Texas Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists

14.10%

If you’re exploring Texas by car, there may be something you haven’t considered lately: “Am I paying too much for car insurance?” How much is average car insurance in Texas? It’s important to know what to look for in a good policy, so you can get the best price.

As for Texas car insurance rates, motorists in Texas paid an average of $1,109.66 for car insurance in 2015. We’re going to go over the best car insurance in Texas now and more with this best Texas car insurance guide.

We know car insurance isn’t something you want to spend a lot of time on, so we’ve compiled this comprehensive guide about cheap car insurance in Texas. We’ve done the work for you so that you can get on with life. To get affordable Texas car insurance, enter your ZIP code to get started and find the best insurance in Texas.

How much are Texas car insurance coverage and rates?

Is car insurance expensive in Texas? The median household income in Texas in 2017 was over $59,206, and the average auto insurance rates in Texas were $1,109 (or $92.42 per month). We know everything is big in Texas, but no one wants to pay too much for car insurance. We’re not “big” on that.

What can you do about it? And, how do you find the best Texas auto insurance rates? You could spend endless hours searching and calling every company in the state, or you can keep reading and let us do the work for you.

In this guide, we’re going to show you what coverage is required in Texas, and other options, so you can choose the best coverage for your needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much are average monthly car insurance rates in TX (liability, collision, comprehensive)?

Who has the best car insurance rates in Texas? The main concern of almost every Texas motorist is the rising cost of car insurance.

The table below shows data based on the state’s minimum requirements provided by the National Association of Insurance Commissioners, which is an agency dedicated to keeping up with the changing costs of car insurance. As the data reflects, Texans pay $100 more than the countrywide average of $1,009.

Coverage Type Annual Costs (2015)

Liability $528.75

Collision $374.49

Comprehensive $206.42

Combined $1,109.66

This data is from 2016. So rates may have increased even more, and one thing to remember: your rates could be higher or lower based on your provider and individual circumstances. These are the average rates for a sample set of coverages. If you get more comprehensive coverage or collision coverage or less, it could dramatically change your rates as could a higher or lower deductible.

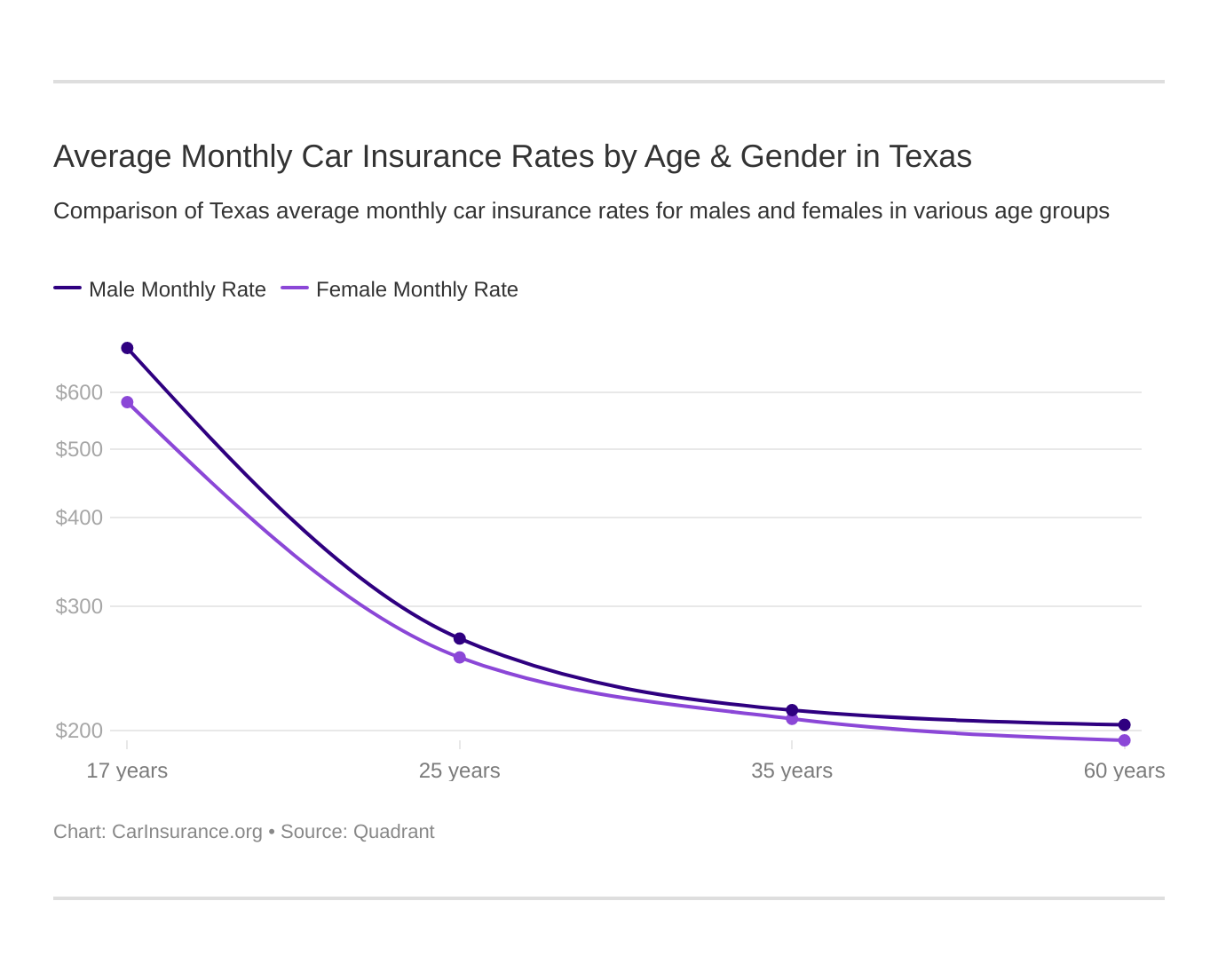

What are average monthly car insurance rates by age & gender in TX?

Inc.com wrote an article that says women pay $100,000 more for the same products as men do. Gender discrimination in car insurance rates is such a problem that California and other states banned gender discrimination and created gender-neutral insurance plans.

In the following table, we partnered with Quadrant data to show you what various folks pay for car insurance based on gender and marital status. This data is based on actual coverage purchased by the state population and includes high-risk drivers and those who purchased additional coverage.

Company Married 35-year old female annual rate Married 35-year old male annual rate Married 60-year old female annual rate Married 60-year old male annual rate Single 25-year old female annual rate Single 25-year old male annual rate Single 17-year old female annual rate Single 17-year old male annual rate

Allstate F&C $3,564.65 $3,599.14 $3,520.01 $3,520.01 $4,410.14 $4,599.76 $9,359.61 $11,309.20

The General Automobile Ins Co Inc $2,918.37 $3,249.14 $2,712.68 $3,109.48 $4,191.50 $4,782.23 $7,713.17 $10,116.84

Geico County Mutual Ins Co. $2,433.73 $2,622.73 $2,340.42 $2,649.67 $2,632.39 $2,627.86 $5,298.09 $5,502.21

Nationwide CCMIC $2,430.55 $2,473.88 $2,146.15 $2,275.09 $2,851.87 $3,088.49 $6,856.66 $8,817.88

Progressive Cty Mtl $2,496.28 $2,372.24 $2,219.05 $2,262.84 $2,956.93 $2,997.99 $10,406.29 $11,607.15

State Farm Mutual Auto $2,020.71 $2,020.71 $1,797.39 $1,797.39 $2,195.23 $2,262.71 $4,814.71 $6,130.76

USAA $1,594.84 $1,608.07 $1,522.66 $1,516.79 $2,125.64 $2,286.61 $4,423.33 $4,827.05

As you see from the table, in some cases, car insurance for teenagers in Texas costs thousands more than for older drivers. Unfortunately, for parents, those insurance rates are thousands higher than what they pay. However, in some instances, married folks pay less than their single counterparts.

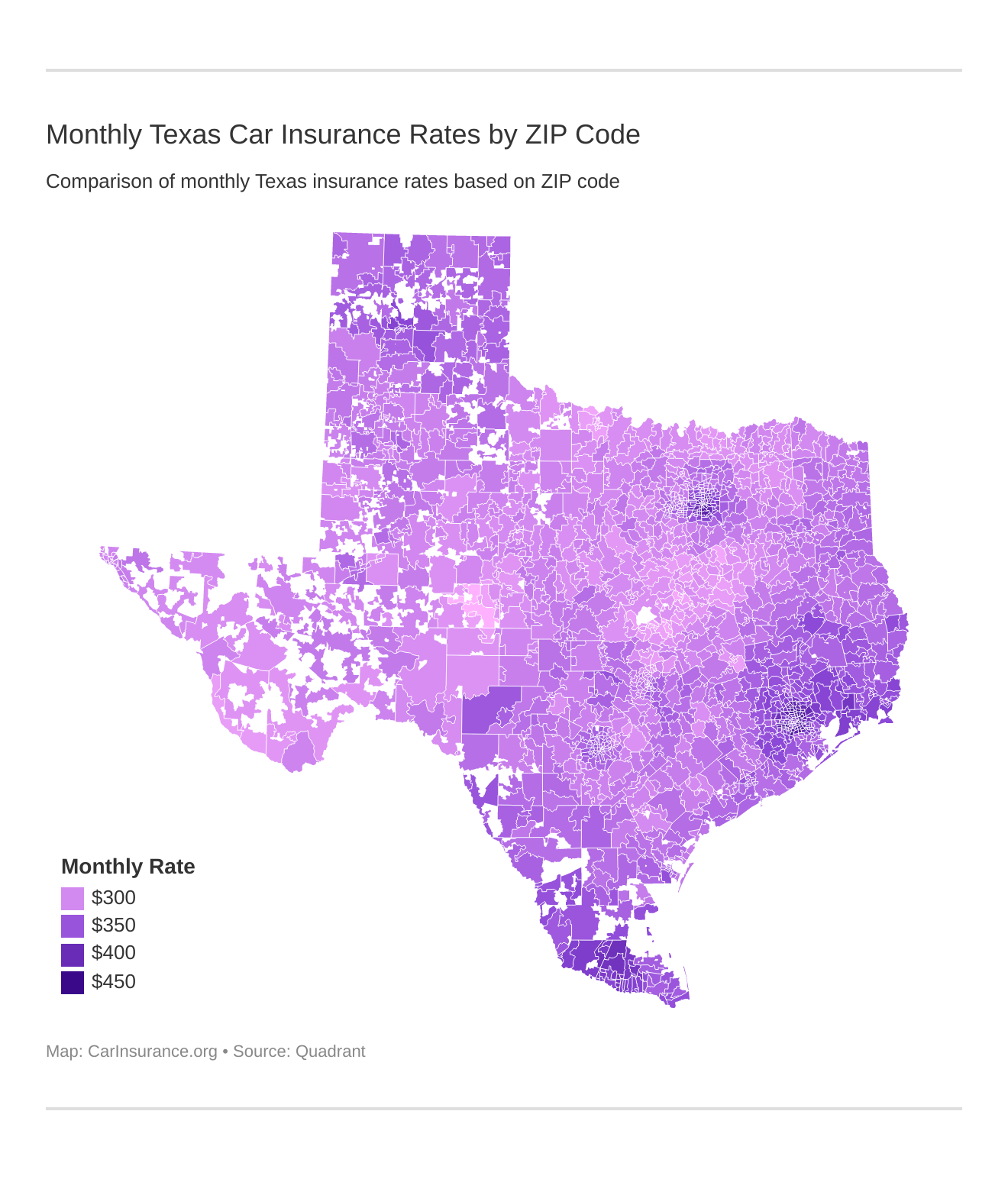

Which zip codes have the cheapest insurance in Texas?

In addition to gender and age, where you live can affect your car insurance rates. We’ve collected data on the least and most expensive ZIP codes, so search to see where your ZIP code lands on the list.

The table below reflects the top 25 ZIP codes in Texas with the lowest rates on car insurance.

