Wisconsin

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 14.3%

If you are facing car insurance shopping in Wisconsin with little enthusiasm, we understand. No one enjoys the car insurance research process, but when it’s personal, matters become all the more complicated.

How much coverage does the average Wisconsin resident need? How much coverage can you afford? What factors affect the price of car insurance? The list of questions is endless, even including something like asking what the DMV in Ashwaubenon WI’s hours are.

You don’t have to face that research process alone. In this guide to Wisconsin car insurance, we cover everything from Wisconsin car insurance rates to Wisconsin car insurance laws to Wisconsin car insurance quotes.

Ready to get started? If you want to get a jump on car insurance rates by state, you can use our FREE online tool to find affordable car insurance in your area of Wisconsin. Just enter your ZIP code to get started.

What are Wisconsin car insurance coverage & rates?

The driving culture in Wisconsin is beginner-friendly. There’s no need to rush from one side of the state to the other. Instead, you can enjoy meandering drives that get you where you need to be in a reasonable amount of time. That said, you’re going to run into a lot of motorcycles. Wisconsin is home not only to car lovers but to the original roots of Harley Davidson.

But what does this mean for your coverage options? Let’s dive into the basics of Wisconsin’s rates and coverage availability.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

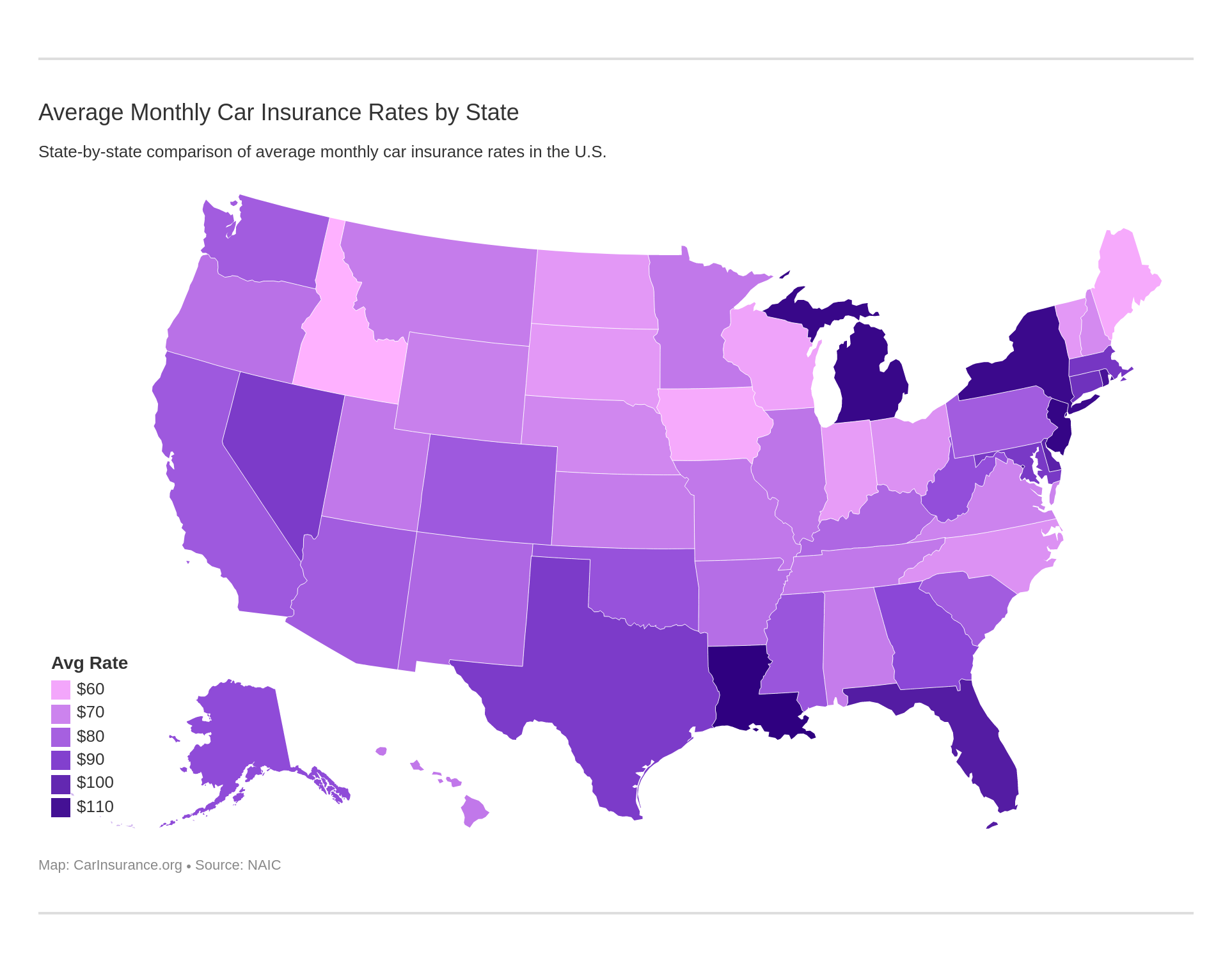

What are average monthly car insurance rates in WI (liability, collision, and comprehensive)?

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for car insurance coverage below:

There’s more coverage available to you in Wisconsin than the minimum liability coverage. Take a look at the table below for more information:

| Type of Coverage | Cost |

|---|---|

| Liability | $374.37 |

| Collision | $226.00 |

| Comprehensive | $136.81 |

| Full Coverage | $737.18 |

The above rates were provided by the National Association of Insurance Commissioners in 2015. This means that the rates have likely increased and will be higher as of 2019 and later. That said, Wisconsin’s rates come in below the national average, making it a little easier for Wisconsin residents to afford their coverage of choice.

Do you need additional car insurance liability?

If you’re interested in expanding your coverage, you’ll want to look into additional liability coverage. These types of coverage keep you and your bank account safer when or if you get into an accident.

Before you go choosing what additional liability you may want, though, you’ll need to think about the loss ratios that might come along with it. The table below details the loss ratios each additional form of liability coverage generates, in the long-term:

| Additional Liability Coverage in Wisconsin | Loss Ratio |

|---|---|

| Medical Pay | 74.83 |

| Uninsured/Underinsured Motorist Coverage | 67.21 |

| % of uninsured and rank | 14.3% (15) |

Loss ratios describe the amount of financial security each provider and coverage type can offer a driver. Higher loss ratios reflect a company’s willingness to pay out on applicable claims but can also reflect that company’s wobbly financial standing. Comparatively, lower loss ratios mean that a company is more financially stable but perhaps less likely to pay out on claims.

Typically, you’ll want to work with a car insurance provider and coverage type with a loss ratio between 60-80 percent.

What add-ons, endorsements, & riders for car insurance are available?

Watch this video to learn about Personal Injury Protection (PIP).

You can explore additional, optional coverage by considering some of the add-ons below. Click on the available links to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

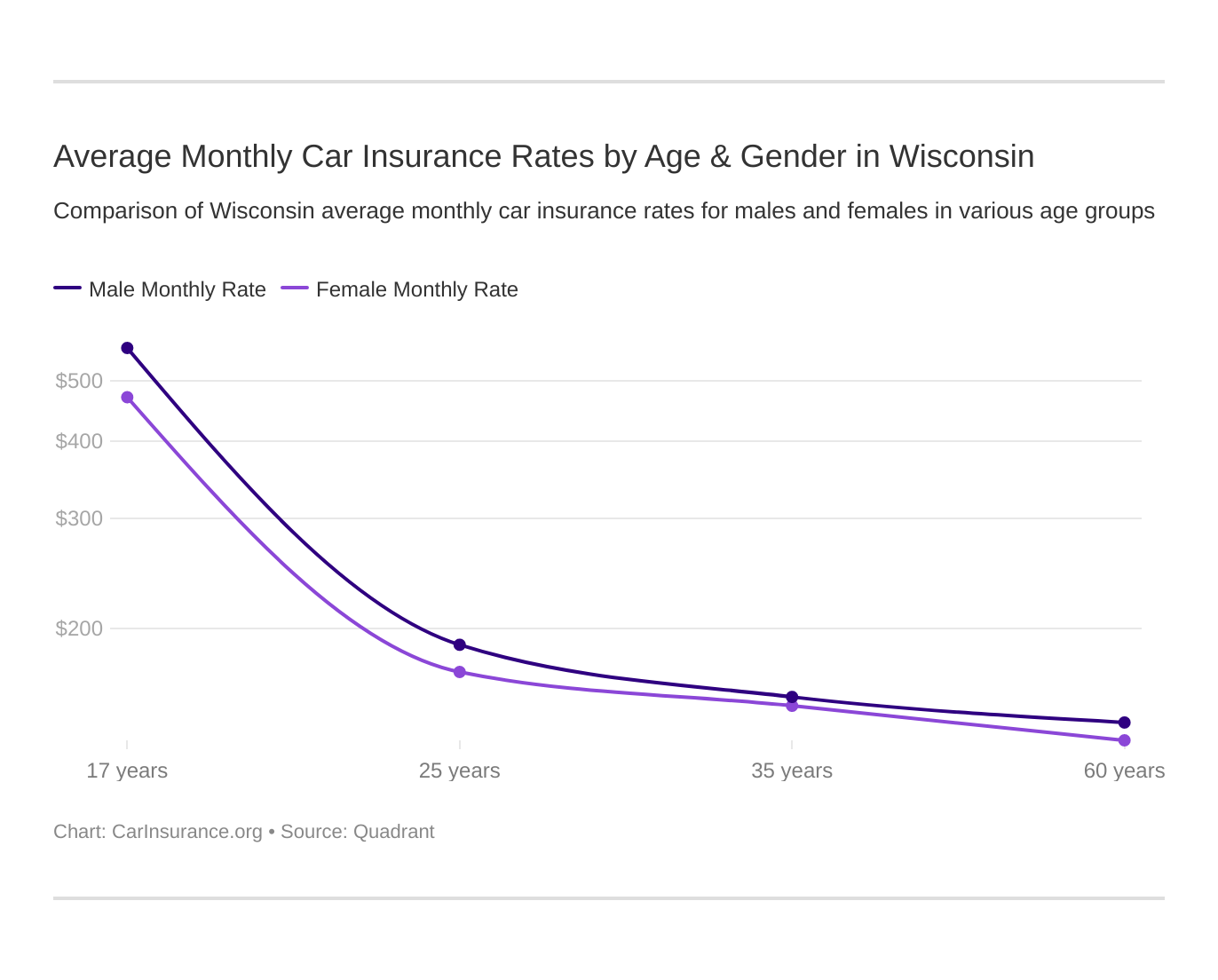

What are average monthly car insurance rates by age & gender in WI?

The myths surrounding men and women drivers differ. Some sources say women have to pay more for their car insurance, whereas others suggest men’s reckless driving will cost them more in the long run.

| Company | Married 35-year-old female annual rate | Married 35-year-old male annual rate | Married 60-year-old female annual rate | Married 60-year-old male annual rate | Single 17-year-old female annual rate | Single 17-year-old male annual rate | Single 25-year-old female annual rate | Single 25-year-old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,260.76 | $2,382.47 | $2,088.63 | $2,308.36 | $7,334.19 | $9,404.12 | $2,294.78 | $2,492.10 |

| American Family Ins | $958.90 | $1,002.57 | $907.25 | $914.15 | $2,844.04 | $3,134.61 | $1,135.28 | $1,209.31 |

| Mid-Century Ins Co | $1,914.63 | $1,915.25 | $1,697.53 | $1,797.98 | $9,058.32 | $9,384.83 | $2,174.00 | $2,277.36 |

| Geico Cas | $1,292.65 | $1,428.00 | $1,341.28 | $1,540.98 | $4,301.84 | $4,635.16 | $1,195.24 | $1,231.20 |

| SAFECO Ins Co of IL | $1,770.81 | $1,933.28 | $1,431.26 | $1,626.57 | $5,989.99 | $6,720.07 | $1,882.36 | $2,040.80 |

| AMCO Insurance | $3,597.48 | $3,785.31 | $2,981.78 | $3,141.26 | $7,388.96 | $11,333.17 | $4,379.28 | $5,192.67 |

| Artisan and Truckers Casualty | $1,760.63 | $1,676.02 | $1,442.61 | $1,504.23 | $6,692.88 | $7,551.66 | $2,112.73 | $2,290.54 |

| State Farm Mutual Auto | $1,345.30 | $1,345.30 | $1,195.81 | $1,195.81 | $3,833.87 | $4,845.21 | $1,516.77 | $1,732.41 |

| USAA | $1,315.46 | $1,311.45 | $1,193.74 | $1,212.48 | $3,367.35 | $3,901.46 | $1,705.43 | $1,869.61 |

As you can see, age has more of an impact on your rates than gender does. The older you get, the more likely it is you’ll see your rate level out, regardless of your gender. By the time drivers hit middle age, as you can see above, the premiums they’ll see should be balanced. In some cases, women even have to pay more than their male companions.

