Winston-Salem, NC Car Insurance Guide (Comprehensive)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Nov 1, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

| WINSTON-SALEM STATISTICS | DETAILS |

|---|---|

| City Population | 244,605 |

| City Density | 2,247 people per square mile |

| Average Cost of Car Insurance | $2,654.84 |

| Cheapest Car Insurance Provider | Liberty Mutual |

| Road Conditions | Poor Share: 12% Mediocre Share: 25% Fair Share: 25% Good Share: 38% VOC: $435 |

Welcome to the heart of the North Carolina Piedmont. Winston-Salem is a postcard-ready city with roads that can lead you to both its storied past and its bright future.

The first Krispy Kreme Doughnuts opened on South Main Street in 1937. Before that, R. J. Reynolds Tobacco Company was founded in Winston-Salem in 1875 (leading to one of the city’s nicknames, Camel City). But whether you call the city Camel City, Twin City, or City of the Arts and Innovation, Winston-Salem is a great place to call home.

Whether you’re a long-time resident or new to the region, we’ve created this guide to help you navigate car insurance average costs in North Carolina.

Need car insurance? Start comparing rates for FREE. Just enter your zip code in our quote tool above.

What Kind of Cheap Car Insurance Rates Do You Get in Winston-Salem, North Carolina?

Whether you’re drawn here by the abundance of outdoor adventures, by the top-tier universities, or just the lure of the old Camel City, there’s a lot to love about Winston-Salem.

With a cost of living 14 percent below the national average, the city is an affordable place to call home, whether you’re here to work, raise a family, or retire.

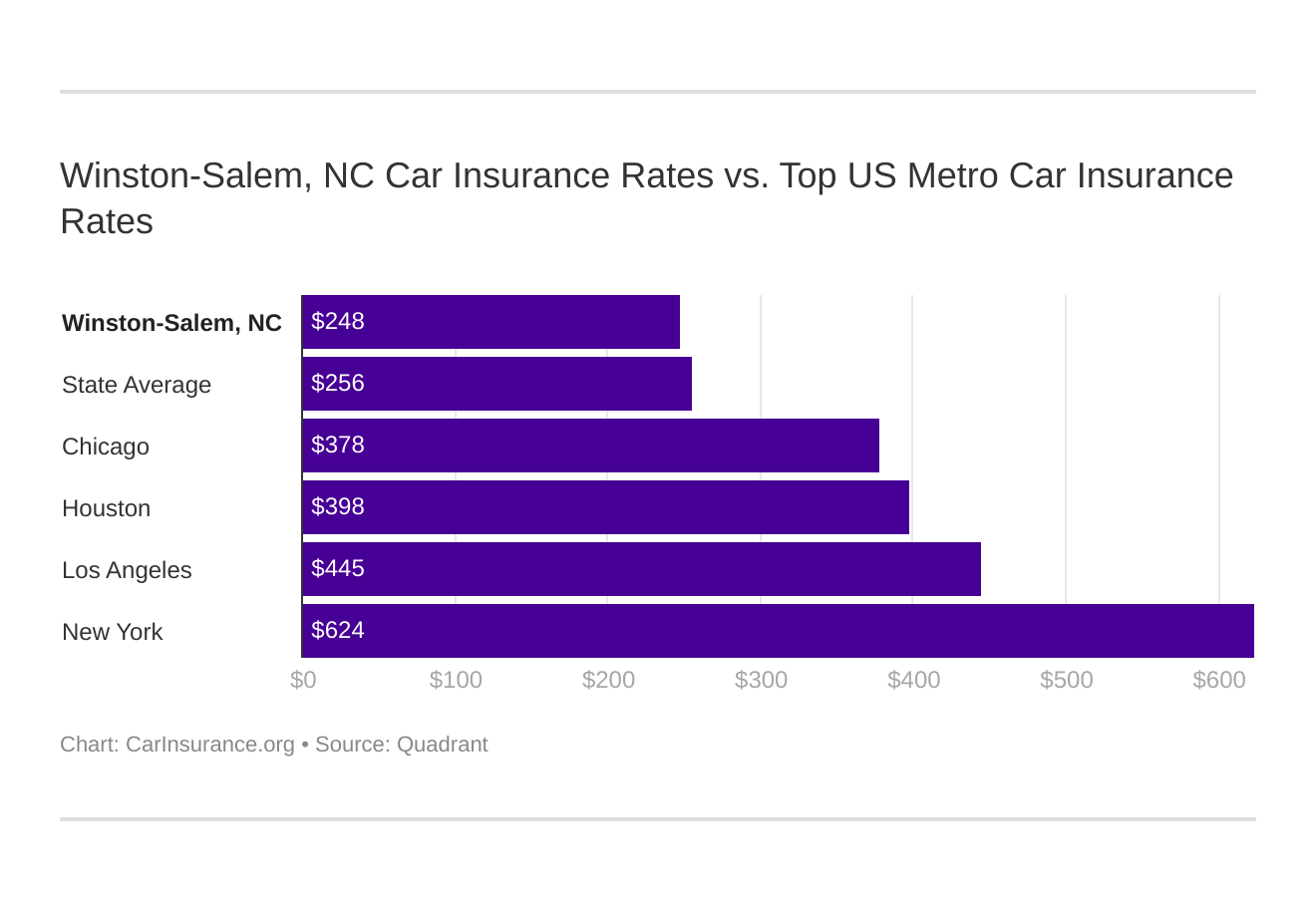

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare against other top US metro areas’ auto insurance rates.

In the sections below, we’ll cover some of the key factors that can help you make a more affordable car insurance decision.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

