Massachusetts Car Insurance Guide (Cheap Rates + Best Companies)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Uninsured Motorists 6.2

Massachusetts car insurance can be complicated. You need to make sure you are in compliance with no-fault insurance laws in Massachusetts while also trying to find the best car insurance companies in Massachusetts and get the cheapest Massachusetts auto insurance rates.

What is the cheapest car insurance in Massachusetts? What’s the average car insurance cost in Massachusetts? How do you know which car insurance provider is right for you? This is where we come in. We’ll take a look at what factors affect your car insurance rates. We’ll also explain everything from how MRB affects car insurance rates using your driving record to how driving without insurance in MA can land you in a lot of trouble.

Read on to learn everything there is to know about Massachusetts auto insurance. Enter your ZIP code above right now to see affordable Massachusetts car insurance rates side by side.

What are typical MA auto insurance rates and coverage?

Drivers need to consider personalized factors such as age, driving record, credit history, and location. In Massachusetts, the cheapest car insurance is liability coverage that meets the state minimum requirements. Finding the best car insurance also depends on factors such as affordability, customer satisfaction, claims experience, and financial strength.

The first thing that most people consider when they begin shopping for a car insurance policy is the amount of coverage they need and the rates that they will pay for it. There is so much more to it than that though.

Understanding your state’s car culture and the minimum coverage requirements before you purchase your policy can prevent hours of frustration later.

According to the Insurance Information Institute Massachusetts ranks 9th among the top 10 most expensive states for Automobile insurance. This is why shopping around can really save you money. We can help you with that.

We have looked at the statistics and sorted through all of the data concerning the Bay State so that we can help you make a smart decision when it comes to choosing your car insurance provider.

Keep scrolling to find out what the minimum requirements in Massachusetts are and how we can help you get the most for your money.

Let’s take a look at the average monthly car insurance rates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the minimum car insurance coverage requirements in Massachusetts?

Massachusetts requires that all vehicles registered in the Bay State have the following minimum car insurance coverage:

- Bodily injury liability: $20,000/$40,000

- Uninsured/Underinsured Motorist: $20,000/$40,000

- Personal injury protection: $8,000

- Property damage liability: $5,000

AAA also notes that by law a person’s policy must cover any person operating [a] vehicle with [the] owner’s express or implied consent.

The official state website for Massachusetts also states that:

Your auto insurance policy must list all licensed drivers living in your household who are related to you by blood, marriage, or adoption, including drivers already covered by their own insurance policies.

The Bay State does allow you to exclude household members who don’t drive your car, but only if you have submitted an “exclusion form” to your car insurance provider.

If you fail to comply with the minimum requirements for car insurance in the Bay State you can be subject to fines, loss of your driving privileges, and in some cases imprisonment. The risks far outweigh the benefits so you should always be sure that you maintain the proper amount of coverage when operating a motor vehicle on Massachusett’s roadways.

What are acceptable forms of financial responsibility for Massachusetts car insurance?

Unlike most states in the Union, Massachusetts does not require that a driver carry proof of insurance when operating a motor vehicle.

This is because all of the information regarding the status of your insurance policy is already electronically available to law enforcement via the RMV database.

This can be a real headache for Massachusetts drivers of the Bay State who are pulled over in a state that does require such proof.

The best way to avoid any hassles when traveling outside of Massachusetts then is to ask your provider if there is a place where you can download and print a paper copy of your car insurance ID card or access it electronically since 46 states in the country accept either one.

If your car insurance provider does not have a way for you to access either one then you can always carry a copy of your car insurance policy with you just to be on the safe side.

How much are insurance rates in Massachusetts as a percentage of income?

On average 2.2 percent of every resident of the Bay State’s annual disposable income is spent on car insurance.

This may not seem like a lot but when broken down the true cost of choosing the wrong car insurance provider is made clear.

The per capita disposable income for residents of Massachusetts is approximately $50,366 a year. Bay Staters spend about $1,129 of that income on car insurance assuming that the driver has no tickets or accidents.

This means that most Massachusetts residents spend around $94 of their $4,197 monthly budget on car insurance.

Car insurance rates in the Bay State have also been on an upward trend meaning that your monthly budget could be stretched even further in the next few years.

Thinking about moving to Connecticut or New York to avoid the pinch? Forget it.

Connecticut ranks only slightly lower on the Insurance Institute’s list of the top 10 most expensive states for car insurance, and New York actually ranks as the 3rd highest in the nation.

If you have tickets or an accident the price could go even higher no matter where you live which is why you should always shop around for your car insurance first.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

MA insurance rates: How much are core coverage rates?

One of the best ways to get every penny’s worth from your car insurance policy is to understand what the state of Massachusetts requires of you as an owner and operator of a motor vehicle in the Bay State.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $606.04 |

| Collision | $388.28 |

| Comprehensive | $134.96 |

| Combined Total | $1,129.29 |

Part of shopping around is looking at the providers in your area and the rates that they are offering for a driver like you. You should get multiple Massachusetts car insurance quotes from insurance companies.

What additional coverage are available for car insurance in Massachusetts?

Because every driver is unique it could pay big to add additional liability coverage to your policy.

Massachusetts already requires the purchase of uninsured/underinsured motorist coverage as part of the minimum state requirements but another option available to you in the Bay State is the addition of MedPay to your policy.

MedPay insurance can help you cover the costs of the medical payments of all passengers in your vehicle who are injured in an accident.

MedPay will even help pay for such things as the dreaded and notoriously expensive ambulance ride.

When deciding if you should add MedPay or any other type of additional coverage to your policy it is smart to consider the loss ratios of the companies that you are looking at.

While NAIC currently only has data regarding the loss ratio as it pertains to Personal Injury Protection the three-year data collected on this type of coverage reveals that Massachusetts has a relatively healthy car insurance market overall.

In 2014 the Bay State had a loss ratio for Personal Injury Protection of just 65 percent. This percentage is good news for you as you shop for car insurance.

Why? What does the loss ratio really mean to you? Simply put:

- A High Loss Ratio (over 100 percent) could indicate that the car insurance companies in Massachusetts are losing money and may need to raise rates in the future.

- A Low Loss Ratio would indicate that companies in the Bay State might have overpriced their policies.

With a loss ratio of 65 percent then, Massachusetts falls near the middle indicating that the overall car insurance market is strong and stable.

The Bay State also ranks 49th in overall uninsured/underinsured motorists meaning that only 6.2 percent of its drivers are failing to comply with the state minimum requirements which is good news for you when shopping for coverage.

Less uninsured/underinsured motorists on the roadway translates into lower overhead for your car insurance provider which keeps rates down.

What Massachusetts auto insurance add-ons and endorsements are available?

Even though Massachusetts has minimum coverage requirements that can help you if you sustain an injury or suffer property damage in an accident sometimes there is just not enough coverage to go around.

This is where choosing the right combination of add-ons or endorsements to add to your policy can really help out.

Some of the best-known add-ons include:

- Guaranteed Auto Protection (GAP)This add-on covers your car if it is ever totaled or stolen. If you suffer from either of these unfortunate events then GAP will pay any money that remains owed on the lease or loan as well.

- Substitute Transportation-this type of add-on broadens the coverage you receive from your collision and comprehensive components of your policy by paying for a rental car while your car undergoes repairs.

- Towing and Labor-For a small premium, this type of add-on will help you pay for the cost of towing and labor should you need either after an accident.

- Classic Car Insurance-One of the cheapest add-ons available, this type of insurance will cover your classic, antique, or collector vehicle should something happen to it while you are out showing it off.

- Non-Owner Car – This type of coverage is perfect for you if you don’t own a car but still drive on occasion. If you are borrowing your friend’s ride it will be nice to know that this type of policy will protect you with limited liability coverage for bodily injury and property damage.

- Modified Car Insurance-If you have a need to stand out from the norm then modifications to your car are a great way to do it. With this type of coverage, all of the additions to your lean machine will be covered should the unfortunate occur.

The type of car you drive is only one of the many factors that car insurance companies use to determine your rates.

Keep reading to find out how your age, your gender, and even where you live can make a major difference in the price that you pay for your policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How much are average monthly car insurance rates in Massachusetts by age and gender?

No matter your age or gender you are most likely going to find yourself shopping for car insurance at some point in your life. The external factors such as age and gender that you see as a part of life can add up though when purchasing your policy.

One of the most common things that can impact your Mass. auto insurance rates is gender.

In fact, the Consumer Federation of America released a study in 2017 that revealed that women of a certain age are more likely to pay more for car insurance than men in the same age range.

According to their study:

Most large auto insurers charge 40 and 60-year-old women higher rates than men, often more than $100 a year.

This is shocking to a lot of people since the common belief has always been that men, in general, pay more for car insurance at any age level.

Age and gender are just two of the things that go into determining your premiums. Take a look at the table below to see how your marital status can also impact your rates.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Insurance | $2,272.30 | $2,272.30 | $2,272.30 | $2,272.30 | $7,606.60 | $7,606.60 | $2,546.37 | $2,546.37 |

| Geico Govt Employees | $1,982.01 | $1,982.01 | $1,834.98 | $1,834.98 | $5,423.66 | $5,423.66 | $2,048.23 | $2,048.23 |

| Liberty Mutual | $2,879.48 | $2,879.48 | $2,508.74 | $2,508.74 | $8,950.89 | $8,950.89 | $3,012.24 | $3,012.24 |

| Progressive Direct | $2,252.65 | $2,252.65 | $2,160.74 | $2,160.74 | $8,484.75 | $8,484.75 | $2,436.98 | $2,436.98 |

| State Farm Mutual Auto | $954.11 | $954.11 | $954.11 | $954.11 | $2,583.18 | $2,583.18 | $954.11 | $954.11 |

| Standard Fire Ins Co | $2,813.43 | $2,813.43 | $2,485.69 | $2,485.69 | $5,731.25 | $5,731.25 | $3,118.46 | $3,118.46 |

| USAA CIC | $1,424.10 | $1,424.10 | $1,402.61 | $1,402.61 | $3,320.22 | $3,320.22 | $1,573.41 | $1,573.41 |

This means that your age and gender are two fewer things to worry about as you shop around for the perfect car insurance policy in the Bay State.

