Car Insurance Basics

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Car Insurance Works

Car insurance is a crucial aspect of owning and driving a car. It provides financial protection in case of accidents, damages, or other unfortunate events. Understanding how car insurance works is essential for every driver. In this article, we will explore the basics of car insurance, the different types available, how to choose the right…

Can you insure a car that is not in your name?

Can you insure a car you don’t own? The short answer is yes, but not without difficulty. In theory, it should be easy, as you simply tell the insurance company that you’re not the owner when you apply. In practice, however, the process can be a little frustrating. The problem is that most car insurance…

Can you deduct car insurance on your taxes?

Paying income taxes and car insurance premiums can add up over time. Most people would like to save money wherever they can, so a common question is: “Is car insurance tax-deductible?” A tax deduction is an expense that you subtract from your reported income, lowering your tax liability. As a result, you get a larger…

Do you need a driver’s license to buy a car?

Do you need a driver’s license to buy a car? Legally there are no barriers to purchasing an automobile, even if you are unlicensed, provided you are able to either pay cash or qualify for financing. There are also a number of legitimate reasons why a person may wish to buy a car, even if…

What do car insurance brokers do?

Shopping for auto insurance is a hassle, especially if you are determined to get the best coverage at the most affordable rates. While it makes the most financial sense to shop around until you find that coverage, the process can be complex, confusing, and time-consuming. Fortunately, car insurance brokers exist. Insurance brokers bring a level…

Why do you need car insurance?

A car insurance policy is a legal contract between a driver and an insurance company. The driver pays the insurance company a premium, and, in exchange, the insurer agrees to pay for any damages the driver causes. The insurance company bases its rates on how risky it perceives the driver to be, based on age,…

How to cancel GAP insurance?

GAP insurance is a type of car insurance coverage that’s essential if you want to ensure you’re fully covered in case your car is totaled before you pay off your lease or loan. That said, there are situations where GAP insurance starts to cost more than it’s worth. If this happens you’ll want to know…

Does your car insurance and registration have to be under the same name?

Does your car insurance and registration have to be under the same name? In many cases, no. Whether you want to buy insurance for a family member or are looking for car insurance coverage that applies to you if you borrow a friend’s vehicle, there are plenty of situations where registration and insurance for a…

Why You Need Car Insurance

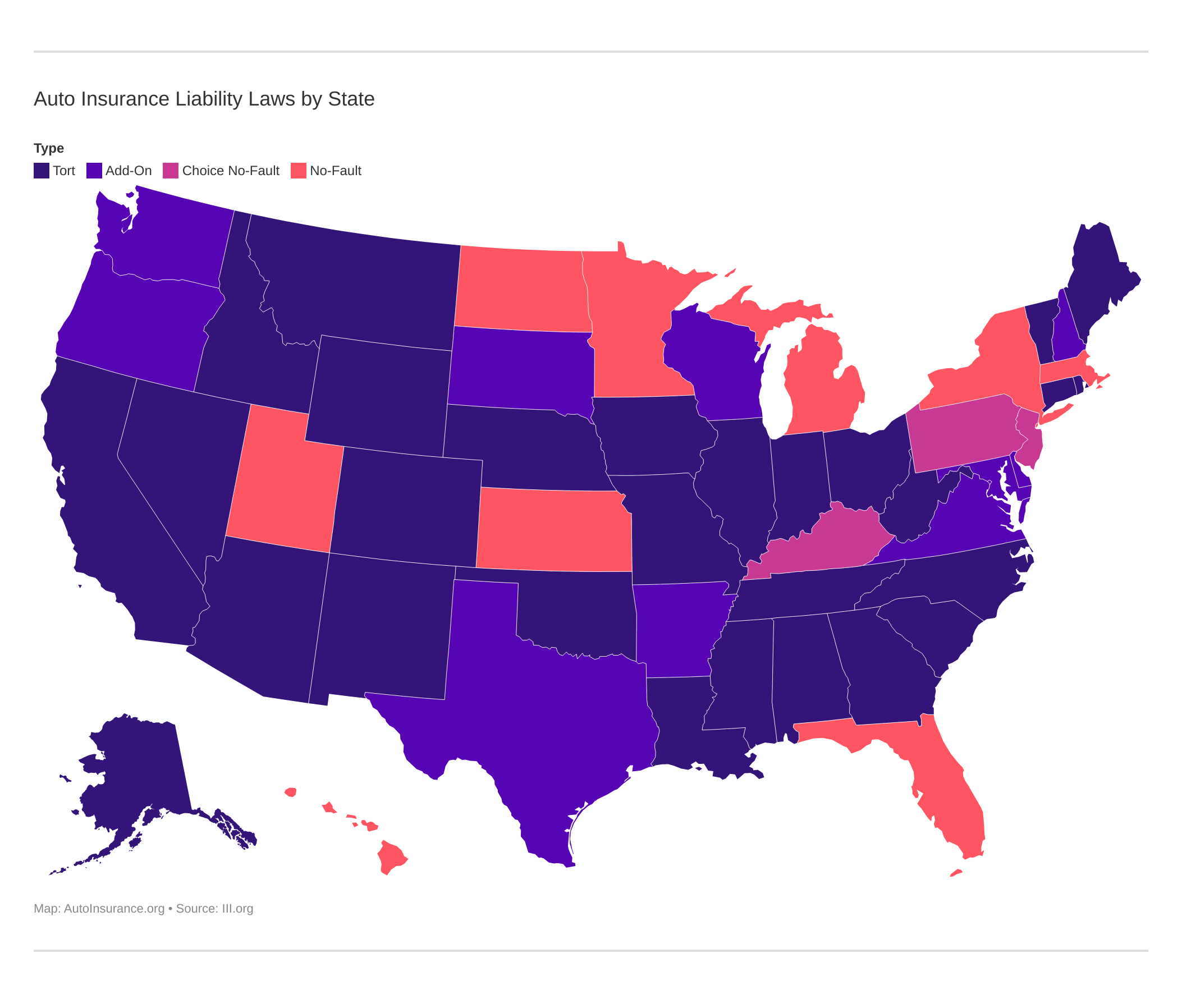

Although shopping for car insurance is a frustrating and often confusing task, you are legally required to have this financial protection in place before getting behind the wheel of your car. For 49 out of the 50 states in the country, you’re required by law to carry an insurance policy. Not only can we help…

What is a policy number on an insurance card?

A policy number on an insurance card is a unique number assigned by your insurance company to identify your account. The number appears on your insurance card, bills, statements, and other documents about your account with the insurance company. It is a convenient way for the insurance company to quickly find all of the information…