Tennessee Car Insurance

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists

20%

Tennessee car insurance rates cost an average of $889 per year or $74 per month. There are a lot of factors that affect car insurance rates in Tennessee. It can be confusing, and we understand that. Tennessee car insurance laws changed in 2017 when the state adopted a new bill to decrease the number of uninsured drivers in the state.

This guide will help you to understand Tennessee auto insurance laws from 2019, 2020, 2021, and more. We will look at everything you need to know from auto insurance rates specific to the state of Tennessee, as well as coverage options in the Tennessee insurance market.

Start comparing Tennessee car insurance rates right now by entering your ZIP code in the FREE comparison tool above!

What are the Tennessee car insurance coverage requirements and rates?

In this section, we’re going to cover the various types of car insurance coverage and rates in Tennessee. We know this information can be a little bit overwhelming, but we’ve tried to lay out the data in an easy to read format.

The Volunteer State is home to both the Grand Old Opry and Graceland, making it a destination choice for both rock & roll and country music lovers. From Memphis BBQ to Nashville Hot Chicken, Tennessee has a flavorful culture that’s all its own.

For this insurance guide, we looked at everything from Tennessee’s car culture and Tennessee’s minimum coverage, to the forms of financial responsibility required in Tennessee, premiums as a percentage of income, and much more.

How much insurance is required for Tennessee minimum coverage?

In Tennessee, there is a minimum amount of coverage you need to drive. If you’re a resident purchasing minimum coverage, you’ll be happy to know that the average cost of insurance in Tennessee is one of the lowest in the US.

The following are Tennessee car insurance requirements:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $15,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle.

It’s also worth noting that Tennessee is a state that accepts electronic proof of insurance. So if you don’t have a paper card, you can pull up your insurance card on your phone, tablet, or other mobile device.

This minimum coverage is designed to cover your liability if you cause an accident. A minimum coverage auto insurance policy does not cover the policyholder’s auto damage or medical bills if they are at fault. If another party was at fault, you would need to make your claim with their insurance company if you only had liability coverage.

You can find Tennessee car insurance quotes by using our FREE comparison tool! Enter your ZIP code to start comparing rates from local car insurance companies!

What are the forms of financial responsibility in Tennessee?

In Tennessee, there are certain forms of financial responsibility. You must have to prove you have insurance that can cover any potential accidents.

According to Tennessee law, the forms you can use to prove you have adequate insurance include a document (or electronic document) confirming that you have an auto liability insurance policy.

According to Tennessee state law, other ways that you can prove financial responsibility are by posting a bond with the Department of Revenue for $65,000 or making a cash deposit with the Department of Revenue for $65,000. So, you have options when you’re proving that you can legally drive. You will need to carry a certificate to back this up, though. If you’ve been in an at-fault accident, especially if uninsured, these requirements could be stricter.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much do Tennessee residents pay for insurance?

Next, we’re going to check out the premiums as a percentage of income for car insurance for Tennessee drivers. Here is the three-year trend for Tennessee that shows the percentages from 2012 to 2014.

In 2012, the percentage was 2.12%, in 2013, it was 2.33%, and in 2014, it was 2.32%. As you can see, the highest percentage was right in the middle of 2013, and the lowest is in 2012.

Now, let’s check out the percentages of some states surrounding Tennessee. Note: the most recent year for this information is 2014, which is what we are showing you with these numbers.

For Arkansas, the percentage was 2.65%; Kentucky was 2.76%; Virginia was 1.90%; Alabama was 2.50%, and Mississippi was 3.05%.

As you can see, comparatively, Tennessee, is in the middle of its surrounding states. It’s significantly more affordable than some states. If you were to compare it to the countrywide average in 2014, which was 2.29%, Tennessee was slightly higher.

Now that you know how your income is affected, start looking for car insurance quotes in your local area by entering your ZIP code in the FREE comparison tool!

Compare Quotes From Top Companies and SaveFree Car Insurance Comparison

Secured with SHA-256 Encryption

What are the average monthly car insurance rates in TN (liability, collision, comprehensive)?

Average monthly car insurance rates vary by state.

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review Tennessee auto insurance rates for coverage below:

The table below shows the core coverage for Tennessee.

Core Car Insurance Coverage Costs In Tennessee

Liability $413.91

Collision $309.07

Comprehensive $148.45

Full Coverage $871.43

Please note that the data in this table is from the NAIC. As you can see, the cheapest core insurance coverage is comprehensive coverage at $148.45. Comprehensive coverage is the coverage you get for everything that can damage your car other than a collision.

The next cheapest coverage available is collision insurance ($309.07). Collision insurance is insurance that reimburses the insured for damage sustained to a vehicle due to the fault of the insured driver. Then there is liability insurance, which is an average of $413.91. This type of insurance gives the insured party protection against claims resulting from injuries and damage to people and property.

The final type of insurance on this list is full coverage, which is a bit more expensive, at $871.43. Full coverage is pretty self-explanatory; it’s a combination of collision insurance and comprehensive insurance.

Some drivers also have coverage to protect against uninsured motorists. Some states have made this coverage part of their minimum standards, while others allow drivers to opt out. If you’re worried about hit and run accidents, drunk drivers, etc., uninsured motorist coverage can go a long way towards peace of mind.

What additional liability coverage is available in Tennessee?

Let’s talk about additional liability insurance. Additional liability insurance is optional insurance for rental cars that protects all authorized drivers if they injure someone or damage someone else’s property.

There are a few categories that pertain to liability insurance that we’re going to share with you. These categories are personal injury protection, medical payments, and uninsured/underinsured motorists.

It’s also important to examine the loss ratio for each of these categories, too. A loss ratio is the amount of money that companies spend on claims. If a ratio is over 100%, it means a company is losing money. If it’s too low, the company isn’t paying claims. The best ratio range is from 60-70.

For personal injury protection, there was no loss ratio for any of the years listed. As for medical payments, the loss ratios for Tennessee for medical payments were 75.2 in 2015, 68.85 in 2014, and 71.22 in 2013.

For uninsured or underinsured drivers, in 2015, the loss ratio was 77.24, in 2014, it was 69.94, and in 2013 it was 67.52. Unfortunately, Tennessee has the fifth-most uninsured drivers in the United States. According to our data, 20%of drivers in Tennessee drive without car insurance.

What add-ons, endorsements, and riders are available in Tennessee?

We’ve just about covered all the essential insurance types, but they may not cover all your needs. So, we’ve compiled a list of the other insurance options available to you. You can add these on top of your property damage liability and medical coverage. Some increase your limits, while others offer other necessary benefits to keep you safe and happy on the road.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement Insurance

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Make sure to check out these coverages. Some of them might be helpful for your specific needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

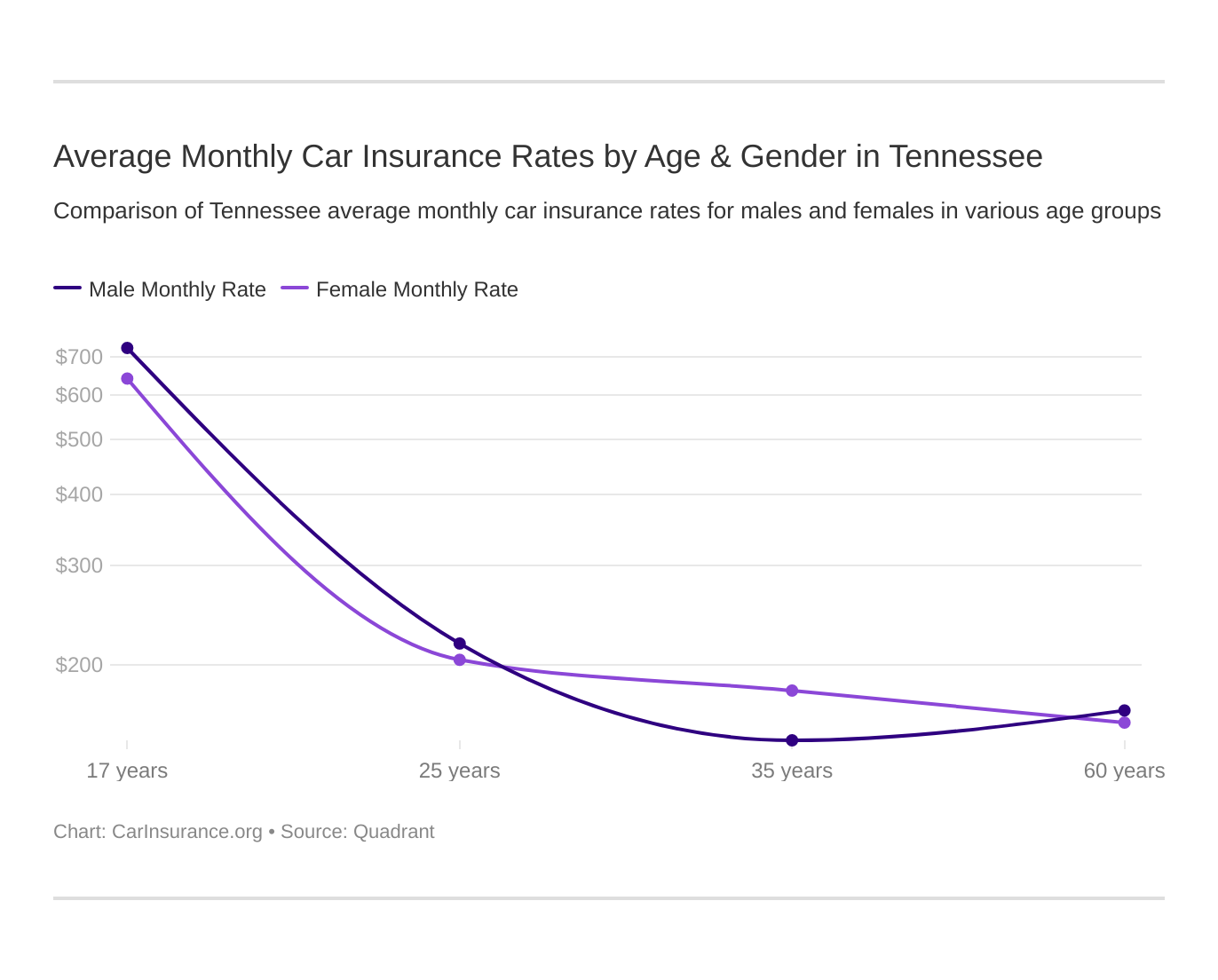

What are the average monthly car insurance rates by age & gender in TN?

For this section of the article, we’re going to look at the Tennessee car insurance rates for male and female drivers. California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and certain parts of Michigan have outlawed basing rates on gender. However, Tennessee allows gender as a determining factor for car insurance.