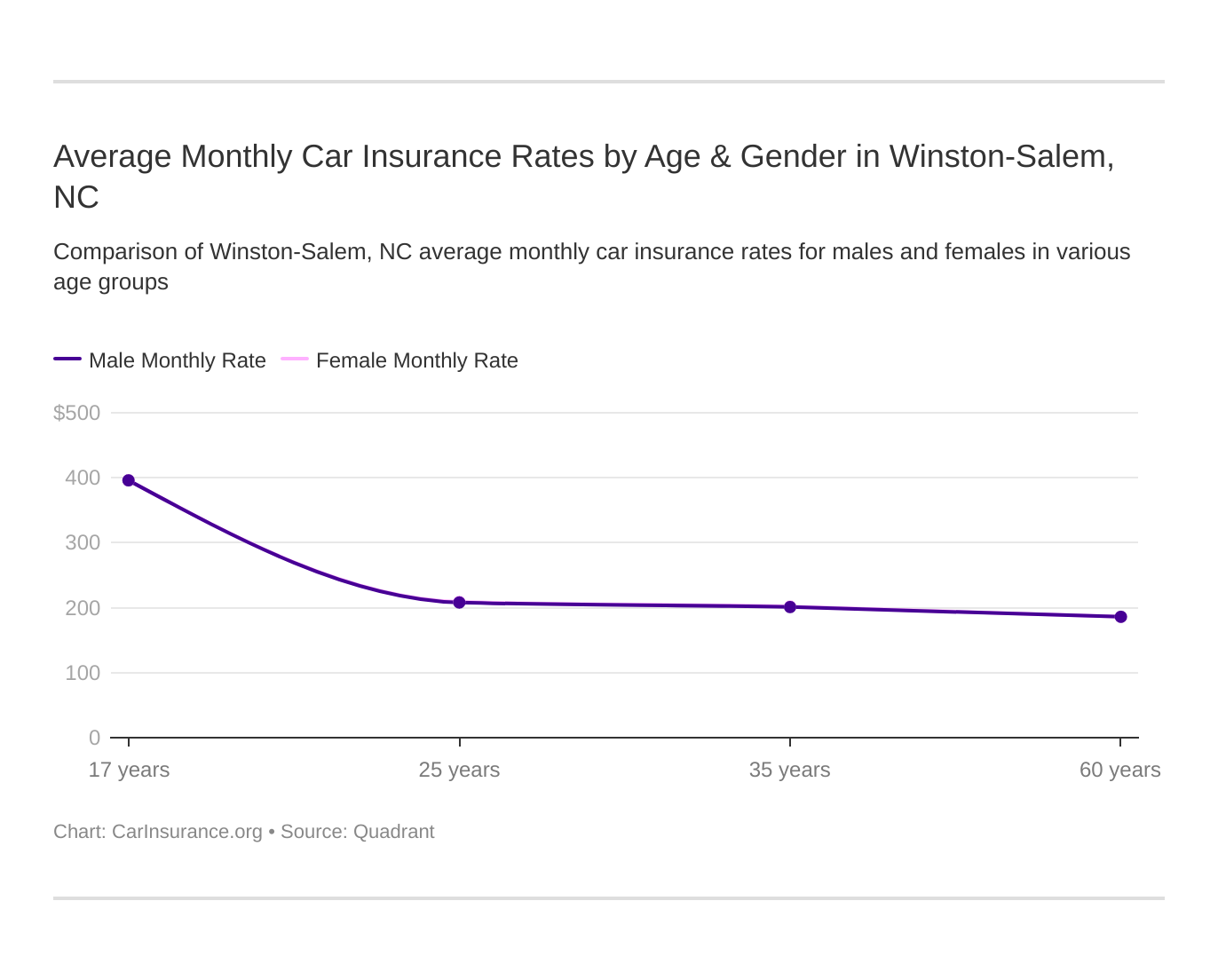

How Do Age and Gender Affect Insurance Rates in North Carolina?

Though North Carolina is one of states to ban gender discrimination in car insurance premiums, there is often still a gender gap. In most places, men will pay more than women. When young, this is partly due to driving records. Teen boys are more likely than teen girls to speed, get in accidents, etc. This drives up rates for several years. In many states, girls are reportedly catching up on this trend closing the gap in rates.

It’s important to know that this gap is small and decreases with age and marital status.

These states no longer use gender to calculate your auto insurance rates: California, Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Winston-Salem.

The table below provides the average car insurance annual rates for folks of various genders, ages, and marital status.