If you have a teen driver on your policy that is driving up your auto insurance rates, make sure to take advantage of as many insurance discounts as you can. For instance, your auto insurance company might offer a discount for bundling your auto insurance policy with homeowners insurance or apartment insurance. You might also get a discount if your car has certain safety features, like an anti-theft device. Many insurance companies offer usage-based insurance programs that use an app to monitor your driving habits. You get a discount just for driving safely.

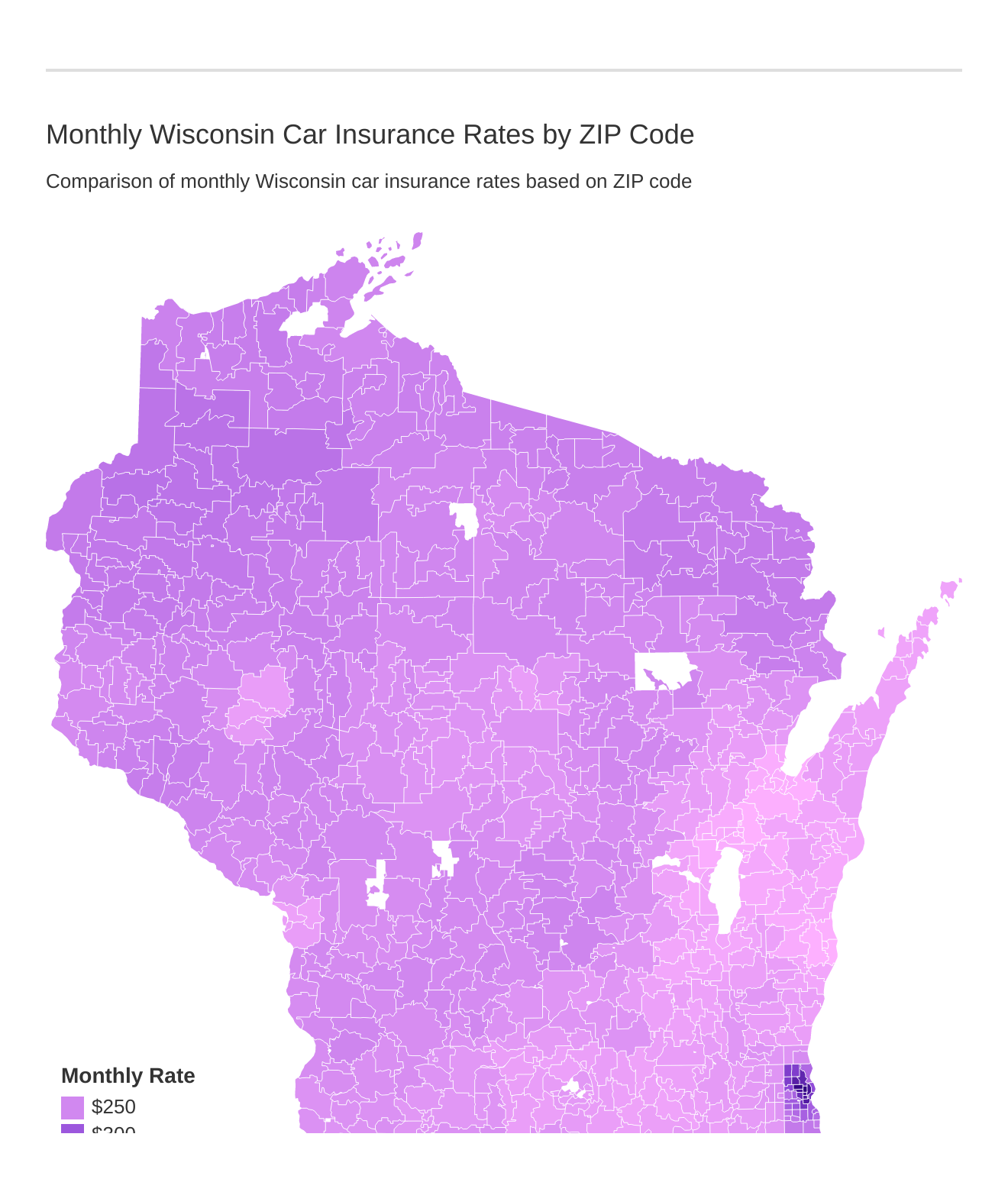

What are the cheapest car insurance rates by ZIP code?

Where you live also has an impact on your rates. The tables below show the cheapest and most expensive rates by ZIP codes in Wisconsin.

| Cheapest ZIP Codes in Wisconsin | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 54130 | KAUKAUNA | $2,491.30 | Nationwide | $4,220.90 | Farmers | $3,365.95 | American Family | $1,325.23 | Geico | $1,652.89 |

| 53081 | SHEBOYGAN | $2,494.36 | Nationwide | $3,861.19 | Farmers | $3,449.82 | American Family | $1,282.73 | USAA | $1,631.12 |

| 54136 | KIMBERLY | $2,506.22 | Nationwide | $4,220.90 | Farmers | $3,392.03 | American Family | $1,324.07 | Geico | $1,648.45 |

| 54311 | GREEN BAY | $2,510.86 | Nationwide | $4,176.89 | Farmers | $3,349.88 | American Family | $1,428.76 | Geico | $1,670.01 |

| 53085 | SHEBOYGAN FALLS | $2,513.86 | Nationwide | $3,861.19 | Farmers | $3,570.64 | American Family | $1,300.22 | USAA | $1,633.42 |

| 54113 | COMBINED LOCKS | $2,518.18 | Nationwide | $4,220.90 | Farmers | $3,392.03 | American Family | $1,320.94 | Geico | $1,652.89 |

| 54301 | GREEN BAY | $2,519.58 | Nationwide | $4,176.89 | Farmers | $3,474.80 | American Family | $1,312.84 | Geico | $1,683.22 |

| 53083 | SHEBOYGAN | $2,521.05 | Nationwide | $3,861.19 | Farmers | $3,499.01 | American Family | $1,261.88 | USAA | $1,631.12 |

| 54115 | DE PERE | $2,521.59 | Nationwide | $4,176.89 | Allstate | $3,373.77 | American Family | $1,356.11 | Geico | $1,670.01 |

| 53044 | KOHLER | $2,525.46 | Nationwide | $3,861.19 | Farmers | $3,570.64 | American Family | $1,261.88 | USAA | $1,631.12 |

| 54304 | GREEN BAY | $2,526.11 | Nationwide | $4,176.89 | Farmers | $3,474.80 | American Family | $1,399.48 | Geico | $1,683.22 |

| 54956 | NEENAH | $2,538.80 | Nationwide | $4,220.90 | Allstate | $3,674.96 | American Family | $1,316.63 | Geico | $1,648.45 |

| 54123 | FOREST JUNCTION | $2,540.14 | Nationwide | $4,174.98 | Farmers | $3,399.89 | American Family | $1,289.92 | USAA | $1,751.92 |

| 54302 | GREEN BAY | $2,540.45 | Nationwide | $4,176.89 | Farmers | $3,474.80 | American Family | $1,544.78 | Geico | $1,683.22 |

| 54303 | GREEN BAY | $2,541.33 | Nationwide | $4,176.89 | Farmers | $3,474.80 | American Family | $1,385.56 | Geico | $1,683.22 |

| 54952 | MENASHA | $2,541.36 | Nationwide | $4,174.98 | Farmers | $3,396.10 | American Family | $1,329.05 | Geico | $1,648.45 |

| 54313 | GREEN BAY | $2,545.82 | Nationwide | $4,176.89 | Farmers | $3,349.88 | American Family | $1,325.38 | Geico | $1,670.01 |

| 54915 | APPLETON | $2,552.14 | Nationwide | $4,220.90 | Allstate | $3,683.58 | American Family | $1,308.75 | Geico | $1,648.45 |

| 54110 | BRILLION | $2,556.05 | Nationwide | $4,174.98 | Farmers | $3,423.05 | American Family | $1,289.92 | USAA | $1,751.92 |

| 54155 | ONEIDA | $2,556.22 | Nationwide | $4,176.89 | Allstate | $3,353.35 | American Family | $1,356.11 | USAA | $1,788.03 |

| 54140 | LITTLE CHUTE | $2,561.22 | Nationwide | $4,220.90 | Allstate | $3,683.58 | American Family | $1,323.76 | Geico | $1,652.89 |

| 53020 | ELKHART LAKE | $2,564.46 | Nationwide | $4,174.98 | Farmers | $3,469.07 | American Family | $1,343.88 | USAA | $1,633.42 |

| 54914 | APPLETON | $2,568.06 | Nationwide | $4,220.90 | Allstate | $3,674.96 | American Family | $1,397.78 | Geico | $1,648.45 |

| 53073 | PLYMOUTH | $2,570.18 | Nationwide | $4,174.98 | Farmers | $3,570.64 | American Family | $1,315.70 | USAA | $1,633.42 |

| 54913 | APPLETON | $2,573.22 | Nationwide | $4,220.90 | Allstate | $3,674.96 | American Family | $1,349.38 | Geico | $1,652.89 |

The city of Green Bay has a number of the cheapest ZIP codes in Wisconsin.

| Most Expensive ZIP Codes in Wisconsin | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 53206 | MILWAUKEE | $5,102.46 | Nationwide | $9,162.87 | Allstate | $6,835.70 | American Family | $2,057.23 | USAA | $2,851.01 |

| 53216 | MILWAUKEE | $5,010.47 | Nationwide | $9,051.09 | Allstate | $6,835.70 | American Family | $2,095.87 | USAA | $2,859.72 |

| 53205 | MILWAUKEE | $4,815.48 | Nationwide | $9,162.87 | Allstate | $6,645.94 | American Family | $2,013.75 | USAA | $2,851.01 |

| 53212 | MILWAUKEE | $4,770.80 | Nationwide | $9,162.87 | Allstate | $6,785.91 | American Family | $1,964.02 | USAA | $2,851.01 |

| 53210 | MILWAUKEE | $4,751.86 | Nationwide | $9,051.09 | Allstate | $6,331.60 | American Family | $1,989.90 | USAA | $2,859.72 |

| 53233 | MILWAUKEE | $4,657.36 | Nationwide | $9,162.87 | Allstate | $6,464.17 | American Family | $2,012.43 | USAA | $2,851.01 |

| 53204 | MILWAUKEE | $4,566.46 | Nationwide | $9,162.87 | Allstate | $6,645.94 | American Family | $2,007.62 | USAA | $2,851.01 |

| 53218 | MILWAUKEE | $4,508.38 | Allstate | $6,983.45 | Farmers | $6,282.99 | American Family | $2,102.37 | USAA | $2,331.50 |

| 53209 | MILWAUKEE | $4,400.48 | Allstate | $6,983.45 | Farmers | $6,282.99 | American Family | $1,764.77 | USAA | $2,247.46 |

| 53203 | MILWAUKEE | $4,379.97 | Nationwide | $9,162.87 | Farmers | $5,501.63 | American Family | $2,015.65 | USAA | $2,851.01 |

| 53208 | MILWAUKEE | $4,254.76 | Allstate | $6,321.24 | Nationwide | $6,195.71 | American Family | $2,053.73 | USAA | $2,244.28 |

