Connecticut Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 9.40

A collection of seaside cities and prestigious colleges, Connecticut features an array of state attractions. For those that live in Connecticut, though, vehicle transportation to Connecticut’s attractions requires car insurance.

But with over two million vehicles registered in Connecticut, there is a dizzying amount of providers offering car insurance!

It can be hard to fish out the information you need to make a decision, and even harder to find a provider that is right for you. We want to help you with this process, as well as provide you with important information about providers, state requirements, laws, and can’t-miss driving facts.

Read this comprehensive guide to learn about all this and much more! Want to start comparing rates today? Enter your zip code in our FREE online tool above!

How to Get Connecticut Car Insurance Coverage and Rates

With so many rates and coverage options out there, it can be difficult to pick out ones that fit both your wallet and your needs. Additionally, every state has different coverage requirements, making moving even more confusing.

Don’t worry, we are going to help guide you through the process of picking out coverage options by explaining what you need and what you should have.

Keep scrolling to learn about Connecticut’s car insurance requirements and average rates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s Connecticut Minimum Car Insurance Coverage?

It is against the law to drive without car insurance in Connecticut. At the bare MINIMUM, Connecticut requires drivers to have bodily injury liability, property damage, and uninsured/underinsured coverages.

Connecticut requires bodily injury and property damage coverages in the following amounts.

- $25,000 to cover injury costs of one person in an accident

- $50,000 to cover injury costs of all people in an accident

- $20,000 to cover property damages from an accident

You are also required to have uninsured and underinsured coverage, the importance of which we will cover shortly.

If you are a motorcyclist, Connecticut requires you to carry the same coverages as motor vehicle owners.

What are the Forms of Financial Responsibility?

So how do you prove that you have car insurance? In Connecticut, you must provide a form of proof of car insurance, also known as a form of financial responsibility.

According to the DMV, the following are acceptable forms of proof of financial responsibility.

- A declaration page

- Valid permanent insurance card

The following forms are NOT acceptable.

- Temporary insurance cards

- Bills

- Insurance binders

You must provide acceptable proof of financial responsibility in the following situations.

- Traffic stop

- Registering your car

- When in an accident

If you are unable to provide proof of insurance in a timely manner or don’t have insurance, you face penalties such as fines, jail time, or license/registration suspension.

What Percentage of Income are Insurance Premiums?

Your per capita disposable income is the amount of money you have to spend or save after taxes. We want to take a look at how much Connecticut residents have to spend each year, and how much car insurance takes out of that budget.

Connecticut resident’s average per capita disposable income is $56,186, which is about $16,000 more than the countrywide average!

The bad news is that while the average Connecticut resident makes more than other U.S. state residents, Connecticut’s insurance rates are also HIGHER than the countrywide average.

The cost of full coverage in Connecticut is $1,132, which is $151 more than most Americans pay.

This means that out of a monthly budget of $4,682, about $94 is going to purchase car insurance. This isn’t terrible, but it does pay to shop around for auto insurance providers and the lowest rates to make sure you are getting the best deal possible!

After all, that monthly budget is needed for necessities other than car insurance, such as groceries, rent, and gas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Average Monthly Car Insurance Rates in CT (Liability, Collision, Comprehensive)

Let’s take a look at the average costs of core auto insurance coverage in Connecticut and how they compare to the nationwide averages.

| Coverage Type | Average Annual Cost |

|---|---|

| Liability | $650.94 |

| Collision | $368.51 |

| Comprehensive | $131.62 |

| Full Coverage Annual Premium | $1,151.07 |

Because the nationwide overall cost for car insurance is $1,009.38, Connecticut’s costs are a little on the higher end.

Is There an Additional Coverage?

Remember when we said Connecticut requires uninsured and underinsured coverage? Well, we are going to take a look at this coverage and why it is important, as well as another additional coverage option — Medpay.

- Uninsured and Underinsured Motorist Coverage — If you are in an accident and the person at fault is uninsured or underinsured, the likelihood is that the at-fault person will be unable to pay off the accident costs. Uninsured and underinsured motorists risk going bankrupt in an accident, as accident costs can quickly add up. This means you will be stuck paying the bills yourself unless you have uninsured and underinsured motorist coverage.

- Medpay Coverage — Medpay coverage will pay off both your medical costs and your passengers’ medical costs from an accident, from ambulance rides to treatment.

To see how well these coverages are performing, we want to take a look at the coverages’ loss ratios in Connecticut. Loss ratios show the financial strength of a company.

A high loss ratio that is over 100 percent is bad, as it means a company is paying out too many claims for the premium it has collected and risks going bankrupt. On the other hand, a very low loss ratio means that a company might have overpriced its coverage.

So let’s take a look at the coverages’ loss ratios in Connecticut. We’ve also included personal injury protection’s loss ratio, which you may remember is required in the state of Connecticut.

| Coverage Type | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection | 95.40 | 78.54 | 77.20 |

| Medpay | 84.13 | 78.08 | 79.20 |

| Uninsured and Underinsured | 66.29 | 61.90 | 57.37 |

The bad news is that every coverages’ loss ratio has slightly decreased. The good news is that none of them have reached terribly low levels, and they are still decent loss ratios.

As well, don’t let the decrease in loss ratios scare you away. These coverages are important to have!

9.4 percent of motorists are uninsured in Connecticut, placing the state at rank 36th for uninsured motorists. Uninsured/underinsured coverage is vital if you are in an accident with one of these drivers.

So make sure to have all the additional coverages necessary, as it’s not worth it to be stuck paying the bills yourself in an accident!

Are There Any Add-ons, Endorsements, and Riders?

Add-on coverages are useful for when you want extra protection at an affordable price. Check out some of the most popular add-ons below.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP) — PUP provides extra coverage in case your liability limits are exhausted.

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance — Pays for vehicle repairs that were NOT caused by an accident.

- Non-Owner Car Insurance — If you’re driving a vehicle you don’t own, this insurance provides you with bodily injury and property damage liability coverages.

- Modified Car Insurance Coverage — You’ll need this coverage if you modify your car (anything from a custom paint job to engine changes).

- Classic Car Insurance — Classic car insurance is generally cheaper because classic cars aren’t driven as much.

- Pay-As-You-Drive Insurance — This insurance lets you pay less if you drive less.

Ask your insurance provider about the above add-ons, as your provider can help you create a customized plan that fits your needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

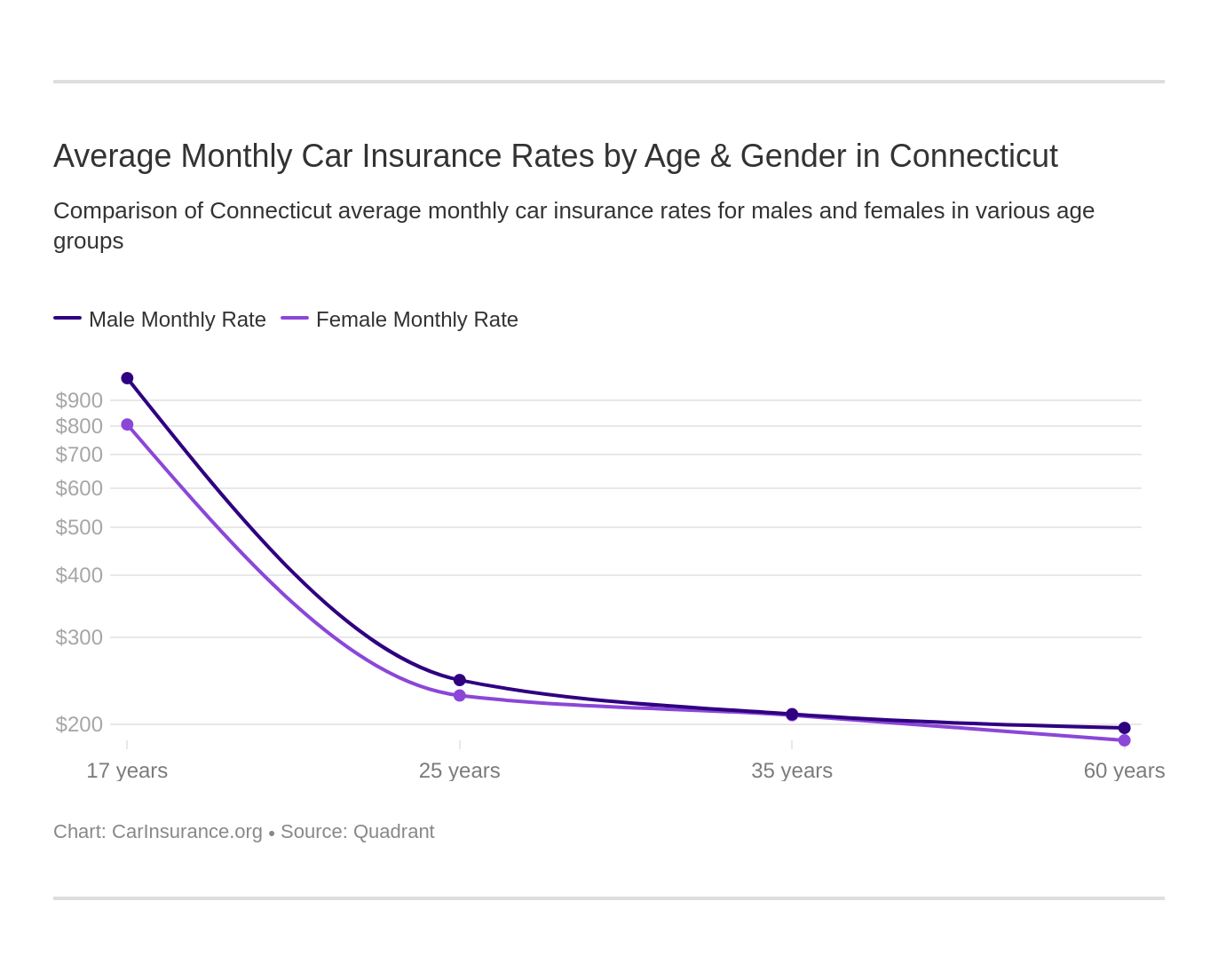

What are the Average Monthly Car Insurance Rates by Age & Gender in CT?

Demographics actually play a significant role in how much a person pays for car insurance. From marital status to credit score, everything has an impact on costs.

To help you see how companies change rates based on demographics, we’ve included multiple demographics’ impact on car insurance rates.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,673.14 | $3,634.67 | $3,382.07 | $3,621.23 | $3,843.87 | $4,038.70 | $11,215.24 | $13,243.90 |

| Geico General | $2,272.26 | $2,278.35 | $2,107.40 | $2,124.47 | $2,191.49 | $2,126.23 | $5,263.28 | $6,225.80 |

| Safeco Ins Co of IL | $3,516.76 | $3,825.92 | $2,706.04 | $3,337.15 | $3,558.72 | $3,883.84 | $17,597.17 | $19,837.39 |

| Nationwide Discover Agency | $2,343.37 | $2,370.04 | $2,105.93 | $2,209.18 | $2,717.04 | $2,921.42 | $6,485.04 | $8,226.75 |

| Progressive Casualty | $2,642.90 | $2,461.27 | $2,252.80 | $2,346.17 | $3,016.42 | $3,379.83 | $11,031.05 | $12,232.33 |

| State Farm Mutual Auto | $1,815.86 | $1,815.86 | $1,670.41 | $1,670.41 | $2,041.38 | $2,342.71 | $5,517.07 | $6,936.22 |

| Travelers Home & Marine Ins Co | $1,810.97 | $1,837.61 | $1,806.15 | $1,800.54 | $1,970.21 | $2,216.01 | $13,987.79 | $22,605.07 |

| USAA CIC | $1,958.26 | $1,937.36 | $1,826.50 | $1,802.82 | $2,622.21 | $2,716.62 | $6,175.72 | $6,480.54 |

Gender and age play a large role in rates. Younger males tend to pay more than females, especially in the teen years. Teens also pay the highest rates if purchasing their own car insurance, which is why most parents will place teens on the parents’ insurance plan.

