Nevada Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 10.60

Searching for the best Nevada car insurance rates can be a stressful experience. Even if you know what to look for, you can still get lost along the way or end up meeting some dead ends. Without a road map to guide you, you may wind up on a road to nowhere that leads to disappointment and frustration.

That’s why we’ve compiled this comprehensive guide. It’s here to help you, the fearless researcher searching for information to help you make the right decision for your car insurance needs without all the hassles and the hype. You might be looking for Interstate Auto Insurance in Reno, NV, or Geico in Vegas.

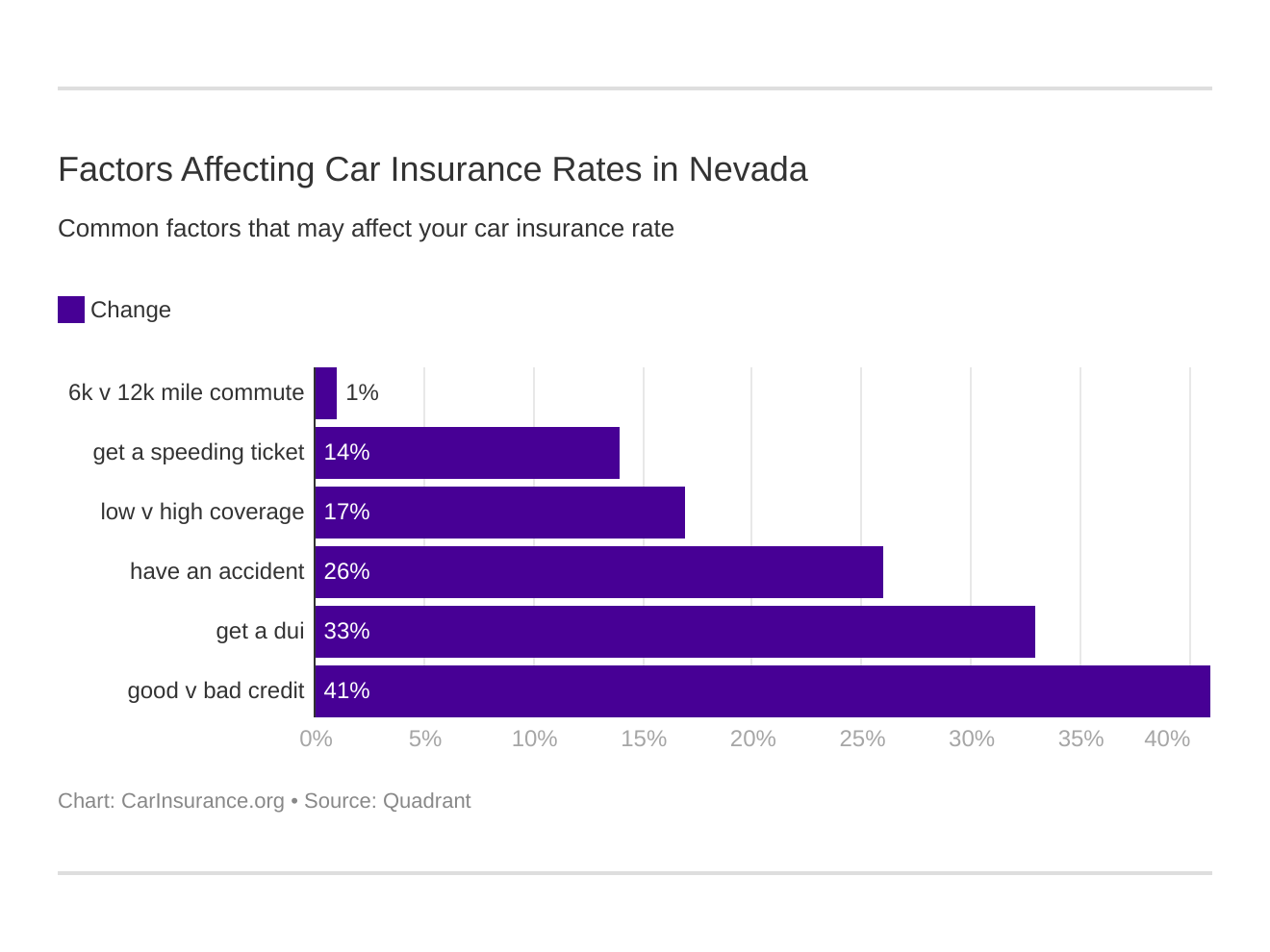

We know your time is valuable and that you can’t afford to waste it, so we’ve gathered vital data on Nevada car insurance laws, driving and safety laws, auto insurance coverage requirements, and more factors that affect the price of car insurance. We’re almost ready to make the first stop along the journey to affordable Nevada car insurance.

But first, find out how much you can save on Nevada car insurance — get car insurance quotes for Nevada car insurance rates for FREE. Enter your ZIP code above to get started.

How to Get Nevada Car Insurance Coverage & Rates

Is car insurance expensive in Nevada? With Las Vegas being the Entertainment Capital of the World and Reno is known as The Biggest Little City in the World, it’s not hard to imagine you’ll find plenty of amusement here.

However, when it comes to shopping for car insurance, it’s not always fun and games. Thinking about the coverage you need, the research involved, and what it takes to get set up with a provider can make you feel overwhelmed.

But there’s no need to break into a sweat. We’ve completed the hard work for you. From state car insurance requirements to coverage options, state and insurance laws to statistics, we’ve got all the information you need.

Let’s get ready to learn more about your car insurance options.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the average monthly car insurance rates in NV (liability, collision, comprehensive)?

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

How much is car insurance in Nevada? The table below contains the most recent average rate data from the National Association of Insurance Commissioners.

| Coverage Type | Annual Costs in 2015 |

|---|---|

| Liability | $681.56 |

| Collision | $303.86 |

| Comprehensive | $117.63 |

| Combined | $1,103.05 |

Overall, the average cost of a combined or full coverage policy — just over $1,100 — is $200 less than the annual U.S. average of $1,311. Expect Nevada car insurance rates to rise significantly in 2019 and later.

As we mentioned earlier, mandatory liability coverage protects you from damages in an accident someone else caused.

Nevada car insurance laws don’t require collision coverage, but it’s helpful to have it for damage protection regardless of who is at fault. It will cover the cost of repairs or the replacement of your vehicle.

Comprehensive coverage insures you in case of theft, or damage to your vehicle from other causes — such as hail damage, a flood, or a fire.

Full or combined coverage includes all three types of insurance, and, depending on your options, might be the most affordable choice for the most protection.

Read on to find out about additional liability coverage options.

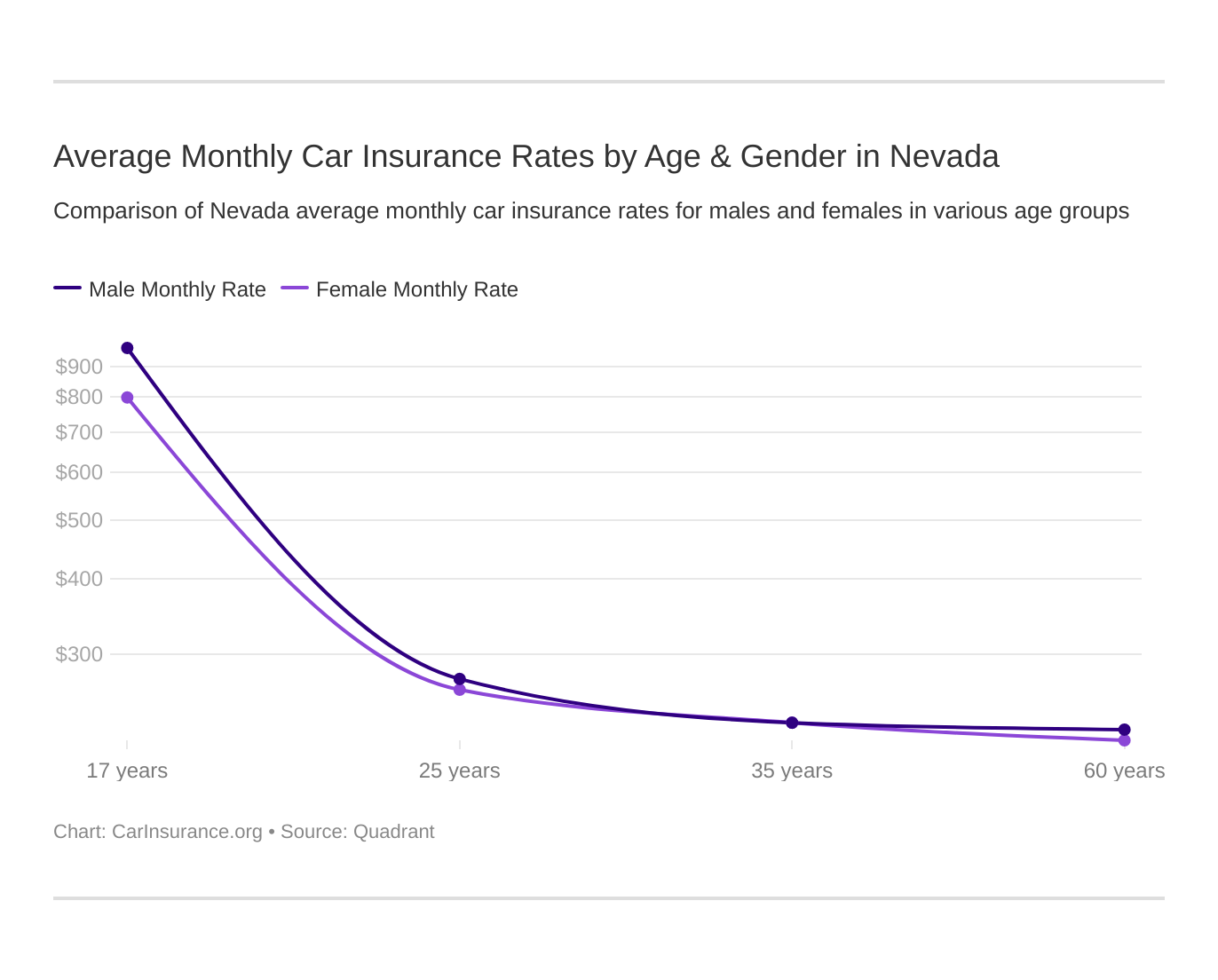

What are the average monthly car Insurance Rates by age & gender in NV?

Which gender and age pay more for car insurance? Drivers under 25 years old are often in the highest risk class. See if the gender stereotype (males vs female car insurance rates) holds true in Nevada.

We partnered with Quadrant Data to provide the premium data in the tables below.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,213.12 | $3,187.35 | $2,980.43 | $3,148.67 | $10,608.38 | $12,771.99 | $3,436.69 | $3,631.01 |

| American Family Mutual | $3,166.61 | $3,166.61 | $2,821.83 | $2,821.83 | $10,708.72 | $14,014.29 | $3,166.61 | $3,653.13 |

| Mid-Century Ins Co | $3,309.54 | $3,398.72 | $3,017.95 | $3,407.39 | $11,011.64 | $11,728.64 | $4,410.53 | $4,434.89 |

| Geico Cas | $2,764.87 | $2,674.83 | $2,816.04 | $2,873.57 | $6,851.05 | $6,237.15 | $2,737.80 | $2,324.96 |

| Safeco Ins Co of IL | $3,084.15 | $3,335.64 | $3,041.79 | $3,434.95 | $14,026.77 | $15,639.03 | $3,477.93 | $3,637.13 |

| Depositors Insurance | $2,362.11 | $2,414.50 | $2,152.73 | $2,282.29 | $5,805.75 | $6,979.24 | $2,808.27 | $2,994.55 |

| Progressive Direct | $2,182.18 | $1,873.41 | $1,904.77 | $1,899.44 | $9,436.38 | $10,231.11 | $2,535.15 | $2,328.90 |

| State Farm Mutual Auto | $3,496.78 | $3,496.78 | $3,171.99 | $3,171.99 | $10,846.02 | $13,863.57 | $3,917.14 | $4,378.51 |

| Travelers Home & Marine Ins Co | $2,107.82 | $2,137.13 | $2,013.94 | $2,011.37 | $11,261.00 | $18,350.69 | $2,332.62 | $2,582.53 |

| USAA | $2,044.07 | $2,007.42 | $1,960.43 | $1,948.62 | $5,313.62 | $5,987.19 | $2,576.44 | $2,740.28 |

As you can see, men pay more for car insurance than women, and inexperienced teen drivers usually pay the highest rates. The rates begin to nosedive slightly by age 25 and continue as the driver ages.

From ages 35 – 60, there isn’t much of a cost difference. For instance, Mid-Century Insurance Company charges 35-year-old male drivers nearly $90 more yearly than female drivers of the same age. Other carriers charge them the same rates.

Below, the table shows average annual rates for each age group by gender. Sometimes, age affects the cost of premiums more than gender does.