While age and gender might not make that big of a difference in the rates that you pay for car insurance where you live could cost you plenty. Keep scrolling to find out how.

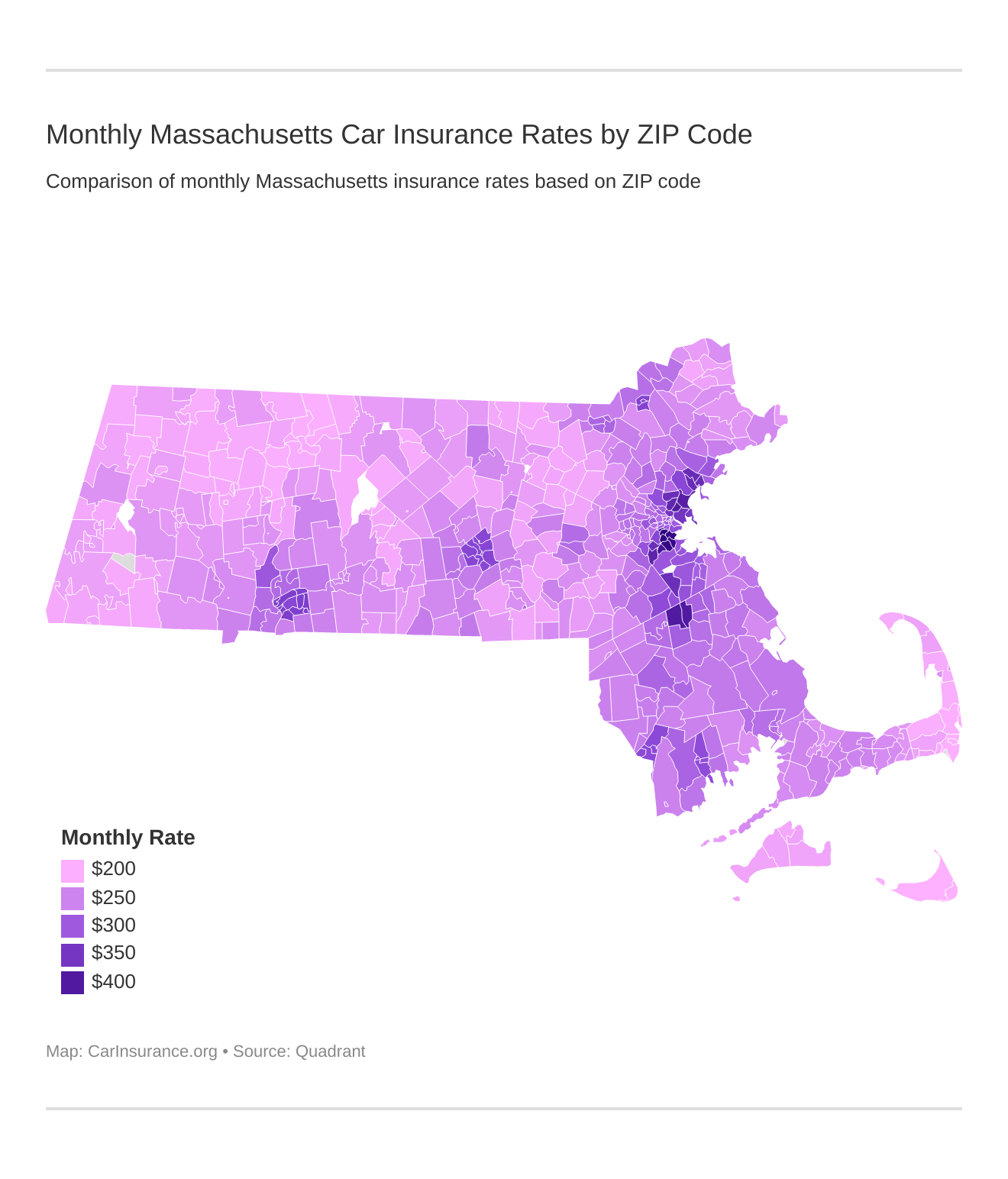

Car Insurance Rates by Town in Massachusetts

What are Massachusetts’ car insurance rates by town? When choosing the perfect house most people consider the neighborhood or the schools and shopping that are close by. Almost nobody thinks about how their ZIP code could affect their car insurance rates.

| Cheapest ZIP Codes in Massachusetts | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 02554 | NANTUCKET | $2,378.90 | Liberty Mutual | $3,462.64 | Progressive | $2,952.21 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 02564 | SIASCONSET | $2,378.90 | Liberty Mutual | $3,462.64 | Progressive | $2,952.21 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 02633 | CHATHAM | $2,382.38 | Liberty Mutual | $3,462.64 | Allstate | $2,831.36 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 02650 | NORTH CHATHAM | $2,382.38 | Liberty Mutual | $3,462.64 | Allstate | $2,831.36 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 02643 | EAST ORLEANS | $2,395.53 | Liberty Mutual | $3,462.64 | Allstate | $2,976.96 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 02653 | ORLEANS | $2,395.53 | Liberty Mutual | $3,462.64 | Allstate | $2,976.96 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01360 | NORTHFIELD | $2,398.18 | Liberty Mutual | $3,462.64 | Allstate | $2,890.75 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01354 | GILL | $2,406.50 | Liberty Mutual | $3,462.64 | Allstate | $2,999.17 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01344 | ERVING | $2,416.96 | Liberty Mutual | $3,462.64 | Progressive | $2,993.38 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01342 | DEERFIELD | $2,419.45 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01373 | SOUTH DEERFIELD | $2,419.45 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 02631 | BREWSTER | $2,426.70 | Liberty Mutual | $3,462.64 | Progressive | $2,960.74 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 02642 | EASTHAM | $2,426.81 | Liberty Mutual | $3,462.64 | Allstate | $2,942.54 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01330 | ASHFIELD | $2,434.92 | Liberty Mutual | $3,462.64 | Travelers | $3,037.33 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01220 | ADAMS | $2,440.33 | Liberty Mutual | $3,462.64 | Progressive | $3,025.98 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01367 | ROWE | $2,441.98 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01366 | PETERSHAM | $2,445.46 | Liberty Mutual | $3,462.64 | Progressive | $2,943.26 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01337 | BERNARDSTON | $2,446.65 | Liberty Mutual | $3,462.64 | Progressive | $3,054.03 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01349 | MILLERS FALLS | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01351 | MONTAGUE | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01376 | TURNERS FALLS | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01225 | CHESHIRE | $2,452.70 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01026 | CUMMINGTON | $2,454.99 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01267 | WILLIAMSTOWN | $2,455.41 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| 01338 | BUCKLAND | $2,458.33 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

City life definitely has its perks! As you can see from the table above though, moving just a couple of miles away from the city center could save you a few bucks.

A good example of this can be seen by looking at the difference in insurance rates in the Boston area.

| Most Expensive ZIP Codes in Massachusetts | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Anual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 02119 | BOSTON | $5,333.79 | Liberty Mutual | $7,656.09 | Progressive | $7,555.93 | State Farm | $2,120.44 | USAA | $3,675.58 |

| 02120 | BOSTON | $5,333.79 | Liberty Mutual | $7,656.09 | Progressive | $7,555.93 | State Farm | $2,120.44 | USAA | $3,675.58 |

| 02121 | BOSTON | $5,307.03 | Liberty Mutual | $7,656.09 | Progressive | $7,555.93 | State Farm | $2,120.44 | USAA | $3,675.58 |

| 02122 | BOSTON | $5,194.04 | Progressive | $7,560.57 | Liberty Mutual | $7,110.13 | State Farm | $2,022.32 | USAA | $3,315.64 |

| 02124 | BOSTON | $5,194.04 | Progressive | $7,560.57 | Liberty Mutual | $7,110.13 | State Farm | $2,022.32 | USAA | $3,315.64 |

| 02125 | BOSTON | $5,194.04 | Progressive | $7,560.57 | Liberty Mutual | $7,110.13 | State Farm | $2,022.32 | USAA | $3,315.64 |

| 02126 | MATTAPAN | $4,932.12 | Progressive | $7,560.57 | Liberty Mutual | $7,110.13 | State Farm | $2,022.32 | Geico | $2,902.61 |

| 02137 | READVILLE | $4,875.75 | Progressive | $7,896.19 | Liberty Mutual | $6,524.08 | State Farm | $1,840.58 | USAA | $2,924.38 |

| 02301 | BROCKTON | $4,786.09 | Progressive | $7,001.90 | Liberty Mutual | $6,328.82 | State Farm | $1,874.03 | USAA | $3,039.00 |

| 02302 | BROCKTON | $4,786.09 | Progressive | $7,001.90 | Liberty Mutual | $6,328.82 | State Farm | $1,874.03 | USAA | $3,039.00 |

| 02150 | CHELSEA | $4,784.05 | Liberty Mutual | $6,676.29 | Progressive | $6,173.07 | State Farm | $1,994.65 | USAA | $3,037.65 |

| 02151 | REVERE | $4,690.58 | Liberty Mutual | $6,690.23 | Progressive | $6,080.32 | State Farm | $2,047.29 | USAA | $3,215.80 |

| 02136 | HYDE PARK | $4,593.55 | Liberty Mutual | $6,524.08 | Progressive | $5,920.78 | State Farm | $1,840.58 | USAA | $2,924.38 |

| 02149 | EVERETT | $4,536.68 | Progressive | $6,171.49 | Liberty Mutual | $5,945.54 | State Farm | $1,881.27 | USAA | $2,768.55 |

| 01901 | LYNN | $4,407.06 | Liberty Mutual | $5,964.38 | Progressive | $5,850.09 | State Farm | $1,934.67 | USAA | $2,939.86 |

