Florida Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 26.7%

Florida is known for its beaches, tourism, and high-profile living. It’s also known for higher than average car insurance rates. Read our car insurance guide for everything you need to know to get cheap Florida car insurance.

There are a number of factors that affect the price of car insurance and a number of ways to reduce it. Even where you live in the state will affect your rates. In addition to how Florida car insurance rates by ZIP code differ, we’ll give you a run-down of other information to maximize your driving experience in Florida.

Get a Florida car insurance quotes comparison right now using our free comparison tool. Enter your ZIP code to start comparing cheap Florida car insurance rates now.

What are Florida car insurance coverage and rates?

No matter which state you drive in, there will always be insurance requirements. Knowing what you need and when you need it can sometimes be overwhelming. This is where having the right car insurance provider can benefit you.

Having the right car insurance provider can help you understand Florida’s car insurance laws. Continue reading to learn how additional types of coverage can bail you out should you ever find yourself in high water.

This is where we come in. There are many factors that affect the price of car insurance, and we will show you how to lower your rates as much as possible.

We are here to help you understand car insurance in the Sunshine State and to simplify the data that you will need to make an educated decision when choosing both a car insurance provider and the types of coverage that are best for you.

Keep scrolling to determine the types of coverage required by Florida State law, how much insurance you need for your car, and how we can help you get the most for your money.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the average monthly car insurance rates in FL for liability, collision, and comprehensive?

Now we’ll cover some of the Florida car insurance laws because getting the most out of every dollar you spend on car insurance means understanding what is required of you as a car owner in Florida. (For more information, read our “Dollar-a-Day Insurance Coverage“).

The rates reflected below are from 2015, so rates for 2021 might be slightly higher. Educating yourself on the best 2021 car insurance in Florida will help you save money.

First, understand the car insurance requirements for Florida, research the car insurance companies available in your area, and then shopping around for the best rates from each of them can help keep your costs down, though.

| Coverage Type | Annual Rates |

|---|---|

| Liability | $857.64 |

| Collision | $282.96 |

| Comprehensive | $116.53 |

| Combined Total | $1,257.13 |

According to the Insurance Information Institute, Florida ranks among the top 10 most expensive states for annual average car insurance expenditures.

Why is Florida car insurance so expensive? Florida has a dense population with major metropolitan areas across the state. It also has no-fault insurance, which tends to drive up rates. To see how much the average car insurance rate will cost in those areas, continue reading.

What are the cheapest Florida car insurance rates by ZIP code?

Most people don’t know that their car insurance rates can be impacted simply by their address. It’s true, though. Where you live can determine the car insurance rate that you might receive. Check out car insurance by zip code in this section to find the best bang for your buck car insurance.

The best car insurance rates in South Florida are the most expensive in the state. Take a look at the following tables to see average car insurance rates by zip code.

| 25 Most Expensive Zip Codes in Florida | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 33142 | MIAMI | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33147 | MIAMI | $7,626.18 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33125 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33135 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33130 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33136 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33127 | MIAMI | $7,517.24 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33010 | HIALEAH | $7,448.04 | Allstate | $12,185.02 | Progressive | $8,805.26 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33150 | MIAMI | $7,428.69 | Allstate | $12,124.19 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33128 | MIAMI | $7,404.00 | Allstate | $12,185.02 | Progressive | $8,497.04 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33012 | HIALEAH | $7,304.68 | Allstate | $11,716.92 | Progressive | $8,805.26 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33126 | MIAMI | $7,297.22 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33013 | HIALEAH | $7,275.81 | Allstate | $11,715.10 | Progressive | $8,604.99 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33168 | MIAMI | $7,240.81 | Allstate | $11,827.36 | Progressive | $8,466.37 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33167 | MIAMI | $7,216.08 | Allstate | $11,654.27 | Progressive | $8,466.37 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33145 | MIAMI | $7,199.47 | Allstate | $10,732.87 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33144 | MIAMI | $7,197.53 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33174 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33199 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33122 | MIAMI | $7,163.83 | Allstate | $11,836.51 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33054 | OPA LOCKA | $7,162.08 | Allstate | $11,656.10 | Progressive | $8,533.79 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33184 | MIAMI | $7,153.94 | Allstate | $12,193.91 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33016 | HIALEAH | $7,146.88 | Allstate | $11,656.10 | Progressive | $8,805.26 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33175 | MIAMI | $7,127.61 | Allstate | $12,009.61 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33162 | MIAMI | $7,110.30 | Allstate | $11,684.61 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | Geico | $4,603.44 |

The list of car insurance companies in Miami, Florida, is competitive and expensive. Take advantage of any discounts to lower the higher than average car insurance rates.

Now, let’s review the top 25 cheapest auto insurance rates by zip code.

| 25 Least Expensive Zip Codes in Florida | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 32694 | WALDO | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32643 | HIGH SPRINGS | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32618 | ARCHER | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32667 | MICANOPY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32669 | NEWBERRY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32601 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32609 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32641 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32615 | ALACHUA | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32658 | LA CROSSE | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32612 | GAINESVILLE | $3,492.52 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32603 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32605 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32606 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32607 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32608 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32611 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32653 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32610 | GAINESVILLE | $3,504.58 | Allstate | $5,675.46 | Progressive | $3,951.64 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32631 | EARLETON | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32550 | MIRAMAR BEACH | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

| 32664 | MC INTOSH | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32681 | ORANGE LAKE | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32633 | EVINSTON | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32640 | HAWTHORNE | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

While living in the city may have its conveniences, the data reveals that choosing to live outside the city center could have its advantages.

This can be seen by looking at the rates for drivers who reside in South Tampa, the cheapest zip code for car insurance, with a ZIP code of 33611 versus drivers who live in the up and coming area of Ybor City (ZIP Code: 33603).

South Tampa residents pay almost $1,000 less for car insurance rates than their neighbors north of Kennedy Blvd. This goes to show that when it comes to investing in car insurance, being an educated consumer and shopping around can result in big savings.

It is not just your neighborhood that can influence what you pay for your car insurance coverage. The city you love can also determine how much you will spend. Keep scrolling, and let us show you how.

What are the cheapest Florida car insurance rates by the city?

Although we don’t have Florida auto insurance rates by county, we do have rates by ZIP code.

We have done the work for you. Take a look at the tables below to see how the zip code you live in and the city that you love play a role in determining just what you will pay for your car insurance.

| 10 Most Expensive Cities in Florida | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brownsville | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| Gladeview | $7,527.43 | Allstate | $12,154.60 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| Fountainebleau | $7,237.96 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,037.71 | Geico | $4,603.44 |

| Hialeah | $7,178.98 | Allstate | $11,504.33 | Progressive | $8,630.10 | USAA | $4,248.38 | Geico | $4,603.44 |

| Golden Glades | $7,161.53 | Allstate | $11,695.48 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | Geico | $4,603.44 |

| Coral Terrace | $7,081.53 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,045.62 | Geico | $4,603.44 |

| Olympia Heights | $7,078.68 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| Miami | $7,078.48 | Allstate | $11,539.59 | Liberty Mutual | $8,684.52 | USAA | $4,077.32 | Geico | $4,603.44 |

| Biscayne Park | $6,983.18 | Allstate | $11,896.30 | Progressive | $8,392.79 | USAA | $4,505.83 | Geico | $4,603.44 |

| Miami Gardens | $6,972.48 | Allstate | $10,667.38 | Liberty Mutual | $8,209.82 | USAA | $4,505.83 | Geico | $4,603.44 |

Given its size and population, it should come as no surprise that Miami ranks as one of the expensive cities for car insurance rates. More cars on the road usually translate into more traffic incidents, which inevitably results in more claims.

| 10 Least Expensive Cities in Florida | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Waldo | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| High Springs | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Archer | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Micanopy | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Newberry | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Alachua | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| La Crosse | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Gainesville | $3,494.00 | Allstate | $5,666.29 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Earleton | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Miramar Beach | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

Should you ever need to file a claim, it is good to know where your car insurance provider stacks up among the others operating in the Sunshine State. Keep reading to get information about the best car insurance companies in Florida.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