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Travelers Home & Marine Ins Co | Single 17-year old male | $18,350.69 | 1 |

| Safeco Ins Co of IL | Single 17-year old male | $15,639.03 | 2 |

| Safeco Ins Co of IL | Single 17-year old female | $14,026.77 | 3 |

| American Family Mutual | Single 17-year old male | $14,014.29 | 4 |

| State Farm Mutual Auto | Single 17-year old male | $13,863.57 | 5 |

| Allstate F&C | Single 17-year old male | $12,771.99 | 6 |

| Mid-Century Ins Co | Single 17-year old male | $11,728.64 | 7 |

| Travelers Home & Marine Ins Co | Single 17-year old female | $11,261.00 | 8 |

| Mid-Century Ins Co | Single 17-year old female | $11,011.64 | 9 |

| State Farm Mutual Auto | Single 17-year old female | $10,846.02 | 10 |

| American Family Mutual | Single 17-year old female | $10,708.72 | 11 |

| Allstate F&C | Single 17-year old female | $10,608.38 | 12 |

| Progressive Direct | Single 17-year old male | $10,231.11 | 13 |

| Progressive Direct | Single 17-year old female | $9,436.38 | 14 |

| Depositors Insurance | Single 17-year old male | $6,979.24 | 15 |

| Geico Cas | Single 17-year old female | $6,851.05 | 16 |

| Geico Cas | Single 17-year old male | $6,237.15 | 17 |

| USAA | Single 17-year old male | $5,987.19 | 18 |

| Depositors Insurance | Single 17-year old female | $5,805.75 | 19 |

| USAA | Single 17-year old female | $5,313.62 | 20 |

| Mid-Century Ins Co | Single 25-year old male | $4,434.89 | 21 |

| Mid-Century Ins Co | Single 25-year old female | $4,410.53 | 22 |

| State Farm Mutual Auto | Single 25-year old male | $4,378.51 | 23 |

| State Farm Mutual Auto | Single 25-year old female | $3,917.14 | 24 |

| American Family Mutual | Single 25-year old male | $3,653.13 | 25 |

| Safeco Ins Co of IL | Single 25-year old male | $3,637.13 | 26 |

| Allstate F&C | Single 25-year old male | $3,631.01 | 27 |

| State Farm Mutual Auto | Married 35-year old female | $3,496.78 | 28 |

| State Farm Mutual Auto | Married 35-year old male | $3,496.78 | 28 |

| Safeco Ins Co of IL | Single 25-year old female | $3,477.93 | 30 |

| Allstate F&C | Single 25-year old female | $3,436.69 | 31 |

| Safeco Ins Co of IL | Married 60-year old male | $3,434.95 | 32 |

| Mid-Century Ins Co | Married 60-year old male | $3,407.39 | 33 |

| Mid-Century Ins Co | Married 35-year old male | $3,398.72 | 34 |

| Safeco Ins Co of IL | Married 35-year old male | $3,335.64 | 35 |

| Mid-Century Ins Co | Married 35-year old female | $3,309.54 | 36 |

| Allstate F&C | Married 35-year old female | $3,213.12 | 37 |

| Allstate F&C | Married 35-year old male | $3,187.35 | 38 |

| State Farm Mutual Auto | Married 60-year old female | $3,171.99 | 39 |

| State Farm Mutual Auto | Married 60-year old male | $3,171.99 | 39 |

| American Family Mutual | Married 35-year old female | $3,166.61 | 41 |

| American Family Mutual | Married 35-year old male | $3,166.61 | 41 |

| American Family Mutual | Single 25-year old female | $3,166.61 | 41 |

| Allstate F&C | Married 60-year old male | $3,148.67 | 44 |

| Safeco Ins Co of IL | Married 35-year old female | $3,084.15 | 45 |

| Safeco Ins Co of IL | Married 60-year old female | $3,041.79 | 46 |

| Mid-Century Ins Co | Married 60-year old female | $3,017.95 | 47 |

| Depositors Insurance | Single 25-year old male | $2,994.55 | 48 |

| Allstate F&C | Married 60-year old female | $2,980.43 | 49 |

| Geico Cas | Married 60-year old male | $2,873.57 | 50 |

| American Family Mutual | Married 60-year old female | $2,821.83 | 51 |

| American Family Mutual | Married 60-year old male | $2,821.83 | 51 |

| Geico Cas | Married 60-year old female | $2,816.04 | 53 |

| Depositors Insurance | Single 25-year old female | $2,808.27 | 54 |

| Geico Cas | Married 35-year old female | $2,764.87 | 55 |

| USAA | Single 25-year old male | $2,740.28 | 56 |

| Geico Cas | Single 25-year old female | $2,737.80 | 57 |

| Geico Cas | Married 35-year old male | $2,674.83 | 58 |

| Travelers Home & Marine Ins Co | Single 25-year old male | $2,582.53 | 59 |

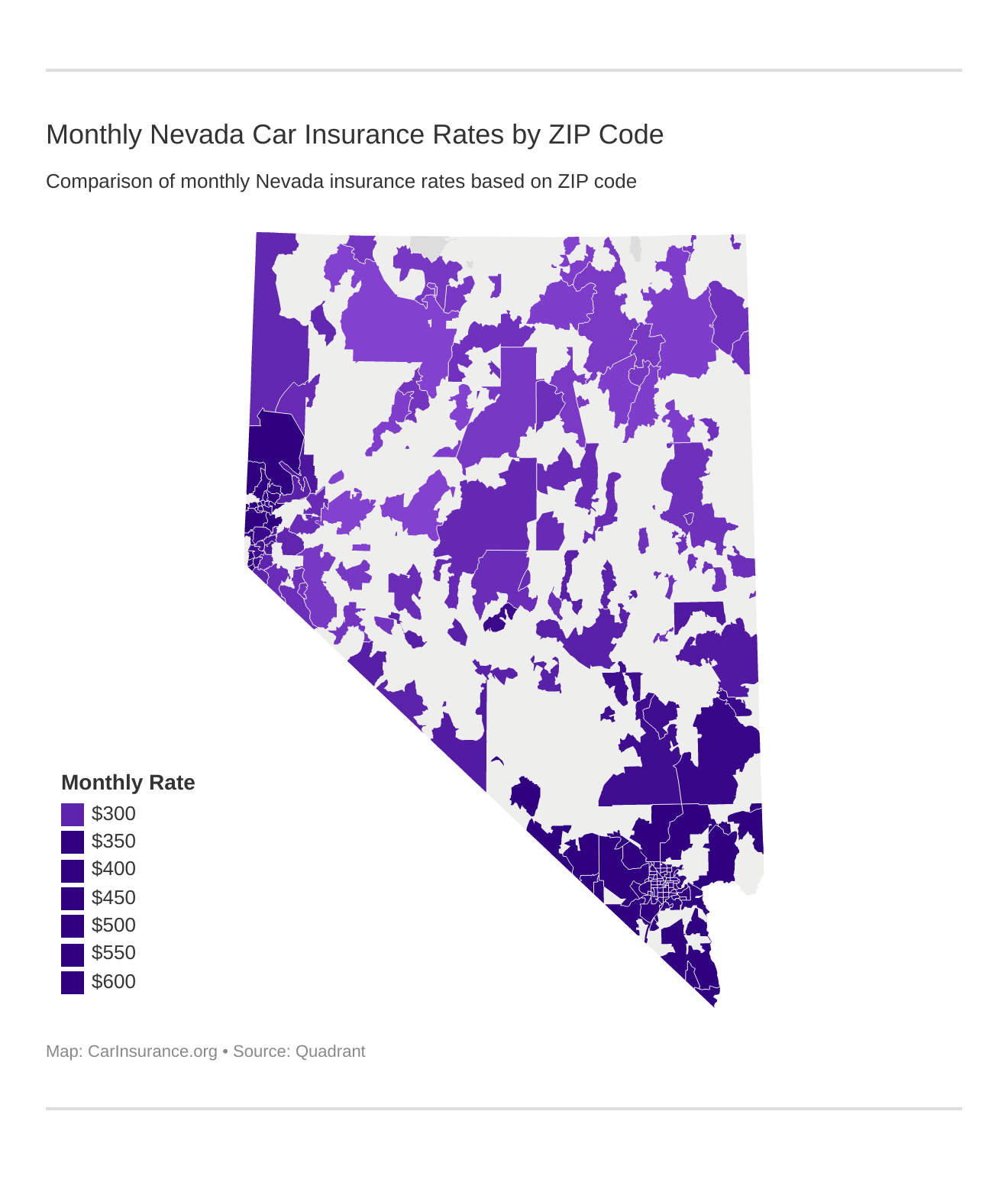

What are the car insurance rates in Nevada’s 10 largest cities?

Below, we’ve compared the average annual premium rates for the most and least expensive Nevada cities.

| Ten Most Expensive Cities | Ten Least Expensive Cities | ||||

|---|---|---|---|---|---|

| City | Zip Code | Average Rate | City | Zip Code | Average Rate |

| Las Vegas | 89101 | $7486.53 | Fallon | 89406 | $3411.08 |

| Henderson | 89074 | $6094.27 | Owyhee | 89832 | $3411.87 |

| Reno | 89502 | $4360.16 | Winnemucca | 89445 | $3413.48 |

| North Las Vegas | 89030 | $7347.44 | Lovelock | 89419 | $3428.28 |

| Paradise | 89120 | $6856.41 | Wells | 89835 | $3430.06 |

| Sunrise Manor | 89122 | $6808.18 | Tuscarora | 89834 | $3434.38 |

| Spring Valley | 89148 | $6782.42 | Spring Creek | 89815 | $3434.84 |

| Enterprise | 89123 | $6105.08 | Ruby Valley | 89833 | $3437.66 |

| Sparks | 89431 | $4280.7 | Elko | 89801 | $3451.43 |

| Carson City | 89701 | $3701.65 | Carlin | 89822 | $3456.72 |

Unsurprisingly, the cities with the highest populations generally post higher rates than those with fewer citizens. This shows how much the area where you live can affect rates. For example, the cost difference between the most expensive premium, in Las Vegas, and the cheapest, in Carlin, is a whopping $4,000.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the cheapest car insurance rates by ZIP code?

Let’s take a bigger view of the difference in average annual premium costs for ZIP codes throughout Nevada. If you can’t find your town on the list, try searching in the bar above.

| City | Zipcode | Average | Zipcode | Average | Allstate F&C | American Family Mutual | Mid-Century Ins Co | Geico Cas | Safeco Ins Co of IL | Depositors Insurance | Progressive Direct | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LAS VEGAS | 89001 | $3,750.89 | 89101 | $7,486.53 | $8,048.30 | $8,553.10 | $9,480.30 | $4,836.05 | $9,883.38 | $5,319.48 | $5,888.23 | $9,533.35 | $9,371.11 | $3,951.95 |

| LAS VEGAS | 89002 | $5,582.91 | 89102 | $7,376.44 | $8,048.30 | $8,409.97 | $9,480.30 | $5,120.65 | $9,545.82 | $5,166.70 | $5,994.61 | $9,241.46 | $8,794.42 | $3,962.16 |

| LAS VEGAS | 89003 | $3,973.32 | 89106 | $7,374.13 | $7,769.45 | $8,409.97 | $9,480.30 | $4,962.07 | $10,172.89 | $5,533.73 | $6,020.83 | $9,274.17 | $8,165.97 | $3,951.95 |

| LAS VEGAS | 89004 | $5,596.93 | 89104 | $7,360.29 | $7,272.17 | $8,553.10 | $9,480.30 | $4,808.57 | $9,617.41 | $5,060.70 | $6,334.43 | $9,503.70 | $9,020.61 | $3,951.95 |

| NORTH LAS VEGAS | 89005 | $4,614.02 | 89030 | $7,347.44 | $8,088.48 | $8,409.97 | $9,318.62 | $4,836.05 | $9,883.38 | $5,533.73 | $6,251.86 | $8,285.37 | $8,915.00 | $3,951.95 |

| LAS VEGAS | 89007 | $4,203.71 | 89107 | $7,255.06 | $7,273.19 | $8,409.97 | $9,480.30 | $4,927.35 | $9,638.95 | $4,791.34 | $6,042.04 | $9,232.25 | $8,862.80 | $3,892.43 |

| LAS VEGAS | 89008 | $3,789.18 | 89109 | $7,199.02 | $7,710.41 | $8,553.10 | $9,480.30 | $4,846.89 | $9,183.10 | $5,060.70 | $5,686.59 | $8,294.43 | $9,297.97 | $3,876.74 |

| LAS VEGAS | 89010 | $3,611.34 | 89110 | $7,189.04 | $7,638.37 | $8,553.10 | $9,318.62 | $4,735.03 | $9,325.59 | $5,382.89 | $5,830.40 | $9,304.06 | $8,097.44 | $3,704.95 |

| LAS VEGAS | 89011 | $5,810.24 | 89169 | $7,157.11 | $7,319.33 | $8,553.10 | $9,480.30 | $4,960.96 | $9,183.10 | $5,060.70 | $5,164.44 | $8,674.52 | $9,297.97 | $3,876.74 |

| LAS VEGAS | 89012 | $5,687.07 | 89146 | $7,073.86 | $7,611.76 | $8,409.97 | $9,480.30 | $5,119.94 | $8,278.72 | $5,166.70 | $6,302.95 | $8,675.02 | $7,700.06 | $3,993.24 |

| LAS VEGAS | 89013 | $3,657.04 | 89103 | $7,029.98 | $7,954.13 | $8,409.97 | $8,690.65 | $4,977.04 | $8,275.86 | $5,166.70 | $5,732.50 | $8,928.35 | $8,202.41 | $3,962.16 |

| LAS VEGAS | 89014 | $5,964.11 | 89121 | $6,944.29 | $7,564.25 | $8,284.68 | $9,480.30 | $4,652.70 | $8,323.80 | $4,954.07 | $5,799.01 | $9,135.53 | $7,371.80 | $3,876.74 |