| 01902 | LYNN | $4,407.06 | Liberty Mutual | $5,964.38 | Progressive | $5,850.09 | State Farm | $1,934.67 | USAA | $2,939.86 |

| 01904 | LYNN | $4,407.06 | Liberty Mutual | $5,964.38 | Progressive | $5,850.09 | State Farm | $1,934.67 | USAA | $2,939.86 |

| 01905 | LYNN | $4,407.06 | Liberty Mutual | $5,964.38 | Progressive | $5,850.09 | State Farm | $1,934.67 | USAA | $2,939.86 |

| 02148 | MALDEN | $4,371.72 | Liberty Mutual | $5,945.54 | Progressive | $5,661.62 | State Farm | $1,881.27 | USAA | $2,768.55 |

| 02368 | RANDOLPH | $4,356.13 | Progressive | $6,107.09 | Liberty Mutual | $5,945.54 | State Farm | $1,881.27 | USAA | $2,768.55 |

| 02131 | ROSLINDALE | $4,353.82 | Liberty Mutual | $6,101.02 | Progressive | $6,055.71 | State Farm | $1,789.24 | USAA | $2,741.89 |

| 02128 | BOSTON | $4,228.13 | Liberty Mutual | $6,097.80 | Allstate | $4,971.70 | State Farm | $2,005.13 | USAA | $3,308.41 |

| 02129 | CHARLESTOWN | $4,228.13 | Liberty Mutual | $6,097.80 | Allstate | $4,971.70 | State Farm | $2,005.13 | USAA | $3,308.41 |

| 02152 | WINTHROP | $4,155.31 | Progressive | $5,499.95 | Liberty Mutual | $5,476.30 | State Farm | $2,047.29 | USAA | $2,539.22 |

| 02187 | MILTON VILLAGE | $4,139.60 | Liberty Mutual | $5,945.54 | Allstate | $5,255.89 | State Farm | $1,881.27 | USAA | $2,768.55 |

The comparison between Roxbury and Roslindale makes it clear that where you live in a city matters when it comes to car insurance rates. The city you love could cost you more as well.

Keep scrolling to see how your city stacks up against others in the Bay State when it comes to the cost of car insurance.

Where are the cheapest Massachusetts car insurance rates by city?

Car insurance rates by city in Massachusetts can vary a lot between major cities like Boston and smaller towns. (For more information, read our “Car Insurance Rates by City“).

Part of purchasing the right amount of coverage from a provider you can trust means knowing what the average rates in your city are. This is where we come in.

| Cheapest Cities in Massachusetts | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Nantucket | $2,378.90 | Liberty Mutual | $3,462.64 | Progressive | $2,952.21 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Siasconset | $2,378.90 | Liberty Mutual | $3,462.64 | Progressive | $2,952.21 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Chatham | $2,382.38 | Liberty Mutual | $3,462.64 | Allstate | $2,831.36 | State Farm | $1,082.84 | USAA | $1,526.01 |

| North Chatham | $2,382.38 | Liberty Mutual | $3,462.64 | Allstate | $2,831.36 | State Farm | $1,082.84 | USAA | $1,526.01 |

| East Orleans | $2,395.53 | Liberty Mutual | $3,462.64 | Allstate | $2,976.96 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Orleans | $2,395.53 | Liberty Mutual | $3,462.64 | Allstate | $2,976.96 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Northfield | $2,398.18 | Liberty Mutual | $3,462.64 | Allstate | $2,890.75 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Gill | $2,406.50 | Liberty Mutual | $3,462.64 | Allstate | $2,999.17 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Erving | $2,416.96 | Liberty Mutual | $3,462.64 | Progressive | $2,993.38 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Deerfield | $2,419.45 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| South Deerfield | $2,419.45 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Brewster | $2,426.70 | Liberty Mutual | $3,462.64 | Progressive | $2,960.74 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Eastham | $2,426.81 | Liberty Mutual | $3,462.64 | Allstate | $2,942.54 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Ashfield | $2,434.92 | Liberty Mutual | $3,462.64 | Travelers | $3,037.33 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Adams | $2,440.33 | Liberty Mutual | $3,462.64 | Progressive | $3,025.98 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Rowe | $2,441.98 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Petersham | $2,445.46 | Liberty Mutual | $3,462.64 | Progressive | $2,943.26 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Bernardston | $2,446.65 | Liberty Mutual | $3,462.64 | Progressive | $3,054.03 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Millers Falls | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Montague | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Turners Falls | $2,448.40 | Liberty Mutual | $3,462.64 | Progressive | $3,086.01 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Cheshire | $2,452.70 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Cummington | $2,454.99 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Williamstown | $2,455.41 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

| Buckland | $2,458.33 | Liberty Mutual | $3,462.64 | Allstate | $3,004.25 | State Farm | $1,082.84 | USAA | $1,526.01 |

We’ve put all the data into two tables for you so that you can see just where your city ranks when it comes to the cost of car insurance.

| Most Expensive Cities in Massachusetts | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Roxbury | $5,333.79 | Liberty Mutual | $7,656.09 | Progressive | $7,555.93 | State Farm | $2,120.44 | USAA | $3,675.58 |

| Roxbury Crossing | $5,333.79 | Liberty Mutual | $7,656.09 | Progressive | $7,555.93 | State Farm | $2,120.44 | USAA | $3,675.58 |

| Dorchester | $5,231.70 | Progressive | $7,559.03 | Liberty Mutual | $7,292.12 | State Farm | $2,055.02 | USAA | $3,435.62 |

| Dorchester Center | $5,194.04 | Progressive | $7,560.57 | Liberty Mutual | $7,110.13 | State Farm | $2,022.32 | USAA | $3,315.64 |

| Mattapan | $4,932.12 | Progressive | $7,560.57 | Liberty Mutual | $7,110.13 | State Farm | $2,022.32 | Geico | $2,902.61 |

| Readville | $4,875.75 | Progressive | $7,896.19 | Liberty Mutual | $6,524.08 | State Farm | $1,840.58 | USAA | $2,924.38 |

| Brockton | $4,786.09 | Progressive | $7,001.90 | Liberty Mutual | $6,328.82 | State Farm | $1,874.03 | USAA | $3,039.00 |

| Chelsea | $4,784.05 | Liberty Mutual | $6,676.29 | Progressive | $6,173.07 | State Farm | $1,994.65 | USAA | $3,037.65 |

| Revere | $4,690.58 | Liberty Mutual | $6,690.23 | Progressive | $6,080.32 | State Farm | $2,047.29 | USAA | $3,215.80 |

| Hyde Park | $4,593.55 | Liberty Mutual | $6,524.08 | Progressive | $5,920.78 | State Farm | $1,840.58 | USAA | $2,924.38 |

| Everett | $4,536.67 | Progressive | $6,171.49 | Liberty Mutual | $5,945.54 | State Farm | $1,881.27 | USAA | $2,768.55 |

| Lynn | $4,407.06 | Liberty Mutual | $5,964.38 | Progressive | $5,850.09 | State Farm | $1,934.67 | USAA | $2,939.86 |

| Malden | $4,371.72 | Liberty Mutual | $5,945.54 | Progressive | $5,661.62 | State Farm | $1,881.27 | USAA | $2,768.55 |

| Randolph | $4,356.13 | Progressive | $6,107.09 | Liberty Mutual | $5,945.54 | State Farm | $1,881.27 | USAA | $2,768.55 |

| Roslindale | $4,353.81 | Liberty Mutual | $6,101.02 | Progressive | $6,055.71 | State Farm | $1,789.24 | USAA | $2,741.89 |

| Charlestown | $4,228.12 | Liberty Mutual | $6,097.80 | Allstate | $4,971.70 | State Farm | $2,005.13 | USAA | $3,308.41 |

| Winthrop Town | $4,155.31 | Progressive | $5,499.95 | Liberty Mutual | $5,476.30 | State Farm | $2,047.29 | USAA | $2,539.22 |

| Milton Village | $4,139.60 | Liberty Mutual | $5,945.54 | Allstate | $5,255.89 | State Farm | $1,881.27 | USAA | $2,768.55 |

| Springfield | $4,027.19 | Liberty Mutual | $5,603.76 | Progressive | $5,333.03 | State Farm | $1,800.81 | USAA | $2,828.84 |

| Indian Orchard | $3,995.20 | Liberty Mutual | $5,603.76 | Progressive | $5,408.83 | State Farm | $1,485.33 | USAA | $2,828.84 |

| Lawrence | $3,943.76 | Liberty Mutual | $5,345.75 | Progressive | $5,155.26 | State Farm | $1,749.34 | USAA | $2,811.60 |

| Worcester | $3,901.71 | Liberty Mutual | $5,476.30 | Progressive | $5,305.63 | State Farm | $1,779.66 | USAA | $2,539.22 |

| Jamaica Plain | $3,894.59 | Liberty Mutual | $5,388.78 | Progressive | $4,995.75 | State Farm | $1,769.03 | USAA | $2,945.48 |

| Saugus | $3,860.14 | Progressive | $5,081.61 | Liberty Mutual | $5,077.97 | State Farm | $1,673.97 | USAA | $2,421.35 |

| Fall River | $3,841.69 | Liberty Mutual | $5,476.30 | Progressive | $4,927.80 | State Farm | $1,779.66 | USAA | $2,539.22 |

Siasconset with its population density of only 3,025 people per square mile in comparison boasts one of the lowest rates for car insurance in the Bay State.

Why such a vast difference? The answer is simple. More people mean more cars on the road which translates into more accidents resulting in more insurance claims.

Should you ever need to file a claim it will be good to know where your car insurance company ranks among the others in the Bay State. That is where we come in.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Which are the best Massachusetts auto insurance companies?

If the unfortunate arises and you find yourself in need of filing a claim it can be a huge comfort to know that you have chosen the right car insurance provider to have in your corner. If you’re thinking of switching car insurance in Massachusetts, you need to know how the companies rate.

We have compiled a list of the top-rated car insurance company in the Bay State according to AM Best rating services to help you feel more confident in your decision.