Zip Code City Average Annual Rate by Zip Codes Most Expensive Company Most Expensive Annual Rate 2nd Most Expensive Company 2nd Most Expensive Annual Rate Cheapest Company Cheapest Annual Rate 2nd Cheapest Company 2nd Cheapest Annual Rate

76901 SAN ANGELO $3,157.68 Allstate $4,542.85 American Family $3,786.57 USAA $2,191.07 State Farm $2,428.78

76904 SAN ANGELO $3,158.56 Allstate $4,542.85 Progressive $3,809.41 USAA $2,074.47 State Farm $2,401.91

76939 KNICKERBOCKER $3,209.72 Allstate $4,542.85 American Family $3,866.31 USAA $2,086.49 State Farm $2,422.19

76306 WICHITA FALLS $3,210.65 Allstate $4,736.95 American Family $3,838.60 USAA $1,891.48 State Farm $2,518.20

76909 SAN ANGELO $3,224.21 Allstate $4,542.85 Progressive $3,954.71 USAA $2,074.47 State Farm $2,422.19

76502 TEMPLE $3,260.31 Allstate $4,841.18 American Family $3,890.07 USAA $2,228.61 Geico $2,679.10

76886 VERIBEST $3,267.18 Allstate $4,926.00 American Family $3,815.43 USAA $2,191.07 State Farm $2,422.19

76798 WACO $3,267.20 Allstate $5,137.52 Progressive $3,902.02 Nationwide $2,326.70 USAA $2,345.00

76712 WOODWAY $3,268.96 Allstate $5,153.61 Progressive $4,103.39 Nationwide $2,245.76 USAA $2,276.47

76908 GOODFELLOW AFB $3,281.51 Allstate $4,542.85 American Family $3,972.20 USAA $2,074.47 State Farm $2,437.99

75110 CORSICANA $3,285.30 Allstate $4,920.59 Progressive $3,748.30 USAA $2,189.79 Geico $2,551.76

76354 BURKBURNETT $3,293.59 Allstate $4,898.60 American Family $3,869.85 USAA $2,065.82 State Farm $2,533.62

76543 KILLEEN $3,306.33 Allstate $4,929.48 American Family $4,125.00 USAA $2,227.94 State Farm $2,673.85

76309 WICHITA FALLS $3,315.43 Allstate $4,816.42 American Family $4,292.15 USAA $2,065.82 Geico $2,530.78

76706 WACO $3,320.96 Allstate $5,137.52 American Family $4,044.42 Nationwide $2,326.70 USAA $2,345.00

76905 SAN ANGELO $3,322.35 Allstate $4,926.00 Progressive $4,180.44 USAA $2,091.54 State Farm $2,389.41

76903 SAN ANGELO $3,331.83 Allstate $4,799.16 American Family $4,047.69 USAA $2,187.37 State Farm $2,424.89

76957 WALL $3,332.11 Allstate $4,542.85 Progressive $3,999.84 USAA $2,191.07 State Farm $2,422.19

76513 BELTON $3,334.52 Allstate $5,137.52 American Family $3,792.42 USAA $2,184.73 State Farm $2,632.49

76564 PENDLETON $3,336.13 Allstate $5,114.28 American Family $3,910.53 USAA $2,199.69 State Farm $2,658.77

76710 WACO $3,337.22 Allstate $5,128.65 American Family $3,865.74 USAA $2,276.47 Geico $2,681.32

76711 WACO $3,347.58 Allstate $5,153.61 Progressive $3,857.42 USAA $2,276.47 Geico $2,690.25

77881 WELLBORN $3,347.60 Allstate $4,860.77 Progressive $3,942.06 USAA $2,198.68 State Farm $2,671.94

76311 SHEPPARD AFB $3,351.07 Allstate $4,975.86 American Family $4,243.10 USAA $1,891.48 Geico $2,530.78

76310 WICHITA FALLS $3,351.57 Allstate $4,952.60 American Family $4,289.31 USAA $2,065.82 State Farm $2,480.04

It’s good news for State Farm customers who live in San Angelo. They pay the lowest rates in the state averaging $2,428 yearly. USAA also has cheap rates, but their coverage is only available to those in and affiliated with the military.

The table below reflects the top 25 ZIP codes in Texas with the most expensive rates on car insurance.

Zip Code City Average Annual Rate by Zip Code Most Expensive Company Most Expensive Annual Rate 2nd Most Expensive Company 2nd Most Expensive Annual Rate Cheapest Company Cheapest Annual Rate 2nd Cheapest Company 2nd Cheapest Annual Rate

78049 LAREDO $5,538.80 American Family $11,340.83 Progressive $7,300.88 USAA $2,748.03 State Farm $3,078.58

78599 WESLACO $5,452.78 American Family $11,340.83 Allstate $6,223.28 State Farm $2,972.86 USAA $3,185.94

77036 HOUSTON $5,430.22 American Family $9,058.31 Allstate $7,237.52 USAA $3,028.85 State Farm $3,600.90

77033 HOUSTON $5,271.84 American Family $8,080.72 Allstate $7,297.35 USAA $3,021.85 State Farm $3,649.74

77072 HOUSTON $5,247.11 American Family $9,024.11 Allstate $6,217.03 USAA $3,028.85 State Farm $3,485.64

75207 DALLAS $5,225.75 Allstate $7,664.33 Progressive $7,367.34 USAA $2,935.83 State Farm $3,620.92

77053 HOUSTON $5,188.07 American Family $8,091.63 Allstate $7,155.33 USAA $3,035.35 State Farm $3,538.37

77060 HOUSTON $5,173.49 American Family $7,251.55 Allstate $6,756.97 USAA $3,031.86 State Farm $3,941.98

77067 HOUSTON $5,166.35 American Family $7,397.64 Allstate $7,135.70 USAA $3,031.86 State Farm $3,965.58

77076 HOUSTON $5,164.01 Allstate $7,297.35 American Family $6,965.79 USAA $3,007.16 State Farm $3,863.19

77091 HOUSTON $5,162.46 Allstate $7,297.35 American Family $6,976.94 USAA $3,155.30 State Farm $3,768.48

77078 HOUSTON $5,154.98 Allstate $7,352.64 American Family $7,217.59 USAA $3,158.70 State Farm $3,763.05

75242 DALLAS $5,150.98 Allstate $7,822.46 Progressive $7,730.91 USAA $3,035.63 Geico $3,508.43

79430 LUBBOCK $5,143.23 American Family $11,340.83 Progressive $7,300.88 USAA $2,679.39 State Farm $2,898.28

77037 HOUSTON $5,141.92 Allstate $7,292.85 American Family $6,534.37 USAA $3,031.86 State Farm $3,803.26

77022 HOUSTON $5,115.43 Allstate $7,297.35 American Family $6,978.54 USAA $3,007.16 State Farm $3,906.52

77039 HOUSTON $5,115.40 American Family $7,325.25 Allstate $6,770.35 USAA $3,007.16 State Farm $3,857.41

77081 HOUSTON $5,113.05 American Family $7,787.38 Allstate $7,121.41 USAA $3,179.07 State Farm $3,384.26

77088 HOUSTON $5,111.68 American Family $8,232.62 Allstate $6,585.55 USAA $3,155.30 State Farm $3,823.85

77016 HOUSTON $5,108.01 Allstate $7,352.64 American Family $6,981.03 USAA $3,007.16 State Farm $3,777.08

77028 HOUSTON $5,107.10 Allstate $7,664.33 American Family $6,909.53 USAA $3,158.70 State Farm $3,494.20

77093 HOUSTON $5,104.27 Allstate $7,286.61 American Family $6,716.86 USAA $3,158.70 State Farm $3,838.99

77026 HOUSTON $5,098.02 Allstate $7,352.64 American Family $7,017.25 USAA $3,158.70 State Farm $4,012.27

77050 HOUSTON $5,097.68 Allstate $7,306.24 American Family $6,677.08 USAA $3,007.16 State Farm $3,762.08

75210 DALLAS $5,095.76 Allstate $7,664.33 American Family $7,286.10 USAA $3,025.08 State Farm $3,565.59

Texans who live in Laredo have the most expensive rates in the state, topping out at $11,340 per year.

Where are the cheapest car insurance rates by city in TX?

We’ve also collected data on car insurance rates by city. Below is a list of the least expensive and most expensive cities for car insurance. Enter your city in the search box to see if you made the list.

The table below reflects the top 25 cities in Texas with the lowest rates on car insurance.

City Average by City Most Expensive Company Most Expensive Rate 2nd Most Expensive Company 2nd Most Expensive Rate Cheapest Company Cheapest Rate 2nd Cheapest Company 2nd Cheapest Rate

Grape Creek $3,157.68 Allstate $4,542.85 American Family $3,786.57 USAA $2,191.07 State Farm $2,428.78

Knickerbocker $3,209.72 Allstate $4,542.85 American Family $3,866.31 USAA $2,086.49 State Farm $2,422.19

San Angelo $3,259.24 Allstate $4,702.71 Progressive $3,992.96 USAA $2,106.96 State Farm $2,409.60

Veribest $3,267.18 Allstate $4,926.00 American Family $3,815.43 USAA $2,191.07 State Farm $2,422.19

Goodfellow AFB $3,281.51 Allstate $4,542.85 American Family $3,972.20 USAA $2,074.47 State Farm $2,437.99

Burkburnett $3,293.59 Allstate $4,898.60 American Family $3,869.85 USAA $2,065.82 State Farm $2,533.62

Robinson $3,320.96 Allstate $5,137.52 American Family $4,044.42 Nationwide $2,326.70 USAA $2,345.00

Wall $3,332.11 Allstate $4,542.85 Progressive $3,999.84 USAA $2,191.07 State Farm $2,422.19

Belton $3,334.52 Allstate $5,137.52 American Family $3,792.42 USAA $2,184.73 State Farm $2,632.49

Pendleton $3,336.13 Allstate $5,114.28 American Family $3,910.53 USAA $2,199.69 State Farm $2,658.77

Beverly Hills $3,347.58 Allstate $5,153.61 Progressive $3,857.42 USAA $2,276.47 Geico $2,690.25

Wellborn $3,347.60 Allstate $4,860.77 Progressive $3,942.06 USAA $2,198.68 State Farm $2,671.94

Sheppard AFB $3,351.07 Allstate $4,975.86 American Family $4,243.10 USAA $1,891.48 Geico $2,530.78

Wichita Falls $3,357.55 Allstate $4,892.91 American Family $4,292.31 USAA $2,017.62 Geico $2,530.78

Christoval $3,359.14 Allstate $4,542.85 Progressive $4,363.18 USAA $2,086.49 State Farm $2,384.33

Temple $3,360.15 Allstate $5,049.46 American Family $4,170.69 USAA $2,202.93 Geico $2,679.10

Mexia $3,361.10 Allstate $5,091.11 American Family $3,727.04 USAA $2,189.79 State Farm $2,618.65

Heidenheimer $3,364.77 Allstate $5,153.61 Progressive $4,006.20 USAA $2,243.44 State Farm $2,658.77

Iowa Park $3,367.05 Allstate $5,109.77 American Family $3,848.86 USAA $2,065.82 State Farm $2,496.96

Tennyson $3,367.34 Allstate $4,799.16 Progressive $4,001.70 USAA $2,223.72 State Farm $2,464.41

Copperas Cove $3,368.96 Allstate $5,075.02 Progressive $3,714.41 USAA $2,250.13 State Farm $2,640.95

West $3,373.02 Allstate $5,223.83 American Family $3,709.63 USAA $2,409.44 Geico $2,608.93

Killeen $3,375.97 Allstate $4,975.95 American Family $4,281.63 USAA $2,202.42 State Farm $2,678.96

Presidio $3,379.33 Allstate $4,542.85 American Family $4,486.47 USAA $2,341.36 State Farm $2,485.11

Hewitt $3,382.22 Allstate $4,841.18 Progressive $3,805.97 USAA $2,337.64 Geico $2,679.10

Besides USAA, which is only for military-affiliated families, State Farm is a great option, occupying 18 of the top 25 slots for the least expensive car insurance in Texas.