Curious to see what demographics have the highest costs in Connecticut? Take a look at the table below.

| Rank | Company | Demographic | Average Annual Rate |

|---|---|---|---|

| 1 | Travelers Home & Marine Ins Co | Single 17-year old male | $22,605.07 |

| 2 | Safeco Ins Co of IL | Single 17-year old male | $19,837.39 |

| 3 | Safeco Ins Co of IL | Single 17-year old female | $17,597.17 |

| 4 | Travelers Home & Marine Ins Co | Single 17-year old female | $13,987.79 |

| 5 | Allstate F&C | Single 17-year old male | $13,243.90 |

| 6 | Progressive Casualty | Single 17-year old male | $12,232.33 |

| 7 | Allstate F&C | Single 17-year old female | $11,215.24 |

| 8 | Progressive Casualty | Single 17-year old female | $11,031.05 |

| 9 | Nationwide Discover Agency | Single 17-year old male | $8,226.75 |

| 10 | State Farm Mutual Auto | Single 17-year old male | $6,936.22 |

| 11 | Nationwide Discover Agency | Single 17-year old female | $6,485.04 |

| 12 | USAA CIC | Single 17-year old male | $6,480.54 |

| 13 | Geico General | Single 17-year old male | $6,225.80 |

| 14 | USAA CIC | Single 17-year old female | $6,175.72 |

| 15 | State Farm Mutual Auto | Single 17-year old female | $5,517.07 |

| 16 | Geico General | Single 17-year old female | $5,263.28 |

| 17 | Allstate F&C | Single 25-year old male | $4,038.70 |

| 18 | Safeco Ins Co of IL | Single 25-year old male | $3,883.84 |

| 19 | Allstate F&C | Single 25-year old female | $3,843.87 |

| 20 | Safeco Ins Co of IL | Married 35-year old male | $3,825.92 |

| 21 | Allstate F&C | Married 35-year old female | $3,673.14 |

| 22 | Allstate F&C | Married 35-year old male | $3,634.67 |

| 23 | Allstate F&C | Married 60-year old male | $3,621.23 |

| 24 | Safeco Ins Co of IL | Single 25-year old female | $3,558.72 |

| 25 | Safeco Ins Co of IL | Married 35-year old female | $3,516.76 |

| 26 | Allstate F&C | Married 60-year old female | $3,382.07 |

| 27 | Progressive Casualty | Single 25-year old male | $3,379.83 |

| 28 | Safeco Ins Co of IL | Married 60-year old male | $3,337.15 |

| 29 | Progressive Casualty | Single 25-year old female | $3,016.42 |

| 30 | Nationwide Discover Agency | Single 25-year old male | $2,921.42 |

| 31 | Nationwide Discover Agency | Single 25-year old female | $2,717.04 |

| 32 | USAA CIC | Single 25-year old male | $2,716.62 |

| 33 | Safeco Ins Co of IL | Married 60-year old female | $2,706.04 |

| 34 | Progressive Casualty | Married 35-year old female | $2,642.90 |

| 35 | USAA CIC | Single 25-year old female | $2,622.21 |

| 36 | Progressive Casualty | Married 35-year old male | $2,461.27 |

| 37 | Nationwide Discover Agency | Married 35-year old male | $2,370.04 |

| 38 | Progressive Casualty | Married 60-year old male | $2,346.17 |

| 39 | Nationwide Discover Agency | Married 35-year old female | $2,343.37 |

| 40 | State Farm Mutual Auto | Single 25-year old male | $2,342.71 |

| 41 | Geico General | Married 35-year old male | $2,278.35 |

| 42 | Geico General | Married 35-year old female | $2,272.26 |

| 43 | Progressive Casualty | Married 60-year old female | $2,252.80 |

| 44 | Travelers Home & Marine Ins Co | Single 25-year old male | $2,216.01 |

| 45 | Nationwide Discover Agency | Married 60-year old male | $2,209.18 |

| 46 | Geico General | Single 25-year old female | $2,191.49 |

| 47 | Geico General | Single 25-year old male | $2,126.23 |

| 48 | Geico General | Married 60-year old male | $2,124.47 |

| 49 | Geico General | Married 60-year old female | $2,107.40 |

| 50 | Nationwide Discover Agency | Married 60-year old female | $2,105.93 |

| 51 | State Farm Mutual Auto | Single 25-year old female | $2,041.38 |

| 52 | Travelers Home & Marine Ins Co | Single 25-year old female | $1,970.21 |

| 53 | USAA CIC | Married 35-year old female | $1,958.26 |

| 54 | USAA CIC | Married 35-year old male | $1,937.36 |

| 55 | Travelers Home & Marine Ins Co | Married 35-year old male | $1,837.61 |

| 56 | USAA CIC | Married 60-year old female | $1,826.50 |

| 57 | State Farm Mutual Auto | Married 35-year old female | $1,815.86 |

| 57 | State Farm Mutual Auto | Married 35-year old male | $1,815.86 |

| 59 | Travelers Home & Marine Ins Co | Married 35-year old female | $1,810.97 |

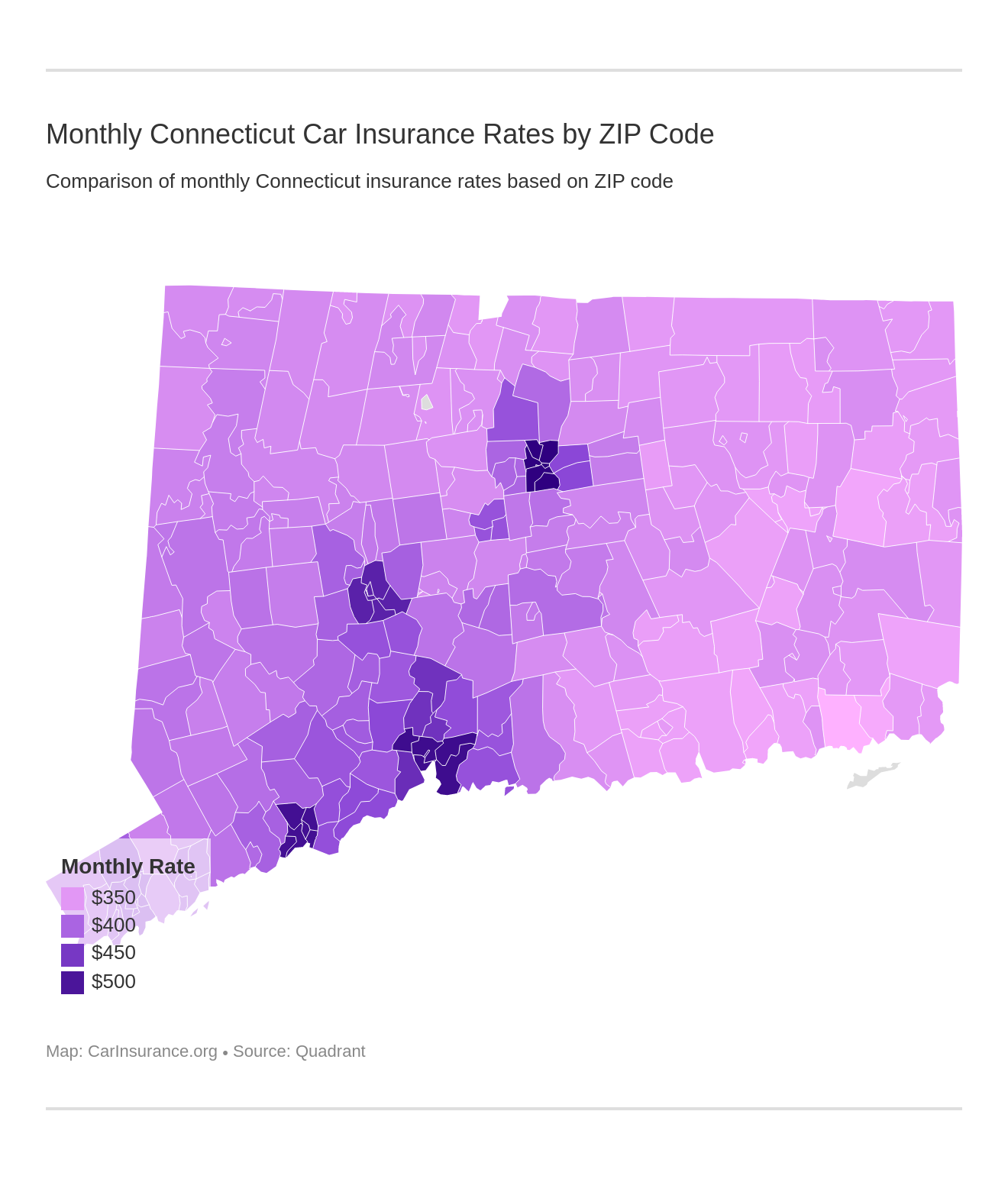

What are the Cheapest Rates by ZIP Code?

The area you live in is another rate changer. Where you live can sometimes have an ENORMOUS impact on your rates. We’ve also included insurers by area so you can check who the cheapest car insurance provider is in your ZIP code.

| Most Expensive ZIP Codes in Connecticut | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 06103 | HARTFORD | $6,373.96 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06105 | HARTFORD | $6,373.96 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06106 | HARTFORD | $6,373.96 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06112 | HARTFORD | $6,373.96 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06114 | HARTFORD | $6,373.96 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06120 | HARTFORD | $6,373.96 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06160 | HARTFORD | $6,373.96 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06510 | NEW HAVEN | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| 06511 | NEW HAVEN | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| 06512 | EAST HAVEN | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| 06513 | NEW HAVEN | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| 06515 | NEW HAVEN | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| 06519 | NEW HAVEN | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| 06101 | HARTFORD | $6,148.49 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06152 | HARTFORD | $6,148.49 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| 06604 | BRIDGEPORT | $6,112.78 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | State Farm | $4,104.01 | USAA | $4,160.98 |

| 06605 | BRIDGEPORT | $6,112.78 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | State Farm | $4,104.01 | USAA | $4,160.98 |

| 06606 | BRIDGEPORT | $6,112.78 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | State Farm | $4,104.01 | USAA | $4,160.98 |

| 06607 | BRIDGEPORT | $6,112.78 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | State Farm | $4,104.01 | USAA | $4,160.98 |

| 06608 | BRIDGEPORT | $6,112.78 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | State Farm | $4,104.01 | USAA | $4,160.98 |

| 06610 | BRIDGEPORT | $6,112.78 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | State Farm | $4,104.01 | USAA | $4,160.98 |

| 06650 | BRIDGEPORT | $5,793.71 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | Geico | $3,632.90 | State Farm | $4,104.01 |

| 06702 | WATERBURY | $5,790.41 | Travelers | $8,351.14 | Liberty Mutual | $8,132.56 | USAA | $3,668.44 | State Farm | $3,833.37 |

| 06704 | WATERBURY | $5,790.41 | Travelers | $8,351.14 | Liberty Mutual | $8,132.56 | USAA | $3,668.44 | State Farm | $3,833.37 |

| 06705 | WATERBURY | $5,790.41 | Travelers | $8,351.14 | Liberty Mutual | $8,132.56 | USAA | $3,668.44 | State Farm | $3,833.37 |

There is over a $2,000 difference between the most and least expensive ZIP codes! That’s quite of bit of a cost difference!