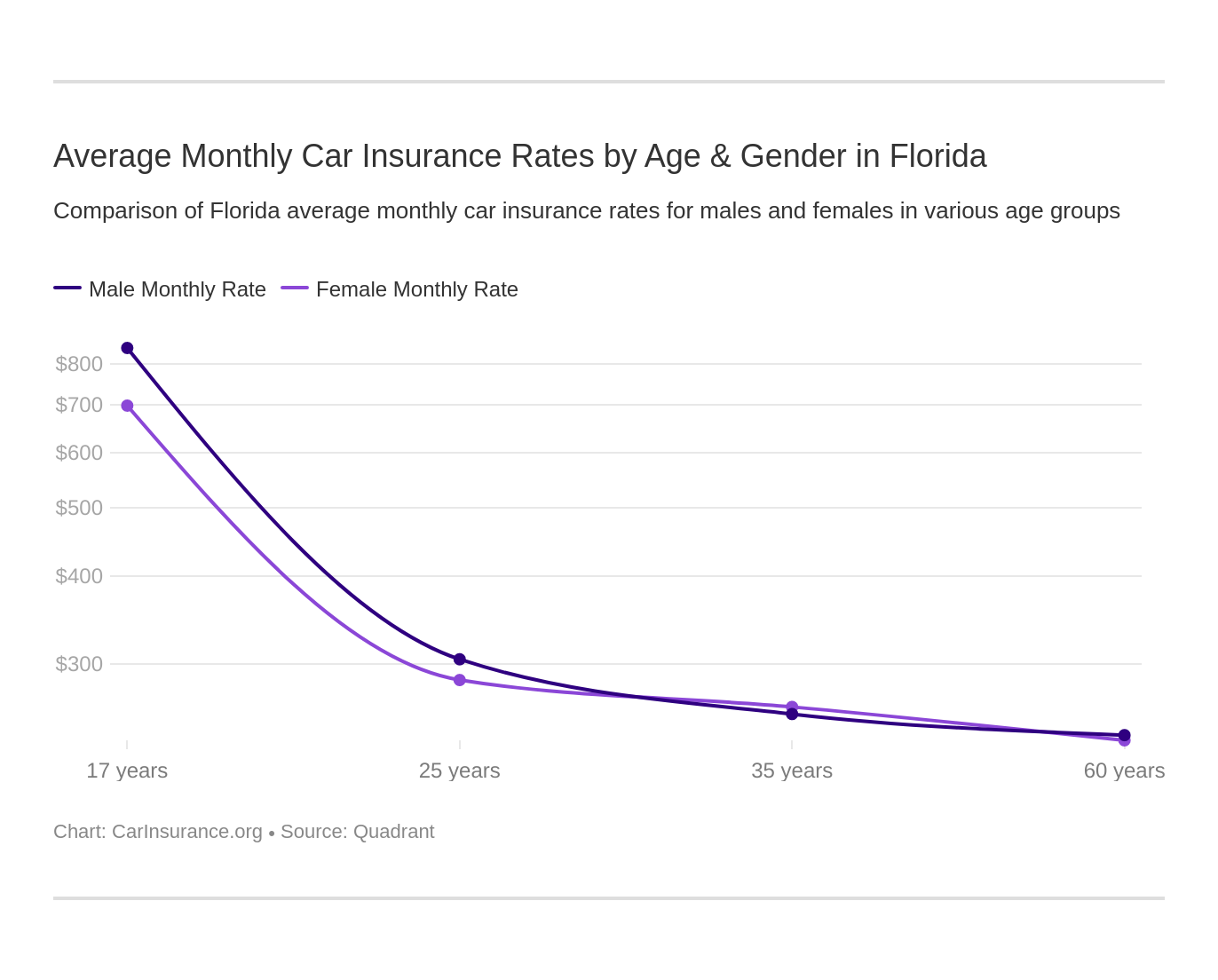

What are the average monthly car insurance rates by age and gender in FL?

How much does car insurance cost in Florida based on your age and gender? And what is the average cost of car insurance in Florida?

You are most likely going to need car insurance coverage at some point in your life. These external factors could also have an impact on how much you end up paying for that coverage as well.

The Consumer Federation of America released a study in 2017, which reveals that, contrary to popular belief, older women pay more for car insurance coverage than their male counterparts. In fact, according to Forbes magazine:

Among its findings, the CFA found that in 38 instances, women with perfect driving records are charged at least $100 more per year than male drivers, and in six cases, have to pay $500 higher annual premiums.

While gender and age were combined to reach the conclusions in the CFA report, each of these factors alongside marital status also impacted what a person might pay for car insurance coverage.

For a variety of reasons, including a history of devastating storms and hurricanes, Florida’s car insurance rates are often higher than the national average.

This table shows you average car insurance rates by age in Florida.

| Company | Married 35-year old Female Annual Rate | Married 35-year old Male Annual Rate | Married 60-year old Female` Annual Rate | Married 60-year old Male Annual Rate | Single 17-year old Female Annual Rate | Single 17-year old Male Annual Rate | Single 25-year old Female Annual Rate | Single 25-year old Male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $4,653.38 | $4,423.29 | $4,040.00 | $4,089.70 | $15,905.72 | $17,179.33 | $4,592.92 | $4,639.32 |

| Geico General | $2,986.89 | $3,001.17 | $2,793.99 | $2,793.99 | $5,342.74 | $6,713.47 | $3,292.51 | $3,344.27 |

| Liberty Mutual Ins. Co. | $3,711.14 | $3,711.14 | $3,398.94 | $3,398.94 | $7,859.88 | $12,116.72 | $3,711.14 | $5,037.27 |

| Allied P&C | $3,039.80 | $3,000.81 | $2,710.48 | $2,806.30 | $7,314.60 | $9,013.69 | $3,347.30 | $3,483.83 |

| Progressive Select | $3,736.10 | $3,523.35 | $3,200.74 | $3,428.17 | $10,512.83 | $11,453.56 | $4,508.82 | $4,302.83 |

| State Farm Mutual Auto | $2,158.99 | $2,158.99 | $1,954.51 | $1,954.51 | $6,166.09 | $7,832.79 | $2,399.41 | $2,556.07 |

| USAA | $1,646.31 | $1,619.33 | $1,536.18 | $1,525.12 | $5,638.10 | $6,551.72 | $2,060.09 | $2,226.40 |

It is interesting to note that a single 25-year-old female pays about the same as a female who is 60 years old and married, whereas the rates for males tend to decrease with age.

Your age and gender are not the only things that can impact your car insurance rates. Your credit rating and driving history also make a big difference in Florida auto insurance rates.

You’ll want to compare rates using your specific zip code, as rates will fluctuate from city to city and county to county. Miami car insurance quotes will be different from quotes for car insurance in Orlando, FL. Use our quote comparison tool to get the best idea of what the cost of car insurance will be to you as a Florida resident.

What is the minimum car insurance required in Florida?

According to the Florida Department of Motor Vehicles, the Florida car insurance requirements are:

- $10,000 in Personal Injury Protection (PIP)

- AND $10,000 in Property Damage Liability (PDL)

PIP will help cover lost wages, in-house care, and equipment if you are injured in an accident. It will also help pay for funeral costs if necessary.

AAA also notes that Florida has a no-fault law and that:

No-fault law requires anyone who owns or has registered a motor vehicle with four or more wheels (excluding taxis and limos) to have the following coverage. All drivers are required to have insurance policies of at least $10,000 for an individual’s bodily injury, $20,000 for injury to multiple persons; $10,000 for property damage; and a $30,000 minimum per accident.

Failure to comply with these requirements can result in the suspension of your driving privileges, vehicle registration, and vehicle license tag for up to three years, so why take the risk?

A Florida driver is responsible for following the Florida Financial Responsibility Law. This law requires that a person with certain types of marks on their driving record maintain:

- A minimum limit of bodily injury liability of $10,000 per person

- A minimum limit of $20,000 per crash

- A minimum of $10,000 property damage liability per crash

- AND personal injury protection limits of $10,000 per person per crash

To ensure that all car insurance law requirements are met, residents of the Sunshine State must be able to present acceptable forms of financial responsibility should they be involved in an accident or pulled over by police for a traffic violation.

What forms of financial responsibility are accepted in Florida?

According to the AAMVA, upon request from a law enforcement officer, a driver must present insurance during a roadside traffic stop. Proof of insurance is also required if you are involved in an accident.

Some of the acceptable forms used to demonstrate this type of financial responsibility in Florida include:

- An e-insurance card accessible through your car insurance provider’s app on your smartphone, laptop, tablet, or electronic other devices

- A printed paper insurance ID card presented to you by your car insurance provider when you open an auto insurance policy with them

These options make providing the proper officials your proof of insurance when registering your vehicle or sorting out any traffic incidents as easy as feeding seagulls on a Florida beach on a sunny afternoon.

Your proof of financial responsibility can also be updated online should you need to reinstate your license plate registration.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Florida’s car insurance rates as a percentage of income?

Being able to access your proof of insurance or update your insurance information online saves you time and money. These are savings that all Florida divers can appreciate.

According to Business Insider and the Insurance Information Institute, Florida has some of the highest average car insurance rates nationwide.

On average, 3.15% of every Floridians’ annual disposable income is spent on car insurance. Florida residents spend $1,257 from their average disposable income of $38,350 per year.

Even as Florida’s average annual car insurance rates have remained relatively stable over the past few years, they are still higher than those of its neighboring states of Georgia and Alabama. Their residents pay $991 and $837, respectively, on average per year.

