Requirements for the provisional license are:

- Minimum age of 16

- Successful completion of requirements for learner’s permit

- No convictions or probations

- Completion of Maryland’s driver’s education program with an approved provider

- Completion of required practice hours under a supervisory driver

Restrictions include:

- Drivers under 21 may not have alcohol of any kind in their system

- If under 18 the driver cannot drive with passengers under 18 who are not immediate family members for the first 151 days

- No driving between 12 A.M. and 5 A.M. unless supervised by a driver who is 21 or older and has three years of driving experience or you are driving to or from work or official school-sanctioned activity

- Must use a safety belt

Requirements for a full license are:

- Minimum age of 18

- Must hold a provisional license for minimum of 18 months and be conviction-free

It may seem like a lot but it is worth it to keep your teen and others safe while on Maryland’s roads.

Driver License Renewal Procedures

Teenagers are not the only ones who have laws specific to them. Older drivers also have laws that they must follow when it comes time to renew their license.

In Maryland the average aged person is required to renew their license every eight years and is only required to take the vision test when they are renewing in person. Drivers over 40 must take the vision test at every renewal interval.

Maryland may also require information on your medical status, military standing, and marital status if any of this has changed since you were first issued your license in the Old Line State.

New Residents

As previously stated, you have 60 days to change your license over once you establish residency in Maryland.

You are considered a resident if:

- Your permanent home is in Maryland

- You maintain a place of abode in Maryland for more than six months

As a resident, you will be expected to know and comply with the driving, vehicle registration, and driver’s licensing laws of the state of Maryland.

To obtain a driver’s license or register a vehicle in the Old Line State proof of insurance will be required.

Now that you know how to get your license in Maryland we want to help you keep it in good standing. Keep reading to find out more.

Negligent Operator Treatment System

Knowing that Maryland licensing law runs by the demerit driver’s license point system doesn’t mean a thing if you don’t understand which infraction cost you what number of points.

The following things can add points to your driving record in Maryland if you are not careful:

- 1 point for disregarding a school crossing guard, traffic control devices, failing to yield, tailgating, driving below the speed limit, or between 1-9 miles over the speed limit.

- 2 points for multiple citations for a red light or stop sign violation, passing or failing to yield to emergency vehicles, and speeding between 10-19 mph over the limit

- 5 points failure to report a crash, driving without insurance or a license, and speeding in excess of 30 or more miles above the speed limit

- 6 points reckless driving of any manner

- 8 points DWI or failure to stop after an accident with damage to a vehicle or property

- 12 points Using a car without proper consent or stealing one, license or registration fraud. or a DUI

So what happens when you accrue points? The MVA has laid out the following guidelines:

- 3 to 4 points -You will get a warning letter.

- 5 to 7 points – You will be required to enroll in a Driver Improvement Program (DIP).

- 8 to 11 points -You will get a notice of suspension from MVA

- 12 or more points – Your license will be revoked

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the rules of the road?

There are rules of the road no matter which state you reside in. Knowing what they are in Maryland could help you keep your driving record clean and your car insurance rates low.

Knowing the rules of the road can also help keep others around you safe which is always a good thing.

Keep reading to find out how we can help you become a well-informed driver and how you can keep yourself and your passengers safe when you head out on the highway.

No-Fault Vs. At-Fault

You already discovered that Maryland is a fault state meaning that the driver who causes the accident will bear the brunt of the financial consequences for his or her actions.

The opposite end of the spectrum is a no-fault state which is an:

Auto insurance system in which each driver’ own insurance company pays for certain losses, regardless of fault.

Whether you live in a fault state like Maryland or a no-fault state like Florida, there are certain laws that cross state lines like the laws that govern seat belt use. Who is required to wear one and when may differ from state to state though.

Seat Belt and Car Seat Laws

According to IIHS, all passengers 16 years or older in all seats must wear a seat belt. The fine for being caught without one is $50.

Any passenger 7 years old or younger who is less than 57 inches must be in a safety seat, and children between the ages of 8-15 who are at least 57 inches tall must wear a seat belt as well. The penalty for failure to comply with this is also $50.

Maryland’s safety belt law is a primary enforcement law which means that a law enforcement officer can stop you and issue you a citation for it even if you have committed no other offenses.