| Cheapest ZIP Codes in Connecticut | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 06340 | GROTON | $3,896.10 | Liberty Mutual | $6,416.79 | Allstate | $5,237.70 | Geico | $2,455.10 | State Farm | $2,654.24 |

| 06355 | MYSTIC | $3,986.37 | Liberty Mutual | $6,416.79 | Allstate | $5,237.70 | Geico | $2,455.10 | State Farm | $2,654.24 |

| 06331 | CANTERBURY | $4,028.12 | Liberty Mutual | $6,378.51 | Allstate | $5,403.39 | Geico | $2,637.09 | State Farm | $2,684.12 |

| 06333 | EAST LYME | $4,041.05 | Liberty Mutual | $6,503.20 | Allstate | $5,237.70 | Geico | $2,573.58 | State Farm | $2,666.69 |

| 06357 | NIANTIC | $4,041.05 | Liberty Mutual | $6,503.20 | Allstate | $5,237.70 | Geico | $2,573.58 | State Farm | $2,666.69 |

| 06359 | NORTH STONINGTON | $4,068.88 | Liberty Mutual | $6,326.05 | Allstate | $5,225.68 | Geico | $2,545.86 | State Farm | $2,684.12 |

| 06226 | WILLIMANTIC | $4,070.37 | Liberty Mutual | $6,913.93 | Allstate | $5,338.09 | State Farm | $2,684.12 | Geico | $2,784.21 |

| 06266 | SOUTH WINDHAM | $4,070.37 | Liberty Mutual | $6,913.93 | Allstate | $5,338.09 | State Farm | $2,684.12 | Geico | $2,784.21 |

| 06280 | WINDHAM | $4,070.37 | Liberty Mutual | $6,913.93 | Allstate | $5,338.09 | State Farm | $2,684.12 | Geico | $2,784.21 |

| 06475 | OLD SAYBROOK | $4,076.16 | Liberty Mutual | $6,631.86 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| 06264 | SCOTLAND | $4,084.21 | Liberty Mutual | $6,537.83 | Allstate | $5,403.39 | Geico | $2,637.09 | State Farm | $2,684.12 |

| 06334 | BOZRAH | $4,085.37 | Liberty Mutual | $6,821.20 | Allstate | $5,237.70 | Geico | $2,637.09 | State Farm | $2,684.12 |

| 06371 | OLD LYME | $4,087.72 | Liberty Mutual | $6,430.78 | Travelers | $5,354.34 | Geico | $2,573.58 | State Farm | $2,666.69 |

| 06426 | ESSEX | $4,088.33 | Liberty Mutual | $6,693.61 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| 06442 | IVORYTON | $4,088.33 | Liberty Mutual | $6,693.61 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| 06420 | SALEM | $4,091.02 | Liberty Mutual | $6,780.41 | Allstate | $5,237.70 | State Farm | $2,684.12 | Geico | $2,708.26 |

| 06498 | WESTBROOK | $4,093.66 | Liberty Mutual | $6,728.53 | Allstate | $5,244.00 | State Farm | $2,666.69 | Geico | $2,832.06 |

| 06375 | QUAKER HILL | $4,094.49 | Liberty Mutual | $6,643.12 | Travelers | $5,363.30 | State Farm | $2,654.24 | USAA | $2,700.71 |

| 06385 | WATERFORD | $4,094.49 | Liberty Mutual | $6,643.12 | Travelers | $5,363.30 | State Farm | $2,654.24 | USAA | $2,700.71 |

| 06249 | LEBANON | $4,099.90 | Liberty Mutual | $6,376.82 | Allstate | $5,469.52 | State Farm | $2,684.12 | Geico | $2,784.21 |

| 06417 | DEEP RIVER | $4,103.33 | Liberty Mutual | $7,027.36 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| 06332 | CENTRAL VILLAGE | $4,105.28 | Liberty Mutual | $6,571.22 | Allstate | $5,573.25 | Geico | $2,545.86 | State Farm | $2,684.12 |

| 06354 | MOOSUP | $4,105.28 | Liberty Mutual | $6,571.22 | Allstate | $5,573.25 | Geico | $2,545.86 | State Farm | $2,684.12 |

| 06374 | PLAINFIELD | $4,105.28 | Liberty Mutual | $6,571.22 | Allstate | $5,573.25 | Geico | $2,545.86 | State Farm | $2,684.12 |

| 06423 | EAST HADDAM | $4,112.43 | Liberty Mutual | $6,707.15 | Travelers | $5,328.44 | Geico | $2,480.89 | State Farm | $2,666.69 |

What are the Cheapest Rates by City?

Just like ZIP codes, cities have varying rates.

| Most Expensive Cities in Connecticut | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Hartford | $6,323.85 | Travelers | $9,948.34 | Liberty Mutual | $9,887.85 | Geico | $4,205.53 | USAA | $4,206.85 |

| East Haven | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| New Haven | $6,173.99 | Travelers | $9,256.06 | Liberty Mutual | $8,718.72 | State Farm | $3,935.59 | Geico | $4,223.88 |

| Bridgeport | $6,067.20 | Liberty Mutual | $9,542.38 | Travelers | $8,780.42 | State Farm | $4,104.01 | USAA | $4,160.98 |

| Waterbury | $5,790.41 | Travelers | $8,351.14 | Liberty Mutual | $8,132.56 | USAA | $3,668.44 | State Farm | $3,833.37 |

| West Haven | $5,574.19 | Liberty Mutual | $8,292.16 | Travelers | $7,392.35 | State Farm | $3,664.33 | Geico | $3,818.52 |

| Hamden | $5,500.65 | Liberty Mutual | $8,433.73 | Progressive | $7,127.90 | State Farm | $3,300.29 | Geico | $3,695.54 |

| South Britain | $5,154.91 | Travelers | $9,256.06 | Liberty Mutual | $7,593.52 | Geico | $3,123.27 | State Farm | $3,125.79 |

| East Hartford | $5,131.08 | Liberty Mutual | $7,723.42 | Travelers | $6,353.95 | USAA | $3,350.48 | State Farm | $3,667.23 |

| Woodbridge | $5,126.81 | Liberty Mutual | $8,032.50 | Allstate | $6,902.19 | Geico | $3,126.08 | State Farm | $3,300.29 |

| Milford | $5,105.40 | Liberty Mutual | $7,939.79 | Travelers | $6,838.54 | State Farm | $2,888.56 | Geico | $3,127.90 |

| East Glastonbury | $5,103.26 | Travelers | $9,948.34 | Liberty Mutual | $7,311.53 | USAA | $2,855.32 | Geico | $3,033.26 |

| North Haven | $5,079.93 | Liberty Mutual | $8,186.95 | Travelers | $6,838.54 | State Farm | $3,232.22 | Geico | $3,500.50 |

| Stratford | $5,035.21 | Liberty Mutual | $8,284.57 | Allstate | $6,438.54 | State Farm | $3,322.57 | USAA | $3,447.97 |

| Milldale | $5,026.12 | Travelers | $9,948.34 | Liberty Mutual | $7,018.89 | USAA | $2,855.32 | State Farm | $2,876.04 |

| Naugatuck | $5,020.78 | Liberty Mutual | $8,194.68 | Allstate | $6,565.08 | State Farm | $3,125.79 | Geico | $3,483.96 |

| Branford | $5,015.32 | Liberty Mutual | $8,134.73 | Travelers | $6,435.56 | Geico | $3,062.65 | State Farm | $3,232.22 |

| Prospect | $5,005.80 | Liberty Mutual | $8,135.07 | Allstate | $6,565.08 | State Farm | $3,125.79 | USAA | $3,452.12 |

| New Britain | $5,004.15 | Liberty Mutual | $7,650.63 | Travelers | $6,948.18 | USAA | $3,482.43 | State Farm | $3,501.20 |

| Bloomfield | $4,999.25 | Liberty Mutual | $7,311.53 | Travelers | $6,783.66 | State Farm | $3,243.57 | USAA | $3,350.48 |

| North Branford | $4,989.45 | Liberty Mutual | $7,819.09 | Travelers | $6,811.12 | State Farm | $3,232.22 | Geico | $3,253.57 |

| Shelton | $4,965.43 | Liberty Mutual | $7,712.67 | Travelers | $6,496.25 | USAA | $3,259.50 | State Farm | $3,322.57 |

| Poquonock | $4,961.51 | Travelers | $9,948.34 | Liberty Mutual | $7,235.38 | State Farm | $2,604.03 | USAA | $2,855.32 |

| Orange | $4,955.71 | Liberty Mutual | $7,519.57 | Allstate | $6,521.58 | State Farm | $2,888.56 | Geico | $3,127.90 |

| Derby | $4,940.32 | Liberty Mutual | $7,514.91 | Allstate | $6,902.19 | State Farm | $3,300.29 | Geico | $3,398.46 |

Not surprisingly, Bridgeport and New Haven, the state’s two largest cities, also have some of the highest rates.

| Cheapest Cities in Connecticut | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Conning Towers Nautilus Park | $3,896.10 | Liberty Mutual | $6,416.79 | Allstate | $5,237.70 | Geico | $2,455.10 | State Farm | $2,654.24 |

| Mystic | $3,986.37 | Liberty Mutual | $6,416.79 | Allstate | $5,237.70 | Geico | $2,455.10 | State Farm | $2,654.24 |

| Canterbury | $4,028.12 | Liberty Mutual | $6,378.51 | Allstate | $5,403.39 | Geico | $2,637.09 | State Farm | $2,684.12 |

| East Lyme | $4,041.05 | Liberty Mutual | $6,503.20 | Allstate | $5,237.70 | Geico | $2,573.58 | State Farm | $2,666.69 |

| Niantic | $4,041.05 | Liberty Mutual | $6,503.20 | Allstate | $5,237.70 | Geico | $2,573.58 | State Farm | $2,666.69 |

| North Stonington | $4,068.88 | Liberty Mutual | $6,326.05 | Allstate | $5,225.68 | Geico | $2,545.86 | State Farm | $2,684.12 |

| South Windham | $4,070.37 | Liberty Mutual | $6,913.93 | Allstate | $5,338.09 | State Farm | $2,684.12 | Geico | $2,784.21 |

| Windham | $4,070.37 | Liberty Mutual | $6,913.93 | Allstate | $5,338.09 | State Farm | $2,684.12 | Geico | $2,784.21 |

| Old Saybrook | $4,076.16 | Liberty Mutual | $6,631.86 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| Scotland | $4,084.20 | Liberty Mutual | $6,537.83 | Allstate | $5,403.39 | Geico | $2,637.09 | State Farm | $2,684.12 |

| Bozrah | $4,085.37 | Liberty Mutual | $6,821.20 | Allstate | $5,237.70 | Geico | $2,637.09 | State Farm | $2,684.12 |

| Old Lyme | $4,087.72 | Liberty Mutual | $6,430.78 | Travelers | $5,354.34 | Geico | $2,573.58 | State Farm | $2,666.69 |

| Essex Village | $4,088.33 | Liberty Mutual | $6,693.61 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| Ivoryton | $4,088.33 | Liberty Mutual | $6,693.61 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| Salem | $4,091.02 | Liberty Mutual | $6,780.41 | Allstate | $5,237.70 | State Farm | $2,684.12 | Geico | $2,708.26 |

| Westbrook | $4,093.66 | Liberty Mutual | $6,728.53 | Allstate | $5,244.00 | State Farm | $2,666.69 | Geico | $2,832.06 |

| Quaker Hill | $4,094.49 | Liberty Mutual | $6,643.12 | Travelers | $5,363.30 | State Farm | $2,654.24 | USAA | $2,700.71 |

| Waterford | $4,094.49 | Liberty Mutual | $6,643.12 | Travelers | $5,363.30 | State Farm | $2,654.24 | USAA | $2,700.71 |

| Lebanon | $4,099.90 | Liberty Mutual | $6,376.82 | Allstate | $5,469.52 | State Farm | $2,684.12 | Geico | $2,784.21 |

| Deep River | $4,103.33 | Liberty Mutual | $7,027.36 | Allstate | $5,244.00 | Geico | $2,480.89 | State Farm | $2,666.69 |

| Central Village | $4,105.28 | Liberty Mutual | $6,571.22 | Allstate | $5,573.25 | Geico | $2,545.86 | State Farm | $2,684.12 |

| Moosup | $4,105.28 | Liberty Mutual | $6,571.22 | Allstate | $5,573.25 | Geico | $2,545.86 | State Farm | $2,684.12 |

| Plainfield | $4,105.28 | Liberty Mutual | $6,571.22 | Allstate | $5,573.25 | Geico | $2,545.86 | State Farm | $2,684.12 |

| East Haddam | $4,112.43 | Liberty Mutual | $6,707.15 | Travelers | $5,328.44 | Geico | $2,480.89 | State Farm | $2,666.69 |

| Moodus | $4,112.43 | Liberty Mutual | $6,707.15 | Travelers | $5,328.44 | Geico | $2,480.89 | State Farm | $2,666.69 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Some of the Best Connecticut Car Insurance Companies?

With over two million cars in Connecticut requiring insurance, car insurance companies are numerous. With all of them competing for your attention, picking out an insurance company that meets your needs is hard!