Company Demographic Average Annual Rate Rank

SAFECO Ins Co of IL Single 17-year old male $16,572.79 1

SAFECO Ins Co of IL Single 17-year old female $14,916.05 2

Allstate P&C Single 17-year old male $11,441.86 3

Allstate P&C Single 17-year old female $10,516.65 4

Progressive Hawaii Single 17-year old male $9,440.45 5

Progressive Hawaii Single 17-year old female $8,386.68 6

Mid-Century Ins Co Single 17-year old male $7,883.17 7

Nationwide Mutual Single 17-year old male $7,760.40 8

Mid-Century Ins Co Single 17-year old female $7,410.65 9

Geico General Single 17-year old male $6,739.05 10

Geico General Single 17-year old female $6,620.63 11

USAA Single 17-year old male $6,309.85 12

Travelers Prop Cas Ins Co Single 17-year old male $6,143.14 13

State Farm Mutual Auto Single 17-year old male $6,139.77 14

Nationwide Mutual Single 17-year old female $6,012.22 15

USAA Single 17-year old female $5,501.37 16

Travelers Prop Cas Ins Co Single 17-year old female $4,956.52 17

State Farm Mutual Auto Single 17-year old female $4,907.17 18

SAFECO Ins Co of IL Single 25-year old male $4,159.27 19

SAFECO Ins Co of IL Single 25-year old female $3,902.85 20

SAFECO Ins Co of IL Married 35-year old female $3,639.40 21

SAFECO Ins Co of IL Married 60-year old male $3,342.39 22

Allstate P&C Single 25-year old male $3,082.46 23

SAFECO Ins Co of IL Married 60-year old female $2,991.77 24

Allstate P&C Single 25-year old female $2,980.14 25

Allstate P&C Married 35-year old female $2,796.09 26

Nationwide Mutual Single 25-year old male $2,739.66 27

Allstate P&C Married 35-year old male $2,684.61 28

Allstate P&C Married 60-year old male $2,612.46 29

Mid-Century Ins Co Single 25-year old male $2,601.27 30

Nationwide Mutual Single 25-year old female $2,520.95 31

Allstate P&C Married 60-year old female $2,516.49 32

Mid-Century Ins Co Single 25-year old female $2,457.63 33

Progressive Hawaii Single 25-year old male $2,451.94 34

Geico General Single 25-year old male $2,286.01 35

Progressive Hawaii Single 25-year old female $2,246.65 36

Geico General Single 25-year old female $2,216.18 37

Nationwide Mutual Married 35-year old male $2,211.90 38

Geico General Married 35-year old male $2,202.22 39

Nationwide Mutual Married 35-year old female $2,192.98 40

Geico General Married 35-year old female $2,182.11 41

USAA Single 25-year old male $2,157.82 42

State Farm Mutual Auto Single 25-year old male $2,116.70 43

USAA Single 25-year old female $2,023.45 44

Geico General Married 60-year old female $2,010.58 45

Geico General Married 60-year old male $2,010.58 45

Nationwide Mutual Married 60-year old male $1,997.15 47

Travelers Prop Cas Ins Co Single 25-year old male $1,981.27 48

Nationwide Mutual Married 60-year old female $1,964.40 49

Travelers Prop Cas Ins Co Single 25-year old female $1,882.49 50

Progressive Hawaii Married 35-year old female $1,864.12 51

Travelers Prop Cas Ins Co Married 35-year old male $1,860.42 52

Mid-Century Ins Co Married 35-year old male $1,850.03 53

State Farm Mutual Auto Single 25-year old female $1,821.23 54

Mid-Century Ins Co Married 35-year old female $1,817.48 55

Mid-Century Ins Co Married 60-year old male $1,788.38 56

Travelers Prop Cas Ins Co Married 35-year old female $1,767.42 57

Progressive Hawaii Married 35-year old male $1,757.10 58

Travelers Prop Cas Ins Co Married 60-year old male $1,710.20 59

As you can see, male drivers who are in their teens have the highest rates, which is typical for most states. The most expensive company for this demographic is Safeco Insurance. Teenage females have the second-highest rates (Safeco), followed by a 25-year-old single male (Safeco, again). While boys may pay more automatically in the state of Tennessee, there is often a small division between boys and girls in states that don’t allow insurance companies to consider sex or gender. Teen boys, in particular, are more likely to be caught speeding or to get in at-fault accidents.

In addition to the age and gender of drivers, the marital status of a person also affects car insurance rates. If you bundle policies and take advantage of other opportunities, it can even lead to insurance discounts. Typically, if one is married, one tends to have lower insurance rates. We can see examples of this for a married 60-year-old male, which is the demographic with the cheapest insurance in Tennessee (Travelers).

This principle applies to women, too, regardless of age, as we can see that a woman who is 35 and married has the third least expensive insurance (Travelers, again).

Please note that this is based on purchased coverage by the state population, and this data includes rates for high-risk drivers and those drivers. They choose to purchase more than the state minimum for insurance coverage.

What are the cheapest rates by ZIP code in Tennessee?

ZIP codes affect auto insurance because of factors like traffic, crime, to name a few. Insurers look at the rate of break-ins and vandalism, collision claims, and much more. Find out how your ZIP code stacks up in TN.

The table below reveals the cost of insurance for each ZIP code in Tennessee.