The table below reflects the top 25 cities in Texas with the most expensive rates on car insurance.

City Average Annual Rate by City Most Expensive Company Most Expensive Annual Rate 2nd Most Expensive Company 2nd Most Expensive Annual Rate Cheapest Company Cheapest Annual Rate 2nd Cheapest Company

Weslaco $5,452.78 American Family $11,340.83 Allstate $6,223.28 State Farm $2,972.86 USAA

Texhoma $5,290.29 American Family $11,340.83 Progressive $7,937.62 USAA $2,417.11 State Farm

Aldine $5,143.60 American Family $7,037.06 Allstate $6,940.06 USAA $3,023.62 State Farm

Cockrell Hill $4,805.29 Allstate $6,750.75 American Family $6,361.56 USAA $2,898.46 State Farm

North Houston $4,799.60 Progressive $7,300.88 Allstate $6,438.51 USAA $2,760.28 State Farm

Houston $4,770.73 American Family $6,846.57 Allstate $6,514.79 USAA $2,931.67 State Farm

Garciasville $4,762.95 Progressive $7,172.16 Allstate $6,903.43 State Farm $2,719.54 USAA

South Houston $4,748.61 Allstate $6,493.81 American Family $6,132.67 USAA $3,023.90 State Farm

Galena Park $4,739.02 Allstate $6,493.81 American Family $6,255.89 USAA $3,163.52 State Farm

Linn $4,726.10 Progressive $6,965.34 Allstate $6,148.71 State Farm $3,080.73 USAA

Four Corners $4,725.43 American Family $7,099.38 Allstate $5,778.86 USAA $3,026.34 State Farm

Santa Elena $4,706.00 Progressive $6,792.94 Allstate $6,588.22 State Farm $2,719.54 USAA

Dallas $4,682.06 Allstate $6,793.69 American Family $6,354.16 USAA $2,842.16 State Farm

McAllen $4,673.94 Allstate $6,096.88 American Family $6,072.08 USAA $2,893.08 State Farm

Hidalgo $4,664.22 Allstate $6,588.22 Nationwide $6,084.75 USAA $2,893.08 State Farm

Fresno $4,655.49 American Family $6,911.13 Allstate $5,956.87 USAA $3,045.00 State Farm

Devers $4,645.50 Progressive $6,929.03 American Family $5,960.18 USAA $2,789.77 State Farm

Edcouch $4,631.97 Allstate $6,320.76 American Family $5,478.44 State Farm $3,047.18 USAA

Doolittle $4,631.85 Allstate $6,167.63 Nationwide $5,705.17 USAA $3,013.60 State Farm

Grulla $4,624.28 Progressive $6,837.33 Allstate $6,143.37 State Farm $2,719.54 USAA

Sullivan City $4,608.29 Allstate $6,710.46 Nationwide $5,455.81 State Farm $3,098.35 USAA

Alief $4,606.74 Allstate $6,217.03 Progressive $5,819.67 USAA $2,686.48 State Farm

Channelview $4,605.85 Allstate $6,681.17 American Family $6,115.98 USAA $2,869.94 State Farm

Hilshire Village $4,604.38 Allstate $6,378.68 American Family $6,105.10 USAA $2,986.57 State Farm

Alton $4,599.58 Allstate $6,355.48 American Family $5,498.36 USAA $2,863.94 State Farm

The city of Weslaco leads the way for the city with the most expensive car insurance at $5,450 per year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are Texas’ minimum car insurance coverage requirements?

If you own a vehicle and plan on driving it anywhere in the state of Texas, you are required by law to purchase insurance in case you are in an accident.

Let’s take a look at Texas minimum liability insurance requirements:

- $30,000 for bodily injury liability per person injured in an accident you cause

- $60,000 for total bodily injury liability when two or more people are injured in an accident you cause

- $25,000 for property damage per accident you cause

Liability insurance pays all individuals drivers, passengers, pedestrians, etc. who are owed compensation for property damage and injuries resulting from a car accident that you or anyone under your policy causes. If you are in an at-fault accident, liability insurance pays other parties affected by the crash. It does not cover your medical bills or auto repairs. Going with minimum only coverage saves you money on your annual premium, but the average cost of even a small accident could be in the thousands when you account for your expenses.

These numbers are for just the minimum requirements. You may want to purchase additional coverage based on your personal needs. Drivers typically buy personal injury protection in many states along with comprehensive and collision coverage. These cover the insurance holder’s costs.

What forms of financial responsibility count in TX?

What is financial responsibility, and how does auto insurance coverage play into it? Financial responsibility is proof that you have state minimum liability coverage. State laws require every driver and owner of a vehicle to have evidence they can cover a certain amount of liability at all times. Here are a few acceptable forms of proof of financial security in Texas:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Electronic insurance ID card

- Picture proof of your insurance ID card (can be on your smartphone)

The penalties for driving without proof of car insurance in Texas include:

- suspension of driving privileges

- fines of up to $350 for a first offense and up to $100 for subsequent offenses

- vehicle impoundment for up to 180 days

Our best advice: Always carry the minimum requirements of insurance and never drive without proof of insurance.

Otherwise, you may find yourself meeting a Texas ranger.

How much are car insurance rates as a percentage of income in TX?

In Texas, the per capita disposable income is $44,720. On average, residents spend $1,109 a year on car insurance. To put this amount in perspective, the nationwide annual average for car insurance is $981.

This means people in Texas pay more than the countrywide average and more than neighboring states, New Mexico and Oklahoma, who pay yearly amounts of $920 and $985, respectively.

To explain further if income is $44,720, and residents spend $1,109 yearly on car insurance, that means Texans are paying 2.48% of personal income on car insurance. The good news, however, is that this percentage has decreased over the last three years from a high of 2.61 percent.

Do you need additional liability car insurance?

To assess the financial health of insurance companies, you should look at its loss ratios. Loss ratios are the money insurance companies payout on claims compared to the money they take in on premiums.

This video explains more:

https://youtu.be/2H_FkXcmAIM

For example, if an auto insurer collects $100,000 of premiums in a given year and pays out $45,000 in claims, the company’s loss ratio is 45% ($45,000 incurred losses/$100,000 earned premiums).

Check out the loss ratio for these types of coverage in Texas:

Loss Ratio 2015 2014 2013

Personal Injury Protection 60.73% 66.3% 64.35%

Medical Payments 69.55% 68.78% 65.76%

Uninsured/Underinsured Motorist Coverage 64% 61.36% 53.54%

The additional coverage types above are all optional liability plans which can be added to any basic insurance policy.

Here’s an interesting fact:

14.1% of drivers in Texas are uninsured. Texas ranks 16th in the U.S. for uninsured and underinsured drivers.

Even though drivers aren’t required by law to carry these add-ons, it still might be a great addition to your policy.

Add-ons, Endorsements, and Riders for Car Insurance in TX

No one wants to have an accident, but if you do, will you have enough protection for you and your family? Have you considered adding extra coverages to your policy?

Choosing from a list of options can be daunting, and we know you want the best options for your family at affordable prices. To help you decide, we’ve made a list of affordable options to add to your policy.

Check out the selections below:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Usage-Based or Pay-As-You-Drive Insurance

The great thing about these extra coverages is that they are optional, and therefore, not required in Texas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the best Texas car insurance companies?

If you own a vehicle, there’s a good chance you are paying too much for your insurance. But it isn’t just cost that you should look for in a good policy

Who wants to spend time looking for the lowest price? That’s why we’ve done all the work for you and researched the best insurance carriers in Texas so you can make the best choice for your situation. We’ve looked at companies’ financial ratings, A.M.’s best ratings, and which companies have the most complaints.

Keep reading to learn more about car insurance providers in Texas.

What are the largest companies’ financial ratings in TX?

Loss ratios play a large part in how secure a company is doing financially. That’s why we want to include A.M. Best ratings, which look at loss ratios to determine if a company has solid financial security.

What are AM Best Ratings?

AM Best Ratings are how we measure a company’s financial strength. We can also measure a company’s strength by loss ratio percentages.

All of the companies listed below show AM Best Ratings of an A rating or higher. They also all have great loss ratio percentages.

Company AM Best Rating Direct Premiums Written Loss Ratio Market Share

State Farm Group A++ $3,563,120 78.29% 16.83%

Geico A++ $2,637,489 88.18% 12.46%

Allstate Insurance Group A+ $2,362,584 66.19% 11.16%

Progressive Group A+ $2,041,345 68.91% 9.64%

Farmers Insurance Group NR $1,842,735 66.07% 8.70%

USAA Group A++ $1,712,949 88.30% 8.09%

Liberty Mutual Group A $1,195,735 83.96% 5.65%

Texas Farm Bureau Mutual Group A- $693,004 77.31% 3.27%

Consumers County Mutual Insurance Co NR $541,825 86.45% 2.56%

Nationwide Corp Group A+ $473,342 65.53% 2.24%

Car Insurance Companies with Best Ratings in TX

Texas drivers who want greater insight into customer satisfaction can turn to J.D. Power. For years, the company has surveyed consumers and analyzed their feedback. J.D. Power delves into whether drivers are happy with their insurance company.

Through its 2019 U.S. Car Insurance Study, care insurance companies are ranked by region and measured in five areas (in order of importance):

- Interaction

- Policy offerings

- Price

- Billing process and policy information

- Claims

J.D. Power additionally assigns “Power Circle Ratings” to each insurer. They are:

- Five out of Five Circles, also known as “Among the Best”

- Four out of Five Circles/“Better than Most”

- Three out of Five Circles/“About Average”

- Two out of Five Circles/“The Rest”

Here’s a look at how insurers fared in the study’s Mid-Atlantic region. We placed them in order of their customer satisfaction index rating, from highest to lowest:

Insurance Provider Customer Satisfaction

Index Rating

(out of 1,000)JDPower.com

Power Circle Ratings

TX Farm Bureau 857 5/5

Allstate 836 3/5

Geico 836 3/5

State Farm 835 3/5

Texas Average 835 3/5

Farmers 834 3/5

Auto Club of Southern California Insurance Group 831 3/5

Nationwide 829 3/5

Progressive 816 2/5

Liberty Mutual 802 2/5

USAA 894 5/5

Of the larger providers, Allstate and Geico lead the way with an overall satisfaction score of 836. Conversely, Liberty Mutual is at the bottom of the list when it comes to customer satisfaction, with a score of 802. Additional top providers like State Farm and Farmers are only separated by two points when it comes to customer satisfaction.

Lastly, it’s worth mentioning USAA’s status on this list. Though the insurer is part of the study, it is not ranked. This is because USAA is only open to U.S. military personnel and their families, and therefore, is not included in J.D. Power’s overall rankings.

Next, let’s check out their record of official complaints.

Which car insurance companies have the most complaints in Texas?

One thing to keep in mind is that a high complaint index doesn’t necessarily mean you should avoid a company. You should also look at a company’s customer satisfaction ratings because how a company deals with complaints is also important.

Company National Median

Complaint RatioCompany Complaint

Ratio 2017Total Complaints

2017

State Farm Group 1 0.44 1482

Geico 0.007 6

Allstate Insurance Group 1 0.5 163

Progressive Group 1 0.75 120

Farmers Insurance Group 1 0.59 7

USAA Group 0 2

Liberty Mutual Group 1 5.95 222

Texas Farm Bureau Mutual Group 1 0.16 3

Consumers County Mutual Insurance Co 1 0.1 5

Nationwide Corp Group 1 0.28 25

If you want more details of the complaints or to check out other insurers, the data is provided in the Consumer Insurance Search section on the website of the National Association of Insurance Commissioners.