| 53215 | MILWAUKEE | $4,169.07 | Allstate | $6,308.98 | Nationwide | $6,195.71 | American Family | $2,045.70 | USAA | $2,449.64 |

| 53202 | MILWAUKEE | $4,107.54 | Nationwide | $9,162.87 | Allstate | $4,886.72 | American Family | $2,012.80 | USAA | $2,311.63 |

| 53225 | MILWAUKEE | $3,983.62 | Nationwide | $5,835.34 | Allstate | $5,734.60 | American Family | $1,905.69 | USAA | $2,331.50 |

| 53224 | MILWAUKEE | $3,958.34 | Allstate | $5,987.59 | Nationwide | $5,835.34 | American Family | $1,939.50 | USAA | $2,281.41 |

| 53223 | MILWAUKEE | $3,957.10 | Allstate | $5,987.59 | Nationwide | $5,835.34 | American Family | $2,016.17 | USAA | $2,281.41 |

| 53222 | MILWAUKEE | $3,782.96 | Nationwide | $5,835.34 | Allstate | $5,719.90 | American Family | $1,816.85 | USAA | $2,260.05 |

| 53211 | MILWAUKEE | $3,747.76 | Nationwide | $6,195.71 | Allstate | $4,883.51 | American Family | $1,922.76 | USAA | $2,127.31 |

| 54818 | BRILL | $3,647.62 | Progressive | $7,590.37 | Nationwide | $5,667.48 | American Family | $1,585.14 | USAA | $2,090.03 |

| 53219 | MILWAUKEE | $3,629.96 | Nationwide | $6,195.71 | Farmers | $4,649.36 | American Family | $1,861.10 | USAA | $2,073.02 |

| 54434 | JUMP RIVER | $3,572.87 | Progressive | $7,590.37 | Nationwide | $5,797.61 | American Family | $1,557.59 | State Farm | $2,072.49 |

| 54532 | HEAFFORD JUNCTION | $3,569.38 | Progressive | $7,590.37 | Nationwide | $5,797.61 | American Family | $1,442.50 | State Farm | $2,072.49 |

| 54439 | HANNIBAL | $3,561.28 | Progressive | $7,590.37 | Nationwide | $5,797.61 | American Family | $1,453.20 | State Farm | $2,072.49 |

| 53214 | MILWAUKEE | $3,554.42 | Nationwide | $6,195.71 | Farmers | $4,649.36 | American Family | $1,987.16 | USAA | $2,060.76 |

| 53207 | MILWAUKEE | $3,515.05 | Nationwide | $6,195.71 | Farmers | $4,649.36 | American Family | $2,015.05 | USAA | $2,075.48 |

Milwaukee has a number of the most expensive ZIP codes in the state.

Where are the cheapest car insurance rates by city?

Because most of the ZIP codes are lumped into one or two cities, we want to broaden our information and look at which cities have the cheapest or most expensive rates.

| Cheapest Cities in Wisconsin | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Kaukauna | $2,491.30 | Nationwide | $4,220.90 | Farmers | $3,365.95 | American Family | $1,325.23 | Geico | $1,652.89 |

| Sheboygan | $2,494.36 | Nationwide | $3,861.19 | Farmers | $3,449.82 | American Family | $1,282.73 | USAA | $1,631.12 |

| Kimberly | $2,506.22 | Nationwide | $4,220.90 | Farmers | $3,392.03 | American Family | $1,324.07 | Geico | $1,648.45 |

| Sheboygan Falls | $2,513.86 | Nationwide | $3,861.19 | Farmers | $3,570.64 | American Family | $1,300.22 | USAA | $1,633.42 |

| Combined Locks | $2,518.18 | Nationwide | $4,220.90 | Farmers | $3,392.03 | American Family | $1,320.94 | Geico | $1,652.89 |

| Howards Grove | $2,521.05 | Nationwide | $3,861.19 | Farmers | $3,499.01 | American Family | $1,261.88 | USAA | $1,631.12 |

| De Pere | $2,521.59 | Nationwide | $4,176.89 | Allstate | $3,373.77 | American Family | $1,356.11 | Geico | $1,670.01 |

| Kohler | $2,525.45 | Nationwide | $3,861.19 | Farmers | $3,570.64 | American Family | $1,261.88 | USAA | $1,631.12 |

| Bellevue | $2,525.66 | Nationwide | $4,176.89 | Farmers | $3,412.35 | American Family | $1,486.77 | Geico | $1,676.62 |

| Ashwaubenon | $2,535.96 | Nationwide | $4,176.89 | Farmers | $3,412.35 | American Family | $1,362.43 | Geico | $1,676.62 |

| Neenah | $2,538.80 | Nationwide | $4,220.90 | Allstate | $3,674.96 | American Family | $1,316.63 | Geico | $1,648.45 |

| Forest Junction | $2,540.14 | Nationwide | $4,174.98 | Farmers | $3,399.89 | American Family | $1,289.92 | USAA | $1,751.92 |

| Green Bay | $2,541.34 | Nationwide | $4,176.89 | Farmers | $3,474.80 | American Family | $1,385.56 | Geico | $1,683.22 |

| Menasha | $2,541.36 | Nationwide | $4,174.98 | Farmers | $3,396.10 | American Family | $1,329.05 | Geico | $1,648.45 |

| Brillion | $2,556.05 | Nationwide | $4,174.98 | Farmers | $3,423.05 | American Family | $1,289.92 | USAA | $1,751.92 |

| Hobart | $2,556.22 | Nationwide | $4,176.89 | Allstate | $3,353.35 | American Family | $1,356.11 | USAA | $1,788.03 |

| Allouez | $2,561.19 | Nationwide | $4,176.89 | Farmers | $3,576.57 | American Family | $1,333.95 | Geico | $1,683.22 |

| Little Chute | $2,561.22 | Nationwide | $4,220.90 | Allstate | $3,683.58 | American Family | $1,323.76 | Geico | $1,652.89 |

| Elkhart Lake | $2,564.46 | Nationwide | $4,174.98 | Farmers | $3,469.07 | American Family | $1,343.88 | USAA | $1,633.42 |

| Plymouth | $2,570.18 | Nationwide | $4,174.98 | Farmers | $3,570.64 | American Family | $1,315.70 | USAA | $1,633.42 |

| Appleton | $2,570.34 | Nationwide | $4,220.90 | Allstate | $3,679.27 | American Family | $1,367.48 | Geico | $1,649.56 |

| Greenville | $2,573.51 | Nationwide | $4,220.90 | Allstate | $3,674.96 | American Family | $1,318.93 | Geico | $1,652.89 |

| Chilton | $2,578.45 | Nationwide | $4,174.98 | Allstate | $3,418.28 | American Family | $1,311.89 | USAA | $1,751.92 |

| Cleveland | $2,585.53 | Nationwide | $4,175.53 | Farmers | $3,469.07 | American Family | $1,337.15 | USAA | $1,615.95 |

| Suamico | $2,588.38 | Nationwide | $4,176.89 | Farmers | $3,515.06 | American Family | $1,340.49 | Geico | $1,670.01 |

If your city isn’t on the table above, it may be one of the most expensive cities for car insurance.

| Most Expensive Cities in Wisconsin | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brown Deer | $4,178.79 | Allstate | $6,485.52 | Nationwide | $6,015.52 | American Family | $1,890.47 | USAA | $2,264.43 |

| Milwaukee | $4,161.26 | Nationwide | $7,219.59 | Allstate | $5,621.38 | American Family | $1,973.06 | USAA | $2,434.41 |

| Brill | $3,647.62 | Progressive | $7,590.37 | Nationwide | $5,667.48 | American Family | $1,585.14 | USAA | $2,090.03 |

| Jump River | $3,572.87 | Progressive | $7,590.37 | Nationwide | $5,797.61 | American Family | $1,557.59 | State Farm | $2,072.49 |

| Heafford Junction | $3,569.38 | Progressive | $7,590.37 | Nationwide | $5,797.61 | American Family | $1,442.50 | State Farm | $2,072.49 |

| Hannibal | $3,561.27 | Progressive | $7,590.37 | Nationwide | $5,797.61 | American Family | $1,453.20 | State Farm | $2,072.49 |

| Galloway | $3,475.38 | Progressive | $7,590.37 | Nationwide | $5,117.13 | American Family | $1,557.59 | USAA | $2,046.34 |

| Mikana | $3,466.47 | Farmers | $5,843.46 | Nationwide | $5,667.48 | American Family | $1,585.14 | USAA | $2,090.03 |

| St. Francis | $3,461.08 | Nationwide | $6,195.71 | Farmers | $4,649.36 | American Family | $1,759.85 | USAA | $2,049.94 |

| Bayside | $3,396.38 | Nationwide | $4,938.69 | Allstate | $4,883.51 | American Family | $1,672.72 | USAA | $1,955.86 |

| Elmwood Park | $3,363.02 | Nationwide | $5,481.23 | Allstate | $4,580.92 | American Family | $1,795.49 | USAA | $2,140.26 |

| Greenfield | $3,358.65 | Nationwide | $5,357.70 | Farmers | $4,606.33 | American Family | $1,714.21 | USAA | $2,010.57 |

| Cudahy | $3,345.01 | Nationwide | $6,195.71 | Farmers | $4,649.36 | American Family | $1,620.79 | USAA | $2,049.94 |

| Hertel | $3,344.17 | Nationwide | $5,946.74 | Farmers | $4,574.93 | American Family | $1,595.78 | State Farm | $2,116.33 |

| Webster | $3,292.41 | Nationwide | $5,946.74 | Farmers | $4,574.93 | American Family | $1,594.49 | USAA | $2,133.57 |

| Hayward | $3,264.76 | Nationwide | $5,797.61 | Farmers | $4,176.65 | American Family | $1,519.25 | USAA | $2,155.89 |

| Minong | $3,262.41 | Nationwide | $5,946.74 | Farmers | $4,176.65 | American Family | $1,586.80 | USAA | $2,133.57 |

| Gordon | $3,261.36 | Nationwide | $6,056.27 | Farmers | $3,991.81 | American Family | $1,606.76 | USAA | $2,167.16 |

| Spooner | $3,257.94 | Nationwide | $5,946.74 | Farmers | $4,198.52 | American Family | $1,574.94 | USAA | $2,133.57 |

| Stone Lake | $3,252.68 | Nationwide | $5,946.74 | Farmers | $4,176.65 | American Family | $1,595.06 | USAA | $2,133.57 |

| Springbrook | $3,252.01 | Nationwide | $5,946.74 | Farmers | $4,176.65 | American Family | $1,595.06 | USAA | $2,133.57 |

| Trego | $3,251.33 | Nationwide | $5,946.74 | Farmers | $4,176.65 | American Family | $1,597.88 | USAA | $2,133.57 |

| Shell Lake | $3,246.88 | Nationwide | $5,946.74 | Farmers | $4,014.10 | American Family | $1,568.99 | USAA | $2,133.57 |

| Maplewood | $3,246.07 | Progressive | $7,590.37 | Nationwide | $4,497.68 | American Family | $1,344.11 | State Farm | $1,778.65 |

| Kenosha | $3,245.87 | Nationwide | $5,377.01 | Allstate | $4,602.37 | American Family | $1,726.42 | USAA | $2,238.51 |

Brown Deer and Milwaukee have the most expensive rates for car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