| LAS VEGAS | 89015 | $5,592.27 | 89119 | $6,919.52 | $7,883.30 | $8,284.68 | $8,690.65 | $4,652.70 | $9,183.10 | $5,238.74 | $5,024.44 | $8,931.76 | $7,429.11 | $3,876.74 |

| LAS VEGAS | 89017 | $3,760.00 | 89156 | $6,903.68 | $7,452.92 | $7,876.90 | $9,318.62 | $4,737.88 | $8,276.43 | $5,103.24 | $6,432.02 | $8,465.05 | $7,832.08 | $3,541.66 |

| LAS VEGAS | 89018 | $4,548.91 | 89147 | $6,898.71 | $7,915.29 | $7,953.51 | $9,160.06 | $5,280.42 | $8,177.41 | $4,959.82 | $6,140.50 | $8,392.48 | $7,111.97 | $3,895.68 |

| NORTH LAS VEGAS | 89019 | $4,769.17 | 89032 | $6,879.48 | $7,769.45 | $8,409.97 | $9,318.62 | $4,190.21 | $8,636.05 | $4,933.96 | $5,456.27 | $8,675.45 | $7,591.30 | $3,813.50 |

| LAS VEGAS | 89020 | $4,186.62 | 89142 | $6,870.53 | $7,231.45 | $7,876.90 | $9,318.62 | $4,685.71 | $8,276.43 | $4,954.07 | $5,769.08 | $9,242.92 | $7,554.76 | $3,795.37 |

| LAS VEGAS | 89021 | $4,545.43 | 89117 | $6,861.26 | $7,915.29 | $8,184.95 | $8,485.83 | $5,307.64 | $8,378.44 | $4,948.36 | $5,793.08 | $8,493.85 | $7,111.97 | $3,993.24 |

| LAS VEGAS | 89022 | $3,774.00 | 89120 | $6,856.41 | $7,489.95 | $8,284.68 | $9,480.30 | $4,635.57 | $7,922.66 | $4,738.80 | $5,423.88 | $8,609.67 | $8,101.88 | $3,876.74 |

| LAS VEGAS | 89023 | $4,320.45 | 89108 | $6,830.19 | $6,748.50 | $7,876.90 | $9,318.62 | $4,318.70 | $8,317.02 | $4,791.34 | $5,730.61 | $9,255.16 | $8,052.63 | $3,892.43 |

| LAS VEGAS | 89025 | $4,475.32 | 89122 | $6,808.18 | $7,143.22 | $7,876.90 | $9,318.62 | $4,691.99 | $8,276.43 | $4,738.80 | $5,717.62 | $9,035.87 | $7,364.02 | $3,918.32 |

| LAS VEGAS | 89026 | $4,643.58 | 89118 | $6,803.81 | $7,620.98 | $7,953.51 | $8,690.65 | $5,158.39 | $8,275.86 | $4,978.20 | $5,899.43 | $8,520.80 | $7,151.05 | $3,789.24 |

| LAS VEGAS | 89027 | $4,096.49 | 89148 | $6,782.42 | $7,748.82 | $7,818.69 | $9,160.06 | $5,070.96 | $8,079.21 | $4,809.06 | $5,965.21 | $7,852.17 | $7,424.37 | $3,895.68 |

| LAS VEGAS | 89029 | $4,572.33 | 89115 | $6,731.08 | $6,336.10 | $7,876.90 | $9,318.62 | $4,193.14 | $9,570.04 | $4,969.50 | $5,651.34 | $8,558.04 | $8,049.05 | $2,788.04 |

| LAS VEGAS | 89030 | $7,347.44 | 89139 | $6,708.63 | $7,753.29 | $6,967.21 | $8,602.85 | $5,231.49 | $7,975.48 | $4,647.53 | $6,376.44 | $8,087.23 | $7,655.58 | $3,789.24 |

| LAS VEGAS | 89031 | $6,478.19 | 89128 | $6,592.48 | $6,728.87 | $8,184.95 | $8,485.83 | $4,287.10 | $7,998.88 | $4,665.41 | $5,790.97 | $8,380.51 | $7,438.02 | $3,964.26 |

| LAS VEGAS | 89032 | $6,879.48 | 89145 | $6,585.70 | $7,032.37 | $8,184.95 | $8,485.83 | $4,287.10 | $8,309.94 | $4,665.41 | $5,440.70 | $8,260.80 | $7,182.67 | $4,007.21 |

| LAS VEGAS | 89033 | $5,797.39 | 89179 | $6,583.81 | $7,768.42 | $6,610.58 | $9,160.06 | $5,222.35 | $8,419.64 | $4,526.94 | $5,017.65 | $7,550.30 | $7,666.47 | $3,895.68 |

| LAS VEGAS | 89034 | $4,213.97 | 89113 | $6,554.22 | $7,211.62 | $6,967.21 | $9,160.06 | $5,050.28 | $8,177.41 | $4,647.53 | $5,423.24 | $8,408.23 | $6,707.34 | $3,789.24 |

| LAS VEGAS | 89039 | $4,495.80 | 89178 | $6,523.70 | $6,890.02 | $6,610.58 | $9,160.06 | $5,158.39 | $8,079.21 | $4,526.94 | $5,657.99 | $7,833.77 | $7,424.37 | $3,895.68 |

| LAS VEGAS | 89040 | $4,527.30 | 89141 | $6,518.11 | $7,334.79 | $6,967.21 | $8,602.85 | $5,318.02 | $7,957.22 | $4,446.61 | $5,489.04 | $7,764.76 | $7,464.11 | $3,836.45 |

| LAS VEGAS | 89042 | $3,781.93 | 89158 | $6,508.30 | $6,748.50 | $8,553.10 | $9,480.30 | $4,318.70 | $9,183.10 | $5,060.70 | $5,218.90 | $5,145.97 | $7,832.08 | $3,541.66 |

| NORTH LAS VEGAS | 89043 | $3,666.14 | 89031 | $6,478.19 | $7,331.22 | $7,244.78 | $8,485.83 | $4,326.08 | $8,484.53 | $4,933.19 | $5,505.84 | $7,780.21 | $7,288.23 | $3,402.05 |

| LAS VEGAS | 89044 | $5,713.37 | 89161 | $6,461.55 | $8,013.37 | $5,330.75 | $9,160.06 | $3,477.01 | $9,183.10 | $4,526.94 | $5,476.35 | $7,583.60 | $8,322.66 | $3,541.66 |

| LAS VEGAS | 89045 | $3,534.41 | 89130 | $6,440.03 | $6,865.14 | $7,876.90 | $8,485.83 | $4,069.19 | $8,248.52 | $4,416.05 | $5,258.29 | $7,743.91 | $7,592.66 | $3,843.79 |

| LAS VEGAS | 89046 | $4,576.29 | 89183 | $6,327.10 | $7,254.97 | $6,967.21 | $8,602.85 | $4,487.19 | $8,151.48 | $4,446.61 | $5,212.74 | $8,056.46 | $6,255.03 | $3,836.45 |

| LAS VEGAS | 89047 | $3,617.00 | 89135 | $6,310.96 | $6,888.72 | $7,818.69 | $7,819.91 | $4,568.56 | $8,092.19 | $4,362.11 | $5,671.28 | $7,681.26 | $6,400.51 | $3,806.38 |

| LAS VEGAS | 89048 | $4,492.04 | 89199 | $6,285.39 | $7,231.10 | $5,330.75 | $9,480.30 | $4,652.70 | $9,057.59 | $5,238.74 | $5,024.44 | $5,145.97 | $8,904.30 | $2,788.04 |

| NELLIS AFB | 89049 | $3,627.28 | 89191 | $6,248.03 | $7,452.92 | $7,876.90 | $9,318.62 | $3,477.01 | $8,276.43 | $4,969.50 | $5,278.70 | $8,441.18 | $4,600.98 | $2,788.04 |

| NORTH LAS VEGAS | 89052 | $5,986.00 | 89087 | $6,236.06 | $6,589.11 | $8,409.97 | $7,145.80 | $4,295.37 | $8,484.53 | $5,533.73 | $6,265.79 | $5,145.97 | $7,088.27 | $3,402.05 |

| LAS VEGAS | 89054 | $5,508.41 | 89129 | $6,214.77 | $6,748.50 | $7,078.20 | $8,485.83 | $4,230.49 | $7,998.88 | $4,484.60 | $5,027.29 | $8,051.30 | $6,267.31 | $3,775.28 |

| LAS VEGAS | 89060 | $4,470.11 | 89138 | $6,129.99 | $6,888.72 | $6,669.23 | $7,819.91 | $4,540.02 | $8,142.28 | $4,251.58 | $5,590.24 | $6,974.62 | $7,316.80 | $3,106.51 |

| LAS VEGAS | 89061 | $4,505.44 | 89144 | $6,123.71 | $6,884.22 | $6,669.23 | $7,819.91 | $4,332.97 | $7,998.88 | $4,362.11 | $5,366.50 | $7,002.32 | $7,168.56 | $3,632.40 |

| LAS VEGAS | 89067 | $4,763.30 | 89165 | $6,119.23 | $6,865.14 | $5,330.75 | $7,145.80 | $3,477.01 | $8,498.42 | $4,476.42 | $5,651.34 | $7,502.24 | $8,703.52 | $3,541.66 |

| LAS VEGAS | 89074 | $6,094.27 | 89123 | $6,105.08 | $6,411.06 | $6,967.21 | $8,602.85 | $4,008.83 | $7,922.66 | $4,279.18 | $5,311.08 | $7,512.97 | $6,255.03 | $3,779.97 |

| NORTH LAS VEGAS | 89081 | $6,097.13 | 89081 | $6,097.13 | $6,944.30 | $7,244.78 | $8,485.83 | $4,156.71 | $6,865.80 | $4,476.42 | $4,935.08 | $7,362.78 | $7,711.55 | $2,788.04 |

| HENDERSON | 89084 | $6,032.79 | 89074 | $6,094.27 | $7,231.10 | $6,493.72 | $6,904.95 | $4,703.77 | $7,299.27 | $4,379.13 | $5,469.34 | $7,760.80 | $7,105.66 | $3,594.96 |

| LAS VEGAS | 89085 | $6,014.64 | 89134 | $6,068.78 | $6,728.87 | $6,669.23 | $7,819.91 | $4,391.12 | $7,998.88 | $4,665.41 | $5,515.58 | $7,142.07 | $6,124.29 | $3,632.40 |

| LAS VEGAS | 89086 | $5,912.55 | 89149 | $6,034.31 | $6,465.60 | $7,078.20 | $7,145.80 | $4,230.49 | $8,087.77 | $4,416.05 | $5,046.09 | $7,408.64 | $6,723.77 | $3,740.68 |

| NORTH LAS VEGAS | 89087 | $6,236.06 | 89084 | $6,032.79 | $6,865.14 | $7,244.78 | $7,145.80 | $4,278.44 | $7,889.70 | $4,549.77 | $4,918.01 | $7,509.06 | $6,758.47 | $3,168.79 |

| LAS VEGAS | 89101 | $7,486.53 | 89131 | $6,017.17 | $6,865.14 | $7,244.78 | $7,145.80 | $4,230.58 | $8,283.97 | $4,340.33 | $5,254.59 | $6,532.13 | $6,679.80 | $3,594.55 |

| NORTH LAS VEGAS | 89102 | $7,376.44 | 89085 | $6,014.64 | $6,865.14 | $7,244.78 | $7,145.80 | $4,261.88 | $7,717.29 | $4,549.77 | $4,757.14 | $7,502.24 | $7,088.27 | $3,014.07 |

| HENDERSON | 89103 | $7,029.98 | 89052 | $5,986.00 | $6,762.52 | $6,669.23 | $7,438.51 | $4,236.19 | $7,430.58 | $4,218.37 | $4,987.71 | $7,185.79 | $7,336.14 | $3,594.96 |

| HENDERSON | 89104 | $7,360.29 | 89014 | $5,964.11 | $7,143.22 | $6,493.72 | $6,904.95 | $4,470.72 | $7,321.50 | $4,412.13 | $4,905.02 | $7,498.85 | $6,731.89 | $3,759.11 |

| NORTH LAS VEGAS | 89106 | $7,374.13 | 89086 | $5,912.55 | $6,589.11 | $7,244.78 | $7,145.80 | $4,295.37 | $6,851.40 | $4,476.42 | $4,700.72 | $7,331.05 | $7,088.78 | $3,402.05 |

| LAS VEGAS | 89107 | $7,255.06 | 89143 | $5,907.97 | $6,465.60 | $7,078.20 | $7,145.80 | $4,420.94 | $8,087.77 | $4,156.60 | $5,122.52 | $6,843.90 | $6,336.41 | $3,422.00 |

| HENDERSON | 89108 | $6,830.19 | 89011 | $5,810.24 | $6,337.44 | $6,493.72 | $6,904.95 | $3,892.22 | $7,724.66 | $4,306.38 | $4,823.40 | $7,334.15 | $6,595.15 | $3,690.29 |

| NORTH LAS VEGAS | 89109 | $7,199.02 | 89033 | $5,797.39 | $6,855.93 | $7,244.78 | $7,145.80 | $4,289.74 | $6,616.96 | $4,549.77 | $5,222.71 | $5,145.97 | $7,088.78 | $3,813.50 |

| HENDERSON | 89110 | $7,189.04 | 89044 | $5,713.37 | $5,970.85 | $6,669.23 | $7,438.51 | $4,236.30 | $7,430.58 | $3,807.01 | $5,054.67 | $6,414.67 | $6,516.92 | $3,594.96 |