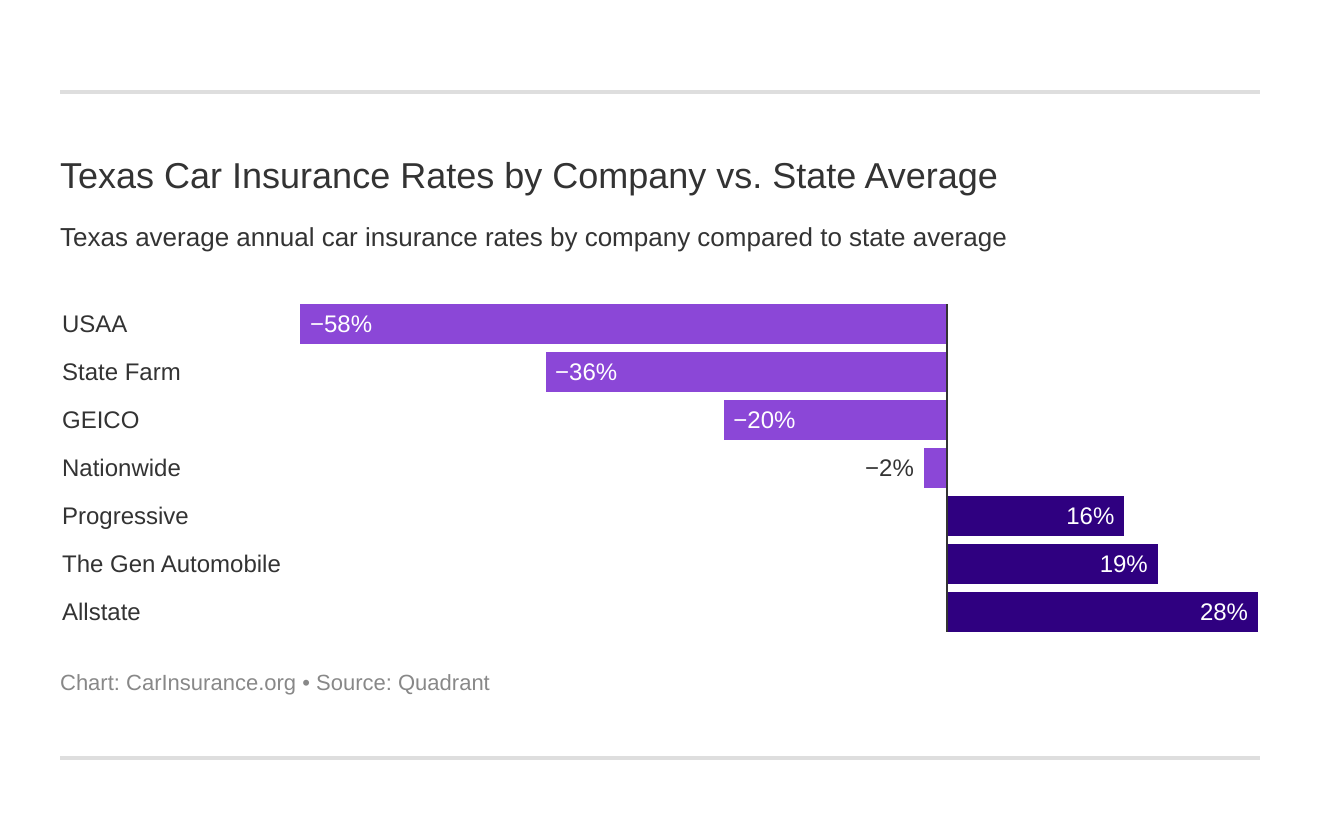

Who are the cheapest car insurance companies in Texas?

Do you like saving money? We do. That’s why we’ve compiled a list of the companies that have the cheapest rates in Texas. To save money, you should shop around to see what’s available. The table below displays the top auto insurance carriers in Texas and their average rate for all drivers and compares it to the state average of all companies.

Company Average Annual Rate Compared to State Average Percentage Compared to State Average

Allstate F&C $5,485.32 $1,556.98 28.38%

The Gen Automobile Ins Co Inc $4,849.18 $920.84 18.99%

Geico County Mutual Ins Co. $3,263.39 -$664.95 -20.38%

Nationwide CCMIC $3,867.57 -$60.77 -1.57%

Progressive Cty Mtl $4,664.85 $736.51 15.79%

State Farm Mutual Auto $2,879.95 -$1,048.39 -36.40%

USAA $2,488.12 -$1,440.22 -57.88%

According to the data, State Farm and Geico are the companies you should consider first if you’re looking for the cheapest car insurance.

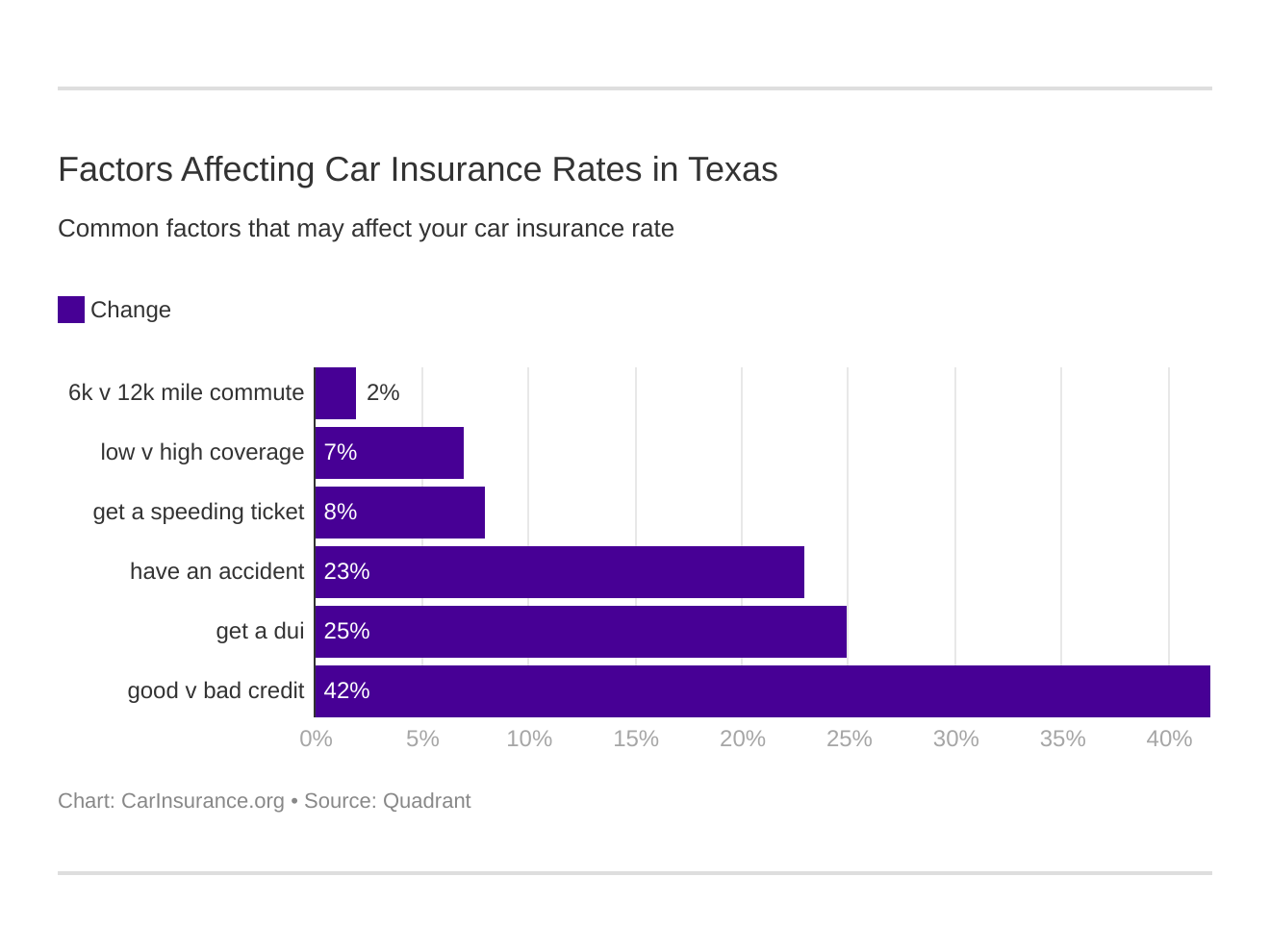

But there are many factors that affect the price of car insurance rates in Texas

What are commuter car insurance rates by Companies?

At some companies, how far you drive each day influences your insurance rates. Beyond age, gender, location, marital status, and carrier, other factors that affect your quoted rates from each carrier are those specific to your situation, such as how much coverage you want, credit history, and driving record.

The tables below compare such factors based on each carrier.

Company 10 miles commute / 6,000 annual mileage 25 miles commute / 12,000 annual mileage

Allstate $5,354.10 $5,616.53

American Family $4,849.18 $4,849.18

Geico $3,201.27 $3,325.50

Nationwide $3,867.57 $3,867.57

Progressive $4,664.85 $4,664.85

State Farm $2,879.95 $2,879.95

USAA $2,456.42 $2,519.83

Most company rates don’t change when the drive shortens to a 10-mile commute, except for Allstate, who offers rate reductions of over $260.

What are coverage level rates by car insurance companies?

Do you need better coverage, but don’t want to spend any more money? You might be surprised some companies offer more coverage with only small increases in rates.

Company Low Coverage Medium Coverage High Coverage

Allstate $5,361.24 $5,438.89 $5,655.81

American Family $4,517.27 $4,672.73 $5,357.52

Geico $3,090.73 $3,221.75 $3,477.68

Nationwide $4,165.19 $3,701.00 $3,736.52

Progressive $4,431.31 $4,642.33 $4,920.90

State Farm $2,729.50 $2,870.49 $3,039.86

USAA $2,403.46 $2,477.96 $2,582.94

For example, the data above shows State Farm has less than $300 increases from low to high coverage.

What are credit history rates by car insurance companies?

The quality of your credit score impacts your insurance rates. In Texas, the average credit score is 656, which is significantly below the nationwide average of 675. This means motorists may have difficulty getting great rates because of their below-average credit scores.

The table below shows what you can expect to pay yearly on car insurance based on your credit history.

Company Good Credit History Fair Credit History Poor Credit History

Allstate $4,370.89 $5,107.95 $6,977.11

American Family $3,672.27 $4,205.41 $6,669.84

Geico $1,902.16 $2,851.60 $5,036.40

Nationwide $3,235.20 $3,722.88 $4,644.64

Progressive $4,201.38 $4,536.59 $5,256.57

State Farm $2,023.50 $2,538.85 $4,077.51

USAA $1,696.02 $2,109.52 $3,658.82

If you have coverage through Geico and have poor credit, you can expect to pay nearly $4,000 more for car insurance than someone with good credit.

How does your driving record affect rates by car insurance companies?

Have you gotten a speeding ticket? Did you know it could raise your car insurance rates?

A clean driving record is the easiest way to keep rates down. As you can see from the information below, at Nationwide, just one speeding violation can raise your rate by over $400.

Company Clean record With 1 speeding violation With 1 accident With 1 DUI

Allstate $4,270.52 $4,270.52 $6,562.28 $6,837.95

American Family $4,418.84 $4,418.84 $5,627.66 $4,931.37

Geico $2,769.60 $3,570.55 $3,651.43 $3,061.96

Nationwide $3,351.99 $3,789.11 $3,351.99 $4,977.19

Progressive $4,066.74 $4,581.27 $5,258.36 $4,753.00

State Farm $2,561.35 $2,561.35 $2,934.63 $3,462.47

USAA $1,858.11 $2,132.96 $2,737.39 $3,224.03

A better record equals better rates. We encourage you to obey posted speed limit signs and NOT drink and drive.