Companies also tend to make the same promises, making it hard to know which company is actually best.

To help you make the right choice, we’ve collected everything you need to know. From auto insurance companies’ ratings to premium rates, keep reading to learn everything you need to know about Connecticut’s insurance companies!

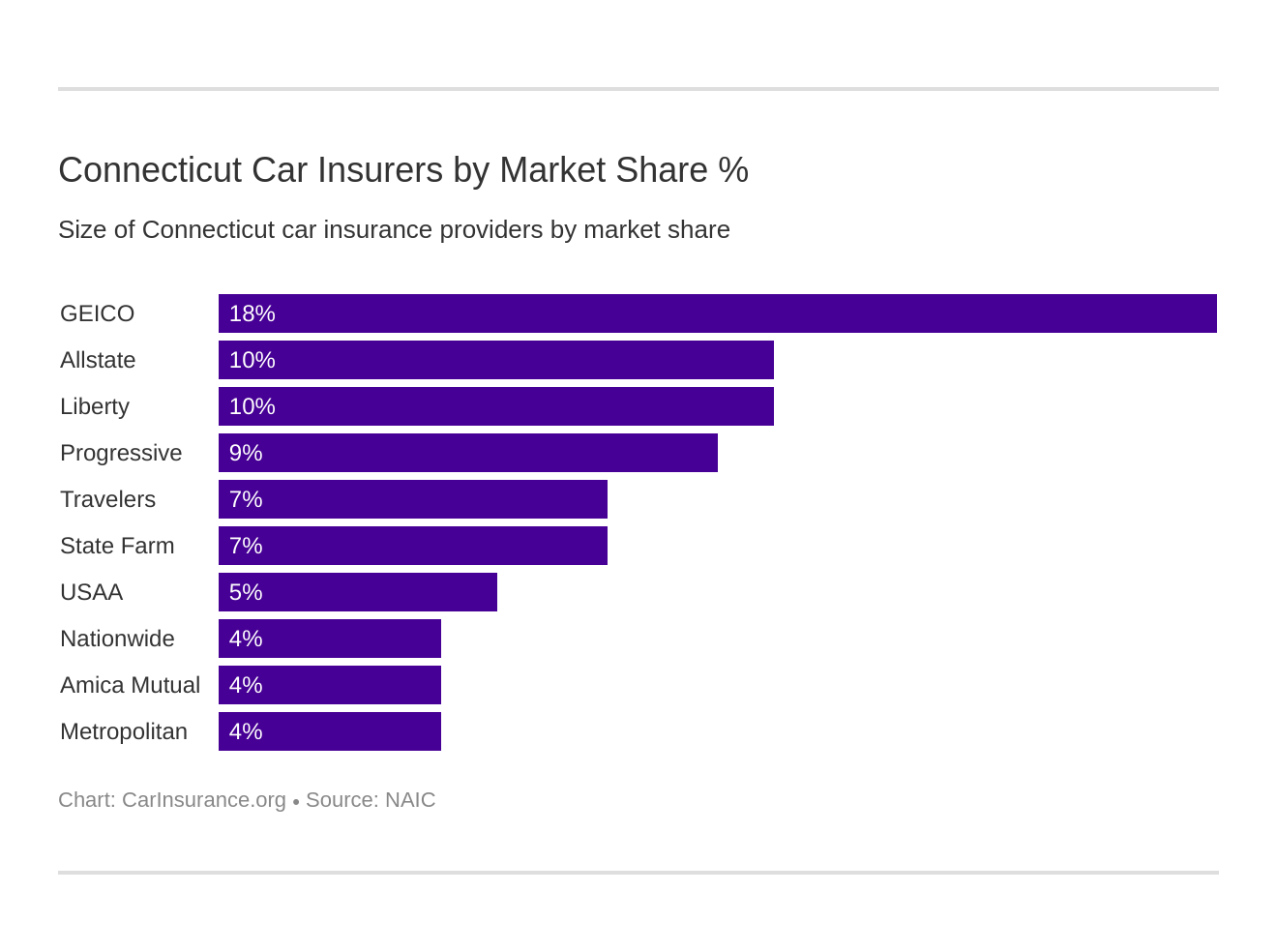

What is the Financial Rating of the Largest Companies?

What is an AM Best rating? Basically, AM Best rates a company’s financial strength (if the company has a good or bad financial future ahead of it).

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| Geico | A++ | $528,907 | 75.82% | 18.02% |

| Allstate Insurance Group | A+ | $304,028 | 54.93% | 10.36% |

| Liberty Mutual Group | A | $297,602 | 64.66% | 10.14% |

| Progressive Group | A+ | $268,001 | 63.25% | 9.13% |

| Travelers Group | A++ | $195,421 | 72.77% | 6.66% |

| State Farm Group | A | $192,401 | 61.48% | 6.55% |

| USAA Group | A++ | $137,617 | 70.23% | 4.69% |

| Nationwide Corp Group | A+ | $123,130 | 63.22% | 4.19% |

| Amica Mutual Group | A+ | $111,152 | 60.16% | 3.79% |

| Metropolitan Group | A | $105,129 | 59.38% | 3.58% |

All of the largest insurance companies in Connecticut have excellent AM Ratings (A++ is the highest rating), showing that they have solid financial standings.

Which are the Companies with the Best Ratings?

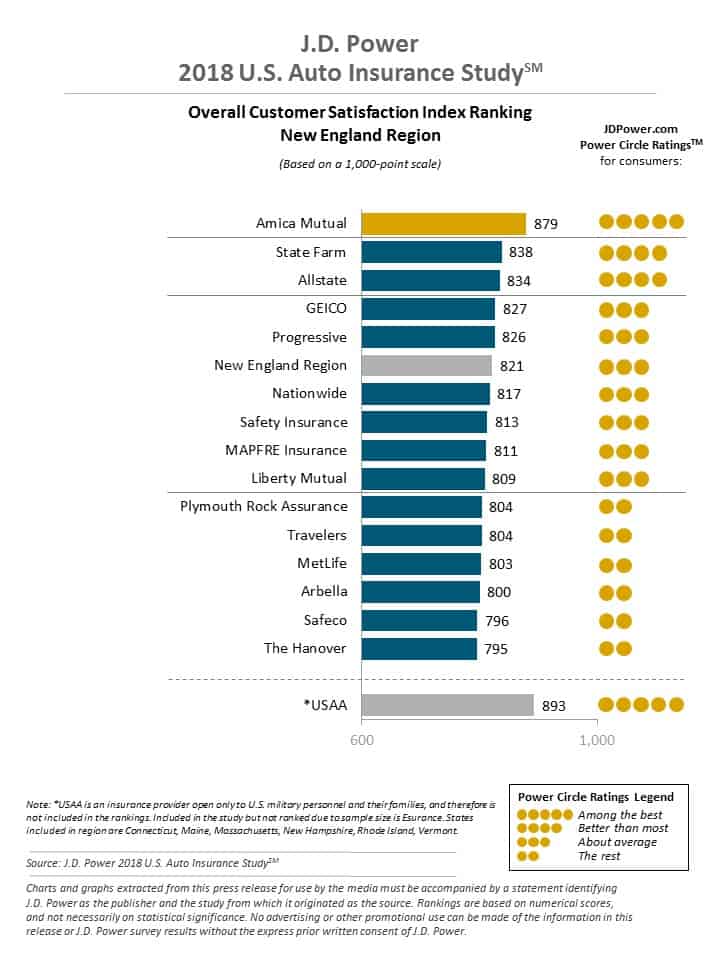

JD Power rates companies based purely on a company’s customer satisfaction ratings.

Now let’s see who is the cheapest car insurance company in Connecticut.

Below, you will see JD Power’s rankings of insurance companies in Connecticut.

State Farm and Allstate, some of the largest and cheapest car insurance companies in Connecticut, rank as better than most for customer satisfaction.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which are the Companies with Most Complaints in Connecticut?

We looked at the financial ratings of the largest companies in Connecticut, and now we want to take a look at the companies’ complaint ratios.

| Company | Total Complaints 2017 | Complaint Ratio |

|---|---|---|

| State Farm Group | 1,482 | 0.44 |

| Liberty Mutual Group | 222 | 5.95 |

| Allstate Insurance Group | 163 | 0.5 |

| Progressive Group | 120 | 0.75 |

| Metropolitan Group | 70 | 1.3 |

| Amica Mutual Group | 52 | 0.46 |

| Nationwide Corp Group | 25 | 0.28 |

| Travelers Group | 2 | 0.09 |

| Geico | 2 | 0 |

| USAA Group | 2 | 0 |

It is important to note that while a company may have a large number of complaints, it could still have a low complaint ratio. This is because if a company has a high number of customers, a thousand complaints may only make up a small number of total customers.

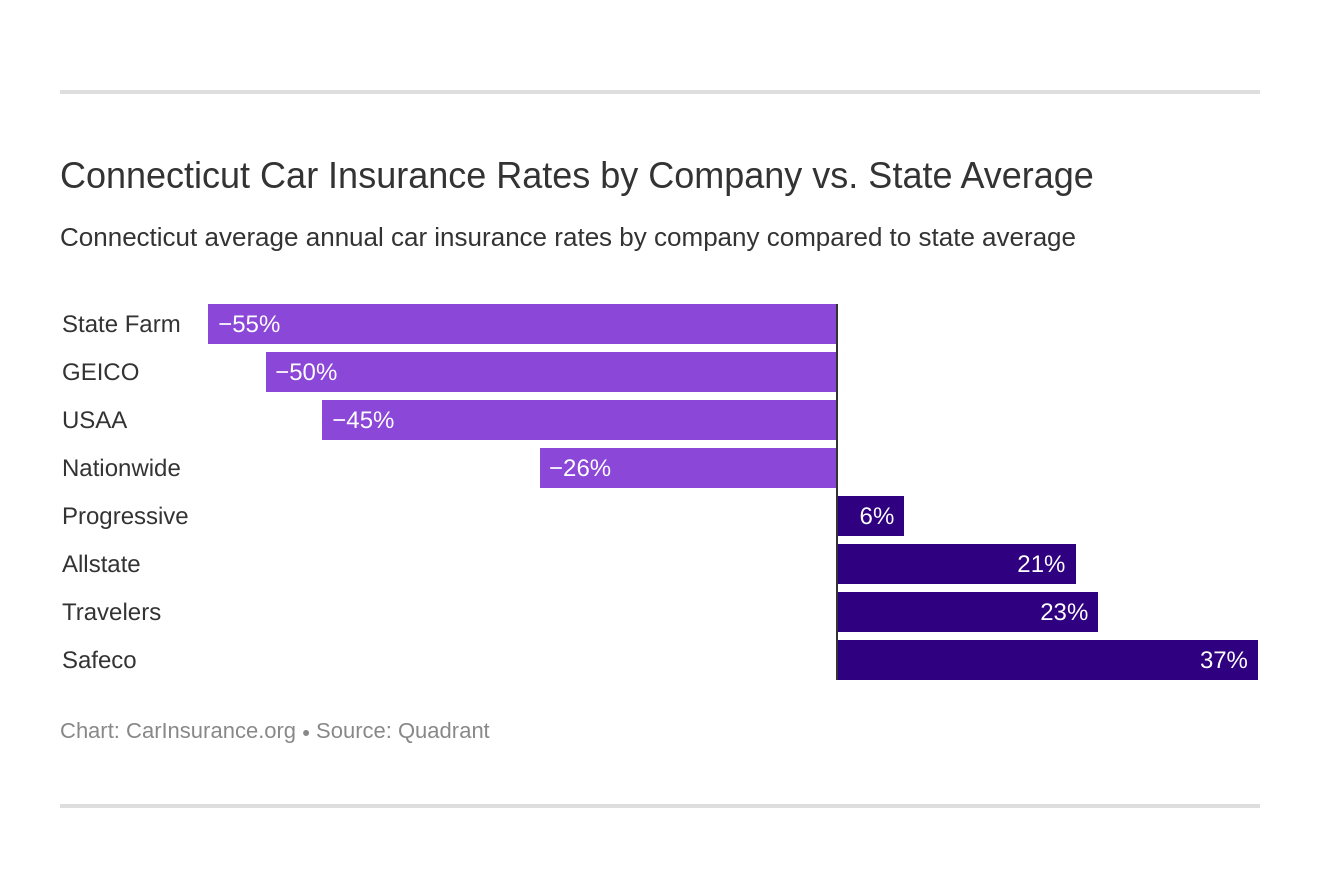

Which are the Cheapest Companies in Connecticut?