| HENDERSON | 89113 | $6,554.22 | 89012 | $5,687.07 | $6,270.94 | $6,669.23 | $7,438.51 | $3,916.59 | $7,299.27 | $4,379.13 | $4,424.68 | $6,616.82 | $6,260.58 | $3,594.96 |

| BLUE DIAMOND | 89115 | $6,731.08 | 89004 | $5,596.93 | $7,347.57 | $5,330.75 | $5,087.44 | $3,477.01 | $8,446.02 | $4,526.94 | $5,218.90 | $6,841.13 | $6,586.57 | $3,106.95 |

| HENDERSON | 89117 | $6,861.26 | 89015 | $5,592.27 | $5,692.37 | $6,493.72 | $7,242.44 | $3,921.91 | $7,406.70 | $4,133.45 | $4,642.86 | $6,603.14 | $6,131.33 | $3,654.79 |

| HENDERSON | 89118 | $6,803.81 | 89002 | $5,582.91 | $5,692.37 | $6,493.72 | $7,242.44 | $3,736.50 | $7,651.11 | $4,133.45 | $4,284.42 | $6,864.79 | $6,131.33 | $3,598.96 |

| LAS VEGAS | 89119 | $6,919.52 | 89166 | $5,539.07 | $5,776.23 | $5,330.75 | $7,145.80 | $4,420.94 | $8,087.77 | $4,156.60 | $4,899.94 | $5,207.08 | $7,258.63 | $3,106.95 |

| SLOAN | 89120 | $6,856.41 | 89054 | $5,508.41 | $6,411.06 | $5,330.75 | $5,087.44 | $3,477.01 | $7,649.04 | $3,278.18 | $5,492.04 | $7,816.48 | $6,705.62 | $3,836.45 |

| LAS VEGAS | 89121 | $6,944.29 | 89124 | $5,228.48 | $6,456.37 | $5,330.75 | $5,514.97 | $3,477.01 | $7,649.04 | $3,278.18 | $4,957.35 | $5,808.56 | $6,705.62 | $3,106.95 |

| JEAN | 89122 | $6,808.18 | 89019 | $4,769.17 | $6,456.37 | $5,330.75 | $5,087.44 | $3,477.01 | $5,471.24 | $3,278.18 | $5,148.59 | $5,437.45 | $4,534.92 | $3,469.71 |

| COYOTE SPRINGS | 89123 | $6,105.08 | 89067 | $4,763.30 | $5,424.60 | $5,330.75 | $5,087.44 | $3,477.01 | $6,233.74 | $3,278.18 | $5,427.51 | $5,145.97 | $4,391.35 | $3,836.45 |

| JEAN | 89124 | $5,228.48 | 89026 | $4,643.58 | $5,424.60 | $5,330.75 | $5,087.44 | $3,477.01 | $7,649.04 | $3,278.18 | $2,833.99 | $5,358.02 | $4,391.35 | $3,605.45 |

| BOULDER CITY | 89128 | $6,592.48 | 89005 | $4,614.02 | $5,766.98 | $5,161.19 | $5,087.44 | $3,726.31 | $6,746.98 | $3,278.18 | $3,632.52 | $5,266.75 | $4,366.89 | $3,106.95 |

| SEARCHLIGHT | 89129 | $6,214.77 | 89046 | $4,576.29 | $6,337.44 | $5,330.75 | $5,087.44 | $3,477.01 | $5,471.24 | $3,278.18 | $3,556.14 | $5,145.97 | $4,971.78 | $3,106.95 |

| LAUGHLIN | 89130 | $6,440.03 | 89029 | $4,572.33 | $6,337.44 | $5,330.75 | $4,531.81 | $3,477.01 | $5,473.21 | $3,278.18 | $3,037.94 | $4,865.38 | $6,284.62 | $3,106.95 |

| INDIAN SPRINGS | 89131 | $6,017.17 | 89018 | $4,548.91 | $5,779.77 | $5,330.75 | $5,087.44 | $3,477.01 | $5,957.20 | $3,278.18 | $4,655.31 | $4,828.04 | $3,988.43 | $3,106.95 |

| LOGANDALE | 89134 | $6,068.78 | 89021 | $4,545.43 | $5,424.60 | $5,161.19 | $5,087.44 | $3,477.01 | $6,233.74 | $3,278.18 | $3,787.75 | $5,506.14 | $4,391.35 | $3,106.95 |

| OVERTON | 89135 | $6,310.96 | 89040 | $4,527.30 | $5,424.60 | $5,161.19 | $5,087.44 | $3,477.01 | $6,233.74 | $3,278.18 | $3,484.97 | $5,627.56 | $4,391.35 | $3,106.95 |

| PAHRUMP | 89138 | $6,129.99 | 89061 | $4,505.44 | $4,970.26 | $4,375.11 | $6,124.86 | $3,470.76 | $6,190.13 | $3,279.40 | $4,415.03 | $5,013.98 | $4,494.42 | $2,720.50 |

| CAL NEV ARI | 89139 | $6,708.63 | 89039 | $4,495.80 | $6,337.44 | $5,330.75 | $5,087.44 | $3,477.01 | $5,471.24 | $3,278.18 | $2,833.99 | $5,063.20 | $4,971.78 | $3,106.95 |

| PAHRUMP | 89141 | $6,518.11 | 89048 | $4,492.04 | $4,963.43 | $4,375.11 | $6,124.86 | $3,470.76 | $6,190.13 | $3,279.40 | $4,354.45 | $4,967.64 | $4,474.19 | $2,720.50 |

| MOAPA | 89142 | $6,870.53 | 89025 | $4,475.32 | $5,424.60 | $5,330.75 | $5,087.44 | $3,477.01 | $6,216.11 | $3,278.18 | $2,833.99 | $5,606.78 | $4,391.35 | $3,106.95 |

| PAHRUMP | 89143 | $5,907.97 | 89060 | $4,470.11 | $4,963.43 | $4,375.11 | $6,124.86 | $3,470.76 | $6,190.13 | $3,279.40 | $4,390.68 | $4,888.85 | $4,297.36 | $2,720.50 |

| RENO | 89144 | $6,123.71 | 89502 | $4,360.16 | $4,480.81 | $4,458.57 | $5,141.78 | $3,628.06 | $5,543.97 | $3,190.76 | $3,908.31 | $5,178.41 | $5,314.11 | $2,756.81 |

| MERCURY | 89145 | $6,585.70 | 89023 | $4,320.45 | $6,623.66 | $4,247.71 | $6,124.86 | $2,935.94 | $5,415.60 | $2,535.31 | $4,223.75 | $4,285.73 | $4,195.23 | $2,616.68 |

| RENO | 89146 | $7,073.86 | 89509 | $4,318.19 | $4,387.62 | $4,701.37 | $5,141.78 | $3,490.17 | $5,516.58 | $3,190.76 | $3,744.41 | $5,211.40 | $5,041.04 | $2,756.81 |

| RENO | 89147 | $6,898.71 | 89501 | $4,308.50 | $4,353.16 | $4,701.37 | $5,141.78 | $3,717.85 | $4,998.72 | $3,190.76 | $3,934.26 | $5,568.30 | $4,775.26 | $2,703.59 |

| RENO | 89148 | $6,782.42 | 89519 | $4,293.24 | $4,387.62 | $4,458.57 | $5,141.78 | $3,628.53 | $5,516.58 | $3,021.96 | $3,547.36 | $5,504.12 | $5,041.04 | $2,684.80 |

| SPARKS | 89149 | $6,034.31 | 89431 | $4,280.70 | $4,387.62 | $4,701.37 | $5,341.05 | $3,723.15 | $4,957.20 | $3,000.32 | $3,825.13 | $5,226.48 | $4,743.47 | $2,901.21 |

| CRYSTAL BAY | 89156 | $6,903.68 | 89402 | $4,276.79 | $4,313.24 | $4,102.86 | $6,298.44 | $3,691.95 | $4,736.62 | $3,043.41 | $2,939.09 | $5,752.58 | $5,026.90 | $2,862.88 |

| RENO | 89158 | $6,508.30 | 89503 | $4,270.71 | $4,261.49 | $4,701.37 | $5,141.78 | $3,716.57 | $5,477.70 | $3,190.76 | $3,482.78 | $5,109.24 | $4,762.55 | $2,862.88 |

| STATELINE | 89161 | $6,461.55 | 89449 | $4,255.26 | $4,003.00 | $4,102.86 | $6,336.64 | $3,577.65 | $4,364.76 | $2,816.60 | $3,160.21 | $5,849.86 | $5,718.66 | $2,622.31 |

| SUN VALLEY | 89165 | $6,119.23 | 89433 | $4,237.31 | $4,261.49 | $4,701.37 | $5,341.05 | $3,626.78 | $4,878.17 | $3,000.32 | $3,755.46 | $5,262.67 | $4,682.86 | $2,862.88 |

| RENO | 89166 | $5,539.07 | 89512 | $4,226.10 | $4,261.49 | $4,701.37 | $5,141.78 | $3,724.41 | $5,074.76 | $3,000.32 | $3,827.36 | $5,233.93 | $4,432.72 | $2,862.88 |

| SPARKS | 89169 | $7,157.11 | 89434 | $4,217.12 | $4,479.30 | $4,458.57 | $4,937.32 | $3,503.50 | $5,177.13 | $3,000.32 | $3,749.33 | $5,468.33 | $4,496.22 | $2,901.21 |

| MESQUITE | 89178 | $6,523.70 | 89034 | $4,213.97 | $5,424.60 | $4,247.71 | $3,881.42 | $3,477.01 | $5,878.22 | $3,278.18 | $2,580.52 | $5,145.97 | $4,412.55 | $3,813.50 |

| ZEPHYR COVE | 89179 | $6,583.81 | 89448 | $4,208.43 | $3,853.98 | $4,102.86 | $6,336.64 | $3,577.65 | $4,364.76 | $2,816.60 | $3,527.83 | $5,776.84 | $5,104.79 | $2,622.31 |

| RENO | 89183 | $6,327.10 | 89521 | $4,205.94 | $4,459.72 | $4,458.57 | $5,141.78 | $3,559.76 | $4,627.42 | $3,207.52 | $3,481.87 | $5,189.95 | $5,181.38 | $2,751.45 |

| BUNKERVILLE | 89191 | $6,248.03 | 89007 | $4,203.71 | $5,424.60 | $5,161.19 | $3,881.42 | $3,477.01 | $6,233.74 | $3,278.18 | $2,404.98 | $4,677.73 | $4,391.35 | $3,106.95 |

| RENO | 89199 | $6,285.39 | 89506 | $4,198.94 | $4,185.59 | $4,458.57 | $5,033.35 | $3,536.94 | $5,311.28 | $2,952.59 | $3,733.80 | $5,285.24 | $4,629.13 | $2,862.88 |

| AMARGOSA VALLEY | 89301 | $3,518.76 | 89020 | $4,186.62 | $5,405.01 | $4,247.71 | $6,124.86 | $2,935.94 | $5,431.25 | $2,535.31 | $4,266.93 | $4,107.30 | $4,195.23 | $2,616.68 |

| RENO | 89310 | $3,568.23 | 89523 | $4,158.67 | $4,261.49 | $4,458.57 | $5,141.78 | $3,571.14 | $5,199.66 | $2,952.59 | $3,400.62 | $5,249.62 | $4,647.62 | $2,703.59 |

| SPARKS | 89311 | $3,529.65 | 89436 | $4,122.20 | $4,261.49 | $4,458.57 | $4,833.47 | $3,503.50 | $4,909.99 | $2,952.59 | $3,532.13 | $5,449.43 | $4,419.67 | $2,901.21 |

| GLENBROOK | 89314 | $3,612.73 | 89413 | $4,118.99 | $4,003.00 | $4,102.86 | $6,298.44 | $3,577.65 | $4,364.76 | $2,816.60 | $3,527.83 | $5,752.58 | $4,123.88 | $2,622.31 |

| MESQUITE | 89316 | $3,556.01 | 89027 | $4,096.49 | $5,424.60 | $4,247.71 | $3,881.42 | $3,477.01 | $5,878.22 | $3,278.18 | $2,580.52 | $4,677.73 | $4,412.55 | $3,106.95 |

| RENO | 89317 | $3,513.94 | 89508 | $4,093.90 | $4,185.59 | $4,458.57 | $5,141.78 | $3,536.94 | $4,998.72 | $2,878.87 | $3,638.66 | $5,065.80 | $4,171.21 | $2,862.88 |

| SPARKS | 89318 | $3,524.26 | 89441 | $4,089.00 | $4,261.49 | $4,458.57 | $4,833.47 | $3,176.90 | $4,932.22 | $3,000.32 | $3,638.66 | $5,305.79 | $4,419.67 | $2,862.88 |

| RENO | 89319 | $3,522.02 | 89511 | $4,083.86 | $4,024.07 | $4,458.57 | $5,085.68 | $3,577.65 | $4,674.50 | $3,021.96 | $3,417.76 | $5,205.80 | $4,726.47 | $2,646.15 |

| RENO | 89402 | $4,276.79 | 89557 | $4,083.67 | $4,261.49 | $4,247.71 | $5,141.78 | $3,717.85 | $5,477.70 | $2,952.59 | $3,400.62 | $4,285.73 | $4,647.62 | $2,703.59 |

| INCLINE VILLAGE | 89403 | $3,584.29 | 89451 | $4,083.26 | $4,313.24 | $4,102.86 | $3,619.53 | $3,691.95 | $4,736.62 | $3,043.41 | $3,728.02 | $5,707.18 | $5,026.90 | $2,862.88 |