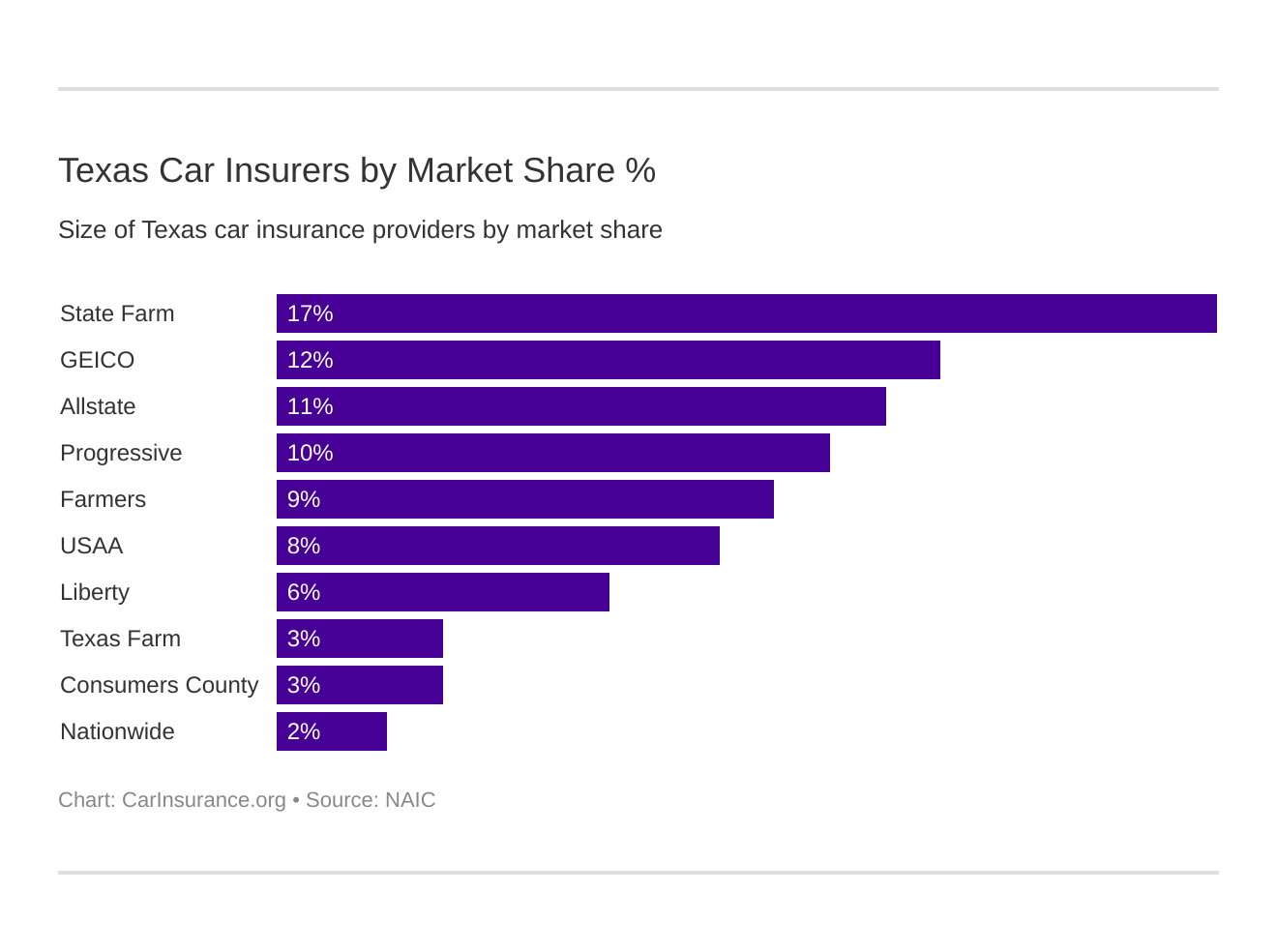

Who are the largest car insurance companies in Texas?

Here’s a list of the largest and best car insurance companies in Texas. State Farm is the largest provider in Texas, where 16.83% of Texans purchase their insurance. Take a look at this list of auto insurance companies in Texas and their market shares.

Company Direct Written Premiums Loss Ratio Market Share

State Farm Group $3,563,120 78.29% 16.83%

Geico $2,637,489 88.18% 12.46%

Allstate Insurance Group $2,362,584 66.19% 11.16%

Progressive Group $2,041,345 68.91% 9.64%

Farmers Insurance Group $1,842,735 66.07% 8.70%

USAA Group $1,712,949 88.30% 8.09%

Liberty Mutual Group $1,195,735 83.96% 5.65%

Texas Farm Bureau Mutual Group $693,004 77.31% 3.27%

Consumers County Mutual Insurance Co $541,825 86.45% 2.56%

Nationwide Corp Group $473,342 65.53% 2.24%

Who are the largest car insurance companies in Texas?

How many car insurers are in Texas?

Domestic insurance means a company is formed under Texas state laws, whereby a foreign provider is formed under the laws of any state in the country.

- Domestic Insurers: 199

- Foreign Insurers: 937

Up next, we discuss how insurance laws are formed, why they are essential to know, and much more.

What are Texas’ driving laws?

Insurance companies are subject to specific rules and regulations. These regulations are in place to protect the consumer against fraud and other untoward activities. Let’s look at some of the specific laws for consumers regarding car insurance.

How State Laws for Insurance are Determined

The states employ a variety of rate regulation mechanisms. Options include: 1) determined by Commissioner; 2) prior approval; 3) modified prior approval; 4) flex rating; 5) file and use; 6) use and file; and 7) no file.

Texas uses two processes: prior approval and by regulating policy forms as needed, according to Chapter 2301 (Art. 5.145 & Sect. 8, Art. 5.13-2, TX INS CODE).

Prior Approval: Rates/forms must be filed with and approved by the state insurance department before they can be used. Approval can be by means of a deemer provision, which indicates approval if rates/forms are not denied within a specified number of days.

It may be something you haven’t thought about a lot, but how laws are determined can have a significant impact on your car insurance rates.

Windshield Coverage

Unfortunately, there aren’t any laws regarding windshield repair in Texas at this time.

However, individual insurance companies may offer windshield repair coverage with a comprehensive insurance plan.

High-Risk Insurance

What happens with motorists who consistently accumulate points on their driving record? Initially, insurance providers raise their rates, but at times, it gets riskier to insure such motorists. When a motorist becomes high-risk, they can be denied coverage by insurance providers.

According to the Texas Department of Public Safety, high-risk drivers must file a Financial Responsibility Insurance Certificate (SR-22) to verify that they have liability insurance.

Texas also offers a program, the Texas Automobile Insurance Plan Association (TAIPA), to help “high-risk” drivers buy Texas car insurance. To qualify, at least two carriers must have denied them coverage within 60 days. Their insurance carrier must apply on their behalf. They don’t need proof of refusal to insure, but they must sign a statement.

TAIPA offers the state-required minimum coverage and the following types and levels:

- $2,500 Personal Injury Protection (PIP) — Medical Payments coverage not available

- $30,000/60,000/25,000 of Uninsured/Underinsured Motorist coverage

In this plan, high-risk drivers are distributed equitably among insurers who are licensed to write insurance in the market of Texas in proportion to their market share. This practice enables a fair risk-sharing between all insurance providers.

Low-Cost Insurance

Though Texas has a program to help high-risk drivers, it doesn’t have one for low-income drivers.

California, Hawaii, and New Jersey are the only states with government-funded programs to help low-income drivers pay for their car insurance.

Automobile Insurance Fraud in Texas

What is automobile insurance fraud? Creating a claim for damages or injuries that never occurred (such as faking an accident) or adding “extra” costs onto a legitimate claim are examples of fraud.

Car insurance fraud is a crime in Texas and includes the following penalties:

- When the claim amount is less than $50: Anything lower than $50 is considered a “Class C” misdemeanor, with a fine of $500.

- When the claim amount is more than $200,000: fines up to $10,000 and/or jail time of five to 99 years.

In 2017, the Texas fraud unit received 7,756 reports of motor vehicle insurance fraud, which made up more than 60% of the overall insurance fraud claims.

If you suspect insurance fraud and would like to report it, or you need assistance with an insurance claim, please contact the Texas State Department of Insurance at 512-676-6000, write to P.O. Box 149104, Austin, TX 78701, or visit their office located at the address listed below.

333 Guadalupe, Austin, TX 78701

Statute of Limitations

If you are in a car accident in Texas, there is a statute of limitations if you want to file a claim. Watch this video to learn more:

https://youtu.be/yr9vAqZVmlw

To recap, if you are involved in an automobile accident in Texas, you have two years from the date of the incident to file a claim for personal injury or property damage.

Texas Specific Laws

Every state makes its laws, and they may be similar to ones already on the books in other states. One rule we discovered which is unique to Texarkana is horse riders must have taillights on their horses while riding at night.

Whoa, there. Hold on a minute. We’re not sure how many horses will appreciate having taillights unless it’s a Ford Mustang, so we’ll just move along to other laws in Texas to help keep you safe and legal on the road.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are TX laws about vehicle licensing?

Texas, just like every other state, has mandatory licensing laws in addition to the statute of limitations and car insurance laws we previously covered.

Below, we’ll cover the requirements for getting and renewing a driver’s license and the state’s “points” system for penalties.

REAL ID

Texas is in full compliance with the REAL ID Act passed by Congress and enforced by Homeland Security. This means that a driver’s license or state ID issued by the Lone Star State is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

https://youtu.be/D0NwTNUuToo

One important date to remember is October 1, 2020. After that date, if you haven’t upgraded to the REAL ID, you may not be able to fly or enter certain government facilities.

Penalties for Driving Without Insurance

In Texas, you must show proof of insurance in the following situations:

- Whenever a police officer asks for it

- If you get into a car accident

- When you register or renew your car’s registration

- When you apply for or renew your driver’s license

- When your car undergoes an inspection

Government agencies, including local police and sheriff departments, use the online TexasSure program to verify whether drivers have car insurance. If the system shows a driver is uninsured or there is inconsistent information regarding their insurance, they may receive the following notices:

- Unmatched notice – Drivers will get this notice if they’re on record as having car insurance, but the coverage doesn’t match the car registration.

- Uninsured notice – Drivers will get this notice if they’ve registered a vehicle without car insurance.

But what if you are caught driving without insurance? According to the Texas Department of Public Safety and the Transportation Code, Title 7., these are the penalties you face:

Penalties for Driving Without Insurance in Texas Details

First Offense - Fine: $175 to $350 fine

- pay up to a $250 surcharge every year for three years (may be reduced with certain requirements)

Second Offense - Fine: $350 to $1000

- pay up to a $250 surcharge every year for three years (may be reduced with certain requirements)

- suspend the driver's license and vehicle registrations of the person unless the person files and maintains evidence of financial responsibility with the department until the second anniversary of the date of the subsequent conviction

- Impoundment: for 180 days and

cannot apply for release of car without evidence of financial responsibility and impoundment fee of $15/day

It’s important to remember the best Texas auto insurance rates go to the safest, most responsible drivers.

Our best advice: drive legal and always carry the Texas minimum requirements for car insurance.

Teen Driver Laws

To begin driving in Texas, people who are 15 or older but under 18 must satisfactorily complete and pass the classroom phase of an approved driver education course to be issued a permit.

Check out these teen driving laws in the table below.

Requirements for Getting a License in Texas Details

Mandatory Holding Period 6 months

Minimum Supervised Driving Time 30 hours, 10 of which must be at night

Minimum Age 16 years old (the minimum license age is 18 for applicants who have not completed driver education)

Teens can apply for a provisional or intermediate license if they’ve satisfied the requirements under the learner’s permit. These are the laws for young drivers with a restricted license.

Restricted License Laws in Texas Details

Nighttime restrictions midnight-5 a.m.

Passenger restrictions (family members excepted unless noted otherwise) no more than 1 passenger younger than 21 secondary enforcement

Minimum age at which restrictions may be lifted

Nighttime restrictions until age 18

Passenger restrictions until age 18

Older Driver License Renewal Procedures

Texas has different license renewal requirements based on the driver’s age. Drivers younger than age 85 must renew their licenses every eight years. Those 85 or older must renew their licenses every two years.

Texans can renew their licenses within a year before they’re supposed to expire and up to two years after their licenses have expired. However, if two years have passed since the license expired, residents must apply for a new one.