We know that price is a large part of picking out an insurance company. That’s why we’ve included a list of the cheapest providers in Connecticut.

| Company | Average Annual Rate | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Safeco Ins Co of IL | $7,282.87 | $2,663.95 | 36.58% |

| Travelers Home & Marine Ins Co | $6,004.29 | $1,385.37 | 23.07% |

| Allstate F&C | $5,831.60 | $1,212.68 | 20.79% |

| Progressive Casualty | $4,920.35 | $301.43 | 6.13% |

| Nationwide Discover Agency | $3,672.34 | -$946.58 | -25.78% |

| USAA CIC | $3,190.00 | -$1,428.92 | -44.79% |

| Geico General | $3,073.66 | -$1,545.26 | -50.27% |

| State Farm Mutual Auto | $2,976.24 | -$1,642.68 | -55.19% |

Geico and State Farm are both about 50 percent CHEAPER than the national average. That’s quite a big difference in cost!

Does Commute Affect Car Insurance Rates?

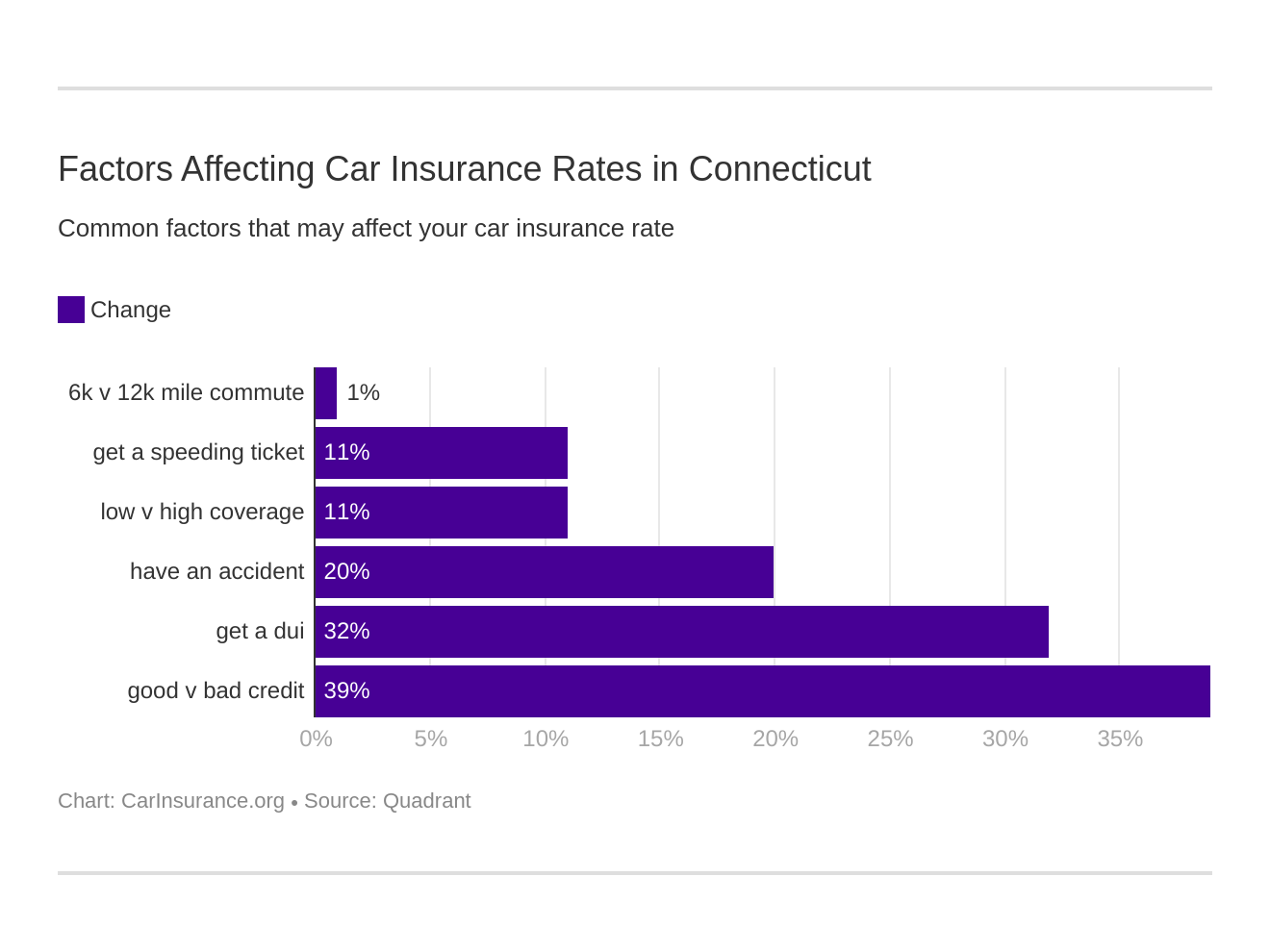

Did you know that some companies charge more based on how far you drive? Your commute distance can have an impact on your auto insurance rates. Usually, about $100 is added to your annual costs.

Six major factors affect auto insurance rates in CT. Which car insurance factors will affect your rates the most? Find out below:

Some companies don’t change rates based on commute distance, though, so you may want to check out the complete list below.

| Group | Commute and Annual Mileage | Annual Average |

|---|---|---|

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $7,282.87 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $7,282.87 |

| Travelers | 10 miles commute. 6000 annual mileage. | $6,004.29 |

| Travelers | 25 miles commute. 12000 annual mileage. | $6,004.29 |

| Allstate | 10 miles commute. 6000 annual mileage. | $5,831.60 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,831.60 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,920.35 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,920.35 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,672.34 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,672.34 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,228.20 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,151.80 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,120.67 |

| State Farm | 25 miles commute. 12000 annual mileage. | $3,049.73 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,026.65 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,902.75 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Coverage Level Rates?

Most people are reluctant to purchase higher levels of coverage because of the added cost. At some companies, though, the price increase is affordable.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Liberty Mutual | High | $7,625.34 |

| Liberty Mutual | Medium | $7,227.27 |

| Liberty Mutual | Low | $6,996.02 |

| Travelers | High | $6,499.29 |

| Allstate | High | $6,172.41 |

| Travelers | Medium | $5,961.96 |

| Allstate | Medium | $5,823.32 |

| Travelers | Low | $5,551.63 |

| Allstate | Low | $5,499.08 |

| Progressive | High | $5,318.35 |

| Progressive | Medium | $4,875.19 |

| Progressive | Low | $4,567.50 |

| Nationwide | Low | $3,727.81 |

| Nationwide | Medium | $3,699.88 |

| Nationwide | High | $3,589.35 |

| USAA | High | $3,396.11 |

| Geico | High | $3,347.61 |

| USAA | Medium | $3,193.11 |

| State Farm | High | $3,157.66 |

| Geico | Medium | $3,033.89 |

| State Farm | Medium | $2,981.27 |

| USAA | Low | $2,980.78 |

| Geico | Low | $2,839.48 |

| State Farm | Low | $2,789.79 |

At Geico, an increase from low to high coverage is an extra $508. This may seem pricy, but $508 only adds an extra $42 a month to your bill, which isn’t bad! Other companies have similar rate changes, so make sure to look around for one that best fits your budget.

A high coverage level will pay for itself in an accident, as it will protect you from having to pay a pricy bill yourself that is MUCH higher than an extra $42 a month!

Does Credit History Affect Car Insurance Rates?

Credit history is a large part of the insurance rate determination process. The worse your credit score is, the higher your rates.

The good news is that Connecticut’s average credit score is 690, which is above the national average of 675!

This means Connecticut residents who meet the average credit score have a better chance of receiving decent rates. The table below shows how good credit can result in SIGNIFICANTLY lower rates.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $10,341.99 |

| Allstate | Poor | $7,423.44 |

| Travelers | Poor | $6,815.35 |

| Liberty Mutual | Fair | $6,442.61 |

| Travelers | Fair | $5,680.08 |

| Allstate | Fair | $5,615.43 |

| Travelers | Good | $5,517.46 |

| Progressive | Poor | $5,354.50 |

| Liberty Mutual | Good | $5,064.02 |

| Nationwide | Poor | $4,862.94 |

| Progressive | Fair | $4,804.53 |

| Progressive | Good | $4,602.01 |

| Geico | Poor | $4,471.11 |

| Allstate | Good | $4,455.94 |

| USAA | Poor | $4,216.70 |

| State Farm | Poor | $4,142.03 |

| Nationwide | Fair | $3,264.41 |

| Nationwide | Good | $2,889.69 |

| USAA | Fair | $2,847.51 |

| Geico | Fair | $2,696.58 |

| State Farm | Fair | $2,652.13 |

| USAA | Good | $2,505.79 |

| State Farm | Good | $2,134.56 |

| Geico | Good | $2,053.29 |

At Liberty Mutual, having a good credit score will save you over five thousand dollars!

Does Your Driving Record Affect Car Insurance Rates?

DUIs and accidents are the most detrimental to rates, but speeding violations can also raise your rates.

| Group | Driving Record | Annual Average |

|---|---|---|

| Liberty Mutual | With 1 accident | $7,985.83 |

| Liberty Mutual | With 1 DUI | $7,908.84 |

| Travelers | With 1 DUI | $7,620.42 |

| Allstate | With 1 DUI | $7,267.10 |

| Liberty Mutual | With 1 speeding violation | $6,859.28 |

| Liberty Mutual | Clean record | $6,377.55 |

| Travelers | With 1 speeding violation | $6,327.84 |

| Allstate | With 1 accident | $6,130.79 |

| Progressive | With 1 accident | $6,093.37 |

| Geico | With 1 DUI | $5,420.88 |

| Travelers | With 1 accident | $5,235.67 |

| Progressive | With 1 speeding violation | $4,975.08 |

| Allstate | Clean record | $4,964.26 |

| Allstate | With 1 speeding violation | $4,964.26 |

| Travelers | Clean record | $4,833.25 |

| USAA | With 1 DUI | $4,713.93 |

| Nationwide | With 1 DUI | $4,466.56 |

| Progressive | With 1 DUI | $4,415.90 |

| Progressive | Clean record | $4,197.03 |

| Nationwide | With 1 accident | $3,900.02 |

| Nationwide | With 1 speeding violation | $3,331.67 |

| USAA | With 1 accident | $3,104.24 |

| State Farm | With 1 DUI | $3,044.79 |

| State Farm | With 1 accident | $3,044.79 |

| State Farm | With 1 speeding violation | $3,044.79 |

| Nationwide | Clean record | $2,991.13 |

| State Farm | Clean record | $2,770.61 |

| Geico | With 1 accident | $2,546.81 |

| USAA | Clean record | $2,470.92 |

| USAA | With 1 speeding violation | $2,470.92 |

| Geico | With 1 speeding violation | $2,384.75 |

| Geico | Clean record | $1,942.20 |

The best way to avoid paying hundreds or thousands more each year is to try and keep as clean a driving record as possible!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Insurers in Connecticut?

The following information shows the number of insurers in Connecticut.

- Domestic Insurers: 67

- Foreign Insurers: 729

- Total Insurers: 796

With a total of 796 insurers, there are a lot of insurers to choose from! You might be wondering, though, what the difference is between domestic and foreign insurers.

Basically, domestic insurers are formed under Connecticut’s laws and can sell insurance only in Connecticut. Foreign insurers are formed under another state’s laws and can sell in different states.

What are the Connecticut State Laws?

With so many states passing their own laws, it can be overwhelming to move to Connecticut and have to learn new laws. Even if you live in Connecticut, it can still be confusing to learn everything you need to.

Breaking the law will likely result in fines and other penalties, which is why knowing driving laws are so important.

To help you avoid tickets (or worse), we’ve put together a section on important state information. From insurance laws to rules of the road, it is all covered here!