| Demographic | Average Rate |

|---|---|

| Single 17-year old female | $4,756.83 |

| Single 17-year old male | $4,751.23 |

| Single 25-year old female | $2,503.10 |

| Single 25-year old male | $2,501.35 |

| Married 35-year old female | $2,420.49 |

| Married 35-year old male | $2,414.09 |

| Married 60-year old female | $2,237.70 |

| Married 60-year old male | $2,231.55 |

| Overall Average | $2,977.04 |

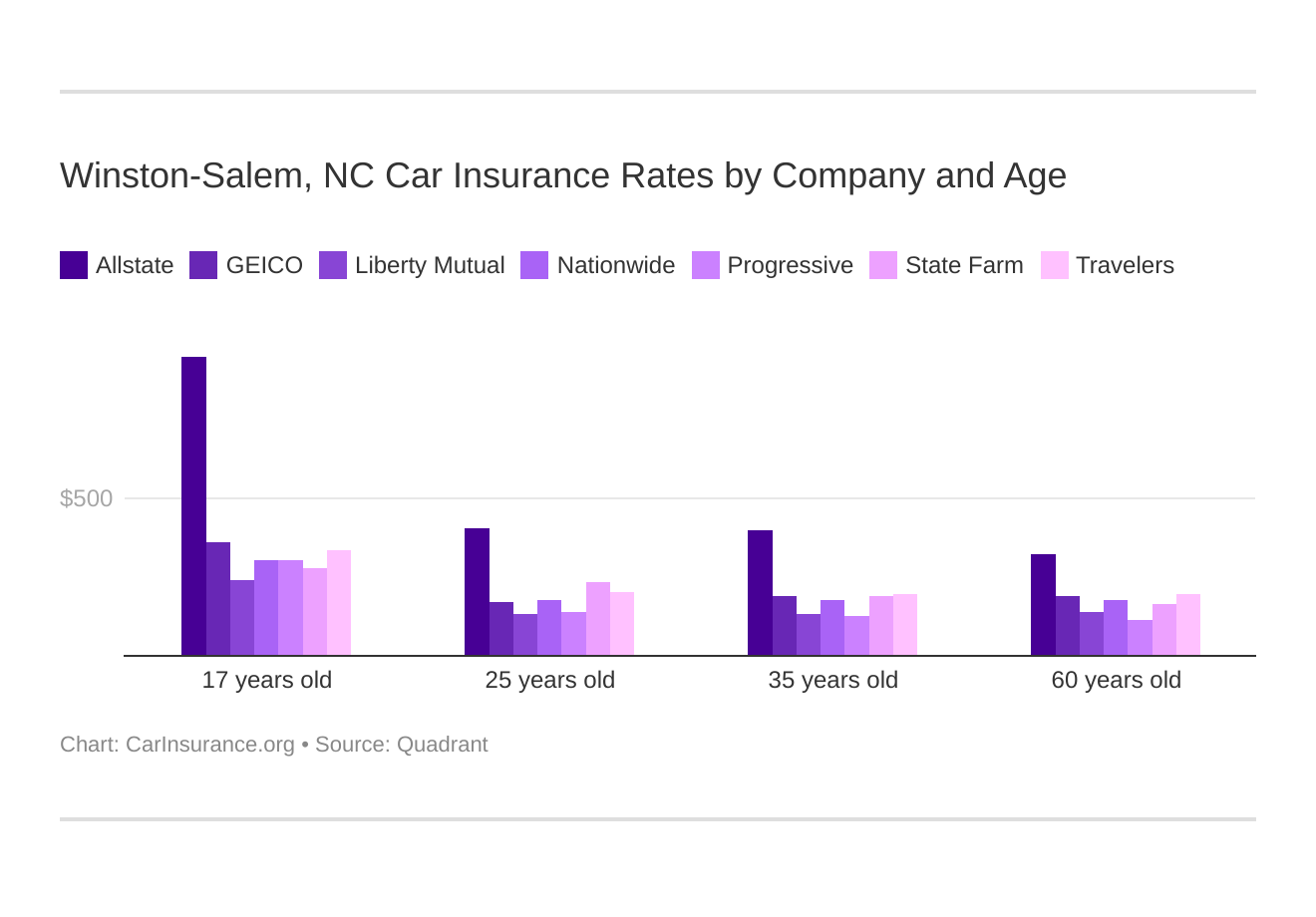

Winston-Salem, NC auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

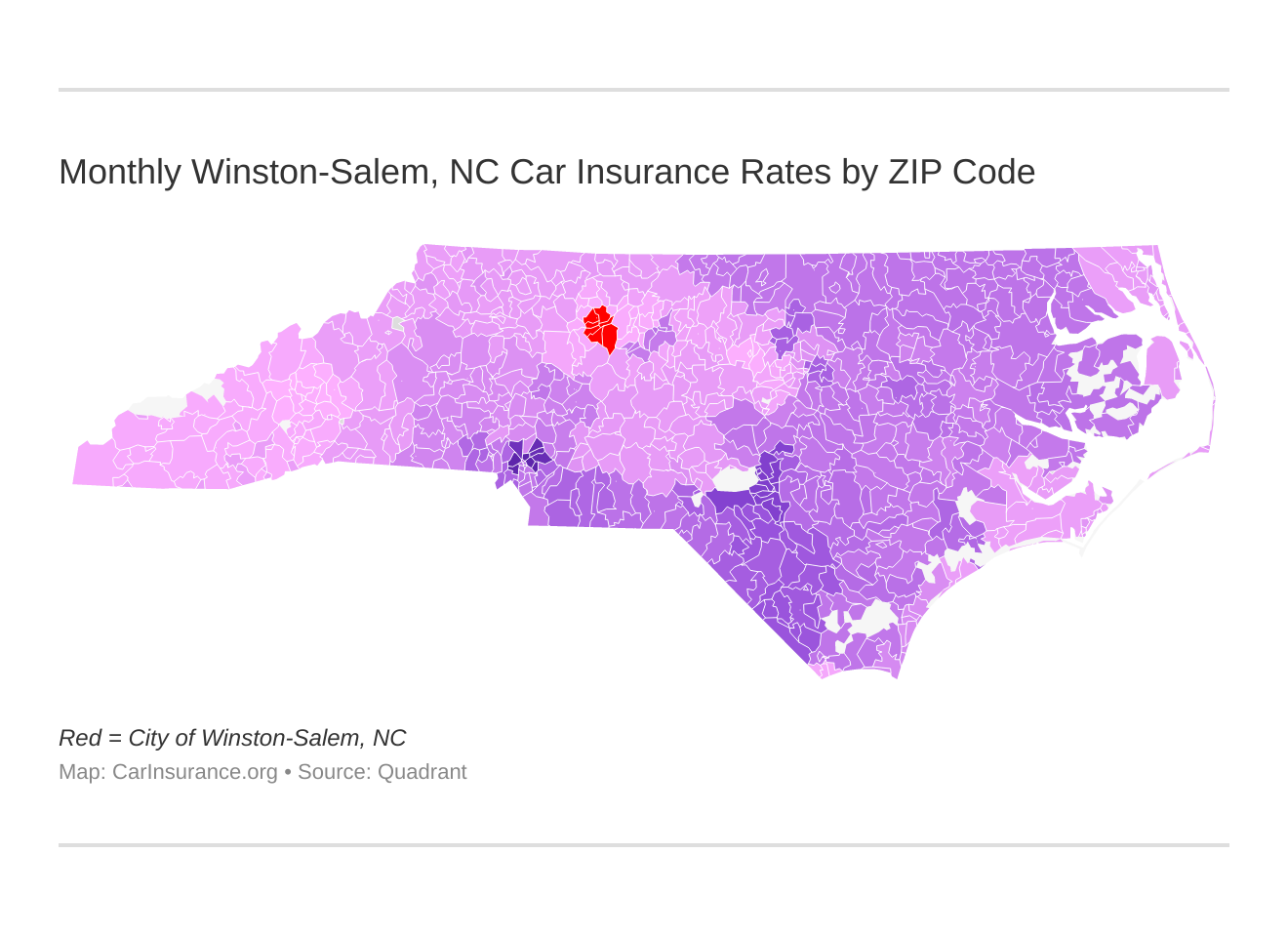

Where are the cheapest ZIP codes in Winston-Salem?

Did you know your car insurance premium can not only vary by what city you live in, but by what ZIP code you live in within that city? You might think of factors like poverty and crime rates driving up insurance costs, and they might. The frequency and costs of claims, commute, and how busy the surrounding roads are also play a part. Your annual premiums are a combination of a wide range of factors whether you live in Raleigh or Wilmington. In Winston-Salem, even neighborhoods and zip codes right next to each other could pay different rates.

Find more info about the monthly Winston-Salem, NC car insurance rates by ZIP Code below:

Luckily, car insurance premiums across Winston-Salem, North Carolina only vary slightly. The cheapest ZIP code is 27105, a neighborhood just north of downtown and east of Wake Forest University. Residents of 27105 can expect to pay a yearly average of $2,654.09 for their car insurance.

The table below shows you average car insurance premiums for Winston-Salem by ZIP code.

| Zip Code | Average Rate |

|---|---|

| 27105 | $2,654.09 |

| 27103 | $2,654.84 |

| 27101 | $2,658.64 |

| 27109 | $2,664.81 |

| 27104 | $2,667.20 |

| 27106 | $2,673.69 |

| 27127 | $2,773.71 |

| 27110 | $2,777.40 |

| 27107 | $2,781.36 |

| 27157 | $2,823.48 |

What’s the best car insurance company in Winston-Salem?

Folks in Winston-Salem might say the Wake Forest Devil Deacons are the best athletes in the NCAA. They might not be wrong.