Drivers age 79 or older must provide proof of adequate vision at every renewal.

New Residents

Are you moving to Texas? You need to make sure your insurance is updated to meet the minimum liability insurance required by the state. To do so, new residents will need to contact their current insurance provider to provide updated address information.

To apply for your new driver’s license, you will need to provide:

- Proof of identity (such as your valid out-of-state license)

- Proof of residency

- Proof of U.S. citizenship or lawful presence

- Proof of social security number

- Proof of vehicle registration in Texas (assuming you have a car titled to your name)

License renewal procedures

Methods of renewal: If you’re younger than age 79, you can renew your license by phone, mail, or online at every other renewal. Drivers under 18 and older than 79 must renew their licenses in-person at a local DMV office.

The DMV requires proof of adequate vision for drivers younger than age 79 if they renew in person.

Negligent Operator Treatment System (NOTS)

According to the Texas Department of Public Safety, as of September 1, 2019, the state repealed its Driver Responsibility Program. As it states:

“The Department of Public Safety has reinstated all driver privileges that were previously suspended solely for having unpaid surcharges. If your license was suspended for other offenses, you may check the status of your driver’s license and determine any reinstatement requirements by visiting our License Eligibility page.

Additional information on the repeal of the program may be found at the Driver Responsibility Program (Surcharge) Repeal FAQs.”

Drivers will still be responsible for any other suspensions, fines, or fees on their driving records.

What are the Rules of The Road in Texas?

We all should obey the rules, but if you are new to the state, there may be laws you’re unfamiliar with. That’s why we’ve assembled a list of several relevant laws to help keep you in good standing and on the road.

Fault vs. No-Fault

Texas is an at-fault car accident state. If you cause an accident, you are held responsible for covering the costs of damages resulting from that accident.

The at-fault driver will also need to cover all medical bills of anyone needing medical intervention caused by the accident.

It’s always a good idea to have more insurance than the minimum amount required when you live in an at-fault state.

Seat Belt and Car Seat Laws

Seat belts can considerably reduce the risk of serious injury in a crash, and the laws of Texas require all front-seat passengers to wear a seat belt when the car is in motion. The following chart provides more information about the required use of safety belts.

[table “2071responsivescroll” not found /]

Children in Texas must also be properly restrained. The following chart provides more details.

Type of Car Seat Required Age

Must be in child safety seat 7 years and younger and less than 57 inches

Preference for rear seat law states no preference for rear seat

Adult Belt Permissible not permissible

Maximum base fine 1st offense, additional fees may apply $25 minimum; maximum unlisted

If you are caught breaking these car seat laws, you could have to pay a fine of $45 plus fees.

It is illegal to ride in the cargo area of a pick-up truck in Texas.

Keep Right and Move Over Laws

Texas traffic laws mandate that you must keep right when traveling slower than the average speed of traffic around you. Generally, the left lane is for faster traffic and passing.

The “move over” law requires motorists to slow down and maneuver to the closest lane if they approach a stationary emergency vehicle, including Texas DMV vehicles and tow trucks using approved visual signals and traveling in the same direction.

Speed Limits

We know Texas is a large state, and you may be tempted to go over the speed limit once you get out on the open roads. To help keep you from getting a ticket, we’ve posted the speed limits on different types of roads in Texas.

Type of Roadway Speed Limit

Rural Interstates 75; 80 or 85 on specified segments of road

Urban Interstates 75 mph

Other Limited Access Roads 75 mph

Other Roads 75 mph

Ridesharing

In 2017, Texas established statewide standards for Transportation Network Companies (TNC), also known as ridesharing companies.

State law requires rideshare drivers to undergo criminal background checks yearly and carry the minimum car insurance coverage. The state prohibits sex offenders from rideshare driving.

The liability insurance required while ridesharing is $1 million for bodily injury and property damage total for each incident.

The following providers offer rideshare insurance in Texas:

- Allstate

- Farmers

- Geico

- Liberty Mutual

- Metlife

- Progressive

- USAA

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS):

Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera, and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.

Currently, in Texas, autonomous vehicles are in the deployment stage. State law mandates that the operator doesn’t need to be licensed or in the vehicle during operation. However, liability insurance is required for all vehicles.

The state has also formed a Connected and Autonomous Vehicle (CAV) Task Force to test self-driving cars.

What are safety laws in Texas?

Up next, we take a closer look at the safety laws in Texas so that you can arrive alive. Please don’t drink and drive.

DUI Laws

Driving while impaired has disastrous results for everyone involved, and that’s why strict laws are in place to prevent such tragedies. In Texas alone, drunk driving caused 1,468 deaths in 2017. Each state differs in how they address drunk driving and therefore have different penalties.

The table below shows detail on what a driver will face if they are charged and convicted of DUI.

DUI Laws in Texas Details

Name for Offense Driving under the influence (DUI)

BAC Limit 0.08

High BAC Limit 0.15

Criminal Status 1st class B misdemeanor, 2nd in 5 years class A misdemeanor, 3rd+ third degree feonies

Look Back Period unlimited/lifetime for sentencing; 5 years for 2nd+ when determining need for IID

Marijuana-Impaired Driving Laws

According to the Marijuana Policy Project, Texas allowed the first sales of low-THC medical cannabis in early 2018 under its Compassionate Use Program.

The law places a 0.5% cap on the level of THC prescribed to medical marijuana patients. Only patients with certain conditions can use it:

- intractable epilepsy

- multiple sclerosis

- ALS

- terminal cancer

- autism

- spasticity

- and incurable neurodegenerative diseases.

The state also allows the use of CBD oil. It hasn’t decriminalized marijuana use, and there are currently no laws in Texas that regulate driving under the influence of marijuana.

Distracted Driving Laws

Distracted driving can be just as life-threatening as impaired driving. Texas has regulated the use of cellphones in cars, so drivers pay more attention to the road. All it takes is a single second of distraction to cause a lifetime of complications.

The following table shows what restrictions Texas lawmakers have implemented to combat distracted driving in the state.

Cell Phone Laws in Texas Details

Hand-Held Ban drivers in school crossing zones and on public school property during the time the reduced speed limit applies

Text Ban all drivers

Young drivers all cellphone ban drivers younger than 18

Enforcement primary

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What do you need to know about driving in Texas?

Now that you have a good understanding of Texas state laws, let’s dive into some facts that you might not know. While insurance is essential, it’s also crucial to know what to keep your eyes out for on the road.

Vehicle Theft in Texas

No one wants to have their car stolen. In 2016, nearly 13,000 cars were stolen in Houston. When considering your next car purchase, one thing to consider is that certain vehicles are stolen more frequently, and thus, may have higher insurance rates.

The following shows a list of the top 10 stolen vehicles in Texas.

CITY MOTOR VEHICLE THEFT

Amarillo 990

Mesquite 849

Garland 810

El Paso 800

Corpus Christi 731

Irving 711

Killeen 566

Grand Prairie 495

Beaumont 405

Pasadena 379

Plano 339

Baytown 326

Denton 298

Galveston 284

Odessa 273

San Angelo 272

Abilene 260

Longview 242

Lancaster 240

Temple 238

Wichita Falls 238

Lewisville 229

Carrollton 227

Midland 220

Waco 191

Richardson 189

Conroe 176

Humble 176

Laredo 170

Duncanville 169

San Marcos 169

DeSoto 158

McKinney 155

Port Arthur 153

Haltom City 150

New Braunfels 148

Balch Springs3 146

Tyler 146

Brownsville 141

Euless 140

Bryan 123

Texas City 123

Texarkana 121

College Station 117

Victoria 110

Edinburg 108

South Houston3 106

Bedford 102

North Richland Hills 101

Cedar Hill 98

Addison 97

League City 93

Farmers Branch 92

Harlingen 91

Huntsville 88

Big Spring 85

Grapevine 85

Frisco 84

Lufkin 83

Webster 81

Seagoville 79

Sherman 77

Mission 74

Rowlett 71

Denison 70

Waxahachie 70

Missouri City 69

Hurst 68

Burleson 67

Terrell 67

Greenville 65

Marshall 65

La Marque 64

Round Rock 64

Leon Valley 62

Pharr 62

Kyle 61

Alvin 60

Rosenberg 59

Saginaw 59

Schertz 57

Sugar Land 56

Stafford 54

Allen 52

Harker Heights 52

Alamo 51

Cedar Park 51

Cleburne 51

Rockwall 51

San Juan 51

Weslaco 50

La Porte 49

Plainview 49

White Settlement 49

Paris 48

Converse 47

Dickinson 47

Donna3 47

Orange 47

McAllen 46

Pflugerville3 45

Universal City 45

Balcones Heights 42

Kirby 42

Mansfield 42

The Colony 42

Tomball 40

Live Oak 39

Rio Grande City 39

Weatherford 39

Alice 38

Corsicana 37

Borger3 36

Forest Hill 36

Katy 36

Nederland 36

Ennis 35

Georgetown 35

Jacinto City 35

Copperas Cove 34

Deer Park 34

Vidor 34

Eagle Pass 33

Mercedes 33

Taylor 33

Jersey Village 32

Levelland 31

Cleveland 30

Windcrest 30

Boerne 29

Groves 29

Kilgore 29

Pleasanton 29

Bellmead3 28

Dumas 28

Palestine3 28

Richland Hills 28

Wylie 28

Athens 27

Nacogdoches 27

Port Aransas 27

Seguin 27

Selma 27

Little Elm 26

Port Neches 26

Sweetwater3 26

Kingsville 25

San Benito 25

Shenandoah3 25

As is common in many states, the Honda Accord and multiple brand pickup trucks lead the way as the most stolen vehicles in the state.

Where you live also plays a role in the number of vehicle thefts. The FBI created a report on Texas vehicle thefts by cities, which are listed below.