ZIP code Average Annual Rate

38118 $4,991.62

38112 $4,984.00

38128 $4,967.47

38132 $4,958.99

38116 $4,954.44

38131 $4,952.11

38126 $4,950.53

38111 $4,919.47

38127 $4,916.69

38122 $4,912.60

38107 $4,906.85

38115 $4,904.13

38105 $4,889.05

38108 $4,886.59

38114 $4,883.14

38109 $4,879.55

38106 $4,855.29

38152 $4,820.32

38104 $4,818.28

38141 $4,774.38

38163 $4,759.35

38103 $4,753.52

38157 $4,658.51

38125 $4,510.60

38134 $4,485.51

38120 $4,400.44

38117 $4,360.18

38018 $4,340.28

38133 $4,323.93

38119 $4,302.46

38016 $4,289.19

38053 $4,265.27

38137 $4,219.83

38135 $4,219.79

38138 $4,184.91

38139 $4,136.05

38002 $4,114.08

38011 $4,105.10

38029 $4,102.16

38023 $4,094.22

38028 $4,080.50

38054 $4,079.26

38017 $4,078.89

38004 $4,075.14

38058 $4,056.03

38015 $4,042.45

38066 $4,041.12

38076 $4,036.66

38377 $4,029.52

38019 $4,010.68

38057 $4,004.99

38060 $4,003.01

38049 $3,966.47

38378 $3,963.50

38550 $3,945.78

38014 $3,941.45

38068 $3,939.49

38235 $3,925.54

38254 $3,923.76

38071 $3,923.43

37217 $3,921.40

38393 $3,921.11

38338 $3,913.21

38346 $3,909.40

38389 $3,907.41

38223 $3,900.59

38039 $3,898.63

38067 $3,894.39

37115 $3,893.03

38052 $3,884.72

38455 $3,878.41

38042 $3,875.17

38365 $3,872.80

38075 $3,870.39

37076 $3,865.64

38008 $3,864.80

38381 $3,861.98

38331 $3,860.33

38044 $3,851.70

37206 $3,845.82

38336 $3,838.12

37013 $3,837.12

37189 $3,821.98

37207 $3,819.83

38063 $3,817.32

37863 $3,808.45

37766 $3,807.39

38313 $3,801.79

38069 $3,799.78

38061 $3,799.67

37710 $3,794.50

37214 $3,791.89

38392 $3,789.20

37080 $3,788.41

37714 $3,787.19

38041 $3,786.20

37876 $3,786.11

38037 $3,784.49

37862 $3,784.30

37819 $3,784.17

38305 $3,782.99

38012 $3,773.88

37211 $3,772.78

38301 $3,769.73

37843 $3,767.75

37722 $3,760.56

37204 $3,760.39

37072 $3,758.35

38046 $3,755.78

37753 $3,755.45

37779 $3,755.34

37729 $3,755.23

37762 $3,755.07

38356 $3,754.97

37727 $3,754.41

38352 $3,754.34

37138 $3,754.05

38388 $3,753.13

37082 $3,752.45

38048 $3,752.37

38391 $3,752.29

37915 $3,752.13

37764 $3,750.77

38036 $3,750.75

38366 $3,749.46

38345 $3,749.29

37917 $3,745.66

37841 $3,744.53

38340 $3,743.56

37866 $3,742.36

37807 $3,741.65

37756 $3,739.65

37755 $3,739.28

37821 $3,738.24

37754 $3,738.01

37923 $3,737.89

37738 $3,737.41

37208 $3,737.25

37902 $3,737.16

37143 $3,736.56

37887 $3,734.89

37916 $3,734.16

37396 $3,731.40

37909 $3,730.75

37849 $3,729.26

37892 $3,729.23

38347 $3,729.19

37938 $3,728.69

38045 $3,728.11

37829 $3,727.15

37035 $3,726.24

37921 $3,726.02

37015 $3,725.68

38010 $3,725.49

38351 $3,725.42

37919 $3,720.70

37146 $3,720.19

38332 $3,719.81

37340 $3,719.22

37871 $3,719.22

37886 $3,718.43

38362 $3,718.02

37996 $3,716.14

38315 $3,715.97

37374 $3,715.24

37932 $3,713.28

37918 $3,711.75

37840 $3,710.95

37209 $3,708.97

37721 $3,706.19

37716 $3,706.18

37394 $3,705.27

37059 $3,704.74

37095 $3,704.73

37356 $3,703.63

37854 $3,703.33

38387 $3,702.13

38328 $3,701.85

37397 $3,701.84

38390 $3,701.12

37922 $3,701.11

37166 $3,700.04

37847 $3,698.46

37912 $3,697.59

38220 $3,697.53

37853 $3,697.15

37701 $3,696.82

37757 $3,696.47

37347 $3,695.64

38040 $3,692.60

38321 $3,691.92

38348 $3,691.92

37380 $3,691.77

37387 $3,689.63

38334 $3,688.79

37998 $3,688.70

37737 $3,687.62

37705 $3,687.62

38504 $3,687.12

38368 $3,685.48

38556 $3,685.18

37201 $3,684.92

38258 $3,684.92

37929 $3,683.35

37806 $3,683.33

37852 $3,683.04

37769 $3,682.43

37865 $3,682.41

37301 $3,682.41

37870 $3,681.68

37339 $3,681.58

37872 $3,680.59

37221 $3,679.02

38367 $3,678.13

37366 $3,677.89

38371 $3,677.85

37713 $3,676.61

37219 $3,675.94

38374 $3,674.63

37804 $3,674.52

37051 $3,674.29

38569 $3,673.77

37216 $3,673.53

37218 $3,671.00

38482 $3,669.87

37777 $3,668.90

38342 $3,667.97

37924 $3,667.63

38359 $3,667.57

38236 $3,666.96

37238 $3,666.11

38355 $3,664.78

37313 $3,664.45

37931 $3,664.15

37205 $3,663.87

37326 $3,662.86

37801 $3,661.47

37305 $3,660.65

38401 $3,658.28

38047 $3,658.16

37934 $3,657.33

37235 $3,657.12

38487 $3,656.85

37742 $3,655.32

37882 $3,655.29

37367 $3,654.74

37830 $3,654.55

37165 $3,653.64

37378 $3,652.61

37228 $3,652.37

37210 $3,652.08

37029 $3,650.60

37365 $3,649.90

37036 $3,648.69

38376 $3,648.22

37825 $3,647.88

37063 $3,646.30

37848 $3,644.86

38320 $3,643.59

37723 $3,642.99

38476 $3,640.87

37752 $3,640.68

38553 $3,639.95

38565 $3,638.90

37748 $3,638.35

38451 $3,638.09

37061 $3,637.96

38222 $3,637.36

37213 $3,637.16

38333 $3,636.96

38256 $3,636.89

38339 $3,636.71

37763 $3,636.51

37220 $3,636.24

37878 $3,636.19

38221 $3,635.53

37178 $3,635.43

38474 $3,635.11

38581 $3,634.59

38589 $3,634.56

38329 $3,634.40

37203 $3,634.30

38549 $3,633.69

37828 $3,631.92

38585 $3,631.85

38363 $3,630.92

37715 $3,629.25

37175 $3,628.44

37861 $3,627.48

38380 $3,627.39

38080 $3,626.88

38370 $3,626.42

37709 $3,626.19

37215 $3,626.17

38337 $3,626.01

37724 $3,625.79

38357 $3,625.75

38077 $3,625.71

38034 $3,625.49

38261 $3,625.46

37772 $3,625.19

37181 $3,625.18

37760 $3,624.24

38251 $3,623.49

37803 $3,623.30

37240 $3,622.30

37726 $3,622.29

37888 $3,621.96

38021 $3,621.42

37012 $3,621.07

38201 $3,621.00

37845 $3,620.34

38260 $3,618.75

38079 $3,618.42

38375 $3,618.04

38344 $3,617.26

38232 $3,615.82

37770 $3,615.58

38318 $3,615.10

38001 $3,614.42

37074 $3,614.03

38242 $3,612.99

38560 $3,610.82

37314 $3,609.62

38257 $3,609.57

37025 $3,609.47

37327 $3,609.40

38253 $3,608.83

38226 $3,608.77

37771 $3,608.71

37725 $3,608.03

37317 $3,607.25

37879 $3,606.82

37101 $3,606.70

37914 $3,604.41

37820 $3,602.70

37421 $3,602.35

38317 $3,602.06

37357 $3,601.59

38006 $3,600.08

38341 $3,598.22

37765 $3,598.22

37411 $3,598.21

37391 $3,597.00

37316 $3,596.68

37119 $3,595.93

38311 $3,594.50

37338 $3,593.87

37732 $3,593.43

37034 $3,592.61

37920 $3,592.23

37026 $3,591.69

37412 $3,591.53

37055 $3,591.50

37171 $3,591.14

37187 $3,589.90

37042 $3,588.65

37212 $3,588.07

38463 $3,587.20

37172 $3,586.98

37404 $3,586.57

37190 $3,586.30

37869 $3,585.71

37140 $3,585.27

38030 $3,584.11

37057 $3,583.66

37867 $3,583.39

37047 $3,583.13

38475 $3,582.38

37307 $3,581.87

37450 $3,581.37

37032 $3,581.16

37145 $3,581.10

37890 $3,580.63

37333 $3,580.63

38310 $3,580.57

38471 $3,580.31

38577 $3,579.78

38259 $3,578.83

38240 $3,578.80

37019 $3,578.08

37385 $3,577.92

38024 $3,577.44

37110 $3,577.44

38563 $3,577.23

38224 $3,576.66

37341 $3,576.48

38449 $3,575.89

37098 $3,574.99

38361 $3,573.44

38452 $3,573.04

37086 $3,572.89

38231 $3,571.63

37137 $3,571.44

38567 $3,571.01

37153 $3,570.82

37023 $3,570.34

38379 $3,570.32

38564 $3,570.13

37151 $3,569.34

37362 $3,568.84

37885 $3,568.68

37851 $3,568.48

37050 $3,568.28

37091 $3,567.11

37030 $3,566.60

38327 $3,566.38

37325 $3,565.67

37361 $3,565.16

37369 $3,564.85

37136 $3,564.78

37058 $3,564.34

38326 $3,563.41

38580 $3,563.21

38554 $3,563.17

37708 $3,561.43

37185 $3,560.03

37028 $3,559.17

37149 $3,558.93

37040 $3,557.92

37046 $3,557.89

38372 $3,557.50

37060 $3,557.42

37403 $3,553.92

38551 $3,553.88

37085 $3,552.01

37128 $3,551.85

37773 $3,551.71

38481 $3,551.26

38588 $3,550.98

38007 $3,550.93

38545 $3,549.78

37406 $3,549.45

38238 $3,549.20

37043 $3,548.94

37033 $3,548.57

38070 $3,548.55

37408 $3,548.54

38468 $3,548.34

37409 $3,548.12

37846 $3,548.01

37407 $3,547.92

37335 $3,547.58

37382 $3,547.33

37014 $3,547.21

38457 $3,546.99

38454 $3,546.10

37707 $3,546.02

38486 $3,545.80

37052 $3,545.61

38461 $3,544.45

37774 $3,544.23

38464 $3,543.97

37778 $3,542.90

37348 $3,542.78

38547 $3,541.94

37096 $3,541.31

37037 $3,541.16

38469 $3,541.15

37071 $3,541.04

38330 $3,540.76

38562 $3,540.39

37354 $3,539.52

37027 $3,539.46

38543 $3,539.20

38230 $3,539.14

38552 $3,538.77

37078 $3,538.20

37402 $3,537.68

38477 $3,537.00

38059 $3,536.92

38473 $3,536.08

37130 $3,533.43

37359 $3,532.89

37062 $3,530.69

38459 $3,530.58

37142 $3,530.51

37730 $3,530.20

37743 $3,529.76

38460 $3,529.75

37118 $3,529.60

38382 $3,529.46

37877 $3,529.26

37044 $3,528.26

37127 $3,527.90

37328 $3,526.48

37134 $3,526.25

37129 $3,525.46

37132 $3,525.40

38555 $3,524.86

37379 $3,522.44

38488 $3,522.33

38316 $3,522.00

38478 $3,521.73

38572 $3,521.24

37410 $3,520.83

37179 $3,520.71

37874 $3,520.70

38542 $3,519.84

38241 $3,519.75

38450 $3,519.73

37174 $3,519.21

38050 $3,518.80

37302 $3,518.67

37150 $3,518.40

37334 $3,518.06

37881 $3,517.81

37135 $3,517.77

38369 $3,517.50

37073 $3,517.27

38255 $3,517.26

37167 $3,516.54

38571 $3,515.44

38578 $3,513.30

38229 $3,512.31

38575 $3,512.15

38483 $3,511.57

37309 $3,511.10

37308 $3,510.33

38558 $3,510.10

37818 $3,509.85

38485 $3,509.64

37373 $3,509.45

38568 $3,508.27

37809 $3,508.07

37079 $3,507.93

38225 $3,505.95

38425 $3,505.63

37813 $3,505.08

37329 $3,504.31

38570 $3,504.20

38456 $3,503.91

38237 $3,503.49

37097 $3,503.33

37336 $3,503.13

37405 $3,500.65

37745 $3,497.81

37083 $3,497.57

38472 $3,496.70

37069 $3,496.10

38358 $3,494.75

38343 $3,494.39

37343 $3,494.03

37416 $3,493.87

37144 $3,493.25

37810 $3,492.79

38541 $3,491.02

38453 $3,490.91

37363 $3,490.63

37826 $3,490.46

37860 $3,489.95

37350 $3,488.34

38462 $3,486.76

37351 $3,486.50

37415 $3,486.50

38233 $3,486.45

37010 $3,484.72

37322 $3,484.29

37814 $3,483.95

37141 $3,483.80

37377 $3,483.53

38573 $3,482.45

37733 $3,481.93

37337 $3,481.20

37331 $3,476.20

37049 $3,475.62

37880 $3,474.18

37020 $3,473.96

37891 $3,473.64

37304 $3,472.06

37419 $3,469.93

37355 $3,468.40

37075 $3,465.56

37064 $3,463.78

37303 $3,463.23

37388 $3,457.09

37370 $3,455.49

37616 $3,452.95

37353 $3,450.98

37048 $3,449.31

37122 $3,449.02

37031 $3,448.77

37180 $3,446.66

37160 $3,443.42

37090 $3,443.35

37066 $3,442.39

37148 $3,442.16

37323 $3,440.30

37311 $3,438.68

37352 $3,437.77

37018 $3,435.75

37183 $3,429.88

37312 $3,428.67

37345 $3,426.74

37186 $3,425.58

37398 $3,424.23

38587 $3,421.54

37191 $3,421.12

37087 $3,420.40

37310 $3,418.31

37022 $3,417.65

37016 $3,417.50

38579 $3,415.69

37375 $3,415.49

37360 $3,414.87

37641 $3,414.36

37318 $3,413.15

37324 $3,412.92

37376 $3,412.29

37381 $3,410.88

37067 $3,410.24

37731 $3,410.17

37306 $3,407.39

37389 $3,406.20

37342 $3,406.03

37811 $3,405.57

37873 $3,401.96

38559 $3,401.21

37383 $3,398.63

38574 $3,398.30

37184 $3,397.64

37332 $3,396.69

37188 $3,396.54

37642 $3,393.56

37321 $3,390.17

37645 $3,386.37

37711 $3,385.92

38505 $3,385.52

38501 $3,373.08

38583 $3,373.07

37330 $3,367.08

37857 $3,361.55

38506 $3,361.19

37640 $3,361.10

37683 $3,359.00

37691 $3,358.19

38582 $3,353.11

38548 $3,328.08

38544 $3,319.72

37681 $3,308.69

37687 $3,298.94

37658 $3,294.15

37664 $3,286.44

37665 $3,282.60

37656 $3,275.84

37688 $3,269.32

37680 $3,266.48

37660 $3,265.10

37618 $3,259.15

37682 $3,257.45

37686 $3,248.25

37617 $3,226.34

37657 $3,222.95

37663 $3,220.96

37659 $3,217.01

37650 $3,212.85

37694 $3,210.85

37643 $3,200.59

37615 $3,199.74

37690 $3,197.59

37684 $3,188.99

37604 $3,187.79

37692 $3,177.19

37620 $3,176.81

37614 $3,175.79

37601 $3,173.65

As you can see from the table, the 28 most expensive ZIP codes are all in Memphis. The most expensive ZIP code, 38118, has an average rate of $4,991.6, but the 29th-most expensive ZIP code (38018) is in Cordova, with an average rate of $4,340.28. The cheapest ZIP code is 37601 in Johnson City, and its average is $3,173.65.

As far as prices of insurance companies go, the highest prices tend to be Allstate, and the least expensive tend to be USAA car insurance, regardless of the ZIP code.

What are the cheapest rates by city in Tennessee?

We know that car insurance prices vary based on ZIP code. So it makes sense that car insurance rates also change based on the city you live in, too. Tennessee farmers in rural areas don’t face the same challenges residents of Nashville might face.

Here is a table that shows the average car insurance cost of each city in Tennessee.