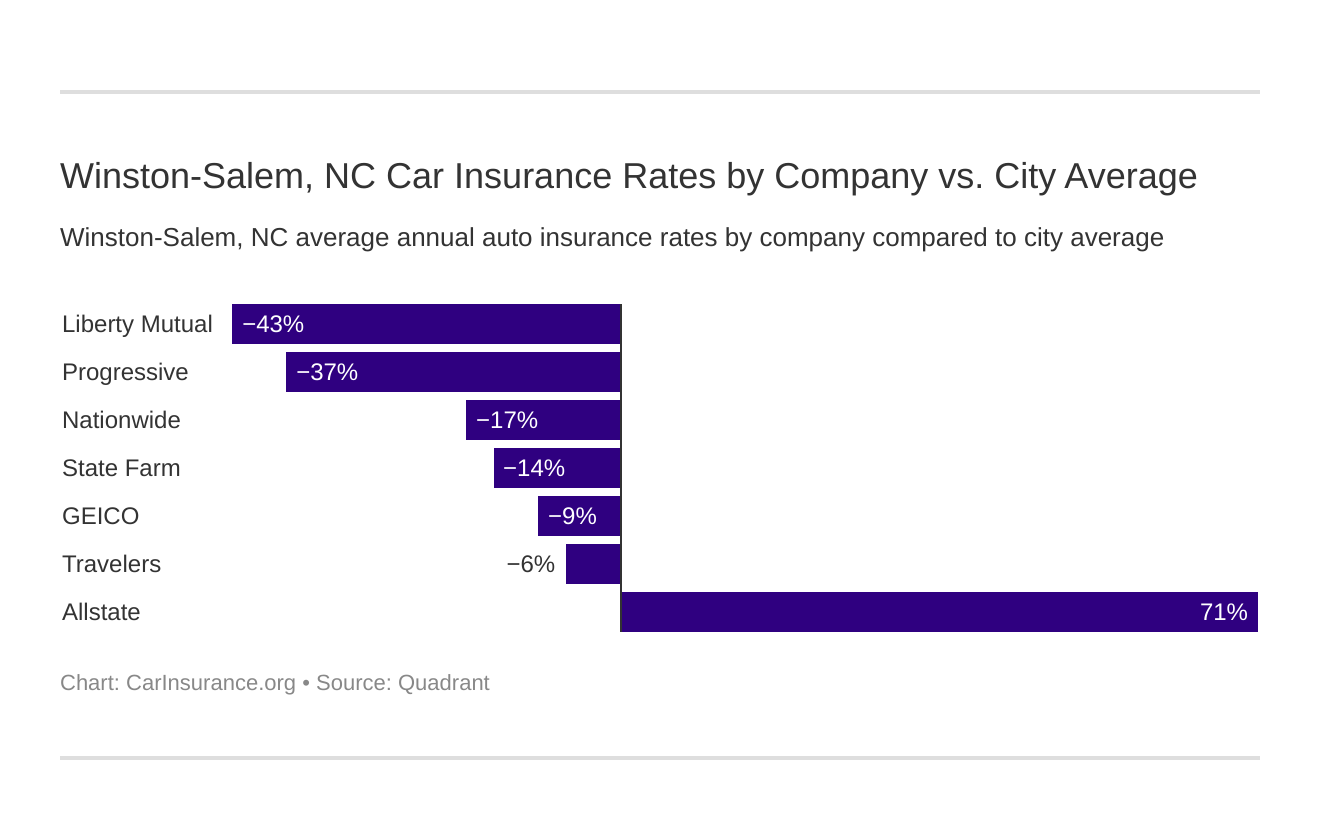

The cheapest auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average North Carolina auto insurance company rates?” We cover that as well.

But who do they say is the best car insurance company?

Not surprisingly, the best car insurance company largely depends on what you want from your insurer. In the sections below, we’ll cover some of the factors that can help you figure out the best car insurance company for you and your family.

Some companies offer more discounts to families with a teen driver. Others might offer flexible coverage options for those willing to pay higher deductibles or adjust their coverage limits. If you drive for services like Uber or Lyft, some insurers won’t want to cover you at all. So who you go to for insurance for drivers in your household could change dramatically.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which are the cheapest car insurance rates by company?

Is the cheapest always the best? Not always, but that doesn’t mean a cheap provider is a bad provider either. Often, it’s a matter of balance. You shouldn’t pay more than you have to for the coverage you need or sacrifice coverage for cheap car insurance.

It’s like shopping in bulk. Sometimes, bigger companies can offer cheaper premiums to their many customers. Small companies that limit their target clientele may also be able to offer lower rates by limiting their risk.

In Winston-Salem, Liberty Mutual is likely to be your cheapest car insurance provider.

The table below offers the average premiums for Winston-Salem’s seven biggest car insurance companies.

| Company | Average |

|---|---|

| Allstate | $6,224.04 |

| Travelers | $2,806.97 |

| Geico | $2,726.95 |

| State Farm | $2,582.25 |

| Nationwide | $2,510.41 |

| Progressive | $2,051.02 |

| Liberty Mutual | $1,937.65 |

What Are The Best Car Insurance Rates for Commutes in Winston-Salem?

Did you know that your commute distance can also affect your car insurance premium? The more miles you drive, the more time you spend on the road every year. The more time you spend on the road, the more likely you are to be in an accident. Cheap car insurance companies have to factor this into their algorithm.

The table below provides average premiums for the Camel City’s top insurers based on a 10- or 25-mile average commute.

| Company | 10 mile commute. 6000 annual mileage. | 25 mile commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Allstate | $6,224.04 | $6,224.04 | $6,224.04 |

| Travelers | $2,806.97 | $2,806.97 | $2,806.97 |

| Geico | $2,726.95 | $2,726.95 | $2,726.95 |

| State Farm | $2,574.56 | $2,589.95 | $2,582.26 |

| Nationwide | $2,510.40 | $2,510.40 | $2,510.40 |

| Progressive | $2,051.02 | $2,051.02 | $2,051.02 |

| Liberty Mutual | $1,937.65 | $1,937.65 | $1,937.65 |

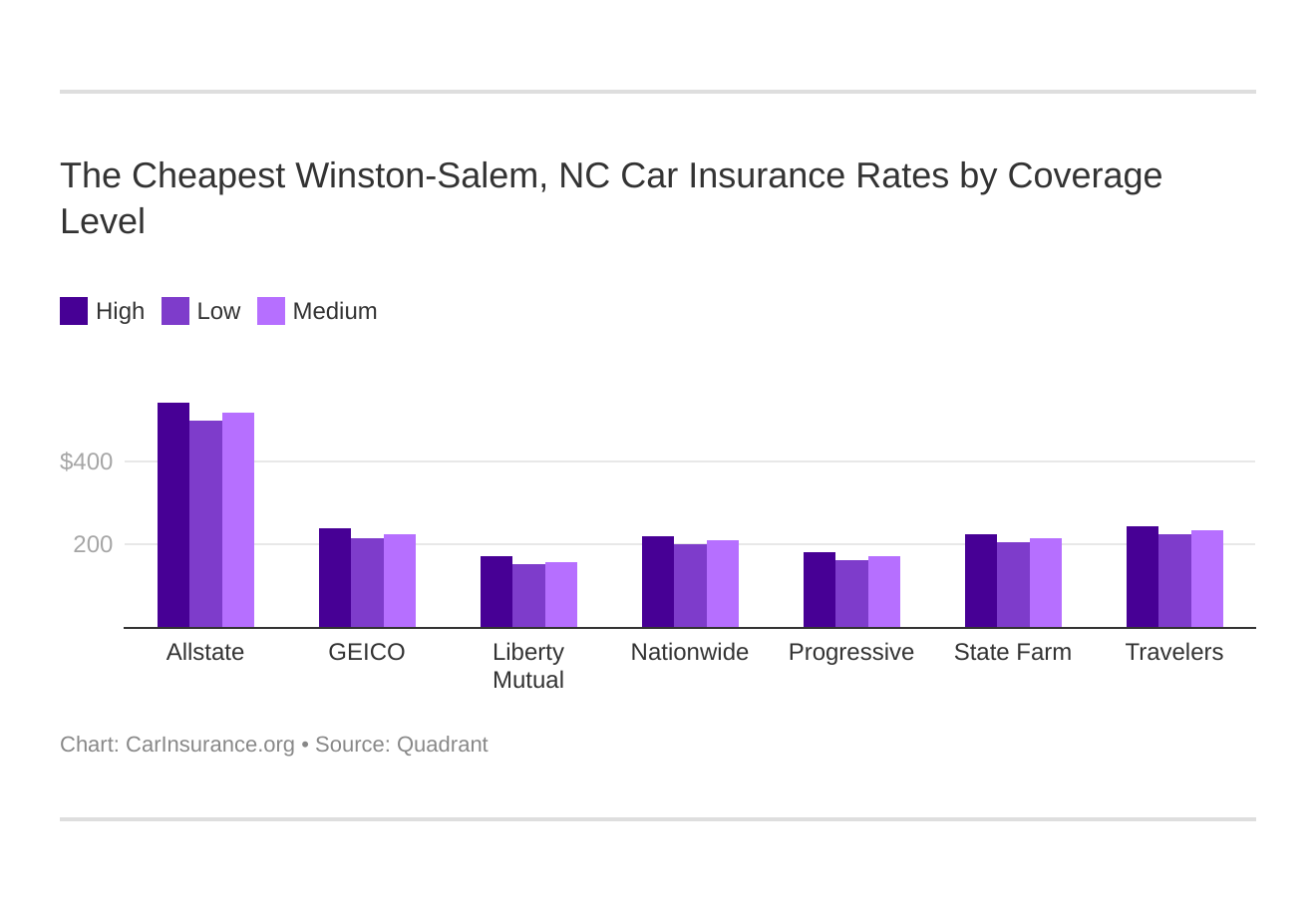

What are the best car insurance for coverage level rates?