Florida is on the high side of the national average and places the average expenditure for car insurance nationwide at $935.80 per year. Floridians are paying about $322 more than the rest of the country to drive in the Sunshine State.

This is why it is important to choose the right insurance provider who can help you understand exactly which type of coverage will get you the most bang for your buck.

What additional coverages are available in FL?

While Florida may only require you to maintain $10,000 for an individual’s bodily injury, $20,000 for injury to multiple persons, $10,000 for property damage, and a $30,000 minimum per accident, there are benefits to going above and beyond what the law requires.

Some of these options include:

- MedPay insurance subject to the policy limits will cover the medical payments for all passengers in a vehicle that is injured in an accident. This includes the ambulance ride and treatment.

- Uninsured/Underinsured insurance will protect you if you are in an accident with an at-fault driver who isn’t carrying liability insurance or whose limits are too low to cover the damages and medical expenses incurred by you or others during an accident.

Below are the loss ratio trends for Florida as a whole, which can give you an indication of how the car insurance market as a whole is doing.

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection | 75% | 62% | 76% |

| Medical Payments (MedPay) | 74% | 73% | 81% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 73% | 80% | 86% |

The loss ratio numbers for PIP, MedPay, and Uninsured/Underinsured motorist sections are good news to you as a Florida consumer. Why? What do these loss ratios mean to you?

- A High Loss Ratio (over 100%) indicates that the companies are losing money because they pay out too many claims for the rates they have earned, which might cause them to face bankruptcy. A high loss ratio is a good indicator of future rate increases.

- A Low Loss Ratio indicates that companies might have overpriced their policies and that a rate decrease could occur soon.

Florida’s car insurance loss ratios are relatively good.

Considering that, on average, around 27% of Florida drivers are uninsured/underinsured ranking Florida number one in this area, it could be a major benefit to you to invest in additional coverage beyond just what the state requires.

Keep reading to find out about all of the add-ons and endorsements that you can invest in to protect yourself and your passengers should you ever need more coverage.

Are there add-ons and endorsements available in Florida?

Understanding what each type of these add-ons and endorsements means to you can go a long way to ensuring that you are never left unassisted should the joys of car ownership take a turn for the worse.

- Guaranteed Auto Protection (GAP) – If your car is ever totaled or stolen, GAP will pay any money that remains outstanding on the lease or loan.

- Personal Umbrella Policy (PUP) – When your underlying liability limits have been reached, PUP protects you from lawsuits.

- Rental Reimbursement – Should you ever need to leave your car in the shop, rental reimbursement will help you pay the costs of renting a car until your repairs are finished. (For more information, read our “Pros and Cons of Renting Your Car to Others“).

- Emergency Roadside Assistance – This is just what it sounds like. If your car breaks down or you have a flat emergency roadside assistance will be there to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance – This type of coverage helps pay for repairs to your car, which did not result from an accident.

- Non-Owner Car Insurance – Don’t own a car but still drive on occasion? This type of coverage is perfect for you then because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage – If a basic model just isn’t your style, then modified car insurance should be. This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance – Classic Car Insurance coverage helps ensure that if something happens, you and your classic car while on the road, both will be well protected. This type of insurance typically costs less since classic cars are generally not driven as much as their contemporary counterparts.

- Pay-As-You-Drive or Usage-Based Insurance – This type of coverage is based on the way you drive. The insurance provider considers your speed, distance traveled, and other such factors and issues discounts based on that information.

The type of car you drive or how you drive is not the only factor determining the type of coverage you may need or how much that coverage may cost. Sometimes it is just who you are that impacts the rate that you receive. Keep reading to find out how.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the best Florida car insurance companies?

Should you ever need to file a claim, it is comforting to know that you have the best car insurance provider on your side. We have collected a list of the top-rated Florida car insurance providers for you.

Which of the largest companies have the best financial rating?

As the only worldwide credit agency to have a particular focus on the insurance industry, A.M. Best has become a trusted agency to use when determining the overall health and viability of insurance providers globally.

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| ACE American Insurance Company | A++ | Stable |

| Agri General Insurance Company | A++ | Stable |

| Auto-Owners Insurance Company | A++ | Stable |

| Automobile Ins Co of Hartford, CT | A++ | Stable |

| Chubb Insurance Company | A++ | Stable |

| Columbia Insurance Company | A++ | Stable |

| Continental Divide Insurance Company | A++ | Stable |

| Geico | A++ | Stable |

| Great Northern Insurance Company | A++ | Stable |

| Owners Insurance Company | A++ | Stable |

This means that when you choose a company with an A++ rating from A. M. Best, you are choosing one that has a good loss ratio, and the overall financial outlook is stable.

What all of this does this mean to you as a consumer? It means that you can be sure that should you ever need to file a claim with one of the insurance providers that has received an A++ rating from AM Best that you will be less likely to have your claim rejected.

You are also less likely to face any negative consequences, which could result if your insurance provider goes bankrupt.

What are the ratings for Florida car insurance companies?

A. M. Best is not the only trusted adviser keeping its eye on the car insurance industry. J. D. Power is watching out for you, and what they have noted is that customer satisfaction among customers of automobile insurance is at a record high.

Your experience can be better by browsing through customer complaints and reviews.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which car insurance companies in Florida have the most complaints?

Part of choosing the right car insurance provider is knowing just how many complaints each one of your choices. This is where the complaint ratio comes in. This ratio tells you as a consumer just where the providers in your area stand about their competitors.

The baseline for the complaint ratio is 1.0. This means that a company with a complaint ratio of 1.0 has an average number of complaints. The higher the complaint ratio, the higher the number of complaints lodged against the company.

Below is a list of the top 10 best car insurance companies in Florida and their complaint ratios so that you can see how each one compares.

| Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| Amtrust NGH Group | $413,351 | 0 | 61.98% | 2.16% |

| Travelers Group | $444,623 | 0.09 | 67.79% | 2.32% |

| State Farm Group | $3,042,871 | 0.44 | 79.80% | 15.89% |

| Allstate Insurance Group | $1,842,800 | 0.50 | 55.45% | 9.63% |

| Geico | $4,678,326 | 0.68 | 78.78% | 24.44% |

| USAA Group | $1,357,367 | 0.74 | 82.20% | 7.09% |

| Progressive Group | $3,031,444 | 0.75 | 66.17% | 15.84% |

| InFinanciality Prop & Casualty Insurance Group | $357,011 | 2.03 | 67.06% | 1.86% |

| Liberty Mutual Group | $617,089 | 5.95 | 68.42% | 3.22% |

| J. Whited Group (Windhaven) | $385,885 | 7.43 | 56.59% | 2.02% |

These numbers can be a bit deceiving when taken out of context.

For instance, a glance at the numbers would make it seem like Amtrust NGH Group is the best choice. Still, this company only holds 2.16% of the market share, which means that it has fewer customers, and fewer customers translates into fewer possibilities for complaints.

If you want to see for yourself, search for complaints using Florida car insurance company codes:

- Amtrust NGH Group – NAIC Code: 15954

- Travelers Group – NAIC Code: 36161

- State Farm Group – NAIC Code: 25178

- Allstate Insurance Group – NAIC Code: 29688

- Geico – NAIC Code: 35882

- USAA Group – NAIC Code: 25968

- Progressive Group – NAIC Code: 25232

- InFinanciality Prop & Casualty Insurance Group – NAIC Code: N/A

- Liberty Mutual Group – NAIC Code: 23043

- Windhaven – NAIC Code: 12541

The National Association of Insurance Commissioners (NAIC) has a report for each company, which details the companies’ total assets, direct rates, and the number of complaints they receive on average.

Looking at the numbers for Geico, which holds almost 25% of Florida’s overall market share, means that their complaint ratio of 0.68 is better given the company size and the number of customers that Geico services. The devil is in the details.

If you ever need to file a complaint against your car insurance provider in Florida, there are several points of contact for you to choose from. Some of these include:

- The Statewide Toll-Free Number: 1-877-My-FL-CFO

- Out of State Callers can contact: (850) 413-3089

- There is also a TDD Line for the hearing impaired: 1-800-640-0886

- Or you can send an email: [email protected]

The office of Florida’s Chief Financial Officer also offers Floridians a way to check the number of complaints against insurance providers for a given year through their Complaint Comparison Database search tool.

Now that you know what the loss ratio and complaint ratio mean to you, and how to file a complaint should you need to, it is time to start comparing the rates.