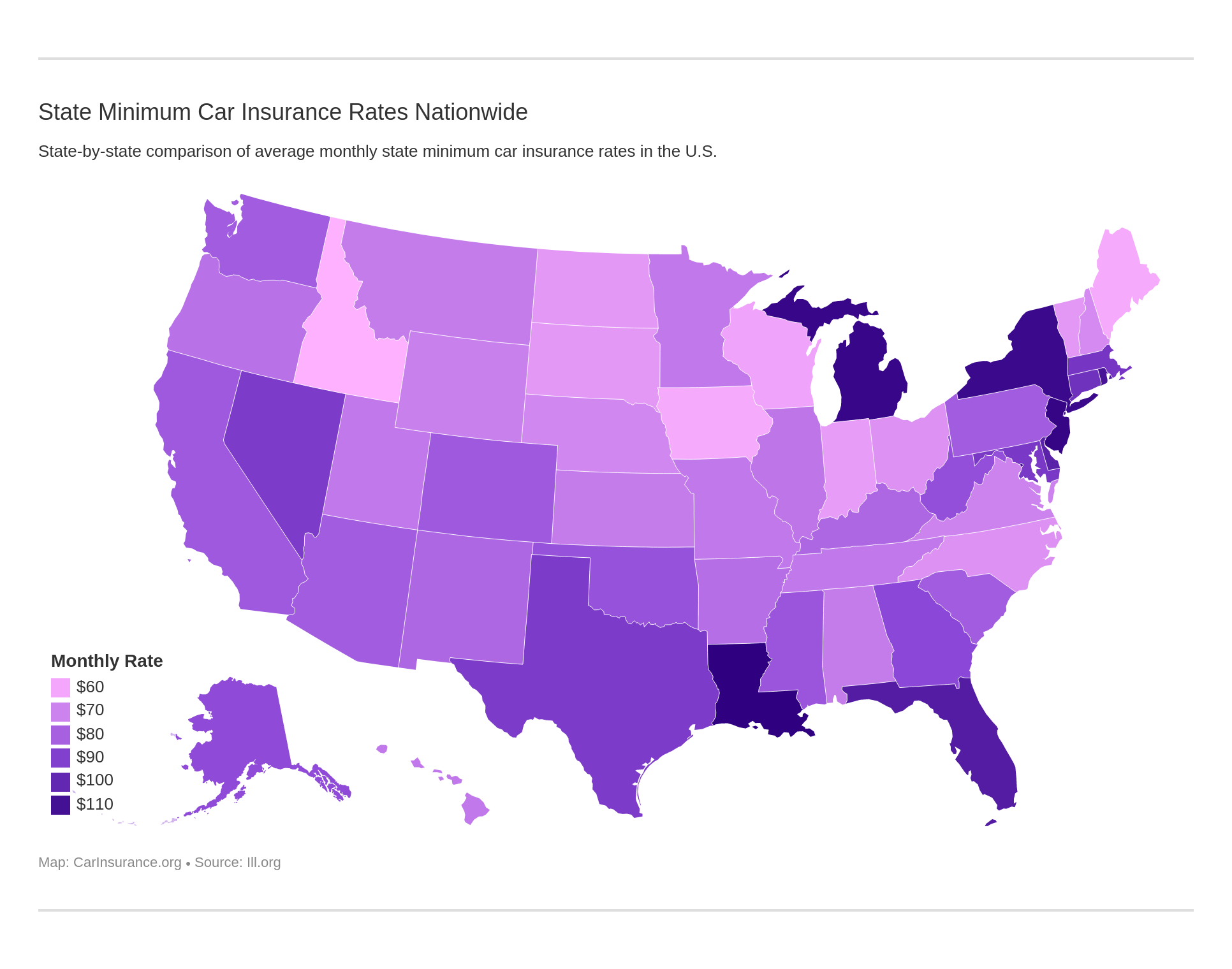

What are Wisconsin minimum car insurance coverage requirements?

Wisconsin is an at-fault state, meaning that, at the point of an accident, one driver will be assigned financial responsibility for the whole of the accident’s financial weight. Combine that with Wisconsin’s intense uninsured driver fees ($500 at a minimum), and you’re looking at a state that takes its road safety seriously.

What are the minimum Wisconsin auto insurance requirements?

Wisconsin requires all of its drivers to at least maintain minimum liability insurance. This required insurance breaks down as follows;

- $25,000 for bodily injury coverage per person

- $50,000 for bodily injury coverage per accident

- $10,000 for property damage coverage per accident

Note that this same coverage is required for anyone riding a motorcycle in Wisconsin. Drivers and riders alike will also have to procure uninsured motorist coverage to protect themselves in case of an accident.

Maybe you’re looking for Erie Insurance in Eau Claire, WI, or Portage, WI. Or maybe you’d rather go with the General insurance or American Family insurance in Waupaca for Wisconsin coverage. Regardless, the Wisconsin car insurance minimum requirements apply.

What are Wisconsin’s required forms of financial responsibility for car insurance?

If you get into an accident or pulled over on the road, you’re going to need to show the law enforcement officer at hand a form of financial responsibility, or proof of insurance. In Wisconsin, these forms include:

- Car insurance ID

- A cash bond from an insurance company

- Proof of a $60,000 deposit with the Wisconsin Department of Transportation

Law enforcement in Wisconsin accepts electronic forms of financial responsibility, so you don’t necessarily have to carry proof of insurance on your person. You’ll need some evidence, though, should you ever find yourself in a tight spot.

How much are premiums as a percentage of income in Wisconsin?

Paying for your coverage isn’t always easy. The budget you use to do so comes out of your disposable personal income, or the amount of money you have left after you’ve paid taxes for the year.

On average, Wisconsinites have disposable personal incomes of between $37,000 and $39,000.

Full coverage in Wisconsin costs roughly $716.83 a year. That means Wisconsin residents will spend 1.82 percent of their disposable personal income on car insurance coverage per year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which are the best Wisconsin car insurance companies?

Read on to learn about some of the best car insurance companies in Wisconsin.

The Largest Companies’ Financial Ratings

A.M. Best outlines individual insurance companies’ financial ratings, as you can see below:

| Company | A.M. Best Rating |

|---|---|

| American Family Insurance | A+ |

| Progressive | A+ |

| State Farm | A+ |

| Allstate | A+ |

| Geico | A++ |

| Acuity | A+ |

| Erie Insurance | A+ |

| West Best Mutual Insurance | A |

| Liberty Mutual | A |

| USAA | A++ |

Car Insurance Companies with the Best Ratings

Customer experience and satisfaction also contribute to a company’s state-wide reputation:

Car Insurance Companies with the Most Complaints

Complaints are among the most informative forms of data when it comes to insurance. While you can’t always take them at face value, you should keep them in mind when choosing a company to work with.

| Company | Number of Complains |

|---|---|

| State Farm | 1482 |

| Geico | 333 |

| American Family Insurance | 73 |

| USAA | 296 |

| Liberty Mutual | 222 |

| Allstate | 163 |

| Progressive | 120 |

| Erie Insurance | 22 |

| West Bend Mutual Insurance | 6 |

| Acuity | 5 |

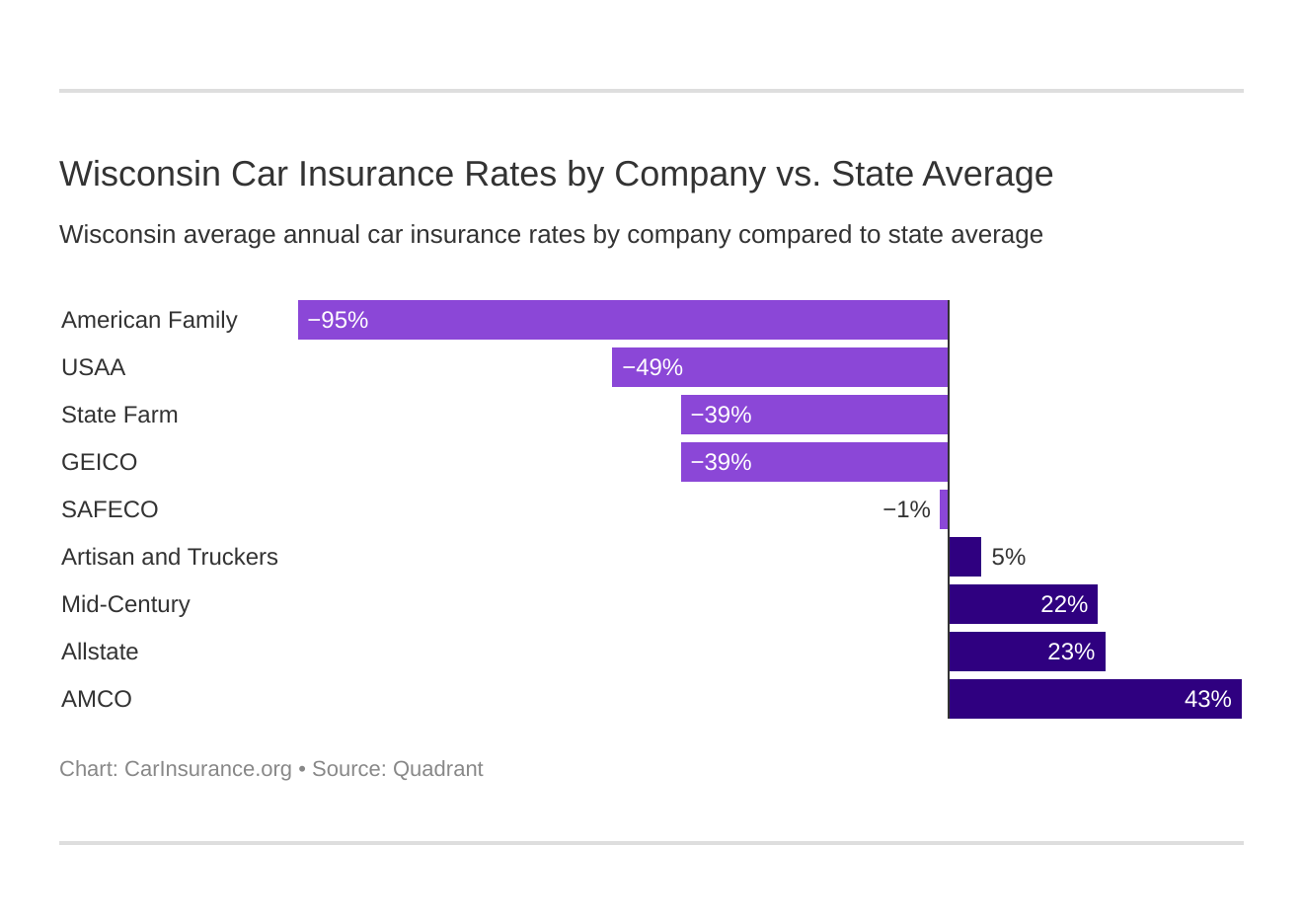

Which are the cheapest car insurance companies in Wisconsin?

We know that you’re on a budget when it comes to car insurance. If you’re looking for the cheapest rates in Wisconsin, then you’ve come to the right place.

| Company | Average Annual Rate |

|---|---|

| Allstate P&C | $3,820.68 |

| American Family Ins | $1,513.26 |

| Mid-Century Ins Co | $3,777.49 |

| Geico Cas | $2,120.79 |

| SAFECO Ins Co of IL | $2,924.39 |

| AMCO Insurance | $5,224.99 |

| Artisan and Truckers Casualty | $3,128.91 |

| State Farm Mutual Auto | $2,126.31 |

| USAA | $1,984.62 |

American Family Insurance has the least expensive average coverage in the state that still meets Wisconsin’s minimum liability requirements. Comparatively, Mid-Century Insurance Company has the most expensive coverage.

How much are commute rates by car insurance company?

The distance you drive over the course of a year is going to impact the rate that insurance providers are able to offer you.

| Group | 10 Mile Commute | 25 Mile Commute |

|---|---|---|

| Allstate | $3,728.72 | $3,912.63 |

| American Family | $1,487.57 | $1,538.96 |

| Farmers | $3,777.49 | $3,777.49 |

| Geico | $2,077.44 | $2,164.15 |

| Liberty Mutual | $2,924.39 | $2,924.39 |

| Nationwide | $5,224.99 | $5,224.99 |

| Progressive | $3,128.91 | $3,128.91 |

| State Farm | $2,074.01 | $2,178.62 |

| USAA | $1,958.85 | $2,010.39 |

As you can see, Allstate offers the least variation between its rates based on commute. Nationwide and Progressive retain the same averages, regardless of commute. Farmers, comparatively, will charge you the most for your coverage based on commute.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are coverage level rates by car insurance company?