You’re probably not surprised to learn that the more car insurance you need, the higher your premium will be.

Your coverage level will play a significant role in your auto insurance rates. If you choose the minimum coverage, you pay less now. But what happens after an accident? Your annual premium goes up, and you have to pay for your own repair or replacement. Find the cheapest North Carolina auto insurance rates by coverage level below:

In Winston-Salem, Liberty Mutual is likely to be your cheapest provider whether you need a high, medium, or low level of car insurance. Of course, these are sample rates. If you have poor credit, a bad driving record, or the opposite, the exact quotes you get would be different. This is why it’s so important to get multiple quotes any time you’re looking for the lowest rates.

The table below provides average rates for the city’s biggest car insurers by coverage level.

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $6,493.28 | $5,980.89 | $6,197.96 | $6,224.04 |

| Travelers | $2,945.05 | $2,684.79 | $2,791.06 | $2,806.97 |

| Geico | $2,863.95 | $2,600.27 | $2,716.64 | $2,726.95 |

| State Farm | $2,706.20 | $2,472.49 | $2,568.07 | $2,582.25 |

| Nationwide | $2,630.07 | $2,404.28 | $2,496.86 | $2,510.40 |

| Progressive | $2,174.80 | $1,940.88 | $2,037.38 | $2,051.02 |

| Liberty Mutual | $2,046.19 | $1,841.97 | $1,924.80 | $1,937.65 |

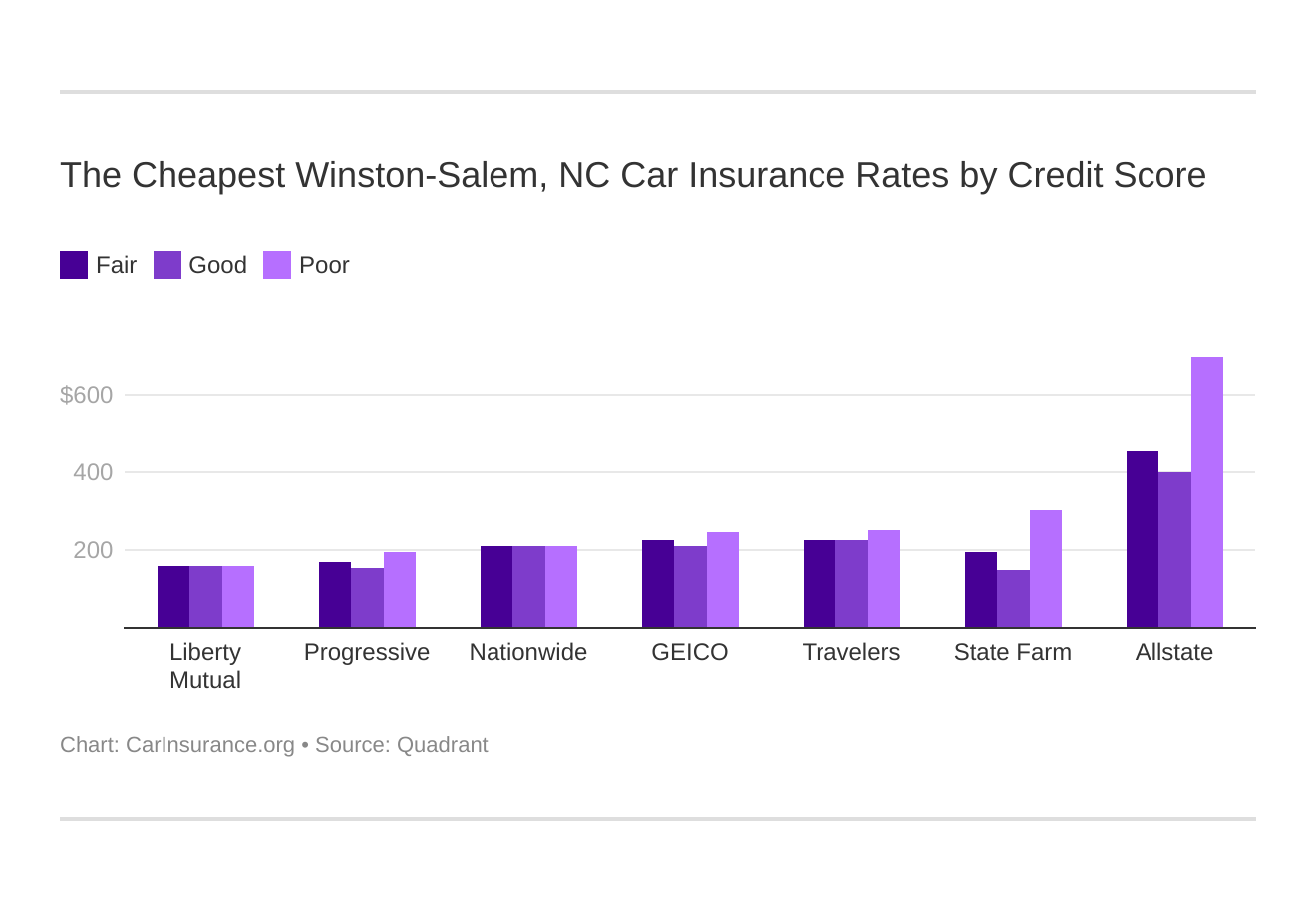

Did you know that your credit history is one of the key factors car insurance companies use to determine your car insurance premium?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are The Best Car Insurance Rates for Credit History in Winston-Salem?

Your credit history can seriously affect your car insurance premiums. This video offers a great explanation as to how and why.

Your bad credit score will play a major role in your auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest auto insurance rates by bad or excellent credit score below.

Winston-Salemites with good credit might find Progressive or State Farm to be even more affordable than Liberty Mutual.

The table below offers average premiums for those with good, fair, or poor credit histories.

| Company | Good | Fair | Poor | Average |

|---|---|---|---|---|

| Allstate | $4,806.26 | $5,474.35 | $8,391.51 | $6,224.04 |

| Travelers | $2,700.18 | $2,728.34 | $2,992.39 | $2,806.97 |

| Geico | $2,510.32 | $2,713.62 | $2,956.91 | $2,726.95 |

| State Farm | $1,802.42 | $2,319.02 | $3,625.33 | $2,582.26 |

| Nationwide | $2,510.40 | $2,510.40 | $2,510.40 | $2,510.40 |

| Progressive | $1,836.23 | $2,001.94 | $2,314.89 | $2,051.02 |

| Liberty Mutual | $1,937.65 | $1,937.65 | $1,937.65 | $1,937.65 |

But let’s be honest: what affects your car insurance premium even more than your credit history? Your driving record.

