Types of Car Insurance Coverage

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dollar-a-Day Insurance Coverage

Car insurance can be expensive. If you’re paying high car insurance rates, you may be wondering how to reduce the cost of car insurance. But did you know you could qualify for dollar-a-day insurance coverage? If you or your family are struggling to make ends meet you could be eligible for dollar-a-day insurance coverage. This…

Rideshare Insurance Coverage

If you drive for a rideshare app, delivery service, or some other money-earning activities, you may have realized there’s a coverage gap. Many insurance companies now ask if you drive for business. They don’t cover your activity while you’re on the clock. Rideshare insurance could help you make sure you have enough accident coverage before…

SR-50 Insurance Coverage

If you live in Indiana, you’ve probably heard about SR-50 insurance. Anyone who needs SR-50 car insurance has been ticketed for driving without proof of insurance. Unfortunately, this type of violation makes you a higher risk to insurance companies, and it could be associated with temporary license suspension. So insurance companies can raise your rates…

Learner’s Permit Insurance Coverage

For many people, getting your learner’s permit is a right of passage, but it also opens up a lot of questions. Do you need your own learner’s permit insurance? Can you be added to your parents’ car insurance policy? The good news is that there are ways to get affordable learner’s permit car insurance, no…

Bodily Injury Liability Insurance Coverage

There are so many different types of car insurance coverage that it’s even tough to get a handle on the basics. The following article examines bodily injury liability. Keep reading to learn what bodily injury liability insurance is, why it’s necessary and how much you need. As you learn about bodily injury liability, you’ll also…

One-Day Car Insurance Coverage

There are many reasons you might need one-day car insurance, such as borrowing a car from a friend or looking for auto insurance for the first time. You could also be trying to reduce the cost of auto insurance by limiting the amount of time you are paying. No matter the reason, it’s good to…

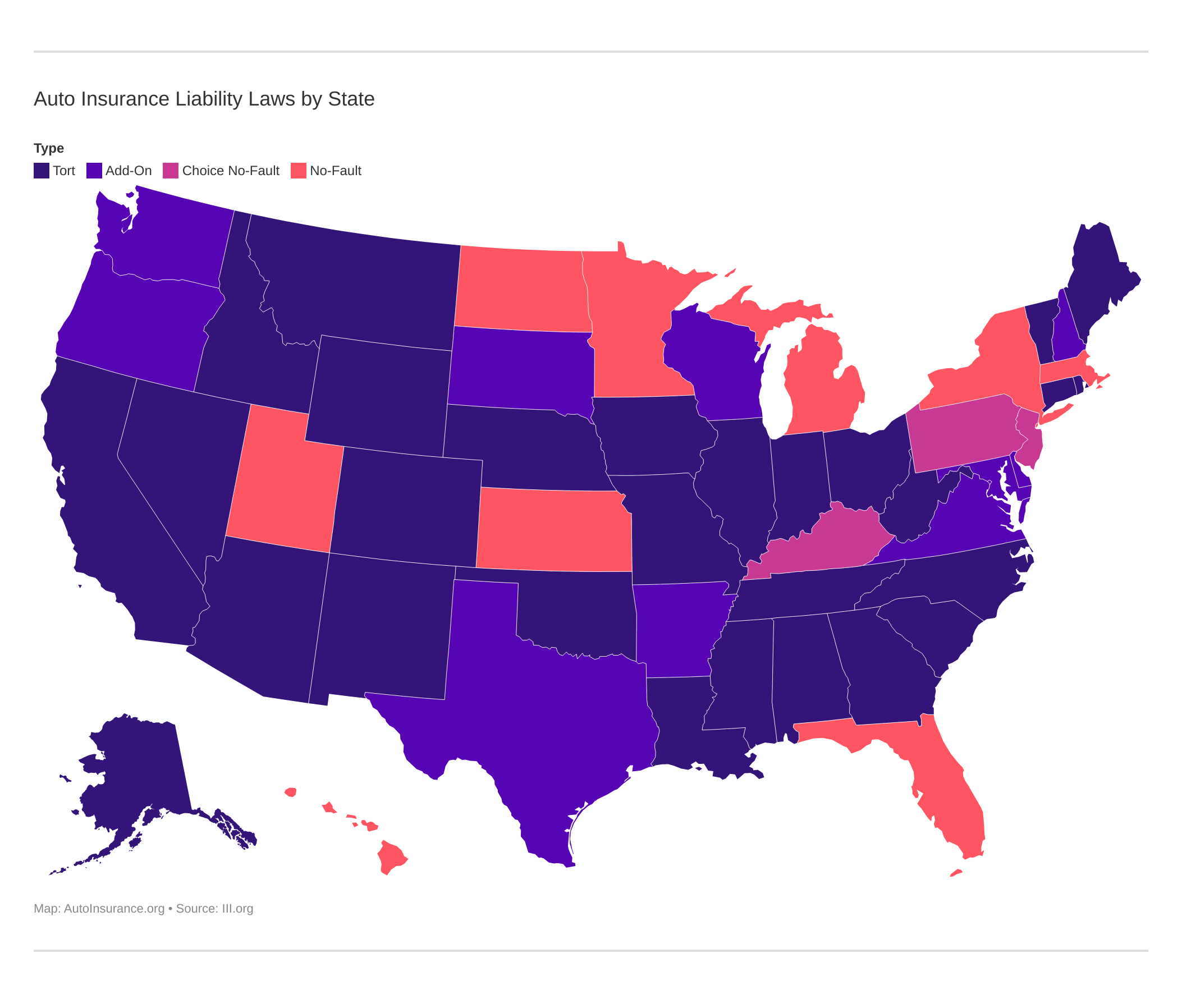

What’s the Difference: No-Fault vs. Tort Car Insurance

There are two basic types of auto insurance systems: “no fault” and “at fault” (this is normally referred to as tort). We’ll be the first to admit that having varying systems, with each state having its own specifics and guidelines, can be quite confusing.