City Average Grand Total

BRISTOL $3,176.81

UNICOI $3,177.18

JOHNSON CITY $3,184.24

MOUNTAIN HOME $3,188.99

TELFORD $3,197.59

ELIZABETHTON $3,200.59

WATAUGA $3,210.86

ERWIN $3,212.85

JONESBOROUGH $3,217.01

FLAG POND $3,222.95

BLOUNTVILLE $3,226.34

PINEY FLATS $3,248.25

MILLIGAN COLLEGE $3,257.45

BLUFF CITY $3,259.15

KINGSPORT $3,263.78

LAUREL BLOOMERY $3,266.48

SHADY VALLEY $3,269.32

FALL BRANCH $3,275.84

HAMPTON $3,294.15

ROAN MOUNTAIN $3,298.94

LIMESTONE $3,308.69

BAXTER $3,319.72

BUFFALO VALLEY $3,328.08

SILVER POINT $3,353.11

TRADE $3,358.19

MOUNTAIN CITY $3,359.00

BUTLER $3,361.10

ROGERSVILLE $3,361.55

ESTILL SPRINGS $3,367.08

SPARTA $3,373.07

COOKEVILLE $3,373.26

BULLS GAP $3,385.92

MOUNT CARMEL $3,386.37

DAYTON $3,390.17

CHURCH HILL $3,393.56

WHITE HOUSE $3,396.54

EVENSVILLE $3,396.70

WATERTOWN $3,397.64

MONTEREY $3,398.30

DOYLE $3,401.22

SURGOINSVILLE $3,401.96

MOORESBURG $3,405.57

HILLSBORO $3,406.03

ARNOLD A F B $3,406.20

SEWANEE $3,407.06

BELVIDERE $3,407.39

EIDSON $3,410.16

SPRING CITY $3,410.88

SHERWOOD $3,412.29

DECHERD $3,412.91

COWAN $3,413.15

CHUCKEY $3,414.37

NORMANDY $3,414.87

QUEBECK $3,415.69

AUBURNTOWN $3,417.50

BETHPAGE $3,417.65

CHARLESTON $3,418.31

WOODLAWN $3,421.12

WALLING $3,421.54

WINCHESTER $3,424.23

WESTMORELAND $3,425.58

HUNTLAND $3,426.74

WARTRACE $3,429.88

LEBANON $3,431.88

BEECHGROVE $3,435.75

CLEVELAND $3,435.88

LYNCHBURG $3,437.77

PORTLAND $3,442.16

GALLATIN $3,442.39

SHELBYVILLE $3,443.41

UNIONVILLE $3,446.66

CASTALIAN SPRINGS $3,448.77

MOUNT JULIET $3,449.02

COTTONTOWN $3,449.31

MC DONALD $3,450.98

AFTON $3,452.95

RICEVILLE $3,455.49

FRANKLIN $3,456.71

TULLAHOMA $3,457.09

ATHENS $3,463.23

HENDERSONVILLE $3,465.56

MANCHESTER $3,468.40

BAKEWELL $3,472.06

WHITESBURG $3,473.64

BELL BUCKLE $3,473.96

TEN MILE $3,474.18

CROSS PLAINS $3,475.62

ETOWAH $3,476.20

GRANDVIEW $3,481.20

RUGBY $3,481.93

MONROE $3,482.45

SIGNAL MOUNTAIN $3,483.53

ORLINDA $3,483.80

DECATUR $3,484.29

ADAMS $3,484.72

KENTON $3,486.45

LUPTON CITY $3,486.50

HOHENWALD $3,486.76

LOOKOUT MOUNTAIN $3,488.34

RUSSELLVILLE $3,489.95

NIOTA $3,490.47

OOLTEWAH $3,490.63

DELLROSE $3,490.91

ALLONS $3,491.02

MOHAWK $3,492.79

PETERSBURG $3,493.25

HIXSON $3,494.03

HUMBOLDT $3,494.39

MORRISTOWN $3,494.52

MILAN $3,494.75

LYNNVILLE $3,496.70

LAFAYETTE $3,497.57

GEORGETOWN $3,503.13

LOBELVILLE $3,503.33

ETHRIDGE $3,503.91

LIVINGSTON $3,504.20

ENGLEWOOD $3,504.31

CLIFTON $3,505.63

DRESDEN $3,505.96

INDIAN MOUND $3,507.93

MIDWAY $3,508.08

HILHAM $3,508.27

SALE CREEK $3,509.45

WAYNESBORO $3,509.64

MOSHEIM $3,509.85

BIRCHWOOD $3,510.33

CALHOUN $3,511.10

SUMMERTOWN $3,511.57

MOSS $3,512.15

GLEASON $3,512.32

PLEASANT HILL $3,513.30

GREENEVILLE $3,513.79

SMYRNA $3,516.54

GREENBRIER $3,517.27

SHARON $3,517.27

RUTHERFORD $3,517.51

NOLENSVILLE $3,517.77

THORN HILL $3,517.81

CROSSVILLE $3,517.91

FAYETTEVILLE $3,518.06

RED BOILING SPRINGS $3,518.40

APISON $3,518.67

MAURY CITY $3,518.80

SPRING HILL $3,519.21

COLLINWOOD $3,519.73

PALMERSVILLE $3,519.75

ALLRED $3,519.84

SWEETWATER $3,520.70

THOMPSONS STATION $3,520.71

PULASKI $3,521.73

BRADFORD $3,522.00

TAFT $3,522.33

SODDY DAISY $3,522.44

NEW JOHNSONVILLE $3,526.25

MARTIN $3,526.35

ELORA $3,526.48

TALBOTT $3,529.26

TRENTON $3,529.46

MILTON $3,529.60

GOODSPRING $3,529.75

EAGAN $3,530.20

PALMYRA $3,530.51

FRANKEWING $3,530.58

FAIRVIEW $3,530.69

MURFREESBORO $3,532.81

MULBERRY $3,532.89

MINOR HILL $3,536.09

NEWBERN $3,536.92

PROSPECT $3,537.00

HURRICANE MILLS $3,538.20

CHESTNUT MOUND $3,538.77

GREENFIELD $3,539.14

ALPINE $3,539.20

BRENTWOOD $3,539.46

MADISONVILLE $3,539.53

GAINESBORO $3,540.39

DYER $3,540.76

GLADEVILLE $3,541.04

LORETTO $3,541.15

CHRISTIANA $3,541.16

LINDEN $3,541.31

BRUSH CREEK $3,541.94

KELSO $3,542.78

LOWLAND $3,542.90

LAWRENCEBURG $3,543.97

LOUDON $3,544.23

HAMPSHIRE $3,544.45

CHATTANOOGA $3,544.84

CUNNINGHAM $3,545.61

WESTPOINT $3,545.80

ARTHUR $3,546.03

DUCK RIVER $3,546.10

FIVE POINTS $3,547.00

ARRINGTON $3,547.21

SUMMITVILLE $3,547.33

FLINTVILLE $3,547.58

PHILADELPHIA $3,548.01

LEOMA $3,548.34

TIGRETT $3,548.55

CENTERVILLE $3,548.57

BLOOMINGTON SPRINGS $3,549.78

BOGOTA $3,550.93

WHITLEYVILLE $3,550.98

SAINT JOSEPH $3,551.26

LONE MOUNTAIN $3,551.71

LASCASSAS $3,552.00

CELINA $3,553.88

CLARKSVILLE $3,555.94

EAGLEVILLE $3,557.42

SAVANNAH $3,557.50

COLLEGE GROVE $3,557.90

READYVILLE $3,558.93

BUMPUS MILLS $3,559.17

WAVERLY $3,560.03

BEAN STATION $3,561.43

CRAWFORD $3,563.18

RICKMAN $3,563.21

COUNCE $3,563.41

DOVER $3,564.34

NORENE $3,564.78

RELIANCE $3,564.85

OCOEE $3,565.17

DELANO $3,565.67

CRUMP $3,566.38

CARTHAGE $3,566.60

LEWISBURG $3,567.11

CUMBERLAND CITY $3,568.28

PRUDEN $3,568.48

VONORE $3,568.68

OLD FORT $3,568.84

RIDDLETON $3,569.34

GRANVILLE $3,570.13

STANTONVILLE $3,570.32

BIG ROCK $3,570.34

ROCKVALE $3,570.82

HICKMAN $3,571.01

NUNNELLY $3,571.44

HENRY $3,571.63

LA VERGNE $3,572.89

CYPRESS INN $3,573.04

MORRIS CHAPEL $3,573.44

LYLES $3,574.99

ARDMORE $3,575.89

HARRISON $3,576.48

COTTAGE GROVE $3,576.66

GORDONSVILLE $3,577.23

DYERSBURG $3,577.44

MCMINNVILLE $3,577.44

TELLICO PLAINS $3,577.92

BELFAST $3,578.08

OBION $3,578.80

TRIMBLE $3,578.83

PALL MALL $3,579.78

LUTTS $3,580.31

ADAMSVILLE $3,580.57

FARNER $3,580.63

WHITE PINE $3,580.63

PLEASANT SHADE $3,581.10

CEDAR HILL $3,581.16

BENTON $3,581.87

OLIVEHILL $3,582.38

CORNERSVILLE $3,583.13

SHAWANEE $3,583.39

DIXON SPRINGS $3,583.66

FINLEY $3,584.11

ONLY $3,585.27

SNEEDVILLE $3,585.71

WOODBURY $3,586.30

SPRINGFIELD $3,586.98

IRON CITY $3,587.20

WHITE BLUFF $3,589.90

SOUTHSIDE $3,591.14

DICKSON $3,591.50

BRADYVILLE $3,591.69

CHAPEL HILL $3,592.61

ELGIN $3,593.43

GRAYSVILLE $3,593.87

BATH SPRINGS $3,594.50

MITCHELLVILLE $3,595.93

CONASAUGA $3,596.68

TURTLETOWN $3,597.00

HOLLADAY $3,598.22

KYLES FORD $3,598.22

BELLS $3,600.08

MORRISON $3,601.59

BRUCETON $3,602.07

NEW MARKET $3,602.70

MC EWEN $3,606.70

TAZEWELL $3,606.82

COPPERHILL $3,607.25

DANDRIDGE $3,608.03

DUKEDOM $3,608.77

RIVES $3,608.83

DUNLAP $3,609.40

BON AQUA $3,609.47

SOUTH FULTON $3,609.57

COKER CREEK $3,609.62

ELMWOOD $3,610.82

PARIS $3,612.99

HARTSVILLE $3,614.03

ALAMO $3,614.42

BUENA VISTA $3,615.10

LANCING $3,615.58

HORNBEAK $3,615.82

LENOIR CITY $3,616.95

HUNTINGDON $3,617.26

SELMER $3,618.04

TIPTONVILLE $3,618.42

TROY $3,618.75

PETROS $3,620.34

MC KENZIE $3,621.00

ALEXANDRIA $3,621.07

CROCKETT MILLS $3,621.43

WASHBURN $3,621.96

DEER LODGE $3,622.29

PURYEAR $3,623.49

JEFFERSON CITY $3,624.24

VANLEER $3,625.18

UNION CITY $3,625.46

FRIENDSHIP $3,625.49

WYNNBURG $3,625.71

MICHIE $3,625.75

CUMBERLAND GAP $3,625.79

GADSDEN $3,626.01

BLAINE $3,626.19

SALTILLO $3,626.42

RIDGELY $3,626.89

SUGAR TREE $3,627.39

RUTLEDGE $3,627.48

STEWART $3,628.44

CLAIRFIELD $3,629.25

PARSONS $3,630.92

SPENCER $3,631.85

NORRIS $3,631.93

BYRDSTOWN $3,633.69

DECATURVILLE $3,634.41

WILDER $3,634.56

ROCK ISLAND $3,634.59

MOUNT PLEASANT $3,635.11

TENNESSEE RIDGE $3,635.43

BIG SANDY $3,635.53

TALLASSEE $3,636.19

KINGSTON $3,636.51

GUYS $3,636.71

SPRINGVILLE $3,636.89

EVA $3,636.96

BUCHANAN $3,637.36

ERIN $3,637.96

CULLEOKA $3,638.09

HARRIMAN $3,638.35

GRIMSLEY $3,638.90

CLARKRANGE $3,639.94

HARROGATE $3,640.68

PRIMM SPRINGS $3,640.87

CRAB ORCHARD $3,642.99

CAMDEN $3,643.59

POWDER SPRINGS $3,644.86

FOSTERVILLE $3,646.30

NEW TAZEWELL $3,647.88

SHILOH $3,648.22

CHARLOTTE $3,648.69

PALMER $3,649.90

BURNS $3,650.60

SMARTT $3,652.61

MARYVILLE $3,653.10

SLAYDEN $3,653.64

OAK RIDGE $3,654.55

PIKEVILLE $3,654.74

TOWNSEND $3,655.29

GREENBACK $3,655.32

WILLIAMSPORT $3,656.86

LENOX $3,658.16

COLUMBIA $3,658.28

BEERSHEBA SPRINGS $3,660.65