The Largest Companies’ Financial Ratings

AM Best is the only global credit rating agency to have a singular focus on the insurance industry. As such, you can trust that the rankings that they provide to you are not influenced by industries outside of the market.

The rankings provided by AM Best can help you determine the overall health and viability of all of the insurance providers available to you which could save you money when shopping for car insurance.

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| Mapfre Insurance Group | A | Stable |

| Liberty Mutual Group | A | Stable |

| Geico | A++. | Stable |

| Safety Group | A | Stable |

| Arbella Insurance Group | A- | Stable |

| Plymouth Rock Insurance Group | A- | Stable |

| Progressive Group | A+ | Stable |

| Metropolitan Group | A | Stable |

| USAA Group | A++ | Stable |

| The Hanover Insurance Group | A | Stable |

The higher the rating from AM Best the less likely it is that your car insurance company will go bankrupt either, and companies with higher ratings are also more likely to pay out your claim should you ever have an accident.

Companies with Best Ratings

AM Best ratings are a great place to start as you are trying to determine just which car insurance provider is right for you. AM Best is not the only one looking out for you though.

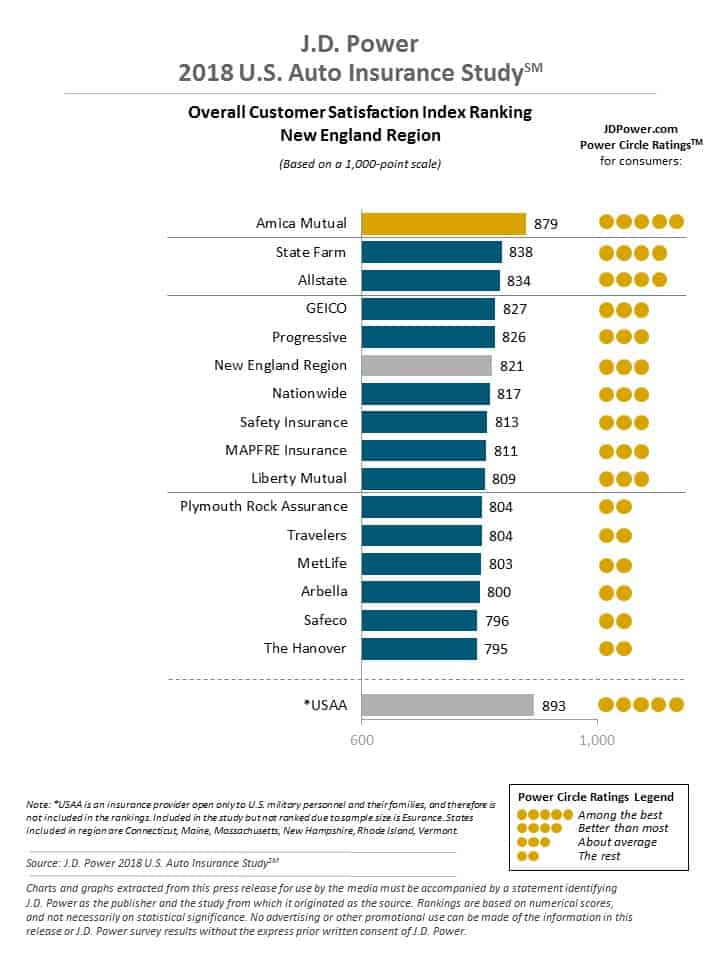

J.D. Power’s auto insurance survey also has your back, and what they have discovered is that customer satisfaction among car insurance consumers is at an all-time high.

Purchasing car insurance in Massachusetts isn’t always a satisfying experience though. Scroll down to see just which car insurance company in the Bay State has the highest complaint ratio and what that means to your bottom line.

Companies with the Most Complaints

When choosing your car insurance provider you will want to consider how many complaints have been filed against them before making your purchase. This means knowing what the complaint ratio is and what it means to you.

The baseline for the complaint ratio is 1.0. A company with a 1.0 complaint ratio thus has an average number of complaints. Consequently, the more complaints a company has filed against it the higher its complaint ratio will be.

Below is a list of the top 10 best car insurance companies in Massachusetts along with their complaint ratio so that you can see how each one compares.

| Company | Direct Premiums Written | complaint ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| Mapfre Insurance Group | $1,239,686 | 6.25 | 66.64% | 23.89% |

| Liberty Mutual Group | $603,974 | 5.95 | 54.01% | 11.64% |

| Geico | $578,476 | 0.68 | 69.56% | 11.15% |

| Safety Group | $454,424 | 0 | 61.11% | 8.76% |

| Arbella Insurance Group | $408,350 | 1.33 | 57.89% | 7.87% |

| Plymouth Rock Insurance Group | $350,475 | 1.16 | 62.97% | 6.75% |

| Progressive Group | $218,901 | 0.75 | 61.95% | 4.22% |

| Metropolitan Group | $214,443 | 1.3 | 56.44% | 4.13% |

| USAA Group | $157,593 | 0.74 | 68.42% | 3.04% |

| The Hanover Insurance Group | $154,607 | 2.43 | 59.73% | 2.98% |

| **state Total** | $5,188,449 | 62.44% | 100.00% |

In order to put the complaint ratio into context, you should consider the market share that each company has. Higher market shares mean that these companies service more customers.

Servicing more customers raises the possibility that eventually some customers might feel dissatisfied with their service and thereby complain.

This explains why Mapfre Insurance Group has such a high complaint ratio given that it has $1,239,686 in Direct Premiums Written and thereby commands almost 25 percent of the total market share in the Bay State.

If you ever need to file a complaint against your insurance provider you should contact The Massachusetts Division of Insurance.

Here are a few of the ways that you can contact them:

- In person – 1000 Washington Street, Suite 810, Boston, MA 02118

- By Phone – At (617) 521-7794 or toll-free at (877) 563-4467

- Online – https://www.mass.gov/info-details/about-the-division-of-insurance

The Massachusetts Division of Insurance also offers the following options and advice when filing a complaint against your provider:

- Online – https://www.mass.gov/forms/doi-insurance-complaint-submission-form

- Through e-mail simply fill out the complaint form and attach it to an e-mail addressed to [email protected]

- Snail Mail just print out the complaint form and mail it to: Commonwealth of Massachusetts Division of Insurance, Consumer Service Department, 1000 Washington Street, Boston, MA 02118-6200

- Or FAX your complaint form to (617) 753-6830

Now that you know how the loss ratio and complaint can help you determine what car insurance provider might be best for you it is time to start comparing rates.

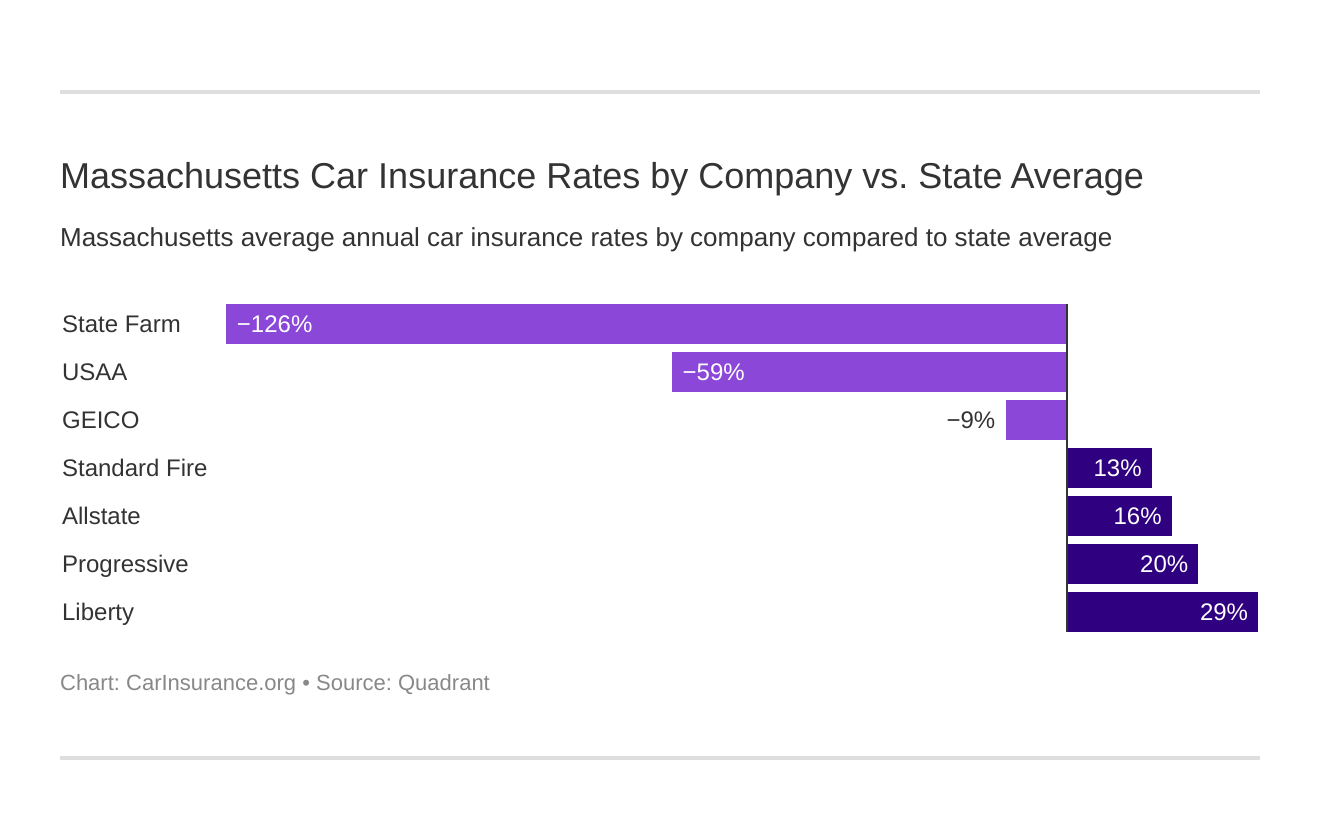

Which are the cheapest Massachusetts car insurance companies?