| VERDI | 89404 | $3,474.95 | 89439 | $4,060.03 | $4,185.59 | $4,458.57 | $4,937.32 | $3,571.14 | $5,199.66 | $2,952.59 | $2,923.53 | $5,185.71 | $4,482.65 | $2,703.59 |

| BEATTY | 89405 | $3,551.51 | 89003 | $3,973.32 | $4,434.73 | $4,247.71 | $6,124.86 | $2,935.94 | $5,431.25 | $2,535.31 | $3,010.18 | $4,201.34 | $4,195.23 | $2,616.68 |

| RENO | 89406 | $3,411.08 | 89510 | $3,931.74 | $4,187.11 | $4,458.57 | $5,141.78 | $2,935.94 | $4,778.81 | $2,878.87 | $3,571.84 | $4,354.28 | $4,269.11 | $2,741.06 |

| CALIENTE | 89408 | $3,553.17 | 89008 | $3,789.18 | $5,424.60 | $4,247.71 | $3,314.88 | $2,935.94 | $4,831.57 | $2,535.31 | $3,752.54 | $4,373.32 | $3,859.26 | $2,616.68 |

| PANACA | 89409 | $3,538.25 | 89042 | $3,781.93 | $4,454.33 | $4,247.71 | $3,314.88 | $2,935.94 | $4,895.11 | $2,535.31 | $4,780.48 | $4,179.56 | $3,859.26 | $2,616.68 |

| GENOA | 89410 | $3,544.17 | 89411 | $3,779.91 | $4,003.00 | $4,102.86 | $3,783.38 | $3,481.28 | $4,275.90 | $2,816.60 | $3,544.88 | $5,276.91 | $3,891.96 | $2,622.31 |

| WASHOE VALLEY | 89411 | $3,779.91 | 89704 | $3,777.79 | $4,003.00 | $4,458.57 | $3,120.67 | $3,176.90 | $4,759.89 | $3,021.96 | $3,215.13 | $5,222.63 | $3,982.74 | $2,816.39 |

| MANHATTAN | 89412 | $3,576.38 | 89022 | $3,774.00 | $4,230.11 | $4,247.71 | $3,314.88 | $2,935.94 | $5,415.60 | $2,535.31 | $4,428.95 | $4,285.73 | $3,729.14 | $2,616.68 |

| HIKO | 89413 | $4,118.99 | 89017 | $3,760.00 | $4,434.73 | $4,247.71 | $3,314.88 | $2,935.94 | $5,326.95 | $2,535.31 | $3,724.69 | $4,285.73 | $4,177.38 | $2,616.68 |

| CARSON CITY | 89414 | $3,507.02 | 89705 | $3,752.62 | $4,003.00 | $4,102.86 | $3,783.38 | $3,481.28 | $4,633.92 | $2,816.60 | $3,211.56 | $4,643.14 | $4,224.20 | $2,626.26 |

| ALAMO | 89415 | $3,497.60 | 89001 | $3,750.89 | $4,434.73 | $4,247.71 | $3,314.88 | $2,935.94 | $5,342.60 | $2,535.31 | $3,752.54 | $4,158.84 | $4,169.63 | $2,616.68 |

| CARSON CITY | 89418 | $3,487.58 | 89703 | $3,740.66 | $4,003.00 | $4,102.86 | $3,783.38 | $3,517.09 | $4,618.27 | $2,618.76 | $3,200.55 | $4,730.13 | $4,237.79 | $2,594.78 |

| CARSON CITY | 89419 | $3,428.28 | 89706 | $3,722.98 | $4,003.00 | $4,102.86 | $3,783.38 | $3,481.28 | $4,633.92 | $2,633.46 | $3,223.90 | $4,696.04 | $4,077.19 | $2,594.78 |

| CARSON CITY | 89420 | $3,609.41 | 89702 | $3,712.29 | $4,003.00 | $4,102.86 | $3,783.38 | $3,481.28 | $4,618.27 | $2,633.46 | $3,019.64 | $4,616.94 | $4,237.79 | $2,626.26 |

| CARSON CITY | 89422 | $3,630.32 | 89701 | $3,701.65 | $4,003.00 | $4,102.86 | $3,783.38 | $3,481.28 | $4,618.27 | $2,633.46 | $3,019.64 | $4,611.23 | $4,168.61 | $2,594.78 |

| NIXON | 89423 | $3,599.50 | 89424 | $3,683.95 | $4,187.11 | $3,937.56 | $3,120.67 | $2,935.94 | $4,726.82 | $2,878.87 | $3,450.85 | $4,974.36 | $3,886.29 | $2,741.06 |

| PIOCHE | 89424 | $3,683.95 | 89043 | $3,666.14 | $4,454.33 | $4,247.71 | $3,314.88 | $2,935.94 | $4,895.11 | $2,535.31 | $3,395.54 | $4,406.65 | $3,859.26 | $2,616.68 |

| GOLDFIELD | 89425 | $3,470.37 | 89013 | $3,657.04 | $4,434.73 | $4,247.71 | $3,314.88 | $2,935.94 | $5,431.25 | $2,535.31 | $2,638.03 | $4,275.63 | $4,140.27 | $2,616.68 |

| VIRGINIA CITY | 89426 | $3,468.91 | 89440 | $3,650.41 | $4,024.07 | $3,937.56 | $3,120.67 | $2,994.32 | $5,109.35 | $2,772.10 | $3,208.96 | $4,260.84 | $4,382.27 | $2,693.93 |

| MINA | 89427 | $3,468.42 | 89422 | $3,630.32 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $5,307.76 | $2,535.31 | $3,064.82 | $4,285.73 | $4,218.99 | $2,573.74 |

| TONOPAH | 89428 | $3,598.18 | 89049 | $3,627.28 | $4,434.73 | $4,247.71 | $3,314.88 | $2,935.94 | $5,415.60 | $2,535.31 | $2,813.57 | $4,049.01 | $3,909.33 | $2,616.68 |

| WADSWORTH | 89429 | $3,538.92 | 89442 | $3,625.44 | $4,024.07 | $3,937.56 | $3,120.67 | $2,935.94 | $4,726.82 | $2,878.87 | $3,432.51 | $4,285.73 | $4,171.21 | $2,741.06 |

| SILVERPEAK | 89430 | $3,502.58 | 89047 | $3,617.00 | $4,434.73 | $4,247.71 | $3,314.88 | $2,935.94 | $5,251.67 | $2,535.31 | $2,638.03 | $4,285.73 | $3,909.33 | $2,616.68 |

| DUCKWATER | 89431 | $4,280.70 | 89314 | $3,612.73 | $4,032.11 | $4,247.71 | $3,314.88 | $2,935.94 | $5,415.60 | $2,535.31 | $2,889.62 | $4,285.73 | $3,853.70 | $2,616.68 |

| DYER | 89433 | $4,237.31 | 89010 | $3,611.34 | $4,434.73 | $4,247.71 | $3,314.88 | $2,935.94 | $5,251.67 | $2,535.31 | $2,420.49 | $4,215.68 | $4,140.27 | $2,616.68 |

| LUNING | 89434 | $4,217.12 | 89420 | $3,609.41 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $5,307.76 | $2,535.31 | $3,064.82 | $4,285.73 | $4,009.91 | $2,573.74 |

| GARDNERVILLE | 89436 | $4,122.20 | 89460 | $3,605.21 | $4,003.00 | $4,102.86 | $3,783.38 | $3,071.64 | $4,275.90 | $2,816.60 | $3,051.98 | $4,649.79 | $3,674.68 | $2,622.31 |

| MINDEN | 89438 | $3,517.20 | 89423 | $3,599.50 | $4,003.00 | $4,102.86 | $3,783.38 | $3,107.45 | $4,275.90 | $2,630.68 | $3,029.98 | $4,659.34 | $3,776.12 | $2,626.26 |

| SILVER CITY | 89439 | $4,060.03 | 89428 | $3,598.18 | $4,024.07 | $4,247.71 | $3,120.67 | $3,176.90 | $4,633.92 | $2,630.68 | $3,091.05 | $4,285.73 | $4,077.19 | $2,693.93 |

| DAYTON | 89440 | $3,650.41 | 89403 | $3,584.29 | $3,853.98 | $3,937.56 | $3,578.66 | $3,099.79 | $4,941.45 | $2,630.68 | $2,946.92 | $4,278.12 | $3,881.80 | $2,693.93 |

| GERLACH | 89441 | $4,089.00 | 89412 | $3,576.38 | $4,017.03 | $3,937.56 | $3,120.67 | $2,935.94 | $4,461.08 | $2,878.87 | $3,474.35 | $4,285.73 | $3,911.55 | $2,741.06 |

| AUSTIN | 89442 | $3,625.44 | 89310 | $3,568.23 | $4,012.51 | $4,247.71 | $3,314.88 | $2,935.94 | $4,899.81 | $2,535.31 | $2,944.42 | $4,285.73 | $3,932.26 | $2,573.74 |

| EUREKA | 89444 | $3,533.97 | 89316 | $3,556.01 | $4,032.11 | $4,247.71 | $3,314.88 | $2,935.94 | $4,899.81 | $2,535.31 | $3,107.57 | $4,277.60 | $3,635.45 | $2,573.74 |

| FERNLEY | 89445 | $3,413.48 | 89408 | $3,553.17 | $3,853.98 | $3,937.56 | $3,120.67 | $2,958.17 | $4,824.69 | $2,762.64 | $3,177.22 | $4,190.08 | $4,012.76 | $2,693.93 |

| EMPIRE | 89447 | $3,465.95 | 89405 | $3,551.51 | $4,017.03 | $3,937.56 | $3,120.67 | $2,935.94 | $4,461.08 | $2,878.87 | $3,432.60 | $4,104.03 | $3,886.29 | $2,741.06 |

| GARDNERVILLE | 89448 | $4,208.43 | 89410 | $3,544.17 | $3,853.98 | $4,102.86 | $3,398.05 | $3,107.45 | $4,275.90 | $2,816.60 | $2,928.33 | $4,712.22 | $3,674.68 | $2,571.69 |

| SILVER SPRINGS | 89449 | $4,255.26 | 89429 | $3,538.92 | $3,853.98 | $3,937.56 | $3,120.67 | $2,994.32 | $4,883.41 | $2,762.64 | $3,118.55 | $4,227.64 | $3,796.55 | $2,693.93 |

| GABBS | 89451 | $4,083.26 | 89409 | $3,538.25 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $5,001.20 | $2,535.31 | $2,760.38 | $4,285.73 | $3,909.33 | $2,573.74 |

| ROUND MOUNTAIN | 89460 | $3,605.21 | 89045 | $3,534.41 | $4,012.51 | $4,247.71 | $3,314.88 | $2,935.94 | $4,899.81 | $2,535.31 | $2,813.57 | $4,041.54 | $3,926.12 | $2,616.68 |

| WELLINGTON | 89501 | $4,308.50 | 89444 | $3,533.97 | $3,853.98 | $4,102.86 | $3,120.67 | $2,935.94 | $4,439.50 | $2,535.31 | $2,923.53 | $4,650.50 | $4,203.65 | $2,573.74 |

| BAKER | 89502 | $4,360.16 | 89311 | $3,529.65 | $4,032.11 | $4,247.71 | $3,314.88 | $2,935.94 | $4,775.13 | $2,535.31 | $2,699.29 | $4,285.73 | $3,853.70 | $2,616.68 |

| MC GILL | 89503 | $4,270.71 | 89318 | $3,524.26 | $4,032.11 | $4,247.71 | $3,314.88 | $2,935.94 | $4,778.71 | $2,535.31 | $2,889.62 | $4,037.98 | $3,853.70 | $2,616.68 |

| CRESCENT VALLEY | 89506 | $4,198.94 | 89821 | $3,522.86 | $4,032.11 | $4,247.71 | $3,120.67 | $2,935.94 | $4,613.21 | $2,535.31 | $2,972.63 | $4,285.73 | $3,911.55 | $2,573.74 |

| RUTH | 89508 | $4,093.90 | 89319 | $3,522.02 | $4,032.11 | $4,247.71 | $3,314.88 | $2,935.94 | $4,778.71 | $2,535.31 | $2,889.62 | $4,015.55 | $3,853.70 | $2,616.68 |

| ELY | 89509 | $4,318.19 | 89301 | $3,518.76 | $4,032.11 | $4,247.71 | $3,314.88 | $2,935.94 | $4,778.71 | $2,535.31 | $2,781.43 | $4,091.09 | $3,853.70 | $2,616.68 |

| VALMY | 89510 | $3,931.74 | 89438 | $3,517.20 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,460.46 | $2,535.31 | $2,921.11 | $4,285.73 | $3,911.55 | $2,741.06 |

| LUND | 89511 | $4,083.86 | 89317 | $3,513.94 | $4,032.11 | $4,247.71 | $3,314.88 | $2,935.94 | $4,769.26 | $2,535.31 | $2,870.11 | $4,285.73 | $3,531.72 | $2,616.68 |

| MONTELLO | 89512 | $4,226.10 | 89830 | $3,507.76 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,682.79 | $2,535.31 | $3,065.83 | $4,285.73 | $3,784.82 | $2,573.74 |

| GOLCONDA | 89519 | $4,293.24 | 89414 | $3,507.02 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,460.46 | $2,535.31 | $2,911.37 | $4,193.58 | $3,911.55 | $2,741.06 |