DUCKTOWN $3,662.86

COALMONT $3,664.45

MEDINA $3,664.78

MANSFIELD $3,666.97

MILLEDGEVILLE $3,667.57

HOLLOW ROCK $3,667.97

LOUISVILLE $3,668.90

SANTA FE $3,669.87

LANCASTER $3,673.77

CUMBERLAND FURNACE $3,674.29

SCOTTS HILL $3,674.63

BYBEE $3,676.61

SARDIS $3,677.85

PELHAM $3,677.89

RAMER $3,678.13

SUNBRIGHT $3,680.59

GRUETLI LAAGER $3,681.58

SPEEDWELL $3,681.69

ALTAMONT $3,682.41

SEYMOUR $3,682.42

LAKE CITY $3,682.43

ROBBINS $3,683.04

MASCOT $3,683.33

TREZEVANT $3,684.92

JAMESTOWN $3,685.18

REAGAN $3,685.48

ALLARDT $3,687.12

ANDERSONVILLE $3,687.62

FRIENDSVILLE $3,687.62

FINGER $3,688.79

TRACY CITY $3,689.63

SOUTH PITTSBURG $3,691.77

LAVINIA $3,691.92

CEDAR GROVE $3,691.93

HALLS $3,692.60

JASPER $3,695.64

JACKSBORO $3,696.47

ALCOA $3,696.82

ROCKFORD $3,697.15

ATWOOD $3,697.53

PIONEER $3,698.46

NASHVILLE $3,699.11

SMITHVILLE $3,700.04

KNOXVILLE $3,700.52

YUMA $3,701.12

WHITWELL $3,701.84

DARDEN $3,701.85

WESTPORT $3,702.13

ROCKWOOD $3,703.33

MONTEAGLE $3,703.63

LIBERTY $3,704.73

DOWELLTOWN $3,704.74

VIOLA $3,705.27

CLINTON $3,706.18

CORRYTON $3,706.19

OLIVER SPRINGS $3,710.95

SEQUATCHIE $3,715.24

BETHEL SPRINGS $3,715.97

OAKFIELD $3,718.03

WALLAND $3,718.43

GUILD $3,719.22

STRAWBERRY PLAINS $3,719.22

ENVILLE $3,719.81

PLEASANT VIEW $3,720.19

LEXINGTON $3,725.42

BRADEN $3,725.49

ASHLAND CITY $3,725.68

CHAPMANSBORO $3,726.24

OAKDALE $3,727.15

LACONIA $3,728.11

JACKS CREEK $3,729.19

WINFIELD $3,729.23

POWELL $3,729.26

WHITESIDE $3,731.40

WARTBURG $3,734.88

PEGRAM $3,736.56

GATLINBURG $3,737.42

HEISKELL $3,738.01

NEWPORT $3,738.24

HELENWOOD $3,739.28

HUNTSVILLE $3,739.65

MAYNARDVILLE $3,741.65

SHARPS CHAPEL $3,742.36

HENDERSON $3,743.56

ONEIDA $3,744.53

HURON $3,749.29

PINSON $3,749.46

GALLAWAY $3,750.75

KODAK $3,750.77

DENMARK $3,752.29

MACON $3,752.37

KINGSTON SPRINGS $3,752.45

WILDERSVILLE $3,753.13

OLD HICKORY $3,754.05

LURAY $3,754.33

DEL RIO $3,754.41

MEDON $3,754.97

JELLICO $3,755.07

DUFF $3,755.23

LUTTRELL $3,755.34

HARTFORD $3,755.45

LA GRANGE $3,755.78

GOODLETTSVILLE $3,758.35

COSBY $3,760.56

PARROTTSVILLE $3,767.75

BROWNSVILLE $3,773.88

JACKSON $3,776.36

NEWCOMB $3,784.17

GATES $3,784.49

SEVIERVILLE $3,785.21

HENNING $3,786.20

CARYVILLE $3,787.19

JOELTON $3,788.41

MERCER $3,789.20

BRICEVILLE $3,794.50

POCAHONTAS $3,799.67

STANTON $3,799.78

BEECH BLUFF $3,801.79

LA FOLLETTE $3,807.39

PIGEON FORGE $3,808.45

RIPLEY $3,817.32

WHITES CREEK $3,821.98

ANTIOCH $3,837.12

FRUITVALE $3,838.12

HORNSBY $3,851.70

EATON $3,860.33

TOONE $3,861.98

BOLIVAR $3,864.80

HERMITAGE $3,865.64

WHITEVILLE $3,870.39

PICKWICK DAM $3,872.80

HICKORY VALLEY $3,875.17

ELKTON $3,878.41

MIDDLETON $3,884.72

MADISON $3,893.03

SAULSBURY $3,894.39

GRAND JUNCTION $3,898.62

COMO $3,900.59

YORKVILLE $3,907.41

IDLEWILD $3,909.40

GIBSON $3,913.21

CHEWALLA $3,921.11

TIPTON $3,923.43

SAMBURG $3,923.76

MC LEMORESVILLE $3,925.54

SOMERVILLE $3,939.49

BRUNSWICK $3,941.45

CAMPAIGN $3,945.78

SPRING CREEK $3,963.50

MASON $3,966.47

OAKLAND $4,003.02

MOSCOW $4,004.99

COVINGTON $4,010.68

SILERTON $4,029.52

WILLISTON $4,036.66

ROSSVILLE $4,041.12

BURLISON $4,042.45

MUNFORD $4,056.03

ATOKA $4,075.15

COLLIERVILLE $4,078.89

EADS $4,080.50

DRUMMONDS $4,094.22

ELLENDALE $4,102.16

BRIGHTON $4,105.10

ARLINGTON $4,114.08

GERMANTOWN $4,160.48

MILLINGTON $4,172.26

CORDOVA $4,314.74

MEMPHIS $4,745.79

As you can see from this data, which is ranked from the cheapest city to most expensive city, the city in Tennessee with the cheapest car insurance rates is Bristol, with an average insurance cost of $3,176.81.

Conversely, the most expensive city for car insurance is Memphis, as their average cost of insurance is $4,745.79. This is not surprising, as we have seen that Memphis has the most expensive ZIP codes, and Memphis is the second-largest city in Tennessee, after Nashville.

What are the best Tennessee car insurance companies?

Now that you have an idea of how much your car insurance costs based on where you live, let’s see what the best car insurance companies in Tennessee are so you know which company is worth your hard-earned money.

We understand that finding the right car insurance company is tough because it’s based on your specific needs. But we will do our best to show you enough companies and facts about these companies so you can have an idea about what company is best for you.

In this section, we’re going to take a look at the largest companies’ financial rating, the companies with the best ratings, the companies with the most complaints, and other facts that will help you decide which company is best for you.

What are the financial ratings of the largest car insurance companies in Tennessee?

We’re going to take a look at the financial ratings of the largest companies in Tennessee, using information from the highly reputable A.M. Best.

COMPANY A.M. BEST FINANCIAL RATING

State Farm A++

Farmers A+

Geico A++

Progressive A+

Allstate A+

USAA A++

Liberty Mutual A

Nationwide A+

Erie Insurance A+

Travelers A++

This table shows that most of the insurance companies for Tennessee have excellent grades for their financial ratings. Four companies have the highest possible rating of A++ (State Farm, Geico, USAA, and Travelers). Five companies have a very impressive A+ rating (Farmers, Progressive, Allstate, Nationwide, and Erie Insurance), and only one company has a “low” rating of an A (which is still good), which is Liberty Mutual.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which car insurance companies have the best ratings in Tennessee?

We have a table with information from the always credible J.D. Best Power Press. This data shows a rating out of 1,000 based on customer satisfaction from 2019 for the largest car insurance companies in the Southeast region of the United States.

Company Rating

Farm Bureau Insurance-Tennessee 888

Erie 870

Alfa 855

NC Farm 855

State Farm 853

Auto Owners 852

Southeast Average 841

Geico 838

KY Farm Bureau 830

Safeco 829

Nationwide 828

Progressive 824

Travelers 822

National General 820

MetLife 814

Allstate 813

Liberty 809

According to this table, the top-rated insurance company in this region is actually from Tennessee, and it’s Farm Bureau Insurance, with a rating of 888.

The next highest company is Erie Insurance with 870, and then Alfa Insurance with a rating of 855. The lowest-rated company on this list is Liberty, with a rating of 809. However, this rating is still pretty good considering that the average rating for insurance companies in this region is 841.

Which car insurance companies have the most complaints in Tennessee?

No insurance company is perfect, but some companies have fewer complaints than others. You should know about which companies have the most complaints, as this can have a profound effect on your decision about which car insurance company to use. Below, we have given you a table with the number of complaints about each company.

Company Number of Complaints

State Farm 1482

Geico 333

USAA 296

Liberty Mutual 222

Allstate 163

Progressive 120

Tennessee Farmers 39

Nationwide 25

Erie Insurance 22

Travelers 2

According to this information, the company with the most complaints is State Farm, with 1482 complaints. The company with the least amount of complaints is Travelers, and they have a mere two complaints.

But while this number is impressive, you should consider that there are certainly other factors you must consider when purchasing your insurance.

It is also worth noting that State Farm is the largest insurance company, so the simple fact that they have more customers is likely one of the reasons they have more complaints. You should also see how well companies handle their complaints before making a decision, too.