Anyone who has ever shopped around knows that it is human nature to start from the lowest price and sort out your purchases from there. This is where we can help.

The table below puts you in control of choosing the best car insurance by showing you just how far your hard-earned money can go when purchasing your car insurance policy.

| Company | Average Annual Rate | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allstate Insurance | $3,674.39 | $603.41 | 16.42% |

| Geico Govt Employees | $2,822.22 | -$248.77 | -8.81% |

| Liberty Mutual | $4,337.84 | $1,266.85 | 29.20% |

| Progressive Direct | $3,833.78 | $762.79 | 19.90% |

| State Farm Mutual Auto | $1,361.37 | -$1,709.61 | -125.58% |

| Standard Fire Ins Co | $3,537.21 | $466.22 | 13.18% |

| USAA CIC | $1,930.09 | -$1,140.90 | -59.11% |

Everything from your education level to your commuting distance can have an impact on how much you will pay for car insurance. Keep scrolling to find out how we can help.

What are Massachusetts auto insurance rates by commute?

Many residents of the Bay State don’t realize that the more they drive the higher their rates will be. This is why it is just as important to shop around for car insurance as it is for your next new car.

The table below makes sense of it all so that you can make the best decision for your family budget while keeping the ones you hold dear safe and protected when they travel in your car with you.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $3,556.25 | $3,792.54 |

| Geico | $2,769.02 | $2,875.42 |

| Liberty Mutual | $4,168.55 | $4,507.13 |

| Progressive | $3,833.78 | $3,833.78 |

| State Farm | $1,329.38 | $1,393.36 |

| Travelers | $3,369.13 | $3,705.29 |

| USAA | $1,876.77 | $1,983.40 |

If your commute is short and sweet then it might be best to go with a company like State Farm. If your commute is longer though you might want to consider choosing USAA.

Longer commute rates increase your chances of an accident. Because USAA has a relatively low loss ratio they will be more likely to pay out a claim in case you should be forced to file one.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Massachusetts auto insurance rates by coverage level?

As you can tell, knowing which company is the cheapest in your area is only part of what goes into deciding on the perfect car insurance provider to protect you and your loved ones in case of an accident.

When making a smart decision you should also consider how much coverage you will need. The table below can help you get started.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,398.46 | $3,732.43 | $3,892.29 |

| Geico | $2,600.65 | $2,872.94 | $2,993.07 |

| Liberty Mutual | $4,057.68 | $4,394.25 | $4,561.58 |

| Progressive | $3,514.05 | $3,905.26 | $4,082.03 |

| State Farm | $1,238.07 | $1,385.33 | $1,460.72 |

| Travelers | $3,194.57 | $3,608.06 | $3,808.99 |

| USAA | $1,788.95 | $1,961.62 | $2,039.69 |

The age of your car might mean that you need more or less coverage. Your credit can also impact how much you will pay for the coverage you need no matter how old you are or what type of car you drive.

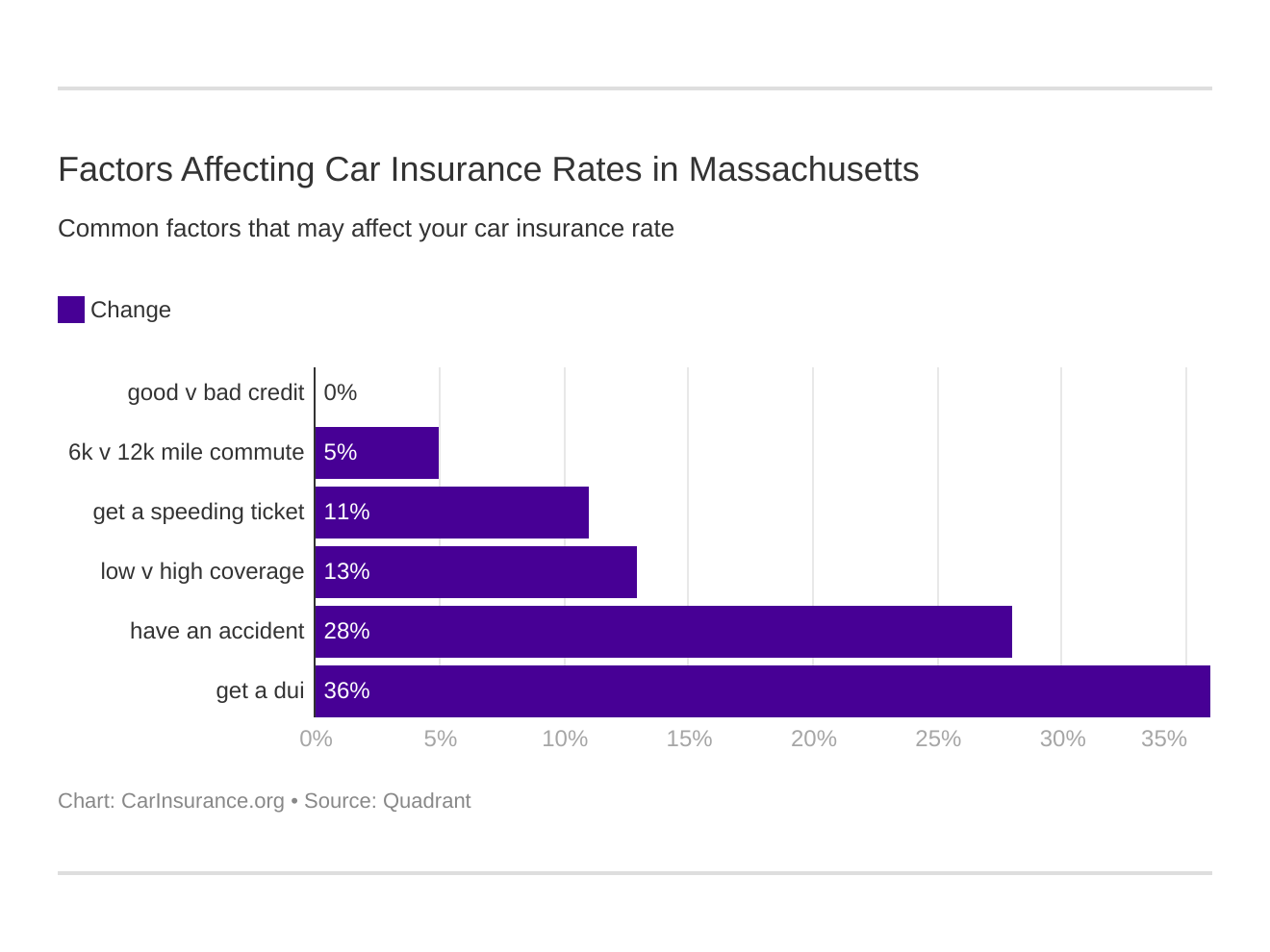

What are Massachusetts auto insurance rates by credit history?

Massachusetts is one of the few states that prohibit insurers from using your credit score to set your rates.

Because your credit score is not a factor your driving record is all the more important in the Bay State.

If you should ever decide to move out of Massachusetts though you should be aware of the article published by Consumer Reports in 2015 which came as a shock to most Americans.

This article revealed that car insurance providers are indeed considering your credit report before they sell you a car insurance policy.

One of the main reasons that people with better credit ratings pay less for car insurance is because they are more likely to pay out-of-pocket than to file a claim should a traffic accident or incident befall them.

Experian credit rating asserts that:

A credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent.

The average Bay Stater has a credit score of 710 which is not too shabby.

Cleaning up your credit and/or maintaining a good credit score are not the only ways to save money when shopping for car insurance though. Keep scrolling to find out just how important safe driving really is.

What are Massachusetts auto insurance rates by driving record?

What you do behind the wheel when on the roads in Massachusetts can really matter to your wallet when it comes to purchasing car insurance.

Massachusetts operates under what is known as a “Surchargeable Point” system. What does that mean to you? It means that your driving record is as important to the cost of your car insurance policy as any other factor. For example, drivers that have high-risk driving violations such as driving under the influence (DUI) will get higher rates than the national average because they are riskier drivers.

“Surchargeable Points” stay on your driver’s license for six years so drive defensively and responsibly when on the roads in the Bay State.

| Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| Allstate | $2,843.93 | $2,843.93 | $4,770.08 | $4,239.63 |

| Geico | $2,256.59 | $2,382.22 | $3,545.26 | $3,104.81 |

| Liberty Mutual | $3,417.00 | $3,651.90 | $5,614.34 | $4,668.12 |

| Progressive | $3,220.36 | $3,974.60 | $3,601.17 | $4,538.99 |

| State Farm | $1,077.70 | $1,154.69 | $1,745.31 | $1,467.80 |

| Travelers | $2,757.25 | $3,500.48 | $4,078.44 | $3,812.67 |

| USAA | $1,373.89 | $1,536.81 | $3,026.22 | $1,783.42 |

The table above reveals that just one DUI could cost you over $2,000 just in insurance premiums. That doesn’t take into account the cost of life and property so always drink responsibly and never drink and drive.