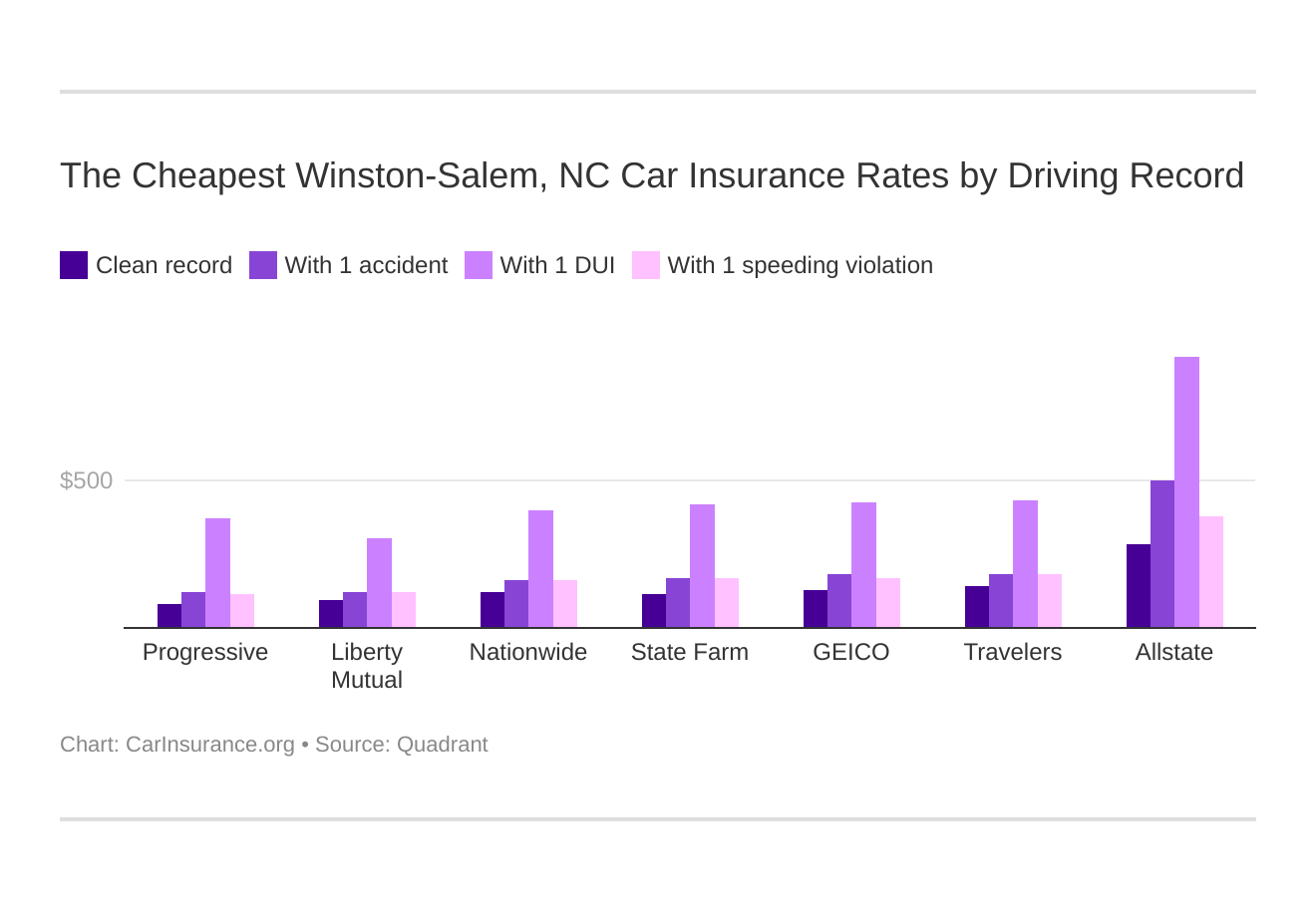

What are the best car insurance for driving record rates?

Most of us don’t have spotless driving records. Accidents (and speeding tickets) happen. But not all past violations affect your car insurance premium equally.

Your driving record will affect your auto insurance rates. For example, a Winston-Salem, North Carolina DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest North Carolina auto insurance rates by driving record.

The following table provides the average rates for drivers of various histories.

| Company | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $3,370.40 | $5,952.80 | $11,019.20 | $4,553.78 | $6,780.80 |