So keep reading to save yourself the headache of sifting through pages of information or paying expensive driving tickets.

What are the Car Insurance Laws?

There are multiple laws about car insurance beyond having a minimum liability amount, which is we’ve covered everything from state legislation to low-cost insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How State Laws for Insurance are Determined?

Every state has a different insurance policy filing process. The National Association of Insurance Commissioners (NAIC) says that Connecticut insurers must file rates and forms with Connecticut’s state insurance provider before use.

This means that before you can start driving on your new insurance, the state needs to make sure the policy meets the minimum liability insurance requirements before approving it.

How to Get Windshield Coverage

Cracked or broken windshield? In Connecticut, there is a full glass coverage option that covers the cost of repair/replacement costs with no deductible.

You can choose what shop to have your car repaired at, but if it is not on your insurer’s approved list you may have to pay the cost difference.

Connecticut also allows insurers to use aftermarket and used parts. The insurer is legally required to inform you if it is using aftermarket/used parts.

How to Get High-Risk Insurance

In Connecticut, the state doesn’t require drivers to fill out an SR-22 form to purchase high-risk insurance. This doesn’t mean that accidents and other mishaps won’t raise your rates!

While you won’t need to purchase high-risk insurance with an SR-22 form, your insurer may still consider you a high-risk driver for the following reasons and charge you accordingly.

- Serious violations (DUI, reckless driving, etc.)

- Accidents that cause injury or property damage

- A bad driving record (consistent violations)

- New and inexperienced drivers

- High-risk vehicle owners (such as an exotic car or sports car)

- A lapse in car insurance

- Over 70 years of age

If you meet any of the criteria above, your insurer may charge you more for a coverage plan. Some insurers may actually refuse to cover you, in which case you have two insurance options.

- Apply to a company with non-standard insurance programs.

- Apply to the Connecticut Automobile Insurance Assigned Risk Plan.

The DMV recommends applying first to a non-standard insurer, as it is less expensive than Connecticut’s risk plan option. If a non-standard insurer won’t cover you, though, Connecticut’s risk plan will provide you with insurance.

Anyone who applies for car insurance through Connecticut’s risk plan is guaranteed car insurance because insurers are not allowed to turn away Connecticut risk plan applicants.

The downside is that your rates will be much HIGHER through a risk plan option than through a standard or non-standard plan.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Low-Cost Insurance

Connecticut is NOT one of the three states that offer a government-sponsored program for low-income families. This doesn’t mean insurance is impossible to purchase for those on a budget!

Plenty of discounts are available through providers that make insurance more affordable. Most Connecticut providers will offer the following insurance discounts to customers.

- Good driver discount

- Good student discount (B+ average usually required)

- Multi-car owner discount

- Homeowners’ discount

- Anti-theft device discount

- Safety discount

These are just a few basic discounts most providers offer, so make sure to ask your provider for a complete discount list.

Is There an Automobile Insurance Fraud in Connecticut?

The Insurance Information Institute found that in 2007, over 4.8 billion was stolen in auto insurance fraud. Losses like this have made insurance fraud an object of concern, resulting in Connecticut creating a fraud bureau to track fraud.

Insurance fraud is a crime in Connecticut, and committing insurance fraud could result in jail time and/or fines.

Below are the two main ways to commit insurance fraud.

- Adding “extra” onto a claim. For example, you had a legitimate accident but then added in false expenses.

- Staging an accident (creating a false claim for something that never happened).

The easiest way to avoid being investigated for insurance fraud is to ALWAYS be honest on your claims.

Is There a Statute of Limitations?

A statute of limitations places a time limit on how long you have to file and resolve your claim after an accident. Connecticut’s statute of limitations is below.

- Personal Injury: two years

- Property Damage: three years

The statute of limitations starts the day of your accident, so you will have two years to file for injury claims and three years to file for property damage claims.

Don’t wait! Years can pass quicker than one thinks, and it is always best to be paid for damages or injuries as soon as possible to lessen the strain on your bank account.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does Connecticut have Fair Claims Settlement Practices Act?

Connecticut does NOT have a fair claims settlement practices Act, which means you should always be aware of your policy benefits when filing a claim.

A fair claims settlement practice prevents insurers from leaving out policy benefits when disclosing information to clients. If you make a claim, your insurer may not provide you with all the benefits you are owed.

To make sure that benefits aren’t “forgotten” by your insurer, make sure to study your policy and be familiar with its contents.

What are the Vehicle Licensing Laws?

Do you know the proper steps for vehicle licensing? Having insurance and a driver’s license are necessary steps for driving in Connecticut. Keep reading to learn about Connecticut’s vehicle licensing process.

What are the Penalties for Driving Without Insurance?

Driving without insurance is illegal. To discourage drivers from driving without insurance, Connecticut has the following penalties in place.

- First Offense: Fine of $100-$1000 and suspended registration/license for one month ($175 reinstatement fee).

- Second Offense: Fine of $100-$1000 and suspended registration/license for six months ($175 reinstatement fee).

If you recall, the following are accepted as proof of insurance.

- A declaration page

- Valid permanent insurance card

Proof of insurance must be provided at traffic stops, when registering your car, or when you are in an accident. If you fail to provide proof of insurance or don’t have insurance, Connecticut will suspend your car’s registration.

You will receive an intent to suspend registration letter, and in order to reinstate your registration you must do the following:

- Pay uninsured motorist civil penalties for each insurance lapse

- Provide proof of your insurance

- Registration will be valid after authorities receive a receipt of uninsured motorist civil penalty payment and proof of insurance

The best way to avoid fines is to have insurance and carry proof of insurance on you at all times.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Teen Driver Laws?

Teens must be at least 16 years old to get a learner’s license (also known as a permit). Before getting a license or a restricted license, teens must meet the requirements listed below.

| Requirements | Details |

|---|---|

| Mandatory Holding Period | 6 months (4 months with driver education) |

| Minimum Supervised Driving Time | 40 hours |

| Minimum Age | 16 years, 4 months |

If teens have a restricted license or learner’s license, they must obey the driving restrictions set by Connecticut.

| Restricted License Requirements | Details |

|---|---|

| Nighttime Restrictions | 11 p.m. to 5 a.m. |

| Passenger Restrictions (family members excepted unless otherwise noted) | First 6 months no passengers other than parents or a driving instructor. Second 6 months no passengers other than parents, driving instructor or members of the immediate family. |

| Minimum Age Restrictions can be Lifted | Details |

| Nighttime Restrictions | Until age 18 (minimum age 18) |

| Passenger Restrictions | 12 months or until age 18, whichever occurs first (minimum age: 17 years, 4 months.) |

Passenger and nighttime restrictions are meant to keep teenagers safer on the roads by limiting distractions.

What are the License Renewal Procedures for Older Drivers?

Like younger drivers, older drivers also have special restrictions. Luckily, in Connecticut, the requirements for license renewals for older drivers aren’t that different from older drivers.

Check out the list below to see what older drivers need to renew their license.

- Renewal Cycle — two years or six years for people 65 and older (personal option)

- Proof of Adequate Vision — NOT required at renewal

- Online or Mail Renewal — NOT permitted

Older drivers have the option of going to the DMV to renew their licenses every two years but may go every six years if they wish.

What’s the Procedure for New Residents?

If you are moving to Connecticut, you will need to have Connecticut’s minimum liability coverage. You will need to contact your provider to make sure you will have the correct amounts, as well as give them your new address to receive updated insurance cards.

As a reminder, here are the required bodily injury coverage and property damage coverage amounts.

- $25,000 to cover injury costs of one person in an accident

- $50,000 to cover injury costs of all people in an accident

- $20,000 to cover property damages from an accident

You are also required to have uninsured and underinsured coverage, but you may choose to submit a form to your insurance provider rejecting this coverage.

Up next, we will share license renewal procedures, as getting a new license is another important step on a moving to-do list.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the License Renewal Procedures?

If you are part of the general population (neither a teen or older driver), the license renewal procedures are as follows:

- Renewal Cycle — six years

- Proof of Adequate Vision — Required at first renewal only

- Online or Mail Renewal — NOT permitted

The only exception to the mail renewal is if you are military personnel or a resident living outside the state. If so, you can renew your license by mail in Connecticut.

What’s Considered Reckless Driving?

Reckless driving is whenever a person places themselves or others at risk through careless driving. To discourage reckless driving, Connecticut has the following penalties in place.

| Offense | Crime Classification | Fines | Jail Time | License Suspension |

|---|---|---|---|---|

| First | Class D Misdemeanor | $100 to $300 | Up to 30 days | 30 to 90 days |

| Second and Subsequent | Class A Misdemeanor | Maximum $600 | Up to 1 year | Minimum 90 days |

If a driver was under the influence when receiving a reckless driving charge, it is possible to plea bargain the reckless driving down to a “wet reckless.” A wet reckless is a lesser charge, which means the driver could get out of some of the penalties above.

What are the Rules of the Road?

Every driver must know the rules of the road. If drivers don’t follow the rules, it can lead to accidents and fatalities. Keep reading to familiarize yourself with some of the most important rules of the road in Connecticut.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is Connecticut a Fault or No-Fault State?

Connecticut is an at-fault state. This means that the driver who caused the accident is liable for the costs of the accident.

These costs can include injury and property damage payments, which is why it is important to at least have the MINIMUM coverage required.

If you don’t have insurance and are at-fault, you will find that an accident will quickly deplete your funds!

What are the Seat Belt and Car Seat Laws?

Seat belts are a necessity. If you aren’t wearing one in an accident, you could be thrown from your car and have a higher risk of being killed. Connecticut has created the following seat belt law to keep Connecticut drivers as safe as possible.

All drivers and front-seat passengers MUST wear a seat belt.

| Initial Effective Date | Primary Enforcement | Who is Covered? In What Seats? | Maximum Fine 1st Offense |

|---|---|---|---|

| January 1, 1986 | Yes, effective since January 1, 1986 | 8+ years in front seat | $50 |

For smaller passengers, Connecticut has the following car seat laws. Make sure you are familiar with them, as the type of car seat you use is important in making sure children are safe.

| Type of Child Seat | Age and Weight Details |

|---|---|

| Rear-facing child restraint | Younger than 2 years or less than 30 pounds |

| Forward or rear-facing child restraint | 2-4 years or between 30-40 pounds |

| Forward or rear-facing child restraint or a booster seat secured with a lap and shoulder belt | 5-7 years or between 40-60 pounds |

| Adult seat belt | 8 through 15 years and 60+ pounds |

The fine for violating the car seat law is the same as violating the seat belt law — max $50.

Finally, Connecticut has restrictions placed on riding in a pickup truck bed. People may ride in the cargo area of pickup trucks ONLY if they meet the following criteria.

- 16 and older

- 15 and younger ONLY if belted

- Farming operations

- Hayrides in the months of August through December

These regulations are important, as people riding in the cargo area of a pickup always run the risk of being jostled about or thrown from the vehicle.

What are the Keep Right and Move Over Laws?

These laws are as simple as they sound! Here’s the keep right law: if you are driving slower than the average speed of traffic around you, keep to the right.

Here’s another rule — you are prohibited from passing on the right unless there are three or more lanes.

Just remember that the right lane is reserved for slower travelers, not passing, and you’ll be fine! Let’s move onto another important rule of the road, the move over law.

The move over law is one of the most important laws to follow. Sadly, not enough people do. Every year, hundreds of people are killed because of drivers who fail to move over!

So let’s take a closer look at what this law requires.

If you see a stationary vehicle with flashing lights, you must SLOW DOWN and MOVE OVER if possible.

These vehicles include police, emergency vehicles, tow trucks, garbage trucks, and any vehicle that has its flashing emergency lights on. Moving over a lane creates a safety cushion so that people aren’t hit while on the side of the road.

If you can’t move over, you need to SIGNIFICANTLY slow down and keep a close eye out for people moving around the vehicles.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Speed Limit?

Speed limits make sure drivers aren’t barrelling down the road and posing a risk to both themselves and others. Connecticut created a speed limit law that outlines the MAXIMUM speeds allowed in Connecticut.

| Rural Interstates | Urban Interstates | Other Limited Access Roads | Other Roads |

|---|---|---|---|

| 65 mph | 55 mph | 65 mph | 55 mph |

Bear in mind that these are the maximum speeds. If you are going 65 mph on a 30 mph road, you will still receive a ticket even though you didn’t go over the maximum speed for that road type.