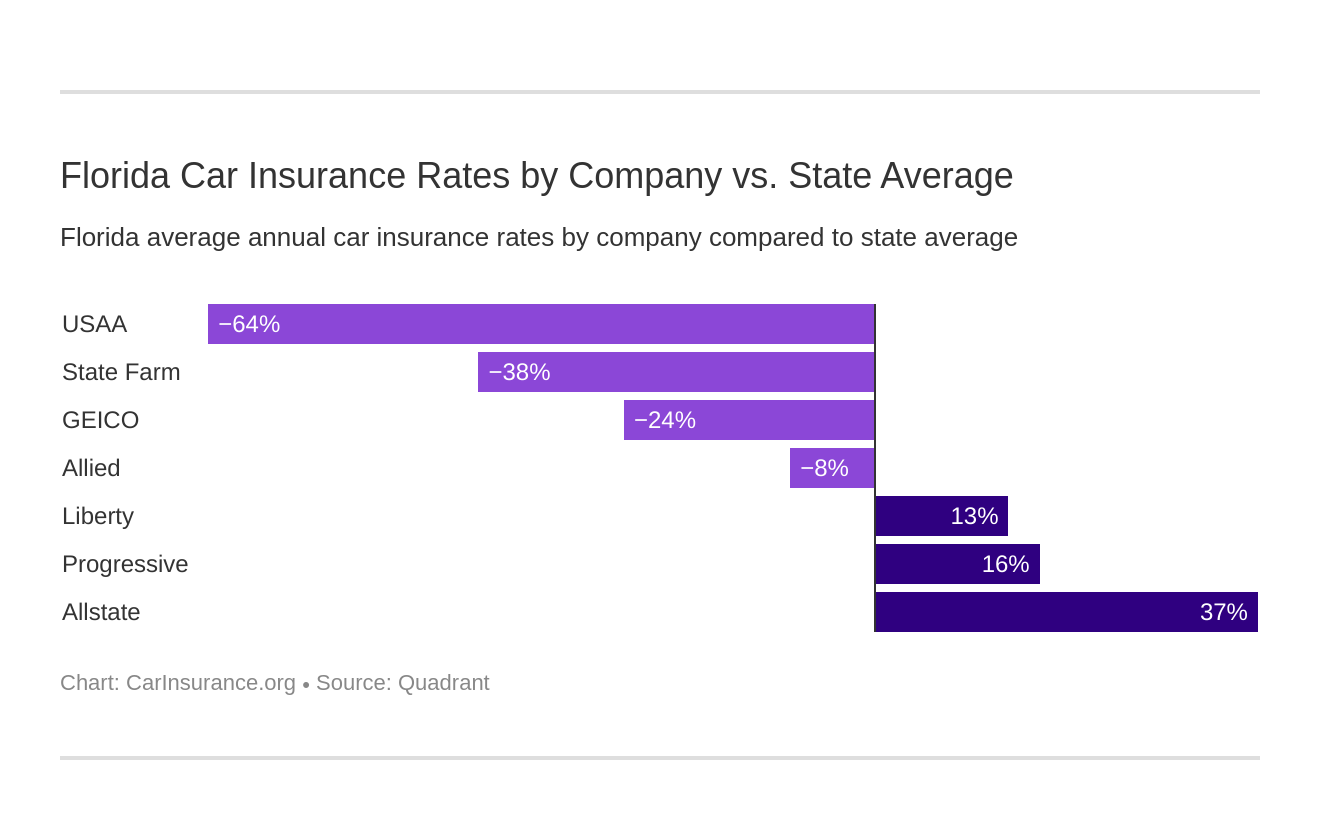

Who are the cheapest car insurance companies in Florida?

Like any financially savvy consumer, you will want to start with the companies with the cheapest rates in Florida. We are here to help you with that. The table below puts you in the driver’s seat when choosing the best car insurance provider that your hard-earned dollar can buy.

| Company | Average | +/- Compared to State Average (rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allstate F&C | $7,440.46 | $2,760.00 | 37.09% |

| Geico General | $3,783.63 | -$896.83 | -23.70% |

| Liberty Mutual Ins Co | $5,368.15 | $687.69 | 12.81% |

| Allied P&C | $4,339.60 | -$340.86 | -7.85% |

| Progressive Select | $5,583.30 | $902.84 | 16.17% |

| State Farm Mutual Auto | $3,397.67 | -$1,282.79 | -37.75% |

| USAA | $2,850.41 | -$1,830.05 | -64.20% |

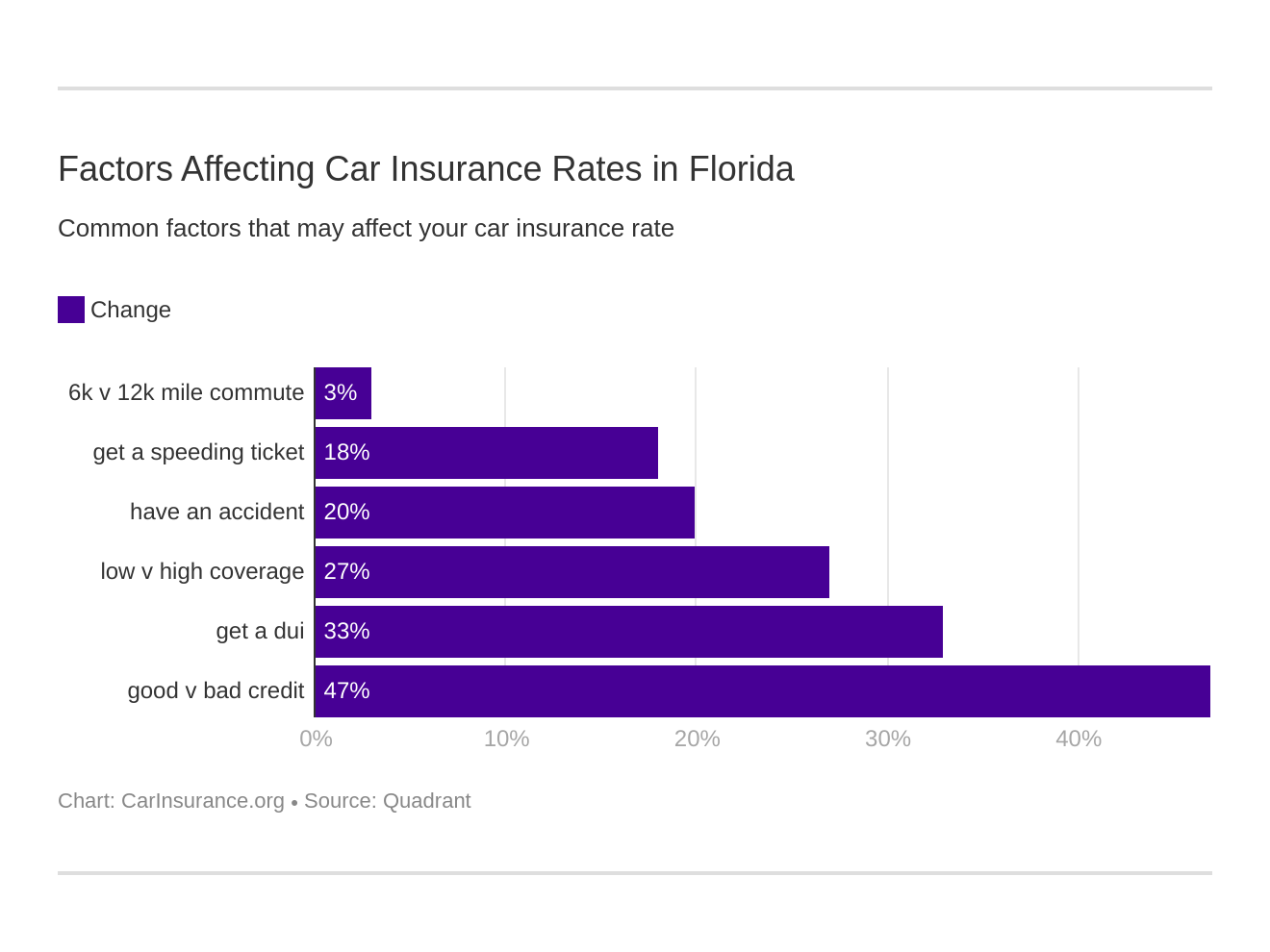

Knowing how much purchasing power you have when shopping for the right car insurance provider is important. It is also important to know how each of these providers determines your rates once you become a customer.

Sometimes your rates are adjusted based on the distance of your commute, while in other cases, your rate is determined by the type of coverage you have or even your credit rating. Keep reading to find out how.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the car insurance commute rates by the company?

There is no way around the fact that the more you drive, the higher your rates will be. This is why it pays to compare the annual rates that Florida car insurance providers charge customers based on the number of miles they travel annually.

The table below can help you put these numbers in perspective to make an informed choice when you decide to purchase car insurance in the Sunshine State.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $7,227.85 | $7,653.06 |

| Progressive | $5,583.30 | $5,583.30 |

| Liberty Mutual | $5,193.97 | $5,542.32 |

| Nationwide | $4,339.60 | $4,339.60 |

| Geico | $3,765.00 | $3,802.25 |

| State Farm | $3,278.22 | $3,517.12 |

| USAA | $2,818.01 | $2,882.80 |

Looking at these numbers reveals that if you have a short commute, then a company like USAA. USAA car insurance in Florida might be right for you, but you won’t be able to enroll unless you’re in the military or part of the immediate family of someone who serves or has served.