| Travelers | $1,680.44 | $2,189.93 | $5,197.09 | $2,160.42 | $3,022.49 |

| Geico | $1,514.35 | $2,210.91 | $5,133.34 | $2,049.21 | $2,952.87 |

| State Farm | $1,374.01 | $1,990.38 | $4,974.24 | $1,990.38 | $2,779.54 |

| Nationwide | $1,481.81 | $1,912.13 | $4,735.55 | $1,912.13 | $2,709.83 |

| Progressive | $971.33 | $1,412.54 | $4,453.94 | $1,366.27 | $2,279.27 |

| Liberty Mutual | $1,158.17 | $1,483.92 | $3,624.58 | $1,483.92 | $2,088.89 |

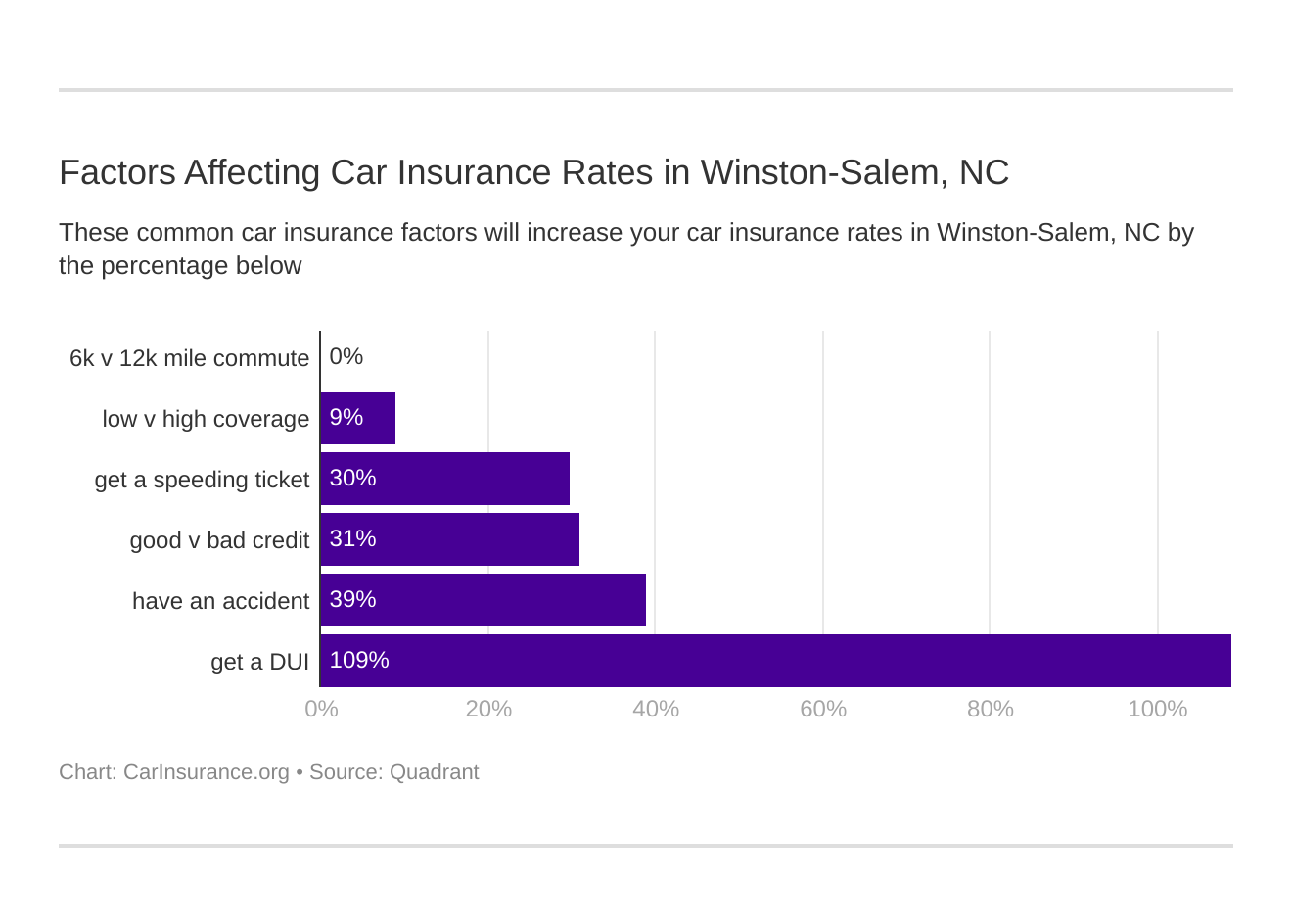

What factors affect your car insurance factors?

As more people discover how great the city is, Winston-Salem is forging forward. The City of the Arts and Innovation is outpacing North Carolina’s average growth rate in every year for the last few decades.

Factors affecting auto insurance rates may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest North Carolina auto insurance.

In the sections below we’ll cover some of the factors of this growth that can affect your car insurance premiums.

Metro Report – Growth & Prosperity

The Brookings Institute shows that people aren’t the only things moving to Winston-Salem. The area is seeing tremendous financial growth and job prosperity.

The figures below reflect their most recent findings.

Growth

- Jobs: +0.8 percent (74th of 100)

- Gross metropolitan product (GMP): +4.8 percent (ninth of 100)

- Jobs at young firms: +3.1 percent (53rd of 100)

Prosperity

- Productivity: +4.0 percent (third of 100)

- Standard of living: +3.9 percent (fourth of 100)

- Average annual wage: +4.3 percent (second of 100)

Median Household Income

According to DataUSA, “Households in Winston-Salem, NC have a median annual income of $42,219, which is less than the median annual income of $60,336 across the entire United States.”

But as we’ve seen above, annual incomes are growing in the area, as DataUSA confirms that this median annual income “is in comparison to a median income of $40,898 in 2016, which represents a 3.23 percent annual growth.”

With an average annual car insurance premium of $2,654.84, that means folks in Winston-Salem spend approximately 6.28 percent of their annual income on car insurance.

Homeownership in the Winston-Salem

Winston-Salem is growing in part because of the city’s affordable cost of living. In 2017, the median home value was $142,200.

And more people are buying homes here. According to DataUSA, “In 2017, 54.5 percent of the housing units in Winston-Salem, NC were occupied by their owner. This percentage grew from the previous year’s rate of 54.1 percent.”

Education in Winston-Salem

Winston-Salem is truly the City of Innovation and Arts. This is in large part because it’s an educational hub.

The city is home to several world-class research universities, both public and private.

They include Wake Forest University, Winston-Salem State University, University of North Carolina School of the Arts, Salem College, and Piedmont International University. Forsyth Technical Community College is a technical school in Winston-Salem quickly growing to meet the industrial needs of the growing Piedmont region.

DataUSA reports that “in 2016, universities in Winston-Salem, NC awarded 6,271 degrees.”

Poverty by Age and Gender

Women ages 18-34 make up a disproportionate amount of the people living below the poverty line in Winston-Salem.

Employment by Occupations

According to DataUSA, “The most common job groups, by number of people living in Winston-Salem, NC, are Office & Administrative Support Occupations (13,067 people), Sales & Related Occupations (10,713 people), and Management Occupations (10,360 people).”

Get started on your search for car insurance in Winston-Salem today by entering your zip code below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is driving in Winston-Salem like?

Winston-Salem offers not only gorgeous country drives just outside its city limits, but also the excitement of a much larger city.

If you call Winston-Salem home, you should know that the city’s road conditions, congestion, and traffic laws can all affect your car insurance premiums.

In the sections below, we’ll provide you with some of the best information about driving in the gorgeous Twin City.

Roads in Winston-Salem

Most folks in Winston-Salem drive. So what kind of roads do they have to work with?

Though Winston-Salem isn’t the largest city in North Carolina, several major highways converge here.

Lucky for Winston-Salemites, no toll roads exist near the city.

Popular Road Trips/Sites

Winston-Salem offers a lot to visitors. From outdoor adventures to world-class theater, it’s definitely a place worth spending a weekend (or a lifetime).

We recommend the Reynolda House Museum of American Art at Wake Forest University, located in the restored 1917 mansion of R.J. and Katharine Reynolds.

Thrillist offers a great list of Winston-Salem’s best restaurants to keep you well-fed and, uh, hydrated.

Road Conditions in Winston-Salem

TRIP, a national transportation research nonprofit, finds that road conditions are pretty good in Winston-Salem, North Carolina.

In 2018, they break down the city’s roads as follows:

- Poor condition — 12 percent

- Mediocre condition — 25 percent

- Fair condition — 25 percent

- Good condition — 38 percent

With 63 percent of roads in either fair or good condition, it’s clear the city cares about keeping its residents safe.

Does Winston-Salem use speeding or red light cameras?

The city of Winston-Salem currently doesn’t utilize speeding or red light cameras. Though keep in mind: moving violations are one of the quickest ways to raise your car insurance premiums.

And it should be pretty easy to get around Winston-Salem anyway. The city recently installed wireless traffic signals, meaning residents will be spending less time at red lights with no oncoming traffic.

What is owning a vehicle like in Winston-Salem?

If you live in Winston-Salem, chances are you live in a two-car household, have a commute under 20 minutes each way, and drive alone to work.

In the sections below, we’ll look at the particulars of Winston Salem’s car culture.

How many cars per household

Around 42 percent of Winston-Salem households own two vehicles, as DataUSA illustrates.

Households without a Car

Less than 5 percent of Winston-Salemites live in a household without a car.

Speed traps in Winston-Salem

Residents report that Winston-Salem is home to some of the worst speed traps in the state of North Carolina, particularly along the stretch of I-40 that runs through the city.

Vehicle Theft in Winston-Salem

In 2017, the FBI recorded 15 vehicle thefts in the city of Winston-Salem.

Crime is fairly high in Winston-Salem, according to Neighborhood Scout, who explains that the city is only safer than 7 percent of U.S. cities. Though it’s important to note that the vast majority of these crimes are non-violent petty crimes concentrated around Winston-Salem’s universities.

What is traffic like in Winston-Salem?

As we’ve talked about above, Winston-Salem has fairly good roadways. But how congested are the Twin City’s roads?

Traffic Congestion

Winston-Salem does not have much of a traffic problem, our research shows.

According to TomTom, Winston-Salem had an overall congestion level of 10 percent in 2018. The city’s highways were less congested, at only 4 percent, and its non-highways were 16 percent on average.

They also report that folks in Winston-Salem spent an extra four minutes for their morning commute and an extra eight minutes for their evening commute because of traffic congestion during peak driving hours.