| WEST WENDOVER | 89521 | $4,205.94 | 89883 | $3,504.32 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,682.79 | $2,535.31 | $3,065.83 | $4,251.31 | $3,784.82 | $2,573.74 |

| SMITH | 89523 | $4,158.67 | 89430 | $3,502.58 | $4,003.00 | $3,937.56 | $3,120.67 | $2,935.94 | $4,439.50 | $2,535.31 | $2,941.77 | $4,196.68 | $4,341.67 | $2,573.74 |

| HAWTHORNE | 89557 | $4,083.67 | 89415 | $3,497.60 | $3,849.47 | $4,247.71 | $3,120.67 | $2,935.94 | $4,399.49 | $2,535.31 | $3,064.82 | $4,238.98 | $4,009.91 | $2,573.74 |

| IMLAY | 89701 | $3,701.65 | 89418 | $3,487.58 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,775.11 | $2,535.31 | $2,586.28 | $4,285.73 | $3,635.45 | $2,741.06 |

| DENIO | 89702 | $3,712.29 | 89404 | $3,474.95 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,372.72 | $2,535.31 | $2,586.28 | $4,285.73 | $3,911.55 | $2,741.06 |

| BATTLE MOUNTAIN | 89703 | $3,740.66 | 89820 | $3,471.07 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,519.53 | $2,535.31 | $2,620.81 | $4,232.92 | $3,911.55 | $2,573.74 |

| OROVADA | 89704 | $3,777.79 | 89425 | $3,470.37 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,379.95 | $2,535.31 | $2,596.03 | $4,222.97 | $3,911.55 | $2,741.06 |

| LAMOILLE | 89705 | $3,752.62 | 89828 | $3,470.27 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,684.24 | $2,631.58 | $3,065.83 | $4,285.73 | $3,312.12 | $2,573.74 |

| PARADISE VALLEY | 89706 | $3,722.98 | 89426 | $3,468.91 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,335.52 | $2,535.31 | $2,596.03 | $4,285.73 | $3,878.60 | $2,741.06 |

| SCHURZ | 89801 | $3,451.43 | 89427 | $3,468.42 | $3,849.47 | $4,247.71 | $3,120.67 | $2,935.94 | $4,450.28 | $2,535.31 | $2,799.99 | $4,285.73 | $3,885.34 | $2,573.74 |

| YERINGTON | 89815 | $3,434.84 | 89447 | $3,465.95 | $3,853.98 | $3,937.56 | $3,120.67 | $2,935.94 | $4,439.50 | $2,535.31 | $2,936.92 | $4,095.71 | $4,109.98 | $2,693.93 |

| DEETH | 89820 | $3,471.07 | 89823 | $3,464.10 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,727.26 | $2,535.31 | $2,624.45 | $4,285.73 | $3,745.13 | $2,573.74 |

| JACKPOT | 89821 | $3,522.86 | 89825 | $3,463.15 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,578.64 | $2,535.31 | $2,624.45 | $4,424.85 | $3,745.13 | $2,573.74 |

| CARLIN | 89822 | $3,456.73 | 89822 | $3,456.73 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,580.09 | $2,535.31 | $3,027.03 | $4,123.70 | $3,577.95 | $2,573.74 |

| ELKO | 89823 | $3,464.10 | 89801 | $3,451.43 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,684.24 | $2,631.58 | $2,667.27 | $4,230.11 | $3,577.95 | $2,573.74 |

| RUBY VALLEY | 89825 | $3,463.15 | 89833 | $3,437.66 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,602.12 | $2,535.31 | $2,624.45 | $4,285.73 | $3,605.85 | $2,573.74 |

| SPRING CREEK | 89828 | $3,470.27 | 89815 | $3,434.84 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,684.24 | $2,631.58 | $2,662.57 | $4,334.73 | $3,312.12 | $2,573.74 |

| TUSCARORA | 89830 | $3,507.76 | 89834 | $3,434.38 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,564.00 | $2,535.31 | $2,657.68 | $4,285.73 | $3,577.95 | $2,573.74 |

| MOUNTAIN CITY | 89831 | $3,431.30 | 89831 | $3,431.30 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,505.15 | $2,535.31 | $2,685.71 | $4,285.73 | $3,577.95 | $2,573.74 |

| WELLS | 89832 | $3,411.87 | 89835 | $3,430.06 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,682.79 | $2,535.31 | $2,576.54 | $3,998.00 | $3,784.82 | $2,573.74 |

| LOVELOCK | 89833 | $3,437.66 | 89419 | $3,428.28 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,386.51 | $2,535.31 | $2,586.28 | $4,081.33 | $3,635.45 | $2,741.06 |

| WINNEMUCCA | 89834 | $3,434.38 | 89445 | $3,413.48 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,359.85 | $2,453.46 | $2,521.14 | $4,106.98 | $3,635.45 | $2,741.06 |

| OWYHEE | 89835 | $3,430.06 | 89832 | $3,411.87 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,505.15 | $2,535.31 | $2,522.37 | $4,254.77 | $3,577.95 | $2,573.74 |

| FALLON | 89883 | $3,504.32 | 89406 | $3,411.08 | $3,853.98 | $4,247.71 | $3,120.67 | $2,899.82 | $4,391.57 | $2,572.09 | $2,876.00 | $4,060.20 | $3,928.62 | $2,160.12 |

What are the cheapest car insurance rates by city?

Let’s explore the cheapest rates in Nevada by city.

| City | Average Grand Total |

|---|---|

| FALLON | $3,411.08 |

| OWYHEE | $3,411.87 |

| WINNEMUCCA | $3,413.48 |

| LOVELOCK | $3,428.28 |

| WELLS | $3,430.06 |

| MOUNTAIN CITY | $3,431.30 |

| TUSCARORA | $3,434.38 |

| SPRING CREEK | $3,434.84 |

| RUBY VALLEY | $3,437.66 |

| ELKO | $3,451.43 |

| CARLIN | $3,456.72 |

| JACKPOT | $3,463.15 |

| DEETH | $3,464.10 |

| YERINGTON | $3,465.95 |

| SCHURZ | $3,468.42 |

| PARADISE VALLEY | $3,468.91 |

| LAMOILLE | $3,470.27 |

| OROVADA | $3,470.37 |

| BATTLE MOUNTAIN | $3,471.07 |

| DENIO | $3,474.95 |

| IMLAY | $3,487.58 |

| HAWTHORNE | $3,497.60 |

| SMITH | $3,502.58 |

| WEST WENDOVER | $3,504.32 |

| GOLCONDA | $3,507.01 |

| MONTELLO | $3,507.76 |

| LUND | $3,513.95 |

| VALMY | $3,517.20 |

| ELY | $3,518.76 |

| RUTH | $3,522.02 |

| CRESCENT VALLEY | $3,522.86 |

| MC GILL | $3,524.26 |

| BAKER | $3,529.65 |

| WELLINGTON | $3,533.97 |

| ROUND MOUNTAIN | $3,534.41 |

| GABBS | $3,538.25 |

| SILVER SPRINGS | $3,538.93 |

| EMPIRE | $3,551.51 |

| FERNLEY | $3,553.17 |

| EUREKA | $3,556.01 |

| AUSTIN | $3,568.23 |

| GARDNERVILLE | $3,574.70 |

| GERLACH | $3,576.38 |

| DAYTON | $3,584.29 |

| SILVER CITY | $3,598.18 |

| MINDEN | $3,599.50 |

| LUNING | $3,609.41 |

| DYER | $3,611.34 |

| DUCKWATER | $3,612.73 |

| SILVERPEAK | $3,617.00 |

| WADSWORTH | $3,625.44 |

| TONOPAH | $3,627.28 |

| MINA | $3,630.32 |

| VIRGINIA CITY | $3,650.41 |

| GOLDFIELD | $3,657.04 |

| PIOCHE | $3,666.14 |

| NIXON | $3,683.95 |

| CARSON CITY | $3,726.04 |

| ALAMO | $3,750.89 |

| HIKO | $3,760.00 |

| MANHATTAN | $3,774.01 |

| WASHOE VALLEY | $3,777.79 |

| GENOA | $3,779.91 |

| PANACA | $3,781.93 |

| CALIENTE | $3,789.18 |

| BEATTY | $3,973.32 |

| VERDI | $4,060.03 |

| INCLINE VILLAGE | $4,083.26 |

| GLENBROOK | $4,118.99 |

| MESQUITE | $4,155.23 |

| SPARKS | $4,177.26 |

| AMARGOSA VALLEY | $4,186.62 |

| RENO | $4,194.89 |

| BUNKERVILLE | $4,203.71 |

| ZEPHYR COVE | $4,208.43 |

| SUN VALLEY | $4,237.30 |

| STATELINE | $4,255.26 |

| CRYSTAL BAY | $4,276.79 |

| MERCURY | $4,320.45 |

| MOAPA | $4,475.32 |

| PAHRUMP | $4,489.20 |

| CAL NEV ARI | $4,495.80 |

| OVERTON | $4,527.30 |

| LOGANDALE | $4,545.43 |

| INDIAN SPRINGS | $4,548.91 |

| LAUGHLIN | $4,572.33 |

| SEARCHLIGHT | $4,576.29 |

| BOULDER CITY | $4,614.02 |

| JEAN | $4,706.38 |

| COYOTE SPRINGS | $4,763.30 |

| SLOAN | $5,508.41 |

| BLUE DIAMOND | $5,596.93 |

| HENDERSON | $5,803.78 |

| NELLIS AFB | $6,248.03 |

| NORTH LAS VEGAS | $6,310.63 |

| LAS VEGAS | $6,621.74 |

Who has the cheapest car insurance in Nevada? As you can see, the cheapest auto insurance nevada”}” data-sheets-userformat=”{“2″:513,”3”:{“1″:0},”12″:0}”>cheapest auto insurance in Nevada seems to be in Fallon.

Like the data above, large cities like Las Vegas have higher rates than smaller towns, such as Paradise Valley.

What are Nevada’s minimum coverage for auto insurance policies?

Minimum coverage and rates vary from state to state. Compare state to state below:

It’s unsafe to drive without insurance, and in Nevada, you must have it if you drive. Nevada state insurance laws require drivers to buy car insurance in the following minimum coverage amounts:

| Insurance Required | Coverage |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $20,000 per accident |

More about these coverages and why you need them appear below.

- $20,000 per accident to cover the total property damage from an accident the driver caused

- $25,000 per person to cover the bodily injury or death of any person from an accident the driver caused

- $50,000 per accident to cover total bodily injury liability or death liability that occur from a crash the driver caused

Liability coverage exists to cover things like property damage expenses, medical bills, and other costs a driver, passenger, or pedestrian who suffers losses incurs in an accident you cause.

But those requirements are just the minimum. To better protect yourself and others, it makes sense to buy more coverage than required, if you can afford it.

Also, in Nevada, whoever causes an accident is responsible, or “at fault,” for any damages. If you lack enough coverage to pay for all the costs, you may need to pay out of pocket.

Your insurance won’t cover damages someone else causes. For more protection, you may need MedPay, Personal Injury Protection (PIP), or collision coverage.

This video further explains liability insurance in Nevada:

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there forms of financial responsibility for auto insurance premiums?

If an officer pulls you over in Nevada, you’re required to show proof of insurance, such as your insurance card or the declarations page of your current insurance policy.

Your card is also acceptable in electronic form on a mobile device, too. It should be easy to read and show your name and policy information, just like the paper card.

There’s also the LIVE program from the Nevada Department of Motor Vehicles (DMV), which can verify your coverage in real-time.

Otherwise, if you can’t provide proof or aren’t covered, an officer may give you a ticket.

If your license has been revoked, an SR-22 form is your proof of financial responsibility until your license is reinstated. The Nevada DMV requires drivers to update these forms for three years, otherwise, the DMV will suspend their licenses, and a new three-year period to maintain the SR-22 will begin.

If you are required to maintain an SR-22 filing as a condition of your reinstatement, you must maintain it for three years from the date you reinstate your driver’s license.

The DMV asks drivers to ensure they have the correct address on their driver’s licenses to ensure they receive DMV notices.

What percentage of income are car insurance rates?

The average Nevada resident’s annual 2017 disposable income — after they paid taxes — was $46,159.

With an average yearly cost of roughly $1,100, Nevada residents spend about 3 percent of their income on car insurance premiums. Average car insurance rates in Nevada cost on average $200 less than the national average of $1,311 per year.

From 2012 – 2014, car insurance premium costs in Nevada rose by about $60, while the percentage of the income spent remained steady.

Their average cost of premiums was higher than those of neighboring states California, Idaho, Utah, Oregon, and Arizona.

Arizona came close to matching the percentage that Nevadans pay for insurance, but the rest of the border states paid rates closer to 2 percent from 2012 – 2014. All border states had average annual premium rates under $1,000.

Out of an average monthly income of $3,850 to cover expenses such as housing and food, $92 of Nevada drivers’ earnings go to insurance.

Is there additional car insurance coverage?

The table below, filled with data from NAIC, shows Nevada car insurers’ average loss ratios for Medical Payments (MedPay) and uninsured/underinsured motorist coverage.

An insurer’s loss ratio compares how much they earn in premiums to the amount paid in claims. For example, a loss ratio of 60 percent means the company pays an average of $6o in claims for every hundred dollars in earned premium.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 79.00 | 78.32 | 81.58 |

| Uninsured/Underinsured Motorist Coverage | 98.40 | 107.13 | 101.86 |

As shown above, some Nevada car insurers had loss ratios over 100 percent. A ratio over 100 reveals that the company paid more in claims than it earned on premiums, which signals they’re taking a loss on those claims. For the most part, the table shows that Nevada car insurance companies have made profits despite the claims filed.