The amount of coverage you want protecting your car can also raise or lower your rates.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,654.68 | $3,811.28 | $3,996.08 |

| American Family | $1,493.77 | $1,527.11 | $1,518.91 |

| Farmers | $3,483.48 | $3,748.00 | $4,100.98 |

| Geico | $1,978.72 | $2,119.69 | $2,263.97 |

| Liberty Mutual | $2,688.32 | $2,951.27 | $3,133.59 |

| Nationwide | $5,067.77 | $5,223.68 | $5,383.51 |

| Progressive | $2,937.23 | $3,154.18 | $3,295.33 |

| State Farm | $2,009.33 | $2,132.87 | $2,236.73 |

| USAA | $1,910.55 | $1,986.37 | $2,056.95 |

Naturally, the more coverage you want, the more expensive your rate is going to be. However, American Family offers the least expensive annual rates in Wisconsin for all three different levels of coverage.

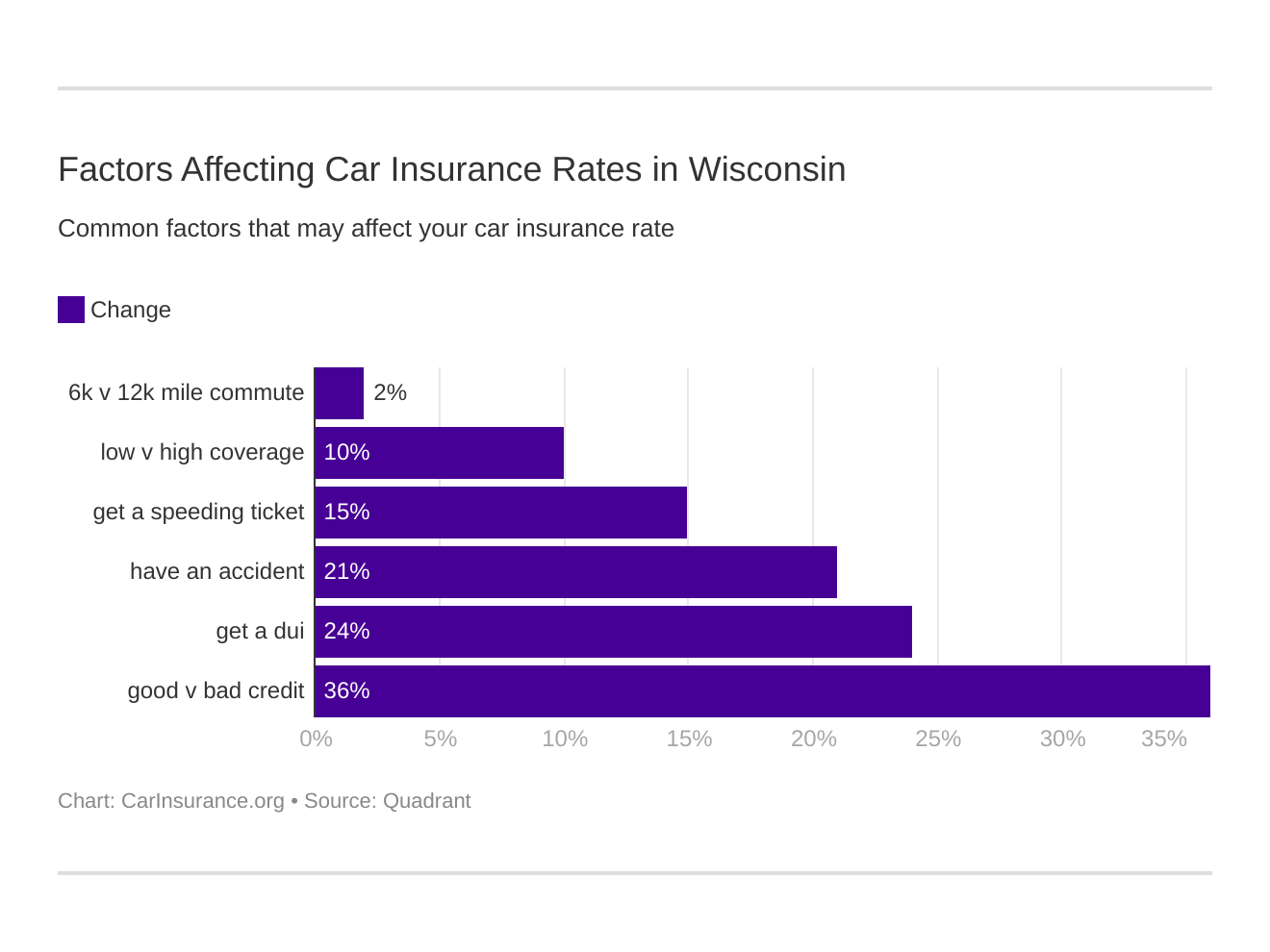

How much are credit history rates by car insurance company?

Your credit history reflects your ability to pay back debts you owe to corporations or individuals. Because car insurance providers want to be sure that you’re a trustworthy driver, they’re going to take this data into account when awarding you with a rate.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $2,993.20 | $3,450.95 | $5,017.88 |

| American Family | $1,178.86 | $1,334.71 | $2,026.23 |

| Farmers | $3,451.72 | $3,609.50 | $4,271.24 |

| Geico | $1,593.81 | $1,985.07 | $2,783.50 |

| Liberty Mutual | $2,005.82 | $2,546.86 | $4,220.50 |

| Nationwide | $4,900.57 | $4,900.57 | $5,873.82 |

| Progressive | $2,806.94 | $3,020.30 | $3,559.49 |

| State Farm | $1,386.69 | $1,820.90 | $3,171.35 |

| USAA | $1,288.58 | $1,612.94 | $3,052.34 |

Nationwide is not particularly forgiving of drivers with poor credit. American Family, comparatively, changes its rates the least, raising costs by roughly $900 for drivers with poor credit.

How much are driving record rates by car insurance company?

Your driving record details the number of points you have on your license and your history of accidents if you have one. You need to disclose this information to your provider of choice. When you do, though, you may find that your rates increase or decrease accordingly.

| Company | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $3,121.09 | $4,288.02 | $4,006.31 | $3,867.28 |

| American Family | $1,447.69 | $1,535.12 | $1,535.12 | $1,535.12 |

| Farmers | $3,291.98 | $4,156.55 | $3,935.54 | $3,725.87 |

| Geico | $1,468.48 | $2,378.98 | $2,725.87 | $1,909.84 |

| Liberty Mutual | $2,235.20 | $3,178.56 | $3,298.08 | $2,985.72 |

| Nationwide | $4,417.75 | $5,109.89 | $6,262.41 | $5,109.89 |

| Progressive | $2,864.87 | $3,470.52 | $2,973.89 | $3,206.37 |

| State Farm | $1,955.72 | $2,296.91 | $2,126.31 | $2,126.31 |

| USAA | $1,554.36 | $1,959.72 | $2,651.10 | $1,773.31 |

Accidents, speeding violations, and DUIs will all raise your rates, regardless of the provider you choose to work with. Once again, Nationwide stands out from the crowd, issuing the most significant rate changes based on driving record.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

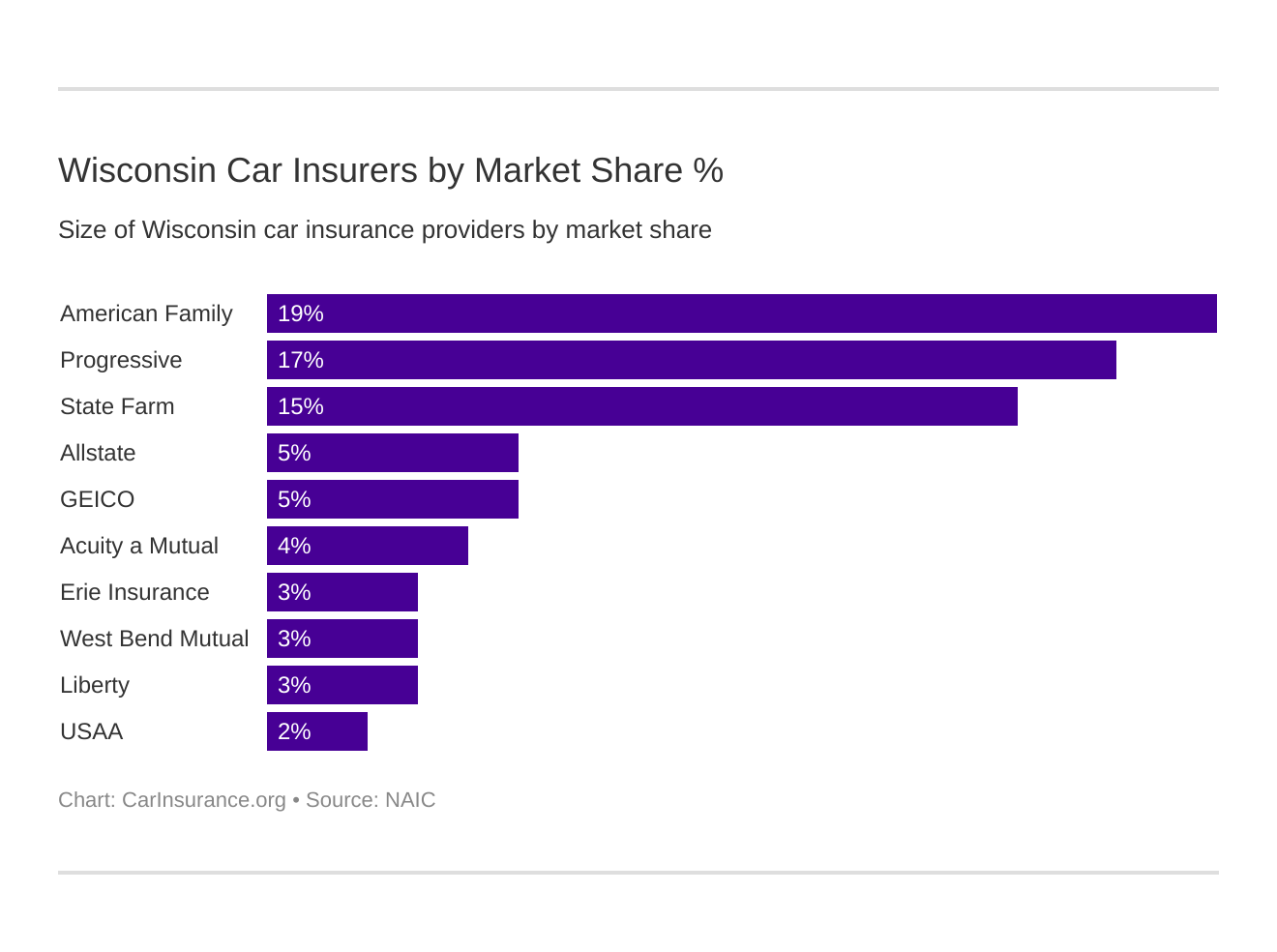

What are the largest car insurance companies in Wisconsin?

But where do all of these providers stand, in terms of their financial security? You can take a look at their market share for a better idea of how car insurance politics play out in Wisconsin.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| American Family Insurance Group | $583,243 | 18.73% |

| Progressive Group | $530,761 | 17.05% |

| State Farm Group | $468,020 | 15.03% |

| Allstate Insurance Group | $146,726 | 4.71% |

| Geico | $146,184 | 4.69% |

| Acuity a Mutual Insurance Co | $111,548 | 3.58% |

| Erie Insurance Group | $97,480 | 3.13% |

| West Bend Mutual Insurance Co | $92,535 | 2.97% |

| Liberty Mutual Group | $78,174 | 2.51% |

| USAA Group | $72,958 | 2.34% |

American Family Insurance, with its cheaper rates, has a 1.68 percent lead over its competitor, Progressive, and holds the majority of Wisconsin’s car insurance market share. This means that the company is likely able to pay down its drivers’ claims with ease, thanks to a sense of financial stability.

Number of Car Insurers in Wisconsin

There is a distinct difference between a domestic provider and a foreign provider – but it’s not the difference you think. Domestic car insurance providers are providers who only operate within a particular state or proximity. Foreign car insurance providers, comparatively, operate on a national level.

In Wisconsin, you have your choice of domestic and foreign providers. The numbers break down as follows:

- Domestic: 174

- Foreign: 813

As you can see, you have far more foreign choices than you do domestic ones. That doesn’t mean that you can’t work with a local provider, though.