If you have a long commute, it might be wiser to go with a more expensive company such as State Farm since it has a lower complaint ratio and better loss ratio than USAA when the market share of each of these companies is compared.

After all, more time spent on the road means an increase in the chances that you might be involved in a traffic incident, and you will want to make sure that your claim is less likely to be rejected should you ever need to file one.

You will also want to consider the coverage level rates of each company as you shop around for the best value in car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the car insurance coverage level rates by the company?

Now that you are beginning to understand how things can influence the type of coverage you might need, it is time to consider how much coverage you might need. The table below can help you do just that.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $5,762.84 | $7,820.73 | $8,737.79 |

| Geico | $3,105.08 | $3,915.19 | $4,330.61 |

| Liberty Mutual | $4,921.70 | $5,456.65 | $5,726.09 |

| Nationwide | $3,427.69 | $4,511.14 | $5,079.97 |

| Progressive | $4,681.36 | $5,712.27 | $6,356.27 |

| State Farm | $2,915.85 | $3,477.29 | $3,799.88 |

| USAA | $2,450.79 | $2,954.56 | $3,145.87 |

As you can see, the higher your coverage, the higher your car insurance rate will be, which is why it is so important to shop around. That is not the end of the story.

An older car with higher mileage might not need as much coverage. A lender on a new car might require you to have a better credit score or clean driving record.

How does credit history impact car insurance rates for each company?

Consumer Reports published an article in 2015 that came as a shock to most Americans. This article revealed that your credit score does indeed have an impact on your car insurance rates. The table below shows the best car insurance rates in Florida based on credit history.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $5,314.82 | $6,574.17 | $10,432.38 |

| Geico | $2,505.51 | $3,335.60 | $5,509.78 |

| Liberty Mutual | $4,109.70 | $5,073.66 | $6,921.08 |

| Nationwide | $3,596.12 | $3,981.62 | $5,441.06 |

| Progressive | $4,302.18 | $5,169.65 | $7,278.07 |

| State Farm | $2,495.39 | $3,045.80 | $4,651.82 |

| USAA | $1,645.31 | $2,266.46 | $4,639.45 |

One of the reasons that people with good credit scores get better car insurance rates is because they are less likely to submit a claim. The higher the credit rating, the more likely it is that the person will pay out of pocket to have repairs done or settle damages after an accident.

That doesn’t mean that maintaining a clean driving record is useless. When it comes to determining how much you will pay to maintain your car insurance coverage in Florida.

Keep scrolling to see just how important it is to be a safe driver in the Sunshine State.

How does the driving record impact car insurance rates for each company?

In Florida, what you do behind the wheel matters to your bottom line when it comes to purchasing car insurance. This is because Florida operates under a point system. These driving points are based on a graduated system that sets forth relative values for traffic offenses.

These driving points also stay on your driving record for three years and are used by car insurance companies to determine your rates. Let’s look at a list of car insurance companies for high-risk drivers in Florida.

| Company | Clean record | With 1 speeding violation | With 1 DUI | With 1 accident |

|---|---|---|---|---|

| Allstate | $6,417.39 | $7,119.64 | $8,524.13 | $7,700.66 |

| Geico | $2,636.72 | $4,116.12 | $5,012.72 | $3,368.94 |

| Liberty Mutual | $3,869.33 | $5,285.32 | $7,291.64 | $5,026.31 |

| Nationwide | $3,705.32 | $4,114.99 | $5,472.37 | $4,065.71 |

| Progressive | $4,407.95 | $5,915.72 | $5,490.35 | $6,519.19 |

| State Farm | $3,105.11 | $3,397.66 | $3,397.66 | $3,690.25 |

| USAA | $2,233.94 | $2,341.64 | $4,070.81 | $2,755.24 |

Looking at just how much one ticket or accident can change your car insurance rates demonstrates how important it is to drive defensively in the Sunshine State. The table shows that it’s just as important to you as a Floridian to be aware of what is on your driving record as it is for you to keep an eye on your credit score.

Now that you know how your credit score and driving record can impact your car insurance rates, keep reading to find out why bigger doesn’t always mean better when choosing a car insurance provider.

You can still get car insurance quotes with Florida DUI. Just enter your ZIP code in the free comparison tool to start.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

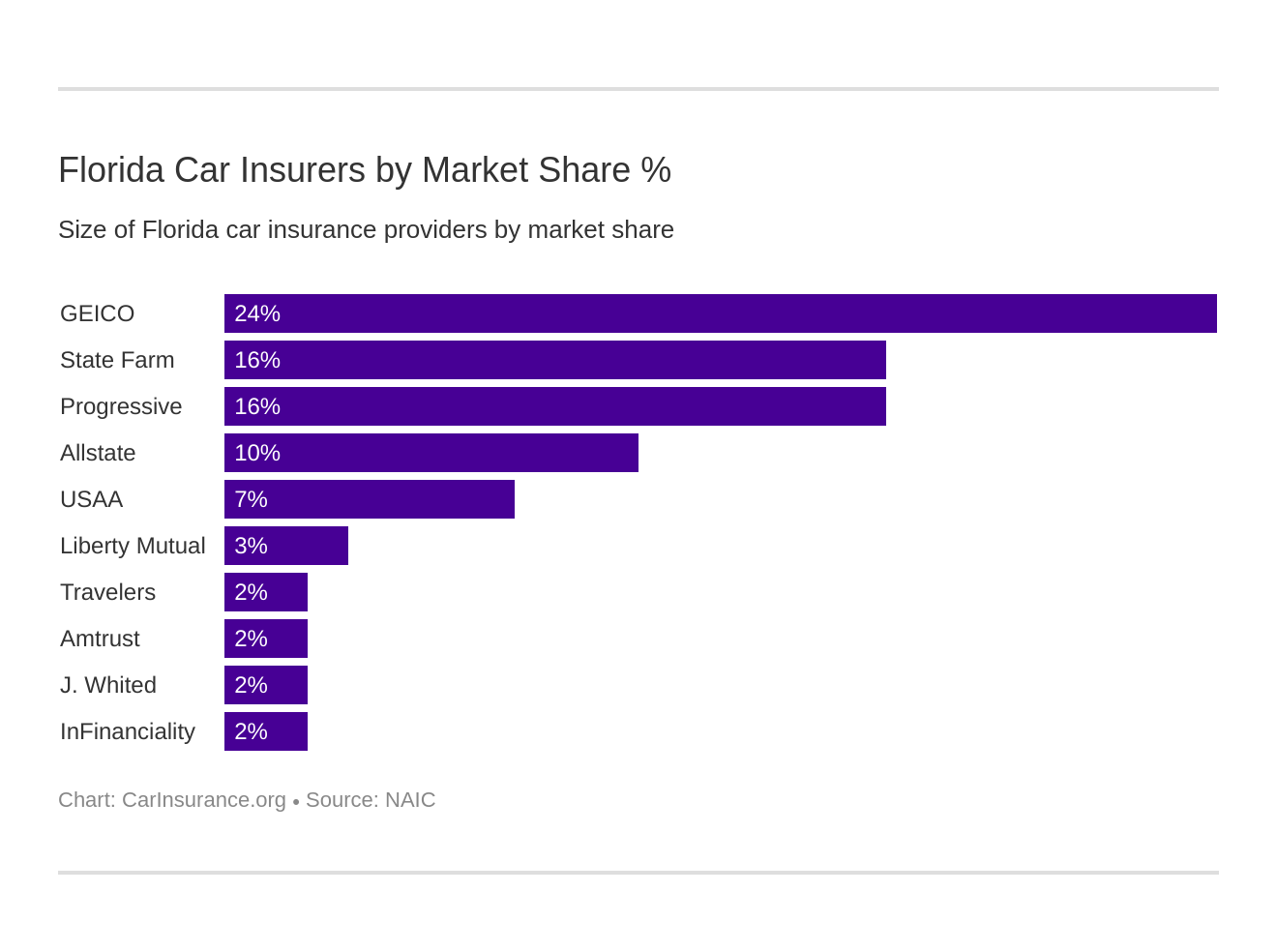

What are the largest car insurance companies in Florida?

We gave you a brief overview of how a car insurance provider’s market share and how it works alongside loss ratio to help you get better customer service. But what does market share mean?