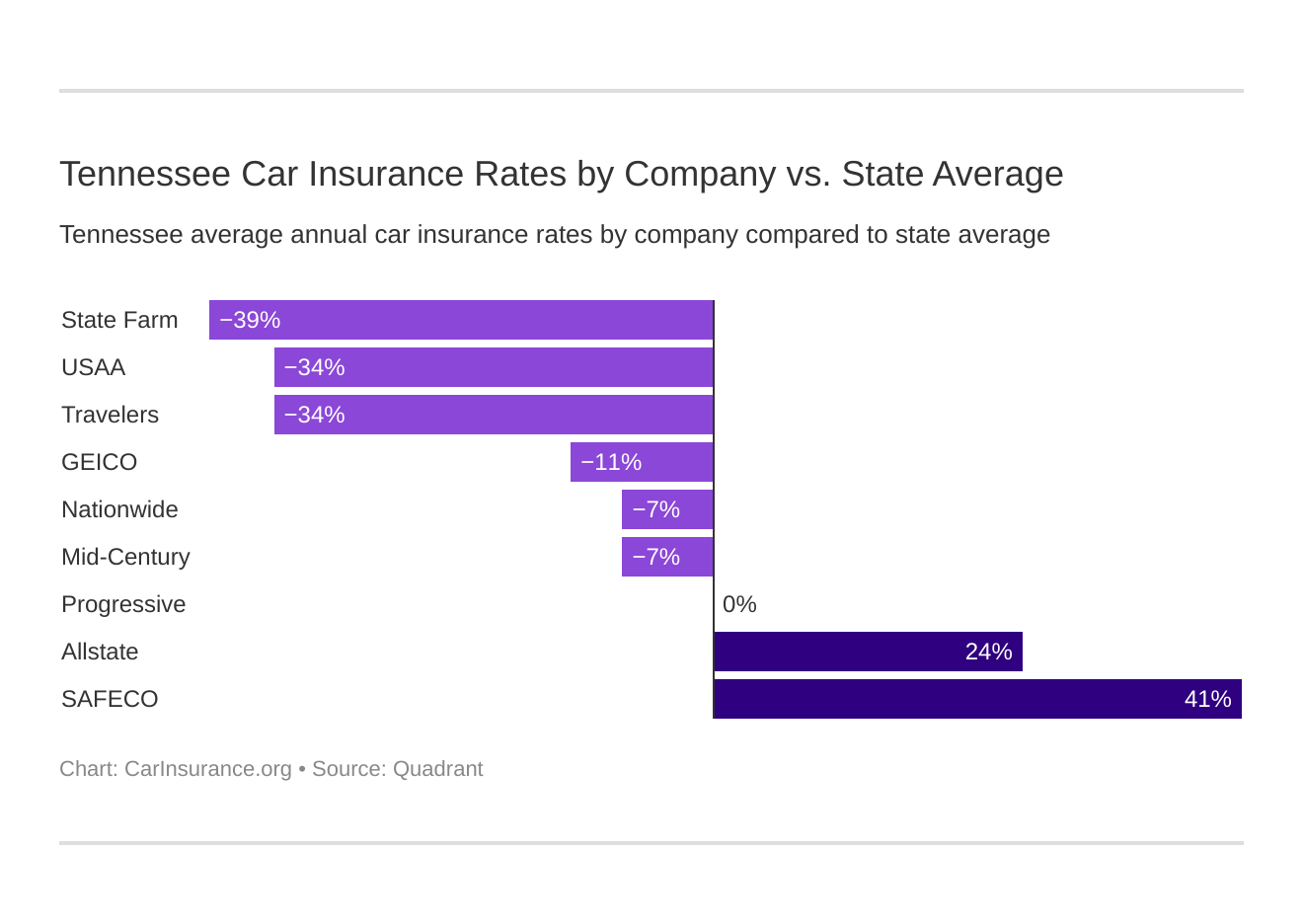

What are the cheapest car insurance companies in Tennessee?

Ah, yes. Cheap. Cheap is everyone’s favorite word when it comes to buying things with your cash. That’s why we’ve compiled a list of the insurance companies with the cheapest insurance options and arranged them in a table for you.

Company Average Annual Rate Compared to State Average (Dollars) Compared to State Average (Percentage)

SAFECO $6,206.69 +$2,545.80 41.02%

Allstate $4,828.85 +$1,167.96 24.19%

Progressive $3,656.91 -$3.98 -0.11%

Mid-Century $3,430.07 -$230.82 -6.73%

Nationwide $3,424.96 -$235.93 -6.89%

Geico $3,283.42 -$377.47 -11.50%

USAA $2,739.28 -$921.60 -33.64%

Travelers $2,738.52 -$922.37 -33.68%

State Farm $2,639.30 -$1,021.59 -38.71%

This table is great because it not only shows the average cost of each insurance company, but it also shows the difference in price from the state total of $3,660.89 in dollars and percentages.

As you can see, according to this table, of these companies, the most expensive company is Safeco, and they cost $6,206.69 on average, which is $2,545.80 (41.02%) more than the state average. The cheapest company is State Farm, and their average cost is $2,639.30, which is $1,021.59 (38.71%) less than the state average.

We know that the word “cheap” is always alluring, but remember: cheaper isn’t always better. You must find out what companies work best for your specific needs. Another massive part of selecting your car insurance is not only seeing the average cost of a car insurance company, but what the particular costs are for you and your driving record. In the section below, we will share some of these costs with you.

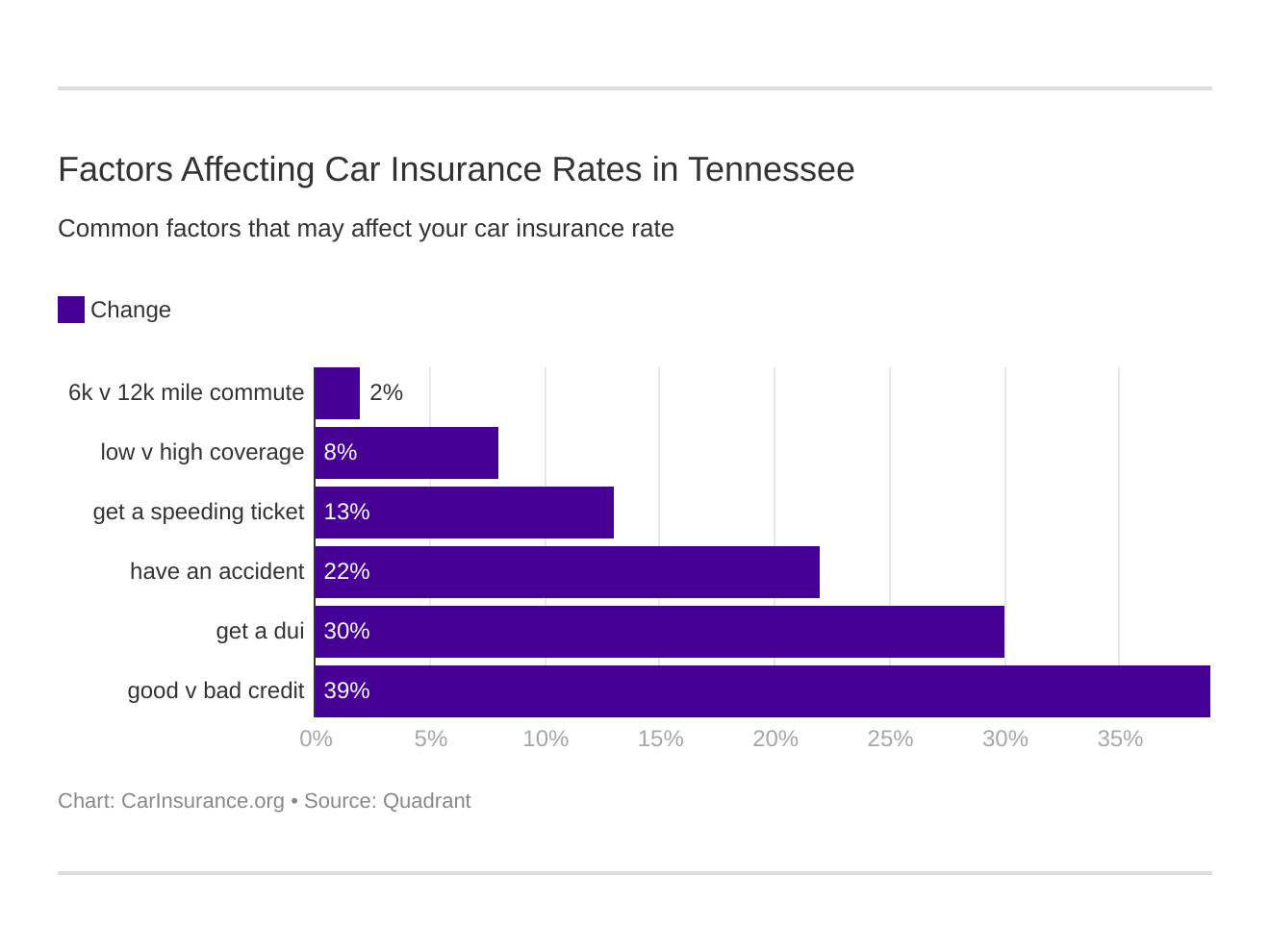

Does my commute affect my Tennessee car insurance rate?

One of the major aspects of your driving that a company considers is the number of miles that you drive for your commute. They generally separate the commutes into an average of 10 miles and 25 miles. Here is a table showing how much the major companies in Tennessee charge based on these different commute distances.

Company 10 Mile Commute 25 Mile Commute

Liberty Mutual $6,206.69 $6,206.69

Allstate $4,828.85 $4,828.85

Progressive $3,656.91 $3,656.91

Farmers $3,430.06 $3,430.06

Nationwide $3,424.96 $3,424.96

Geico $3,263.57 $3,303.27

Travelers $2,630.93 $2,846.10

USAA $2,661.90 $2,816.66

State Farm $2,576.56 $2,702.04

The most expensive company for both a 10-mile commute and a 25-mile commute is Liberty Mutual, as they charge $6,206.69 for both distances. The cheapest company for both commutes is State Farm, and they charge $2,576.56 for a 10-mile commute and $2,702.04 for a 25-mile commute.

Something worth noting is that many companies charge the same amount for each commute distance. These companies include Liberty Mutual, Allstate, Progressive, Farmers, and Nationwide. Thus, it might be beneficial to just get longer coverage just in case.

Lastly, an interesting observation is that the cheapest companies do not charge the same amount for 10-mile and 25-mile commutes, with the 25-mile commutes costing more.

Can coverage level change my Tennessee car insurance rate with companies?

Another major factor that companies consider when charging you for insurance is the type of coverage level you purchase. There are three types of coverage that you can purchase: high, medium, and low. We’ve listed each major insurance company in Tennessee and how they charge based on coverage level in the table below.

Group Coverage_Type Annual Average

Liberty Mutual High $6,477.10

Liberty Mutual Medium $6,204.78

Liberty Mutual Low $5,938.19

Allstate High $5,024.87

Allstate Medium $4,816.41

Allstate Low $4,645.25

Progressive High $3,884.63

Progressive Medium $3,657.30

Farmers High $3,639.71

Nationwide High $3,473.64

Nationwide Low $3,450.27

Geico High $3,448.43

Progressive Low $3,428.80

Farmers Medium $3,413.80

Nationwide Medium $3,350.97

Geico Medium $3,276.37

Farmers Low $3,236.69

Geico Low $3,125.46

Travelers High $2,902.69

USAA High $2,836.70

State Farm High $2,773.95

Travelers Medium $2,736.50

USAA Medium $2,729.45

USAA Low $2,651.70

State Farm Medium $2,651.21

Travelers Low $2,576.37

State Farm Low $2,492.73

According to this data, the most expensive “high” coverage level is from Liberty Mutual ($6,477.10). Liberty Mutual also has the highest “medium” coverage level ($6,204.78) and “low” coverage level ($5,938.19). The cheapest “high” coverage level is from State Farm car insurance ($2,773.95), and they have the cheapest “medium” ($2,651.21) and “low” ($2,492.73) rates, too.