What Wisconsin car insurance laws do you need to know?

We can’t all readily keep up with a state’s changing legislation. If you want to get a leg up, though, read on! In this section, we’ll dive into the details that define Wisconsin’s car insurance and roadways laws. In doing so, we’ll hopefully make it easier for you to stay safe – and legal – on the road.

The car insurance laws in Wisconsin come from the Office of the Commissioner of Insurance of the State of Wisconsin. But what do those laws look like, and what sort of details do they cover? Read on to learn more.

Windshield & Glass Repair

The below videos answered windshield and auto glass insurance FAQs.

There are no specific laws in Wisconsin that dictate whether or not a car insurance provider has to cover a driver’s window, in case of an accident or general damage.

Most insurers have access to aftermarket parts and will use them, upon request, to replace damaged glass on your car. That said, you can also request original manufacturer parts, but you’ll need to pay the difference off, as your car insurance provider will only cover the cost of an aftermarket repair.

High-Risk Car Insurance

If you have a spotty driving history, you may have to seek out high-risk insurance. High-risk insurance, or an SR-22, is a type of insurance that high-risk drivers are required to add to their existing coverage after a conviction or similar punishment.

You may be required to get an SR-22 if you’ve received any of the following:

- DUI conviction

- Reprimand for driving without insurance

- Reprimand for driving with a suspended license

- Reprimand for leaving the scene of an accident

Keep reading to learn about low-cost car insurance in Wisconsin.

Low-Cost Car Insurance

Wisconsin does not offer car insurance programs for low-income families that would ease the pressure of paying for car insurance. However, drivers can seek out discounts to make the cost of insurance more bearable.

Be sure to ask your provider of choice if you or your family are eligible for any of the following:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking – some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around in order to find the best coverage for you that is equally cost-effective.

Automobile Insurance Fraud in Wisconsin

The insurance industry sees 10 percent of its operating costs go to enduring fraudulent claims or accounts over the course of a year.

There are two different types of automobile fraud.

- Hard fraud sees a driver deliberately falsifying a claim or faking an accident in order to receive compensation

- Soft fraud sees a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of these two types of fraud.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a class 5 felony.

In simple terms: do not commit fraud.

Car Insurance Statute of Limitations

A statute of limitations describes the amount of time you have after an accident to file a claim with your insurance provider. If you file a claim outside of your statute of limitations, your provider can deny the claim without facing any consequences. In Wisconsin, you have three years to file for both personal injury and property damage cases.

Wisconsin-Specific Legislation

All that said, Wisconsin also has some state-specific legislation which residents will have to abide by, including:

- Wagon campers on public highways will face a fine of $10 if caught

- You need consent to sit on another person’s vehicle in Hudson, Wisconsin, but nowhere else in the state

- In Milwaukee, Wisconsin, you cannot leave your car parked on the street for more than two hours unless there is a horse – a literal, breathing horse – using the car as a post.

- That said, it is illegal to tie a horse up on Third Street in LaCrosse, Wisconsin

- Wisconsin statute 346.21 states that all vehicles must give livestock the right of way or else face variable fines

While you may not have to worry about these laws, yourself, it’s good to acknowledge them (even if it’s just for a laugh).

Want to learn more about the car insurance rates available to you? Just enter your zip code into our FREE online tool to start comparing rates.

What are Wisconsin’s vehicle licensing laws?

Car insurance laws differ from vehicle licensing laws. Vehicle licensing laws apply specifically to a driver, and you’ll need to know them if you ever have to share your license, registration, or other identifying documents with a law enforcement representative.

REAL ID

What is REAL ID, and what kind of impact is it going to have on your license?

Real ID is arriving in 2020. It’s been implemented as a potential safety measure designed to keep airlines across the United States safer. If you haven’t gotten your license renewed since 2016, you’ll need to head to the DMV to receive REAL ID certification before 2020.

All Wisconsin drivers – and drivers throughout the United States – will need to have REAL ID to get on a plane, be the flight domestic or international.

Driving Without Insurance

It is illegal to drive on the road in Wisconsin if you don’t have car insurance. If you’re caught by a law enforcement representative, you may face any of the following consequences:

- A fine of up to $500

- License suspension

- $60 reinstatement fees

If you’re caught driving without proof of insurance but are insured, then you’ll be fined $10.

Teenager Driver Laws

It’s always exciting – and a little nervewracking – for a teenager to take to the road. Teens in Wisconsin can start driving as soon as they turn 15 and a half, but there are restrictions in place to keep them safe. These restrictions and restricted licenses break down as follows:

- Instructional Permit: teens at 15 and a half must apply for an instructional permit by passing a written and vision test. Upon completion, these drivers can only take to the road when someone 19 years old or older (25 after dark) is in the car with them. Drivers will need to complete 30 hours of driving practice, 10 of which need to be at night.

- Probationary License: so long as the driver in question has remained conviction-free for six months after obtaining an instructional permit, they may receive a probationary license. This license allows a driver 16 years old or older to drive alone at any time EXCEPT Between the hours of midnight and 5 A.M.

- Full License: after nine months with a probationary license, the teen driver no longer has restrictions on their license and can drive as they please.

License Renewal Procedures

What do I need to renew my license in WI? Wisconsin legislation allows you to renew your license on an eight-year cycle. Every time you renew your license, you’ll need to submit proof of adequate vision.

Different rules dictate whether or not you can renew your license online, in person, or through the mail. For the most part, though, you’ll be able to renew your license online or through the mail.

Note that you can only use these alternative renewal processes every other eight years.

To learn more (and to determine whether or not your type of license allows for distance-renewal), you can take a look at the legislation outlined on Wisconsin’s DMV website.

Older Driver License Renewal Procedures

Older drivers who want to continue operating on the road in Wisconsin will need to go about license renewals in a slightly different — but no more complicated — process than younger drivers.

Drivers in Wisconsin who are over 55 years old need to:

- Renew their licenses on an eight-year cycle

- Bring proof of vision to every renewal

Older drivers are also allowed to mail in or renew their licenses online for every other renewal. In between these stretches, renewals will need to take place in-person.

New Residents

Moving to Wisconsin will require you to register your vehicle with your local DMV. You’ll need to receive a new, Wisconsin license and license plate within 60 days of moving to the state.

To procure your state-appropriate materials, you’ll need to:

- Submit a Driver’s License Application

- Bring proof of identity and residency to your local DMV

- Pass a vision screening

- Pass a driving knowledge exam

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Wisconsin rules of the road?

Wisconsin’s rules of the road describe the kind of behaviors you should expect to see on all of the state’s motorways.

Fault vs. No-Fault

Is Wisconsin a no-fault car insurance state? What’s the difference between a no-fault and tort auto insurance policy?

Once again, Wisconsin is an at-fault state. This means that, if you get into an accident, either you or the other party involved will be determined to be “at-fault,” or responsible for the whole of the accident. The party determined to be at-fault will not only have to manage their own post-accident financial needs but the financial needs of the other party.

Seat Belts & Car Seat Laws

Seat belt and car seat laws are designed to keep you, your passengers, and any children in your car as safe as possible.

In Wisconsin, any passenger over the age of eight must wear a seat belt. Because seat belt laws are primarily enforced throughout the state, law enforcement representatives won’t need any other reason to pull you over if you’re seen driving without a seat belt on.

Likewise, car seat requirements break down as follows:

- Children 20 pounds or lighter must be in rear-facing car seats

- Children between 20 and 40 pounds between one and three years old can sit in either rear-facing or forward-facing car seats

- Children who weigh between 40 and 80 pounds between the ages of four and seven may sit in forward-facing car seats or booster seats

You may be charged a fine of $10 if a law enforcement officer spots a child in your car riding without the appropriate car seat.

There are also specific laws in place regarding a person’s ability to ride in the cargo area of a truck. These laws dictate that you may only ride in the cargo area of a truck if:

- The riding space is enclosed

- You’re in a parade

- You’re hunting deer

- The space is meant for human passengers

- You’re on private property

Keep reading to learn about more driving laws in Wisconsin.

Keep Right & Move Over Laws

If you are driving more slowly than the posted speed limit, or if you are not looking to pass a car in front of you, then Wisconsin law dictates that you must remain in the right-hand lane of the applicable interstate.

You must also move over for vehicles that have their lights flashing, regardless of whether or not they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Below are Wisconsin’s average speed limits.

Speed Limits

The speed limits in Wisconsin break down as follows:

- Urban Interstates: 70

- Rural Interstates: 70

- Limited Access Roads: 70

- All Other Roads: 55

Note that these limits detail the fastest you’re legally allowed to go on these types of roads. Going any faster could get you pulled over and awarded a ticket.

Ridesharing

The rise of Uber and Lyft have made it easier than ever for people to get to the places they need to go. These companies have also created a new industry for drivers across the United States. If you currently work with either company or one of their competitors, or if you’ve thought about using your vehicle for a job before, you’ll need to get ridesharing insurance.

Right now, the only providers offering rideshare insurance in Wisconsin are:

- Allstate

- Farmers

- Geico

- State Farm

- American Family Rideshare Insurance

Does Wisconsin have any rules about automated vehicles? Read on to find out.

Automation on the Road

At this point in time, Wisconsin does not have any laws in place designed to limit or otherwise dictate the way automated vehicles may operate on the road. That said, the state is in the process of testing its automated vehicles at the Wisconsin Automated Vehicle Proving Grounds.

What are the safety laws?

With all of that in mind, let’s touch on the state laws meant to dictate human behavior and keep drivers safe from bad habits while in the car.

DUI Laws

DUI laws in Wisconsin are referred to, as a crime, “Operating While Intoxicated.” The penalties for driving while intoxicated include but are not limited to:

- Fines between $150 and $300

- OWI charges of up to $365

- Mandatory drug and alcohol assessments

- Suspension of a driver’s license for up to nine months

- A license reinstatement fee of $200

- An ignition interlock device (if BAC is over .15)

Below is information on distracted driving laws in Wisconsin.

Distracted Driving Laws

In the same vein, Wisconsin lawmakers have instituted texting legislation to keep drivers safe on the road. At this point in time, it is illegal to text and drive in Wisconsin.

Drivers in construction zones, as well as drivers with learner’s permits or intermediate licenses, are also banned from using handheld devices while behind the wheel.

If you’re caught texting and driving or using a handheld device inappropriately, distracted driving can cause you to be fined between $20 and $400.

Is there a lot of vehicle theft in Wisconsin?

Driving culture, as we’ve already touched on, varies by state. What’s it like to drive through Wisconsin, and what kind of dangers do you have to keep your eye out for? In this section, we’ll touch on vehicle theft, fatalities, and traffic patterns throughout the state.

Surprisingly, it’s not sports cars that most vehicle thieves are after.

| Vehicle | Model Year | Number Stolen |

|---|---|---|

| Dodge Caravan | 2002 | 1,035 |

| Honda Civic | 1998 | 470 |

| Honda Accord | 1997 | 450 |

| Chrysler Town & Country | 2002 | 313 |

| Chevrolet Impala | 2007 | 232 |

| Dodge Stratus | 2002 | 209 |

| Toyota Camry | 2007 | 191 |

| Chevrolet Malibu | 2015 | 179 |

| Dodge Intrepid | 2002 | 179 |

| Honda CR-V | 2000 | 172 |

Instead, you’ll want to keep a close eye on your Hondas and Caravans. Dodge Caravans, in particular, were stolen 1,035 times as of 2015, according to the National Insurance Crime Bureau. These thefts are most often seen in cities, but the breakdown across the state of Wisconsin varies:

| City Vehicle Thefts | Motor |

|---|---|

| Madison | 374 |

| West Allis | 202 |

| Wauwatosa | 145 |

| Racine | 100 |

| Kenosha | 94 |

| Green Bay | 87 |

| Greenfield | 79 |

| Oshkosh | 68 |

| La Crosse | 66 |

| Eau Claire | 60 |

| Superior | 58 |

| Brown Deer | 57 |

| Glendale | 52 |

| Janesville | 51 |

| West Milwaukee | 49 |

| Wausau | 46 |

| Waukesha | 44 |

| Appleton | 39 |

| Sheboygan | 36 |

| Beloit | 35 |

| Oak Creek | 34 |

| Cudahy | 29 |

| Menomonee Falls | 29 |

| Mount Pleasant | 27 |

| South Milwaukee | 27 |

| Shorewood | 26 |

| Fitchburg | 24 |

| Fond du Lac | 24 |

| Menasha | 24 |

| Sun Prairie | 22 |

| Grand Chute | 21 |

| Neenah | 21 |

| Brookfield | 17 |

| Franklin | 17 |

| Manitowoc | 16 |

| Ashland | 15 |

| Town of Madison | 15 |

| West Bend | 15 |

| Antigo | 14 |

| Hudson | 14 |

| Pleasant Prairie | 14 |

| River Falls | 14 |

| Ashwaubenon | 13 |

| Mequon | 13 |

| St. Francis | 13 |

| Wisconsin Rapids | 12 |

| Hartford | 11 |

| Menomonie | 11 |

| Sparta | 11 |

| Caledonia | 10 |

| Kaukauna | 10 |

| Lake Delton | 10 |

| Monona | 10 |

| Monroe | 10 |

| New Richmond | 10 |

| Whitewater | 10 |

Milwaukee, as you might expect, tops the list with over 6,000 vehicles stolen, according to the FBI Criminal Justice Information Services Division. If you’re in town for the weekend, or if you’re a local, you may want to invest in a security system to keep your vehicle safe.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How many road fatalities occur in Wisconsin?