On the other hand, the table also shows Nevada auto insurance companies are enjoying average gains to losses in a healthy range for MedPay coverage. The NAIC’s 2018 Auto Insurance Database Report has loss ratio data for Personal Injury Protection (PIP).

MedPay and Personal Injury Protection (PIP) cover the costs of injuries you or your passengers suffer from an accident, regardless of who caused it. It will also cover you if you’re in a pedestrian/motor vehicle accident.

If you get in an accident with an at-fault motorist who lacks coverage or doesn’t have enough of it to pay the cost of damages, then uninsured/underinsured motorist insurance will cover those costs.

Nevada currently ranks 29th nationwide for uninsured motorists.

More coverage is optional, but it’s worth considering for greater protection after an accident.

The video below details how much car insurance Nevada drivers need:

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there car insurance add-ons, endorsements, and riders?

Here are more coverage options you can add to a basic Nevada car insurance policy:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Pay-as-You Drive or Usage-Based Insurance

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

To get the best Nevada car insurance quotes, you’ll likely have to go to one of the top Nevada car insurance companies. Read on to learn about the best in the state.

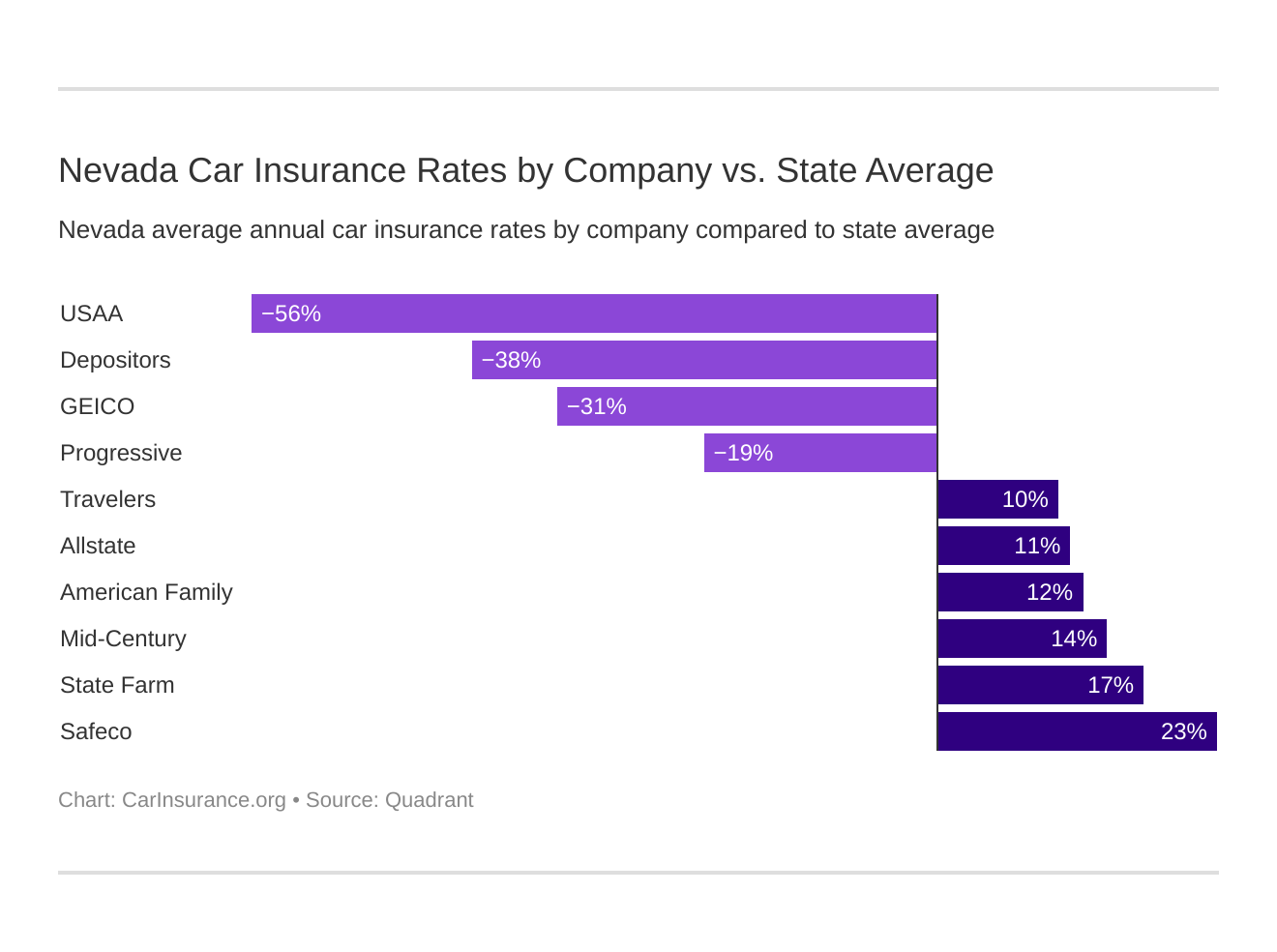

What are some of the best Nevada car insurance companies?

With so many insurance providers available in The Silver State, finding the best one for you and your needs can be confusing.

Now, you can breathe easy. Here we’ll cover insurer reviews and ratings to help you break down the pros and cons of each and narrow down your choices.

Keep reading to discover more about the top carriers in Nevada.

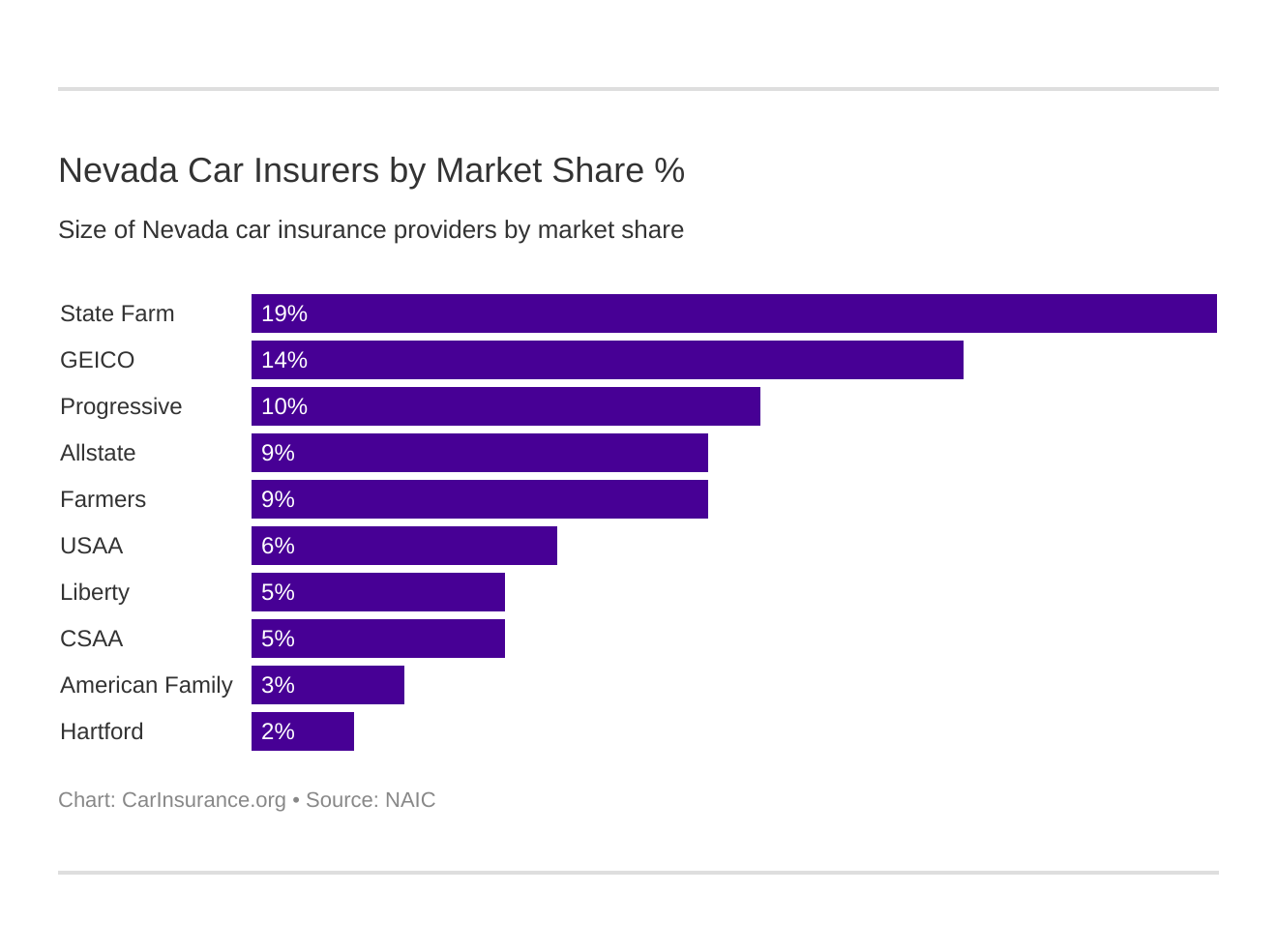

What’s the financial rating of the largest car insurance companies?

A.M. Best rates insurers based on their financial strength. Let’s see how the largest ones rank in Nevada.

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Progressive Group | A+ |

| Allstate Insurance Group | A+ |

| Farmers Insurance Group | A |

| USAA Group | A++ |

| Liberty Mutual Group | A |

| CSAA Insurance Group | A |

| American Family Insurance Group | A |

| Hartford Fire & Casualty Group | A+ |

State Farm and USAA are among those that received the highest rating of “A++,” showing they have strong financial resources and can pay large amounts of claims.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which car insurance companies have the best ratings?

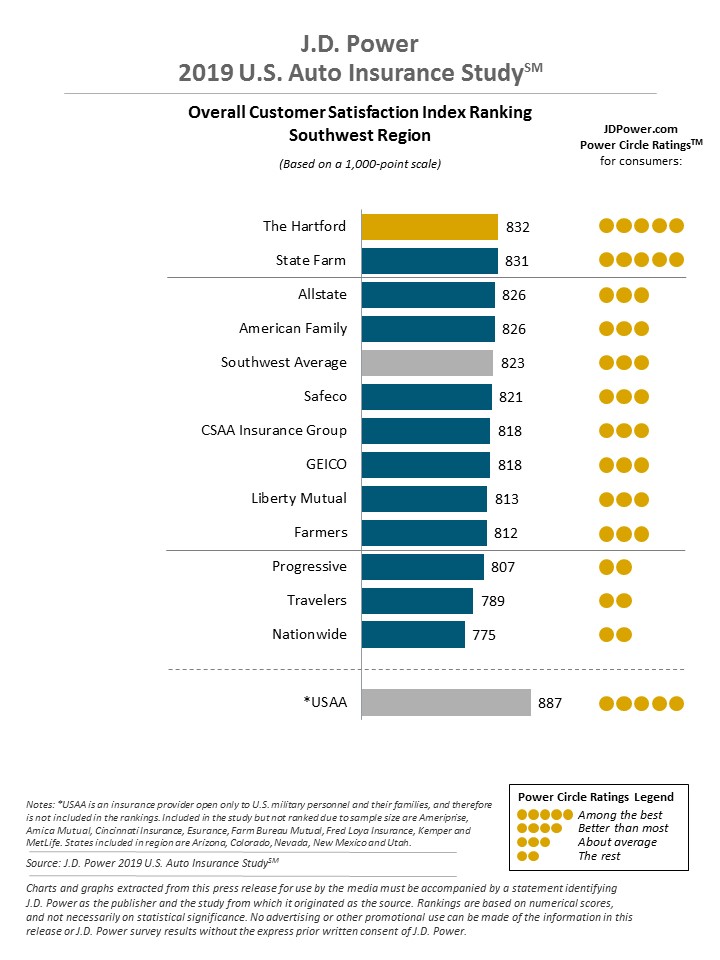

J.D. Power’s Auto Insurance Study measures insurance companies’ overall customer satisfaction ratings yearly.

Of the top 10 companies, The Hartford and State Farm earned five of J.D. Power’s “Power Circle ratings,” which means their service is “among the best.”

Which car insurance companies have the most complaints in Nevada?