City Motor

vehicle

theft

Abernathy 8

Abilene 260

Addison 97

Alamo 51

Alamo Heights 5

Alice 38

Allen 52

Alpine 7

Alton 12

Alvarado 13

Alvin 60

Amarillo 990

Andrews 16

Anna 11

Anson 3

Anthony 11

Aransas Pass 23

Arcola 0

Argyle 2

Arlington3 1,360

Arp 0

Athens 27

Atlanta 5

Aubrey 3

Austin 2,079

Azle 7

Baird 4

Balch Springs3 146

Balcones Heights 42

Ballinger 1

Bangs 0

Bartonville 2

Bastrop 23

Bay City3 11

Bayou Vista 0

Baytown 326

Beaumont 405

Bedford 102

Bee Cave 5

Beeville 8

Bellaire 12

Bellmead3 28

Bellville3 0

Belton 4

Benbrook 21

Beverly Hills 9

Big Sandy 1

Big Spring 85

Bishop 4

Blanco 1

Blue Mound 4

Boerne 29

Bogata 1

Bonham 4

Borger3 36

Bovina 1

Bowie 9

Boyd 1

Brady 6

Brazoria 5

Breckenridge 3

Bridge City 13

Bridgeport3 4

Brookshire 12

Brownfield 8

Brownsville 141

Brownwood 22

Bryan 123

Buda 11

Bullard 1

Bulverde 0

Burkburnett 21

Burleson 67

Burnet3 9

Cactus 3

Caddo Mills 0

Caldwell 0

Calvert 2

Cameron 1

Canton 3

Canyon 10

Carrollton 227

Carthage 10

Castle Hills3 21

Castroville 13

Cedar Hill 98

Cedar Park 51

Celina 4

Center 7

Chandler 2

Cibolo 14

Cisco 11

Clarksville 0

Cleburne 51

Cleveland 30

Clifton 4

Clint 0

Clute 18

Clyde 2

Cockrell Hill 15

Coleman 1

College Station 117

Colleyville 7

Collinsville 0

Colorado City 7

Comanche 1

Combes 0

Commerce 2

Conroe 176

Converse 47

Coppell 23

Copperas Cove 34

Corinth 21

Corpus Christi 731

Corrigan3 4

Corsicana 37

Crandall 10

Crane 1

Crockett 7

Crosbyton 0

Crowell 0

Crowley 12

Crystal City 0

Cuero2 9

Cumby 0

Daingerfield 3

Dalhart 16

Dallas 7,913

Dalworthington Gardens 4

Danbury 0

Dayton3 20

Decatur 11

Deer Park 34

De Kalb 4

De Leon 2

Del Rio 19

Denison 70

Denton 298

Denver City 2

DeSoto 158

Devine3 15

Diboll 3

Dickinson 47

Dilley 5

Dimmitt 9

Donna3 47

Double Oak3 0

Driscoll 1

Dublin 1

Dumas 28

Duncanville 169

Eagle Lake 0

Eagle Pass 33

Early 2

Eastland3 1

Edcouch 3

Edinburg 108

Edna 7

El Campo3 19

Electra3 5

El Paso 800

Elsa 0

Encinal 1

Ennis 35

Estelline 0

Euless 140

Fairfield 3

Fair Oaks Ranch 2

Fairview 1

Falfurrias 0

Farmers Branch 92

Farmersville 2

Farwell 0

Fate3 3

Ferris 1

Flatonia 1

Floresville 12

Flower Mound 19

Floydada 4

Forest Hill 36

Forney 23

Fort Stockton 7

Fort Worth 2,706

Frankston3 2

Fredericksburg 3

Freeport 12

Freer 3

Friendswood 17

Friona 1

Frisco 84

Fulshear 2

Fulton 3

Gainesville 23

Galveston 284

Ganado 1

Garden Ridge 0

Garland 810

Gatesville 15

Georgetown 35

George West 5

Giddings 2

Gilmer 7

Gladewater 9

Glenn Heights 12

Godley 3

Gonzales 8

Gorman 1

Graham 10

Granbury 13

Grand Prairie 495

Grand Saline 2

Granger 1

Granite Shoals 6

Grapeland 0

Grapevine 85

Greenville 65

Gregory 1

Groesbeck 3

Groves 29

Gun Barrel City 12

Hallettsville3 1

Hallsville 3

Haltom City 150

Hamilton 4

Hamlin 0

Happy 0

Harker Heights 52

Harlingen 91

Haskell 1

Hawkins 0

Hawley 1

Hearne 4

Heath 2

Hedwig Village 6

Helotes 3

Hemphill 0

Henderson 16

Hereford 24

Hewitt 8

Hickory Creek 6

Hidalgo 10

Highland Park 5

Highland Village 5

Hill Country Village 2

Hillsboro 24

Hitchcock 21

Hollywood Park3 6

Hondo 16

Hooks 2

Horizon City 7

Horseshoe Bay 2

Houston 11,596

Hughes Springs 0

Humble 176

Huntington 3

Huntsville 88

Hurst 68

Hutchins 0

Hutto 4

Idalou 1

Indian Lake3 0

Ingleside 17

Ingram 3

Iowa Park 7

Irving 711

Itasca 1

Jacinto City 35

Jacksboro 4

Jacksonville3 16

Jamaica Beach 1

Jarrell 1

Jasper 14

Jersey Village 32

Jones Creek 1

Jonestown 6

Josephine 0

Joshua 7

Jourdanton 0

Junction 1

Karnes City 3

Katy 36

Kaufman2, 3 17

Keene 4

Keller 11

Kemah 6

Kenedy 5

Kennedale 10

Kermit 0

Kerrville 23

Kilgore 29

Killeen 566

Kingsville 25

Kirby 42

Knox City 0

Kountze 7

Kress 0

Kyle 61

Lacy-Lakeview 11

La Feria 6

Lago Vista 3

La Grange 4

La Grulla 0

Laguna Vista 2

La Joya 1

Lake City 0

Lake Dallas 4

Lake Jackson 24

Lakeside 6

Lakeview, Harrison County 6

Lakeway 8

Lake Worth 15

La Marque 64

Lampasas 8

Lancaster 240

La Porte 49

Laredo 170

La Vernia 5

La Villa 0

Lavon 0

League City 93

Leander 24

Leon Valley 62

Levelland 31

Lewisville 229

Liberty 12

Lindale 13

Linden 4

Little Elm 26

Littlefield3 7

Live Oak 39

Livingston3 7

Lockhart 18

Log Cabin 3

Lone Star 0

Longview 242

Lorena 4

Los Indios 0

Lufkin 83

Luling 12

Lumberton2 10

Lyford 3

Lytle 6

Madisonville 0

Magnolia 2

Manor 15

Mansfield 42

Manvel 9

Marble Falls 7

Marshall 65

Martindale 0

Mathis 3

McAllen 46

McGregor 1

McKinney 155

Meadows Place 12

Melissa 5

Memorial Villages 0

Memphis 1

Mercedes 33

Merkel 2

Mesquite 849

Mexia 3

Midland 220

Midlothian 22

Milford 1

Mineola 5

Mission 74

Missouri City 69

Monahans 6

Mont Belvieu3 17

Montgomery 0

Moulton 0

Mount Pleasant 18

Muleshoe 4

Munday 0

Murphy 3

Nacogdoches 27

Naples 0

Nash 6

Nassau Bay 8

Natalia 0

Navasota 14

Nederland 36

Needville 2

New Boston 9

New Braunfels 148

Newton 2

Nixon 3

Nocona 1

Nolanville 3

Normangee 0

Northeast 3

Northlake 7

North Richland Hills 101

Oak Ridge 0

Odessa 273

Olmos Park 2

Olney 3

Olton 1

Omaha 1

Onalaska 3

Orange 47

Ovilla 2

Oyster Creek 3

Paducah 0

Palacios 3

Palestine3 28

Palmer 5

Palmhurst 0

Palm Valley 0

Palmview 3

Panhandle 1

Pantego3 9

Paris 48

Parker 4

Pasadena 379

Patton Village 7

Pearsall 11

Pecos 1

Pelican Bay 0

Penitas 2

Perryton3 12

Pflugerville3 45

Pharr 62

Pilot Point 1

Pinehurst 3

Pittsburg 5

Plainview 49

Plano 339

Pleasanton 29

Ponder3 1

Port Aransas 27

Port Arthur 153

Port Isabel 12

Portland 9

Port Lavaca 23

Port Mansfield 0

Port Neches 26

Poteet 13

Poth 2

Pottsboro 0

Prairie View 1

Premont 2

Presidio 1

Primera 1

Princeton3 5

Prosper 7

Queen City 2

Quitman 1

Ralls 0

Rancho Viejo 0

Ranger 3

Raymondville 6

Red Oak 24

Refugio 0

Reno 4

Richardson 189

Richland Hills 28

Richmond 9

Richwood 3

Riesel 0

Rio Bravo 0

Rio Grande City 39

Rio Hondo 2

River Oaks 17

Roanoke 11

Robinson 5

Robstown 12

Rockdale3 8

Rockport 24

Rockwall 51

Rollingwood 0

Roma 22

Roman Forest 2

Rosenberg 59

Round Rock 64

Rowlett 71

Royse City 11

Runaway Bay 1

Rusk 2

Sabinal 0

Sachse 22

Saginaw 59

Salado 4

San Angelo 272

San Antonio 6,864

San Augustine 1

San Benito 25

San Diego 0

Sanger 5

San Juan 51

San Marcos 169

San Saba 3

Sansom Park Village 10

Santa Anna 0

Santa Fe 18

Santa Rosa 2

Schertz 57

Schulenburg 5

Seabrook 14

Seagoville 79

Seagraves 1

Sealy 15

Seguin 27

Selma 27

Seminole3 8

Seven Points 6

Seymour3 2

Shallowater 7

Shamrock 0

Shavano Park 2

Shenandoah3 25

Sherman 77

Shiner 0

Shoreacres 0

Sinton 14

Slaton 13

Smithville 2

Socorro 22

Somerset 2

Sonora 0

Sour Lake 3

South Houston3 106

Southlake 5

South Padre Island 14

Southside Place 0

Spearman 0

Splendora 4

Springtown 0

Spring Valley 4

Spur 0

Stafford 54

Stagecoach 0

Stamford 3

Stephenville 15

Sugar Land 56

Sullivan City 4

Sulphur Springs 13

Sunrise Beach Village 0

Sunset Valley 1

Surfside Beach 0

Sweeny 2

Sweetwater3 26

Taft 3

Tahoka 2

Tatum 1

Taylor 33

Teague 7

Temple 238

Terrell 67

Terrell Hills 0

Texarkana 121

Texas City 123

The Colony 42

Thorndale 0

Thrall 0

Three Rivers 0

Tioga 2

Tomball 40

Tool 4

Trophy Club 8

Troup 2

Tulia 5

Tye 2

Tyler 146

Universal City 45

University Park 19

Uvalde 10

Van 7

Van Alstyne 3

Venus 4

Vernon 14

Victoria 110

Vidor 34

Waco 191

Waelder 0

Wake Village 10

Waller 5

Wallis 0

Watauga 14

Waxahachie 70

Weatherford 39

Webster 81

Weimar 4

Weslaco 50

West 1

West Lake Hills3 5

West Orange 6

Westover Hills 1

West University Place 4

Westworth 5

Wharton 6

Whitehouse 2

White Oak 19

Whitesboro 3

White Settlement 49

Wichita Falls 238

Willis 11

Willow Park3 3

Wills Point 2

Wilmer 8

Windcrest 30

Wink 1

Winnsboro 6

Winters 3

Wolfforth 0

Woodbranch 0

Woodville 0

Woodway 0

Wortham 1

Wylie 28

Yoakum 3

Yorktown 2

If you’re worried about car theft in your city, we encourage you to lock your vehicle when not in use and purchase more than the minimum liability requirements if you own an expensive car.

How many road fatalities happen in Texas?

Accidents can and do happen, and next, we’re going to show you statistics from the National Highway Traffic Safety Administration for different kinds of accidents in Texas.

Most Fatal Highway in Texas

Have you ever wondered where the most dangerous highway in your state is located? According to Geotab, US-83 (also known as the Texas Vietnam Veterans Memorial Highway), running north and south, is the most fatal highway. It has averaged 26 crash deaths every year for the past decade.

Fatal Crashes by Weather Condition and Light Condition

Since states have different weather conditions to watch out for, we want to take a look at fatalities in Texas during different types of weather conditions. The following table shows how many crashes occurred when weather and light conditions are a factor.

Weather Condition Daylight Dark, but Lighted Dark Dawn or Dusk Other / Unknown Total

Normal 1,316 664 930 94 8 3,012

Rain 91 53 85 9 0 238

Snow/Sleet 9 0 1 0 0 10

Other 17 18 32 4 0 71

Unknown 3 0 3 0 6 12

TOTAL 1,436 735 1,051 107 14 3,343

As the data reflects, most crashes occurred during daylight hours.

Fatalities (All Crashes) by County

The National Highway Traffic Safety Administration (NHTSA) has collected extensive data on crashes in Texas. One of the first statistics we want to look at is how fatalities vary from county to county. The following table shows how many crashes occurred by county in the state of Texas.