Accidents are called accidents for a reason – no one can predict when they’ll happen. Unfortunately, these unpredictable events often result in fatalities. Let’s break down the data to see what fatalities plague Wisconsin and what you need to look out for while on the road.

Fatal Crashes by Weather & Light Conditions

Weather and light have an immediate impact on your ability to process activity on the road in front of you. As you might expect, these uncontrollable factors have resulted in a number of Wisconsin fatalities:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown |

|---|---|---|---|---|---|

| Normal | 272 | 55 | 130 | 25 | 3 |

| Rain | 12 | 9 | 19 | 0 | 0 |

| Snow/Sleet | 8 | 1 | 8 | 0 | 0 |

| Other | 1 | 1 | 3 | 2 | 0 |

| Unknown | 1 | 1 | 3 | 0 | 3 |

Fatalities (All Crashes) by County

Location is just as likely to impact a person’s chance of getting in an accident as the weather. Different counties throughout Wisconsin, as you can see, have higher fatality percentages than others.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 2 | 2 | 5 | 3 | 2 |

| Ashland | 1 | 1 | 1 | 6 | 3 |

| Barron | 7 | 3 | 8 | 4 | 5 |

| Bayfield | 3 | 2 | 10 | 4 | 3 |

| Brown | 9 | 9 | 15 | 18 | 25 |

| Buffalo | 1 | 3 | 2 | 3 | 0 |

| Burnett | 5 | 3 | 1 | 5 | 4 |

| Calumet | 2 | 3 | 4 | 2 | 5 |

| Chippewa | 11 | 2 | 9 | 1 | 12 |

| Clark | 9 | 6 | 3 | 10 | 9 |

| Columbia | 12 | 5 | 10 | 21 | 7 |

| Crawford | 3 | 1 | 5 | 3 | 1 |

| Dane | 35 | 29 | 30 | 38 | 32 |

| Dodge | 9 | 14 | 11 | 12 | 20 |

| Door | 3 | 1 | 4 | 4 | 1 |

| Douglas | 6 | 6 | 4 | 2 | 4 |

| Dunn | 13 | 5 | 6 | 11 | 8 |

| Eau Claire | 4 | 4 | 6 | 10 | 4 |

| Florence | 0 | 2 | 1 | 1 | 2 |

| Fond Du Lac | 10 | 10 | 12 | 10 | 11 |

| Forest | 3 | 3 | 3 | 2 | 3 |

| Grant | 6 | 5 | 7 | 11 | 8 |

| Green | 6 | 3 | 6 | 6 | 6 |

| Green Lake | 1 | 3 | 3 | 1 | 0 |

| Iowa | 7 | 2 | 3 | 3 | 3 |

| Iron | 3 | 0 | 1 | 3 | 2 |

| Jackson | 5 | 3 | 4 | 3 | 6 |

| Jefferson | 8 | 12 | 7 | 7 | 13 |

| Juneau | 6 | 5 | 7 | 9 | 6 |

| Kenosha | 19 | 17 | 6 | 18 | 18 |

| Kewaunee | 3 | 3 | 0 | 2 | 3 |

| La Crosse | 6 | 8 | 4 | 7 | 12 |

| Lafayette | 5 | 2 | 1 | 2 | 6 |

| Langlade | 2 | 5 | 3 | 2 | 2 |

| Lincoln | 4 | 3 | 7 | 4 | 6 |

| Manitowoc | 11 | 11 | 5 | 3 | 6 |

| Marathon | 19 | 9 | 15 | 9 | 15 |

| Marinette | 8 | 5 | 5 | 6 | 5 |

| Marquette | 1 | 4 | 5 | 3 | 6 |

| Menominee | 2 | 1 | 5 | 0 | 0 |

| Milwaukee | 46 | 66 | 81 | 74 | 86 |

| Monroe | 7 | 4 | 4 | 10 | 6 |

| Oconto | 6 | 7 | 17 | 7 | 9 |

| Oneida | 9 | 9 | 3 | 5 | 3 |

| Outagamie | 13 | 13 | 13 | 14 | 20 |

| Ozaukee | 5 | 1 | 5 | 7 | 5 |

| Pepin | 0 | 2 | 0 | 1 | 0 |

| Pierce | 8 | 5 | 2 | 10 | 7 |

| Polk | 3 | 8 | 5 | 10 | 8 |

| Portage | 9 | 7 | 3 | 2 | 5 |

| Price | 2 | 0 | 2 | 4 | 2 |

| Racine | 9 | 14 | 25 | 17 | 11 |

| Richland | 4 | 7 | 0 | 4 | 2 |

| Rock | 11 | 13 | 18 | 23 | 13 |

| Rusk | 1 | 0 | 3 | 0 | 3 |

| Sauk | 5 | 13 | 9 | 11 | 11 |

| Sawyer | 1 | 2 | 5 | 3 | 1 |

| Shawano | 5 | 10 | 6 | 8 | 16 |

| Sheboygan | 11 | 8 | 13 | 10 | 11 |

| St. Croix | 12 | 12 | 12 | 7 | 7 |

| Taylor | 1 | 1 | 3 | 6 | 1 |

| Trempealeau | 5 | 6 | 8 | 0 | 3 |

| Vernon | 5 | 5 | 6 | 4 | 3 |

| Vilas | 6 | 1 | 4 | 14 | 2 |

| Walworth | 11 | 12 | 14 | 24 | 21 |

| Washburn | 5 | 1 | 4 | 1 | 4 |

| Washington | 6 | 11 | 9 | 10 | 7 |

| Waukesha | 28 | 24 | 10 | 27 | 26 |

| Waupaca | 13 | 2 | 14 | 6 | 8 |

| Waushara | 6 | 9 | 6 | 3 | 7 |

| Winnebago | 10 | 14 | 7 | 10 | 10 |

| Wood | 10 | 4 | 11 | 6 | 11 |

Traffic Fatalities: Rural vs. Urban

Weather isn’t the only cause of fatalities throughout Wisconsin, though. Urban areas tend to see more fatalities than rural areas, as you can see in the table below.

| - | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 413 | 381 | 366 | 377 | 389 | 359 | 338 | 360 | 406 | 397 |

| Urban | 192 | 180 | 206 | 205 | 226 | 181 | 167 | 205 | 194 | 214 |

Fatalities by Person Type

The people impacted by a fatality will vary, as well, based on their relationship to the vehicles in question. That is what “people type” means here, as opposed to a demographic division.

| Person | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 213 | 209 | 236 | 250 | 256 |

| Light Truck - Pickup | 64 | 64 | 70 | 57 | 71 |

| Light Truck - Utility | 71 | 62 | 56 | 85 | 70 |

| Light Truck - Van | 27 | 27 | 25 | 38 | 40 |

| Light Truck - Other | 1 | 0 | 1 | 1 | 0 |

| Large Truck | 13 | 11 | 8 | 7 | 10 |

| Bus | 1 | 0 | 0 | 0 | 0 |

| Total Motorcyclists | 85 | 73 | 81 | 85 | 77 |

| Pedestrian | 37 | 45 | 57 | 51 | 56 |

| Bicyclist and Other Cyclist | 10 | 4 | 15 | 11 | 7 |

It’s passenger cars, motorcyclists, and pedestrians who most often see the negative impacts of a fatal car accident.

Fatalities by Crash Type

There are also several different types of crashes that may result in a fatality.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 285 | 279 | 302 | 338 | 318 |

| Involving a Large Truck | 83 | 55 | 56 | 69 | 82 |

| Involving Speeding | 178 | 168 | 167 | 212 | 180 |

| Involving a Rollover | 153 | 147 | 152 | 170 | 169 |

| Involving a Roadway Departure | 344 | 314 | 344 | 358 | 325 |

| Involving an Intersection (or Intersection Related) | 136 | 140 | 152 | 171 | 178 |

In Wisconsin, single vehicles are more likely to endure fatal accidents than trucks. However, roadway departures result in more fatalities than any other type of crash in the state.

Five-Year Trend for the Top 10 Counties

Wisconsin’s largest 10 counties see most of the state’s traffic. As you can see, fatality rates are inconsistent, but there was a sharp increase in fatalities across most counties in 2017.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Milwaukee County | 46 | 66 | 81 | 74 | 86 |

| Dane County | 35 | 29 | 30 | 38 | 32 |

| Waukesha County | 28 | 24 | 10 | 27 | 26 |

| Brown County | 9 | 9 | 15 | 18 | 25 |

| Walworth County | 11 | 12 | 14 | 24 | 21 |

| Dodge County | 9 | 14 | 11 | 12 | 20 |

| Outagamie County | 13 | 13 | 13 | 14 | 20 |

| Kenosha County | 19 | 17 | 6 | 18 | 18 |

| Shawano County | 5 | 10 | 6 | 8 | 16 |

| Marathon County | 19 | 9 | 15 | 9 | 15 |

Fatalities Involving Speeding by County

Who hasn’t dreamed of becoming Speed Racer? Unfortunately, there are several drivers in Wisconsin who wanted to make that dream a reality – and paid for it.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 0 | 1 | 3 | 0 | 0 |