Transportation

As the DataUSA graph shows below, residents of Winston-Salem, North Carolina, have a significantly lower than average commute time at 19.6 minutes each way vs. the national average of 25.1 minutes.

They also report that “in 2017, the most common method of travel for workers in Winston-Salem, NC was Drove Alone (82.9%), followed by those who Carpooled (7.48 percent) and those who Worked At Home (4.61 percent).”

How safe are Winston-Salem’s streets and roads?

Though the National Highway Traffic Safety Administration doesn’t track city-specific roadway safety statistics, they do provide county-wide statistics for Forsyth County, of which Winston-Salem is the largest city and the county seat.

In 2017, 42 fatalities were recorded on the county’s streets. The table below provides the number of fatalities in Forsyth County by crash type from 2013 to 2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| All Crashes | 27 | 34 | 40 | 42 | 42 |

| Involving an Alcohol-Impaired Driver (BAC = .08+) | 8 | 12 | 10 | 18 | 12 |

| Involving a Single Vehicle | 21 | 20 | 17 | 17 | 23 |

| Involving a Large Truck | 1 | 4 | 6 | 6 | 3 |

| Involving Speeding | 11 | 12 | 10 | 14 | 11 |

| Involving a Roadway Departure | 15 | 22 | 20 | 25 | 21 |

| Involving an Intersection | 2 | 4 | 10 | 9 | 6 |

Though the majority of fatalities in Winston-Salem are car passengers, pedestrians and cyclists are also at risk, especially in a college town. The table below provides the number of fatalities in Forsyth County for car passengers, pedestrians, and cyclists from 2013 to 2017.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Car Passenger | 8 | 17 | 13 | 18 | 17 |

| Pedestrian | 6 | 4 | 8 | 6 | 6 |

| Cyclist | 0 | 0 | 0 | 0 | 0 |

Allstate America’s Best Drivers Report

Drivers in Winston-Salem are pretty safe across the board.

According to Allstate America’s Best Drivers Report for 2019, Winston-Salem ranked as the 28th safest driving city in the United States.

On average, residents of the City of Arts and Innovation also went around 11.1 years between filing each car insurance claim.

Ridesharing

According to RideGuru, the following rideshare services are available in Winston-Salem:

- Blacklane

- Lyft

- Traditional taxis

- Uber

Lyft, Uber, and traditional taxis are available to pick you up from or take you to both Piedmont Triad International Airport (GSO) and Smith Reynolds Airport (INT).

EStar Repair Shops

You will want to make sure that you are getting quality repairs on your vehicle should you, unfortunately, find yourself involved in an accident.

One of the best ways to do this is to locate your nearest EStar Repair Shop. You can do this by typing in your address in their convenient EStar repair Shop finder tool.

Winston-Salem has one EStar Repair Shop: Carolinas Collision Center at North Point. You can call them at (336) 759-2993 and find them at 7600 Phoenix Drive, Winston-Salem, NC 27106.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is transportation like?

Weather in Winston-Salem

Winston-Salem enjoys a very temperate climate with very little snowfall.

The table below offers some of the Camel City’s annual atmospheric averages.

| Atmospheric Condition | Average |

|---|---|

| Annual high temperature: | 69.7°F |

| Annual low temperature: | 49.4°F |

| Average temperature: | 59.55°F |

| Average annual rainfall: | 46.93 inches |

Public Transit in Winston-Salem

As we’ve seen above, not many Winston-Salemites take public transit. But that’s not because it isn’t available. The Winston-Salem Transit Authority offers fairly comprehensive bus routes for the city’s residents, especially to and from the city’s several institutions of higher education.

WSTA Fares are fairly affordable, too. Adults pay $1.00 per trip (transfers are free) and can buy a 30-day pass for $30. They also offer services for the elderly and disabled.

Alternate Transportation in Winston-Salem

The Winston-Salem Journal reports that the city has recently given operating licenses to two electric scooter companies, Zagster and VeoRide.

Parking in Winston-Salem

The City of Winston-Salem operates several public parking garages downtown, with park and shuttle, hourly, and monthly options.

The city also operates 800 metered parking spots. Single-space meters only take quarters, but Winston-Salem has been installing more parking stations that accept both cash and credit cards.

Air Quality in Winston-Salem

The Environmental Protection Agency (EPA) provides air quality reports for all cities and counties across the nation. The agency designates an area’s air quality as good, moderate, unhealthy for certain groups, unhealthy, and very unhealthy for every day of the year.

The air quality in Winston-Salem is consistently good, with a vast majority of days being designated as such by the EPA.

The table below shows the number of days in Winston-Salem with each EPA designation for the years 2016 to 2018.

| YEAR | GOOD | MODERATE | UNHEALTHY FOR SENSITIVE GROUPS | UNHEALTHY | VERY UNHEALTHY |

|---|---|---|---|---|---|

| 2018 | 233 | 130 | 2 | 0 | 0 |

| 2017 | 256 | 109 | 0 | 0 | 0 |

| 2016 | 228 | 135 | 3 | 0 | 0 |

Unique City Laws

Do a lot of active military/ veterans live in the city?

According to DataUSA, “Winston-Salem, NC has a large population of military personnel who served in Vietnam, 2.03 times greater than any other conflict.”

Though no active military base is within an hour of Winston-Salem, many veterans still call the city home.

Our research shows that many car insurance companies offer discounts to either active or retired military personnel, including Allstate, Esurance, Farmers Insurance, Geico, Liberty Mutual, MetLife, Safe Auto, Safeco, State Farm, and The General.

USAA is consistently ranked as one of the best auto insurance companies, and they insure only military personnel, active or retired, and their immediate family members.

Do you have more questions about Winston-Salem car insurance?

Now that you have a good grasp of the types of car insurance options available to you in the City of Arts and Innovation, plus a general idea of the culture that makes Winston-Salem so unique, we want to help you really make the city feel like home.

Here are some of the questions asked most by new and soon-to-be Winston-Salemites.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Who handles the utilities in Winston-Salem?

Winston-Salem/Forsyth County provides water, waste, and recycling services to residents through their public utility co-op. Duke Energy provides the area with gas and electric services.

Do I need to get a resident parking permit?

Nope. Easy breezy.

What are the state minimum coverage requirements for car insurance in North Carolina?

According to the North Carolina Department of Transportation, the minimum car insurance coverage that you must carry to comply with state laws is:

- Bodily injury coverage (one person): $30,000

- Bodily injury liability coverage per accident (two or more people): $60,000

- Property damage coverage: $25,000

Keep in mind that having only the minimum limits doesn’t cover you. You’ll need a full-coverage policy that includes comprehensive coverage and collision insurance. You may also need or choose to get uninsured motorist coverage/ underinsured motorist coverage. Other available coverage options include Medical Payments (MedPay) and Personal Injury Protection (PIP).

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Where is the airport?

Good question! Smith Reynolds Airport in Winston-Salem itself is not a passenger-serving airport. Most folks fly into Piedmont Triad International Airport (GSO). GSO is in Greensboro, North Carolina, just 24 miles from downtown Winston-Salem.

Is there really anything to do in Winston-Salem, NC?

ABSOLUTELY. Just ask these two.

Now that you understand the basics of driving, living, and working in the City of Arts and Innovation, it’s time to put your knowledge to work for you by getting the best deal on your car insurance.

Need car insurance? Start comparing rates for FREE. Just enter your zip code in our quote tool above.