Keep-Right and Move Over

in addition to safety belt laws, Maryland has both a keep right and a move over law.

The Keep Right Law in Maryland states that you must move to the right lane if you are traveling 10 mph under the speed limit, or if you driving slower than the speed of traffic.

Maryland’s Move Over Law is designed to keep emergency personnel safe when they are operating on the side of the road. This law was recently expanded to include not just firetrucks, police cars, and ambulances. The law now incorporates transportation service vehicles, utility vehicles, trash trucks, and recycling trucks into itself.

Speed Limits

Maryland also has speed limits which vary by location. The maximum speed on the interstate or expressway in the Old Line State is 70 mph and 55 on most other highways.

Some specific speed limits are also as follows:

- 15 miles per hour in Baltimore County alleys

- 30 miles per hour in business districts

- 30 miles per hour on undivided highways in residential districts

- 35 miles per hour on divided highways in residential districts

- 50 miles per hour on undivided highways in non-residential districts, and

- 55 miles per hour on divided highways in non-residential districts

Business and residential areas generally have a speed limit of between 30-35 mph but you should always be aware of your surroundings and keep an eye out for speed limit signs.

Ridesharing

Ridesharing is becoming both a popular and trendy way to get around nowadays. It is also a popular way t make some extra side cash for many people. Anyone wishing to engage in this endeavor should know the laws and insurance requirements first though.

Maryland’s official state website states that unlike carpooling, Rideshare is not covered under your personal car insurance policy. The site goes on to say that:

Typically, you will need to purchase a commercial policy to have the appropriate coverage.

You should check with your provider about Maryland commercial auto insurance requirements before taking on your first paying passenger at any rate, just to be safe.

Ridesharing is not the only thing gaining in popularity. The use of automation and crash avoidance technology is also on the rise. Read on to find out how this will impact your future.

Automation on the Road

Automation and crash avoidance technology has been proven to help reduce crashes. From back-up cameras to lane assist and automatic breaking the future of America’s roads is looking safer every day.

According to the IIHS, if passenger vehicles had been equipped with crash avoidance technology just a few years ago nearly 55,000 injuries could have been prevented.

Cash avoidance technology is not the only thing on the market with an eye towards keeping Maryland residents safer while on the road.

At the current moment companies and organizations who would like to test their autonomous vehicles in the Old Line State are required to get a permit, but at this rate full automation might be more than a Sci-Fi pipe dream.

What are the safety laws?

Technology is not the only thing trying to keep Maryland Residents safe. The Old Line State has enacted a number of laws to help its residents out as well. Some of these include DWI, DUI, and distracted driving laws.

There is a time and place for everything, and some things do not belong behind the wheel. Scroll down to find out what they are.

DUI and DWI Laws

Maryland distinguishes between a DUI and DWI when it comes to the law. A DUI in the Old Line State is not to be taken lightly either way.

Get caught with a BAC of 0.08 and you will be at the legal limit. Push it to 0.15 and you will be considered to have a high BAC. A DUI carries with it some heavy penalties.

Here is how things break down by offense:

- First offense could result in up to $1,000 in fines and up to one year in jail

- Second Offense could land you with a $2,00 fine and two years in prison as well as with 12 points on your license

Two convictions in two years could also see you wind up with a mandatory period of license suspension followed by a minimum required period of participation in the Ignition Interlock Program

You could also be required to take an alcohol abuse assessment and program.

The penalties for DWI are no less harsh.

- First Offense up to a $500 fine and two months of possible imprisonment as well as eights points on your license. You will also face a six-month license suspension (or a year if you are under 21)

- Second Offense up to a $500 fine and possible one-year imprisonment with eights points placed on your license. You will also face a license suspension of 9-12 months (or 2 years if you are under 21).

Just don’t do it is the best advice.

Distracted Driving

Too many people texting and driving has become the norm. This is frightening considering how dangerous it is. Maryland state law prohibits the use of a handheld phone while operating a motor vehicle.

The Old Line State does not distinguish between how you are using the device either. Texting is as bad as eating so just avoid the ticket or the fine by putting the phone or hairbrush down.