If you feel that your driving record is wrong you can always request a review.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

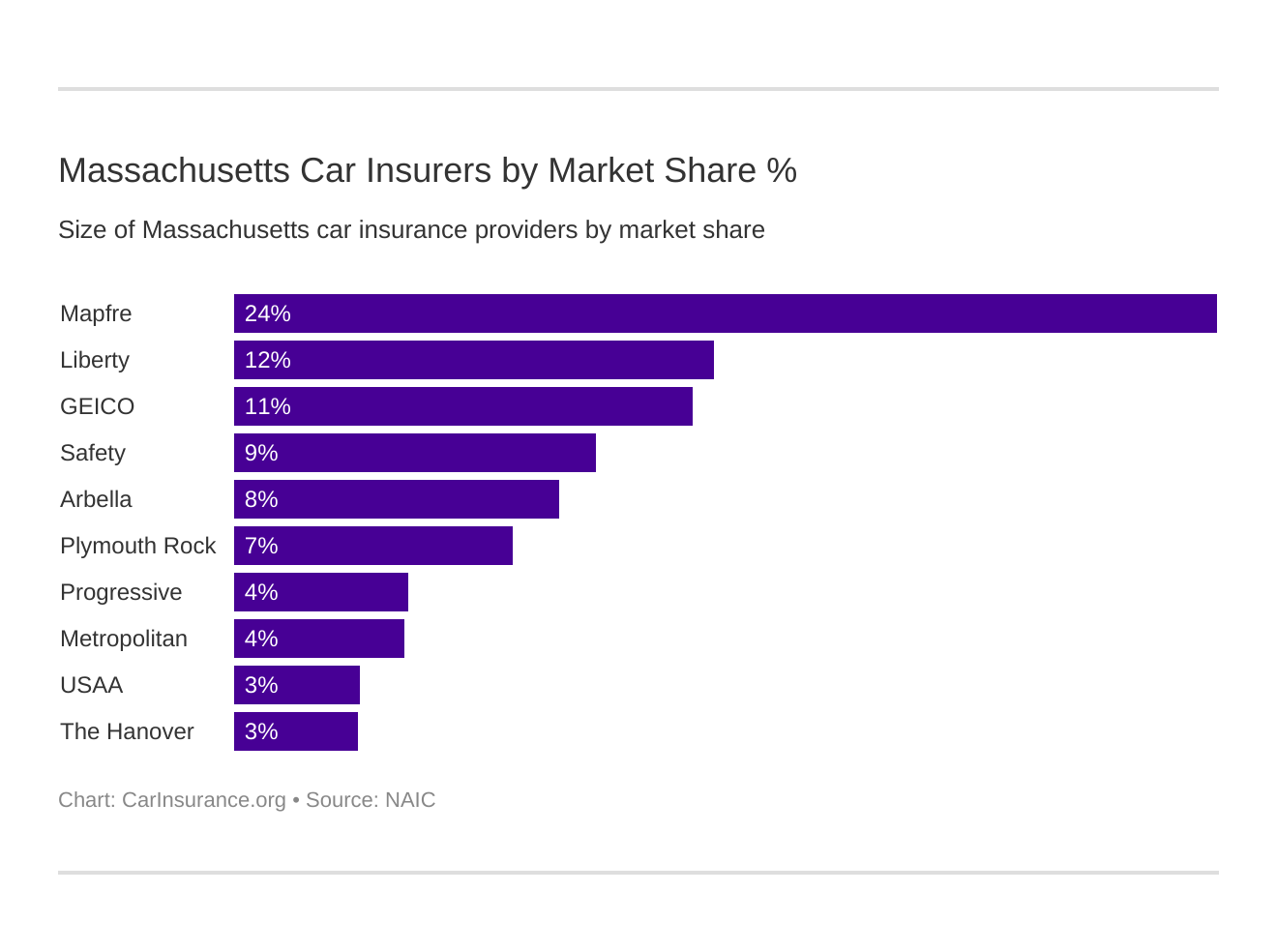

Which are the largest insurance companies in Massachusetts?

With all the talk of complaint ratios and loss ratios, it is easy to think that bigger is always better when it comes to purchasing your car insurance policy.

Sometimes it pays to go with a smaller company though even if the rates are just a little higher. The only way to know is to understand what market share truly means.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| Mapfre Insurance Group | $1,239,686 | 23.89% |

| Liberty Mutual Group | $603,974 | 11.64% |

| Geico | $578,476 | 11.15% |

| Safety Group | $454,424 | 8.76% |

| Arbella Insurance Group | $408,350 | 7.87% |

| Plymouth Rock Insurance Group | $350,475 | 6.75% |

| Progressive Group | $218,901 | 4.22% |

| Metropolitan Group | $214,443 | 4.13% |

| USAA Group | $157,593 | 3.04% |

| The Hanover Insurance Group | $154,607 | 2.98% |

Mapfre Insurance Group also has $1,239,686 in Direct Premiums Written which translates to stability within the market because according to Investopedia:

The main driver for growth…is writing new policies.

Choosing a company with a good share of the market balanced against the right amount of Direct Premiums Written can help you save money then.

Number of Insurers by State

There are 48 domestic insurance providers in the Bay State and 697 foreign ones. So what is the difference between the two?

- Domestic Insurers are ones that have been formed under the laws of the state of Massachusetts.

- Foreign Insurers are insurers who have been formed under the laws of any state, district, territory, or commonwealth of the United States other than the Bay State but who have agreed to adhere to the insurance laws that govern the Commonwealth of Massachusetts.

There really is no difference between the 745 insurance providers available to you in Massachusetts. In the end, it all comes down to comfort level.

Dealing with either type of insurer is most definitely easier when you understand the laws that they were formed under. We are here to help you with that. Keep reading to find out about the laws that govern driving and car insurance in the Bay State.

What Massachusetts car insurance laws should you know?

In Massachusetts driving without insurance is illegal. Massachusetts driving and insurance laws can seem overly complicated at times. This is especially true after an accident.

Trying to navigate who is responsible for what after the unfortunate has occurred can be a nightmare without the right car insurance provider on your side.

Sometimes just knowing what could happen is enough to prevent it. This is where we come in. We are here to help you gain a better understanding of the laws that will most impact you should the worst occur.

Knowing your responsibilities and the consequences for everyone after an accident will make you more aware behind the wheel.

This starts with a good grasp of the car insurance laws in the Bay State.

Let’s refresh. As we began our journey together we told you that Massachusetts has the following minimum coverage requirements:

- Bodily injury liability: $20,000/$40,000

- Uninsured/Underinsured Motorist: $20,000/$40,000

- Personal injury protection: $8,000

- Property damage liability: $5,000

Before 2007 the car insurance market in the Bay State was also highly regulated making it so that consumers had limited options and discounts when it came to shopping for their policy. That all changed when the insurance commissioner and the Massachusetts state legislature instituted Managed Competition.

Managed Competition opened up the car insurance market to providers who had previously shunned the Bay State and in just three years’ time:

Massachucettes drivers…saved nearly a half-billion dollars in car insurance premium since managed competition was instituted.

More competition and less regulation may be good for your bottom line when shopping for car insurance, but it means that you have to pay more attention to the finer details as you do.

This starts by understanding how the laws in the Bay State are determined.

How State Laws are Determined

The state legislature is responsible for determining the laws that govern car insurance and driving in the Commonwealth of Massachusetts and it has determined under Section 340 that everyone who owns or operates a motor vehicle must maintain a liability policy or vehicle liability bond.

Confused about the difference between a liability policy and a vehicle surety bond? You are not alone. Plainly put:

- A Liability Policy is held by an owner of a vehicle to protect them and their passengers against bodily injury or property damage after an accident.

- A Surety Bond is held by a company and acts as a way of ensuring the financial security of consumers.

Surety bonds are usually held by such entities as driving schools to protect both the student and the general population during the time that the student driver spends on the road.

Windshield Coverage

Student drivers are not the only hazard on the road. There are also a plethora of things that are lying along the roadway in the Bay State that could come flying up and hit your windshield.

If this happens you will want to know which types of damage will require definite repair and which types the state of Massachusetts turns a blind eye to.

You will also want to know just what your car insurance policy will cover. Generally speaking, according to CarWindshields.info:

“If you have comprehensive insurance, the repair/replace is either at no cost to you or there is a $100 deductible (only if you opr into it), regardless of your normal comprehensive deductible. If your car has less than 20,000 miles…you can have OEM parts.

Be forewarned that filing windshield damage on your car insurance policy may result in a rate hike so it is good to know what types of damage require repair by law and which types you can ignore if you choose to.

Every car registered in Massachusetts must pass the mandatory vehicle safety inspection.

As part of this safety inspection each vehicle in the Bay State must meet the following minimum insurance requirements when it comes to the condition of its windshield:

- Windshield wipers that can remove rain, snow, and other types of moisture from the field of view

- Windshield Wiper Fluid Dispenser must be found to be in working order

- All Windshields must be constructed from safety glass

- Stickers cannot obstruct the field of view

- Non-reflective tint can only be along the top six inches of the windshield

- Cracks or other areas of damage are not allowed within the path of the windshield wipers

- Chips cannot be larger than a quarter

Tickets for violations of any of these things are generally left up to the law enforcement offer’s discretion if you are pulled over, and the first and second offenses carry with them a fine of $250.

If you have a third offense your license will be suspended for up to 90 days. All of these penalties could land you in the high-risk driver category so why not just get any questionable damage repaired?

High-Risk Insurance

Nobody’s perfect, but having a less-than-perfect driving record in the Bay State could cost you big time when it comes to purchasing your car insurance policy.

This is because filing a claim against your provider, tickets, and accidents can all land you in the high-risk driver category. Drivers with even minor driving violations in their history are charged higher rates compared to those with a clean record.

Given the sheer amount of bad driving in Massachusetts, according to national standards, if you are a high-risk driver you are not alone.

Risky behavior behind the wheel can lead to higher amounts of Surchargeable Points being placed on your license.

The more “Surchargeable Points” you accrue the higher your rates will be because car insurance is what is known as a risk market. What this means is that each time a provider ensures you they are betting on the fact that you won’t get a ticket or cause an accident.

If you do become involved in a traffic incident then the insurance provider has essentially lost the bet. Car insurance providers are a business which means that they must recoup their losses.

If you have been involved in a traffic incident then you have become part of that loss which makes you a high-risk driver.

Because “Surchargeable Points” place you in the high-risk driver category and can stay with you for 6 years it is best to avoid them at all costs.

If you do find yourself racking up a few though all hope is not lost when it comes to shopping for car insurance.

Low-Cost Insurance

We all know that low-cost insurance is a given if you have good credit and a clean driving record. What do you do though if your driving record is less than perfect?

The best option for you if you find yourself with one too many “Surchargeable Points” is to shop around and look for insurance discounts. Some of these discounts could include:

- Good Student DiscountsAvailable to students who maintain a certain GPA

- Military/Veteran Discounts-These are offered to active duty or retired military personnel upon proof of service.