How does Ridesharing Work?

If you want to work at a company like Uber or Lyft, you will need to purchase ridesharing insurance. The following insurance providers sell ridesharing insurance in Connecticut.

- Geico

- Liberty Mutual

- State Farm

You will also need to meet basic requirements, such as the ones listed below.

- Three years of driving experience

- 21 years old or older

- Clean driving record

- Inspected and registered car

Every ridesharing company will have its own criteria, but you can expect to have to purchase ridesharing insurance, have driving experience, have a clean record, and have a safe car.

After all, people are getting into a car with you, so the company needs to know that you can drive and that your car is safe to operate!

What’s the Law for Automation on the Road?

Connecticut is one of the few states that has a law about automated vehicles. If you own an automated vehicle, you will need to follow the rules below.

| What type of driving automation on public roads does the law/provision permit? | Licensed Operator Required | Operator Required to be in Vehicle | Liability Insurance |

|---|---|---|---|

| Testing | Yes | Yes | Required, $5,000,000 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Safety Laws?

With so many driving risks, Connecticut has laws in place that attempt to prevent drivers from making crucial mistakes. Impaired driving and distracted driving are all too common and often result in tragedy.

What are the DUI Laws?

Drunk driving claimed 120 lives in 2017 alone. Too many people misjudge their alcohol-content — thinking that one more drink won’t hurt or thinking that they have sobered up enough to drive.

So what is Connecticut’s DUI law? We’ve outlined the details below, but bear in mind this is just a general overview — we will get to the penalties for DUIs shortly.

| BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back/Washout Period |

|---|---|---|---|---|

| 0.08 | NA | 1st misdemeanor 2+ within 10 years felony | Driving Under the Influence (DUI) | 10 years |

The lookback or washout period means that a DUI will stay on your record for ten years. If you recall, a bad driving record (DUIs, accidents, or speeding) will raise your rates astronomically.

If you need further incentive to never drive drunk, take a look at the penalties in the table below.

| Number of Offense | License Revocation | Jail Time | Fines | IID Lock | Other |

|---|---|---|---|---|---|

| 1st | 45 days | Up to 6 months with mandatory 2 day minimum OR Up to six months suspension with probation requiring 100 hours community service | $500 to $1,000 | 1 year | NA |

| 2nd | 45 days | Up to 2 years with mandatory minimum of 120 consecutive days and probation with 100 hours community service | $1,000 to $4,000 | 3 years | 1st year limited to travel to and from work, school and substance abuse treatment program, IID service center or probation appointment |

| 3rd | License revoked, but eligible for reinstatement after 2 years | Up to 3 years and mandatory minimum of one year and probation with 100 hours community service | $2,000 to $8,000 | If reinstated license, must only drive IID vehicle (may be lifted after 15 years by DMV commissioner) | NA |

Fourth offenses, and every offense after that, have the same penalties as the third offense. Basically, you will lose your right to drive altogether, as well as earning jail time and hefty fines!

What are the Marijuana-Impaired Driving Laws?

Connecticut does not have a specific law against marijuana-impaired driving, but anyone driving under the influence of marijuana can be charged with impaired driving.

Impaired driving in Connecticut carries many of the same penalties as drunk driving: fines, jail time, and license suspension.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Distracted Driving Laws?

Distracted driving is just as dangerous as driving impaired. All it takes is a second with your eyes off the road to crash. To help prevent this, Connecticut created the following cellphone use law.

| Hand-Held Ban | Young Drivers All Cellphone Ban | Texting Ban | Enforcement |

|---|---|---|---|

| All drivers | Drivers younger than 18 | All drivers | Primary |

Connecticut’s distracted driving law doesn’t just apply to texting and general phone use — there is a law that prohibits drivers from ALL distracting activities in the car.

These activities can range from brushing your hair to eating, but the basic rule is that if the activity makes you take your eyes off the road for even a second it IS a distracting activity!

What are Some Connecticut Can’t-Miss Facts?

Do you know what dangers to watch out for on the road? Every state has different risk factors. For example, Connecticut is a hotspot in the fall for whitetail deer!

According to the NHSA, collisions with deer result in over $1 billion in accident costs each year.

The State of Connecticut Insurance Department gives useful tips for avoiding deer collisions and what to do if you hit a deer.

To help you know what to keep an eye out for on Connecticut’s roads, we’ve covered all the major risk factors, from vehicle theft to crash stats. Let’s jump right into it!

Is There a Vehicle Theft in Connecticut?

The type of car you drive carries it’s own risk factors, such as how the car performs in collisions or on snowy roads. One risk factor that most people don’t consider, though, is the likelihood of their car being stolen.

If you have one of the vehicles below, be aware that it is one of the top ten stolen vehicles in Connecticut.

| Vehicle Make and Model | Vehicle Year | Total Thefts |

|---|---|---|

| Honda Accord | 1997 | 534 |

| Honda Civic | 1998 | 532 |

| Nissan Maxima | 1998 | 184 |

| Nissan Altima | 1997 | 143 |

| Toyota Camry | 2014 | 131 |

| Jeep Cherokee/Grand Cherokee | 2000 | 110 |

| Toyota Corolla | 1999 | 99 |

| Honda CR-V | 1998 | 92 |

| Dodge Caravan | 2000 | 79 |

| Acura TL | 2003 | 76 |

The Honda brand is one of the most stolen vehicles in Connecticut, with three different models making the list. Up next, we have the FBI’s 2013 crime report on vehicle theft by cities.

| City | Motor Vehicle Theft |

|---|---|

| Ansonia | 50 |

| Avon | 6 |

| Berlin | 11 |

| Bethel | 6 |

| Bloomfield | 22 |

| Branford | 40 |

| Bridgeport | 663 |

| Bristol | 127 |

| Brookfield | 5 |

| Canton | 1 |

| Cheshire | 10 |

| Clinton | 0 |

| Coventry | 6 |

| Cromwell | 4 |

| Danbury | 64 |

| Darien | 2 |

| Derby | 25 |

| East Hampton | 3 |

| East Hartford | 120 |

| East Haven | 101 |

| Easton | 1 |

| East Windsor | 9 |

| Enfield | 25 |

| Fairfield | 39 |

| Farmington | 20 |

| Glastonbury | 7 |

| Granby | 2 |

| Greenwich | 42 |

| Groton | 4 |

| Groton Long Point | 0 |

| Groton Town | 18 |

| Guilford | 7 |

| Hamden | 77 |

| Hartford | 639 |

| Madison | 0 |

| Manchester | 53 |

| Meriden | 146 |

| Middlebury | 5 |

| Middletown | 74 |

| Milford | 105 |

| Monroe | 9 |

| Naugatuck | 60 |

| New Britain | 236 |

| New Canaan | 5 |

| New Haven | 753 |

| Newington | 34 |

| New London | 61 |

| New Milford | 13 |

| Newtown | 4 |

| North Branford | 12 |

| North Haven | 33 |

| Norwalk | 106 |

| Norwich | 52 |

| Old Saybrook | 3 |

| Orange | 14 |

| Plainfield | 16 |

| Plainville | 16 |

| Plymouth | 14 |

| Portland | 5 |

| Putnam | 7 |

| Redding | 0 |

| Ridgefield | 0 |

| Rocky Hill | 15 |

| Seymour | 17 |

| Shelton | 40 |

| Simsbury | 6 |

| Southington | 42 |

| South Windsor | 10 |

| Stamford | 149 |

| Stonington | 8 |

| Stratford | 136 |

| Suffield | 6 |

| Thomaston | 5 |

| Torrington | 34 |

| Trumbull | 31 |

| Vernon | 16 |

| Wallingford | 27 |

| Waterbury | 689 |

| Waterford | 7 |

| Watertown | 43 |

| West Hartford | 83 |

| West Haven | 243 |

| Weston | 0 |

| Westport | 11 |

| Wethersfield | 28 |

| Willimantic | 52 |

| Wilton | 6 |

| Winchester | 6 |

| Windsor | 18 |

| Windsor Locks | 11 |

| Wolcott | 34 |

| Woodbridge | 17 |

Bridgeport, Hartford, New Haven, and Waterbury are the worst cities for vehicle theft, with over 600 vehicles stolen from each city in 2013.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the Dangers on the Road in Connecticut?

To help you keep a wary eye out, we’ve covered the major dangers on Connecticut’s roads. Keep reading to learn about Connecticut’s fatality rates by weather condition, person type, and much more.

What’s the Number of Fatal Crashes by Weather Condition and Light Condition?

Every teen driver learns about the dangers of hydroplaning and driving on icy roads, but this knowledge doesn’t always make it easier to navigate dangerous conditions. Each year, weather conditions cause fatal crashes in Connecticut.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 106 | 80 | 32 | 11 | 0 | 229 |

| Rain | 13 | 3 | 6 | 1 | 1 | 24 |

| Snow/Sleet | 0 | 2 | 0 | 0 | 0 | 2 |

| Other | 2 | 2 | 0 | 0 | 0 | 4 |

| Unknown | 0 | 1 | 0 | 0 | 0 | 1 |

| TOTAL | 121 | 88 | 38 | 12 | 1 | 260 |

While most fatalities happen during normal weather, rain is a contributor to fatalities in Connecticut.

What’s the Number of Traffic Fatalities?

The type of roadway often plays a role in traffic fatalities. Typically, more deaths occur on rural than urban roadways.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 55 | 36 | 62 | 38 | 77 | 130 | 60 | 46 | 37 | 44 |

| Urban | 247 | 188 | 258 | 183 | 186 | 156 | 188 | 221 | 261 | 232 |

| Unknown | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 3 | 6 | 2 |

| Total | 302 | 224 | 320 | 221 | 264 | 286 | 248 | 270 | 304 | 278 |

Unfortunately, the fatality rate has had small increases over the years.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Fatalities by Person Type?

In this report, person type does not mean a driver’s personality! Person type looks at the type of vehicle driven and occupant versus pedestrian fatalities.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 131 | 109 | 108 | 118 | 117 |

| Light Truck - Pickup | 13 | 7 | 16 | 11 | 17 |

| Light Truck - Utility | 37 | 18 | 27 | 36 | 25 |

| Light Truck - Van | 4 | 2 | 4 | 9 | 2 |

| Light Truck - Other | 2 | 0 | 0 | 0 | 1 |

| Large Truck | 2 | 4 | 8 | 7 | 4 |

| Bus | 0 | 0 | 1 | 1 | 2 |

| Other/Unknown Occupants | 0 | 2 | 2 | 1 | 2 |

| Total Motorcyclists | 57 | 55 | 55 | 52 | 57 |

| Pedestrian | 37 | 47 | 46 | 59 | 48 |

| Bicyclist and Other Cyclist | 3 | 4 | 3 | 6 | 3 |

| Other/Unknown Nonoccupants | 0 | 0 | 0 | 4 | 0 |

| Overall Total | 286 | 248 | 270 | 304 | 278 |

If you are a pedestrian or cyclist, make sure to keep one eye on the road because you can’t always trust drivers to avoid you!

What’s the Number of Fatalities by Crash Type?

The type of crash can have a significant impact on fatalities. A rollover is significantly more deadly than a light fender bender.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| - (1) Single Vehicle | 176 | 157 | 162 | 187 | 161 |

| - (2) Involving a Large Truck | 20 | 21 | 37 | 30 | 23 |

| - (3) Involving Speeding | 76 | 69 | 77 | 82 | 88 |

| - (4) Involving a Rollover | 41 | 35 | 41 | 39 | 38 |

| - (5) Involving a Roadway Departure | 165 | 145 | 147 | 164 | 144 |

| - (6) Involving an Intersection (or Intersection Related) | 78 | 51 | 54 | 65 | 71 |

| Total Fatalities (All Crashes) | 286 | 248 | 270 | 304 | 278 |

Up next, we will take a look at county fatality rates.