Market share is the percentage of the overall market that is controlled by a single company.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| Geico | $4,678,326 | 24.44% |

| State Farm Group | $3,042,871 | 15.89% |

| Progressive Group | $3,031,444 | 15.84% |

| Allstate Insurance Group | $1,842,800 | 9.63% |

| USAA Group | $1,357,367 | 7.09% |

| Liberty Mutual Group | $617,089 | 3.22% |

| Travelers Group | $444,623 | 2.32% |

| Amtrust NGH Group | $413,351 | 2.16% |

| J. Whited Group (Windhaven) | $385,885 | 2.02% |

| InFinanciality Prop & Casualty Insurance Group | $357,011 | 1.86% |

Geico controls approximately 25% of the overall car insurance market in Florida. Geico also has $4,678,326 in Direct Premiums Written, which indicates that Geico is financially sound as well since:

While insurance companies can increase revenue by increasing premiums on policies that have come up for renewal, the main driver for growth in this area is writing new policies.

What about The General auto insurance in Florida? You can get cheaper car insurance, but Geico and other high market companies perform much better.

How many insurers are there in Florida?

There are 14 domestic insurance providers in the state of Florida and 953 foreign ones. This means that you have 967 to choose from as you shop for the best rates and coverage.

So, what is the difference between a foreign or domestic insurer?

- Domestic insurer means that the insurer is one that has been formed under the laws of the state of Florida.

- Foreign insurer means that the insurer is one that has been formed under the laws of any state, district, territory, or commonwealth of the United States other than the state of Florida.

Neither type of insurer is better or worse when it comes to providing you with the coverage you need. Ultimately then, it is a personal choice about which one you are more comfortable dealing with.

Dealing with either type of insurer is easier when you understand the laws that they are formed under. We have provided you a brief overview of these laws in the next section.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Florida’s state driving laws?

Navigating the laws that govern car insurance in the Sunshine State can be a complicated and confusing process. Trying to understand just which laws apply to you after a car accident can be frustrating as well. Having a general understanding of what these laws are before you find yourself involved in a traffic incident can help.

This is where we come in. We are here to help you gain a good grasp of the laws governing driving and car insurance in the Sunshine State. Keep scrolling to find out the basic information you need to keep your rates down and your family safe while on the road in Florida.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the car insurance laws in Florida?

As discussed in the earlier section, there are minimum coverage requirements for drivers and car owners in Florida. According to the NAIC, the Sunshine State also requires that you file the proper forms before your insurance can be used.

While it is common knowledge that you must be covered by car insurance to tag a vehicle or drive in Florida, many people are shocked to learn that they can also be denied car insurance coverage simply because they are considered to be a high-risk driver.

This is why it pays to be proactive by driving defensively when you are on Florida’s roads, and why you should always obey all traffic laws. By practicing safe driving, you can keep your driving record clean and thereby prevent yourself from being labeled a high-risk driver.

You can also do your part by understanding how the laws in the state of Florida are determined.

How are FL state laws determined?

Like all other laws in Florida, the laws that govern car insurance are determined by the state legislature. This governmental body has declared Florida to be a no-fault state when it comes to car insurance coverage types and amounts.

This can be confusing to some people, but understanding who is responsible and when, according to Florida’s no-fault laws, is quite simple.

- No-Fault coverage is meant to protect the insured by paying for their expenses in an accident.

- After No-Fault coverage benefits are exhausted the insured can then turn to MedPay

- When MedPay benefits have reached their limits, and if the insured is not at fault, the insured can then look towards the other party’s insurance to seek reimbursement.

- Uninsured Motorists can cover the rest if the other party’s benefits reach their limits, but only within the limits of the uninsured motorist policy limits.

Of course, having an accident can increase your chances of being categorized as a high-risk driver, so it pays to be careful.

Should you find yourself in the high-risk category, purchasing car insurance is impossible; it just means that you will have to shop around a bit more and that you will need to be well informed.

What is high-risk car insurance?

This type of car insurance is designed for those who find themselves with driving points on their Florida license. High-risk car insurance companies in Florida will issue more expensive rates, as discussed in the Driving Record Rates section.

You may be required to carry an SR-22 or FR-44 form if you have had your license suspended, gotten into an accident with no insurance, or have recent severe violations such as drug or alcohol charges.

According to the Florida DMV, driving points remain on your license for three years, and they are used by car insurance companies to determine your rates and coverage eligibility.

The more driving points that you have on your Florida driving record, the more likely car insurance companies feel you are to be involved in another traffic incident.

This increase in likelihood translates into higher rates because it also means that you, or an opposing party, are more likely to file a claim with your insurer.

You don’t have to have a traffic incident to increase your driving points. Sometimes something so simple as filing a claim for a cracked windshield can increase your rates as well.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the windshield coverage laws in Florida?

There are a few things you should know when it comes to windshields in Florida. The first of these is that all vehicles operating in the Sunshine State must have functioning windshield wipers.

Florida laws do not mention cracked or damaged windshields. But there are other relevant Florida car insurance regulations that can make driving with a damaged, chipped, or broken windshield illegal.

It is also important to note that, in Florida, coverings, stickers, or signs on windshields are against the law. There are a few exceptions, such as:

- Stickers that are mandatory by law

- GPS devices

- And/or toll payment devices, such as Florida’s SunPass device

These stickers or devices cannot obstruct the driver’s view. This is also damage, such as cracks or chips, which can potentially interfere with the driver’s view.

Florida also adheres to the federal regulation that any cracks or chips smaller than ¾-inch in diameter are permitted, but that this damage cannot be located within three inches of another crack. This damage must also be located away from the driver’s view.

Comprehensive coverage will generally cover windshield damage in the Sunshine State, but as with the filing of all other types of claims, this could increase your rates the next time that you rewrite your policy.

All of this talk of high-risk drivers and increased rates seems intimidating, but there are low-cost options in Florida’s state. Keep reading to find out what they are and if they might be right for you.

How can you get low-cost car insurance?

Low-cost insurance is provided with no hassle to those who have good driving records, a good credit rating, and those who fit a certain demographic. What do you do if one or more of these factors is working against you?

The best option in this scenario is to investigate which types of discount programs are available to you as you shop for car insurance. Some of these discount programs include:

- Safe Driver Discount

- Student Discount

- AND Veteran Discounts

Taking a defensive driving course can lower your rates if you have the time and money to invest.

With all of these ways to save or recover from driving points, why wouldn’t you take advantage of a few of them? Despite the variety of discounts and recovery options, some people still feel compelled to file false claims.

Be forewarned though that the State of Florida takes insurance fraud VERY seriously.

What are the car insurance fraud laws in Florida?

While being a no-fault state can have its advantages for Florida residents in need of quick reimbursement after an accident, it also lends itself to higher car insurance fraud incidents. The Insurance Information Institute notes that:

In many no-fault states, unscrupulous medical providers, attorneys, and others perpetrate fraud by padding costs associated with a legitimate claim, for example, by billing an insurer for a medical procedure that was not performed.

Because of this, if you are ever injured in an accident or sustain damage to your vehicle, it is best that you, as the insured, pay close attention to the billing practices of the service providers that you employ.

Florida law dictates that any person who submits a claim based on deliberate falsehood, exaggerations, or loss and/or injury that is the result of deliberate action on the part of the claimant has committed insurance fraud.

A person commits insurance fraud by submitting a claim based on a false, exaggerated, or deliberate injury or loss. It is against Florida law to submit false or misleading information to an insurer on a claim or an application for an insurance policy.

A person caught committing insurance fraud in the Sunshine State can be subject to:

- The loss of license and charges of criminal liability and/or civil fines, if the perpetrator is a lawyer, doctor, and other professional.

- Fines and/or imprisonment in the case of those not so professionally inclined.

The severity of the punishment also increases with the value of the fraudulent claim, and can even result in first, second, or third-degree felony charges.

There is a bright side to Florida’s insurance fraud laws. In 2012 Florida enacted the No-Fault Insurance Reform Law, which has helped to reduce fraud within the state resulting in lower rates for Floridians overall.

Is there a statute of limitations in Florida?

Almost all crimes committed in Florida carry with them a statute of limitations. Personal injury and property damage are no exceptions. According to the Florida State Legislature, these crimes carry with them the following:

- Four Years for Personal Injury claims

- Four Years for Property Damage claims

While statutes of limitations are commonplace in all states nationwide, there are a few driving laws unique to Florida that all residents and visitors should be aware of.

What are Florida specific driving laws?

In 2013 the State of Florida overturned the previous law that had allowed foreign tourists to drive with their licenses from homelands.

Florida also has a Move-Over law that requires drivers to slow their car down to 20 miles per hour below the posted speed limit to protect the lives of law enforcement or emergency personnel operating alongside the roadway. Violating this law makes you subject to fines.

You must also feed the parking meter if you tie an elephant, goat, or alligator to it according to Florida law.

Florida truly is a weird and wonderful state.

There is nothing weird about the vehicle licensing laws in Florida. Keep reading to find out how they affect you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Florida’s vehicle licensing laws?