- Defensive Driving Course Discount-This becomes available to you with proof that you have completed a state-approved defensive driving course.

Even if your provider does not offer a defensive driver discount, taking a course designed to improve your skills behind the wheel can go a long way toward keeping your rates down.

While proof may be required to start up any of these discounts it is your responsibility to maintain your eligibility in each of these programs.

Should your grades slip, or your active duty status change, you should always notify your car insurance provider.

Failure to notify your car insurance provider regarding changes in your eligibility could result in a charge of fraud being brought against you.

Automobile Insurance Fraud in Massachusetts

The state of Massachusetts recognizes four areas of fraud:

- Fake Insurance Companies-This area covers fake insurers who collect premiums for false policies.

- Unlicensed Insurance Companies-This area of fraud applies when a legitimate company is operating without a license.

- Fraud committed by Individuals-Individuals who are operating within the insurance industry that collect premiums without the intention of paying those premiums forward to the auto insurance company falls into this category.

- Fraud committed by Consumers-Consumers who exaggerate injuries or damages on a claim made to their insurance agency, and those who provide their car insurance provider with false information in order to procure discounts, fall into this area of fraud.

Insurance fraud can also be committed by the repair shop or other individuals employed to help you with the repair or replacement of your vehicle after an accident so it pays to keep an eye on the billing and filing practices of all parties involved.

Should you ever find yourself the victim of fraud, or need to report a case of fraud on behalf of someone you love, the state of Massachusetts has provided several ways to do so:

- You can call the Massachusetts Divison of Insurance at (617) 521-7794

- You can file a complaint with the Division of Insurance at www.mass.gov/doi

- Or you can contact the Insurance Fraud Bureau of Massachusetts (IFB) at (800) 323-7283 or online at www.ifb.org.

If you are caught committing insurance fraud penalties could include:

- Being charged with a felony which is punishable with up to five years in prison or six months to 2 1/2 years in jail

- A fine of $500 to $10,000, or both

- Civil penalties such as fines and the loss of your business license

Statute of Limitations

As with all laws, the laws of the Commonwealth of Massachusetts come with statutes of limitations.

The Bay State has a three-year statute of limitations on the following infractions with regard to insurance fraud and car insurance claims:

- Personal injury (Ch. 260 §4)

- Fraud (Ch. 260 §2A)

- Injury to personal property (Ch. 260 §4)

While statutes of limitations are commonplace across the United States, there are a few driving laws that are unique to the Bay State.

Massachusetts Specific Driving Laws

In the great state of Massachusetts, it is illegal to drive with a gorilla in the back seat of your car. It kinda makes you wonder how that law ever got on the books.

Okay, so the law actually states:

Whoever leads or drives a bear or other dangerous wild animal or causes it to travel upon or be covered over a public way unless properly secured in some covered vehicle or cage shall be punished by a fine of not less than five or more than $20.

It sounds more fun to say gorilla than bear though.

It is also illegal to curse within the city limits of Middleborough so be careful what you let fly with your windows down on Main Street during rush hour. Christmas has also been outlawed in the Bay State since 1659, but don’t let that turn you away.

Massachusetts is a great state that really cares for its residents which is why they have instituted vehicle licensing laws to ensure that all Bay Staters are protected against bodily injury or property damage.

What are the Massachusetts vehicle licensing laws?

Along with the minimum coverage requirements in the Bay State, Massachusetts has also instituted a variety of laws that govern how you register your vehicle. One of the most important of these is that you acquire and maintain a valid car insurance policy.

As in most states, registering your vehicle in Massachusetts begins by obtaining a car insurance policy from an agent licensed by the state.

If you recently bought your car then you will need to have your agent complete the Application for Registration of Title before you sign it and take it to your nearest RMV branch where you can start the registration process.

You will also need the following when you arrive at RMV so come prepared:

- A signed copy of the Application for Registration and Title

- Out-of-state title for your vehicle (if applicable)

- Payment for the registration fee

- Proof of insurance, so bring a copy of your policy

- Bill of sale and statement of mileage (if you are titling a car previously not owned by you)

Registration fees are as follows:

- Passenger vehicles will cost $60

- Motorcycles will cost $20

- Title fee of $75

You will have seven days to get your vehicle safety inspected after your registration is completed otherwise your registration will become invalid.

The Bay State also protects you if you have bought a lemon, but that doesn’t mean that you shouldn’t do your homework before you make your purchase.

Along with vehicle registration laws and lemon laws, the Bay State also participates in the national program called REAL ID.

According to Mass.gov, in order to obtain a learner’s permit, driver’s license, or Massachusetts ID card you will need proof of citizenship or lawful residence within the United States.

You will also need:

- A Social Security number

- Proof of Massachusetts residency

Once you arrive at the RMV you will need to determine whether you want to get a standard driver’s license/ID or a REAL ID.

As you make your choice, keep in mind that you will need a REAL ID to fly within the United States or to enter any federal building. Getting one will also require you to present additional documentation at the RMV.

All first-time applicants for REAL ID will have to come into their nearest RMV office in person with the proper documentation.

Penalties for Driving Without Insurance

If you are caught driving without insurance in the Bay State the penalties and fines can really add up.

Some of these penalties for the first offense include:

- A Fine of $500 to $5,000

- And/or imprisonment for 1 year

A second offense (if it occurs within six years) could end up costing you a license suspension for up to one year.

All vehicle registrations and car insurance policies are linked by computer to RMV. Should your coverage lapse your previous car insurance provider will notify the RMV who will block your registration.

As a consumer, according to the state of Massachusetts, you do have rights though.

First, and foremost, car insurance providers in the Bay State cannot discriminate against you based on demographic factors.

Some of your other rights include:

- Your right not to be denied coverage based on your credit history.

- Your right to know why you were denied if it comes to that.

- You have the right to an explanation of how your driving record has impacted your rates.

- You have the right to view your driving history available at www.mass.gov/mrb for a small fee.

- You have the right to cancel your policy at any time you choose to do so.

- You have the right to a notice of your car insurance provider’s intent to cancel your policy.

- And you have the right to appeal the cancelation.

- You also have the right to be notified of non-renewal.

All of these rights can be super important to you should you have a teen driver on your policy.

Teen Driving Laws

The Bay State has a multi-stage (or graduated) licensing process. This process allows teen drivers to gain experience behind the wheel over a period of time rather than setting them loose on the open highway with a license and the wind in their hair.

The stages that teen drivers in Massachusetts must progress through are as follows:

- Learner’s Permit-Beginning at age 16, teenagers can apply for a learner’s permit. They must provide proof of identification, be accompanied by a parent or guardian, complete the application, and pass both a written and vision examination which includes knowledge of traffic laws and recognition of road signs.

- Junior Operator License-At 16 1/2 teenagers can apply for a junior operator’s license. This requires the completion of driver’s education and an additional 40 hours of supervised practice. This level also requires that the teen driver also hold a learner’s permit with a clean driving record for 6 months prior to the application.

- A full license requires the applicant to be 18 years of age and to have held a junior operator license for 12 months prior to the application.

The AAA also recommends a parent-teen driving contract as a means of encouraging teenagers to behave properly while behind the wheel.

There are restrictions for each stage of the driver’s licensing process for teens in the Bay State as well. These include:

- Learner’s Permit must be accompanied by a licensed adult who is 21-years-old and who has no less than one year of driving experience. This stage also requires that the teen log 40 hours of practice with a supervised driver who is also 21 or older.

- Junior Operator’s License-These teens cannot drive with passengers under 18 years of age in the car unless the person(s) is an immediate family member and they are accompanied by an experienced driver who is 21 years old or older. These drivers may also not operate a motor vehicle between the times of 12:30 a.m. and 5 a.m. unless they are accompanied by their parent or guardian.

- Full License-All restrictions are lifted but the driver must comply with all traffic and safety laws designated by the Commonwealth of Massachusetts.

Once you receive your driver’s license you will want to keep it in good standing of course.

Driver’s License Renewal Procedures

No matter what age you are you will eventually have to renew your driver’s license. When that time comes it will be good to know what the Bay State requires of you depending on your age.

As you have seen, teen drivers are a category all their own, but what about older drivers?

For an older driver in the Bay State, the renewal requirements allow you to renew your license every five years like the general population, but if you are 75-years-old or older you must do it in person because each renewal will require a vision test.

If you are a part of the general population and you want to renew your license online simply go to the state’s website and follow the directions.

New Residents

New residents to Massachusetts can follow the same procedures as residents of the Bay State when it comes to receiving their first license.

Part of this procedure is proving residency though and you can do so by first establishing yourself as a resident of the Bay State.

Some ways to establish residency include:

- Filing a state income tax return

- Enrolling your dependants in public school

- Receiving public assistance

- Buying property meant to be used as your primary residence

- Or becoming employed

Once you have become a resident of the Bay State and you have your license in hand you will be expected to follow all traffic laws set forth by the Commonwealth.

Negligent Operator Treatment System

Being a good driver in the Bay State can prevent you from accruing “Surchargeable Points”. We have done a lot of talking about “Surchargeable Points” up until now, but just exactly what are they and how do they work?

Simply put, “Surchargeable Points” are points added to your license as a result of surchargeable incidents.

Surchargeable incidents fall into one of four categories:

- Major traffic violations-5 SDIP Points

- Major at-fault accidents-4 SDIP Points

- Minor traffic violations-2 SDIP Points

- Minor at-fault accidents-3 SDIP Points

These are all part of the Massachusetts Safe Driver Insurance Program (SDIP) guidelines.

You can have SDIP points removed sooner than six years by following the “Clean in 3” criteria.

These criteria are as follows:

The value of surcharge points for each surchargeable incident is reduced by 1 point if: (1) you have three or fewer surchargeable incidents on your driving record in the six years immediately preceding your policy’s effective date, (2) the most recent surcharge date is at least three years before your policy’s effective date, and (3) you have at least 3 years of driving experience.