Maryland considers distractions as such:

- Texting

- Using a cell or smartphone

- Eating/drinking

- Grooming

- Talking to passengers

- Reading (Yes, even reading a map)

- Using a navigation system

- Watching a video or playing with the radio or other musical devices

Is there a lot of vehicle theft in Maryland?

Like all things in life, driving in Maryland comes with its risks. These risks can often go beyond the expected like distracted driving.

Everything from sunset to an unsecured load or sudden snowstorm could present a road hazard. Keep reading to find out the many ways that you can help avoid such things as property loss, vehicle theft, or even driving fatalities.

The number one stolen vehicle in the Old Line State is a 2003 Dodge Caravan.

| Make/Model | Rank | Vehicle Year | Thefts |

|---|---|---|---|

| Dodge Caravan | 1 | 2003 | 727 |

| Honda Accord | 2 | 2008 | 675 |

| Toyota Camry | 3 | 2014 | 347 |

| Honda Civic | 4 | 2012 | 313 |

| Ford Pickup (Full Size) | 5 | 2004 | 287 |

| Nissan Altima | 6 | 2013 | 230 |

| Toyota Corolla | 7 | 2014 | 204 |

| Jeep Cherokee/Grand Cherokee | 8 | 2015 | 194 |

| Chevrolet Pickup (Full Size) | 9 | 1999 | 192 |

| Hyundai Sonata | 10 | 2013 | 169 |

You may not own any of the vehicles on the list but it is still a good idea comprehensive car insurance to ensure that you are covered against theft, vandals, or a natural disaster.

Remember that thieves and mother nature are indiscriminate in how they pick their victims. So are deer and falling debris.

Vehicle Thefts by City

The data below was gathered from the FBI website and shows the top 10 cities in Maryland when it comes to the amount of vehicle theft.

| City | Motor Vehicle Thefts |

|---|---|

| Baltimore | 5,317 |

| Hagerstown | 113 |

| Laurel | 88 |

| Greenbelt | 72 |

| Hyattsville | 65 |

| Bowie | 61 |

| Salsibury | 51 |

| Frederick | 48 |

| Baldensburg | 47 |

| Elkton | 46 |

Looking at the table it is easy to assume that Baltimore is a very dangerous city. The reality is that the sheer size of Baltimore means that there are more people and thereby more possibility for crime rather than actually having a high crime rate.

Still, it is not a bad idea to consider carrying additional coverage options beyond the minimum state requirements because no matter where you live you just never know.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there a lot of road fatalities in Maryland?

Sometimes no matter how careful people are behind the wheel a fatality can occur.

Keep reading to find out how Maryland rates in some of the things that can quite often result in this type of crash.

Fatal Crashes by Weather Conditions and Light Conditions

Sometimes just the right time of day can result in the wrong type of accident.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 184 | 117 | 104 | 18 | 0 | 423 |

| Rain | 14 | 9 | 9 | 4 | 0 | 36 |

| Snow/Sleet | 2 | 0 | 1 | 0 | 0 | 3 |

| Other | 1 | 5 | 0 | 0 | 0 | 6 |

| Unknown | 16 | 8 | 15 | 2 | 2 | 43 |

| TOTAL | 217 | 139 | 129 | 24 | 2 | 511 |

As you can see from the table, driving at night can be dangerous. Always remember to wear your seat belt, and use your high beams only when there is no oncoming traffic.

Fatalities by County

Take a look at the table below to see how your county ranked in the number of fatalities over a five-year trend.

| Maryland Counties by 2017 Ranking | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Allegany | 1 | 1 | 8 | 9 | 3 |

| Anne Arundel | 20 | 20 | 19 | 22 | 22 |

| Baltimore City | 24 | 21 | 21 | 34 | 27 |

| Baltimore | 38 | 43 | 40 | 32 | 45 |

| Calvert | 2 | 3 | 7 | 3 | 3 |

| Caroline | 7 | 4 | 4 | 4 | 4 |

| Carroll | 4 | 8 | 6 | 9 | 7 |

| Cecil | 14 | 5 | 10 | 9 | 18 |

| Charles | 8 | 5 | 4 | 16 | 25 |

| Dorchester | 1 | 4 | 4 | 4 | 3 |