As mentioned in the previous section on minimum coverage requirements in Florida, all car owners in the Sunshine State are also required to maintain minimum coverage of:

- $10,000 in Personal Injury Protection (PIP)

- AND $10,000 in Property Damage Liability (PDL)

Florida also began issuing licenses that were REAL ID-compliant after January 1, 2010. Floridians can tell if their state-issued id-card or driver’s license is REAL ID-compliant by looking for the star in the upper right corner of their cards,

To be issued a REAL ID, you will need to bring at least one of the primary documents listed below:

U.S. Citizens should bring with them:

- Valid, unexpired U.S. passport

- Original or Certified copy of a birth certificate

- Consular Report of Birth Abroad

- Certificate of Naturalization issued by DHS

- Certificate of Citizenship

If your current name is different from what appears on any of these, you will need to bring one of the following:

- Court-ordered name change document

- Marriage certificate, issued by the courts and/or

- Divorce decree, issued by the courts

For Non-Citizens the following should be brought with you:

- Valid, unexpired Permanent Resident Card – I-551 for Lawful Permanent Residents

- Valid Passport for non-immigrants except for asylum applicants and refugees

- Other government-issued document showing your full name

- Department of Homeland Security document showing proof of the lawful presence

- If your name has changed by marriage/divorce, you must have your name changed on your Citizen and Immigration Services (CIS) documents.

Both Citizens and Non-Citizens will need to bring:

- Their Social Security Card or proof of your social security number.

- Two documents that show their principal residence

For in-depth information on the identity documents required to obtain your REAL ID, you can visit the FLHSMV website.

Just like the laws that govern REAL ID are meant to keep Floridians safe, so are the penalties imposed for driving without car insurance. Read on to discover what they are.

What are the penalties for driving without insurance in Florida?

Driving without car insurance in the Sunshine State has its consequences.

The first offense carries with it a penalty of the suspension of your license and registration until you have paid the reinstatement fee of $150. Proof that you have secured non-cancelable coverage is given once you’ve paid.

Should you find yourself driving without insurance coverage for a second time, the second offense carries the penalty of the suspension of your license and registration until the reinstatement fee of $250 is paid proof that you have secured non-cancelable coverage is given.

Florida also has a set of laws specifically aimed at teenage drivers to keep all Florida drivers safe.

What are the teen driving laws in Florida?

Florida laws that regulate teenage drivers operate under a multi-stage licensing process.

Their age or pre-determined requirements determine each stage of the licensing process for teenagers.

For instance:

- At age 15, Florida teenagers can apply for a learner’s license. To do so through the teenager has to have completed a Traffic Law and Substance Abuse Course. They must also have passed the written, vision, and hearing tests, and they must have a signed parent consent form.

- When a driver turns 16, if they had their learner’s license for at least one year without any traffic violations and had completed 50 hours of practice driving, they could apply for the intermediate license.

- The issuance of this type of license is also contingent on the teenager being able to pass a behind-the-wheel driving test, complete a vision test, and provide proof of practice driving time. A legal guardian must also accompany the teenager to the DMV to sign the application form unless their signature has been notarized before the teenager, presenting it to the DMV officer. At the intermediate stage, driving privileges are also based on age.

- At age 18, a teenager becomes eligible for a full unrestricted license.

All first-time drivers in Florida are required to take a Traffic Law and Substance Abuse course and a written exam to receive a learner’s license.

After you have had your driver’s license for some time, the procedures for renewing it will be applied.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Florida’s driver license renewal procedures?

The renewal procedures in the state of Florida vary by age. For the general population, a Florida Driver’s License is only required to be renewed every eight years.

Florida is renowned as a retirement destination, which means that a substantial part of the state’s population falls into the older population category, which requires a renewal cycle of every six years for those residents over the age of 80.

If you do not fall into the teenage driver category and you are under 80 years old, you are only required to take the vision test if you apply for a renewal of your license in person. For all Florida residents over the age of 80, a vision test is required for every renewal.

Mail-in or online renewal is permitted for the general Florida population and those residents over the age of 80 every other renewal cycle.

Just as with teenage drivers, the general population of Floridians on the road, and older operators of motor vehicles, the procedures and requirements for new drivers in the state of Florida are slightly different. Read on to discover how.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the procedures for new residents to get a Florida driver’s license?

Even if you have a residence outside of Florida, you can be considered a new resident if you have done any of the following in the Sunshine State:

- Enrolled your children in public school

- Registered to vote in the state of Florida

- Filed for a homestead exemption

- Accepted employment within the state

- OR resided in Florida for more than six consecutive months

As a resident, it is your responsibility to know that a motor vehicle is required by law in the State of Florida to be registered within 30 days of the owner either becoming employed, placing children in public school, or establishing residency.

If you have an out-of-state license, it might be possible to convert it to one from Florida without having to take the written or road test.

All those seeking to obtain a driver’s license in Florida are required to show proof of valid car insurance from a licensed company in the Sunshine State.

Additionally, proof of identity will be required of anyone seeking to procure a Florida state driver’s license.

Now that you know how to get a driver’s license in Florida, let us help you understand how to keep it. Keep reading to get a better grasp of how the driver point system works in the Sunshine State.

Does Florida have a negligent operator treatment system?

For every traffic law violation in Florida, the Florida Department of Highway Safety and Motor Vehicles has set forth a set number of driver points.

The following infractions all carry a weight of three points:

- Running a stop sign

- Failure to yield

- Curfew violations

- Driving with an open container

- Child seatbelt violation

- Driving on the shoulder

Four points can be added to your driving record for traffic tickets written because you have endangered the lives of others with your actions. Some of these things include:

- Passing a stopped school bus

- Speeding more than 15 MPH over the speed limit

- Or running a red light

For more serious infractions such as the following, six points are added to your record:

- Leaving the scene of an accident

- Speeding resulting in an accident

- A moving violation resulting in bodily harm

More points mean higher car insurance rates and could result in the suspension or revocation of your driver’s license. It is best to drive safely then and obey all applicable traffic laws when traveling on Florida roadways.

What are the rules of the road in Florida?

No matter which state you reside in, there will always be rules of the road. Knowing what they are in Florida could help you keep your driving record clean.

Knowing the laws and obeying them can also help you keep your cool when shopping around for the best prices on car insurance.

Keep scrolling to find out all you need to know to be a well-informed driver as you head out on the road.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is Florida a no-fault or at-fault state?

You have already read that Florida is a no-fault state, meaning that:

- No-Fault coverage is meant to protect the insured by paying for their expenses in an accident.

- After No-Fault coverage benefits are exhausted the insured can then turn to MedPay

- When MedPay benefits have reached their limits, and if the insured is not at fault, the insured can then look towards the other party’s insurance to seek reimbursement.

- Uninsured Motorists Coverage can cover the rest is the other party’s benefits reach their limits, but only within the limits of the uninsured motorist policy limits.

So what does it mean to be an at-fault state? Well, unlike a no-fault state, in an at-fault state, the person who was legally “at-fault” for the accident bears the liability for damages and injuries caused by the crash.

Whether you live in a no-fault state like Florida or an at-fault state like North Carolina, certain laws across all state lines, seat belt laws are one of these, but the requirements for when and where a person in a motor vehicle must buckle up varies by state law.

What are the seat belt and car seat laws in Florida?

Florida Law requires the use of safety belts as follows:

- Safety Belts are required to be used by drivers of motor vehicles, all front-seat passengers, and all children riding in a vehicle under 18.

- Child Restraints – Car Seats and Booster Seats are required for use on children age five and under.

- Children ages zero to three must be in child restraint devices of a separate carrier or a vehicle manufacturer’s integrated child seat.

- Children, ages four and five, must be in a separate carrier, an integrated child seat, or a booster seat.

Bear in mind that Florida’s safety belt law is a primary enforcement law. This means that an officer can stop you and issue you a citation simply for your failure to observe safety belt and/or restraint laws.

Florida Safety Belt Laws also require that the driver of a pick-up truck and passengers under the age of 18 wear a seat belt. Riding in the bed is forbidden if you are under 18 years of age.

Florida also has Keep Right and Move Over laws just like many other states do. Keep reading to find out what they are.

Does Florida have “keep right and move over” laws?

According to Florida statute 316.081, Florida drivers must yield by moving right if blocking traffic is in the left lane. Floridians must also move to the right and allow faster traffic to pass by them.

Florida also has a Move-Over law that was discussed in the section on Florida specific driving laws.

This Move-Over law requires drivers to slow their car down to at least 20 miles per hour below the posted speed limit to protect the lives of law enforcement or emergency personnel who are operating alongside the roadway.

Florida also has speed limits, which vary by location.

What are the speed limits in Florida?

Because speed is a factor in most traffic accidents, the state of Florida has set forth speed limits to keep its residents safe.