Five-Year Trend for the Top 10 Counties

Below, you will see the data for the top 10 worst counties in Connecticut for traffic fatalities.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| New Haven County | 63 | 52 | 65 | 82 | 75 |

| Hartford County | 79 | 56 | 63 | 60 | 60 |

| Fairfield County | 50 | 47 | 35 | 73 | 59 |

| New London County | 29 | 31 | 29 | 27 | 28 |

| Litchfield County | 19 | 16 | 22 | 16 | 20 |

| Windham County | 12 | 15 | 18 | 16 | 14 |

| Tolland County | 17 | 18 | 17 | 12 | 12 |

| Middlesex County | 17 | 13 | 21 | 18 | 10 |

| Top Ten Counties Total | 286 | 248 | 270 | 304 | 278 |

| All Counties Total | 286 | 248 | 270 | 304 | 278 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the Number of Fatalities Involving Speeding by County?

Speeding contributes to fatalities every year, as higher speeds mean greater impacts.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Fairfield County | 17 | 15 | 13 | 20 | 22 |

| Hartford County | 15 | 25 | 16 | 18 | 25 |

| Litchfield County | 5 | 4 | 3 | 3 | 5 |

| Middlesex County | 5 | 1 | 6 | 2 | 0 |

| New Haven County | 25 | 11 | 21 | 28 | 20 |

| New London County | 4 | 7 | 10 | 5 | 10 |

| Tolland County | 3 | 3 | 4 | 4 | 4 |

| Windham County | 2 | 3 | 4 | 2 | 2 |

Above, you will see the fatality rates for the different counties in Connecticut. New Haven, Hartford, and Fairfield counties have the highest fatality numbers throughout the years.

What’s the Number of Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC=0.08+) by County?

Another cause of fatalities is drunk driving. Below, the fatality rates demonstrate why drunk driving is such a significant problem.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Fairfield County | 21 | 17 | 17 | 24 | 28 |

| Hartford County | 35 | 25 | 17 | 27 | 27 |

| Litchfield County | 10 | 5 | 12 | 5 | 10 |

| Middlesex County | 10 | 2 | 7 | 8 | 5 |

| New Haven County | 29 | 19 | 21 | 34 | 29 |

| New London County | 9 | 15 | 13 | 11 | 12 |

| Tolland County | 10 | 8 | 8 | 5 | 4 |

| Windham County | 3 | 6 | 5 | 4 | 6 |

Drinking impairs drivers’ judgment, which is why the chance of an accident and fatality increases with every drink!

What’s the Rating for Teen Drinking and Driving?

Sadly, despite the enormous risks, many teens participate in drinking and driving. Nationally, an average of 1.2 teens per 100,000 population are killed every year because of underage drinking and driving.

In Connecticut, this average is slightly better. Per 100,000 people, 0.9 deaths occur due to underage drinking and driving.

While Connecticut’s average is lower than most, any number above zero means underage drunk driving is still an issue. To see how Connecticut is handling underage drinking and driving, we’ve included Connecticut’s arrest record.

| DUI Arrest (Under 18) | DUI Arrests (Under 18) Per 100,000 People | Rank |

|---|---|---|

| 41 | 54.43 | 35 |

Connecticut ranks 35th for its number of underage drunk driving arrests. This means Connecticut is not arresting a high number of teens. But since Connecticut also has a lower fatality rate, it seems Connecticut is doing a decent job of managing underage drunk driving.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What’s the EMS Response Time?

Since we’ve covered numerous different contributors to fatalities, we want to give you some peace of mind if you are in an accident. Below, you will see the EMS response times for Connecticut.

| Road Type | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Urban | 2.27 minutes | 6.44 minutes | 26.61 minutes | 34.55 minutes | 249 |

| Rural | 2.17 minutes | 9.47 minutes | 39.67 minutes | 48.60 minutes | 37 |

In both rural and urban settings, it takes under an hour from the time of the call to arrive at the hospital. So rest easy that if you are in an accident, you will be at the hospital as quickly as possible.

What’s the Transportation in Connecticut like?

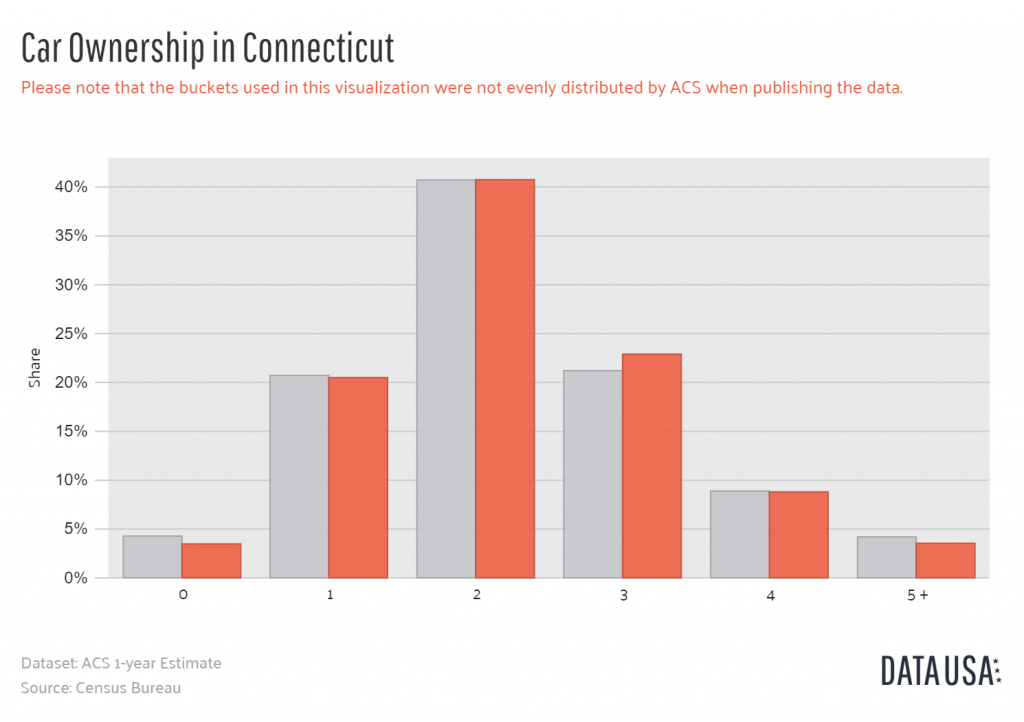

Transportation is a vital part of our day. We use transportation to get to work, to the grocery store, to meet friends, and much more. In Connecticut, the most common method of transportation is owning a car.

Owning two cars is by far the most popular option, with ownership of one or three cars the next most popular choices.

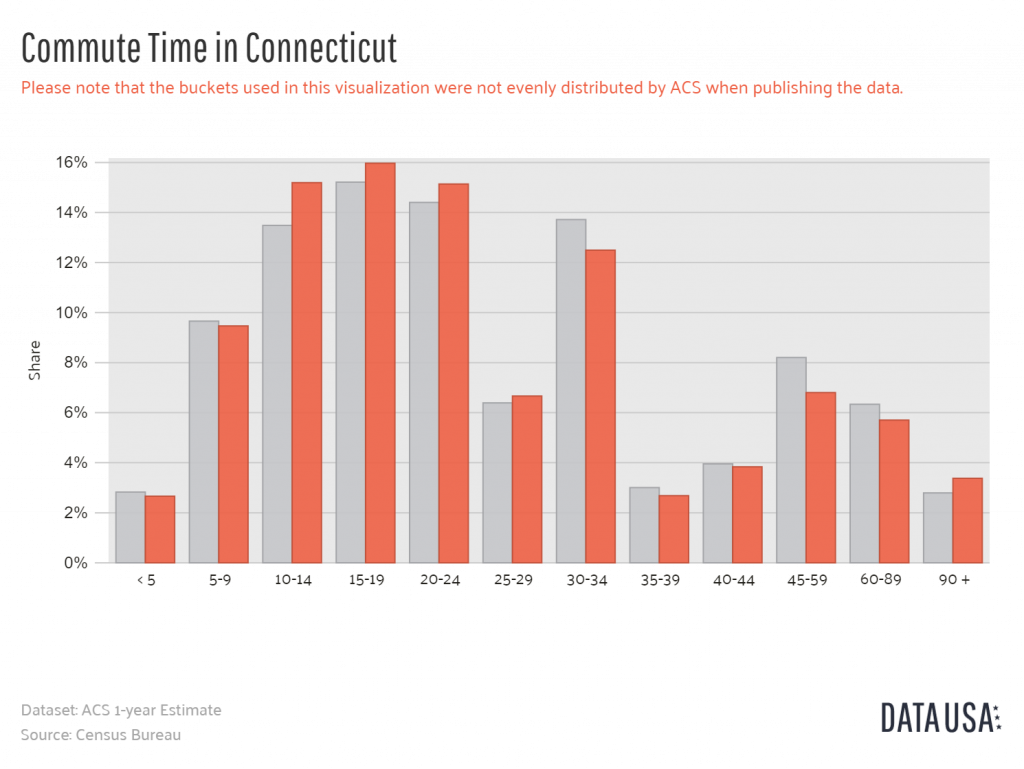

What’s the Commute Time?

Commuting to work is a necessary part of most people’s day. Connecticut’s average commute time of 24.9 minutes is just slightly under the national average of 25.3 minutes.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

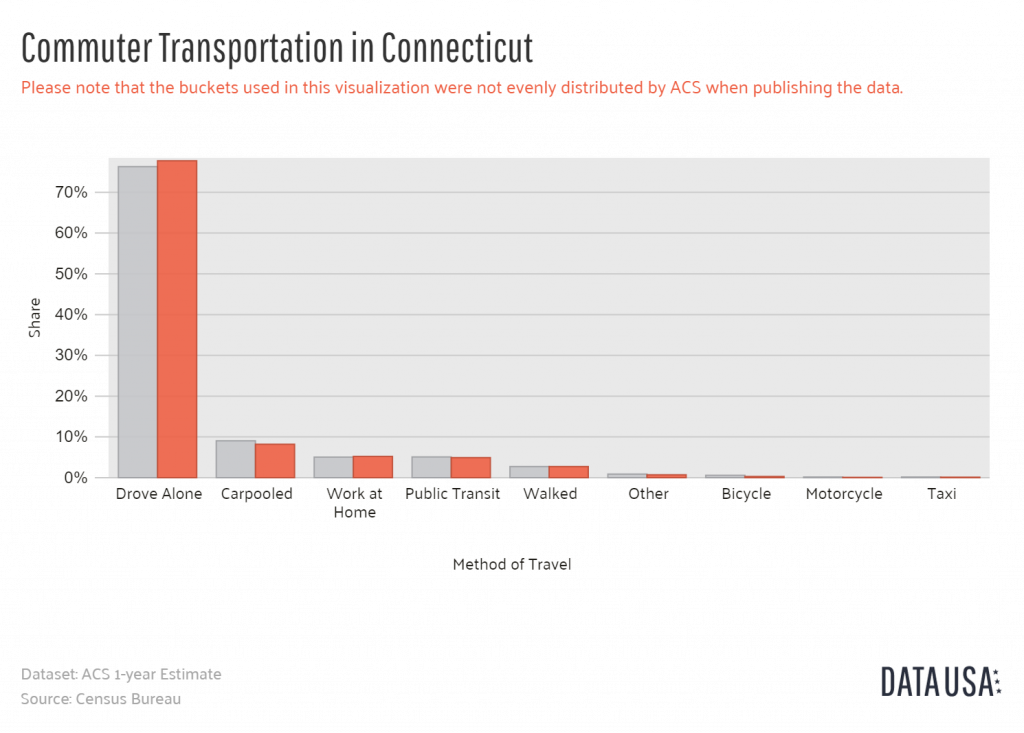

Is there a Commuter Transportation?

How do you get to work each day? While driving alone is the most common method, people also carpool, work from home or use public transportation in Connecticut.

What are the Top Two Cities for Traffic Congestion?

Two of Connecticut’s cities ranked on TomTom’s list of most congested cities worldwide. If you are planning on driving through either of the two cities below, make sure to allow extra time for traffic.

| City | World Rank | Congestion Level | Morning Peak | Evening Peak |

|---|---|---|---|---|

| New Haven | 147 | 19% | 23% | 45% |

| Hartford | 167 | 16% | 26% | 42% |