News

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Will 85 MPH in Texas up the speed elsewhere?

By Joni Gray Why does 85 MPH in Texas matter for the rest of the United States? The fastest highway in Texas is a 41-mile-long toll road in the Lone Star State called Texas Highway 130 (SH130), connecting Austin and San Antonio. This highway has set the bar as the highest posted maximum speed limit…

Ford Upgrades Sync to Read Text Messages

Unfortunately, not many mobile phones on the market currently support MAP, and owners must have a compatible phone.

Honda Announces Massive Recall of 1.5 Million Cars

The transmission in the affected vehicles can be damaged if the transmission is quickly shifted between reverse, neutral and drive positions.

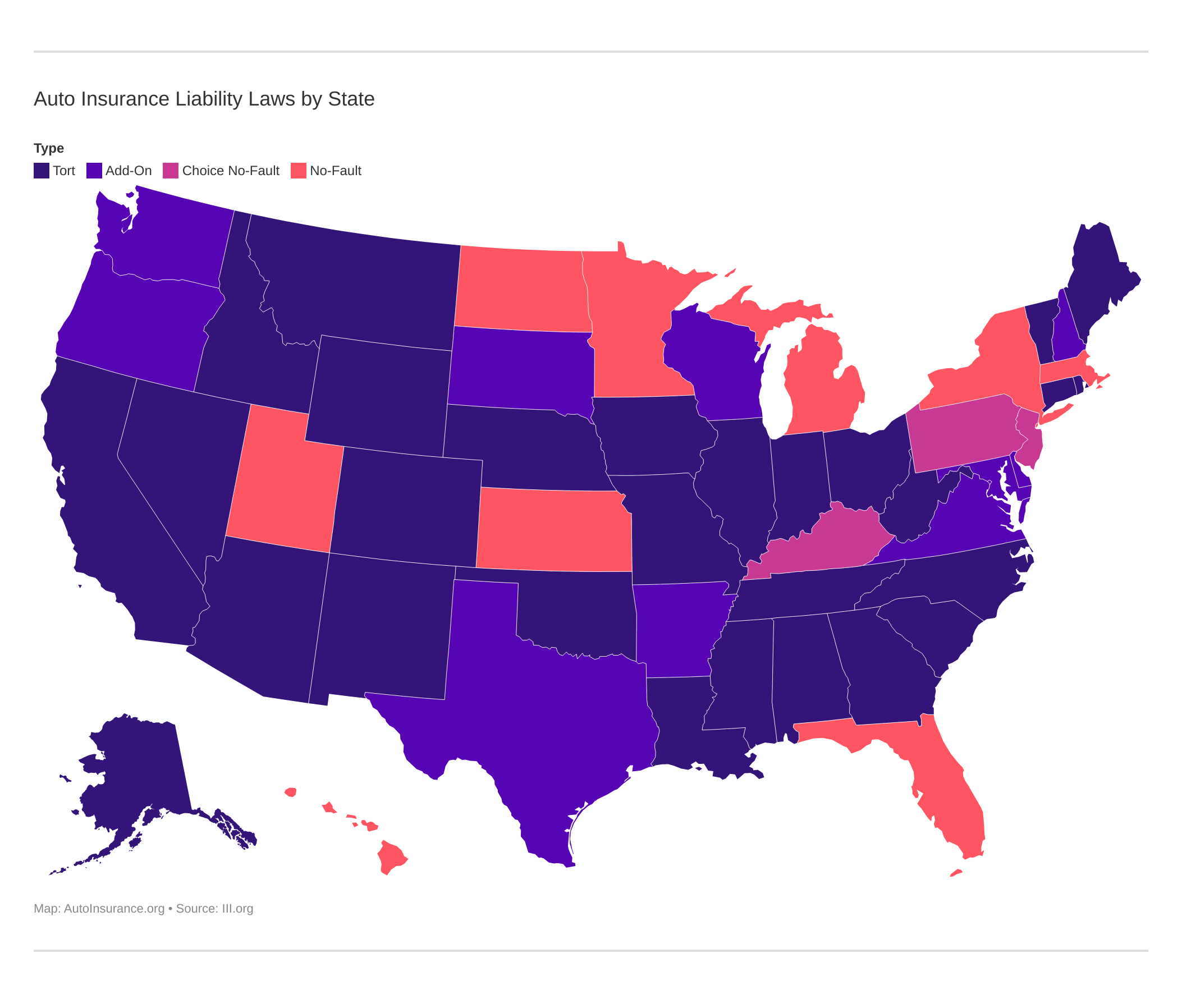

Alabama Set for Insurance Verification System

Insurance verification systems set up online databases that allow police and other government officials to access the coverage status of any driver in the state.