Generally speaking, these limits are as follows:

- Municipal Speed Areas………………..30 MPH

- Business or Residential Areas………30 MPH

- Rural Interstate Limited………………..70 MPH

- Limited Access Highways…………….70 MPH

- All other Roads and Highways……….55 MPH

- School Zones…20 MPH

Violation of these speeding restrictions can result in a traffic citation and between 3-4 driver points on your record, depending on the situation.

Does Florida have ridesharing services?

Ridesharing services nationwide are on the rise. Anyone wishing to engage in driving for a rideshare company in Florida should brush up on the car insurance requirements for this endeavor before taking on their first fare.

While rideshare drivers in Florida are required to carry the minimum amount of car insurance requirement, Florida also has an additional law that requires rideshare drivers to carry much more coverage.

Rideshare drivers must have at least $1 million in liability coverage for property damage, physical injury, and death. They must also carry the PIP insurance minimums that apply to all drivers. Even when an Uber or Lyft driver isn’t actively driving a passenger, they still must have $50,000 in physical injury or death liability coverage that applies anytime a driver has the app on to look for a customer.

Like ridesharing has increased in popularity, so has the use of automation and crash avoidance devices. Read on to find out what this means to you.

Does Florida allow automation on the road?

The use of automation and crash avoidance devices technology is on the rise. It makes sense given the fact that they have been proven to help reduce crashes.

Things such as back-up cameras and collision avoidance systems can help drivers see and avoid obstacles before impact, but what about full automation?

Recognized as one of the nation’s leaders in self-driving technology, Florida is currently working on expanding the Self-Driving Car Law. If the Florida legislature has anything to say about it, then driverless cars could be very soon in the Sunshine state.

If the law passes, then more laws regulating its use are sure to follow, as are ones regarding the insurance required by the companies that operate them.

What are Florida’s safety laws?

There are several laws on the books in Florida that are designed to keep Floridians safe while on the road. Some of these include DUI laws and laws that regulate distracted driving.

Partying and texting have their place, but not behind the wheel. Scroll down to find out how the state of Florida deals with such bad decisions.

What are the DUI laws in Florida?

Drinking and driving is nothing to celebrate. According to Responsibility.org, Florida suffered 839 Alcohol-Impaired Driving fatalities in 2017 alone.

The penalties for driving while impaired are stiff, and they should be. Take a look at what it could cost you to take your party on the road.

- First Offense up to six months in jail, $500-$2,000 fine/penalty, and between 180 days to a year of license suspension.

- Second Offense up to nine months in jail, $1,00-$4,000 fine/penalty, and between 1-5 years of license suspension.

- Third Offense 30 days to five years in jail, $2,000-$5,000 fine/penalty, and 2-10 years of license suspension.

It is just not worth the risk. As we say in Florida: Arrive Alive.

Does Florida have marijuana-impaired driving laws?

While it is now legal to partake in medical marijuana in the Sunshine State, it is still illegal to drive while under its influence.

Penalties and fines for driving while under the influence of drugs are just as stiff as they are for DUIs. Take a look:

- First offense – a fine of $500 -$1,000, up to six months in jail, 180 days to one-year license suspension, 50 hours community service, and a 10-day vehicle impoundment/immobilization.

- Second offense –a fine of $1,000 -$2,000, up to nine months in jail, a mandatory ignition interlock,180 days to one-year license suspension, a mandatory one year of probation, a required psychosocial evaluation, 50 hours of community service, and a 10-day vehicle impoundment/immobilization.

- Third offense – a fine of $2,000 – $5,000, up to jail up to 12 months in jail, a mandatory ignition interlock, one-year license suspension, a mandatory year of probation, a required psychosocial evaluation, 50 hours community service, and a 90-day vehicle impoundment/immobilization.

- The third offense within ten years of the second offense is a felony. It carries a minimum fine of $2,000- $5,000, up to 30 days to five years in jail, a mandatory ignition interlock, a 10-year mandatory license suspension, a mandatory year of probation, a required psychosocial evaluation, 50 hours community service, and a 90-day vehicle impoundment/immobilization.

- Fourth offense-This is a 3rd-degree felony, and penalties include up to $5,000 in fines, a five-year prison sentence, and the penalties imposed for the third offense.

In short, Florida is not kidding around, so make sure that you choose not to get behind the wheel while under the influence.

What is considered distracted driving in Florida?

While texting and driving may not seem as bad to some as getting behind the wheel while under the influence of drugs or alcohol, it is not without consequences, and in the state of Florida, you will be penalized for it.

As of July 1, 2019, texting and driving will become a primary offense in the Sunshine State. Florida also has a ban on the use of all handheld devices while operating a motor vehicle with only the following exceptions:

- When performing official duties as an operator of an authorized emergency vehicle as defined in s.322.01.

- If you are reporting an emergency or criminal or suspicious activity to law enforcement authorities.

- When you are receiving messages related to the operation or navigation of the motor vehicle or safety-related information

- When using the device or system for navigation purposes

- If you are conducting wireless interpersonal communications that do not require manual entry of multiple letters, numbers, or symbols

- When conducting wireless interpersonal communications that do not require reading text messages

- Or if you are operating an autonomous vehicle, as defined in s. 316.003

AAA also notes:

A cellular phone with a headset is permitted while driving if the sound is provided through one ear and allows surrounding sounds to be heard with another ear. Localities are prohibited from regulating the use of commercial mobile radio services, including cell phones.

Driving while distracted is never a good idea. The risk of accidents and traffic tickets just isn’t worth it.

What do you need to know about driving in Florida?

As you have seen so far, driving in Florida does not come without risk. The risks extend off the road as well.

Everything from road debris to vehicle theft and break-ins can cause you frustration and confusion that you never signed on for. Keep scrolling to find out how you can prevent theft or loss of your property and road fatalities.

What are the number of vehicle theft stats in Florida?

The number one car stolen in the Sunshine State is the Ford Pickup.

| Make/Model | Rank | Vehicle Year | Thefts |

|---|---|---|---|

| Ford Pickup (Full Size) | 1 | 2006 | 2,070 |

| Honda Civic | 2 | 2000 | 1,127 |

| Nissan Altima | 3 | 2015 | 1,098 |

| Toyota Camry | 4 | 2014 | 1,089 |

| Honda Accord | 5 | 1997 | 1,025 |

| Toyota Corolla | 6 | 2014 | 914 |

| Chevrolet Pickup (Full Size) | 7 | 2015 | 786 |

| Chevrolet Impala | 8 | 2015 | 542 |

| Dodge Pickup (Full Size) | 9 | 2005 | 534 |

| Nissan Maxima | 10 | 2014 | 479 |

Even if you don’t own any of the vehicles on this list, it is still good to invest in comprehensive car insurance just in case. Comprehensive covers your vehicle should it be stolen, vandalized, or a natural disaster occurs.

Because thieves and natural disasters don’t discriminate any more than deer strikes do, an investment in comprehensive coverage can give you the peace of mind you need.

What are the number of vehicle thefts by the city?

The data below was gathered from the FBI website and shows the top 10 cities in Florida when it comes to the amount of vehicle theft.

| City | Motor Vehicle Thefts |

|---|---|

| Miami | 1,914 |

| Jacksonville | 1,577 |

| St, Petersburg | 1,124 |

| Orlando | 1,020 |

| Hialeah | 708 |

| Hollywood | 572 |

| Ft. Lauderdale | 567 |

| Tampa | 553 |

| Miami Gardens | 478 |

| Tallahassee | 440 |

Looking at the numbers could fool you into thinking that cities like Jacksonville or Miami are dangerous places to live.

The reality is that these are two of Florida’s largest cities, so the rate of car theft within them is relative considering their population size. Still, it is not a bad idea to consider carrying additional coverage options beyond the minimum state requirements.

What are the road fatality statistics in Florida?

No one likes to think about it, but sometimes driving can result in fatalities as a result of driver error or weather conditions.

Keep reading to see how Florida rates in this regard.

How do weather and light conditions affect fatal crashes?

When it comes to the causes of an accident, negligence, distracted driving, and drugs or alcohol are not the only factors. Sometimes something as every day as weather conditions or light conditions can cause a traffic incident.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 1,125 | 801 | 658 | 147 | 4 | 2,735 |

| Rain | 61 | 47 | 31 | 5 | 0 | 144 |

| Snow/Sleet | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 3 | 8 | 24 | 3 | 2 | 40 |

| Unknown | 0 | 1 | 2 | 0 | 0 | 3 |

| TOTAL | 1,189 | 857 | 715 | 155 | 6 | 2,922 |

Rain or driving can have an impact on driving conditions and your ability to handle your motor vehicle.

This is important to consider for Floridians shopping for car insurance and deciding on coverage types.

Driving defensively and obeying the traffic laws can go a long way towards keeping you safe then as conditions change.

What are the fatalities by county in Florida?