County Fatalities

20132014 2015 2016 2017 Fatalities

Per 100K

Population

20132014 2015 2016 2017

Anderson County 9 10 8 12 10 15.53 17.29 13.88 20.85 17.32

Andrews County 12 11 14 1 16 71.48 63.04 77.38 5.61 90.28

Angelina County 19 18 18 20 16 21.75 20.55 20.48 22.77 18.22

Aransas County 3 3 2 3 4 12.55 12.2 8.05 11.87 15.64

Archer County 7 5 0 4 2 79.61 56.59 0 45.59 22.7

Armstrong County 6 0 0 1 1 309.28 0 0 53.88 53.22

Atascosa County 7 17 17 6 9 14.89 35.64 35.16 12.33 18.37

Austin County 6 8 5 10 3 20.94 27.64 16.98 33.74 10.07

Bailey County 2 0 1 2 1 28.18 0 13.89 27.86 14.13

Bandera County 10 8 8 2 7 48.64 38.44 37.83 9.21 31.32

Bastrop County 21 14 20 37 26 27.67 17.97 24.94 44.71 30.67

Baylor County 7 3 6 0 1 195.69 84.1 164.43 0 27.93

Bee County 4 8 5 8 3 12.19 24.36 15.33 24.36 9.21

Bell County 36 34 40 42 57 11 10.3 11.9 12.31 16.39

Bexar County 189 184 189 226 164 10.38 9.91 9.97 11.72 8.37

Blanco County 5 9 4 8 3 47.01 83.3 36.24 70.54 25.8

Borden County 1 1 1 1 0 154.8 150.15 152.44 151.52 0

Bosque County 5 4 4 2 5 27.99 22.58 22.39 11.1 27.28

Bowie County 25 18 14 22 16 26.75 19.27 14.99 23.43 17.02

Brazoria County 45 30 42 48 43 13.63 8.88 12.15 13.57 11.86

Brazos County 15 14 22 20 28 7.35 6.71 10.19 9.11 12.57

Brewster County 3 1 1 0 0 32.29 10.93 10.95 0 0

Briscoe County 0 0 0 2 0 0 0 0 134.59 0

Brooks County 8 6 3 1 1 110.18 82.69 41.45 13.77 13.82

Brown County 2 2 6 5 3 5.32 5.33 15.91 13.14 7.88

Burleson County 3 4 4 11 5 17.4 23.05 22.78 61.76 27.76

Burnet County 8 20 11 9 16 18.35 45.48 24.56 19.6 34.19

Caldwell County 4 15 12 9 11 10.2 37.79 29.72 21.89 25.98

Calhoun County 7 3 1 1 1 32.21 13.76 4.57 4.56 4.6

Callahan County 12 4 6 7 10 88.92 29.63 44.18 50.81 71.71

Cameron County 39 26 25 41 40 9.35 6.21 5.96 9.72 9.44

Camp County 2 4 1 1 3 16.08 31.69 7.9 7.83 23.34

Carson County 1 3 9 6 3 16.71 49.73 149.83 98.25 49.73

Cass County 7 3 14 4 10 23.15 9.96 46.45 13.3 33.32

Castro County 2 4 1 0 1 24.75 50.58 12.82 0 12.75

Chambers County 13 20 15 22 9 34.81 52.24 38.4 54.61 21.72

Cherokee County 15 13 8 9 10 29.36 25.4 15.51 17.34 19.14

Childress County 2 0 1 2 3 28.35 0 14.2 28.19 42.45

Clay County 6 2 1 0 6 57.4 19.28 9.66 0 57.58

Cochran County 0 2 0 1 0 0 68.17 0 34.35 0

Coke County 1 5 5 4 1 31.46 155.52 155.04 122.59 30.25

Coleman County 1 4 4 6 1 11.73 47.53 48.11 71.25 11.86

Collin County 41 47 37 50 68 4.78 5.31 4.05 5.31 7.01

Collingsworth County 0 0 3 0 0 0 0 99.67 0 0

Colorado County 15 5 14 8 10 72.44 24.17 66.95 38.05 47.1

Comal County 21 20 17 24 17 17.71 16.24 13.21 17.89 12.06

Comanche County 5 2 4 8 7 36.93 14.86 29.92 59.17 51.57

Concho County 4 1 0 0 4 97.7 24.6 0 0 147.22

Cooke County 3 20 13 6 10 7.81 51.69 33.28 15.29 25.07

Coryell County 7 5 13 14 9 9.12 6.56 17.05 18.68 12.01

Cottle County 0 1 0 0 0 0 70.03 0 0 0

Crane County 2 3 2 0 1 42.35 61.15 39.94 0 21.1

Crockett County 5 5 3 4 7 132.94 132.07 80.39 109.5 196.41

Crosby County 0 1 4 5 1 0 17.17 67.61 84.5 16.95

Culberson County 2 6 12 3 3 86.77 263.16 533.1 135.2 134.47

Dallam County 1 8 1 4 3 14.08 111.06 13.77 55.13 41.62

Dallas County 225 238 259 315 282 9.06 9.45 10.14 12.17 10.77

Dawson County 4 6 4 4 2 30.3 44.66 30.81 30.67 15.61

Deaf Smith County 2 3 2 3 3 10.44 15.71 10.64 15.92 15.93

Delta County 2 0 2 6 0 39.08 0 38.78 116.6 0

Denton County 40 37 38 49 49 5.49 4.91 4.87 6.06 5.86

Dewitt County 9 7 3 5 5 44.16 34.12 14.54 24.25 24.72

Dickens County 0 0 1 1 4 0 0 45.41 45.43 181.08

Dimmit County 10 13 8 2 3 91.7 117.96 72.85 18.55 28.8

Donley County 1 4 0 2 2 28.04 114.22 0 58.96 60.4

Duval County 5 3 6 4 6 43.15 26.04 52.9 34.94 53.22

Eastland County 8 9 8 6 6 43.77 49.35 44.05 32.78 32.59

Ector County 59 48 54 34 48 39.43 31.05 33.78 21.58 30.56

Edwards County 0 0 3 1 1 0 0 157.07 52.14 51.2

El Paso County 60 66 62 81 58 7.23 7.92 7.44 9.68 6.9

Ellis County 19 24 25 28 33 12.18 15.08 15.31 16.63 19.01

Erath County 10 15 18 13 10 25.06 37 43.67 31.37 23.83

Falls County 8 7 4 7 3 46.4 40.68 23.22 40.39 17.2

Fannin County 6 5 8 15 14 17.89 14.87 23.9 44.31 40.64

Fayette County 9 9 16 9 17 36.41 36.31 64.08 35.9 67.27

Fisher County 1 6 2 2 2 25.85 154.92 51.67 51.53 51.55

Floyd County 2 2 0 1 2 32.03 33.64 0 17.02 34.16

Foard County 2 1 0 1 1 155.28 78.31 0 82.58 81.83

Fort Bend County 52 36 39 37 39 7.97 5.26 5.46 4.99 5.1

Franklin County 2 4 4 10 0 18.85 37.87 37.76 93.82 0

Freestone County 5 8 11 14 8 25.52 40.7 55.8 71.26 40.76

Frio County 7 1 9 3 3 38.08 5.28 46.73 15.48 15.31

Gaines County 11 5 10 5 3 58.53 25.88 49.47 24.41 14.54

Galveston County 23 35 44 45 40 7.5 11.16 13.69 13.67 11.94

Garza County 1 8 0 1 2 15.69 124.84 0 15.52 30.64

Gillespie County 6 4 5 7 11 23.7 15.71 19.26 26.61 41.28

Glasscock County 4 4 6 2 3 316.46 303.72 438.28 148.15 222.55

Goliad County 3 3 4 4 1 40.26 39.98 53.26 53.18 13.22

Gonzales County 11 13 15 13 12 54.62 63.86 73.04 62.31 57.44

Gray County 3 4 6 5 6 13.05 17.07 25.81 21.99 26.78

Grayson County 27 19 26 24 22 22.08 15.38 20.71 18.72 16.78

Gregg County 21 22 26 21 32 17.05 17.88 20.99 16.99 25.94

Grimes County 10 5 16 8 11 37.32 18.51 58.54 29.01 39.17

Guadalupe County 16 15 19 24 19 11.2 10.22 12.62 15.52 11.9

Hale County 1 8 4 3 4 2.8 23.2 11.73 8.77 11.72

Hall County 3 0 2 0 1 94.85 0 64.68 0 32.56

Hamilton County 4 7 7 0 3 48.61 85.89 86.74 0 35.62

Hansford County 2 2 3 0 2 36.13 36.13 53.49 0 36.72

Hardeman County 2 4 1 2 2 49.21 100.3 25.56 50.11 50.08

Hardin County 11 13 9 11 12 19.89 23.42 16.14 19.55 21

Harris County 369 417 391 447 456 8.48 9.37 8.59 9.68 9.8

Harrison County 22 14 26 16 17 33.21 21.01 38.95 23.98 25.5

Hartley County 4 3 8 5 5 66.74 49.68 140.99 87.63 87.86

Haskell County 3 6 4 2 4 50.8 103.47 68.76 34.69 69.61

Hays County 23 18 17 39 30 13.07 9.74 8.74 19.09 13.99

Hemphill County 1 3 1 1 0 24.14 71.86 23.3 24.24 0

Henderson County 12 12 17 11 16 15.26 15.14 21.4 13.74 19.74

Hidalgo County 65 65 67 75 60 7.95 7.84 7.98 8.82 6.97

Hill County 16 14 16 13 10 45.91 40.26 45.92 36.96 27.89

Hockley County 6 7 5 7 4 25.64 29.84 21.45 30.3 17.33

Hood County 5 8 3 15 11 9.45 14.86 5.42 26.43 18.88

Hopkins County 7 8 9 9 13 19.83 22.42 25.03 24.86 35.62

Houston County 8 6 8 14 10 35.08 26.32 35.19 61.17 43.44

Howard County 12 6 12 8 9 33.19 16.44 32.32 21.85 24.97

Hudspeth County 14 15 7 12 14 419.54 460.41 203.73 294.62 317.6

Hunt County 15 18 22 28 26 17.15 20.3 24.53 30.45 27.7

Hutchinson County 6 8 6 5 0 27.4 36.53 27.55 23.18 0

Irion County 2 10 3 0 0 124.15 635.32 194.43 0 0

Jack County 3 5 6 3 1 33.71 56.43 67.88 34.22 11.32

Jackson County 6 5 10 6 3 41.07 33.97 67.6 40.4 20.26

Jasper County 8 5 12 7 8 22.47 14.12 34.04 19.77 22.5

Jeff Davis County 3 2 0 0 2 134.47 90.09 0 0 87.72

Jefferson County 23 32 27 37 37 9.09 12.66 10.59 14.46 14.44

Jim Hogg County 1 6 1 3 0 19.01 112.78 18.93 57.21 0

Jim Wells County 14 10 15 4 7 33.6 24.11 36.17 9.73 17.13

Johnson County 19 23 22 23 21 12.3 14.67 13.8 14.12 12.55

Jones County 7 5 8 5 9 34.94 25.19 40.03 25.01 45.04

Karnes County 11 7 9 5 4 74.72 47.19 59.03 32.76 26.34

Kaufman County 12 24 18 27 31 11.08 21.64 15.77 22.87 25.23

Kendall County 8 5 9 5 4 21.53 13.02 22.52 11.91 9.09

Kenedy County 2 0 2 2 2 459.77 0 461.89 467.29 479.62

Kent County 0 1 0 0 1 0 133.69 0 0 131.06

Kerr County 16 15 8 11 3 32.15 29.84 15.76 21.44 5.8

Kimble County 4 0 9 12 7 89.61 0 204.92 271 158.73

King County 0 0 1 0 0 0 0 352.11 0 0

Kinney County 2 0 2 2 0 55.08 0 55.66 54.95 0

Kleberg County 5 7 3 11 5 15.62 21.98 9.55 35.09 16.08

Knox County 1 1 1 1 1 26.87 26.31 26.37 26.74 26.95

La Salle County 9 17 4 1 7 120.97 227.3 52.33 13.13 92.3

Lamar County 7 14 8 10 6 14.26 28.34 16.21 20.18 12.1

Lamb County 8 4 4 4 2 58.58 29.66 30.15 30.25 15.14

Lampasas County 3 1 6 5 6 14.9 4.97 29.39 24.2 28.53

Lavaca County 4 5 7 4 7 20.38 25.28 35.15 20.09 34.89

Lee County 8 10 15 9 3 48.33 60.12 88.85 52.95 17.46

Leon County 12 10 8 12 7 72.18 59.76 46.97 69.78 40.6

Liberty County 23 16 18 22 39 29.94 20.51 22.63 27.03 46.62

Limestone County 4 8 5 4 3 17.09 34.04 21.33 17 12.75

Lipscomb County 0 0 1 0 0 0 0 28.11 0 0