| Ashland | 0 | 1 | 0 | 2 | 1 |

| Barron | 0 | 2 | 1 | 0 | 0 |

| Bayfield | 2 | 1 | 4 | 1 | 0 |

| Brown | 6 | 3 | 6 | 11 | 5 |

| Buffalo | 0 | 1 | 0 | 1 | 0 |

| Burnett | 2 | 2 | 1 | 3 | 3 |

| Calumet | 0 | 0 | 0 | 1 | 3 |

| Chippewa | 2 | 1 | 2 | 0 | 2 |

| Clark | 1 | 2 | 1 | 3 | 4 |

| Columbia | 4 | 2 | 1 | 4 | 3 |

| Crawford | 0 | 0 | 3 | 1 | 0 |

| Dane | 10 | 8 | 11 | 11 | 9 |

| Dodge | 2 | 5 | 1 | 4 | 3 |

| Door | 1 | 0 | 2 | 1 | 0 |

| Douglas | 2 | 1 | 1 | 1 | 2 |

| Dunn | 7 | 4 | 5 | 5 | 4 |

| Eau Claire | 1 | 0 | 2 | 4 | |

| Florence | 0 | 1 | 1 | 1 | 1 |

| Fond Du Lac | 2 | 3 | 5 | 4 | 2 |

| Forest | 3 | 1 | 0 | 2 | 1 |

| Grant | 5 | 2 | 1 | 1 | 2 |

| Green | 2 | 1 | 2 | 3 | 3 |

| Green | 0 | 0 | 1 | 0 | 0 |

| Iowa | 4 | 0 | 0 | 1 | 1 |

| Iron | 2 | 0 | 0 | 1 | 1 |

| Jackson | 0 | 0 | 0 | 1 | 3 |

| Jefferson | 2 | 4 | 2 | 0 | 2 |

| Juneau | 3 | 1 | 2 | 2 | 0 |

| Kenosha | 7 | 5 | 0 | 9 | 3 |

| Kewaunee | 1 | 0 | 0 | 1 | 1 |

| La Crosse | 0 | 2 | 0 | 3 | 6 |

| Lafayette | 1 | 1 | 0 | 0 | 2 |

| Langlade | 0 | 1 | 0 | 0 | 0 |

| Lincoln | 2 | 0 | 2 | 0 | 2 |

| Manitowoc | 4 | 5 | 2 | 0 | 1 |

| Marathon | 11 | 4 | 3 | 4 | 3 |

| Marinette | 3 | 1 | 1 | 1 | 3 |

| Marquette | 0 | 2 | 0 | 2 | 2 |

| Menominee | 0 | 1 | 1 | 0 | 0 |

| Milwaukee | 23 | 26 | 34 | 40 | 38 |

| Monroe | 3 | 1 | 1 | 2 | 2 |

| Oconto | 2 | 1 | 2 | 1 | 2 |

| Oneida | 2 | 3 | 0 | 2 | 0 |

| Outagamie | 2 | 3 | 1 | 3 | 4 |

| Ozaukee | 2 | 0 | 2 | 1 | 1 |

| Pepin | 0 | 1 | 0 | 0 | 0 |

| Pierce | 1 | 0 | 2 | 1 | 2 |

| Polk | 0 | 3 | 2 | 4 | 1 |

| Portage | 4 | 2 | 1 | 0 | 4 |

| Price | 1 | 0 | 1 | 2 | 2 |

| Racine | 3 | 5 | 12 | 5 | 6 |

| Richland | 1 | 2 | 0 | 0 | 0 |

| Rock | 4 | 4 | 5 | 10 | 2 |

| Rusk | 1 | 0 | 2 | 0 | 0 |

| Sauk | 1 | 6 | 3 | 2 | 1 |

| Sawyer | 0 | 1 | 1 | 1 | 0 |

| Shawano | 0 | 3 | 0 | 3 | 4 |

| Sheboygan | 3 | 4 | 4 | 2 | 4 |

| St. Croix | 2 | 2 | 2 | 1 | 1 |

| Taylor | 1 | 1 | 0 | 1 | 1 |

| Trempealeau | 0 | 1 | 1 | 0 | 0 |

| Vernon | 0 | 5 | 1 | 2 | 0 |

| Vilas | 1 | 0 | 1 | 3 | 0 |

| Walworth | 4 | 3 | 4 | 5 | 8 |

| Washburn | 3 | 0 | 2 | 0 | 2 |

| Washington | 1 | 6 | 5 | 6 | 2 |

| Waukesha | 9 | 11 | 1 | 14 | 7 |

| Waupaca | 6 | 0 | 4 | 4 | 2 |

| Waushara | 1 | 2 | 2 | 2 | 2 |

| Winnebago | 4 | 3 | 1 | 2 | 2 |

| Wood | 1 | 0 | 3 | 4 | 0 |

Milwaukee has seen the most speeding-related fatalities over the past five years, but speeding seems to be on the decline in the state’s other counties.

Fatalities Involving Alcohol-Impaired Driving by County

Drinking and driving results in a loss of control and a slowing of a person’s reflexes. Even so, drivers in Wisconsin continue to get behind the wheel after drinking:

| Country | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams | 0 | 1 | 2 | 2 | 2 |

| Ashland | 1 | 0 | 0 | 0 | 0 |

| Barron | 3 | 0 | 1 | 0 | 0 |

| Bayfield | 3 | 0 | 4 | 2 | 1 |

| Brown | 3 | 2 | 6 | 8 | 11 |

| Buffalo | 0 | 2 | 0 | 1 | 0 |

| Burnett | 2 | 1 | 0 | 3 | 2 |

| Calumet | 0 | 1 | 1 | 1 | 1 |

| Chippewa | 4 | 0 | 4 | 0 | 1 |

| Clark | 4 | 3 | 1 | 4 | 5 |

| Columbia | 3 | 0 | 3 | 8 | 2 |

| Crawford | 0 | 1 | 0 | 1 | 0 |

| Dane | 15 | 13 | 9 | 8 | 8 |

| Dodge | 1 | 4 | 2 | 3 | 2 |

| Door | 1 | 1 | 0 | 0 | 0 |

| Douglas | 3 | 1 | 1 | 0 | 2 |

| Dunn | 4 | 0 | 4 | 4 | 1 |

| EauClaire | 2 | 1 | 1 | 5 | 0 |

| Florence | 0 | 1 | 0 | 0 | 0 |

| Fond Du Lac | 1 | 0 | 3 | 3 | 2 |

| Forest | 3 | 1 | 1 | 2 | 1 |

| Grant | 2 | 2 | 1 | 4 | 1 |

| Green | 3 | 0 | 0 | 1 | 1 |

| Green Lake | 0 | 0 | 1 | 1 | 0 |

| Iowa | 2 | 0 | 1 | 1 | 1 |

| Iron | 1 | 0 | 1 | 1 | 1 |

| Jackson | 2 | 0 | 1 | 2 | 3 |

| Jefferson | 3 | 1 | 1 | 3 | 6 |

| Juneau | 4 | 1 | 2 | 3 | 2 |

| Kenosha | 6 | 8 | 0 | 9 | 10 |

| Kewaunee | 1 | 0 | 0 | 1 | 1 |

| La Crosse | 3 | 2 | 3 | 3 | 5 |

| Lafayette | 2 | 0 | 0 | 1 | 4 |

| Langlade | 0 | 3 | 1 | 0 | 0 |

| Lincoln | 2 | 1 | 2 | 2 | 4 |

| Manitowoc | 4 | 10 | 1 | 1 | 2 |

| Marathon | 5 | 2 | 6 | 2 | 1 |

| Marinette | 2 | 2 | 0 | 2 | 2 |

| Marquette | 0 | 0 | 1 | 1 | 1 |

| Menominee | 1 | 0 | 3 | 0 | 0 |

| Milwaukee | 17 | 22 | 28 | 20 | 19 |

| Monroe | 2 | 1 | 1 | 2 | 1 |

| Oconto | 1 | 2 | 7 | 3 | 3 |

| Oneida | 5 | 2 | 1 | 3 | 2 |

| Outagamie | 2 | 2 | 2 | 3 | 9 |

| Ozaukee | 1 | 0 | 1 | 1 | 2 |

| Pepin | 0 | 2 | 0 | 0 | 0 |

| Pierce | 0 | 2 | 2 | 5 | 1 |

| Polk | 0 | 3 | 3 | 6 | 4 |

| Portage | 4 | 3 | 0 | 0 | 4 |

| Price | 1 | 0 | 0 | 1 | 1 |

| Racine | 4 | 3 | 11 | 4 | 3 |

| Richland | 1 | 5 | 0 | 1 | 0 |

| Rock | 2 | 5 | 7 | 13 | 4 |

| Rusk | 0 | 0 | 2 | 0 | 0 |

| Sauk | 3 | 7 | 4 | 3 | 1 |

| Sawyer | 0 | 1 | 4 | 2 | 1 |

| Shawano | 0 | 1 | 2 | 5 | 4 |

| Sheboygan | 2 | 3 | 2 | 2 | 3 |

| St. Croix | 1 | 5 | 4 | 2 | 0 |

| Taylor | 1 | 0 | 2 | 0 | 0 |

| Trempealeau | 3 | 1 | 4 | 0 | 2 |

| Vernon | 0 | 2 | 2 | 0 | 3 |

| Vilas | 3 | 0 | 1 | 3 | 0 |

| Walworth | 4 | 6 | 7 | 8 | 6 |

| Washburn | 0 | 0 | 1 | 0 | 2 |

| Washington | 2 | 2 | 4 | 3 | 1 |

| Waukesha | 8 | 9 | 4 | 8 | 11 |

| Waupaca | 4 | 1 | 6 | 3 | 2 |

| Waushara | 1 | 3 | 1 | 1 | 4 |

| Winnebago | 5 | 4 | 3 | 2 | 3 |

| Wood | 3 | 0 | 5 | 2 | 5 |

There isn’t a distinct pattern in these statistics. That, as much as anything, suggests that even as more information about the negative impacts of alcohol are broadly circulated, some drivers are still putting their peers at risk. All the more reason to be careful if you go out on a Friday night.

Teen Drinking & Driving

Do note that the above statistics include fatalities involving intoxicated teenage drivers. Teenage drivers who are caught drinking and driving in Wisconsin are subject to the same consequences that adult drivers are.

Wisconsin, as we’ve mentioned, operates on an absolute sobriety system. That means that if there is any alcohol in your system at all, you’re not allowed to check behind the wheel of a car.

Teenagers, in particular, suffer from a loss of inhibitions and overconfidence when drinking behind the wheel. With fatalities involving alcohol occurring with some frequency in Wisconsin, it’s always safest to let someone else – a friend, parent, or rideshare driver – get you home if you’re intoxicated.

EMS Response Time: Rural vs. Urban

If you get into an accident, you want to know that EMS are on their way to your accident’s location ASAP. IT’s worth noting, though, that EMS response times differ based on where an accident takes place.

| - | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 5 minutes | 11 minutes | 44 minutes | 58 minutes | 355 |

| Urban | 4 minutes | 6 minutes | 30 minutes | 39 minutes | 200 |

As you can see in the table above, urban areas see EMS arrive just a hair quicker than they would in rural areas. Either way, though, you should arrive at a hospital in Wisconsin under an hour after you’ve been in an accident.

What should you know about Wisconsin transportation?

With all of that out of the way, what does driving look like for your average Wisconsin resident? Data USA breaks down the data collected in 2017 to give us a better idea of what the roads in Wisconsin look like.

Car Ownership

On average, homeowners in Wisconsin will have two cars in their garage. Roughly 44.3 percent of people own two vehicles, with those owning one and three racing for second place.

Commute Time

If you’re driving to work in Wisconsin, you’re in luck. The average commute time for Wisconsin residents comes in at 21.1 minutes.

The national average drive time for commuters is 25.2 minutes.

While they might have less time to listen to their morning podcasts, then, at least Wisconsin drivers get the chance to sleep in!

However, not all of them are so lucky. 1.62 percent of the Wisconsin workforce has to commit to a super-commute – a commute that forces drivers to remain on the road for 90 minutes or longer, both ways around.

Commuter Transportation

Most Wisconsin residents also prefer to make their commutes – be they super commutes or otherwise – on their own. 81.1 percent of Wisconsin’s workforce takes a single car into work on a daily basis. Carpooling is significantly less popular, though still a viable option, coming in at roughly 8 percent.

Traffic Congestion

Now for some especially good news: according to INRIX, there isn’t a single city in Wisconsin that ranks internationally for its traffic congestion. Even so, driving out of Madison during rush hour isn’t exactly fun. Regardless, so long as you pay attention to the road around you, you should be able to navigate Wisconsin’s roadways with ease.

Want to start comparing Wisconsin car insurance rates? You can use our FREE online tool to find an affordable premium in your area.

Do you have more questions about Wisconsin auto insurance?

We’ve added a few more FAQs below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – What is the DMV in Ashwaubenon WI’s hours?

The site for the Ashwaubenon’s DMV lists its hours as 8:30 am to 4:45 pm, Monday through Friday. They are closed on weekends. It’s the same for the Wisconsin DMV in West Bend, WI, but its best to check with your local DMV before going.

#2 – Is the WI DMV still open since the COVID-19 pandemic began?

The DMVs in Wisconsin are still listed as open for driver’s license and ID card customers. However, the website states that most renewals can be done online, and all vehicle transactions must be done online as well.

Read more: Driving During COVID-19 [Trends & Savings]

#3 – What time of day is DMV least busy?

What is the best day to go to DMV without an appointment? Early morning and early afternoons tend to be the least busy times for the DMV.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Is there a Wisconsin car insurance grace period?

There is typically no grace period required for car insurance, but check your policy to see if you have it built in.