Similar to rates by commute, there is a small difference between many of the different coverage levels, so it might be more cost-effective to go with a higher coverage level.

How does my credit history affect my Tennessee car insurance rate with companies?

Your credit is another part of your history that car insurance companies take into consideration when deciding how much you should pay for your rates. So, we’ll provide some information about how each type of credit score (separated into “good,” “fair,” and “bad”) affects your coverage for the major insurance companies in Tennessee.

Company Good Credit Fair Credit Poor Credit

Liberty Mutual $4,266.12 $5,455.32 $8,898.63

Allstate $3,604.43 $4,718.43 $6,163.68

Nationwide $2,894.15 $3,265.47 $4,115.26

Progressive $3,314.09 $3,545.77 $4,110.86

Farmers $3,019.09 $3,191.56 $4,079.54

USAA $1,918.82 $2,326.47 $3,972.56

State Farm $1,785.62 $2,299.30 $3,832.98

Geico $2,933.59 $3,190.30 $3,726.36

Travelers $1,996.22 $2,735.47 $3,483.87

According to this table, the most expensive company for good credit is Liberty Mutual ($4,266.12), and they have the most expensive rates for fair ($5,455.32) and poor ($8,898.63) credit, too.

The company that is most forgiving to poor credit with their rates is Travelers, as their average rate for poor credit is $3,483.87.

According to Experian, the average credit score for Tennessee is 662. A 662 credit score is very close to the good range, which is 670-739. So, it seems that the good and average rates for car insurance companies are the most relevant to Tennessee drivers.

It’s worth noting that many of these companies charge significantly more if you have poor credit, with some companies charging hundreds, and some thousands, more dollars for a lower credit rating. It’s important to pay close attention to which companies accommodate your credit score best and to pick that company. That way, you can pay the most reasonable price for car insurance.

How does my driving record change my rates with Tennessee car insurance companies?

The final major factor that car insurance companies take into consideration when determining your rates is your driving record. When looking at your driving records, there are three offenses that the car insurance companies take into account: accidents, DUIs, and speeding tickets. You’ll receive cheaper car insurance if you have a clean record.

The table below shows you the rates for the major companies in Tennessee for each type of driving record.

Company Clean Record One Accident One DUI One Speeding Violation

Liberty Mutual $5,031.00 $7,257.06 $6,748.89 $5,789.80

Allstate $4,043.94 $4,821.64 $5,823.95 $4,625.86

Geico $2,386.13 $3,197.12 $5,164.31 $2,386.13

Nationwide $2,961.85 $2,961.85 $4,454.01 $3,322.14

Farmers $2,930.61 $3,622.99 $3,709.20 $3,457.46

USAA $1,992.65 $2,984.18 $3,509.42 $2,470.89

Progressive $3,221.09 $4,182.08 $3,430.36 $3,794.09

Travelers $2,220.52 $2,851.81 $3,150.18 $2,731.56

State Farm $2,406.95 $2,871.65 $2,639.30 $2,639.30

As you can see from this table, the company that is cheapest if you have a DUI is State Farm, as their average rate for a driver with a DUI is $2,639.30. The company that is cheapest for speeding violation is Geico ($2,386.13 as the average rate), and the company that is best for accidents is Travelers, with an average rate of $2,851.81 for this offense.

If you have a clean record, the best company to go with is USAA, and their rate for this category is $1,992.65.

On average,DUIs are the most expensive violation. It varies from company to company, which of these two is the most expensive. For example, the average insurance rate for someone with a DUI for Liberty Mutual is $6,748.89, while an insurance rate for someone with an accident is $7,257.06.

Conversely, the average insurance rate for someone who has had a DUI and has Allstate is $5,823.95, but someone who has Allstate who has had an accident must pay an average rate of $4,821.64.

Lastly, the most expensive company on average is Liberty Mutual, and the cheapest is State Farm.

You can find the cheapest car insurance company in your local area by entering your ZIP code in the FREE comparison tool!

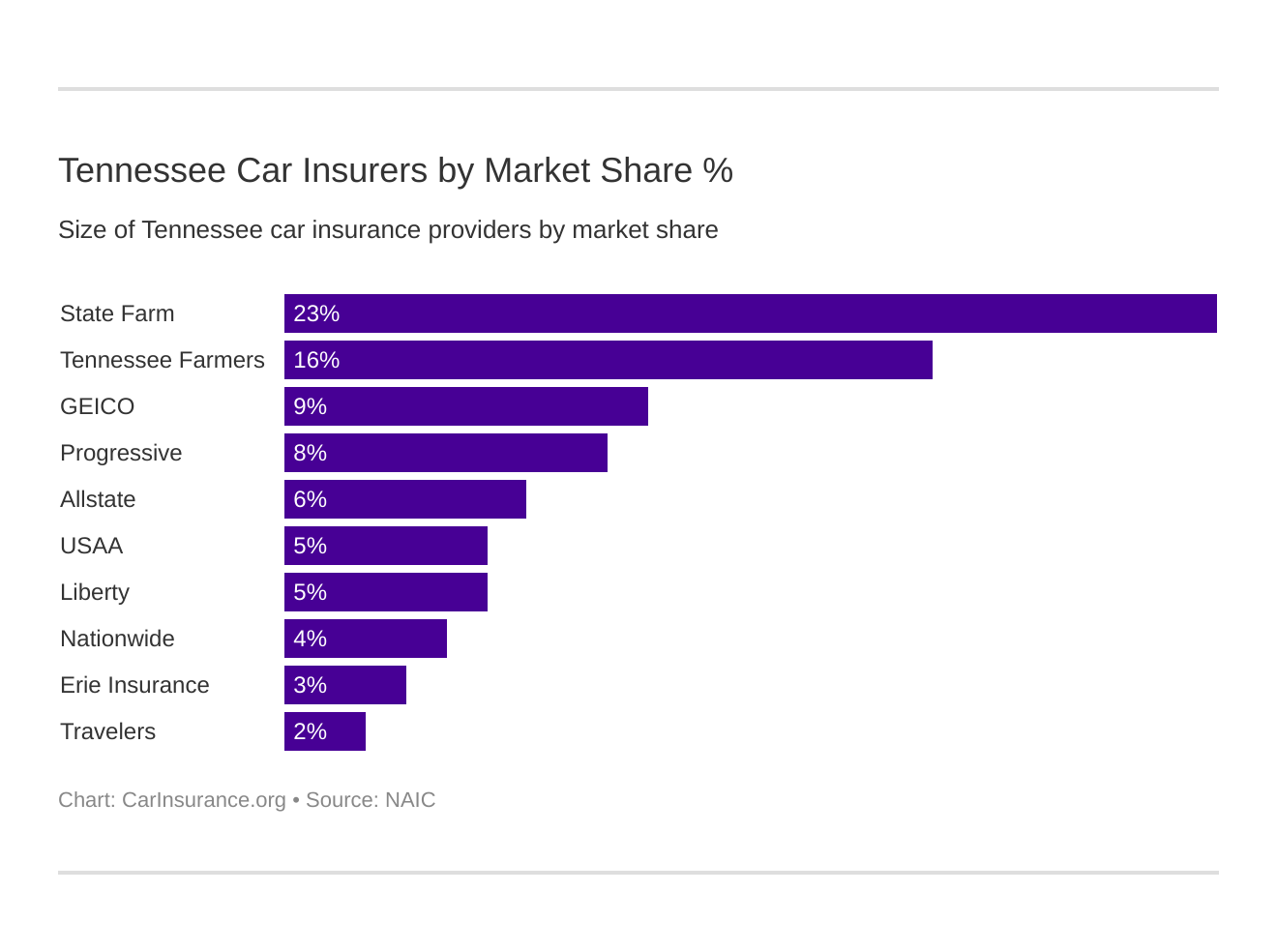

Which Tennessee car insurance companies are the largest?

You need to know about the ten largest insurance companies in Tennessee because you may end up using one of them. The table we’ve provided shows the Volunteer State’s ten largest car insurance companies, as well as some necessary information about them.

Company/ Group Direct Premiums Written Loss Ratio Market Share

State Farm $948,604 62.03% 23.23%

Farmers $654,613 74.33% 16.03%

Geico $348,059 69.97% 8.52%

Progressive $311,706 61.15% 7.63%

Allstate Insurance $254,285 47.23% 6.23%

USAA Group $221,585 71.72% 5.43%

Liberty Mutual $211,928 62.66% 5.19%

Nationwide Corp $171,166 68.01% 4.19%

Erie Insurance $114,508 76.69% 2.80%

Travelers $84,329 64.98% 2.06%

State Total $4,083,911 64.96% 100.00%

You may notice there are three categories for this table: direct premiums written, loss ratio, and the market share. If you are unfamiliar with these terms, here are some definitions. A direct premium written is the total amount of an insurance company’s written premiums during a given year, without accounting for the amount ceded to reinsurance.

A loss ratio is the proportionate relationship of incurred losses to earned premiums, expressed as a percentage. The best loss ratios are between 60 and 70. Finally, a market share is the percentage of the market for a product or service that a company supplies.

So, we can see from this table that State Farm has the most direct premiums written ($948,604), one of the best loss ratios (62.03%). And, as you can tell from this table, they have the largest percentage of the market share at 23.23%. So, based on all this information, you can see not only that State Farm is the largest car insurance company, but also why and how it is.

Travelers is the smallest of the top 10 largest car insurance companies in Tennessee, as they have $43,084 in direct premiums written, a 57.72% loss ratio, and they only control 3.44% of the market.

Finally, here are the numbers for the state total, so you can see how State Farm measures up to the rest:

- Direct Premiums Written: $4,083,911

- Loss Ratio: 64.96%

As we can see, State Farm has earned its place at the top in the state.

How many car insurance companies are available in Tennessee?

It’s important to know the largest insurance companies in Tennessee, but it’s also important to know how many insurance companies there are.

Tennessee has a total of 945 insurance companies, and of these, 15 are domestic, and 930 are foreign. The difference between these two types of insurance companies is pretty simple: domestic insurance is insurance that is based within your state, and foreign insurance is based in a state outside of your home state. You can use a foreign insurance company for coverage and have no issues, so either option works.

Are you still unsure about the number of companies in Tennessee? Enter your ZIP code in the FREE comparison tool to compare car insurance rates from different companies in your local area!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the laws in Tennessee?

Look, we get it: knowing your state laws can be confusing, especially the ones about driving. But it’s necessary to know these laws so you can avoid unnecessary fines and so that your roads are safe. And while it’s annoying to know all about all these laws, we hope that we can help you understand them better in a way that doesn’t require hours of studying documents that seem like they’re in another language.

In this part of the article, we’re going to explain these laws simply. We will look at laws about car insurance, windshield coverage, high-risk insurance, and all the other laws about driving that are necessary for all Tennessee drivers.