Reducing your “Surchargeable Points” is one way to lower your car insurance rates, but knowing the rules of the road can help you avoid those points altogether.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are Massachusetts rules of the road?

It doesn’t matter which state you drive in, there are always going to be rules of the road. Understanding the rules that are particular to the Bay State can help you avoid all of those pesky points on your license.

Understanding the laws and obeying them can also help you be a more informed shopper when looking to get the best deal on car insurance.

Keep scrolling to find out all of the ways that we can help you do just that.

No-Fault Vs. At-Fault

You may have already discovered that Massachusetts is a no-fault state, but what does that mean to you exactly?

Basically, the term is defined as follows:

- No-Fault-In these types of states coverage is meant to protect the insured by paying for their expenses in an accident.

- At-Fault-In a state with an at-fault system each insurance company pays for injuries or damages incurred during an accident based on the degree of fault of each party involved.

What this means to you is that in the Bay State your car insurance provider will be the one who is initially responsible for your injuries or damages.

No-fault systems do not allow for payouts for pain and suffering.

In order to recoup pain and suffering or other monetary damages resulting from a car accident in a no-fault state, you will have to file a third-party claim or a lawsuit.

Seat Belt and Car Seat Laws

Insurance laws in the Bay State may seem a bit complex but Massachusetts is pretty straightforward when it comes to seat belt and car seat safety requirements.

In the Commonwealth of Massachusetts, seat belt and car safety violations are primary offenses which means that the law enforcement officer does not need any other reason for pulling you over outside of not wearing your seatbelt or having your child buckled in properly.

If you are 13-years-old or older you must be wearing a seat belt at all times when the vehicle is on no matter which seat in the vehicle you are occupying.

The fine for not doing so is $25 according to the Insurance Institute for Highway Safety.

If your child is 7 years old or younger and is less than 57 inches tall, they must be in a safety seat.

Children between the ages of 8 years old and 15 years old who are over 57 inches may wear an adult seat belt.

Failure to comply will result in a fine of $25.

Keep Right and Move Over Laws

The Bay State requires that drivers keep to the right unless they are turning or legally passing someone.

As of March 22, 2009, Massachusetts also has a Move Over Law which requires that all drivers move over and slow down when approaching police, firefighters, paramedics, tow truck driver, and all other roadside assistance and/or maintenance professionals who are working along the highway.

If you fail to move over and slow down you are putting these professionals at risk and it could cost you up to $100 in fines.

Speeding Laws

Massachusetts also has a variety of other laws designed to keep everyone safe while on the road. Some of these laws govern the rate of speed that you are allowed to travel in specific areas.

Some of the more general speed limits in the Bay State are:

- Highway and Interstate…………………………………………..65 MPH

- Two-lane roads………………………………………………………55 MPH

- Highways outside of thickly settled areas………………….50 MPH

- On undivided highways outside thickly settled areas….40 MPH

- Inside thickly settled areas………………………………………30 MPH

- Residential areas…………………………………………………….30 MPH Max.

- School zones…………………………………………………………..20 MPH

A thickly settled area is an area in which residential or commercial structures are under 200 feet apart.

Be warned that if you are caught speeding in the Bay State you could be fined $50 or more and $10 for each additional mile over 10 that you were traveling. You could avoid all of the trouble by obeying all speed limits, or you could leave the driving to someone else.

Ridesharing

Nationwide Ridesharing services are on the rise. There are some rules that you should consider before beginning your career as a rideshare driver.

If you intend to use your car for ridesharing purposes you must inform your car insurance provider. You must also carry a minimum of liability coverage as follows:

- Liability coverage for accidents of $50,000 for any individual injured

- $100,000 per accident and $30,000 for property damage

- $100,000 per accident and $30,000 for uninsured protection

Uber and Lyft also offer additional insurance to back you up if you drive for them.

Automation

Ridesharing is not the only thing changing the face of Massachusetts streets and highways.

The use of automation and crash avoidance devices has become increasingly more popular in the past few years. While things such as backup cameras and collision avoidance systems have been proven to help reduce crashes many people are leery of full automation, and for good reason.

There is no question that automation is the wave of the future. What that means to the auto insurance industry remains to be seen.

What are Massachusetts safety laws?

You may not own a new car with all of the fancy new safety gadgets available to help you be a better driver, but there are a few things that you can do to make sure the roads in the Bay State are safer for everyone.

One of these things is to make sure that when you are hauling your gear around you ensure that it is tied down the right way.

Section 36 of the laws of the Commonwealth of Massachusetts even requires that you secure your load.

Loose cargo is only one of the many things that can cause the roads in the Bay State to become hazardous.

Keep reading to discover what else you can do to make sure that everyone arrives alive.

DUI Laws

According to Responsibility.org the Bay State saw 120 Alcohol-related fatalities in 2017 alone.

The possible penalties for OUI/DUI offenses in the Commonwealth of Massachusetts are as follows:

- First Offense No more than 2 1/2 years in jail, fines of $500-$5,00, and a license suspension of one year with no consideration for hardship for at least three months.

- Second Offense-Up to 2 1/2 years in jail, fines of $600-$10,00, license suspension of two years, no consideration for hardship for at least one year, and an interlock-ignition device to be installed at your expense.

- Third Offense-Up to five years in State Prison, fines $1,000-$15,000, license suspension of up to eight years, with no consideration for hardship for a period of two years, and the installation of an interlock device at your expense.

- Fourth Offense-Up to five years in State Prison, fines of $1,000-$25,000, a license suspension of 10 years with no consideration for hardship for five years, forfeiture of your vehicle to the state, and the installation of an interlock device at your expense.

- Fifth Offense-Up to five years in State Prison, fines of $2,000-$50,000, your license will be revoked for life, and you will be forced to forfeit your vehicle to the state without compensation.

It is not worth the risk so just don’t do it.

Marijuana-Impaired Driving Laws

Alcohol is not the only thing that can get you into trouble when driving in the Bay State. Getting high and then climbing behind the wheel could also cost you.

Penalties for your first offense of driving under the influence of marijuana include:

- Probation for one year

- Being required to complete the 24D program

- Loss of driving privileges for 45-90 days

The laws regarding marijuana use behind the wheel of a car are relatively new so you should keep checking Mass.gov for the latest information.

Distracted Driving Laws

Distracted driving laws in the Bay State are also ones which you should keep your eye on.

Currently, Massachusetts prohibits the use of cell phones by all drivers, as well as other mobile devices to text or send an email while you are operating a motor vehicle.

It doesn’t matter if you are stopped at a red light; the rules still apply.

This is a primary law as well which means that law enforcement can pull you over for it without the need for another infraction.

There are a few things that you can do to avoid the hassle. The first thing is to just turn the phone off. If you just can’t bear that idea then there are a few apps out there to help you.

We all have places to go and people to see, but the road really is a better place to be without all of the distractions.

How bad of a problem is vehicle theft in Massachusetts?

Driving in the Bay State carries with it some risk. Distracted drivers and unsecured loads are not the only hazards out there though.

Sometimes the risks can occur when you aren’t even behind the wheel. Things such as vehicle theft and vandalism can really ruin your day. Keep scrolling to find out how we can help you avoid these risks or make them better if the worst should happen.

The number one stolen vehicle in the Bay State is a 2000 Honda Civic

| Make/Model | Rank | Vehicle Year | Thefts |

|---|---|---|---|

| Honda Civic | 1 | 2000 | 426 |

| Honda Accord | 2 | 1997 | 402 |

| Toyota Camry | 3 | 2014 | 260 |

| Toyota Corolla | 4 | 2010 | 203 |

| Dodge Caravan | 5 | 2005 | 188 |

| Ford Pickup (Full Size) | 6 | 2004 | 178 |

| Nissan Altima | 7 | 2005 | 156 |

| Jeep Cherokee/Grand Cherokee | 8 | 1999 | 143 |

| Honda CR-V | 9 | 1999 | 107 |

Even if your vehicle doesn’t appear on the list above it still might be a good idea to invest in comprehensive coverage.

This type of coverage does not just cover the loss if your vehicle is stolen or vandalized. Comprehensive also covers damage done in case of a natural disaster.

Vehicle Thefts by City

Now that you know what types of cars are most popular with thieves let’s take a look at the top 10 cities in the Bay State, according to the FBI, when it comes to vehicle theft.

| City | Motor Vehicle Thefts |

|---|---|

| Boston | 1,223 |

| Springfield | 587 |

| Lawrence | 581 |

| Worcester | 519 |

| Lowell | 401 |

| Brockton | 280 |

| New Bedford | 274 |

| Fall River | 237 |

| Lynn | 221 |

| Holyoke | 129 |

Don’t let these numbers fool you. Just because these cities ended up on the top ten list for vehicle thefts in Massachusetts does not make them more dangerous overall.

More people in a smaller area just means more chances for crimes to be recorded.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Do a lot of road fatalities occur in Massachusetts?

It is something that none of us likes to think about when we are driving, but the possibility is always there.

Whether they are the result of weather conditions or driver error, driving fatalities are a reality of life on the road.

Keep scrolling to find out how the Bay State compares.

Fatal Crashes by Weather Conditions and Light Conditions

Sometimes something so ordinary as the time of day or a sudden rainstorm can present drivers with just the wrong conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 133 | 56 | 70 | 22 | 1 | 282 |

| Rain | 10 | 15 | 12 | 1 | 0 | 38 |

| Snow/Sleet | 0 | 4 | 2 | 2 | 0 | 8 |

| Other | 0 | 2 | 0 | 0 | 0 | 2 |

| Unknown | 3 | 2 | 1 | 0 | 0 | 6 |

| TOTAL | 146 | 79 | 85 | 25 | 1 | 336 |

Looking at the table reveals just how dangerous certain types of weather or light conditions can be

If the worst should happen you will want to have the best car insurance provider you can have on your side.

Fatalities by County

Below is a table showing the five-year trend for the top 10 counties in Massachusetts and their fatalities.