The Nevada Division of Insurance’s 2018 Consumer Complaint Report reveals which companies receive the most complaints.

| Insurance Company | Date Complaint Opened | Date Complaint Closed | Coverage Level 1 | Coverage Level 2 | Reason for Complaint | Reason Type | Department of Insurance Findings |

|---|---|---|---|---|---|---|---|

| KEY INSURANCE COMPANY | 01-02-2018 | 02-02-2018 | Private Passenger | Collision | Claim Handling | Delay | Compromised Settlement/Resol. |

| HORACE MANN INSURANCE COMPANY | 01-04-2018 | 03-02-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| American Family Mutual Insurance Company, S.I. | 01-04-2018 | 02-08-2018 | Private Passenger | Collision | Claim Handling | State Specific | Company Position Upheld |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-09-2018 | 03-08-2018 | Private Passenger | Collision | Claim Handling | Adjuster Handling Delay | Claim Settled |

| Geico Advantage Insurance Company | 01-10-2018 | 01-31-2018 | Private Passenger | Collision | Claim Handling | Denial of Claim Unsatisfactory Settle Offer | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-15-2018 | 03-12-2018 | Private Passenger | Collision | Claim Handling | Adjuster Handling Delay | Claim Settled |

| BARSANTI, JOHN S FARMERS INSURANCE EXCHANGE | 01-18-2018 | 03-12-2018 | Private Passenger | Collision | Claim Handling | Adjuster Handling Coordination of Benefits Unsatisfactory Settle Offer | Company Position Upheld No Further Action Req/Rqd |

| American Family Mutual Insurance Company, S.I. | 01-24-2018 | 03-08-2018 | Private Passenger | Collision | Claim Handling | Delay | No Further Action Req/Rqd |

| STATE FARM FIRE & CASUALTY COMPANY | 01-27-2018 | 01-30-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| MENDOTA INSURANCE COMPANY | 01-29-2018 | 03-28-2018 | Private Passenger | Collision | Claim Handling | Delay Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-30-2018 | 03-08-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| FARMERS INSURANCE EXCHANGE | 02-06-2018 | 03-14-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-07-2018 | 03-07-2018 | Private Passenger | Collision | Claim Handling | Denial of Claim | Company Position Upheld |

| Geico CASUALTY COMPANY | 02-09-2018 | 03-01-2018 | Private Passenger | Collision | Claim Handling | Denial of Claim | Company Position Upheld |

| Geico Secure Insurance Company | 02-12-2018 | 03-14-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 02-12-2018 | 03-14-2018 | Private Passenger | Collision | Claim Handling | Delay | No Further Action Req/Rqd |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 02-13-2018 | 03-16-2018 | Private Passenger | Collision | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| UNITED SERVICES AUTOMOBILE ASSOCIATION | 02-14-2018 | 03-26-2018 | Private Passenger | Collision | Claim Handling | Delay | Claim Settled |

| Self Insured Services Company | 02-28-2018 | 03-05-2018 | Private Passenger | Collision | Claim Handling | Delay | Complaint Withdrawn |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 03-09-2018 | 03-29-2018 | Private Passenger | Collision | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| NEVADA GENERAL INSURANCE COMPANY | 01-10-2018 | 03-02-2018 | Private Passenger | Comprehensive | Claim Handling | Delay | Claim Settled |

| KEY INSURANCE COMPANY NMSW INC | 01-25-2018 | 02-09-2018 | Private Passenger | Comprehensive | Policyholder Service | Coverage Question Payment Not Credited | Compromised Settlement/Resol. Compromised Settlement/Resol. |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 02-01-2018 | 03-15-2018 | Private Passenger | Comprehensive | Claim Handling | Denial of Claim | Company Position Upheld |

| NEVADA GENERAL INSURANCE COMPANY | 01-30-2018 | 02-16-2018 | Private Passenger | Comprehensive | Claim Handling | Denial of Claim | State Specific |

| NEVADA GENERAL INSURANCE COMPANY | 01-30-2018 | 03-30-2018 | Private Passenger | Comprehensive | Claim Handling | Denial of Claim | Company Position Upheld |

| MID-CENTURY INSURANCE COMPANY PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-02-2018 | 02-14-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-02-2018 | 01-30-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-02-2018 | 02-28-2018 | Private Passenger | Liability | Claim Handling Policyholder Service | Coverage Question Post Claim Underwriting | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-02-2018 | 01-03-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-02-2018 | 01-22-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| STATE FARM FIRE & CASUALTY COMPANY | 01-02-2018 | 01-03-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| NATIONWIDE MEMBER SOLUTIONS AGENCY, INC VICTORIA FIRE & CASUALTY COMPANY | 01-02-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service Underwriting | Coverage Question State Specific | Compromised Settlement/Resol. No Further Action Req/Rqd |

| Geico Advantage Insurance Company | 01-02-2018 | 01-16-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| NEVADA GENERAL INSURANCE COMPANY | 01-02-2018 | 03-02-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| ALLSTATE PROPERTY & CASUALTY INSURANCE COMPANY | 01-02-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service Underwriting | CLUE Reports Coverage Question | Company Position Upheld |

| JAMES RIVER INSURANCE COMPANY | 01-03-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| LARIOS GALVEZ, CARLOS OMAR OMAR STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY WHITMORE, BROOKS ELLIOT | 01-03-2018 | 03-01-2018 | Private Passenger | Liability | Policyholder Service Underwriting | Cancellation Coverage Question | Company Position Upheld No Further Action Req/Rqd No Further Action Req/Rqd |

| MID-CENTURY INSURANCE COMPANY | 01-03-2018 | 01-12-2018 | Private Passenger | Liability | Claim Handling | Adjuster Handling Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| American Family Insurance Company | 01-03-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| BAXTER-BARTON, SUSAN N LUNDEEN AND ASSOCIATES LLC MENDAKOTA INSURANCE COMPANY | 01-03-2018 | 03-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ESIS INC HERTZ CLAIM MANAGEMENT CORPORATION | 01-03-2018 | 03-23-2018 | Private Passenger | Liability | Claim Handling | Delay | Compromised Settlement/Resol. |

| LM GENERAL INSURANCE COMPANY | 01-03-2018 | 03-09-2018 | Private Passenger | Liability | Underwriting | Nonrenewal | Company Position Upheld |

| Geico CASUALTY COMPANY | 01-04-2018 | 01-17-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PERMANENT GENERAL ASSURANCE CORPORATION | 01-04-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PLAIN INC PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-04-2018 | 02-02-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| POLISEEK AIS INSURANCE SOLUTIONS INC PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-04-2018 | 02-05-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question Premium Notice/Billing Premium Refund | Company Position Upheld No Further Action Req/Rqd |

| ALLSTATE PROPERTY & CASUALTY INSURANCE COMPANY | 01-04-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-04-2018 | 02-27-2018 | Private Passenger | Liability | Policyholder Service | Premium Notice/Billing | No Further Action Req/Rqd |

| ACCEPTANCE INS AGENCY OF TENNESSEE INC NATIONAL GENERAL INSURANCE COMPANY | 01-04-2018 | 02-02-2018 | Private Passenger | Liability | Marketing & Sales Policyholder Service | Coverage Question State Specific | Company Position Upheld No Further Action Req/Rqd |

| FREEWAY INSURANCE SERVICES OFNEVADA, INC KEY INSURANCE COMPANY | 01-04-2018 | 01-23-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY American Family Mutual Insurance Company, S.I. | 01-05-2018 | 03-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd No Further Action Req/Rqd |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-05-2018 | 02-21-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| Geico CASUALTY COMPANY | 01-05-2018 | 01-18-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Claim Settled |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-06-2018 | 01-19-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-08-2018 | 02-01-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| NEVADA GENERAL INSURANCE COMPANY | 01-08-2018 | 03-29-2018 | Private Passenger | Liability | Claim Handling | Delay Denial of Claim | Compromised Settlement/Resol. |

| NATIONWIDE AFFINITY INSURANCE COMPANY OF AMERICA | 01-08-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| 21st CENTURY INSURANCE COMPANY | 01-08-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| CSAA General Insurance Company | 01-08-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 01-09-2018 | 01-09-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-09-2018 | 02-07-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| Geico CASUALTY COMPANY | 01-09-2018 | 03-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| PROPERTY AND CASUALTY INSURANCE COMPANY OF HARTFORD | 01-09-2018 | 02-08-2018 | Private Passenger | Liability | Marketing & Sales | Misrepresentation Premiums Misquoted | Compromised Settlement/Resol. |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-10-2018 | 02-16-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| Geico CASUALTY COMPANY | 01-10-2018 | 02-08-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 01-10-2018 | 01-24-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| RENO SPARKS CAB COMPANY | 01-10-2018 | 01-22-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | No Jurisdiction |

| CSAA General Insurance Company | 01-10-2018 | 02-16-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 01-10-2018 | 02-02-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| USAA GENERAL INDEMNITY COMPANY | 01-11-2018 | 03-02-2018 | Private Passenger | Liability | Claim Handling | Subrogation | Company Position Upheld No Further Action Req/Rqd |

| Geico Choice Insurance Company | 01-11-2018 | 01-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| USAA GENERAL INDEMNITY COMPANY | 01-11-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| PROGRESSIVE DIRECT INSURANCE COMPANY | 01-11-2018 | 03-29-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 01-11-2018 | 01-12-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-11-2018 | 01-29-2018 | Private Passenger | Liability | Claim Handling | Delay | Compromised Settlement/Resol. |

| Geico Choice Insurance Company | 01-12-2018 | 01-17-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | No Further Action Req/Rqd |

| Geico GENERAL INSURANCE COMPANY | 01-12-2018 | 02-05-2018 | Private Passenger | Liability | Underwriting | Premium & Rating | Company Position Upheld |

| CSAA General Insurance Company | 01-12-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| 21ST CENTURY ASSURANCE COMPANY | 01-12-2018 | 02-07-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ACCEPTANCE INS AGENCY OF TENNESSEE INC Geico Advantage Insurance Company MENDAKOTA INSURANCE COMPANY | 01-12-2018 | 01-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld Company Position Upheld Company Position Upheld |

| FARMERS INSURANCE EXCHANGE | 01-12-2018 | 02-09-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| HENDRIX INSURANCE, L.L.C. HENRY, LISA ANN PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-12-2018 | 02-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd No Further Action Req/Rqd |

| STANDARD FIRE INSURANCE COMPANY (THE) | 01-13-2018 | 02-06-2018 | Private Passenger | Liability | Claim Handling | Delay Denial of Claim | Referred for Disciplinary Act. |

| Geico Choice Insurance Company | 01-13-2018 | 01-29-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. |

| Hasson, Cheryl A STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-14-2018 | 03-08-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY FIRST CLASS INSURANCE SERVICES INC | 01-16-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| MERCURY CASUALTY COMPANY | 01-16-2018 | 02-14-2018 | Private Passenger | Liability | Claim Handling | Delay | No Further Action Req/Rqd |

| AMERICAN ACCESS CASUALTY COMPANY | 01-17-2018 | 02-23-2018 | Private Passenger | Liability | Claim Handling | Delay | Company Position Upheld |

| AMERICAN ACCESS CASUALTY COMPANY | 01-17-2018 | 03-02-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld No Further Action Req/Rqd |

| KEY INSURANCE COMPANY | 01-17-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| DIVISION OF INSURANCE | 01-17-2018 | 01-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Insufficient Information |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-18-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| KEY INSURANCE COMPANY | 01-18-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Compromised Settlement/Resol. |

| FARMERS INSURANCE EXCHANGE | 01-18-2018 | 01-31-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question Premium Refund | Company Position Upheld |

| Geico Advantage Insurance Company | 01-18-2018 | 02-27-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| ALLSTATE FIRE AND CASUALTY INSURANCE COMPANY | 01-19-2018 | 03-01-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| STATE FARM FIRE & CASUALTY COMPANY | 01-22-2018 | 02-28-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| LIBERTY MUTUAL FIRE INSURANCE COMPANY | 01-22-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Delay | Claim Settled |

| AMERICAN ACCESS CASUALTY COMPANY GOMEZ ENTERPRISE GROUP INC | 01-22-2018 | 03-13-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| USAA CASUALTY INSURANCE COMPANY | 01-22-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Claim Settled |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-23-2018 | 02-02-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Company Position Upheld |

| HANSEN & HANSEN AGENCY INC KEY INSURANCE COMPANY | 01-23-2018 | 03-13-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld No Further Action Req/Rqd |

| COUNTRY PREFERRED INSURANCE COMPANY EVANS, BRIDGET MARIE | 01-23-2018 | 02-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| NEVADA DIVISION OF INSURANCE | 01-23-2018 | 01-30-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Insufficient Information |

| COAST NATIONAL INSURANCE COMPANY | 01-23-2018 | 03-12-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim Unsatisfactory Settle Offer | Company Position Upheld |

| Geico Advantage Insurance Company | 01-23-2018 | 02-09-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| LM GENERAL INSURANCE COMPANY | 01-23-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld Compromised Settlement/Resol. |

| STATE FARM FIRE & CASUALTY COMPANY | 01-24-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Denial of Claim | Claim Settled |

| ESURANCE PROPERTY AND CASUALTY INSURANCE COMPANY | 01-24-2018 | 03-19-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| ALLSTATE INDEMNITY COMPANY | 01-24-2018 | 02-14-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Overturned |

| STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-24-2018 | 03-05-2018 | Private Passenger | Liability | Claim Handling | Unsatisfactory Settle Offer | Company Position Upheld |

| ABCEDE INSURANCE AGENCY LLC SHELTER MUTUAL INSURANCE COMPANY | 01-24-2018 | 02-26-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Compromised Settlement/Resol. No Further Action Req/Rqd |

| DUFFIELD, ROXANNE STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY | 01-24-2018 | 02-26-2018 | Private Passenger | Liability | Marketing & Sales Policyholder Service | Coverage Question Failure to Submit Application | Compromised Settlement/Resol. No Further Action Req/Rqd |

| NATIONWIDE AFFINITY INSURANCE COMPANY OF AMERICA | 01-25-2018 | 03-06-2018 | Private Passenger | Liability | Policyholder Service | Coverage Question | Company Position Upheld |

| FAMILY INSURANCE STORE INC (THE) PROGRESSIVE NORTHERN INSURANCE COMPANY | 01-25-2018 | 03-08-2018 | Private Passenger | Liability | Claim Handling | Delay | Compromised Settlement/Resol. |