What are the Tennessee car insurance laws?

Here are some very important car insurance laws in Tennessee. Check them out to drive safely and securely in the Volunteer State.

How State Laws for Insurance are Determined

Before talking about car insurance laws, it’s important to figure out how car insurance laws are determined. According to the NAIC, Tennessee is a Prior Approval/Flex state. A state that uses prior approval requires car insurance companies in that state to justify their rate changes to state regulators before implementing them. Flex laws require insurers to get approval for rate changes that exceed a specified percentage.

So basically, this means that car insurance companies must get state approval if they want to increase their rates more than a specified amount. This law is part of Tennessee’s Title 56, which you can read more about here.

Windshield Coverage

Next, let’s take a look at the windshield coverage laws in Tennessee. There are no unique laws for windshields or regarding the choice of a repair shop or OEM (the vehicle’s manufacturer makes parts) vs. aftermarket parts (any part for a vehicle that isn’t sourced from the car’s maker).

It’s also not a law that companies have zero deductible with comprehensive coverage. Even if you have comprehensive coverage, the insurance company does not have to waive your deductible if you get a windshield replacement. However, some companies do.

High-Risk Insurance

Now, let’s examine high-risk insurance. There are three types of documents for high-risk drivers: SR-22s, SR-22As, and FR-44s. However, the only form that pertains to you is the SR-22 because SR-22As are only in Georgia, Texas, and Missouri. FR-44s are required in Virginia and Florida.

An SR-22 proves that you carry car insurance, and you usually need to get one after the following:

- DUI or DWI

- Reckless driving

- At-fault accidents

- Driving without insurance coverage

- Driving with a suspended license

An SR-22 form is what is required for “high-risk” drivers. Though it is a document proving you have the minimum insurance requirements, it is not a form of car insurance.

In Tennessee, you must contact your liability insurance representative and inform them of the needed filing within your state. The form needs to be filed by an insurance company licensed through the Tennessee Department of Commerce and Insurance issues liability insurance coverage in Tennessee.

It must also follow the minimum insurance coverage requirements in Tennessee, which are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage.

Did you know you can still get car insurance as a high-risk driver? Find out how much you can pay for insurance using our FREE auto insurance quotes comparison tool! Enter your Tennessee ZIP code to start comparing rates now!

Low-Cost Insurance

Though Tennessee has a high-risk insurance program, unfortunately, it does not have a low-cost insurance program for low-income families.

The only states that have low-cost insurance programs are California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Tennessee

Like in many fields, fraud is an inevitable part of auto insurance. “What constitutes car insurance fraud?” you may ask. According to the IIHS, it can range from misrepresenting facts on insurance applications and inflating insurance claims to staging accidents and submitting claim forms for injuries or damage that never occurred, to false reports of stolen vehicles.

The most common form is when someone either exaggerates or fabricates a claim made to their automobile insurance provider. An example of this would be if a person claimed the damage was greater in an auto accident than it was so that they could make more money.

However, there are some strict laws in place in Tennessee that protect against insurance fraud. In Tennessee, insurance fraud is 100% classified as a crime. They also have immunity laws, which allow insurance companies to report information about insurance fraud without fear of criminal or civil prosecution. Tennessee has also set up a fraud bureau, which helps authorities crackdown on insurance fraud.

Lastly, Tennessee has set up a mandatory insurer fraud plan, which requires insurers to set up a specific program that identifies insurance fraud and outlines actions taken to reduce insurance fraud (they are one of 21 states, and D.C., that do this).

Auto insurance fraud not only affects insurance companies: it affects you, too. Because insurance companies lose money from auto insurance fraud, they must earn the money back from somewhere, so they end up charging you more.

If you know of any cases of auto insurance fraud, please visit the Tennessee state department website, and send them an email at or call them at (615) 251-5166.

Statute of Limitations

Find Law defines a statute of limitations as the amount of time you have to pursue a claim after an accident. In Tennessee, there are two different types of a statute of limitations: personal injury and property damage.

For personal injuries, the statute of limitations is one year in Tennessee and three years for property damage.

Make sure to file your claim immediately, as your time to file the claim starts running out the day of the accident.

Tennessee-Specific Laws

Like many states, Tennessee has its own unique and strange laws for driving. Here are some of them:

- If you’re from out of state, and you legally own a handgun, it’s legal to have it in your car.

- The maximum length of a recreational combination vehicle is 65 feet.

- All motorcycle drivers and passengers must wear a helmet.

- Don’t even think about driving with a skunk when you travel to North Carolina because it’s illegal to carry a skunk over state borders.

- You can, however, pick up the roadkill if you feel the need.

- The only animal that is legal to shoot out of your car window is a whale.

- It’s also illegal to drive while you’re asleep.

Some of these are funny, but some of them are serious, too. Follow these laws to secure your safety to make the roads a better place.

What are the vehicle licensing laws in Tennessee?

In this section, we’re going to take a look at the licensing laws for vehicles in Tennessee.

REAL ID

Tennessee is in compliance with the REAL ID Act. If you’re wondering what the REAL ID Act is, it’s a law that sets standards for the issuance of sources of identification, such as driver’s licenses. It establishes a set of minimum security standards for license issuance and production, and it prohibits Federal agencies from accepting for certain purposes driver’s licenses and identification cards from states not meeting the Act’s minimum standards.

https://www.youtube.com/watch?v=ONEIV0eFiCQ

The video above does a great job explaining just how important it will be this coming year to have a REAL ID-compliant driver’s license.

Penalties for Driving Without Insurance

When you drive, your car must always be insured. Failing to have insurance will result in serious penalties. If you’re caught driving without insurance in Tennessee, you’ll have to pay a $25 coverage failure fee within 30 days of notice. If you don’t pay, then you’ll incur an additional $100 coverage failure fee with suspension or revocation of your registration, and you’ll have to pay a reinstatement fee of no more than $25.

If you have insurance (and hopefully you do), you must be able to prove it if you are pulled over. You can prove that you have insurance with the following:

- Your insurance ID card

- Insurance binder

- Policy declaration page

Police officers can enforce these laws with a new verification system that allows them to check whether or not you have insurance in real-time.

If you do not comply with the Tennessee state department’s payment plan, you will receive a notice of intent to suspend your license via regular mail that states that you will lose your license 30 days after receiving this letter.

Teen Driver Laws

Like all states, Tennessee has specific rules about teen drivers. In Tennessee, you must be 15 years old to get your learner’s permit, and you need to have it for a minimum of six months. You also need a minimum of 50 hours of supervised driving, and 10 of these hours must be at night. After all of this, you may get your license at 16. But keep in mind: there are rules for intermediate drivers, too.

When you’re an intermediate driver (being 16 and having just gotten your license), you are not allowed to drive unsupervised from 11 p.m. to 6 a.m. Also, you can only have one passenger in the car unless the extra passengers are 21 with unrestricted driver’s licenses or your siblings. You can be an unrestricted driver and have as many passengers as you want and drive at night if you’ve had your license for 12 months, or if you’ve turned 18.

Older Driver License Renewal Procedures

Older drivers, like younger drivers, have rules to follow as well. If you’re an older resident in Tennessee, you have to renew your license every eight years, which is the same as the general population. There is no vision test required, and you may renew online or through the mail.

New Residents

When you move to the Volunteer State, you have 30 days to get a Tennessee license. To do this, you need to present the following:

- Your current license (or certified copy of a driving record or other acceptable ID).

(The certified copy of your driving record, known as a Motor Vehicle Record (MVR), must be an original (no photocopies) and issued no more than 30 days before your Tennessee application date.) - Proof of name change, such as original certified court order, marriage certificate, or divorce decree.

- Two Proofs of Tennessee Residency with your name and resident address – NO P.O. BOXES (Documents must be current. Must be dated within the last four months.)

- Proof of U.S. Citizenship, Lawful Permanent Resident Status, Proof of authorized stay, or temporary legal presence in the United States.

- A Social Security Number or affidavit if no Social Security number has been issued.

Once you have all these materials together, and they have been approved, you must surrender your out-of-state license and pass a vision test. If your license has expired for over six months, you must pass a Tennessee knowledge exam, road skills test, and vision screening.

Finally, if you’re a driver from out of the country, you must pass a vision screening, knowledge exam, and road skills test. However, you may keep your license from another country.

License Renewal Procedures

If you’ve just turned 21, you need to get a new license that is in a horizontal or landscape format. For the general population, you need to renew your license every eight years.

An application for a new license that is begun 30 days after the expiration date carries a fee, and if it is more than five years, the license holder must apply as if it was for an original license. If you want to get started early and avoid a fee, you can renew your license up to 12 months before the expiration date.

Negligent Operator Treatment System (NOTS)

The Negligent Operator Treatment System is only in practice in California, but there is a point system in place if you’re a negligent driver. You get points on your license for breaking driving laws, and if you’re an adult and accrue 12 points in a year, you may lose your license altogether.

Below, we have listed out some common driving offenses and the points you get from committing them.

- Speeding 1-5mph over speed zone – 1 point

- Speeding 6-15mph over speed zone – 3 points

- Speeding 16-25mph over speed zone – 4 points

- Speeding 26-35mph over speed zone – 5 points

- Speeding 36-45mph over speed zone – 6 points

- Following improperly – 3 points

- Failing to obey traffic instructions – 4 points

- Improper passing – 4 points

- Wrong-way, side, or direction – 4 points

- Failing to yield the right-of-way – 4 points

- Making an improper turn – 4 points

- Failure to report a crash – 4 points

- Leaving the scene of a crash – 5 points

- Reckless driving – 6 points

- Violation of license or certificate restrictions – 6 points

- Failure to yield to emergency vehicles – 6 points

- Reckless endangerment by vehicle – 8 points

- Failure to stop at a railroad crossing – 8 points

As seen here, it can be fairly easy to accrue 12 points with as few as just two offenses. Make sure to always drive defensively when on the road!

What are the rules of the road in Tennessee?

Let’s take a look at the rules of the road, shall we? These are especially important because they come into play while you’re driving.

Fault vs. No-Fault

Tennessee is an at-fault state, which means that if someone hits you and you’re injured, you can recover damages from them. They must pay for whatever damages they cause, regardless of whether it’s personal or property damage.

Seat Belt and Car Seat Laws

In Tennessee, the seat belt laws fall under the category of primary enforcement, which means that an officer can give you a ticket for not wearing a seat belt even if no other laws were broken. Seat belts are required for the driver and all front-seat passengers who are 16 or older. If you’re caught without a seat belt for the first time, you must pay a fine of $30.

As for child safety laws, children younger than one year, or weighing 20 pounds or less, must be in a rear-facing child restraint. Children one through three years and over twenty pounds should be in a forward-facing child restraint, and children ages four through eight years and less than four feet nine inches need to be in a booster seat.

Children that are eligible for an adult seat belt can be nine through 15 years old, or any child who is 12 or younger who is four feet nine inches or taller. Lastly, for the rear seat preference, children eight years and younger and less than four feet nine inches must be in a rear-facing seat if it’s available. The rear seat is recommended for those who are nine through 12. If you break a child seat belt law, you have to pay a higher fee of $50.

In addition to seat belt laws, there are also laws about riding in the cargo area of a truck.